Mechanic Shop Invoice Template for Efficient Billing

For any business offering vehicle repair services, maintaining accurate records and providing clear documentation to clients is crucial. A well-structured document ensures transparency, helps track services rendered, and fosters trust between the provider and the customer. It serves not only as a receipt for completed tasks but also as a formal record of financial transactions.

Having a customizable document that includes all necessary details, such as parts, labor, and charges, can streamline the administrative process. This allows business owners to save time, reduce errors, and ensure they meet legal and tax requirements. Whether you’re managing a small garage or a larger enterprise, an efficient billing solution is a key element of your daily operations.

Providing accurate statements builds professionalism and allows clients to review the services they’ve paid for in a clear, organized manner. This minimizes confusion and supports positive business relationships in the long run. In this guide, we’ll explore the essentials of creating and using the right documentation for your services.

Understanding Mechanic Shop Invoices

In any service-based business, providing customers with a detailed record of the work done is essential. This document not only serves as proof of the transaction but also helps to clarify the breakdown of charges, materials used, and labor performed. It is a vital part of maintaining clear communication and ensuring both parties are in agreement regarding the costs and services provided.

For businesses offering vehicle repairs, having a comprehensive and well-organized document is crucial for smooth operations. It helps to keep track of payments, monitor outstanding balances, and ensures compliance with tax regulations. Without this form of documentation, businesses risk confusion, errors, and potential disputes with clients.

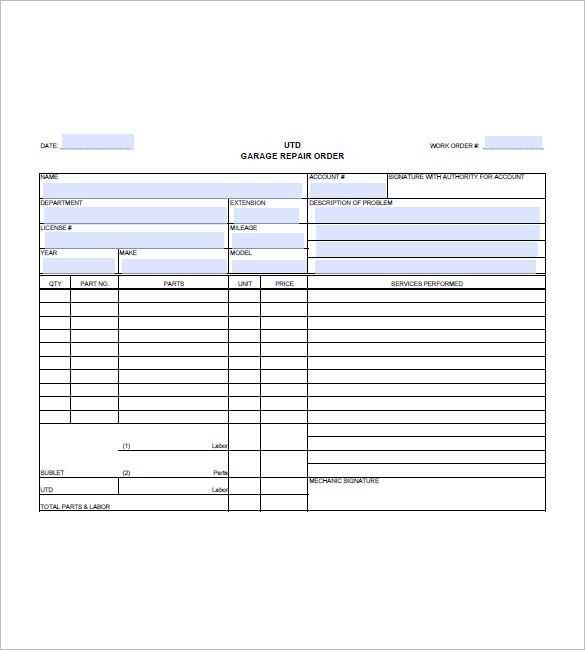

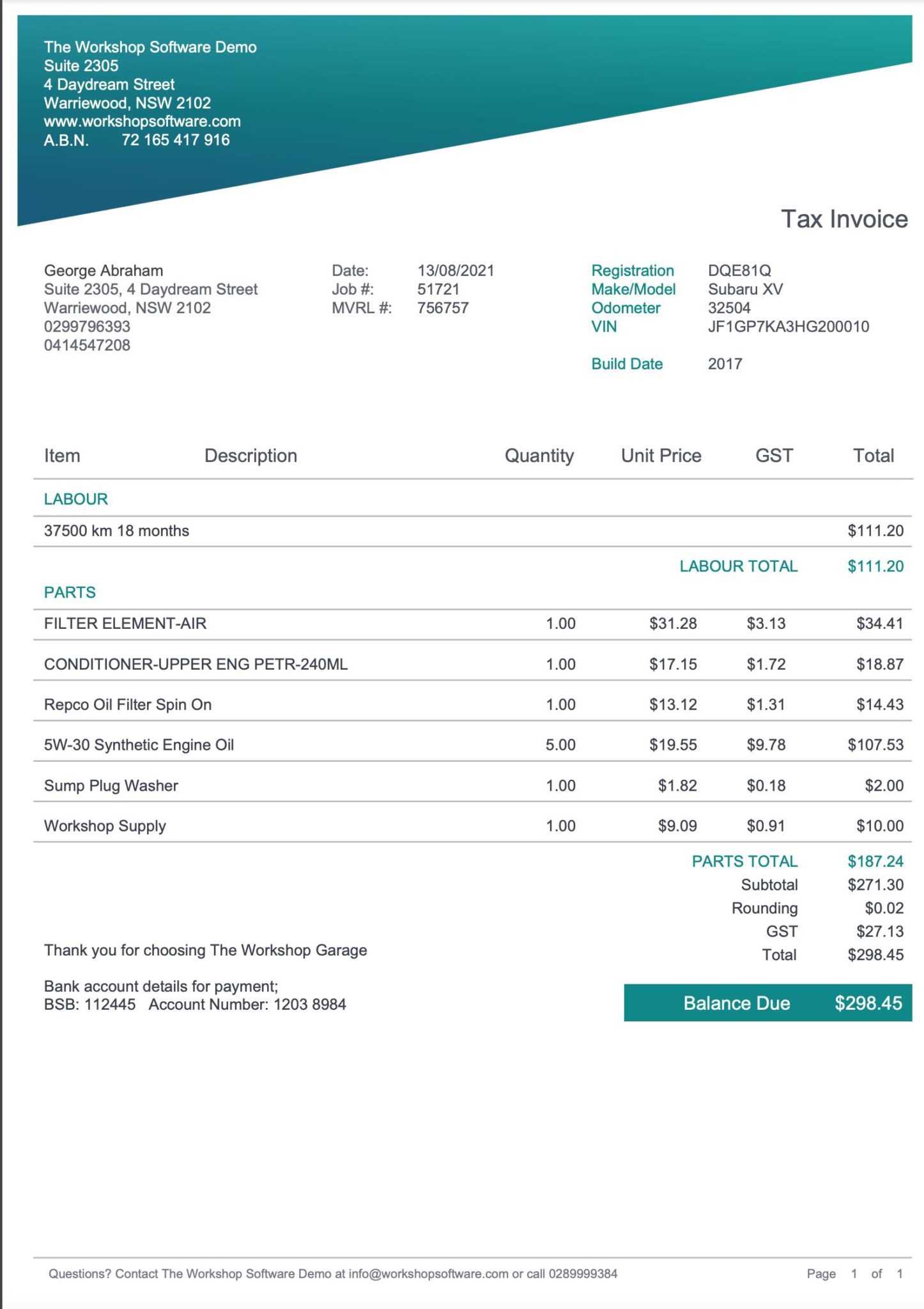

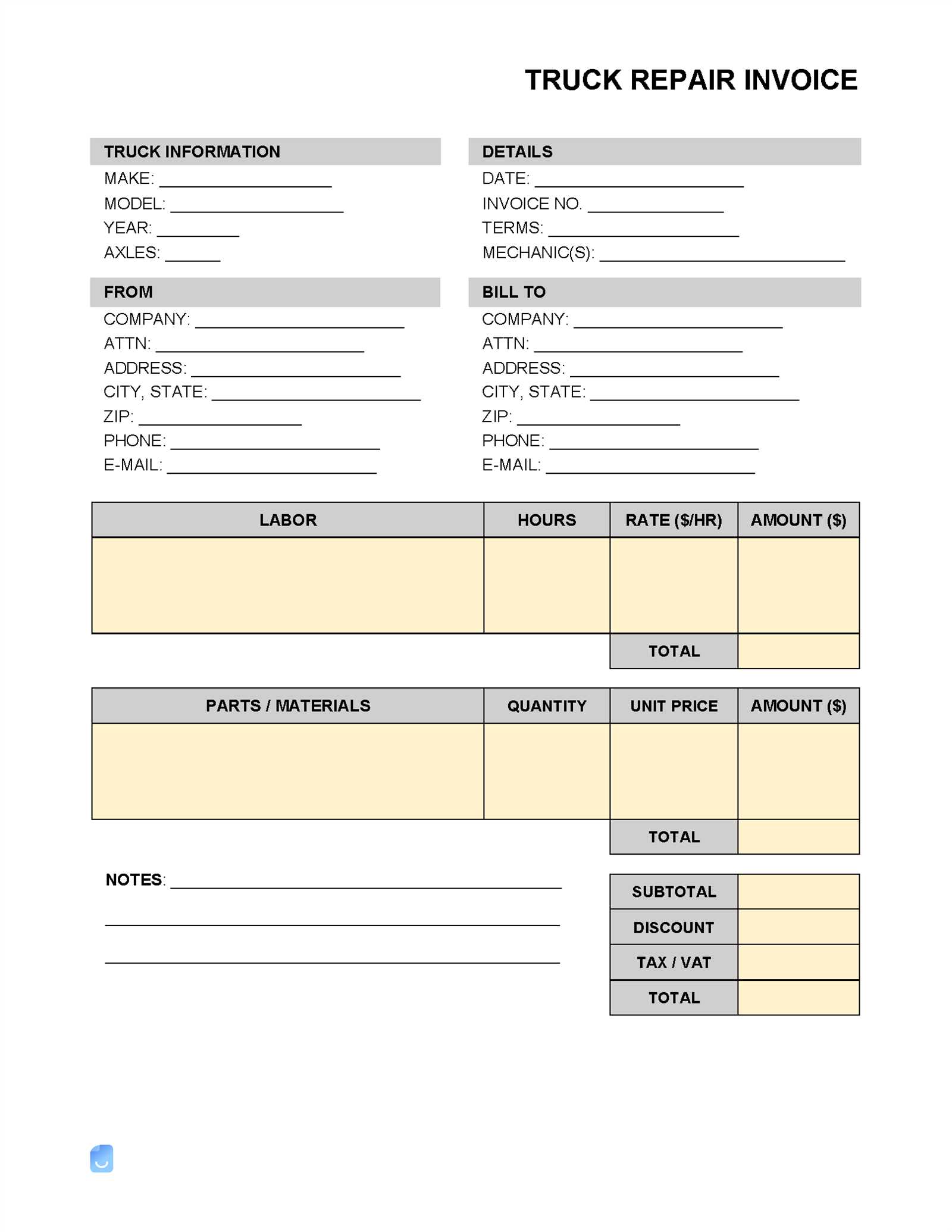

A well-structured record should include several key elements to ensure clarity and professionalism:

- Customer Information: Details like the name, contact information, and vehicle identification.

- Work Description: A detailed list of services performed, including labor and any parts used.

- Pricing Breakdown: Clear charges for each service or part, including tax calculations.

- Payment Terms: Information about payment methods and deadlines for balances due.

- Business Contact: The name, address, and contact details of the business providing the service.

Understanding these key elements helps to streamline the process, reduces misunderstandings, and creates a transparent and professional relationship with the customer.

Why Invoices Matter in Auto Repair

Clear documentation of the services rendered is essential for any business in the vehicle repair industry. It provides both the customer and the business with a comprehensive record of the work done, ensuring transparency and minimizing the risk of confusion. Accurate records not only facilitate smooth transactions but also protect both parties in case of future disputes or misunderstandings.

In addition to maintaining professionalism, these records play a crucial role in financial management. They help track payments, monitor outstanding balances, and ensure that the business adheres to tax regulations. A detailed document is also valuable for accounting purposes, offering insights into the business’s cash flow and profitability.

Benefits of Providing Detailed Records

| Benefit | Description |

|---|---|

| Clear Communication | Customers receive a full breakdown of services, eliminating any confusion about charges. |

| Financial Management | Helps keep track of payments and manage accounts, reducing the risk of missed payments. |

| Legal Protection | Provides evidence of the services provided in case of disputes or legal issues. |

| Tax Compliance | Ensures the business is meeting tax obligations by documenting sales and services correctly. |

Maintaining Professionalism and Trust

For any vehicle repair business, establishing trust with customers is paramount. Providing a detailed and organized record of services not only shows professionalism but also builds long-term customer loyalty. It assures customers that their vehicles are in good hands and their transactions are handled with care and accuracy.

Key Elements of an Invoice Template

A well-organized record of services should include all necessary details to ensure clarity and accuracy for both the service provider and the client. These key elements form the backbone of any professional billing document, helping to avoid confusion, ensure transparency, and simplify the payment process. A properly structured document not only outlines the services rendered but also reinforces the business’s professionalism.

Essential Information for Clear Billing

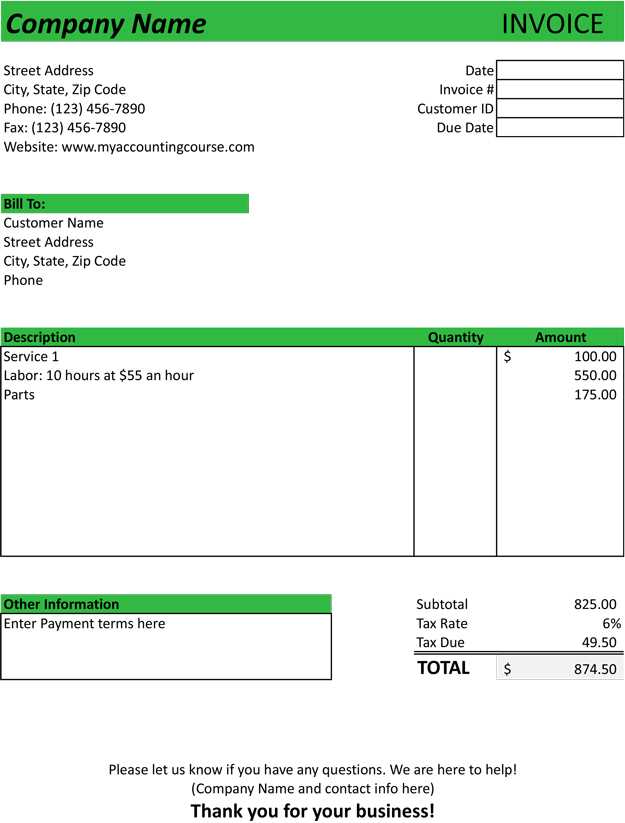

Each billing statement should clearly communicate the following elements:

- Service Provider Information: Include the name, address, and contact details of the business providing the service.

- Customer Details: Essential contact information for the customer or client, ensuring accurate communication.

- Detailed List of Services: A clear description of the work performed, parts used, and labor charges.

- Pricing Breakdown: Itemized charges for each service, including any taxes or discounts applied.

- Payment Terms: Clearly outline the due date, accepted payment methods, and any applicable late fees.

Why These Elements Matter

Including all relevant details on each document ensures a smooth transaction process. Customers can easily review the charges, which helps prevent misunderstandings. For the service provider, it offers a clear overview of completed work and payments due, which aids in financial tracking and customer relationship management.

Essential Information for Accurate Billing

For a seamless transaction process, it’s crucial to include all relevant details that provide a complete record of the services provided and the charges incurred. This ensures that both the service provider and the customer have a clear understanding of the financial aspects of the work completed. By organizing this information correctly, businesses can minimize misunderstandings and ensure timely payments.

Here are the key components that should be included to ensure accurate billing:

- Customer Contact Information: Full name, address, and phone number for the customer to ensure the bill is accurately addressed.

- Service Description: A detailed account of the work done, including specific tasks, parts used, and any relevant measurements or specifications.

- Labor Costs: Clear breakdown of the time spent on each task, along with the rate charged for labor.

- Material Costs: List of parts or supplies used during the service, including individual prices and total costs.

- Taxes and Additional Fees: Include applicable sales tax or any extra charges that may apply, such as environmental fees or handling charges.

- Payment Terms: Information on payment due dates, acceptable payment methods, and any discounts or late fees that may apply.

Providing this level of detail ensures that the document is comprehensive and professional, leaving no room for confusion. It also helps to build trust with customers, as they can clearly see what they are being charged for and why. By maintaining accuracy in every transaction, businesses ensure smooth operations and foster long-term customer relationships.

How to Create a Custom Invoice

Creating a personalized billing document allows you to tailor it to the specific needs of your business and clients. A custom record ensures that all necessary information is included and organized in a way that suits your operations. Whether you’re designing it from scratch or using software, the goal is to make sure every detail is accurate and clear for both parties involved.

Follow these steps to design a customized billing statement that meets your needs:

- Choose a Format: Decide whether you will create the document manually, use software, or opt for an online service that offers pre-designed templates.

- Add Your Business Information: Include your business name, address, phone number, and email. It’s also a good idea to add a logo to enhance branding.

- Input Client Details: Include the full name, address, and contact information of the customer to ensure the document is correctly addressed.

- Describe the Services Provided: Clearly list all services rendered, including parts replaced, time spent on repairs, and any labor costs. Be as specific as possible to avoid confusion.

- Include Pricing Information: Break down the pricing for each service, part, or labor charge. Also, specify any applicable taxes or additional fees.

- State Payment Terms: Provide clear instructions on how and when payment is expected, including payment methods and late fee policies.

- Review and Finalize: Double-check the document for accuracy, ensuring that all charges are correct and the layout is clear and professional.

By following these steps, you can create a custom billing document that reflects your business’s professionalism and ensures accurate, timely payments. A well-organized statement not only keeps financial records in order but also fosters trust and confidence with clients.

Steps to Design Your Template

Designing a customized billing document requires careful planning to ensure that all relevant details are clearly presented and easy to follow. A well-structured design not only enhances the document’s professional appearance but also ensures that both the service provider and client can easily understand the information. By following a few simple steps, you can create a streamlined, effective document that fits your business’s needs.

Here’s how to design an effective document for your services:

- Choose a Clean Layout: Start by selecting a layout that is simple and clean, ensuring that the information is organized logically. Avoid clutter and ensure there is enough space between different sections for readability.

- Include Essential Information: Make sure to include your business details, the client’s information, a list of services rendered, pricing, taxes, and payment terms. This will help prevent confusion and ensure all relevant data is included.

- Highlight Important Details: Use bold text or different font sizes to highlight key pieces of information, such as the total amount due and payment deadlines. This makes the document easier to navigate.

- Incorporate Your Branding: Add your business logo, color scheme, and other branding elements to make the document unique and aligned with your business identity.

- Ensure Compatibility: Make sure your document is compatible across different platforms, such as PDF, Word, or Google Docs, so it can be easily shared with clients via email or printed if necessary.

- Test for Accuracy: Before using the document, test it with sample data to ensure that all fields are properly formatted, calculations are correct, and everything appears as intended.

By following these steps, you can design a professional, clear, and effective billing record that enhances your business operations and builds stronger relationships with clients.

Best Practices for Invoice Formatting

Proper formatting is crucial for creating a professional and easy-to-understand billing document. A well-organized layout not only enhances the document’s readability but also ensures that all essential information is presented clearly. Following best practices for design and structure helps avoid confusion, ensures transparency, and improves the overall customer experience.

Key Formatting Tips

- Keep It Simple: Use a clean, straightforward layout that’s easy to navigate. Avoid overcrowding the document with too many fonts or colors, as this can distract from important details.

- Logical Flow: Arrange the content in a logical order–begin with your business details, followed by the client’s information, a list of services, pricing, and payment terms. This will make it easy for both parties to follow.

- Readable Fonts: Choose legible fonts such as Arial or Times New Roman. Ensure that text is large enough to be read without straining, and maintain a consistent font size throughout.

- Use Columns for Clarity: When detailing services and prices, organize information into columns. For example, one column for service description, another for quantities, and a third for the price. This will make the document easier to scan.

- Bold Key Information: Highlight important sections such as total amounts due, taxes, and due dates using bold text or larger fonts to draw attention.

- White Space is Important: Don’t overcrowd the document. Adequate spacing between sections and around text makes it easier to read and less intimidating for the customer.

Considerations for Mobile Devices

- Responsive Design: If you’re sending the document digitally, ensure it’s optimized for viewing on mobile devices. This means keeping the layout simple and avoiding excessive text or complex images that might not display well on smaller screens.

- Clear Formatting for Digital Viewing: Make sure all text is legible on digital devices, with large enough fonts and easy-to-follow organization. Use PDFs or other file formats that maintain the integrity of the formatting across different platforms.

By following these formatting best practices, you can create a billing document that not only looks professional but also ensures that your clients can easily understand and process the details. A well-formatted document reflects positively on your business and builds trust with your clients.

Ensuring Clarity and Professionalism

When it comes to billing documentation, maintaining a clear and professional appearance is essential for fostering trust with your clients. The document should not only convey the necessary details but also reflect the quality and reliability of your business. A well-designed and properly structured record ensures that both the service provider and client are on the same page, minimizing confusion and improving the overall experience.

Here are some strategies to ensure your document communicates professionalism and clarity:

- Use Clear and Concise Language: Avoid jargon and overly technical terms that may confuse the reader. Stick to simple, easy-to-understand language to explain the services provided, charges, and payment terms.

- Organize Information Logically: Structure your document in a way that makes sense, starting with your business details, followed by client information, a detailed list of services, pricing breakdown, and payment instructions.

- Consistent Formatting: Keep fonts, colors, and styles consistent throughout the document. Consistency in formatting creates a polished, professional look that enhances the readability of the information.

- Double-Check for Accuracy: Ensure that all the details are correct, from the services rendered to the prices charged. Small errors or omissions can damage your credibility and cause unnecessary confusion.

- Highlight Key Information: Use bold or larger text to highlight important details such as the total amount due, due dates, or any applicable discounts. This draws attention to the most critical information for your client.

- Be Transparent: Make sure all charges are clearly listed and explained. Transparency in pricing helps to build trust and prevents misunderstandings later on.

By focusing on clarity and professionalism, you ensure that your billing document serves its purpose effectively and reflects well on your business. A well-presented, accurate document not only helps with smoother transactions but also strengthens your relationship with customers, promoting future business.

Tracking Payments with Invoice Templates

Efficient tracking of payments is essential for maintaining financial accuracy and ensuring that all transactions are properly accounted for. A well-organized document helps you keep track of amounts due, received payments, and any outstanding balances. By setting up a clear system for monitoring payments, you can ensure that your business runs smoothly and that no payments are overlooked.

Here are some key practices for effectively tracking payments through a billing document:

- Include Payment Status: Always include a section to indicate whether the payment has been made, is pending, or is overdue. This simple addition helps you keep track of the current status of each transaction.

- Record Payment Dates: Make sure to document the date when a payment is received. This helps in tracking overdue payments and also provides a clear timeline for your records.

- Break Down Payments: If a client makes partial payments, clearly break them down in the document. List the amount paid and the remaining balance to avoid any confusion.

- Use Unique Identifiers: Assign a unique reference number to each transaction or billing document. This makes it easier to track payments across different records and refer back to specific details if needed.

- Update Regularly: Make sure to update the document whenever a payment is received. Regular updates will ensure that all balances are accurate and that no details are missed.

- Keep a Record of Payment Methods: It’s important to note how payments are made (e.g., credit card, check, cash, bank transfer). This information can be helpful in case of disputes or for accounting purposes.

By implementing these tracking practices, you can maintain organized records, reduce the risk of errors, and ensure that your financial transactions are transparent and easy to manage. A clear payment tracking system contributes to smoother business operations and helps foster trust with your clients.

Keeping Accurate Financial Records

Maintaining precise financial records is crucial for the long-term success of any business. It ensures that you can track revenue, expenses, and profits, while also providing clear documentation for tax purposes and audits. A solid record-keeping system allows you to make informed decisions, manage cash flow, and prevent financial discrepancies.

Key Practices for Accurate Record-Keeping

- Document Every Transaction: Ensure that every financial transaction, including payments received and expenses incurred, is properly recorded. This helps prevent mistakes and provides an accurate history of your financial activities.

- Organize Records Chronologically: Keeping records in a chronological order makes it easier to track progress over time and retrieve information when needed. This also helps identify any gaps or errors in your records.

- Use Consistent Categories: Establish consistent categories for different types of transactions (e.g., services provided, parts purchased, overhead costs). Categorizing your expenses and income helps you better understand your financial picture and streamline reporting.

- Keep Digital and Physical Copies: Maintaining both digital and physical copies of important documents ensures that you have a backup in case one version is lost or damaged. Digital records are easier to store, search, and share, while physical copies can serve as official documentation for legal purposes.

- Regular Reconciliation: Reconcile your records regularly with bank statements and other financial documents. This helps identify errors early and ensures that your accounts remain balanced.

- Monitor Outstanding Balances: Keep track of amounts owed to you by clients, as well as any overdue payments. Regularly checking on outstanding balances ensures you stay on top of collections and prevents cash flow issues.

Tools for Managing Financial Records

- Accounting Software: Invest in reliable accounting software to streamline the process of recording and categorizing transactions. Software can automatically generate reports and provide insights into your financial health.

- Spreadsheets: For smaller businesses, spreadsheets can be an effective tool for tracking income and expenses. They offer flexibility in how you organize and analyze financial data.

- Professional Bookkeepers: Hiring a professional bookkeeper or accountant can help ensure that your records are accurate and compliant with relevant laws and regulations.

By adopting best practices for keeping accurate financial records, you can improve business operations, ensure compliance, and have a clear overview of your financial health. This discipline not only enhances decision-making but also builds trust with clients and pa

Choosing the Right Invoice Software

When managing business transactions, selecting the appropriate software for creating and managing payment records can make a significant difference in efficiency and accuracy. The right tool not only saves time but also ensures consistency, reduces errors, and enhances overall professionalism. With many software options available, it’s crucial to choose one that aligns with your business needs and goals.

Factors to Consider When Selecting Software

- User-Friendliness: Opt for software that is easy to navigate, even for those without a background in accounting. A clean, intuitive interface will help you get up and running quickly and reduce the learning curve.

- Customization Options: Choose software that allows you to personalize templates to fit your specific needs. Whether it’s adding your company logo, adjusting layout, or tailoring fields, the ability to customize helps you maintain a consistent brand image.

- Automation Features: Look for tools that automate recurring tasks like payment reminders, due date tracking, or report generation. Automation helps streamline the process and reduces the chances of manual errors.

- Integration Capabilities: Ensure the software can integrate with other tools you use, such as accounting software, payment platforms, or customer relationship management (CRM) systems. Seamless integration allows for better workflow and data consistency across different platforms.

- Security and Backup: Since financial data is sensitive, choose software that offers strong encryption and regular backups. This ensures your records remain secure and are easily recoverable in case of any system failures.

- Cost and Scalability: Consider the cost of the software and whether it can grow with your business. Start with a plan that fits your current needs, but make sure there are options to upgrade as your business expands.

Top Software Features to Look For

- Mobile Access: Having access to your records on the go is increasingly important. Look for software with mobile apps or cloud-based solutions that let you manage billing from anywhere.

- Client Management Tools: Some software offers integrated client management, which allows you to track client information, payment history, and communication, all in one place.

- Real-Time Reporting: Instant access to reports on income, expenses, and outstanding balances can help you make quick, informed decisions and track business performance over time.

- Multi-User Access: If your business involves multiple team members, choose software that supports multiple users with different access levels. This can help with collaboration and accountability.

By carefully considering these factors, you can select softwar

Top Tools for Mechanic Shops

In any repair business, having the right tools at your disposal is essential for efficiency, accuracy, and customer satisfaction. Whether you’re handling routine maintenance or complex repairs, a well-equipped workspace ensures you can meet client needs while keeping operations smooth. From diagnostic equipment to customer management systems, a variety of tools can help streamline workflow and improve service quality.

Here are some of the top tools that can enhance business operations:

- Diagnostic Tools: Modern diagnostic equipment allows for quick identification of issues, helping to diagnose problems accurately and save time. Tools like OBD scanners and engine analyzers are essential for performing thorough inspections.

- Repair Management Software: Software solutions that handle service orders, work scheduling, and customer communication help to improve workflow and reduce administrative tasks. These tools ensure that you stay organized and efficient, keeping track of every repair request and completed job.

- Billing and Payment Systems: Streamlined billing tools help you create detailed service records, track payments, and manage financial transactions. Integrating these tools with payment gateways simplifies the process for both you and your customers.

- Inventory Management Systems: Keeping track of parts and supplies is essential for maintaining adequate stock levels and reducing operational delays. Inventory management software helps ensure that parts are available when needed and helps prevent overstocking.

- Customer Relationship Management (CRM): A CRM tool helps manage customer information, service history, and communication. By having all client data in one place, businesses can offer more personalized service and keep customers coming back.

- Time Tracking Software: To ensure accurate billing and track employee productivity, time tracking software can log hours worked on each task. This helps in managing labor costs and ensuring that projects are completed on time.

- Appointment Scheduling Tools: Streamlining appointment scheduling can help optimize shop efficiency by avoiding overbooking or long waiting periods. Many systems integrate with online booking, allowing customers to schedule visits at their convenience.

- Marketing Tools: Online marketing tools can help your business reach new customers. From email campaigns to social media management, these tools are essential for growing your customer base and staying competitive.

With the right tools, you can create a more organized, efficient, and professional environment for both employees and customers. These tools will not only help in managing daily operations but also improve the overall customer experience, ensuring long-term success for your business.

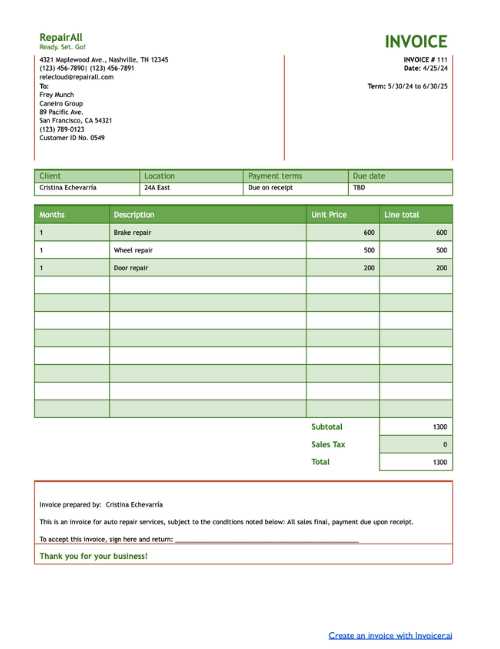

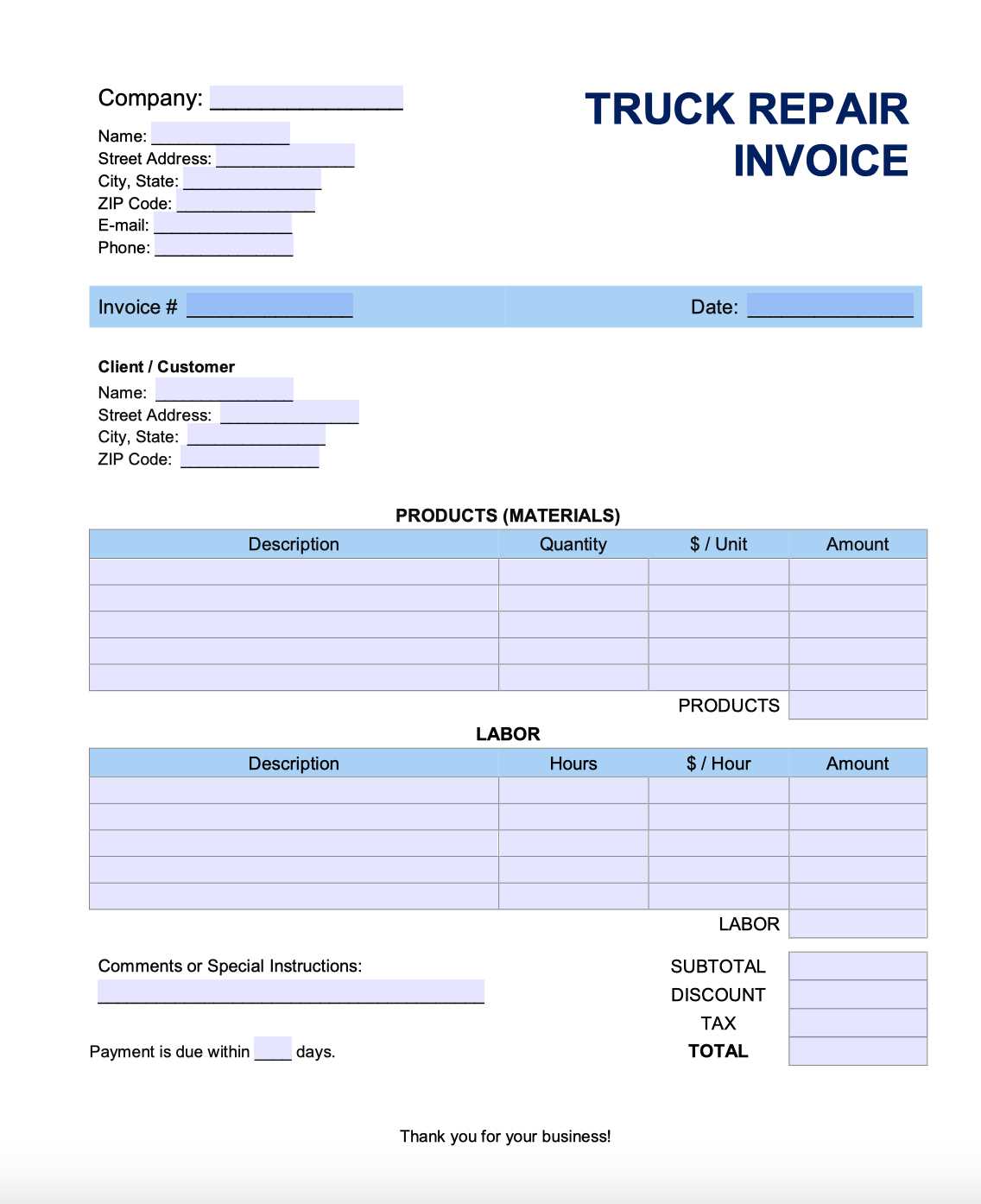

How to Include Labor and Parts Costs

When preparing a detailed cost breakdown for any service or repair, it is important to clearly outline both the labor and parts involved. This ensures transparency for your customers and allows for accurate billing. Properly calculating and displaying these costs can help prevent confusion and build trust between you and your clients. Here’s how to effectively include these elements in your service documentation.

To ensure clarity, follow these steps when listing both labor and parts costs:

- Labor Costs: Start by detailing the amount of time spent on the service and the rate charged per hour. It’s crucial to itemize the time spent on specific tasks to justify the total labor cost.

- Parts Costs: List each part or component used during the repair or service, along with the cost per unit. Make sure to include both the part number and description to avoid any confusion about what was used.

- Hourly Rate for Labor: Clearly state the hourly rate you charge for your work. If different tasks require different rates, specify each one individually.

- Material and Part Markups: Include any markups on parts or materials. Often, businesses add a markup to cover procurement costs, so it’s important to be transparent about how those prices are calculated.

- Discounts or Adjustments: If any discounts or adjustments are applied to either labor or parts, make sure to include these as well. This ensures that the final amount reflects any special deals or negotiated rates.

- Total Costs: After breaking down the individual components, calculate the total cost of labor and parts combined. This is the final amount that the customer will need to pay for the service rendered.

- Itemization: Be as specific as possible when itemizing costs. A detailed list helps your customers understand what they are paying for and provides a clear breakdown of the work performed.

By following these guidelines, you ensure that both labor and parts costs are presented clearly and professionally. This transparency not only builds credibility but also helps customers feel confident about the value of the service they are receiving.

Breaking Down Service Charges

When offering services, it is essential to present a clear breakdown of the charges involved to avoid misunderstandings and ensure transparency with clients. By clearly outlining each aspect of the service and its associated costs, you make it easier for customers to understand what they are paying for and why. Here’s how to effectively break down the charges for various services.

To help your customers clearly see where their money is going, consider including the following elements in your breakdown:

- Labor Hours: Clearly list the number of hours spent on each task or phase of the service. This allows customers to see exactly what work was done and how long it took.

- Hourly Rates: Specify the rate you charge per hour for the labor involved. If different rates apply to different types of work, make sure each is detailed separately.

- Service Fees: If there are additional charges for things like diagnostic fees, emergency service premiums, or special handling, list these separately so they are not confused with the primary service charges.

- Materials and Supplies: Itemize any materials or supplies used during the service. For example, list cleaning materials, specialty tools, or lubricants used in the process.

- Additional Costs: If any unexpected costs arose during the service (such as the need for extra parts or an extended service period), make sure to outline these with detailed explanations.

- Discounts or Promotions: If any discounts were applied, whether for first-time customers or a special promotion, ensure that these are clearly visible and deducted from the total amount.

- Tax and Fees: Don’t forget to include applicable taxes, as well as any other government-imposed fees or surcharges. These should be clearly listed at the end of the breakdown.

- Grand Total: Summarize the total cost after factoring in all charges, taxes, and discounts. This should be the amount the customer is expected to pay.

By thoroughly breaking down each aspect of the service charge, you help build trust with your clients and give them confidence in the value they are receiving. This transparency leads to better communication, fewer disputes, and a stronger relationship with your customers.

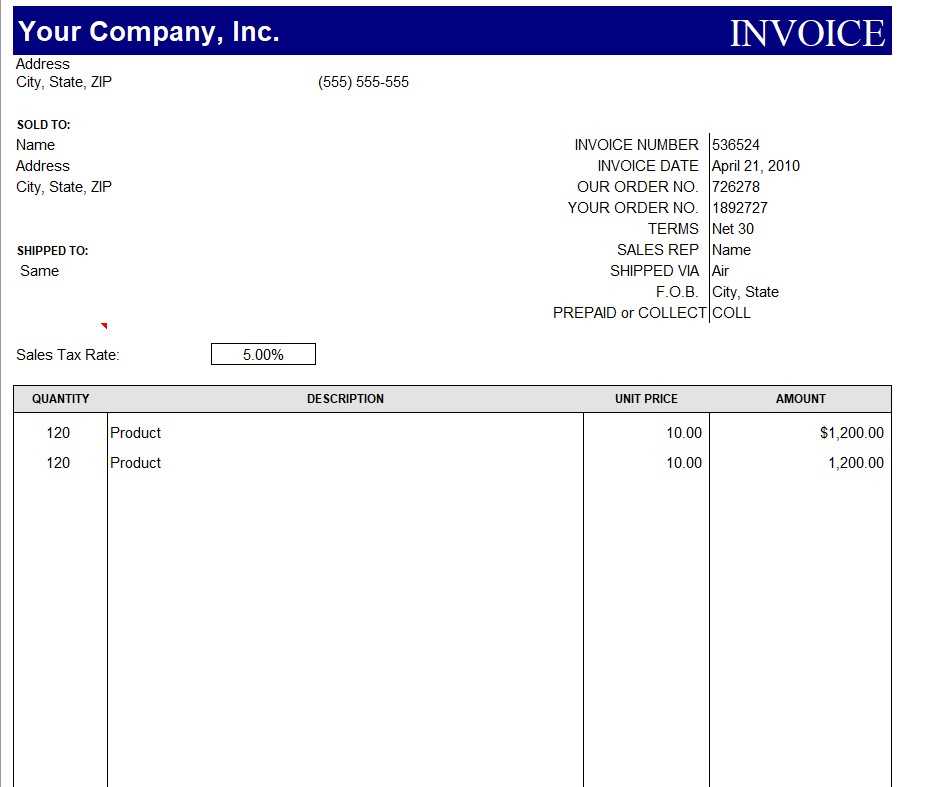

Managing Tax Information on Invoices

Properly handling tax information on billing documents is a crucial aspect of business operations, ensuring both compliance with regulations and clarity for your clients. Accurate tax reporting not only helps avoid legal issues but also builds trust by providing transparency in financial transactions. Here’s how to effectively manage tax information on your documents.

When preparing documents for clients, be sure to include the necessary tax details that are specific to your location and the type of service provided. This includes:

| Tax Information | Details |

|---|---|

| Tax Rates | Specify the applicable tax rates, whether local, state, or federal. Different services may have different tax rates, so clearly indicate which rate applies to each service or product. |

| Taxable Items | Identify the goods and services that are subject to tax. Some items or services may be tax-exempt, so ensure that these are indicated correctly. |

| Tax Calculation | Clearly show how the tax is calculated. For instance, if there are multiple items with different tax rates, break down the calculation for each item. |

| Tax Total | Include the total tax amount separately, making it easy for customers to understand how much they are being charged in taxes. |

| Exemptions | If the client qualifies for a tax exemption, be sure to note this on the document. Include any exemption number or reference as necessary. |

| Location-Based Tax | For businesses operating in multiple areas, list the tax rates applicable to each location, especially if services are provided in different jurisdictions. |

Managing tax information with clarity ensures that both you and your clients are on the same page regarding financial expectations. By following these steps, you can ensure that your transactions are both legally compliant and easy to understand, promoting transparency and professionalism in all dealings.

Including Sales Tax Correctly

Properly incorporating sales tax into your financial documents is essential to ensure both legal compliance and clear communication with your clients. It’s important to accurately calculate and display the sales tax on every transaction, as this not only reflects transparency but also keeps your business in line with local tax regulations.

Here are some key steps to include sales tax correctly:

- Understand Applicable Tax Rates: Determine the correct sales tax rate based on the location of your business and the jurisdiction of the customer. Tax rates can vary by state, city, and even by the type of service or product provided.

- Break Down the Tax Calculation: Clearly separate the sales tax from the total price of goods or services. This helps clients understand exactly what portion of their payment goes toward taxes.

- Use the Correct Taxable Items: Identify which items are taxable and which are not. Some services or products may be exempt from sales tax, so make sure to account for these differences when preparing the financial documents.

- Indicate the Tax Total: After calculating the sales tax, provide a clear breakdown showing the total tax charged for the transaction. This ensures that the client can easily identify how much tax they are paying.

- Apply Tax to the Right Elements: For transactions involving multiple items or services, be sure that each taxable item is subjected to the correct tax rate and that the tax is applied to the right amount.

- Consider Special Tax Exemptions: If your customer qualifies for any tax exemptions, ensure that this is noted clearly on the document, along with any relevant exemption reference numbers or codes.

By following these steps, you can ensure that sales tax is included correctly and that your business maintains accurate financial records. Proper tax handling not only keeps your operations compliant with tax laws but also builds trust with clients by making your transactions clear and transparent.

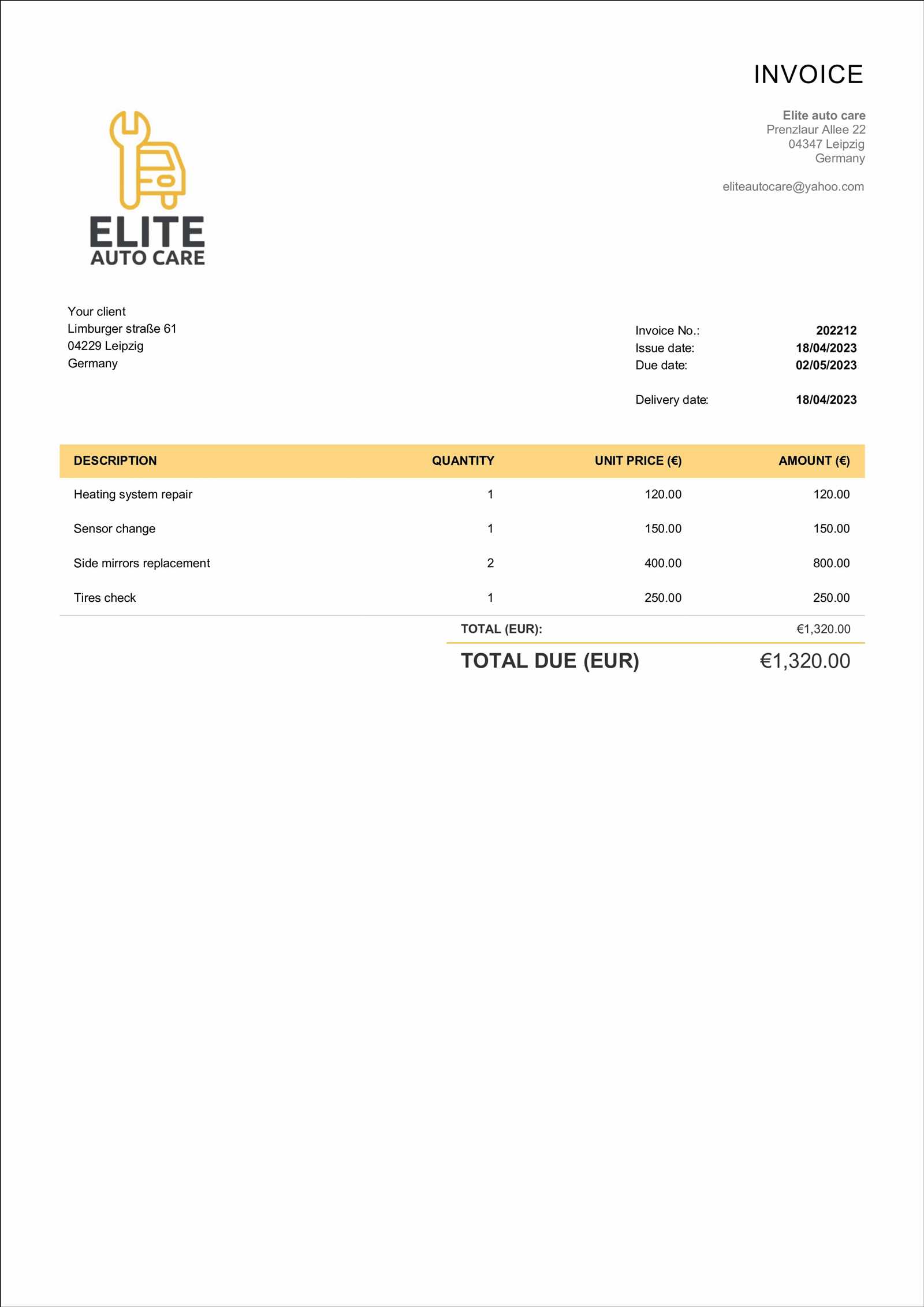

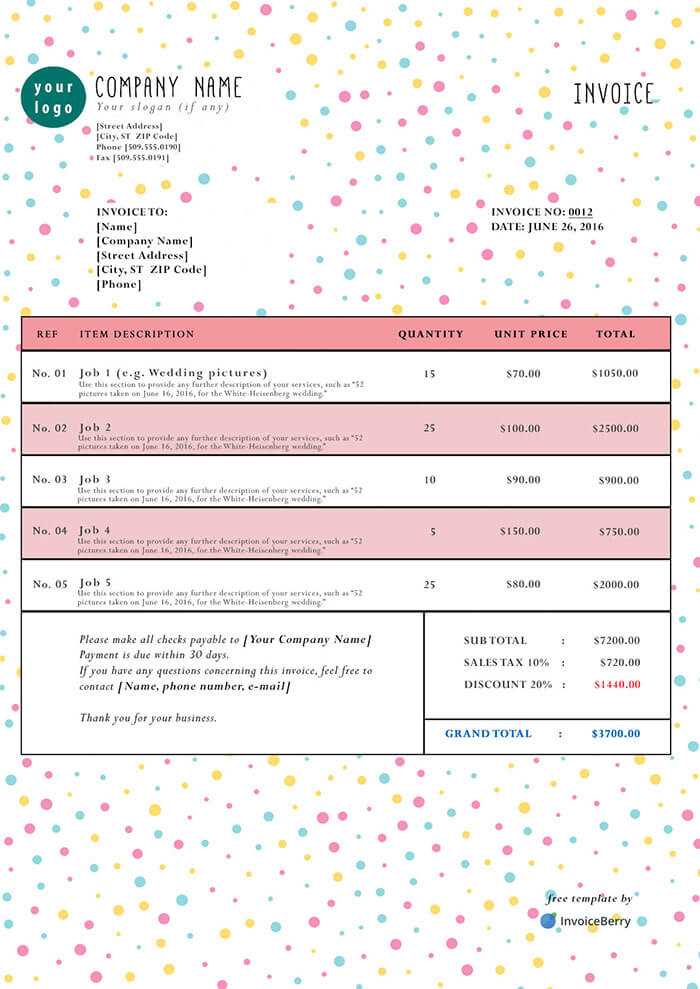

Invoice Customization for Branding

Customizing financial documents is an excellent way to strengthen your business’s brand identity and create a professional image. By incorporating your company’s logo, colors, and fonts, you can ensure that your transactions not only look polished but also reflect your brand’s personality and values. This not only makes your documents stand out but also reinforces your business’s identity every time a client receives one.

Key Elements to Customize

Here are a few elements you can customize to enhance your brand presence:

- Logo Placement: Position your logo prominently at the top of the document. This is the most visible part of the page and ensures that your clients immediately recognize your brand.

- Color Scheme: Choose a color palette that aligns with your business’s branding. Consistent use of colors across all documents enhances recognition and cohesion.

- Font Style and Size: Select fonts that are easy to read while reflecting your brand’s tone. Whether professional, casual, or creative, your choice of typeface can convey a lot about your company’s style.

- Contact Information: Include your contact details such as phone number, email, and website in a clearly visible section. This makes it easier for clients to reach you and also ensures consistency across your communications.

- Footer Message: A footer with a friendly message or a call to action can add a personal touch. You can use this space for promoting services, offering discounts, or simply thanking the client for their business.

Why Customization Matters

Customization not only creates a professional and cohesive look but also builds trust and credibility with your clients. When your documents consistently reflect your brand, they reinforce the impression that your business is organized, trustworthy, and client-focused. Clients are more likely to engage with a business that presents itself in a polished, consistent manner. Plus, a well-designed document stands out and leaves a lasting impression.

Adding Your Shop’s Logo and Details

Incorporating your business’s logo and essential contact information into your financial documents is an important step in maintaining a professional and cohesive brand identity. This simple customization can make your documents more recognizable and help clients quickly identify the source of the transaction. Additionally, clear contact details ensure that clients can easily reach you if they have any questions or need follow-up services.

Essential Elements to Include

When adding your logo and details to the document, consider including the following elements:

- Logo Placement: Place your company logo at the top of the document for maximum visibility. This helps reinforce your brand identity with each transaction.

- Business Name: Your business name should be clearly stated, typically near the logo, so it’s easy to associate the document with your brand.

- Contact Information: Include phone numbers, email addresses, and the physical address of your business. This ensures that clients have multiple ways to reach you if needed.

- Website URL: If applicable, add the URL of your website. This allows clients to easily access more information about your services or products.

- Social Media Handles: Including your social media profiles is an easy way to stay connected with customers and enhance brand visibility.

Why It Matters

By adding your logo and contact details to each document, you establish a professional, branded presence with every transaction. This not only strengthens your image but also fosters trust and recognition among clients. Clear and consistent communication is key to maintaining long-term relationships with your customers, and having your details prominently displayed ensures that they can always find the necessary information when needed.