Free Mechanic Invoice Template PDF for Easy and Professional Billing

For professionals in the auto repair industry, managing financial transactions smoothly and accurately is essential for maintaining a successful business. One of the most effective ways to streamline this process is by using pre-designed documents that simplify payment recording and ensure clarity. These documents not only save time but also create a polished and consistent appearance that builds trust with clients.

Customizable formats are particularly useful for service providers who want to add personal touches or adjust details according to the specific job or customer. They can include important information such as services rendered, prices, and payment terms, making it easy to track and review financial records.

By choosing the right file format, businesses can ensure compatibility across various devices and platforms, enhancing accessibility and ease of use. Whether for small shops or larger auto service centers, these documents are designed to support efficient transactions, helping professionals focus more on their work than on administrative tasks.

Why Use a Billing Document Format

Using a pre-designed billing document format is an efficient way for service providers to manage payments and maintain accurate financial records. These ready-made forms help ensure that all essential details are included, reducing the risk of missing critical information. Whether you run a small business or a larger service center, these documents can save you valuable time while creating a more professional appearance for your clients.

Consistency and Professionalism

Adopting a standardized format for your billing ensures that every transaction is clearly outlined, with no ambiguity regarding the services provided or the amount due. This consistent approach enhances the professionalism of your business and fosters trust with your customers, who will appreciate the clear and organized presentation of their charges.

Time-Saving and Efficiency

By using a pre-built document, you eliminate the need to create a new bill from scratch each time you provide a service. This streamlines the entire process, allowing you to focus on other aspects of your work while still ensuring that each transaction is documented correctly. With just a few edits, the format can be reused for different clients and jobs, saving you time and effort.

Benefits of Using a PDF Format

Choosing a widely recognized file format for billing documents provides several advantages that make the entire process more efficient and professional. The main benefits lie in the flexibility, security, and compatibility that this file type offers, which ensures a smooth transaction and keeps both service providers and clients satisfied.

Key Advantages

- Universal Compatibility: This format is supported by virtually all devices and operating systems, ensuring that your document can be opened and viewed without issues, no matter where it is accessed.

- Security Features: Using this format allows you to easily encrypt and password-protect your documents, preventing unauthorized access to sensitive information.

- Professional Presentation: The format ensures that your document maintains its original layout and formatting, regardless of the device or software used to open it.

- Easy to Store and Share: These files are compact, making them easy to store in digital archives and quick to share with clients through email or other online methods.

Streamlining Workflow

With this file type, you can also benefit from enhanced organization and reduced paperwork. When the document is ready, it can be quickly sent out without the need for physical printing or mailing. Additionally, saving these documents digitally makes it simple to track past transactions and retrieve information when needed.

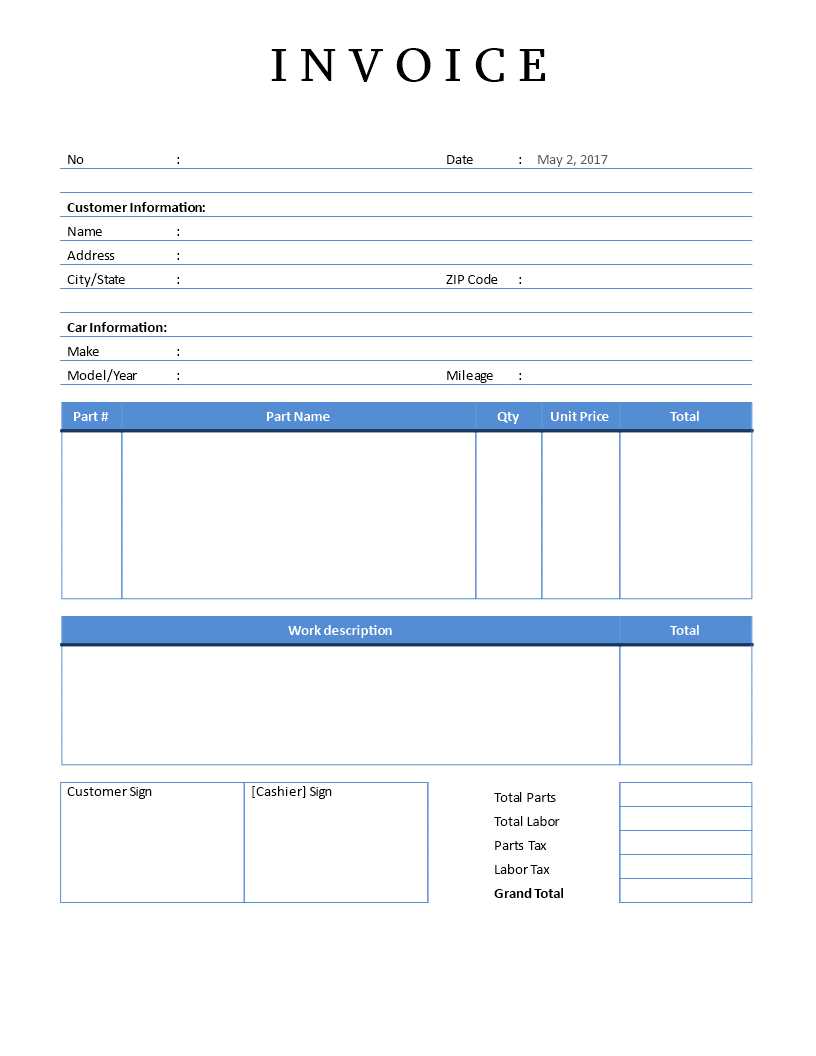

How to Customize Your Billing Document

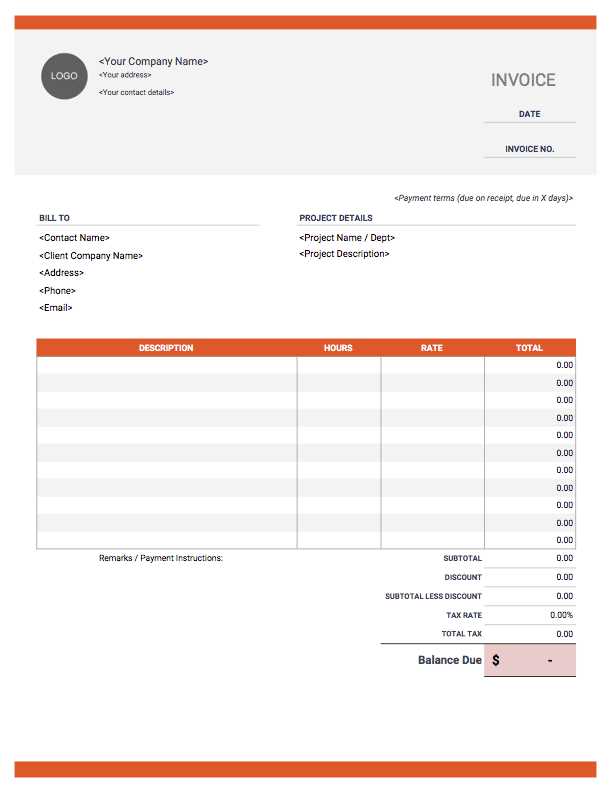

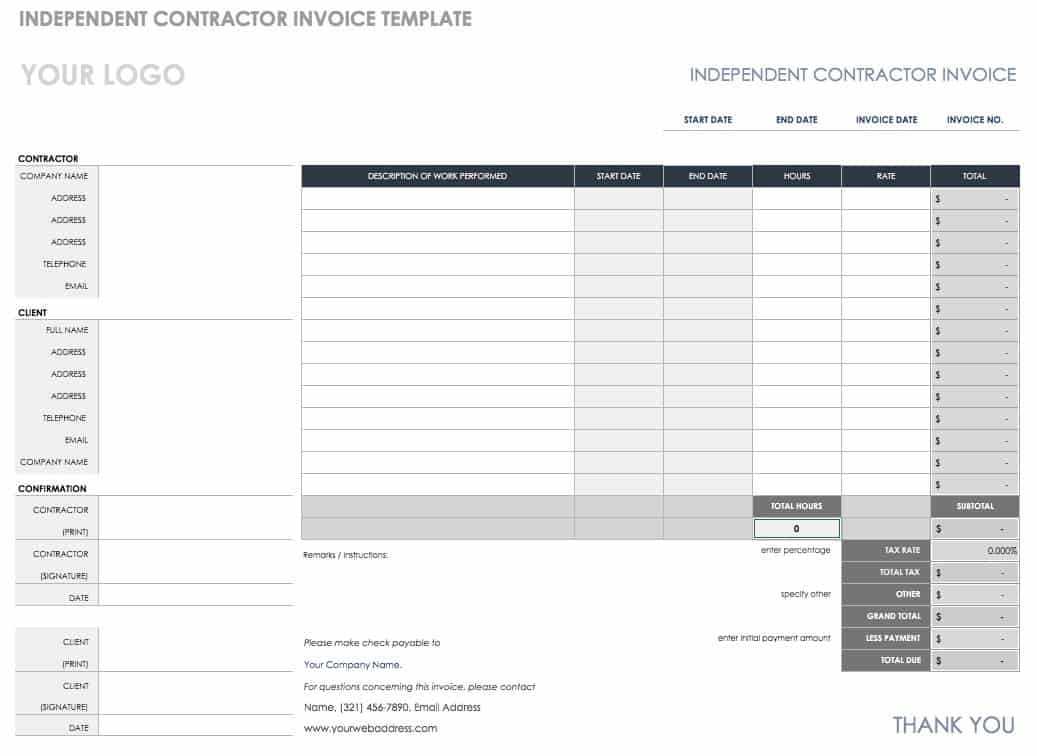

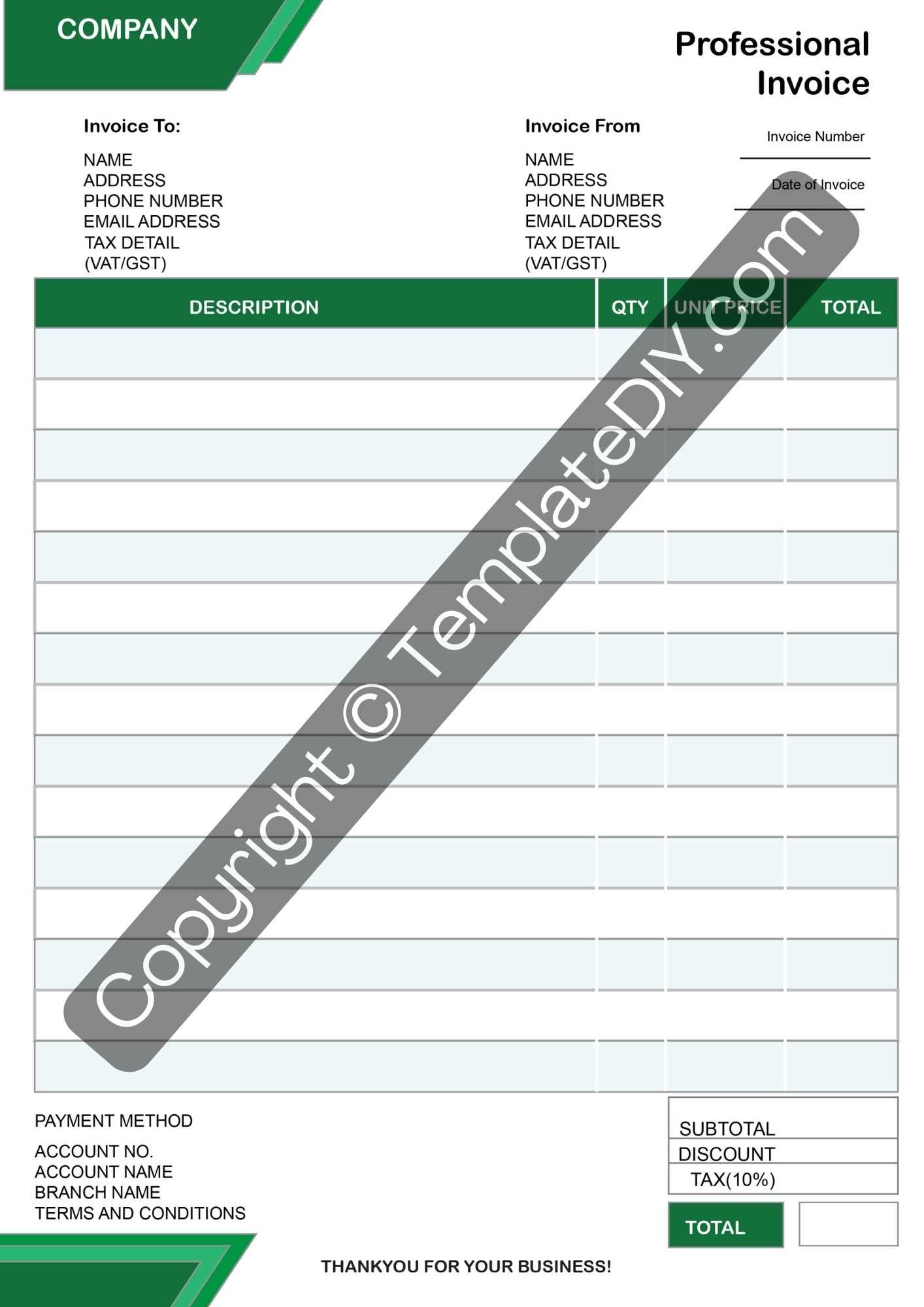

Personalizing your billing form allows you to align it with your business needs and provide a clear, professional look to clients. Customization helps to include necessary details, such as specific services offered, payment terms, and business branding, making it easier for customers to understand their charges. Adjusting the layout and content ensures that every transaction is represented accurately, with all essential information clearly presented.

Adjusting Essential Details

Start by modifying the basic fields in the document, such as the business name, contact details, and logo. This not only helps with brand recognition but also provides clients with the necessary contact information for future inquiries. You should also include clear sections for:

- Customer details: Name, address, and contact information.

- Services provided: List of tasks completed or products sold.

- Payment terms: Clear instructions on when and how payment is due.

Design and Layout Adjustments

Once the core details are in place, consider adjusting the design to suit your style. You can change fonts, colors, and layout to match your brand’s identity. Adding your company logo or using a professional color scheme can enhance the document’s appearance, making it look polished and trustworthy. It’s important to keep the format simple and easy to read, ensuring that all information is well-organized and accessible at a glance.

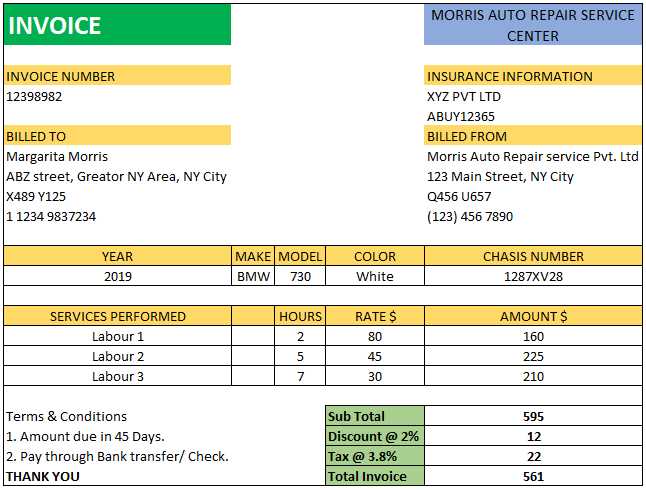

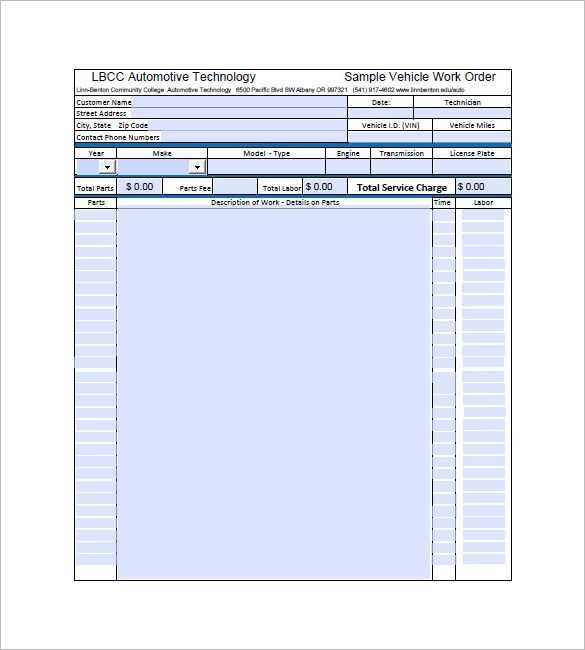

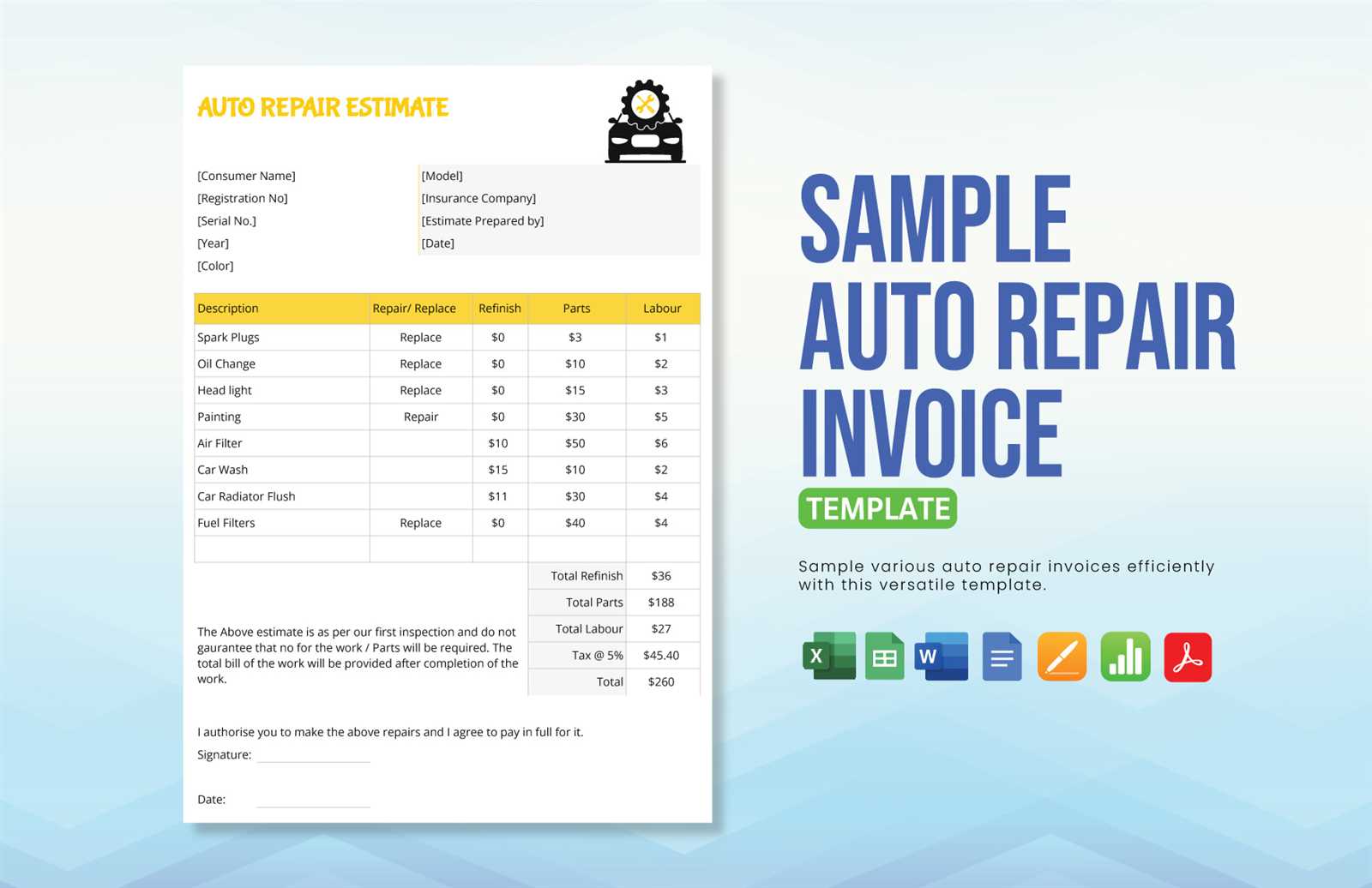

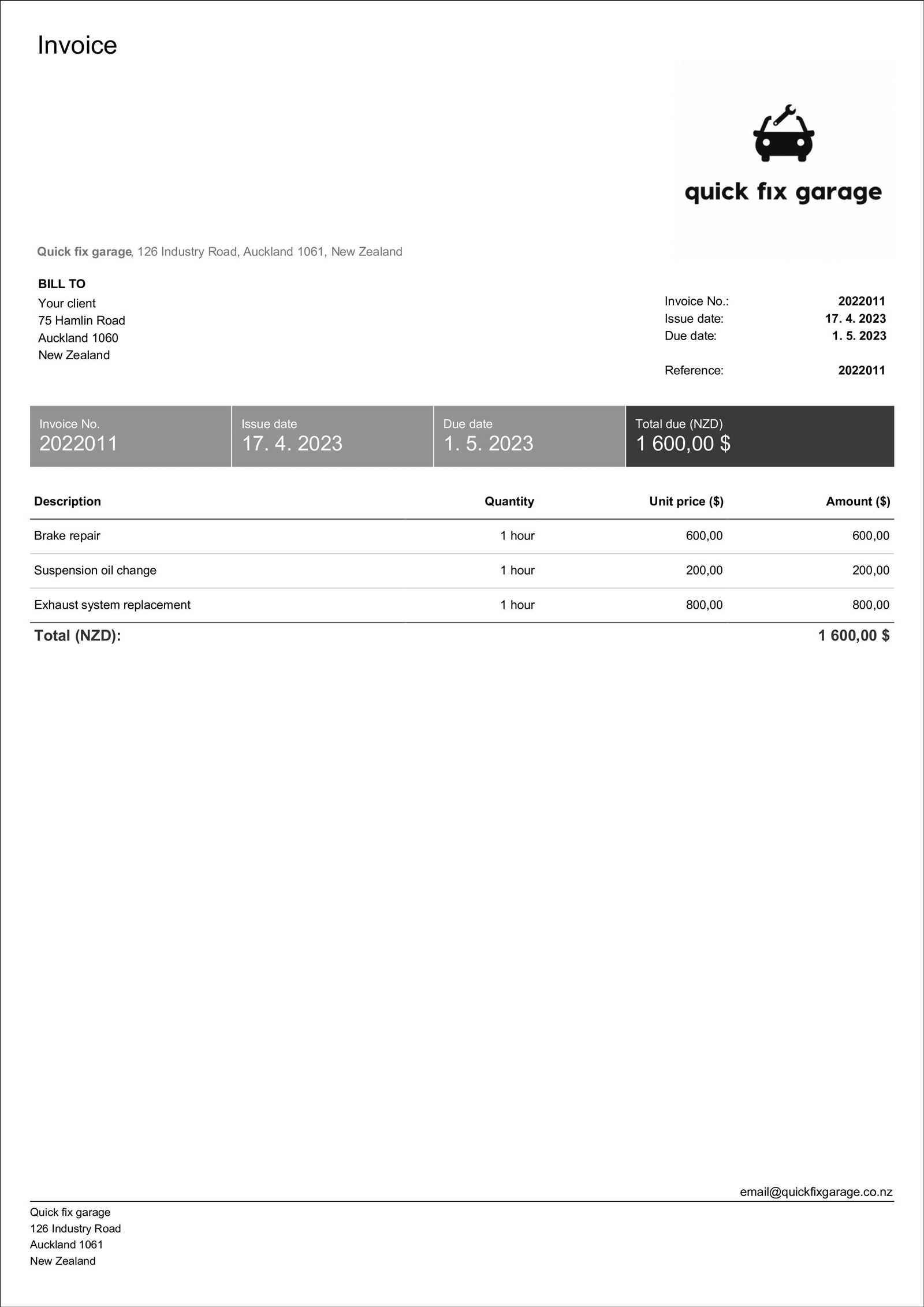

Common Fields in Service Billing Documents

When creating a billing document for auto repair services, certain key fields are essential to ensure clear communication between the service provider and the customer. These fields help to outline the work completed, the costs involved, and any other relevant information regarding payment. A well-structured document ensures that both parties are on the same page, reducing the risk of misunderstandings.

Here are some of the most common elements that should be included in these documents:

- Service Provider Details: This section includes the name, address, phone number, and email of the business or individual providing the service. It’s important to make sure this information is easily visible so that clients can contact you if needed.

- Client Information: This field contains the customer’s name, address, and contact information. It ensures that the document is properly associated with the correct person or business.

- Description of Services: A detailed list of the tasks performed, parts replaced, or repairs made. This section clarifies what exactly was done for the client and helps justify the charges.

- Pricing: The cost for each service or part provided, along with any additional fees or taxes. This should be broken down clearly to show how the final total was calculated.

- Payment Terms: Information on how the payment should be made, including accepted methods and due dates. It may also include any late payment fees or discounts for early payment.

- Unique Document Number: A reference number that helps track the document for accounting and future reference.

Including these key fields ensures that your billing document provides all the necessary information for a smooth transaction, leaving no room for confusion.

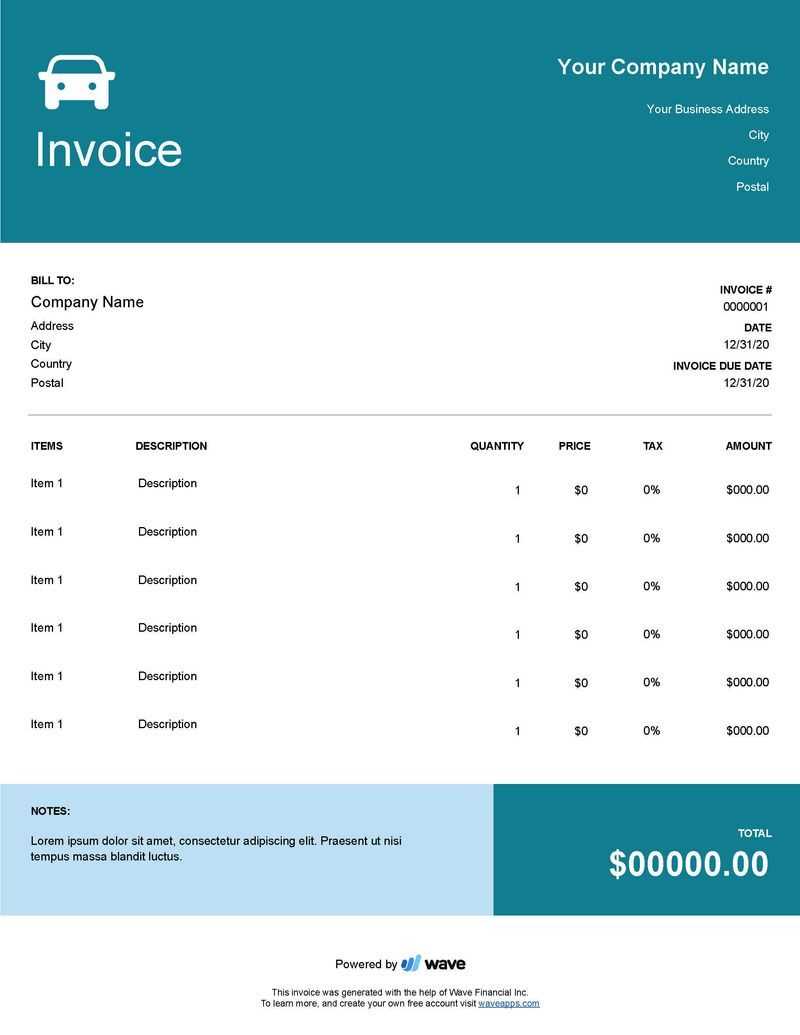

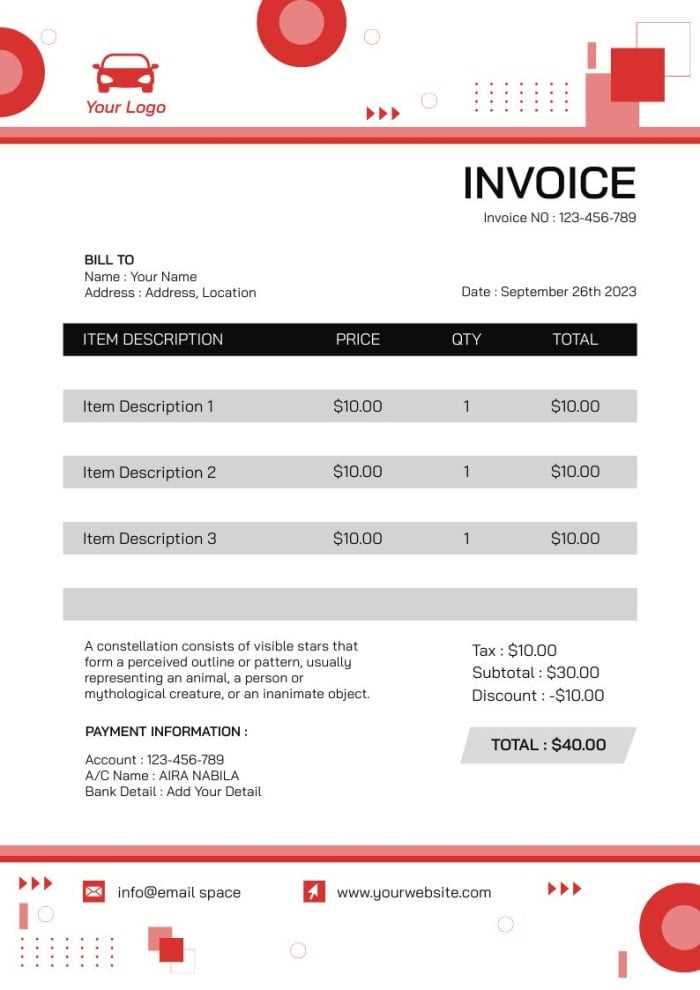

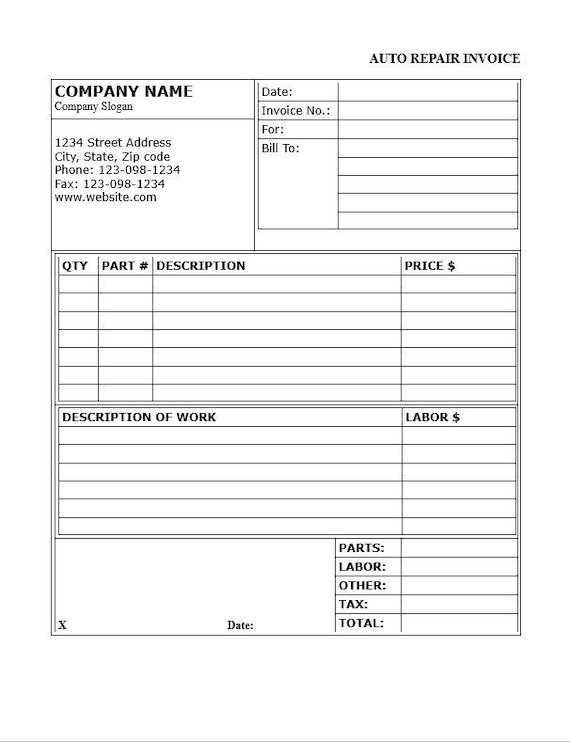

Top Features of Professional Billing Documents

Professional billing documents are designed to create a clear and transparent transaction between service providers and clients. A well-crafted document not only ensures that all necessary information is communicated but also helps to build trust and credibility with customers. There are several important features that contribute to a professional and effective billing document.

Here are the key elements that define high-quality billing forms:

| Feature | Description |

|---|---|

| Clear Branding | Including your business name, logo, and contact information prominently at the top of the document helps reinforce brand identity and ensures clients know who they are dealing with. |

| Itemized Breakdown | Providing a detailed list of services or products offered, along with individual costs, makes it easier for clients to understand what they are being charged for. |

| Unique Document Number | Including a unique reference number for each document helps with tracking and organization, especially when handling multiple clients or projects. |

| Payment Terms | Clearly outlining the payment due date, late fees, and accepted payment methods ensures there are no misunderstandings about how and when payment should be made. |

| Contact Information | Making sure your phone number, email address, and physical address are included makes it easy for clients to reach out with any questions or concerns. |

| Professional Layout | A clean, organized, and easy-to-read design helps clients quickly find all the information they need, which reflects positively on your business. |

By incorporating these features, you can ensure that your billing documents convey professionalism and efficiency, making it easier for clients to process and pay their dues on time.

How to Download a Free Billing Document

If you’re looking for a way to streamline your payment process, downloading a free pre-designed document can be a great solution. These files are available online and can be easily accessed with just a few clicks. By choosing a free version, you can get started quickly without having to spend time creating a document from scratch.

Steps to Download

To download your free document, follow these simple steps:

- Visit a reliable website: Look for reputable platforms that offer free resources for business professionals, such as websites dedicated to small business tools or document management.

- Choose your format: Once you find the right document, select the file format that suits your needs. Most platforms offer multiple formats, including editable options for flexibility.

- Click download: After selecting the file, click the download button. The document will be saved to your device, ready for customization and use.

Customizing After Download

Once downloaded, you can open the document and make necessary adjustments. Many free versions allow you to edit text fields, adjust pricing, and add your business details. This customization ensures the document fits your specific needs while maintaining a professional appearance.

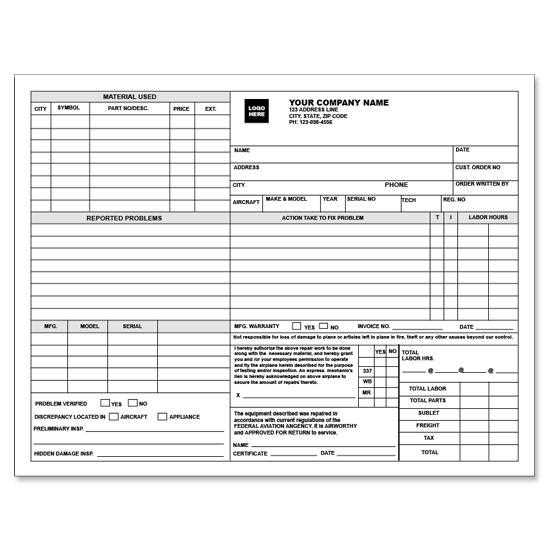

Creating a Billing Document from Scratch

Creating a billing document from the ground up allows you to fully tailor it to your business needs, ensuring that every detail is included and presented exactly as you require. While using a pre-designed format is convenient, building your own document gives you the flexibility to adjust the layout, structure, and content to match your unique services and branding.

Key Components to Include

When crafting a document from scratch, it’s important to ensure that all the essential information is covered. Here are the key elements to include:

- Business Information: Start by adding your company name, address, phone number, email, and logo at the top of the document. This helps clients easily identify your business and makes your document look more professional.

- Client Details: Include the name, address, and contact information of the customer to ensure the document is properly associated with the correct client.

- Description of Services: Provide a detailed breakdown of the services performed, including any parts used or work completed. This section ensures transparency and clarifies what the client is being charged for.

- Pricing: List the cost of each service or item, along with applicable taxes or fees. Include a subtotal and total to make it clear how the final amount was calculated.

- Payment Information: Specify the payment terms, including the due date, accepted methods of payment, and any late fees or discounts offered for early payment.

Formatting and Finalizing the Document

Once all the necessary components are in place, focus on the document’s layout and design. A clean, organized format helps clients quickly find the information they need. Make sure there is enough space between sections to ensure the document is easy to read and understand. After reviewing the content for accuracy, you can save the document and send it to the client, either digitally or in print.

Adding Payment Terms to Your Billing Document

Including clear and concise payment terms in your billing documents is essential for ensuring that both you and your clients understand the expectations surrounding payments. Setting out these conditions helps prevent misunderstandings and can improve the likelihood of receiving timely payments. Payment terms should cover due dates, accepted methods of payment, and any additional fees that may apply.

Here are the most important payment-related elements to include in your document:

| Payment Term | Description |

|---|---|

| Due Date | Clearly state when the payment is expected. This could be immediately, within 30 days, or another time frame. Including a specific date avoids confusion and provides a clear deadline for the client. |

| Accepted Payment Methods | Specify how clients can make payments, whether through bank transfers, credit card payments, checks, or online platforms. This helps clients understand their options and ensures smoother transactions. |

| Late Fees | If payments are not made on time, include any penalties or interest charges that will apply. Be sure to state the amount or percentage that will be added if the payment is overdue. |

| Early Payment Discounts | Offering discounts for early payments can encourage clients to settle their bills sooner. Include any terms for discounts and the timeframe within which the payment must be made to qualify. |

By outlining these terms in your billing document, you create a professional and transparent agreement that benefits both you and your clients. Having clear payment terms in place helps ensure timely compensation for your services, while also maintaining positive relationships with your customers.

Why PDF Format is Ideal for Billing Documents

When choosing a format for your billing documents, it’s important to select one that offers security, reliability, and universal compatibility. The right file type ensures that the document retains its formatting, is easily accessible by all parties, and can be sent quickly and safely. Among various options, the most suitable choice for business transactions is the widely used format known for its flexibility and consistency.

Here are the key reasons why this format is perfect for creating and sharing billing documents:

- Consistency Across Devices: One of the main advantages of this file type is that it preserves the document’s layout and formatting, regardless of the device or software used to view it. This ensures that both the sender and the recipient see the exact same version of the document.

- Security Features: This format allows for password protection and encryption, ensuring that sensitive financial information remains safe from unauthorized access. You can also add digital signatures for added authenticity.

- Universal Accessibility: This format is compatible with nearly all operating systems and devices, whether it’s opened on a computer, tablet, or smartphone. This universal access makes it easy for clients and service providers to view documents quickly.

- Compact and Easy to Share: Documents in this format are typically smaller in size compared to other types, making them easy to store and share via email or cloud storage without taking up too much space.

Choosing this format ensures that your business’s billing process is both professional and efficient, while minimizing the risk of miscommunication or formatting errors. Whether for one-time projects or long-term client relationships, it offers a streamlined solution that benefits both service providers and clients alike.

How to Protect Your Billing Files

Securing your financial documents is essential to prevent unauthorized access, tampering, or theft of sensitive information. Protecting these files ensures that your business transactions remain confidential and that both you and your clients can trust the integrity of the details provided. There are several methods to safeguard your documents from external threats or accidental exposure.

Here are some effective ways to protect your files:

- Password Protection: Adding a password to your files is one of the simplest and most effective ways to prevent unauthorized access. By requiring a password to open the document, you ensure that only authorized recipients can view its contents.

- Encryption: Encrypting your documents adds an additional layer of security, making it nearly impossible for unauthorized individuals to read the information even if they gain access to the file.

- Watermarking: Adding a watermark to your documents can act as a deterrent for unauthorized use or distribution. This technique visibly marks the document with your branding or other identifying information, making it harder for someone to use the document without attribution.

- Access Controls: For businesses that store documents on cloud platforms or shared servers, setting access permissions is crucial. Only grant access to individuals who need it, and regularly review these permissions to ensure that no one has inappropriate access.

- Digital Signatures: A digital signature is a cryptographic method of verifying the authenticity and integrity of your document. By adding a signature, you confirm that the file has not been altered since it was signed and that it originated from a trusted source.

Implementing these security measures ensures that your financial records are well-protected, minimizing the risk of fraud or data breaches. Taking the time to secure your documents builds trust with your clients and demonstrates that you value the confidentiality of their personal and financial information.

Integrating Your Billing Document with Accounting Software

Automating the process of tracking payments and expenses can significantly streamline your business operations. By linking your billing documents with accounting software, you can easily record transactions, track outstanding payments, and generate financial reports with minimal manual effort. This integration not only saves time but also reduces the risk of errors that can occur when data is entered manually.

Benefits of Integration

Integrating your billing system with accounting software offers several key advantages:

- Automated Data Entry: Once you generate a billing document, the software can automatically capture and store the relevant details, such as client information and payment amounts, without the need for manual input.

- Real-Time Tracking: Integration allows you to monitor payments and balances in real time, providing up-to-date information on the status of your accounts receivable and outstanding invoices.

- Financial Reporting: By connecting your billing documents with accounting software, you can easily generate financial reports that give you an overview of your business’s financial health. This helps with budgeting and decision-making.

- Improved Accuracy: Automation reduces the likelihood of human error, ensuring that all transactions are accurately recorded and reflected in your financial records.

How to Integrate

To integrate your billing documents with accounting software, follow these steps:

- Choose compatible software: Select an accounting solution that supports integration with your preferred billing format. Many modern accounting tools offer built-in templates and integration options for ease of use.

- Set up data syncing: Follow the software’s guidelines to sync the data between your billing platform and accounting system. This may involve importing your document into the software or using an API to transfer the details automatically.

- Customize settings: Configure the software to categorize transactions and apply the appropriate payment terms, taxes, and discounts according to your business needs.

By integrating your billing process with accounting software, you create a seamless flow of information that improves efficiency and accuracy, making financial management much simpler.

Tips for Clear and Concise Billing Documents

Creating clear and concise billing documents is essential for avoiding confusion and ensuring that clients understand the charges they are being asked to pay. A well-organized document not only facilitates quicker payments but also helps maintain a professional image for your business. By following a few simple guidelines, you can create documents that are both informative and easy to comprehend.

Keep It Simple and Direct

One of the most important aspects of an effective billing document is clarity. Here are some tips to help make your documents more straightforward:

- Use Clear Language: Avoid using jargon or overly complicated terms. Make sure your descriptions are simple and easy to understand, so clients can quickly grasp what they’re being charged for.

- Be Specific: Provide as much detail as needed, but don’t overcomplicate things. Break down your charges clearly–list each service or product and its associated cost. This makes the document easier to follow.

- Consistent Formatting: Use a consistent font, size, and layout throughout the document. This helps readers focus on the content without distractions. A clean, organized format enhances readability and reduces errors.

Include All Essential Information

In addition to keeping the document clear, make sure it contains all the necessary details for both you and the client to reference later:

- Business and Client Information: Always include both parties’ contact details and a unique reference number for easy tracking.

- Dates and Payment Terms: Clearly state the issue date, due date, and any applicable payment terms. This avoids confusion about deadlines and payment expectations.

- Breakdown of Costs: List services, quantities, and individual costs to give your client a clear understanding of what each charge represents.

By keeping your documents straightforward, well-organized, and informative, you not only make it easier for clients to understand their payments but also improve the likelihood of receiving payments on time.

Legal Considerations for Billing Documents

When creating billing documents for services rendered, it is important to ensure that they comply with relevant laws and regulations. Having legally sound documents not only protects your business but also establishes clear expectations for both parties. Legal considerations typically involve contract terms, payment agreements, tax requirements, and consumer protection laws, all of which must be accurately reflected in your paperwork.

Essential Legal Elements to Include

To avoid potential legal issues, it’s crucial to include the following key elements in your billing documents:

- Clear Payment Terms: Specify the payment due date, accepted payment methods, and any late fees that may apply. This sets expectations and provides legal grounds if payment disputes arise.

- Detailed Descriptions: Provide a comprehensive breakdown of the services or goods provided. Clear documentation of what was delivered ensures there is no confusion about what is being charged and helps prevent disputes.

- Tax Information: Include applicable taxes in accordance with local or national regulations. Ensure that sales tax, VAT, or other relevant tax rates are correctly applied to avoid legal complications with tax authorities.

Protecting Your Rights

To further protect your business, consider the following legal practices:

- Contractual Clauses: If your services are governed by a contract, include references to the terms of the agreement in your billing document. This ensures that both parties are aware of their obligations and rights.

- Dispute Resolution Process: Include information on how any disputes will be handled, such as through mediation or arbitration. This provides a clear pathway for resolving issues without involving litigation.

- Retention of Documentation: Keep a copy of all billing documents and related correspondence for record-keeping purposes. This ensures you have proof of agreements and transactions should any legal questions arise in the future.

By adhering to legal requirements and including the necessary elements in your documents, you can avoid potential pitfalls and foster trust with your clients. A legally sound billing process contributes to smoother business operations and a stronger reputation in the marketplace.

Tracking Payments with Your Billing Document

Keeping track of payments is a crucial aspect of managing your business’s finances. Proper tracking ensures that you can easily identify which clients have paid, which are overdue, and how much is still outstanding. By incorporating effective payment tracking into your billing documents, you can stay on top of your cash flow and reduce the likelihood of missed payments or disputes.

Here are some essential strategies for tracking payments effectively through your billing system:

Include a Payment Status Section

One of the simplest ways to track payments is by adding a section on your billing document that clearly indicates the payment status. This could include the following:

- Paid: Marking the document as “Paid” once a payment has been received helps you keep a record of settled accounts.

- Unpaid: Highlighting unpaid amounts ensures that you can quickly identify clients who still owe money.

- Partially Paid: For clients who have made partial payments, indicate the amount received and the remaining balance.

Set Up Payment Due Dates

Including a clear payment due date on each document is crucial for timely tracking. When clients know exactly when the payment is due, it reduces confusion and helps you track overdue accounts more effectively. It also enables you to follow up in a timely manner if payment is not received by the due date.

By using these methods to track payments, you create a straightforward system that helps both you and your clients stay organized. This reduces administrative work and provides transparency, ensuring smoother financial transactions and more effective cash flow management.

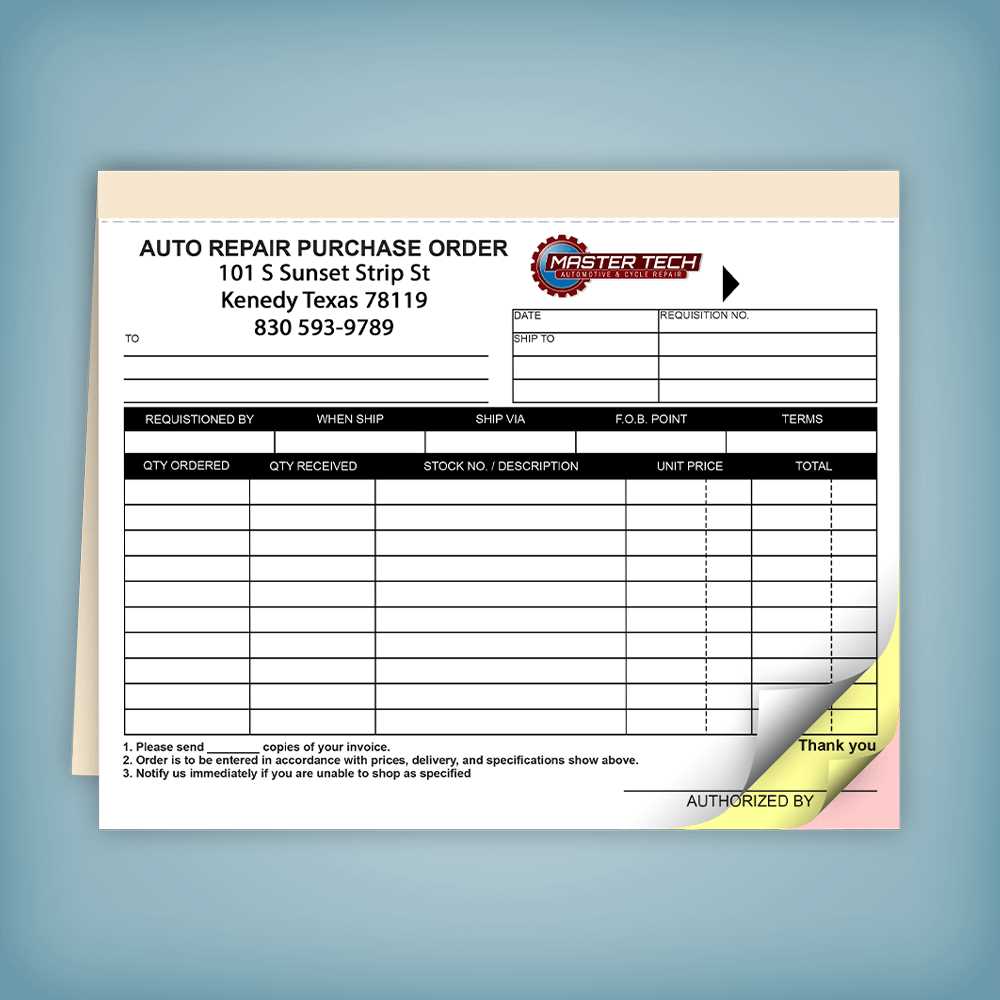

Pre-designed Documents vs Custom Billing Statements

When it comes to creating billing documents, businesses often face the decision between using pre-designed, standardized forms or designing custom documents tailored to their specific needs. Each option offers distinct advantages, depending on the type of business, the complexity of services provided, and the level of customization required. Understanding the differences between these two approaches can help you choose the right method for your business operations.

Advantages of Pre-designed Documents

Pre-designed documents are ready-made templates that can be easily filled out and sent to clients. These forms offer several benefits:

- Quick Setup: Ready-to-use formats save time by eliminating the need to start from scratch. You simply input the necessary details and send the document.

- Consistency: Pre-designed forms help maintain a consistent look for all your billing documents, ensuring your business appears professional and organized.

- Cost-effective: Many pre-designed options are available for free or at a low cost, making them an affordable solution for small businesses or startups.

Advantages of Custom Billing Statements

On the other hand, custom billing statements are tailored to your specific business needs. They allow for greater flexibility and personalization, and here’s why they may be the better option in some cases:

- Full Customization: With custom documents, you have complete control over the layout, design, and content, allowing you to include unique features that suit your business style.

- Branding Opportunities: Customizing your documents helps reinforce your brand identity by incorporating your logo, colors, and overall aesthetic, which can enhance professionalism and client trust.

- Better Adaptation to Complex Needs: If your business involves complex services or pricing structures, a custom document can be structured in a way that clearly communicates all the necessary details, making it easier for clients to understand.

Ultimately, the choice between using a pre-designed document or creating a custom one depends on your business’s requirements. Pre-designed options are ideal for those who need a simple and quick solution, while custom documents are best for businesses that require a more personalized and detailed ap

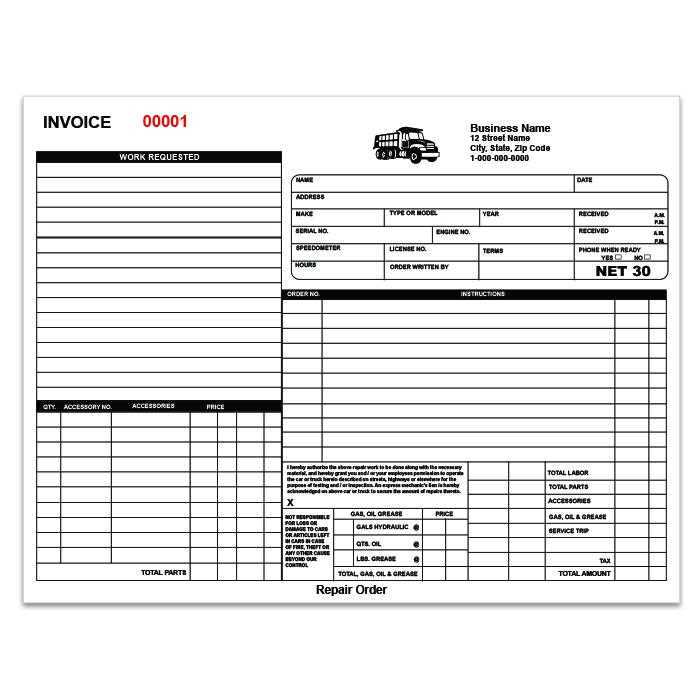

How to Handle Multiple Services in One Billing Document

When providing several services to a client, it’s important to present them clearly and systematically in a single billing document. A well-structured layout ensures that your client understands exactly what is being charged, and it helps you avoid confusion or misunderstandings. Managing multiple services in one document requires careful organization to make sure each item is listed accurately and clearly, with appropriate costs attached.

Break Down the Services Clearly

The first step in handling multiple services in one document is to break down each service separately. This allows the client to see exactly what they’re paying for. Here’s how you can structure this section:

- Service Description: Provide a brief yet detailed description of each service rendered. The description should be specific enough for the client to understand what they are being charged for.

- Unit Cost: Clearly indicate the cost of each individual service or product, whether it’s hourly, per unit, or as a flat fee.

- Quantity: If applicable, specify the quantity of each service performed (e.g., number of hours worked, units provided, etc.).

- Total Cost: For each service, calculate the total amount (unit cost multiplied by quantity) and display it prominently.

Group Related Services Together

If the services are related, group them together under a common heading or category. This helps to simplify the document and provides a clear overview of the different areas of service provided. For example, if you offer both routine maintenance and emergency repairs, you could list them separately under “Routine Maintenance” and “Emergency Services” to clarify what was done in each category.

- Category Headings: Use bold or highlighted headings to group related services together, making the document more visually organized.

- Subtotals for Categories: After listing all services in a category, provide a subtotal for that group to make it easier for the client to see how much they owe for each type of service.

Ensure Total Transparency

To avoid confusion, always provide a final total at the bottom of the document that includes the subtotal for each category, any applicable taxes, and the grand total. This gives the client a complete breakdown of the total cost, leaving no room for uncertainty. It’s also helpful to include any terms of payment, such as when payment is due, late fees, or available discounts.

- Grand Total: Ensure that all charges are added up correctly and that the total is clear and easy to read.

- Payment Terms: Don’t forget to mention when the payment is due and what methods of payment are accepted. You can also include any special discounts or incentives for early paym

Common Mistakes to Avoid in Billing Documents

When preparing billing documents, even small errors can lead to confusion, delayed payments, or even disputes with clients. It’s essential to be meticulous in ensuring that all details are correct and clearly presented. There are several common mistakes that businesses often make, and by identifying and addressing them in advance, you can streamline your process and maintain professional relationships with your clients.

Inaccurate or Missing Information

One of the most critical aspects of a well-prepared billing document is accuracy. Failing to provide the correct details or omitting necessary information can create unnecessary delays and confusion. Below are some common errors to watch out for:

- Incorrect Client Information: Always double-check that the client’s name, address, and contact details are correct to avoid issues with communication or payment.

- Missing Payment Terms: If payment terms, such as due dates, late fees, or accepted methods of payment, are omitted, clients may be unclear about when and how to settle their balance.

- Unclear Descriptions: Vague descriptions of the services provided can lead to misunderstandings. Always be specific about what services were performed or products delivered.

Calculation Errors

Mathematical mistakes can undermine the accuracy of your document and cause clients to question the validity of your charges. Make sure you take extra care when calculating totals, taxes, and discounts. Common errors include:

Potential Mistake How to Avoid It Incorrect Totals Double-check your calculations for each service, including unit costs and quantities, and ensure all subtotals are correct before finalizing the document. Missing Taxes Ensure that any relevant taxes (e.g., sales tax, VAT) are correctly calculated and listed separately on the document. Discount Confusion Clearly state any discounts applied and calculate them correctly. Be sure to show the original price and the discounted price. By avoiding these common errors, you can create billing documents that are clear, accurate, and easy for clients to process. This not only speeds up payments but also helps maintain a strong professional reputation.