Free Material Invoice Template for Easy Billing and Tracking

Managing transactions and keeping accurate records is essential for any business, especially when it comes to tracking the supply of materials and goods. Streamlining the billing process can save time, reduce errors, and improve overall business efficiency. A well-structured document that records each exchange provides clarity for both suppliers and clients, ensuring smooth financial operations.

By using an organized system to outline itemized charges, companies can maintain better control over their expenses and income. This is particularly useful in industries where precise calculations and detailed documentation are crucial. Whether you’re handling construction materials, raw goods, or other supplies, having a standardized form for all financial interactions helps prevent misunderstandings and promotes professionalism.

In this guide, we explore how businesses can simplify their accounting practices by adopting a ready-made solution for documenting transactions. These solutions not only ensure accuracy but also save time, so you can focus on what really matters–growing your business.

Material Invoice Template Overview

When managing transactions in any business, having a structured document that records the details of exchanges is crucial for smooth operations. Such a document serves as both a record of goods provided and a request for payment, ensuring clarity for both parties involved. This system is especially important in industries dealing with supplies, where accurate tracking of quantities, pricing, and delivery is key to maintaining control over finances.

An effective billing document helps to formalize the sales process, providing both the seller and buyer with a clear understanding of what has been exchanged and at what cost. It also serves as an essential reference for accounting, auditing, and future business negotiations.

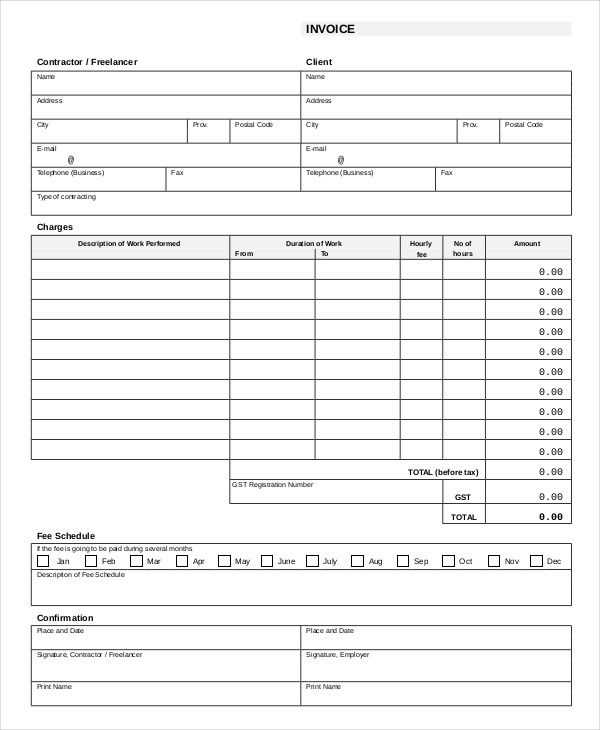

Key aspects of this type of document include:

- Clear identification of the products or goods provided

- Accurate pricing and quantities

- Detailed payment terms and conditions

- Legal or contractual information, where applicable

- Dates of transaction and delivery

Having a consistent and reliable structure for these records can significantly reduce the potential for disputes and errors, leading to more efficient operations. It also provides an easily accessible document for clients and internal teams to refer to when tracking payments or fulfilling orders.

What is a Material Invoice Template?

A structured document used to record the details of a transaction between a seller and a buyer is essential for maintaining clear and efficient financial records. This document outlines the goods or services provided, along with their quantities, prices, and any other relevant information. It serves both as a request for payment and as proof of the exchange, ensuring both parties have a mutual understanding of the terms.

In essence, it is a tool designed to simplify the billing process and keep track of various exchanges. These records are particularly important for industries dealing with supplies, where accurate tracking and documentation are vital for smooth business operations. It helps the seller ensure payment for delivered goods and provides the buyer with a breakdown of their purchase for future reference.

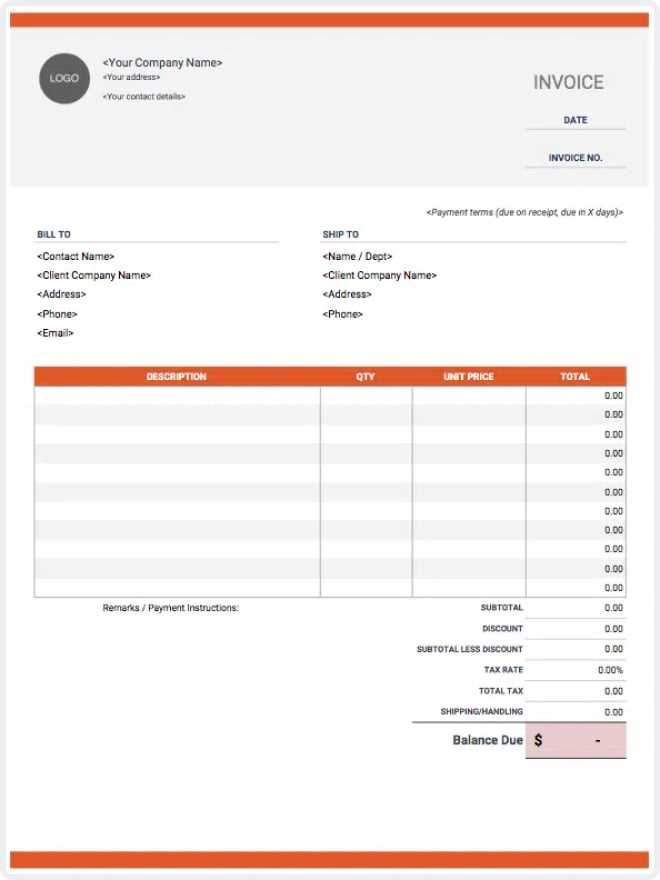

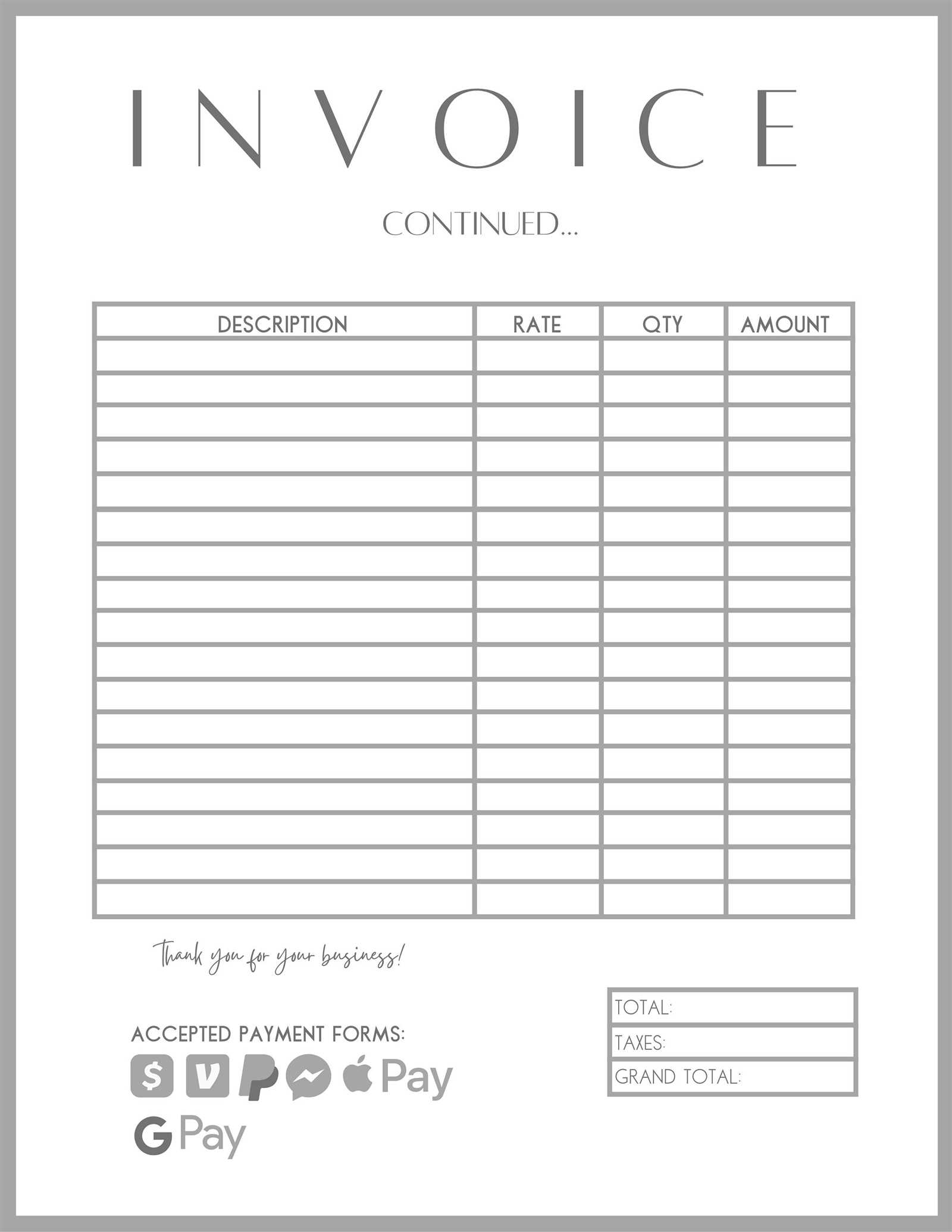

A well-designed document typically includes:

- Description of items or services provided

- Quantity and price breakdown

- Payment terms and conditions

- Contact and business details of both parties

- Transaction dates and reference numbers

Using such a document ensures that the exchange is well-documented and transparent, making it easier to track payments, resolve disputes, and manage financial records effectively.

Key Features of a Material Invoice

A well-structured billing document includes several critical elements that ensure both clarity and accuracy in the transaction process. These features are designed to provide both the buyer and seller with a detailed overview of the exchange, outlining essential information such as item descriptions, prices, and payment terms. By including these elements, businesses can avoid misunderstandings and maintain organized financial records.

Essential Information in a Billing Document

Each section of the document serves a specific purpose in tracking the transaction. From listing the products or services provided to specifying payment deadlines, each detail plays a role in ensuring a smooth financial process. Below are the most common features included in such a document:

| Feature | Description |

|---|---|

| Itemized List | A detailed breakdown of each product or service with corresponding quantities and prices. |

| Business Information | Contact details for both the supplier and the client, including names, addresses, and phone numbers. |

| Transaction Date | The date when the goods were provided or the service was completed. |

| Payment Terms | Information on how and when payment should be made, including deadlines and any discounts or penalties. |

| Unique Reference Number | A unique number assigned to the document for easy tracking and reference. |

Additional Considerations

In addition to the basic features, some businesses may include extra details, such as tax rates, shipping costs, or contractual clauses. These elements provide further clarity and can help avoid any potential disputes in the future. By customizing the document to meet specific needs, companies can ensure that every important aspect of the transaction is covered.

Benefits of Using an Invoice Template

Utilizing a pre-designed billing structure can significantly simplify and streamline the process of documenting transactions. With such a format, businesses can avoid common errors, save time, and maintain consistency across all financial records. By reducing the need to manually create documents from scratch, companies can focus more on operational aspects while ensuring that all necessary details are included in every exchange.

Key Advantages of Using a Standardized Document

One of the primary benefits of using a standardized billing document is the consistency it offers. By following a uniform format, businesses can ensure that every record contains the essential details, making it easier for clients and internal teams to understand and reference. Here are some of the key benefits:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-made formats save time by eliminating the need to create each document from scratch. |

| Improved Accuracy | Standardized fields reduce the risk of missing or incorrect information. |

| Professional Appearance | A polished and consistent document enhances your business’s professional image. |

| Easy Tracking | A uniform structure makes it easier to organize, track, and reference past transactions. |

| Reduced Errors | By automating certain elements, such as calculations, the likelihood of human error decreases. |

Increased Productivity and Organization

Having a ready-made structure also improves organization. With essential fields already pre-arranged, it becomes simpler to fill in the required information and maintain accurate records over time. Whether used for regular transactions or specific projects, these documents help businesses maintain a well-organized financial

How to Create a Material Invoice

Creating a document to record the details of goods provided or services rendered is an essential task for any business. This document serves as a formal request for payment and includes important information for both the supplier and the customer. Understanding the key components of such a document is crucial for ensuring accuracy and clarity, which helps streamline business transactions and maintain a professional relationship between parties involved.

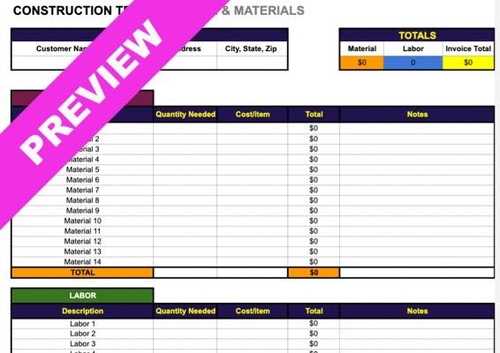

Key Elements to Include

When preparing this type of document, several crucial details must be listed clearly to avoid confusion. Here are the main sections to consider:

- Business Information: Include the name, address, and contact details of both the supplier and the recipient.

- Transaction Details: Clearly state the description of the goods or services provided, including quantities, unit prices, and any applicable discounts.

- Payment Terms: Specify the due date, payment methods, and any penalties for late payments, if applicable.

- Document Number: Assign a unique identifier to help track this transaction.

- Total Amount: Calculate the total cost including taxes, shipping, and any additional charges.

Step-by-Step Process

To ensure everything is in order, follow this simple process when creating the document:

- Start with a Header: Include your company name, address, and contact information at the top.

- Detail the Transaction: Describe the products or services provided with clear breakdowns of quantity and cost.

- Include Payment Instructions: Make sure the recipient knows how and when to pay.

- Review for Accuracy: Double-check all numbers, dates, and details to avoid mistakes.

- Send and Archive: Once completed, send it to the customer and keep a record for your own files.

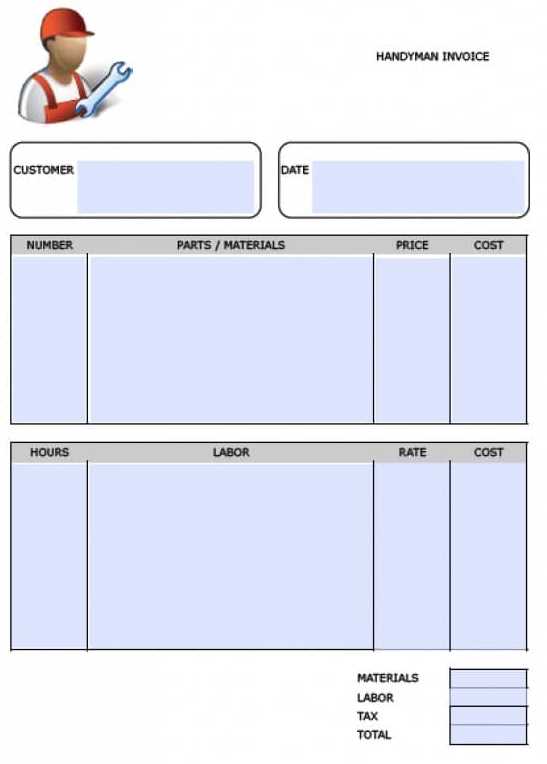

Common Elements in Material Invoices

When preparing a document to request payment for goods delivered or services rendered, it is essential to include certain details to ensure clarity and avoid misunderstandings. These elements help both the supplier and the recipient to track the transaction efficiently, ensuring smooth communication and timely processing of payments.

Essential Components to Include

Each transaction document should contain specific information to serve its intended purpose. The following key elements are commonly found in such documents:

- Business Information: This includes the name, address, and contact details of both the supplier and the customer. It helps identify the parties involved in the transaction.

- Unique Identifier: A reference number or code for the document, which helps in tracking and organizing records.

- Description of Goods or Services: A clear list of the items provided or work completed, along with quantities and unit prices, if applicable.

- Payment Terms: Detailed information about when and how the payment should be made, including due dates and any penalties for late payments.

- Subtotal and Total: A breakdown of the charges, including taxes, shipping costs, or any additional fees that apply to the order, with a final total amount due.

- Payment Instructions: Specific guidelines on how the recipient should process the payment (bank details, payment methods, etc.).

Additional Optional Information

While the core details are essential, some documents may also include additional information to provide further context or assist in record-keeping:

- Shipping or Delivery Information: If applicable, the shipping address, delivery method, or tracking number can be included to clarify logistics.

- Terms and Conditions: Some businesses choose to include their terms of service or any specific clauses regarding refunds, returns, or other policies.

- Discounts or Promotions: If discounts were applied, it’s helpful to show how they were calculated and what impact they had on the total.

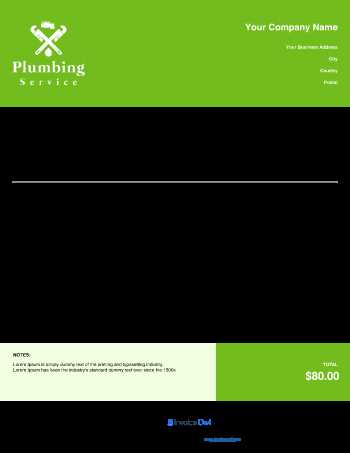

Customizing Your Material Invoice Template

Tailoring a document to match the specific needs of your business is crucial for creating a professional and functional record of transactions. Customizing this document not only helps represent your brand effectively but also ensures that all necessary details are included in a clear and organized manner. By adjusting the layout, content, and design, you can create a version that reflects your business style while maintaining clarity and ease of use for your customers.

Key Customization Options

When adapting this document for your business, there are several areas where customization can add value and enhance its effectiveness:

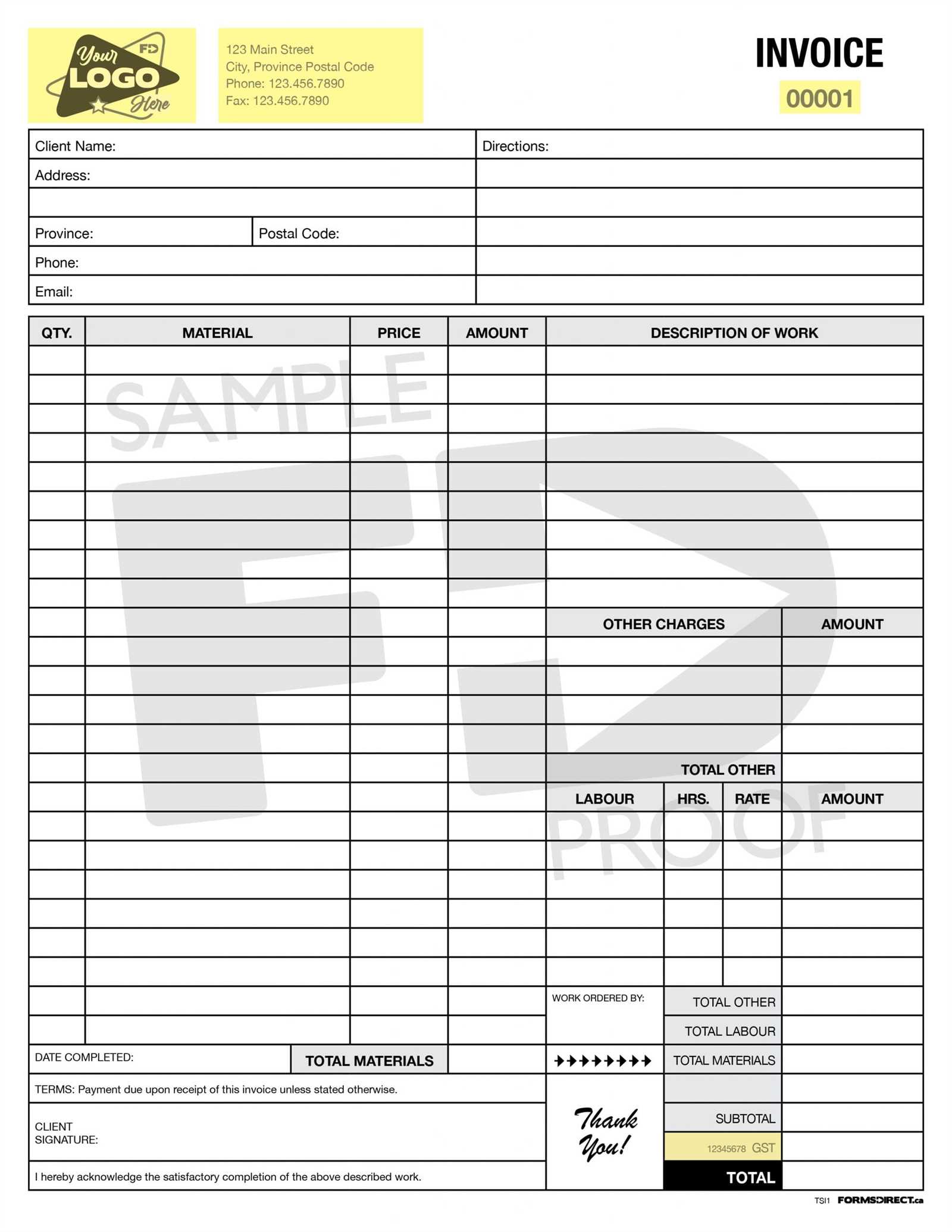

- Branding: Include your company logo, colors, and fonts to make the document instantly recognizable and consistent with your branding materials.

- Header Information: Personalize the header with your business name, contact details, and any legal information that may be required, such as tax ID numbers.

- Item Descriptions: Customize the list of items or services to suit your specific offerings. You can also modify the columns to include fields such as product codes or serial numbers.

- Terms and Conditions: Adjust the payment terms, deadlines, and any applicable late fees to match your business practices or customer agreements.

- Additional Charges: If you offer extras like delivery, installation, or handling fees, create custom fields for these charges to ensure all costs are accounted for.

Design and Layout Adjustments

Aside from content, the visual presentation of your document is important. A well-structured design makes it easier for recipients to understand the details at a glance:

- Sections and Headings: Organize the document into distinct sections, such as customer details, transaction description, and payment terms, to improve readability.

- Tables and Grids: Use tables to neatly display itemized lists, prices, an

Free vs Paid Material Invoice Templates

When choosing a format to document transactions and request payments, businesses have the option to either use a free or paid version of a design. Each choice comes with its own set of benefits and limitations, depending on the needs of the company. Understanding the key differences between free and paid options will help you make an informed decision about which route is best for your operations.

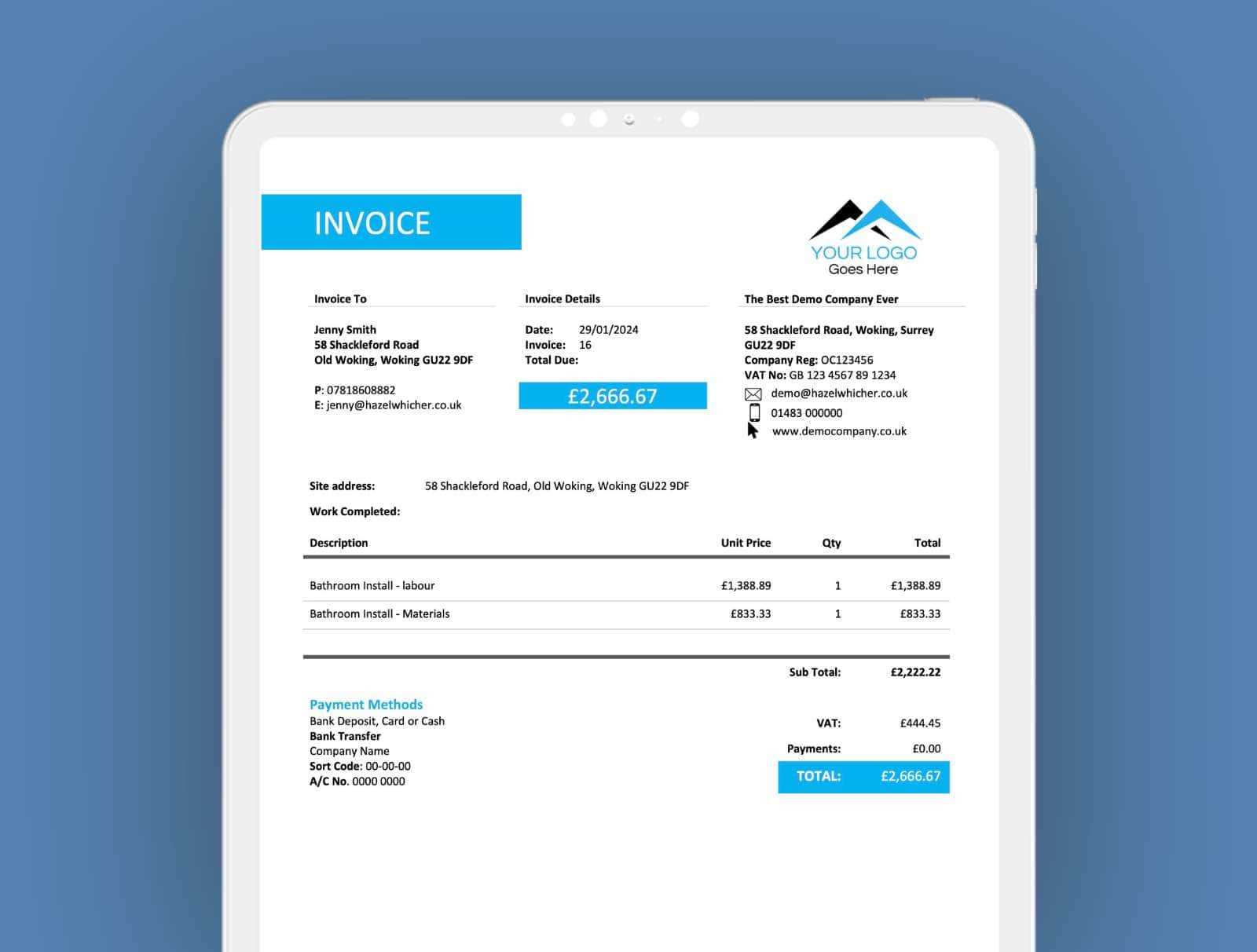

Comparison of Free and Paid Options

Both free and paid designs offer useful features, but the level of customization, functionality, and support can vary significantly. Here’s a breakdown of the primary differences:

Feature Free Versions Paid Versions Customization Options Limited; basic designs with few customization features. Extensive; full control over layout, branding, and content. Design Quality Simple and basic designs, often with limited visual appeal. Professionally designed with more polished and visually appealing options. Support Minimal to no customer support. Dedicated customer support and assistance for setup and issues. Advanced Features Few or none, often lacking advanced functionalities. Access to advanced features like automated calculations, integrated payment options, and cloud storage. Cost Free to use with no upfront cost. Requires a one-time payment or subscription fee. Which Option is Right for

Free vs Paid Material Invoice Templates

When choosing a format to document transactions and request payments, businesses have the option to either use a free or paid version of a design. Each choice comes with its own set of benefits and limitations, depending on the needs of the company. Understanding the key differences between free and paid options will help you make an informed decision about which route is best for your operations.

Comparison of Free and Paid Options

Both free and paid designs offer useful features, but the level of customization, functionality, and support can vary significantly. Here’s a breakdown of the primary differences:

Feature Free Versions Paid Versions Customization Options Limited; basic designs with few customization features. Extensive; full control over layout, branding, and content. Design Quality Simple and basic designs, often with limited visual appeal. Professionally designed with more polished and visually appealing options. Support Minimal to no customer support. Dedicated customer support and assistance for setup and issues. Advanced Features Few or none, often lacking advanced functionalities. Access to advanced features like automated calculations, integrated payment options, and cloud storage. Cost Free to use with no upfront cost. Requires a one-time payment or subscription fee. Which Option is Right for You?

Choosing between a free or paid design depends largely on your business needs. If you’re just starting out or running a small operation, free versions might be sufficient for basic transactions. However, for larger businesses or those seeking more advanced features, a paid version could offer greater flexibility and support, ensuring that your transaction records are both professional and efficient.

Best Practices for Material Invoicing

Creating accurate and professional documents to request payment is a crucial part of any business transaction. Following best practices ensures that the process is smooth, reduces the chances of errors, and fosters trust with your clients. By focusing on clarity, accuracy, and consistency, businesses can streamline their billing operations and maintain strong customer relationships.

Key Practices for Effective Billing

Adhering to certain guidelines will help ensure that your payment requests are clear and error-free. Below are essential practices to follow when creating such documents:

Practice Description Clear and Detailed Descriptions Provide a thorough breakdown of the products or services provided, including quantities, prices, and any special terms. This minimizes confusion and sets clear expectations. Accurate Pricing Ensure all prices are correct and consistent with previous agreements. Double-check for any discounts, taxes, or additional charges to avoid discrepancies. Consistent Format Use a standard layout for all your documents to ensure consistency. This makes them easier to read and keeps your branding uniform. Timely Submission Submit the request promptly after delivering the product or completing the service. Delays in sending the document can cause confusion and slow down the payment process. Include Payment Terms Clearly state the due date, acceptable payment methods, and any late fees or penalties for overdue payments. This helps set clear expectations for both parties. Additional Considerations

In addition to the above practices, consider these extra tips to improve your billing process:

- Maintain Records: Always keep a copy of the document for your own records. This can help resolve any disputes that may arise.

- Follow Up: If payment is delayed, follow up with a polite reminder

How to Track Materials with Invoices

Effectively monitoring goods provided or services completed is an essential part of managing business operations. One of the best ways to track transactions is by maintaining clear and organized records that document each delivery or service. These records not only help you keep track of what has been provided but also ensure you can easily verify payments and maintain proper stock levels for future needs.

Steps for Tracking Goods and Services

To successfully monitor your transactions, follow these key steps:

- Record Details Clearly: Each document should include a detailed list of all items delivered or services rendered. Include descriptions, quantities, and pricing to make it easy to track what has been supplied.

- Assign Unique Identifiers: Use a unique reference number for each document. This helps you quickly locate and cross-reference transactions, especially when managing large volumes of goods or services.

- Track Delivery Dates: Include the date of delivery or service completion on each document. This helps with inventory management and ensures timely follow-ups when necessary.

- Match Payments with Records: Compare incoming payments with the details listed in each transaction document. This ensures all payments are accounted for and helps resolve discrepancies.

Using Technology to Improve Tracking

Modern tools can greatly enhance your ability to track transactions and goods more efficiently:

- Accounting Software: Many businesses use specialized software to automate the tracking process, reducing manual entry and improving accuracy. These systems can also integrate with your inventory management to keep your stock updated in real time.

- Cloud Storage: Storing documents in the cloud allows for easy access and sharing. This ensures that all records are safe, organized, and accessible when needed, whether on-site or remotely.

- Record Details Clearly: Each document should include a detailed list of all items delivered or services rendered. Include descriptions, quantities, and pricing to make it easy to track what has been supplied.

- Assign Unique Identifiers: Use a unique reference number for each document. This helps you quickly locate and cross-reference transactions, especially when managing large volumes of goods or services.

- Track Delivery Dates: Include the date of delivery or service completion on each document. This helps with inventory management and ensures timely follow-ups when necessary.

- Match Payments with Records: Compare incoming payments with the details listed in each transaction document. This ensures all payments are accounted for and helps resolve discrepancies.

- Accounting Software: Many businesses use specialized software to automate the tracking process, reducing manual entry and improving accuracy. These systems can also integrate with your inventory management to keep your stock updated in real time.

- Cloud Storage: Storing documents in the cloud allows for easy access and sharing. This ensures that all records are safe, organized, and accessible when needed, whether on-site or remotely.

- Barcode Scanning: If your business deals with physical goods, barcode scanning can help you quickly log and track deliveries, linking them to specific documents and inventory systems.

- Automated Data Entry: Integration eliminates the need for manual data input, reducing the likelihood of mistakes and saving time that would otherwise be spent on duplicate entries.

- Real-Time Updates: Once a payment or transaction is logged, it is automatically updated in the accounting system, providing you with up-to-date financial insights at any given moment.

- Improved Accuracy: By syncing your

Integrating Invoice Templates with Accounting Tools

Integrating your billing documents with accounting software can significantly streamline financial management. By linking these records directly with accounting tools, you can automate the tracking of payments, expenses, and profits, reducing the risk of errors and saving valuable time. This integration ensures seamless data flow between your transaction logs and financial systems, improving accuracy and efficiency in managing your business finances.

Benefits of Integration

When your billing system is connected to accounting software, several key advantages emerge:

- Automated Data Entry: Integration eliminates the need for manual data input, reducing the likelihood of mistakes and saving time that would otherwise be spent on duplicate entries.

- Real-Time Updates: Once a payment or transaction is logged, it is automatically updated in the accounting system, providing you with up-to-date financial insights at any given moment.

- Improved Accuracy: By syncing your transaction records with accounting tools, you minimize the chances of discrepancies between your billing and financial reports, ensuring consistency across your records.

- Faster Reporting: With all transaction data in one place, generating financial reports, such as profit and loss statements, becomes quicker and easier, enabling you to make informed decisions without delay.

Steps to Integrate Billing Records with Accounting Systems

Here are some steps to effectively integrate your transaction records with your accounting tools:

- Choose Compatible Software: Select accounting tools that offer integration with your chosen billing system or document format. Many modern tools allow for easy syncing via APIs or built-in connectors.

- Set Up Data Sync: Configure the synchronization between your billing documents and accounting software to ensure that relevant information–such as amounts, dates, and payment terms–is automatically transferred.

- Test the System: Before fully relying on the integration, run a few tests to ensure that data flows smoothly between the two systems and that no details are missing or incorrect.

- Train Your Team: Ensure your accounting team understands how to use the integrated systems, so they can efficiently track transactions and generate financial reports.

Integrating Invoice Templates with Accounting Tools

Integrating your billing documents with accounting software can significantly streamline financial management. By linking these records directly with accounting tools, you can automate the tracking of payments, expenses, and profits, reducing the risk of errors and saving valuable time. This integration ensures seamless data flow between your transaction logs and financial systems, improving accuracy and efficiency in managing your business finances.

Benefits of Integration

When your billing system is connected to accounting software, several key advantages emerge:

- Automated Data Entry: Integration eliminates the need for manual data input, reducing the likelihood of mistakes and saving time that would otherwise be spent on duplicate entries.

- Real-Time Updates: Once a payment or transaction is logged, it is automatically updated in the accounting system, providing you with up-to-date financial insights at any given moment.

- Improved Accuracy: By syncing your transaction records with accounting tools, you minimize the chances of discrepancies between your billing and financial reports, ensuring consistency across your records.

- Faster Reporting: With all transaction data in one place, generating financial reports, such as profit and loss statements, becomes quicker and easier, enabling you to make informed decisions without delay.

Steps to Integrate Billing Records with Accounting Systems

Here are some steps to effectively integrate your transaction records with your accounting tools:

- Choose Compatible Software: Select accounting tools that offer integration with your chosen billing system or document format. Many modern tools allow for easy syncing via APIs or built-in connectors.

- Set Up Data Sync: Configure the synchronization between your billing documents and accounting software to ensure that relevant information–such as amounts, dates, and payment terms–is automatically transferred.

- Test the System: Before fully relying on the integration, run a few tests to ensure that data flows smoothly between the two systems and that no details are missing or incorrect.

- Train Your Team: Ensure your accounting team understands how to use the integrated systems, so they can efficiently track transactions and generate financial reports.

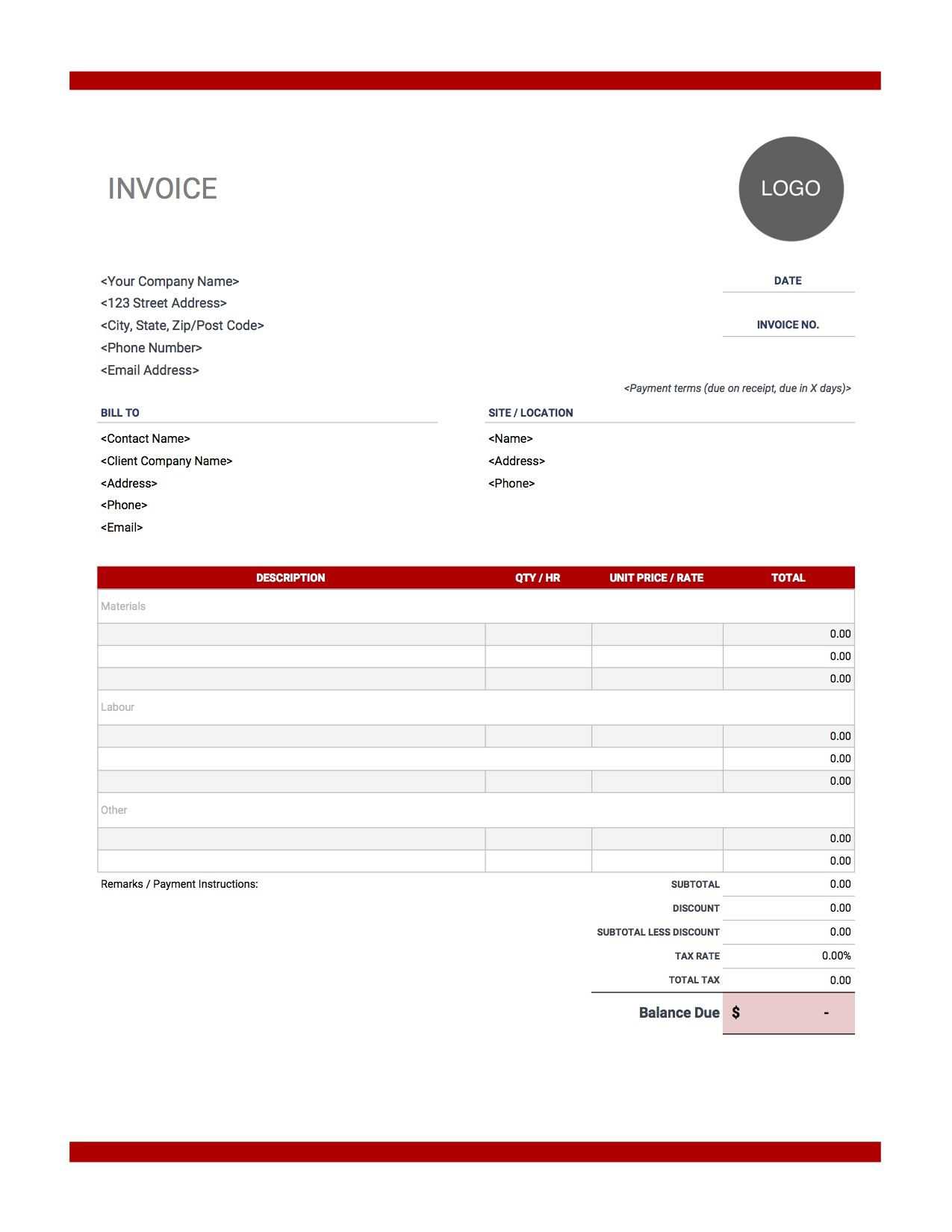

Choosing the Right Template for Your Business

Selecting the appropriate format to document transactions and request payment is crucial for any business. The right design can help present a professional image, improve clarity, and ensure accurate tracking of deliveries or services. However, with so many options available, it’s important to consider your business needs, the level of detail required, and the features you value most when choosing a suitable format.

Factors to Consider

Here are the key factors to think about when choosing the right design for your business:

- Industry-Specific Needs: Different industries may require specific details or layouts. For example, service-based businesses may need to focus on hours worked and rates, while product-based businesses may prioritize item descriptions and quantities.

- Customization Options: Consider how much flexibility you need. A design that allows for easy customization will ensure you can modify it to reflect your brand, whether through colors, fonts, or layout.

- Ease of Use: Choose a design that is user-friendly, with fields and sections that are easy to fill out. Complicated formats can lead to errors and increase the time spent on each transaction.

- Automation Features: Some designs offer built-in features like automatic calculations, date tracking, or integration with accounting software. If efficiency is a priority, these features can be invaluable in reducing manual work.

Finding the Right Balance

While it’s tempting to choose a fully customizable, feature-rich design, it’s important to find a balance between complexity and simplicity. A more detailed design may offer advanced functionality, but it could also be overwhelming for smaller businesses or those with simpler needs. Assess the scale of your operations and select a format that meets your current requirements without being overly complicated.

How to Download and Use Templates

Downloading and utilizing a ready-made document format can greatly simplify your workflow and help maintain consistency in your billing process. Whether you are looking for a basic layout or a more advanced design, these pre-designed files can save you time while ensuring you include all the necessary details. Here’s how to find, download, and effectively use these formats for your business needs.

Steps to Download the Right Design

Follow these steps to find and download a suitable layout for your business:

- Identify Your Needs: Determine what features you need in the format. Do you require space for detailed descriptions, automatic calculations, or integration with other tools? Knowing what you need will help you choose the best option.

- Search for Trusted Sources: Look for reliable websites that offer high-quality, professional document formats. Many platforms provide both free and paid options, so make sure to review user feedback before downloading.

- Select a Format: Once you find a suitable layout, choose the file format that is compatible with your preferred software (e.g., Word, Excel, or PDF). Ensure it fits your business type and is easy to customize.

- Download the File: Click the download link and save the file to your computer or cloud storage. Always download from secure websites to avoid malware or corrupted files.

How to Use the Downloaded File

After downloading the design, here’s how to use it efficiently:

- Open the Document: Open the file in the appropriate software (e.g., Word, Excel, or Google Docs). Check if it is editable, especially if you want to add your company’s details, payment terms, or other specific information.

- Customize the Fields:

How to Track Materials with Invoices

Effectively monitoring goods provided or services completed is an essential part of managing business operations. One of the best ways to track transactions is by maintaining clear and organized records that document each delivery or service. These records not only help you keep track of what has been provided but also ensure you can easily verify payments and maintain proper stock levels for future needs.

Steps for Tracking Goods and Services

To successfully monitor your transactions, follow these key steps:

Using Technology to Improve Tracking

Modern tools can greatly enhance your ability to track transactions and goods more efficiently:

Integrating Invoice Templates with Accounting Tools

Integrating your billing documents with accounting software can significantly streamline financial management. By linking these records directly with accounting tools, you can automate the tracking of payments, expenses, and profits, reducing the risk of errors and saving valuable time. This integration ensures seamless data flow between your transaction logs and financial systems, improving accuracy and efficiency in managing your business finances.

Benefits of Integration

When your billing system is connected to accounting software, several key advantages emerge: