Master Invoice Template for Streamlined Billing and Professional Invoices

Creating clear, professional, and accurate financial documents is essential for any business. A well-organized billing system not only helps maintain a positive relationship with clients but also ensures timely payments. Having a pre-designed structure for generating these documents can save time and eliminate common errors that can cause delays.

By utilizing a reliable structure, businesses can quickly produce consistent and polished statements, allowing them to focus more on growth and less on administrative tasks. With the right format, you can easily track services rendered, payments due, and other key information without the hassle of reinventing the wheel each time.

In this guide, we’ll explore how to efficiently create and manage these essential business documents. From customizing a layout to incorporating all the necessary details, this approach will streamline your workflow and improve the professional appearance of your communications.

Master Invoice Template Overview

A structured document for billing and payment tracking is a crucial tool for any business. It serves as a standardized format that ensures all necessary information is captured and presented clearly. This type of format allows you to manage financial transactions with ease, improving both efficiency and accuracy. With a uniform approach, you can avoid confusion and streamline your overall process, ensuring that your clients receive consistent and professional documents every time.

In this section, we’ll provide an overview of what this tool entails and how it can be effectively used in various business settings. From helping small startups to larger corporations, having a well-designed format simplifies the process of documenting services, products, and payments.

Key Features of a Standardized Billing Document

- Clear Layout: A clean and easy-to-read design that highlights key information.

- Consistent Formatting: Uniformity in fonts, spacing, and sections helps maintain professionalism.

- Essential Sections: Includes fields for client details, itemized services, and payment terms.

- Customizable: Ability to adjust the layout to suit the needs of various industries and services.

Who Benefits from Using This Format?

- Small businesses and freelancers who need to send clear and professional documents.

- Large companies with multiple departments requiring consistent financial communication.

- Consultants and service providers who need an efficient method for invoicing clients.

Ultimately, using a standardized billing document simplifies administrative tasks and contributes to a more organized and efficient business operation. By having a ready-to-use format at hand, you can spend less time worrying about document details and more time on your core work.

Why Use an Invoice Template

Using a pre-designed format for financial documents simplifies the billing process, ensuring that all the necessary details are included without missing anything important. This approach saves time, reduces the risk of errors, and guarantees that each document maintains a professional appearance. Instead of creating each document from scratch, a ready-made structure offers consistency and efficiency, allowing businesses to focus on what matters most: delivering their products or services.

Time-Saving Benefits

- Quick Creation: Having a set format allows you to generate documents instantly without starting from zero each time.

- Fewer Mistakes: By following a consistent structure, the likelihood of forgetting key details is minimized.

- Automation Potential: Many tools enable automation, so you can generate and send documents with just a few clicks.

Consistency and Professionalism

- Uniform Appearance: A standardized layout ensures that every document looks polished and well-organized.

- Client Confidence: Well-designed documents contribute to a sense of trust and professionalism, encouraging timely payments.

- Brand Identity: Customizable formats allow you to incorporate your company’s branding, reinforcing your identity.

By using a pre-structured document, businesses not only enhance their operational efficiency but also create a streamlined experience for clients. It’s an investment in both time and quality that pays off with smoother transactions and improved financial management.

Benefits of a Master Invoice Template

Having a pre-designed structure for billing documents offers numerous advantages, particularly when it comes to maintaining organization and ensuring consistency across all financial communications. By using a ready-made format, businesses can streamline their processes, avoid errors, and create a more professional image. This not only saves time but also improves the efficiency of managing client payments and tracking outstanding balances.

One of the key benefits of using such a structure is time efficiency. With a standardized design, creating new documents becomes a matter of filling in the necessary details rather than starting from scratch each time. This saves valuable hours, especially for businesses that issue invoices frequently.

Another important advantage is accuracy. A pre-set layout ensures that all required information is included and correctly placed, reducing the chance of forgetting important elements such as payment terms or client details. This leads to fewer mistakes and less confusion for both businesses and their clients.

Additionally, using a structured format contributes to professionalism. Well-organized and uniform documents make a lasting impression on clients, which can improve relationships and foster trust. A clean, consistent presentation helps communicate reliability and attention to detail.

Finally, such a system can lead to better financial management. With a consistent approach to tracking services, prices, and payment status, businesses can more easily monitor outstanding balances and ensure timely follow-ups. This level of organization can also assist in tax preparation and overall financial tracking.

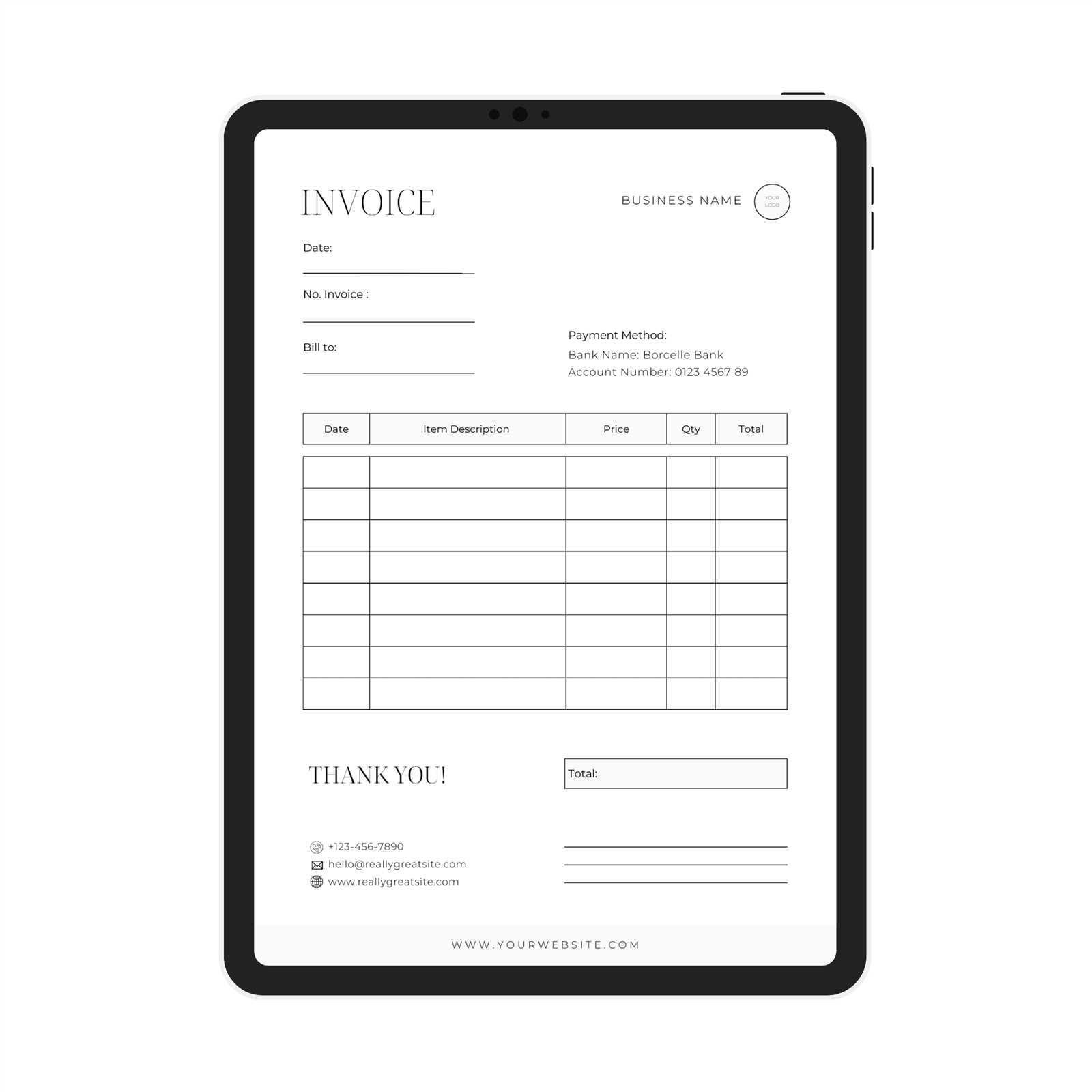

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to your business’s specific needs while ensuring it aligns with your brand identity. Whether you need to adjust the layout, add specific fields, or include personalized terms, making these modifications is simple and can enhance the professionalism and clarity of your financial communications. In this section, we’ll explore how to personalize your billing structure to suit your style and requirements.

Adjusting the Layout

The first step in customization is deciding on the layout that best represents your business. A clean, easy-to-read design is crucial, but you can also personalize sections to include specific details that are important for your workflow. For instance, you might want to rearrange the order of the fields or add logos and branding elements. Below is a basic example of a customizable structure:

| Section | Details |

|---|---|

| Company Information | Add your company name, address, and contact details. |

| Client Information | Include the client’s name, company (if applicable), and address. |

| Service/Products Rendered | Detail each service or product, along with quantities and pricing. |

| Payment Terms | Specify payment due dates, late fees, or other conditions. |

| Notes | Provide any additional notes or instructions specific to the client. |

Adding Personalization

In addition to adjusting the structure, there are other ways to make the document unique to your business. This includes adding your company’s logo, adjusting fonts to match your branding, or including custom color schemes. Personalization creates a consistent brand experience and helps strengthen your business’s identity in the eyes of your clients.

Customizing your document ensures that each billing statement aligns with your business’s requirements, improves clarity, and enhances your overall professional image. Whether you need to include extra information or just want a unique design, the flexibility to personalize your format is invaluable.

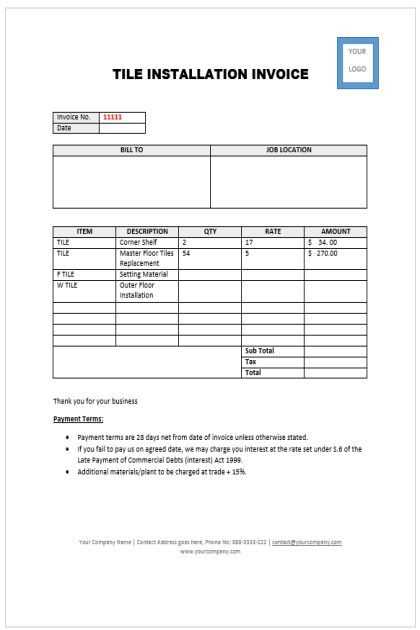

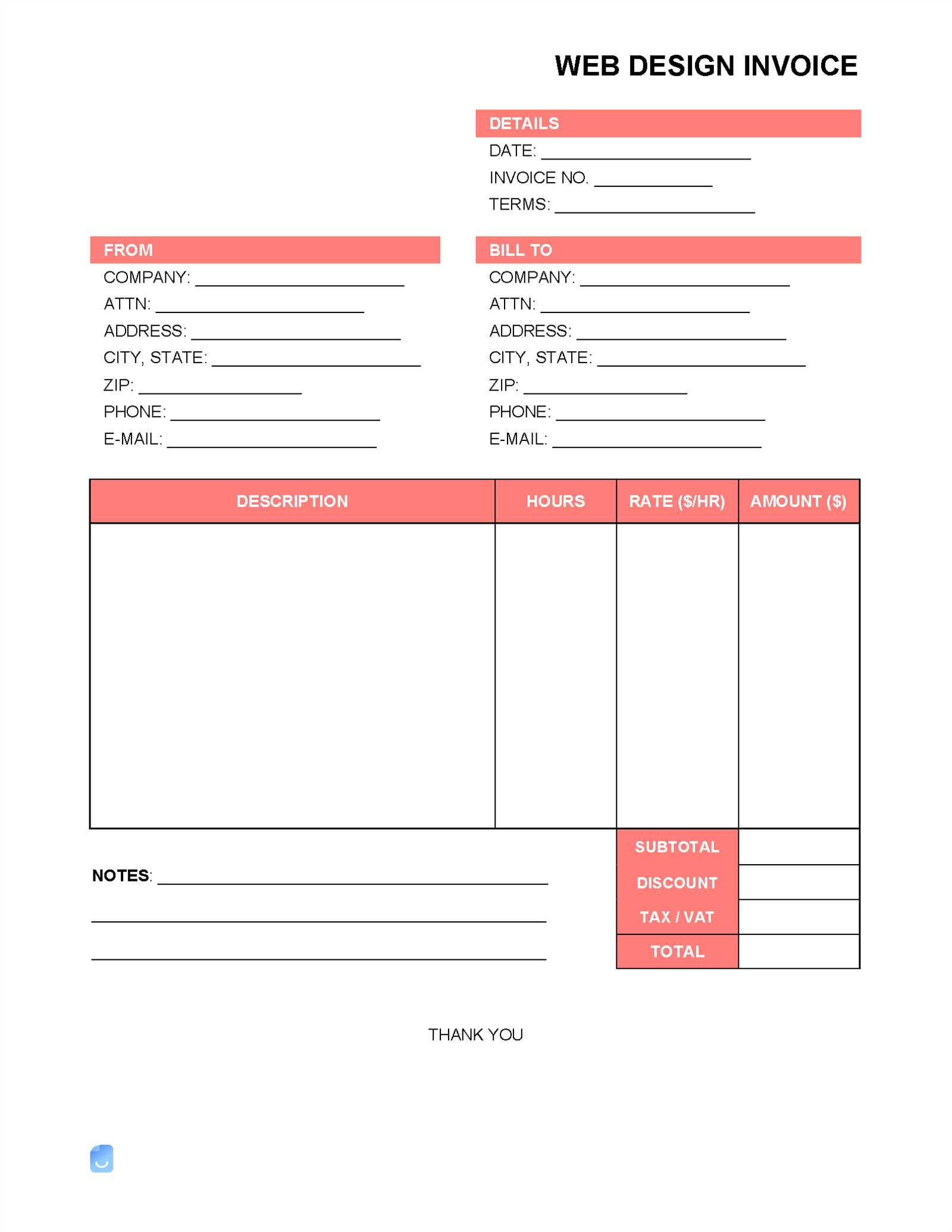

Key Elements of an Invoice Template

Creating a clear and effective billing document requires certain essential components to ensure that all necessary information is communicated properly. These elements not only help maintain consistency but also ensure that the recipient can easily understand the charges, terms, and payment instructions. Whether you are sending a simple service fee or a detailed project breakdown, each section plays a vital role in making the transaction smooth and transparent.

The key elements of a well-structured billing document typically include the following:

- Header Information: This includes your business name, logo, contact details, and the recipient’s information. Clear identification of both parties is crucial for a professional appearance.

- Unique Identification Number: Each document should have a unique reference number for tracking purposes. This helps with organization and allows both you and your client to reference the specific transaction easily.

- Itemized List of Services/Products: Provide a breakdown of what was provided, including descriptions, quantities, and individual prices. This ensures transparency and helps prevent disputes over charges.

- Payment Terms: Clearly state when payment is due, including any late fees or discounts for early payment. This ensures both parties are aligned on expectations.

- Totals and Taxes: Include a summary of the total charges, including applicable taxes, fees, or shipping costs. This helps clients understand the final amount due at a glance.

- Payment Instructions: Offer clear guidance on how payments should be made, such as bank account details, online payment methods, or instructions for cheque payments.

- Notes/Additional Information: This section is for any extra details you might need to communicate, such as terms and conditions, special discounts, or reminders.

By including these key elements, you ensure that your documents are not only functional but also convey a professional image. Well-organized billing statements help clients process payments on time and prevent confusion, leading to a smoother business relationship.

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing documents is essential for ensuring clarity, consistency, and efficiency in your financial processes. The format you choose should align with your business needs, client expectations, and the type of services or products you offer. An effective layout not only communicates professionalism but also ensures that the necessary details are easily accessible for both you and your clients.

When choosing the right structure, there are several factors to consider:

- Industry-Specific Needs: Some industries may require more detailed descriptions or specific sections (e.g., consultants may need to include hourly rates, while product-based businesses may focus on quantities and SKUs). Tailoring your format to suit your specific field will improve efficiency.

- Client Preferences: Some clients may prefer detailed, itemized documents, while others may only need a simple summary. Understanding your client’s needs can help determine how complex or simple your billing format should be.

- Frequency of Use: If you bill clients regularly, a streamlined format with preset fields will save you time. On the other hand, occasional invoices may benefit from a more customized layout to account for special charges or conditions.

- Legal and Tax Requirements: Ensure that your format complies with local regulations or tax laws, which may dictate the inclusion of certain details such as tax identification numbers, service descriptions, or specific payment terms.

In choosing the right layout, it’s important to strike a balance between clarity and functionality. A format that is too complex may overwhelm clients, while one that is too simple might leave out necessary details. The key is to select a design that suits your business, provides the necessary information, and meets your clients’ expectations.

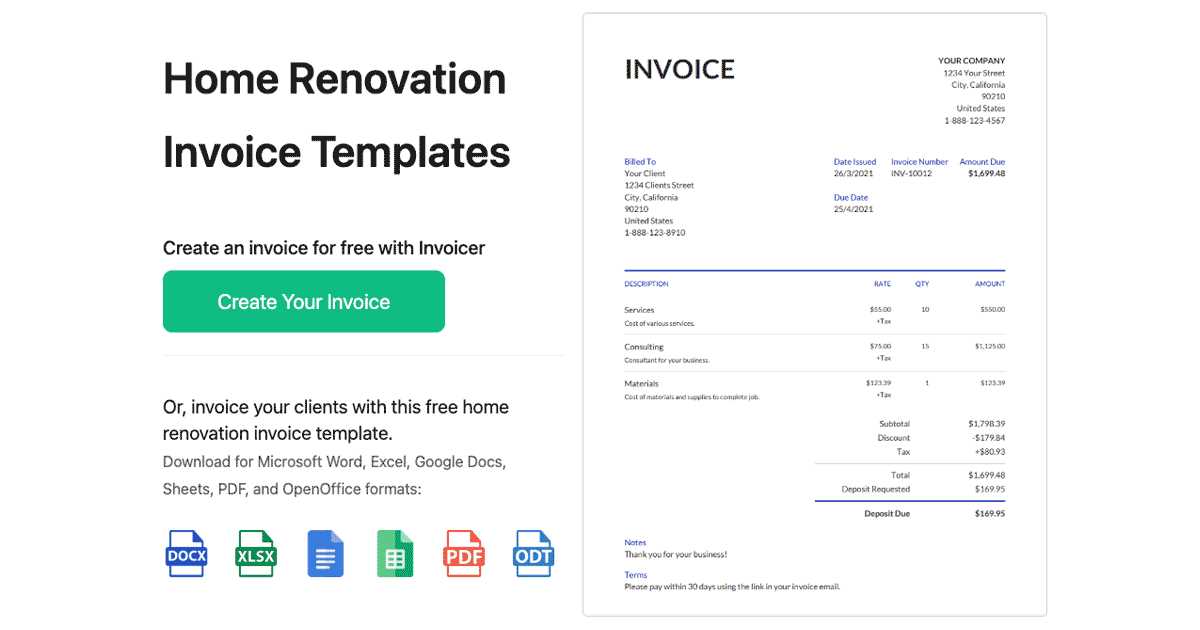

How to Download a Master Invoice

Downloading a pre-designed billing document is a quick and simple way to streamline your billing process. Whether you’re looking for a basic format or one tailored to your business needs, the right structure can be easily obtained online. By downloading a ready-made document, you can save time and ensure consistency across all your financial communications without having to create a new document from scratch each time.

Steps to Download a Billing Document

- Search for Trusted Sources: Start by finding reputable websites or platforms that offer free or paid downloadable options. Ensure that the site provides secure downloads and high-quality formats.

- Select the Format You Need: Choose a layout that suits your business. Some websites offer multiple options, from basic designs to more advanced ones with customizable fields.

- Download the File: Once you’ve chosen the appropriate document, simply click the download button. Most sites offer formats such as PDF, Word, or Excel, depending on your preference.

- Save the Document: Save the file to your computer or cloud storage for easy access whenever you need it. Consider organizing it into a dedicated folder for financial documents.

Customizing After Download

Once you have the structure on your device, you can make any necessary adjustments to align it with your business practices. Adding your logo, adjusting payment terms, or including specific pricing information are all simple customizations that can be done in just a few clicks. Some downloadable files are even designed to be fully editable, so you can make changes as needed.

By downloading a pre-made structure, you can quickly start creating professional billing documents without the hassle of designing one from the ground up. This approach ensures efficiency while maintaining consistency across all your transactions.

Creating Professional Invoices with Ease

Generating polished, accurate financial documents doesn’t have to be a time-consuming task. With the right structure in place, creating professional statements for clients can be quick and efficient. By using a pre-designed layout or easy-to-use tools, you can ensure your documents maintain a consistent and clean appearance, leaving a positive impression on your clients and streamlining your billing process.

The key to creating professional documents lies in using a clear, easy-to-read format that includes all the essential details–without unnecessary complexity. By focusing on simplicity and accuracy, you can produce well-organized statements that communicate important information, such as services provided, payment terms, and due dates, all while saving time on repetitive tasks.

With a structured approach, you can quickly generate new documents, customize them when needed, and maintain professionalism across all your financial communications. Whether you’re a freelancer, small business owner, or part of a larger organization, this method ensures you can focus more on your core work and less on administrative overhead.

Common Invoice Mistakes to Avoid

While creating billing documents may seem straightforward, there are several common mistakes that can lead to confusion, delays, or even disputes with clients. Avoiding these errors is crucial to maintaining professionalism and ensuring that payments are processed smoothly. By understanding and addressing these common pitfalls, you can ensure that your documents are clear, accurate, and effective.

Key Mistakes to Watch Out For

- Missing Contact Information: Failing to include the correct details for both your business and the client can lead to confusion. Always ensure that names, addresses, and contact information are accurate and up to date.

- Incorrect Amounts: Double-check the amounts listed for each service or product. Even small errors can cause frustration and delay payments.

- Lack of Clear Payment Terms: Not specifying the payment due date or terms can lead to misunderstandings. Always make sure to include clear instructions on when and how payments should be made.

- Forgetting Taxes or Fees: If your services or products are taxable, ensure

How to Organize Your Invoices

Proper organization of your financial documents is essential for maintaining a smooth business operation. Keeping track of billing records in an efficient and structured way ensures that you can easily find important information, monitor payments, and manage outstanding balances. Without a solid system in place, managing transactions can quickly become overwhelming, leading to confusion and missed deadlines.

By setting up a simple and clear organization system, you can save time, reduce errors, and improve your overall financial management. This process includes creating categories for easy access, setting up a filing system, and using tools that help track outstanding payments.

Key Tips for Organizing Your Financial Documents

- Create Folders by Year and Month: For easy access, organize your records by year and then by month. This way, you can quickly find specific documents when needed.

- Use a Unique Numbering System: Implement a consistent numbering system for each document, making it easier to reference or locate specific files. This could be a simple sequential number or one that includes the client’s name and the date.

- Maintain Digital and Physical Copies: Having both digital and physical records can serve as a backup in case one system fails. Scan and save all documents on your computer or cloud storage, while also keeping organized paper copies for important legal or tax purposes.

- Track Payment Status: Keep a separate list to track the payment status of each document, noting which invoices are paid, pending, or overdue. This will help you follow up efficiently and avoid missing payments.

Using Software to Streamline Organization

Accounting software can significantly simplify the process of managing billing records. Many tools offer features like automatic categorization, invoice numbering, and payment tracking, allowing you to maintain a digital archive and access all your documents in one place. These tools can also send automated reminders for unpaid invoices, reducing the manual effort needed to follow up with clients.

Organizing your financial records effectively reduces stress, increases efficiency, and helps ensure timely payments. Whether you manage your records manually or through software, a structured system is crucial to keeping your business finances in order.

Essential Information to Include in Invoices

When creating a billing statement, it’s crucial to ensure that all the necessary information is included. This not only helps to clarify the terms of the transaction but also ensures that the client has everything they need to process the payment efficiently. Including key details minimizes misunderstandings and delays, providing both parties with a clear record of the agreement.

There are several important elements that must be included in every billing document. These components ensure that the document is both legally compliant and professional, making it easier for clients to understand the charges and for businesses to maintain organized records.

Key Information to Include

- Business and Client Details: Clearly list your company name, address, contact information, and tax identification number, along with the same details for the client. This helps avoid confusion and ensures that the document is properly attributed to the right parties.

- Unique Document Number: Each statement should have a unique reference number. This helps in tracking payments and organizing records. It’s also essential for accounting and tax purposes.

- Description of Services or Products: Provide a clear breakdown of the services rendered or products supplied, including quantities, unit prices, and any discounts. This ensures transparency and prevents disputes over what was provided.

- Total Amount Due: Include a clear summary of the total amount owed, including any taxes, fees, or additional charges. This gives clients a clear picture of the final payment amount.

- Payment Terms: Specify when the payment is due, any applicable late fees, and acceptable payment methods. This ensures that both parties are aligned on when and how payment will be made.

- Issue and Due Dates: Clearly list the date the statement was issued and the payment due date. This helps establish a timeline for payment and allows you to follow up if necessary.

Additional Optional Information

- Notes or Instructions: If necessary, include any specific instructions or additional information, such as return policies or special terms. This section allows you to address any unique conditions or requests related to the transaction.

- D

How to Save Time with Templates

Creating professional documents from scratch every time you need to bill a client can be time-consuming and repetitive. By using a ready-made structure, you can significantly speed up the process, ensuring that each document is created quickly while maintaining consistency. Templates offer a convenient way to streamline your workflow, reducing the time spent on administrative tasks and allowing you to focus on more important aspects of your business.

With a pre-designed structure, much of the work is already done for you. All you need to do is input specific details such as client information, services rendered, and payment terms. This efficiency leads to fewer mistakes, quicker turnaround times, and a more professional appearance overall.

How Templates Help You Save Time

- Predefined Layouts: Templates come with prearranged sections for all the essential details, eliminating the need to design each document from scratch.

- Reduced Errors: With a consistent structure, you minimize the chances of missing critical information, such as payment terms or item descriptions, which can result in follow-up tasks and delays.

- Faster Customization: Simply fill in the blanks with specific details, saving time compared to manually formatting each document every time you need one.

- Easy Updates: Updating templates with new information (like your business details or payment terms) is quick and easy, ensuring that all future documents are consistent and up-to-date.

Tools for Efficient Template Management

- Digital Tools: Many online platforms offer customizable structures that you can adjust according to your needs, saving time by automating much of the process.

- Cloud Storage: Storing your templates in the cloud ensures easy access from anywhere, allowing you to quickly generate new documents on the go without searching through files or worrying about version control.

By integrating templates into your workflow, you not only save time but also improve the efficiency and professionalism of your billing processes. This allows you to focus more on your core business while keeping your financial records organized and up to date.

How to Maintain Invoice Consistency

Consistency in your billing documents is essential for maintaining a professional image and ensuring clarity for your clients. By using a uniform format across all financial records, you create a sense of order and reliability that helps clients understand the information more easily. Keeping the same structure and design in each document streamlines your process and reduces the risk of errors or misunderstandings.

Establishing a consistent approach involves setting standard practices for how each document should be laid out, including the order of information, the style of language, and the types of details included. Once you have a consistent system in place, you can create documents quickly and confidently, knowing that they will align with your established format and branding.

Steps to Ensure Consistency

- Use a Standard Layout: Design a clear and organized structure that you can apply to every document. Whether you choose a simple or detailed format, keep it consistent from one document to the next.

- Set a Common Design Style: Ensure that elements like fonts, colors, and logos remain the same across all your billing documents. This reinforces your brand identity and gives your communications a professional look.

- Predefine Key Sections: Create predefined sections such as payment terms, product or service descriptions, and client details. By having these categories established, you eliminate the need to rethink the format with every new document.

- Automate When Possible: Consider using accounting software or document management tools to automate the creation of your financial records. This ensures all elements are standardized and reduces the risk of human error.

Review and Update Regularly

- Audit Documents Periodically: Regularly review your documents to ensure they are still aligned with your branding and business practices. This helps maintain consistency even as your business evolves.

- Update Templates as Needed: If you need to make adjustments, such as updating your business address or adjusting payment terms, do so across all your forms to maintain uniformity.

Maintaining consistency not only helps to improve the clarity of your documents but also builds trust with your clients. When clients know what to expect from your communications, they feel more confident in doing business with you, which can lead to stronger professional relationships.

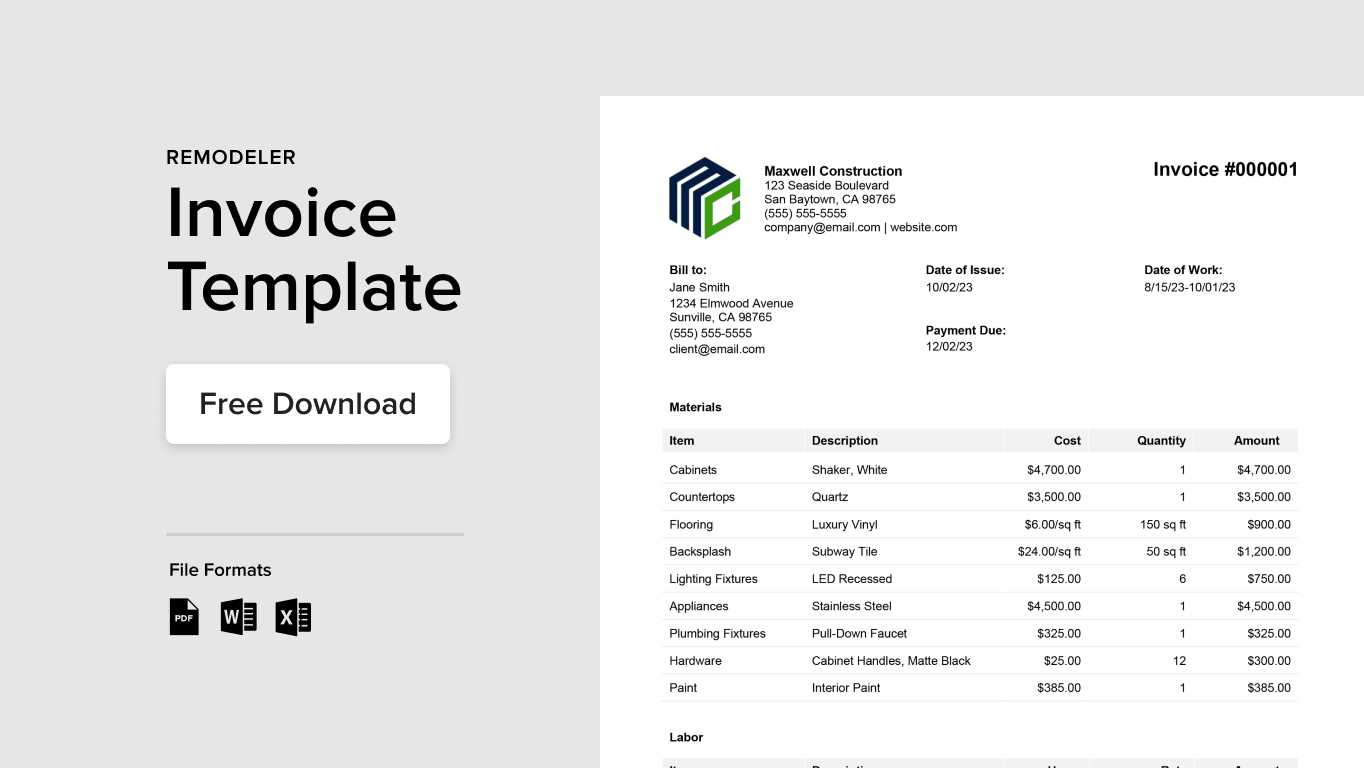

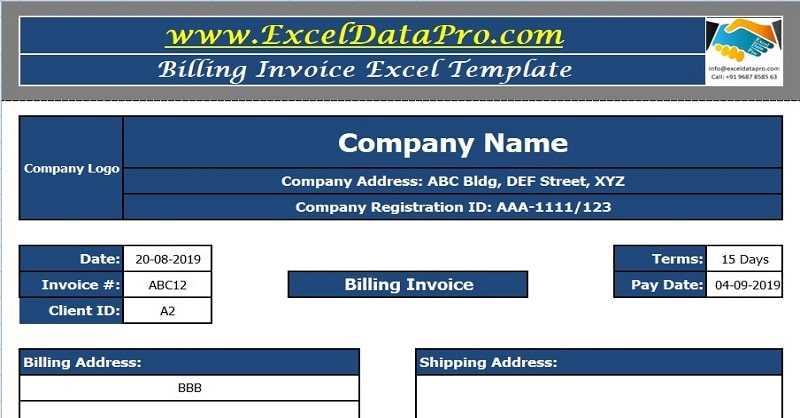

Invoice Templates for Different Industries

Different industries have specific needs when it comes to creating financial documents. A standard layout might not suit all types of businesses, as each sector has its own set of requirements and conventions. Customizing your documents to reflect the particularities of your industry ensures clarity and professionalism, helping you meet both client expectations and regulatory standards.

Whether you work in construction, consulting, retail, or any other field, tailoring your billing records to your industry can make the process smoother and more efficient. Each sector might require unique fields, such as work hours, materials used, or product specifications, which will need to be clearly documented. By understanding the key elements that different industries need, you can create more effective and functional financial records.

Industry-Specific Considerations

- Construction: In construction, detailed breakdowns of labor hours, materials, and equipment used are essential. Billing documents should include itemized lists of the services rendered, costs for materials, and completion milestones for clarity.

- Consulting: For consultants, financial documents often include hourly rates, project milestones, and specific deliverables. It’s important to list the hours worked and describe the completed tasks in detail to avoid confusion.

- Retail: In retail, receipts or financial records often need to include SKU numbers, quantities, unit prices, and any discounts offered. Additionally, tax breakdowns may be required depending on local regulations.

- Freelance Services: Freelancers typically need to account for services provided over a defined period, with detailed descriptions and a clear breakdown of rates for specific tasks or projects. Payment terms and deadlines should be explicitly stated to ensure timely payment.

- Real Estate: In real estate, agents need to specify commission percentages, property details, and payment timelines. The document may also include terms for future transactions or deposits to ensure transparency in the sales process.

Customizing Your Financial Documents for Your Industry

- Understand Your Clients’ Needs: Different industries have varying expectations regarding billing. Tailor your financial records to meet these expectations by researching common practices within your field.

- Use Specialized Tools: Many industries benefit from specialized software that includes industry-specific fields and calculations. These tools can save time and ensure that your records are both accurate and in compliance with relevant standards.

- Keep It Clear and Professional: Regardless of your industry, a clear and organized layout is key. Customizing your documents to match the needs of your industry while maintaining a professional look will help you build trust with your clients.

By customizing y

Best Practices for Invoice Management

Efficient management of billing documents is crucial for maintaining cash flow, reducing administrative errors, and ensuring smooth operations in your business. Proper organization and timely follow-ups not only help keep your financial records in order but also strengthen your relationship with clients by promoting transparency and reliability. By adopting best practices for managing these documents, you can streamline your accounting process and minimize the chances of delays or mistakes.

From creating clear and consistent records to organizing them for quick access, there are several strategies that can help you manage your financial documents more effectively. With the right tools and practices, you can improve both the accuracy and speed of your billing process, making it easier to track payments and manage your cash flow.

Key Best Practices for Efficient Management

- Standardize Your Process: Develop a consistent system for generating and sending financial records. This includes using the same format, layout, and terminology to ensure that each document is easily understandable and professional.

- Organize Your Records: Create an easy-to-follow filing system, either digital or physical, that allows for quick retrieval of documents. Sorting by client, date, or payment status can help you stay organized and on top of due payments.

- Set Clear Payment Terms: Clearly state payment due dates, late fees, and accepted payment methods on each document. This helps set expectations and reduces confusion over when and how payments should be made.

- Automate Reminders: Use automated tools or software to send reminders for overdue payments. This can save time and help maintain a steady cash flow by prompting clients to pay on time.

- Monitor Payment Status: Track which documents have been paid, which are pending, and which are overdue. This helps you stay on top of your finances and ensures that no payment goes unnoticed.

Tools to Streamline Invoice Management

- Accounting Software: Software designed for invoicing and financial management can automate many tasks, such as sending reminders, tracking payments, and generating reports. This reduces manual work and the chance for human error.

- Cloud Storage: Storing your records in the cloud makes them easily accessible from any device, providing an extra layer of security and ensuring that documents are always backed up and organized.

By following these best practices, you ensure that your financial documents are well-managed, reducing the risk of errors and delays. A streamlined and professional approach to billing can also improve client relationships and help maintain a steady cash flow f

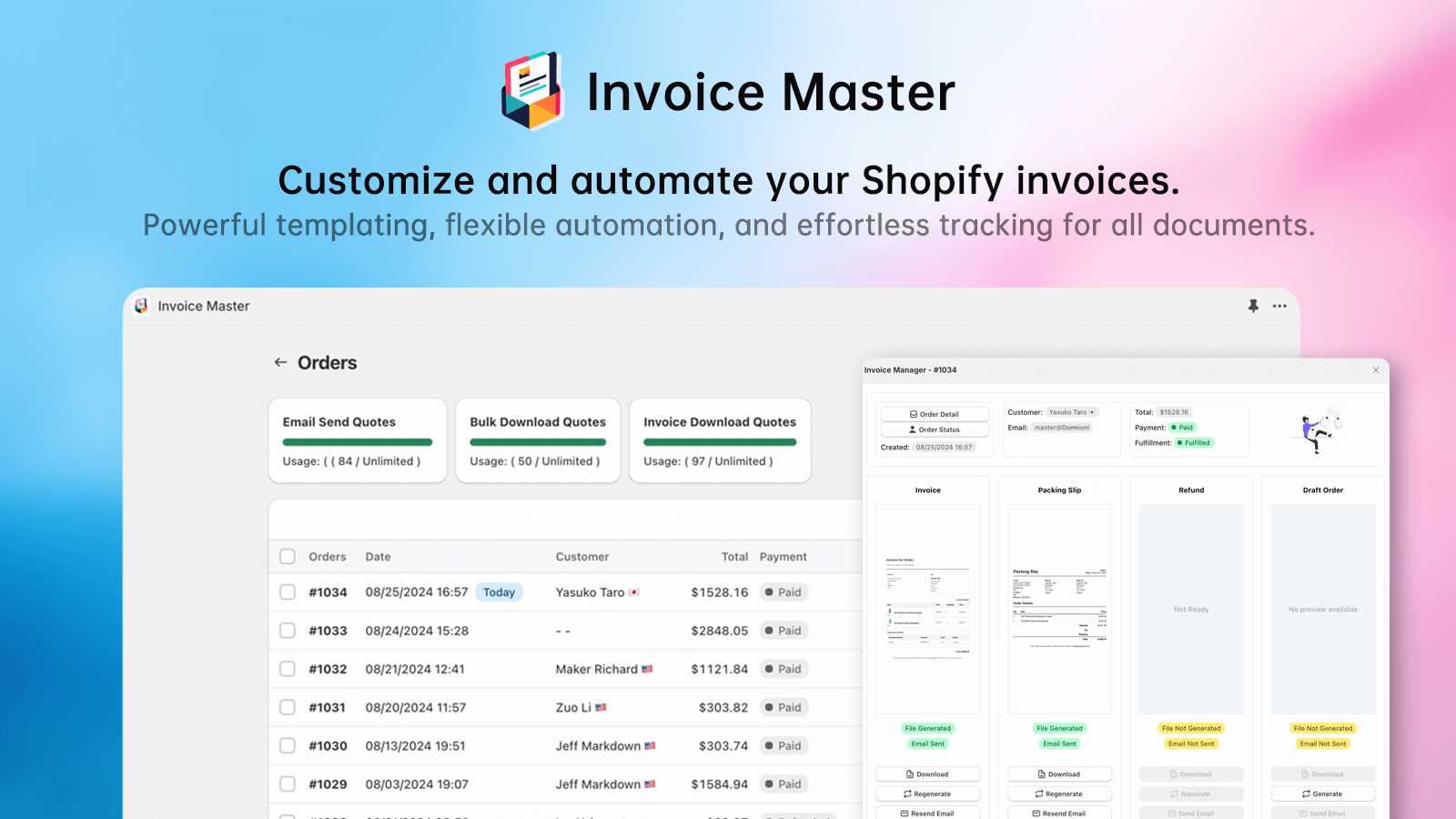

How to Automate Invoicing with Templates

Automating the creation and sending of billing documents is an efficient way to streamline your business processes. By using ready-made structures, you can eliminate repetitive tasks, reduce errors, and speed up the entire payment cycle. Automation saves valuable time and ensures consistency in your financial records, allowing you to focus on other essential aspects of your business.

With the right tools and techniques, you can set up a system that generates and sends these documents automatically based on predefined triggers, such as project completion, product shipment, or regular billing cycles. This level of automation not only ensures accuracy but also makes it easier to track payments and maintain an organized financial system.

Steps to Automate Billing with Predefined Structures

- Choose the Right Software: Use accounting or invoicing software that offers automation features. Many platforms allow you to set up recurring billing cycles, pre-filled forms, and automated reminders for overdue payments.

- Customize Your Document Layout: Create a reusable structure that includes all essential details such as client information, services provided, pricing, payment terms, and due dates. Once this is set up, the software can automatically generate these documents with minimal input from you.

- Set Up Triggers for Automation: Configure your system to trigger the creation and delivery of documents based on specific actions or timelines, like the completion of a service or monthly billing cycles. This ensures timely delivery without requiring manual effort.

- Link to Payment Systems: Integrate your billing documents with online payment gateways so that clients can pay directly through the document. This simplifies the payment process and improves cash flow management.

Benefits of Automating Billing Processes

- Time Savings: Automation significantly reduces the amount of time spent on creating and sending documents manually, freeing up your time for more important tasks.

- Improved Accuracy: By using predefined structures, you redu

Legal Requirements for Invoices

When generating billing documents, it’s essential to ensure compliance with local laws and regulations. Legal requirements vary depending on your location, industry, and the nature of the transaction, but all businesses must follow certain guidelines to ensure that their financial records are both accurate and legally valid. Failing to meet these requirements can result in disputes, tax issues, and potential fines.

Understanding what information needs to be included in each document, along with the correct formatting and timing, will help ensure your business remains compliant. In many regions, the government requires specific details to appear on all billing documents, such as tax information, company registration details, and itemized lists of goods or services provided. This section will outline the general requirements that businesses should consider when creating their billing documents.

Key Legal Elements to Include

Requirement Description Unique Document Number Each billing document must have a unique identifier, typically a sequential number, to track and reference it easily. Company Information Include your business name, address, and contact details. If required by law, also add your company registration or tax identification number. Client Information The client’s name and address should be clearly stated, as well as their tax ID number, if applicable. Itemized List of Goods or Services Each product or service provided must be listed separately, including the quantity, description, and price. This ensures transparency and allows for accurate tax calculations. Tax Information Include any applicable taxes, such as VAT or sales tax, and provide a breakdown of the total tax amount. Tax rates must also be clearly stated. Payment Terms Clearly outline payment due dates, late fees (if any), and acceptable payment methods. Issue Date and Due Date These dates are critical for calculating payment terms and for legal purposes, as they establish the timeline for payment. Top Tools for Creating Invoices

In the modern business world, using the right tools to generate billing documents can make all the difference. From improving efficiency to reducing errors, the right software can streamline your entire billing process. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, there are numerous tools available that simplify the creation, customization, and tracking of financial records.

These tools not only automate routine tasks but also provide valuable features such as client management, payment tracking, and built-in tax calculations. Choosing the best one for your needs will depend on your specific business requirements, such as the volume of transactions, integration with accounting systems, and ease of use. Below are some of the top tools that can help you create professional, error-free billing documents with ease.

Top Software for Efficient Billing Management

- FreshBooks: FreshBooks is a popular choice for freelancers and small businesses. It offers easy-to-use invoicing features, time tracking, expense management, and the ability to customize documents. FreshBooks also allows for automatic payment reminders and integrates with multiple payment gateways.

- QuickBooks: As a comprehensive accounting solution, QuickBooks helps businesses with invoicing, tracking payments, and generating financial reports. It’s ideal for businesses that require more robust accounting features, including tax management and payroll services.

- Zoho Invoice: Zoho Invoice is a cloud-based solution with a user-friendly interface and excellent customization options. It offers automated invoicing, recurring billing, and integration with other Zoho products, making it a great choice for businesses looking for a complete suite of tools.

- Wave: Wave is a free accounting tool that includes invoicing features, such as the ability to create and send professional billing documents, track payments, and manage customers. It’s especially suitable for freelancers and small businesses on a budget.

- Bill.com: Bill.com is an invoicing and payment management platform that allows businesses to automate their billing processes. It offers features such as approval workflows, automatic payment scheduling, and seamless integration with accounting software like QuickBooks and Xero.

Additional Tools for Specialized Needs

- Invoicely: Invoicely offers multi-currency support and is ideal for businesses that deal with international clients. It includes invoicing, expense tracking, and payment processing, with both free and paid plans.

- Xero: Xero is another cloud-based accounting software that provides comprehensive invoicing features. It’s known for its strong financial reporting capabilities and integrates well with other financial systems.

- And.co: