Free Massage Invoice Template for Easy Billing

Managing financial transactions is a crucial aspect of running a service-based business. Having a professional and streamlined way to document payments can save time and prevent misunderstandings. With the right tools, this process becomes much simpler, allowing you to focus on delivering quality services.

One of the most effective ways to handle client payments is through well-structured documentation. Whether you are a freelancer or a business owner, the ability to generate clear and accurate records can enhance your professionalism and ensure prompt payments. With the right resources, this task can be done efficiently without the need for complex software or systems.

Creating clear records ensures that both parties are on the same page regarding services rendered, amounts due, and payment terms. This straightforward approach builds trust and can simplify your financial workflow. A simple yet comprehensive system is all you need to get started.

Free Billing Document Guide

When running a service-based business, creating clear and professional billing records is essential. These documents serve as a formal record of transactions, ensuring both you and your clients have the same understanding of the services provided and the amounts due. The right structure can make the entire process more efficient, helping you avoid errors and delays.

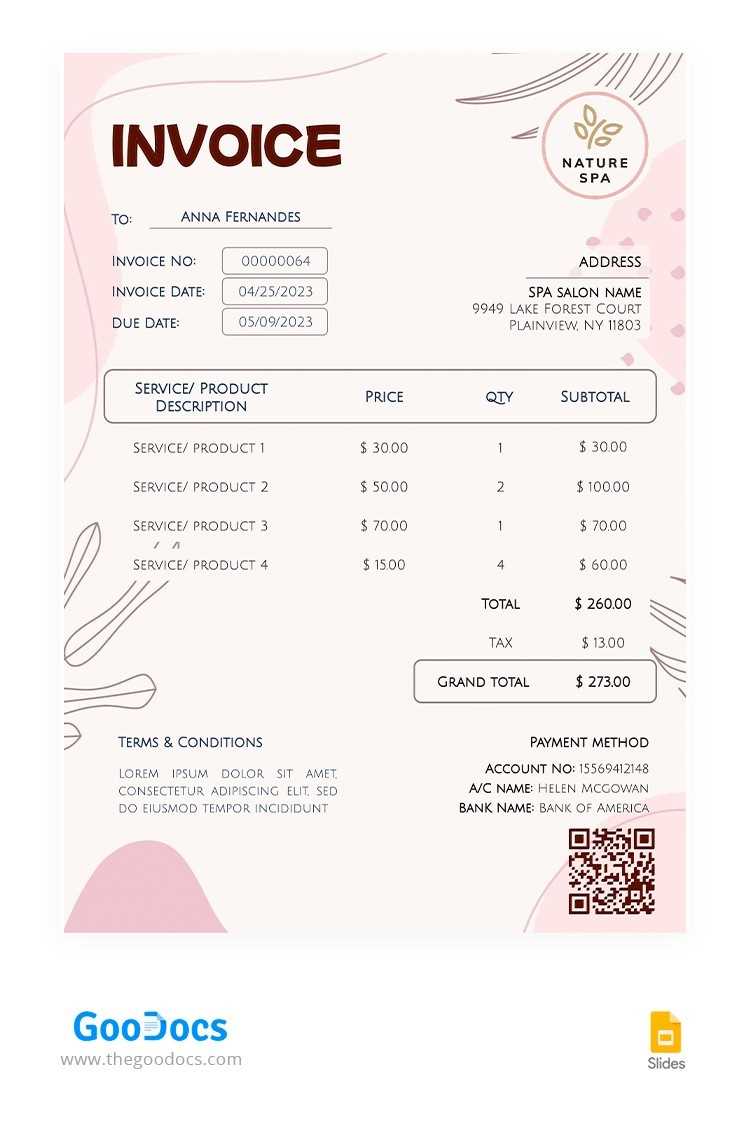

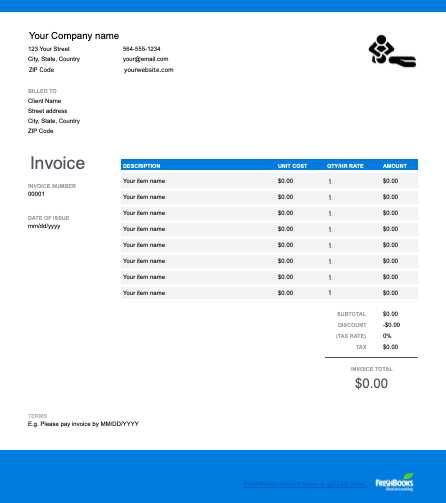

Utilizing accessible resources can make creating these records much easier. Instead of starting from scratch, many professionals rely on pre-designed formats that allow for quick customization. These resources are ideal for individuals and businesses looking to save time while maintaining a polished appearance for their documentation.

With the right approach, setting up a proper record-keeping system doesn’t require extensive knowledge of accounting. A simple, well-organized document can ensure that every detail, from services to payment terms, is clear and professional. This guide will help you understand how to make the most of available resources and design effective billing documents.

Why You Need a Billing Document Format

Maintaining clear and consistent records of transactions is crucial for any service provider. These documents not only provide a formal record of services rendered but also help ensure that both parties understand the terms of the agreement. With a standardized approach, you can simplify your workflow and enhance professionalism.

Streamlining the Process

Using a predefined structure helps save time and effort, allowing you to focus on delivering your services rather than worrying about creating a new document each time. With an organized format, it becomes easier to input the necessary details, ensuring accuracy in every transaction. A uniform approach also reduces the chances of overlooking key information.

Building Trust and Professionalism

When clients receive clear, well-organized documentation, it shows that you are committed to transparency and professionalism. This can build trust and strengthen your client relationships. Additionally, a polished document can help prevent misunderstandings, making it easier to address payment-related issues if they arise.

Benefits of Using Free Templates

Utilizing pre-designed resources for creating professional documentation can save time and effort while ensuring consistency across all your records. These ready-made formats provide a quick and easy way to generate clear, organized documents without the need for extensive design or technical skills.

By using a structured format, you can focus more on the core aspects of your service while having a reliable framework for your financial documentation. This method is especially useful for service providers who need to maintain a professional image without dedicating too much time to administrative tasks.

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-made formats allow for faster document creation, letting you focus on your core work. |

| Professional Appearance | Consistent use of structured documents enhances your credibility and professionalism. |

| Easy Customization | These resources can be easily adjusted to suit your specific needs, saving you the hassle of creating documents from scratch. |

| Cost-Effective | Access to high-quality resources without additional costs can help reduce overhead. |

How to Customize Your Billing Document

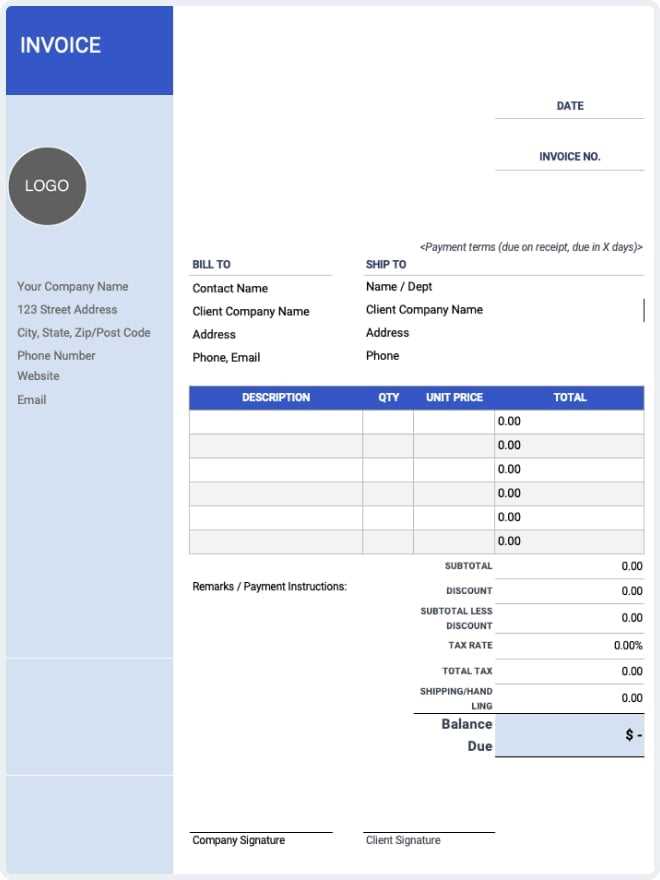

Customizing your billing document allows you to tailor it to your specific business needs and present a professional image to your clients. By adjusting various sections, you can ensure that the document reflects the details of the service provided, the agreed terms, and your branding. The following steps outline how to effectively personalize your records.

- Add Your Business Information: Include your business name, contact details, and logo. This helps your clients easily identify the source of the document.

- Personalize Payment Details: Make sure to include your preferred payment methods, such as bank transfer, credit card, or other options. This clarifies how payments should be made.

- Specify Service Descriptions: Clearly describe the services provided, including duration, rate, and any additional fees. This ensures that both you and your client are on the same page.

- Adjust Layout and Design: Choose a layout that suits your business style. Ensure that it’s easy to read, with a clear structure for the client to follow.

- Include Payment Terms: Set clear terms regarding deadlines, late fees, and any other conditions that apply to the transaction. This helps avoid confusion.

By making these adjustments, you create a document that is both functional and aligned with your business practices. Customizing your records is an important step in maintaining a professional image while ensuring clarity in financial transactions.

Key Elements of a Billing Document

When creating a financial record for your services, it’s important to include all necessary details to ensure clarity and prevent misunderstandings. A well-structured document not only outlines the services rendered but also sets clear expectations regarding payment and terms. The following elements are essential to include in any professional document of this nature.

Client Information: Always include the client’s name, address, and contact details. This ensures the document is correctly associated with the right individual or business.

Your Business Information: Include your own name or business name, address, and contact information. This helps the client recognize where the document originates and how to reach you if needed.

Description of Services: Clearly outline the services provided, including details such as the type of service, duration, and the rate. This helps to avoid any confusion and ensures the client understands exactly what they are paying for.

Payment Details: Specify the total amount due, including any applicable taxes, and break down individual costs if necessary. This will help the client understand how the total was calculated.

Payment Terms: Clearly outline the due date for payment, late fees (if applicable), and any other terms that may apply. This sets clear expectations and can help avoid payment delays.

Unique Document Number: Assign a unique identifier to each document for easy reference. This can help both you and your clients track payments and any related issues.

Including these key components ensures that your documents are comprehensive, transparent, and professional, which can help you maintain a smooth and efficient financial process with your clients.

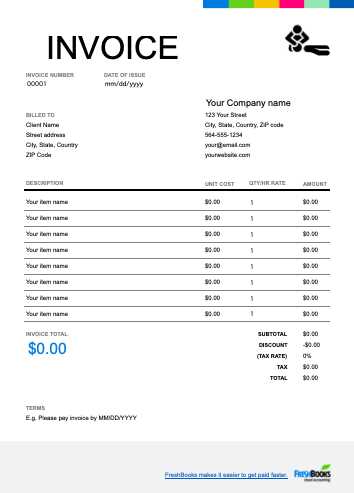

Choosing the Right Billing Document Format

Selecting the correct structure for your billing records is essential to ensure clarity and professionalism. The right format will make it easier for you to create documents quickly while maintaining a polished appearance. It also helps to present information in a way that your clients can easily understand and process.

Consider Your Business Needs

The format you choose should align with the type of services you provide and the way you interact with your clients. If you offer hourly services, a format that clearly shows the time worked and rates charged would be beneficial. For project-based work, you may prefer a format that breaks down individual tasks and costs.

Simplicity vs. Detail

While some businesses may benefit from detailed records with line-by-line descriptions of services, others may prefer a more straightforward approach. Choose a format that strikes the right balance between simplicity and detail, ensuring it meets both your needs and your clients’ expectations.

Essential Fields to Include in a Billing Record

When creating a formal document for services rendered, it is crucial to include all necessary information to avoid confusion and ensure transparency between you and your client. Certain fields are essential for ensuring that the record is complete, accurate, and easily understood by both parties. These key elements help maintain a professional appearance and streamline the payment process.

Key Components to Include

| Field | Description |

|---|---|

| Client Information | Include the client’s name, address, and contact details to ensure the document is properly attributed to them. |

| Your Business Information | Provide your business name, address, and contact information to make sure your client knows who issued the document. |

| Service Description | Clearly state what services were provided, including specifics such as the duration, type of service, and any related details. |

| Amount Due | Specify the total amount owed, breaking down the costs if necessary (e.g., rates, taxes, and any additional fees). |

| Payment Terms | Include payment deadlines, late fees, and accepted payment methods to avoid confusion and set clear expectations. |

Additional Information

While the above fields are essential, you can further customize the document to include a unique reference number for tracking purposes, as well as any relevant tax identification details. These additional fields can help streamline record-keeping and ensure that both you and your client can easily reference the document in the future.

Common Mistakes to Avoid in Billing

Creating accurate and professional records for services rendered is essential to ensure smooth transactions and maintain positive client relationships. However, there are common errors that can lead to confusion, payment delays, and misunderstandings. By being aware of these mistakes, you can take steps to avoid them and streamline your billing process.

One of the most frequent errors is failing to include all the necessary details, such as clear descriptions of the services provided or accurate payment terms. Incomplete or vague records can cause clients to question the charges or forget what they are paying for. Another common mistake is not specifying the due date for payment or omitting late fee information, which can lead to missed payments and misunderstandings.

Additionally, errors in math, such as incorrect totals or tax calculations, can result in disputes or delays in payment. It’s also important to check for consistency, such as ensuring that the same name, address, and payment terms are used across all documents. Taking time to review each document carefully can prevent these common issues and promote a professional, efficient billing process.

How to Add Tax Information to Your Billing Document

Including tax details in your financial records is crucial for compliance and transparency. This ensures that both you and your client are on the same page regarding the applicable taxes, helping to prevent confusion and ensure accurate payments. Below are the key steps to follow when adding tax information to your records.

Identify the Applicable Tax Rate

First, determine which tax rate applies to your services. This may depend on your location, the nature of the service, and whether the client is in a different tax jurisdiction. Common taxes include sales tax, value-added tax (VAT), or service tax. Make sure you are aware of the current rate and any exemptions that may apply.

Include Tax Information Clearly

Once you’ve identified the appropriate tax rate, clearly list the tax amount on the billing document. It’s essential to break it down separately from the total charge for services rendered, so your client can see exactly how much they are being charged for tax. Include the tax rate and specify whether it is a flat rate or percentage-based.

For example, you can present the tax calculation in this manner:

Service Fee: $100

Tax (8%): $8

Total Due: $108

By clearly displaying tax information, you help ensure a smooth transaction and maintain transparency with your clients.

Free Tools for Creating Professional Billing Records

There are several online resources and software tools available that can help you create polished and professional documents for your services, without the need for expensive software or complicated designs. These tools offer templates and easy-to-use interfaces that allow you to quickly generate accurate records, keeping your business operations streamlined and efficient.

Online Platforms: Many websites provide no-cost services that allow you to design and download professional-looking records. These platforms often include customizable fields, making it easy to tailor the document to your specific needs.

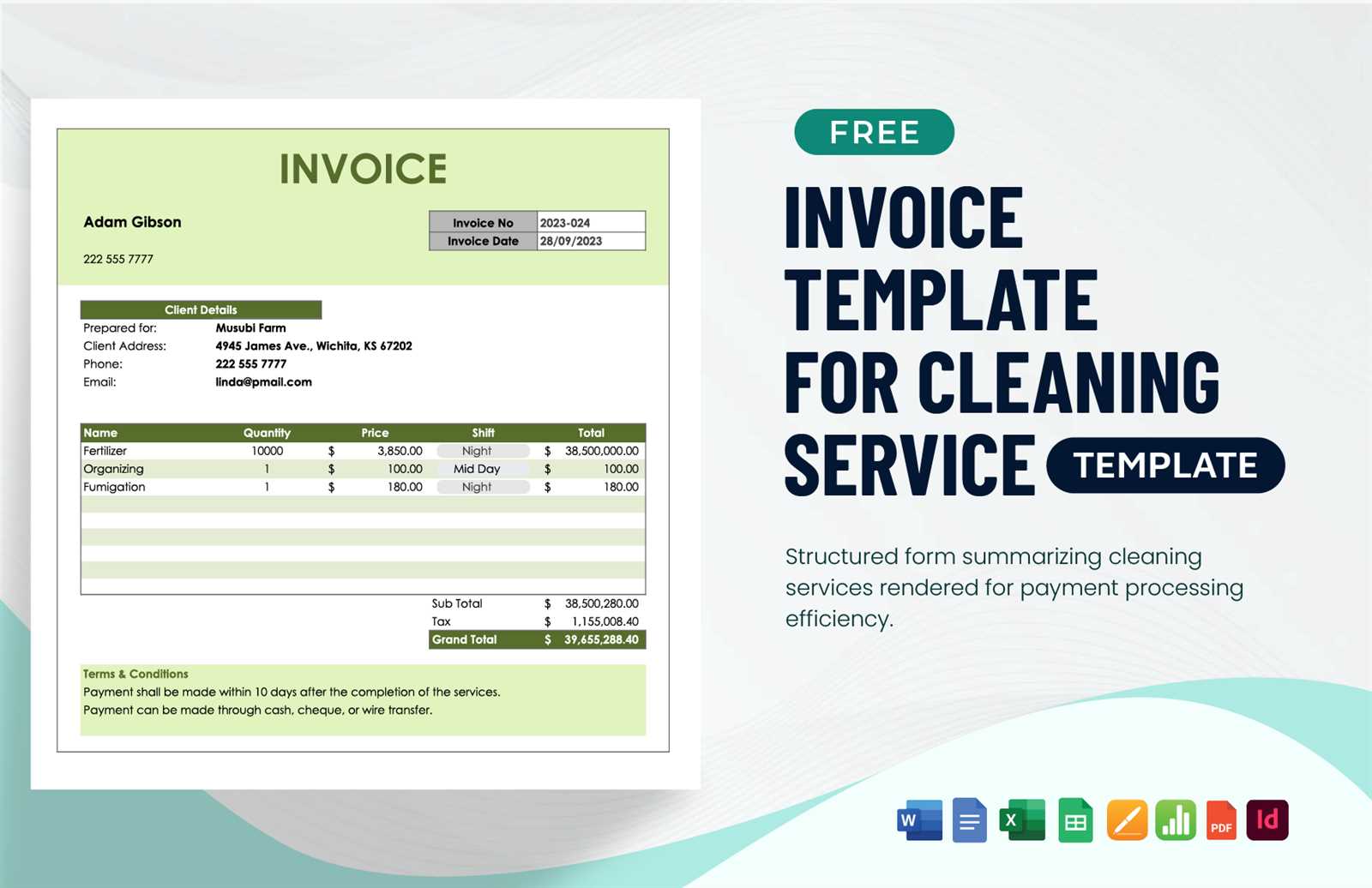

Spreadsheet Software: Programs like Google Sheets or Microsoft Excel can be used to create simple, clean documents. With pre-built templates available, you can modify them to suit your business style and include all the necessary details, from client information to payment terms.

Accounting Software: Some accounting platforms, even in their basic versions, offer the ability to create and manage billing records. These tools can automatically calculate totals, taxes, and apply payment terms, saving you time while ensuring accuracy.

Using these accessible tools, you can easily generate professional records that reflect well on your business, while minimizing the time spent on administrative tasks.

Best Practices for Billing Record Design

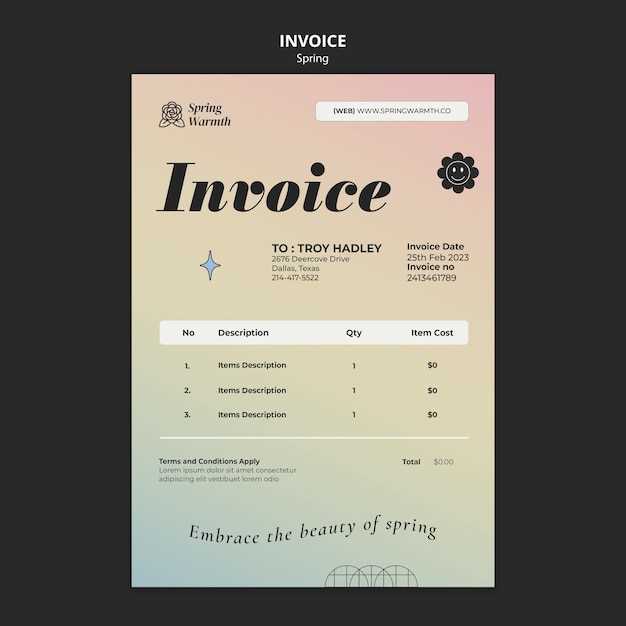

Creating a well-designed billing document is essential to ensure clarity and professionalism. A clean, organized layout not only makes it easier for clients to understand the charges but also reflects positively on your business. Here are some best practices for designing an effective billing document that enhances readability and promotes efficient payment processing.

Keep It Simple and Organized: The design should prioritize functionality and ease of use. Use clear headings, bold text, and ample spacing to differentiate sections like service details, totals, and payment terms. Avoid cluttering the document with unnecessary information or decorative elements.

Consistency in Fonts and Colors: Use legible fonts and maintain consistent font sizes and colors throughout the document. This helps ensure that the document looks professional and is easy to read. Stick to a limited color palette to maintain a formal appearance and avoid overwhelming the reader.

Include Key Information Clearly: Always highlight the most important details, such as the amount due, payment terms, and your contact information. Use tables to break down costs and provide clarity. These visual elements guide the reader’s attention to the most relevant information, making it easier to process the payment quickly.

Leave Room for Notes or Customization: Offering space for personal messages or custom instructions can make your document more personalized. This could include payment reminders, special discounts, or additional terms related to your business.

By following these simple yet effective design principles, you can create professional documents that are not only functional but also convey a polished, organized image to your clients.

How to Send Your Billing Record Effectively

Sending your financial document in a professional and timely manner is crucial for ensuring smooth transactions and prompt payments. The method you choose to send the record can affect how quickly and efficiently the client processes it. Whether you prefer electronic or traditional methods, the goal is to ensure that the client receives it in a clear, organized, and easy-to-understand format.

Choosing the Right Delivery Method

The first step is deciding how you will send the document. Digital delivery is often the quickest and most efficient way to share your document, especially via email or secure online portals. Email allows you to send the document instantly and track its delivery. For more formal transactions or clients who prefer paper, consider using traditional mail. Be sure to choose a method that aligns with your client’s preferences and the urgency of the payment.

Tips for Sending via Email

When sending your billing document via email, follow these tips for effective communication:

- Subject Line: Clearly state the purpose of the email, such as “Payment Due for Services Rendered” or “Your Billing Record for [Service Name].” This ensures the client knows exactly what the email contains.

- Personalized Message: Include a brief, polite message to accompany the document. Thank the client for their business and remind them of any payment terms or due dates.

- File Format: Attach the document as a PDF file to maintain formatting and ensure it is easily accessible across different devices and platforms.

Ensure Clarity in the Document

Regardless of the method you use, always ensure that the billing record is clear and well-organized. Use easy-to-read fonts, include a breakdown of charges, and list payment terms clearly. This helps avoid confusion and makes the payment process more straightforward for the client.

By choosing the right delivery method and ensuring clarity in your communication, you increase the chances of timely payments and maintain positive professional relationships with your clients.

How to Track Payments with Billing Records

Keeping track of payments is essential for maintaining cash flow and ensuring that no outstanding balances are overlooked. By using properly organized documents, you can easily track which transactions have been completed and which are still pending. This allows you to stay on top of your finances and provide clients with clear, up-to-date payment information.

Organize Payment Details Clearly: A well-structured billing document should include a section dedicated to payment status. Clearly mark whether the payment is pending, completed, or overdue. This helps both you and your client easily identify the status of the transaction and avoid confusion.

Record Payment Dates and Amounts: Always keep track of when payments were made and the amounts received. This can be done manually on each record or by using a digital accounting tool. Maintaining accurate payment records not only helps you stay organized but also provides a reference point in case of disputes.

Use Digital Tools for Easy Tracking: There are many software solutions available that allow you to track payments automatically. These tools can link to your billing records, helping you monitor outstanding payments and even send reminders to clients as the due date approaches. Using digital platforms simplifies the tracking process and reduces the risk of human error.

By staying organized and using digital tools where necessary, you can ensure that your payment tracking is both efficient and accurate, improving your cash flow management and business operations.

Understanding Payment Terms in Billing Records

Clear payment terms are essential for ensuring both you and your client are on the same page regarding the timing and conditions of payment. Setting and communicating these terms helps avoid confusion, delays, and potential misunderstandings. By outlining specific expectations, you create a structured approach to how and when payments should be made.

Common Payment Terms

Different businesses may have different expectations for when payments are due. Below are some of the most common terms used to set expectations for clients:

- Net 30: Payment is due within 30 days of the billing date. This is one of the most common terms used in business transactions.

- Due on Receipt: Payment is expected immediately upon receiving the billing record.

- Net 60 or Net 90: Payment is due within 60 or 90 days of the billing date, giving clients a longer window to settle their balance.

- Early Payment Discount: A discount offered if the payment is made before a certain date, incentivizing clients to pay sooner.

Why Payment Terms Matter

Clearly defining your payment terms in your billing record offers several benefits:

- Improved Cash Flow: Setting clear payment deadlines helps you manage your cash flow more effectively and predict your business’s financial health.

- Avoiding Disputes: Clearly outlined terms prevent disputes by setting expectations from the outset and reducing confusion regarding payment deadlines.

- Professionalism: Clear terms demonstrate a professional approach to your financial dealings and instill confidence in your clients.

By understanding and effectively communicating payment terms, you can streamline your financial processes and ensure smoother transactions with your clients.

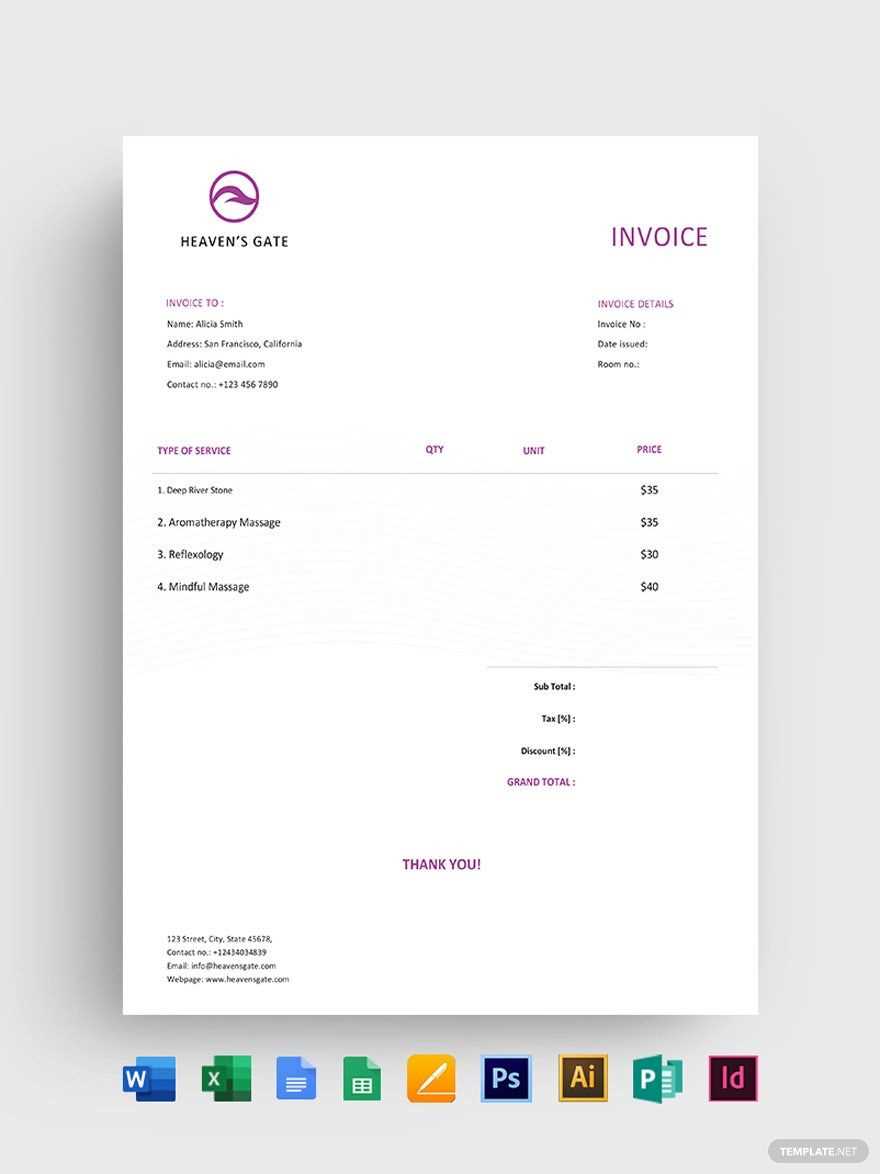

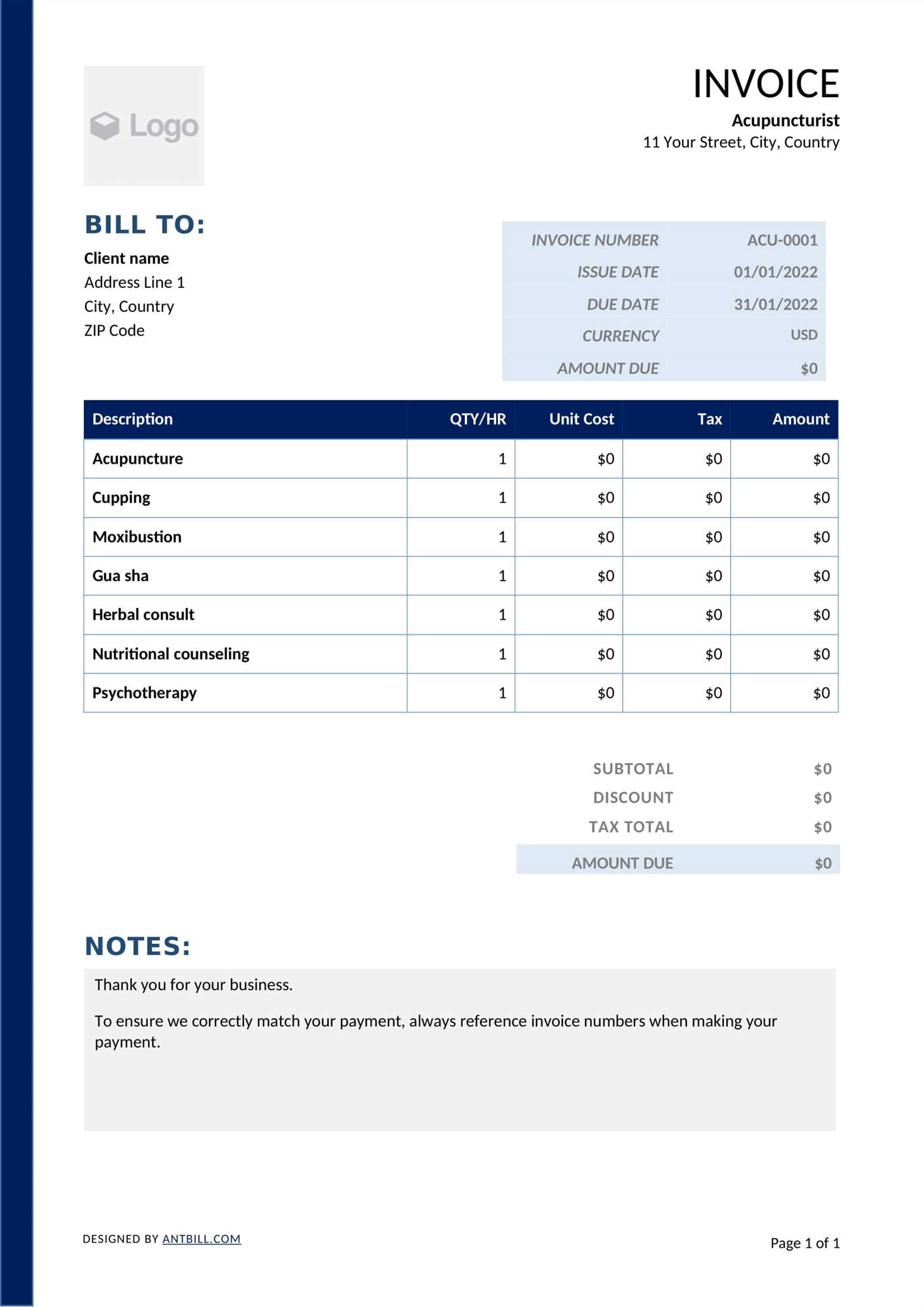

Billing Records for Independent Therapists

For independent health and wellness professionals, creating and managing billing documents is crucial for smooth financial transactions with clients. By using properly formatted records, you can ensure clear communication regarding services rendered, payment expectations, and due dates. A well-structured document not only keeps you organized but also reinforces your professionalism in the eyes of your clients.

When working as a freelancer in the wellness field, it’s important to create billing records that are both simple and thorough. The document should reflect the nature of your services, the time spent, and any applicable charges. Below is a sample structure of how such a record could be organized for better clarity and efficiency.

| Field | Description |

|---|---|

| Client Information | Include the client’s name, contact information, and any relevant account numbers. |

| Services Rendered | List the services provided, including any special treatments or packages offered during the session. |

| Duration of Service | Specify the time spent on each service or session, allowing clarity in pricing. |

| Payment Terms | Clearly state the payment due date and whether any advance deposit or late fee applies. |

| Total Amount Due | Summarize the total payment expected, including taxes or discounts if applicable. |

Using a structured document like this helps to avoid confusion and ensures your clients know exactly what they’re paying for. This clarity helps you maintain transparency and professionalism while also protecting your business interests.

How to Handle Billing Disputes

Disagreements regarding financial documents can arise for various reasons, whether due to misunderstandings about the services provided or confusion over charges. When such disputes occur, it’s crucial to approach the situation professionally and calmly to ensure a positive resolution. Addressing billing issues promptly can help maintain strong relationships with clients and prevent further complications.

The first step in resolving any dispute is to carefully review the details of the transaction, ensuring all charges are accurate and justified. If the client raises concerns, it is important to listen attentively and verify the specific areas of contention. By being proactive in seeking clarity and understanding, both parties can come to an agreement more efficiently.

Steps for Resolving Disputes

- Review Documentation: Double-check all details on your record, including services rendered, time spent, and charges applied.

- Clarify Misunderstandings: Speak with the client to understand their concerns and explain your charges in detail.

- Offer Solutions: If an error was made on your part, acknowledge it and provide a fair adjustment. If no error occurred, explain your reasoning clearly.

- Settle Professionally: Reach a fair conclusion that leaves both parties satisfied, and ensure any changes are documented for future reference.

Best Practices for Preventing Disputes

- Clear Communication: Ensure your billing documents are clear and easily understandable.

- Set Expectations: Outline terms and conditions clearly before providing services, including pricing and payment terms.

- Follow Up: After sending the bill, follow up with clients to confirm receipt and address any concerns before they escalate.

Handling disputes effectively can turn a potentially negative experience into an opportunity to strengthen your client relationship. By maintaining transparency, professionalism, and open communication, you can resolve conflicts amicably and continue to grow your business.

Using Digital Billing for Your Business

In today’s fast-paced world, many businesses are transitioning to digital platforms for their financial documentation needs. Moving away from paper-based processes to electronic methods can provide numerous advantages in terms of efficiency, security, and organization. By adopting digital billing solutions, companies can streamline their operations and improve overall workflow, making it easier to manage payments and maintain accurate records.

Digital billing systems allow for the quick creation and sending of payment requests, eliminating the need for physical paperwork and reducing the time spent on administrative tasks. These tools often come with features such as automatic reminders, customizable formats, and secure online payment options, making them ideal for businesses looking to enhance their invoicing practices.

Advantages of Using Digital Billing

- Faster Transactions: Digital documents can be generated, sent, and paid faster than traditional methods, improving cash flow.

- Better Organization: Electronic records are easier to store, search, and organize compared to physical paperwork.

- Increased Security: Digital platforms provide encryption and secure methods for handling sensitive information, reducing the risk of fraud.

- Environmental Benefits: Going paperless reduces waste, helping your business contribute to sustainability efforts.

How to Implement Digital Billing

- Choose a Reliable Platform: Select an online service or software that suits your business needs and allows for secure transactions.

- Customize Your Documents: Personalize your billing documents to reflect your branding, including your logo, payment terms, and other necessary information.

- Integrate Payment Options: Provide clients with the ability to pay directly through the platform, making it easier for them to settle bills.

- Track Payments: Use digital tools to track the status of payments, set reminders, and issue receipts automatically.

By embracing digital billing methods, businesses can not only increase operational efficiency but also enhance customer satisfaction. The ability to quickly and securely handle transactions helps build trust and ensures smooth financial interactions, benefiting both the company and its clients.

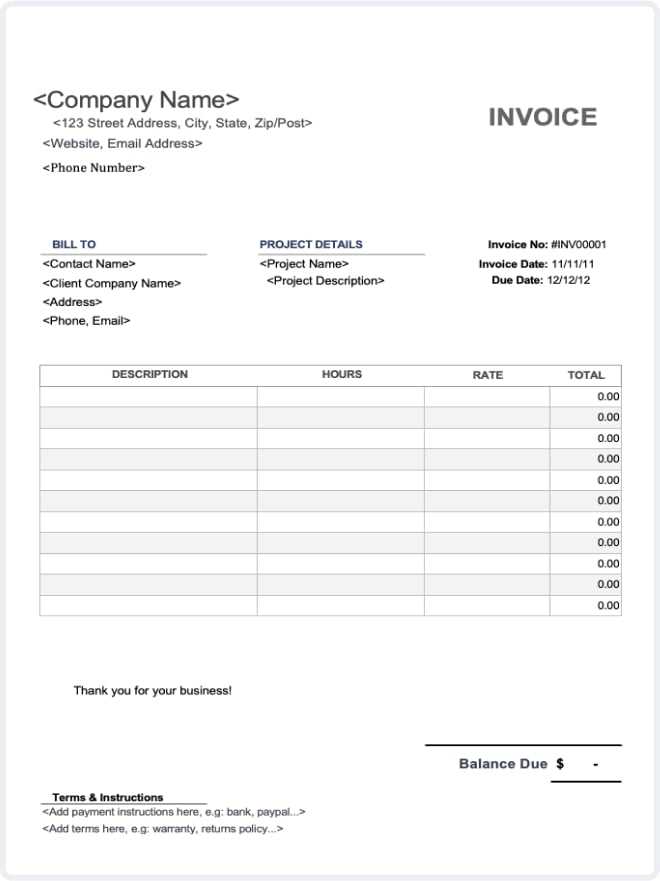

Free Billing Formats for Different Platforms

When it comes to handling financial transactions, having access to customizable and easy-to-use billing formats can significantly improve efficiency. Many platforms now offer digital solutions to assist small businesses and freelancers in generating professional payment requests. These platforms provide various options for customizing documents that meet specific business needs, whether it’s for a service-based or product-driven company.

Choosing the right platform can make all the difference. Depending on your business type and preferences, some tools may offer additional features like automatic reminders, direct payment links, or integrations with accounting software. These features can simplify administrative tasks and ensure that your billing process is seamless and organized.

Popular Platforms Offering Billing Formats

- Google Docs: Google Docs provides a simple and versatile way to create customized payment requests. You can use pre-designed documents or start from scratch with a blank page. Integration with Google Sheets allows for easy calculation and tracking of payments.

- Microsoft Word: Microsoft Word is another widely used platform that offers templates for creating professional payment requests. Templates can be easily modified to suit your branding and payment terms, making it an ideal choice for many businesses.

- Canva: Known for its user-friendly design tools, Canva offers visually appealing formats that are easy to customize. Whether you’re a freelancer or a small business, Canva’s templates can help create invoices that stand out.

- Zoho Invoice: Zoho Invoice is a cloud-based platform that simplifies the billing process for businesses. It offers free customizable formats with features like time tracking and payment management, allowing users to create professional documents with minimal effort.

- Wave: Wave is an excellent choice for small businesses, offering free invoicing and billing tools. The platform’s easy-to-navigate interface allows you to generate billing documents, track payments, and even accept online payments.

Choosing the Right Platform for Your Business

- Ease of Use: Consider a platform that is intuitive and easy to navigate, especially if you’re new to creating digital payment documents.

- Customization Features: Look for platforms that allow you to adjust fonts, logos, and layout to align with your brand.

- Payment Integration: Some platforms offer integrated payment options, allowing clients to pay directly through the document, which can streamline the payment process.

- Reporting and Tracking: Platforms with tracking and reporting features can help you keep tabs on the status of payments and send reminders for overdue bills.

Each platform has its own set of strengths, so it’s important to choose one that fits the scale and scope of your business. By using these tools, you can easily generate professional documents, improve cash flow, and enhance your overall bu