Manager IO Invoice Templates for Easy and Efficient Billing

Efficient document creation is essential for businesses of all sizes, ensuring smooth transactions and professional communication with clients. By using pre-designed formats, you can easily generate clean and consistent billing records, saving time and reducing errors. These tools help organize financial details and present them in a professional manner, making the entire process more reliable.

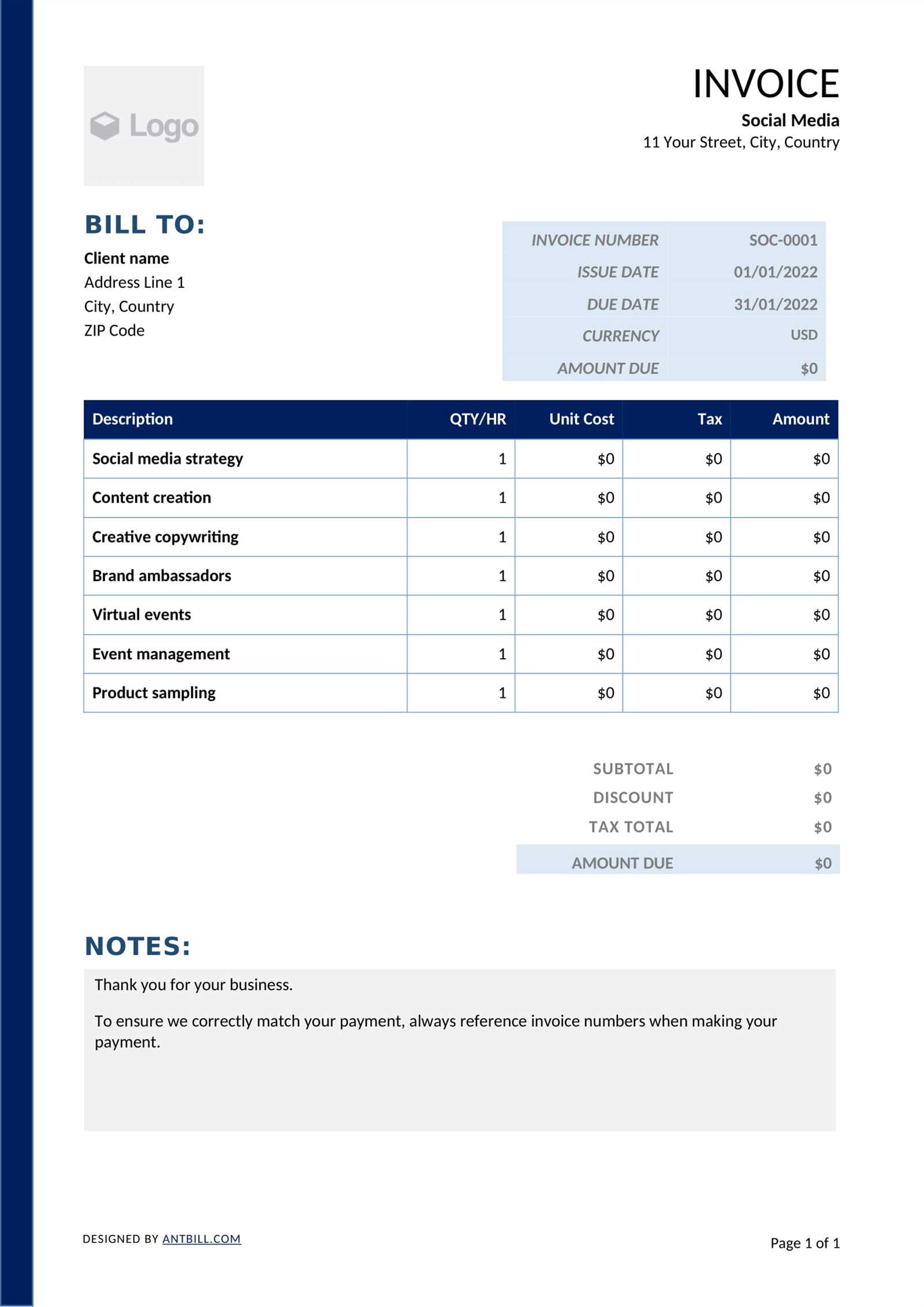

Customizing your business documents allows for a more personalized approach. With simple modifications, you can adjust each form to reflect your brand’s identity, including logos, colors, and contact information. This not only enhances your professional image but also ensures that every communication aligns with your business standards.

Whether you’re handling a single transaction or managing multiple clients, having access to organized and effective formats simplifies administrative tasks. Automating key aspects of financial documentation boosts productivity and reduces the likelihood of mistakes, making it an invaluable resource for any organization looking to optimize its financial workflows.

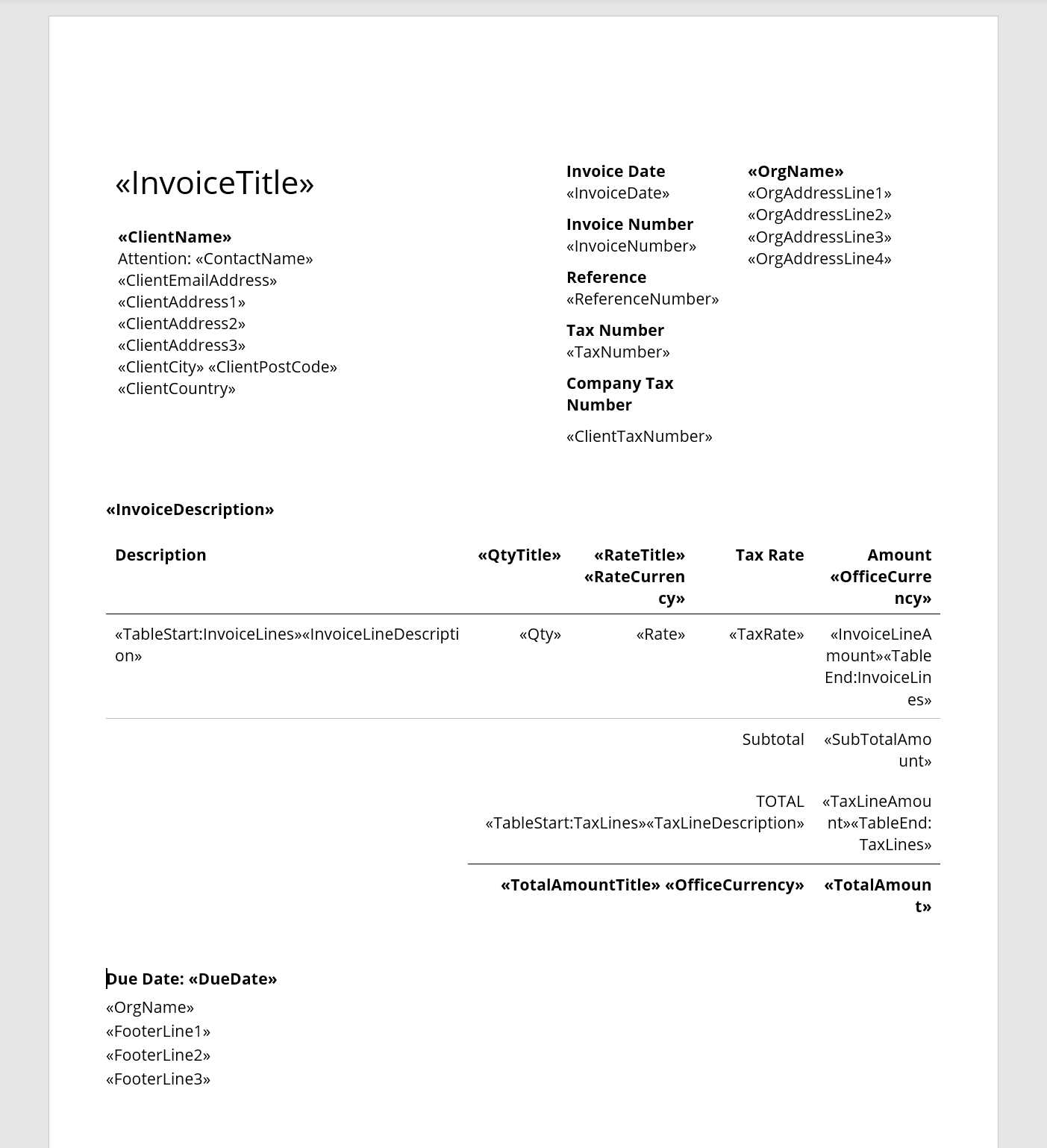

Manager IO Invoice Templates Overview

Effective billing tools are essential for businesses looking to streamline their financial documentation processes. These solutions offer a structured and organized way to create clear, consistent records for transactions, reducing the risk of errors and improving overall efficiency. With pre-built formats, you can ensure that each document reflects the necessary information while maintaining a professional appearance.

Key Features of Billing Solutions

One of the main advantages of using these tools is the flexibility they provide. Whether you’re handling small projects or large-scale contracts, you can adjust the layout and content to suit specific needs. Customizable sections allow businesses to easily include their branding, payment terms, and relevant client information, offering a personalized touch while maintaining a clean and organized presentation.

Streamlining Workflow and Reducing Errors

Automating the creation of financial documents also significantly reduces the likelihood of human errors. By relying on automated processes, businesses can quickly generate consistent and accurate paperwork, improving workflow and minimizing the need for manual data entry. This efficiency ultimately saves time, allowing teams to focus on other critical areas of their operations.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for financial documents brings numerous advantages to any business. These solutions simplify the process of creating accurate, professional-looking records, eliminating the need for starting from scratch each time. By relying on structured layouts, you ensure consistency across all communications and reduce the chances of errors that can occur when manually inputting data.

Time Efficiency is one of the most significant benefits of using such tools. Pre-built formats allow for quicker generation of paperwork, enabling businesses to focus on other important tasks rather than spending excessive time on document creation. With just a few adjustments, you can create personalized records without the need for extensive formatting each time.

Professionalism is enhanced by these solutions, as they ensure that every document looks polished and well-organized. Whether it’s for internal use or external communication, having a clear and uniform appearance helps build trust with clients and partners. Customizable sections also allow you to add branding elements, making each document align with your business’s identity.

Consistency is another key advantage. Using the same structure for each document guarantees that all essential information is included, and it prevents mistakes such as missing data or incorrect formatting. This consistency across all paperwork promotes a sense of reliability and attention to detail in the eyes of your clients.

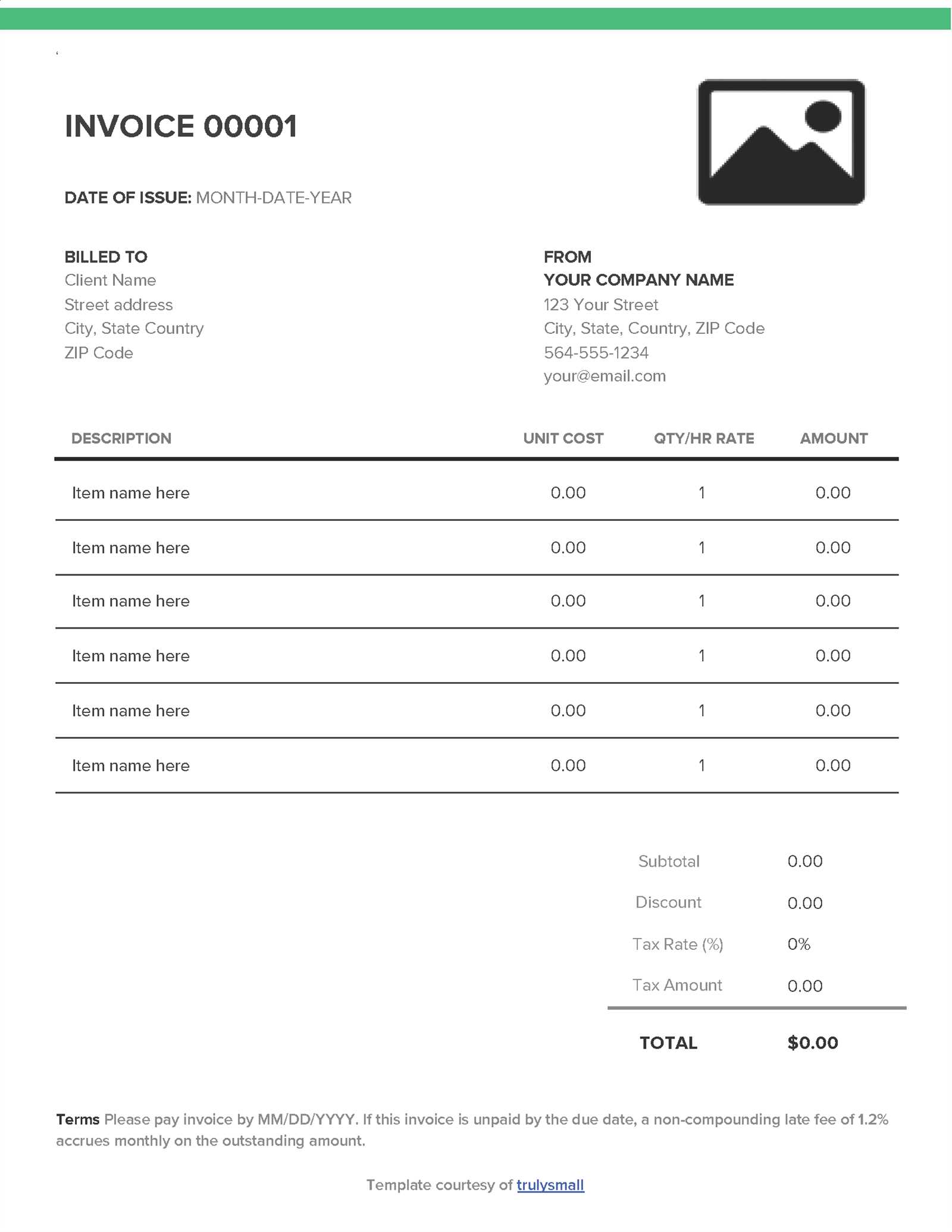

How to Customize Your Invoice Templates

Personalizing your financial documents is an important step to make them more relevant and aligned with your business needs. Customization allows you to modify various elements of the format to reflect your brand identity and ensure the necessary information is included in a clear and professional manner. Here are the key steps to follow when adjusting your documents:

- Adjust Layout and Design: Choose from a variety of layout options that best suit your style. Customize colors, fonts, and logos to match your brand’s visual identity.

- Include Business Information: Make sure your company’s contact details, such as address, phone number, and email, are clearly visible. This is crucial for maintaining professionalism and transparency.

- Add Custom Fields: Depending on the nature of your business, you may need to include specific sections like project codes, terms of payment, or due dates. Tailor the format to your operational needs.

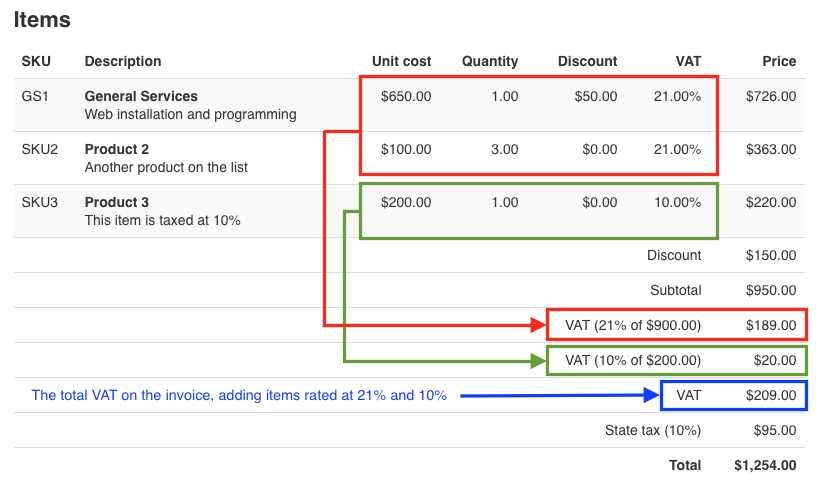

Once you’ve made these initial customizations, consider fine-tuning the document for specific use cases. For example, if you often deal with international clients, you may want to add currency options or adjust tax rates based on different regions. Streamlining these processes reduces the time spent on each document while ensuring accuracy and relevance.

- Personalize Client Information: For each document, ensure that client details are pre-filled correctly. This can be automated, saving you time and reducing errors.

- Review and Save Templates: After customization, save the updated format for future use. This allows you to maintain consistency across all communications and easily generate new records as needed.

Integrating Manager IO with Payment Systems

Connecting your financial documentation system with payment platforms is an essential step in automating your billing and payment collection process. Integration ensures smooth transactions, real-time updates, and accurate record-keeping. By linking your billing tools with payment systems, you streamline operations, reduce manual data entry, and improve cash flow management.

Through integration, businesses can easily track payments, send automated reminders, and reconcile accounts quickly. The connection also allows you to securely accept online payments, making it easier for clients to pay invoices directly from their electronic records. Below is a general overview of how integration typically works:

| Feature | Description |

|---|---|

| Automated Payment Tracking | Real-time updates of payment status directly linked to your documents. |

| Seamless Payment Processing | Direct payment links in the document allow clients to make instant payments. |

| Invoice Reconciliation | Automatic matching of payments with the correct transaction records. |

| Multiple Payment Options | Integrate various payment methods, including credit cards, bank transfers, and digital wallets. |

By implementing this integration, businesses not only save time but also improve the accuracy and security of financial transactions. This system ensures that your team can focus on growing the business while the tools handle the administrative workload. The seamless connection between documentation and payments is crucial for enhancing efficiency and reducing the risk of errors in financial operations.

Creating Professional Invoices with Ease

Generating polished and accurate billing records is a vital part of any business operation. With the right tools, creating well-structured financial documents becomes a straightforward task. These solutions allow you to quickly produce clear, professional paperwork while ensuring all necessary details are included. With minimal effort, you can ensure that each document meets your business standards and client expectations.

Key Elements for a Professional Look

When crafting your billing documents, certain elements should be prioritized to create a professional appearance. Clear fonts, consistent formatting, and proper organization ensure that your document looks polished and is easy for clients to understand. Below is a list of essential components for a well-designed financial document:

| Element | Importance |

|---|---|

| Company Information | Displays your contact details and reinforces your brand image. |

| Client Details | Ensures accurate and clear communication between both parties. |

| Itemized List of Services | Provides transparency and clarity on the products or services provided. |

| Payment Terms | Clearly states payment deadlines and methods to avoid misunderstandings. |

Streamlining the Creation Process

Once you’ve designed the basic layout, automating the creation of these documents further enhances efficiency. By using pre-configured formats, you can quickly generate customized records for every transaction without having to manually input repetitive information. This time-saving approach allows you to focus on your core business activities, while ensuring that your financial documentation remains consistent and professional.

Exploring Different Invoice Template Styles

When it comes to creating billing documents, the style and structure can significantly impact both functionality and the perception of your business. Different document styles cater to various needs and industries, and understanding these options can help you choose the right approach for your specific requirements. Whether you prefer a minimalist design or a more detailed, structured format, selecting the right style ensures that your documents remain professional and effective.

Types of Document Styles

There are various styles available, each with its own set of advantages depending on the nature of your business. From simple and straightforward designs to more complex and customized layouts, each style serves a different purpose. Below are some common options and their key characteristics:

| Style | Features |

|---|---|

| Minimalist | Simplified design with clean lines and essential information. Perfect for businesses that prioritize efficiency and clarity. |

| Modern | Stylish design with a focus on typography and visuals. Ideal for creative industries that want to showcase their brand identity. |

| Classic | Traditional design with more structure and detailed sections. Suitable for corporate or legal environments that require detailed records. |

| Detailed | Includes multiple sections and fields to accommodate complex transactions. Great for businesses with extensive service lists or varied pricing models. |

Choosing the Right Style for Your Business

The style of your billing documents should reflect your brand’s identity and the complexity of your services. For businesses offering a wide range of products or services, a more detailed design may be necessary. However, if you’re focused on providing quick and straightforward services, a minimalist design may be more suitable. Tailoring your style to your business’s needs ensures that your documents are both functional and professional.

Setting Up Your Invoice Template for Success

Creating effective financial documents starts with setting up a strong foundation. A well-organized format ensures that all necessary details are included and presented clearly, allowing for smooth transactions and reducing the chances of errors. The key to success is customizing the structure to fit both your business needs and your clients’ expectations, making sure that every essential piece of information is easily accessible.

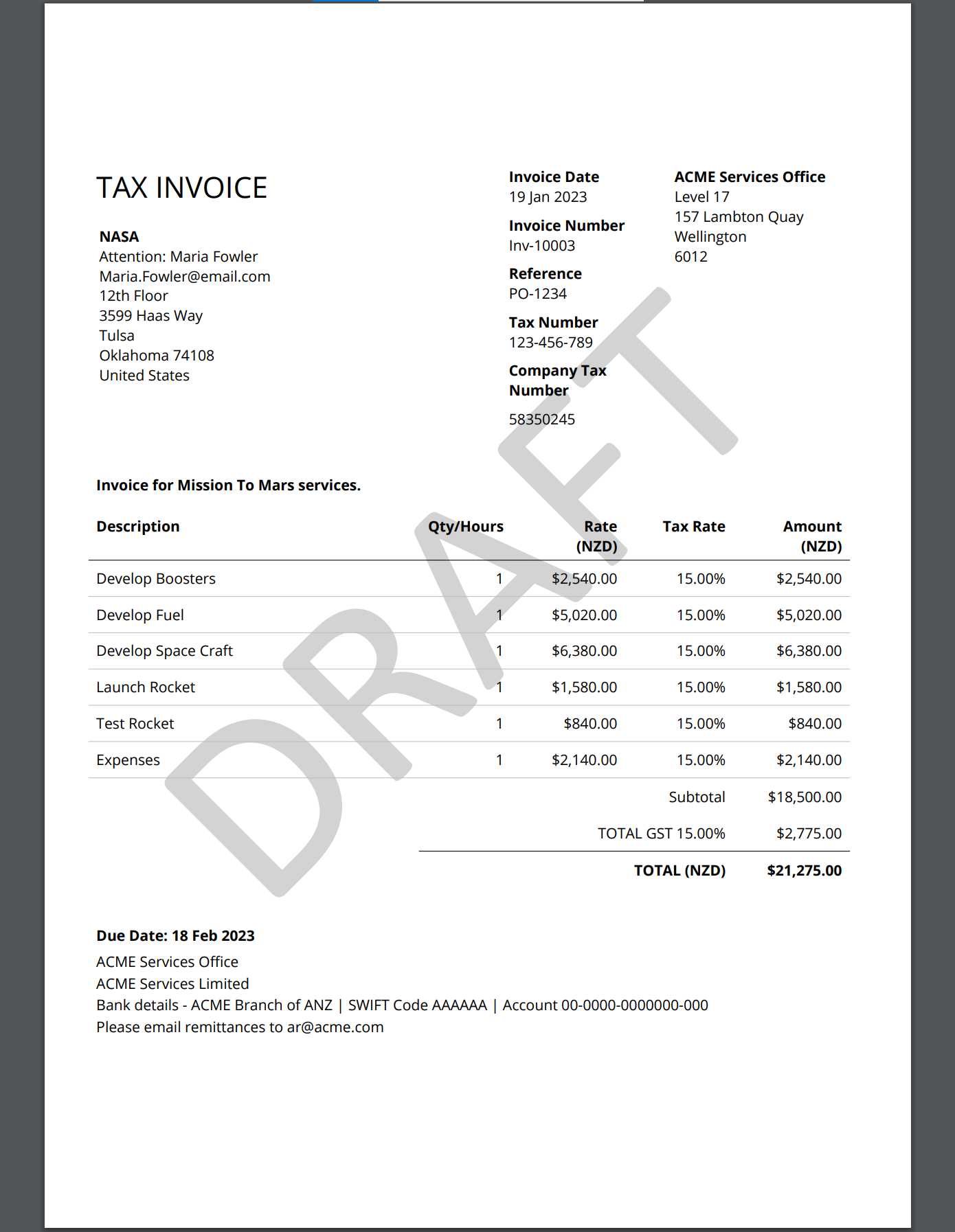

First, ensure that all essential details are included in the layout, such as your company’s contact information, payment terms, and client details. Without these elements, your document might lack clarity or lead to confusion, which can affect payment timelines. Clear sections, well-placed headers, and easy-to-read fonts help your clients quickly understand the content, making the document both functional and professional.

Next, think about the customization options that best represent your brand. Adding your logo, adjusting the color scheme, or including a personalized message can elevate the overall presentation. This not only makes your documents stand out but also strengthens your brand identity in your client’s eyes. A customized document shows professionalism and attention to detail, which is essential for maintaining trust with your clients.

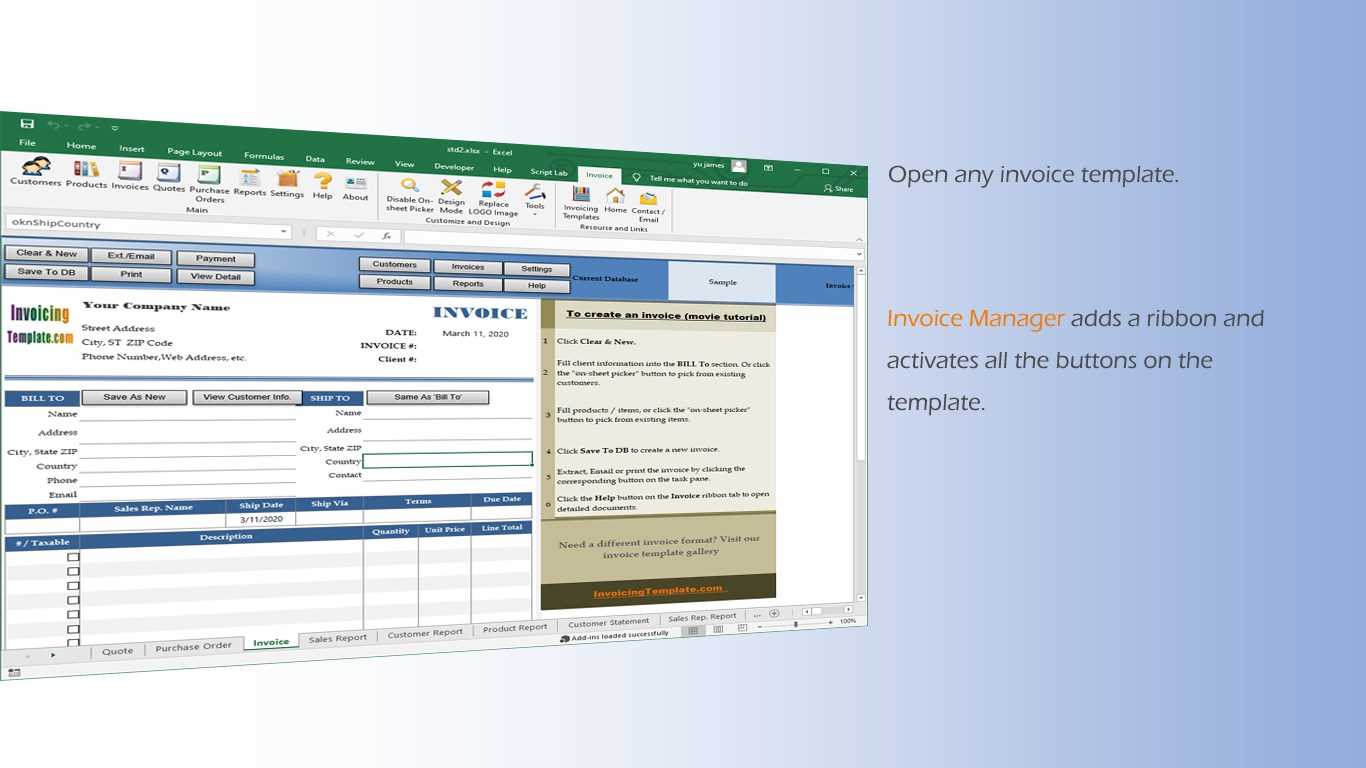

Finally, streamline the process by utilizing automated features that allow for quick generation and easy updating of your documents. Automated fields, such as client names or service descriptions, save you time and ensure that you don’t miss any critical information. By setting up a flexible, automated system, you can focus more on your core business activities while ensuring that your financial records are always accurate and on time.

How to Manage Multiple Invoice Templates

When running a business, it’s common to need different styles of financial documents for various purposes. Whether you’re dealing with one-time clients, long-term contracts, or different types of services, having several formats at your disposal ensures that each document suits its specific use case. Managing multiple formats effectively allows you to maintain organization, streamline workflow, and provide a tailored experience for every client.

Start by categorizing your document types based on your business’s needs. For example, you might have separate formats for individual services, bulk orders, or recurring transactions. By creating distinct categories, you can easily locate and apply the right format for each situation, ensuring consistency and clarity in your records.

Next, consider implementing a centralized system where all your document styles are stored and accessible. Cloud-based platforms or business management tools can help keep your files organized and allow you to access them from any device. This not only saves time but also reduces the risk of confusion when working with different document formats.

Finally, automate where possible. Set up your system to automatically fill in fields such as client names, service descriptions, or pricing details. This reduces the time spent manually editing each document and ensures that all the information is accurate. Automation can also help with generating multiple documents at once, streamlining your workflow and reducing the potential for human error.

Enhancing Brand Identity with Templates

Your financial documents are not just tools for transactions; they also serve as a reflection of your business’s professionalism and identity. By incorporating your brand’s visual elements into these documents, you create a consistent, cohesive image that reinforces your company’s values and personality. Customizing your documents with branding elements such as logos, colors, and typography helps distinguish your business and leaves a lasting impression on clients.

Incorporating Your Logo and Branding Colors

One of the simplest and most effective ways to enhance brand identity is by including your company’s logo and brand colors in the design. These visual elements make your documents instantly recognizable and create a sense of trustworthiness and familiarity. Ensure that your logo is placed prominently and that the color scheme aligns with your overall branding, maintaining consistency across all business materials.

Typography and Layout Design

The fonts you choose and the overall layout of your documents also play a significant role in reinforcing your brand’s identity. Select fonts that reflect your business’s tone – whether professional, creative, or casual. Consistency in font choice across all documents builds a stronger brand presence and ensures your financial records align with other marketing materials.

By customizing your documents with your unique branding elements, you not only improve their visual appeal but also create a more professional and cohesive brand experience for your clients. Each interaction with your business, even through something as simple as a document, contributes to how your company is perceived, making it essential to reflect your brand values in every detail.

Automating Document Generation in Manager IO

Automating the process of creating financial records not only saves time but also reduces the chances of human error. By setting up automated workflows, businesses can streamline the creation of essential documents, ensuring that every detail is accurate and up-to-date. Automation allows for quicker turnaround times and eliminates the need for manual data entry, freeing up resources for other important tasks.

Setting Up Automation for Client Billing

To fully automate your document generation process, start by setting up templates that can be automatically filled with client-specific information, such as names, addresses, and service details. Once your template is configured, the system can pull the relevant data from your database and populate the document in real time. This eliminates the need to manually enter repetitive details, allowing you to generate multiple documents efficiently.

Benefits of Automation in Document Creation

Automating the generation of financial records also ensures consistency and accuracy, as the system can apply the same format and structure each time. This not only makes documents easier to read and understand but also helps maintain professional standards across all client communications. Additionally, automated systems often integrate with payment gateways, enabling seamless transactions once documents are finalized.

By automating the document creation process, businesses can achieve greater efficiency and improve accuracy, all while maintaining a professional appearance in every interaction with clients.

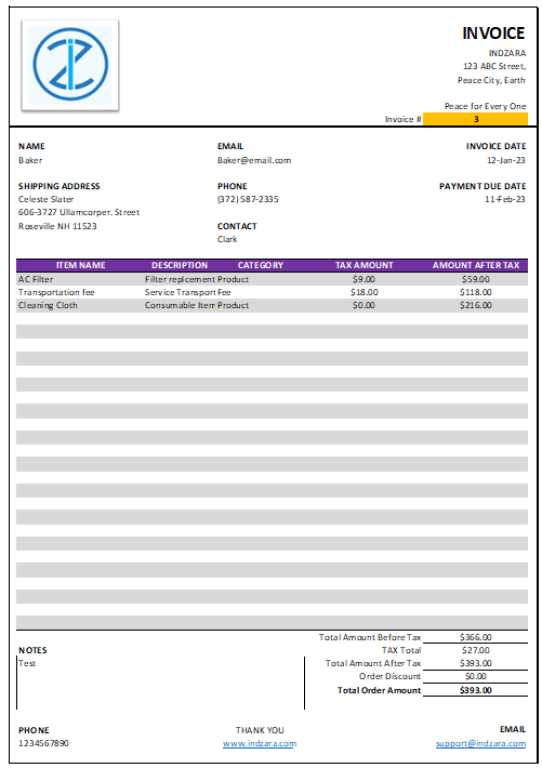

Tracking Payments Through Invoice Templates

Efficiently managing and tracking payments is a crucial aspect of maintaining healthy business cash flow. By structuring your financial documents to include clear payment tracking features, you can easily monitor outstanding amounts, due dates, and payment status. This ensures you never lose track of any transaction, helping to avoid missed payments and allowing for quick follow-ups when necessary.

Including Payment Status and Due Dates

One of the most effective ways to track payments is by incorporating fields that indicate the status of each payment and the due date. By including a payment status section, such as “Paid,” “Pending,” or “Overdue,” you can instantly see which accounts require attention. Additionally, marking each document with clear due dates helps both you and your clients stay on top of payment timelines, ensuring timely and organized settlements.

Automating Payment Reminders

Incorporating automated reminders in your document system is another efficient way to keep payment tracking seamless. Once a due date approaches or passes, an automated reminder can be sent to the client, prompting them to complete the payment. This feature saves time and reduces the need for manual follow-up, helping businesses maintain professionalism while ensuring payments are received on time.

By carefully structuring your documents to include these tracking features, you ensure a smooth financial workflow, reducing errors and improving overall payment collection efficiency.

Using Manager IO for International Invoices

When dealing with clients from different countries, it’s essential to tailor financial documents to meet international standards. This includes adapting the layout, currency, and language to suit each region’s specific needs. Using a versatile platform can streamline this process, ensuring that documents are consistent, professional, and in compliance with local requirements.

Customizing Currency and Language

One of the key advantages of using such a platform is the ability to customize financial documents based on the client’s country. Some important features to consider include:

- Currency selection: Choose from a wide variety of global currencies, making it easy to reflect accurate payment amounts.

- Language translation: Adapt the language to suit the client’s preference, enhancing clarity and professionalism.

- Tax adjustments: Automatically apply region-specific tax rates, helping businesses stay compliant with local tax regulations.

Ensuring Compliance with International Standards

Each country may have its own legal requirements for financial documents, such as the inclusion of specific details or formats. A robust platform can automatically incorporate these details into your records, reducing the risk of errors and ensuring that all documents meet international standards. This can save time, especially when dealing with multiple clients from different jurisdictions.

By utilizing a system designed for international use, businesses can expand their global reach while maintaining smooth and efficient financial operations.

Common Document Design Mistakes to Avoid

When creating professional financial documents, attention to detail is essential. Even small mistakes can cause confusion, delay payments, or damage your reputation. It’s important to recognize and avoid common pitfalls that can affect the clarity and effectiveness of your documents. By being aware of these errors, you can ensure your records are always accurate, clear, and professional.

Overlooking Key Information

One of the most common mistakes is failing to include all the necessary information. Essential details such as the client’s full name, address, and payment terms should never be omitted. Also, always ensure that the document includes a clear breakdown of the products or services provided, payment due dates, and any applicable taxes or fees. Missing any of these pieces of information can lead to confusion or disputes later on.

Formatting Issues

Another frequent error is poor document layout. A disorganized or cluttered format can make the document hard to read, leading to misunderstandings or overlooked details. Ensure that your layout is clean and well-structured, with clearly defined sections for each piece of information. Consistent fonts, headings, and spacing also contribute to a professional appearance and make your document easier to understand.

By avoiding these common mistakes, you can create documents that are clear, professional, and effective in ensuring smooth financial transactions.

How to Export Your Documents Efficiently

Exporting your financial documents in a quick and organized manner is essential for maintaining smooth business operations. Whether you’re sending them to clients, archiving them for future reference, or integrating them with accounting software, the process should be seamless and error-free. Efficient export methods ensure that you save time and prevent unnecessary complications.

Choosing the Right File Format

One of the first steps to exporting documents efficiently is selecting the right file format. Common formats include PDF, which is widely accepted and ensures that the layout remains unchanged, and Excel or CSV formats, which are ideal for record-keeping or further data manipulation. Each format has its advantages, depending on how you intend to use or share the document.

Batch Exporting for Large Volumes

When handling large volumes of documents, batch exporting is a time-saving method. Instead of exporting each document individually, look for systems that allow you to select and export multiple files at once. This functionality helps streamline workflows, especially when managing monthly or quarterly reports, and significantly reduces the amount of time spent on repetitive tasks.

By mastering these strategies, you can export your financial documents quickly, ensuring smooth processes and keeping your business operations running efficiently.

Protecting Your Document Data with Security

When handling financial documents, safeguarding sensitive information is crucial. These records often contain details like payment amounts, personal data, and business information that can be targeted by cybercriminals. Implementing strong security measures helps protect both your business and your clients from potential breaches, ensuring confidentiality and integrity at all times.

Key Security Practices

There are several essential security practices to follow when managing financial records:

- Encryption: Use encryption tools to protect your documents during storage and transmission. This ensures that only authorized parties can access the content.

- Access Controls: Limit access to sensitive documents by setting permissions. Only authorized users should be able to view, edit, or share these records.

- Regular Backups: Regularly back up your documents to avoid data loss in case of system failures or cyberattacks.

Using Secure Platforms

Choosing secure platforms for storing and sharing financial documents is also important. Look for solutions that offer built-in security features such as two-factor authentication, secure file-sharing capabilities, and automatic updates to fix potential vulnerabilities. Additionally, make sure the platform complies with data protection regulations to ensure your practices align with legal requirements.

By following these steps, you can minimize the risk of unauthorized access and keep your financial records safe and secure.

Optimizing Document Workflow with Efficient Tools

Streamlining the process of generating and managing financial documents can significantly improve business efficiency. By using efficient tools that automate and standardize the creation of these documents, you can minimize manual input, reduce errors, and speed up overall workflow. This approach not only saves time but also enhances consistency and accuracy in document handling.

Key Benefits of Optimized Workflow

Implementing optimized workflows offers a range of advantages:

- Faster Processing: Automation reduces the time spent on repetitive tasks, enabling quicker document creation and submission.

- Consistency: Standardized documents ensure that all records follow the same format, reducing errors and confusion.

- Improved Tracking: Digital tools provide easy access to real-time updates on document status, helping you track progress more effectively.

Setting Up an Optimized Workflow

To get the most out of your document management system, setting up a structured workflow is crucial. Consider the following steps:

| Step | Action | Benefit |

|---|---|---|

| 1 | Choose a user-friendly system | Simplifies document creation and reduces learning curves. |

| 2 | Set up automation for recurring tasks | Speeds up workflow by eliminating manual repetition. |

| 3 | Integrate with accounting tools | Enables seamless data flow between platforms, reducing the risk of errors. |

By implementing these steps, you can optimize your document handling process, allowing for faster, more accurate management of business operations.

How to Share Financial Documents with Clients

Sharing financial documents with clients in an efficient and secure manner is crucial for maintaining professional relationships and ensuring smooth business transactions. With various communication channels available, selecting the right method can streamline the process and help both parties stay organized.

There are several ways to deliver these documents to clients, and choosing the most suitable method depends on factors like speed, security, and client preferences. Below are a few popular options to consider:

- Email: One of the most common and efficient methods is emailing a digital copy of the document directly to the client. Make sure to use a secure format such as PDF to prevent unauthorized changes.

- Cloud Storage: Sharing a link to a cloud storage service like Google Drive or Dropbox allows clients to access the document at their convenience. Ensure that access is restricted to only authorized individuals.

- Client Portals: Some businesses offer secure online portals where clients can log in and view or download their financial documents. This method is especially useful for recurring clients or ongoing projects.

- Postal Service: For clients who prefer physical copies or in cases where digital methods are not viable, sending a printed copy through traditional mail is a reliable option.

By offering a range of sharing options and prioritizing security, you can ensure that financial documents are delivered in a timely, professional, and secure manner, fostering trust and improving client satisfaction.

Maximizing the Features of Manager IO

Maximizing the functionality of any software tool requires understanding its full range of capabilities and utilizing them effectively. By fully exploring all available features, businesses can streamline processes, improve accuracy, and save time. In this section, we will explore how to leverage the various functions of this platform to enhance overall efficiency and productivity.

The platform offers a variety of features that can be tailored to meet the unique needs of your business. From managing financial records to automating workflows, here are some ways you can maximize its potential:

- Customizable Settings: Customize your user interface and functionality to suit your business processes. This allows for a more personalized experience and helps in automating routine tasks.

- Integration with Third-Party Tools: Take advantage of integration options to link the platform with other business tools such as accounting software, payment systems, or customer relationship management tools, creating a seamless flow of information.

- Automating Repetitive Tasks: Set up automated actions such as regular document creation, payment reminders, and report generation to reduce manual workload and eliminate human error.

- Advanced Reporting Features: Use built-in reporting tools to generate detailed and customizable financial reports, helping with decision-making and business planning.

- Multi-Currency and Language Support: If you deal with clients from different countries, take advantage of multi-currency and multi-language support to ensure accuracy and professionalism in your transactions.

By making the most of these features, businesses can not only improve efficiency but also enhance their financial management capabilities, ensuring that every aspect of their operations is running smoothly and effectively.