How to Make an Invoice Template for Your Business

When running a business, having a standardized method for requesting payment is crucial. A well-structured document not only streamlines the process but also enhances the professionalism of your transactions. It’s important to have a clear and organized approach that both you and your clients can rely on.

The right approach to crafting this document ensures that all essential details are included, from contact information to payment terms. A well-designed document not only facilitates timely payments but also reflects your attention to detail and professionalism. With a few simple steps, you can create a reliable and effective format that suits your specific business needs.

Whether you’re managing a small business or running a large organization, having a consistent system for documenting payments is an essential part of maintaining smooth operations. By focusing on clarity and simplicity, you can create a document that serves both as a formal request for payment and a record for future reference.

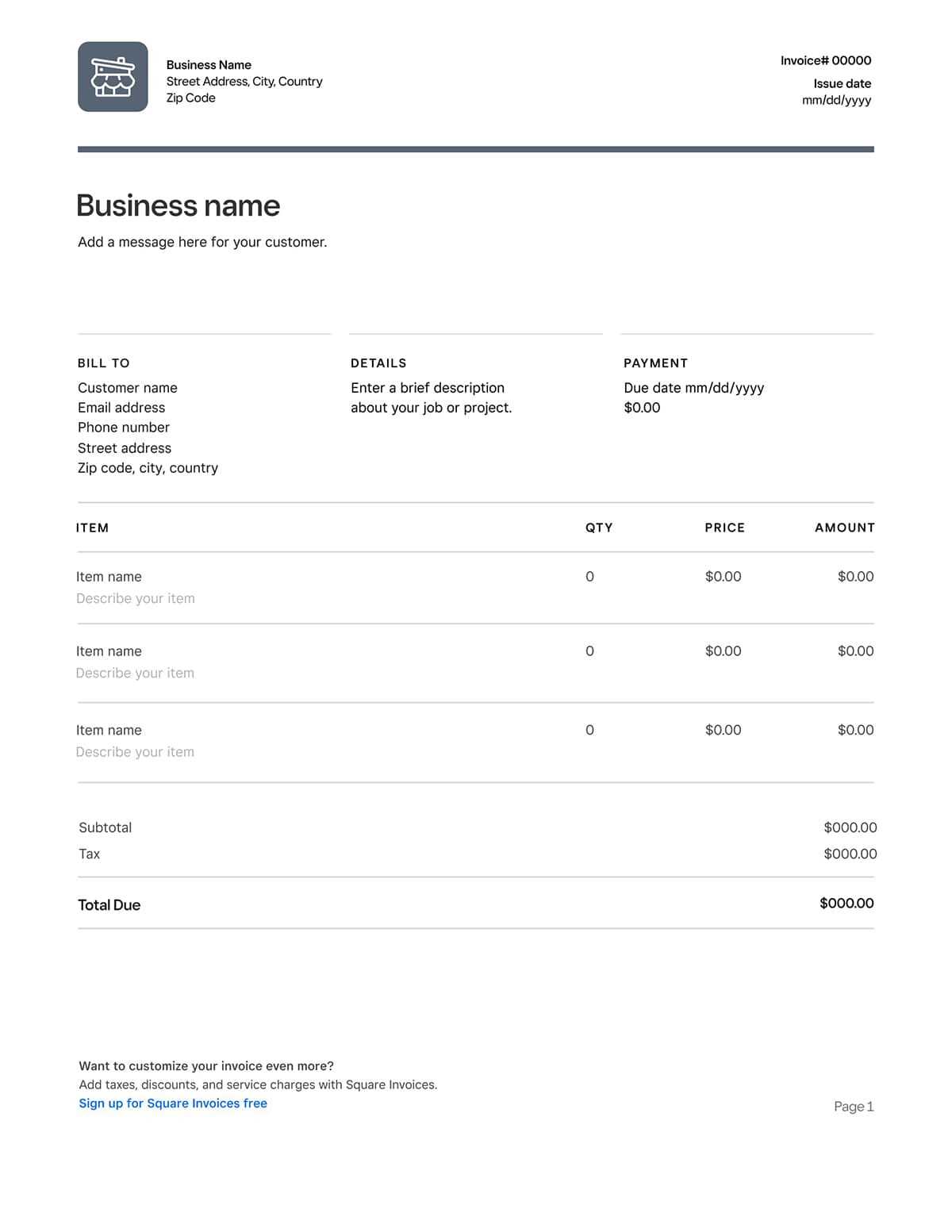

Creating a Billing Document Structure

Designing a reliable structure for payment requests is essential for businesses of any size. By organizing all necessary details in a clear and consistent manner, you ensure smooth financial transactions with your clients. A well-prepared format helps avoid confusion and ensures that both parties understand the terms of the transaction.

Essential Components to Include

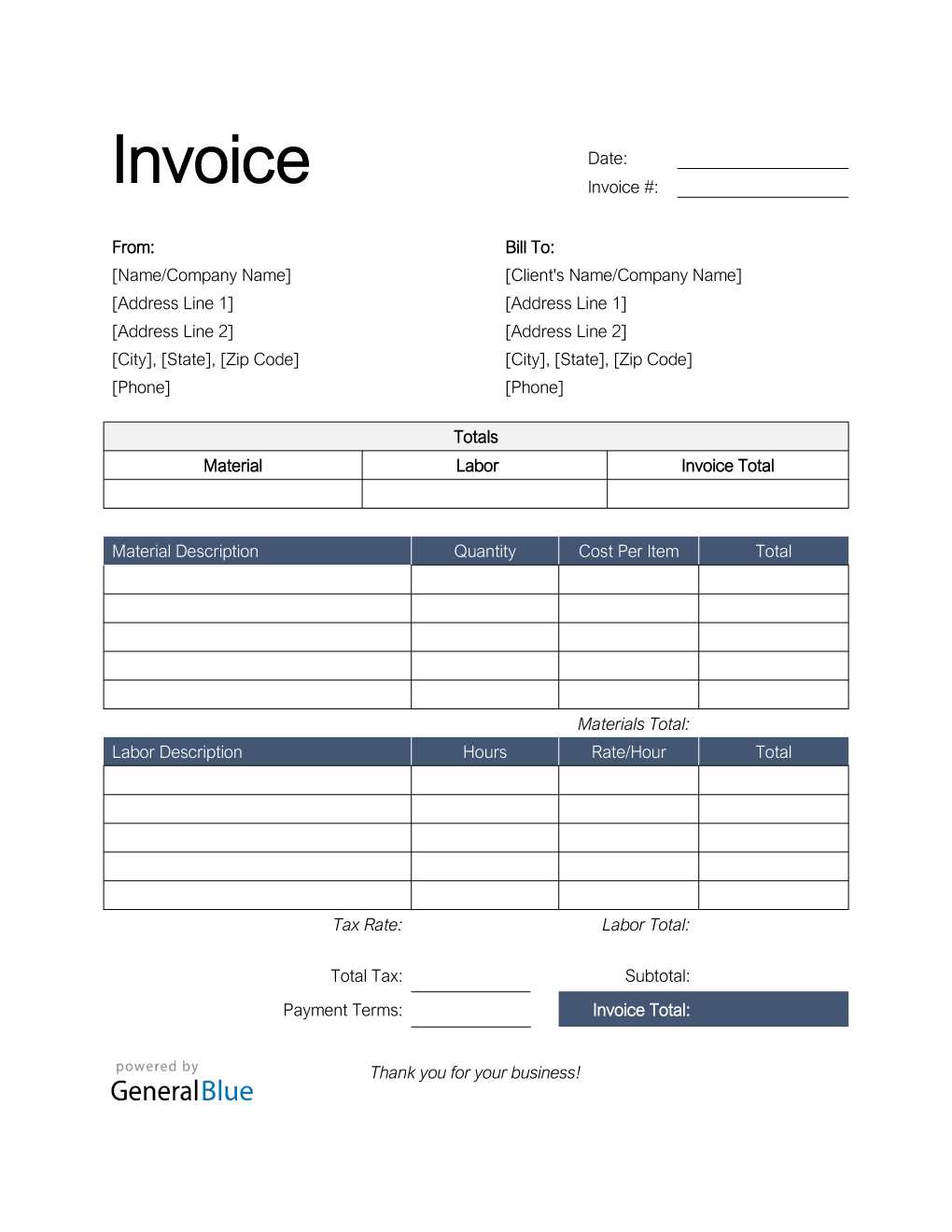

The first step in creating a solid structure is identifying the critical elements that should be part of every request. These include your business name and contact information, a unique reference number, a description of the goods or services provided, and the payment terms. Including tax information and any applicable discounts is also important to ensure complete transparency.

Customizing Your Design for Clarity

While the essential elements remain the same, the visual presentation can vary. Consider customizing your format to reflect your brand and ensure it is easy to read. Use clear fonts, appropriate spacing, and a logical flow to guide the recipient through the document. The goal is to create a structure that looks professional and can be easily understood at a glance.

Why You Need a Standardized Billing Format

Having a standardized document for payment requests is crucial for maintaining consistency and professionalism in your business transactions. It ensures that all important details are clearly outlined and easily accessible, reducing the risk of misunderstandings or missed payments. A well-structured format helps streamline the payment process, making it faster and more efficient for both you and your clients.

Here are some key reasons why using a consistent format is essential:

- Improved Professionalism: A polished and well-organized document gives a professional impression to your clients, showing that you are serious about your business operations.

- Faster Payment Processing: With a clear structure, clients can quickly understand what is being billed and the terms of payment, leading to quicker responses and faster transactions.

- Reduced Errors: Standardizing your documents ensures that all necessary information is included each time, minimizing the chance of forgetting important details like tax rates, item descriptions, or payment deadlines.

- Better Record Keeping: A consistent approach makes it easier to track past transactions and maintain financial records, which is helpful for both business management and tax reporting.

- Customizable for Different Needs: A flexible format allows you to make adjustments based on specific client requirements or project details without losing structure.

By using a reliable and organized structure for your payment requests, you not only simplify the process for yourself but also help build trust with your clients, ensuring a smoother workflow and stronger business relationships.

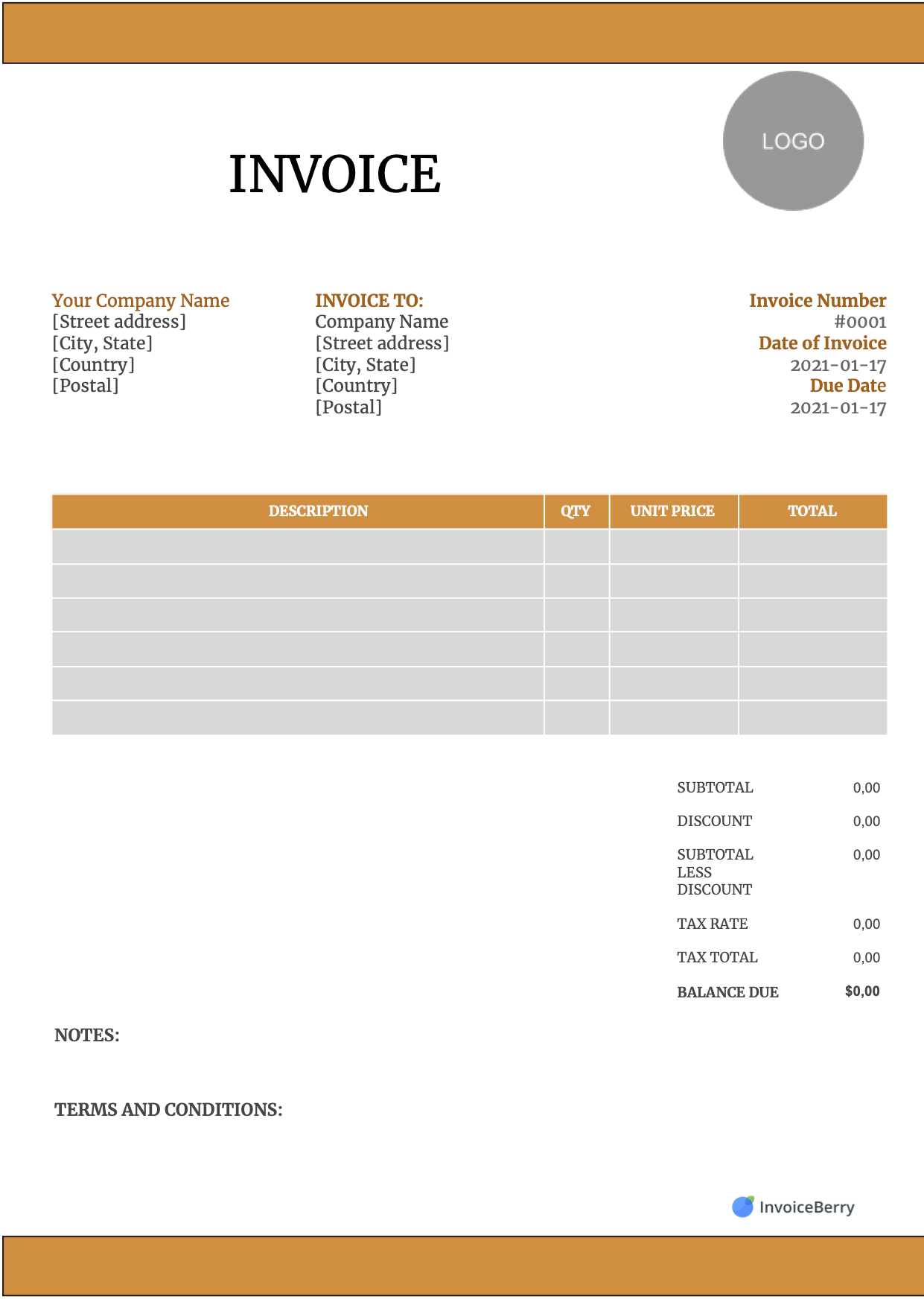

Choosing the Right Billing Document Format

Selecting the appropriate format for your payment request is a crucial step in ensuring clarity and efficiency in your financial transactions. The right structure can make a significant difference in how easily your client understands the details, how professional your business appears, and how smoothly the payment process runs. Different situations may call for slightly varied layouts, so it’s important to choose a format that fits your needs and aligns with your business goals.

Here are a few factors to consider when choosing the right structure:

| Factor | Consideration |

|---|---|

| Business Type | Different industries might have unique needs; for example, freelancers might require a simpler format, while large companies may need more detailed layouts. |

| Client Preferences | Some clients may prefer more formal, detailed documents, while others might appreciate a quicker, simpler style. Adjusting for your client’s expectations can improve the client relationship. |

| Legal or Tax Requirements | Depending on your location or business type, you may need to include specific information to comply with tax regulations or other legal obligations. |

| Clarity and Readability | The format should be simple and easy to read, with clear sections for each important element, such as payment details, due dates, and itemized costs. |

By understanding these factors and tailoring the layout to meet both your business needs and client expectations, you can create a highly effective payment document that streamlines the entire process.

Key Elements of a Billing Document

To ensure clarity and efficiency in payment requests, it’s important to include all the necessary components in your document. A well-structured format will not only streamline the process but also help avoid confusion, ensuring both parties are on the same page. The key to a successful document is its ability to clearly communicate the transaction details, leaving no room for misunderstandings.

Essential Information to Include

The core of any payment request lies in the following key elements:

- Business Information: Your company name, address, contact details, and logo should be clearly displayed at the top.

- Client Information: Include the name, address, and contact details of the client or company receiving the payment.

- Unique Reference Number: A unique identifier helps you and your client track the document, ensuring easy reference in case of follow-up.

- Description of Goods or Services: Clearly list the items or services provided, along with a detailed description to avoid confusion.

- Payment Terms: Include information about payment deadlines, late fees, or any discounts that may apply.

- Total Amount Due: Provide a clear breakdown of charges and taxes, as well as the final amount due.

Formatting for Clarity

In addition to the essential elements, it’s important to format the document in a way that is easy to read and understand. Use headings, bullet points, and tables to clearly separate each section. The more organized your document is, the quicker it will be processed and the less likely there will be any confusion or disputes.

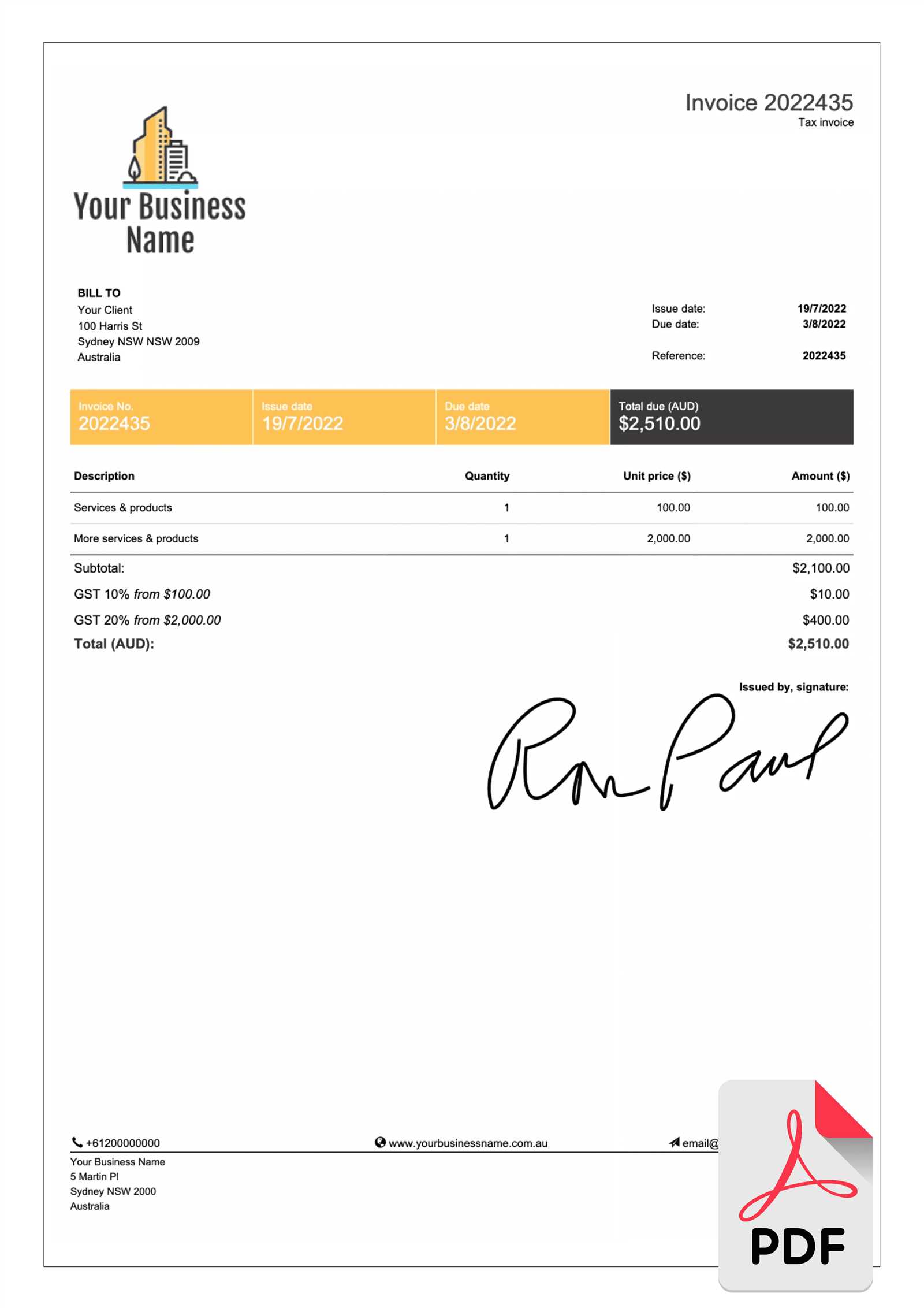

How to Add Company Information

Including accurate company details in your payment request document is crucial for ensuring smooth communication and providing essential information for processing. This section serves as the identification of your business, allowing clients to easily verify who they are transacting with and how to contact you if needed. Properly presenting this information adds credibility and professionalism to the document.

Here are the key elements you should include when adding your company information:

- Business Name: Clearly display your official company name at the top of the document. This should match the legal name on your registration and business license.

- Logo: Adding your company logo is a great way to make the document look more professional and strengthen your brand identity.

- Physical Address: Include the full address of your business, including street, city, state, and ZIP code. This helps clients know where you are located and provides a legal point of contact.

- Phone Number: A contact number allows clients to reach you quickly in case of any issues or clarifications regarding the transaction.

- Email Address: Provide an email address where clients can send inquiries or payments. It’s best to use a business-specific email address rather than a personal one.

- Website: If applicable, include your business website URL. This provides clients with easy access to more information about your services or products.

By including all of these elements in a clear and organized manner, you help create a professional and trustworthy appearance, which can foster better client relationships and smoother transactions.

Setting Up Invoice Numbers

Assigning unique reference numbers to your billing documents is essential for organization and record-keeping. These numbers serve as identifiers, making it easier to track payments, manage accounts, and resolve any potential disputes. A consistent and logical numbering system not only helps you stay organized but also adds professionalism to your business operations.

Importance of Sequential Numbering

Sequential numbering is a widely adopted practice for structuring payment requests. This system ensures that every document has a unique number, preventing confusion and providing a clear, organized trail of transactions. It’s crucial to keep the numbers in order, as this will simplify tracking and auditing, especially when managing multiple clients or large volumes of work.

How to Create a Numbering System

When setting up your numbering system, consider the following tips:

- Start with a simple format: For example, begin with “001”, “002”, and so on. This ensures easy readability and simple organization.

- Include relevant details: You might want to incorporate the year, client ID, or project number. For instance, a format like “2024-001” helps track both the year and the sequence of your requests.

- Avoid resetting numbers: Once you’ve chosen a system, stick with it to maintain consistency across all your records.

- Consider automated software: Many invoicing tools can automatically generate sequential numbers, saving you time and reducing the risk of errors.

By setting up a logical and consistent numbering system, you not only improve your internal organization but also enhance the professionalism of your documents, making it easier for clients to reference and pay on time.

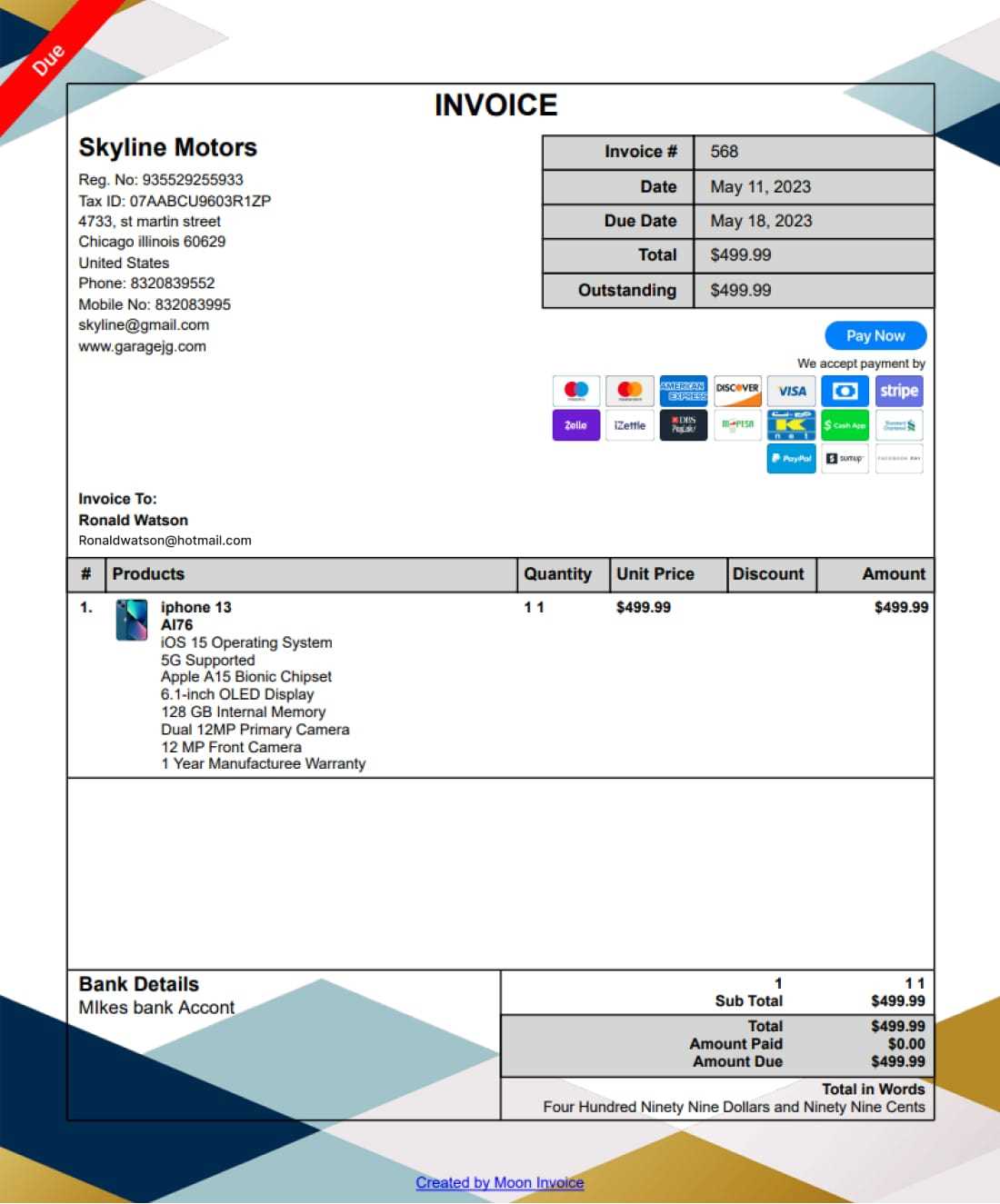

How to Include Payment Terms

Clearly outlining payment terms in your billing documents is crucial for managing expectations and ensuring timely payments. These terms provide both you and your clients with a mutual understanding of when and how payments should be made, as well as any potential penalties for late payments. By setting clear guidelines, you reduce the risk of confusion and disputes down the line.

Essential Information to Include

When specifying payment terms, make sure to cover the following important aspects:

- Due Date: State the exact date by which payment should be received. This could be a specific day, such as “Due by April 30th,” or a set number of days after the document is issued, such as “Net 30” (30 days from the date of issue).

- Accepted Payment Methods: Clearly mention which payment methods are acceptable, such as bank transfer, credit card, PayPal, or checks. This helps avoid delays due to uncertainty over payment options.

- Late Fees: Specify any late fees or interest charges that may apply if the payment is not received by the due date. For example, “A late fee of 1.5% per month will be applied to overdue amounts.”

- Discounts for Early Payment: If applicable, offer incentives for early payment, such as “A 5% discount for payments made within 10 days.” This can encourage prompt payment.

Making Payment Terms Clear

For easy reference, the payment terms should be placed in a prominent location within the document. Ensure the language is clear and unambiguous to avoid any confusion. Using bullet points or a dedicated section for payment terms can help draw attention to this important information, making it easier for your clients to understand their obligations.

Adding Item Descriptions and Prices

Clearly outlining the goods or services provided is a crucial part of any financial document. A detailed description of each item, along with its price, helps ensure that both parties have a clear understanding of what is being billed and how the charges are calculated. Providing accurate and transparent information in this section minimizes confusion and improves the overall clarity of the transaction.

When adding descriptions and prices, consider the following guidelines:

- Item Descriptions: Provide a concise but clear description of each product or service. For example, instead of simply writing “Consultation,” describe the service as “Consultation for marketing strategy development (2 hours).” This helps clients easily identify the specific services rendered.

- Quantity and Unit Price: If applicable, specify the quantity of each item and the unit price. For example, “5 hours at $50/hour” or “3 units at $25 each.” This makes it easier for clients to verify the charges.

- Total Price for Each Item: Always calculate and display the total cost for each item by multiplying the quantity by the unit price. This should be clearly shown next to the corresponding description.

- Discounts or Adjustments: If any discounts or adjustments apply, include these clearly next to the relevant item or as a separate line. For example, “10% discount applied to consultation hours” or “Shipping charge: $15.”

By being detailed and precise in listing each item and its associated price, you provide both clarity and transparency, ensuring that clients understand exactly what they are being billed for and can easily track individual charges.

Calculating Taxes and Discounts

Accurately calculating taxes and discounts is essential for providing a transparent breakdown of the total amount due. This not only ensures compliance with local tax regulations but also helps maintain clear communication with your clients about how the final charges are derived. Properly applied taxes and discounts can affect the total price and should be clearly outlined to avoid any misunderstandings.

When adding taxes or applying discounts, make sure to follow these steps:

| Step | Action |

|---|---|

| Tax Calculation | Determine the applicable tax rate based on your location and the client’s location. Multiply the subtotal by the tax rate (e.g., 5%) to calculate the amount of tax to be added. |

| Discount Calculation | To apply a discount, calculate the discount amount by multiplying the subtotal by the discount percentage (e.g., 10%). Subtract the discount amount from the subtotal to get the new total. |

| Total Calculation | After adding the tax and subtracting any discounts, calculate the final total by adding the tax to the discounted amount or subtracting any applicable discounts from the initial subtotal. |

For example, if the subtotal is $200, with a 10% discount and a 5% tax, the calculation would be as follows:

- Discount: $200 × 10% = $20

- New subtotal after discount: $200 – $20 = $180

- Tax: $180 × 5% = $9

- Total: $180 + $9 = $189

By clearly calculating and displaying taxes and discounts, you ensure both accuracy and transparency in the billing process, making it easier for clients to understand the final amount due.

Customizing Your Billing Document

Personalizing your payment request document can greatly enhance your brand’s image and make the process more efficient. A customized layout not only reflects your business identity but also allows you to adjust the format to better suit the specific needs of your clients. Whether you’re working with a standard format or using specialized software, adding personalized elements helps make the document more professional and tailored to your business style.

Branding and Design Elements

Incorporating your brand’s visual identity into the payment request is an effective way to establish recognition and consistency. Consider the following:

- Logo: Add your business logo at the top of the document to reinforce your brand image.

- Color Scheme: Use your business’s brand colors to make the document visually appealing and consistent with other marketing materials.

- Font Choices: Select clear and professional fonts that align with your brand style, ensuring the document is easy to read.

Tailoring Content for Clients

Beyond design, the content of your document should reflect specific details relevant to each transaction. Personalizing the following can enhance the client experience:

- Client-specific Terms: Adjust payment terms or details based on the agreement with each client, such as offering discounts or specifying deadlines unique to a particular project.

- Item Descriptions: Modify product or service descriptions to ensure they accurately reflect the work performed or the goods provided for that specific client.

By customizing both the design and content, you create a payment request that not only serves its purpose but also strengthens your business’s professional image.

Using Billing Software vs Manual Creation

When it comes to creating payment requests, businesses often face the choice between using specialized software or manually crafting each document. Both methods have their advantages and limitations, and the best option largely depends on the scale of your operations, the complexity of your transactions, and your personal preferences. Understanding the differences between these two approaches can help you determine which is most suitable for your business needs.

Benefits of Using Billing Software

Billing software is designed to streamline the creation process, offering several benefits for businesses, especially those with a high volume of transactions:

- Time Efficiency: Automated systems allow you to create documents quickly by filling in predefined fields, reducing the time spent on manual entry.

- Consistency and Accuracy: Software eliminates human errors and ensures that each document follows a consistent format, maintaining professional standards.

- Advanced Features: Many tools include features like automatic tax calculations, integration with payment systems, and the ability to track outstanding payments.

- Customization: While automation is helpful, most software also offers templates that can be customized to fit your branding and specific needs.

Advantages of Manual Creation

For smaller businesses or those just starting out, manually creating payment requests can also be a viable option. Here are some reasons why:

- Cost-Effective: Manual creation eliminates the need for software subscriptions, making it an affordable option for businesses with minimal overhead.

- Flexibility: When creating documents manually, you have full control over the layout and details. You can tailor each request to the specific transaction without being limited by software templates.

- Simple for Low Volume: For businesses that only handle a small number of transactions, manually creating payment requests can be more manageable and practical.

In the end, the decision between using billing software or creating payment documents manually comes down to your business’s size, budget, and needs. Larger businesses or those with frequent transactions may benefit more from automation, while smaller operations with fewer transactions might find manual creation sufficient and cost-effective.

Best Practices for Billing Document Design

Designing a professional and effective payment request is key to ensuring that your business appears organized and credible. A well-structured layout not only makes the document easy to read but also helps clients quickly find the necessary information, such as payment terms, total amounts, and contact details. The right design can improve clarity, reduce errors, and facilitate prompt payments.

To create an effective and visually appealing document, follow these best practices:

1. Keep the Layout Clean and Simple

- Minimal Clutter: Avoid overcrowding the document with unnecessary elements. Use white space effectively to ensure that important information stands out.

- Logical Structure: Organize content in a clear and consistent manner. For example, place the payment details and client information at the top, followed by item descriptions, taxes, and the final total.

- Readable Fonts: Use easy-to-read fonts that are professional and simple. Stick with standard fonts like Arial or Times New Roman, and avoid overly decorative styles.

2. Highlight Key Information

- Prominent Business and Client Details: Make sure your business and client details are easy to find. This may include the name, address, and contact information of both parties, which should be displayed at the top of the page.

- Bold Important Sections: Bold key information such as the total amount due, due date, and payment terms to make them stand out from the rest of the content.

- Use Clear Headings: Each section of the document (e.g., item list, taxes, discounts) should have a clear heading so that the reader can quickly navigate the document.

3. Maintain Consistent Branding

- Logo and Color Scheme: Incorporate your business logo and brand colors into the document. This adds a professional touch and ensures that your payment request aligns with your overall brand identity.

- Consistent Font and Style: Use a consistent font size and style throughout the document. Different font types or sizes can make the document look disorganized.

4. Ensure Mobile and Print Compatibility

- Responsive Design: If you plan to send the document digitally, ensure that it is easily viewable on different devices, including phones and tablets.

- Clear for Printing: For physical copies, make sure the document is formatted correctly for printing, with margins and spacing that allow the content to be easily read on paper.

By adhering to these best practices, you will create a payment request that is not only professional in appearance but also efficient and easy for your clients to process. A well-designed document helps build trust and reduces the chances of errors or delays in payment.

Ensuring Document Readability

Creating a clear and readable payment request is essential for smooth communication between you and your clients. A document that is easy to read ensures that your clients can quickly understand the charges, terms, and other important details. Proper readability reduces confusion, minimizes disputes, and encourages timely payments. Achieving this requires attention to font choice, structure, and organization of information.

1. Choosing the Right Font and Text Size

The font you use plays a major role in how easily the document can be read. It’s important to choose a font that is both professional and legible. Here are some tips for selecting the right font:

- Use Simple Fonts: Stick to fonts like Arial, Helvetica, or Times New Roman. These are commonly used in professional documents and are easy to read.

- Avoid Decorative Fonts: While creative fonts may seem fun, they can make the text hard to read, especially in a formal business context.

- Font Size Matters: Keep the main text between 10pt and 12pt for body content. This ensures that the text is not too small or too large.

2. Structuring the Document for Easy Navigation

A well-structured layout makes it easier for clients to navigate the document. Consider these best practices for organizing your content:

- Group Related Information: Place related sections together, such as contact information, item descriptions, totals, and payment terms. This helps clients find what they need without having to search through the document.

- Use Headings and Subheadings: Use headings to clearly distinguish different sections, like “Services Provided,” “Total Due,” or “Payment Terms.” This allows for easier scanning of the document.

- Bullet Points and Lists: Use bullet points or numbered lists for clarity, especially when listing items or important terms. This makes it easier for the reader to quickly absorb the information.

3. Using Tables for Financial Breakdown

One of the best ways to present charges clearly is through tables. Tables organize numbers and descriptions in a structured way, making the financial details easier to understand.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Hours | 5 | $50 | $250 |

| Website Design | 1 | $500 | $500 |

| Subtotal | $750 | ||

| Tax (5%) | $37.50 | ||

| Total Amount Due | $787.50 | ||

By using tables like this, you can present prices, quantities, and subtotals in a clear, easy-to-follow format. This helps clients immediately understand the breakdown of costs.

Ultimately, ensuring that your document is readable and well-organized not only enhances professionali

How to Save and Export Billing Documents

Once a payment request is ready, it’s important to know how to save and export it for easy access and sharing. Properly saving and exporting your documents ensures they are stored securely, remain easy to locate, and can be sent to clients efficiently. Whether you’re storing files for internal records or sending them electronically to clients, having the right format and storage method can make all the difference in maintaining smooth business operations.

1. Choosing the Right File Format

The file format you choose for saving and exporting your document is crucial for ensuring compatibility and ease of use. Common formats include:

- PDF: This is the most widely used format for sending formal documents. PDF files preserve the layout and design, ensuring that the document appears the same on any device.

- Word Document: A Word document is useful if you need to edit the document later, but it is less secure and can look different depending on the software used.

- Excel or CSV: These formats are useful if you are managing multiple documents or need to perform calculations. However, they are less professional for client-facing documents.

2. Saving the Document Locally

To ensure that you have a backup and can easily access your document in the future, save your payment requests on your computer or local storage. Follow these best practices:

- Organized Folder System: Create a dedicated folder for financial documents and use subfolders to organize them by year, client, or project. This helps you quickly locate past requests.

- File Naming Conventions: Name the file in a way that’s easy to identify. A good naming convention could include the client name, date, and a unique number for reference, such as “ClientName_Invoice_2024-11-05.pdf.”

- Backup Copies: Ensure you back up these files regularly using cloud storage or external hard drives to avoid data loss.

3. Exporting and Sending Documents

Once you’ve saved your document, the next step is exporting it in a format suitable for sharing. Here’s how to send documents securely:

- Email: For most clients, emailing a PDF document is the easiest and most secure option. You can attach the file to an email, include a message explaining the charges, and send it to the client.

- Cloud Storage: If the file is too large or you want to provide ongoing access, you can use cloud-based file sharing platforms like Google Drive or Dropbox. Just ensure that you set appropriate permissions.

- Client Portals: For businesses with frequent transactions, using a client portal where they can log in to view and download their requests can be more efficient. This also helps you track which documents have been viewed and paid.

By following these steps for saving and exporting your payment documents, you ensure that they are properly stored, easily accessible, and ready for distribution whenever needed. This adds efficiency to your workflow and helps maintain a professional image with clients.

How to Track Payment Status

Tracking the status of your billing documents is essential to ensure that payments are received on time and that there are no discrepancies. By monitoring payment progress, you can stay on top of outstanding balances and address any issues promptly. Implementing an organized system for tracking payments helps you maintain a healthy cash flow and fosters a professional relationship with your clients.

1. Create a Payment Tracking System

Setting up a reliable tracking system is the first step toward managing payments effectively. Here’s how you can do it:

- Spreadsheet Method: Using a simple spreadsheet can be a cost-effective way to track payments. Create columns for the client name, document number, due date, total amount, and payment status (e.g., “Paid,” “Pending,” or “Overdue”).

- Accounting Software: Accounting tools often come with built-in features to help track payments. These tools automatically update payment statuses when clients make payments and can generate reminders for overdue balances.

- Manual Logs: For smaller businesses, a manual logbook can also be effective, especially if you’re dealing with a limited number of transactions.

2. Set Up Payment Reminders

Timely reminders can help ensure that clients don’t forget to pay. You can set up automatic reminders or send them manually. Consider these approaches:

- Automated Alerts: Many accounting tools allow you to set up automatic payment reminders. These reminders can be sent via email at regular intervals (e.g., a week before the due date and again a few days after the due date).

- Custom Email Reminders: If you’re not using automated tools, you can send polite email reminders to clients with a friendly tone. Always reference the specific document number and due date for clarity.

- Phone Calls: For high-value transactions, a phone call might be necessary to follow up on a missed payment.

3. Monitor Payment Methods

Understanding how your clients prefer to make payments will help you stay organized and track incoming funds. Be sure to note down the payment method for each transaction. Common methods include:

- Bank Transfers: Keep track of wire transfers, and confirm the deposit with your bank records.

- Online Payment Systems: Tools like PayPal, Stripe, or credit card services often provide real-time notifications when payments are made, which helps you update your records instantly.

- Checks: If clients pay by check, note the check number and bank details for reference until the payment clears.

Having a system in place to track payments and communicate with clients about outstanding balances ensures that you maintain good cash flow and can address any issues promptly. It also helps you keep accurate financial records for future business planning and

Handling Billing Errors or Disputes

Errors and disputes are an inevitable part of business transactions. Whether it’s a discrepancy in charges, incorrect calculations, or a misunderstanding about payment terms, addressing issues promptly and professionally is crucial to maintaining good relationships with clients. A systematic approach to resolving billing disputes can help preserve trust and ensure timely payments while preventing future issues.

1. Review the Document Thoroughly

The first step in resolving any dispute is to carefully review the payment request for any errors. Here’s what to check:

- Double-check Amounts: Ensure that the amounts charged match the agreed-upon prices, including taxes and discounts.

- Verify Client Details: Confirm that the client’s name, address, and contact information are correct to avoid confusion.

- Review Payment Terms: Make sure the payment due date, late fees, and any other terms are accurately stated.

2. Communicate Clearly and Professionally

Once you’ve identified the error, communicate with your client in a calm and professional manner. It’s essential to acknowledge their concerns and provide them with clear, updated information. Consider the following approaches:

- Immediate Response: Respond to the client’s inquiry as soon as possible to show that you value their business and are addressing the issue promptly.

- Clear Explanation: If the dispute stems from an error on your end, provide a detailed explanation of what happened and how you plan to resolve it.

- Offer Solutions: If a mistake has occurred, offer a solution, whether it’s a corrected document, a partial refund, or a revised payment schedule. Show flexibility where appropriate.

3. Keep Detailed Records of the Dispute

Maintain a record of all communication and changes made during the dispute process. This ensures transparency and serves as documentation in case the issue needs to be revisited. You should:

- Document Emails and Phone Calls: Keep copies of emails or written communication regarding the issue. If the dispute was handled over the phone, take notes and send a follow-up email summarizing the conversation.

- Update Your System: If the issue is resolved, update your payment tracking system with the new status of the billing document.

- Record Adjustments: If changes to the charges or payment terms are made, note them clearly on any revised documents and communicate them to the client.

4. Prevent Future Disputes

To minimize the likelihood of errors or disputes in the future, consider the following preventative measures:

- Automate Calculations: Use software or tools that automatically calculate totals, taxes, and discounts to reduce human error.

- Clear Communication: Be upfront about your pricing, terms, and any additional fees before sending out a payment request. This helps manage client

Tips for Creating Professional Billing Documents

Creating polished and professional payment requests is an essential part of maintaining a good business image. A well-designed document not only helps ensure timely payments but also reflects the credibility of your business. By focusing on clarity, consistency, and proper formatting, you can make sure your clients receive a document that’s easy to understand and trust.

1. Use Clear and Concise Language

Keep the language simple and professional. Avoid using jargon or overly complex terms that might confuse the recipient. Focus on clarity and transparency:

- Be Direct: Clearly state what the payment is for and include a breakdown of costs.

- Avoid Ambiguity: Ensure that all terms, fees, and charges are easy to understand.

- Use Formal Tone: Keep the language formal, respectful, and free of slang or overly casual phrases.

2. Maintain a Consistent Layout

Consistency in design is crucial for professionalism. A clean, uniform layout helps the recipient quickly navigate the document. Consider these tips for a consistent appearance:

- Header and Footer: Include your business name, logo, and contact details in a consistent header or footer that appears on every document you create.

- Proper Alignment: Align text and numbers neatly in columns for easy reading. Use grids and borders to separate sections logically.

- Legible Fonts: Choose readable fonts, such as Arial or Times New Roman, and maintain a font size that is easy to read (typically between 10 and 12 points).

3. Include All Essential Details

Make sure your payment request contains all the necessary information. Missing details can delay payments or lead to confusion. Essential elements to include are:

- Unique Reference Number: Every document should have a unique number for easy tracking and reference.

- Client Information: Include the client’s name, address, and contact details to avoid mistakes.

- Service or Product Breakdown: List the products or services provided, including quantities, unit prices, and any discounts applied.

- Due Date and Payment Terms: Clearly state when payment is due and any penalties for late payments.

4. Add Your Business Branding

Incorporate your business’s branding into the design to make the document feel personalized and professional. This can enhance brand recognition and trust. Some suggestions include:

- Logo and Color Scheme: Use your company’s logo and consistent colors that match your website or business materials.

- Professional Font Choices: Select fonts that reflect your brand’s tone, whether it’s formal