Free Makeup Invoice Template for Beauty Professionals

As a beauty expert, keeping track of payments and providing clear, professional records is essential to running a successful business. Whether you’re a freelancer or part of a larger team, having a standardized document for each service you provide can save time and reduce misunderstandings with clients. A well-organized billing document helps you maintain a professional image and ensures timely payments.

Creating a personalized and easy-to-use billing record can be an overwhelming task for many. However, using a pre-designed structure tailored to beauty services can simplify the process. These customizable formats help you focus on what you do best, while ensuring that all necessary details are included to protect both you and your clients.

In this article, we’ll explore how a simple tool can transform your business workflow. By incorporating all essential elements like service descriptions, pricing, and payment terms, you can easily manage your financial transactions and keep clients satisfied with clear and transparent communication.

What is a Beauty Service Billing Document

A beauty service billing document is a structured way to record the details of a transaction between a beauty professional and a client. It serves as an official request for payment, outlining the services provided, their costs, and payment terms. This document helps both parties understand the financial aspect of their agreement and ensures clarity in case of any future disputes.

For beauty professionals, using such a document streamlines the financial process. It helps keep track of individual services rendered, whether it’s a single session or multiple treatments. It also provides a professional image, demonstrating attention to detail and organization, which can improve client trust and satisfaction.

Generally, these documents include important details such as the date of service, descriptions of the treatments performed, the agreed-upon price, and payment instructions. By using a standardized format, beauty experts can save time and avoid the stress of manually creating each record from scratch, ensuring that all the necessary information is included every time.

Benefits of Using a Billing Document Format

Using a pre-designed billing structure offers several advantages to beauty professionals. It saves valuable time by eliminating the need to create a new document from scratch for every client or session. With a ready-made format, all the necessary fields are already organized, allowing you to simply fill in the relevant details.

Another major benefit is consistency. A standardized format ensures that every financial record is clear, professional, and easy to read. This consistency helps reduce errors and ensures that all important information, such as services provided, pricing, and payment instructions, are always included. Clients appreciate the transparency and organization, which can help build trust and improve overall satisfaction.

Moreover, using a set structure can assist in better financial management. It allows beauty professionals to easily track payments, monitor overdue accounts, and keep an organized record of transactions for future reference or tax purposes. By streamlining the process, you can focus more on your craft and less on administrative tasks.

How to Customize Your Billing Document

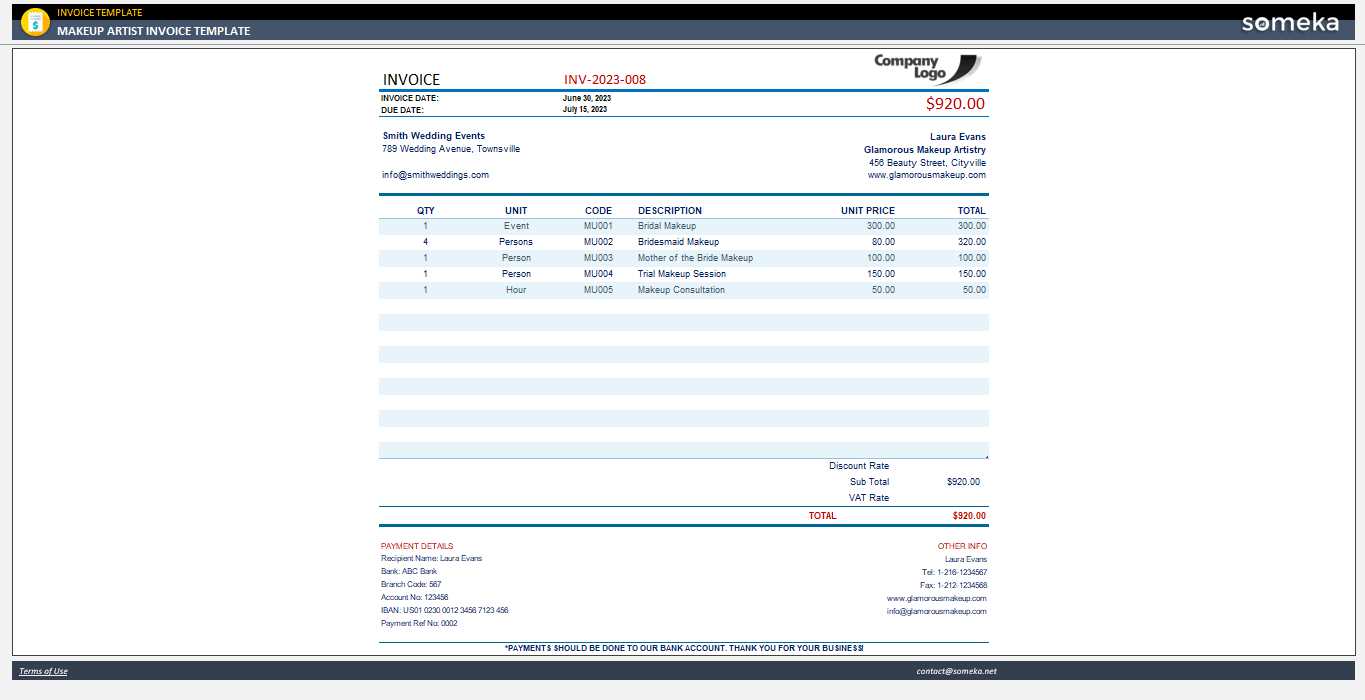

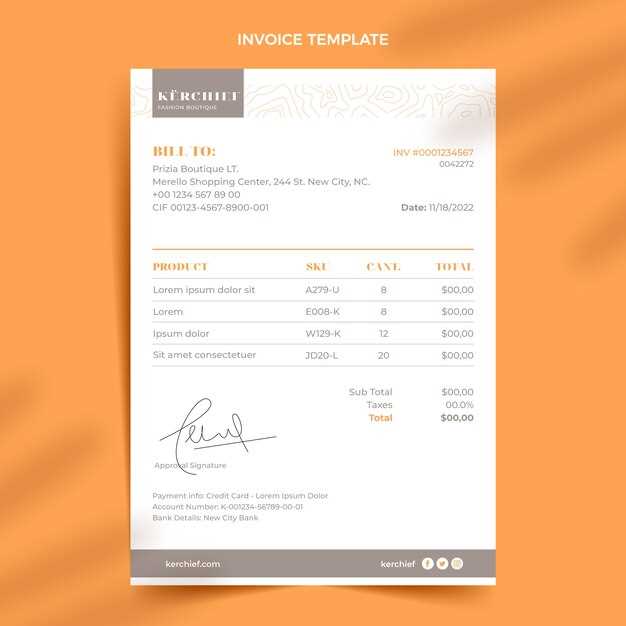

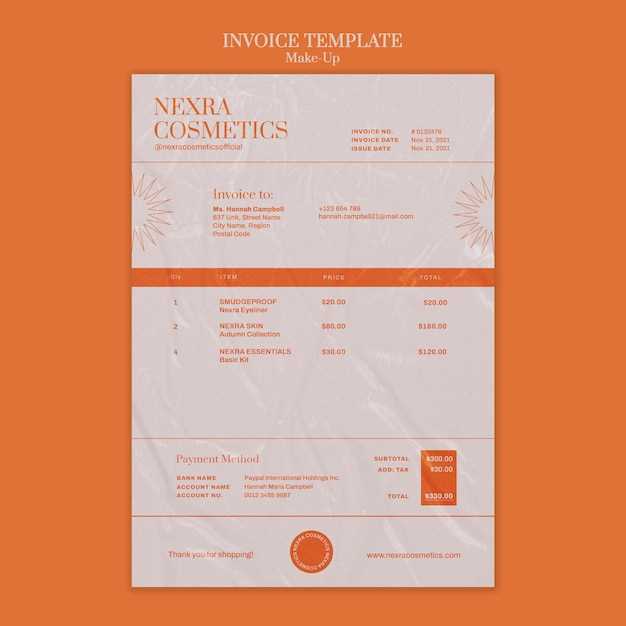

Customizing your billing record allows you to tailor it to your business needs, ensuring it reflects your brand and the unique services you provide. Personalizing the document is important not only for consistency but also for creating a professional image that resonates with clients. There are several key aspects to focus on when making adjustments to your structure.

Key Elements to Personalize

- Business Details: Include your name, logo, contact information, and business address. This makes the document look official and helps clients easily reach you.

- Service Descriptions: Clearly describe the treatments or sessions provided. Customize these sections to match your offerings, whether it’s hairstyling, skincare, or other beauty services.

- Payment Instructions: Clearly outline payment methods, due dates, and any late fees if applicable. Make it easy for clients to understand how and when to pay.

- Design and Layout: Adjust fonts, colors, and sections to match your branding. The look and feel of your document should align with your overall aesthetic as a professional.

Steps to Customize

- Choose a platform or software that allows easy editing of your document.

- Input your business name, logo, and contact details into the header section.

- List the services provided with clear descriptions and prices in a dedicated section.

- Ensure the payment terms are easy to understand and include all necessary instructions for the client.

- Review the layout and design to ensure consistency with your brand image.

By customizing each aspect of your billing record, you not only make the process smoother for yourself but also create a more professional experience for your clients. A personalized document helps reinforce your brand identity and promotes trust between you and those you serve.

Essential Elements of a Billing Document

To ensure a smooth and professional transaction, certain key details must always be included in any billing record. These essential elements provide clarity and help avoid any confusion between the beauty professional and the client. A well-organized document should cover all necessary information, from service descriptions to payment terms, to ensure both parties are on the same page.

- Client Information: The document should include the client’s name and contact details, ensuring that the transaction can be easily identified and tracked.

- Service Description: A clear and detailed list of the services provided, along with any applicable timeframes, so that both parties understand exactly what was delivered.

- Pricing and Fees: A breakdown of costs for each service or item, allowing clients to see exactly what they are being charged for. This promotes transparency and avoids confusion.

- Payment Terms: Information about when payment is due, accepted payment methods, and any late fees or discounts. This helps clients understand how and when they should settle the balance.

- Dates: The date the service was provided and the due date for payment are critical. This helps keep track of when the transaction occurred and when payment is expected.

- Business Information: Include the business name, contact details, and any other relevant details like website or social media links. This not only promotes brand consistency but also makes it easier for clients to contact you if needed.

- Unique Document Number: Assigning a unique reference number to each billing record helps keep your finances organized and makes it easier to track past transactions.

Including these essential elements ensures that your billing record is complete, clear, and professional. It helps facilitate smooth financial transactions and builds trust with clients, encouraging them to return for future services.

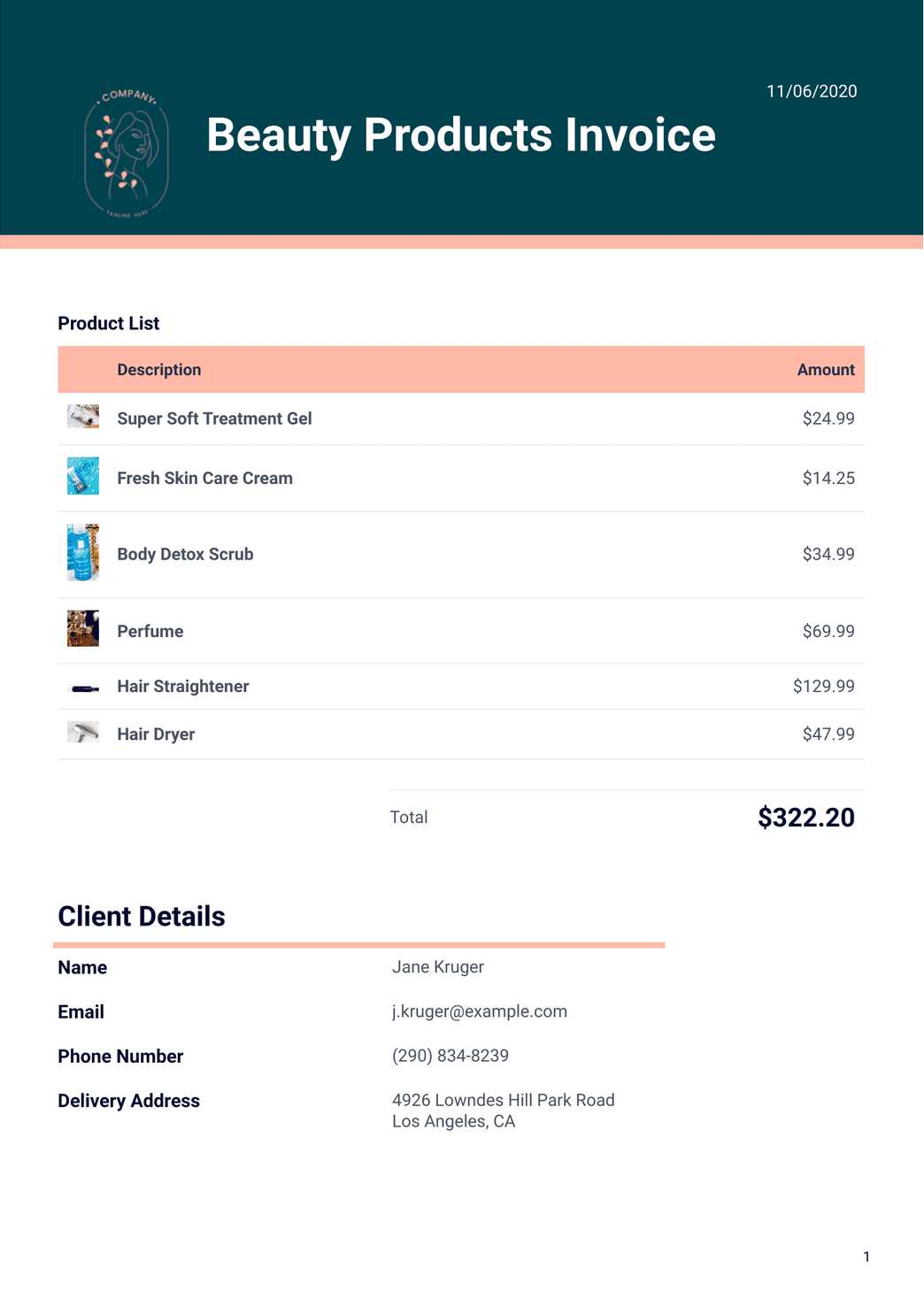

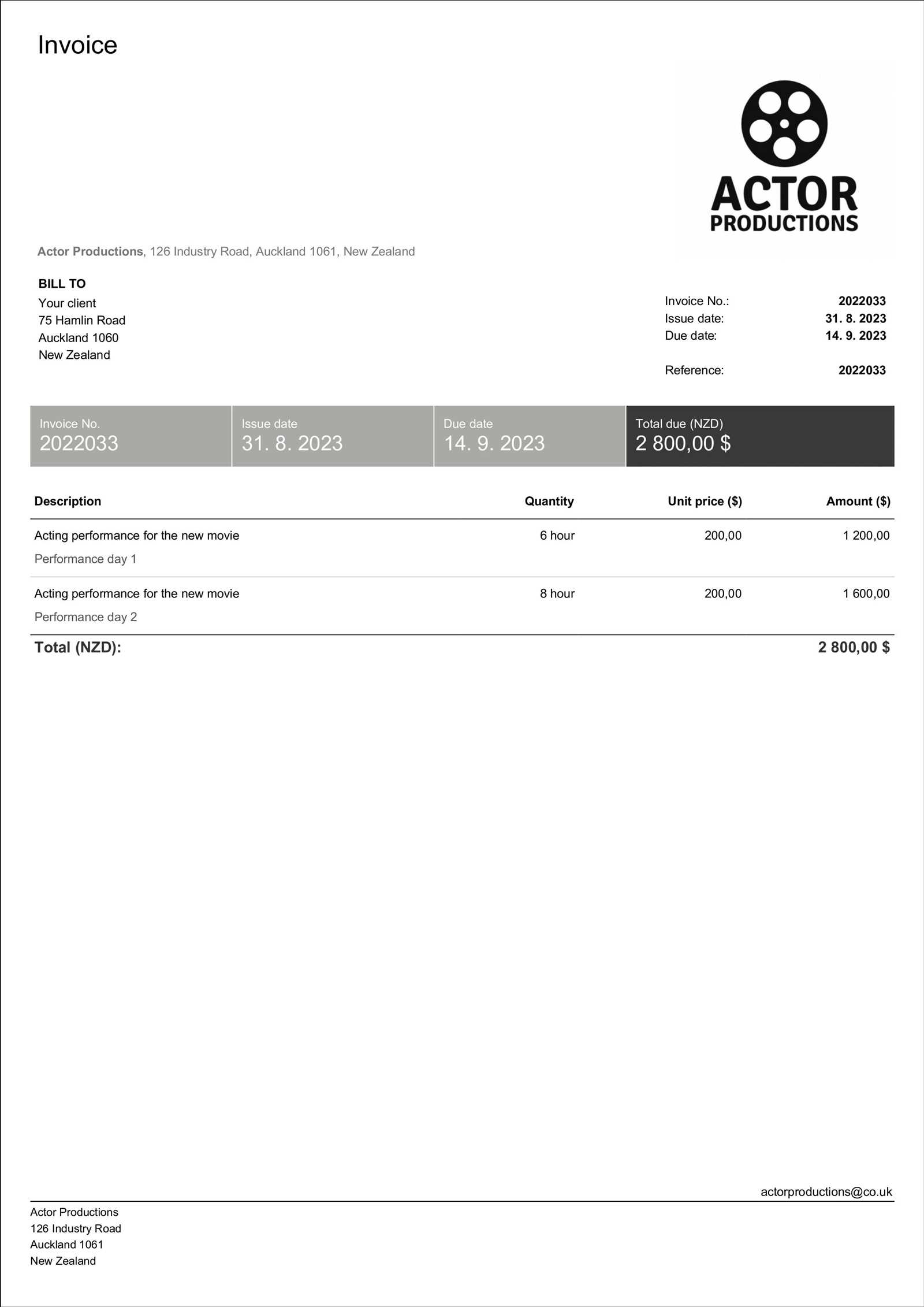

Free Billing Document Formats Online

For beauty professionals looking for a convenient and cost-effective solution, there are numerous free resources available online offering pre-designed billing documents. These customizable structures make it easy to create professional-looking records without the need for complicated software or design skills. Whether you’re just starting out or looking to streamline your administrative tasks, these free options can save you time and effort while ensuring accuracy and professionalism.

Many websites provide a wide range of free formats that cater specifically to beauty services. These resources often allow you to download the documents in various formats such as Word, PDF, or Excel, ensuring flexibility for your business needs. By choosing a free option, you can quickly customize the fields, such as service descriptions, prices, and payment terms, to reflect your own offerings.

Some popular online platforms also offer built-in tools to automatically generate and send billing records, making the process even simpler. These digital solutions often include helpful features like automatic calculations, date tracking, and payment reminders, which help keep everything organized and on schedule.

With free billing document formats available online, beauty professionals can take advantage of ready-made designs that are both functional and customizable, ensuring a smooth, efficient payment process for their services.

Choosing the Right Billing Document Format

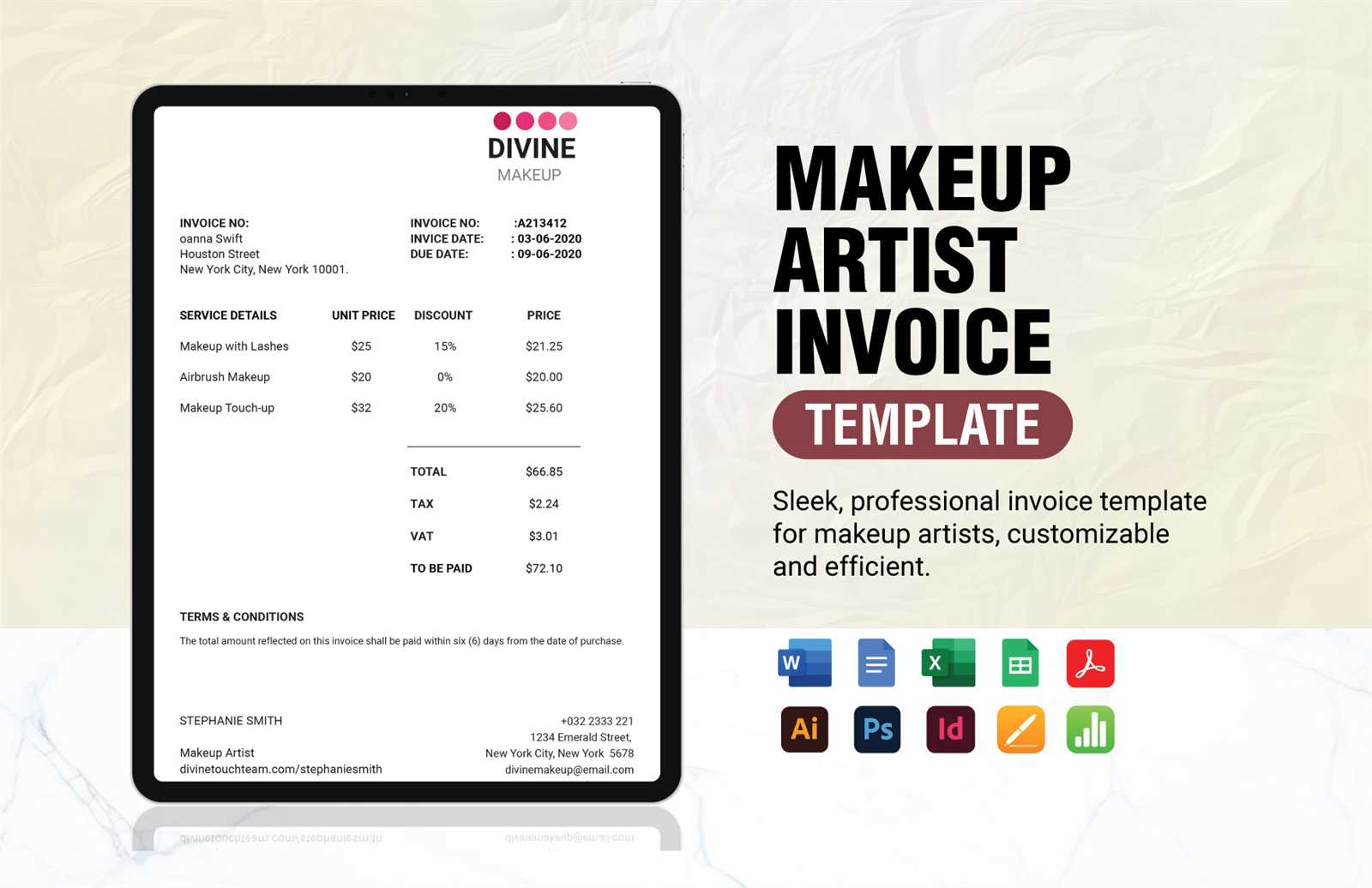

Selecting the right structure for your billing records is crucial to maintaining a smooth financial workflow. The format you choose will not only impact how clearly you communicate with clients but also how easy it is for you to track payments and manage your business. Whether you’re a freelancer or part of a larger team, finding a format that suits your style and operational needs is key to ensuring accuracy and professionalism.

When choosing a format, consider factors such as ease of customization, clarity, and compatibility with your existing systems. Some professionals prefer simple designs with just the essentials, while others may need more detailed layouts that include additional sections for tax breakdowns, discounts, or payment history. The format should align with the nature of your services, your brand image, and how you wish to present yourself to clients.

Key factors to consider include:

- Flexibility: Look for a format that allows easy editing, so you can tailor it to different clients or services.

- Clarity: The document should be easy to read, with well-organized sections for all relevant details.

- Compatibility: Ensure the format works with the software or tools you already use, such as word processors, spreadsheets, or accounting systems.

- Professional Appearance: A clean and polished layout reflects your brand and creates a positive impression with clients.

Ultimately, the right format should help streamline your billing process, ensuring that your records are consistent, accurate, and easy for both you and your clients to manage.

Billing Records for Freelancers vs Studios

When it comes to managing financial transactions, the needs of individual beauty professionals differ greatly from those of larger studios. While both require clear, professional records, the structure and content of these documents can vary based on the scale and type of services offered. Understanding the key differences between freelancer and studio billing structures is essential for ensuring that both parties maintain accurate and efficient financial systems.

Freelancers typically work independently, providing personalized services to clients in various locations. Their billing records often need to be simple, flexible, and easy to create. Studios, on the other hand, handle multiple clients and employees, often requiring more detailed documentation that covers a wider range of services, pricing, and team members. Here’s how the two differ:

Freelancer Billing Documents

- Simple Structure: Freelancers often need a clean, straightforward layout with essential details such as service descriptions, price, and payment terms.

- Personalized Services: Each document may include a unique breakdown of services tailored to the individual client’s needs.

- Flexible Customization: Freelancers may need to adjust the format for different clients, making easy editing a priority.

- Smaller Volume: The volume of records is typically smaller, meaning that each document doesn’t require extensive sections for tax or employee details.

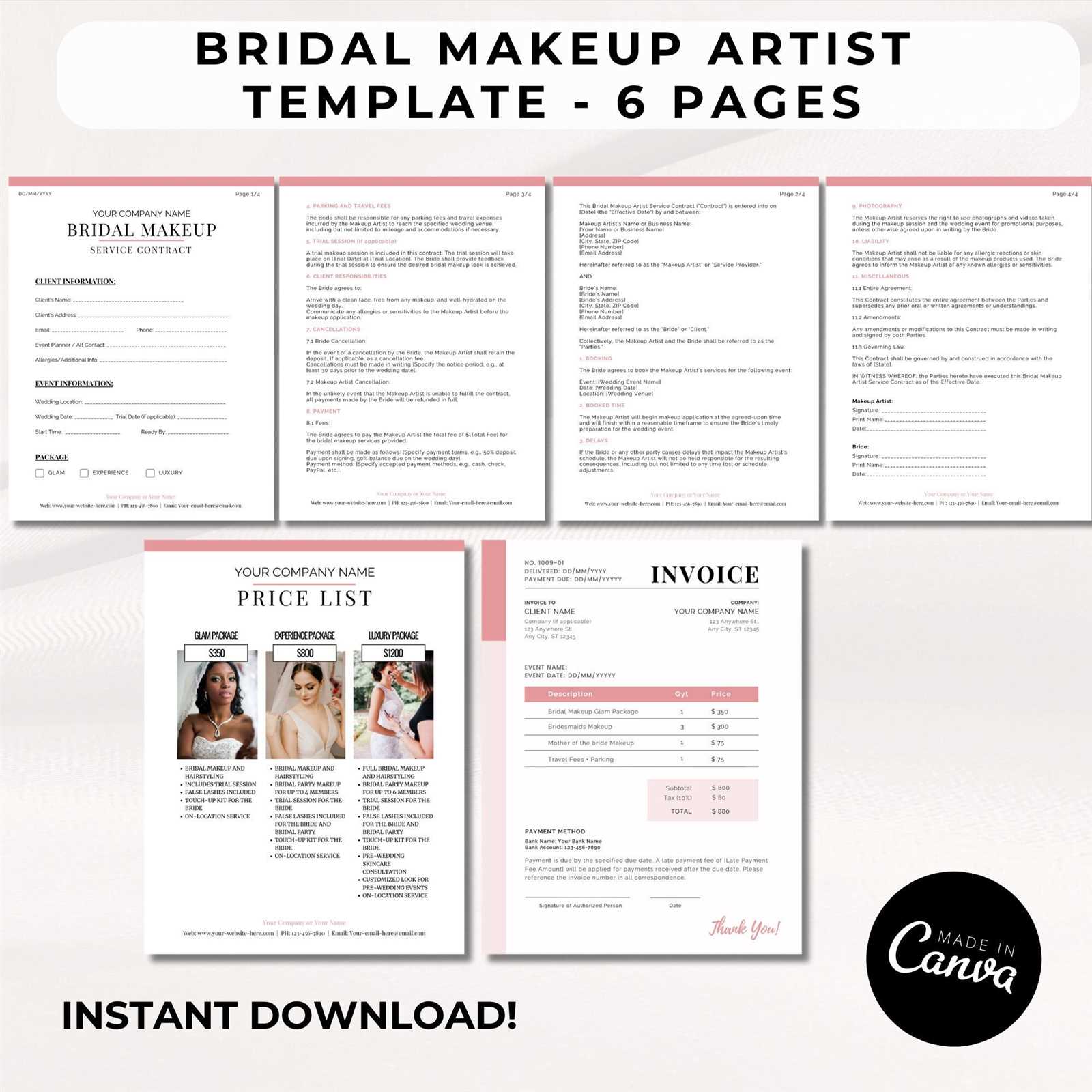

Studio Billing Documents

- Detailed Layout: Studios require more comprehensive formats, including multiple service categories, employee names, and itemized charges.

- Multiple Services: The structure needs to accommodate a broader range of treatments and services, often with tiered pricing or package options.

- Employee Tracking: Studios may need to include separate sections to allocate payment for different team members who provided services.

- Higher Volume: The volume of billing records can be high, requiring organized systems for tracking payments and managing multiple clients simultaneously.

Whether working as an independent freelancer or as part of a larger studio, having the right billing structure is key to maintaining organized records and ensuring that both clients and service providers are on the same page regarding payments and services rendered.

How to Add Taxes to Your Billing Document

When providing beauty services, it’s essential to include the appropriate tax calculations in your financial records. Including taxes ensures that you remain compliant with local laws and provides clarity to your clients. The process of adding taxes to your document can vary depending on the tax rate in your region and the type of services you offer. Below is a simple guide to help you incorporate taxes into your billing structure.

Typically, taxes are calculated as a percentage of the total service fee. Depending on your location, there may be different rates for various services. Here’s how you can add taxes to your billing records:

| Description | Amount | Tax Rate | Tax Amount | Total Amount |

|---|---|---|---|---|

| Service A | $100.00 | 8% | $8.00 | $108.00 |

| Service B | $50.00 | 8% | $4.00 | $54.00 |

| Total | $150.00 | $12.00 | $162.00 |

As shown in the table, the total amount for each service is calculated by applying the tax rate to the original cost. Ensure that you clearly display both the service cost and the tax amount, as well as the final total, so that clients can easily understand the breakdown of the charges. If your area requires a specific tax rate for different types of services, make sure to apply the correct rate for each service listed.

Incorporating taxes into your billing document is a straightforward process, but it’s crucial to stay up-to-date with local tax regulations to ensure compliance. By doing so, you maintain transparency with your clients and avoid potential legal issues related to incorrect tax calculations.

Tips for Professional Billing Document Design

Creating a professional and polished billing document is essential for any beauty expert or service provider. A well-designed document not only helps with organization and clarity but also contributes to a positive impression with clients. By focusing on layout, branding, and readability, you can ensure that your records are both functional and aesthetically pleasing.

1. Keep the Layout Clean and Organized

The design of your billing record should be clear and easy to navigate. Avoid clutter and ensure that each section is distinctly separated. Use headings and bullet points to break down important details such as services rendered, prices, and payment terms. A simple, logical structure makes it easier for clients to understand their charges and helps you stay organized.

2. Maintain Brand Consistency

Use colors, fonts, and logos that match your business’s branding. A cohesive design strengthens your professional image and reinforces your brand identity. For example, use the same font style and color scheme as your business cards or website to create a unified look across all client communications. A consistent design helps make your documents instantly recognizable to clients.

3. Prioritize Readability

Clarity is key. Ensure the text is easy to read by selecting simple, professional fonts, and avoid using too many different styles. Stick to one or two fonts, with clear headings and subheadings. Also, make sure the font size is large enough for easy reading, particularly for important details like payment terms and service descriptions. White space is equally important–leave room between sections to allow the content to “breathe” and make it more approachable.

4. Include All Necessary Details

Even the best design is ineffective if it doesn’t provide all the required information. Be sure to include your name, contact information, the date of service, itemized list of services provided, pricing, and payment terms. Also, include any other important elements, such as tax calculations, discounts, or late fees, so the document is both complete and accurate.

By following these design tips, you can create a visually appealing, professional document that reflects your business values and ensures a seamless experience for your clients.

Including Payment Terms in Billing Records

Clear payment terms are essential for any business transaction, especially when it comes to beauty services. Including detailed payment instructions in your financial documents helps avoid confusion and ensures that both you and your clients are on the same page regarding the expected payment schedule. Properly outlining these terms can also contribute to smoother transactions and better cash flow management.

When setting payment terms, it’s important to be transparent and precise about how and when clients should settle their balances. Below are key elements you should include when specifying payment terms:

Key Elements of Payment Terms

- Due Date: Clearly state when payment is expected. This could be immediately after the service is rendered, within a set number of days (e.g., 7, 14, or 30 days), or at a later agreed-upon date.

- Accepted Payment Methods: List the payment options available, such as credit cards, bank transfers, PayPal, or cash. This ensures clients know how they can pay you.

- Late Payment Fees: If applicable, specify any additional charges for late payments. Clearly mention the fee structure, such as a fixed amount or a percentage of the total amount due after a certain grace period.

- Discounts for Early Payment: Offer incentives for clients who pay early, such as a discount for payments made within a specific timeframe. This can encourage prompt payment and help improve cash flow.

- Deposit Requirements: If you require a deposit or partial payment upfront, state this clearly. Include the percentage or fixed amount, and mention if it is refundable or non-refundable.

Examples of Payment Terms

- Full payment is due upon completion of the service.

- Payment due within 14 days of the service date. Late payments will incur a 5% fee per week.

- A 50% deposit is required to confirm the booking, with the balance due on the day of the service.

- 10% discount for payments made within 7 days of the service date.

By clearly outlining these payment terms in your billing records, you set the right expectations for both you and your clients. It helps reduce misunderstandings and creates a professional, efficient system for handling payments. This transparency also fosters trust and builds stronger client relationships.

Common Mistakes to Avoid in Billing Documents

While creating billing records may seem straightforward, there are several common mistakes that can lead to confusion or delays in payment. These errors not only affect the clarity of the document but also can result in missed payments, unhappy clients, or even legal issues. Being aware of these pitfalls and taking steps to avoid them can help ensure smooth financial transactions and maintain a professional reputation.

Here are some of the most frequent mistakes people make when creating billing records:

- Incomplete Client Information: Failing to include essential details such as the client’s name, address, and contact information can make it difficult to track payments and communicate effectively. Always ensure that all client details are correct and complete.

- Missing or Incorrect Dates: Not listing the service date or payment due date can cause confusion about when the payment should be made. Always include accurate dates to avoid any misunderstandings about deadlines.

- Unclear Service Descriptions: Vague or ambiguous descriptions of services provided can lead to disputes. Make sure each service is clearly described, including any specific details such as duration, materials used, or additional charges.

- Incorrect Calculations: Mathematical errors in pricing or taxes can lead to incorrect totals, which may result in delayed payments. Double-check all amounts and ensure that your calculations are correct, especially if you apply taxes or discounts.

- Not Including Payment Terms: Failing to clearly outline payment terms, such as due dates, accepted methods, or late fees, can create confusion for clients. Be sure to include detailed instructions about how and when payment should be made.

- Overcomplicating the Layout: A cluttered or overly complex design can make it difficult for clients to quickly understand the charges. Keep the layout clean and organized, and avoid excessive information that isn’t necessary for the transaction.

- Not Using a Unique Reference Number: Without a unique identifier, it becomes challenging to track payments and distinguish between different transactions. Always assign a unique reference number to each billing document.

By paying attention to these common errors, you can ensure that your financial documents are clear, professional, and error-free. This attention to detail not only helps maintain smooth business operations but also builds trust with clients, encouraging prompt payments and repeat business.

How to Send Billing Records Effectively

Sending your financial documents in a timely and professional manner is essential for maintaining good relationships with clients and ensuring smooth payment processing. The way you deliver your billing records can affect how quickly clients respond, so it’s important to choose the most efficient and professional method. Here are some key strategies to help you send billing documents effectively and increase the likelihood of prompt payments.

First, it’s important to choose the right method for sending your billing records. With technology today, you have multiple options, such as email, online payment platforms, or even traditional mail. The method you select should depend on your client’s preferences and the nature of your services. Below are some tips for sending your billing documents:

- Use Professional Email: Email is one of the most common methods of sending billing records. Ensure your email is professional, clear, and includes a subject line such as “Payment Request for [Service] on [Date].” Attach the billing document as a PDF to maintain formatting and ensure the file can be opened by the client easily.

- Provide a Clear Payment Link: If you’re using an online payment platform, include a direct payment link in the email. This saves your client time and simplifies the process for them, increasing the chances of faster payment.

- Follow Up: If the payment is not received by the due date, don’t hesitate to send a polite follow-up email. A gentle reminder can often prompt clients to make the payment promptly. Keep the tone professional and respectful, reiterating the payment terms and including the original billing record for reference.

- Offer Multiple Payment Methods: The more options you provide for payment, the more likely your clients are to pay quickly. Make sure to include different accepted payment methods (e.g., credit card, bank transfer, PayPal) in your billing documents to give clients flexibility.

- Maintain Records of Sent Documents: Keep track of all the billing records you’ve sent, especially if you’re using email or digital platforms. Maintain a log of the date sent, method of delivery, and any responses. This will help you stay organized in case there are any disputes or payment delays.

By implementing these strategies, you’ll not only ensure that your billing records are delivered effectively but also create a more professional image that encourages timely payments from clients. Effective communication around payment terms and methods is key to maintaining a smooth business operation and avoiding misunderstandings.

Billing Record Tracking for Beauty Professionals

Keeping track of your financial records is crucial for managing your business efficiently and ensuring that all payments are accounted for. As a beauty professional, staying organized with your billing documents helps you track pending payments, identify overdue accounts, and maintain a smooth cash flow. Proper tracking not only keeps you on top of your finances but also helps you stay professional and proactive with your clients.

To effectively manage your billing records, it’s important to implement a reliable system that allows you to monitor the status of each transaction. Below are some essential strategies to help you track your records and ensure timely payments:

- Use Digital Tools: Modern software and online platforms provide tools specifically designed for tracking financial documents. These systems allow you to log each transaction, track outstanding balances, and set up reminders for follow-up communications. Popular tools for beauty professionals include platforms like QuickBooks, Wave, and HoneyBook.

- Assign Unique Reference Numbers: Assign a unique reference number to each financial document. This will help you easily identify specific transactions and keep your records organized. It also allows clients to refer to their payment with a unique identifier when contacting you.

- Monitor Payment Status: Regularly update the status of each payment, noting whether it’s been paid, partially paid, or overdue. Having a clear status for each record helps you prioritize follow-ups and manage any outstanding amounts efficiently.

- Set Up Reminders: Scheduling reminders for payment due dates or follow-up communications can help you stay proactive. Many billing platforms allow you to set automated reminders, or you can manually track them through a calendar or task management app.

- Create a Payment Log: Maintain a log to record every transaction. This log should include the client name, service provided, total amount, payment received, and date of payment. This provides a quick overview of your financial status at any given time.

- Review Financial Reports Regularly: Periodically reviewing your financial records will help you spot trends, track revenue, and analyze any payment delays. This will help you adjust your billing practices if necessary, ensuring smoother transactions in the future.

By implementing a tracking system for your financial documents, you ensure that you are always aware of what payments are due and which have been completed. This level of organization not only helps you stay financially on track but also shows clients that you are professional and diligent in handling your business transactions.

Automating Your Billing Process

Streamlining your billing process through automation can save you time, reduce human error, and improve efficiency in managing client payments. For beauty professionals, handling multiple clients can become overwhelming, especially when manually creating and sending financial records. Automating these tasks helps you stay organized, allows for faster transactions, and ensures that nothing falls through the cracks.

Here are several ways to automate your financial documentation process:

- Use Automated Billing Software: Many software solutions offer automated features that generate and send billing records to clients. These tools can automatically populate client details, services rendered, and prices, making the creation process faster. Popular tools include FreshBooks, QuickBooks, and Square, which allow you to create customized templates and set up recurring billing cycles for regular clients.

- Set Up Recurring Payments: For repeat clients or subscription-based services, automate the payment collection process. Set up recurring payment schedules that charge clients automatically on a regular basis (e.g., weekly, monthly). This ensures timely payments and reduces the need to manually follow up with clients.

- Integrate Payment Gateways: Use integrated payment systems that allow clients to pay directly from the financial record you send them. Solutions like PayPal, Stripe, or Square offer seamless integrations, so clients can pay instantly, without any delays or extra steps. This ensures you receive payments promptly and securely.

- Set Payment Reminders: Automated systems can send reminders to clients before the due date and even follow-up messages if payment hasn’t been made on time. These reminders reduce the need for manual follow-up and help improve cash flow by encouraging timely payments.

- Track Payment Status Automatically: Automation tools can track and update the payment status of each transaction, noting when payments are received or when they are overdue. This helps you monitor your cash flow and take action when necessary, without manually checking each account.

- Create Customizable Billing Records: Automated systems often allow you to create templates that are specific to your business. You can save time by using pre-built or custom templates that automatically fill in the client’s details, services, and other necessary information.

By automating your billing process, you free up time to focus on other important aspects of your business while ensuring that your financial records are accurate, consistent, and timely. Automation reduces errors, minimizes administrative workload, and improves client satisfaction through faster and more efficient payment processes.

How to Manage Multiple Client Billing Records

Managing multiple financial records for different clients can be challenging, especially when handling a growing client base. Keeping track of services provided, due dates, and payments across various accounts requires an organized approach to prevent errors and ensure smooth operations. By establishing efficient processes and using the right tools, you can easily manage your financial documents and maintain a professional relationship with each client.

Here are some key strategies for managing multiple client billing records effectively:

- Organize Your Client Information: Start by maintaining an up-to-date client database with all the relevant details–contact information, services rendered, and payment histories. This allows you to quickly access the information needed when sending or following up on financial records.

- Use Accounting Software: Accounting software like QuickBooks, FreshBooks, or Xero can help you manage multiple clients by automatically generating billing records and tracking payment statuses. These tools also allow you to organize your clients by categories (e.g., repeat clients, one-time services) for easier tracking.

- Establish a Payment Schedule: For clients with regular services, set up recurring billing cycles. Automating this process ensures you never miss sending a financial document, and clients will know when to expect their charges. For one-time clients, maintain a clear record of their service dates and payment deadlines.

- Track Payments and Due Dates: Stay on top of payments by creating a payment tracker. This tool can help you monitor which accounts are paid, which are outstanding, and which have overdue payments. A simple spreadsheet or integrated tool can keep track of this information efficiently.

- Batch Billing Process: When working with multiple clients, batch processing can help you send several billing records at once. Prepare your documents in advance and send them in bulk at a scheduled time to save time. Many platforms offer the option to send multiple records automatically.

Example of a Client Billing Tracker

| Client Name | Service Date | Amount Due | Status | Due Date |

|---|---|---|---|---|

| Client A | October 5, 2024 | $150 | Paid | October 5, 2024 |

| Client B | October 8, 2024 | $200 | Pend |