How to Make Your Own Invoice Template for Professional Billing

Efficiently managing payments requires more than just keeping track of transactions. A well-designed billing document serves as an essential tool for clearly communicating charges, due dates, and payment instructions to clients. Whether for small businesses or freelancers, having a clear and professional structure can streamline the financial side of any operation.

Designing a personalized format allows for flexibility and control, ensuring all necessary details are included while maintaining a professional look. This approach also helps avoid common errors and confusion that can arise from generic, one-size-fits-all solutions.

With the right components and layout, creating a document that reflects both professionalism and accuracy can save valuable time and reduce administrative overhead. Whether you need to track hours, products, or services, a customized solution can ensure the process is straightforward and transparent for both parties.

How to Create an Invoice Template

Designing a well-structured billing document starts with understanding the key elements needed to clearly communicate payment details. It’s essential to organize information in a way that makes it easy for both parties to understand the charges, deadlines, and terms of the transaction.

Begin by choosing the right layout that suits your business style and the needs of your clients. A clean, professional design that includes all relevant details–such as contact information, itemized charges, and due dates–will ensure clarity and prevent confusion.

Next, ensure the format is flexible enough to adapt to different types of transactions. Whether for products, services, or hourly rates, the document should allow for easy customization of line items and totals. Consistent use of fonts, spacing, and alignment is key to creating a polished, readable result.

Finally, save your design in a reusable format, such as a Word document or PDF, so you can quickly generate new billing records without starting from scratch each time. With these basic steps, creating a billing document that is both functional and professional becomes a simple and time-saving task.

Choosing the Right Format for Invoices

When designing a billing document, selecting the right format is crucial to ensure both functionality and professionalism. The format should support clear communication of payment terms and be easy for both the sender and receiver to understand. A well-organized structure can prevent confusion and enhance the overall business experience.

Consider the Business Type

Different industries and business models may require distinct approaches. For example, a service-based business may prioritize tracking hours or labor rates, while a product-based business will need a section for listing items, quantities, and prices. Adapting the structure to fit specific needs will increase the document’s effectiveness in conveying the necessary details.

Opt for Compatibility

Choosing a format that is compatible with various platforms is essential for ease of use and accessibility. Common formats like PDF or Word documents ensure that clients can open and view the document without issues, regardless of the device or operating system they use. Flexibility in format guarantees smooth communication and reduces the likelihood of technical problems during the payment process.

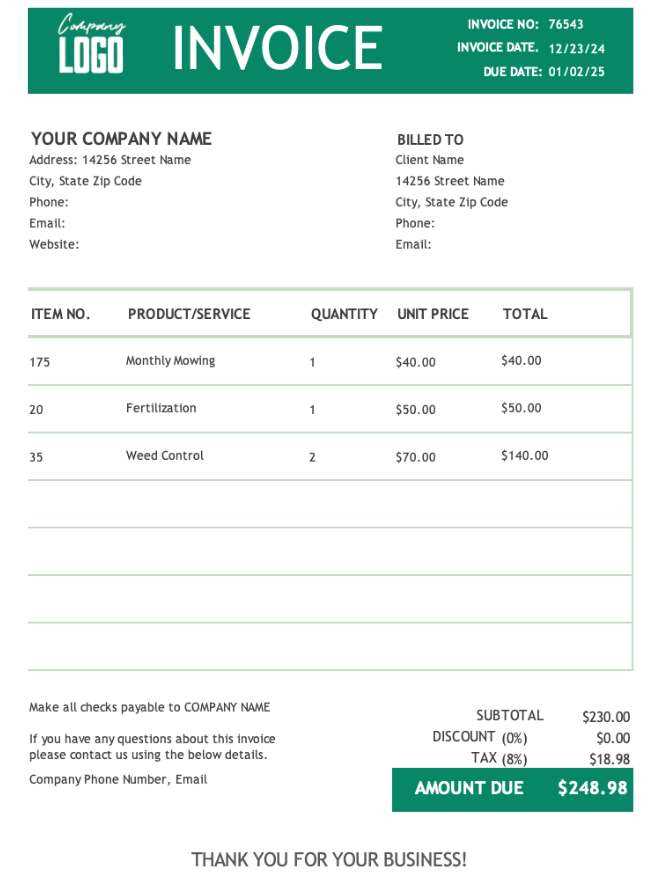

Essential Elements of an Invoice

Creating a billing document that is clear and effective requires including specific information that ensures transparency and accuracy. Each part of the document serves a distinct purpose, from identifying both parties involved to outlining payment expectations. Including the right components helps prevent confusion and delays in payment.

Key Information to Include

The following items are essential for a complete and professional billing record:

- Sender’s Contact Information: Name, address, and phone number or email address.

- Recipient’s Contact Information: Details of the person or company receiving the payment.

- Unique Document Number: A reference number for easy tracking and organization.

- Date of Issue: The date the billing document is created.

- Payment Due Date: The deadline by which the payment should be made.

- Description of Goods or Services: A clear list of what is being charged, including quantities and prices.

- Total Amount Due: The sum of all charges, including taxes or additional fees, if applicable.

Optional Additions

Some documents may also benefit from including additional details, such as:

- Payment Instructions: Methods of payment accepted, including bank transfer details or online payment links.

- Terms and Conditions: Any legal or contractual terms related to the transaction, including late fees or discounts.

- Notes or Special Instructions: Additional comments or specifics regarding the payment or transaction.

Free Tools for Designing Invoices

There are numerous online tools available that make the process of creating professional billing documents fast and easy. These platforms offer various templates and customization options to suit different business needs. Most importantly, many of these tools are free to use, providing an affordable solution for small businesses and freelancers alike.

Here are some popular free tools that can help in designing effective billing records:

| Tool | Features | Best For |

|---|---|---|

| Invoice Generator | Customizable templates, easy to use, export options (PDF, Excel) | Freelancers and small businesses |

| Zoho Invoice | Professional designs, automatic calculation of totals, supports multiple currencies | Small businesses with international clients |

| Canva | Customizable templates, drag-and-drop editor, cloud storage | Businesses looking for highly visual, branded documents |

| PayPal Invoicing | Integrated payment processing, automatic tax calculations, simple design | Freelancers and e-commerce businesses |

These tools offer a variety of features and templates, allowing users to select the best option based on their specific requirements. With no cost involved, they provide an accessible way to create high-quality billing records without the need for design expertise or expensive software.

Customizing Invoice Templates for Your Business

Adapting a billing document to align with the unique needs of a business helps maintain a consistent brand image while ensuring that all necessary information is included. Tailoring the structure and design allows for easier communication and better organization of financial details. This customization can make the process more efficient and improve the overall client experience.

First, consider your business type and the specific information you need to include. For example, a service-based business might require detailed descriptions of services rendered and the number of hours worked, while a retail business may need sections for itemized products and quantities.

Next, integrate your company’s branding into the layout. This includes using your logo, selecting appropriate colors, and choosing fonts that match your business’s identity. A professional-looking document not only makes a strong impression but also reinforces brand recognition with clients.

Finally, adjust the layout for ease of use by ensuring that important sections, such as payment details and contact information, are prominently displayed. Clear organization improves readability and reduces the chances of errors or misunderstandings.

Adding Company Branding to Your Invoice

Incorporating a company’s branding into financial documents not only creates a professional appearance but also strengthens the brand identity. This visual consistency helps clients recognize your business and fosters a sense of trust and reliability. By customizing design elements, you can make sure that every document reflects your company’s values and style.

The key components of branding that should be included in a billing document are the company logo, color scheme, fonts, and contact details. These elements help maintain a cohesive look across all communication channels, both online and offline. A well-branded document enhances your business’s image and sets you apart from competitors.

| Branding Element | Purpose | Best Practices |

|---|---|---|

| Logo | Identifies the company and adds professionalism | Place it in the header or top section for visibility |

| Color Scheme | Reinforces brand identity and creates visual appeal | Use brand colors sparingly to highlight key sections |

| Fonts | Aligns with your brand’s overall aesthetic and tone | Choose easy-to-read fonts and limit the number used |

| Contact Information | Ensures clients can easily reach out for questions or support | Position it clearly at the top or bottom of the document |

By carefully selecting and applying these elements, a financial document can become a seamless extension of your company’s brand, making every interaction with clients more engaging and professional.

Including Payment Terms in Your Template

Clearly outlining payment terms in financial documents is crucial for setting expectations and avoiding misunderstandings between businesses and clients. These terms specify the due dates, methods of payment, and any conditions related to late payments or discounts. Including this information helps maintain a professional relationship and ensures that payments are processed smoothly and on time.

Key Payment Terms to Include

When defining payment conditions, consider incorporating the following elements:

- Payment Due Date: Specify when the payment is expected to be made, whether it’s a specific calendar date or a certain number of days after the issue date.

- Accepted Payment Methods: Clearly state which forms of payment are accepted (e.g., credit card, bank transfer, online payment systems).

- Late Fees or Penalties: Define any fees that will apply if the payment is not made by the agreed-upon date.

- Discounts for Early Payments: Mention any discounts or incentives for clients who pay ahead of schedule.

- Currency: If dealing with international clients, specify the currency in which the payment should be made.

How to Present Payment Terms

Payment terms should be prominently displayed in the document, typically near the total amount due or at the bottom of the page. Consider highlighting them in a separate section or using bold text to make sure they stand out. Being clear and concise with these terms will help both parties understand their responsibilities and avoid potential confusion.

Best Practices for Invoice Layout

The design of a billing document plays a significant role in ensuring clarity and ease of use. A well-organized structure allows both the sender and the recipient to quickly access essential details, reducing the chances of errors or confusion. Following a few key layout principles will help create a professional and efficient document.

Key Layout Considerations

When arranging the content, focus on the following practices:

- Clear Sections: Break the document into distinct sections such as sender and recipient details, item descriptions, and payment terms. This organization makes the information easier to navigate.

- Consistent Alignment: Align text and numbers properly, especially for itemized lists and totals. Ensure that the columns are clearly defined, with all numerical values lined up for easy comparison.

- Use of White Space: Don’t overcrowd the page. Use ample white space between sections to avoid clutter, making the document more readable and aesthetically pleasing.

- Legible Font Size and Style: Choose clear, easy-to-read fonts and sizes. Ensure that the font used for headings is distinguishable from the body text, and avoid using too many different styles or colors.

- Highlight Important Information: Use bold or underlined text to emphasize key details such as the total amount due, due date, and payment instructions.

Order and Flow

The layout should have a logical flow, guiding the reader from one section to the next in a way that feels natural. Typically, the recipient’s information appears at the top, followed by the item list and amounts, and finishing with the payment instructions and terms. Keeping a consistent order improves readability and ensures that all essential information is easy to find.

Common Mistakes to Avoid in Invoices

Creating clear and accurate billing documents is essential for smooth transactions between businesses and clients. However, even the most experienced professionals can make mistakes that lead to confusion or delayed payments. Recognizing and avoiding these errors will help ensure a seamless and professional process for both parties.

1. Missing or Incorrect Details

One of the most common mistakes is failing to include essential information or providing incorrect data. This can lead to confusion, disputes, or delays in payment. Always double-check the following:

- Client Information: Ensure that the recipient’s name, address, and contact details are accurate.

- Billing Amount: Double-check the calculation of the total, including any taxes, discounts, or additional fees.

- Due Date: Clearly specify when the payment is expected to avoid late fees or misunderstandings.

2. Poor Formatting and Organization

A cluttered or poorly organized billing document can make it difficult for clients to quickly understand the charges. To avoid this, maintain a clean layout with clear headings, bullet points, and proper alignment. This helps highlight important information and makes the document more readable.

Additionally, ensure that the design is consistent and professional, matching your company’s branding. A clean, well-structured document reduces the chances of errors and presents a positive image of your business.

How to Include Taxes on Invoices

Properly incorporating taxes into billing documents is essential to ensure compliance and avoid confusion. Tax rates can vary depending on the jurisdiction, and accurately reflecting these charges is crucial for transparency with clients. Including taxes correctly helps maintain professionalism and ensures that the business receives the appropriate compensation.

Understanding Tax Calculation

Before adding taxes, it’s important to understand the tax laws that apply to the transaction. The following steps can guide you in calculating and adding the correct tax amount:

- Identify the Tax Rate: Research the appropriate tax rate based on your location and the nature of the transaction. For instance, some items or services may be exempt or subject to different rates.

- Calculate the Tax Amount: Multiply the total cost of goods or services by the applicable tax rate to determine the amount to be added.

- Ensure Compliance: Double-check any applicable regional tax laws to make sure the right rates are applied for both local and international transactions.

Where to Place Taxes on the Document

Taxes should be clearly listed and separated from the base amount. A common practice is to show the tax amount as a line item, followed by the total amount due, which includes both the cost and tax charges. This helps clients see exactly what they are being charged and why. For added clarity, you can use labels such as “Tax Rate,” “Sales Tax,” or “VAT” to specify the type of tax being applied.

Creating Professional Looking Invoices

A well-designed billing document is not just about displaying numbers; it’s an essential aspect of your business’s professionalism and credibility. Clients are more likely to trust and pay on time when the document is visually appealing, clear, and easy to read. Ensuring a polished, professional appearance for these documents helps build strong relationships and reflects well on the business.

Key Design Elements for Professional Documents

When creating a billing document that stands out for its professionalism, consider the following aspects:

- Consistent Branding: Incorporate your company’s logo, color scheme, and font styles to create a cohesive brand experience. This gives your document a polished and recognizable look.

- Clean Layout: Keep the design simple and free from unnecessary decorations. Use ample white space to prevent the document from looking cluttered, and organize sections logically.

- Readable Fonts: Choose legible, professional fonts for both headers and body text. Avoid overly decorative fonts that may be hard to read, especially for important details like amounts due or payment terms.

- Clear Sectioning: Break the content into distinct sections (e.g., contact information, list of services/products, payment terms) to ensure clarity and improve the document’s flow.

- Professional Tone: While the visual appearance is important, the tone and wording also contribute to professionalism. Use polite, concise language when detailing amounts, payment deadlines, and instructions.

Additional Tips for Refining the Design

Consider these additional techniques to elevate the quality of your billing document:

- Use Borders and Lines: Adding subtle borders around sections or between rows can help visually separate different pieces of information, making the document easier to follow.

- Highlight Important Information: Use bold text or larger fonts to emphasize critical details such as the total amount due or payment instructions.

- Maintain Consistency: Ensure that the design remains consistent throughout your documents. Consistent elements such as logo placement, color schemes, and font choices create a cohesive and professional look across all communications.

Why Consistency Matters in Invoices

Maintaining uniformity across all billing documents is vital for building trust, improving clarity, and ensuring smooth financial transactions. Consistency in design, layout, and language can eliminate confusion and make it easier for clients to understand the charges and payment details. A consistent approach also contributes to a professional image and helps reinforce your brand identity.

Benefits of Consistency in Billing Documents

Incorporating consistent elements throughout all financial documents brings several key advantages:

- Enhanced Professionalism: A uniform design and format give the impression that your business is well-organized and reliable, which can increase client confidence.

- Clear Communication: Standardized sections, fonts, and layout make it easier for clients to find important details such as the total amount due, payment methods, and deadlines.

- Brand Recognition: Consistent use of colors, fonts, and logos strengthens your brand’s visual identity, making your documents instantly recognizable to clients.

- Improved Efficiency: By following a consistent structure, you reduce the time spent on creating or editing each new document, which improves workflow and reduces errors.

Maintaining Consistency in Design and Content

Achieving consistency requires attention to both the visual and written elements of the document:

- Design Elements: Stick to the same color scheme, font style, and layout for each new document. This creates a cohesive look that reflects your brand and enhances the document’s readability.

- Terminology: Use the same terms and language in all financial communications. Avoid switching between terms like “total amount,” “balance due,” or “outstanding balance” to prevent confusion.

- Formatting: Always follow the same structure for headings, sections, and payment details. This consistency makes it easier for clients to navigate the document quickly and find the information they need.

How to Automate Invoice Creation

Automating the generation of financial documents can save significant time and reduce errors. By setting up a system that generates these documents automatically, you can streamline the billing process and ensure consistency across all records. This process can be achieved using software tools or services that handle the heavy lifting, allowing you to focus on more strategic tasks.

Steps to Automate the Billing Process

To effectively automate the creation of your billing records, follow these steps:

- Choose the Right Software: Many accounting or invoicing software solutions are available that can automate the process, such as QuickBooks, FreshBooks, or Zoho Invoice. These platforms integrate with other business systems to make data entry more efficient.

- Integrate Payment Systems: Integrating with payment processors like PayPal, Stripe, or others can automatically update billing details once a transaction is made, reducing manual entry.

- Customize Invoice Details: Most software options allow for customization, so you can set up fields for business name, client information, due dates, and itemized charges. This ensures that each document generated meets your specific needs.

Tools for Automating the Process

Here are some commonly used tools that simplify the creation of financial documents:

| Tool | Description | Key Features |

|---|---|---|

| QuickBooks | A comprehensive accounting software that includes automation for creating financial documents. | Customizable templates, recurring billing, integrations with accounting software. |

| FreshBooks | Popular for small businesses, automates billing and payment reminders. | Automatic invoice creation, time tracking, client management features. |

| Zoho Invoice | An invoicing tool with a strong focus on automation and client management. | Recurring invoices, automated reminders, detailed reporting tools. |

Automating the creation of billing documents can help save time, reduce errors, and improve overall efficiency in your business operations.

How to Save Time with Invoice Templates

Streamlining the billing process can significantly reduce the time spent on administrative tasks. By utilizing pre-designed structures for financial records, businesses can quickly input necessary details and generate accurate documents. This approach not only saves time but also minimizes the risk of errors and ensures consistency across all outgoing correspondence.

Benefits of Using Pre-Designed Formats

Adopting standardized formats for generating financial documents brings multiple advantages:

- Quick Data Entry: With a pre-established structure, most of the information can be easily filled in, eliminating the need to manually create documents from scratch each time.

- Consistency: Having a set format ensures that each document follows the same design, reducing confusion for both you and your clients.

- Reduced Errors: With a consistent layout and automated calculations, there’s less chance of making mistakes in the details, such as totals or due dates.

How to Maximize Efficiency

To truly maximize the time-saving benefits, consider these tips:

- Use Automation Features: Many billing software tools allow you to save preferred formats and set up recurring entries, making it even easier to generate documents quickly without re-entering the same details.

- Customize for Specific Needs: Pre-built structures can still be tailored to fit unique business requirements, such as adding specific fields or adjusting the layout, so you don’t need to start from scratch each time.

By leveraging efficient systems, businesses can dramatically cut down on the time spent on financial documentation, freeing up valuable time for other crucial tasks.

Legal Considerations When Creating Invoices

When preparing financial documents for transactions, it is crucial to ensure that all legal requirements are met. These documents not only serve as a record of a transaction but also as a legal instrument that may be used in case of disputes, audits, or tax reporting. Understanding the necessary components and the regulations that apply will help protect your business from potential legal issues.

Key Legal Elements to Include

To avoid legal complications, certain information must always be included in your documents:

| Element | Description |

|---|---|

| Business Details | Ensure that your company’s legal name, address, and tax identification number (TIN) are clearly listed. |

| Client Information | Include the client’s name, contact details, and any relevant account or reference numbers. |

| Transaction Details | Provide a clear description of the goods or services provided, including quantities, pricing, and payment terms. |

| Tax Information | List the applicable sales tax or VAT, following local tax laws and regulations. |

| Payment Terms | Specify the payment deadline, accepted payment methods, and any late payment penalties. |

Local Regulations and Compliance

Different regions have specific requirements regarding the contents of business documentation. Depending on your country or state, you may be obligated to comply with local tax regulations, including issuing specific forms for VAT, sales tax, or service charges. Additionally, some jurisdictions require businesses to maintain copies of financial records for a certain period, often ranging from 3 to 7 years.

Always consult local regulations or a legal advisor to ensure that your financial documents meet the necessary standards and provide the required information for legal protection. Neglecting these details can lead to fines, audits, or challenges in enforcing payment agreements.

When to Update Your Invoice Template

As business practices evolve and regulatory requirements change, it’s essential to periodically review and modify the format used for billing purposes. Regular updates ensure that your financial documentation remains compliant, clear, and effective in maintaining professional standards. Whether it’s due to legal updates, changes in services or products, or just the need for improved clarity, knowing when to revise these documents is vital for smooth business operations.

Reasons for Updating Billing Documents

Here are some common reasons that may require a revision of your billing format:

| Reason | Description |

|---|---|

| Legal or Tax Changes | If tax rates, regulations, or required details such as tax ID numbers change, it’s important to update your billing forms to remain compliant. |

| Business Rebranding | Changes in the company’s logo, contact information, or other branding elements should be reflected in the billing format to maintain a consistent brand identity. |

| New Payment Methods | If new payment options are added, such as digital wallets or cryptocurrencies, these should be incorporated to provide clients with the most relevant payment choices. |

| Additional Services | If your product or service offerings change, you may need to adjust how the items are listed or described on the document. |

| Improving Clarity | To ensure that clients understand payment terms, item descriptions, and the total amount due, updates might be needed to enhance clarity and readability. |

How Often Should You Update Billing Documents?

While there’s no strict timeline for when to update your billing forms, it’s good practice to review them annually or whenever a significant change occurs in your business. Regular checks can help spot any outdated information and ensure that your documents continue to meet legal and customer expectations.

Maintaining up-to-date billing records also helps to build trust with clients by ensuring transparency and professionalism in every transaction.