How to Make My Own Invoice Template and Customize It for My Business

Designing a professional and efficient billing document is essential for any business. Whether you’re a freelancer, small business owner, or entrepreneur, having a tailored format that suits your needs can help streamline your financial processes and enhance your professionalism. The right document ensures clear communication with your clients and facilitates timely payments.

While there are many pre-designed options available, creating a personalized version can offer more flexibility and control. You can include specific information relevant to your services, adjust the layout to reflect your branding, and choose a format that aligns with your workflow. By developing a unique document, you establish consistency and clarity in your transactions.

In this guide, we will explore the key steps and tools to help you craft a custom billing form, highlighting important components, design tips, and best practices for an efficient financial tool. Whether you’re looking to use free software or advanced design features, you’ll find the necessary resources to create a document that works best for you and your business.

How to Design Your Own Invoice Template

Creating a personalized billing document begins with understanding your specific needs and how you want to present the details of a transaction. A well-designed form not only communicates professionalism but also ensures that clients can easily review and process payments. The design process should focus on simplicity, clarity, and alignment with your brand’s style.

Step 1: Select the Right Layout

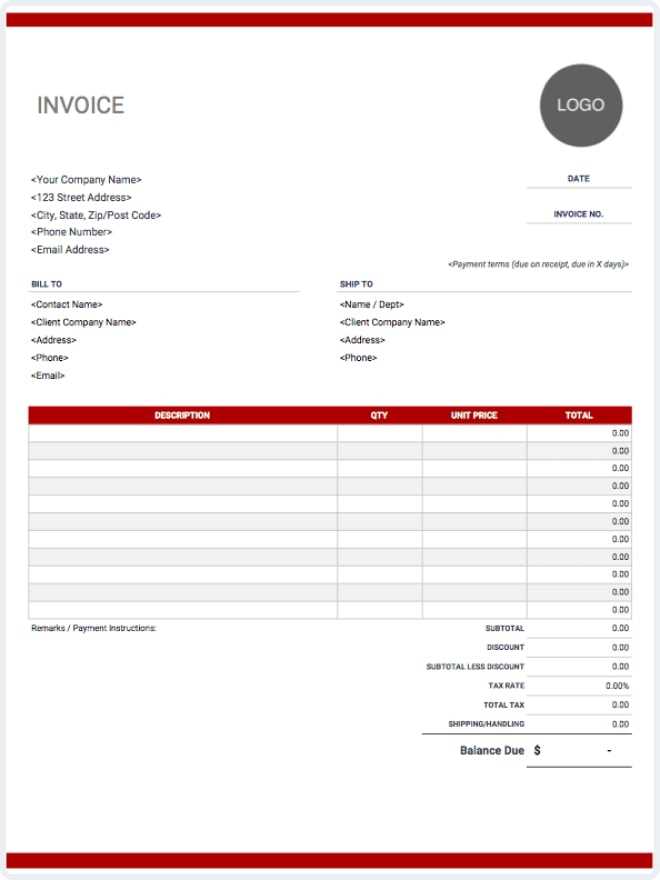

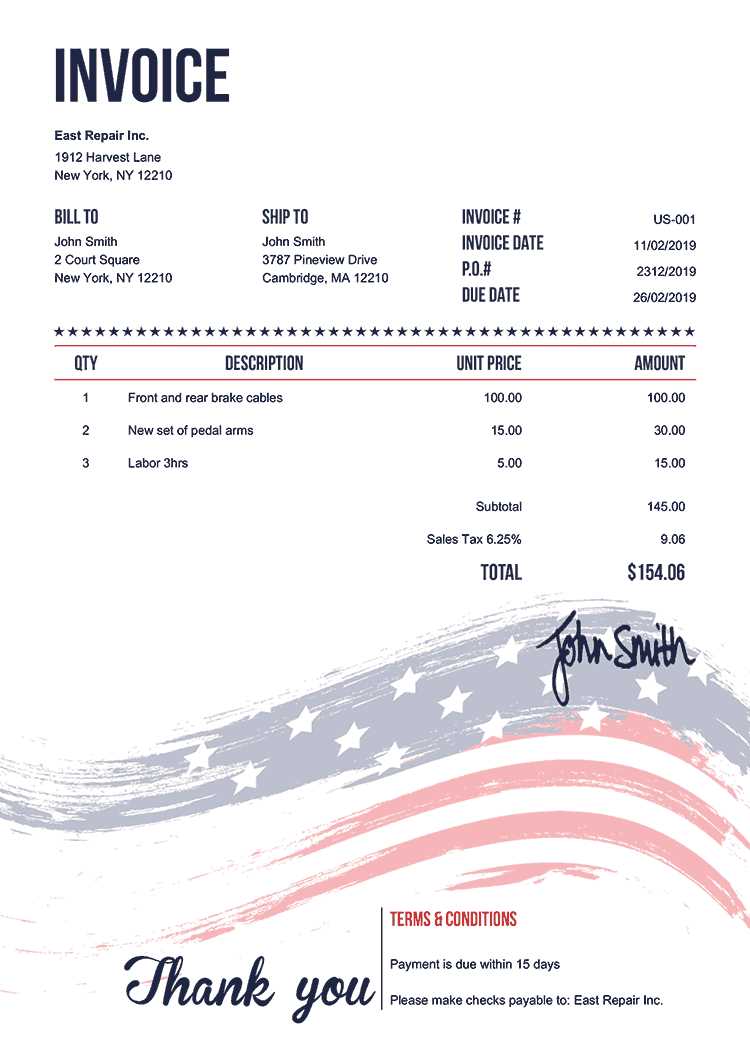

Choosing an appropriate layout is crucial for clarity and ease of use. The layout should guide the user’s eye through the most important information, such as the services or products provided, the payment amount, and deadlines. Decide whether you want a more formal or creative look, depending on your business type and audience. Consider a clean, structured format with clear sections for each relevant detail.

Step 2: Include Essential Information

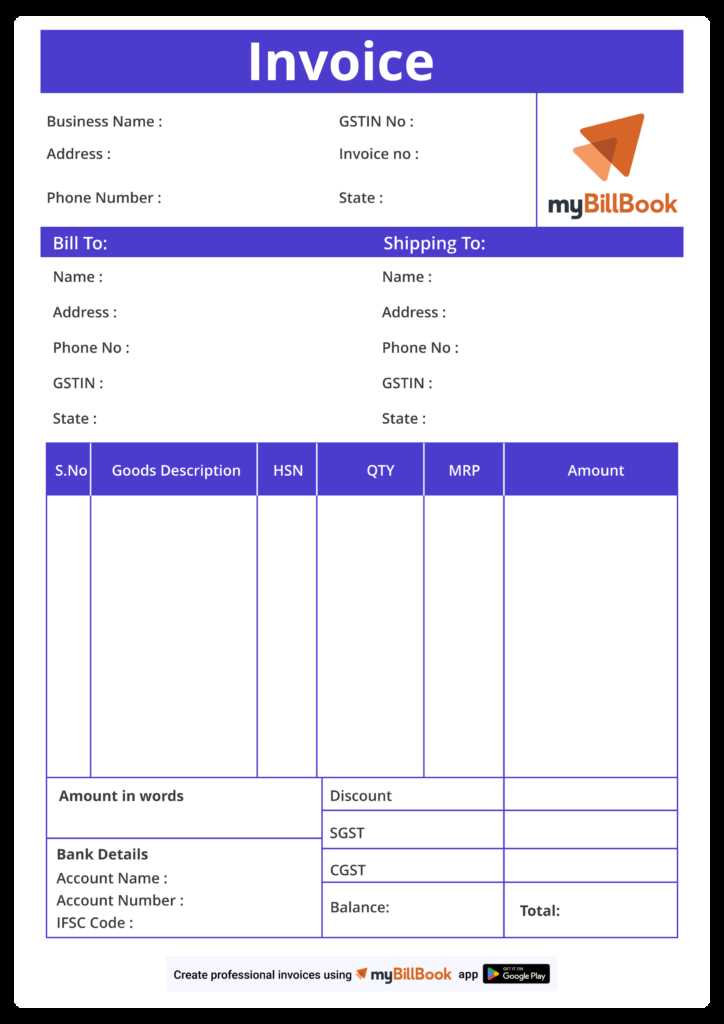

Regardless of your design, certain pieces of information must be included to ensure the document is functional and legally sound. At a minimum, you should include your business name and contact details, the client’s information, a description of services or goods provided, payment terms, and the total due. It’s also helpful to include a unique identification number for each document for tracking purposes.

Once you’ve decided on the layout and included all necessary details, you can refine your design by incorporating branding elements like logos and color schemes. A customized form not only improves efficiency but also reinforces your professional identity.

Why Create Your Own Invoice

Customizing your billing documents offers several key advantages, particularly when it comes to enhancing professionalism, streamlining operations, and tailoring information to your specific needs. Instead of relying on generic formats, designing a personalized version allows you to incorporate the precise details and style that reflect your business identity. This can lead to better client relationships and improved efficiency in tracking payments.

Control Over Design and Content

By crafting your own document, you gain complete control over the layout, structure, and included information. This flexibility ensures that every detail is tailored to your services, eliminating unnecessary elements and adding features that are specific to your workflow. Whether you prefer a minimalist design or something more detailed, you can create a form that best suits your business needs. This level of customization allows you to present information in a way that is both clear and aligned with your brand’s tone.

Professional Image and Brand Consistency

When you design a personalized document, it serves as an opportunity to reinforce your brand’s visual identity. By including your logo, color scheme, and fonts, you create a cohesive look across all your communications. A consistent and professional presentation helps build trust with clients and shows that you are organized and committed to delivering high-quality services. A custom document reinforces the perception of professionalism and attention to detail, which can lead to stronger client relationships.

Key Elements of an Invoice

To ensure clarity and accuracy, every billing document should include several essential components. These elements not only provide the necessary information for completing a transaction but also help avoid misunderstandings between the service provider and the client. Including all the right details ensures that both parties are on the same page, making payment processing smoother and more efficient.

First, it’s important to include your business contact information, such as your name, address, phone number, and email. This ensures that the recipient knows how to reach you in case of questions or concerns. Next, include the client’s details, including their name, business name, and contact information. This helps to avoid any confusion regarding who the bill is directed to.

Another crucial element is a clear and accurate breakdown of the services or products provided, with corresponding prices. Be specific about each item, and consider including a brief description if necessary. You should also specify the payment terms, including the total amount due, the due date, and any late fees or penalties for overdue payments.

Finally, consider adding a unique identifier for each document, such as a reference number, which helps with tracking and record-keeping. This is especially important for businesses managing multiple transactions. A well-organized form with these key elements not only ensures smooth financial operations but also reflects your business’s professionalism.

Choosing the Right Invoice Format

Selecting the right format for your billing document is crucial for both functionality and aesthetics. The format you choose should suit your business needs while making the process of reviewing and processing payments as smooth as possible. A well-structured design enhances the client’s experience and ensures they can quickly find the key details needed to settle the transaction.

Consider Simplicity and Clarity

When choosing a layout, it’s important to prioritize simplicity and clarity. A clean, easy-to-read structure helps prevent confusion and ensures that the recipient can quickly locate essential information, such as the total amount due, payment terms, and contact details. A minimalistic approach often works best, as it avoids unnecessary clutter and focuses on the most important elements of the transaction.

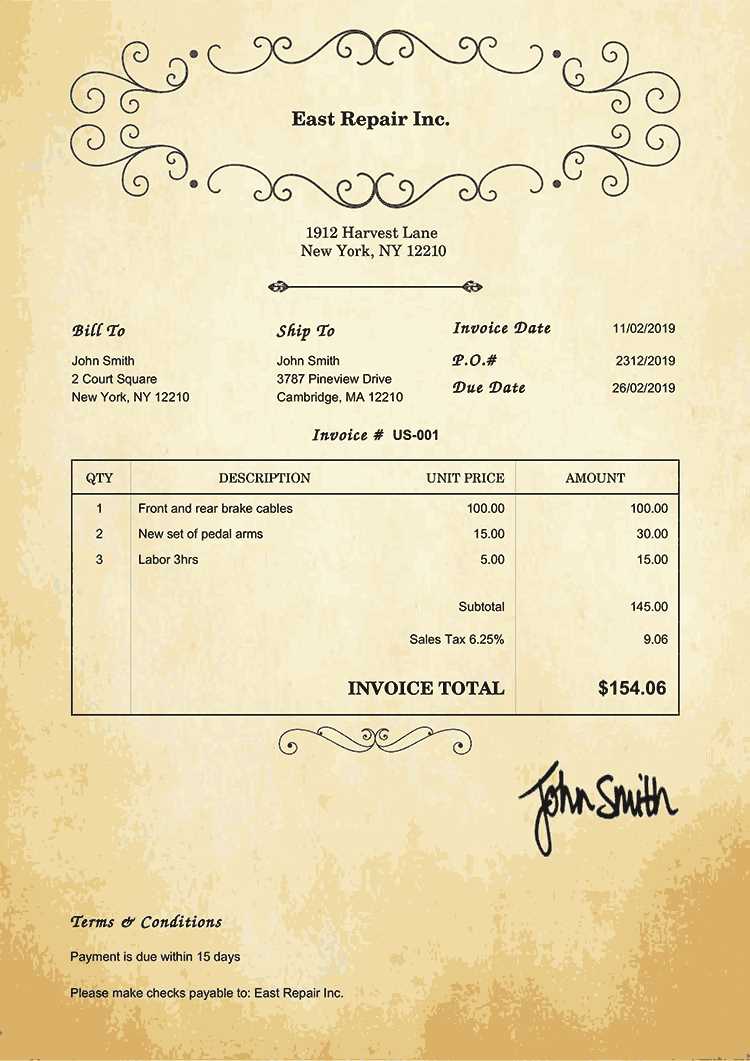

Adapt the Design to Your Business

The format should also reflect the nature of your business. For example, a freelancer might prefer a more casual design with space for a personal message, while a larger company might opt for a more formal, corporate style. Think about your audience and their preferences: some clients might appreciate a modern, streamlined design, while others may prefer a traditional, structured approach. Aligning the design with your brand helps create consistency across all client interactions and strengthens your professional image.

Free Tools for Invoice Creation

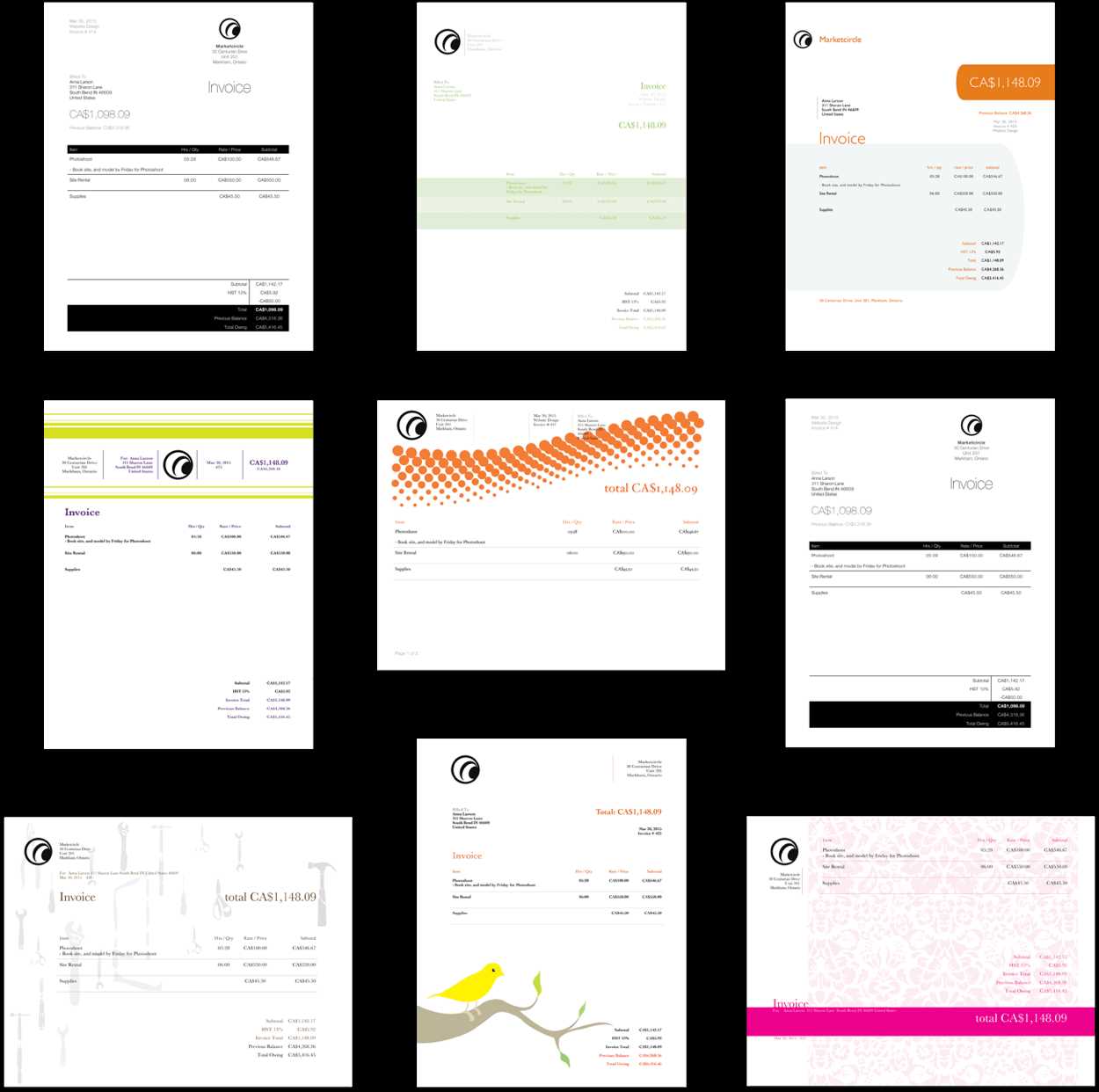

There are several free tools available that can help you design and generate professional billing documents quickly and easily. These platforms offer a range of features that allow you to customize your documents without needing advanced design skills or expensive software. Whether you’re a freelancer, small business owner, or entrepreneur, using free tools can save you time and money while ensuring your financial documents are polished and effective.

Many of these tools offer pre-built templates that you can modify to fit your needs, but they also allow for full customization. You can adjust layouts, fonts, colors, and fields to create a unique and functional design that works best for your business. Using these platforms also often means you can save your documents in various formats, such as PDF, making it easy to share with clients via email or print for physical copies.

Additionally, some of these free tools provide useful features like automatic number generation, tax calculation, and integration with payment platforms. These can help streamline your workflow and ensure you don’t miss any critical details. For businesses of any size, these free resources are invaluable in creating accurate, professional financial documents without added costs.

Customizing Invoice Layouts for Business

Tailoring your billing document layout to match your business needs can improve both functionality and client perception. A well-structured format not only makes it easier to present important transaction details but also helps reinforce your brand identity. By adjusting elements such as design, typography, and spacing, you can create a more personalized and professional presentation that aligns with your business style.

The layout should reflect the nature of your business while ensuring that all necessary information is easy to find. For example, a creative agency might prefer a more visually appealing design with bold fonts and vibrant colors, while a law firm may opt for a cleaner, more formal look. Tailoring the appearance to your target audience is key to making a lasting impression while still maintaining clarity and professionalism.

Consider adjusting the position of key sections, such as payment terms, client details, and the description of goods or services. By strategically placing these elements, you can guide the reader’s eye in a logical order, making the document easier to process. Making thoughtful adjustments to your layout not only improves the efficiency of your financial operations but also enhances the overall client experience.

Best Practices for Invoice Design

Designing a clear and effective billing document requires careful consideration of both functionality and visual appeal. A well-organized layout ensures that the recipient can easily locate key information, such as the total amount due and payment terms, while a professional design helps reinforce your brand’s image. Following best practices for structure, typography, and formatting can improve the overall client experience and streamline your payment process.

1. Keep It Simple and Organized

Clarity is the cornerstone of good design. Avoid clutter and unnecessary elements that could distract from important details. Focus on the essentials, like the itemized list of services, client details, and payment instructions. Use plenty of white space to allow the document to “breathe” and make it easier to read. Here are some key elements to include:

| Element | Description |

|---|---|

| Business Information | Your company name, address, and contact details |

| Client Details | Recipient’s name and contact information |

| Service Breakdown | A detailed list of services or products provided |

| Total Amount | The total cost, including taxes or fees if applicable |

| Payment Terms | Due date and any late fees or discounts |

2. Use Clear, Readable Fonts

Font choice plays a critical role in making your document legible. Choose fonts that are easy to read, such as sans-serif fonts for the main body and serif fonts for headings or subheadings. Avoid using too many different fonts or sizes, as this can create visual chaos. A clean, simple design with a consistent font style helps guide the reader’s eye through the document without unnecessary distractions.

By following these design practices, you can create a functional, professional, and visually appealing document that makes a strong impression on clients and ensures smooth financial transactions.

How to Add Your Branding to Invoices

Incorporating your brand elements into your billing documents helps reinforce your company’s identity and creates a cohesive experience for your clients. By using your logo, color scheme, and typography, you can ensure that every communication, including payment requests, reflects your brand’s professional image. Consistency in branding across all materials contributes to greater recognition and trust with your clients.

1. Include Your Logo and Company Name

Start by adding your company logo and name at the top of the document. This is the first thing clients will see, making it a prime spot for branding. Ensure the logo is clear and appropriately sized–large enough to be visible but not overwhelming. If your logo includes a tagline or slogan, consider including that as well, as it further strengthens your brand message.

2. Use Brand Colors and Fonts

Color plays a significant role in brand identity. By using your brand’s colors for headings, borders, and key sections, you create a sense of unity and recognition. Similarly, choose fonts that align with your brand’s typography guidelines. If you don’t have specific fonts, select clean, professional-looking fonts that reflect your company’s style. Avoid using too many different fonts or colors, as it may distract from the main content.

| Branding Element | Best Practices |

|---|---|

| Logo | Place at the top, clearly visible, proportional to the document size |

| Color Scheme | Use brand colors for headings, borders, and accents |

| Font Style | Choose legible fonts that match your business’s personality |

| Contact Information | Place in a consistent format at the bottom or top of the document |

By incorporating these branding elements, you not only make your billing documents more visually appealing but also ensure that they align with the rest of your marketing materials. A well-branded billing form contributes to a positive client experience and helps build recognition over time.

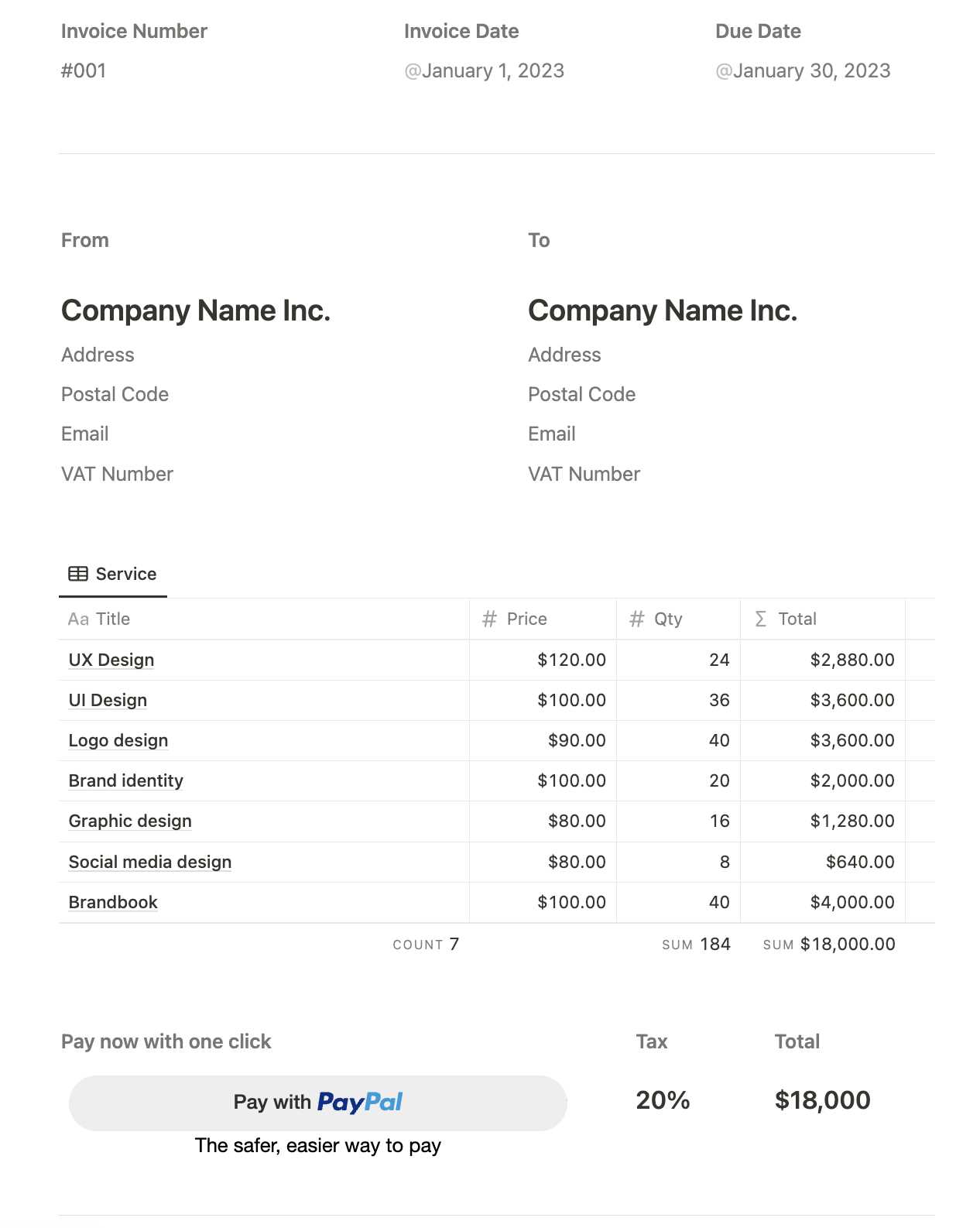

Understanding Invoice Numbering Systems

Establishing a clear and organized numbering system for your billing documents is crucial for maintaining accurate records and simplifying financial management. A well-structured numbering approach allows you to track transactions, avoid duplication, and improve the efficiency of your accounting process. Proper numbering not only helps you stay organized but also makes it easier for clients to reference specific bills if needed.

The numbering system should be simple to follow and scalable as your business grows. There are different ways to structure the numbering, depending on your needs and preferences. The most common method is to assign a sequential number to each document, but you may also choose to include additional elements like dates or client codes for added clarity.

| Numbering Style | Description |

|---|---|

| Sequential | Numbers increase by 1 for each new document (e.g., 001, 002, 003…) |

| Year-Based | Incorporates the year in the format (e.g., 2024-001, 2024-002…) |

| Client-Specific | Includes a client or project code (e.g., CLIENT001-001, CLIENT002-001) |

| Custom Format | Combination of date, project number, or service type (e.g., 04-2024-001, PROD-001) |

When choosing a numbering system, consistency is key. Whether you opt for a simple sequential system or a more complex format with multiple components, ensure that the system you use is easy to follow and does not cause confusion. This will help with both internal organization and client interactions, making your financial management process more streamlined and professional.

How to Include Payment Terms

Clearly outlining payment terms in your billing documents is essential for ensuring smooth transactions and avoiding misunderstandings with clients. Payment terms specify the expectations regarding when and how payments should be made. Including this information in a transparent and easy-to-understand format helps both parties stay on the same page and ensures that payments are processed efficiently and on time.

The most common payment terms typically include the due date, accepted payment methods, and any discounts or late fees associated with early or delayed payments. For example, you may offer a discount if the payment is made within a certain number of days, or you may outline penalties for late payments to encourage timely settlement.

Here are a few key elements to include when specifying payment terms:

- Due Date: Clearly state when the payment is expected. For example, “Due within 30 days from the date of issue.”

- Accepted Payment Methods: List the methods you accept, such as credit card, bank transfer, or PayPal.

- Late Fees: If applicable, specify any penalties for overdue payments, such as “Late fee of 2% per month after the due date.”

- Discounts for Early Payment: If offering discounts for early settlement, state the conditions clearly, like “5% discount for payments made within 10 days.”

Including these details in a straightforward manner helps prevent delays, reduces the risk of disputes, and ensures that both you and your clients are clear on the payment expectations. Always make sure that payment terms are easily visible on your document, usually at the bottom or near the total amount due, to ensure they’re not overlooked.

Essential Invoice Fields for Small Businesses

For small businesses, it’s crucial to include the right details in every billing document to ensure smooth financial operations and professional communication with clients. A well-structured document should contain key fields that not only make it easier to process payments but also ensure compliance and clarity. By incorporating the essential elements, you can avoid confusion, ensure accurate tracking, and foster stronger client relationships.

1. Business and Client Information

The first step in creating an effective document is to clearly identify both the sender and the recipient. Include your business name, address, phone number, and email address, as well as the client’s details. This ensures both parties can easily contact each other if needed. It’s also helpful to include your business registration number or tax ID if applicable, as this adds a layer of professionalism and helps with tax purposes.

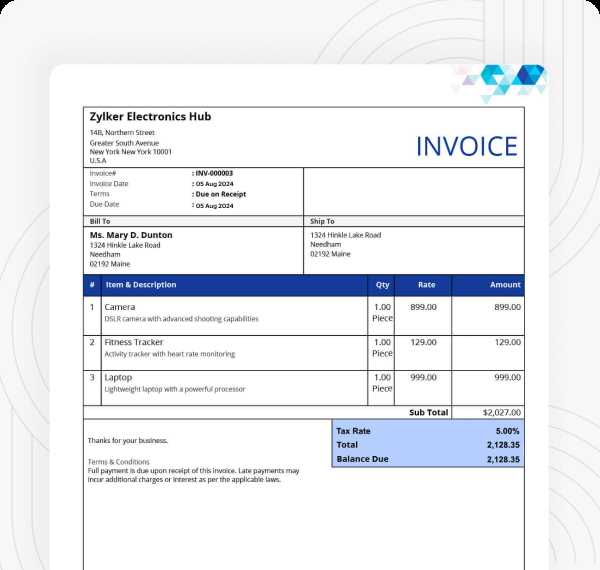

2. Service or Product Breakdown

Next, it’s essential to provide a detailed list of services or products provided, along with their respective costs. This breakdown helps the client understand exactly what they are paying for and ensures transparency. Clearly list each item with its description, quantity, rate, and total cost. For added clarity, you can also include the date the services were provided or products delivered. This section is vital for both your own record-keeping and for providing clarity to clients regarding the billing details.

In addition to these core fields, make sure to include other relevant details such as the payment terms, due date, and any applicable taxes or discounts. Keeping the structure simple and organized will help clients process payments promptly and maintain good financial practices for your business.

What to Avoid in Invoice Templates

While designing a billing document, it’s just as important to know what to leave out as it is to include the right details. A cluttered or poorly structured document can confuse the recipient, delay payments, and even harm your professional image. By avoiding certain design and content mistakes, you can ensure that your financial forms are clear, easy to understand, and effective in securing timely payments.

One common mistake is overcrowding the document with unnecessary information. Avoid adding too many decorative elements, irrelevant text, or excessive details that can distract from the key financial information. Keep it simple and focused on the essential details like the total amount due, the services or products provided, and the payment terms.

Another mistake is inconsistent formatting. Using multiple fonts, colors, or styles can make your document look unprofessional and difficult to read. Stick to a consistent design with a clean layout that highlights the most important sections. Clarity is key, so ensure that the document is easy for the client to navigate and understand quickly.

Lastly, don’t forget to proofread. Typos or incorrect information can lead to confusion and even damage your reputation. Always double-check that the details, including pricing, client names, and payment terms, are accurate before sending the document. A small mistake can cause delays in payment or create unnecessary back-and-forth with the client.

Using Invoice Templates for Different Services

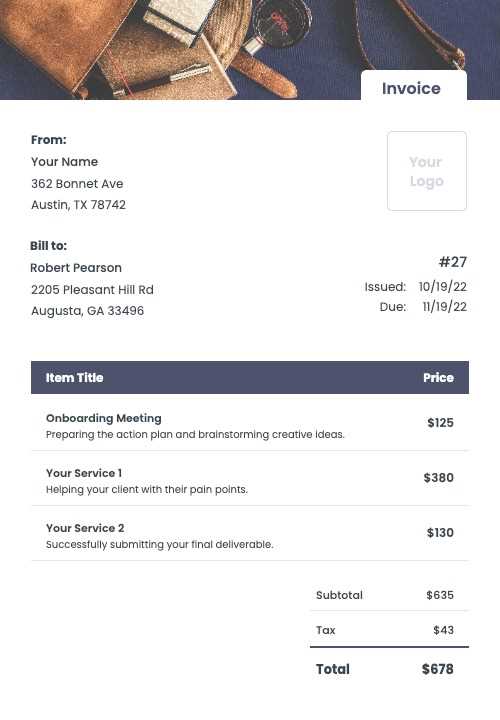

When providing various types of services, it’s essential to customize your billing documents to accurately reflect the nature of the work performed. Different services have different billing requirements, and tailoring your documents can help ensure that all relevant details are clearly communicated. Whether you’re offering consulting, creative services, or physical products, the format and structure of your financial forms may vary to suit the type of work you’re invoicing for.

1. Consulting Services

For consulting services, the billing document typically includes detailed descriptions of the work completed, hours spent, and the agreed-upon hourly rate. Additionally, it’s important to clearly indicate any project milestones or stages of work that have been completed, especially for long-term or ongoing projects. Including a section for notes or comments can also be helpful for explaining complex tasks or providing context to the client.

2. Creative and Design Services

Creative services such as graphic design, web design, or marketing require a slightly different approach. These types of services often involve package pricing, royalties, or licensing fees. It’s crucial to specify which services were rendered, any revisions allowed, and the associated costs. A breakdown of the work completed in each phase can help avoid confusion and ensure that the client understands the value of the service provided.

| Service Type | Details to Include |

|---|---|

| Consulting | Hourly rate, number of hours, project milestones, and consultation topics |

| Creative Services | Package price, revisions included, project stages, licensing fees |

| Physical Products | Quantity, unit price, shipping details, applicable taxes |

For physical product sales, the document should include an itemized list of the products, their quantities, and prices. In this case, it’s important to detail any shipping or handling costs, as well as applicable taxes. By customizing the structure of your billing document according to the type of service provided, you can ensure that your clients have a clear understanding of the charges and that the payment process goes smoothly.

How to Ensure Invoice Clarity

Clarity is key when preparing any financial document. A clear and well-structured billing statement ensures that both you and your client are on the same page, reducing confusion and the likelihood of payment delays. When creating a document to request payment, it’s important to present all relevant information in a straightforward manner, making it easy for the recipient to quickly understand the details. Here are some essential practices to achieve clarity in your billing forms:

1. Use Clear and Concise Language

Ambiguous or overly complex language can create confusion and delay payments. Always aim to use simple and direct wording that clearly describes the services or products provided. Avoid jargon or technical terms that may not be familiar to the client.

2. Organize Information Logically

The layout of the document should be easy to navigate, with the most important details standing out. A structured format will guide the reader’s eyes to the key sections such as the total amount due, payment instructions, and service breakdown.

3. Include Key Information

- Business Information: Clearly list your business name, address, contact number, and email.

- Client Details: Include the client’s name, address, and contact information to avoid any confusion.

- Service or Product List: Provide a detailed description of each service or product, including quantities, rates, and total costs.

- Payment Terms: Specify the due date, accepted payment methods, and any penalties for late payments.

- Taxes and Discounts: Clearly indicate any applicable taxes or discounts to avoid any confusion about the final amount due.

4. Use Proper Formatting and Spacing

A well-spaced and clean design improves readability. Use bold headings, bullet points, and clear section dividers to separate different parts of the document. Proper spacing around each section ensures that key information is easy to locate. Avoid cramming too much text into a small area, and leave enough white space around the content for a neat, uncluttered look.

5. Double-Check for Accuracy

- Verify that all client details are correct, including their name and contact information.

- Double-check the pricing for accuracy and ensure that the amounts add up correctly.

- Ensure the payment terms and due date are clearly stated.

By following these steps and ensuring that your documents are logically structured, you can enhance clarity and reduce the risk of payment issues or misunderstandings. A clear document not only reflects professionalism but also builds trust with your clients, making the

How to Save Time with Templates

Creating detailed billing documents from scratch for every client or project can be time-consuming and repetitive. Instead of designing a new document each time, using pre-built structures can streamline the process, save time, and reduce errors. By utilizing structured formats that can be quickly customized, you can focus on delivering quality work rather than worrying about administrative tasks.

1. Pre-Defined Fields for Faster Setup

With a pre-set document, you only need to fill in key information like the client’s details, services rendered, and total amounts. The format is already in place, so you don’t need to worry about layout, font choices, or alignment. This speeds up the process significantly, especially if you’re managing multiple clients or projects at once.

2. Customizable Sections for Flexibility

Having a flexible structure allows you to adapt the document for different types of work. Whether you’re billing for a one-time project, ongoing services, or products, a customizable framework can accommodate various needs. You can easily adjust sections like the item list or payment terms, making the process quick and efficient for any situation.

By saving time on formatting and layout, you free up more time to focus on the core aspects of your business, such as customer service, quality control, and expanding your services. In the long run, this efficiency translates to more time for growth and a more organized, professional workflow.

Making Invoices Work for Your Workflow

Efficient financial documentation is key to maintaining a smooth workflow in any business. Integrating well-designed billing statements into your daily operations can save time, reduce errors, and streamline communication with clients. By aligning your financial paperwork with your workflow, you ensure that every transaction is recorded, processed, and followed up on efficiently. This integration helps maintain professionalism while minimizing administrative tasks.

To make your billing process more effective, start by organizing your documents in a way that fits your schedule and project management system. For example, if you manage multiple projects or clients at once, ensure your forms are adaptable and easy to update. Using a consistent structure can help reduce the time spent on each document, allowing you to focus more on your core tasks.

Another important consideration is timing. Having a system in place that automatically tracks completed work and triggers when a billing statement should be sent allows for a more proactive approach to client payments. Automation and reminders can help you avoid delays, ensuring that your financial records are up-to-date and that clients receive their billing statements promptly.

In the long term, making billing documents a seamless part of your workflow will not only improve your efficiency but also enhance your client relationships by maintaining clarity and consistency in your communication. Whether you use digital tools, project management platforms, or even manual tracking, the key is to integrate billing seamlessly with your overall process.

Printing or Sending Your Custom Invoice

Once your financial document is prepared, the next crucial step is ensuring it reaches the client promptly and in the correct format. Whether you prefer to send it digitally or print and mail it, the method of delivery can impact how quickly the payment process begins. Choosing the right delivery method ensures that the document is received in a timely manner, while also maintaining a professional image.

1. Sending Digitally

Sending billing documents electronically has become the most efficient method in today’s digital age. Emailing your document in PDF format is secure, fast, and environmentally friendly. This method also allows for easy tracking and archiving, which can be helpful for your records. When sending digitally, ensure the document is clear and formatted correctly for easy viewing on any device. Additionally, it’s a good practice to include a brief message in the email body outlining the payment terms and reminding the client of the due date.

2. Printing and Mailing

For clients who prefer physical documents, printing and mailing your billing form may still be the preferred option. Ensure that the printed document is of high quality, with clear text and legible details. Consider using branded paper or including your logo on the printed form to enhance your professional image. If mailing, remember to use appropriate packaging to ensure the document arrives in good condition, and consider using a tracking service for added security.

| Delivery Method | Advantages | Considerations |

|---|---|---|

| Fast, cost-effective, easy to track, and eco-friendly | Ensure proper file formatting and security of the document | |

| Preferred by some clients, adds a personal touch | Higher costs, potential delays, less eco-friendly |

Regardless of the delivery method, the key is to ensure that the client receives the document promptly and without any issues. Clear communication about the payment due date and easy accessibility to the document will improve the chances of receiving timely payments and help maintain positive client relationships.