How to Create an Invoice Template in Word

Designing efficient and professional payment documents is an essential part of managing your business finances. Having a well-structured document to send to clients ensures that your services are clearly outlined and helps avoid misunderstandings. Whether you are a freelancer or a small business owner, producing consistent, clear, and accurate billing papers is crucial for smooth transactions.

One of the easiest ways to create these documents is by using a widely accessible word processing software. With just a few adjustments, you can tailor it to suit your needs, making it easier to track payments and maintain professionalism. This approach saves time and reduces the complexity of the billing process, providing you with a ready-made solution that you can adapt quickly.

In this guide, we will walk through the process of designing a personalized billing document that works for your business. By the end, you will have a custom-made document that looks professional, reflects your brand, and simplifies your payment procedures.

How to Create an Invoice Template in Word

Designing a billing document that meets your business needs can be done quickly with the right approach. By using a text editor, you can create a customized layout that includes all necessary fields for payment details, services provided, and contact information. This allows you to focus on efficiency and professionalism while simplifying the process of sending payment requests to your clients.

Follow these steps to create a functional and visually appealing billing document:

- Choose a Blank Document – Start with a clean slate by opening a new file in your text editor.

- Set Up the Page Layout – Adjust margins and page orientation to suit your needs. Commonly, documents are set in portrait mode with standard margins.

- Include Your Business Information – At the top of the page, add your business name, address, and contact details. This will make it easy for clients to reach you if needed.

- Add Client Information – Leave space for your client’s name, address, and any other relevant details. This will help you personalize the document for each transaction.

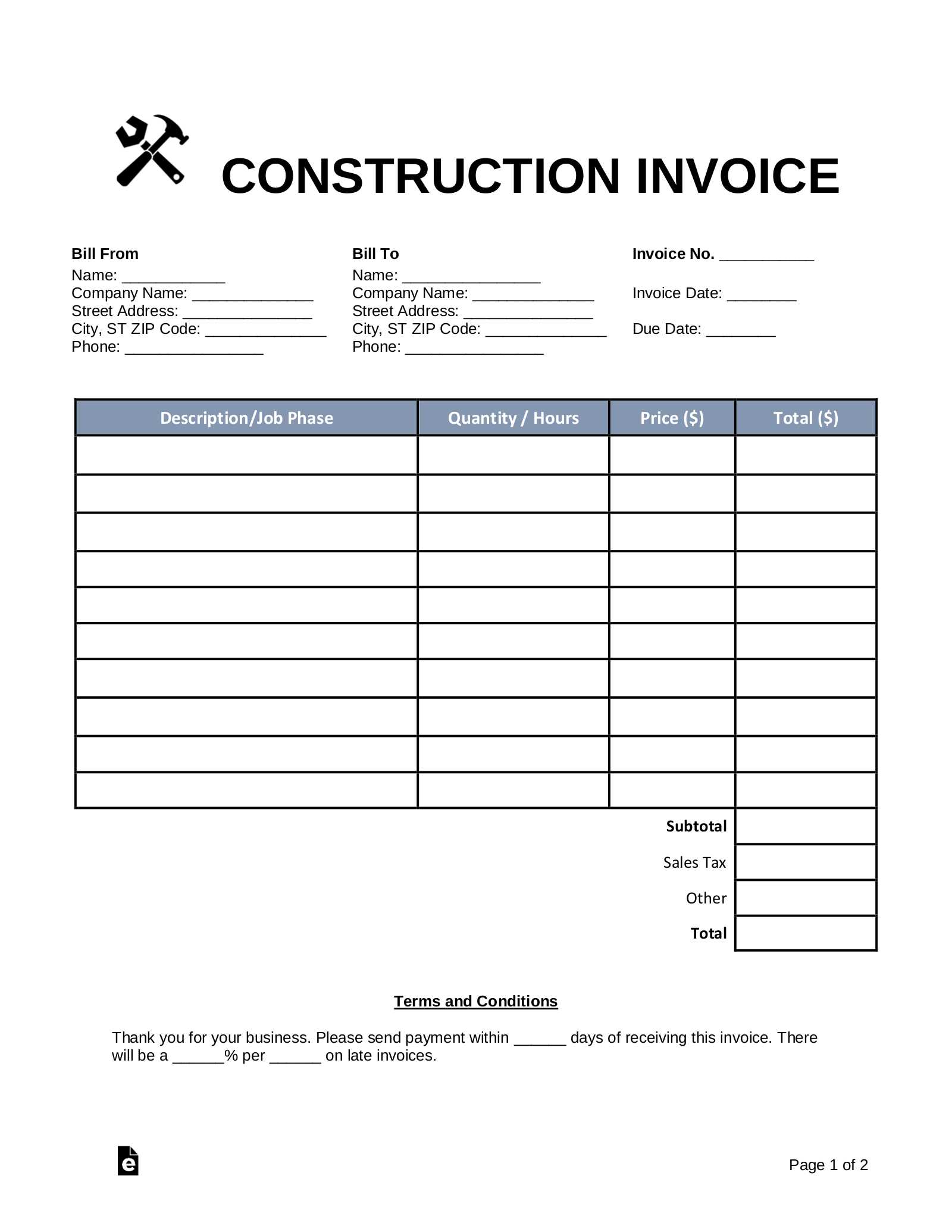

- Create a Table for Billing Details – Organize the list of services or products provided in a simple table. Include columns for descriptions, quantities, unit prices, and totals.

- Include Tax and Total Amount – Calculate any applicable taxes and clearly display the final amount due. Make sure this is easy to understand and transparent for your client.

- Add Payment Terms – Specify payment due dates, accepted methods, and any penalties for late payments.

- Save Your Document – Once you’re happy with the layout and information included, save the file so you can reuse it for future transactions.

By following these steps, you will have a custom billing document that is ready to use for any future client interactions. You can easily update or adjust details as needed and ensure consistency across all of your payments requests.

Choosing the Right Format for Your Invoice

When preparing a document to request payment for services or goods provided, the format you choose is crucial for both clarity and professionalism. A well-structured layout can enhance readability and ensure that all necessary details are clearly presented. The right structure not only helps avoid misunderstandings but also reflects your attention to detail and business organization.

Here are some factors to consider when selecting the right structure for your billing document:

1. Simplicity and Clarity

The format should be easy to follow and not overly complex. Overcrowding the document with unnecessary details can confuse your clients. Focus on the essentials such as:

- Business name and contact information

- Client details

- Description of products or services

- Total amount due and payment terms

2. Professional Design

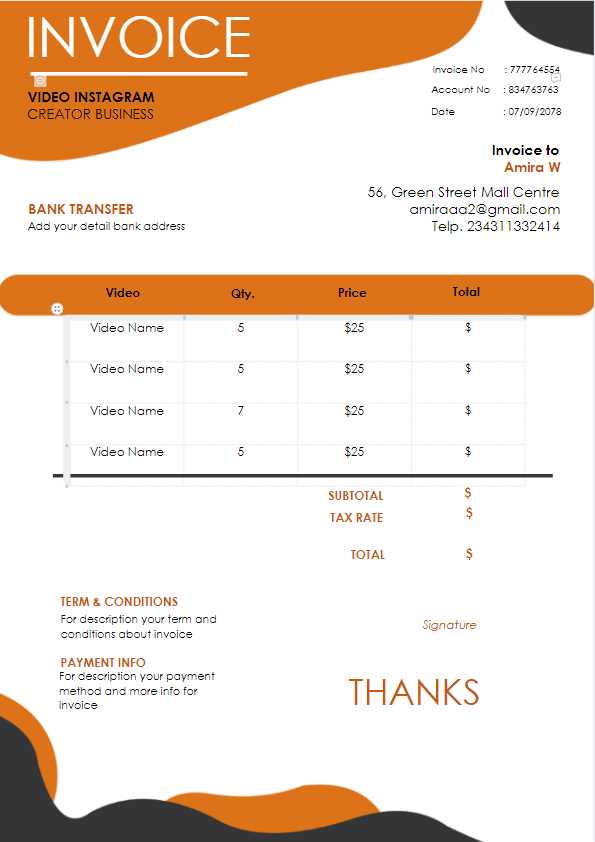

Your format should reflect the professionalism of your business. A clean, organized layout with consistent font styles, proper alignment, and sufficient white space can make a significant difference. A well-structured document helps reinforce your brand’s image. Consider these design elements:

- Logo and branding elements

- Clear headings and section breaks

- Readable fonts and font sizes

- Appropriate use of color (if needed)

Choosing the right layout will not only ensure your clients can easily understand the information, but it will also help you project a more professional and trustworthy image.

Understanding Invoice Elements and Structure

Creating a professional document to request payment involves understanding the essential components that make it both functional and clear. Each section serves a specific purpose, from identifying both parties to detailing the transaction and ensuring the correct amount is paid. A well-organized structure allows for easy reading and ensures that no crucial information is overlooked.

Key Components of Your Billing Document

While the exact layout can vary, there are several critical elements that should always be included. These components help create clarity and transparency for your client. Here’s a breakdown of the most important sections:

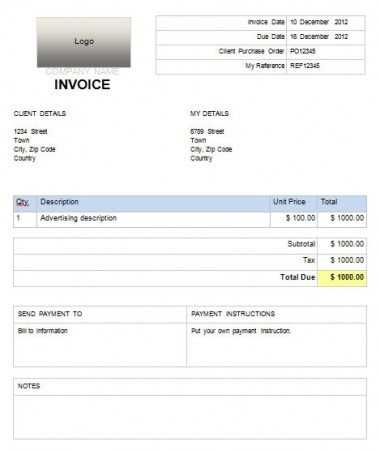

- Header Information – The top section should contain your business name, logo, and contact details. This allows clients to easily identify your company and know how to get in touch if necessary.

- Client Information – Include the client’s name, company name (if applicable), and contact details. This ensures the document is personalized and easily identifiable.

- Unique Identifier – Each document should have a unique reference number. This helps track transactions and avoid confusion, especially when dealing with multiple clients or projects.

- Detailed List of Services or Products – Provide a clear breakdown of what was provided, including quantities, descriptions, and prices. This section should be structured for easy reading, usually in a table format.

- Payment Information – Clearly state the total amount due, including taxes and any additional fees. This section should also include payment terms such as due date, late fees, and acceptable payment methods.

How to Organize the Layout

Organizing these elements in a clear and logical order is crucial for readability and ease of use. The structure should flow logically from the header down to the total amount due. Here’s how to arrange them:

- Start with your business information and the client’s details at the top.

- Follow with the unique reference number and issue date.

- Place the description of goods or services in a table format to allow easy tracking of individual items.

- End with a summary of the amount due, payment terms, and instructions.

By ensuring that each section is clearly defined and logically placed, you create a document that is both professional and easy to navigate. This structure not only aids in efficient transactions but also helps you maintain consistency in your billing process.

Setting Up a Professional Invoice Design

A well-designed billing document not only provides essential information but also enhances your company’s professional image. A clean, organized layout makes a strong impression on clients and can help ensure that payments are processed promptly. The visual appeal of your document plays a key role in how it is perceived and whether it is taken seriously.

1. Choosing a Clean Layout

The structure of your document should be straightforward and easy to follow. Avoid clutter and ensure that all sections are clearly separated. Use lines, boxes, or spacing to differentiate between different parts of the document. A balanced layout with proper alignment ensures that the reader can quickly scan through the necessary information.

- Keep headings bold and clearly separated from the rest of the content.

- Use white space effectively to avoid overcrowding.

- Group related information together, such as client details and service descriptions.

2. Incorporating Your Brand Elements

Your design should reflect your brand’s identity. Incorporating your company logo, brand colors, and consistent fonts can make the document feel more personalized and professional. This helps create a cohesive experience for your clients and strengthens brand recognition.

- Use your logo at the top to make the document easily recognizable.

- Choose colors that align with your brand while maintaining readability.

- Stick to two or three complementary fonts to avoid visual clutter.

By focusing on simplicity and alignment, and integrating your unique brand elements, you can create a polished and professional document that clients will appreciate and trust.

Customizing Invoice Fields for Your Business

Every business has unique needs when it comes to requesting payment for products or services. Customizing the fields of your billing document allows you to tailor it to your specific requirements, ensuring that all necessary information is included and presented clearly. By adapting the fields to your workflow, you can create a more efficient and personalized experience for both you and your clients.

Here are some key areas you may want to customize in your billing document:

1. Adding Specific Service or Product Details

Depending on your business model, you might need to adjust the descriptions or breakdown of the services or goods you offer. This can help clients better understand the value they’re receiving. Consider including the following fields:

- Item/Service Description: Provide a clear description of the service or product.

- Quantity or Hours: Specify the number of items or hours worked, if applicable.

- Unit Price: Include individual prices for each item or service.

- Total Price: Automatically calculate the total cost for each item based on quantity and unit price.

2. Tailoring Payment Terms and Conditions

Clear payment terms help manage client expectations and ensure timely payments. Customize the payment section to reflect your specific policies:

- Due Date: Specify when payment is expected to avoid confusion.

- Late Fees: If applicable, include details about penalties for late payments.

- Accepted Payment Methods: List the methods you accept, such as bank transfer, credit card, or online payment platforms.

- Discounts or Offers: If you offer any discounts or special pricing, make sure this is clearly stated to encourage early payment.

Customizing these fields ensures that your billing document meets the specific needs of your business and provides clear instructions for your clients. The more tailored and organized your document is, the smoother the payment process will be.

Adding Your Business Logo to the Invoice

Incorporating your business logo into your payment documents helps create a professional and cohesive look, reinforcing your brand identity. A well-placed logo not only makes the document easily recognizable but also adds a polished, trustworthy appearance. It communicates to your clients that you take your business seriously and value their trust.

Follow these steps to add your logo to your billing document:

1. Choose the Right Placement

Deciding where to position your logo is essential for maintaining a clean and organized design. The most common placements are:

- Top Left Corner: This is a traditional and professional placement, making your brand easily visible without taking up too much space.

- Top Center: If you want your logo to be the focal point of the document, center it at the top for maximum visibility.

- Top Right Corner: This placement works well if you want to balance your design with other elements, such as client information or a header.

2. Adjust the Size and Quality

Your logo should be large enough to be recognizable but not so big that it overwhelms the other information. Keep the following in mind:

- Maintain High Quality: Ensure that your logo is high resolution so it appears crisp and professional when printed or viewed on-screen.

- Fit the Layout: Adjust the size to suit your document layout without crowding the other fields. A good size will allow the logo to complement the overall design.

3. Ensure Consistency

Once you’ve added your logo, make sure it aligns with your brand’s visual guidelines. Consistency in color, font, and overall design will help your business appear more cohesive and professional. This consistency will also help build brand recognition over time.

By strategically placing your logo and adjusting its size for a balanced design, you enhance the professionalism of your billing documents while reinforcing your business’s identity with every client interaction.

Incorporating Tax and Payment Information

Properly documenting tax and payment information is essential for ensuring transparency in financial transactions. It provides clarity for both you and your clients, avoiding potential misunderstandings about the total amount due. Including detailed tax rates, payment terms, and methods can also streamline the payment process and contribute to smoother business operations.

1. Including Tax Details

Taxes are an important element of any financial document. Including accurate tax information ensures that your client understands the breakdown of charges and helps you maintain compliance with tax regulations. Here’s what you should include:

- Tax Rate: Specify the applicable tax rate for your products or services. This can vary depending on your location and the type of business you operate.

- Tax Amount: Clearly list the amount of tax applied to the total price. Ensure this is easy to spot, often as a separate line item.

- Tax Identification Number: Include your tax ID number if required by law, especially for businesses operating in specific jurisdictions or across borders.

2. Clarifying Payment Terms

Payment terms outline when and how the client is expected to settle the amount due. Providing this information upfront helps manage client expectations and can encourage timely payments. Consider including the following details:

- Due Date: Indicate the exact date by which payment should be made. This could be a fixed number of days after the document is issued or based on a specific calendar date.

- Late Fees: If you charge a penalty for overdue payments, make sure to state the percentage or flat fee and the conditions under which it will apply.

- Accepted Payment Methods: Specify which payment methods you accept (e.g., credit card, bank transfer, PayPal, etc.). This ensures that clients know how to pay and can choose the most convenient method.

Including tax and payment details in a clear and transparent manner helps you maintain professional and straightforward business practices, ensuring that both parties are on the same page when it comes to financial transactions.

Including Terms and Conditions on Invoices

Clear and concise terms and conditions are an essential part of any financial document. These stipulations help protect both parties by outlining expectations, responsibilities, and procedures. Including them ensures that both you and your clients are aware of the agreed-upon policies, which can help prevent disputes and misunderstandings down the line.

1. Payment Terms

One of the most important elements to include is a section dedicated to payment terms. This ensures that clients understand when payments are due and what the consequences are for late payments. Here are the common points to address:

- Payment Due Date: Specify the exact date by which payment should be made or the number of days after the document is issued (e.g., “Due within 30 days”).

- Late Payment Fees: If applicable, mention any penalties for overdue payments, such as a fixed fee or a percentage of the outstanding amount.

- Early Payment Discounts: Offer a discount for early settlement if your business provides such incentives.

2. Refund and Return Policies

If your business deals with products or offers services that may require returns, exchanges, or refunds, include the relevant terms in your document. This sets clear expectations and minimizes confusion. Consider including:

- Refund Policy: State the conditions under which clients can request a refund (e.g., product defects, dissatisfaction, etc.).

- Return Process: Outline any procedures for returning goods or canceling services, including time limits, packaging requirements, and any associated fees.

3. Delivery Terms

In cases where you provide physical products, it’s important to specify delivery details, including who is responsible for shipping costs and how long the delivery will take. Common elements to include are:

- Shipping Costs: Clearly state whether the client is responsible for delivery charges and what shipping methods are available.

- Delivery Timeframe: Specify the expected delivery window, including any possible delays or exceptions.

4. Governing Law and Dispute Resolution

To avoid complications, it’s wise to include a clause outlining the legal jurisdiction that applies should any disputes arise. This could include:

- Jurisdiction: Specify the legal location where any disputes will be handled.

- Dispute Resolution: Indicate whether disputes will be settled via negotiation, arbitration, or legal proceedings.

By incorporating these terms and conditions into your financial documents, you create a clear understanding between your business and your clients, ensuring smoother transactions and reducing the likelihood of misunderstandings or legal issues.

How to Add Payment Instructions in Word

Including clear and concise payment instructions in your billing documents is essential to ensure that your clients know exactly how to settle their outstanding balance. By providing detailed payment information, you minimize the chances of confusion and ensure that transactions are processed smoothly and promptly. Adding these instructions to your document can be done easily, helping you maintain a professional and organized approach to payments.

Follow these steps to add payment instructions to your document:

1. Choose the Right Section for Payment Information

Payment instructions should be clearly visible but not overwhelming. Typically, these instructions are placed towards the bottom of the document, following the breakdown of services or products and total amount due. This placement ensures that clients can easily find the necessary payment details once they have reviewed the rest of the document.

2. Detail the Accepted Payment Methods

Make sure to clearly list all the methods by which clients can pay. Depending on your business model, you may accept a variety of payment options, including:

- Bank Transfer: Provide your bank account number, sort code, and bank name if applicable.

- Credit or Debit Card: Include instructions on how clients can pay via card, whether through an online portal or by phone.

- Online Payment Systems: Specify platforms such as PayPal, Stripe, or others, along with any relevant account details or links.

- Checks: If you accept checks, provide your mailing address and the name to which the check should be made out.

3. Include Payment Deadlines

Be sure to indicate the due date for the payment in a clear and prominent place. This helps set expectations and encourages timely payment. You can also include additional details, such as:

- Late Payment Fees: If you charge a fee for overdue payments, specify the amount or percentage and when it will apply.

- Early Payment Discounts: If applicable, mention any discounts for early payment to incentivize prompt settlement.

4. Provide Contact Information for Payment Queries

If clients have questions or encounter issues with their payment, it’s important to provide them with a way to get in touch. This can include:

- Email: List an email address where clients can reach you for payment-related inquiries.

- Phone Number: Include a contact number for clients who prefer speaking with someone directly.

- Online Chat: If you have an online support system, mention how clients can use it for payment assistance.

By clearly outlining the payment instructions, methods, deadlines, and contact details, you not only make it easier for your clients to settle their accounts but also demonstrate a high level of professionalism and organization in your business operations.

Creating a Simple Layout for Invoices

A well-organized and straightforward design is crucial when preparing a financial document for your clients. A clean layout ensures that important information is easy to read and understand, helping avoid any confusion. By keeping things simple and structured, you enhance the professionalism of your documents while making the payment process clear for your clients.

1. Structure Your Document Clearly

The key to an effective layout is clarity. Focus on grouping related information in distinct sections and use formatting elements like headings, lines, and spacing to keep everything organized. Here’s how to organize the core sections:

- Header: Place your business name, logo, and contact information at the top to make your document easily identifiable.

- Client Information: Below the header, include the client’s name, address, and other relevant details. This personalizes the document.

- Itemized List: Organize services or products in a table format with clear descriptions, quantities, and pricing for easy reference.

- Total Amount: Include a bolded total amount section to highlight the amount due.

- Payment Instructions: Provide details on how to make the payment, including methods, deadlines, and any necessary reference information.

2. Use Simple Design Elements

A simple layout doesn’t need to be dull. Using basic design elements can help enhance readability and create a more professional appearance without overwhelming the reader. Some tips include:

- Bold Headings: Use bold text for section headings to make them stand out and guide the reader through the document.

- Minimalist Color Scheme: Stick to a neutral color palette with one or two accent colors for emphasis. Avoid overusing bright or contrasting colors.

- Consistent Fonts: Use one or two professional fonts throughout the document. Keep fonts legible and avoid using too many different styles.

- Plenty of White Space: Leave enough spacing between sections and text blocks to prevent the layout from feeling crowded.

By focusing on these key elements–clear structure, minimalistic design, and easy-to-read text–you can create a simple, professional, and functional document that ensures all essential details are communicated effectively.

Using Tables to Organize Invoice Data

Organizing financial details in a structured way makes it easier for clients to understand the breakdown of charges and helps ensure that all necessary information is clearly presented. Tables are a great tool for achieving this, as they allow you to neatly display itemized lists, quantities, prices, and totals in a format that is easy to read. By using tables, you can maintain consistency and clarity throughout your document.

1. Structuring Your Data in Tables

Tables allow you to display multiple pieces of related information in rows and columns. This structure makes it simple to present the following details:

- Item Description: Clearly list the products or services being provided with short descriptions.

- Quantity or Hours: Specify how many items were purchased or the number of hours worked.

- Unit Price: Include the cost per unit of the items or services provided.

- Total Price: Show the total price for each item by multiplying the unit price by the quantity or hours worked.

2. Benefits of Using Tables

Incorporating tables into your financial document has several advantages:

- Improved Readability: Tables help separate different types of data, making it easier for clients to read and compare prices.

- Easy Calculations: With a structured layout, you can quickly add up totals for each item and compute the final amount due.

- Consistent Formatting: Tables ensure uniformity in the presentation of information, contributing to a more professional and organized document.

- Time-saving: Once you create a standard table structure, you can reuse it for future documents, reducing the time spent on formatting.

Using tables to organize your financial details not only enhances clarity but also provides a professional, polished appearance. With a well-structured table, your clients can easily review the charges and understand the breakdown of costs, contributing to smoother transactions.

Saving and Reusing Your Invoice Template

Once you’ve designed a professional document for billing purposes, it’s important to save and reuse it efficiently for future transactions. By saving your document as a reusable file, you can avoid the need to start from scratch every time. This streamlines your workflow, saves time, and ensures consistency in your documents.

1. Saving Your Document for Future Use

To save your billing document as a reusable file, follow these steps:

- Save as a Master File: Save the document with placeholders for details like client name, dates, and item descriptions. This way, you only need to update the necessary fields for each new client.

- Use Different Formats: Save the document in various formats, such as DOCX for editing and PDF for sharing. The DOCX format allows easy customization, while PDF ensures a consistent layout when shared with clients.

- Organize Your Files: Keep your saved documents organized in folders, labeled by client or project, for easy access when needed.

2. Reusing Your Document for New Clients

When creating a new document for a client, you don’t need to redesign it. Instead, simply open your saved file and modify the necessary fields:

- Update Client Information: Replace the placeholders with the client’s name, address, and any other relevant details.

- Adjust the Items or Services: Modify the list of products or services, updating quantities, prices, and descriptions as required.

- Change Dates and Amounts: Update the billing date, due date, and any total amounts based on the new transaction.

3. Example of a Simple Layout

Here is an example of how the structure of your document might look, with placeholders for easy editing:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product/Service Name | 1 | $X.XX | $X.XX |

| Additional Item | 2 | $X.XX | $X.XX |

| Total Amount Due | $X.XX | ||

By reusing the layout and simply updating the necessary fields, you can save time while maintaining consistency across all your client transactions.

How to Update and Edit Invoice Templates

Once you have a standardized document set up for billing, it’s important to keep it up to date and make adjustments as your business evolves. Whether you need to update your contact information, change the payment terms, or add new services or products, being able to quickly modify your document is essential for ongoing efficiency. Below are some guidelines to help you easily edit and update your financial documents as needed.

1. Make Necessary Changes to Business Information

As your business grows or changes, some details in your document may need to be updated. For example, if you change your company address, email, or phone number, it’s important to modify these fields to reflect the most current information. Here’s how you can handle these updates:

- Business Name and Contact Info: Update your business name, logo, address, phone number, and email. Ensure this information is at the top of the document for easy access.

- Tax Rates and Legal Requirements: If tax rates or other legal requirements change, be sure to modify the appropriate sections to comply with new regulations.

2. Edit Line Items and Pricing Details

One of the main reasons to update your document is to reflect changes in pricing or services offered. Editing the line items allows you to accurately represent the products or services you’re billing for. Here’s how to update these sections:

- Adding New Services or Products: If you have introduced new offerings, simply add them to the list, including the description, price, and quantity.

- Adjusting Prices: If the cost of an item or service has changed, update the unit price and ensure the total amount reflects the new rate.

- Changing Payment Terms: If your payment policies or due dates have been adjusted, be sure to revise the corresponding section to provide the correct information.

3. Maintaining Consistency and Formatting

When making updates, it’s important to ensure the layout and formatting remain consistent. This helps maintain a professional appearance and makes the document easy to read. Consider the following:

- Font and Style Consistency: Make sure that font types, sizes, and styles are consistent throughout the document for a polished look.

- Spacing and Alignment: Ensure that the spacing between sections and rows is even and that text is properly aligned to maintain clarity.

Regularly updating and editing your financial docume

Sharing Your Invoice Template with Clients

Once your billing document is prepared, sharing it with clients efficiently is crucial for a smooth transaction process. Whether through email, an online portal, or physical mail, it’s important to ensure that the document reaches the client securely and in a format that is easy for them to read and process. By choosing the right method and format, you can maintain professionalism and ensure your client receives all necessary information promptly.

1. Choosing the Best Format for Sharing

When sharing your billing document, consider the most suitable format for both you and your client. The format should make it easy for the client to view, print, or store the document. Here are some common formats:

- PDF Format: This is the most widely used format for sharing business documents as it preserves the layout and can be opened on any device without altering the design. PDFs are ideal for sending professional, finalized copies that cannot be easily altered.

- Editable DOCX: If the client needs to modify certain fields, such as quantities or descriptions, sending the document in an editable format like DOCX allows them to make changes easily. Be mindful to only share this version with trusted clients.

- Online Links: If you use an invoicing software or an online portal, you may prefer to share a direct link to the document, allowing clients to access and download it directly from the cloud.

2. Methods of Sharing Your Document

How you share your billing document depends on your relationship with the client and their preferences. Here are some common methods:

- Email: The most common method, simply attach the document in your chosen format to an email. Be sure to include a clear subject line and brief explanation in the email body.

- File Sharing Services: Use file-sharing platforms like Google Drive, Dropbox, or OneDrive to share large or multiple files securely. You can provide a link to the client, and they can download the document at their convenience.

- Postal Mail: For clients who prefer hard copies, you can print the document and send it through traditional postal services. This method is often used for high-value transactions or clients who specifically request physical documents.

3. Sending Reminders and Follow-ups

Once the document is shared, it’s important to follow up to ensure the client has received it and is clear on the payment terms. Sending a polite reminder can help encourage timely payments. Be sure to:

- Confirm Receipt: After sending the document, consider following up to ensure that the client has received the document without issues.

- Provide a Contact Point: Offer an email address or phone number in case the client has any questions or issues regarding the details in the document.

By selecting the right format and sharing method, you can ensure that your billing process is streamline

Formatting for Print and Digital Invoices

When creating a billing document, it’s essential to consider how it will be viewed and used. A document that is optimized for digital viewing may need adjustments to ensure it prints clearly. Conversely, a print version must have the right layout to ensure that all information fits neatly on paper. Proper formatting ensures that your document is both professional and functional, regardless of how it’s accessed.

1. Formatting for Digital Use

Digital documents are often viewed on screens, which means certain formatting choices should be made to enhance readability on various devices. Here are some tips for optimizing your document for digital viewing:

- Use Clear Fonts: Choose simple and legible fonts like Arial, Helvetica, or Calibri. Avoid overly decorative fonts that can be difficult to read on screens.

- Optimize for Screen Sizes: Ensure that text and images are scalable so that the document displays correctly on different screen sizes, from desktops to mobile phones.

- Ensure Document Accessibility: Make sure the document is easy to read by avoiding dense blocks of text. Include plenty of white space and break information into logical sections.

- Use Hyperlinks for Digital Payments: If applicable, include clickable links to make it easier for clients to pay directly online.

2. Formatting for Print Versions

When preparing a document for printing, ensure it’s designed to fit neatly on standard paper sizes (such as A4 or letter size). Here are key considerations for print formatting:

- Margins and Spacing: Leave sufficient space around the edges to prevent any content from being cut off when printed. Make sure there’s enough space between sections so the document doesn’t look crowded.

- High-Quality Images: If you’re including your company logo or other images, ensure they are high resolution so that they print clearly without pixelation.

- Consistent Alignment: Align text and tables in a uniform manner. This improves the document’s professionalism and readability.

- Printing in Black and White: While color can enhance the design, ensure that your document still looks professional in black and white, especially if clients might print it on monochrome printers.

By keeping these digital and print formatting guidelines in mind, you can ensure that your billing document is effective, whether viewed on a screen or printed out. The right formatting enhances the document’s readability, making it easier for clients to process and understand the details you provide.

Ensuring Invoice Compliance and Accuracy

Creating a document for billing purposes requires careful attention to detail to ensure compliance with legal requirements and accuracy in the information presented. A well-prepared document helps avoid disputes, reduces the likelihood of errors, and ensures that both you and your clients are on the same page regarding terms and payments. This section outlines key strategies for ensuring your billing records are correct and comply with regulations.

1. Verify Legal and Tax Requirements

Each region may have specific legal or tax requirements that must be reflected in your billing document. Whether it’s including tax identification numbers or ensuring compliance with VAT regulations, it’s important to stay informed about local laws and adjust your document accordingly. Key elements to consider include:

- Tax Identification Number (TIN): Ensure that your TIN or VAT number is included, as it is often a legal requirement for businesses in many regions.

- Tax Rates: Double-check tax rates based on the current laws in your jurisdiction. Include appropriate tax percentages and calculations.

- Legal Terms: Depending on the location, certain terms, like payment due dates and penalty clauses, might be mandatory for inclusion.

2. Check for Accuracy in All Fields

Ensuring the accuracy of the details in your billing document is crucial for maintaining trust and professionalism. Inaccuracies, even small ones, can lead to delays in payment or confusion. To ensure accuracy:

- Client Information: Always verify the client’s name, address, and contact details before finalizing the document.

- Item Descriptions and Quantities: Check that each product or service is correctly described, the quantities are accurate, and the pricing reflects the agreed terms.

- Payment Details: Double-check the payment terms, due dates, and the total amount due, ensuring that no errors have been made in calculations.

3. Example of Accurate Billing Details

Here is a sample layout with critical fields that must be filled out carefully to ensure accuracy:

| Item Description | Quantity | Unit Price | Tax Rate | Total |

|---|---|---|---|---|

| Service/Product 1 | 2 | $50.00 | 8% | $108.00 |

| Service/Product 2 | 1 | $100.00 | 8% | $108.00 |

| Total Amount Due | $216.00 | |||

By reviewing these fields carefully and ensuring that all necessary information is accurate and compliant, you can avoid costly mistakes and maintain a professional image. Regularly checking and updating your billing documents will help to maintain compliance with legal standards and ensure smooth transactions with your clients.

Tips for Creating Invoice Templates Quickly

When you need to prepare a billing document quickly, it’s important to streamline the process without sacrificing quality or accuracy. By setting up a consistent structure, utilizing available tools, and adopting efficient strategies, you can create professional documents in less time. This section provides tips for speeding up the creation process while ensuring the document remains clear, comprehensive, and compliant.

1. Use Predefined Structures

Starting with a predefined layout can significantly save time. Instead of designing a document from scratch, consider using a pre-existing format with fields for all the essential information. Most document editing software offers templates that can be customized to fit your needs. Here’s how you can speed up your workflow:

- Choose a Simple Layout: Select a layout with clear sections such as billing information, item descriptions, total amounts, and payment terms. This ensures that you don’t waste time deciding on the structure each time you create a new document.

- Fill In Standard Information: If you frequently deal with the same clients or provide similar services, store your company details and common descriptions in a reusable format. This minimizes the amount of manual input.

- Use Predefined Calculations: If you need to include totals, taxes, or discounts, set up basic formulas in the document to automatically calculate these figures, saving time on manual entry.

2. Utilize Automation and Tools

There are several tools and resources that can help automate and streamline the document creation process:

- Document Editing Software: Use built-in features in tools like Microsoft Office or Google Docs to create reusable billing formats. These platforms often include options for saving and reusing templates, enabling quick document generation.

- Online Invoice Generators: If you need to generate invoices quickly, there are numerous online tools that can automatically create documents based on input fields. These tools usually include pre-built layouts, saving you time on formatting and design.

- Save Templates for Future Use: Once you create a layout that works, save it as a master document. This will allow you to quickly adjust the details for future uses without starting from scratch.

3. Keep the Process Efficient

Efficient document creation is not just about the right tools but also about setting up a process that minimizes distractions and unnecessary steps:

- Standardize Information: Use consistent terms, prices, and descriptions to avoid the need to repeatedly enter the same details. A consistent approach also makes the documents look more professional and organized.

- Limit Customization: Customize only the essential fields–like client name, dates, and amounts–while keeping the rest of the document unchang

Why Use Word for Invoice Templates

Using a document creation program for billing purposes offers several advantages. It provides a simple yet powerful way to create and customize documents, making it easy to produce professional-looking records without requiring specialized software. The flexibility of such programs allows users to quickly adjust the layout, include all necessary details, and ensure that documents are compatible with both digital and print formats. Here are some reasons why this approach is popular for managing billing documentation.

One of the key benefits is the accessibility and familiarity of the software. Most businesses and individuals are already comfortable using these types of programs, which minimizes the learning curve and allows for quick adoption. Additionally, these platforms offer a wide range of design and formatting options, giving users full control over the appearance of their documents while maintaining a polished and professional look.

Another important aspect is the ease of sharing and storing documents. Files created in such programs are easily shared via email, stored in cloud services, or printed when needed. This ensures seamless communication with clients and record-keeping without the need for additional software or complicated processes.