How to Make an Invoice Template for Your Business

For any business, having a structured and reliable way to request payments is essential. A well-organized billing document not only ensures timely compensation but also reflects professionalism and attention to detail. By establishing a clear and consistent format, you make transactions easier for both you and your clients.

Designing your own billing form allows you to customize it to fit your specific needs, whether you’re a freelancer, a small business owner, or part of a larger enterprise. The right approach can help streamline the process and make it more efficient. A personalized format also enhances brand identity, making each interaction with clients more consistent and polished.

In this guide, we’ll walk you through the necessary steps to create a custom billing sheet. We’ll focus on the key components, customization options, and tips for ensuring accuracy and clarity in your financial requests. Whether you’re starting from scratch or refining an existing model, you’ll find useful strategies to build a system that works for your business.

How to Design an Invoice Template

Creating a well-structured document for requesting payments is a critical task for any business. A clear, professional layout ensures that all necessary information is presented in an organized and easily understandable way. Whether you are designing from scratch or modifying an existing document, focusing on simplicity and clarity is key to making the process efficient for both you and your clients.

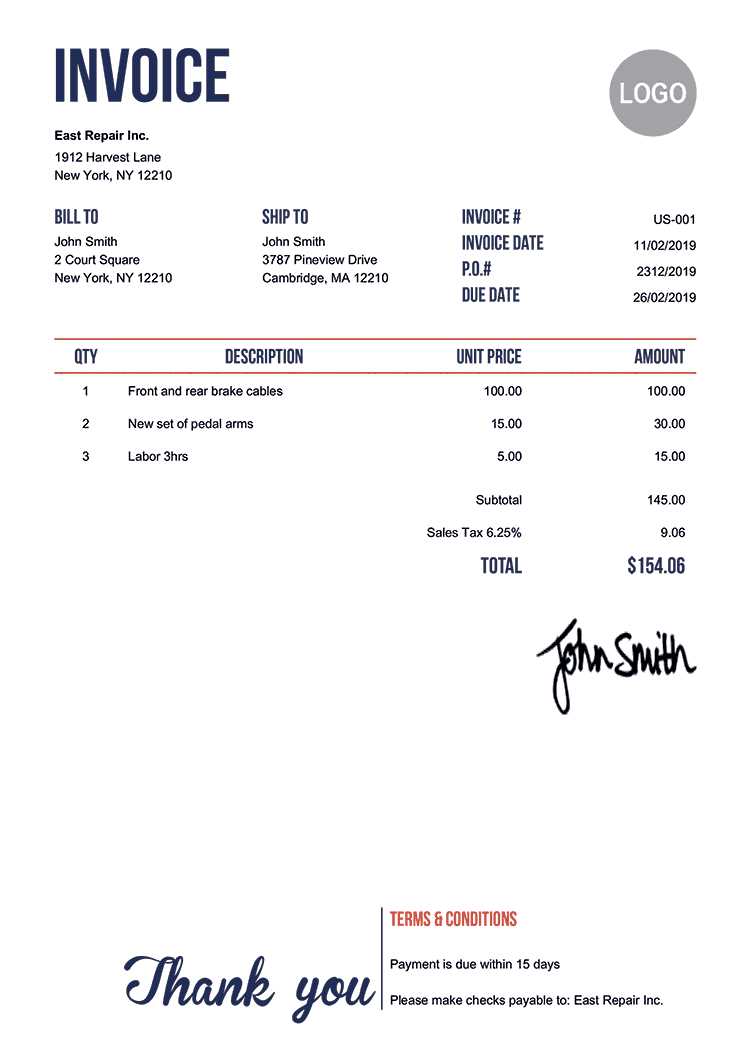

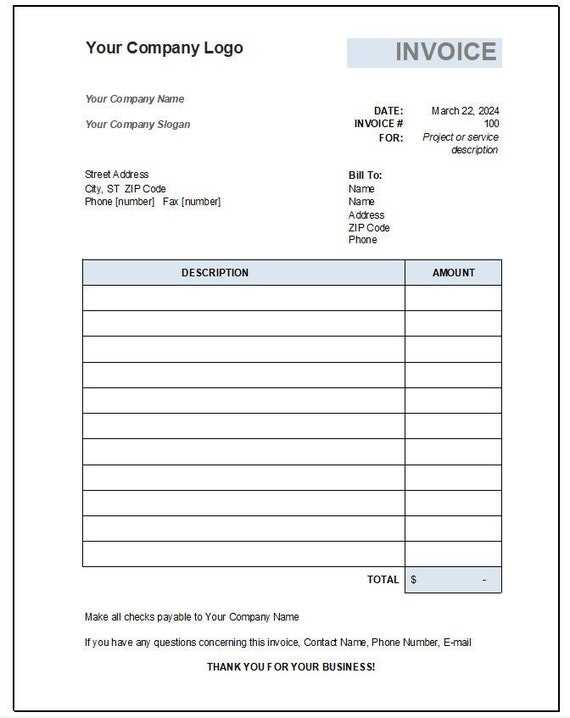

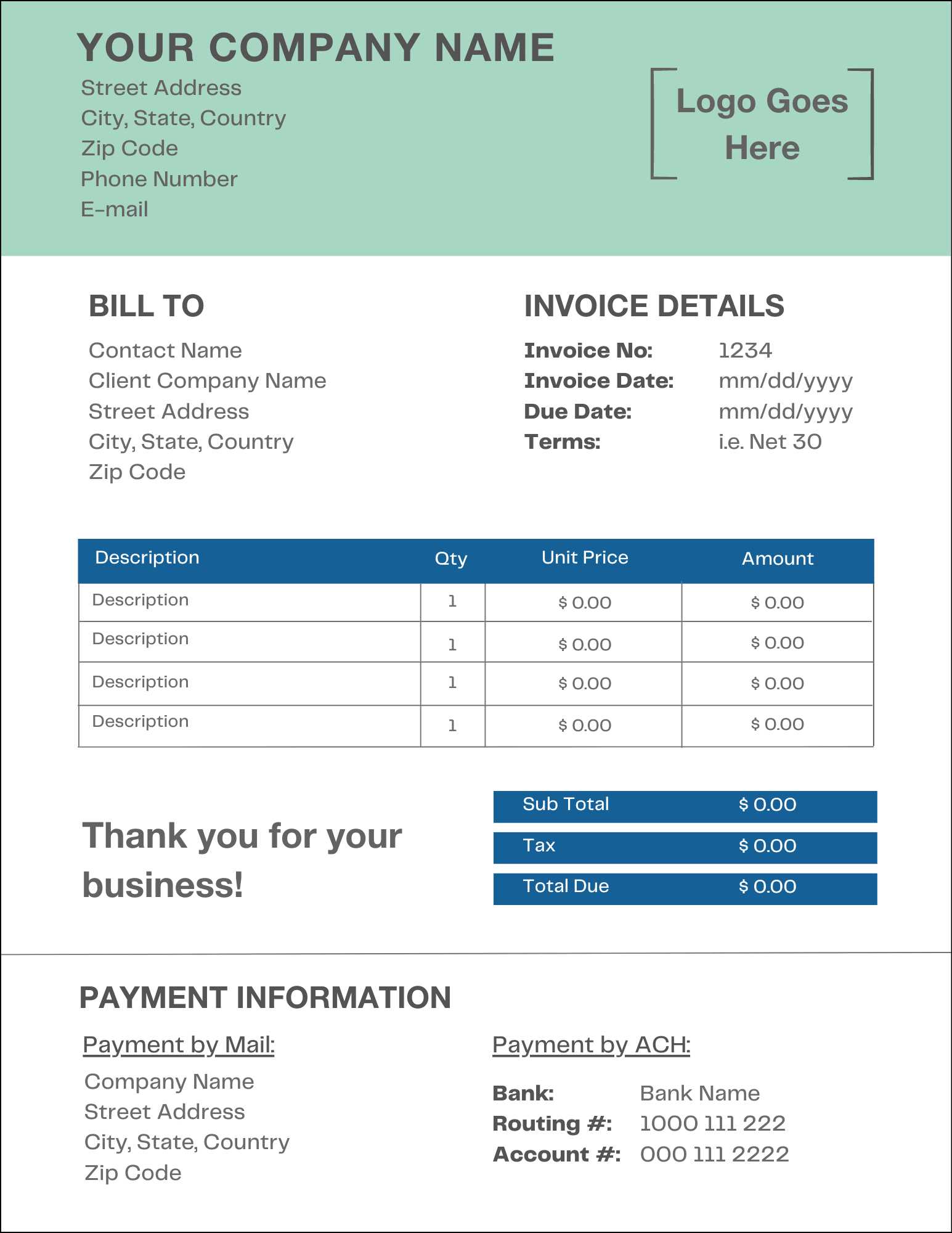

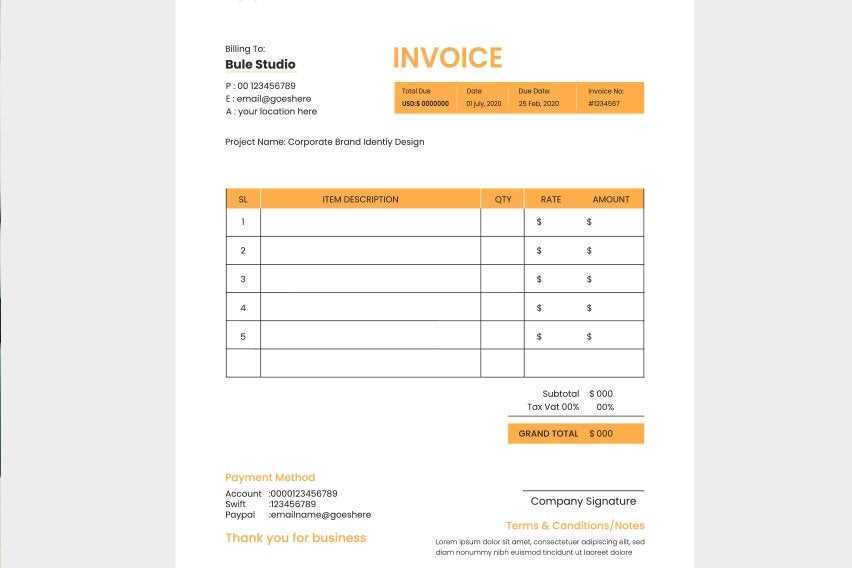

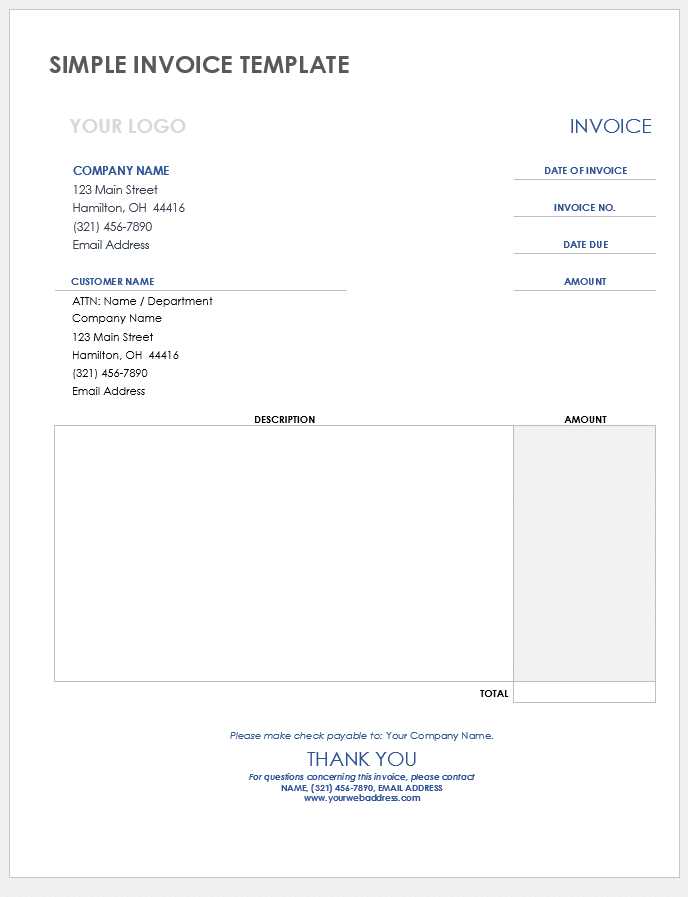

Start by considering the essential components that should appear on the document. These include your business details, client information, a unique reference number, the list of goods or services provided, payment terms, and any applicable taxes or discounts. Each element should be presented in a way that is easy to read and quick to find, as this promotes smooth communication and prevents confusion.

Next, pay attention to the overall visual layout. Use a clean, consistent font, and make sure the document is balanced and not overcrowded with text. Ensure there is enough white space to keep everything legible. Adding your logo and brand colors is a great way to personalize the document and maintain a professional appearance. Consider including a footer with payment instructions or additional contact information.

Lastly, it’s important to test the document before using it regularly. Make sure that all fields are correctly aligned, the content is accurate, and the document prints well on both digital and physical formats. This final review will help avoid any issues when sending the billing request to clients and ensure that everything is clear and professional.

Choose the Right Invoice Format

Selecting the correct format for your billing document is crucial to ensure it meets both your business needs and client expectations. The right structure not only helps maintain professionalism but also simplifies the payment process. Whether you need something simple or more detailed, finding the ideal layout will streamline your operations and reduce errors.

Consider Your Business Type

The format you choose should align with the nature of your business. If you provide ongoing services, a recurring billing structure might be appropriate, while project-based businesses could benefit from a more detailed breakdown of charges. For freelancers, a straightforward design with clear payment terms is often sufficient. Assess your specific requirements to determine the level of complexity needed.

Evaluate Digital vs. Paper Options

In today’s digital world, many businesses opt for electronic versions of their billing forms. Digital formats are easier to store, share, and track, offering both convenience and speed. However, certain clients may still prefer printed documents, especially for legal or formal reasons. It’s important to choose a format that works well for both online and offline use to ensure versatility.

Understanding Key Invoice Elements

To create a functional and professional billing document, it’s essential to include the right information in a clear and organized manner. Each element plays a vital role in ensuring that both you and your client understand the terms and details of the transaction. By incorporating the following key components, you can create a comprehensive and effective billing form.

- Business Information: Include your company name, address, phone number, and email. This helps clients easily identify the source of the document and reach out if needed.

- Client Information: Clearly state the client’s name, address, and contact details to ensure accurate communication and delivery of the request.

- Unique Reference Number: Assign a unique identification number to each document to help track payments and avoid confusion in future communications.

- Details of Products or Services: Provide a detailed list of items or services rendered, including descriptions, quantities, and prices. This section should be clear and easy to read.

- Payment Terms: Specify the payment due date and any terms, such as late fees or discounts for early payment. Clear terms ensure both parties are aligned on expectations.

- Taxes and Additional Charges: If applicable, include any tax rates or extra fees (e.g., shipping) to provide full transparency on the total cost.

By including these essential elements in your document, you create a clear and concise record that reduces the chance of misunderstandings and ensures smooth payment processing.

Customizing Your Invoice for Branding

Customizing your billing document to reflect your brand identity is a powerful way to strengthen your business image. By incorporating your company’s logo, colors, and fonts, you create a cohesive and professional appearance that helps clients recognize your business instantly. A well-branded document also builds trust and reinforces your brand’s values and aesthetic.

Here are a few key ways to personalize your document:

| Element | Customization Tip |

|---|---|

| Logo | Place your business logo at the top of the document, preferably in the header section. This creates immediate brand recognition. |

| Color Scheme | Use your brand’s primary colors for the text, borders, and headings. This creates a cohesive look that aligns with your marketing materials. |

| Font Choice | Choose fonts that match your business’s style. Ensure they are legible and professional, keeping in mind that simplicity often works best. |

| Footer Information | Include your business’s contact details and website in the footer, reinforcing your brand presence and making it easy for clients to reach you. |

By personalizing these elements, you ensure that each billing document reflects your unique brand, setting the tone for your client relationships and presenting your business as trustworthy and professional.

Incorporating Payment Terms Effectively

Clearly defining payment terms in your billing document is essential to avoid confusion and ensure timely transactions. Well-structured terms set clear expectations for both you and your clients, reducing the likelihood of delayed payments or misunderstandings. Including specific details on payment deadlines, late fees, and acceptable methods of payment is critical for a smooth financial relationship.

Specify the Payment Due Date

Make sure to clearly state the payment due date in a prominent location, such as at the top or near the total amount section. This helps clients quickly identify when the payment is expected, eliminating ambiguity. If applicable, mention any grace periods or deadlines for early payment discounts to incentivize prompt settlement.

Include Late Fees and Penalties

To encourage timely payments, it is important to outline any late fees or penalties that will apply if the payment is not made on time. Be specific about the amount or percentage added after a certain period and how it will be calculated. Clearly communicating these terms ensures clients understand the consequences of delayed payments and promotes accountability.

Incorporating these details effectively ensures that your billing process remains smooth and professional, while also protecting your cash flow and fostering positive client relationships.

Adding Invoice Numbers for Organization

Assigning unique reference numbers to each billing document is an essential practice for maintaining organization and clarity. These numbers serve as identifiers that make it easier to track payments, organize records, and manage your financial documents. Without a proper numbering system, it can become difficult to maintain an efficient workflow and quickly locate specific records when needed.

Sequential numbering is the most common method used, where each document is assigned a consecutive number. This approach creates a simple and systematic structure for your records. It’s also helpful for referencing past transactions and ensuring that no documents are overlooked or duplicated.

Additionally, you can include year or month prefixes to further categorize your documents. For example, using a format like “2024-001” or “APR-001” not only helps identify the year or period but also adds an extra layer of organization. This practice is especially useful for businesses that deal with a high volume of transactions, ensuring each document is easily traceable and sorted.

By incorporating a clear and consistent numbering system, you simplify both your internal record-keeping and communication with clients, ensuring your business runs more smoothly.

Including Client Information Properly

Accurate and complete client information is a crucial element of any billing document. It ensures that the right person or organization receives the request and helps avoid any confusion when processing payments. Providing clear contact details, along with the correct address, helps maintain a professional relationship and makes it easier to follow up on outstanding payments.

Start by including the client’s full name or business name at the top of the document. This should be clearly distinguished from other sections, making it easy to identify who the bill is directed to. Follow this with the complete billing address, including street, city, state, and ZIP code, to ensure the information is accurate for postal services or future correspondence.

In addition to basic contact details, include phone numbers and email addresses if possible. These allow for quick communication should any issues arise. If your business works with multiple departments or key contacts, be sure to specify the correct individual or department responsible for handling payments.

By ensuring that all client information is accurately entered and up-to-date, you minimize the risk of delays and demonstrate professionalism in all financial communications.

Using Date and Due Date Fields

Including date-related fields in your billing documents is essential for clear communication and timely payment. By specifying both the issue date and due date, you provide your client with the exact timeline for when the payment is expected, reducing confusion and improving cash flow management.

Importance of the Issue Date

The issue date is the day when the billing request is generated. This date serves as a reference point for tracking payment deadlines and can be used for future reference if questions or disputes arise. It is critical that the issue date is clearly visible and formatted correctly.

- It helps establish the timeline for payment.

- It assists in organizing your financial records.

- It serves as a starting point for any late fees or payment terms.

Setting the Due Date Clearly

The due date is when the payment should be completed. This field is crucial for both the sender and recipient to avoid misunderstandings. It ensures that both parties are on the same page regarding payment expectations.

- Be specific about the number of days for payment (e.g., “Due within 30 days”).

- If there is flexibility, include any grace periods or early payment incentives.

- Highlight the due date to make it stand out and avoid overlooking it.

Clearly defining these dates ensures that the payment process is straightforward and organized, benefiting both your business and your client.

How to Set Up Tax Information

Including accurate tax details in your billing documents is essential for compliance and transparency. Taxes can vary depending on the location, type of service, or product, and it’s important to present this information clearly to avoid confusion. Properly setting up tax fields ensures that clients understand the full cost of their purchases and helps maintain legal and financial accuracy.

Start by identifying the relevant tax rate(s) for your product or service. This can include local, state, or federal taxes, depending on your region. Be sure to specify whether the tax is included in the listed price or added separately. If applicable, include multiple tax rates (e.g., sales tax and VAT) to cover all relevant charges.

Displaying tax breakdowns is also critical. List the exact tax amount, calculated as a percentage of the subtotal, alongside the total cost. This breakdown helps your client see how much of the total charge is attributed to taxes, ensuring transparency.

If your business offers tax-exempt sales or special rates for certain clients (such as nonprofit organizations), make sure to include this information as well. Clearly note any exemptions or reductions, along with the specific reason, to avoid confusion.

By properly setting up tax information, you not only ensure accuracy in billing but also enhance trust with your clients, as they’ll have a clear understanding of their payment obligations.

Integrating Discounts and Shipping Fees

Including discounts and shipping fees in your billing documents is essential for presenting a complete and transparent breakdown of the final amount due. Properly listing these elements ensures that your client clearly understands the full cost of the transaction, including any reductions applied or additional charges for delivery. Transparency in these areas can prevent confusion and foster positive client relationships.

Applying Discounts

Discounts can be a valuable way to incentivize early payment, reward loyal customers, or promote sales. When incorporating discounts, it’s important to state the amount or percentage off the total price clearly and provide a reason for the discount if applicable. This could include promotional offers, bulk discounts, or seasonal sales.

| Discount Type | Description | Amount/Percentage |

|---|---|---|

| Early Payment Discount | Offered if the payment is made before a certain date | 5% off total |

| Volume Discount | Discount based on the quantity purchased | 10% off for 100+ units |

Including Shipping Fees

If your products require shipping, be sure to include the shipping cost in the billing document. Specify whether the shipping fee is flat-rate or calculated based on distance, weight, or other factors. Clearly list the fee so that your client is aware of the additional cost upfront.

| Shipping Type | Cost |

|---|---|

| Standard Shipping | $10.00 |

| Express Shipping | $25.00 |

Including these charges and discounts clearly will help avoid confusion and ensure that your client understands the final amount to be paid, leading to smoother transactions and better customer satisfaction.

Creating a Professional Look for Invoices

Presenting a polished and professional appearance in your billing documents is essential for leaving a positive impression on your clients. A well-designed document not only ensures clarity but also reinforces your business’s credibility. A clean, organized, and visually appealing layout can make your document stand out and convey that you are detail-oriented and serious about your work.

To achieve a professional look, start by maintaining a consistent layout throughout. Use a simple, easy-to-read font and make sure the sections are logically arranged. The client’s information, the list of items or services, and payment terms should be clearly separated for easy reference. Avoid clutter by using adequate spacing between sections and text, ensuring the document is easy to follow.

Incorporating your brand identity can further elevate the look. Use your company’s logo, brand colors, and fonts to create a cohesive design that reflects your business’s image. This adds a personal touch and reinforces brand recognition, making your documents immediately identifiable as coming from your company.

Lastly, ensure that your document is visually balanced. Align text and numbers correctly, and use bold or underlined text sparingly to highlight important details, such as the total amount due or payment due date. A well-structured document is not only easier to read but also communicates a sense of professionalism and trustworthiness.

Choosing the Right Invoice Software

Selecting the right software for generating billing documents is a critical decision for any business. The right tool can streamline your accounting process, reduce errors, and save time. With many options available, it’s important to consider features, ease of use, and compatibility with your existing systems before making a choice.

Key Features to Look For

When choosing the appropriate software, ensure it includes essential features like customizable templates, automatic calculations, and the ability to track payments. Look for tools that allow you to create professional, branded documents quickly and easily. Additionally, software that supports tax calculations, multiple currencies, and recurring billing can be beneficial for businesses with complex billing needs.

Ease of Use and Support

While functionality is important, the software should also be easy to use. An intuitive interface allows you to create and send billing documents without a steep learning curve. Additionally, consider customer support and available tutorials, especially if you’re new to using accounting software. Cloud-based solutions can also be beneficial for accessing your documents from anywhere and ensuring data security.

Choosing the right billing software can significantly improve your efficiency and accuracy, making it easier to focus on growing your business while ensuring timely payments.

Saving and Sharing Your Invoice Template

Once you’ve created your billing document, it’s essential to save it in a format that ensures consistency and can be easily shared with clients. Storing your document in the right format and knowing how to distribute it efficiently can streamline your workflow and ensure that your clients receive their requests promptly and professionally.

Choosing the Right Format

The format you choose for saving your document can affect both its accessibility and presentation. Common formats include PDF and Word, but each has its pros and cons depending on your needs. PDFs are ideal for preserving the layout and preventing alterations, while Word documents are easier to edit for future revisions.

| Format | Advantages | Disadvantages |

|---|---|---|

| Fixed format, easy to share, prevents edits | Cannot be easily edited without special tools | |

| Word | Editable, simple to customize | Can be altered, might not preserve layout on all devices |

Sharing Your Document Efficiently

Once saved, the next step is sharing your billing document with clients. The most common method is via email, where you can attach the document and ensure a quick and direct transfer. If you’re dealing with multiple clients or need to automate the process, consider using a cloud-based platform or invoicing software that allows for easy online sharing, tracking, and management.

By saving and sharing your documents properly, you not only ensure a professional appearance but also improve your efficiency in managing and processing transactions.

Ensuring Legal Compliance in Invoices

It is essential that every billing document you issue complies with the legal requirements of your jurisdiction. Failure to do so could lead to penalties, delayed payments, or disputes with clients. Ensuring that your documents contain the correct legal details not only protects your business but also promotes trust and professionalism with your clients.

Required Legal Information

There are several key elements that must be included in your billing documents to ensure compliance. These elements may vary depending on your location, industry, and the specific type of transaction. Below are some of the most common requirements:

| Element | Description |

|---|---|

| Tax Identification Number (TIN) | Your business’s unique identification number issued by the tax authorities. |

| Business Name and Address | Legal name and physical address of your company. |

| Client Information | Complete details of the client, including their name and address. |

| Transaction Details | Clear description of the services or goods provided, including quantities and prices. |

| Tax Information | Applicable tax rates and tax amount charged (if required by law). |

| Payment Terms | Due dates and any penalties for late payments (if applicable). |

Regional Compliance and Standards

Different regions may have additional rules that must be followed when preparing billing documents. For instance, certain countries may require VAT numbers for international transactions, while others may have specific requirements for small businesses. It’s important to familiarize yourself with the local legal framework, and, when necessary, consult with a tax advisor or legal expert to ensure that your documents meet all requirements.

By ensuring that your documents comply with local regulations, you minimize risks and maintain a professional reputation in the eyes of your clients and tax authorities.

Best Practices for Invoice Layout

A well-structured and clean layout is key to creating a billing document that is both professional and easy to read. A clear design not only helps ensure that all essential details are visible but also enhances the overall user experience, making it easier for clients to understand the charges and due dates. Following best practices for layout can streamline communication and reduce confusion.

Key Design Principles

When designing your billing document, prioritize clarity, consistency, and simplicity. Here are some important design principles to consider:

- Use a clear hierarchy: Ensure that the most important information, such as the total amount due and payment terms, stands out. This can be achieved through larger fonts, bold text, or distinct section headings.

- Consistent alignment: Align text, numbers, and columns neatly to create a well-organized appearance. This improves readability and ensures that the client can quickly find the information they need.

- Avoid clutter: Keep the document clean and uncluttered. Use enough white space between sections and items to make the content easy to follow. Avoid overcrowding the document with too much information or unnecessary graphics.

- Legible fonts: Choose fonts that are easy to read, such as Arial, Helvetica, or Times New Roman. Use no more than two fonts: one for headings and another for body text.

- Logical flow: Present information in a logical order: business details, client information, a list of goods or services, the amount due, and payment instructions.

Sections to Include in the Layout

Make sure to break down your document into clearly defined sections to guide the reader’s eye. Below are the key areas that should be organized for easy comprehension:

- Header: Includes your business name, contact details, and logo. Also, include the document title and issue date here.

- Client Information: Clearly list the client’s name, address, and contact details.

- Line Items: A detailed list of products or services provided, with quantities, rates, and subtotals clearly displayed.

- Tax and Discounts: If applicable, show taxes and any discounts separately, with clear explanations.

- Total Amount: Make the total amount due prominent by using bold text or a larger font size.

- Footer: Include payment terms, methods, and any additional notes (e.g., late fees or special instructions). Provide your bank details or preferred payment channels if necessary.

By following these best practices, you can create a billing document that not only looks professional but also ensures that your clients can easily understand all the relevant information.

Tips for Streamlining Invoice Creation

Creating billing documents can be a time-consuming task, but by adopting certain strategies, you can significantly reduce the effort and time required. Streamlining this process not only boosts productivity but also minimizes errors, ensuring that your clients receive accurate and professional documents without delays.

One of the most effective ways to streamline the process is by using automated tools and pre-built layouts. These tools can save you from manually entering the same information over and over again. Additionally, setting up standard templates with all necessary fields can make creating new documents faster and more efficient.

Automate Repetitive Tasks

Using invoicing software or tools that allow automation can save valuable time. Look for features that automatically populate fields such as your business details, tax rates, and common service descriptions. Some software can also track payments, send reminders, and generate reports, which can help reduce the administrative burden.

- Set up recurring billing: If you have clients on subscription or contract-based pricing, set up automated recurring invoices to eliminate the need to manually create new ones each billing cycle.

- Use saved client profiles: Save your clients’ information once, and it will be automatically filled in each time you create a new document for them.

- Predefine payment terms: Save common payment terms (such as net 30 or 15 days) for quick selection without re-entering the same data every time.

Organize and Store Data Efficiently

By keeping your billing data organized, you can speed up the creation process. Store all necessary information–such as client contact details, pricing structures, and payment terms–in a centralized location. This can be a CRM system, cloud storage, or invoicing platform, which allows for quick access when needed.

- Keep a list of services: Having a pre-defined catalog of services and products, including prices, can save time when entering line items on a new document.

- Track previous documents: Always keep a copy of past documents for reference. This helps you easily replicate common elements, such as item descriptions or payment terms, and maintain consistency.

By automating repetitive tasks and organizing your information efficiently, you can speed up the creation of billing documents, reduce errors, and maintain a high level of professionalism in your business.