Mac Invoice Template Excel for Easy and Professional Invoicing

In today’s fast-paced business environment, managing payments and tracking financial transactions is essential for smooth operations. Whether you are a freelancer, small business owner, or part of a larger organization, having a streamlined method to create and manage financial documents can save valuable time. The right tools can automate calculations, organize records, and provide a professional look for your financial reports.

Advanced solutions allow you to customize documents according to your specific needs, making it easier to add details, adjust pricing, or apply discounts. With the ability to instantly generate well-structured reports, you can enhance both your productivity and your professionalism. These tools help you maintain clarity and consistency across all of your financial paperwork, ensuring nothing is overlooked.

Choosing the right system to handle these tasks not only simplifies the process but also helps improve accuracy. With a user-friendly interface and the ability to handle various currencies and tax regulations, you can stay on top of your financial obligations and focus on growing your business.

Mac Invoice Template Excel for Beginners

Starting with financial documentation can seem overwhelming, especially if you are new to creating and managing business records. Having the right tools can simplify the process significantly, enabling you to produce professional-looking reports quickly and without hassle. By utilizing the correct software, you can easily generate accurate billing documents, track payments, and maintain detailed financial histories, all while saving time and reducing the chances of human error.

Key Features to Look For

When starting out, it’s important to focus on the key features that will make document creation straightforward. Look for solutions that offer easy customization, automatic calculation of totals, and the ability to add various details such as taxes and discounts. These tools are designed to ensure you can complete financial records without requiring advanced skills or extensive training.

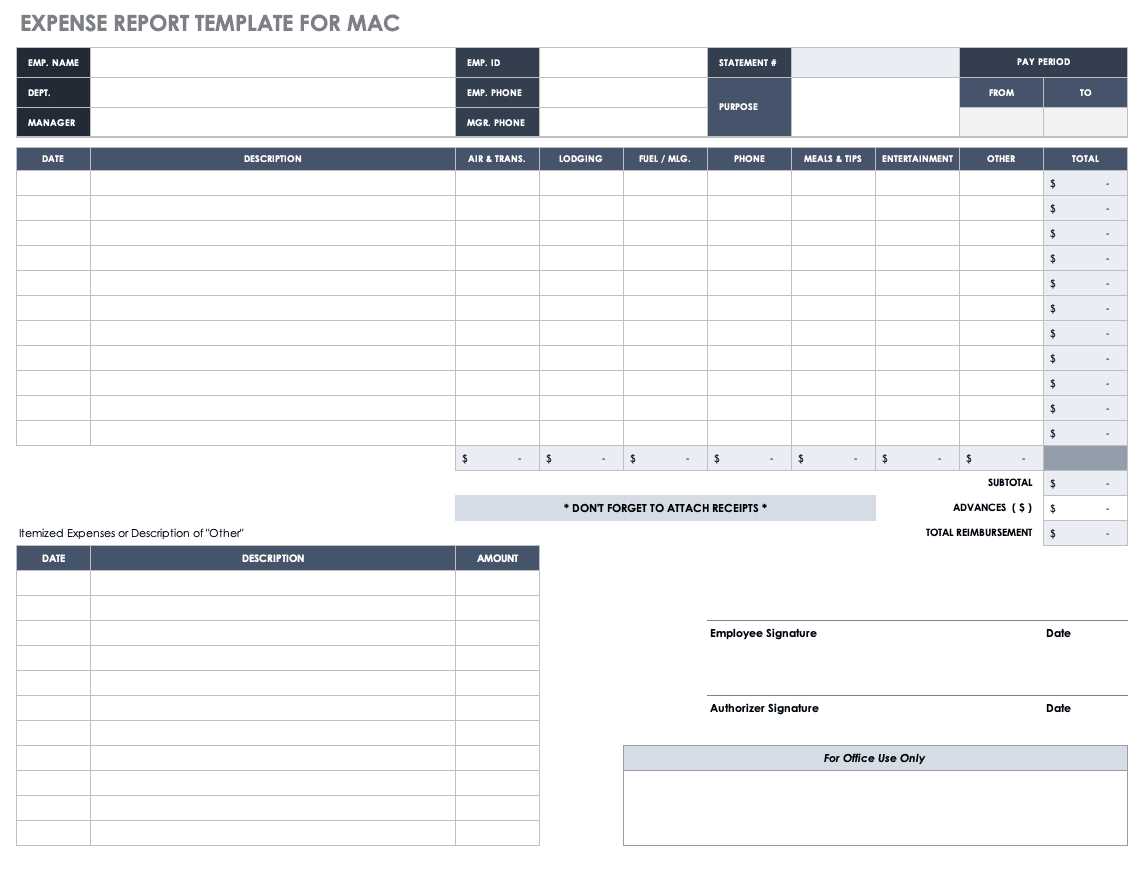

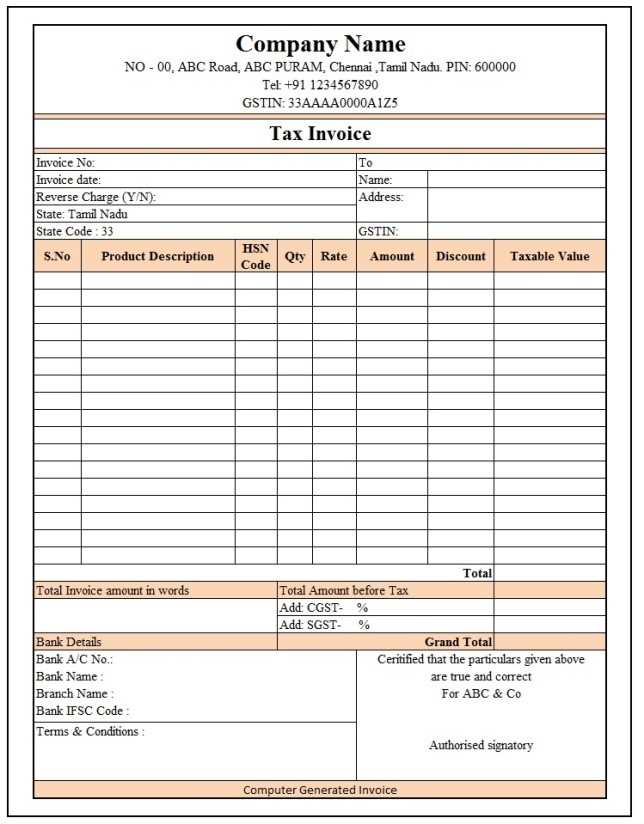

Basic Structure of a Billing Document

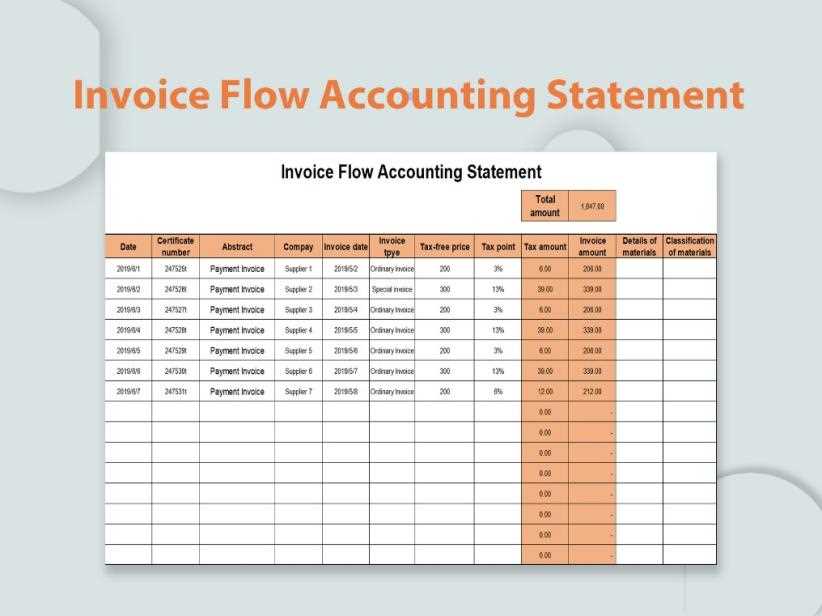

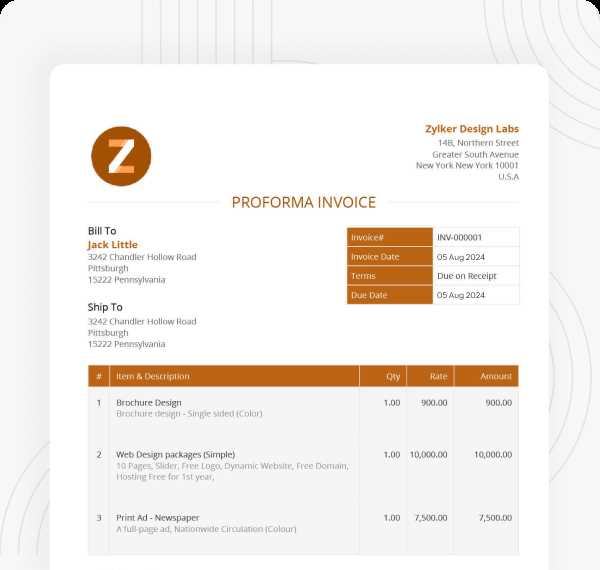

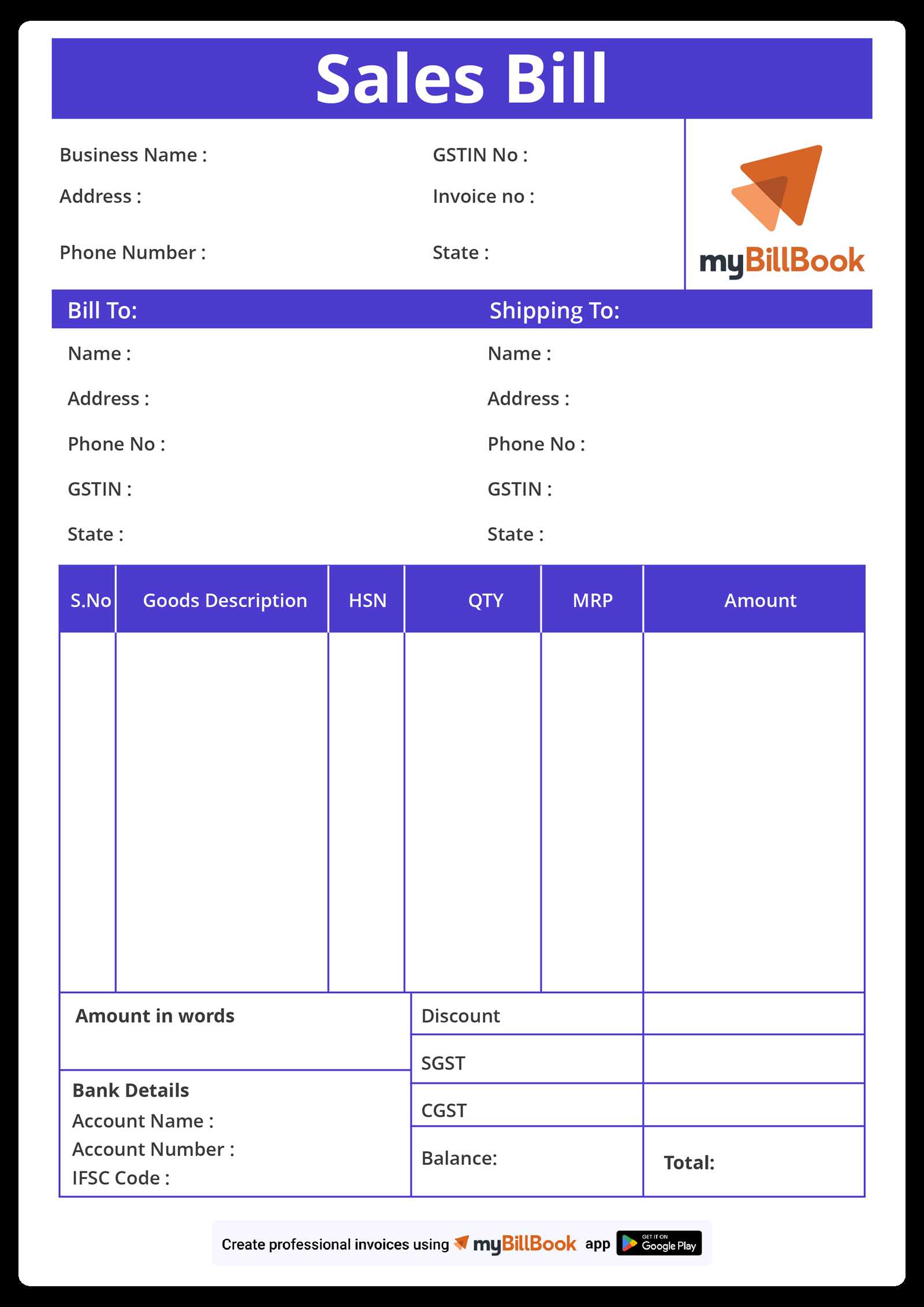

A well-structured financial document is not only clear but also highly functional. The following table outlines the basic components you should expect to work with when generating such reports:

| Section | Description |

|---|---|

| Header | Contains business name, contact information, and other identifiers. |

| Itemized List | Details the services or products provided, with quantity and price. |

| Subtotal | Shows the total amount before taxes and other adjustments. |

| Taxes and Discounts | Any applicable tax rates or discounts applied to the subtotal. |

| Total | Final amount due after taxes and discounts have been applied. |

By understanding the basic structure and key features, beginners can quickly adapt to creating accurate and professional financial documents. The right tools will ensure you can manage your billing system effectively, saving time and enhancing the accuracy of your financial processes.

Why Use Excel for Invoicing on Mac

When it comes to managing business finances, having a reliable and flexible system is crucial. Using a spreadsheet program for creating billing documents offers several advantages, especially when paired with the powerful features of a modern computing system. This combination allows for easy customization, automated calculations, and organized record-keeping–all essential elements for maintaining accurate financial records.

One of the main reasons this software is so effective is its versatility. It enables users to design customized forms that match the specific needs of their business, while also offering built-in tools to manage calculations, track payments, and even generate reports. These capabilities make it an ideal choice for entrepreneurs, freelancers, and small business owners looking for a straightforward way to handle billing without the complexity of specialized accounting software.

Advantages of Using Spreadsheets for Billing

There are several key benefits to choosing a spreadsheet for generating and managing business documents. Here are some of the most notable:

| Advantage | Benefit |

|---|---|

| Customization | Easy to design and modify documents based on specific business needs. |

| Automation | Built-in formulas for automatic calculations, reducing the risk of errors. |

| Data Management | Track payments, manage records, and keep everything organized in one file. |

| Professional Appearance | Create polished, clear documents that enhance the image of your business. |

| Affordability | No need for expensive specialized software when an existing spreadsheet program can handle the task. |

With these advantages, it’s clear why many businesses choose to use a spreadsheet-based system for handling their financial documentation. Whether you’re just starting out or managing an established company, the flexibility and functionality of spreadsheet programs make them an excellent tool for streamlining billing processes and improving financial management.

Top Features of Mac Invoice Templates

When managing financial documents, having access to the right tools can make the process more efficient and less time-consuming. The best solutions for creating professional billing reports offer a range of features designed to simplify document generation, ensure accuracy, and maintain a polished appearance. These essential features not only streamline workflow but also improve the overall quality of financial documentation.

Customizability and Flexibility

One of the standout advantages is the ability to easily customize documents. Users can adjust fields, modify layouts, and tailor the appearance to reflect their unique branding or specific requirements. This level of flexibility ensures that the final product meets all the necessary business needs, from adding custom tax rates to adjusting the format for different types of transactions.

Automation and Accuracy

Another key feature is the built-in automation for calculations. Most advanced solutions come with formulas that instantly update totals, apply taxes, and calculate discounts without requiring manual input. This helps reduce human error, making it easier to maintain accurate financial records while saving time on repetitive tasks.

These powerful tools work together to create seamless and professional documents that are easy to generate, track, and modify as needed. Whether you are a small business owner or managing a larger organization, these features are essential for staying organized and efficient with your billing process.

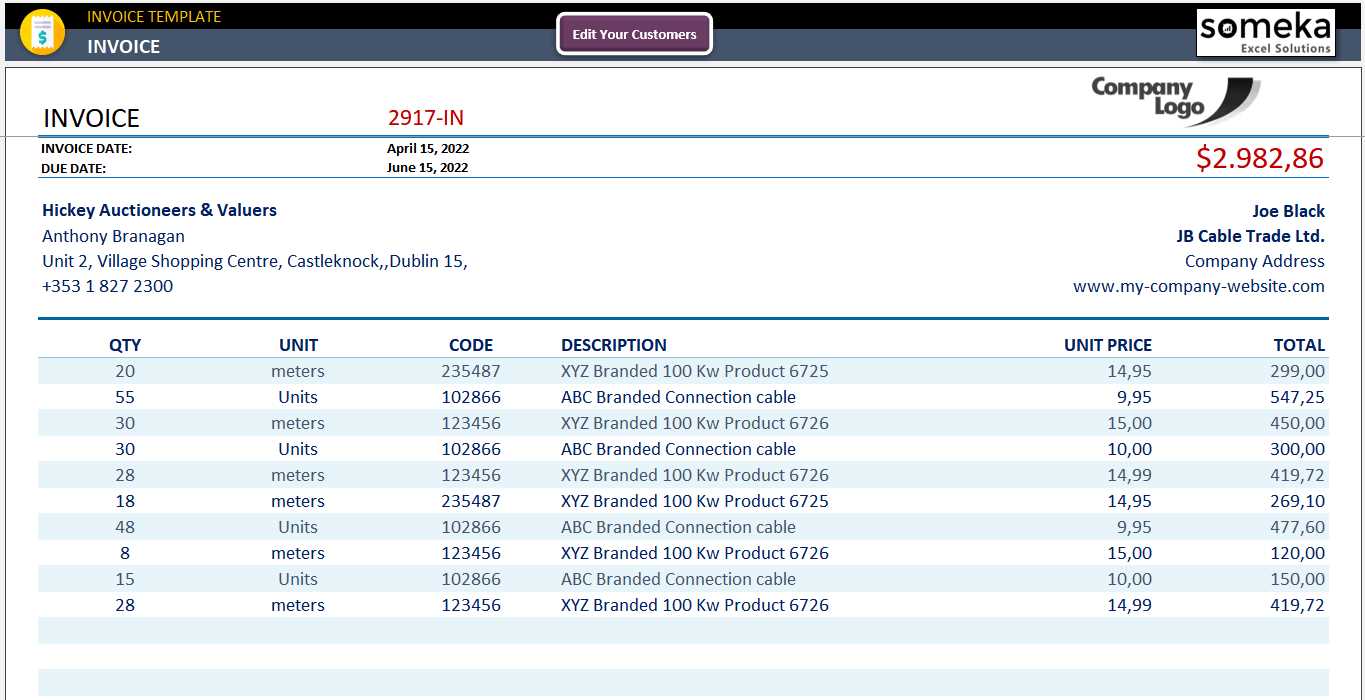

How to Create an Invoice in Excel

Creating a financial document doesn’t have to be a complicated process. With the right tools, you can quickly design a professional-looking report to manage payments, track transactions, and keep your business organized. The following steps will guide you through the process of setting up a billing document from scratch, ensuring you include all the essential details and calculations without any unnecessary complexity.

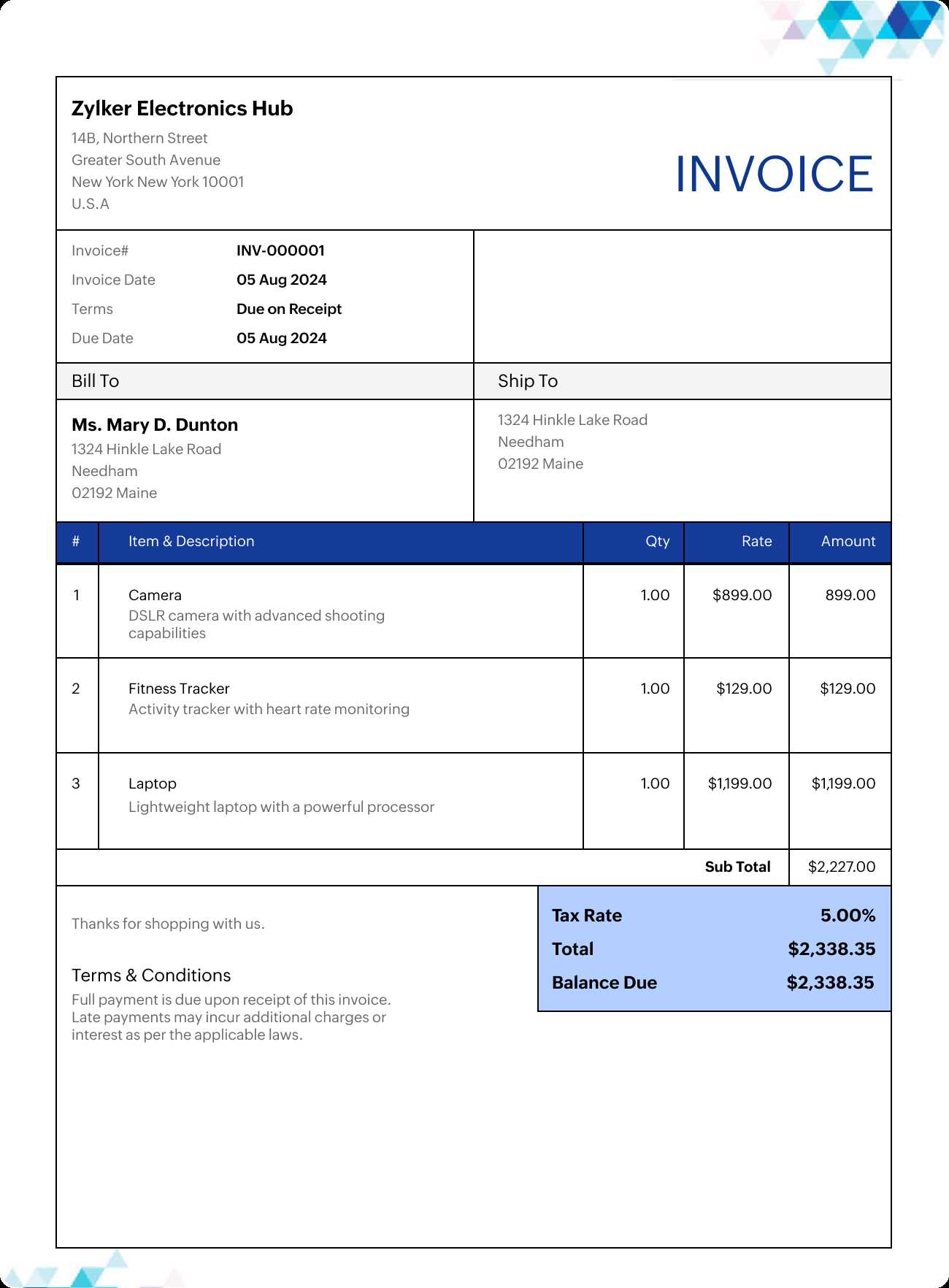

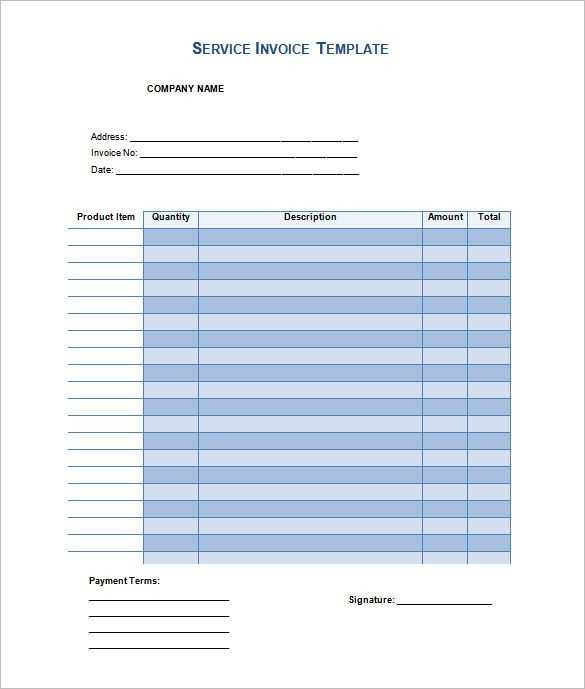

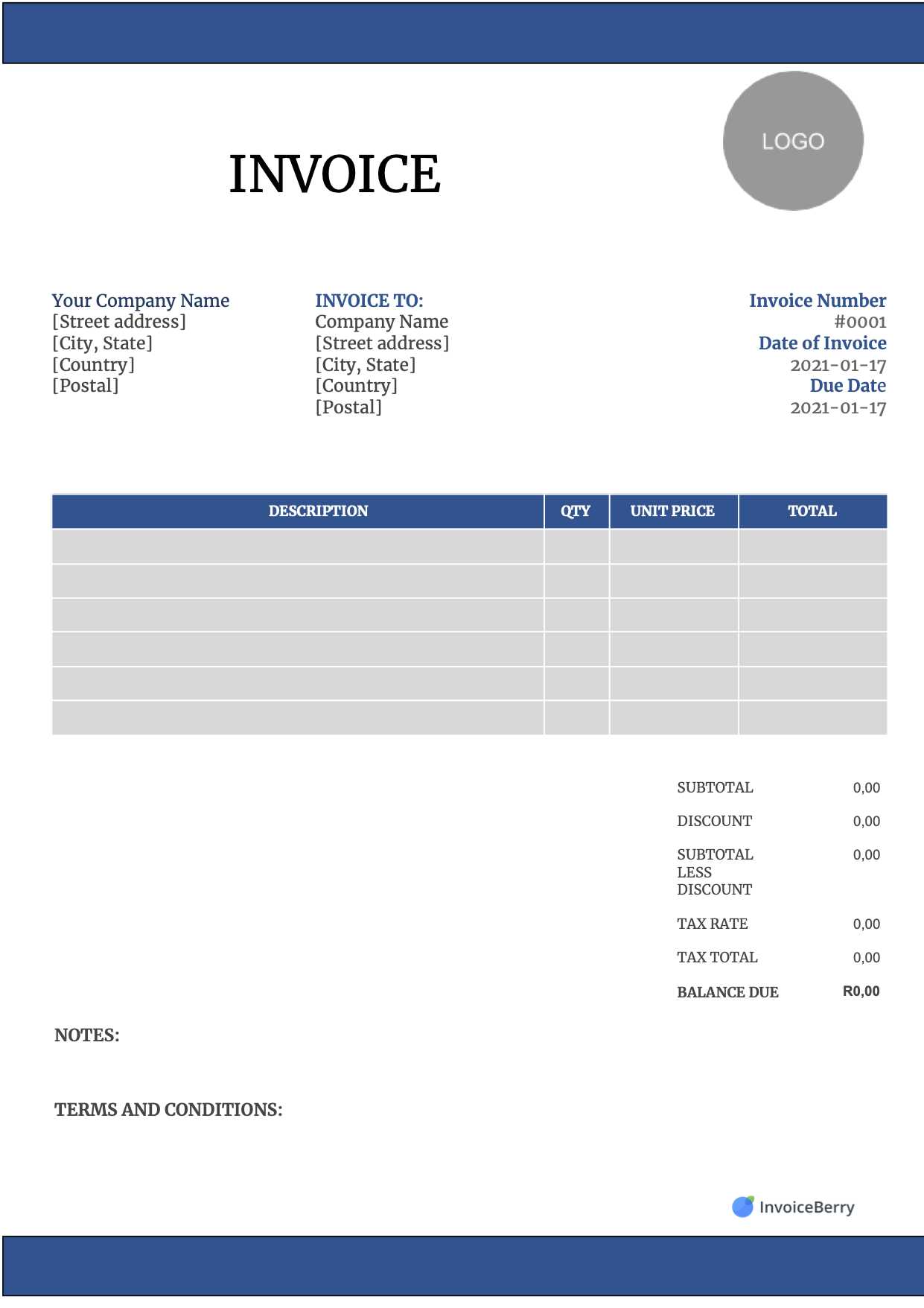

Step 1: Set Up Your Document Structure

Start by organizing your page into distinct sections. A basic layout should include areas for your business name and contact information, the recipient’s details, and the items or services provided. You can create a simple grid layout using rows and columns to separate these sections, allowing for easy editing and readability. Consider adding a header with your business logo to make the document look more professional.

Step 2: Add Itemized Details and Pricing

Next, you’ll need to include a table that lists the services or products being billed. Each row should feature a description of the item, the quantity, the unit price, and the total price for each product or service. You can use built-in formulas to automatically calculate totals and apply taxes or discounts. This ensures the final amount is accurate, reducing the likelihood of errors.

Once you have set up the basic structure, the rest of the process involves filling in the details for each transaction. With the right setup, you can quickly generate and customize financial reports, making your workflow more efficient and saving valuable time.

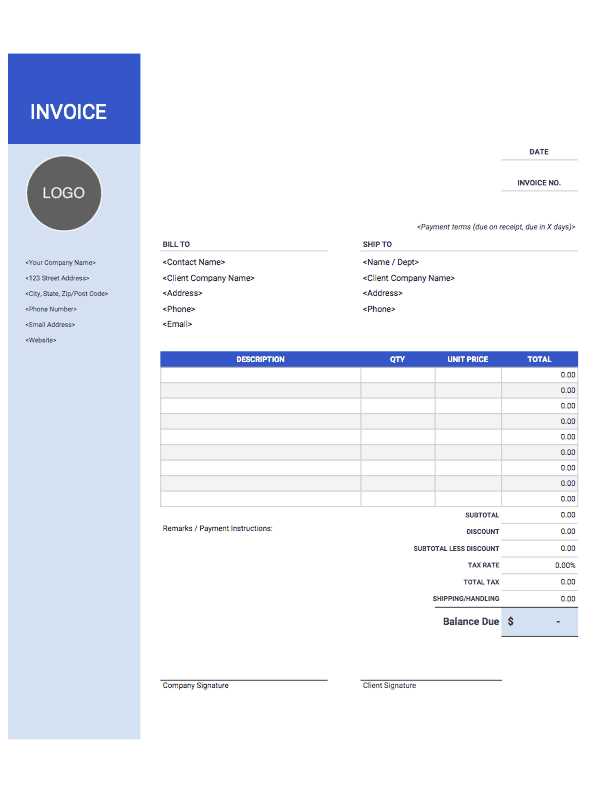

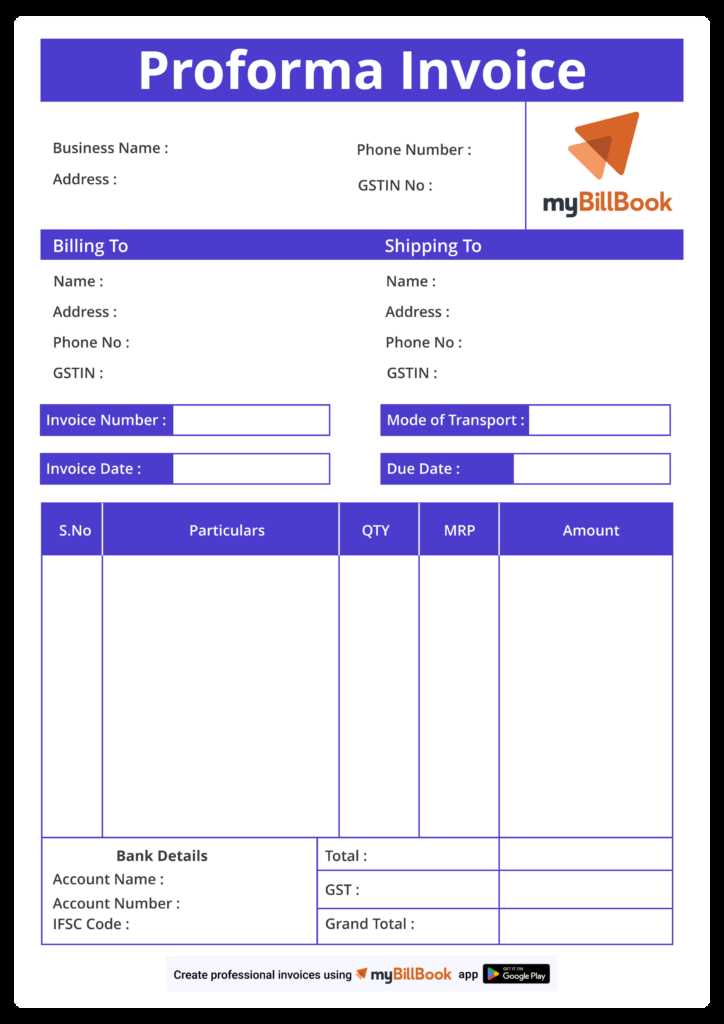

Customizing Templates for Your Business

Every business has unique needs when it comes to managing financial records. Whether you’re tracking products, services, or transactions, having the ability to tailor your documentation ensures that it meets your specific requirements. Customizing your documents allows you to present a more professional appearance, add relevant details, and streamline your workflow, making it easier to manage finances and communicate with clients.

Personalizing Document Layout and Design

One of the main advantages of using customizable solutions is the ability to adjust the design of your documents. From the header and footer to the structure of itemized lists, you can change fonts, colors, and logos to align with your branding. A well-designed document not only looks more professional but also creates a consistent image for your business, helping you build trust with clients.

Essential Fields to Include in Your Document

When tailoring your financial reports, it’s important to include all necessary information. Here are some key elements you may want to adjust or add:

| Section | Description |

|---|---|

| Client Details | Ensure you include space for customer contact information and account numbers. |

| Services/Products | Customize the description, quantity, and price fields to match your offerings. |

| Tax Information | Include a section for applicable taxes and any necessary tax IDs or rates. |

| Payment Terms | Add clear payment instructions, including due dates and acceptable payment methods. |

| Discounts/Promotions | Customize spaces for any special offers or adjustments to the total amount. |

By modifying these fields to suit your business, you ensure that every document provides relevant and clear information. Customization empowers you to manage billing and accounting with greater efficiency and precision, giving you more control over your financial processes.

Automating Invoice Calculations in Excel

Manually calculating totals, taxes, and discounts can be time-consuming and prone to errors. Fortunately, modern spreadsheet tools offer built-in functions that automate these calculations, saving you time and ensuring accuracy. By setting up formulas and leveraging features like automatic updates, you can streamline your billing process, making it more efficient and reliable.

Setting Up Basic Formulas

One of the simplest ways to automate calculations is by using basic formulas to calculate totals and apply tax rates. For example, you can set up a formula to multiply the quantity of items by their unit price and then sum up the totals for all products or services provided. Additionally, you can use formulas to automatically calculate the applicable taxes based on predefined rates. These formulas will update in real time, ensuring that any changes to quantities or prices are immediately reflected in the total amounts.

Advanced Functions for Complex Calculations

For more advanced needs, functions like IF statements and VLOOKUP can be used to automate more complex tasks, such as applying discounts based on quantity or managing tiered pricing structures. The IF function can help automatically apply different rates based on set conditions, while VLOOKUP can pull pricing information from a database or another sheet. These tools allow you to handle more intricate calculations without manually adjusting figures each time.

By utilizing these features, you can create a system that not only saves you time but also reduces the risk of errors, ensuring that your financial documentation remains accurate and up-to-date

Best Excel Invoice Templates for Mac Users

Choosing the right document structure for your financial needs can make a huge difference in how efficiently you handle billing and payments. With the right tools, you can create professional reports quickly, ensuring accuracy and consistency across all transactions. For users of Apple’s operating system, there are several options designed to make the process even smoother, providing customizable features that work seamlessly with your workflow.

Key Features to Look for in a Billing Solution

When selecting the best solution for managing financial documentation, it’s important to prioritize flexibility, automation, and ease of use. The following features should be at the top of your list:

- Customization Options: The ability to modify fields, layouts, and styles to suit your business needs.

- Automatic Calculations: Built-in formulas to handle pricing, taxes, and discounts with minimal effort.

- Professional Layouts: Clean, easy-to-read designs that enhance your business’s credibility.

- Easy Data Management: Tools for tracking payments, customer information, and transaction history.

- Compatibility: Seamless integration with other software or platforms you use for financial management.

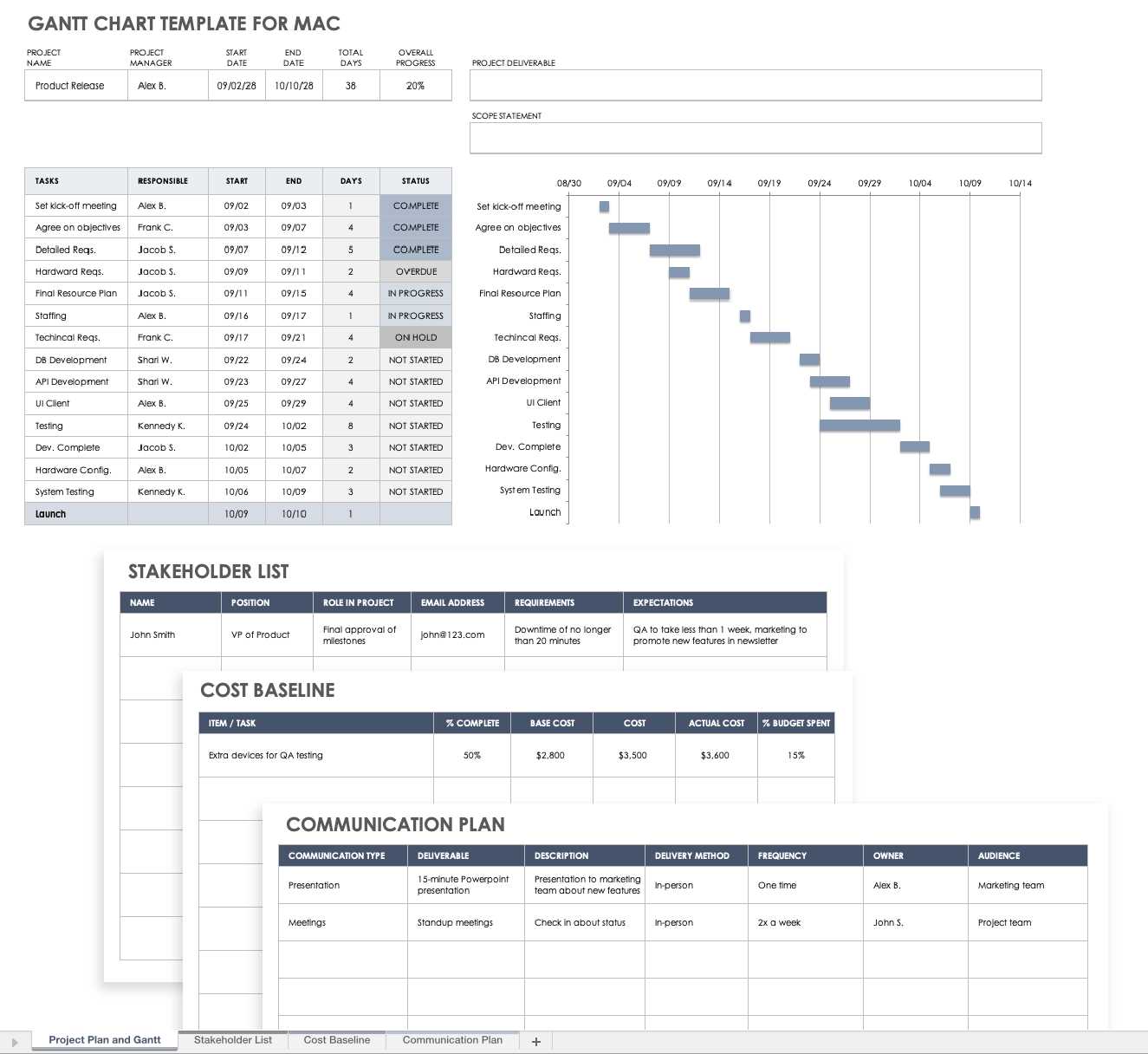

Top Options for Your Billing Needs

Here are some of the best solutions that Mac users can take advantage of when it comes to managing financial records:

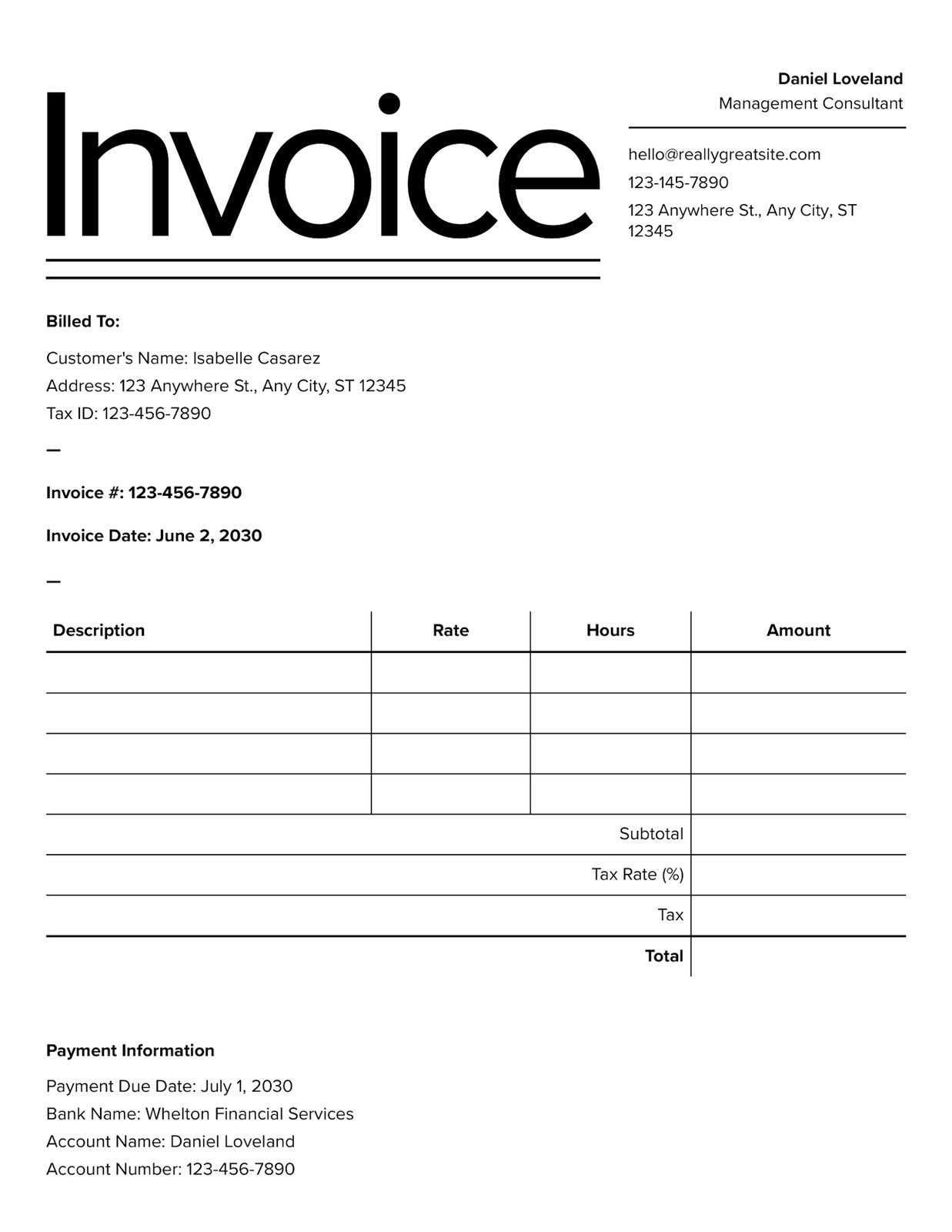

- Simple Billing Solution: Perfect for freelancers or small businesses, this option offers a minimalist layout with customizable sections for service descriptions, pricing, and taxes.

- Professional Service Report: Designed for service-based industries, this template includes detailed fields for time tracking, hourly rates, and total hours worked.

- Comprehensive Business Ledger: Ideal for larger businesses, this template includes multiple sheets for invoicing, payment tracking, and client management.

- Creative Design Invoice: Perfect for businesses in the creative industries, offering unique design elements and space for project-specific details.

Each of these options provides the flexibility and functionality necessary to meet the unique needs of different businesses. By selecting the right solution, you can streamline your financial processes, improve productivity, and ensure that your records are accurate and well-organized.

Saving and Managing Invoices on Mac

Efficiently saving and organizing your financial documents is crucial for maintaining a smooth and well-ordered business operation. Whether you are handling billing records for a small freelance project or managing transactions for a larger company, having a reliable system in place ensures you can quickly access, update, and track important data. With the right approach, you can avoid clutter and ensure that each document is easily retrievable when needed.

On Apple devices, there are several options for managing your files. You can store your financial documents locally on your device or use cloud services to ensure easy access and backup. For local storage, using well-organized folders with clear naming conventions is essential. Cloud-based storage solutions, such as iCloud, offer the added benefit of syncing documents across multiple devices, allowing you to access and update them from anywhere.

It’s also important to implement a version control system for your records. By saving new versions of documents as you make changes or add new entries, you can keep track of updates without losing the original file. This helps with maintaining accurate records, especially when dealing with revisions or client requests for previous versions of a transaction.

Moreover, many document management systems offer search functions, so you can quickly locate specific files by name, date, or client information. This can save valuable time, especially when handling a large volume of paperwork.

How to Add Taxes and Discounts to Invoices

Incorporating taxes and discounts into your financial documents is a crucial part of accurate billing and maintaining clear records. Whether you’re working with a flat tax rate or offering special discounts to clients, automating these calculations can save you time and reduce the potential for errors. By using formulas, you can easily integrate both taxes and discounts into your reports, ensuring everything is correctly calculated before finalizing the document.

Adding Tax Rates

To apply taxes, you’ll first need to define the tax rate in your document. This can be done by creating a specific field for the tax percentage. For example, if the tax rate is 10%, you can set up a formula that multiplies the total price by 0.10 to calculate the tax amount. The formula should automatically update as you adjust the subtotal or change the quantity of items or services.

Here’s an example of a basic tax formula:

Tax Amount = Subtotal * Tax Rate

In this case, if the subtotal is $100 and the tax rate is 10%, the tax amount will be $10, bringing the total to $110. You can apply this formula across all items in the document to ensure tax is accurately calculated for each one.

Applying Discounts

Discounts can be applied in various ways depending on your business practices. If you’re offering a percentage-based discount, you can set up a similar formula that reduces the total based on a percentage. For instance, a 15% discount on a $100 subtotal would reduce the total by $15.

To automate this, use the following formula:

Discount Amount = Subtotal * Discount Rate

Then subtract the discount amount from the subtotal to get the final price:

Final Price = Subtotal - Discount Amount

If you’re offering fixed-value discounts, simply subtract the fixed amount directly from the total price. This can be especially useful for seasonal promotions or special offers.

By integrating tax and discount formulas into your system, you can ensure that your billing is not only accurate but also automated, saving you time and reducing the risk of errors in your financial records.

Design Tips for Professional Invoices

The design of your financial documents plays a crucial role in how your business is perceived. A well-structured and visually appealing document not only enhances your professionalism but also ensures clarity and ease of use for your clients. The right design can make a lasting impression and help ensure that your clients understand all the details of the transaction without confusion.

Keep It Simple and Clear

When designing your financial records, it’s important to focus on simplicity and readability. Avoid cluttering the document with unnecessary graphics or overly complicated layouts. Instead, stick to a clean and straightforward design that highlights the most important information, such as client details, itemized services or products, totals, and payment instructions. Use ample white space to allow the content to breathe and make it easier to read.

Use Consistent Branding Elements

Incorporating your business’s branding into your documents helps reinforce your company’s identity. This can be achieved by including your logo, business name, and consistent color schemes that match your overall brand aesthetic. However, be mindful not to overdo it–branding should complement the document, not overwhelm it. A professional color palette and simple logo placement will maintain a polished and cohesive look.

Highlight Key Information

Make sure that critical details, such as the total amount due and payment terms, stand out. You can do this by using bold or larger font sizes for key sections. Important information like payment due dates and methods of payment should be easy to spot, so clients don’t miss them. Clear headings and section breaks also help guide the reader’s eye and ensure that they can quickly find what they need.

By following these design tips, you can create financial documents that not only look professional but are also easy to navigate, ensuring that your clients receive all the necessary information in a clear and efficient manner.

Managing Invoice Records in Excel

Keeping track of billing records is an essential part of any business. Organizing these documents efficiently can save time, reduce errors, and provide easy access to past transactions. With the right approach, you can create a system that allows you to store, search, and analyze your financial records with minimal effort. Here are some strategies for effectively managing your records within a spreadsheet environment.

Organizing Your Billing Records

A well-organized system starts with a clear and consistent structure for your data. Here’s how you can begin:

- Create Separate Sheets: If you handle multiple clients or projects, consider creating a separate sheet for each. This keeps things organized and helps prevent clutter.

- Use a Consistent Format: Ensure that all entries follow a standardized format, with columns for details such as client name, date, items or services provided, amount due, and payment status.

- Color Code Key Information: Highlight essential data like unpaid amounts or overdue payments by using color-coding. This makes it easy to spot what needs attention.

Tracking Payments and Outstanding Balances

Keeping track of payments is just as important as managing the original billing documents. Here are some tips to help you stay on top of your financial records:

- Mark Payments as Received: Once a payment is made, update the record to reflect that the amount has been received. You can add a “Paid” column or use a checkbox system to mark completed transactions.

- Automate Balance Calculation: Use simple formulas to calculate outstanding balances. Subtract the amount paid from the total due to instantly see how much remains.

- Set Up Reminders: Implement a reminder system for overdue payments. Conditional formatting or alerts can help you stay on top of late accounts.

Analyzing Your Records

Once your records are well-organized and up to date, you can begin analyzing them for insights into your business’s cash flow and financial health. Consider the following:

- Use Pivot Tables: Pivot tables allow you to quickly summarize large amounts of data, making it easier to see patterns in your transactions, such as frequently ordered items or clients with overdue payments.

- Track Trends Over Time: Create graphs or charts that display payment trends, allowing you to spot slow-paying clients or months with higher sales.

- Export Data for Reporting: Export your r

Integrating Payments with Excel Invoices

Integrating payment tracking into your financial documents is essential for efficient business management. By linking payment details directly with your transaction records, you can easily monitor amounts due, received payments, and outstanding balances without switching between multiple platforms. This integration streamlines your workflow, providing a clear overview of your financial status at any given time.

Linking Payment Details to Your Records

To effectively integrate payment information into your documents, start by adding a dedicated section for payment details. This section can include columns such as:

- Payment Date: Record the date the payment was received to track when clients settle their balances.

- Amount Paid: List the amount paid to ensure it corresponds with the total due.

- Payment Method: Include a column for payment method (e.g., bank transfer, credit card, PayPal) to help reconcile payments.

- Payment Status: Use a status field to mark payments as “Paid,” “Partial,” or “Pending.”

Once you have these fields set up, you can link them with formulas that automatically update the balance due based on the amount paid. For example, subtract the paid amount from the total to calculate any remaining balance automatically.

Automating Payment Updates

To further streamline payment tracking, you can automate updates using basic formulas. If you maintain a payment column that logs all amounts received, use the SUM function to calculate the total paid so far. This will help you stay on top of partial payments and ensure that no payments are overlooked.

You can also use conditional formatting to visually distinguish unpaid and partially paid transactions, making it easier to identify overdue accounts. For instance, you could color unpaid balances in red or highlight partial payments in yellow, allowing for quick, at-a-glance updates on payment statuses.

By linking your payment tracking directly to your financial records, you create a seamless process that reduces manual entry errors and keeps every

Common Mistakes in Creating Invoices

When creating financial records, even small errors can lead to confusion, delays, or misunderstandings between you and your clients. These mistakes can be costly, whether in terms of lost payments or damaged client relationships. By being aware of common pitfalls and knowing how to avoid them, you can ensure that your billing process runs smoothly and professionally.

Missing or Incorrect Information

One of the most frequent mistakes in generating billing documents is omitting essential details or entering incorrect data. This can cause delays in payments or lead to disputes with clients. Here are some key areas to double-check:

- Client Details: Ensure that your client’s name, address, and contact information are correct and complete.

- Product or Service Descriptions: Provide clear, detailed descriptions of what is being billed, including quantities, unit prices, and relevant dates.

- Payment Terms: Always include the payment due date, as well as the method of payment you prefer.

- Tax Rates and Additional Fees: Double-check that any applicable taxes or fees are correctly calculated and displayed.

Not Providing Clear Payment Instructions

Another common mistake is failing to provide clear payment instructions, which can create confusion for clients. Ensure that the following information is included:

- Payment Methods: Specify the payment methods you accept (e.g., bank transfer, credit card, PayPal, etc.) and provide the necessary details such as bank account numbers or payment links.

- Late Payment Fees: If applicable, clearly state any late payment fees or penalties for overdue balances to set proper expectations.

- Invoice Number: Assign a unique reference number to each document. This helps both you and your clients track payments and ensures clarity in your accounting records.

Ignoring Consistency and Professionalism

A lack of consistency and professionalism in your documents can make a poor impression on your clients. Here are a few tips to maintain a polished, consistent look:

- Formatting: Use consistent fonts, sizes, and alignment to make the document easy to read.

- Design: While keeping it simple, ma

How to Send Invoices Directly from Excel

Sending your billing documents directly from your spreadsheet software can significantly streamline your workflow. Instead of manually exporting and attaching files to emails, you can use built-in features to send your financial records with just a few clicks. This approach saves time and ensures that your clients receive their documents promptly and professionally.

Using Email Integration to Send Documents

One of the easiest ways to send your financial records directly from your spreadsheet software is through email integration. Most spreadsheet programs, like Microsoft Office, offer built-in options to send documents via email without needing to leave the program.

- Attach as an Email: With a few simple steps, you can attach your document directly to an email from within the program. Select the “Send as Attachment” option, choose your email provider, and the document will be sent to the recipient’s inbox automatically.

- Choose Format: You can select whether to send the file in its original format or convert it to a PDF for easier viewing on different devices.

- Automate Email Content: Some systems allow you to create predefined email templates with personalized content, reducing the need to manually write each message.

Using Mail Merge for Multiple Clients

If you need to send invoices to multiple clients at once, using a mail merge feature can simplify the process. This allows you to automatically generate personalized emails with the attached documents for each client, pulling contact information from your spreadsheet.

- Prepare Your Data: Ensure that your contact list includes email addresses, names, and any other personalized information you want to include in the message.

- Set Up the Merge: Most spreadsheet programs have a mail merge function that connects with email applications. You can use this feature to import the recipient details and generate individual emails for each contact.

- Send in Bulk: Once the mail merge is set up, the system will send the invoices in bulk, allowing you to reach multiple clients in a short amount of time.

Ensuring Proper File Formatting

When sending billing documents, it’s important to ensure that the file is easy for your clients to view and open. Converting your document to a PDF format is often the best option, as it ensures the layout and formatting remain intact across different devices and operating systems.

- PDF Conversion: Before sending, convert your document to PDF by selecting the “Save As” or “Export” option in your spreadsheet program. This guarantees that your invoice will be viewed exactly as intended.

- File Size Considerations: Keep an eye on the file size. Large files can be difficult to send via email and may be rejected by some email servers. If necessary, compress the file or use a cloud-sharing service for easier access.

By following these steps, you can easily send your financial documents directly from your spreadsheet, making the process more efficient and ensuring your clients receive their records quickly and without complication.

Improving Workflow with Excel Templates

Streamlining your processes and automating repetitive tasks can significantly boost productivity. By using pre-designed structures, you can reduce time spent on manual entries and ensure consistency across various documents. These tools help organize data more efficiently, enhance accuracy, and simplify complex tasks, allowing you to focus on more critical aspects of your business.

Using pre-set formats for your financial or business documents is a great way to standardize the information and minimize errors. Whether you’re creating sales records, client accounts, or project summaries, a structured layout can improve efficiency and save valuable time. With just a few customizations, you can adapt these structures to meet your unique needs while maintaining a consistent format.

In addition to reducing manual work, these ready-made setups can help you stay organized and maintain professional standards across your documents. The ability to instantly fill in fields with up-to-date information ensures that your records are always accurate and ready for quick review or reporting. This efficiency is crucial for managing multiple tasks and deadlines without losing focus or creating confusion.

Advanced Excel Tips for Invoice Templates

Enhancing the functionality and efficiency of your financial documents can make a significant difference in managing your business transactions. By leveraging advanced features of your spreadsheet software, you can automate calculations, improve data analysis, and create more dynamic, user-friendly documents. These tips are designed to help you maximize the potential of your system, saving time and reducing errors while maintaining a professional presentation.

One of the most powerful tools for improving your workflow is the use of formulas and functions. Rather than manually calculating totals, taxes, or discounts, you can automate these processes to update in real-time as you input new data. Functions like SUM, VLOOKUP, and IF statements can help you quickly retrieve information, calculate totals, and apply conditional logic based on various criteria. This reduces the need for constant adjustments and ensures consistency across your documents.

Additionally, utilizing data

Why Excel Is Ideal for Mac Invoicing

Using the right tools to manage your business transactions can save you time and increase accuracy. For managing financial records, a widely-used spreadsheet program offers unmatched flexibility and control. It allows users to create custom billing documents, automate calculations, and track payment history, all within an intuitive and user-friendly interface. This makes it an ideal solution for managing your transaction records, especially for those working on specific operating systems.

Seamless Integration and Compatibility

One of the main reasons why this spreadsheet tool is ideal for creating billing documents is its seamless integration with the operating system. The program works smoothly on various platforms, offering users the ability to access and edit their documents from multiple devices. This is particularly helpful for businesses that require flexibility in managing their financial records, as it allows easy sharing, storage, and access across different environments.

Customization and Automation Features

Another advantage of using this program is the ability to fully customize your financial documents. You can design your billing structure to meet the specific needs of your business, adding fields for discounts, taxes, payment terms, and more. Moreover, the program provides powerful automation tools, like formulas and conditional formatting, that can handle complex calculations and provide visual cues for payment status or overdue amounts. These features can significantly reduce the time spent on manual adjustments and ensure that your financial records are always accurate and up-to-date.

With its combination of compatibility, customization, and automation, this program stands out as the perfect tool for managing your business’s financial records, offering both efficiency and professional presentation without the complexity of specialized software.

Free vs Paid Invoice Templates for Excel

When it comes to managing business records, especially for billing, there are a wide variety of options available, ranging from no-cost solutions to premium offerings. Choosing between free and paid options depends on your specific business needs, budget, and the level of customization and functionality you’re seeking. Both free and paid solutions have their merits, but understanding the differences can help you make an informed decision that best fits your workflow.

Advantages of Free Options

Free solutions are often a great starting point for small businesses or freelancers who need basic functionality without committing to any upfront costs. These no-cost solutions are usually easy to find and download, offering simple structures that can handle the most common tasks like calculating totals, taxes, and due amounts. Many free versions also provide basic formatting options, allowing users to quickly generate clean and professional-looking documents.

- Low Cost: The most obvious advantage is that free options require no financial investment, making them an attractive choice for businesses with limited budgets.

- Ease of Use: Many free tools come with pre-built formulas and straightforward layouts, making them accessible even for those with little experience using spreadsheet programs.

- Quick Setup: Free templates can be downloaded and used immediately, without the need for complicated installations or long setup times.

Benefits of Paid Solutions

Paid options, on the other hand, typically offer a higher level of customization and advanced features, making them a valuable choice for businesses that require more complex or specific functionality. These solutions often come with professional-level support, enhanced security features, and the ability to scale as your business grows. With paid solutions, you may also get access to additional tools such as automatic calculations, advanced reporting, and custom branding options.

- Customization: Paid versions typically offer more flexible layouts and additional fields, allowing you to tailor the document to your specific business needs.

- Advanced Features: These solutions often include features like automated calculations, payment tracking, and integration with other business software, making them ideal for businesses that need more than just basic functionality.

- Support and Updates: Premium solutions usually come with dedicated customer support and regular updates, ensuring that the software remains reliable and compatible with new versions of your operating system or spreadsheet program.

In the end, the choice between free and paid options comes down to your specific business requirements and the level of sophistication you’re looking for in your