Mac Excel Invoice Templates for Simple and Professional Billing

Managing financial transactions efficiently is a vital aspect of running any business. One of the easiest ways to stay organized is by using digital tools to create accurate and professional documents for your clients. These customizable files help ensure that every detail is captured, from payment terms to service descriptions, allowing for a smooth exchange between businesses and customers.

By using advanced software available on your device, it’s possible to generate detailed billing records without the need for complex systems or expensive software. With the right approach, you can have fully functional files that fit your business needs, from simple records to more intricate invoicing solutions. The key lies in choosing the right structure and adapting it to your specific requirements.

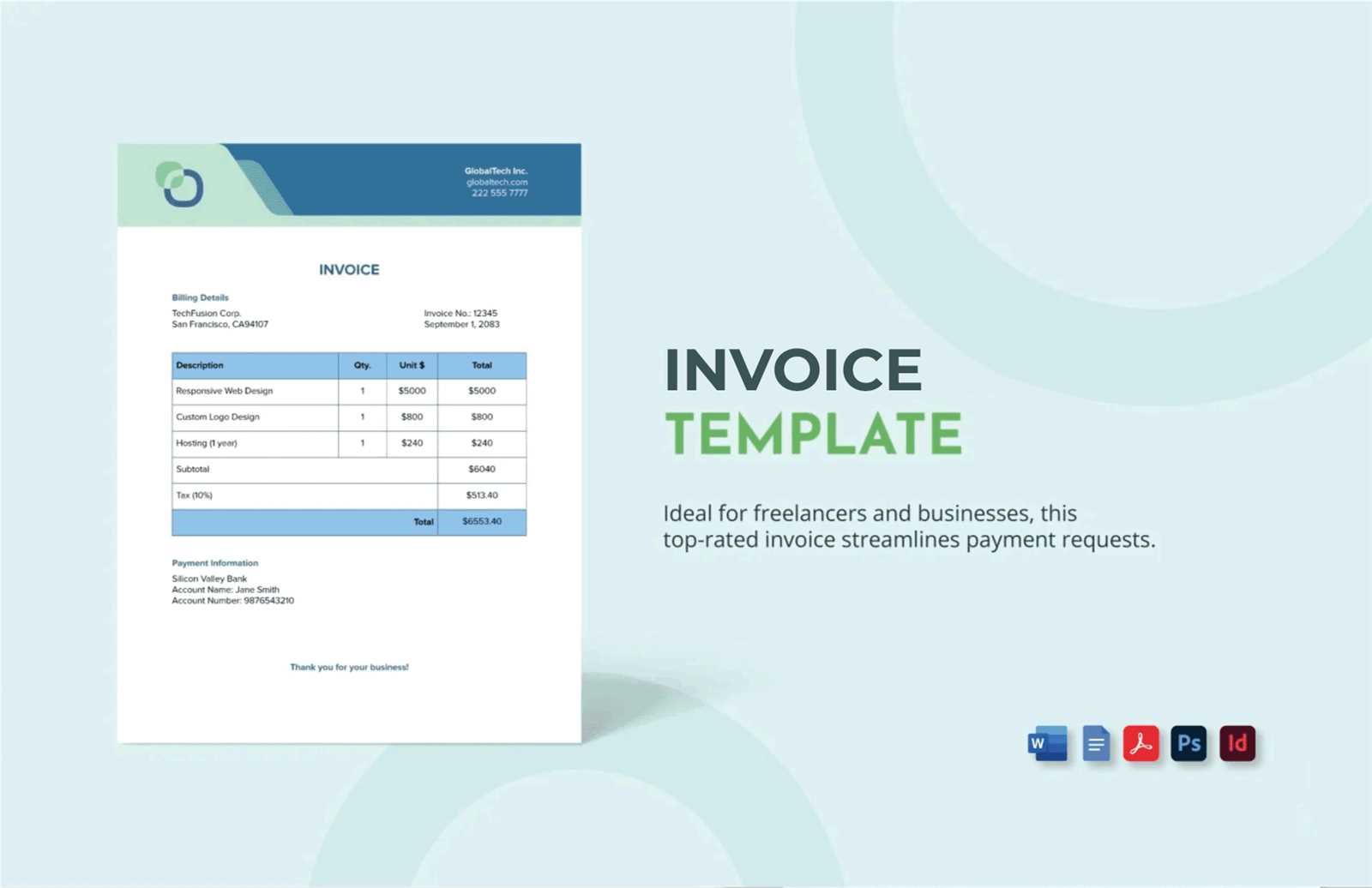

Designing effective records can be quick and intuitive. Customizing these documents with your business logo, adjusting the layout, and including essential payment information helps enhance your professionalism. Additionally, by organizing your financial data efficiently, you can easily track payments, apply taxes, and ensure timely follow-ups on pending amounts.

Mac Excel Invoice Templates Guide

When managing business finances, having a well-organized system for creating billing records is essential. Customizable files allow you to streamline the invoicing process, ensuring consistency and accuracy with every transaction. These documents are designed to meet the unique needs of your business, whether you’re working with clients, customers, or vendors.

By using the right digital tools, you can quickly set up professional documents that look polished and function effectively. The key is understanding how to adjust the structure of these files, including the proper placement of details like services provided, payment terms, and due dates. With a few simple steps, you can personalize the format to fit your brand’s identity and operational workflow.

Creating the perfect document requires a blend of clear design and practicality. Ensuring your records are easy to read, well-organized, and free of errors helps maintain a positive business relationship. Customizable files also allow you to track payments, apply applicable taxes, and manage recurring billing schedules, making the process more efficient overall.

Additionally, adapting these documents for various client needs and regions is simple, making it possible to work globally with ease. Whether you need a basic template or something more specific to your industry, these digital solutions offer flexibility and control over your financial documentation.

Why Use Excel for Invoices

Creating professional financial records doesn’t have to be complicated or expensive. Using digital tools to generate detailed billing documents offers simplicity and flexibility, making it easier to manage payments, services, and terms. These tools are accessible, customizable, and provide all the necessary features to ensure your transactions are documented correctly.

One of the main advantages is the ability to quickly create and edit these documents without needing advanced skills or software. By leveraging pre-built structures and customizable features, you can tailor your billing records to suit your specific business needs. Whether you are a freelancer or managing a small company, the efficiency and control that digital tools provide are unparalleled.

Key Benefits of Using Digital Tools for Billing

| Feature | Benefit |

|---|---|

| Customizable Layout | Adapt documents to match your brand and style. |

| Ease of Use | Quick setup and no learning curve for basic features. |

| Data Management | Track payments and outstanding balances with ease. |

| Cost-Effective | No need for expensive software or subscription services. |

| Universal Compatibility | Easily share and open files across various platforms. |

Additionally, this approach offers the flexibility to add taxes, discounts, and shipping costs directly within the document, ensuring that every detail is accurately accounted for. By using this method, you can maintain a high level of professionalism while saving time and reducing errors.

Top Features of Excel Invoice Templates

Customizable billing records offer a wide range of features that enhance functionality and streamline the invoicing process. By utilizing the right digital tools, you can create professional documents tailored to your business needs, while maintaining accuracy and efficiency. These features make managing financial transactions easier, allowing you to focus on what matters most–growing your business.

Easy Customization and Layout

One of the primary advantages of these billing solutions is their flexibility. You can easily adjust the layout, add your company logo, and change the color scheme to match your branding. This customization ensures your records reflect your business identity while staying professional and clear.

Automatic Calculations and Data Management

Another powerful feature is the ability to automate calculations. With built-in formulas, you can automatically calculate taxes, totals, discounts, and other essential figures. This reduces errors and saves valuable time, allowing for a more streamlined billing process.

How to Customize Your Template

Personalizing your financial documents is essential to ensure they align with your business identity and needs. Customizing these files allows you to adjust various elements, such as layout, fonts, and content, to create a professional and cohesive look. The flexibility of digital tools makes it simple to modify templates to match your unique requirements and improve your workflow.

Adjusting Layout and Design

Start by selecting a layout that suits your business model and the type of transactions you handle. You can rearrange sections, such as service descriptions, payment terms, and totals, to create a flow that works best for your documents. Additionally, personalizing the design by adding your company logo and changing colors helps reinforce your brand identity.

Incorporating Essential Details

It’s important to make sure that all necessary information is included in your billing records. Customize sections to reflect your business specifics, such as payment methods, due dates, or additional terms. With the right setup, you can quickly adapt the template for different clients, services, or regions.

| Element | Customization Tips |

|---|---|

| Header | Add your logo, business name, and contact information. |

| Table Sections | Modify columns for item descriptions, quantities, and unit prices. |

| Footer | Include payment terms, tax information, and thank-you notes. |

| Currency and Tax Fields | Adjust for regional differences and applicable rates. |

Once your document structure is in place, it’s time to fine-tune details like fonts and font sizes to ensure readability. A clean and professional appearance makes it easier for clients to review the information and complete transactions quickly.

Benefits of Using Mac for Invoices

Creating financial records on your device offers a range of advantages, particularly when it comes to speed, customization, and overall ease of use. The software available allows for seamless integration with other tools, making the process of managing transactions, tracking payments, and organizing documents more efficient. This simplicity enables businesses to stay on top of their financial dealings without the need for complex or expensive systems.

One of the key benefits is the user-friendly interface, which allows you to quickly navigate and modify billing documents. Easy customization options ensure you can tailor every detail, from the layout to the content, ensuring your documents align with your business style. Additionally, the ability to save and access these records across various platforms ensures you can work efficiently from anywhere.

Security is another major advantage. Devices designed for productivity often come with advanced protection features, such as encryption and secure storage, ensuring that sensitive financial information is kept safe. This is especially important when handling personal and payment data.

Efficiency and integration are key factors in improving your workflow. With these tools, you can automate calculations, set reminders, and easily export your files, reducing manual work and minimizing errors. This results in smoother transactions and more accurate records, freeing up your time for other business priorities.

Free Invoice Templates for Excel

For businesses looking to streamline their billing process, free customizable document layouts provide an excellent solution. These ready-made structures allow you to generate professional financial records without having to start from scratch. By using these documents, you can save time and effort while ensuring that all essential information is included accurately.

Many online resources offer free options that can be easily downloaded and customized to meet specific business needs. These layouts are often designed with flexibility in mind, offering features such as adjustable fields for items, taxes, and payment terms.

Here are some key benefits of using free customizable document layouts:

- Cost-effective: No need for expensive software or subscriptions.

- Time-saving: Ready-made structures reduce the time spent creating new documents.

- Customizable: Modify fields and layout to suit your business model.

- Easy to use: Simple to download and set up for quick use.

- Professional design: High-quality layouts that enhance your business image.

Whether you’re a freelancer, small business owner, or part of a larger organization, these free solutions make it easy to generate consistent and accurate billing records. They help ensure that every detail is accounted for, from services provided to payment schedules, without the need for complicated software or expensive services.

Creating Professional Invoices on Mac

Generating professional billing documents is an essential task for any business. By using the right tools, you can create polished and accurate records that ensure clear communication with clients. The process of crafting these documents is made simple through user-friendly software that allows you to customize fields, add your branding, and maintain consistency across all transactions.

Key Features for Professional Billing

Creating well-organized and easy-to-read records is crucial. By adjusting the structure, you can include important information such as itemized lists, payment terms, and due dates. Customization options give you the flexibility to design documents that reflect your business style while keeping all necessary details clear and accessible.

Essential Elements for Effective Documents

| Section | Customization Tips |

|---|---|

| Header | Include your logo, business name, and contact information for brand consistency. |

| Item List | Ensure clarity by organizing services or products with descriptions, quantities, and prices. |

| Footer | Include payment instructions, tax information, and terms to avoid confusion. |

| Currency and Taxes | Adjust these fields based on regional requirements and applicable rates. |

Once you’ve organized the main sections of your record, ensure that the document is easy to read by adjusting font size, colors, and spacing. A well-structured document not only enhances your professional image but also helps clients understand the details of the transaction with ease.

Best Practices for Invoice Formatting

Creating clear, professional, and easy-to-read billing documents is essential for ensuring that clients understand the terms of the transaction. Proper formatting not only enhances the document’s readability but also improves the overall impression of your business. Following the right practices ensures that all important details are easily accessible and that clients can quickly process payments without confusion.

When designing your billing records, certain formatting guidelines can make a big difference in the document’s effectiveness. From structuring content logically to ensuring that the document looks polished, every detail matters. Below are some best practices to help you format your records correctly.

Essential Formatting Tips

- Clear Layout: Use clean lines, consistent spacing, and well-organized sections. Ensure there is enough white space to avoid cluttered pages.

- Logical Structure: List services or products first, followed by the total amount due, payment terms, and due date.

- Readable Fonts: Choose a professional, easy-to-read font. Avoid overly decorative fonts that may distract from the document’s content.

- Highlight Key Information: Use bold or italics for key details such as totals, payment due dates, or contact information.

- Consistent Formatting: Keep fonts, sizes, and colors uniform throughout the document for a cohesive look.

Organizing Billing Details

- Business Information: Ensure your name, address, and contact details are easy to locate at the top.

- Service/Item List: Include a table with clear headings such as “Description,” “Quantity,” and “Price” to itemize charges.

- Payment Terms: Clearly state the terms of payment, including methods, due date, and any late fees.

- Additional Notes: Use the footer to add notes like “Thank you for your business” or any other relevant terms or conditions.

By following these best practices, you can create billing records that not only look professional but also help clients process their payments quickly and accurately. Clear formatting reduces the risk of mistakes and misunderstandings, ensuring a smooth transaction process for both parties.

How to Add Branding to Your Invoices

Incorporating your business’s identity into your billing documents is a key step in maintaining a professional and consistent image. Personalizing these records with your branding not only reinforces your business’s values but also helps clients recognize and remember your brand. By including elements such as logos, colors, and business information, you create a stronger connection with your clients while enhancing the document’s professionalism.

Branding is not just about adding a logo–it’s about aligning the visual and textual elements with your overall brand identity. Here’s how you can integrate key brand elements into your billing documents:

Key Elements to Include for Effective Branding

| Brand Element | How to Incorporate |

|---|---|

| Logo | Place your logo at the top of the document for immediate recognition. |

| Color Scheme | Use your brand’s colors for headings, borders, or background highlights to maintain consistency. |

| Business Name and Contact Info | Ensure your business name, phone number, website, and email are clearly visible at the top or bottom. |

| Tagline | Include your tagline or slogan to emphasize your business’s unique value proposition. |

Once you have added these elements, ensure that the design remains clean and organized. Overcrowding the document with too many design elements can detract from the document’s main purpose. Maintain balance by focusing on simplicity and clarity while ensuring your branding remains prominent throughout the document.

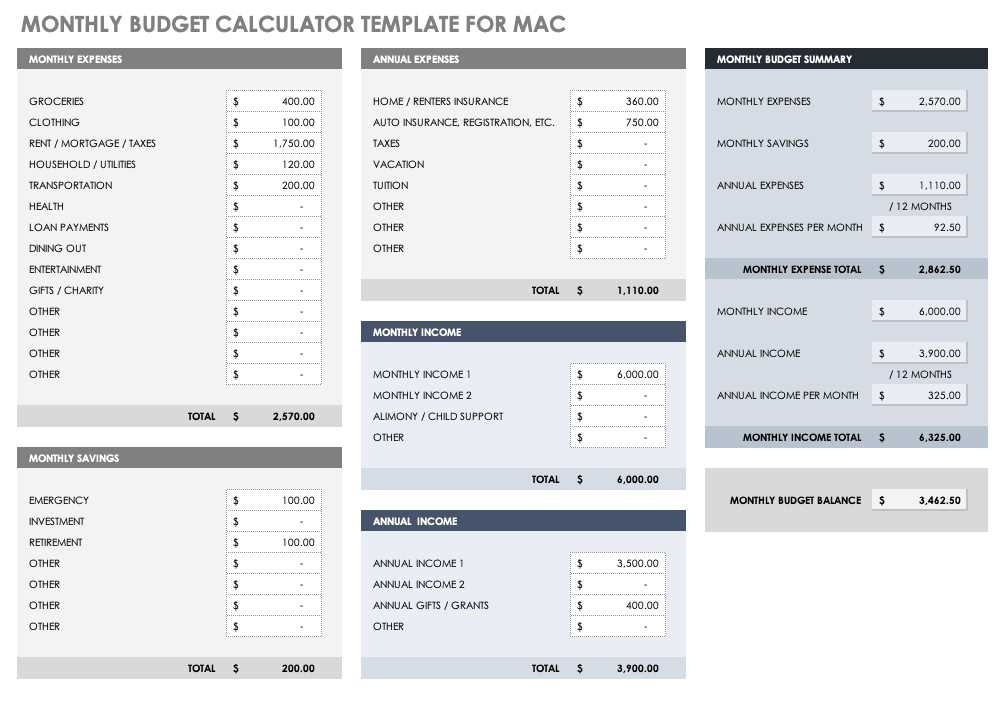

Managing Taxes with Excel Templates

Handling taxes efficiently is a critical part of managing any business’s financial operations. Properly calculating and tracking taxes ensures that you remain compliant with local regulations and avoid any legal or financial penalties. Using a structured document layout for tax management can simplify this process, allowing you to track and manage tax details seamlessly within your financial records.

With the right layout, you can easily include tax rates, calculate totals, and ensure that all taxable items are correctly accounted for. This helps in both personal and business finances, ensuring transparency and accuracy for tax reporting and audits.

Key Features for Managing Taxes

- Automatic Calculations: Use built-in formulas to automatically calculate sales tax or VAT based on the items or services provided.

- Tax Rates: Input different tax rates to ensure accurate tax calculation based on location or product category.

- Itemized Tax Breakdown: Provide a detailed breakdown of tax calculations for each item or service to ensure clarity for both parties.

- Summary Totals: Include a section for the total tax amount, subtotal, and final total for easy reference.

Steps for Setting Up Tax Management

- Define Tax Rates: Input your applicable tax rates into the document to apply automatically to the items listed.

- Configure Formula: Set up the formula to calculate tax based on item prices and applicable rates.

- Review Regularly: Periodically check tax calculations to ensure they are up-to-date with any changes in tax laws or rates.

- Track Tax Categories: If applicable, create separate fields for different tax categories, like sales tax, VAT, and other fees.

By integrating these tax management features into your financial records, you can simplify the process of calculating taxes, ensuring accuracy while saving time and effort. Structured documents help maintain clarity, reduce errors, and make tax filing easier when the time comes.

Tracking Payments with Invoice Templates

Effectively tracking payments is crucial for maintaining financial clarity and ensuring that transactions are completed in a timely manner. By organizing payment details within your billing records, you can monitor outstanding balances, track payment statuses, and streamline your accounts receivable process. A well-structured document can serve as a reliable tool for tracking which payments have been made, which are due, and which are overdue.

Integrating payment tracking features into your billing documents helps you stay on top of your financial flow and reduces the risk of missed or forgotten payments. These features can also provide a clear overview of client payment history and help ensure that proper follow-ups are made when necessary.

Key Features for Payment Tracking

- Payment Status Indicators: Include fields for marking payment status as “paid,” “unpaid,” or “partial” to easily track the progress of each transaction.

- Due Dates: Clearly display payment due dates to remind clients of upcoming deadlines and reduce the chances of delayed payments.

- Payment Methods: Record different payment methods such as credit card, bank transfer, or cash, to provide a complete payment history.

- Outstanding Balances: Track any remaining balance after a partial payment has been made, ensuring that clients are aware of what they still owe.

Steps for Setting Up Payment Tracking

- Enter Payment Details: Include fields for payment amount, method, and date to keep a full record of each transaction.

- Monitor Payment Status: Regularly update the payment status section to reflect whether the client has made a payment, and if so, how much.

- Follow Up on Overdue Payments: Use reminders or highlight overdue amounts to stay on top of collections and ensure payments are received promptly.

- Generate Reports: Periodically review payment records to generate reports on outstanding balances, paid invoices, and overall cash flow.

By incorporating payment tracking into your financial documents, you can simplify the management of your transactions, avoid confusion, and maintain better cash flow management. This not only streamlines your process but also improves the relationship between you and your clients by ensuring transparency and timely communication.

Automating Recurring Invoices in Excel

Handling recurring charges can be time-consuming, but with the right tools, you can automate this process and save valuable time. Setting up automated billing for clients with regular payments ensures consistency and accuracy in your financial records. By leveraging built-in features within spreadsheet software, you can streamline the creation of periodic billing documents, making the entire process more efficient and less prone to errors.

Automation helps eliminate the need for manual data entry each time a new cycle begins, providing a seamless experience for both your business and your clients. With automated recurring invoices, you can easily track due dates, payment amounts, and apply consistent pricing for ongoing services or subscriptions.

How to Set Up Recurring Billing

Setting up automated billing requires some initial configuration. Here’s how to get started:

- Create a Template: Start by designing a standard document that includes all the necessary fields, such as client information, payment terms, and line items.

- Set Billing Frequency: Define how often the billing will occur, whether it’s weekly, monthly, or quarterly. This helps automate the process for the appropriate intervals.

- Use Formulas for Calculation: Implement formulas that automatically calculate totals based on predefined variables, ensuring consistency and accuracy in each cycle.

Benefits of Automation

- Time-saving: Automation eliminates repetitive tasks, freeing up time for other important business operations.

- Accuracy: Using formulas reduces human error, ensuring that each document is generated with correct figures.

- Consistency: Automatically generating documents based on the same format ensures consistency across all billing cycles.

- Improved Cash Flow: Automating billing ensures that payments are issued on time, helping you maintain a steady cash flow.

By automating recurring billing tasks, you can significantly improve efficiency in your business’s accounting process. This not only saves time but also reduces the risk of errors, helping you maintain better financial control while providing a seamless experience for your clients.

Common Errors in Invoice Creation

Creating billing documents involves several steps, and even small mistakes can lead to complications in the payment process. Whether it’s an error in the total amount, incorrect client details, or overlooked payment terms, such mistakes can delay payments and damage professional relationships. Understanding common pitfalls can help you avoid these issues and ensure that your documents are clear, accurate, and professional.

From miscalculating totals to forgetting key payment instructions, the risks of errors are high if careful attention is not given to each detail. In this section, we’ll explore some of the most common mistakes made during the creation of financial documents and how to prevent them.

Common Mistakes in Billing Documents

- Incorrect or Missing Client Information: Omitting or misspelling a client’s name, address, or contact information can lead to confusion and delays in processing payments.

- Wrong Payment Terms: Failing to include clear payment due dates or terms can result in late payments or misunderstandings between the service provider and the client.

- Calculation Errors: Mistakes in adding up totals, taxes, or discounts can lead to inaccurate amounts, requiring re-issuing of the document.

- Not Including Purchase Order Numbers: Omitting reference numbers can cause confusion, particularly for larger businesses that require these identifiers for processing payments.

- Failure to Itemize Charges: A lack of itemized line items can make it unclear what the client is being charged for, leading to disputes or non-payment.

How to Avoid These Errors

- Double-check Client Information: Always review contact details and ensure that everything is accurate before sending the document.

- Review Payment Terms: Clearly define payment deadlines and terms such as discounts for early payment or penalties for late payments.

- Use Formulas to Avoid Calculation Errors: Incorporate automatic calculations to reduce the risk of manual mistakes.

- Include Reference Numbers: Ensure that any purchase order or reference number is included for easy tracking.

- Itemize All Charges: Break down all charges to make it clear to the client what they are being billed for.

By being aware of these common errors and taking steps to prevent them, you can create clear and accurate documents that facilitate smooth transactions and help maintain strong client relationships.

Ensuring Invoice Accuracy on Mac

Accurate financial documentation is essential for maintaining smooth business operations and client trust. Ensuring the precision of billing statements is crucial, as even minor errors can lead to confusion, delays in payment, or disputes. It’s important to utilize the right tools and techniques to avoid mistakes and ensure that all the details–such as amounts, dates, and terms–are correct before sending any documents out.

By following a few key practices, you can guarantee the quality and accuracy of your financial records. These include double-checking client information, using automated calculations, and ensuring all details are properly aligned. This section will guide you on how to maintain error-free billing processes with the help of digital tools, allowing you to focus on other aspects of your business while reducing the chance of mistakes.

Key Practices for Ensuring Accuracy

- Review Client Information: Always verify the details of your client, including their name, address, and contact information. This ensures there are no misunderstandings when sending payment reminders.

- Automate Calculations: Using formulas can eliminate the risk of manual errors when adding totals, taxes, and discounts. Setting up automatic formulas for these calculations can save time and ensure consistency across documents.

- Double-Check Dates and Terms: Make sure that the billing cycle, due date, and payment terms are clearly stated and accurate to avoid confusion regarding when the payment is due.

- Keep Items Itemized: Clearly list all products or services being charged for to provide a transparent breakdown of costs. This not only avoids confusion but also reassures your clients that they are being billed fairly.

Tools and Techniques for Improved Accuracy

- Template Usage: Starting with a professional template can help ensure that you don’t forget any important sections. Templates can also be set up with predefined fields, reducing the chances of error.

- Cross-checking Payments: Regularly cross-checking payment records with the generated document can help detect any discrepancies, allowing for quicker resolution.

By incorporating these best practices, you can significantly reduce errors in your financial documentation process, ensuring accuracy and improving your professionalism. This will not only streamline your workflow but also strengthen relationships with clients by providing clear, reliable billing records.

Using Mac Excel for International Billing

When working with clients or customers from different parts of the world, it’s essential to have a system that can handle the complexities of international transactions. Currency conversion, varying tax rates, and different regulatory requirements can all complicate the process of managing financial documents. Utilizing digital tools can streamline this process, making it easier to maintain accuracy and professionalism in global dealings.

One of the key benefits of using digital tools for international billing is their ability to manage multiple currencies and tax systems with ease. In addition, many platforms offer customizable fields to adjust for local language preferences, payment methods, and other regional considerations. This ensures that the document not only meets international standards but is also user-friendly for clients across the globe.

Managing Multiple Currencies and Conversion Rates

One of the most common challenges in international billing is dealing with multiple currencies. It’s important to provide accurate conversion rates to ensure that clients are being billed correctly. Some systems allow for the automatic integration of current exchange rates, while others require manual input. By keeping track of up-to-date rates and including them clearly in your documents, you can avoid discrepancies and maintain trust with international clients.

Adapting to Local Tax Laws

Different countries have different tax regulations, and it’s vital to account for these in your billing process. Whether it’s VAT in Europe, GST in Asia, or other forms of taxation, your system should allow for the easy application of the correct tax rates based on the location of your client. This helps ensure that all charges are compliant with local laws, reducing the risk of errors and audits.

Incorporating these features into your international billing process allows you to work efficiently with clients worldwide, while maintaining a high level of professionalism and accuracy. By automating currency conversions and adapting to local tax systems, digital tools simplify what would otherwise be a complex and error-prone task.

How to Save and Share Invoices

Once financial documents are created, it is crucial to save them in a way that ensures easy access, security, and proper organization. Additionally, sharing these documents with clients or colleagues should be straightforward and secure. By following a few key steps, you can manage these documents efficiently and ensure that they are delivered in a professional manner.

Firstly, saving your documents in a widely accepted format such as PDF ensures that the layout remains consistent regardless of the device or platform your recipient is using. This format is also easy to store, retrieve, and secure with password protection or encryption if needed. A clear and systematic file naming convention is also important for easy retrieval. Consider including elements such as the client’s name, the document date, or even the type of service provided for clear identification.

Saving Documents Securely

When saving your documents, ensure that you use a reliable storage system. Cloud storage services like Google Drive, Dropbox, or OneDrive offer easy access and the ability to back up documents in case of hardware failure. Alternatively, for those who prefer local storage, organizing files in clearly labeled folders and maintaining regular backups can help protect against data loss. It is important to consider security and privacy when handling sensitive financial documents, so utilizing encryption or password protection is always recommended.

Sharing Documents with Clients

When it comes to sharing financial documents, email remains the most common method. You can attach the document directly, or, for added security, provide a link to the file stored in a cloud service. If the document contains sensitive information, using a secure sharing platform with password protection or encryption is advisable. Additionally, it is a good practice to confirm with the recipient that they have received the document and that all information is clear. If needed, follow up to ensure payment is processed in a timely manner.

By saving your documents securely and sharing them effectively, you ensure that your financial records are both accessible and protected, helping maintain professionalism and streamline your administrative processes.

Excel Invoice Templates for Small Businesses

For small businesses, managing financial transactions efficiently is crucial. One of the simplest and most cost-effective ways to create and manage billing documents is by using spreadsheet-based solutions. These tools offer flexibility and ease of use, allowing business owners to customize their financial documents according to their unique needs.

Using pre-designed spreadsheets for generating billing statements can save time and reduce the risk of errors. These ready-made solutions typically include all the necessary fields, such as client information, services provided, payment terms, and total amounts. With a bit of customization, small business owners can add their logo, adjust the layout, and even include tax rates or discounts as required.

Why Small Businesses Benefit

One of the main advantages of using spreadsheet-based billing systems is the ability to track payments and outstanding balances. These documents can be easily updated with payment statuses, helping businesses keep an accurate record of what has been paid and what is still due. Additionally, spreadsheets can be saved and stored digitally, offering a secure, easily accessible backup of all financial records.

Customization and Flexibility

Another benefit is the high level of customization available. Whether it’s for adjusting itemized lists of products or services, or adding detailed payment instructions, these tools provide the flexibility to modify invoices to fit the business model. Small business owners can ensure that each document reflects their brand identity, contributing to a more professional presentation to clients.

By using these flexible tools, small businesses can streamline their billing process, maintain better control over their finances, and present a more polished image to clients and partners.