Simple Lump Sum Invoice Template for Streamlined Billing

In today’s fast-paced business world, ensuring your payments are clear and well-organized is crucial for maintaining strong relationships with clients. A structured approach to charging for services helps set transparent expectations and can simplify both the client’s and provider’s workload. By using a single-payment format, businesses of all sizes can communicate costs effectively and ensure their transactions are easy to track and understand.

Choosing a clear and concise structure for your billing not only saves time but also reduces the likelihood of misunderstandings or disputes. This format is especially useful for projects with a fixed price, allowing service providers to outline charges in one straightforward document. With a user-friendly approach to billing, you’ll be able to focus more on your work and less on financial paperwork.

A well-organized document for service payments reflects professionalism and helps build trust with clients. It also serves as a reliable record for future ref

Understanding Lump Sum Invoices

For businesses and freelancers alike, setting a fixed price for projects can simplify billing and help clients understand the full cost of a service upfront. This approach offers clarity, as it allows all charges to be clearly presented in one document, making it easier for both parties to align on expectations and terms. Fixed-price billing can reduce the need for frequent follow-up communications about costs, fostering a smoother experience for everyone involved.

With a single-charge structure, service providers detail the agreed amount for the entire project, covering all tasks within a set budget. This format can be particularly beneficial for projects where costs are predictable, helping avoid unexpected fees or adjustments. For clients, knowing the exact cost before work begins adds a layer of reassurance

Benefits of Using a Lump Sum Invoice

For many professionals and companies, utilizing a single-rate approach to billing can offer substantial advantages, especially when it comes to clarity and simplicity. With this format, both clients and providers benefit from understanding the total cost of a project upfront. This level of transparency not only builds trust but also streamlines communication, as all financial aspects are established from the start.

Enhanced Financial Transparency

One of the primary benefits of this type of payment structure is the transparency it brings to transactions. By clearly defining the overall cost in a single document, businesses reduce the potential for confusion and unexpected charges. This approach allows clients to re

Benefits of Using a Lump Sum Invoice

For many professionals and companies, utilizing a single-rate approach to billing can offer substantial advantages, especially when it comes to clarity and simplicity. With this format, both clients and providers benefit from understanding the total cost of a project upfront. This level of transparency not only builds trust but also streamlines communication, as all financial aspects are established from the start.

Enhanced Financial Transparency

One of the primary benefits of this type of payment structure is the transparency it brings to transactions. By clearly defining the overall cost in a single document, businesses reduce the potential for confusion and unexpected charges. This approach allows clients to review and approve costs easily, creating a more efficient process for everyone involved. Having the full payment outlined also provides a solid record that clients and providers can reference as needed, making it easier to stay aligned on the financial terms.

Improved Budget Management

A fixed-rate billing method also helps clients manage their budgets more effectively. Knowing the total cost at the outset means there are no surprises, allowing clients to allocate funds accordingly. This predictability is especially helpful for clients working within specific budget constraints, as it ensures that all expenses are accounted for in advance. Businesses, on the other hand, can focus on delivering results without the need for continuous billing adjustments, enhancing productivity and client satisfaction.

Ultimately, this approach fosters a smoother, more professional relationship between clients and providers. By keeping the process straightforward and predictable, both parties can focus on achieving project goals without being sidetracked by financial details. This makes a fixed-price billing model an appealing option for a wide range of projects and industries.

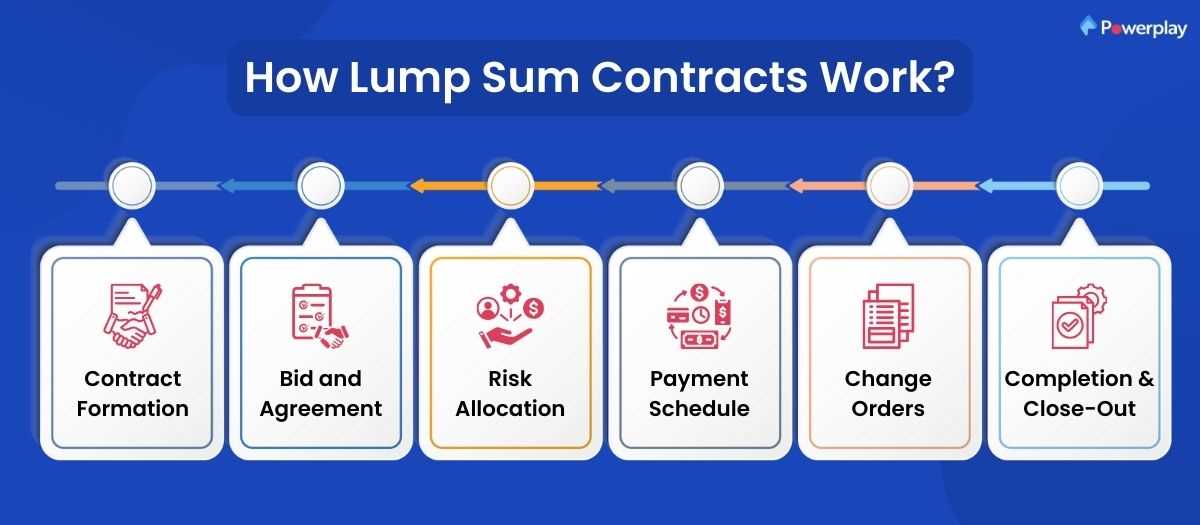

When to Choose Lump Sum Pricing

Opting for a fixed-rate payment structure is often advantageous for specific types of projects where costs can be accurately estimated from the outset. This method works well for assignments that have a defined scope and clear requirements, as it provides both the client and service provider with a straightforward approach to managing the budget and expectations. Deciding to use a single-charge model can depend on various factors, such as project type, risk management, and the nature of the work involved.

Project Characteristics Suited for Fixed Pricing

Fixed-rate billing tends to be ideal for assignments that don’t have significant variables or unknown factors. For instance, tasks that are routine, highly predictable, or follow a set process can often be priced more accurately with this model. On the other hand, projects requiring frequent adjustments or open-ended creativity might benefit more from other pricing structures. Below is a comparison table highlighting scenarios where fixed pricing is more favorable and where

Essential Elements of a Lump Sum Invoice

A clear, well-structured billing document is key to ensuring both parties understand the project’s costs and terms. For a one-time payment arrangement, the document should include specific information that outlines the agreed price, provides an overview of services rendered, and presents a professional summary of the transaction. Including essential details helps create transparency, minimizes potential disputes, and serves as a useful record for future reference.

Client and Service Provider Details: Both parties’ names and contact information should be listed at the top. Including business names, addresses, phone numbers, and emails helps establish professionalism and provides a clear point of contact for any questions.

Project Description and Scope: A brief overview of the services provided or products delivered is crucial. This section should outline the work completed, ensuring that all key elements of the project are clearly documented. Keeping the description concise yet specific helps avoid misunderstandings and confirms the services covered in the payment.

Total

Comparing Lump Sum vs Hourly Invoicing

Choosing between a fixed-price and time-based billing structure can significantly impact both project management and client relationships. Each method has its advantages and is suitable for different types of projects and working styles. Understanding the distinctions between these two approaches helps clients and service providers decide which billing method aligns best with their needs and expectations.

Fixed-Rate Billing: Consistency and Predictability

With a one-time, pre-determined fee, fixed pricing provides a clear budget for the client and ensures predictable income for the provider. This structure is particularly beneficial for projects with a well-defined scope, where the tasks and deliverables are unlikely to change. By establishing the entire cost upfront, both parties can focus on results without worrying about fluctuating expenses or continuous billing adjustments. Fixed pricing also minimizes administrative tasks, as there’

Comparing Lump Sum vs Hourly Invoicing

Choosing between a fixed-price and time-based billing structure can significantly impact both project management and client relationships. Each method has its advantages and is suitable for different types of projects and working styles. Understanding the distinctions between these two approaches helps clients and service providers decide which billing method aligns best with their needs and expectations.

Fixed-Rate Billing: Consistency and Predictability

With a one-time, pre-determined fee, fixed pricing provides a clear budget for the client and ensures predictable income for the provider. This structure is particularly beneficial for projects with a well-defined scope, where the tasks and deliverables are unlikely to change. By establishing the entire cost upfront, both parties can focus on results without worrying about fluctuating expenses or continuous billing adjustments. Fixed pricing also minimizes administrative tasks, as there’s no need to track hours or send frequent updates.

Hourly Billing: Flexibility and Detailed Tracking

Time-based billing, on the other hand, is ideal for projects with evolving requirements or open-ended tasks. This model allows for detailed tracking of hours spent, making it easy to adjust costs based on changes in project scope or client requests. Hourly rates provide flexibility, especially in creative or consultative work where tasks may vary. While this approach offers transparency on the work done, it requires both parties to monitor time closely, which can add an administrative layer to the project.

Choosing the Right Approach

The choice between fixed and hourly billing often depends on project type, scope clarity, and each party’s preference for flexibility or stability. For well-defined projects, a fixed rate can simplify communication and budgeting. Conversely, when project requirements are likely to shift, hourly billing offers the adaptability needed to accommodate new directions. Selecting the most suitable method helps establish trust and ensures that both client and provider can work comfortably within agreed terms.

Ultimately, both billing structures serve their purposes effectively. Weighing their benefits against project demands can make a significant difference in achieving successful, mutually beneficial collaborations.

Tips for Clear Lump Sum Invoicing

Clear and effective communication is essential when billing for a one-time project or fixed-price agreement. Ensuring that the payment details are easy to understand can prevent confusion and foster good relationships between service providers and clients. By following a few simple guidelines, businesses can create straightforward and professional documents that streamline payment processes and reduce the chances of disputes.

1. Provide a Detailed Breakdown

Even when the agreed-upon price is fixed, breaking down the costs can enhance clarity. A detailed description of what is included in the charge helps both parties understand the value of the service or product delivered. This breakdown can include:

- Service descriptions

- Product quantities

- Any additional fees or charges

Providing this level of detail prevents any misunderstandings about what is covered and reinforces transparency in the transaction.

2. Use Simple and Clear Language

Use clear, straightforward language that eliminates ambiguity. Avoid technical jargon or overly complex terms, which can confuse clients or make the payment process seem more complicated than it needs to be. Clearly state the total amount due, the payment terms, and the due date. It is also useful to specify any payment methods you accept to avoid further confusion.

3. Include Contact Information

Always include accurate contact information for both the service provider and the client. This can include email addresses, phone numbers, or any other relevant communication channels. Providing a contact point in case of questions helps resolve potential issues quickly and improves customer satisfaction.

4. Set Clear Payment Terms

Clearly outline the payment schedule and due dates. Be specific about when the payment is expected and any penalties for late payments, if applicable. This helps prevent misunderstandings regarding payment deadlines and reinforces the importance of adhering to the agreed terms.

5. Keep a Professional Format

A clean, organized layout goes a long way in conveying professionalism. Ensure that the document is easy to read and well-structured, with clear headings and well-spaced sections. A polished presentation reflects positively on your business and can enhance client trust.

By following these simple tips, businesses can ensure that their one-time payment documents are clear, professional, and easy to understand, making the billing process smoother for both the client and service provider.

Common Mistakes in Lump Sum Billing

When charging a fixed price for services or projects, errors in the billing process can lead to confusion, delays, or disputes. These mistakes often occur due to poor communication or lack of attention to detail. By being aware of these common pitfalls, businesses can improve the accuracy of their billing and maintain positive relationships with clients.

1. Failing to Clearly Define Scope

One of the most frequent mistakes is not clearly outlining the scope of the work involved. Without a precise description of what is being provided, there is room for misinterpretation. Clients may expect more than what was originally agreed upon, or they may feel dissatisfied with the results. It’s important to outline every service and product included in the price, ensuring both parties are on the same page.

2. Underestimating Costs

Many businesses make the mistake of underestimating the total costs when setting a fixed price. This can happen when unforeseen expenses arise or the initial estimate was too low. If the cost exceeds expectations, it may lead to financial strain on the provider or dissatisfaction from the client. Always take into account potential extra costs when estimating the final charge.

3. Inadequate Payment Terms

Not setting clear payment terms can lead to confusion regarding due dates or accepted payment methods. Without these details, clients may not be aware of the expected timeline for payment or which methods are acceptable. Clearly outline payment schedules, deadlines, and accepted payment forms to avoid any misunderstandings.

4. Lack of Itemization

Some businesses overlook the importance of itemizing the charges, even for fixed-price agreements. A general price without clear breakdowns can leave clients questioning what they are paying for. It’s essential to list all included services, products, and any additional fees to give clients a complete understanding of their payment.

5. Not Updating Terms for New Projects

Failing to update terms and agreements for each new project can lead to mismatched expectations. Using outdated pricing structures or contract terms may result in confusion or disagreements. Each new project should have an updated, customized agreement to ensure both the client and provider are aligned on all aspects of the deal.

By avoiding these common mistakes, businesses can ensure that their fixed-price agreements are clear, accurate, and professional, leading to smoother transactions and stronger client relationships.

Customizing Your Invoice Template

Personalizing your billing documents ensures that they reflect your brand identity and provide a clear, professional presentation to your clients. Customization helps to tailor the document to your specific needs, making it easier for clients to understand the charges, deadlines, and payment terms. Whether you are providing services or products, adjusting the layout and information to suit your business can improve both the client experience and efficiency.

Start by adjusting the overall layout, ensuring that it is easy to read and organized. The inclusion of your logo and brand colors helps clients immediately recognize your business, creating a more cohesive experience. Clear headings, an intuitive structure, and an emphasis on essential details will also ensure that important information like due dates and total amounts are not overlooked.

Adding personalized fields can further improve clarity. For instance, incorporating client-specific references such as project names, contract numbers, or special terms can reduce confusion and prevent errors. Additionally, customizing the payment options and terms section to suit your preferred methods allows you to set expectations for the payment process.

Don’t forget to include clear contact details in case clients have questions or concerns about the charges. Providing a transparent and easily accessible way to communicate helps build trust and facilitates quicker resolutions if there are any issues with the billing process.

By taking the time to customize your billing documents, you ensure they are not only functional but also represent your professionalism and attention to detail, ultimately improving client satisfaction and strengthening your business relationships.

Examples of Lump Sum Invoices

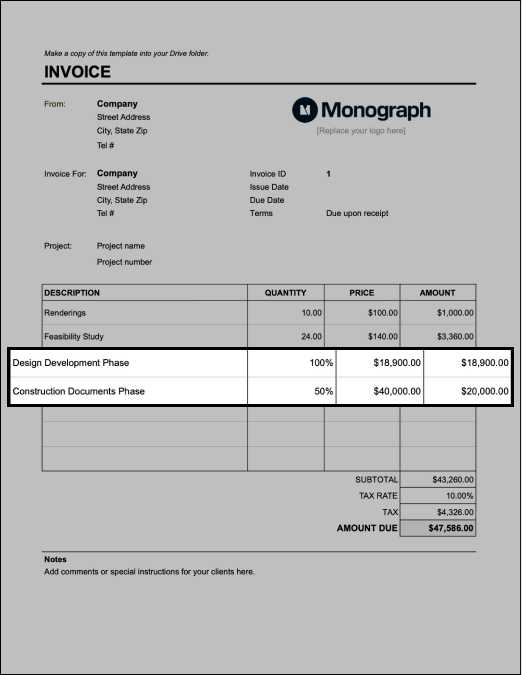

When billing for a fixed price, it’s important to present the charges clearly and concisely. Many businesses use a structured approach to itemize the work completed, while still charging one agreed-upon total amount. Below are a few examples of how such documents can be designed, focusing on the necessary information without overcomplicating the format.

Example 1: Service-Based Contract

In service agreements, the final amount might include the total cost for all services rendered, regardless of the time spent or the specific tasks performed. For example, a consulting firm could present a document showing a flat fee for a project completion, with a breakdown indicating any specific milestones or stages reached. The description would include items such as “Consultation Fees,” “Strategy Development,” and “Implementation Costs,” all under one total charge for easy understanding.

Example 2: Product Delivery Agreement

For product-based agreements, such as bulk orders, a fixed cost can be presented for the entire delivery. In this case, the billing could include details like the product description, quantity, and agreed-upon price per unit, but the final total is a singular amount that reflects the full charge for the entire batch or delivery. This approach works well for both manufacturers and distributors.

These examples show how streamlined billing can benefit both businesses and clients by offering clarity and reducing confusion over charges. The format of presenting a fixed total with some brief details creates transparency, which is crucial for maintaining strong client relationships.

Legal Considerations for Lump Sum Billing

When using a fixed-price approach for billing, it’s essential to understand the legal implications involved. While the process may seem straightforward, there are several legal factors to consider to ensure compliance and avoid potential disputes. Below are key aspects that businesses should keep in mind when creating agreements and documenting charges.

- Clear Contract Terms: It is vital to clearly define the scope of work or services to be provided in the agreement. Ambiguities can lead to misunderstandings and legal disputes. Both parties should have a mutual understanding of what is included in the fixed price and any potential adjustments that may arise.

- Payment Deadlines: Legal contracts should outline specific payment terms, including deadlines for settlement. This helps avoid delays and ensures that both the service provider and client are aware of the expected timeframes for payment.

- Tax Compliance: Different jurisdictions have varying tax requirements for fixed-price contracts. Businesses must ensure that the appropriate taxes are included in the final amount and that they comply with local tax regulations.

- Dispute Resolution: A legal agreement should contain a clause for dispute resolution. This can include mediation or arbitration procedures in case of disagreements between the client and the service provider over the terms or payments.

- Late Fees and Penalties: Many contracts include clauses that specify penalties or interest for late payments. These provisions should be clearly stated in the agreement to avoid confusion and ensure the client is aware of any consequences for missing payment deadlines.

By keeping these legal considerations in mind, businesses can protect themselves from potential risks and create clear, enforceable agreements that promote transparency and trust with their clients. It is always advisable to seek legal advice when drafting contracts to ensure that all necessary provisions are included and legally sound.

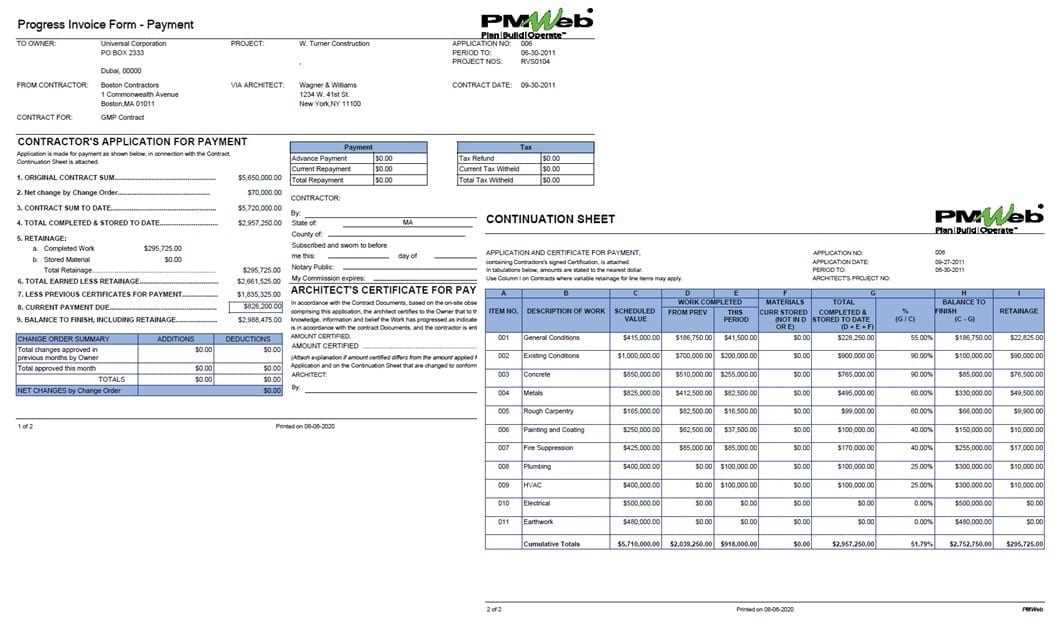

Tracking Payments on Lump Sum Projects

Effective payment tracking is crucial in projects that involve fixed-price agreements. Keeping a clear record of payments helps ensure that both parties are aligned regarding financial expectations and deliverables. Monitoring payments on such projects not only improves cash flow management but also prevents misunderstandings between clients and service providers.

Organizing Payment Schedules

For fixed-price contracts, it is essential to establish a payment schedule that clearly outlines when payments are due throughout the project. This can be based on project milestones or predetermined dates, helping to ensure consistent cash flow and providing both parties with a clear understanding of their obligations. By following this schedule, businesses can easily track the progress of payments and ensure they are received on time.

Utilizing Payment Tracking Tools

Utilizing digital tools or software to monitor payments can significantly streamline the tracking process. Many platforms offer features like automatic reminders for upcoming due dates, detailed payment history logs, and integration with accounting systems. These tools make it easier to track whether a payment has been received, and if not, they help in following up promptly.

By maintaining an organized system for tracking payments and utilizing available tools, businesses can stay on top of their finances and avoid delays in receiving payment for completed work.

Effective Communication in Lump Sum Contracts

Clear and consistent communication is essential in contracts that involve fixed payments for specific tasks. Whether between contractors and clients or among team members, effective communication ensures that everyone is aligned and that the project progresses smoothly. A strong communication strategy helps to prevent misunderstandings, delays, and disputes, making the entire process more efficient.

Setting Expectations Early

Before work begins, it’s important to set clear expectations regarding the scope of the project, deadlines, and payment terms. Both parties should agree on what will be delivered and when, leaving no room for ambiguity. A well-documented agreement at the outset helps avoid miscommunication later in the project.

- Define project milestones and deadlines.

- Agree on payment schedules based on progress.

- Ensure all deliverables are clearly outlined.

Regular Updates and Feedback

Keeping the lines of communication open throughout the project is crucial. Regular updates allow both the client and the contractor to track progress, address any concerns, and make necessary adjustments. Frequent feedback ensures that work stays on course and meets expectations, helping to maintain a positive working relationship.

- Schedule regular check-ins with all stakeholders.

- Share progress reports or summaries regularly.

- Address concerns promptly and make adjustments as needed.

By fostering transparent and frequent communication, both parties can contribute to the success of the project, ensuring that it is completed on time and within budget.