Free Locum Pharmacist Invoice Template in Word Format

When working in healthcare, accurately managing payments for services rendered is essential for smooth operations. Professionals often need a simple yet effective way to bill clients, ensuring that all necessary information is included and presented clearly. Using pre-designed documents can save time and effort while maintaining a high standard of professionalism.

There are various methods to structure these financial documents, but having an easy-to-edit and customizable format can make the entire process more efficient. By using editable files, you can quickly adjust the details for each individual case, without worrying about formatting errors or missing information.

Tailoring these documents to your specific needs and preferences is crucial in making sure that both you and your clients are clear on payment terms, services provided, and other important details. The flexibility of digital files allows for seamless updates and adjustments, keeping everything organized and professional.

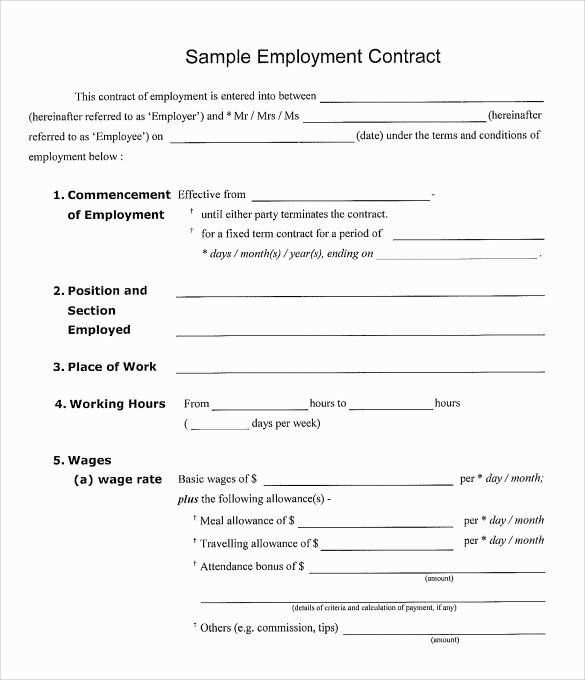

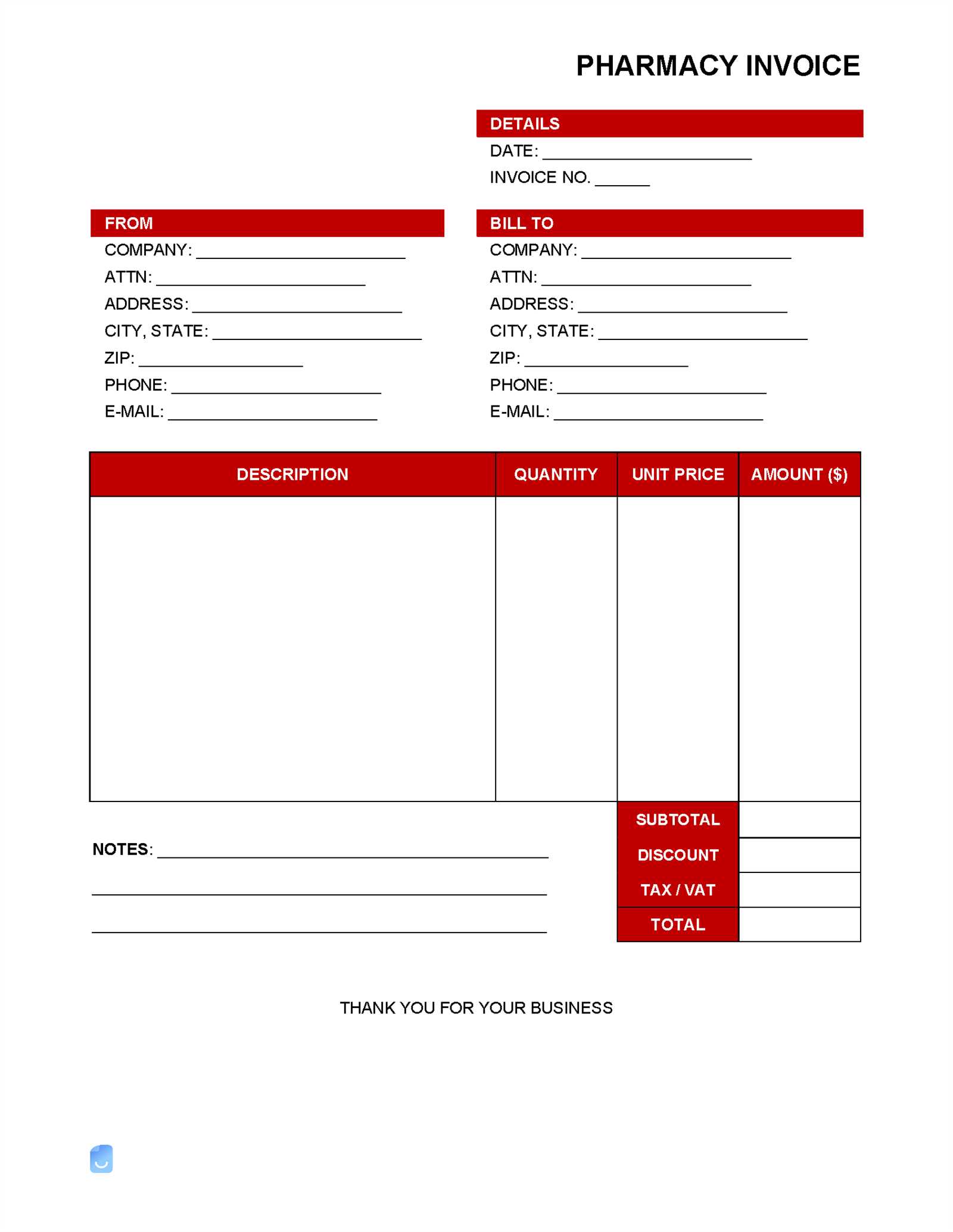

Locum Pharmacist Invoice Template Overview

Creating a clear and organized billing document is essential for professionals providing temporary healthcare services. These documents should contain all relevant information, ensuring transparency and accuracy when it comes to payment processing. The right format can significantly simplify the billing process, saving time and avoiding errors.

Key Features of an Effective Billing Document

An effective document should include several key elements that are crucial for both the service provider and the client. These features help ensure that all necessary details are covered:

- Contact Information: Clearly listing both the service provider’s and the client’s contact details is essential for easy communication.

- Service Description: A detailed breakdown of the services rendered, including dates and hours worked, ensures clarity.

- Payment Terms: Specifying the payment due date, methods of payment, and any applicable late fees helps avoid confusion.

- Total Amount Due: The final amount, including taxes or additional charges, should be clearly stated.

Benefits of Using an Editable Document

One of the biggest advantages of using an editable file is the ability to customize it for each individual case. These documents can be tailored to suit various clients or projects, ensuring that all details are accurate and up to date. Moreover, editable files allow for quick adjustments, whether you need to update the client’s contact information or adjust the services provided.

Additionally, by using a professional and consistent format, these documents help maintain a high level of professionalism and reduce the chances of errors that could delay payment processing.

Why Choose a Word Invoice Template

Choosing the right format for creating billing documents is crucial to ensure efficiency and accuracy. Editable files offer flexibility, allowing professionals to easily modify and update the document as needed. This convenience makes digital formats an ideal choice for generating customized and error-free billing statements, particularly when working with clients on a case-by-case basis.

Advantages of Flexibility and Customization

One of the primary reasons for selecting a digital file format is the ability to easily customize the document for each individual transaction. With editable files, users can:

- Quickly update contact information: Easily change client or service provider details without having to redesign the document each time.

- Modify service descriptions: Tailor the list of services and fees for specific jobs or clients, ensuring accurate billing.

- Adjust formatting: Modify font styles, sizes, and layout to suit personal preferences or company standards.

Cost-Effective and Accessible Solution

Editable files are a cost-effective solution for creating professional documents without the need for expensive software. Most professionals already have access to text editing programs, and many templates are available for free or at a low cost. These documents can be saved and shared digitally, reducing printing costs and ensuring faster processing times.

Additionally, since the file format is widely accessible, clients and service providers can easily open and review the document without compatibility issues, making it a convenient option for both parties involved.

Benefits of Using a Digital Template

Utilizing a digital document format for creating professional billing statements brings several advantages that streamline the process and reduce errors. These benefits not only improve efficiency but also ensure that all necessary details are captured and presented in a clear and consistent manner. Digital formats provide an easy way to create, edit, and share these documents, ultimately saving time and effort.

Enhanced Efficiency and Speed

Using an editable file significantly speeds up the process of generating billing statements. Instead of starting from scratch each time, users can quickly update existing documents, saving time and reducing manual input. Key benefits include:

- Fast document generation: Pre-built structures allow for rapid creation of new statements with minimal effort.

- Quick updates: Easily adjust amounts, services, or client details without creating a new document.

- Instant duplication: Create multiple documents based on the same structure without needing to redo the layout every time.

Improved Accuracy and Consistency

Digital files ensure consistency in the appearance and structure of each billing statement. This reduces the chances of errors that could occur when manually creating documents from scratch. The main advantages include:

- Standardized format: Consistent use of fonts, styles, and sections ensures that every statement looks professional.

- Reduced errors: Automatic formatting and predefined fields help eliminate mistakes in calculations or text.

- Built-in sections: Easily add or remove relevant information, ensuring nothing is left out or overlooked.

Convenient Storage and Sharing

Digital formats also offer the benefit of easy storage and sharing. These files can be stored in the cloud, shared via email, or printed out as needed. Benefits include:

- Easy access: Retrieve files from any device with internet access, allowing for quick edits or reviews from anywhere.

- Quick sharing: Send billing documents directly to clients or colleagues without the need for physical mailing.

- Secure storage: Safely store and organize documents, reducing the risk of losing important information.

How to Create Your Own Invoice

Creating a professional billing document from scratch may seem like a complex task, but it can be easily managed by following a few simple steps. A well-structured statement helps ensure that all necessary details are included, and the recipient understands the payment terms clearly. By using an editable format, you can quickly customize the document to suit any specific job or client.

Steps to Create a Billing Document

Follow these simple steps to create your own billing statement:

- Choose a Layout: Start by selecting a clean, professional layout that includes all key sections like contact information, service description, and payment terms.

- Include Essential Information: Add your personal details, such as name, business name, and contact information, along with the client’s details. Make sure both parties are easily identifiable.

- List the Services Provided: Clearly describe the services you have performed, including dates and quantities if applicable. Provide a breakdown of the fees to ensure transparency.

- Specify Payment Terms: Include the total amount due, payment methods accepted, and the due date. Add any necessary terms related to late fees or discounts.

- Review and Edit: Double-check all the information for accuracy. Ensure there are no spelling errors or missing details that could delay the payment process.

- Save and Send: Once the document is complete, save it in a preferred format and send it to the client. You can share it digitally via email or print it for physical delivery.

Helpful Tips for Customization

To make the billing document more personalized and professional, consider the following tips:

- Use clear, readable fonts: Opt for simple fonts like Arial or Times New Roman for easy reading.

- Keep it organized: Use headings and sections to separate information, ensuring the document looks tidy and well-structured.

- Add your logo: Including your business logo can add a personal touch and enhance the professional appearance of the document.

With these steps and tips, creating your own billing statement becomes a straightforward task that ensures accuracy and professionalism in your financial dealings.

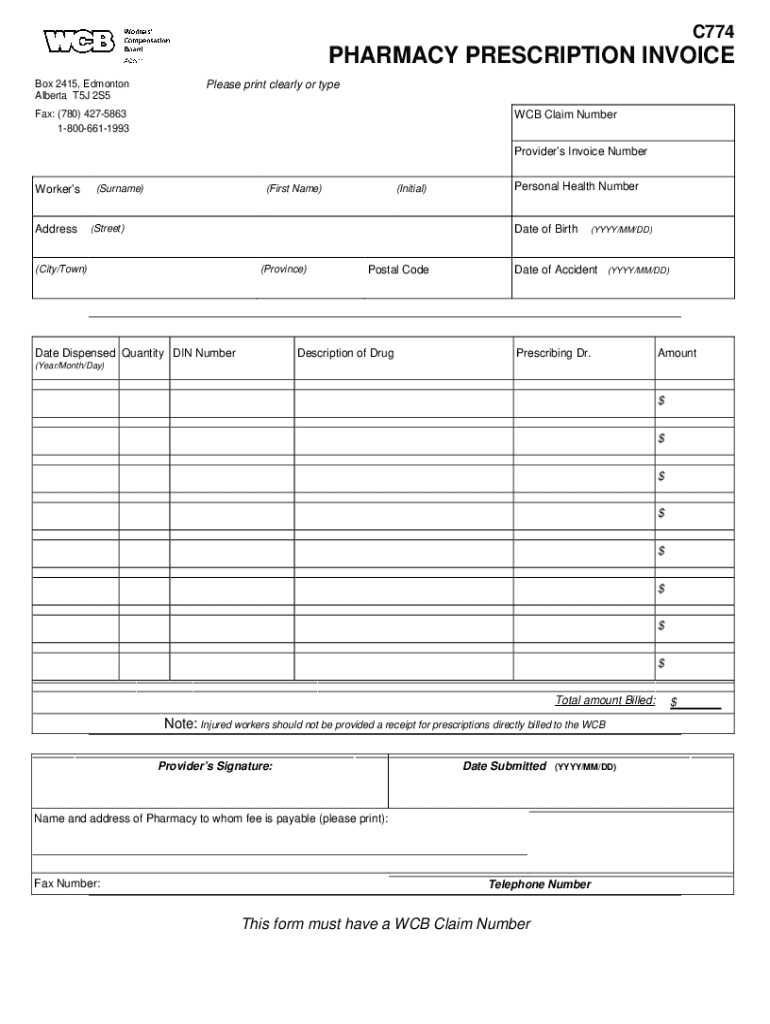

Essential Details in a Billing Document

When preparing a document for payment, including the right information is crucial for ensuring both clarity and legal compliance. A well-structured document makes it easier for clients to understand the charges and for the service provider to receive timely payments. There are several key components that must be included to create a complete and professional billing document.

Key Information to Include

Every billing document should feature these essential details:

- Contact Information: The service provider’s full name or business name, address, phone number, and email address should be listed at the top. Similarly, the client’s contact information must be clearly noted.

- Unique Document Identifier: Assign a unique number to the document for easy tracking and reference in case of future correspondence.

- Description of Services: Provide a clear and detailed description of the services provided, including dates, quantities, and any relevant specifics about the work performed.

- Amount Due: Clearly state the total amount to be paid, breaking down individual fees if applicable. This may include hourly rates, fixed fees, or additional costs.

- Payment Terms: Specify when the payment is due, the accepted methods of payment, and any late payment penalties or discounts for early payment.

Additional Helpful Information

To further enhance clarity and ensure that the client understands the document, consider including these optional details:

- Tax Information: If applicable, include the tax rate and total tax amount separately to ensure transparency.

- Terms and Conditions: Briefly outline any terms or conditions associated with the services provided, such as cancellation policies or warranties.

- Payment Instructions: Provide any necessary instructions for making the payment, such as bank account details or an online payment link.

Including these essential details will help ensure that your billing document is both professional and easy to understand, streamlining the payment process and minimizing any confusion.

Customizing the Template for Your Needs

One of the greatest advantages of using an editable document for billing is the ability to easily customize it to suit the specifics of each client or project. Personalizing the format allows you to tailor the document according to your business needs, making sure that every detail is aligned with the service you provided and the expectations of your clients.

Customizing your document involves modifying various sections such as the layout, content, and style to reflect your brand or the specific nature of the service. Below are some key areas where customization can enhance the document:

| Customizable Section | How to Customize |

|---|---|

| Header | Add your business logo, name, and contact details. You can adjust font size or placement to match your brand identity. |

| Service Description | Modify the list of services according to the specific work done. Be as detailed as necessary to avoid confusion for your client. |

| Pricing and Fees | Adjust the fee structure to reflect hourly rates, flat fees, or discounts. You can also add any additional charges if applicable. |

| Payment Terms | Specify the payment methods accepted, due dates, and late fees. Tailor the terms to suit your business practices. |

| Layout and Design | Adjust the overall design by changing font styles, colors, or adding a footer with additional information like tax numbers or business registration details. |

By making these adjustments, you ensure that your billing document meets your business standards while maintaining clarity and professionalism. Customization also helps in ensuring that each client receives a document that is specific to the work completed and the agreed-upon terms, enhancing overall satisfaction and reducing disputes.

Saving Time with Pre-made Templates

Using pre-designed documents can significantly reduce the time spent creating billing statements. Instead of starting from scratch, professionals can simply input the relevant details into a ready-made structure, allowing for quick adjustments and immediate use. This approach streamlines the process and ensures that no important elements are overlooked.

Benefits of Pre-made Documents

Pre-designed files come with numerous advantages, especially for those who need to create multiple documents in a short period. Some of the key benefits include:

- Reduced Setup Time: With a pre-made document, most of the formatting and structure is already in place. You just need to fill in the specific information.

- Consistency: Using a standard layout for all billing statements ensures a professional and consistent appearance, which helps to build trust with clients.

- Less Risk of Error: Pre-designed formats often include all necessary sections, minimizing the chances of forgetting key details or making layout mistakes.

How Pre-made Documents Improve Efficiency

By using a pre-made format, the time spent on administrative tasks like creating and sending statements is drastically reduced. Whether you’re working with a single client or handling multiple accounts, the ability to quickly generate a document saves valuable time. Additionally, many pre-made files are customizable, allowing you to adjust them for specific needs without having to redo the entire layout.

Overall, pre-designed documents enhance productivity and ensure that your billing process is both efficient and professional.

Legal Requirements for Billing Statements

When creating billing documents for professional services, it’s important to adhere to specific legal requirements to ensure compliance with tax laws and contractual agreements. Properly formatted statements not only help with payment collection but also protect both the service provider and the client in case of disputes. Legal requirements can vary depending on the country or region, but certain key elements should always be included in your billing documents.

Essential Legal Information to Include

To make sure your billing documents meet legal standards, be sure to include the following information:

- Business Identification: Include your full name or business name, as well as any registration number or tax identification number, depending on your jurisdiction.

- Client Information: Clearly state the name and contact details of the client receiving the services. This is crucial for identifying both parties in case of a legal issue.

- Unique Document Number: Assign a unique reference number to each billing document. This helps with tracking and prevents confusion between multiple transactions.

- Date of Service: Provide the date or range of dates when the service was rendered. This ensures that the statement corresponds to the correct billing period.

- Itemized List of Services: List all services or products provided, along with associated costs. This ensures transparency and prevents disputes over charges.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. This helps ensure timely payment and reduces misunderstandings.

- Tax Information: Depending on local regulations, include the applicable tax rate and amount. This is necessary for tax purposes and ensures compliance with VAT or sales tax laws.

Additional Considerations for Compliance

Aside from the basic legal requirements, there may be additional considerations depending on the industry or specific services provided. For example:

- Service Contracts: If services are governed by a specific contract, refer to the terms of the agreement to ensure the billing document aligns with those stipulations.

- Refund Policies: If your business includes any refund policies, note these terms in the document to ensure clients understand their rights regarding payments.

By ensuring that your billing statements meet legal requirements, you not only protect your business but also foster trust and transparency with your clients, leading to smoother transactions and better professional relationships.

How to Edit a Billing Document Template

Editing a pre-designed document for professional billing purposes is a simple process that can save you significant time and effort. By using an editable format, you can quickly modify existing details to suit each transaction, ensuring that all information is up-to-date and accurate. This flexibility allows for easy adjustments to meet the needs of different clients or services provided.

Steps to Edit Your Billing Document

Follow these straightforward steps to customize your billing document:

- Open the Document: Start by opening the editable file on your computer using a compatible text editing program.

- Update Contact Information: Replace your business and client details with the most current information. This includes names, addresses, phone numbers, and email addresses.

- Modify Service Details: Update the description of the services provided, including any relevant dates, hours worked, and quantities.

- Adjust Pricing: If necessary, adjust the fees for services rendered or add any additional charges. Be sure to include the total amount due, including any applicable taxes or discounts.

- Review Payment Terms: Check that the payment due date and accepted payment methods are accurate. Update any late fees or payment instructions as needed.

- Save and Finalize: After making all necessary changes, save the file and ensure it is ready for sharing with your client.

Editing the Layout and Design

In addition to modifying the content, you may also want to adjust the layout to better suit your brand or preferences. Below is a simple guide to help you customize the document’s design:

| Section | Customization Tips |

|---|---|

| Header | Change the font style or size, or add your logo to make the document visually appealing and more aligned with your business identity. |

| Body Content | Adjust the text formatting, such as bold or italics, to highlight important information like due dates or total amounts. |

| Footer | Add any additional legal or business information, such as terms of service or tax identification numbers, to the footer section. |

With these steps and tips, editing your billing document will be quick and easy, ensuring that you can create a professiona

Formatting Tips for Clear Billing Documents

A well-structured and clearly formatted document helps ensure that clients understand the charges and terms associated with the services provided. Proper formatting not only improves the overall presentation but also ensures that critical details, such as payment deadlines and service descriptions, are easily accessible. Here are some essential formatting tips for creating a professional and readable document.

Essential Formatting Guidelines

Follow these simple formatting guidelines to ensure clarity and professionalism in your billing documents:

- Use Clear Headings: Make key sections easy to identify by using bold or larger font sizes for headings such as “Service Description,” “Amount Due,” and “Payment Terms.”

- Consistent Font Style and Size: Stick to simple, readable fonts like Arial or Times New Roman. Use a font size of 11 or 12 for the main body text, and slightly larger (14-16) for headings.

- Proper Spacing: Use sufficient spacing between sections, and avoid overcrowding the document. This makes it easier for clients to follow the content and find important details quickly.

- Align Text Properly: Align your text to the left for easy reading. For financial figures, consider right-aligning the amounts to make them easier to compare at a glance.

- Break Information into Sections: Organize the document into clear sections such as “Client Information,” “Services Provided,” and “Payment Instructions.” This helps keep everything organized and ensures that no details are overlooked.

Additional Tips for Improved Readability

To enhance the legibility and overall presentation of your document, consider the following additional tips:

- Use Tables for Clarity: If you are listing multiple items or services, use tables to organize the information clearly. This helps separate each entry and makes the document easier to read.

- Highlight Key Information: Use bold or italics to draw attention to important details like due dates, payment amounts, or special instructions.

- Incorporate Your Branding: Add your business logo and brand colors to give the document a personalized and professional appearance. Ensure that these elements do not overwhelm the content.

- Include a Footer: A footer can be used to provide additional legal or contact information, such as terms and conditions, tax numbers, or support contact details.

By following these formatting tips, you can create billing documents that are not only clear and professional but also foster a positive relationship with your clients, ensuring they understand the charges and payment terms with ease.

Best Practices for Document Accuracy

Ensuring the accuracy of your billing documents is essential for maintaining professionalism and avoiding misunderstandings with clients. Accurate documents not only facilitate smooth payment processes but also build trust and credibility with your clients. By following best practices, you can prevent errors and ensure that every detail is correct, from the service descriptions to the final amount due.

Key Practices to Ensure Accuracy

Implementing the following practices will help you create accurate and error-free documents:

- Double-Check Contact Details: Ensure that both your business information and the client’s details are up-to-date and accurate. Any incorrect contact information can cause delays or confusion.

- Verify Service Descriptions: Be clear and precise when describing the services provided. Avoid vague language and ensure that each entry is specific enough for the client to understand.

- Review Payment Amounts: Double-check all rates, quantities, and total charges to ensure the calculations are correct. This includes adding taxes, discounts, or additional fees, as applicable.

- Confirm Dates: Verify that the dates for service, as well as the payment due date, are accurate. Mistakes with dates can lead to confusion or missed payments.

- Proofread the Document: Always review the document for typos, spelling mistakes, and grammatical errors. Even small mistakes can make the document look unprofessional and lead to misunderstandings.

Using Tools to Enhance Accuracy

While manual checks are essential, there are several tools available to help ensure accuracy:

| Tool | How It Helps | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Automatic Calculators | Some billing systems and document formats come with built-in calculators to automatically tal

How to Add Payment Terms to Billing DocumentsIncorporating clear payment terms into your billing documents is essential for ensuring that both parties understand the expectations and deadlines for payment. Clear payment terms can help avoid misunderstandings and ensure timely payments. These terms typically include details about payment due dates, accepted payment methods, and any penalties for late payments. By specifying these conditions up front, you set a professional tone and establish transparency in the transaction. Key Elements to Include in Payment TermsWhen adding payment terms to your document, make sure to include the following important details:

Where to Place Payment TermsPayment terms should be included in a clear and prominent location within your document. Ideally, they should appear near the bottom of the page, typically before the total amount due. This ensures that the client sees the terms right before making the payment. It’s also helpful to highlight them using bold or italics so that they stand out from the rest of the text. By clearly stating payment terms, you not only establish a professional approach to handling transactions but also set expectations that reduce the risk of delayed or missed payments. Clear communication of terms helps maintain a smooth and trustworthy relationship with your clients. Tracking Payments with Billing DocumentsMonitoring payments is a crucial aspect of managing professional transactions. Keeping track of paid and outstanding amounts ensures smooth financial operations and helps prevent payment delays. By organizing payment records within your billing documents, you can easily track the status of each transaction and stay on top of overdue payments. Accurate tracking helps maintain financial clarity and builds trust with clients. Key Elements for Payment TrackingTo effectively track payments, consider incorporating these elements into your billing documents:

How to Track Payments EfficientlyTo streamline payment tracking, consider the following practices:

By incorporating these tracking practices, you can stay organized, reduce administrative work, and avoid any confusion regarding financial transactions. Keeping an up-to-date record of payments not only helps with accurate bookkeeping but also ensures a smoother payment process for both you and your clients. Protecting Your Billing Document with Passwords

Securing your financial documents is essential to protect sensitive client information and avoid unauthorized access. By password-protecting your billing records, you ensure that only authorized individuals can view or edit the details. This is especially important when sharing documents electronically, as it adds an extra layer of security to safeguard against potential data breaches or fraud. Why Password Protection is ImportantPassword protection is an effective way to ensure the confidentiality and integrity of your financial documents. Here’s why it matters:

How to Password-Protect Your DocumentsTo keep your documents secure, follow these steps to add a password to your financial records:

|