How to Use a Line Item Invoice Template for Accurate Billing

When managing business transactions, accuracy and clarity in financial documents are essential. Properly documenting each charge ensures that both parties are on the same page and can avoid misunderstandings. Having a structured approach to documenting goods and services helps create transparent communication between a business and its clients.

In this guide, we’ll explore how a well-organized breakdown of services or products on an accounting document can simplify billing. These documents are not only helpful for tracking payments but also serve as proof of the work completed. By following certain guidelines, businesses can ensure their financial records are both professional and precise.

Effective management of such documents can significantly improve your invoicing process, making it easier to track transactions and maintain a reliable payment history. This approach will help both parties involved feel confident in the exchange, fostering trust and professionalism.

What is a Detailed Billing Document

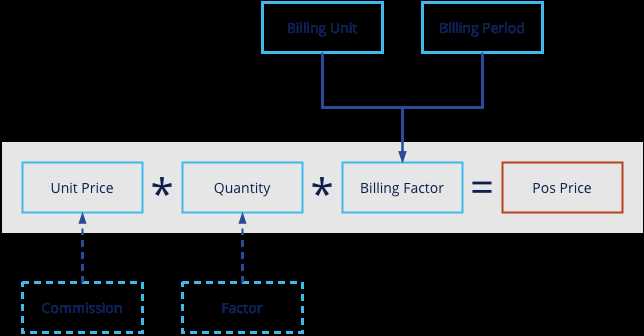

A detailed billing document is a financial record that provides a clear breakdown of goods or services provided during a transaction. Each charge or service is listed separately, making it easy to understand what the customer is being charged for. This format ensures transparency and helps both businesses and clients keep track of their financial exchanges.

Structure of a Detailed Billing Document

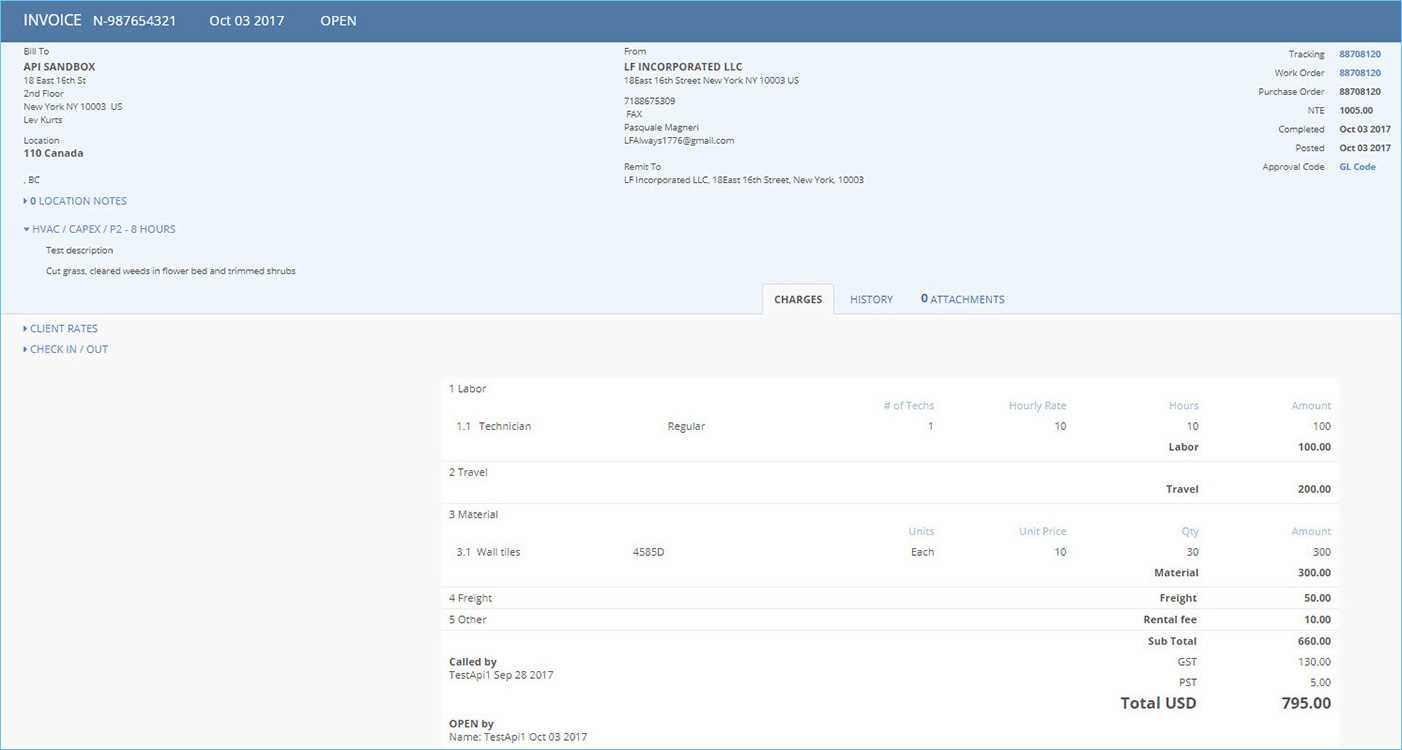

The structure of this document includes sections that specify the description, quantity, rate, and total cost for each service or product. It offers a precise and itemized summary that avoids ambiguity, ensuring that all charges are easily identifiable.

Why This Format is Important

Using this method of documentation benefits both parties by eliminating confusion and enhancing the overall payment experience. It also ensures that all financial details are clearly recorded for accounting and future reference purposes.

Benefits of Using a Detailed Billing Document

Adopting a structured approach to documenting transactions provides numerous advantages for both businesses and clients. It helps ensure clarity, improves record-keeping, and streamlines the payment process. The ability to present a clear, itemized list of charges offers several key benefits.

- Enhanced Transparency: By breaking down each charge, customers can easily understand what they are paying for, which reduces disputes and increases trust.

- Improved Accuracy: A well-organized breakdown minimizes the risk of errors, ensuring all items and services are correctly accounted for.

- Better Record Keeping: Itemized records are easier to track and reference, making it simpler to maintain financial documentation and comply with tax regulations.

- Streamlined Communication: Clear billing details help both businesses and clients communicate effectively about costs, terms, and services rendered.

- Faster Payments: A detailed summary can expedite payment processing since customers have a clear understanding of their obligations.

Overall, using a structured approach to document charges enhances professionalism and simplifies financial management for both the business and its clients.

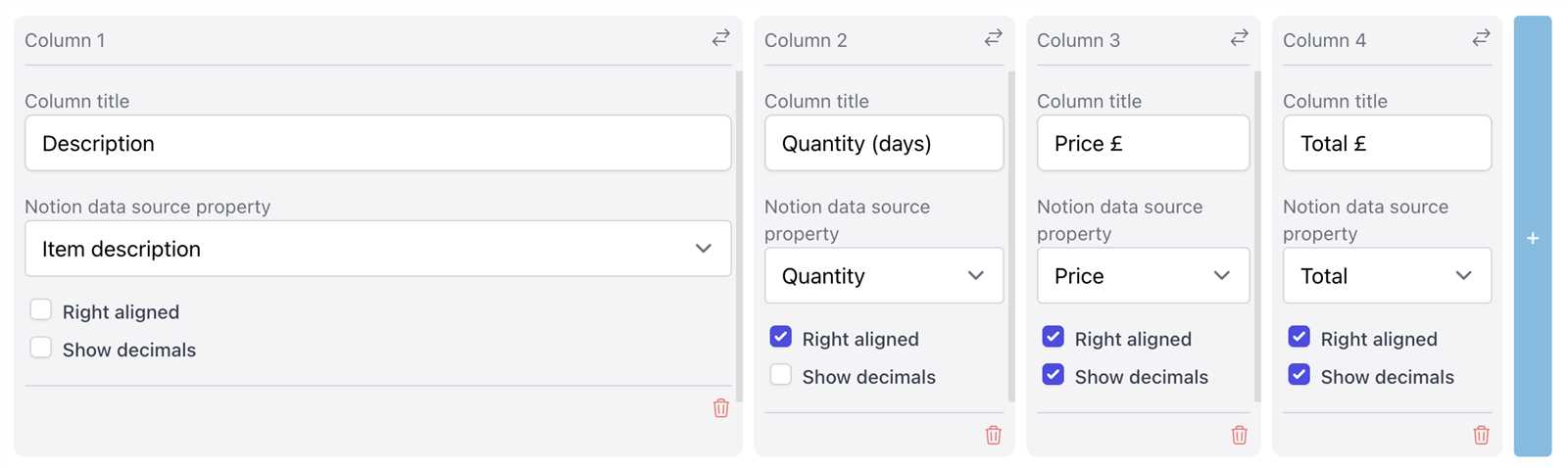

How to Create a Detailed Billing Document

Creating a well-structured financial document involves organizing transaction details in a clear and concise manner. This process ensures that each charge is properly recorded and easily understood by both the business and its clients. Here are the essential steps to create an effective document:

- Start with Basic Information: Include essential details such as the business name, client name, contact information, and the date of the transaction.

- List All Services or Products: For each service or product provided, add a description along with the quantity and individual price. This step ensures that the client can see exactly what they are being charged for.

- Calculate Total Costs: After listing each charge, calculate the total amount due by summing up the individual charges, including any taxes or discounts applied.

- Include Payment Terms: Clearly state the payment due date, accepted methods of payment, and any late fees or penalties for overdue payments.

- Provide Unique Reference: Assign a unique reference number to the document for easy tracking and future reference.

By following these simple steps, you can create a professional and organized financial record that will help ensure accurate billing and smooth transactions.

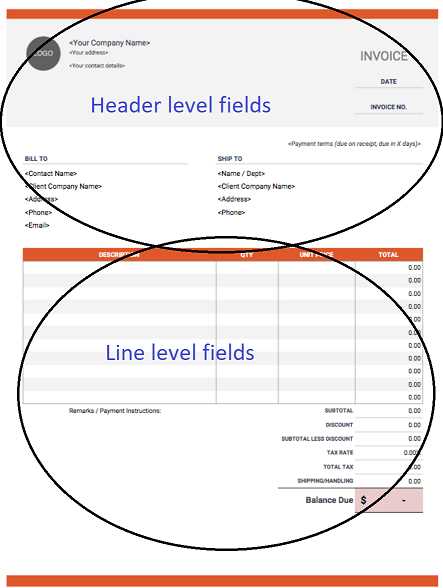

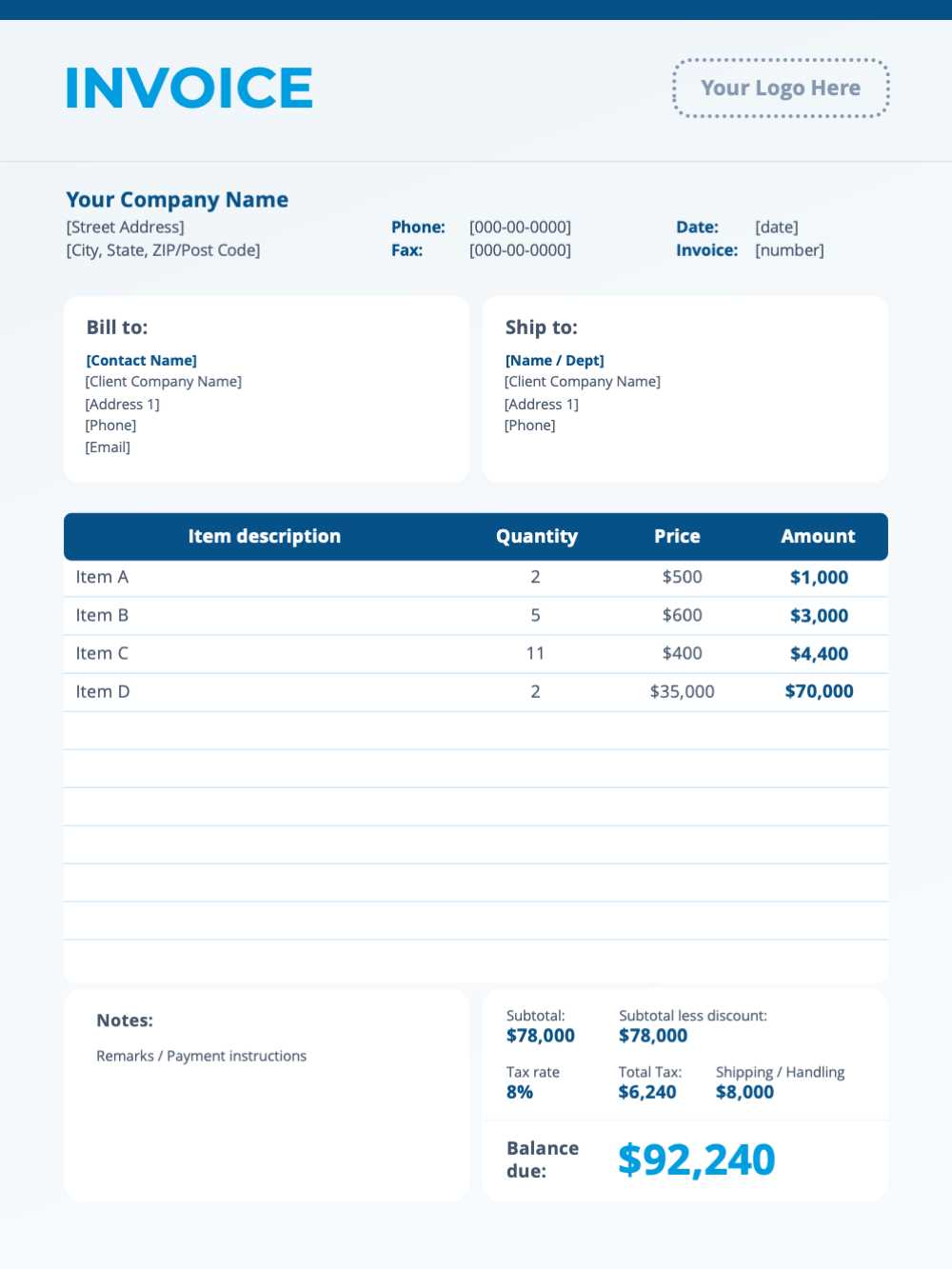

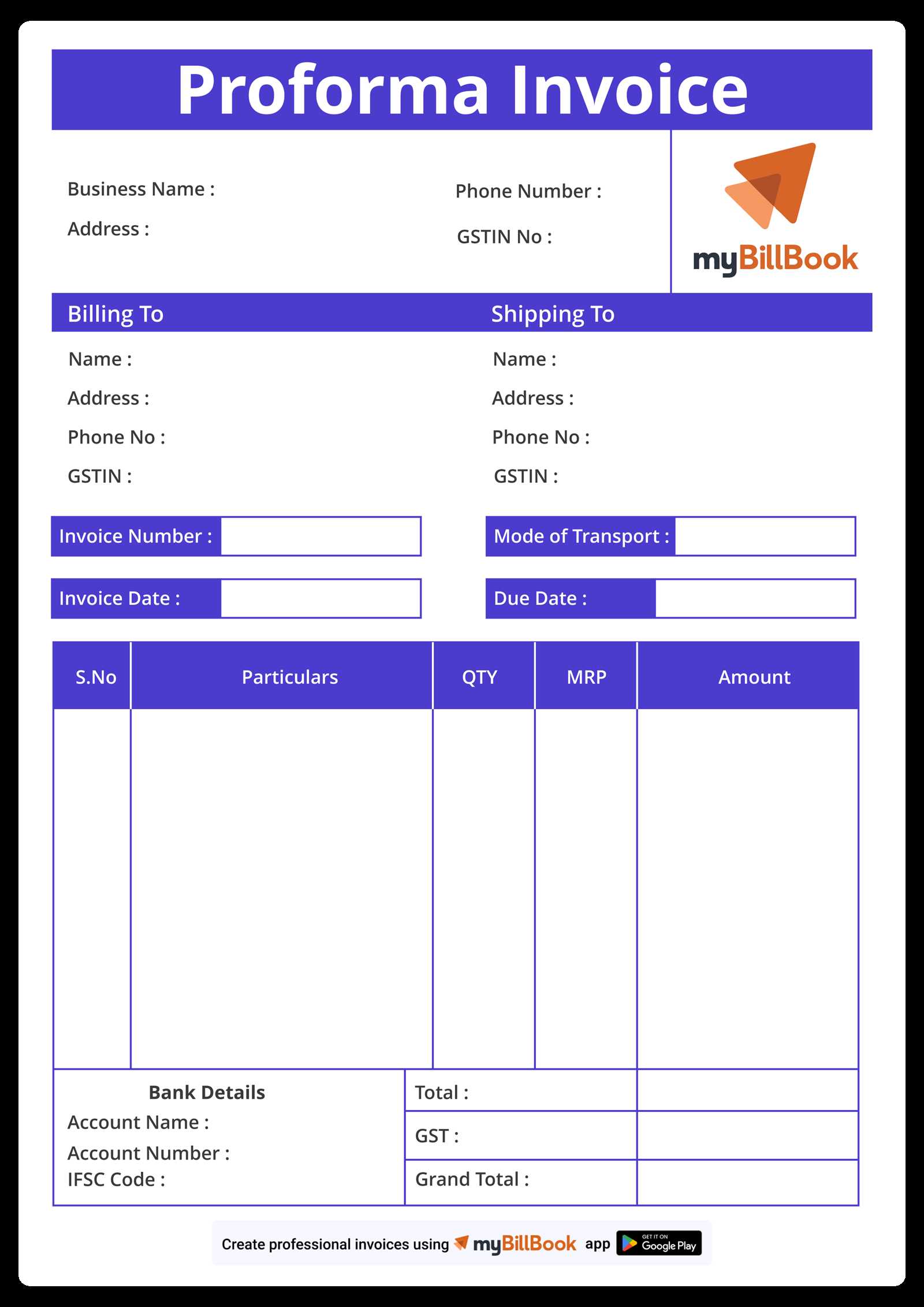

Key Components of a Detailed Billing Document

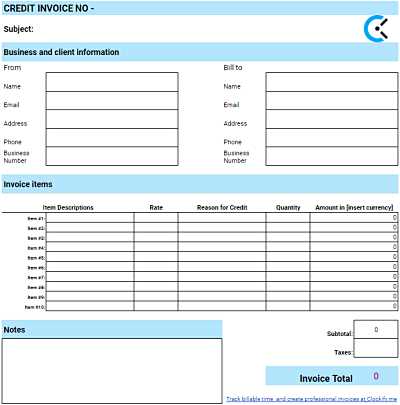

A comprehensive financial record includes several essential elements to ensure clarity and accuracy. These components allow both businesses and clients to understand the charges, terms, and overall transaction details. Here are the primary parts that make up an effective billing document.

Essential Information

Every record should include basic details to identify both parties involved and the nature of the transaction. This includes:

- Business Information: Name, address, and contact details of the business.

- Client Information: Name and contact details of the client or customer.

- Transaction Date: The date when the transaction or service was completed.

- Unique Reference Number: A number that helps track and identify the document for future reference.

Breakdown of Charges

For each product or service provided, it is important to list the details in an organized and itemized format. A table is commonly used to display these elements clearly.

| Description | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Consulting Service | 10 hours | $100 | $1,000 |

| Software License | 1 | $200 | $200 |

| Shipping Fee | 1 | $25 | $25 |

This breakdown ensures that the client clearly understands what they are paying for, the cost of each service or product, and the total amount due.

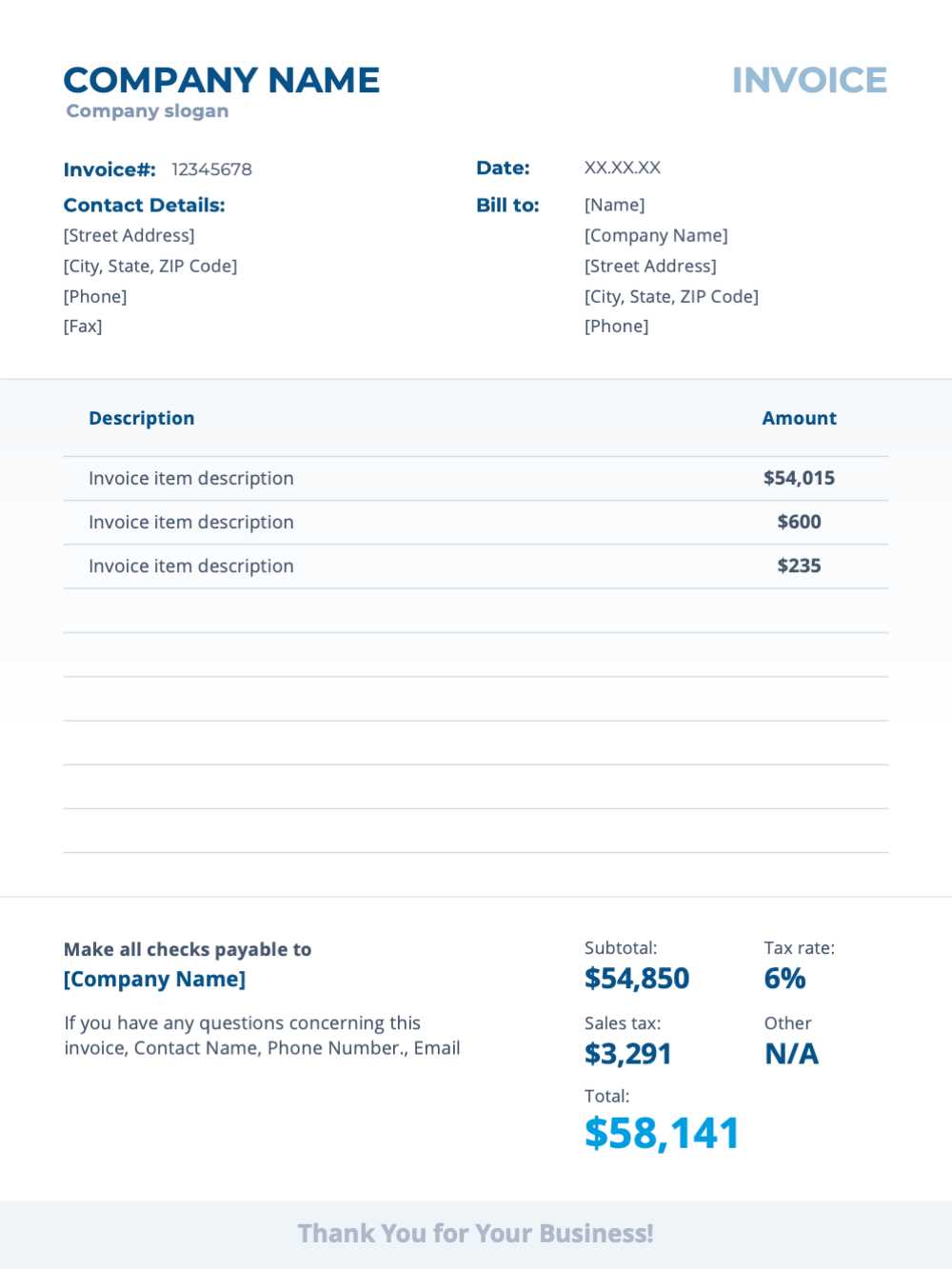

Choosing the Right Billing Document Format

Selecting the appropriate format for your financial records is crucial to ensure clarity, professionalism, and efficiency in communication. The right structure not only helps present charges clearly but also reflects your business’s attention to detail and organization. Below are key considerations to keep in mind when choosing the best format for your documents.

Consider the Nature of Your Business

Different businesses have varying needs based on the services or products they offer. A consulting firm, for example, may require a more detailed breakdown of hourly rates and services, while a retail business might focus more on product listings and quantities. It’s essential to choose a format that fits the type of business you operate, ensuring all relevant information is included and easily understood by the client.

Key Features to Look for in a Format

When evaluating different document formats, ensure that it includes all the necessary components for a clear and complete record. Below is an example of how different sections can be laid out:

| Component | Importance |

|---|---|

| Business and Client Information | Essential for identification and communication. |

| Detailed Description of Charges | Helps prevent confusion by specifying what is being paid for. |

| Total Amount Due | Summarizes all charges, taxes, and discounts for easy reference. |

| Payment Terms and Due Date | Clearly outlines when and how payment should be made. |

By ensuring these essential elements are present, you can select a format that best suits your business’s invoicing needs while maintaining a professional appearance and promoting efficient transactions.

Understanding Charges and Descriptions

Properly documenting each charge with clear and detailed descriptions is essential for transparent and efficient billing. These sections of the financial record help both businesses and clients understand exactly what is being billed. Each entry should be clear enough to eliminate any potential confusion and provide a full explanation of the services or products provided.

Charges refer to the individual costs associated with a product or service. These should be listed separately, with enough detail to justify the amount being requested. This approach ensures that both parties know exactly what they are paying for, whether it is a one-time service or a recurring charge.

Descriptions provide the context for each charge, explaining the nature of the product or service. For instance, a description for a consulting service might include the number of hours worked, the type of work done, and the hourly rate applied. Clear descriptions not only clarify what the charge is for but also enhance the professionalism of the document.

Common Mistakes in Detailed Billing Documents

While creating a detailed financial record may seem straightforward, several common mistakes can occur that may lead to confusion, delays in payment, or disputes. It’s essential to be aware of these errors to ensure that your documents are accurate and professional. Below are some of the most frequent mistakes made when preparing such records.

- Missing or Incorrect Contact Information: Failing to include accurate details for both the business and client can cause confusion and delay communication.

- Omitting Itemized Charges: Not providing a clear breakdown of the services or products rendered can lead to misunderstandings about what the client is being charged for.

- Incorrect Calculations: Simple math errors, such as incorrect totals or misapplied taxes, can undermine the credibility of the document and cause delays in payment.

- Unclear Descriptions: Vague or insufficient descriptions for services or products can leave clients uncertain about the charges, leading to potential disputes.

- Failure to Specify Payment Terms: Not outlining the payment due date, methods of payment, or any late fees can lead to confusion and late payments.

By being mindful of these common mistakes and ensuring that each part of the record is accurate and detailed, businesses can create clear, professional documents that promote timely payments and positive client relationships.

How to Avoid Billing Errors

Billing errors can be costly, not only in terms of financial loss but also in terms of client trust. Avoiding mistakes requires a proactive approach to ensure every detail is accurate and clear. With the right procedures in place, businesses can reduce the risk of errors and maintain smooth financial transactions.

Best Practices for Accurate Billing

To minimize mistakes, it’s essential to follow some key practices that help ensure accuracy. These practices include double-checking calculations, confirming contact details, and ensuring clear descriptions for every charge.

| Practice | Benefit |

|---|---|

| Double-check all calculations | Prevents math errors that could lead to overcharging or undercharging clients. |

| Use automated billing systems | Reduces human error and ensures consistent format and accuracy. |

| Include detailed descriptions | Helps clients understand what they are being charged for, reducing the likelihood of disputes. |

| Review client contact information | Ensures the document is delivered to the right person or department for timely payment. |

Using Tools to Improve Accuracy

Automated tools and software can significantly reduce the likelihood of errors. By choosing reliable platforms for generating financial records, businesses can ensure that key fields such as totals, taxes, and client information are accurately filled out and up to date. Additionally, keeping templates consistent and easy to follow will help maintain professional standards and reduce mistakes in the future.

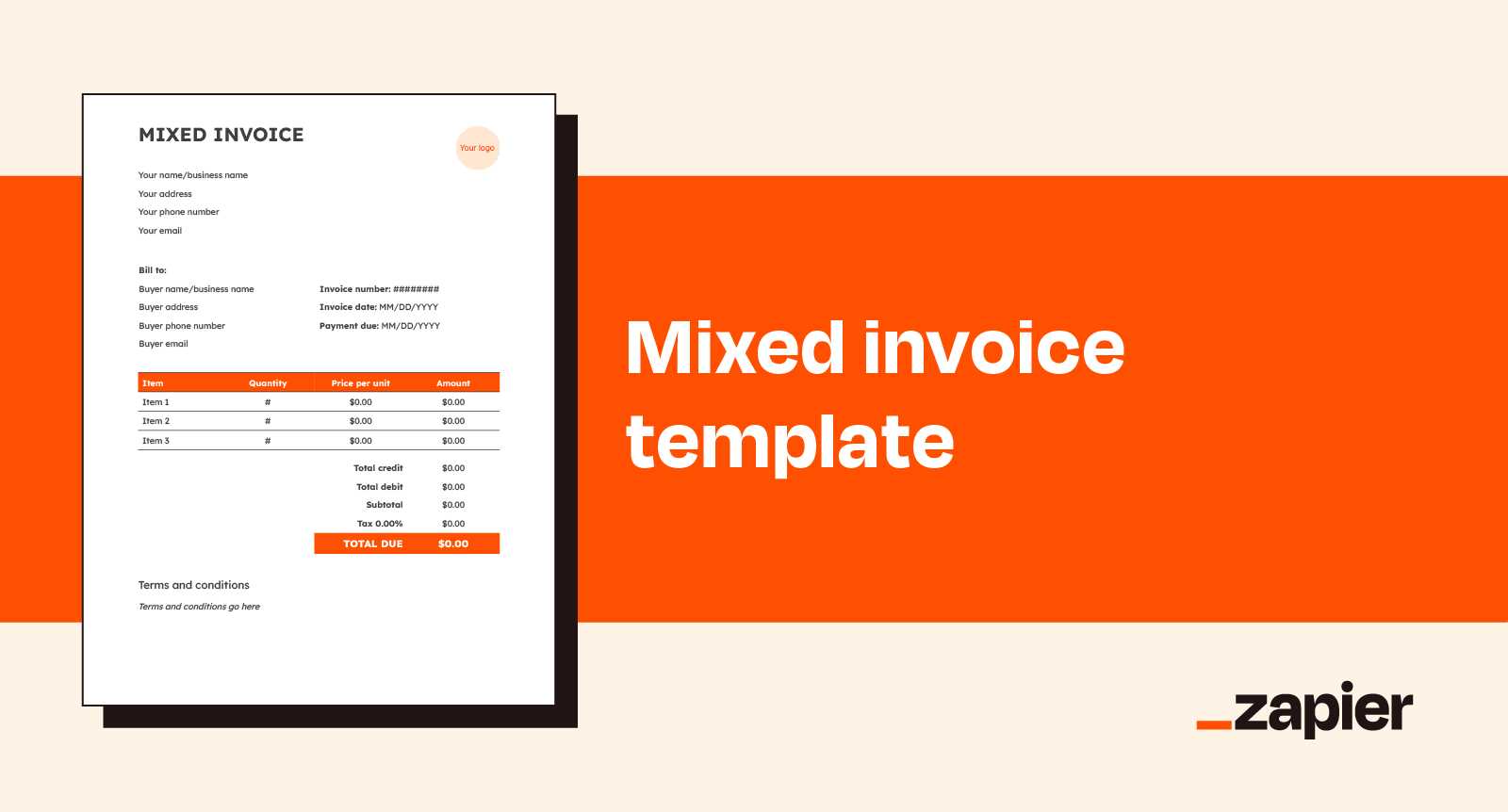

Customizing Your Billing Document

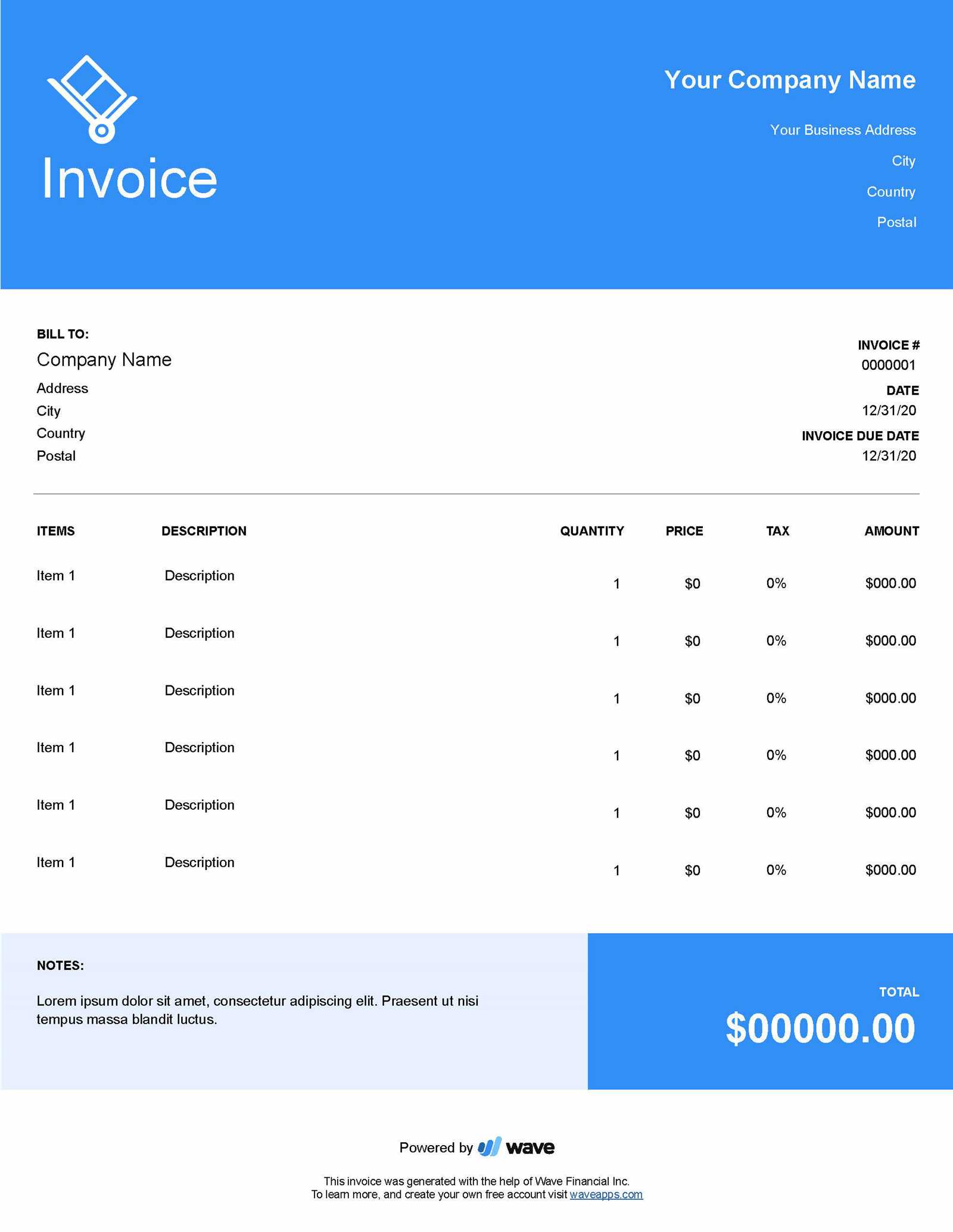

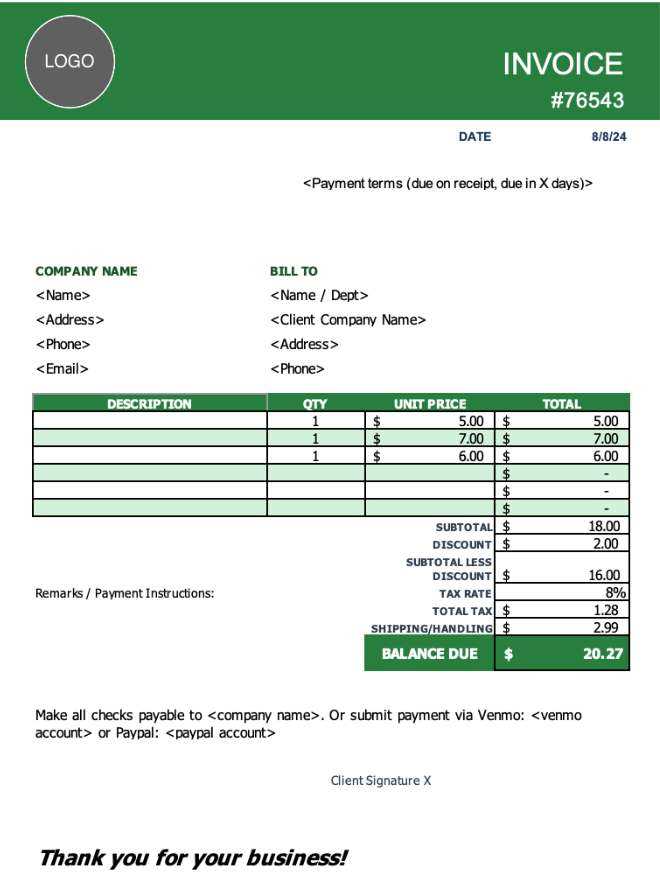

Personalizing your financial records can help you maintain a professional image while ensuring the document aligns with your business’s needs. Customization allows you to add unique branding elements and tailor the structure to best represent your products or services. By adjusting the format, you can ensure that all relevant details are included in a way that suits both your business and your clients.

Branding Your Document

Incorporating your business’s branding into the document can make it instantly recognizable to your clients. Consider adding the following elements:

- Logo: Including your company logo at the top of the document reinforces brand identity.

- Colors and Fonts: Use brand-specific colors and fonts to create a cohesive, professional look that aligns with your marketing materials.

- Business Contact Details: Ensure that your contact information is prominently displayed for easy reference.

Tailoring the Structure

Adapting the structure of your document to suit your business model can improve efficiency and clarity. Here are a few customization options:

- Section Headings: Customize headings to reflect the categories most relevant to your services, such as “Consulting Services” or “Product Breakdown.”

- Payment Instructions: Adjust payment terms and methods to reflect the way your business prefers to receive payments.

- Discounts and Taxes: Add custom fields for discounts, tax calculations, or any other fees that may apply to your specific business situation.

Customizing your financial records ensures they not only look professional but also include the right information in a format that is easy for clients to understand.

Best Practices for Accurate Billing

Ensuring the accuracy of your financial records is vital for maintaining trust and professionalism with your clients. By following best practices, you can avoid common mistakes, reduce errors, and streamline the billing process. These practices not only help in creating precise documents but also contribute to smoother transactions and better client relationships.

Double-Check Your Calculations

One of the most important steps in creating an accurate financial document is verifying that all calculations are correct. Double-check the unit prices, quantities, taxes, and totals before finalizing the record. Small errors in math can lead to disputes or delays in payment, so it’s essential to be thorough in this step.

Ensure Clear and Detailed Descriptions

Clear descriptions of the services or products being billed are crucial. Each charge should have a specific, concise explanation of what is being paid for. This will help prevent misunderstandings and disputes over unclear charges. Providing extra details, such as hours worked or specific deliverables, can make a big difference in how clients perceive the billing process.

Review Client Information

Accurate client contact information is essential for ensuring that the document is delivered correctly and promptly. Review the client’s details before sending the record, including their name, address, and preferred method of communication. This simple step can prevent delays in the payment process.

Set Clear Payment Terms

Make sure to clearly state the payment due date, acceptable payment methods, and any penalties for late payments. By establishing clear expectations upfront, you can help avoid payment delays and ensure smooth transactions.

By following these best practices, you can ensure that your financial records are accurate, clear, and professional, fostering positive relationships with your clients and improving the efficiency of your business operations.

Free vs Paid Billing Document Formats

When choosing a structure for your financial records, one of the first decisions you’ll face is whether to use a free or paid option. Both have their advantages and drawbacks, depending on your specific needs and the scale of your business. Understanding the differences between the two can help you make the best choice for your operations.

Benefits of Free Formats

Free options are a great choice for small businesses or individuals just starting out. They provide basic functionality without any upfront cost, which can be a huge advantage when you’re trying to minimize expenses. Some key benefits of free formats include:

- No Cost: Free formats are accessible at no charge, making them ideal for businesses on a tight budget.

- Easy to Use: Many free formats are simple and straightforward, requiring little time to set up or customize.

- Basic Functionality: They typically include essential fields such as descriptions, quantities, and totals, making them suitable for simple billing needs.

Benefits of Paid Formats

Paid billing formats generally offer more advanced features and customization options. While they come with an upfront cost, these formats can be an investment for businesses that require more comprehensive tools or a higher level of professionalism. Some of the benefits of paid formats include:

- Customization: Paid options often allow more flexibility in design and functionality, including custom branding and personalized fields.

- Advanced Features: These may include automatic calculations, tax management, and integration with accounting software, making it easier to manage complex transactions.

- Better Support: Paid formats often come with customer service and technical support, helping you troubleshoot issues quickly.

Ultimately, the choice between free and paid formats depends on the specific needs of your business. If you require more advanced features or a professional appearance, a paid option might be worth the investment. However, if you’re just starting out or have minimal billing needs, a free option can be a good way to keep costs down while still maintaining clear and organized records.

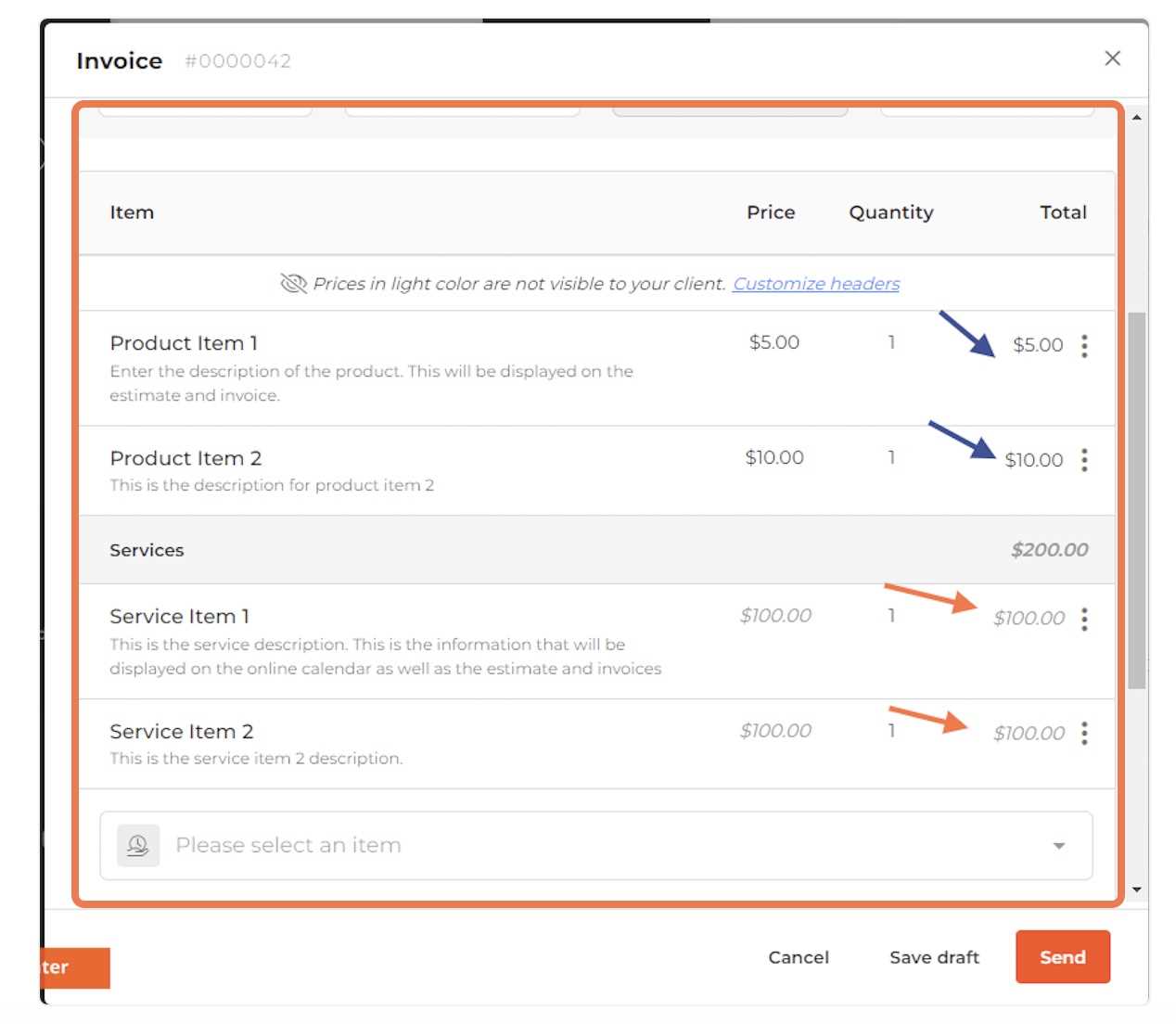

How to Automate Billing Documents

Automating the creation of your financial records can save you valuable time and reduce human error. By using automation tools, you can streamline the process, ensuring that each document is accurate and sent on time without the need for manual input. Here’s how to integrate automation into your billing process for greater efficiency.

Choose the Right Automation Tool

The first step in automating your billing documents is selecting the appropriate software or platform. Many accounting tools and financial management platforms offer automated features that can generate records based on predefined templates. Look for tools that provide the following:

- Customizable Templates: Ensure the software allows you to create or adapt templates that fit your specific business needs.

- Recurring Billing Options: If you offer subscription-based services, choose a tool that can automatically generate and send regular billing records.

- Integration with Payment Systems: The best automation tools can integrate with your payment processing systems, allowing automatic updates of payment statuses.

Set Up Automated Triggers

Once you’ve selected the right platform, the next step is configuring automated triggers. These are conditions that automatically generate a record when specific criteria are met. Common triggers include:

- Service Completion: Automatically generate a record when a service is marked as completed in your system.

- Time-Based Triggers: Set up the system to automatically generate monthly or weekly billing records for recurring services or products.

- Payment Reminders: Set reminders to notify clients of upcoming due dates or overdue payments, reducing the need for manual follow-up.

By setting up these triggers, you can reduce the time spent manually creating and sending records, and ensure that your clients receive timely, accurate documents without delay.

Test and Monitor the Automation

Before fully relying on automation, it’s important to test your system to ensure it’s working correctly. Monitor the generated documents for accuracy and consistency, and adjust the setup if needed. Regularly reviewing your automated process helps you spot any potential issues early and ensure that everything runs smoothly.

Automating the creation of billing documents can greatly improve your business operations, reduce administrative workload, and improve overall accuracy. With the right tools and setup, you can create a seamless and efficient process that works for both you and your clients.

Billing Documents for Different Industries

Different industries have unique billing needs based on the nature of their products, services, and customer interactions. Tailoring your financial records to meet the requirements of your specific industry can help ensure clarity, accuracy, and efficiency in the billing process. Understanding the specific demands of your sector will enable you to create documents that best suit your business model and client expectations.

Service-Based Industries

In service-oriented sectors, such as consulting, design, or healthcare, billing documents often need to reflect the time spent or specific services provided. These sectors may require more detailed descriptions, such as hours worked, project milestones, or specific services rendered. Some key considerations for service industries include:

- Hourly Rates: Clearly list the hours worked, hourly rate, and total charges for each service.

- Milestone Payments: For longer-term projects, it’s common to break down the payment into stages or milestones that align with project progress.

- Detailed Descriptions: Providing detailed descriptions of each service performed can help clients understand the value of what they are being charged for, reducing confusion.

Product-Based Industries

In industries such as retail, manufacturing, and wholesale, billing documents typically focus on the products sold, quantities, and unit prices. These records may also need to reflect shipping, taxes, and discounts. Here are some factors to consider when billing in product-based sectors:

- Quantity and Pricing: Each product should be listed with the quantity sold and the unit price to ensure transparency in pricing.

- Shipping and Handling: If applicable, include shipping charges and other fees related to product delivery.

- Discounts and Taxes: Clearly list any discounts, sales tax, or other applicable fees that affect the final total.

By understanding the unique billing needs of your industry, you can create more accurate and professional financial records, leading to improved client satisfaction and streamlined payment processes.

Legal Requirements for Billing Documents

When creating financial records for your business, it’s crucial to ensure that they meet the legal requirements set by local regulations and tax authorities. Properly formatted documents not only help ensure compliance but also protect both businesses and clients in the event of a dispute. Understanding what must be included in these records is essential for avoiding fines and other legal complications.

Mandatory Information

Depending on your location and industry, specific details must be included in your financial documents to meet legal standards. Commonly required information includes:

- Business Information: Your company name, address, and tax identification number (TIN) should be clearly stated.

- Client Information: Include the client’s full name, address, and contact details.

- Unique Reference Number: Each record should have a unique reference number for tracking and accounting purposes.

- Clear Description of Goods or Services: List the goods or services provided, including the quantity, price, and total amount due.

- Tax Details: Include any applicable taxes, such as sales tax, along with the rates used to calculate them.

- Payment Terms: State the payment due date, acceptable payment methods, and any penalties for late payments.

Regional Variations

Keep in mind that legal requirements may vary by country, state, or region. For example, some countries require businesses to include their VAT (Value Added Tax) number or specify the tax rate applied, while others may have different rules about payment terms or required formatting. It’s essential to stay informed about the regulations in your jurisdiction to avoid legal issues.

By ensuring that your records meet these legal standards, you not only stay compliant but also build trust with clients and enhance the professionalism of your business transactions.

Managing Billing Records

Efficiently managing your financial documents is essential for maintaining organization, improving cash flow, and ensuring accurate bookkeeping. Whether you handle a small number of transactions or manage hundreds of records, having a structured system in place is crucial for tracking payments, following up on overdue amounts, and maintaining compliance. In this section, we’ll explore key strategies for managing your financial records effectively.

Organizing Your Records

To manage your billing documents efficiently, organization is key. Start by categorizing records based on factors such as:

- Client Names: Group records by client to easily track transactions and payment histories.

- Payment Status: Separate records into categories such as “Paid,” “Unpaid,” and “Pending” to quickly assess outstanding amounts.

- Dates: Sort by due dates or issue dates to ensure you can easily track overdue payments and prioritize follow-ups.

Using a well-organized digital or physical filing system will allow you to retrieve any record quickly, saving you time and reducing the risk of errors.

Tracking and Follow-Up

Once records are properly organized, tracking payments and following up on overdue amounts becomes much easier. Consider the following tools and techniques:

- Automated Reminders: Use software or digital tools to set reminders for when payments are due or overdue. Automated follow-up emails or notifications can save time and ensure consistency.

- Regular Reviews: Set aside time weekly or monthly to review your records, ensuring that payments have been processed and that no errors have occurred.

- Communication Log: Keep a log of all communications with clients regarding payments to ensure transparency and avoid misunderstandings.

By staying on top of your financial documents and tracking each transaction, you can ensure smoother operations, faster payments, and a more organized business. Proper management reduces the risk of disputes and enhances client satisfaction, allowing you to focus on growing your business.

Improving Cash Flow with Billing Records

Maintaining a healthy cash flow is vital for the success and stability of any business. One of the most effective ways to manage cash flow is by ensuring that your billing processes are efficient, timely, and accurate. By optimizing how you create and send financial records, you can speed up payment collection, reduce delays, and improve overall business liquidity.

Timely Billing

Sending your financial documents promptly is essential for ensuring that payments are received on time. Delayed records lead to delayed payments, which can disrupt your cash flow. Here are a few ways to streamline the timing of your records:

- Set Regular Schedules: Establish a regular schedule for sending out records, whether weekly, bi-weekly, or monthly, to keep the process consistent.

- Automate the Process: Automating the creation and sending of records can eliminate human error and ensure that documents are sent out promptly as soon as a transaction is complete.

- Utilize Recurring Billing: For regular clients or subscriptions, setting up recurring billing allows you to automatically send records on predetermined dates.

Clear Payment Terms

Clearly stating your payment terms in every record is key to reducing delays and misunderstandings. Clients are more likely to pay on time if the payment expectations are clearly outlined. Some important factors to include are:

- Due Date: Specify the exact date the payment is due to create urgency and minimize the chances of late payments.

- Accepted Payment Methods: Include the different ways clients can pay, such as credit cards, bank transfers, or online payment systems, to make the process as convenient as possible.

- Late Fees: If applicable, state any penalties for late payments to encourage timely settlements.

Tracking Outstanding Payments

Regularly tracking outstanding payments is crucial for keeping your cash flow steady. An organized system for tracking unpaid records helps you identify overdue accounts and take action before they affect your cash flow. Below is an example of how you can track payment statuses:

| Client Name | Amount Due | Due Date | Status |

|---|