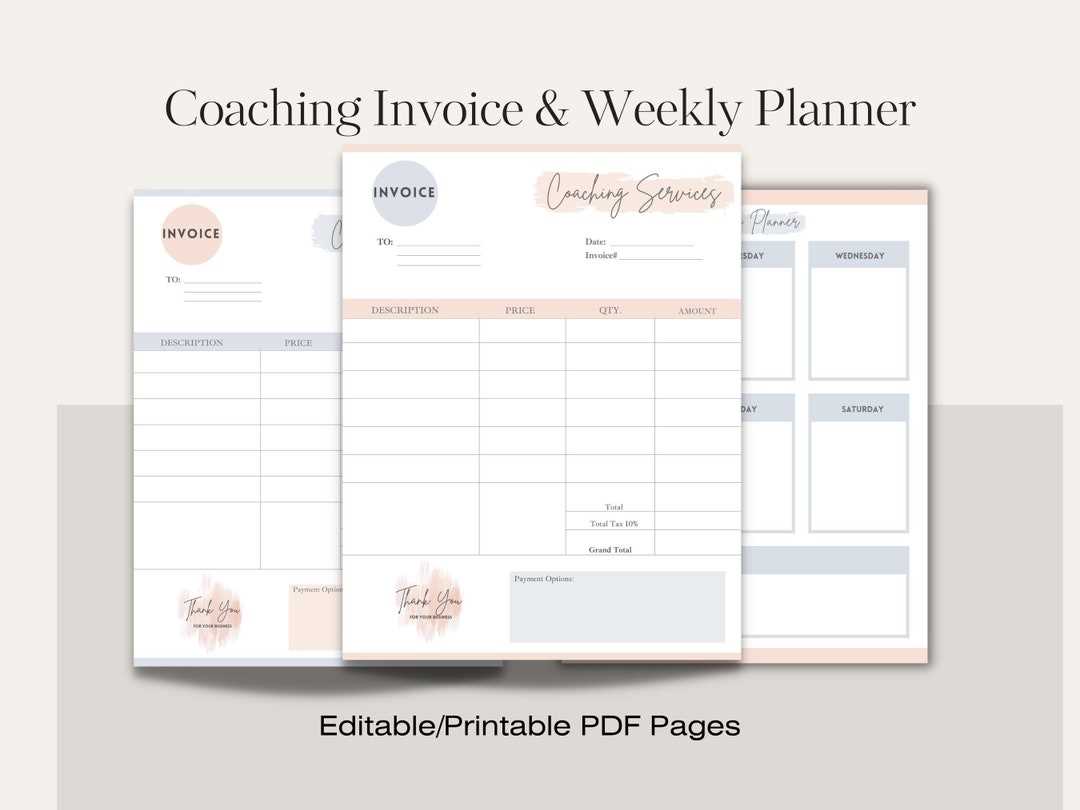

Life Coaching Invoice Template for Easy Billing and Professional Invoicing

For any professional offering personal development or mentoring services, maintaining clear and structured financial records is crucial. Proper documentation not only ensures timely payments but also enhances trust and professionalism with clients. A well-organized system for tracking services provided and payments due is an essential part of a successful practice.

Using the right tools to create accurate and easy-to-understand bills can save time and reduce errors. With a well-designed billing document, clients can quickly grasp the details of their sessions, making the transaction process smoother. Whether you’re just starting or managing a long-established business, having a reliable method to manage financial transactions is key to sustainable growth.

In this guide, we will explore the key components of a comprehensive billing document, including customizable features that align with your business needs. Whether you prefer digital solutions or printable formats, we will show you how to implement a system that suits your workflow and maintains a professional appearance.

Life Coaching Invoice Template Overview

Maintaining a clear and professional financial record is essential for any mentor or counselor offering personal development services. A well-structured billing document not only ensures smooth transactions but also reflects the professionalism of the service provider. It allows clients to easily understand the costs associated with their sessions, while also helping the provider manage their earnings and taxes efficiently.

Having the right kind of billing tool is crucial for streamlining payments and ensuring both parties are on the same page regarding the services rendered. A good document should include all necessary details such as client information, services provided, rates, and payment terms. This section will guide you through the essential components and features of a well-crafted billing solution for professionals in the personal growth industry.

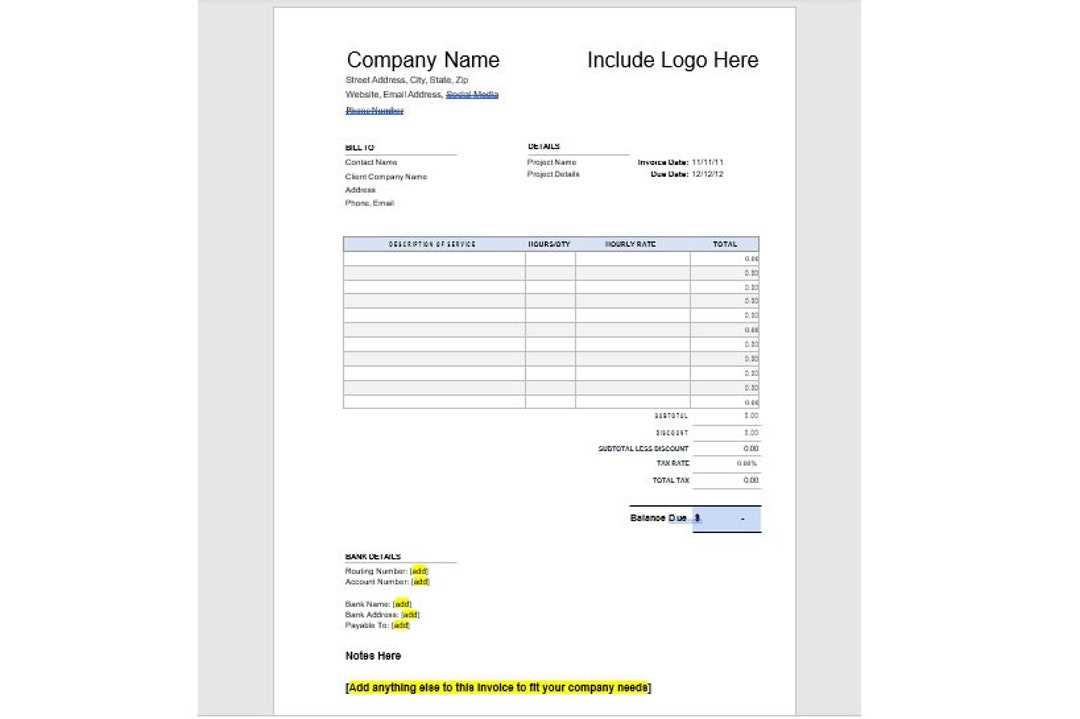

| Component | Description |

|---|---|

| Client Information | Includes the name, contact details, and address of the person receiving the services. |

| Service Description | A clear outline of the services provided, including the duration and nature of each session. |

| Pricing | The agreed-upon rate for services rendered, whether per session, package, or hour. |

| Payment Terms | Details on when payments are due, acceptable methods of payment, and any late fees if applicable. |

| Tax Information | Any applicable taxes based on the location or services provided, ensuring compliance with regulations. |

By including these key elements, you ensure that your billing documents are not only accurate but also contribute to a smoother financial transaction with your clients. The goal is to present all relevant details in a straightforward manner, minimizing confusion and helping you build stronger, more trustworthy relationships with those you serve.

Why You Need a Coaching Invoice

For professionals providing personal development sessions, having a reliable method for documenting financial transactions is essential. A well-organized record not only ensures clarity between the provider and the client but also helps in maintaining a transparent and efficient system for tracking payments. Without a structured billing process, it becomes easy to overlook important details or face misunderstandings regarding fees and services.

Using a formal record of services rendered makes it easier to track earnings, manage business expenses, and comply with tax regulations. It also demonstrates professionalism and builds trust with clients, as they can easily review the costs and terms associated with their sessions. A solid billing process allows for timely payments and reduces the likelihood of disputes, ensuring that the financial aspect of your practice is as smooth as possible.

Key Elements of a Life Coaching Invoice

Creating a well-structured billing document is essential for any professional providing personal development services. It should include all relevant details to ensure clarity for both the client and the service provider. A comprehensive document helps in tracking payments, preventing misunderstandings, and ensuring the business remains organized and professional.

Here are the key components that should be included in your billing document:

- Client Information: Include the full name, address, and contact details of the client receiving the services. This helps to personalize the document and avoid confusion in case of multiple clients.

- Service Description: Clearly outline the services provided, including the type of sessions or consultations, the duration of each session, and any packages or special offers.

- Payment Terms: Specify the amount due, the payment due date, and any late fees that may apply if payment is not received on time.

- Service Dates: List the dates of the sessions provided, as this helps to track the frequency and length of each service offered.

- Tax Information: Include any applicable taxes, depending on your location or the client’s location, to ensure compliance with tax regulations.

- Payment Methods: Indicate the preferred payment options, such as bank transfer, credit card, PayPal, or other digital platforms.

By including these essential elements, you ensure that your billing documents are clear, professional, and easy for your clients to understand, promoting smooth transactions and fostering trust.

How to Customize Your Invoice Template

Customizing your billing document is essential to reflect your brand and business needs. A personalized approach ensures that your records align with your professional image while making the payment process as straightforward as possible for your clients. Whether you’re using a digital solution or creating a printable document, tailoring it to your specific services helps maintain consistency and clarity.

Choose the Right Layout and Design

When customizing your document, it’s important to select a layout that is both professional and easy to read. Start by choosing a clean, simple design that includes clear sections for each necessary detail. Incorporate your logo, business name, and contact information at the top to give the document a personal touch. Using appropriate fonts and colors can also make the document look more polished while still maintaining readability.

Include Your Brand Elements

Adding your branding elements, such as your business logo and color scheme, helps to make the document feel cohesive with your overall brand. This not only strengthens your business identity but also reassures clients that they are working with a professional. Additionally, personalizing payment terms, offering discounts, or creating special fields for recurring clients are simple ways to make the document more aligned with your unique services.

Benefits of Using an Invoice Template

Using a standardized document for financial transactions provides multiple advantages for both businesses and clients. It simplifies the process of tracking payments and ensures consistency in communication. By automating certain aspects of billing, it reduces the chances of errors and fosters a more professional image. These advantages are especially crucial when managing recurring transactions or dealing with multiple clients at once.

Here are some key benefits:

| Benefit | Description |

|---|---|

| Time Efficiency | With a pre-designed structure, creating documents becomes faster, saving valuable time for other important tasks. |

| Consistency | Standardized formats ensure uniformity in all transactions, improving communication and reducing confusion. |

| Professional Appearance | A polished, well-organized document boosts your credibility and reflects positively on your business. |

| Reduced Errors | Built-in fields and clear sections help avoid mistakes in calculations, dates, and other details. |

| Easy Customization | Templates allow for easy customization, ensuring they meet specific needs without starting from scratch. |

| Legal Compliance | Proper documentation helps ensure that all legal and tax requirements are met, reducing the risk of disputes. |

Top Features of a Professional Invoice

A well-crafted financial document serves as a critical tool in ensuring smooth transactions between service providers and clients. The right structure not only guarantees that all necessary details are included but also helps establish trust and transparency. To achieve this, certain elements are crucial to enhance clarity, professionalism, and accuracy.

Essential Elements

Clarity is the cornerstone of any professional document. Clear itemized lists, easy-to-read fonts, and organized sections contribute to a smooth experience for both the sender and receiver. Additionally, it’s important to ensure that the terms and conditions, along with payment instructions, are easily accessible and unambiguous.

Design and Layout

A visually appealing layout goes hand in hand with professionalism. While it should remain simple and straightforward, it’s important that it aligns with your brand’s aesthetic. Including company logos, consistent font styles, and adequate spacing all help make the document look polished and cohesive.

By ensuring these components are in place, you create a document that not only communicates the necessary financial details but also leaves a lasting positive impression on clients.

Creating a Clear Payment Structure

A well-defined payment structure is essential for both the service provider and the client to avoid confusion and ensure a smooth transaction process. By laying out clear terms, amounts, and due dates, you create a transparent agreement that sets expectations and reduces the potential for disputes. This helps both parties stay on the same page regarding the financial aspects of the service.

The payment breakdown should include the exact amount due, a description of the services provided, and any additional fees or taxes that may apply. It’s also crucial to specify the payment due date and any late fees or penalties that might be incurred for delayed payments. A simple yet structured approach to this information encourages prompt and accurate payments while ensuring that no important details are overlooked.

Common Mistakes in Coaching Invoices

When creating financial documents for services rendered, many professionals inadvertently make mistakes that can lead to confusion, delays, or even disputes. These errors, whether in calculation, description, or format, can affect both the service provider’s reputation and their ability to collect payments efficiently. Understanding these common pitfalls and avoiding them is crucial for ensuring smooth transactions and maintaining positive client relationships.

Errors in Calculation

Incorrect totals are one of the most frequent mistakes. Whether due to simple math errors or overlooked discounts, inaccuracies in the final amount can cause delays in payment and frustration for the client. Always double-check calculations and consider using automated systems to ensure precision in the billing process.

Lack of Clear Descriptions

Vague or insufficient details about the services provided can leave clients uncertain about what they are being charged for. Make sure to include a clear breakdown of the work completed, the time spent, and any specific terms that apply. Ambiguity in the description can lead to misunderstandings and may delay the payment process as clients seek clarification.

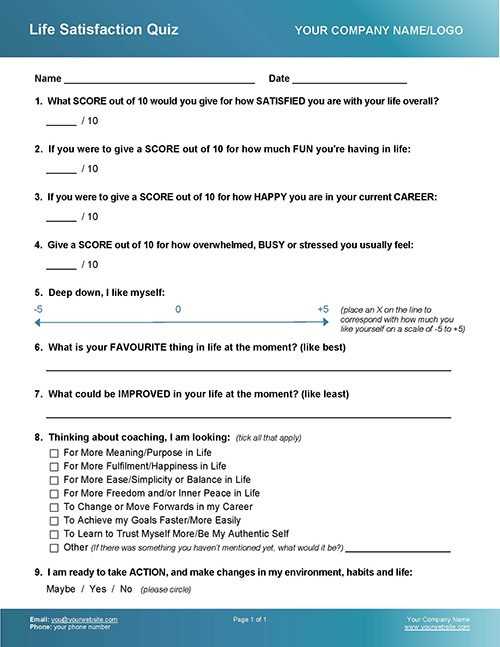

Free vs Paid Invoice Templates for Coaches

When it comes to creating professional documents for services rendered, there are options available in both free and paid formats. Both choices offer distinct advantages and limitations, and understanding the differences can help you decide which option best suits your needs. While free versions might seem appealing due to their cost-effectiveness, paid solutions often come with added features and customizability that can make a significant difference in the long run.

Benefits of Free Options

Cost-effective and easily accessible, free solutions provide a quick and simple way to create essential financial documents. These are ideal for individuals or businesses that need basic functionality without the need for advanced features. However, it is important to note that free options often come with limitations such as fewer design choices, fewer customization features, and lack of support.

Advantages of Paid Solutions

Premiumoptions, on the other hand, offer more advanced features such as customizable designs, automated calculations, and ongoing support. Paid versions often come with pre-designed, polished layouts that reflect a more professional image and can be tailored to fit your branding. Additionally, these tools may offer integrations with accounting software, making it easier to manage finances efficiently. The investment can prove worthwhile if you want a streamlined process and higher-quality output.

How to Include Tax Information Correctly

Incorporating accurate tax details in financial documents is essential for legal compliance and transparency. When you provide services, it’s important to clearly state any taxes applied, such as sales tax or VAT, so that both you and your client are fully aware of the total amount due. Incorrect tax calculations or omissions can lead to confusion, disputes, or even legal issues, so attention to detail is key.

The first step is to determine the correct tax rate based on your location and the nature of the service provided. Ensure you apply the right tax rate for the jurisdiction in which the service is offered. It’s also important to clearly label the tax on the document by specifying the percentage, the total tax amount, and the total cost, including tax. For added clarity, list the tax as a separate line item, so clients can easily distinguish between the base price and the amount due for taxes.

For businesses operating in multiple regions, or internationally, make sure to state any relevant tax numbers, such as VAT registration numbers or other identification codes, if applicable. This can help ensure compliance and provide clients with the confidence that all legal requirements are met. Additionally, consider including a brief note or disclaimer that explains tax responsibilities, especially if taxes vary based on the client’s location or other specific factors.

Best Practices for Life Coaching Invoicing

Managing payments professionally and efficiently is crucial for any service provider. Clear, well-organized financial documents not only ensure timely payment but also help maintain a good relationship with clients. Implementing best practices when issuing such documents can significantly reduce errors, improve client satisfaction, and streamline your business operations. Adopting these strategies can make the payment process smooth and hassle-free for both you and your clients.

Clarity and Transparency

One of the most important aspects of a financial document is clarity. Ensure that all services rendered are clearly described, with corresponding amounts and any applicable taxes. Itemized listings help clients understand what they are being charged for and can prevent misunderstandings. Additionally, specifying payment terms, due dates, and any late fees should be straightforward to avoid any confusion later on.

Timeliness and Consistency

Consistency in sending financial documents is key to maintaining a professional image. Always send documents promptly after the service is delivered, ideally within a few days. This helps clients stay on track with their payments and ensures there are no delays. Also, maintain a consistent format and structure for all your financial records, making it easier for both you and your clients to refer to them whenever needed.

By adhering to these best practices, you ensure that the financial aspect of your business is handled professionally, leading to better client experiences and improved cash flow.

Invoice Template Tools and Software

Creating professional financial documents can be time-consuming, but using the right tools can simplify the process significantly. Various software and online tools are available that automate the creation of these documents, allowing you to focus on your services rather than administrative tasks. These tools not only help you create documents faster but also offer customization features, saving time and ensuring consistency across all your records.

Online Platforms and Services

Many online platforms offer easy-to-use interfaces for creating financial documents. These services typically allow you to select from a variety of pre-designed formats, add your branding elements, and quickly generate documents with automated calculations. Some platforms even allow for recurring billing, saving you time when dealing with repeat clients. Most of these services offer a free tier with basic features and paid plans that unlock additional functionalities such as advanced reporting or integrations with accounting software.

Standalone Software

For those who prefer a more robust solution, standalone software can provide more control and advanced customization. These programs are often installed on your computer and may offer more comprehensive features, including better security, offline access, and a broader range of customization options. Many of these tools also support multiple currencies and tax configurations, making them ideal for businesses that serve clients in different regions.

Both online platforms and standalone software offer unique advantages, so choosing the right tool will depend on your specific needs, whether it’s ease of use or advanced features.

Ensuring Consistency in Your Invoices

Maintaining consistency in your financial documents is essential for professionalism and efficiency. Whether you are managing a small business or handling multiple clients, uniformity helps to avoid confusion and ensures that both you and your clients are on the same page. Establishing a consistent approach to how you create and manage these documents streamlines the billing process and enhances your overall business reputation.

Key Elements to Standardize

Here are some critical areas to focus on when ensuring consistency:

- Design and Layout: Use the same fonts, color schemes, and branding elements in every document to create a cohesive appearance.

- Document Structure: Organize your documents with the same sections, such as service descriptions, payment terms, and totals, so clients know where to find information every time.

- Language and Terminology: Use consistent language when describing services, fees, or terms to avoid misunderstandings.

- Payment Terms: Clearly state due dates, penalties for late payments, and accepted payment methods in a uniform manner.

Automating and Streamlining the Process

To further ensure consistency, consider using software or online tools to automate the creation of these documents. These tools typically allow you to save your settings, ensuring that each document generated follows the same structure and design. Automating this process not only saves time but also reduces the risk of human error.

By focusing on these key elements, you can ensure that every financial document you send is professional, clear, and consistent, leading to improved client relations and smoother business operations.

How to Manage Invoice Payments Efficiently

Efficient payment handling is essential for maintaining steady cash flow and fostering trust with clients. By streamlining the process, businesses can reduce delays, minimize errors, and ensure that transactions are accurately recorded. A well-organized payment approach also helps in tracking finances and anticipating future revenue with greater confidence.

Set Clear Payment Terms

To improve the reliability of incoming payments, define terms of payment clearly from the start. Specify due dates, accepted payment methods, and any late fees or incentives for early settlement. When clients know exactly what to expect, they’re more likely to pay on time, which supports better budget forecasting and reduces the need for follow-up reminders.

Automate Payment Tracking

Using digital tools to monitor payment statuses can greatly improve efficiency. Automated reminders and tracking systems allow

How to Track Outstanding Invoices

Effective monitoring of pending payments is crucial for financial stability and smooth business operations. Keeping track of unpaid transactions helps in identifying overdue accounts, following up promptly, and maintaining accurate financial records. This practice also aids in forecasting revenue and managing cash flow more effectively.

One way to manage outstanding payments is by setting up a centralized tracking system that lists all pending accounts with details like due dates, amounts, and client information. This allows for quick access to relevant data and ensures no payment slips through unnoticed.

Regularly reviewing this system and sending reminders to clients before deadlines can minimize delays. For even greater efficiency, consider utilizing automated tools that notify both you and your clients of upcoming or overdue payments, helping maintain timely follow-ups and a reliable income stream.

Improving Client Relationships Through Clear Invoices

Transparent billing practices can enhance trust and strengthen professional relationships with clients. When clients understand the details of charges and feel informed about the payment process, they are more likely to appreciate the value of the services and pay on time. Clarity in communication is essential for building long-term trust and minimizing misunderstandings.

Providing a detailed breakdown of services rendered can help clarify the value delivered. Consider using a structured layout that highlights key components:

| Description | Quantity | Rate | Total |

|---|---|---|---|

| Consultation Session | 5 | $100 | $500 |

| Follow-Up Support | 3 |