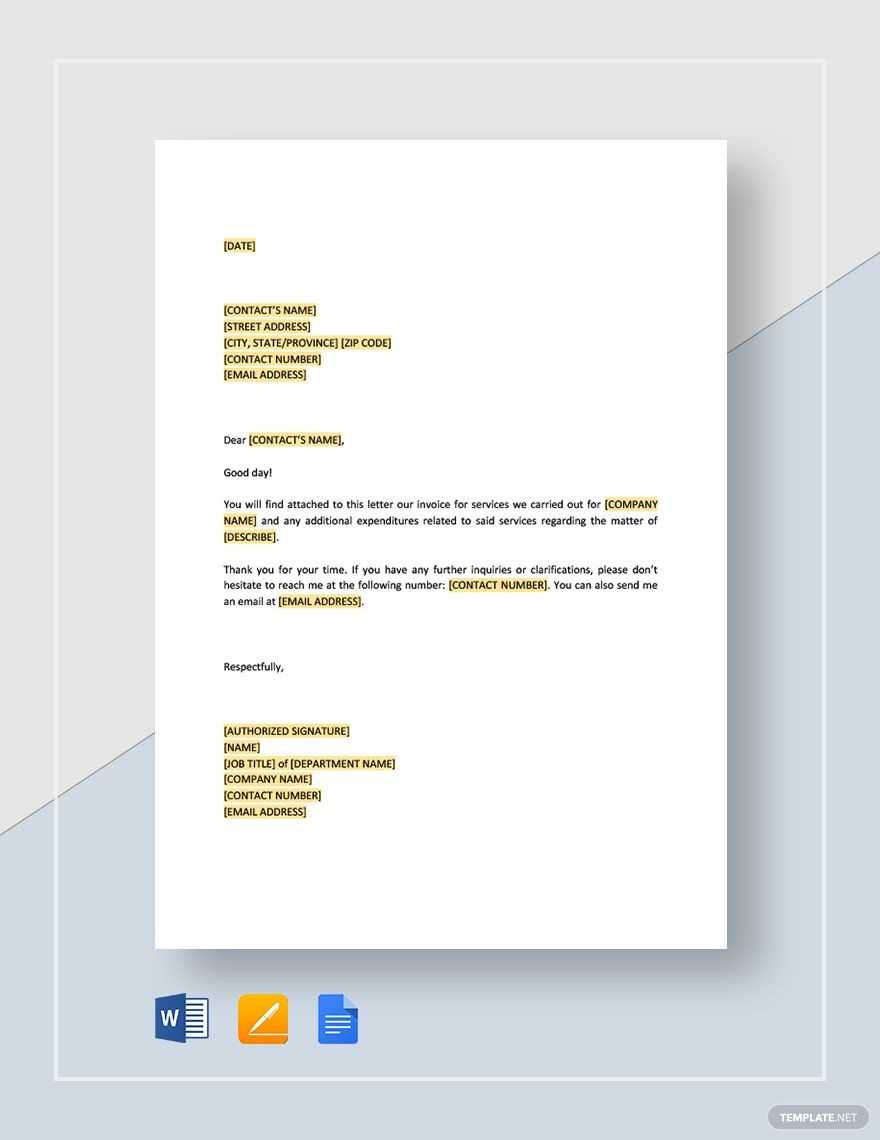

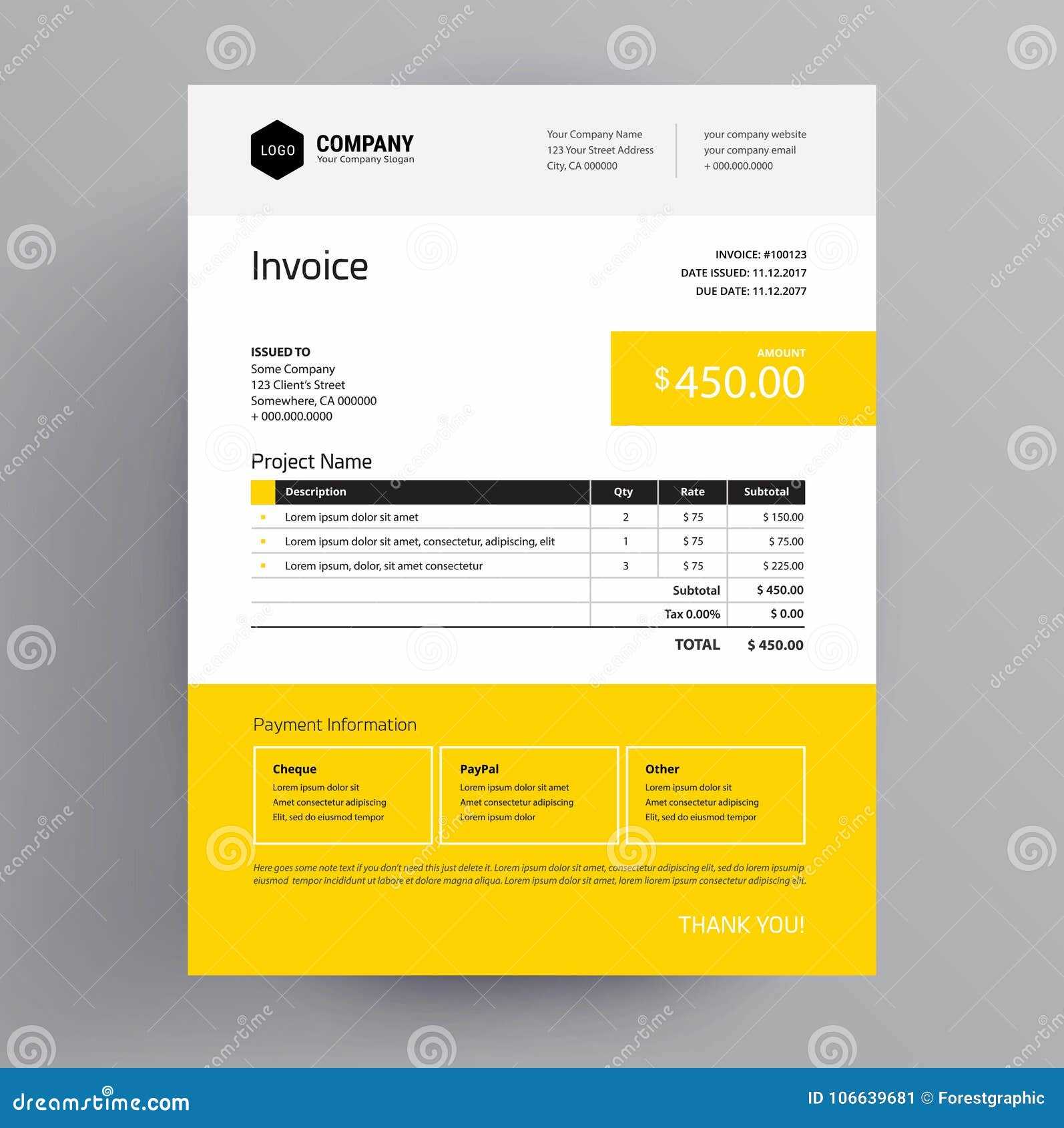

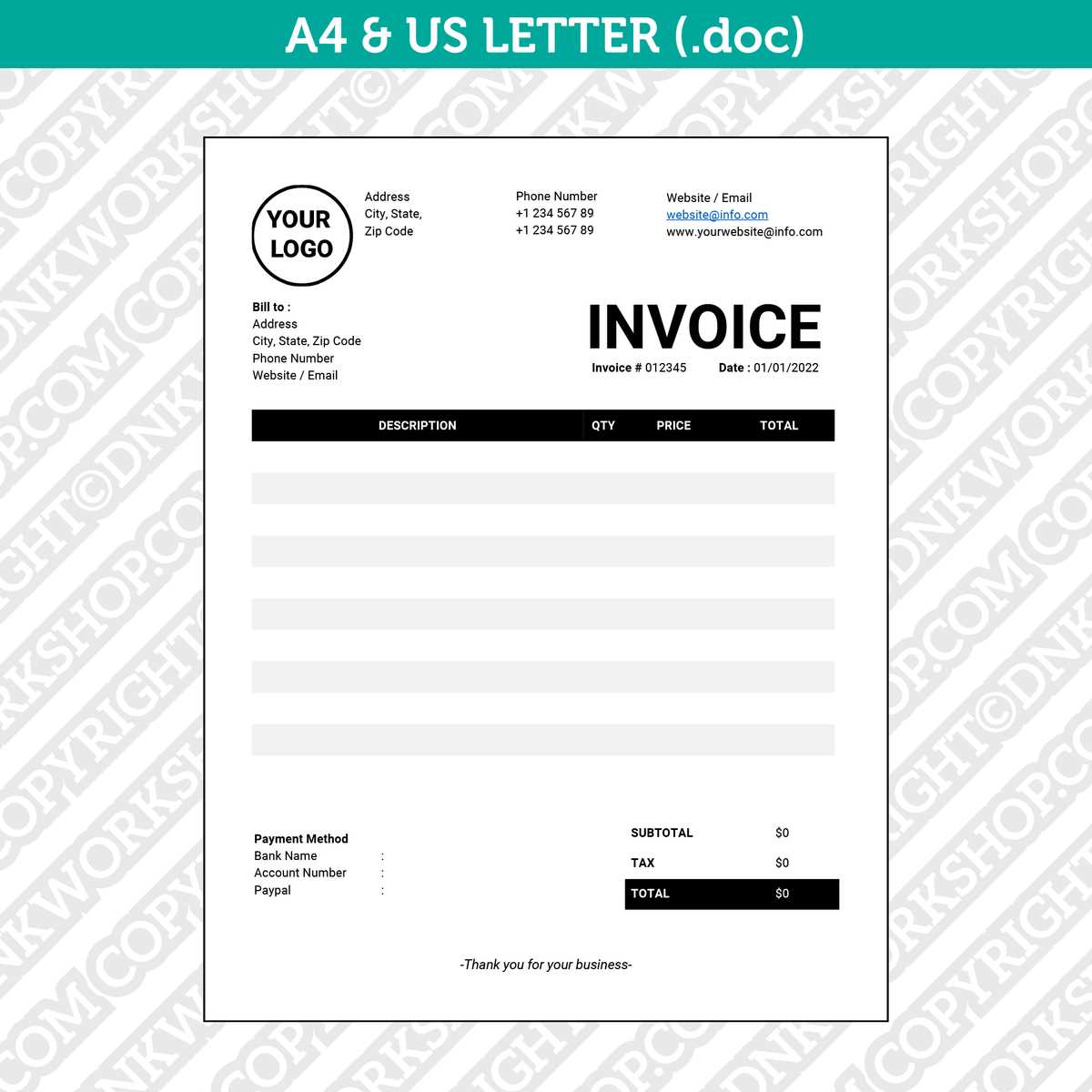

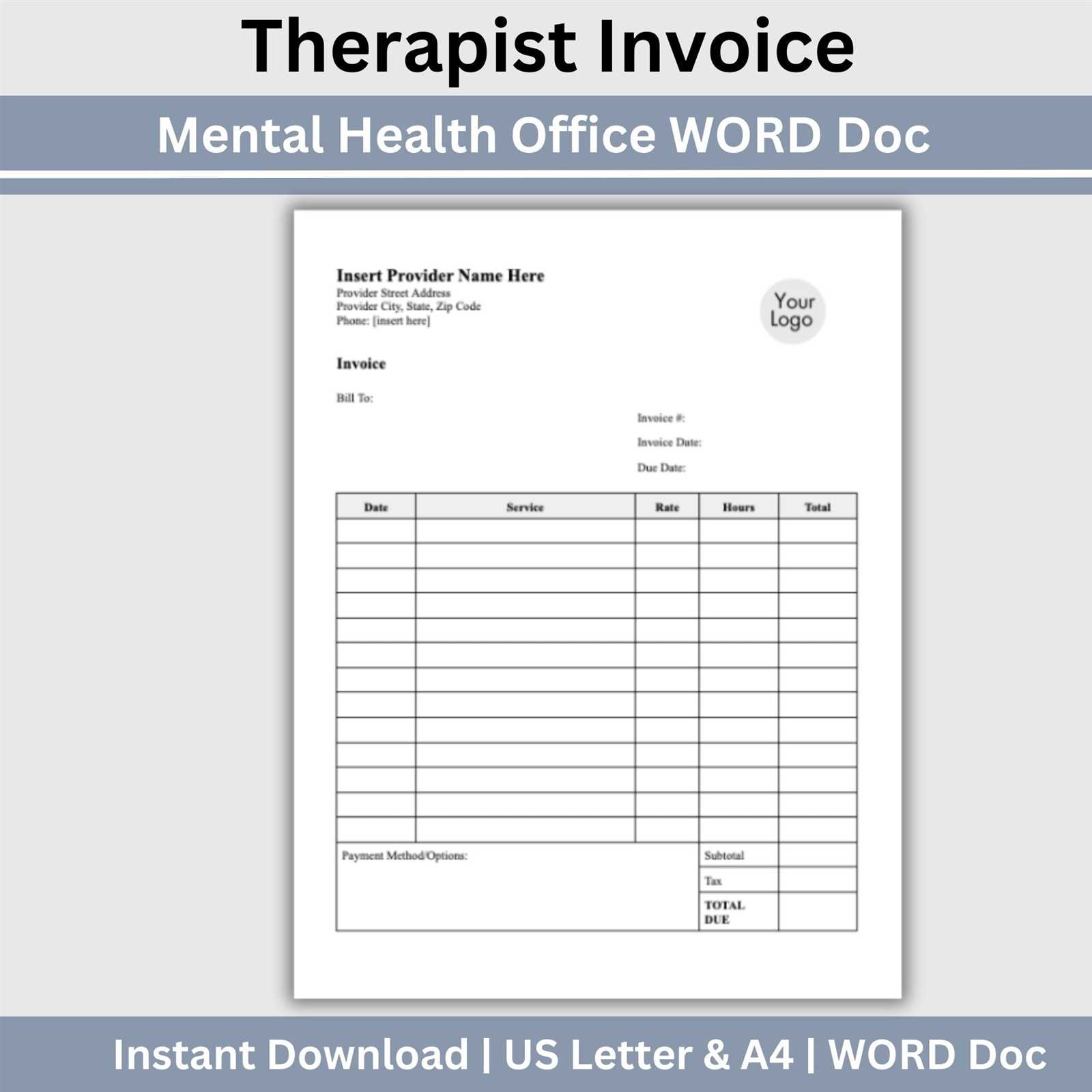

Letter Invoice Template for Professional and Easy Billing

In any business transaction, it’s essential to communicate payment details clearly and professionally. A well-designed document not only ensures transparency but also builds trust between the company and its clients. By using a structured approach, you can streamline the payment process and avoid confusion or delays.

One of the most effective ways to manage financial exchanges is through a formal written request for payment. This document should include all the necessary information to ensure both parties understand the terms and amounts due. With the right format, this communication tool can save time, reduce errors, and enhance the overall professionalism of your business.

By customizing and utilizing pre-made formats, you can create a personalized document that suits your needs. Whether you’re handling large-scale projects or small transactions, adapting a proven structure will help maintain consistency and clarity in all your financial dealings.

Understanding Letter Invoice Templates

When managing business transactions, clear communication regarding payment requests is essential. A well-structured document serves as a formal notice to clients, outlining the specifics of what is owed and the terms of payment. Using a standardized format for such communications helps ensure that all necessary details are included, reducing the risk of misunderstandings and ensuring smoother financial exchanges.

These documents typically include key information such as the amount due, payment deadlines, and the services or products provided. By following a consistent format, businesses can streamline the billing process, making it easier for clients to understand the request and respond accordingly. A reliable structure also reflects professionalism, which can strengthen relationships with clients and promote trust.

Key Features of Effective Billing Documents

An effective financial request should cover all essential elements, such as the company’s contact details, client information, a breakdown of charges, and a clear due date. Including payment methods and terms is also important to avoid confusion. In addition to basic details, the design of the document should be clean and easy to read, helping both parties quickly locate important information.

Customizing for Specific Business Needs

Every business has unique needs, and the format of a payment request should reflect this. Customizing these documents to suit your brand and the type of service offered ensures that they not only convey the necessary information but also align with your company’s image. The ability to adjust details, such as payment instructions or descriptions of services, allows businesses to maintain flexibility while using a standardized structure.

Benefits of Using a Letter Invoice

Adopting a structured approach to requesting payments offers significant advantages for both businesses and clients. A clearly written and professionally formatted communication helps avoid confusion, ensures that both parties understand the terms of payment, and promotes efficient financial transactions. By using a standardized format, companies can improve their billing processes and reduce errors that might delay payments.

One of the key benefits of this method is the ability to maintain consistency across all financial communications. With a set structure in place, businesses can ensure that every client receives the same information in a clear, understandable manner. This consistency also helps in tracking payments and managing accounts more effectively, as all essential details are included in one easily accessible document.

Improved Professionalism

Using a formalized payment request enhances the professionalism of any business. A well-crafted communication reflects attention to detail and a commitment to clarity. This not only strengthens relationships with clients but also conveys trustworthiness and reliability. A professional presentation of payment requests can positively impact how clients perceive your business, leading to stronger, more lasting partnerships.

Faster Payment Processing

When the necessary details are clearly outlined in a structured document, clients can easily understand what is due and when. This clarity reduces the chances of disputes or delays, ultimately leading to faster payment processing. By eliminating confusion and simplifying the payment process, businesses are more likely to receive payments promptly, helping maintain positive cash flow.

How to Create a Professional Invoice Letter

Creating a professional payment request involves several key steps to ensure that all necessary details are included and clearly communicated. By following a structured approach, you can produce a document that not only provides important financial information but also reflects the professionalism of your business. Here are the main elements to include and some best practices to follow when creating a well-organized payment request.

Essential Elements of a Payment Request

A well-structured document should contain the following critical components:

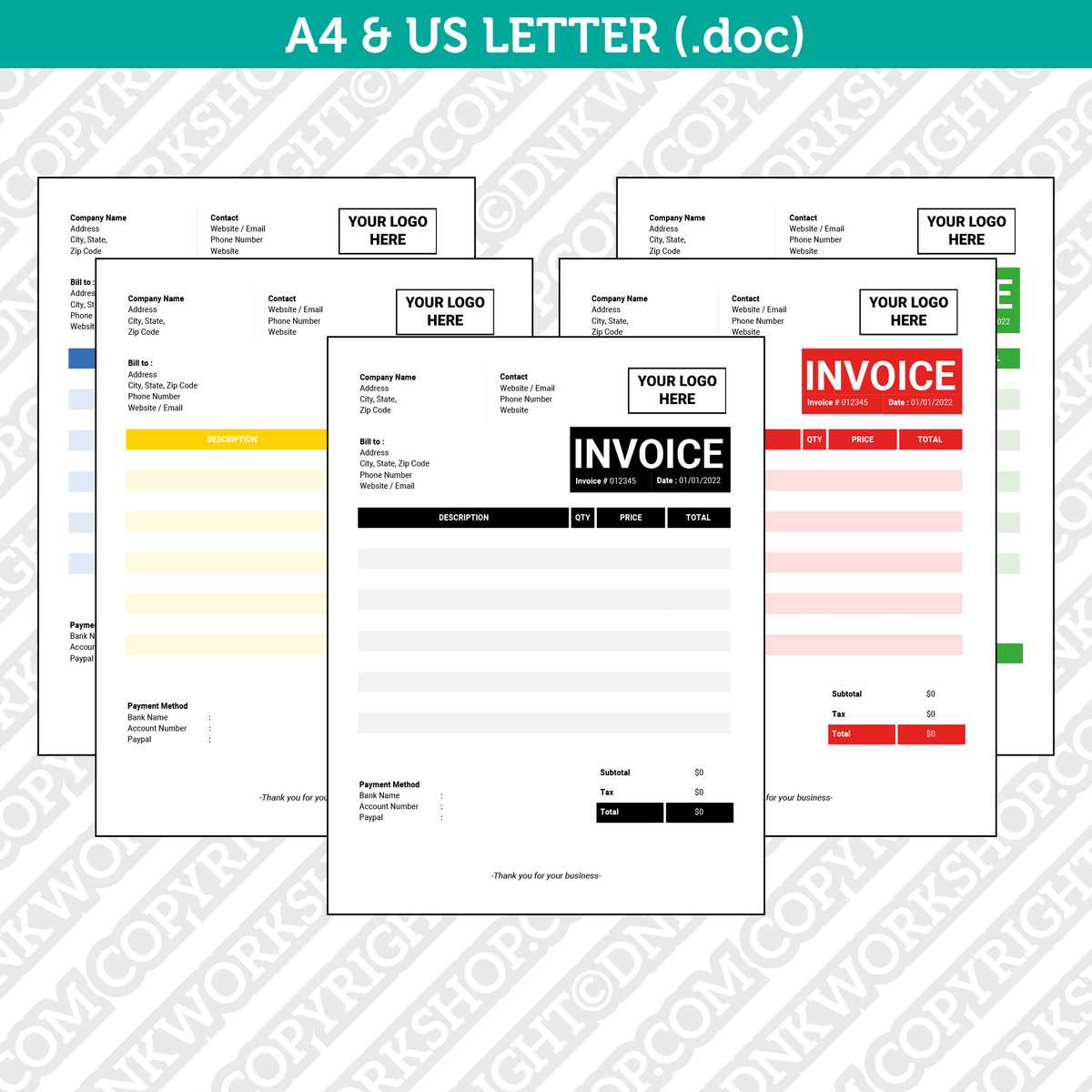

- Header with Business Information: Include your business name, logo, address, phone number, and email for easy contact.

- Client Information: Clearly list the client’s name, address, and contact details to avoid any confusion.

- Date and Reference Number: Always include the date of the request and a unique reference number for tracking purposes.

- Description of Services or Products: Provide a detailed breakdown of the items or services being billed, including quantities and unit prices.

- Total Amount Due: Clearly highlight the total amount owed, including any taxes, discounts, or additional fees.

- Payment Terms: Specify the due date for payment, accepted payment methods, and any penalties for late payments.

Formatting Tips for Clarity and Professionalism

In addition to including all the necessary details, the layout and design of the document play an important role in ensuring clarity and professionalism:

- Use a Clean, Simple Layout: Avoid cluttered designs. Stick to a clean, organized format that makes it easy to find important information.

- Clear Typography: Use readable fonts and sizes for easy readability. Avoid overly decorative fonts that can be difficult to read.

- Highlight Important Information: Use bold text for key items such as the total amount due, payment terms, and due dates.

- Professional Language: Ensure the tone is formal and respectful. Avoid slang or overly casual language.

By following these steps and paying attention to formatting, you can create a document that is both professional and easy for clients to understand, ultimately leading to more efficient payment processing an

Key Elements of a Letter Invoice

Creating a formal payment request requires careful attention to detail. It is essential to include specific information that will ensure both parties fully understand the terms of the transaction and avoid any confusion. A well-organized request not only provides the necessary details but also helps maintain professionalism and encourages timely payment. Below are the key components that should be included in any professional payment document.

Essential Information to Include

Each payment document should contain several key elements to ensure that all the necessary details are communicated clearly:

| Element | Description |

|---|---|

| Business Information | Include your company’s name, address, contact details, and logo to establish identity and make communication easier. |

| Client Information | Provide the client’s full name, address, and other contact details to ensure accurate identification of the recipient. |

| Document Date and Reference Number | Each document should have a clear date and a unique reference number to help both parties track the transaction. |

| Description of Goods or Services | Clearly outline the products or services being billed, with relevant details such as quantity, unit price, and any applicable taxes. |

| Total Amount Due | State the total amount owed, breaking it down if necessary, and highlighting any discounts or additional charges. |

| Payment Terms | Specify the payment deadline, accepted payment methods, and any late fees or penalties if applicable. |

Why These Elements Matter

Including these key elements in your payment request ensures that all necessary information is conveyed in a clear and professional manner. Properly formatted documents can help avoid disputes and make the payment process more efficient for both the sender and the recipient. By providing comprehensive details, you foster trust

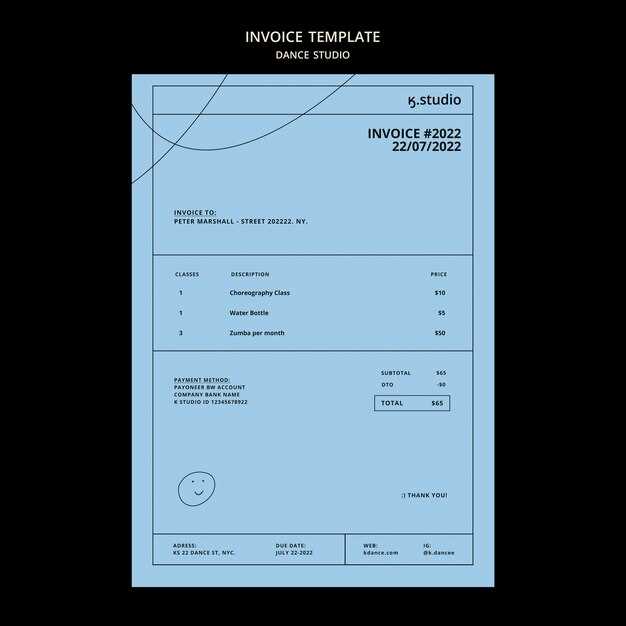

Choosing the Right Invoice Template

When creating a payment request, selecting the appropriate structure is crucial to ensuring clarity and professionalism. The right format can simplify the process for both you and your clients, making it easier to convey all necessary information. With so many available options, it’s important to choose one that suits your business needs, client preferences, and specific financial requirements. By understanding what to look for, you can make an informed decision that benefits both parties.

Factors to Consider When Choosing a Format

There are several important aspects to take into account when selecting the most effective design for your payment request:

- Business Type: The format you choose should reflect the nature of your business. A service-based company may need to include more detailed descriptions, while a product-based business might focus more on quantities and prices.

- Client Preferences: Some clients may prefer more detailed information, while others may favor a simpler format. Consider how much detail your clients expect in the document.

- Brand Consistency: Ensure that the format aligns with your business’s branding. This includes using your company’s colors, logo, and fonts to make the document look professional and cohesive with other business materials.

Benefits of a Customized Approach

A customizable structure offers flexibility, allowing you to adjust elements to suit specific needs, such as adding or removing sections, adjusting payment terms, or including additional notes. Customization can help you stand out by providing a more tailored experience for your clients, which may improve the likelihood of prompt payment and positive client relations. A template that is adaptable to your business’s unique circumstances can save you time and ensure consistency across all your communications.

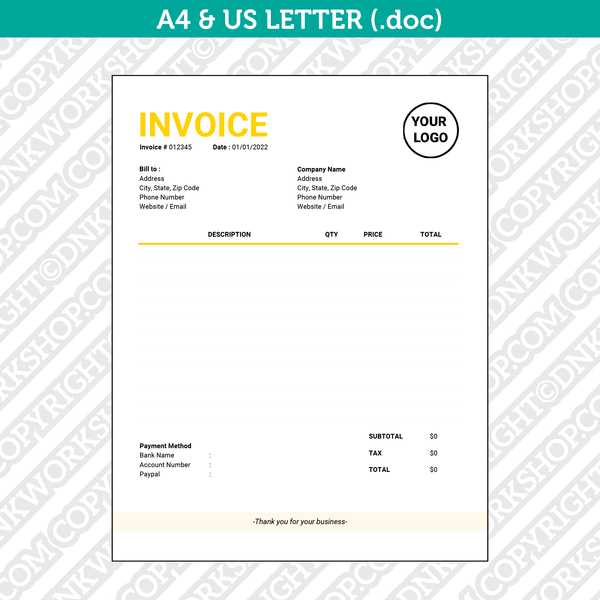

Customizing Your Letter Invoice Template

Personalizing your payment request structure can greatly enhance its effectiveness and reflect the unique aspects of your business. By adjusting various elements, you can ensure the document aligns with your branding, communicates the right level of detail, and meets both your and your client’s needs. Customization allows you to create a more tailored and professional experience, which can contribute to a smoother financial transaction process.

Key Areas for Customization

There are several key areas where customization can make a significant impact:

- Brand Identity: Incorporate your business logo, colors, and fonts to ensure the document matches your brand. This creates a consistent look across all communications and reinforces professionalism.

- Payment Details: Modify sections related to payment methods, due dates, or any special terms that may apply to a particular client or project. Clear payment instructions can help clients process the transaction without delays.

- Descriptions and Breakdown: Depending on the complexity of the goods or services being billed, adjust the level of detail in the descriptions. This could include itemized lists, hourly rates, or specific project milestones.

- Additional Notes: Include any extra information that may be relevant, such as a thank-you note, reminders about future services, or promotional offers for clients who settle payments early.

Benefits of Customization

Personalizing your payment request structure provides several advantages. It allows you to convey a clear, professional image, strengthens your relationship with clients, and ensures the document contains only the most relevant information. Additionally, customization makes it easier to handle specific client needs and adjust for different payment situations, helping to streamline your financial operations.

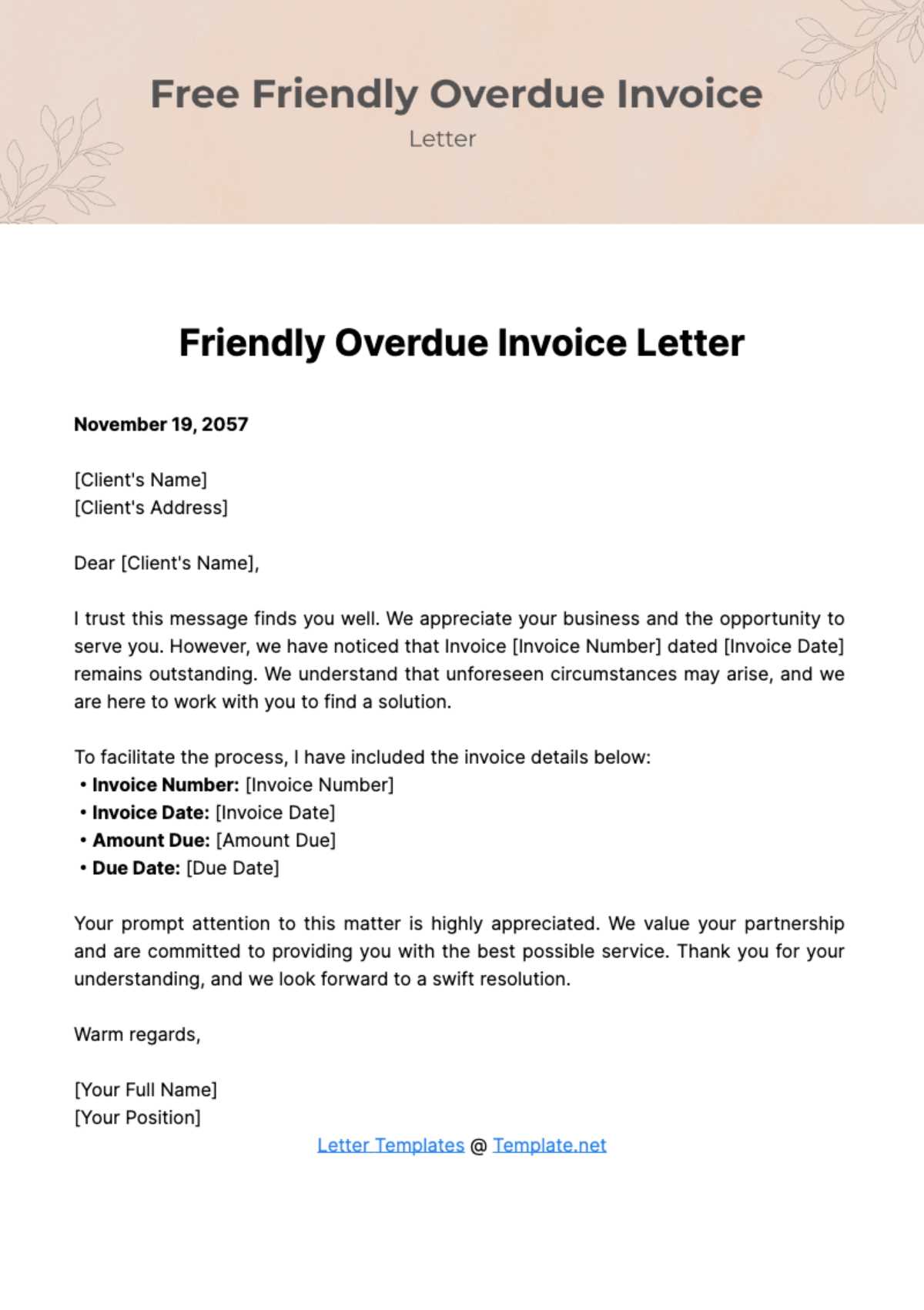

Free Letter Invoice Templates Online

For businesses looking to simplify the billing process, there are many free resources available online offering pre-designed formats that can be easily customized. These tools provide a quick and efficient way to create professional payment requests without the need for expensive software or design expertise. With just a few clicks, you can download a well-structured document that can be tailored to fit your specific needs.

Many online platforms offer a variety of formats, allowing businesses of all sizes to find a style that aligns with their branding and payment requirements. Whether you’re a freelancer, a small business owner, or part of a larger organization, free resources provide an excellent starting point to ensure your communications are clear and professional.

Key Advantages of Using Free Resources:

- Cost-Effective: These tools are free to use, making them an ideal choice for businesses operating on a budget.

- Time-Saving: Pre-designed formats reduce the amount of time needed to create documents from scratch.

- Easy Customization: Most free formats are editable, allowing you to add your business information, client details, and specific terms quickly.

- Professional Quality: Many templates are designed by experts, ensuring that your payment request looks polished and credible.

Using free formats is an excellent way to streamline your billing process while maintaining a high level of professionalism. These resources can help you stay organized, save time, and focus on what matters most–growing your business.

Common Mistakes in Invoice Letter Design

Creating a clear and professional payment request is essential for smooth business transactions. However, even with the best intentions, some common design errors can lead to confusion or delays. These mistakes not only affect the appearance of your document but can also complicate the payment process, resulting in missed deadlines or misunderstandings with clients. Recognizing and avoiding these pitfalls can help ensure your billing process remains efficient and effective.

Typical Design Errors

Several design flaws can detract from the clarity and professionalism of a payment request. Below are some common mistakes to watch out for:

- Cluttered Layout: A disorganized or overly complex design can make it difficult for clients to find essential details, such as the amount due or payment terms. Keep the layout clean and well-structured.

- Poor Typography: Using hard-to-read fonts, small font sizes, or excessive text styles can make the document look unprofessional. Stick to legible fonts with appropriate sizes for easy readability.

- Missing or Incomplete Information: Failing to include key details such as the client’s name, due date, or total amount due can cause confusion and delay payments. Double-check to ensure all required information is present.

- Lack of Branding: Not incorporating your business logo or branding elements can make your document look generic and less trustworthy. Ensure your document reflects your brand identity.

- Unclear Payment Terms: Vague or poorly formatted payment terms can lead to misunderstandings. Clearly state payment deadlines, accepted methods, and any penalties for late payments.

How to Avoid These Mistakes

To avoid common errors, focus on simplicity, clarity, and accuracy. Follow these best practices:

- Maintain a Clean Layout: Use white space to separate sections and guide the reader’s eye to important details.

- Use Readable Fonts: Choose standard, professional fonts like Arial or Times New Roman, and avoid decorative or complex styles.

-

How to Format an Invoice Letter

Properly formatting your payment request ensures that all critical information is easily accessible and clearly understood by the recipient. A well-structured document helps reduce confusion, improves professionalism, and speeds up the payment process. By following a simple, organized layout, you can create a document that communicates all the necessary details in an efficient and visually appealing manner.

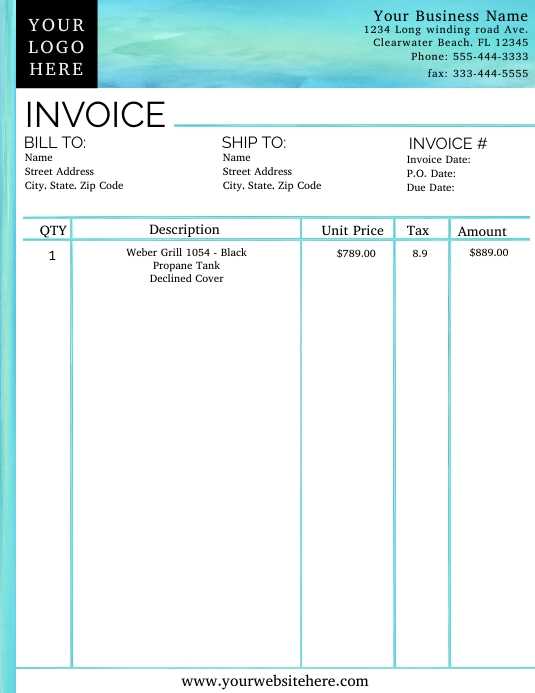

Key Formatting Guidelines

When formatting a payment request, several important elements should be included in a logical and readable order. These are the sections that must be clearly outlined in the document:

Section Description Header Information Start with your business name, logo, and contact details, followed by the client’s information. This helps identify both parties quickly. Document Title Label the document clearly, such as “Payment Request” or “Amount Due.” This makes the purpose of the document obvious at a glance. Transaction Details Include an itemized list of the products or services provided, with corresponding quantities and prices. Total Amount Due Highlight the total amount owed, ensuring it stands out so it’s easy for the recipient to locate. Payment Terms Clearly state the payment deadline, acceptable methods, and any penalties for late payments. Best Practices for Readability and Clarity

In addition to including all the necessary information, proper formatting makes the document more readable and professional. Here are some best practices to follow:

- Use Simple Layouts: Keep the design clean and uncluttered, with distinct sections separated by white space.

- Focus on Font Size: Use readable font sizes–typically 10-12 pt for text and larger sizes for headings to ensure clarity.

- Align Information Logically: Organize information in a top-down flow, with business information first, followed by transaction details, a

Best Practices for Invoice Letter Writing

Writing a clear, professional payment request is essential to ensure that clients understand the terms of the transaction and the details of the amount due. A well-crafted document not only facilitates timely payments but also strengthens your reputation as a trustworthy business. By adhering to some key writing practices, you can ensure that your communication remains professional, effective, and easy to follow.

Key Writing Tips for Professional Payment Requests

To create a well-written payment request, focus on clarity, tone, and structure. Here are several best practices to follow:

- Use Clear and Concise Language: Avoid complex jargon and overly long sentences. Write in a straightforward, easy-to-understand manner to minimize confusion.

- Maintain a Polite, Professional Tone: Even when requesting payment, keep the language polite and respectful. A friendly yet formal tone fosters positive relationships with clients.

- Be Specific: Clearly outline the services or products provided, the total amount due, and any other terms. Vague descriptions can lead to misunderstandings.

- Include Essential Details: Always include important information, such as the payment deadline, accepted payment methods, and contact details for any questions. This ensures that the client has everything they need to complete the transaction.

How to Ensure Timely Payments

To encourage prompt payment, consider including the following elements in your writing:

- Set Clear Deadlines: Specify an exact due date for payment, and mention any late fees that may apply if the deadline is missed. This creates a sense of urgency.

- Offer Multiple Payment Options: Make it easy for clients to pay by providing different payment methods (e.g., bank transfer, credit card, online payment platforms).

- Express Gratitude: Including a brief thank you note at the end of the document not only fosters goodwill but also reinforces your professionalism.

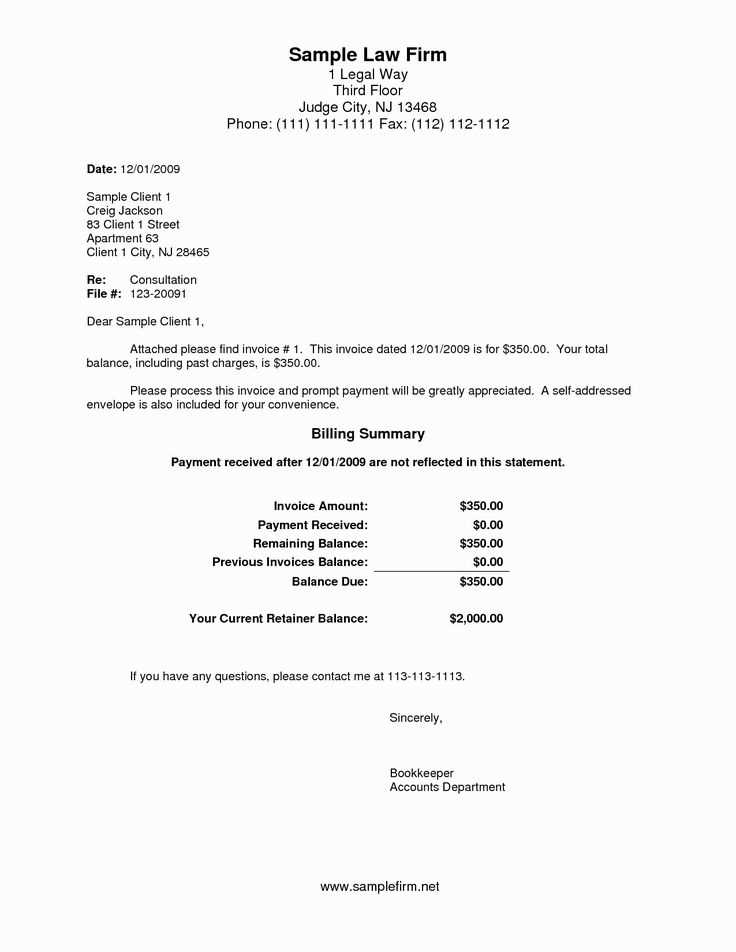

- Clear Payment Terms: Be specific about the amount due, payment deadline, and any late fees or penalties for overdue payments. Clear payment terms prevent misunderstandings and can serve as evidence if a legal dispute arises.

- Tax Information: Depending on your jurisdiction, you may be required to include tax details, such as VAT or sales tax. Failing to do so could result in tax issues for both parties.

- Contractual References: If your request is linked to a prior agreement or contract, reference the contract number or terms in the document. This helps establish the legal basis for the payment and makes it easier to resolve any potential disputes.

- Dispute Resolution Clause: Including a clause that specifies how disputes will be handled (e.g., mediation or arbitration) can save time and money in case of a conflict over payment or terms.

- Jurisdiction: It’s essential to mention the legal jurisdiction under which any potential disputes will be settled. This ensures both parties are aware of where legal actions will be pursued if necessary.

- Email: The most common method for sending formal documents today. Email is fast, efficient, and provides an immediate record of the transaction. Ensure that your document is in PDF format to maintain its professional appearance.

- Postal Mail: For clients who prefer physical documents, or if you’re dealing with international transactions, sending a hard copy via post may be necessary. Be sure to use reliable mailing services to avoid delays.

- Online Payment Platforms: Some businesses use platforms like PayPal or specialized invoicing tools to send formal payment requests. These platforms often allow you to track payments, provide reminders, and add automated features to simplify the process.

- Include a Clear Subject Line: When sending by email, ensure that the subject line is clear and directly references the purpose of the email (e.g., “Payment Request for [Invoice #] – Due [Date]”).

- Provide All Relevant Information: Make sure the payment request includes everything the client needs to process the payment, such as the amount due, payment methods, and due date.

- Set a Reminder: If you don’t receive payment by the due date, follow up with a polite reminder. A gentle nudge can sometimes be the difference between timely payment and delays.

- Keep Records: Always keep a copy of the sent request for your records, whether it’s a digital copy or a physical one. This can serve as a reference if there’s any confusion or dispute regarding the payment.

- Time Efficiency: Automated systems allow you to generate and send requests in minutes, rather than spending time on manual creation and delivery.

- Reduced Errors: By setting up templates and automated processes, you can minimize the risk of errors in client information, amounts, or due dates.

- Consistent Branding: Automation ensures that all your payment requests are consistently formatted, aligning with your company’s branding and professional standards.

- Timely Reminders: Automated systems can send reminders for upcoming or overdue payments, reducing the need for manual follow-ups.

- Accounting Software: Programs like QuickBooks, FreshBooks, and Xero allow you to create, send, and track payment requests automatically. These tools can integrate with your bank accounts and payment gateways, simplifying the entire process.

- Online Billing Services: Platforms like PayPal, Stripe, and Square offer invoicing services that enable you to create professional payment requests and automate reminders and late fees.

- Customizable Workflow Tools: Platforms like Zapier or Microsoft Power Automate allow you to integrate various applications and create a fully customized automated workflow for sending payment requests and processing payments.

- Seamless Data Transfer: Automatically transfer client details, amounts due, and payment histories directly into your accounting system, eliminating the need for manual input and reducing the risk of mistakes.

- Automated Financial Tracking: Once your requests are sent and payments are received, the software can update your financial records in real-time, keeping everything organized and accurate.

- Improved Reporting: Integration allows for easy access to financial reports that combine payment request data, outstanding balances, and payment history, giving you a complete view of your business’s finances.

- Faster Payments: Clients can easily pay directly from the payment request if integrated with online payment gateways, speeding up the transaction process.

- QuickBooks: QuickBooks offers a seamless connection to invoicing tools, allowing you to create, send, and track formal billing documents directly within the software.

- FreshBooks: FreshBooks is another excellent option that integrates with various payment systems and automates the billing process, ensuring everything is synchronized with your financial records.

- Xero: Xero allows you to integrate your payment requests with accounting functions, simplifying the management of expenses, taxes, and payments.

- Wave Accounting: This free accounting software offers integration with billing and payment systems, making it a great choice for small businesses looking to automate their financial processes.

- Professional Image: A consistent format and design show that your business is organized and reliable. When your payment requests look professional, it signals to clients that you take your work seriously.

- Clear Communication: By using the same structure for every request, you ensure that your clients know exactly where to find important details, such as the amount due, payment methods, and due dates. This clarity reduces confusion and speeds up the payment process.

- Fewer Errors: Consistency in the way you format and present information minimizes the chances of mistakes, such as incorrect amounts or missing details. This helps ensure that both parties are on the same page and reduces the need for corrections or follow-ups.

- Streamlined Processes: When you follow a consistent process, it’s easier to automate and track your billing system. Whether you’re using accounting software or an online platform, uniformity in document layout and content allows for seamless integration and reduces administrative workload.

- Trust and Reliability: Clients are more likely to pay on time if they feel confident in your professionalism. Consistency in your communication reassures them that they are working with a dependable partner who values transparency and accountability.

- Use Standardized Formats: Whether you’re using a pre-designed template or creating your own, make sure each document follows the same layout, including the same headers, fonts, and color schemes.

- Stick to Clear Language: Use straightforward, professional language that avoids ambiguity. Be consistent in how you phrase payment terms, due dates, and any late fees or penalties.

- Regularly Review Your Documents: Periodically review your payment requests to ensure all information is up to date and aligned with your business’s policies and legal requirements.

- Clear Payment Terms: Clearly state payment deadlines, methods, and any penalties for late payments. The more transparent you are, the less likely clients will delay payments.

- Timely Sending of Requests: Sending requests promptly ensures that clients have enough time to process payments. Delayed requests can result in delayed payments, impacting your cash flow.

- Offer Multiple Payment Options: The more convenient you make it for clients to pay, the quicker you will receive funds. Provide options such as bank transfers, online payment platforms, or credit card payments to give clients flexibility.

- Early Payment Incentives: Offering discounts for early payment can encourage clients to settle their balances sooner, thus improving your cash flow.

- Automate Payment Reminders: Automated reminders help reduce the need for manual follow-ups and increase the chances of timely payments. This ensures that clients don’t forget about their payment obligations.

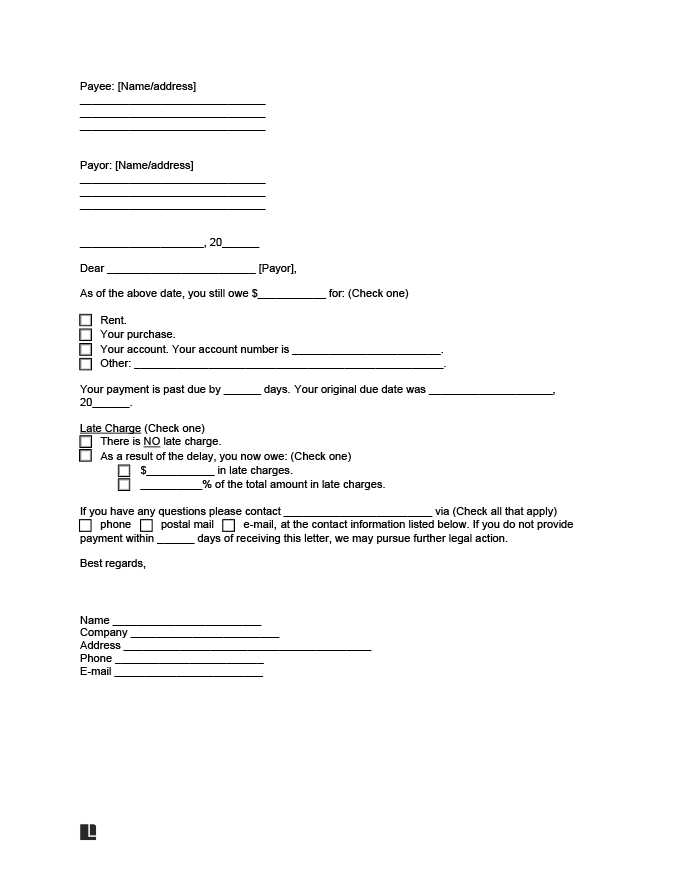

Legal Considerations for Invoice Letters

When preparing a formal payment request, it’s important to be aware of the legal aspects involved in the transaction. Ensuring that the document complies with local laws and includes the necessary terms can help protect both you and your client in case of disputes or non-payment. By incorporating the right legal elements into your document, you establish clear expectations and avoid potential legal issues down the line.

Important Legal Elements to Include:

Why Legal Compliance Matters:

Ensuring legal compliance is crucial not just for avoiding disputes, but also for protecting your business interests. By clearly outlining terms and conditions, including taxes, and addressing potential legal issues proactively, you help safeguard yourself against the risks associated with non-payment or delayed payments. Furthermore, having a legally sound document increases your credibility and professionalism in the eyes of your clients.

Incorporating these legal considerations into your payment requests helps to minimize the likelihood of complications, ensuring a smoother

How to Send a Letter Invoice Effectively

Sending a formal payment request is an essential part of any business transaction. To ensure prompt and accurate payment, it’s important to choose the right method of delivery and communicate your expectations clearly. Whether you’re sending the document via email, post, or another method, the way you send it can significantly affect the timeliness and success of the payment.

Choosing the Right Delivery Method

There are several options for sending your payment request, and the best one depends on your business’s needs and the preferences of your client:

Tips for Ensuring Effective Delivery

Regardless of how you choose to send your document, there are a few key tips to ensure your payment request is received and processed smoothly:

By choosing the right method and ensuring all the necessary information is included, you can streamline the process and improve the chances of receiving payment on time. Effective communication and prom

Automating Your Invoice Letter Process

Automating the payment request process can save valuable time, reduce errors, and ensure consistency in your communications. By leveraging software tools and online platforms, you can create, send, and track your billing documents with minimal manual intervention. This not only enhances efficiency but also helps maintain a professional appearance and ensures that no payment request is overlooked.

Benefits of Automating Billing Communications

There are several key advantages to automating your payment request process:

Tools and Software for Automation

Several tools and platforms can help you automate your billing process:

By automating your payment request system, you can streamline your operations, improve cash flow, and reduce the chances of human error, allowing you to focus on growing your business while ensuring timely and accurate payments.

Integrating Invoice Letters with Accounting Software

Integrating your formal billing documents with accounting software can significantly enhance the efficiency of your business operations. This integration streamlines the process of tracking payments, managing finances, and reducing manual data entry. By connecting your payment requests with your accounting system, you can automate many tasks, reduce errors, and gain a more comprehensive overview of your business’s financial health.

Advantages of Integration

Integrating your payment requests with accounting software offers numerous benefits, including:

Popular Accounting Software for Integration

Several accounting platforms offer easy integration with payment request systems. Here are some of the most popular options:

By integrating your formal payment requests with accounting software, you can optimize your workflow, ensure accurate records, and ultimately improve your business’s efficiency and cash flow management.

Why Consistency Matters in Invoicing Letters

Maintaining consistency in your formal payment requests is crucial for building a professional image and ensuring smooth financial transactions. Whether you’re sending these documents manually or through automated systems, uniformity in structure, design, and content helps clients easily understand the terms and reduces the chance of confusion or delays. Consistency also reinforces trust and reliability, which are vital in sustaining long-term business relationships.

Key Reasons Consistency is Important:

How to Achieve Consistency:

By prioritizing consistency in your formal requests, you can create a smoother, more predictable process for both your business and your clients. The attention to de

Improving Cash Flow with Invoice Letters

Managing cash flow is essential for the financial health of any business. One of the most effective ways to improve cash flow is by optimizing the process of requesting and receiving payments. Properly structured payment requests help ensure that clients understand their obligations, leading to faster payments and fewer delays. By creating clear, professional, and timely requests, you can accelerate cash flow and reduce financial strain.

Key Strategies for Improving Cash Flow:

Why Timely Payment Requests Matter:

Sending your requests on time and following up as needed can significantly reduce the number of overdue accounts. When clients receive well-structured and professional payment requests, they are more likely to prioritize your payment. Furthermore, having a clear system in place helps you stay organized, track outstanding payments, and maintain a steady cash flow.

By implementing these strategies and maintaining consistent communication, you can enhance your cash flow and avoid the cash flow disruptions that often occur from late or missed payments. Building a streamlined process for payment requests helps you focus on growing your business while ensuring that funds come in regularly.