Free Legal Services Invoice Template for Easy Billing

Efficient and accurate billing is a cornerstone of any successful legal practice. Whether you’re managing a large firm or working independently, organizing payments is essential for maintaining financial health. With the right tools, you can streamline the billing process, ensuring that clients are charged correctly and on time, while also reflecting the professional standards of your practice.

One of the easiest ways to simplify this process is by using customizable billing documents. These pre-designed formats allow you to quickly generate well-organized payment requests, saving you valuable time. By incorporating the necessary fields and structure, such templates help eliminate errors and ensure consistency across all client interactions.

In this article, we’ll explore how you can access and use these documents, as well as discuss the key features to look for. Whether you’re new to the profession or looking to improve your current system, having the right tools in place can make all the difference in ensuring smooth financial transactions.

Free Legal Invoice Templates for Professionals

Efficient billing is essential for any professional in the legal field, and having a structured document to handle payments can save a great deal of time. Professionals need simple, yet effective ways to request payments that reflect their business’s standards and avoid errors. Using a pre-designed document allows for faster processing, ensuring that all required details are included in a consistent format, without the need to start from scratch each time.

There are several benefits to using ready-made billing solutions. These documents are designed to include all the critical fields and formatting needed, which makes them versatile and easy to adapt for different client scenarios. They help maintain a professional appearance and contribute to more efficient financial management.

Why Professionals Should Use Pre-Designed Billing Solutions

- Time-Saving: Ready-made documents eliminate the need to create billing records from the ground up.

- Accuracy: Templates are structured to include all necessary information, reducing the risk of missing important details.

- Consistency: Using the same format for every request helps maintain a cohesive and professional image across clients.

- Customization: Most ready-made solutions allow for easy modification, so they can be tailored to specific needs.

Where to Find Billing Documents for Professionals

- Online Resources: There are several websites offering no-cost billing solutions for professionals, from simple formats to more advanced options.

- Industry Websites: Many industry-specific sites provide tools tailored to the unique needs of legal practitioners.

- Word Processing Software: Some office suites include customizable billing formats as part of their templates, available for immediate use.

Why Use a Billing Document Format

Managing financial transactions efficiently is crucial for any professional. Having a pre-made structure to handle client payments not only saves time but also ensures that all necessary information is included and organized. Instead of creating a new record from scratch each time, professionals can focus on customizing the details, thus streamlining the entire process.

Using a standardized billing format brings several advantages that contribute to both professionalism and efficiency. Here are some key reasons why adopting a set structure can benefit any practice:

- Time Efficiency: Pre-designed formats allow you to generate a request quickly, without re-entering the same information repeatedly.

- Accuracy: Ready-made structures include all essential fields, reducing the chances of forgetting important details such as hourly rates or service descriptions.

- Consistency: Using the same layout across all client communications ensures that your business maintains a professional and uniform image.

- Customizability: Most formats allow you to adjust the layout and details to suit individual needs while still adhering to a proven structure.

With a well-organized framework, you can focus on providing top-notch services to clients, knowing that the financial aspects are handled smoothly and efficiently.

Benefits of Customizable Billing Formats

Having the ability to modify your billing documents to fit the unique needs of your practice is a major advantage. Customizable structures allow professionals to adapt each request to the specific details of a transaction, ensuring that clients receive accurate and relevant information every time. This flexibility helps maintain clarity and professionalism while improving the overall efficiency of your billing process.

Here are some of the primary benefits of using adaptable billing documents:

Improved Flexibility

- Tailored to Client Needs: Customizable formats allow you to adjust the content based on the specific requirements of each client or project.

- Ability to Add or Remove Sections: You can include only the most relevant fields, ensuring that each document is concise and clear.

- Personalization: Add your company logo, specific terms, or unique billing details to create a more personalized experience for clients.

Enhanced Professionalism and Accuracy

- Clear and Organized Layout: A well-structured document eliminates confusion and ensures that clients can easily understand the payment terms.

- Fewer Errors: The ability to modify content helps prevent mistakes such as incorrect rates, missing items, or incomplete details.

- Consistency in Appearance: Each customized document can maintain a consistent style, enhancing the overall image of your practice.

By adapting documents to suit your needs, you improve both the effectiveness and professionalism of your billing process, creating a smoother experience for both you and your clients.

How to Create a Billing Document

Creating an accurate and professional billing record is a critical task for any professional. A well-structured payment request ensures that clients are informed clearly about the amount owed and the services provided. By following a simple process, you can craft a document that is both informative and easy to understand, helping to avoid confusion and ensure timely payments.

To build an effective billing document, follow these steps:

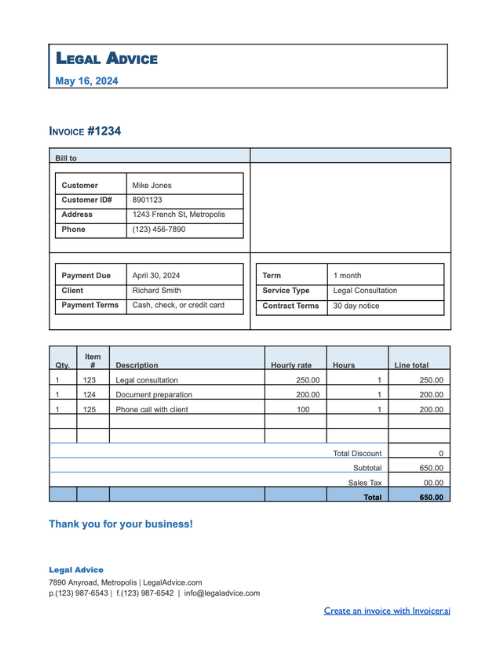

- Step 1: Start with Contact Information

Include your business name, address, phone number, and email. If necessary, add your registration or tax identification number. This helps clients quickly identify the source of the bill.

- Step 2: Add Client Details

Include the client’s name, address, and contact information. This is essential for clarity and ensures that the bill is directed to the correct recipient.

- Step 3: Include a Unique Reference Number

Assign a unique number to each billing record. This helps keep your financial records organized and allows both you and your clients to reference the document easily.

- Step 4: List Services Provided

Break down the work done in clear, concise terms. Include dates, hours worked, and rates for each task. This transparency will help avoid any misunderstandings about the charges.

- Step 5: Specify the Total Amount Due

Clearly state the total amount owed, including any taxes, discounts, or additional fees. Ensure this figure is easy to find and highlight it so clients can quickly see how much they need to pay.

- Step 6: Set Payment Terms

Include the payment due date, acceptable payment methods, and any penalties for late payment. This helps ensure timely transactions and avoids potential disputes.

By following these steps, you can create a clear and professional document that will reflect your business’s attention to detail and commitment to transparent financial practices.

Key Information for Billing Documents

When creating a payment request, it is essential to include all necessary details to ensure clarity and prevent misunderstandings. A well-structured document provides both the service provider and the client with a clear record of the transaction. By ensuring that all relevant information is included, you can help facilitate smooth financial interactions and reduce the likelihood of disputes or delays.

Here are the key elements to include in any billing record:

Basic Contact Information

- Your Details: Include your business name, address, phone number, email address, and any other identifying information, such as tax or registration numbers.

- Client Information: Clearly state the client’s name, address, and contact information to ensure the document is directed to the correct recipient.

Transaction Details

- Work Description: Provide a detailed breakdown of the work done or the goods provided, including dates, hours worked, and any specific rates for each task.

- Payment Amount: Clearly state the total amount due, including taxes, fees, or discounts. Make sure the final figure is easy to identify.

- Due Date: Indicate the date by which the payment should be made, and specify any penalties for late payments.

Including all these elements in your billing record ensures that the client has all the information needed to process the payment efficiently, while also safeguarding your business from potential issues related to unclear financial terms.

Tips for Accurate Billing in Law Firms

Accurate billing is crucial for maintaining the financial health and professionalism of any law practice. Properly documenting work and ensuring correct charges are applied helps avoid disputes and builds trust with clients. By following best practices and implementing a few key strategies, law firms can ensure that their billing process is both efficient and transparent, leading to smoother financial operations.

Track Time and Expenses Carefully

- Record Time Immediately: Keep a detailed log of all time spent on each case or task. The sooner this is done, the less likely you’ll miss billable hours.

- Use Time-Tracking Tools: Leverage software or apps designed to track hours and expenses, ensuring no billable activity goes unnoticed.

- Document Expenses: Make sure to capture all out-of-pocket costs related to a case, including travel, materials, or third-party services, and apply them accordingly.

Ensure Transparency and Clarity

- Detail Every Charge: Break down services, hours, and rates clearly so clients can see exactly what they are being charged for.

- Set Clear Terms in Advance: Discuss billing structures and payment expectations with clients upfront to avoid misunderstandings later.

- Provide Detailed Descriptions: Use concise but detailed descriptions of the work performed, ensuring that the client can easily understand what was done for the fee charged.

By implementing these simple yet effective strategies, law firms can not only increase the accuracy of their billing but also improve client relationships by ensuring transparency and avoiding potential disputes over charges.

Billing Document Features to Look For

When choosing a structured document for payment requests, it’s important to select one that meets the specific needs of your business. The right format can streamline your billing process, reduce errors, and enhance professionalism. Certain features ensure that the document not only includes all necessary details but also presents them in a clear and organized way.

Here are some essential features to look for in a well-designed billing structure:

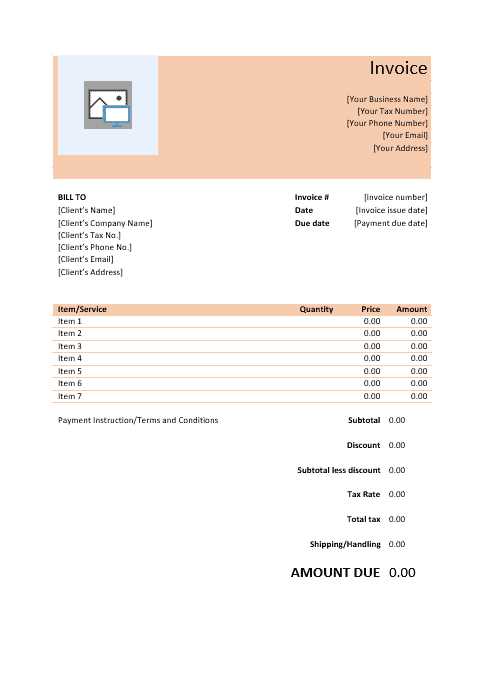

Essential Elements and Customization

- Client and Business Information: Ensure the format includes fields for both your and your client’s contact details, such as names, addresses, and phone numbers.

- Unique Reference Number: The document should allow for unique identification by including a reference or invoice number, making it easy to track payments.

- Clear Work Description: Look for a format that offers sections to clearly list the work completed, including dates, hours, and descriptions of tasks performed.

- Customizable Rates: The ability to adjust rates for different services or tasks is crucial for accuracy and flexibility.

Professional Presentation and Functionality

- Simple and Clean Layout: Choose a design that is visually appealing and easy to follow, ensuring that clients can quickly understand the charges.

- Tax and Discount Calculations: A good format will automatically calculate taxes, discounts, or other adjustments, reducing the risk of errors.

- Payment Terms and Due Date: Ensure the document includes a section to clearly state payment deadlines and accepted methods of payment.

- Additional Notes Section: An optional field for any notes or terms you may need to add, such as special agreements or payment instructions, adds further flexibility.

By selecting a format that includes these features, you can ensure that your billing process remains organized, accurate, and professional, ultimately improving both client satisfaction and financial management.

How to Save Time with Pre-Designed Documents

Creating billing records from scratch can be a time-consuming task, especially when dealing with multiple clients or ongoing projects. By using pre-designed structures, you can significantly reduce the amount of time spent on paperwork and focus more on providing value to your clients. These ready-made solutions allow you to quickly input key details and generate accurate requests without having to build each one from the ground up.

Here are some effective ways to save time by using structured formats:

Streamline Repetitive Tasks

- Pre-set Fields: With pre-built formats, common fields like your business information, client details, and payment terms are already included. This means you only need to update specific sections, reducing the time spent on each request.

- Save Customization: After creating a customized version once, you can reuse it with minor adjustments for future clients, eliminating the need to repeatedly input the same information.

Automate Calculations and Formatting

- Built-In Calculations: Many pre-designed structures automatically calculate totals, taxes, and discounts. This removes the risk of manual errors and saves you time on math and adjustments.

- Consistent Layout: Using a structured format ensures that every document looks the same, saving time on layout and formatting decisions.

By leveraging pre-designed solutions, you can improve efficiency, reduce errors, and ensure that billing is completed faster, all while maintaining a professional appearance.

Choosing the Right Billing Format

Selecting the appropriate structure for your payment requests is crucial to ensure clarity, accuracy, and professionalism. The right format can help you present your charges in an organized way, making it easier for clients to understand what they are being billed for. It also ensures that all necessary details are included, which helps reduce errors and improves your overall workflow.

When choosing a structure for your billing needs, consider the following factors:

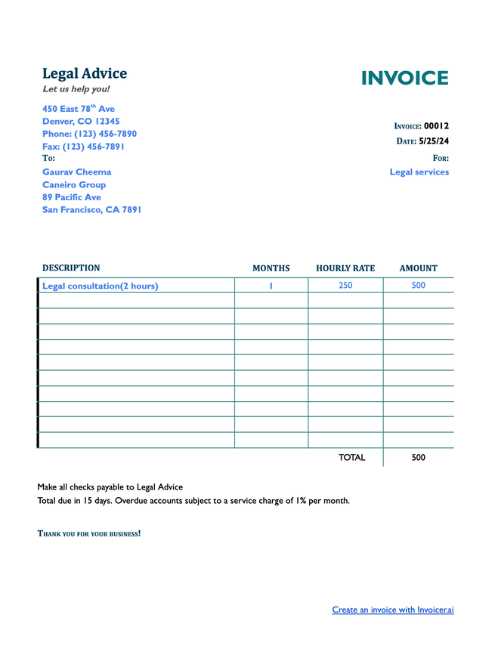

Consider the Type of Work You Do

- Hourly vs Fixed Rates: If your fees are based on hourly rates, look for a format that includes time-tracking fields. If your rates are fixed, choose a design that allows for clear descriptions of services and flat fees.

- Complexity of Billing: For simple tasks, a straightforward format with minimal fields may suffice. For more complex work involving multiple phases or services, opt for a structure that allows for detailed breakdowns.

Look for Ease of Use and Customization

- User-Friendly Layout: Choose a format that is easy to fill out and modify. It should allow you to quickly update fields without unnecessary complexity.

- Customizable Fields: Make sure the format allows you to add, remove, or adjust sections based on your specific requirements, whether it’s adding a discount, adjusting taxes, or adding specific client notes.

By selecting the right format for your needs, you ensure that your billing process is efficient, professional, and adaptable to the unique requirements of each client or project.

Free vs Paid Billing Document Formats

When it comes to choosing a structured format for payment requests, professionals often face the decision between using no-cost options or investing in premium solutions. While both types of formats can serve the purpose of generating billing documents, the features and benefits they offer can vary significantly. Understanding the differences between free and paid options can help you make a more informed choice based on your business needs and preferences.

Advantages of No-Cost Billing Solutions

- Low Initial Cost: The most obvious benefit of free formats is that they come with no financial investment. This makes them an attractive option for new businesses or those on a tight budget.

- Basic Features: Free formats typically offer essential fields such as client information, service descriptions, and payment terms. They can be a good choice for simpler billing needs.

- Quick and Easy to Use: Most no-cost options are straightforward and require minimal setup, making them ideal for those who need a fast, no-fuss solution.

Advantages of Paid Billing Solutions

- Advanced Features: Premium formats often come with advanced functionalities, such as automatic calculations, customizable sections, and integration with accounting software.

- Professional Design: Paid solutions typically offer more polished, visually appealing designs that can help enhance the professionalism of your business communications.

- Customer Support: With paid options, you generally get access to customer service or support teams who can assist with any technical issues or customization questions.

While free formats may suffice for basic needs, investing in a paid solution can provide greater flexibility, customization, and features that save you time and improve your billing accuracy in the long run. The decision between the two largely depends on the complexity of your business and how much time you’re willing to spend on customization.

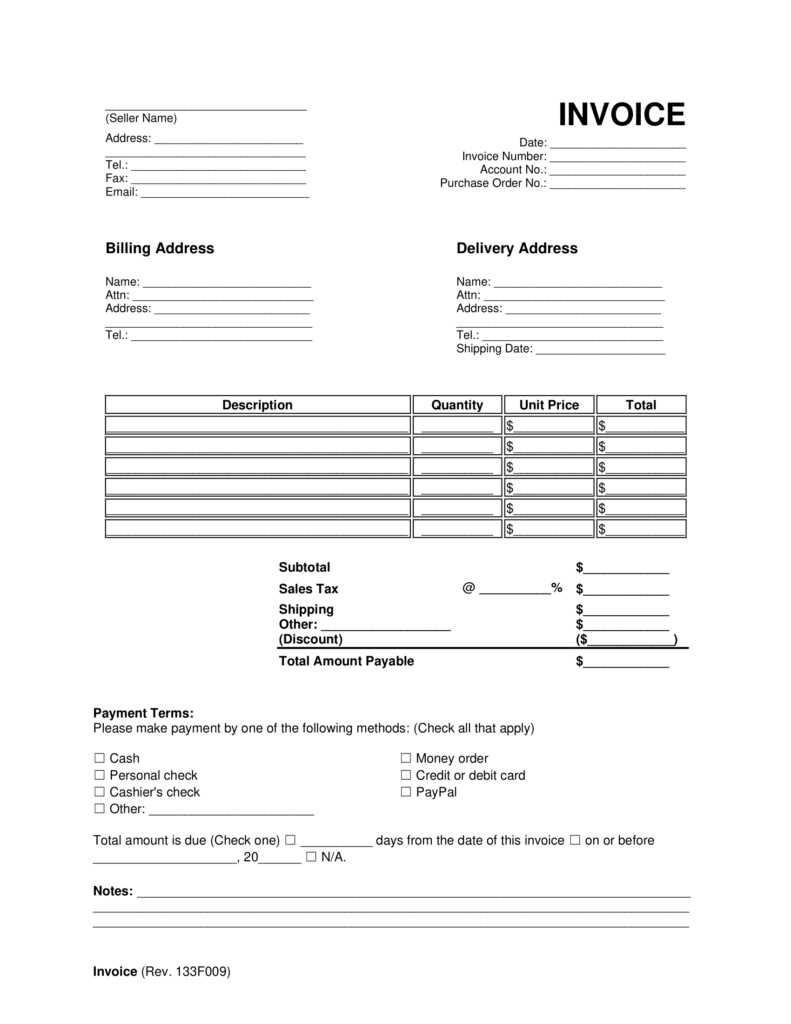

How to Download a Free Billing Document Structure

If you’re looking for a quick and easy way to create professional payment requests without starting from scratch, downloading a pre-made document structure can be an excellent solution. These ready-to-use formats are available from various online sources and can be tailored to fit your specific business needs. By following a simple process, you can have your desired structure in minutes, allowing you to focus on the content rather than the format itself.

To download a pre-designed structure, follow these easy steps:

- Step 1: Find a Reliable Source

Look for websites or platforms that offer trusted and reputable formats. Ensure that the source provides secure downloads and clear terms for usage.

- Step 2: Choose the Right Format

Browse through the available options and select a format that best fits your needs. Look for one with the necessary fields and features, such as space for descriptions, payment terms, and totals.

- Step 3: Download the Document

Once you’ve chosen the format, click the download link. The document will usually come in a standard format like PDF or Word, both of which can be easily edited.

- Step 4: Customize the Structure

After downloading, open the document and customize it with your business and client information. Adjust any sections as needed to suit the specific details of your transactions.

Once downloaded and customized, the structure is ready to use, saving you time and effort when creating future billing records.

Common Mistakes in Billing Documents

When preparing payment requests, it’s easy to overlook certain details, leading to mistakes that can affect both your client relationships and cash flow. Even small errors can cause confusion or delays in payment, making it important to pay attention to every aspect of the document. Avoiding these common mistakes can help ensure that your billing process is efficient and professional.

Here are some frequent errors to watch out for when creating payment documents:

Missing or Incorrect Contact Information

- Omitting Key Details: Failing to include your business name, client’s name, or correct contact details can lead to confusion and delays in processing payments.

- Wrong Address or Email: Double-check that both your and your client’s address and contact information are accurate to prevent any communication issues.

Ambiguous Work Descriptions

- Vague Descriptions: A common mistake is providing unclear or overly general descriptions of the work done. Always break down the tasks and hours worked so that clients know exactly what they are being charged for.

- Unspecified Rates: Be sure to clearly list the rates for each service or task. Failing to do so can lead to confusion and disputes about the charges.

Calculation Errors

- Mathematical Mistakes: Incorrect calculations, such as adding up totals or applying the wrong tax rate, can lead to overcharging or undercharging clients. Always double-check your math.

- Missing Fees or Discounts: Forgetting to include taxes, discounts, or additional fees can impact the final amount due and create issues with payment processing.

By being mindful of these common errors and addressing them proactively, you can ensure that your payment documents are clear, accurate, and professional, leading to faster payments and stronger client trust.

Ensuring Compliance with Billing Practices

Maintaining compliance with industry standards and regulations is essential when preparing payment documents, especially in fields with strict rules and guidelines. Adhering to these requirements not only helps protect your business but also fosters trust with clients by ensuring transparency and accountability in all financial transactions. It’s important to understand the legal or professional standards that apply to your billing process and to follow them carefully.

Here are some key steps to ensure compliance when creating billing records:

| Step | Description |

|---|---|

| Understand Applicable Regulations | Research the specific billing rules that apply to your industry or jurisdiction, including rules for transparency, record keeping, and billing practices. |

| Include Required Information | Ensure that your documents include all mandatory details, such as itemized charges, client information, and clear descriptions of the work performed. |

| Use Standardized Rates | Follow the guidelines for billing rates, ensuring they are in line with industry standards and agreed-upon fees. Always disclose rates and terms upfront. |

| Maintain Records | Keep accurate and organized records of all billing documents, as you may need them for audits, tax filings, or dispute resolution. |

| Follow Payment Terms | Ensure that payment terms, deadlines, and penalties for late payments are clearly defined and compliant with legal requirements or contractual agreements. |

By adhering to these steps and staying informed about the specific requirements in your industry, you can ensure that your payment documents remain compliant, protecting both your business and your clients.

How Pre-Designed Documents Improve Professionalism

Using a well-structured document for financial requests not only ensures accuracy but also significantly boosts the professionalism of your business communications. A polished, organized format communicates to clients that you are thorough and trustworthy. It shows that you take your work seriously and are committed to providing high-quality service, even in the administrative aspects of your business.

Here’s how utilizing pre-designed solutions can elevate your professionalism:

Consistency and Clarity

- Uniform Appearance: Using a set structure ensures that all your documents look the same, creating a consistent brand image that clients can recognize and trust.

- Clear and Understandable Details: Well-organized documents present all necessary information in a clear and easy-to-understand manner, reducing confusion and showing your attention to detail.

Time-Saving Efficiency

- Quick Customization: With pre-designed solutions, you can quickly adjust details to suit each client, ensuring that you don’t waste time on formatting while maintaining a professional appearance.

- Automated Features: Many pre-designed options include automated calculations for totals, taxes, and discounts, which not only reduce the risk of errors but also demonstrate your efficiency in managing financial documents.

By incorporating pre-made structures into your workflow, you make your business processes more streamlined and reliable, presenting yourself as a knowledgeable and well-organized professional to clients.

Best Practices for Billing Document Design

Designing an effective payment request document involves more than just listing charges. It’s about creating a clear, organized, and professional-looking record that clients can easily understand and trust. A well-designed document not only improves the likelihood of timely payments but also enhances the overall client experience. By following a few best practices, you can ensure your documents reflect your professionalism and help avoid confusion or disputes.

Focus on Clarity and Simplicity

- Use Clear Headings: Organize the document with distinct headings for each section, such as client information, work details, and payment terms. This helps clients navigate the document quickly.

- Avoid Clutter: Keep the design simple. Use ample white space, clear fonts, and a logical layout to make the document easy to read and understand at a glance.

Ensure Transparency and Detail

- Itemized Charges: Break down services or tasks with specific descriptions and amounts. This prevents confusion and ensures clients understand what they are paying for.

- Clear Payment Terms: Be explicit about payment terms, including due dates, late fees, and accepted methods of payment. This minimizes misunderstandings and encourages prompt payment.

By following these best practices, you can create a billing document that is professional, clear, and easy for clients to process. Not only does this improve your chances of receiving timely payments, but it also helps build trust and confidence with your clients.

Where to Find Billing Document Formats Online

Finding a reliable source for ready-made payment document structures is easier than ever. There are many websites offering professionally designed options that can be downloaded or customized to fit your needs. These platforms provide a convenient solution for individuals and businesses looking to streamline their billing process without having to create a format from scratch.

Popular Websites Offering Billing Structures

- Online Business Platforms: Websites like Microsoft Office and Google Docs often have pre-designed formats that can be easily customized. These are great for those who need basic but reliable structures.

- Specialized Document Providers: Certain websites specialize in offering business documents, including billing structures tailored to specific industries or needs. These may offer more advanced features and customization options.

Benefits of Online Platforms

- Easy Access: Most platforms allow you to download the document immediately or even use an online editor to customize it directly in your browser.

- Customizable Features: Many online providers allow you to tweak the format, add or remove sections, and adjust designs to suit your business style.

By exploring these online resources, you can quickly find and implement a document structure that helps you maintain professionalism and efficiency in your billing process.

How to Edit and Personalize Document Structures

Once you’ve chosen a ready-made format for your payment requests, the next step is to tailor it to suit your specific needs. Editing and personalizing these structures allows you to include your business details, adjust the content to match each transaction, and ensure that the design aligns with your brand identity. Customizing these documents helps to create a professional and personalized experience for your clients.

Steps to Customize Your Document

- Input Business Information: The first step is to fill in your company’s name, contact details, and logo if applicable. This ensures that your document reflects your brand and provides all necessary contact information for the client.

- Adjust the Content: Edit the sections that pertain to the work done, including descriptions of tasks, dates, and costs. Be sure to make the language clear and concise to avoid any confusion for your clients.

- Modify Design Elements: If the format allows, you can change the colors, fonts, or layout to better match your brand’s aesthetic. Customizing the look helps create a more professional presentation.

Tips for Effective Personalization

- Stay Consistent: Ensure that the design elements and language used are consistent with your other business documents and communications. This creates a cohesive experience for your clients.

- Keep It Simple: Avoid overcomplicating the document with too many design changes or excessive details. Simplicity enhances readability and professionalism.

By carefully editing and personalizing these documents, you can streamline your billing process while maintaining a high level of professionalism that aligns with your business’s unique identity.