Legal Invoice Template Word for Easy Customization and Use

Generating clear and accurate billing statements is crucial for any professional service provider. Whether you’re offering consulting, legal advice, or any other specialized service, presenting a well-structured bill can enhance your credibility and ensure smooth financial transactions with clients.

For those who want to save time and effort, using ready-made formats that are easy to adjust and personalize is a smart solution. These documents help streamline the invoicing process while maintaining a professional appearance. With the right tools, customizing these statements becomes a quick task, allowing you to focus more on delivering quality work and less on administrative details.

In this guide, we’ll explore how to create and modify such billing formats, ensuring you can produce precise and effective financial requests every time. By utilizing the appropriate structure and design, you can present a polished and coherent summary of your services, ensuring clarity and professionalism in all your client interactions.

Legal Invoice Template Word Overview

Creating professional billing documents is essential for any service-based business. The ability to quickly generate clear and accurate statements not only saves time but also helps establish trust with clients. Using pre-designed formats for payment requests simplifies this process, allowing for easy customization while maintaining a polished, consistent appearance.

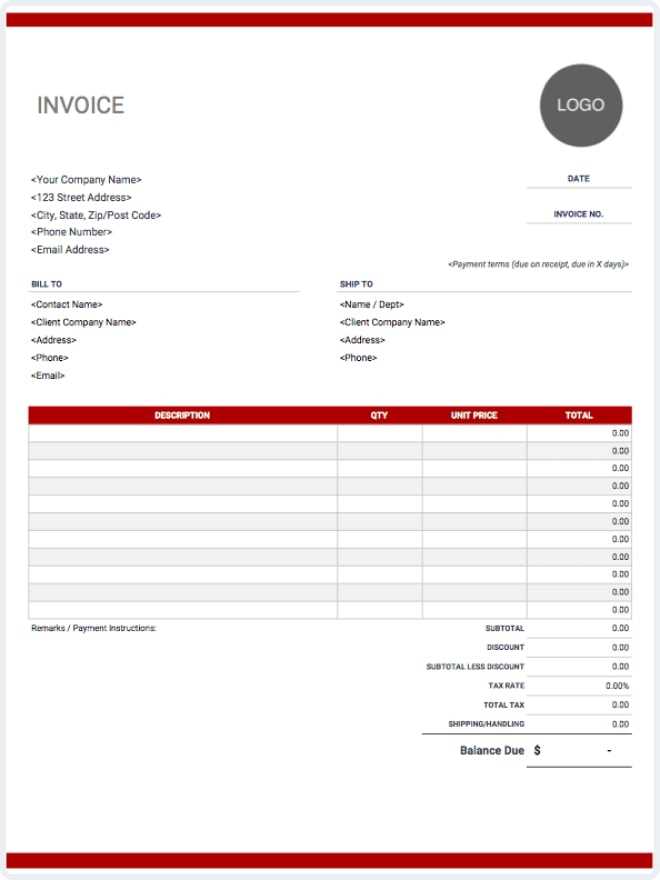

These ready-made billing formats are designed to cover all the necessary information needed for a comprehensive financial record, including client details, services provided, payment terms, and totals. By leveraging such formats, professionals can ensure that their payment documents are both functional and easy to understand, streamlining administrative tasks and enhancing overall efficiency.

In this section, we’ll explore how these structured documents can be created, modified, and used to simplify the billing process. With an easy-to-use layout, anyone can quickly adapt the format to suit their specific business needs and maintain a high standard of professionalism in every transaction.

Why Use a Legal Invoice Template

For professionals, maintaining an efficient billing process is vital to ensuring smooth transactions with clients. By using a pre-designed structure, the task of creating payment documents becomes faster and more streamlined. These structured formats allow you to focus on the content and accuracy of your bill without having to worry about formatting, ensuring your requests are both clear and consistent.

One of the primary advantages of using a ready-made format is the time saved in creating billing statements. With all essential elements already in place, you can simply fill in the necessary details, avoiding the need to start from scratch every time. This consistency also ensures that clients receive uniform and professional documents, which can contribute to better financial management and fewer errors.

Key Benefits of Using Pre-Designed Formats

| Benefit | Description |

|---|---|

| Time-Saving | Pre-designed documents save time by eliminating the need to create new ones from scratch. |

| Professional Appearance | A polished and consistent layout helps reinforce your business’s professionalism. |

| Accuracy | Structured formats reduce the risk of missing essential information or making errors. |

| Customization | Easy to modify for various clients or services, ensuring flexibility while maintaining consistency. |

How It Helps Businesses

Using such a format can help businesses manage their financial records more efficiently. It allows for quick customization for different services or clients, ensuring all necessary information is included. With clear organization and consistent presentation, these documents improve the overall billing experience for both the service provider and the client, fostering trust and prompt payments.

Key Features of Legal Invoice Templates

When it comes to creating payment documents, having the right features in place is essential for ensuring clarity, accuracy, and professionalism. A well-structured billing format typically includes several key elements that streamline the process, from including client details to listing services and payment terms. These elements are designed to be easily customizable, ensuring that each document reflects the specifics of the transaction while maintaining a consistent layout.

By utilizing the right features, professionals can create billing statements that are not only clear but also legally sound and aligned with industry standards. Below are some of the core attributes that make such formats essential for efficient business operations.

| Feature | Description |

|---|---|

| Client Information | Includes fields to input client’s name, address, and contact details for proper identification. |

| Service Descriptions | Clear sections to list the services rendered with detailed descriptions and pricing. |

| Payment Terms | Outlines payment deadlines, methods, and any applicable late fees to set expectations clearly. |

| Tax Calculations | Easy-to-use sections for including taxes, ensuring accuracy and compliance with local regulations. |

| Professional Design | A clean, organized layout that presents the information in an easy-to-read format, enhancing credibility. |

These features are designed to make the process of preparing a billing document both simple and effective, ensuring that all necessary information is included while maintaining a professional presentation. By leveraging these key elements, businesses can reduce errors and improve the efficiency of their financial operations.

How to Customize Your Legal Invoice

Customizing your payment document is essential for tailoring it to specific clients or services. A flexible structure allows you to adjust various details, ensuring that each statement reflects the particular nature of the work provided. Personalization also helps reinforce your brand identity, making your bills more professional and aligned with your business’s style.

The process of customization is typically straightforward. Most billing formats provide editable sections for entering client details, service descriptions, payment terms, and other relevant information. In this section, we will walk through the steps involved in personalizing your billing document to ensure it suits your needs and meets client expectations.

Step-by-Step Customization

| Customization Aspect | How to Adjust |

|---|---|

| Client Information | Enter the client’s full name, address, and contact details to ensure proper identification. |

| Service Details | Describe the services provided, including dates, hours worked, and rates, for transparency. |

| Payment Terms | Specify due dates, accepted payment methods, and any applicable late fees or discounts. |

| Company Branding | Incorporate your business logo, color scheme, and professional fonts to maintain consistency with your branding. |

| Tax Information | Ensure accurate tax rates are applied and reflected in the final total, if necessary. |

Advanced Customization Options

For those who want to go further, advanced formatting options such as adding payment instructions, specifying service categories, or integrating discounts can be easily incorporated. Adjusting the layout, font sizes, and even adding terms and conditions at the bottom of the document can also enhance its effectiveness. With just a few changes, you can ensure that each bill meets your business requirements and makes a lasting impression on your clients.

Benefits of Using Word for Invoices

When it comes to creating professional billing statements, using a versatile document editor like Microsoft’s application offers numerous advantages. From ease of use to full customization capabilities, the platform provides a user-friendly environment that allows businesses to create detailed payment documents quickly and efficiently. Whether you’re a small business owner or a freelance professional, this tool makes financial documentation both accessible and adaptable.

One of the main reasons many professionals opt for this software is its broad accessibility and familiarity. Most people already have experience with basic word processing, making it easy to get started without a steep learning curve. Additionally, the ability to modify templates and adjust elements as needed helps maintain consistency while offering flexibility for different types of transactions.

Ease of Customization

Flexibility in design is one of the primary benefits of using this program for your financial documents. You can quickly add or remove fields, change the layout, and adjust font styles or sizes to suit your preferences or business branding. This flexibility allows you to create documents that are both visually appealing and perfectly tailored to the specifics of each project or client.

Accessibility and Compatibility

Another key benefit is its wide compatibility with other software and devices. Whether you are working on a desktop, laptop, or mobile device, you can easily create, save, and share your documents in multiple formats. Furthermore, the ability to save and send files as PDFs ensures that your payment requests can be opened on almost any device without formatting issues.

In conclusion, using this platform for your billing statements not only saves time but also ensures that your documents are professional, editable, and compatible across different systems, making it an invaluable tool for businesses of all sizes.

Choosing the Right Template for Legal Work

When it comes to preparing billing documents for specialized services, selecting the right structure is crucial for ensuring clarity and professionalism. A well-chosen format should not only reflect the nature of the work but also meet the specific needs of both the service provider and the client. The correct layout helps to present all necessary information in an organized manner, making it easier to communicate payment expectations and avoid any misunderstandings.

For professionals in fields requiring detailed documentation, such as consultancy, advisory, or contractual work, it’s important to choose a layout that includes all essential elements. This includes space for describing the services provided, the rates applied, and payment terms, among other important details. Moreover, the format should align with industry standards and make it easy to adjust according to the specific details of each project or client.

By selecting a flexible and clear format, businesses can streamline the billing process, reduce the risk of errors, and present a polished, cohesive document that enhances their professional image. The right choice not only saves time but also ensures that each payment request is tailored to the scope of work while maintaining consistency and accuracy across all documents.

Steps to Create a Legal Invoice in Word

Creating a professional billing document from scratch may seem like a daunting task, but with the right approach, it can be a simple and efficient process. By following a few straightforward steps, you can produce a clear and organized statement that communicates all necessary details to your client. Whether you’re working on a one-time project or ongoing services, a properly structured document ensures that all aspects of the transaction are transparent and easy to follow.

The process begins with selecting a suitable layout that includes the key elements: your business information, client details, a breakdown of services provided, payment terms, and any applicable taxes. Once the foundation is in place, you can personalize the document to suit your needs, adjusting fields and sections to ensure accuracy and completeness.

Step-by-Step Process

Follow these basic steps to create a professional payment document:

- Choose a layout – Select a blank document or use a pre-built format to start with a clean structure.

- Insert business and client information – Include your name, address, contact details, and your client’s information at the top of the document.

- Describe the services – List the services you provided, including a description, dates, hours worked, and rates applied.

- Include payment terms – Specify payment methods, due dates, and any applicable late fees or discounts.

- Add tax and total – If necessary, calculate taxes and include the final total for payment.

- Review and save – Double-check for accuracy and save the document in your desired format, ready for sending.

By following these steps, you can easily create a professional document that is tailored to your business needs, ensuring that each client receives a clear and accurate billing statement.

Legal Invoice Elements You Need to Include

Creating a comprehensive and professional billing document requires including all the necessary information that ensures transparency and clarity for both parties. An effective statement should detail the services provided, the payment terms, and any other relevant information to avoid confusion. Missing or incomplete details can lead to delays in payment or even disputes, so it is important to include all essential elements in each document you prepare.

The key elements to include in a billing statement are designed to make the transaction clear and straightforward. These include details such as the service description, payment due dates, and tax calculations. Below are the main components that should always be present to ensure that your statement is complete and professional.

Essential Elements of a Billing Document

| Element | Description |

|---|---|

| Business Information | Include your name or company name, address, and contact details to identify who is issuing the statement. |

| Client Details | Provide the client’s name, address, and contact information to ensure clarity and proper identification. |

| Service Description | Clearly describe the work or products provided, including dates, quantity, and pricing for each item or service. |

| Payment Terms | Specify payment methods, deadlines, and any late fees or discounts to set expectations for the client. |

| Tax Information | If applicable, provide tax rates and calculations to comply with local tax laws and ensure transparency. |

| Total Amount | Include the final amount due, clearly showing the breakdown of charges and any taxes or additional fees. |

Additional Considerations

While the elements listed above are the core components of a complete payment document, you may also choose to include additional details such as purchase order numbers, reference numbers, or terms and conditions. These additional sections can further clarify the specifics of the transaction, ensuring both parties are on the same page and minimizing the risk of misunderstandings.

Common Mistakes to Avoid with Legal Invoices

When creating billing documents, small errors can lead to big problems. Whether it’s incorrect calculations, missing information, or unclear terms, these mistakes can delay payments, create confusion, and damage professional relationships. It’s crucial to ensure your statements are precise, well-structured, and free of common errors that could result in unnecessary complications.

Below are some of the most frequent mistakes professionals make when preparing their payment documents, along with tips on how to avoid them.

Common Errors to Avoid

- Missing Client Information: Failing to include the correct contact details of the client, such as their full name, address, or email, can lead to confusion or miscommunication.

- Incorrect Service Descriptions: Not clearly detailing the services or work provided can leave clients unsure about what they are being charged for, leading to disputes or delayed payments.

- Failure to Include Payment Terms: Not specifying due dates, payment methods, or late fees can cause confusion and result in late or missed payments.

- Unclear Tax Calculations: Incorrect tax rates or missing tax information can lead to issues with tax compliance and may result in financial penalties.

- Not Including a Total Amount: Leaving off the final total or improperly calculating the amount due can cause delays in payment and frustration for your client.

How to Prevent These Mistakes

- Double-check Client Details: Always verify that the client’s name, address, and contact information are correct before finalizing your document.

- Be Specific About Services: Provide a clear and detailed breakdown of services rendered, including dates, quantities, and rates, to avoid confusion.

- Clearly Outline Payment Terms: Include the payment method, due date, and any late fees or discounts to set clear expectations.

- Ensure Tax Accuracy: Double-check tax rates and ensure they are applied correctly to the total, if necessary.

- Always Include a Total Amount: Be sure that the total due is clearly marked and accurately reflects the sum of all charges.

Avoiding these common mistakes ensures that your billing documents are professional, accurate, and easy to understand. By paying attention to these details, you can improve cash flow, build stronger client relationships, and maintain a high level of professionalism in all your financial dealings.

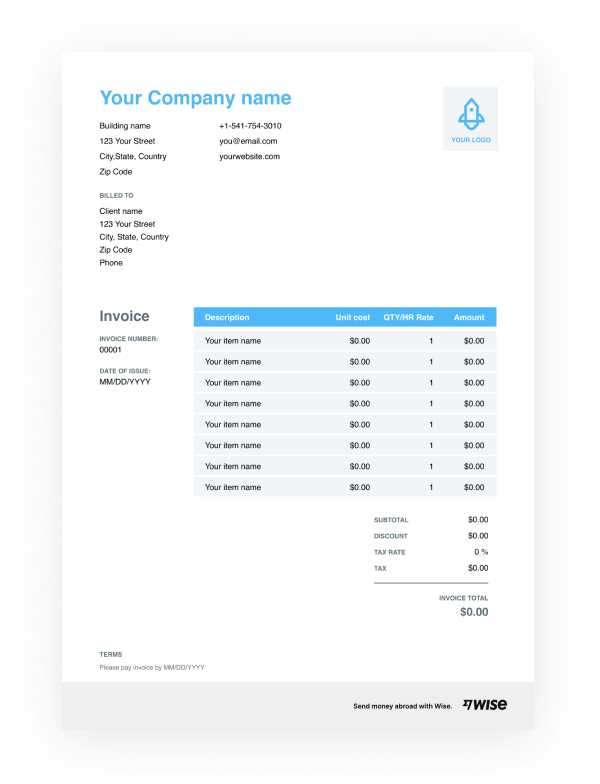

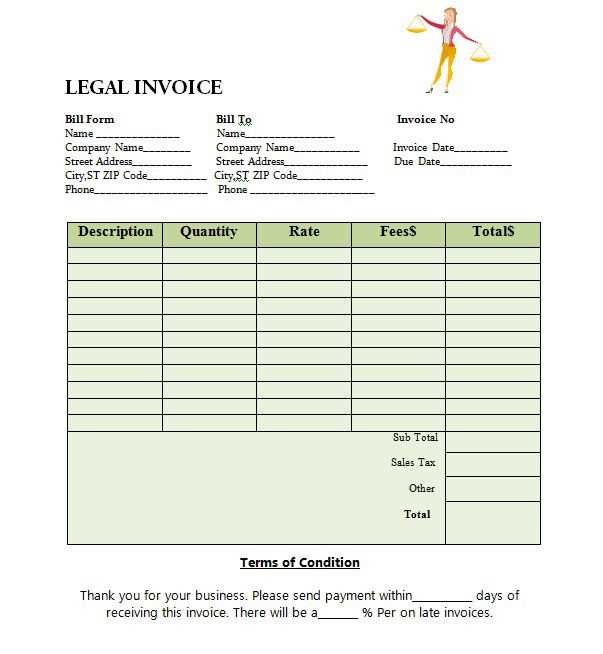

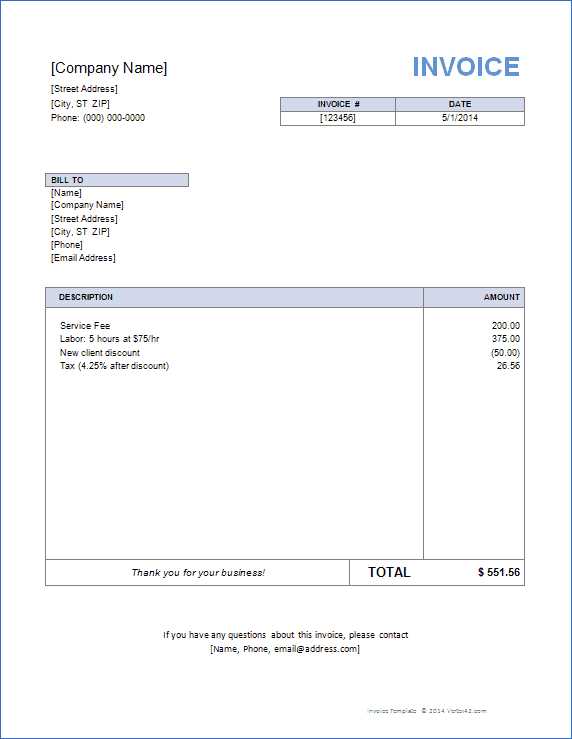

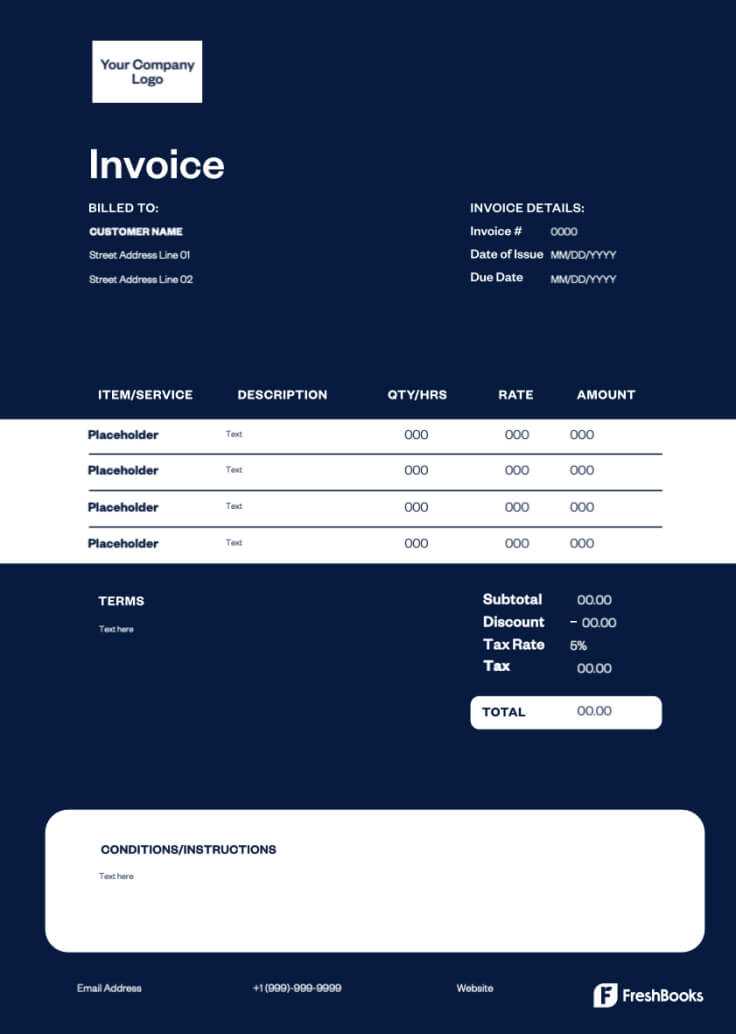

Free Legal Invoice Templates for Word

For professionals looking to streamline their billing process, using a ready-made document layout can save valuable time and effort. Free billing formats are available for download and can be easily customized to suit your specific needs. These pre-designed layouts come with all the essential elements, ensuring that your statements are both professional and easy to manage. Whether you’re a consultant, freelancer, or small business owner, using a free layout can help you maintain consistency and accuracy in your financial communications.

Below are some popular free billing document options that are customizable and suitable for various industries. These formats can be downloaded and adjusted in any standard text editing software, making them an excellent resource for professionals looking to create clear, organized, and effective payment requests.

| Template Type | Features | Best For |

|---|---|---|

| Basic Format | Simple, clean design with basic sections for services, rates, and payment details. | Freelancers, consultants, and small businesses |

| Professional Format | Includes more advanced features such as client terms, tax calculations, and detailed service breakdowns. | Lawyers, accountants, and contractors |

| Customizable Format | Highly customizable, allowing the addition of logos, personalized branding, and other business-specific elements. | Businesses looking to reinforce their brand identity |

| Minimalist Format | Simple layout focused on clarity with no excess information, ideal for straightforward transactions. | Freelancers and solo professionals |

By selecting the right free layout for your needs, you can easily create professional-looking billing statements that save time and reduce the chances of errors. These ready-made documents also help you maintain consistency across all your financial communications, allowing you to focus more on your work and less on paperwork.

How to Add Client Information in Word

In any billing document, it’s essential to include accurate client information to ensure proper identification and avoid errors in communication. Properly formatting client details in your document not only makes it professional but also ensures that the payment request reaches the correct person or company. Adding client information is a straightforward process, but it must be done carefully to avoid mistakes that could delay the payment or cause confusion.

Here’s a step-by-step guide to adding client details in your document, whether you’re working from a pre-made layout or starting from scratch. This will help you ensure that all necessary client information is presented clearly and professionally.

Steps to Add Client Information

- Open the Document – Start by opening your document editor and accessing the layout or starting a new document.

- Insert Client Name – At the top of the document, type the full name of the client or the name of the company. This should be the first piece of information you add.

- Enter Contact Details – Below the client’s name, add their address, phone number, and email address. Be sure to format this clearly to avoid confusion.

- Additional Information – If applicable, include the client’s billing or reference number, project code, or purchase order number for easier tracking and identification.

- Check for Accuracy – Before finalizing the document, double-check the information you’ve entered to ensure all client details are correct and up-to-date.

Tips for Adding Client Information

- Use Consistent Formatting: Maintain a clean and uniform layout for the client’s details to improve readability and professionalism.

- Be Clear and Precise: Avoid abbreviations or vague information. Always provide full addresses and contact details to prevent any confusion.

- Update Regularly: Ensure that the client’s information is current and reflects any changes in their contact details.

By following these simple steps and tips, you can ensure that your documents are accurate, professional, and easy to read, helping you build trust with your clients and avoid any potential issues with payment processing.

Using Word Templates for Multiple Clients

Managing billing documents for multiple clients can be a time-consuming task, especially when each client has different services, terms, and payment details. Using a pre-designed document layout can significantly streamline this process by providing a consistent format that is easy to customize for each client. With the right layout, you can quickly create professional payment requests without having to start from scratch each time.

By utilizing a customizable layout, you can efficiently manage your billing needs while keeping all your client information organized and easily accessible. This approach not only saves time but also ensures that all necessary details are included for each client, reducing the chance of errors or omissions.

How to Use a Layout for Multiple Clients

Follow these simple steps to customize your document layout for different clients:

- Select a Suitable Layout: Choose a pre-designed layout that includes all the necessary fields, such as services, rates, client information, and payment terms. Ensure the layout is flexible and can be easily adapted for different clients.

- Input Client Information: For each client, update the contact details and project-specific information. This ensures that every payment request is personalized and accurately reflects the specific services rendered.

- Adjust Service Details: Modify the description of services, quantities, and rates according to the particular job or project completed for that client.

- Include Payment Terms: Always update payment terms, including due dates, methods of payment, and any other relevant conditions that apply to that particular client.

- Save as a New Document: After making the necessary changes, save the document under a new file name for each client. This keeps your records organized and easily retrievable.

Benefits of Using a Layout for Multiple Clients

- Time Efficiency: By using a pre-made format, you eliminate the need to create a new document from scratch for every client.

- Consistency: Using the same layout for all clients ensures a professional and consistent presentation of your billing documents.

- Customization: Despite using a standard format, you can easily personalize each document to fit the unique needs of every client.

- Organization: Keeping separate files for each client helps maintain clear records and makes future reference easier.

In conclusion, utilizing a pre-designed layout for multiple clients helps streamline your billing process, improve efficiency, and maintain a professional appearance. With minimal effort, you can create customized documents that cater to each client’s

How to Format Legal Invoices Professionally

When preparing payment documents, it’s essential to format them in a way that is clear, organized, and professional. Proper formatting not only ensures that all necessary details are easily accessible but also reflects positively on your business. A well-structured document helps to build trust with clients, reduces the chance of mistakes, and ensures that payments are processed without delays.

In this section, we will explore how to format your payment documents effectively. From layout choices to section organization, following a few simple guidelines can help you present a polished and professional billing request.

Key Formatting Elements for Professional Documents

- Clear Structure: Start with a clean, simple layout. Avoid clutter and unnecessary details that might confuse the reader. Divide the document into logical sections, such as client details, services rendered, amounts due, and payment terms.

- Consistent Fonts and Styles: Choose professional fonts such as Arial or Times New Roman. Keep font sizes consistent for headings, subheadings, and content. Use bold for key information like totals and deadlines to make them stand out.

- Proper Alignment: Align your text and figures neatly. Client details, service descriptions, and amounts should be aligned properly to ensure readability. Use tables for service breakdowns to make the information clear and structured.

- Incorporate Branding: Include your logo and business name at the top of the document. This not only adds a personal touch but also reinforces your brand identity.

- Use of White Space: Leave adequate white space between sections. This makes the document easier to read and prevents it from looking overcrowded.

Formatting Service and Payment Details

- Detailing Services: List each service provided with a brief description, quantity, rate, and total for each item. This helps clients understand exactly what they are paying for.

- Clear Payment Terms: Include clear and concise payment terms, such as the due date, payment methods, and any late fees or discounts. This ensures that both parties have the same expectations.

- Itemized Breakdown: Use a table to break down charges, making it easier for clients to see individual amounts and verify the total.

In conclusion, formatting your payment requests professionally is key to maintaining a positive relationship with your clients and ensuring efficient transactions. A clean, well-organized document shows your attention to detail and fosters trust,

Legal Invoice Templates vs. Custom Invoices

When it comes to creating billing documents, businesses often face the decision of whether to use a pre-designed layout or create a custom document tailored to their specific needs. Each approach has its advantages and drawbacks, and choosing the right option depends on your business requirements, time constraints, and desired level of personalization. While pre-made layouts can be quick and easy to use, custom documents provide flexibility and uniqueness that might be necessary for certain industries or clients.

In this section, we’ll compare the two options, highlighting the pros and cons of using a standard layout versus crafting a document from scratch.

Advantages of Using Pre-Designed Layouts

- Time Efficiency: Pre-made documents are ready to use, meaning you can fill in the details quickly and save time compared to creating a custom document from the ground up.

- Consistency: Using a standard layout ensures that all your billing documents maintain a uniform look, which can help reinforce professionalism and brand identity.

- Ease of Use: Pre-designed formats are user-friendly and typically require minimal customization. Even someone with limited design or formatting skills can use them effectively.

- Cost-Effective: Many pre-designed formats are available for free or at a low cost, making them an affordable option for businesses with tight budgets.

Advantages of Creating Custom Documents

- Complete Flexibility: A custom document allows you to design your billing request exactly how you want it, tailoring it to your business needs and the specific expectations of your clients.

- Brand Identity: You can incorporate your logo, colors, and fonts into a custom document, making it an extension of your brand. This can be important for businesses that want to stand out or maintain a cohesive look across all communications.

- Personalization: Custom documents allow you to add any additional fields or sections that are specific to your industry or the nature of the services you provide, such as project milestones or unique payment terms.

- Professional Appearance: A well-designed custom document can leave a lasting impression on clients, especially if it aligns with your business’s overall aesthetic and values.

In conclusion, the decision between using a pre-made layout or creating a custom billing document depends on your specific needs. Pre-designed layouts are a great option for businesses looking for efficiency and consistency, while custom documents offer more flexibility and personalization for those who want a unique and branded experience. Both methods can result in professional, effective

How to Save and Reuse Your Invoice Template

Once you’ve created a well-designed payment document layout, saving it for future use can save you a significant amount of time and effort. By reusing the same layout for multiple clients or transactions, you can maintain consistency while streamlining your billing process. Properly saving and organizing your documents allows you to easily make adjustments for new clients or services without starting from scratch each time.

This section will guide you on how to save your document effectively and reuse it efficiently for future transactions. Whether you are using a pre-made layout or a custom design, following these steps ensures that your document remains organized and easily accessible whenever you need it.

Saving Your Document for Future Use

Follow these steps to ensure your document is saved correctly for future reuse:

- Choose a Consistent File Name: Give your file a clear, consistent name that includes relevant details, such as the document type or version. For example, “Billing Document – Standard Layout” or “Payment Request Template”.

- Save in a Centralized Location: Store the document in a folder that is easy to find and well-organized, such as a “Billing” or “Finance” folder. This will help you locate it quickly when needed.

- Use Cloud Storage: Consider using cloud storage to save your document. This allows you to access it from any device and ensures that it is backed up securely.

- Create Multiple Versions: If you plan to use the layout for different clients or projects, save different versions with specific details for each one. For example, “Client A Billing – Version 1” and “Client B Billing – Version 1”.

How to Reuse Your Saved Layout

To ensure quick and easy reuse of your saved document layout, follow these tips:

- Open the Saved File: Whenever you need to create a new billing document, open the saved layout file from your chosen storage location.

- Update Client Information: Edit the client details, service descriptions, and amounts as needed. This can be done quickly without affecting the core structure of the document.

- Customize as Necessary: Depending on the specifics of the transaction, you can adjust the terms or add any additional fields. Save the new version separately to maintain a clear record.

- Save New Versions: After updating, save each new version with a unique name to avoid confusion. This will help you track past documents and keep your records organized.

| File Management Tip | Benefit | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Use Clear Naming Conventions | Helps quickly identify document versions and details without opening the file. | |||||||||||

| Store in a Central Folder |

| Service Type | Required Information |

|---|---|

| Consulting | Hourly rate, hours worked, service description, and project milestones. |

| Design/Creative Work | Design project phases, deliverables, payment for each phase, and materials used. |

| Professional Services (e.g., Legal, Accounting) | Hourly rate, detailed service breakdown, retainer fees, and total hours worked. |

| Maintenance or Technical Support | Hourly rate, number of hours, specific tasks performed, and ongoing support agreements. |

| Product Sales | Itemized list of products, quantities, individual prices, and shipping costs if applicable. |

Customizing Your Layout for Each Service

To ensure the document meets the unique needs of each service, you can adjust the following sections:

- Service Description: Tailor this section to describe the specific service provided. For example, consulting services may include a brief summary of sessions or advice provided, while design work would list the creative stages completed.

- Itemization: Depending on the service, you may need to list items, hours, or deliverables. For instance, technical services might require a detailed breakdown of time spent on troubleshooting, while product sales need an itemized list of each product sold.

- Payment Terms: Include payment methods, due dates, and any special terms re

How to Handle Taxes in Legal Invoices

When creating billing documents for services rendered, one of the most important aspects to consider is how to manage taxes. Accurately applying and calculating taxes ensures compliance with local laws and helps avoid potential legal issues. Properly accounting for taxes also contributes to a transparent and professional relationship with your clients, making sure they understand exactly what they are being charged for.

This section provides a guide on how to correctly handle taxes within your payment requests, including how to apply the correct tax rates, present them clearly, and ensure that both you and your clients are aware of any tax obligations.

Understanding the Tax Requirements

Different regions and industries have varying tax requirements. It’s crucial to be aware of the following:

- Sales Tax Rates: The rate can vary depending on your location and the type of service provided. Research your local tax laws to ensure that you are applying the correct percentage.

- Taxable vs. Non-Taxable Services: Some services may be exempt from tax, while others may require full taxation. Familiarize yourself with the specific rules in your jurisdiction.

- Tax Identification Number: If required by law, make sure to include your tax ID number on the billing document for verification purposes.

Including Taxes on Your Billing Document

When handling taxes in your billing document, follow these steps to ensure clarity and accuracy:

- Itemize the Tax: Clearly list the tax applied to each service or item. This allows your client to see the tax amount being charged and ensures transparency.

- Show the Tax Rate: Include the tax rate as a percentage on the document so the client can easily verify how the tax was calculated.

- Total Tax Amount: Sum up all applicable taxes and display the total amount due. This should be clearly separated from the subtotal and final amount to avoid confusion.

- Tax Breakdown: If multiple services are involved, break down the tax for each line item, showing how much tax is applied to each individual service or product.

In conclusion, handling taxes in billing documents correctly is essential for legal compliance and clear communication with clients. By ensuring that taxes are accurately applied, itemized, and displayed, you can maintain a professional approach to your billing process while meeting legal obligations.

Best Practices for Sending Legal Invoices

When sending billing documents to clients, it’s important to follow best practices that ensure your documents are clear, professional, and timely. Properly sending these requests not only helps to maintain positive relationships with your clients but also contributes to quicker payments and fewer disputes. Following established guidelines for delivery and communication can streamline the payment process and ensure that both parties are on the same page.

This section outlines some essential best practices to keep in mind when sending your billing documents to clients, from how to present the document to when and how to follow up.

Ensuring Clear and Professional Communication

To make sure that your client receives and understands your billing document, keep the following points in mind:

- Clear Subject Line: When sending the document via email, include a clear subject line that indicates what the email is about, such as “Payment Request for [Service Name] – [Client Name]”. This will help your client identify the document quickly.

- Attach the Correct Document: Always attach the final version of the payment request. Double-check that the correct version is sent and that all necessary details (e.g., services provided, amounts, and tax information) are included.

- Professional Formatting: Ensure that the document is well-organized and easy to read. Use a consistent font, clear headings, and itemized lists. Avoid clutter to ensure the document appears professional and is easy to understand.

- Include Payment Terms: Clearly state the payment terms, including the due date, accepted payment methods, and any late payment penalties if applicable. This helps set clear expectations for the client.

Choosing the Right Method for Sending

The method you use to send the document can influence how quickly your client processes it. Consider these options:

- Email: Email is one of the most common and efficient ways to send billing documents. Make sure the document is in a widely accessible format, such as PDF, to ensure that the client can open and view it without issues.

- Postal Mail: For clients who prefer traditional methods, mailing a hard copy of the document might be necessary. Ensure the document is printed clearly and securely mailed with any additional required paperwork or terms.

- Online Payment Portals: Some businesses and clients use online platforms for sending and receiving payment requests. These portals often offer additional features, such as automatic reminders and easy payment tracking, making the process smoother for both parties.

In conclusion, following best practices for sending your billing documents ensures that your communication is professional and clear, leading to timely payments and fewer misunderstandings. By choosing the right method, formatting your document correctly, and providing all necessary details upfront, you can make the billing process easier for both you and your clients.