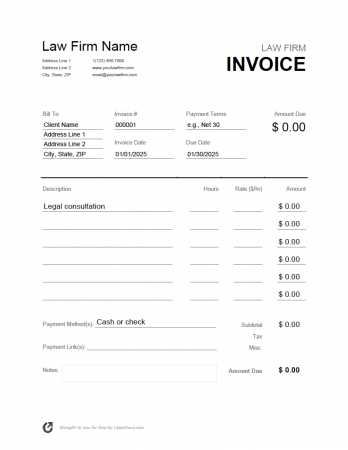

Free Legal Invoice Template for Your Business

Managing client payments effectively is crucial for any service-based business. Having a structured document to request compensation for services rendered not only ensures clarity but also reinforces professionalism. With the right framework, professionals can streamline their financial operations and avoid common billing errors.

For those working in consulting, advisory, or other client-focused industries, a well-organized payment request can significantly impact the perception of the business. Instead of creating a new form from scratch every time, utilizing a standardized format can save time and ensure consistency. These documents help professionals communicate the details of their work and payment expectations transparently.

Moreover, with the abundance of easily accessible resources online, obtaining such documents at no cost is simpler than ever. By using customizable formats, business owners can adapt the document to their specific needs without sacrificing professionalism. Whether for one-time tasks or ongoing projects, a carefully crafted payment request is an essential tool for any service provider.

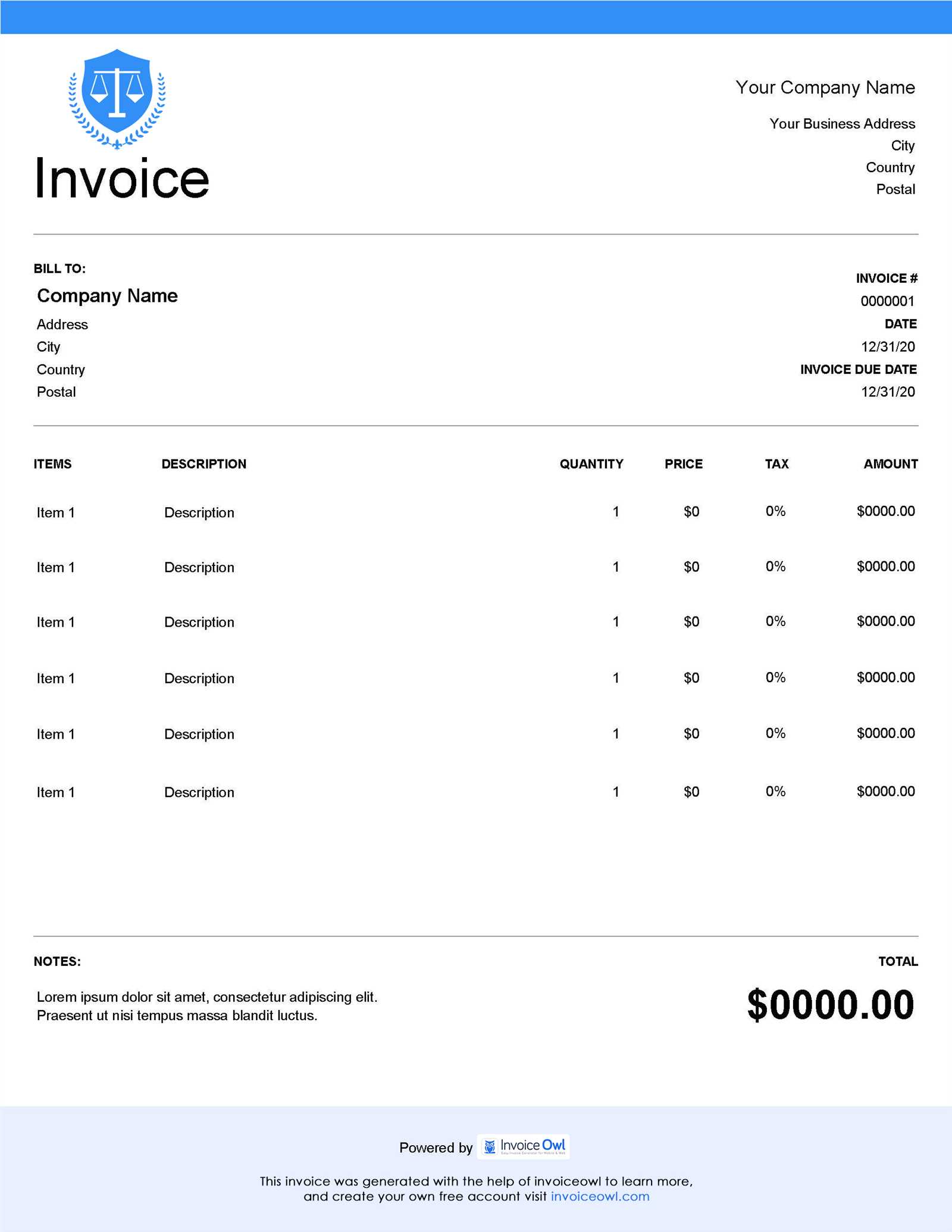

Free Legal Invoice Template Overview

For professionals in various industries, managing billing can become a time-consuming task if not approached efficiently. Having a ready-to-use document for requesting payment helps streamline this process. These documents are designed to meet the needs of different businesses and can be easily adapted to suit specific requirements. They ensure that all necessary details are included, which helps maintain clarity and prevent misunderstandings between service providers and clients.

Key Features of a Payment Request Document

When looking for a suitable billing document, it’s important to ensure it covers all the essential elements that support a smooth transaction. A well-designed document typically includes the following features:

- Professional layout: Clean, organized design for easy readability.

- Service details: Clear description of the work done or services provided.

- Client information: Accurate contact details for both the service provider and the client.

- Payment terms: Information regarding payment deadlines, methods, and penalties for late payments.

- Customizability: Ability to adjust the document to different types of projects or clients.

Why Choose a Ready-Made Billing Document?

Using a pre-designed billing document offers several advantages. It can save considerable time compared to creating one from scratch, ensuring that you don’t miss any key details. Additionally, having a standardized document helps to maintain consistency across your transactions, which is vital for keeping your business operations organized and professional. This is especially beneficial for freelancers and small business owners who manage multiple clients.

Why You Need a Legal Invoice Template

Maintaining a professional approach to financial transactions is essential for any business. A well-structured document for requesting payment ensures that both the service provider and the client are on the same page. It not only simplifies the billing process but also helps avoid misunderstandings, payment delays, and errors. Without a proper system in place, professionals can easily overlook key details, which can lead to complications down the line.

Here are several reasons why having a standardized form for payment requests is important:

| Reason | Description |

|---|---|

| Time-Saving | A pre-designed document saves valuable time by eliminating the need to create a new one for every project. |

| Accuracy | With a set format, you reduce the risk of forgetting important information, ensuring every detail is correctly included. |

| Consistency | Using the same document for all requests helps maintain consistency and professionalism across all transactions. |

| Customization | The ability to adapt the document to various clients and project types ensures flexibility without sacrificing professionalism. |

| Clear Communication | Including all necessary payment details in a clear, concise manner helps avoid confusion and potential disputes. |

In short, using a structured document for requesting payment is a practical and essential tool for any professional. It enhances efficiency, reduces errors, and strengthens client relationships by ensuring that expectations are clearly communicated.

Benefits of Using Free Templates

Choosing pre-made documents for requesting payment offers several advantages, especially for professionals who need to focus their time on client work rather than administrative tasks. By leveraging ready-to-use forms, service providers can save time, reduce errors, and maintain a professional appearance without the need for expensive software or extensive design work.

Cost-Effectiveness

One of the primary benefits of using ready-made documents is their affordability. Many resources are available at no cost, making it possible to create professional and detailed payment requests without any additional financial investment. This is particularly valuable for freelancers or small businesses operating with limited budgets, as it allows them to maintain efficiency without incurring unnecessary expenses.

Time Efficiency

Time is a precious commodity for professionals, and the ability to quickly generate a well-organized payment request document can significantly reduce the time spent on administrative tasks. Instead of starting from scratch, you can simply select a pre-built structure and fill in the necessary details. This way, the document is ready in minutes, freeing up more time to focus on providing quality services to clients.

Overall, using these ready-made solutions streamlines the billing process, ensuring that you can quickly and accurately request payment for your services while maintaining a high standard of professionalism.

Key Features of a Legal Invoice

For any business or professional service provider, having a well-structured document for requesting payment is essential. A carefully designed payment request ensures that both the service provider and the client have a clear understanding of the terms, work completed, and financial expectations. The key elements in such a document serve to clarify these points and help avoid confusion or disputes.

Here are the main features that should be included in a well-crafted payment request document:

- Client Information: Accurate contact details of the client, including name, address, and phone number, are essential to ensure the document is properly addressed.

- Service Description: A detailed breakdown of the work completed or services provided. This helps both parties understand exactly what they are paying for.

- Payment Terms: Clear terms outlining when payment is due, how it should be made, and any late payment penalties.

- Dates: The start and completion dates of the service, as well as the invoice issue date, are crucial for tracking timelines and ensuring timely payment.

- Itemized Charges: A list of all services or products rendered with corresponding costs. This allows the client to see exactly what they are being charged for.

- Total Amount: The final amount due, including taxes or additional fees, should be prominently displayed for clarity.

- Payment Methods: Options for how the client can pay, whether through bank transfer, credit card, or another method.

- Business Information: The service provider’s name, address, and contact details should be included to ensure that the client knows who to direct questions to.

By including these key elements, professionals can ensure that their documents are comprehensive and professional, leaving no room for misunderstanding regarding the payment process.

How to Customize a Legal Invoice

Customizing a payment request document is an essential step to ensure it accurately reflects the specifics of each project or client. Tailoring the document to fit the unique aspects of the services provided helps maintain professionalism and clarity. Whether you’re working with a new client or billing for a complex project, personalizing the details can make the process smoother and more efficient.

Here are the key steps to customize a payment request document effectively:

- Update Client Information: Ensure the recipient’s name, contact details, and address are correct. If the client has multiple contacts, make sure you direct the document to the appropriate person.

- Adjust Service Descriptions: Modify the description of services or products based on the specific work completed. Provide enough detail to avoid ambiguity and justify the charges.

- Set Payment Terms: Clearly define the due date for payment, any late fees, and acceptable payment methods. You can also include discounts for early payment if applicable.

- Itemize Charges: Break down the cost for each service or product separately. This gives the client transparency and allows for easy tracking of what they’re being billed for.

- Include Tax Information: If applicable, ensure you add any necessary taxes or fees to the total amount, following your local tax regulations.

- Brand Your Document: Add your business logo, color scheme, and contact details to make the document match your brand identity. This adds a professional touch and makes your document instantly recognizable.

By customizing your payment request document, you not only make it more professional but also enhance the overall client experience, ensuring that both parties are clear about the work completed and the agreed-upon payment terms.

Where to Find Free Invoice Templates

Finding a well-designed document to request payment has never been easier, thanks to the numerous online resources available today. Many websites offer ready-to-use forms that can be downloaded or customized to suit your needs, saving you time and effort in creating one from scratch. These resources range from general business tools to specialized options tailored for specific industries.

Here are some reliable places to find no-cost payment request forms:

- Online Business Software Websites: Many accounting and invoicing software platforms provide a variety of downloadable forms for users, often at no charge. These websites typically offer templates that are easy to customize and can be used across different business types.

- Freelancer and Small Business Forums: Communities of freelancers and small business owners often share resources, including customizable forms. These templates are designed with entrepreneurs in mind and can be adapted to fit specific service offerings.

- Microsoft Office and Google Docs: Popular office suites like Microsoft Office and Google Docs offer free document templates, including payment requests. These can be edited directly within their respective platforms, making them both accessible and easy to use.

- Online Template Marketplaces: Websites like Canva, Etsy, and others often have free downloadable files that can be edited in graphic design tools or word processors, allowing for greater creative flexibility in customizing the document.

These platforms and websites provide a wealth of options for obtaining customizable and professional forms, making it easy for professionals to maintain a streamlined and consistent billing process.

Common Mistakes in Legal Invoices

When creating documents for payment requests, it’s crucial to ensure every detail is accurate and clear to avoid delays or confusion. Even minor errors in these documents can lead to misunderstandings, payment disputes, or administrative challenges. Recognizing common mistakes can help professionals create more effective and professional documents that facilitate smoother transactions with clients.

Typical Mistakes in Payment Request Documents

Here are some of the most common errors to avoid when preparing your payment request:

| Error | Explanation |

|---|---|

| Missing or Incorrect Client Information | Ensure the client’s contact details, including name and address, are correct to avoid sending the document to the wrong person or location. |

| Unclear Service Descriptions | Vague or overly general descriptions of the services can lead to confusion about what is being charged. Be specific and detailed to clarify the work provided. |

| Incorrect or Missing Payment Terms | Failure to include clear payment terms, such as due dates or penalties for late payments, can lead to delays or disagreements with clients. |

| Not Including Taxes or Fees | Omitting applicable taxes or additional fees can create unexpected costs for the client, leading to disputes or payment delays. |

| Forgetting to Itemize Charges | When charging for multiple services or products, failing to break down each cost can make the document appear unprofessional and cause confusion. |

How to Avoid These Mistakes

To avoid these common errors, always double-check the information before sending out the document. Ensure that all necessary fields are filled out accurately, from client details to service descriptions and total amounts due. Using a standardized form can help reduce the risk of mistakes and maintain consistency across all transactions. Taking a little extra time to review your document can go a long way in maintaining professionalism and ensuring timely payments.

Legal Invoice Format and Structure

Having a clear and organized structure for your payment request document is crucial for ensuring that both you and your client have a mutual understanding of the terms. A well-formatted document not only looks professional but also ensures that all necessary information is presented in a logical and easy-to-understand way. Following a consistent structure can help avoid confusion, prevent errors, and make the payment process more efficient.

Key Elements of a Payment Request Document

A well-structured document typically includes the following key sections:

- Header: This section includes your business name, logo, and contact information. It establishes your brand and provides easy access to your details.

- Client Information: Clearly list the client’s name, address, and contact details. This ensures that the request is directed to the correct recipient.

- Document Title: Include a clear title such as “Payment Request” or “Statement of Charges” to easily distinguish the document.

- Service Details: A description of the services or goods provided. This section should be itemized and include dates, hours worked, or quantities to give a full breakdown of the charges.

- Payment Terms: Clearly outline when the payment is due, the accepted payment methods, and any late fees that might apply if payment is not received on time.

- Total Amount Due: This section should clearly state the amount the client owes, including any taxes, discounts, or extra fees.

- Footer: Include additional business details, such as payment instructions or a thank-you note. This section can also include your terms and conditions or disclaimers if necessary.

Structuring the Document for Clarity

To maintain clarity, ensure that each section is clearly labeled and easy to locate. Keep the layout simple and professional by using proper spacing and alignment. Avoid cluttering the document with unnecessary information that may distract from the essential details. A clean, easy-to-read format will not only improve the client’s experience but also enhance your professional image.

How to Maintain Professionalism with Invoices

Maintaining professionalism in your payment requests is essential to building trust with clients and establishing a reliable reputation. A well-organized and clearly written document reflects positively on your business and ensures that all expectations are met. Paying attention to the details in your billing process can prevent misunderstandings and ensure timely payments while showcasing your dedication to quality service.

Here are several ways to keep your payment requests professional:

- Use a Consistent Format: Adhering to a uniform structure for all your payment requests helps create a cohesive and recognizable brand image. Ensure that your documents are easy to read and follow a logical flow.

- Be Clear and Concise: Avoid using complex language or unnecessary jargon. A straightforward, easy-to-understand document shows that you value your client’s time and clarity is a priority for you.

- Include Complete Details: Make sure every aspect of the work or product provided is outlined clearly. This includes a description of services, dates, quantities, and pricing. Transparency minimizes confusion and builds trust.

- Personalize Your Communication: Address the client by name and make the document feel tailored to them. This personal touch can go a long way in strengthening client relationships.

- Proofread for Errors: Spelling mistakes, incorrect numbers, or missing information can undermine your professionalism. Always double-check your document for accuracy before sending it out.

- Stay On-Time: Send your payment request promptly after the service is completed or the product is delivered. Timeliness shows that you are organized and committed to your work.

By following these simple yet effective strategies, you can maintain a professional approach to billing that will foster positive client relationships and encourage prompt payments.

Ensuring Accuracy in Legal Invoices

Accuracy is crucial when creating payment request documents, as any mistake can lead to delays, disputes, or even lost revenue. Ensuring that all details are correct not only improves client satisfaction but also enhances your professional image. To achieve this, it’s important to pay attention to both the content and the formatting of the document to ensure all necessary information is accurately presented and easily understood.

Key Areas to Double-Check for Accuracy

To maintain precision in your payment requests, focus on these key areas:

| Area | Why It Matters |

|---|---|

| Client Information | Incorrect or outdated contact details can cause delays in communication and payment. Always verify that client names, addresses, and phone numbers are accurate. |

| Service Descriptions | Clear and correct descriptions of the work or products provided prevent confusion about the charges and help avoid disputes over what was delivered. |

| Dates | Incorrect dates for services rendered or payment due can lead to confusion and misinterpretation of terms. Ensure that both the service date and the payment due date are accurate. |

| Charges and Totals | Ensure that the amounts charged for each service or product are correct, and that the final total includes any taxes or fees. Double-check for calculation errors. |

| Payment Terms | Clearly defined payment terms prevent misunderstandings about due dates, payment methods, and penalties for late payments. Make sure these terms are both accurate and fair. |

Steps to Ensure Accuracy

To minimize errors, it’s always a good idea to double-check your document before sending it. Here are some tips:

- Review Everything: Carefully proofread all sections, including client details, service descriptions, and payment terms, to catch any inaccuracies.

- Use Tools for Calculations: If applicable, use a calculator or invoicing software to verify the math, ensuring the totals are accurate.

- Cross-Check with Contracts: Make sure that the details in the payment request match any previous agreements or contracts with the client, such as pricing, timelines, and payment terms.

By taking these precautions, you can ensure that your payment requests are accurate and professional, fostering smoother transactions and better relationships with clients.

Best Practices for Legal Billing

Establishing clear and efficient billing practices is key to maintaining a smooth and professional relationship with clients. A well-organized and transparent approach to billing helps avoid misunderstandings and ensures that both parties are on the same page regarding the services provided and the fees incurred. Implementing best practices not only simplifies the payment process but also strengthens your business’s credibility and client trust.

Clear and Transparent Communication

One of the fundamental elements of effective billing is clear communication with your clients. This includes providing detailed descriptions of the services rendered, setting clear payment terms, and discussing any additional fees upfront. Transparency prevents confusion and ensures that clients fully understand what they are being charged for and when payment is expected.

- Provide Detailed Breakdown: Itemize all charges to ensure the client understands each cost. This breakdown can include hours worked, hourly rates, or flat fees for specific services.

- Agree on Payment Terms: Clearly define payment terms, such as the due date, payment methods, and penalties for late payments. Discuss these terms at the start of the project and include them in the payment request.

- Communicate Additional Costs: If there are any unforeseen expenses or changes to the initial agreement, inform the client as soon as possible. Clear communication about additional charges helps maintain a good working relationship.

Timeliness and Accuracy

Timeliness and accuracy are crucial when it comes to billing. Sending out payment requests promptly ensures that your clients have enough time to review and process payments. Moreover, accurate documents reduce the chances of errors or disputes, ensuring smooth transactions.

- Send Requests on Time: Issue payment requests promptly after the service is provided or the project milestone is completed. Avoid waiting too long, as this can delay payments.

- Double-Check for Errors: Always proofread your payment request to make sure all details, including client information, charges, and payment terms, are correct. This will help prevent misunderstandings and potential disputes.

- Keep Records Organized: Maintain a system for tracking past payments and outstanding balances. This allows for easier follow-ups and ensures you stay on top of your finances.

By adopting these best practices, you will not only make the billing process smoother but also reinforce your professionalism and reliability. Maintaining a transparent, accurate, and timely approach to billing will lead to more satisfied clients and fewer payment delays.

Payment Request Document for Freelancers

Freelancers often face unique challenges when it comes to billing, as they must balance flexibility with professionalism. A well-structured payment request document is essential for ensuring timely payments, maintaining clear communication with clients, and keeping a professional image. By using a streamlined and efficient format, freelancers can simplify the billing process and reduce the likelihood of disputes.

Essential Elements for Freelance Billing

When preparing a payment request for your freelance services, it is important to include all necessary details to ensure that the client knows exactly what they are being charged for. Below are the key components that should be included:

| Component | Description |

|---|---|

| Freelancer Information | Include your name, business name (if applicable), and contact details. This ensures the client knows who the payment request is from and how to reach you. |

| Client Information | List the client’s name, address, and contact information. This helps ensure that the document is directed to the correct recipient. |

| Project Details | Clearly describe the work you performed, including relevant dates, milestones, and tasks completed. Itemizing the services helps the client understand what they are paying for. |

| Charges | Break down the costs associated with the services provided, including hourly rates, flat fees, or any additional costs incurred. This ensures transparency and helps avoid misunderstandings. |

| Payment Terms | Specify when the payment is due, acceptable payment methods, and any late fees that may apply if the payment is not made on time. |

| Total Amount Due | Clearly display the total amount due, including taxes, discounts, and any additional fees. This makes it easy for the client to understand the final payment amount. |

Why a Professional Payment Request Matters

For freelancers, presenting a polished and professional payment request can enhance client relationships and contribute to a positive reputation. A well-organized document shows that you value your work and are serious about your business. Additionally, by being clear and transparent, you make it easier for clients to process your payments without confusion or delay.

Using a simple yet effective format for your payment requests will help streamline your freelance operations and ensure you get paid promptly for your hard work.

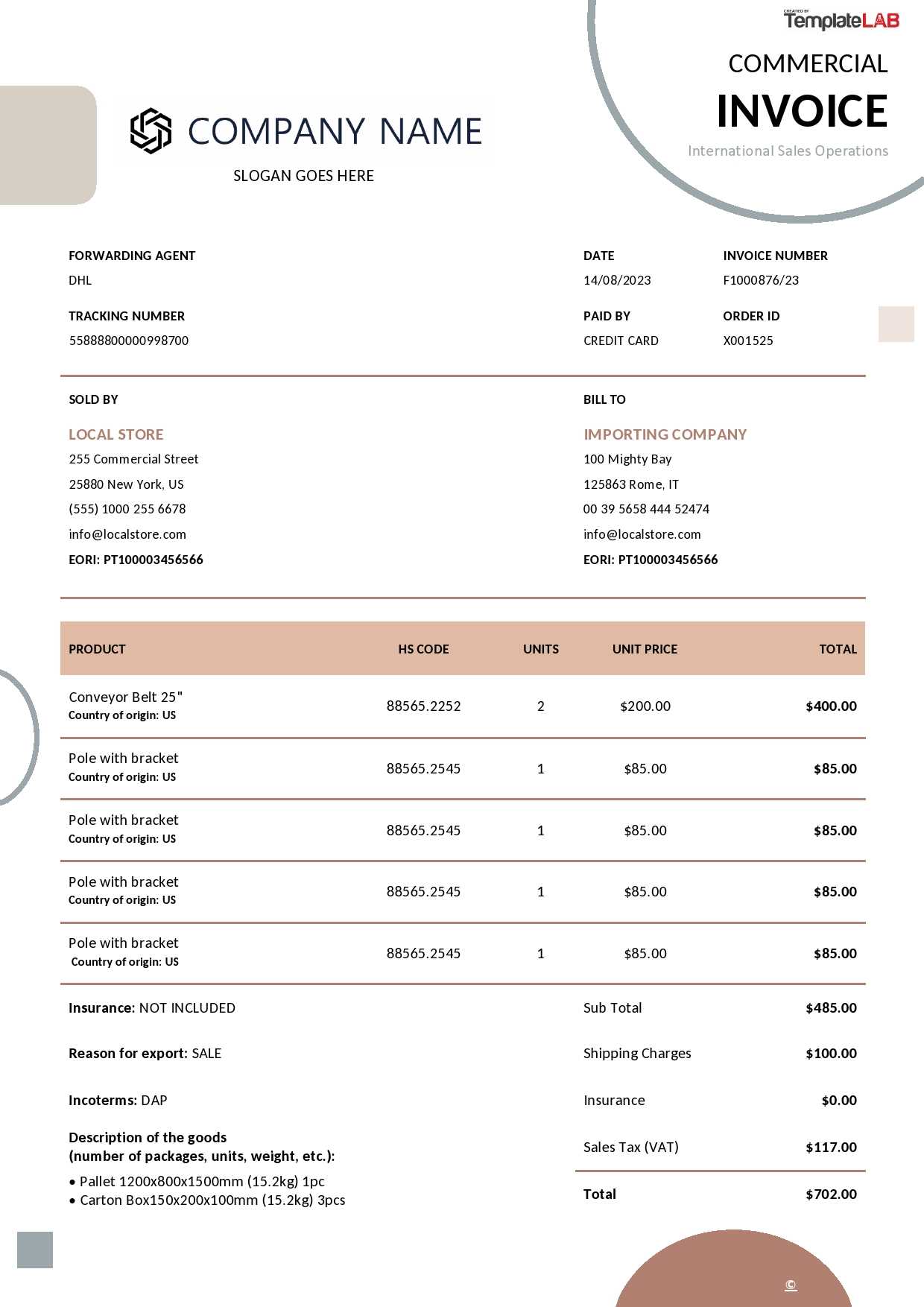

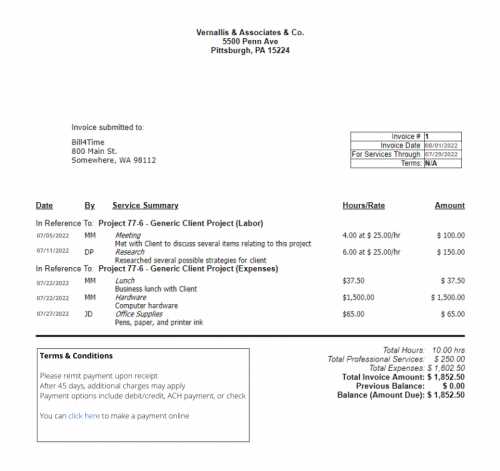

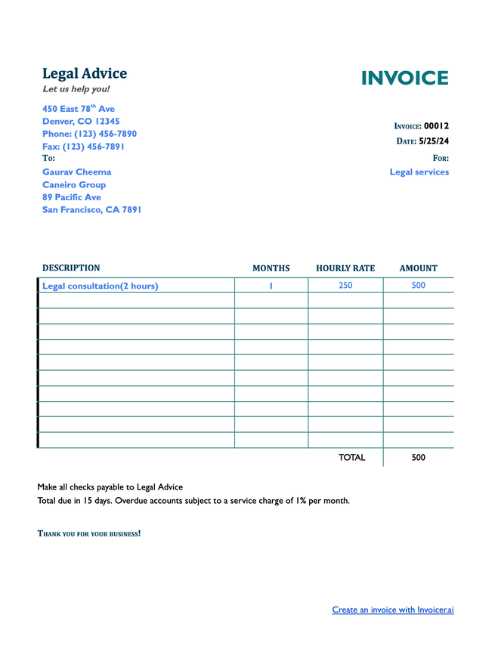

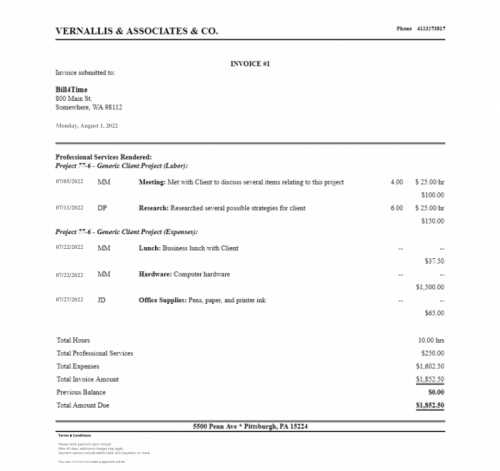

How to Invoice Clients for Legal Services

When providing professional services, clear and accurate billing is essential to maintaining smooth business operations and ensuring timely payments. For those offering legal assistance, creating a detailed payment request document helps clients understand the scope of work, the charges involved, and the payment terms. Crafting such a document requires attention to detail, proper organization, and clear communication.

Here are the steps to effectively bill clients for professional services:

- Detail the Services Rendered: Clearly outline the services you provided. This can include consultations, document preparation, court appearances, or any other task you performed. Providing specifics not only helps justify the costs but also avoids misunderstandings.

- Include Time Tracking: For hourly work, list the number of hours worked on each task or project. Be sure to indicate the hourly rate and calculate the total charges accordingly. This level of detail helps clients understand how charges are applied.

- Specify Payment Terms: Be clear about when the payment is due, the methods of payment you accept, and any late fees or penalties for overdue payments. Setting expectations upfront can prevent delays in payment.

- Provide a Clear Total Amount: Make sure the final amount due is easy to understand. Include any applicable taxes, discounts, or additional charges to avoid confusion. A clear and straightforward total helps clients know exactly what to pay.

- Offer Contact Information: Include your contact information for any questions or clarifications. Having this available ensures that clients can easily reach you if there are any issues or concerns with the payment request.

By following these guidelines, you can create payment requests that are professional, clear, and effective, ensuring both you and your clients are on the same page. This transparent approach fosters better client relationships and reduces the likelihood of disputes over charges.

Customizing Payment Request Documents for Different Cases

Every client and project can have unique requirements when it comes to billing. Customizing your payment request documents ensures that they reflect the specific details of the services provided and the expectations agreed upon. By adjusting the layout, content, and terms for each case, you can ensure that your requests are clear, accurate, and aligned with the nature of the work.

Key Customization Areas for Different Scenarios

When customizing a payment request document, it’s important to tailor the details to the specific nature of the work performed. Here are some areas to focus on based on different types of services or cases:

| Case Type | Customization Focus |

|---|---|

| Hourly Work | For work billed by the hour, include detailed time tracking, with hourly rates for each task performed. Specify the number of hours worked and describe the activities completed during those hours. |

| Flat Fee Projects | When charging a flat fee, clearly outline the services included under the fixed rate. Include any conditions or limitations regarding the scope of work to avoid confusion. |

| Retainer Agreements | For ongoing services, specify the retainer amount, the services covered by the retainer, and the payment frequency. It’s also useful to include how any unused retainer funds are handled. |

| Contingency Fees | For work based on a contingency fee, include the percentage of the fee and specify the conditions under which it will be paid (e.g., after the successful completion of the case or deal). |

Tips for Tailoring Your Documents

When adapting your payment requests for different cases, consider the following tips:

- Be Clear on Terms: Whether you are offering hourly services or a flat rate, make sure the terms are explicitly stated so both you and the client understand the expectations.

- Include All Relevant Details: Depending on the type of case, be sure to add any specifics that may be relevant, such as court dates, project milestones, or agreed-upon deliverables.

- Adjust Payment Due Dates: For ongoing projects, you may want to set up periodic billing. Make sure payment schedules are clear and well-defined, especially for long-term or recurring services.

Customizing your payment requests based on the specifics of each case ensures that your clients understand the services they are being charged for and feel confident in your professional approach. Tailoring your documents helps maintain a high level of clarity, preventing misunderstandings and fostering strong client relationships.

Protecting Your Business with Payment Requests

In any professional service, clear and accurate billing is not only a means of ensuring timely payment, but also a critical component of protecting your business. Properly structured payment requests can help avoid disputes, maintain transparency with clients, and provide a legal safeguard should any financial disagreements arise. By documenting all transactions effectively, you can ensure that both you and your clients are on the same page and prevent potential issues down the road.

Here are some ways that detailed payment requests can protect your business:

- Legal Documentation of Services Rendered: A clear record of the services you have provided serves as evidence should any misunderstandings or disputes arise. It outlines the specific work completed, associated costs, and agreed-upon terms, making it easier to resolve conflicts if needed.

- Establishing Payment Terms: A well-defined payment schedule helps protect both parties by outlining when and how payments are to be made. This can include due dates, late fees, and accepted payment methods, ensuring expectations are clearly set from the start.

- Building Professional Trust: Clear and consistent billing practices show clients that you are a professional, which can increase client trust and satisfaction. A well-documented payment request demonstrates that you value transparency and fairness.

- Avoiding Underpayment or Nonpayment: By providing detailed breakdowns of your services and costs, you make it harder for clients to dispute or avoid payment. This reduces the risk of underpayment or nonpayment, which can affect your cash flow and business stability.

- Tax and Financial Recordkeeping: Payment requests serve as an essential tool for keeping track of your income. This documentation is important for tax reporting, helping you maintain accurate financial records for your business.

By ensuring that your payment request documents are detailed, professional, and well-organized, you protect both your business and your client relationships. Proper documentation not only serves as a safeguard in case of disputes but also reinforces your professionalism, contributing to long-term success and stability.

Free Payment Request Documents vs Paid Versions

When it comes to creating professional billing documents, many individuals and businesses are faced with the choice of using free or paid tools. Both options offer distinct advantages and limitations, and understanding the differences can help you decide which is best suited to your needs. While free solutions are accessible and often easy to use, paid versions may offer more advanced features, greater customization, and additional support. Understanding these differences can make a significant impact on the efficiency of your billing process and the overall professionalism of your documents.

Advantages of Free Payment Request Documents

Free options can be an excellent choice for individuals or small businesses that are just starting out or have simple billing needs. Some of the key benefits of using free solutions include:

- Cost-Effective: The most obvious advantage of free tools is that they don’t require any financial investment, making them ideal for startups or small businesses on a tight budget.

- Ease of Use: Many free tools are designed to be user-friendly, offering easy-to-fill-out templates and simple layouts that require minimal customization.

- Basic Functionality: For individuals with basic billing needs, free options often provide sufficient features, such as itemized charges, payment terms, and basic branding options.

Benefits of Paid Payment Request Documents

While free options may be sufficient for some, paid versions often provide more advanced features and customization that can benefit larger businesses or those with more complex needs. Some advantages of using paid solutions include:

- Greater Customization: Paid solutions typically offer more flexibility in terms of document design, allowing for customized layouts, branding, and the ability to include additional fields for specific requirements.

- Advanced Features: With paid options, you often gain access to features such as automated calculations, recurring billing, integration with accounting software, and professional templates with high-quality designs.

- Customer Support: Paid tools often come with customer service and technical support, ensuring that you can get help when needed, which can be crucial for businesses that rely heavily on efficient billing systems.

- Better Security: Paid solutions often offer enhanced security features, such as encryption and data protection, which can be important for businesses dealing with sensitive financial information.

Choosing between a free or paid solution depends largely on the complexity of your billing needs, the size of your business, and your budget. For basic use, free options can be a quick and efficient solution, while paid versions provide greater functionality and support for businesses that require more robust features. Understanding these differences ensures that you choose the right option for your business’s financial needs and helps you streamline the billing process effectively.