Legal Consultant Invoice Template for Streamlined Billing

Managing financial transactions efficiently is essential for any service provider. For those offering advisory or expertise-based services, having a structured way to present charges and track payments is crucial for maintaining professionalism and ensuring timely compensation. A well-organized document that outlines the costs of services rendered can save time and prevent misunderstandings with clients.

By using a structured document that includes all necessary details, providers can streamline the payment process and maintain clear records. This method not only helps in tracking earnings but also promotes transparency between service providers and clients. With a properly formatted bill, both parties are clear about expectations, which reduces the chances of disputes or delayed payments.

In this section, we will explore how to create a comprehensive and professional billing document, highlighting the key components that should be included. Whether you are just starting out or looking to refine your existing processes, the right format can significantly enhance your administrative tasks and save valuable time.

Billing Document Creation Guide

Creating an effective and professional document for billing purposes is a key step in maintaining clear financial records. This process involves organizing information in a way that ensures accuracy and transparency, making it easier for both the service provider and the client to understand the terms of payment. A structured document helps in avoiding misunderstandings and ensures prompt compensation for the services provided.

Key Components of a Professional Billing Document

For any expert offering advisory services, it’s important to include certain essential details in the billing document. These elements will provide clarity for both parties and streamline the payment process:

- Client Information: Ensure that the recipient’s name, address, and contact details are correct.

- Service Description: Clearly list the tasks performed or advice given, along with the time spent or rate charged.

- Fees and Charges: Specify the amount owed for services, any applicable taxes, and total due.

- Payment Terms: Outline the expected payment methods, due date, and any late fees that may apply.

- Provider Information: Include your own details such as name, address, and payment instructions.

Best Practices for Creating a Billing Document

To ensure your documents are both professional and effective, follow these best practices:

- Use Clear and Concise Language: Avoid ambiguity when describing services and fees.

- Maintain Consistency: Use the same format for all billing documents to establish a professional look.

- Double-Check Accuracy: Verify that all numbers and details are correct to avoid confusion or delays in payment.

- Stay Professional: Ensure the tone and design reflect the professionalism of the services you provide.

Why Use a Structured Billing Document

Using a structured billing document simplifies the entire process of requesting payment for services rendered. A pre-designed format helps ensure that all necessary information is included and presented in an organized manner. This not only saves time but also reduces the risk of errors or missing details that can lead to confusion or delayed payments.

Time Efficiency

By utilizing a standardized format, you can quickly fill in the relevant details without having to start from scratch each time. This time-saving approach allows service providers to focus more on their work and less on administrative tasks. A ready-to-use structure minimizes the time spent on formatting and ensures that you don’t miss important sections that are critical for both clarity and legal purposes.

Professionalism and Accuracy

When a document follows a consistent and professional layout, it reflects well on the service provider. A well-structured bill shows clients that you take your business seriously and that you are organized. Additionally, using a pre-designed format reduces the likelihood of making mistakes when listing charges or payment terms, ensuring that all financial details are accurate and clear.

Using a structured billing document not only improves the efficiency of your payment requests but also enhances the overall client experience by presenting a clear, error-free record of services provided and payments due.

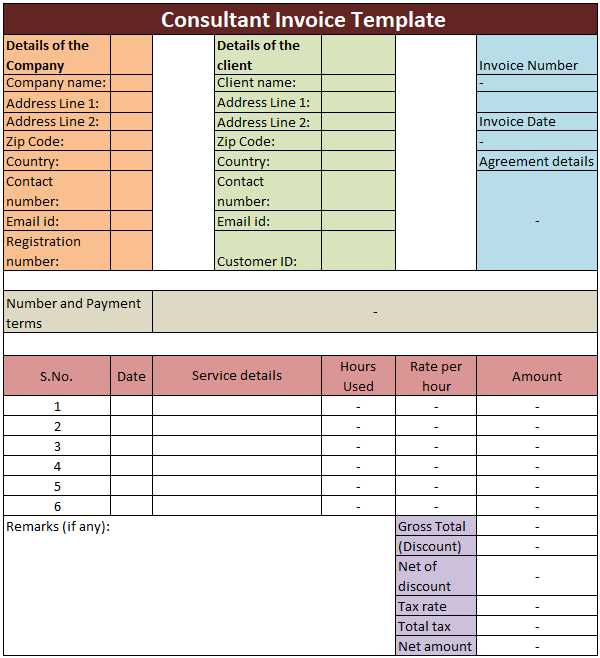

Key Elements of a Professional Billing Document

Creating a complete and accurate document for services rendered requires including specific details that ensure clarity for both the service provider and the client. A well-constructed billing statement not only outlines the services provided but also highlights important information such as payment terms, amounts due, and contact details. These elements form the foundation for smooth transactions and prevent misunderstandings.

Essential Information to Include

The core components that should be present in every billing document are:

- Service Provider Information: Include your name, business name, address, and contact details for easy identification.

- Client Information: Provide the client’s full name or company name, address, and contact details.

- Detailed Service Descriptions: List each service provided, including any applicable time spent or rates charged.

- Fees and Payment Terms: Clearly state the total amount owed, including any taxes, and specify payment methods and deadlines.

- Unique Identifier: Include an invoice or reference number for easy tracking and organization.

Additional Considerations

In addition to the essential details, it is helpful to include payment instructions or any applicable late fees. A well-rounded billing document may also outline terms related to additional costs or future services, creating transparency and maintaining a professional standard for all transactions.

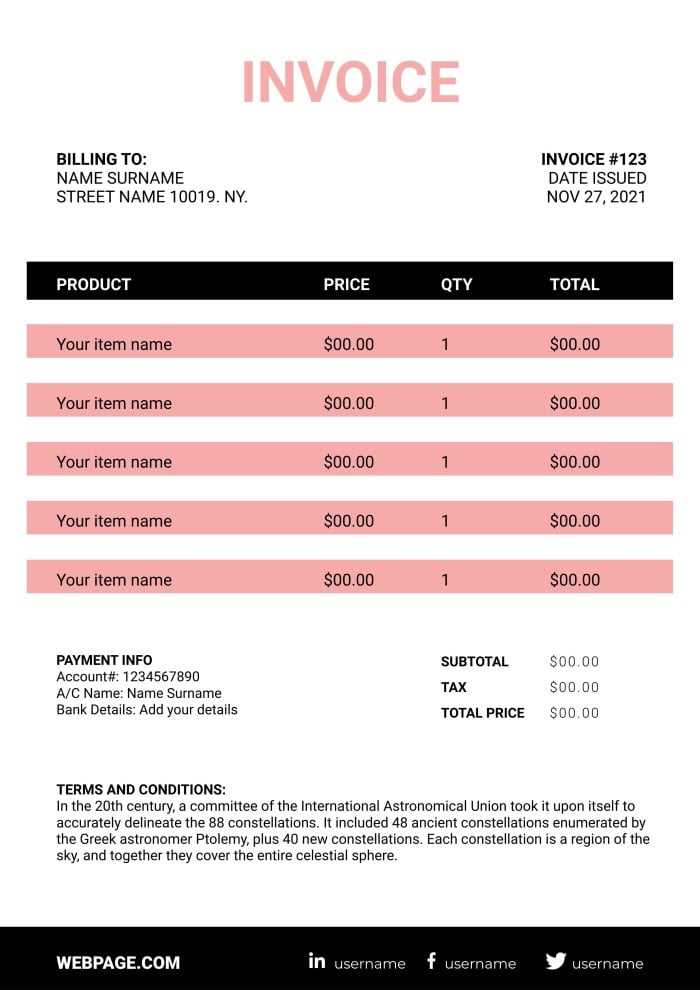

How to Customize Your Billing Document

Customizing your billing document allows you to align it with your specific needs and preferences, making it more personalized and efficient. Adjusting the layout, adding your unique branding, or modifying sections based on the services you offer ensures that the document meets both your professional standards and the expectations of your clients.

To begin, choose a format that suits your workflow and ensure all essential details are included. From there, you can adjust the following elements to tailor the document to your business:

- Branding: Add your company logo, colors, and other elements that reflect your business identity.

- Service Descriptions: Modify the service categories and descriptions to match the type of work you perform.

- Payment Terms: Adjust the payment terms to fit your business model, such as including deposits, late fees, or discounts for early payments.

- Formatting: Change the font, text size, and layout to make the document more professional and easier to read.

- Additional Sections: You may choose to add additional notes or terms, such as confidentiality agreements or future service agreements.

By tailoring these elements, you ensure that each billing document is clear, consistent, and appropriate for your clients, enhancing both the professional appearance and functionality of the document.

Choosing the Right Billing Format

Selecting the appropriate format for your billing document is essential for ensuring clarity and ease of use. The format you choose will impact how easily clients can understand the details of the charges and the process for making payment. A well-structured document not only reflects your professionalism but also streamlines the transaction process, making it easier for both you and your clients to track payments.

When deciding on the right format, consider the following factors:

- Readability: Choose a layout that is easy to read and ensures all details are clearly visible. Avoid clutter and make sure key sections such as services, payment amounts, and terms stand out.

- Client Preferences: Some clients may prefer a digital document, while others might prefer a printed version. Offering both options can help accommodate different preferences.

- Industry Standards: Certain industries may have established norms for billing formats. Understanding these can help you create a document that aligns with client expectations and ensures your billing is professional.

- Customization: Select a format that allows for easy customization. This includes adding or removing sections, adjusting layout, and including your business’s branding.

By considering these factors, you can select a format that enhances communication, promotes timely payments, and represents your services in a professional light.

Essential Information for Billing

When creating a billing document, certain details are crucial to ensure that the transaction is clear and transparent. Including all necessary information not only helps prevent misunderstandings but also ensures that the payment process is smooth and efficient. A well-documented statement can provide both the service provider and the client with a clear record of what is owed, how much, and when payment is expected.

Key elements to include in any billing document are:

- Service Provider Information: Include your full name, business name (if applicable), address, and contact details to ensure the client knows how to reach you.

- Client Information: Provide the recipient’s name, business name, and contact information to personalize the document and confirm who the bill is for.

- Detailed Service Descriptions: Specify the services provided, including the date or time period they were delivered, hours worked, and the agreed-upon rates or fees.

- Total Amount Due: Clearly state the total amount the client owes, including any taxes or additional charges. Make sure the breakdown of charges is easy to follow.

- Payment Instructions: Outline how the client should pay, including bank details, accepted payment methods, and any late fees or discounts that apply.

- Due Date: Specify the date by which payment is expected. This ensures both parties are clear on when the payment should be made.

Including these elements will not only improve the professionalism of your billing process but also ensure you are compensated accurately and on time.

Best Practices for Professional Billing Documents

Creating a professional billing document is crucial to ensuring timely payments and maintaining a positive relationship with clients. A well-organized and clearly written statement helps both the service provider and the client stay on the same page regarding the payment process. Implementing best practices in your billing process can improve communication, reduce errors, and enhance your professional image.

Key Tips for Professional Billing

Following these best practices can ensure your billing documents are not only accurate but also maintain a level of professionalism that reflects well on your business:

- Be Clear and Concise: Keep your descriptions and amounts clear to avoid confusion. Detailed breakdowns of charges can help clients understand exactly what they are being billed for.

- Double-Check Information: Before sending any billing document, ensure that all details are correct, such as the client’s name, service descriptions, rates, and total amount due.

- Provide Multiple Payment Options: Offering various payment methods, such as credit cards, bank transfers, and digital wallets, increases the chances of timely payment.

- Set Clear Payment Terms: Include the due date and specify any late payment penalties or discounts for early payments. This ensures the client is aware of their responsibilities.

- Maintain a Consistent Format: Use the same layout for all your billing documents. Consistency builds professionalism and makes it easier for clients to process payments.

Sample Billing Document Breakdown

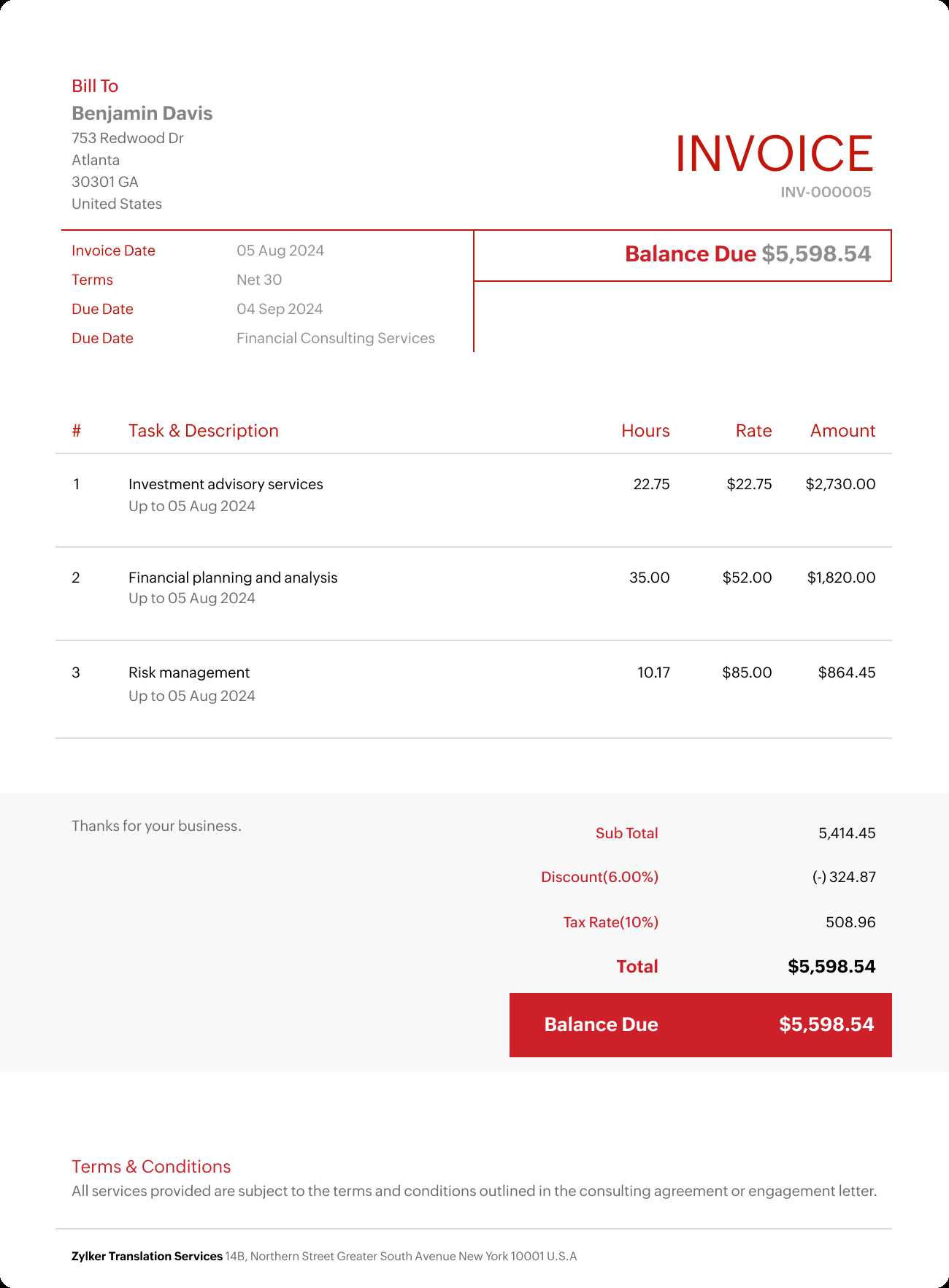

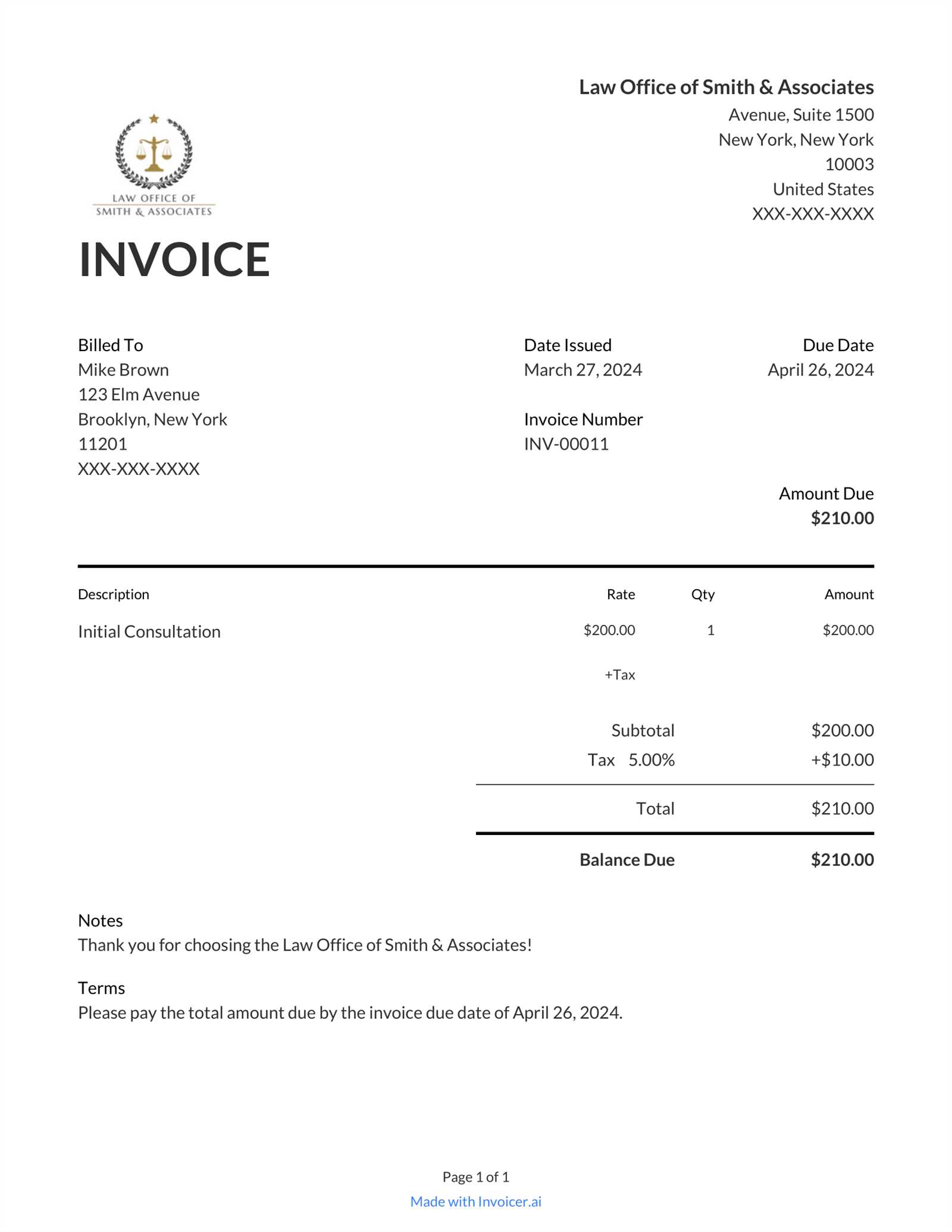

Below is a sample table showing the structure of a well-organized billing document:

| Service Description | Rate | Hours/Quantity | Total |

|---|---|---|---|

| Consultation Fee | $150/hour | 2 | $300 |

| Research and Documentation | $200/hour | 3 | $600 |

| Subtotal | $900 | ||

| Tax (10%) | $90 | ||

| Total Due | $990 | ||

| Client Information | Description |

|---|---|

| Client Name | Ensure that the full legal name of the client or business is correctly spelled. This is essential for legal clarity and ensuring that payments are processed without issues. |

| Billing Address | The address is important for proper identification and ensures that the document is valid, especially in case of disputes or audits. |

| Contact Information | Including the client’s phone number or email address ensures easy communication in case of questions or concerns regarding the document. |

| Purchase Order Number (if applicable) | For businesses that require purchase orders for internal tracking, including this number avoids confusion and ensures proper documentation. |

Double-checking the accuracy of these details before finalizing any document helps maintain professional standards and prevents the need for corrections or follow-ups. Taking the time to ensure all information is accurate is a small effort that can save time and avoid potential conflicts down the line.

Common Mistakes to Avoid in Invoices

How to Handle Invoice Disputes

Disputes over billing can occur for a variety of reasons, from misunderstandings about charges to discrepancies in the terms. When these issues arise, it’s important to handle them professionally and promptly to maintain positive client relationships and ensure timely payment. Addressing conflicts with a clear process helps resolve the issue quickly and avoids unnecessary delays.

Here are some steps to effectively handle billing disputes:

- Stay Calm and Professional: Approach the situation with a calm and professional attitude. Emotions can escalate tensions, so it’s important to remain polite and focused on resolving the issue.

- Review the Details: Before responding to the client, thoroughly review the original document to ensure there are no errors. Check for discrepancies between the agreed-upon terms and what was billed.

- Communicate Clearly: Once you’ve reviewed the document, communicate with the client to understand their concerns. Be clear and transparent in your response, and provide any necessary documentation or clarification to support your position.

- Offer Solutions: If an error has been made, offer a prompt solution. This could involve correcting the mistake, offering a discount, or negotiating a new payment schedule. Always aim for a mutually agreeable resolution.

- Document Everything: Keep a record of all communication related to the dispute, including emails, phone calls, and any agreements made. This will help protect you in case the situation escalates or legal action is required.

- Know When to Escalate: If the dispute cannot be resolved directly, consider involving a third party, such as a mediator or legal advisor, to facilitate a solution. Make sure to follow any formal procedures outlined in your initial agreement or contract.

By following these steps and approaching disputes with professionalism and a focus on resolution, you can manage any billing disagreements in a way that preserves your reputation and ensures fair outcomes for both parties.

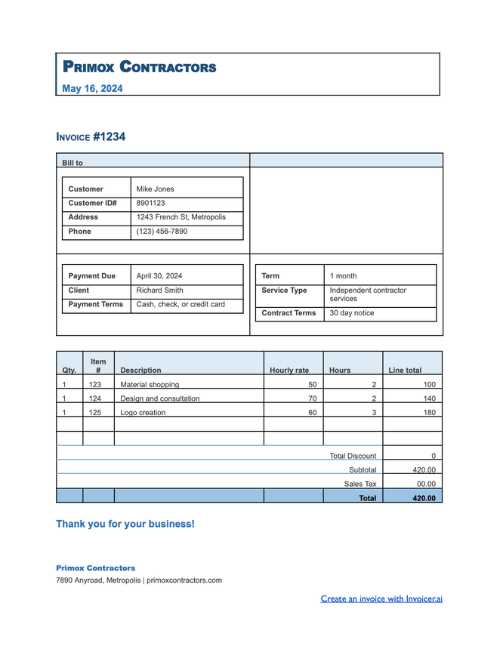

Legal Invoice Templates for Different Clients

When preparing billing documents for various clients, it’s essential to customize the format and structure based on the client’s industry, relationship with you, and the nature of the work performed. Different types of clients may have specific requirements, which can affect the level of detail, payment terms, and overall presentation of the document. Tailoring your approach ensures that the billing process is as smooth and professional as possible.

Here are some ways to adapt billing documents for different types of clients:

- Corporate Clients: Large organizations often require a more formal, detailed breakdown of services provided. These clients may also need additional sections, such as project codes or specific references to contractual terms. Ensure that payment terms and due dates are clearly stated, and include all relevant tax information if necessary.

- Small Businesses: Smaller clients may prefer a simpler, more straightforward format. Provide clear descriptions of services or products and keep the language simple. A concise summary of charges with a total at the bottom can help streamline the billing process for these clients.

- Individual Clients: For personal clients, it’s important to use a more approachable tone while maintaining professionalism. Offering flexibility in payment terms and providing easy-to-understand line items can help facilitate quicker payments.

- Freelance Clients: Independent contractors often work with clients on short-term projects, so the billing format should be concise, clear, and timely. You may want to break down the hours worked and the rates clearly, as these types of clients are particularly sensitive to transparency in charges.

- Government or Non-Profit Clients: When dealing with governmental or non-profit organizations, be sure to include all necessary legal and financial details. These clients typically require detailed itemizations and are more likely to have specific compliance requirements for billing procedures, such as grant funding or project codes.

By adjusting your billing approach based on the needs of each client type, you can ensure that your documents meet expectations and contribute to smoother, faster payments. Whether dealing with large corporations or individual clients, the goal is to maintain professionalism while offering clarity and flexibility in the billing process.

Digital vs Paper Invoice Formats

In today’s world, businesses have the option of choosing between digital or paper formats when sending billing documents to clients. Each method has its own set of advantages and challenges. While traditional paper documents have been used for decades, digital formats are becoming increasingly popular due to their convenience and speed. However, the choice between the two depends on several factors, including client preferences, the scale of the business, and the industry.

Below, we compare the key differences between digital and paper formats:

| Aspect | Digital Format | Paper Format |

|---|---|---|

| Speed of Delivery | Immediate, sent via email or online platforms | Slower, requires mailing |

| Cost | Low or no cost for sending | Higher due to printing and mailing expenses |

| Environmental Impact | Eco-friendly, no paper or ink required | Less eco-friendly, uses paper and ink |

| Storage | Easy digital storage and backups | Physical storage needed, more space required |

| Security | Requires strong cybersecurity to prevent unauthorized access | Physical loss or theft of documents possible |

| Client Preferences | Preferred by clients familiar with technology | Preferred by clients who prefer paper copies |

Ultimately, the decision to use either digital or paper formats depends on your business needs and client preferences. Digital formats are becoming the standard for many industries due to their efficiency, while paper formats may still be necessary for clients who require physical copies or when legal requirements dictate it.

How to Track Payments Effectively

Keeping track of payments is essential for maintaining cash flow and ensuring that clients meet their financial obligations. Accurate tracking helps avoid confusion, reduces the risk of missed payments, and provides a clear record for future reference. Whether you are a small business or a large enterprise, an efficient system for monitoring payments is crucial for your financial health.

Here are some best practices for tracking payments effectively:

- Use Accounting Software: Invest in reliable accounting software to track payments in real-time. These tools can automatically record transactions, issue reminders, and generate reports.

- Set Clear Payment Terms: Clearly define payment deadlines and methods upfront. Having well-established terms helps set expectations and reduces ambiguity.

- Create a Payment Schedule: Maintain a payment calendar to track due dates for each client. This can help you stay organized and ensure no payments are overlooked.

- Send Reminders: If a payment is overdue, send a polite reminder to clients. Automated reminders can help ensure timely payments and reduce the need for manual follow-up.

- Record Every Transaction: Keep detailed records of all payments, including partial payments. This helps you track outstanding balances and identify any discrepancies quickly.

- Reconcile Regularly: Periodically reconcile your accounts to ensure that your payment records match your bank statements. Regular checks can prevent errors and identify issues early.

- Offer Multiple Payment Options: Providing clients with various payment methods increases the likelihood of timely payments and reduces friction in the transaction process.

By implementing these strategies, you can streamline your payment tracking process, reduce errors, and maintain a steady cash flow for your business.

Invoicing Software Options for Professionals

In the modern business landscape, professionals need efficient tools to manage payments and financial records. Specialized software solutions are available to simplify the invoicing process, allowing for quicker billing, easy tracking of transactions, and streamlined financial management. Selecting the right software can enhance productivity, minimize errors, and ensure timely payments.

Top Features to Look For

When choosing invoicing software, it’s essential to focus on features that align with your business needs. Some of the most useful features include:

- Customization: The ability to create personalized billing statements with your branding and necessary details.

- Automated Reminders: Automatic alerts to remind clients of upcoming or overdue payments.

- Multiple Payment Options: Integration with various payment gateways for easy client transactions.

- Detailed Reporting: Generate reports for tracking payments, revenue, and outstanding balances.

- Time Tracking: Useful for professionals who bill by the hour, enabling automatic time capture and conversion into billable amounts.

- Cloud Storage: Secure, cloud-based access to your billing history from any location, on any device.

Popular Software Solutions

There are numerous invoicing platforms tailored to help professionals manage billing. Here are a few noteworthy options:

- FreshBooks: A widely used platform with easy-to-use templates, automated billing, and comprehensive financial reporting.

- QuickBooks: Known for its robust accounting capabilities, QuickBooks also offers invoicing features like recurring billing and payment tracking.

- Zoho Invoice: A flexible, scalable tool ideal for small to medium-sized businesses, offering customizable invoices and detailed analytics.

- Wave: A free invoicing software that provides professional-looking templates and integrates seamlessly with accounting functions.

- Invoice Ninja: A cost-effective solution with a focus on time tracking, recurring invoices, and client management.

Choosing the right invoicing software depends on the specific needs of your business. By carefully evaluating your requirements and the features of each tool, you can improve efficiency and maintain accurate financial records.