Lease Invoice Template for Simplified Rent Billing

Managing financial transactions for rental agreements can be a complex task. It is crucial for property owners and tenants to have clear, professional records that detail the terms of payment. A well-structured document helps ensure both parties understand their financial obligations and avoids confusion. With the right format, tracking payments and managing accounts becomes much easier.

Designing a comprehensive document that includes necessary details such as payment amounts, dates, and tenant information is essential. This not only facilitates smooth communication but also offers legal protection in case of disputes. In the modern digital world, utilizing customizable solutions for creating these records can save both time and effort.

Crafting an efficient document for rent management involves choosing the appropriate structure and layout, ensuring all critical information is included. Whether for personal use or business purposes, these documents should be easy to customize, professional in appearance, and tailored to the needs of the landlord and tenant.

Understanding Rent Billing Documents

For property owners and tenants alike, organizing payment records is an essential part of any rental agreement. A well-organized document helps ensure transparency and clarity when it comes to financial transactions. This structured approach helps track amounts owed, payment due dates, and other important details that are crucial for maintaining smooth business relations.

These documents are designed to outline the specifics of payment obligations, providing both parties with a clear record of transactions. Typically, they include important data such as the rental amount, due dates, and tenant or landlord information. By maintaining a standard format, these documents can easily be filled out and referenced whenever necessary.

- Details of the amount due and payment terms

- Identification of both parties involved in the agreement

- Clear indication of the due dates and payment methods

- Section for late payment penalties, if applicable

Adopting a consistent approach to these financial documents ensures that both parties are on the same page. It provides a simple, professional way to manage rent-related transactions and avoid potential misunderstandings. Properly crafted, these records become a valuable tool for maintaining organized accounts and protecting both the tenant and property owner’s interests.

What is a Rent Billing Document?

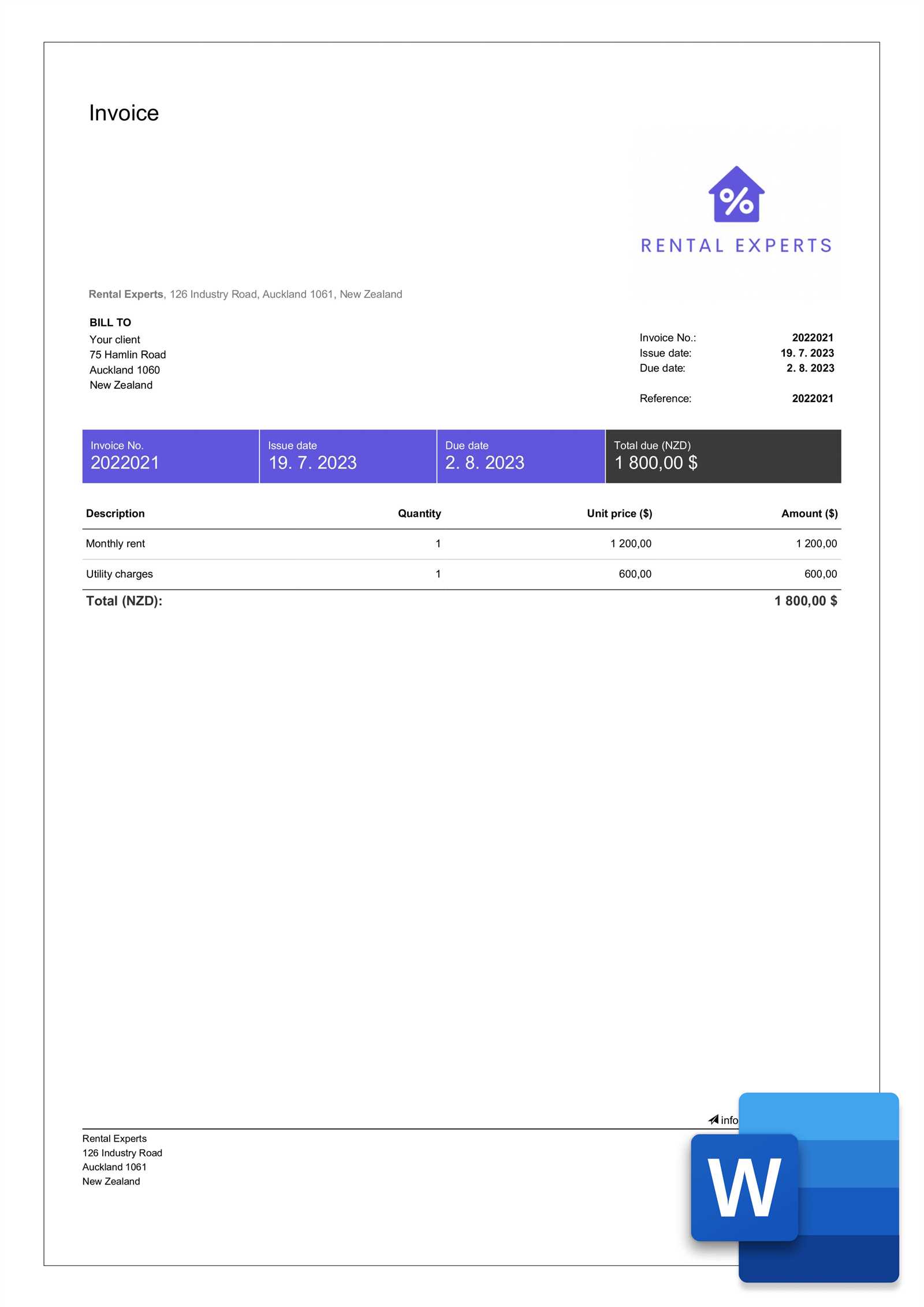

A rent billing document is a formal record used to detail the financial obligations between a property owner and a tenant. It serves as an official request for payment, outlining the agreed-upon terms such as the rental amount, due dates, and any additional fees. This document plays a crucial role in maintaining transparency and ensuring that both parties are aligned when it comes to financial expectations.

Typically, it includes essential information like:

- Tenant and landlord contact details

- Amount due for the rental period

- Payment due dates and methods

- Late fees or penalties for overdue payments

- Description of the rental property or unit

By providing a clear and concise breakdown of charges, this document helps avoid confusion and ensures that all parties are aware of the payment terms. It also provides legal protection in case of any disputes over payments or other rental terms. For property managers and landlords, using a standardized format can streamline the process of collecting payments and managing accounts efficiently.

Benefits of Using Rent Billing Documents

Utilizing structured financial documents in rental agreements provides multiple advantages for both property owners and tenants. These records offer clarity, help streamline payment processes, and can reduce potential disputes. By maintaining an organized system, landlords and tenants ensure smoother transactions and a more professional approach to managing rental agreements.

Enhanced Clarity and Transparency

Using a formal record that details payment amounts, due dates, and other terms ensures that both parties are on the same page. This minimizes confusion and fosters trust between the landlord and tenant. With everything clearly outlined, there is little room for misunderstanding regarding the amount owed or when payments are expected.

- Clear breakdown of charges: Ensures tenants know exactly what they are paying for.

- Defined payment terms: Removes any ambiguity regarding due dates or late fees.

Streamlined Payment Management

For landlords and property managers, these records simplify the process of tracking payments. It allows easy documentation of all transactions, helping both parties stay organized. Additionally, these documents can be used as a reference for future agreements or potential legal matters.

- Efficient tracking: Helps keep a record of payments made and pending.

- Legal protection: Provides documented proof of agreed terms in case of disputes.

By adopting a standardized method for generating these financial documents, landlords reduce administrative time and avoid confusion, ensuring a smoother and more professional re

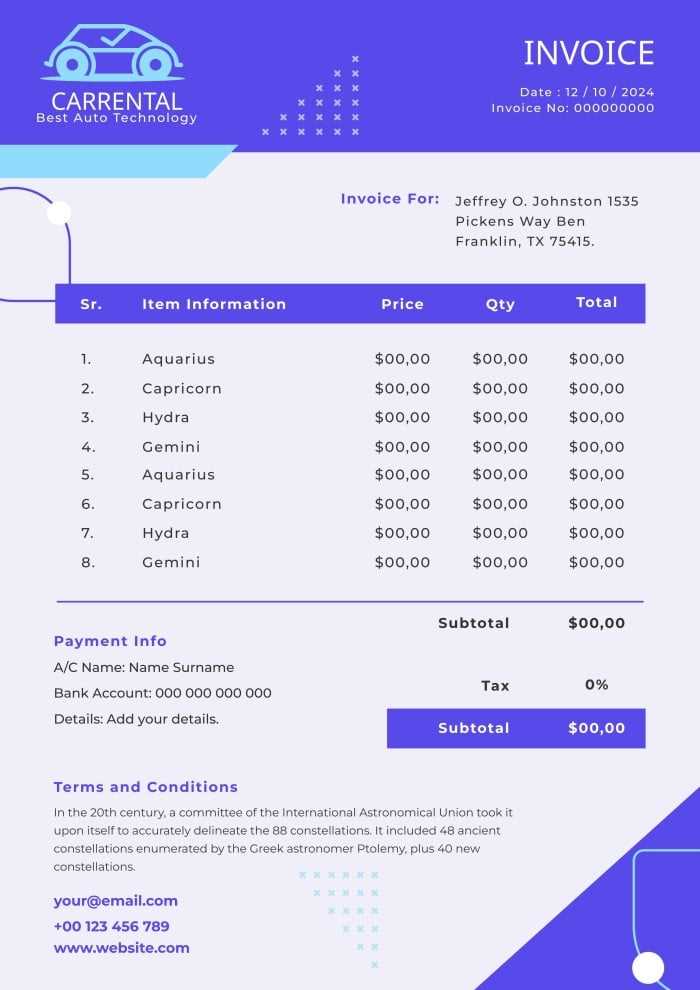

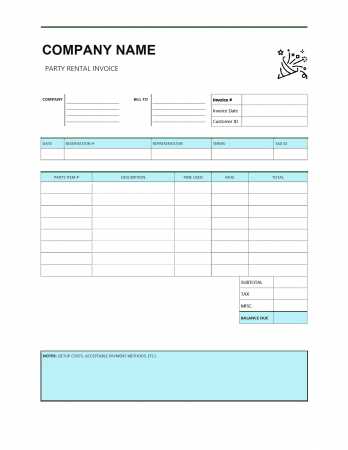

Key Elements of a Rent Billing Document

Creating a well-structured document for rent payments requires including several key pieces of information that ensure both parties understand their financial obligations. These essential components provide clarity and prevent confusion by detailing the terms of payment, the amount due, and other relevant details related to the rental agreement.

The most important elements of such a document include:

- Property Details: Information about the rental property, such as the address and unit number, helps to identify the location being leased.

- Tenant and Landlord Information: The names and contact details of both parties involved in the agreement are crucial for communication and record-keeping.

- Payment Amount: The total sum due for the rental period, including any additional charges such as maintenance or utilities, should be clearly stated.

- Payment Due Date: The specific date by which payment is expected, along with any relevant late fees for overdue amounts, should be included.

- Payment Methods: Information about the acceptable methods for making payments, whether by bank transfer, check, or online payment systems, should be outlined.

- Late Fees or Penalties: If applicable, details regarding late fees or penalties for delayed payments should be clearly mentioned to avoid disputes.

By including these key elements, the document serves as a clear, professional communication tool that benefits both the landlord and tenant, ensuring that all necessary financial details are covered and easily referenced when needed.

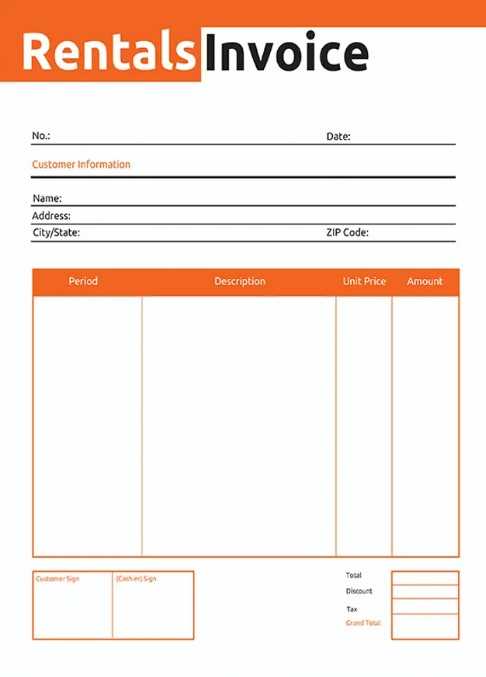

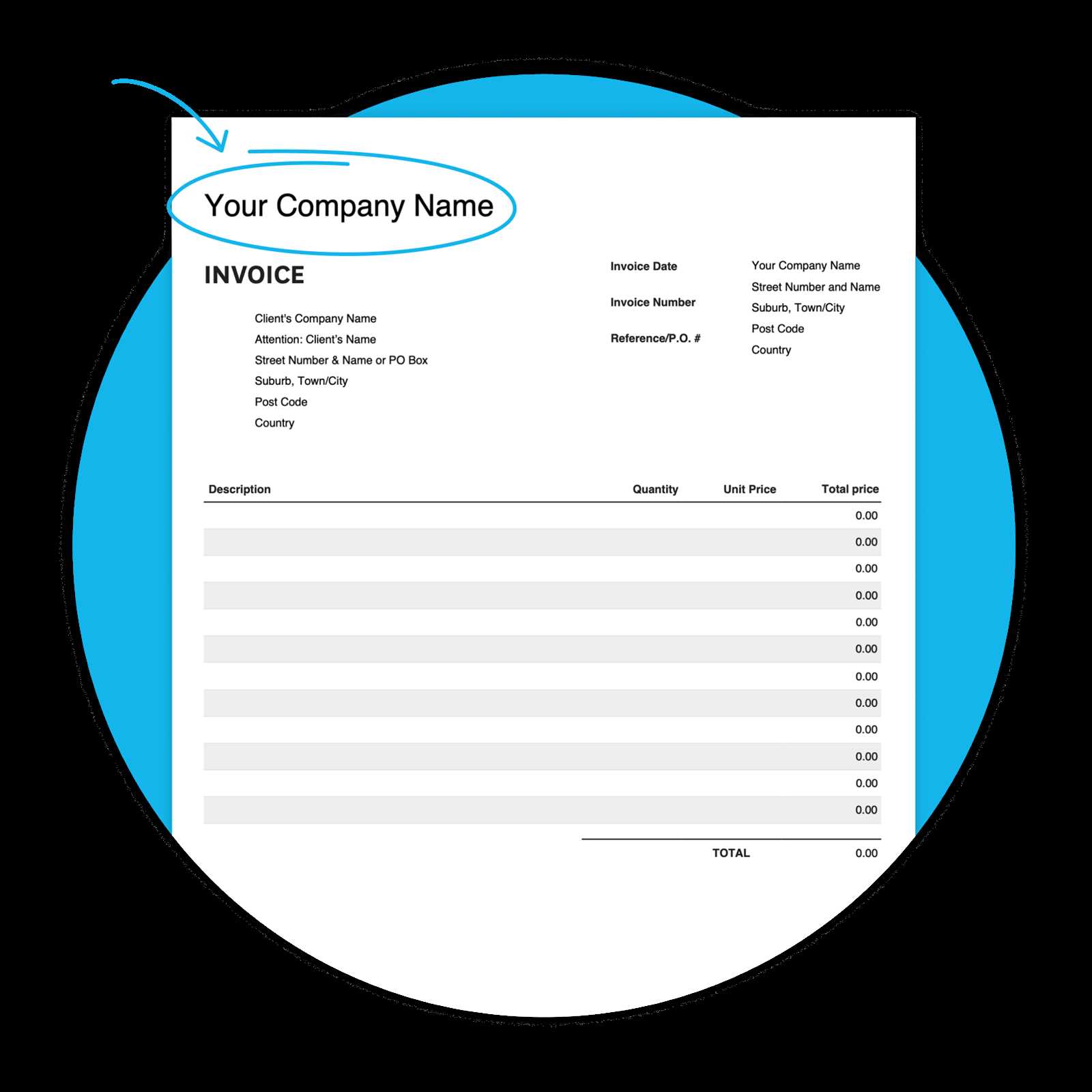

How to Customize Your Rent Billing Document

Personalizing your rent payment document can make the process more efficient and professional. Customization allows you to tailor the document to your specific needs, ensuring that all relevant information is clearly presented and formatted according to your preferences. Whether you are a landlord, property manager, or tenant, adjusting the structure and content can help streamline the payment process and improve communication.

Here are some steps to consider when customizing your rent billing record:

- Adjust the Layout: Choose a layout that suits your style, whether it’s a simple format or a more detailed design. Make sure it’s easy to read and visually appealing.

- Include Specific Terms: Add any special conditions, such as payment due dates, late fees, or security deposits, that apply to your agreement.

- Add Your Branding: If you manage multiple properties, incorporating your logo, company name, and contact information can give the document a professional look.

- Set Payment Methods: Clearly state the available payment options, such as bank transfers, checks, or online platforms, to provide flexibility for tenants.

- Define Payment Periods: Ensure that the start and end dates of the payment period are included, making it clear when each charge applies.

Customizing your document in this way helps avoid misunderstandings and creates a more organized, effective approach to managing rental payments.

Common Mistakes in Rent Billing Documents

When managing rental agreements and payment records, it’s easy to overlook certain details that could lead to confusion or disputes. Whether due to human error or lack of attention to detail, common mistakes in these financial records can complicate the payment process. Identifying and avoiding these pitfalls is crucial for maintaining a smooth and professional relationship between landlords and tenants.

Errors in Payment Amounts

One of the most frequent mistakes is miscalculating the total amount due. This can include errors in adding up rent, utilities, or additional charges, leading to either overcharging or undercharging the tenant. It’s important to double-check all figures and ensure that the correct amount is clearly stated on the document.

- Incorrect charges: Double-check for any extra fees or discounts that may have been missed.

- Incorrect calculations: Ensure that the sums are accurate, especially if taxes or maintenance fees are involved.

Missing or Incomplete Information

Another common issue is leaving out critical details such as payment due dates, tenant or landlord contact information, or payment methods. Incomplete or missing information can lead to confusion and delays in payment. Always ensure that the document includes all the necessary fields and is fully completed before sending it out.

- Incomplete tenant information: Make sure to include the full name and contact details.

- Omitting due dates: Clear payment deadlines should always be specified.

By carefully reviewing and correcting these common mistakes, you can ensure that your financial records are accurate, professional, and effective at facilitating smooth transactions.

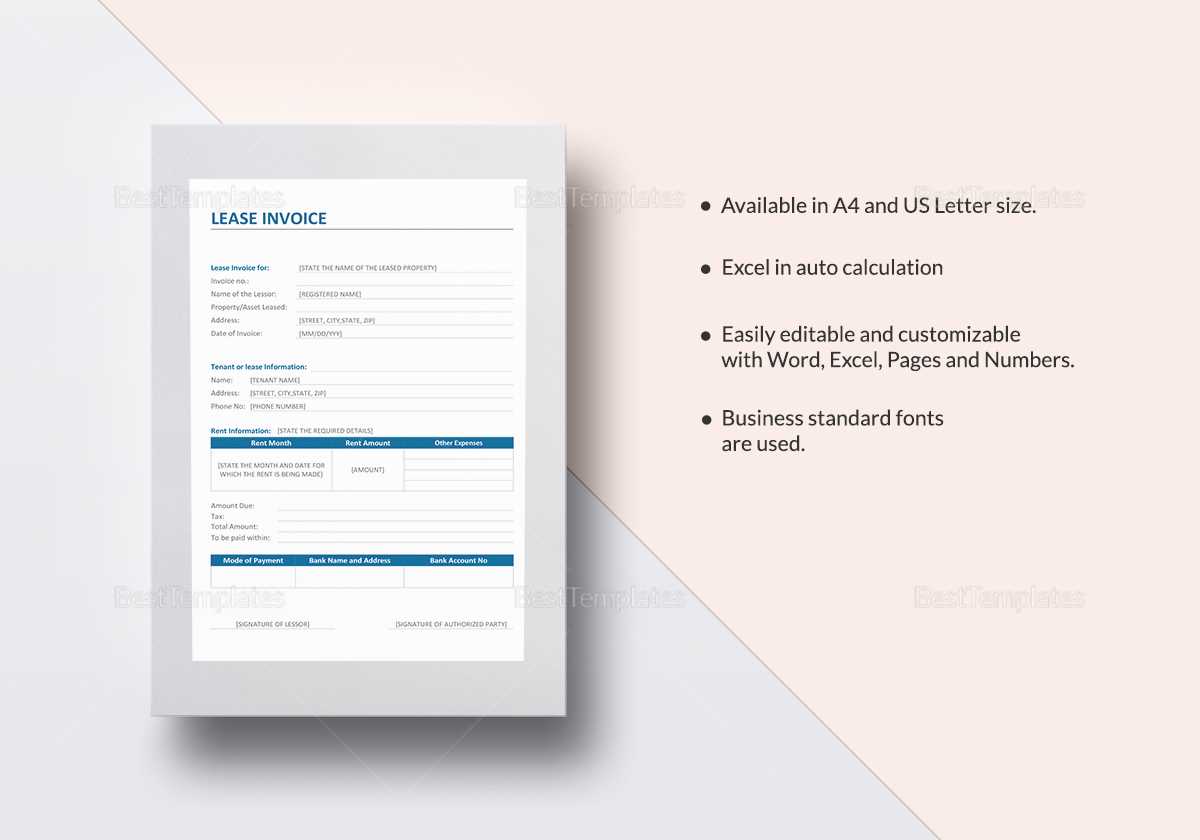

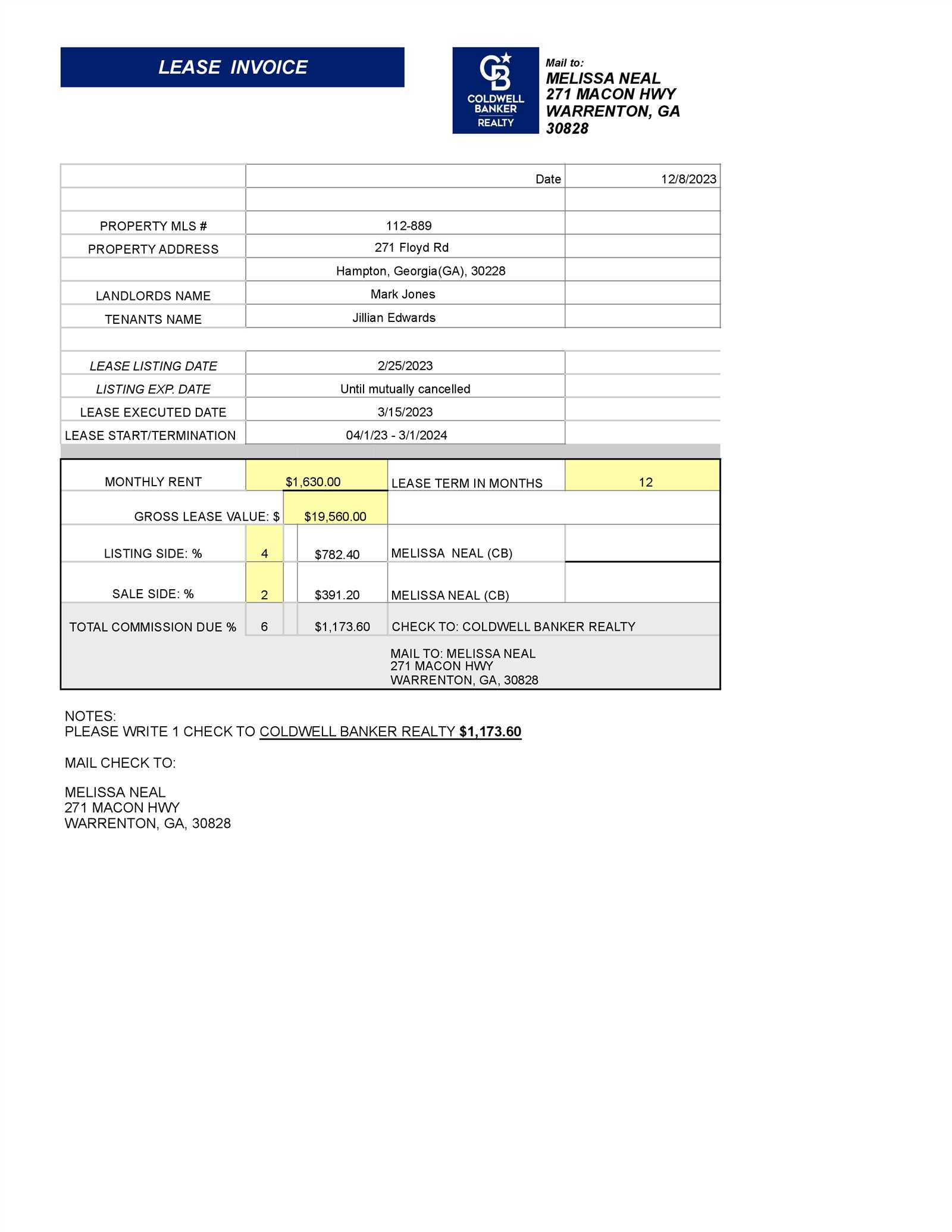

Lease Billing Document vs Rent Billing Document

While both documents serve similar purposes in rental agreements, they are often used in different contexts. Understanding the differences between these two types of financial records can help ensure that the correct format is used for specific rental arrangements. The distinctions mainly lie in the nature of the agreements and the way charges are structured.

The key differences between these two types of documents include:

- Rental Agreement Duration: A rent billing document typically applies to monthly or short-term rental periods, whereas a lease billing document is often associated with long-term agreements, such as a year-long lease or commercial rental contracts.

- Payment Frequency: Rent payments are generally due on a regular monthly cycle, while lease agreements may have different payment schedules, including quarterly or annual payments.

- Nature of Charges: Rent-related records tend to focus on recurring charges for occupying a property, whereas lease-related documents might also include additional terms such as maintenance costs, insurance fees, or utilities that are part of a more comprehensive rental agreement.

Although the differences are often subtle, it is important to choose the right kind of document for your specific situation. Understanding these distinctions helps ensure that both the landlord and tenant are clear about their obligations and rights within the agreement.

Automating Rent Billing Document Creation

Automating the creation of financial documents related to rental payments can save time, reduce errors, and streamline the administrative process. By using software or online tools, property managers and landlords can generate consistent and accurate records without manually entering data each time. This approach not only increases efficiency but also ensures that all required information is included and properly formatted.

Benefits of Automation

Automating the creation of these documents offers several key benefits that can significantly improve the management of rental properties:

- Time-saving: Automation eliminates the need for manual entry, allowing for quicker document creation, especially when managing multiple tenants or properties.

- Accuracy: Automated systems reduce human errors, ensuring that the correct amounts, dates, and terms are always included.

- Consistency: Using predefined templates ensures that all documents follow the same format, making them more professional and easier to read.

- Scalability: As the number of properties or tenants grows, automation makes it easier to manage an increased workload without adding complexity.

Tools for Automating Document Creation

Various software options and platforms offer tools to automate the creation of financial documents for rental agreements. These tools often include features such as:

- Pre-built Templates: Ready-to-use formats that can be customized with tenant details, payment amounts, and other specific terms.

- Integration with Payment Systems: Direct links to payment gateways for tracking payments and automating the generation of related records.

- Recurring Billing Features: Automatic generation of documents for ongoing payments, such as monthly rent, eliminating the need for manual reminders.

By automating this process, landlords and property managers can focus on other important tasks, knowing that billing records are being accurately and consistently generated.

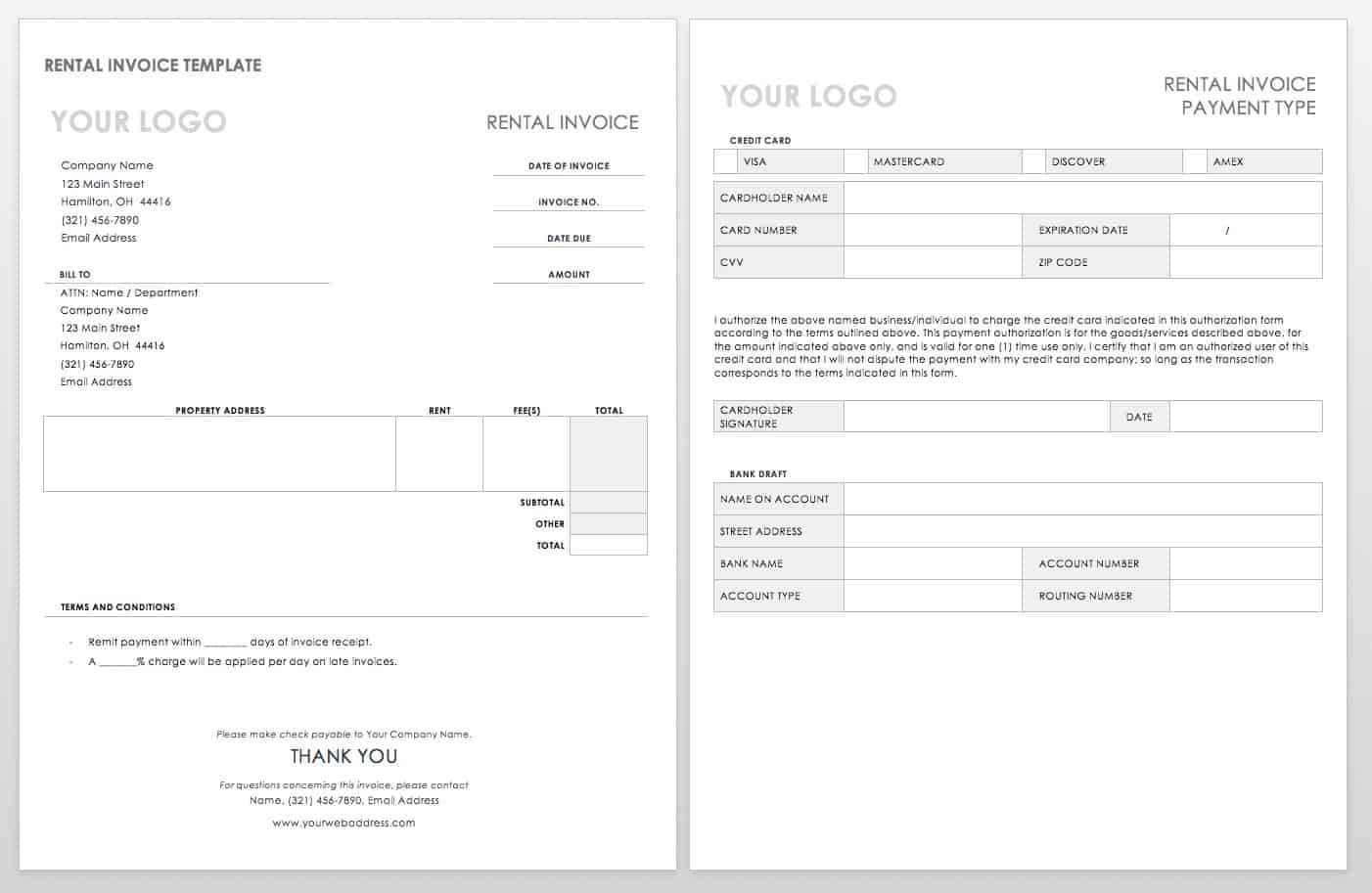

Best Software for Rent Billing Documents

Choosing the right software to manage rental payment records can greatly improve the efficiency and accuracy of financial documentation. Whether you’re managing a single property or an entire portfolio, specialized tools can automate the process, ensure consistent formatting, and integrate with payment systems. The best software options provide user-friendly interfaces, customizable features, and reliable customer support, making them an invaluable resource for property managers and landlords alike.

Below is a comparison of some of the top software solutions for creating and managing billing records for rental payments:

| Software | Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, recurring billing, tax management, payment tracking | Small to medium-sized property managers |

| FreshBooks | Automated billing, cloud-based access, expense tracking, mobile app | Freelancers and small business owners |

| Rentec Direct | Tenant management, accounting, customizable financial reports, automated rent collection | Large property management companies |

| Buildium | Automated billing, lease tracking, payment reminders, accounting integrations | Property managers with multiple units |

| Zoho Books | Recurring payments, invoicing, inventory management, tax calculation | Landlords with a few properties |

By selecting the right software for your needs, you can simplify the process of managing rental payments, ensuring that all records are accurate, professional, and easy to generate.

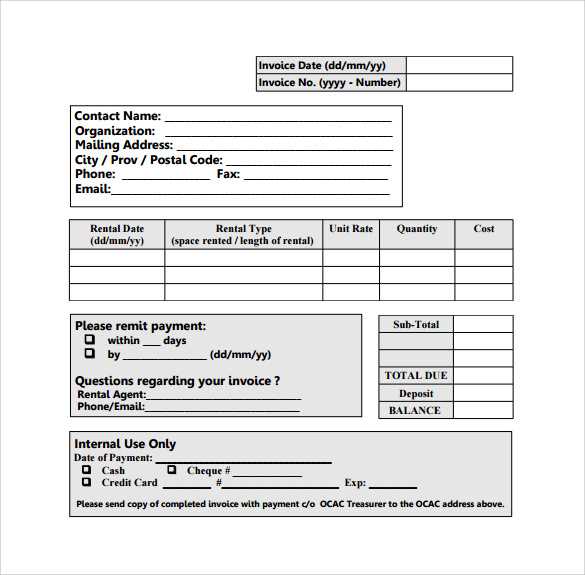

How to Issue a Rent Billing Document

Issuing a billing record for rental payments is an essential part of managing rental agreements. This document serves as a formal request for payment, detailing the amount due, the payment terms, and other important details. Whether you’re sending it manually or using automated systems, it’s important to follow a clear process to ensure accuracy and professionalism in your records.

Steps to Issue a Rent Billing Document

Here is a step-by-step guide to issuing a billing document for rental payments:

- Gather Required Information: Collect the tenant’s details, including the full name, property address, and lease terms. Make sure to have the payment amount, due date, and any applicable taxes or additional fees on hand.

- Include Key Details: Your document should clearly state the tenant’s name, the property being rented, the payment amount, due date, and any late fees or penalties that may apply.

- Choose the Right Format: Use a clear, professional format. You can either use a pre-designed template or create a customized document with your business branding.

- Send the Document: Once the document is complete, send it to the tenant via their preferred method, whether by email or physical mail. Ensure that the tenant receives it in a timely manner to avoid delays.

- Track Payment: Keep a record of when the payment is due and follow up as needed if payment is not received by the specified date.

Important Tips

- Be Clear and Transparent: Make sure all details, including charges and terms, are easy to understand.

- Include Payment Instructions: Clearly state how tenants can make their payments, including payment methods and any instructions for submitting online payments.

- Follow Up: If the payment isn’t made by the due date, send a reminder and outline any late fees or consequences for non-payment.

By following these steps and tips, you can issue accurate and professional billing records that help maintain clear communication between you and your tenants.

Tracking Payments with Rent Billing Records

Properly tracking payments is crucial for ensuring that all financial transactions related to rental agreements are recorded accurately. This not only helps maintain a clear financial overview but also allows property managers to easily monitor outstanding balances and avoid potential disputes. Whether you are managing a single property or a large portfolio, an organized system for tracking payments ensures smooth operations and timely follow-ups.

To effectively track rental payments, it is important to keep detailed records and regularly update them. The key to successful payment tracking is consistency and accuracy, which helps to avoid errors and delays.

Methods for Tracking Payments

- Manual Recording: For smaller portfolios, manually updating records can be an effective way to track payments. Use spreadsheets or dedicated accounting software to note each transaction and its status.

- Automated Systems: Many modern property management tools integrate payment tracking directly with billing records, making it easier to track payments in real time. These systems automatically update your records as payments are made, reducing the chance of missing a payment or making errors.

- Online Payment Platforms: Accepting payments through digital platforms often comes with built-in tracking features, providing a clear overview of payment statuses, including due dates, amounts, and outstanding balances.

Tips for Effective Payment Tracking

- Record Payments Immediately: Always update your records as soon as a payment is received to avoid confusion and ensure accuracy.

- Set Up Automatic Reminders: For recurring payments, consider using reminders to notify tenants of upcoming due dates or late fees.

- Keep Detailed Notes: Include any special payment arrangements, such as partial payments or adjustments, so you have a complete record of each transaction.

- Monitor Overdue Payments: Establish a process for identifying overdue payments, sending reminders, and following up with tenants who haven’t paid on time.

By implementing a consistent payment tracking system, you can ensure that all rental payments are processed effi

Legal Considerations for Rent Billing Records

When issuing billing documents related to rental agreements, it’s important to be aware of the legal requirements that govern these transactions. Proper documentation ensures that both landlords and tenants are protected and that any disputes can be resolved with clear evidence. Adhering to legal guidelines not only prevents misunderstandings but also helps avoid penalties or legal issues related to non-compliance with rental laws.

In this section, we’ll cover the key legal considerations that should be kept in mind when creating and managing rent billing records.

Key Legal Aspects to Consider

| Legal Aspect | Consideration |

|---|---|

| Clear Payment Terms | Always specify payment due dates, amounts, and any late fees in the rental agreement and billing records to avoid disputes over timing or amounts. |

| Tax Compliance | Ensure that any applicable taxes, such as sales or VAT, are accurately included in the billing document and comply with local tax laws. |

| Documentation of Adjustments | If any changes occur in the rental payment (e.g., discounts, partial payments), make sure to document these clearly and obtain tenant acknowledgment. |

| Record Keeping | It’s essential to retain all records for a specified period, as required by local laws, to avoid legal complications in case of audits or disputes. |

| Tenant Consent | For any changes in the payment st

How to Handle Late Payments on Rent Billing RecordsManaging delayed payments is a critical aspect of maintaining financial stability in rental agreements. When tenants miss payment deadlines, it can affect cash flow and create unnecessary tension between the parties involved. Having a clear strategy for dealing with overdue payments can help resolve these situations professionally and efficiently, while maintaining a positive landlord-tenant relationship. To effectively handle late payments, it is important to establish clear procedures, communicate expectations upfront, and take timely action when payments are overdue. Below are some key steps to follow when addressing late payments.

By following these best practices, you can effectively manage late payments, minimize disruptions, and ensure that financial obligations are met in a timely manner. Templates for Commercial Rent Billing RecordsWhen managing rental agreements for commercial properties, it’s essential to have well-structured documents to ensure that both parties are clear on payment expectations. These documents help avoid confusion and streamline the process of billing, ensuring that payments are made on time. The use of pre-designed formats can save time and improve accuracy by including all necessary details without the need for starting from scratch each time. In this section, we will explore different types of formats that can be used for commercial rental payments, highlighting key components that should always be included to ensure clarity and compliance. Key Features of Commercial Billing Records

Benefits of Using Pre-Formatted Documents

By using structured documents for commercial rental payments, landlords can improve organization, communication, and overall efficiency in the payment collection process. Creating a Professional Rent Billing DocumentCreating a professional billing document for rental agreements is essential for maintaining a clear, transparent, and efficient financial process between landlords and tenants. A well-structured document not only ensures that all required information is included but also sets a professional tone, helping to build trust and clarity in the landlord-tenant relationship. In this section, we’ll explore the key elements and best practices for designing a polished and professional billing record that meets legal standards while being easy for both parties to understand. Essential Elements of a Professional Billing Record

Designing the Document for Clarity

By following these guidelines, you can create a professional rent billing document that ensures clarity, professionalism, and compliance while making it easier for both parties to track and manage payments. Using Digital Rent Billing Documents EffectivelyWith the advancement of technology, managing financial transactions related to rental agreements has become more streamlined and efficient. Digital billing records provide numerous benefits, including faster processing, easy access, and reduced administrative costs. When used correctly, these electronic documents can significantly improve the efficiency of both landlords and tenants. This section will explore the key strategies and advantages of using digital records for rental payments, along with tips for ensuring they are utilized to their full potential. Benefits of Digital Billing Records

Best Practices for Managing Digital Billing Records

By adopting digital rent billing documents and following these best practices, you can streamline the payment process, improve communication, and maintain better cont |