Law Firm Invoice Template for Streamlined Billing

Managing financial transactions efficiently is crucial for any professional practice. In the legal industry, clear and precise documentation of services rendered ensures smooth communication with clients and helps maintain transparency in billing. Whether you are a solo practitioner or part of a larger group, having a structured system for creating billing statements is essential for timely payments and avoiding confusion.

By using a well-organized approach to document fees, charges, and other related expenses, you can streamline your administrative tasks while maintaining professionalism. A well-crafted statement not only reflects the services provided but also serves as a tool for keeping track of outstanding balances and managing financial relationships.

Customizing your billing structure to fit your specific needs is key to ensuring that your clients understand the breakdown of costs. Whether it’s for hourly rates, flat fees, or specialized services, your document should be clear and easy to read, helping to minimize disputes and encourage prompt settlement.

Billing Document Guide

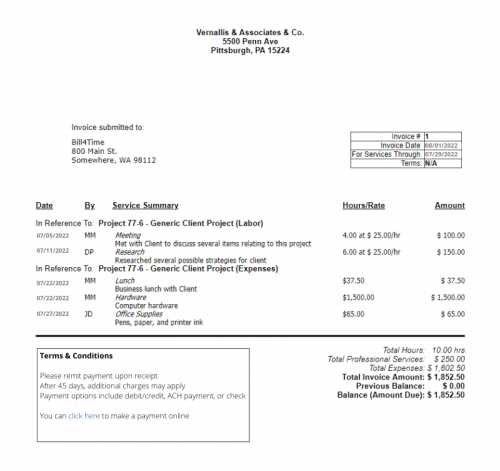

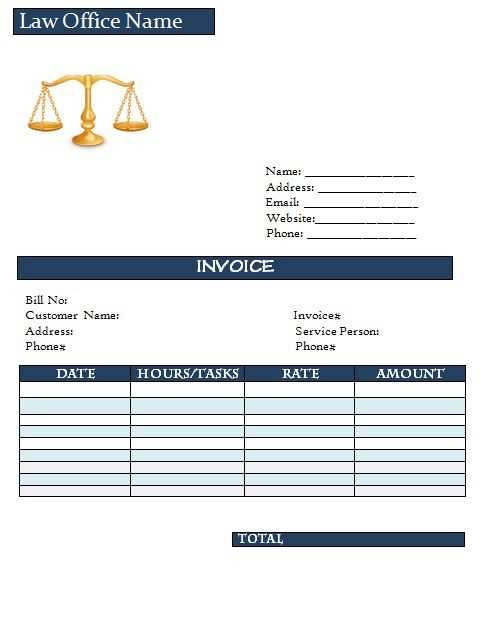

Creating a professional document for tracking charges is essential for any legal practice. The goal is to ensure accuracy, clarity, and ease of understanding for both the service provider and the client. This guide will walk you through the necessary steps to design a comprehensive billing document that covers all aspects of the services provided, including fees, taxes, and additional costs.

To begin, it’s important to include essential details such as the client’s contact information, a breakdown of services rendered, and the corresponding charges. Additionally, specifying payment terms, deadlines, and any other contractual obligations can help avoid misunderstandings and foster trust.

Customizing the document to suit the unique needs of each client or case can further enhance the experience. Including specific notes for additional charges, such as research, travel, or court-related expenses, ensures transparency and minimizes potential conflicts.

Maintaining consistency in the format and structure of your billing documents promotes professionalism and ensures that all necessary information is presented in a clear, concise manner. This also makes it easier for clients to process payments promptly and accurately.

Importance of Professional Invoicing

Having a well-structured document for billing plays a crucial role in maintaining professionalism and fostering positive relationships with clients. Clear and organized billing not only ensures accurate payment collection but also contributes to the credibility and trustworthiness of your practice. A well-prepared statement reflects your attention to detail and commitment to transparency.

Professional billing offers several key benefits:

- Clarity – A clear document helps clients understand exactly what they are being charged for, reducing the risk of confusion or disputes.

- Credibility – Proper documentation establishes your practice as reliable and competent, increasing the likelihood of repeat business.

- Timely Payments – Structured billing encourages prompt payment, as clients can easily follow the breakdown of services and fees.

- Efficient Record Keeping – Well-organized financial documents help maintain accurate records for future reference or tax purposes.

- Transparency – Detailing every charge helps build trust and avoids misunderstandings regarding fees or services.

By prioritizing professional billing practices, you can ensure a smooth payment process, enhance client satisfaction, and maintain financial organization within your practice.

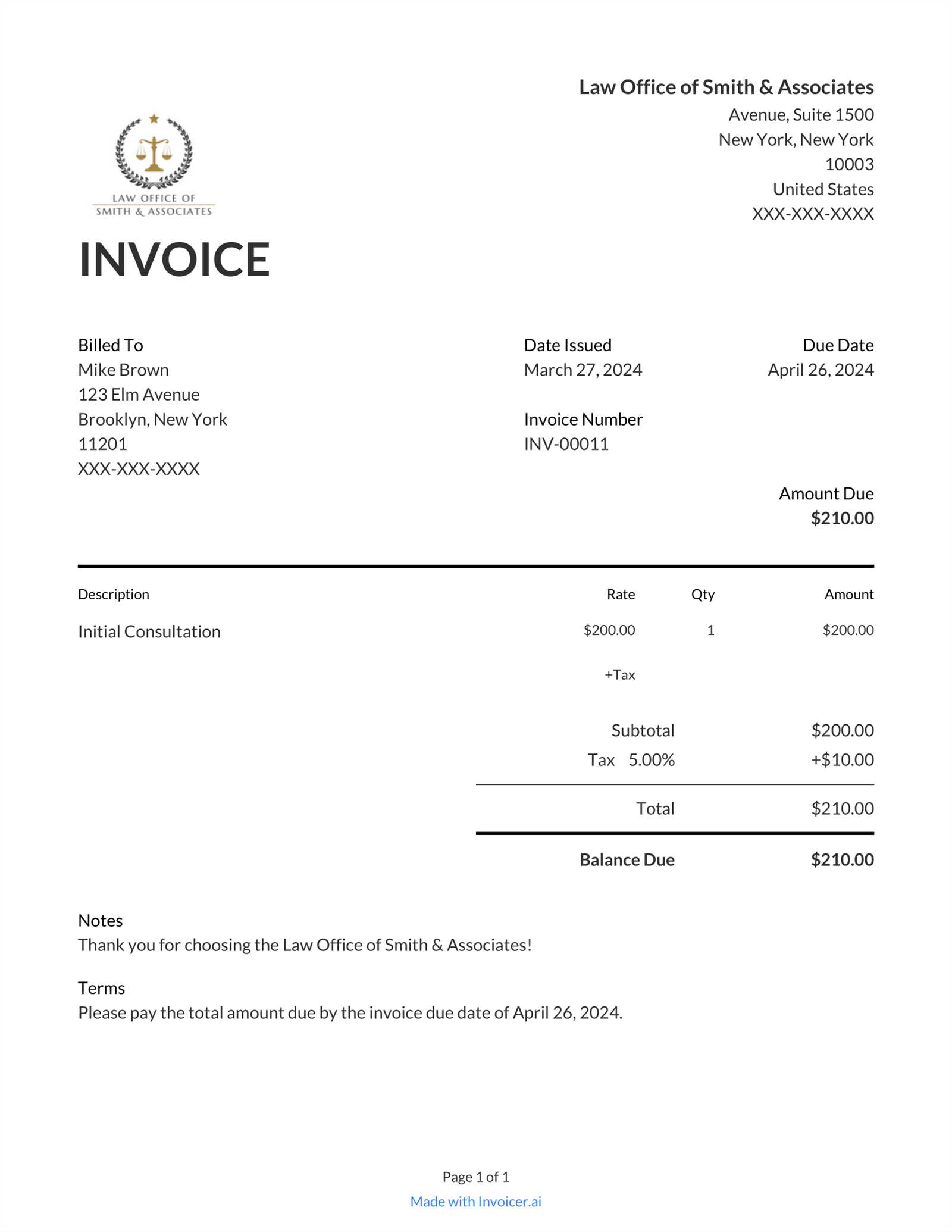

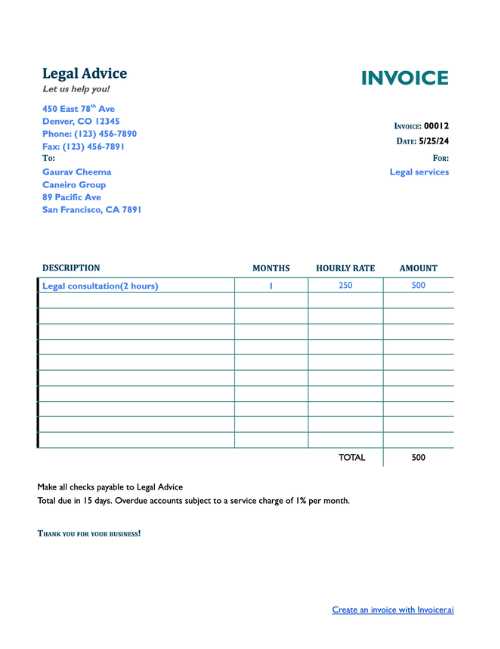

Key Components of an Invoice

To ensure accuracy and professionalism, a billing document must include certain essential elements. These components serve to clearly communicate the charges for services provided, along with the terms and conditions related to payment. A well-structured document not only avoids misunderstandings but also promotes efficient processing of payments.

Basic Information

At the very least, your document should include the following basic details:

| Component | Description |

|---|---|

| Contact Information | Names, addresses, and contact details for both the service provider and the client. |

| Invoice Number | A unique identifier for the document to help with tracking and reference. |

| Issue Date | The date the document is issued to the client. |

| Due Date | The date by which payment is expected. |

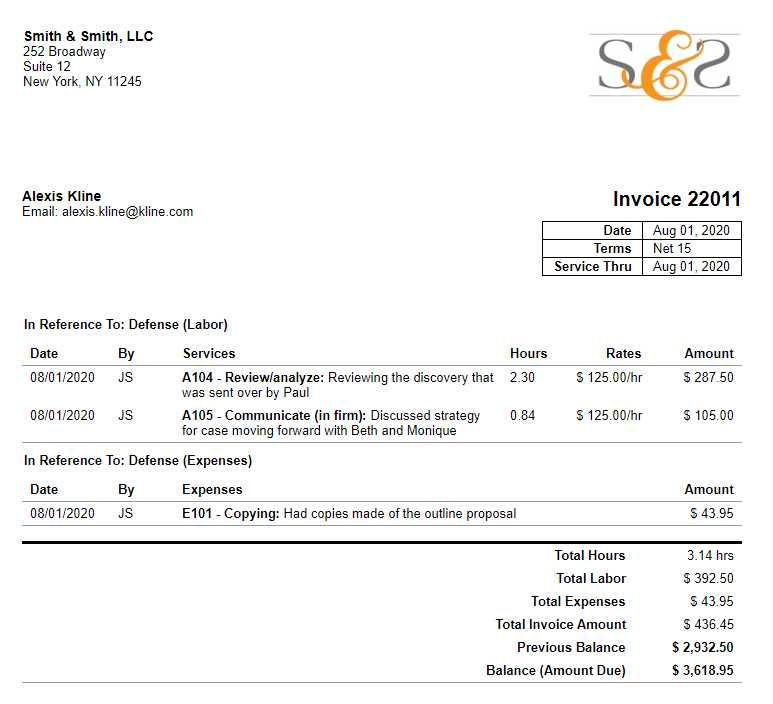

Service Details and Charges

Next, the document should outline the services rendered, with each task or product listed separately along with its cost. This detailed breakdown helps ensure transparency:

| Component | Description |

|---|---|

| Service Description | A clear explanation of the work performed or the product delivered. |

| Hourly Rate or Flat Fee | The agreed rate for each task or the fixed price for a service. |

| Additional Costs | Any extra charges, such as travel, materials, or administrative fees. |

| Subtotal | The sum of all charges before tax or discounts. |

By including these core components, you can ensure your billing documents are professional, accurate, and easy for clients to understand.

Customizing Your Billing Document

Personalizing your billing document allows you to tailor it to the specific needs of your practice while maintaining a professional and organized approach. By customizing the layout, content, and structure, you can better reflect the unique services you provide and enhance client satisfaction. A well-designed document not only improves the overall client experience but also streamlines the payment process.

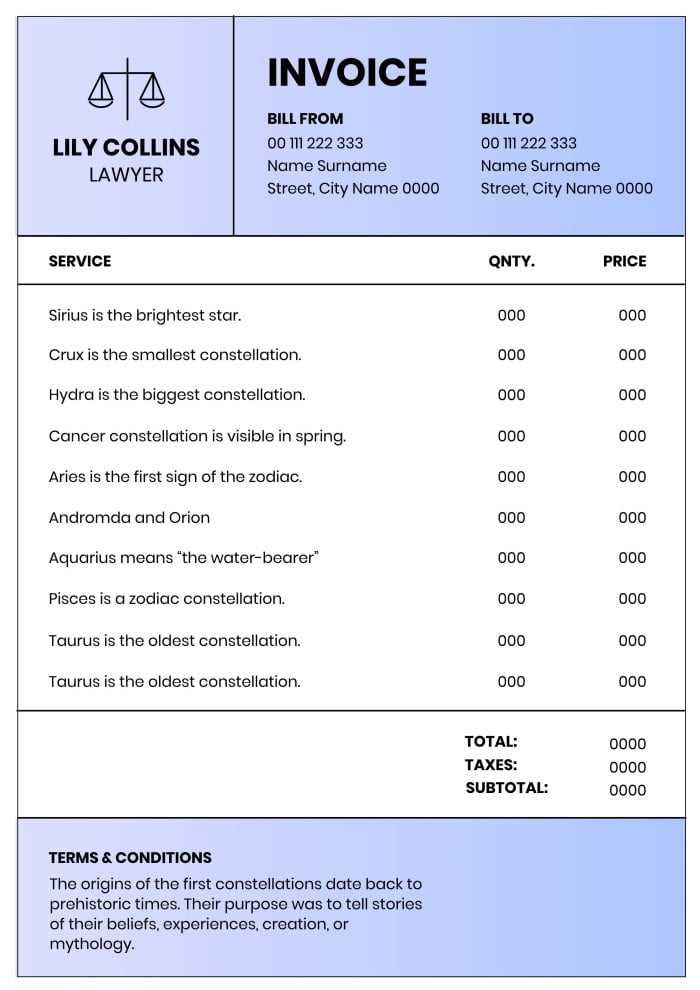

Adding Your Branding

One of the most effective ways to customize your billing document is by incorporating your branding elements. This could include your logo, color scheme, and business name in the header. Having these details prominently displayed helps to reinforce your brand identity and adds a polished, professional look to the document.

Adjusting Layout for Specific Needs

Depending on the nature of your practice, you may need to make adjustments to the layout. For example, if you deal with complex cases, you might want to provide a more detailed breakdown of services or charges. For recurring services, you may opt for a simplified format that allows for quick updates and easy tracking of ongoing work.

Customizing the content and appearance of your billing document can greatly enhance its functionality, making it not only a tool for payment collection but also a representation of your professional services.

Best Practices for Billing Clients

Implementing best practices when billing clients ensures smooth transactions and fosters positive relationships. Consistent and transparent billing can reduce misunderstandings, ensure timely payments, and promote long-term trust. By following a few key strategies, you can streamline the entire process and make your financial documentation both clear and professional.

Setting Clear Payment Terms

Before any work begins, it’s important to establish clear payment expectations. Communicating your terms upfront ensures there are no surprises later on. Consider the following:

| Payment Term | Explanation |

|---|---|

| Due Date | Specify the exact date the client is expected to make payment. |

| Late Fees | Inform clients about any penalties for overdue payments, if applicable. |

| Deposit Requirements | Consider requesting a deposit or retainer before starting work, especially for larger projects. |

Providing Detailed Breakdown of Charges

Transparency is key when it comes to billing. Always provide a detailed breakdown of services and fees so clients can easily understand what they are being charged for. This can include hourly rates, fixed fees, or any additional costs such as materials or administrative expenses.

By following these best practices, you can avoid confusion and ensure that both you and your clients are on the same page, resulting in timely payments and long-term business relationships.

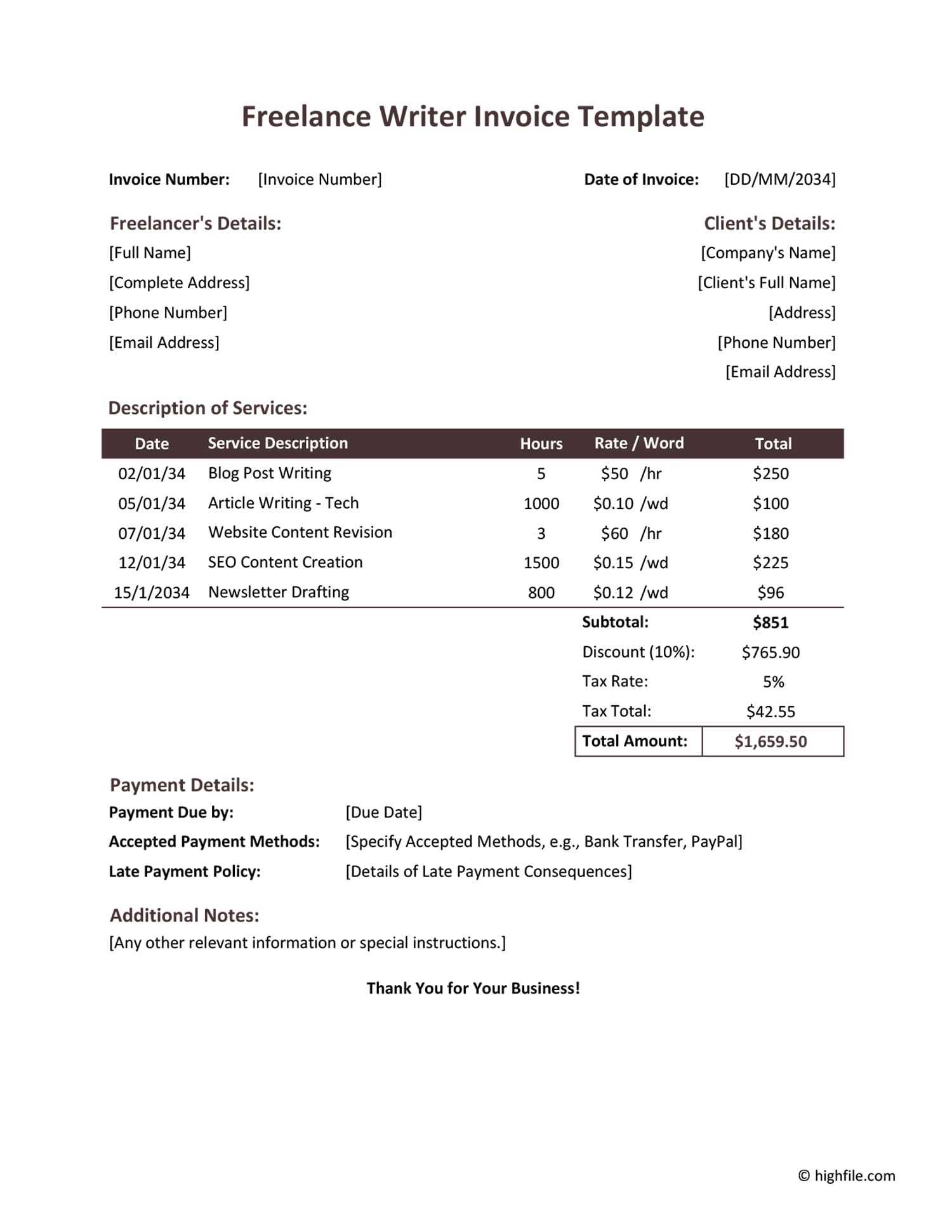

Legal Fee Structures Explained

Understanding the different ways professionals charge for their services is essential for both clients and service providers. A clear understanding of various fee structures helps avoid confusion and ensures that both parties are on the same page when it comes to payment expectations. Different pricing models may apply depending on the nature of the work, the complexity of the case, and the preferences of both the client and the service provider.

There are several common structures used for charging clients in professional practices:

- Hourly Rate – The client is billed based on the time spent working on their case or matter, with an agreed-upon rate per hour.

- Flat Fee – A set amount is charged for a particular service, regardless of the time or effort involved.

- Retainer – The client pays an upfront fee to secure services, with the provider drawing from it as work progresses.

- Contingency Fee – Payment is only made if a favorable outcome is achieved, usually a percentage of the settlement or award.

- Success Fee – This is similar to a contingency fee, but it may be combined with a base hourly or flat rate, where additional charges are paid if specific objectives are met.

Each structure has its own advantages and considerations, and choosing the right one depends on the nature of the service and the preferences of both the service provider and the client.

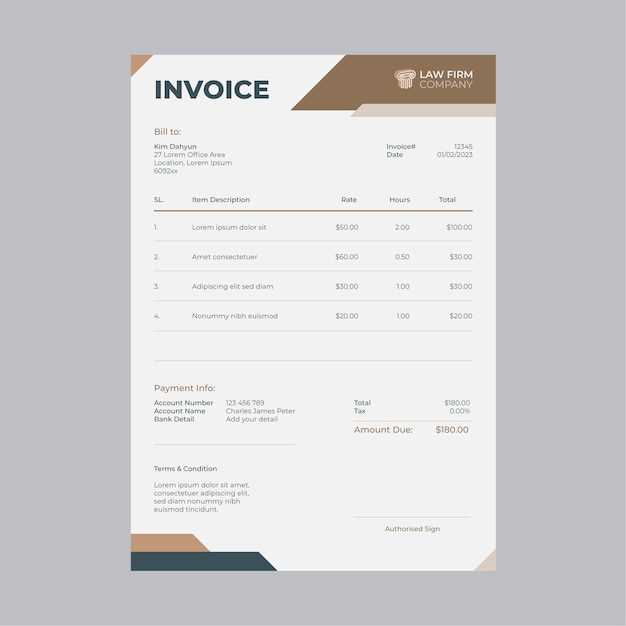

Choosing the Right Billing Format

Selecting the right format for your billing documents is essential for ensuring clarity, professionalism, and efficient payment processing. A well-organized format not only helps clients understand their charges but also reflects your business practices and can improve cash flow. The format you choose should be tailored to the complexity of the services provided, the preferences of your clients, and the nature of the payment terms.

Factors to Consider

When choosing the format, there are several key factors to take into account:

| Factor | Consideration |

|---|---|

| Service Type | Simple tasks may require a basic format, while complex projects may need more detailed itemization. |

| Client Preferences | Some clients may prefer a simple, straightforward layout, while others may require more detailed documentation for their records. |

| Payment Method | Depending on how payments are made (e.g., bank transfer, credit card), you may need to include specific information or payment instructions. |

| Legal Requirements | Certain jurisdictions may require specific information to be included on financial documents, such as tax identification numbers or specific payment terms. |

Popular Formats

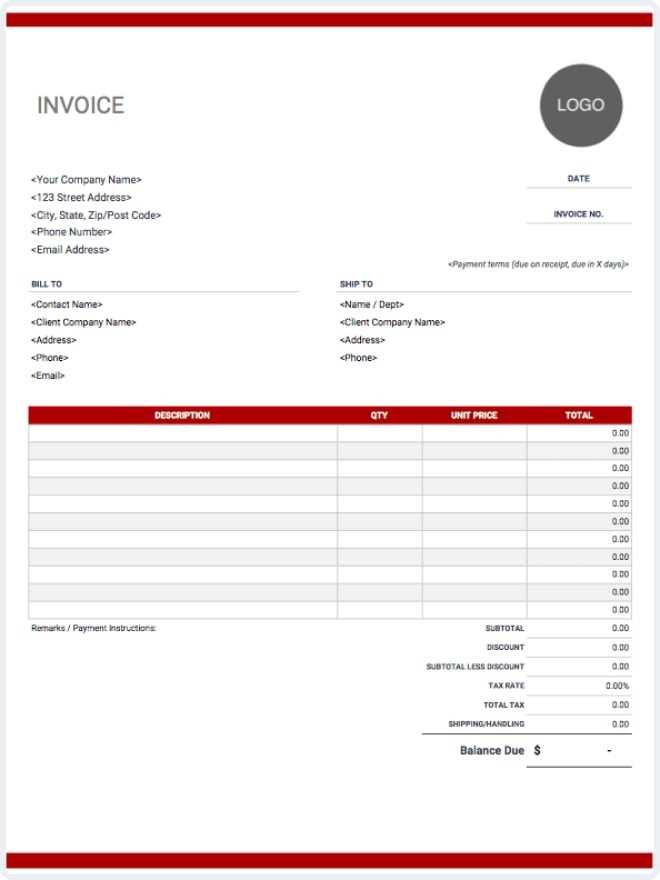

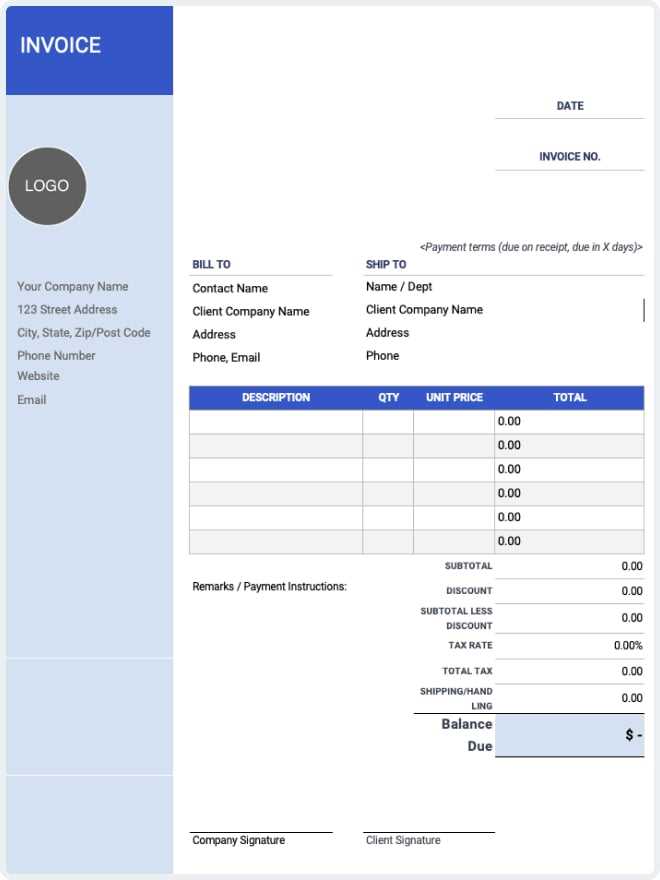

Common formats include:

- Basic Format – Ideal for straightforward services with minimal detail, often used for smaller tasks or repeat clients.

- Itemized Format – Best for more complex work where individual services, hours, or expenses need to be tracked and displayed clearly.

- Recurring Billing Format – Used for ongoing or subscription-based services where billing occurs on a regular schedule, such as monthly or quarterly.

Choosing the right format for your billing document will enhance professionalism, ensure client satisf

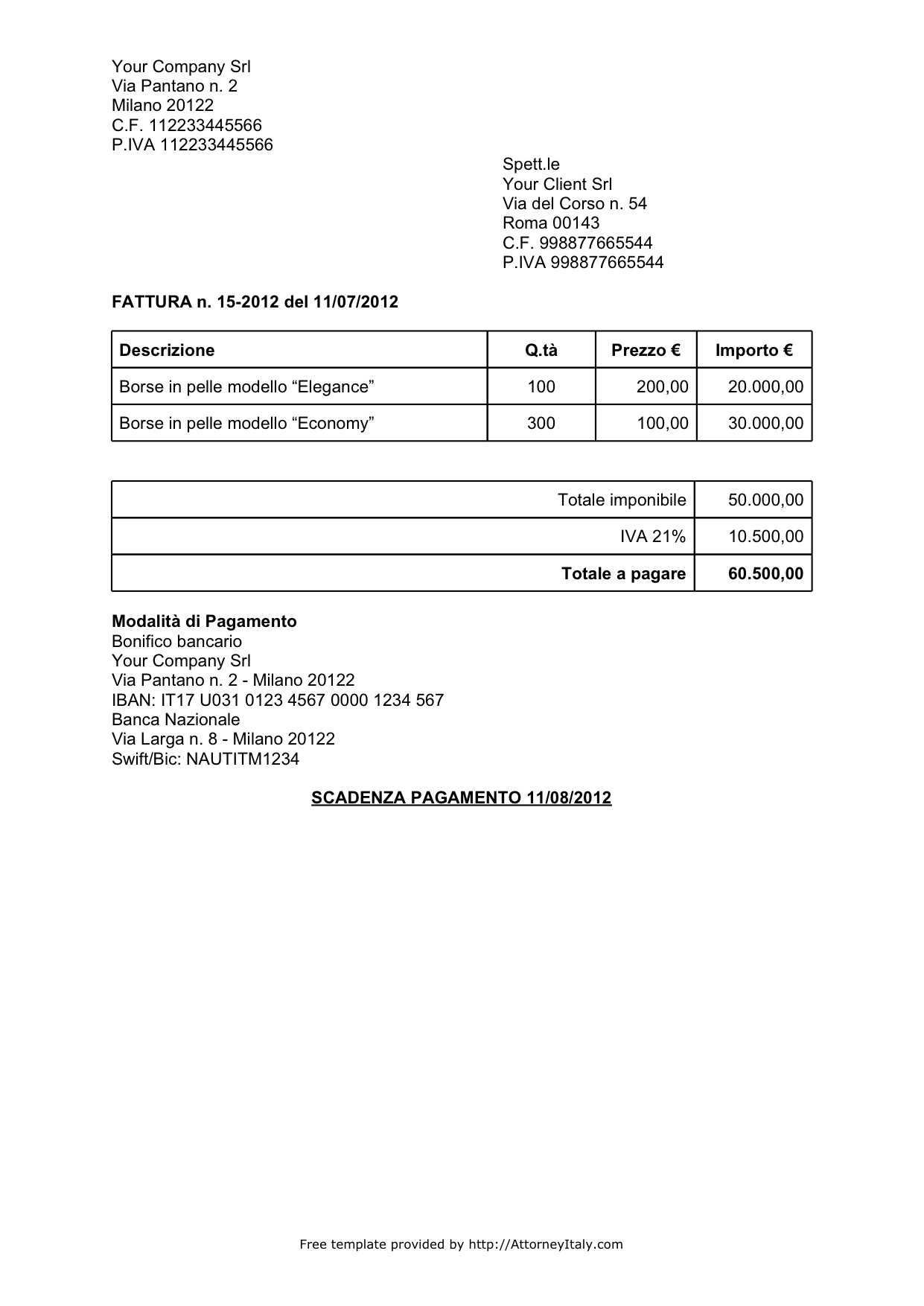

How to Include Disbursements and Taxes

When preparing financial documents for clients, it’s important to clearly show any additional costs, such as disbursements and applicable taxes. Including these details ensures transparency and prevents confusion regarding the total amount due. Properly itemizing these costs allows clients to understand exactly what they are being charged for and ensures that all expenses are accounted for in the final amount.

Disbursements typically refer to out-of-pocket expenses incurred during the course of providing services, such as filing fees, travel costs, or other third-party charges. Taxes, on the other hand, are mandatory levies imposed by the government based on the value of services rendered or products delivered. Both of these should be clearly distinguished and listed separately in the document.

Here’s how to include these items correctly:

- Itemize Each Disbursement – List each disbursement separately with a brief description and the cost. This helps clients understand exactly what the additional charges are for.

- Specify Tax Rates – Clearly state the applicable tax rates for the services provided. This includes sales tax, VAT, or any other relevant tax based on the jurisdiction.

- Separate Taxes and Disbursements – Ensure that taxes and disbursements are listed separately from the main charges. This makes it clear that these are additional costs that are not part of the core services rendered.

- Provide Total Breakdown – Include a final total that sums the services, disbursements, and taxes, ensuring that clients see the full amount due in one place.

By following these steps, you help to maintain a transparent and professional relationship with clients, minimizing any potential misunderstandings regarding the total cost of services provided.

Ensuring Accuracy in Billing Documents

Accuracy is essential when creating financial documents, as it directly impacts the professionalism and trust between you and your clients. Mistakes in calculations, dates, or details can lead to confusion, delays in payment, or even disputes. Taking the time to ensure all the information is correct helps maintain a smooth payment process and strengthens your reputation for reliability.

Here are some key tips for ensuring the accuracy of your billing documents:

- Double-Check Calculations – Always verify the math, especially when adding up charges, taxes, or disbursements. Small errors in totals can lead to bigger issues later.

- Review Client Information – Ensure that the client’s name, address, and contact details are correct to avoid any potential confusion or issues with payment processing.

- Use Consistent Billing Codes – If you use a code system to track services or costs, make sure the codes are accurate and up to date to avoid mistakes when listing services.

- Confirm Dates and Deadlines – Check that the dates, payment deadlines, and service periods are clearly stated and accurate. This helps clients understand when payment is due and what they are being charged for.

- Seek a Second Pair of Eyes – If possible, have someone else review the document before sending it out. A fresh perspective can catch errors that you may have overlooked.

By focusing on these areas, you ensure that your billing documents are accurate, professional, and easy for clients to understand, leading to timely payments and maintaining positive client relationships.

Managing Payment Terms Effectively

Clear and well-structured payment terms are crucial for ensuring timely and predictable cash flow. When both parties agree on when and how payments are expected, it reduces the risk of misunderstandings and disputes. Properly managing these terms can also foster trust, helping maintain positive relationships with clients while ensuring that your business operations remain financially stable.

Key Aspects of Payment Terms

When drafting payment conditions, several factors should be considered to avoid confusion and ensure smooth transactions:

- Payment Due Date – Clearly specify when payments are expected, whether it’s upon completion, within a certain number of days, or on a specific date.

- Late Fees – Include provisions for late payments, such as a percentage of the total due or a fixed fee after the payment deadline has passed. This encourages prompt settlement.

- Accepted Payment Methods – List the payment methods you accept, such as bank transfers, credit cards, or online payment platforms. This provides clarity on how clients can pay.

- Deposit Requirements – If applicable, specify whether an upfront deposit is required and the amount or percentage of the total fee.

Tips for Effective Management

Effectively managing payment terms involves more than just setting them–consistent follow-up and clear communication are key:

- Send Reminders – Prior to the due date, send a gentle reminder to clients, confirming the payment is due. This helps avoid any last-minute delays.

- Clarify Expectations Early – Clearly communicate payment expectations at the beginning of the project, so clients are aware of the terms from the outset.

- Be Flexible, But Firm – While it’s important to be accommodating in certain situations, ensure that your payment policies are still upheld to maintain healthy financial practices.

By managing payment terms effectively, you set the stage for a smoother financial experience for both you and your clients, helping ensure that business transactions are completed promptly and professionally.

Tracking Overdue Payments

Effectively managing overdue payments is essential for maintaining cash flow and ensuring that clients fulfill their financial obligations. Tracking overdue amounts allows you to stay on top of outstanding balances and take timely action before the issue escalates. By implementing a structured approach to monitor overdue payments, you can minimize disruptions and ensure financial stability for your business.

Steps for Tracking Late Payments

Here are some key steps to help you track overdue payments efficiently:

- Maintain a Clear Payment Schedule – Keep a record of payment due dates and follow up promptly when they are missed. A clear and organized schedule will help you track overdue amounts and avoid delays.

- Use Automated Reminders – Set up automated payment reminders to notify clients when payments are overdue. This reduces the need for manual follow-ups and ensures consistency in your communication.

- Monitor Payment History – Keep track of each client’s payment behavior. If clients regularly pay late, you can adjust the terms for future agreements or discuss the matter directly with them.

Actions to Take for Overdue Payments

If a payment becomes overdue, it’s crucial to take appropriate action to resolve the situation without damaging your relationship with the client:

- Send a Formal Reminder – If payment is not received by the due date, send a formal reminder with a polite but firm request for payment.

- Assess Late Fees – If your payment terms include late fees, assess them according to your agreement, and inform the client of the additional charge.

- Offer Flexible Payment Options – If a client is struggling to pay, consider offering an extended payment plan to help them settle their debt in manageable installments.

By staying proactive and organized in tracking overdue payments, you can reduce the risk of non-payment, maintain financial health, and build trust with your clients through clear and consistent communication.

Automating the Billing Process

Automation can significantly streamline the billing process, reducing the time and effort spent on manual tasks. By using software tools to automate recurring tasks, businesses can generate accurate, timely payment requests while minimizing human error. This not only saves time but also ensures consistency and helps maintain a professional workflow.

Benefits of Automation

There are several advantages to automating your billing procedures:

- Time Efficiency – Automated systems can generate billing documents in a fraction of the time it would take to do manually, freeing up valuable time for other business activities.

- Reduced Errors – By minimizing manual data entry, automation reduces the likelihood of mistakes such as incorrect amounts, dates, or client information.

- Consistency – Automation ensures that every bill generated follows the same format and includes all necessary details, leading to greater consistency across all transactions.

- Improved Cash Flow – With automated reminders and scheduled billing, payments are more likely to be made on time, improving cash flow and reducing late payments.

How to Implement Automation

Implementing automation requires careful planning and the right tools:

- Select Appropriate Software – Choose a billing platform or accounting software that offers automation features such as recurring billing, automatic reminders, and payment tracking.

- Set Up Recurring Billing – If you have regular clients, set up recurring billing cycles to automatically generate payment requests at predetermined intervals.

- Customize Payment Reminders – Customize your reminders to automatically notify clients of upcoming, overdue, or late payments, ensuring they stay informed without manual intervention.

By automating the billing process, businesses can achieve greater efficiency, reduce the administrative burden, and ensure timely payments, contributing to long-term financial success and client satisfaction.

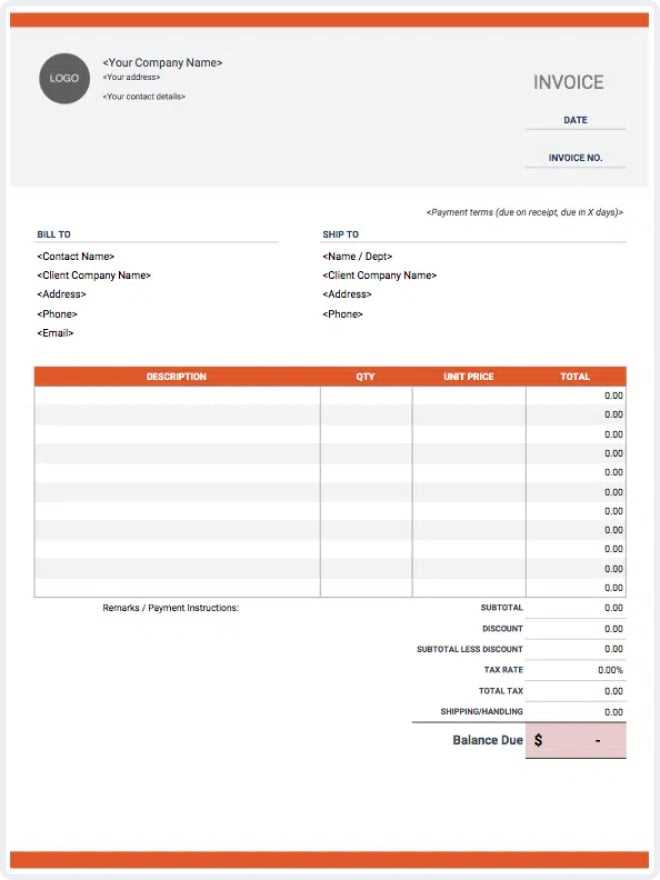

Creating Templates for Future Use

Developing reusable formats for future billing documents can save significant time and effort in the long run. By creating a standardized structure for your financial requests, you ensure consistency, reduce the chance of errors, and streamline your workflow. Templates allow you to maintain professionalism while focusing on the core tasks of your business.

Once established, a well-designed structure can be easily customized for individual clients or specific services, making it highly efficient for ongoing use. The key is to design a document that includes all necessary fields and aligns with your business needs, while also being adaptable for various situations.

Steps to Create Effective Templates

When designing templates for future use, keep the following points in mind:

- Include Essential Information – Ensure that each template has sections for client details, itemized services, rates, and payment terms to make it comprehensive and adaptable for any situation.

- Customize for Different Services – Create different versions of the template for various types of work or client agreements. This flexibility ensures you can tailor each document without starting from scratch.

- Save Time with Automation – Use document automation tools to quickly generate these pre-structured forms. With just a few clicks, you can create customized requests tailored to each client, speeding up the process.

By developing reusable formats, you can create a more efficient billing process, enhance the client experience, and reduce the time spent on repetitive administrative tasks.

Protecting Confidential Client Information

Maintaining the privacy and security of sensitive client data is critical for any business. When handling payment requests and financial records, it’s essential to take steps that protect personal, financial, and transactional information from unauthorized access or breaches. Implementing strong security measures ensures client trust and legal compliance while safeguarding your reputation.

Various strategies can be employed to protect confidential information, whether it’s stored digitally or in physical form. These measures prevent data loss, unauthorized access, and potential exploitation of sensitive details.

Key Strategies for Safeguarding Client Data

To effectively secure confidential information, consider implementing the following best practices:

- Encryption – Encrypt digital files and communications to ensure that sensitive data is unreadable to unauthorized users.

- Secure Access – Restrict access to confidential information by using password protection, multi-factor authentication, and permission-based access controls.

- Regular Backups – Regularly back up data to protect against loss due to system failures, cyber-attacks, or other unforeseen issues.

- Data Minimization – Only collect and store the minimum necessary information required for each transaction or interaction, reducing the potential impact of a breach.

Best Practices for Secure Communication

When sending or sharing sensitive information, ensure the following methods are in place:

- Secure Channels – Use encrypted communication channels such as secure email services or private file-sharing platforms.

- Limit Physical Access – For paper records, ensure they are stored in locked, secure areas with restricted access.

- Clear Labeling – Mark confidential information clearly and limit distribution to authorized individuals only.

By following these steps, businesses can ensure that they protect confidential client information, foster trust, and mitigate the risk of data breaches and security incidents.

Common Mistakes in Legal Billing

When managing billing processes, there are several common errors that can lead to confusion, delays, and even disputes with clients. These mistakes often stem from inadequate tracking, poor communication, or simple oversights that can affect payment timelines and client satisfaction. Avoiding these pitfalls is essential to maintain a professional image and ensure timely compensation for services rendered.

Recognizing these issues early on can help streamline operations and build stronger client relationships. Below are some of the most frequent mistakes to watch out for and how to address them.

Common Billing Errors

- Lack of Detailed Descriptions – Failing to clearly explain the services rendered can lead to confusion and disputes. It’s important to itemize each service or task with clear descriptions, including dates and hours worked.

- Incorrect Rates or Fees – Using incorrect hourly rates, flat fees, or missing discounts can result in clients questioning the accuracy of the charges. Always double-check the rates agreed upon in the contract before issuing any bills.

- Failure to Include Additional Costs – Disbursements, taxes, and any other extra costs should be included clearly in the billing statement. Not doing so can create misunderstandings and affect the timeliness of payments.

- Not Keeping Records Updated – Inconsistent record-keeping can lead to inaccuracies in billing. It’s crucial to track time and expenses in real time to avoid errors in the final statement.

Communication and Timing Issues

- Delayed Billing – Waiting too long to send bills can cause delays in payments. Regular billing intervals and prompt submissions are essential for cash flow management.

- Lack of Transparency – Not discussing payment terms and expectations up front can lead to confusion later on. Clear communication about rates, deadlines, and payment methods should be established from the outset.

- Overcomplicating the Billing Process – A complex or overly detailed invoice may overwhelm clients and delay payment. Keep the document simple, yet thorough, to ensure it is easily understood and processed.

By being mindful of these common billing mistakes, you can improve the efficiency and clarity of your financial processes, ensuring smoother transactions and happier clients.

How to Handle Client Disputes

Disagreements between service providers and clients are an inevitable part of business. Whether the dispute is over charges, services rendered, or payment terms, it’s crucial to address these issues professionally and promptly. Handling disputes effectively can help preserve the relationship and ensure continued business while minimizing the risk of future misunderstandings.

By staying calm, communicating openly, and following a structured process, you can resolve conflicts in a way that benefits both parties. Below are several strategies for managing client disputes related to billing or service issues.

Steps to Resolve Client Disputes

- Listen Carefully – The first step in resolving a dispute is to fully understand the client’s concerns. Listen attentively, ask clarifying questions, and make sure the client feels heard before offering any solutions.

- Review the Agreement – Check the initial agreement or contract to ensure that the terms are being met on both sides. If the dispute concerns the scope of services or payment, referring back to the terms can clarify any misunderstandings.

- Stay Professional – Keep emotions in check, even if the client is upset or angry. Maintain a calm, respectful tone and avoid becoming defensive. A professional attitude will help de-escalate tension and foster a productive discussion.

- Propose a Fair Solution – After understanding the issue, offer a fair solution that aligns with the terms of the agreement. If the client feels a mistake was made, consider offering a discount, refund, or adjustment where appropriate.

Preventing Future Disputes

- Clear Communication – Make sure all expectations are clearly outlined from the beginning of the working relationship. Establish payment terms, service details, and timelines early on to avoid confusion down the road.

- Detailed Documentation – Keep detailed records of communications, agreements, and work completed. This documentation can be invaluable if a dispute arises, serving as proof of what was agreed upon and what was delivered.

- Timely Invoicing – Sending invoices promptly and in a consistent format helps maintain transparency. If there are any discrepancies or issues with payments, clients are more likely to bring them up early, preventing larger conflicts.

By following these guidelines, you can resolve disputes efficiently while maintaining a positive working relationship with your clients, ensuring long-term success and trust.

Optimizing Your Invoicing Workflow

Efficient management of billing procedures is essential for any service-based business. Streamlining the entire process, from tracking work done to sending out statements, can save significant time and reduce the chance of errors. An optimized workflow allows for quicker payments, better client satisfaction, and less administrative stress.

By leveraging tools and adopting best practices, you can simplify your approach, ensure accuracy, and focus more on delivering quality services. Below are some key strategies for improving your billing workflow and making it more effective.

Automating Routine Tasks

Automation is one of the most effective ways to save time and reduce human error. By automating repetitive tasks, such as generating bills or calculating totals, you can ensure that your workflow remains efficient. Consider using specialized software that can handle the following:

- Automatic bill generation based on tracked time or services provided.

- Payment reminders to notify clients when payments are due or overdue.

- Recurring billing for clients with ongoing services or monthly fees.

Establishing Clear Billing Guidelines

Clear and transparent billing guidelines are crucial to avoiding confusion and disputes. By setting clear expectations from the outset, you can minimize misunderstandings regarding payment terms. Ensure that your clients are aware of:

- Payment deadlines and any late fees.

- Billing cycles and how often they will receive statements.

- Accepted payment methods and any associated fees.

Communicating these details up front helps both you and your clients stay organized and on track, leading to a smoother billing process.

By automating processes and maintaining clear communication, you can streamline your entire billing cycle and create a more efficient workflow that benefits both your business and your clients.