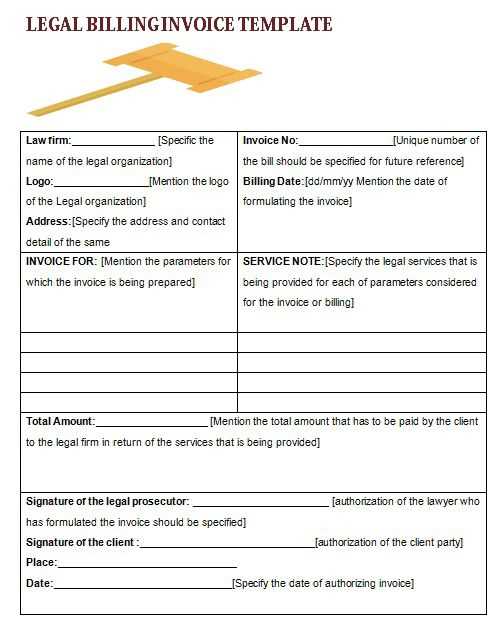

Law Firm Billing Invoice Template for Simplified Legal Invoicing

For any professional providing specialized services, managing payments accurately and promptly is crucial. Clear and detailed documentation helps both service providers and clients stay on the same page, ensuring transparency in financial transactions. It also reduces misunderstandings and potential disputes, which can arise from vague or incomplete records.

Creating a well-structured document for charging clients involves more than just listing services rendered. It requires careful attention to detail, including proper categorization of tasks, rates, and payment terms. By utilizing a standardized format, professionals can streamline the process and improve their workflow while maintaining a high level of professionalism.

In this article, we will explore the importance of having a consistent method for client charges, the essential components of such a document, and practical tips to customize it according to specific needs. Whether you are managing individual projects or recurring client relationships, having an effective system in place can save time and prevent unnecessary errors.

Professional Payment Documentation Format

Having a reliable and organized structure for documenting client payments is essential for any professional service provider. A standardized format ensures that both the service provider and the client have clear expectations and can track financial transactions effectively. A well-constructed record allows for easy reference and minimizes the chances of errors or misunderstandings related to charges.

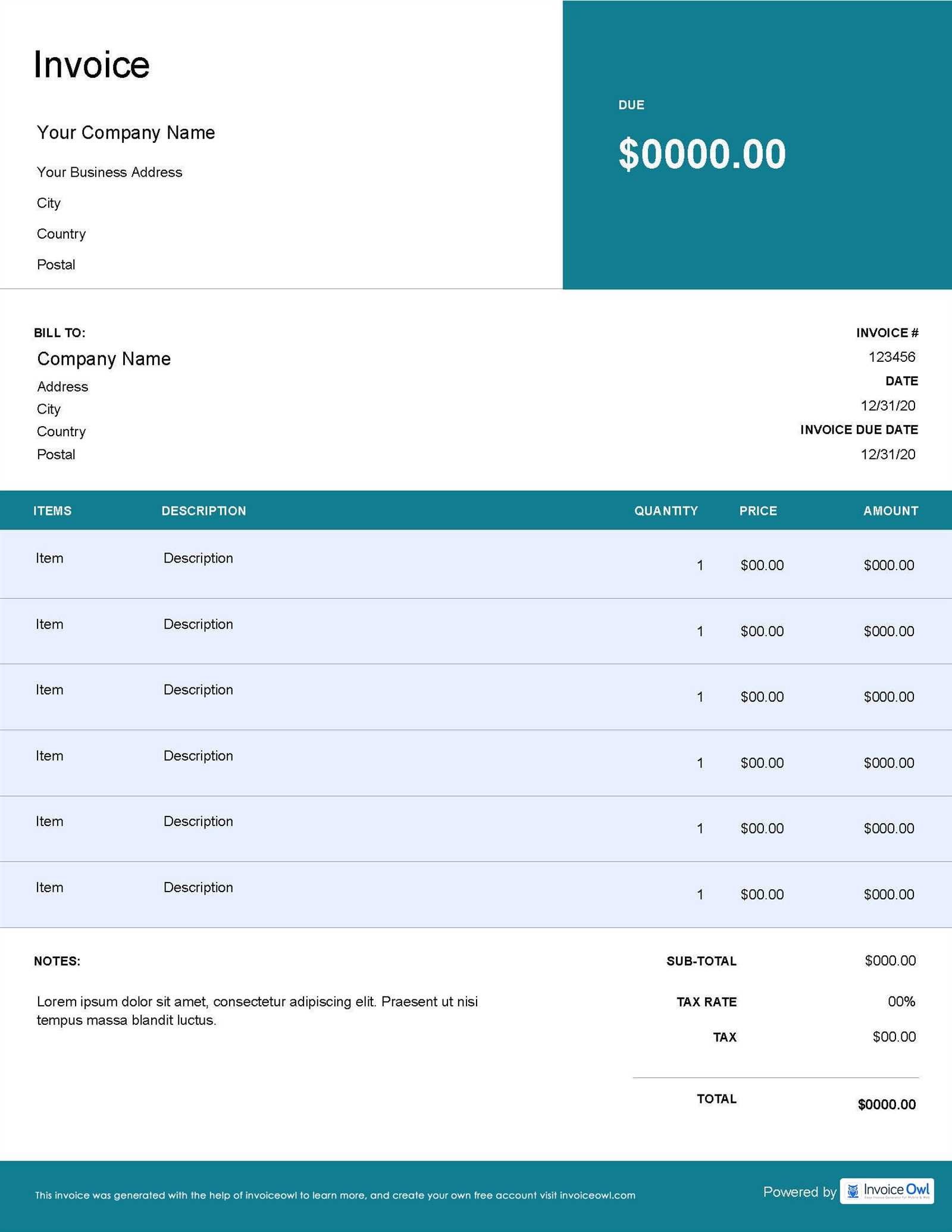

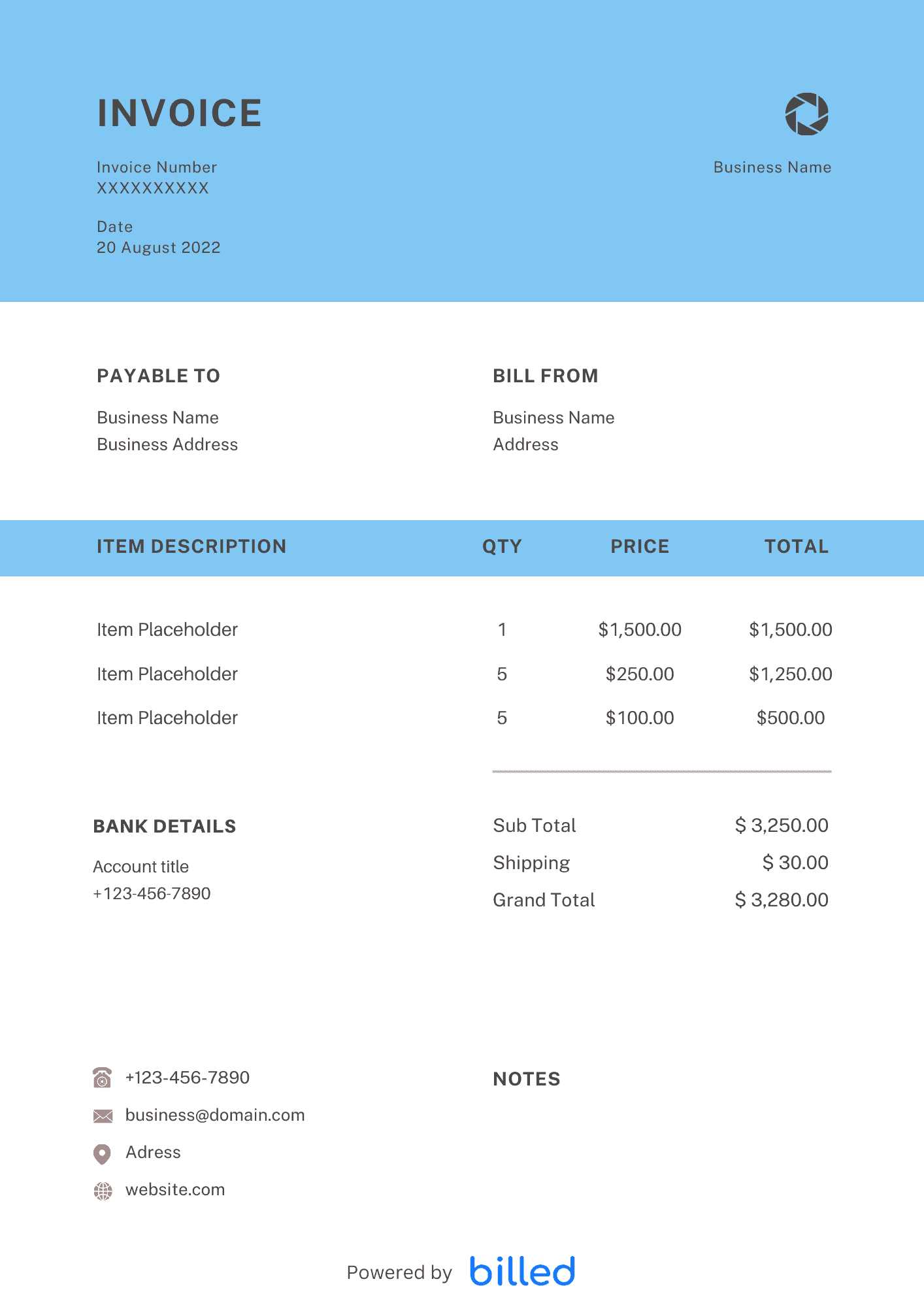

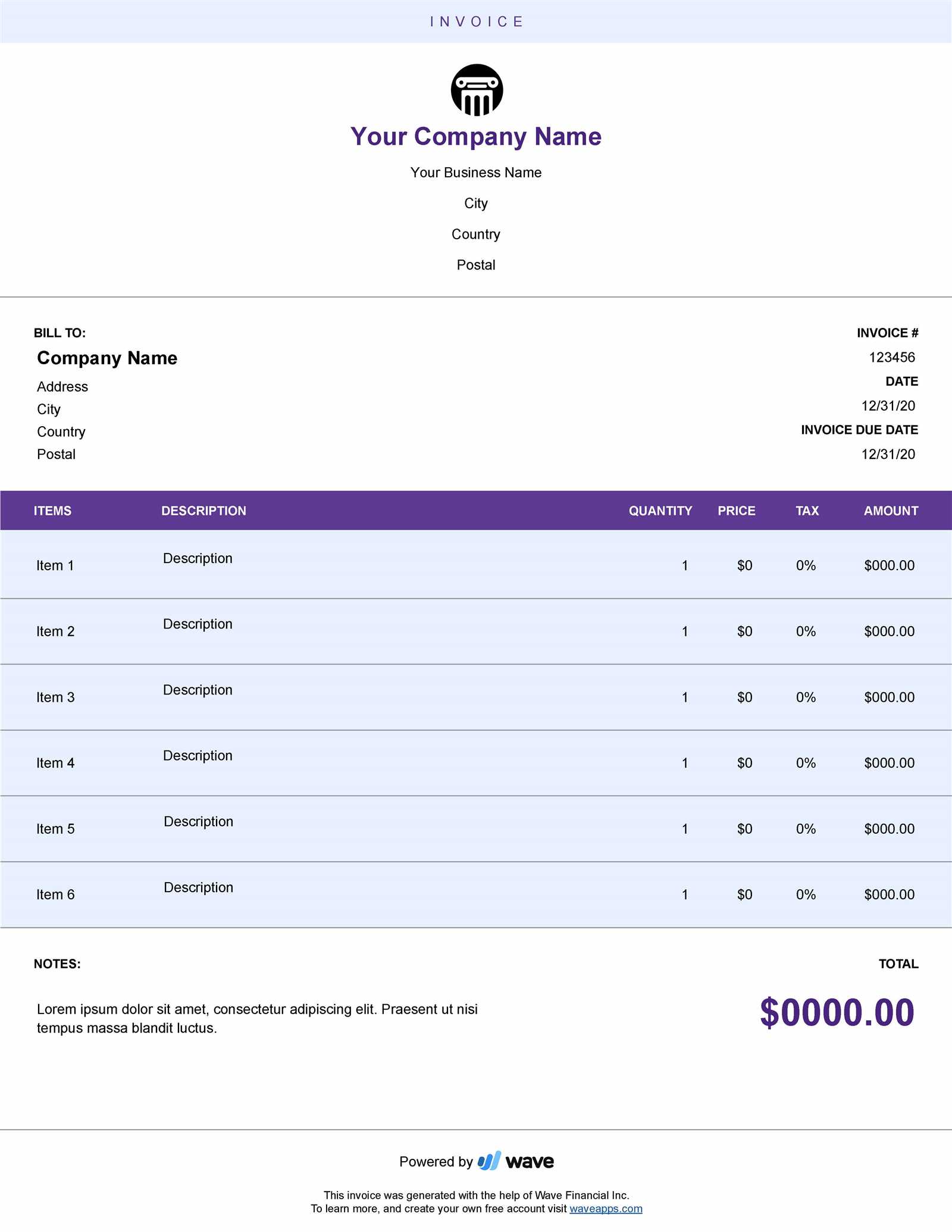

Below is an example of how a detailed payment statement could be laid out, with key sections that should be included for transparency and ease of use:

| Description | Rate | Hours | Total |

|---|---|---|---|

| Consultation | $150/hr | 2 | $300 |

| Document Preparation | $100/hr | 3 | $300 |

| Review of Evidence | $120/hr | 5 | $600 |

| Total | $1200 |

This format breaks down the services provided, the hourly rate, and the total amount for each task. Adjusting these sections based on the specifics of the work performed and the terms agreed upon ensures accuracy and clarity for both parties.

Why a Billing Template is Essential

Having a pre-designed structure for documenting payments is crucial for professionals who manage client accounts. A consistent format not only saves time but also ensures that all necessary details are captured accurately. Without a clear and organized method, there is a higher risk of mistakes, confusion, and missed information, which can result in delayed payments or disputes with clients.

With an established format, the process becomes more efficient, and service providers can easily track services rendered, rates applied, and payment terms. This helps maintain a professional image, as clients are more likely to trust an organization that provides transparent and well-organized financial records. Additionally, a standardized structure minimizes errors, prevents redundant work, and makes it easier to maintain consistency across multiple client accounts.

In sum, having a reliable system for documenting payments simplifies the entire process, improves client relationships, and ensures that both parties are on the same page regarding financial expectations.

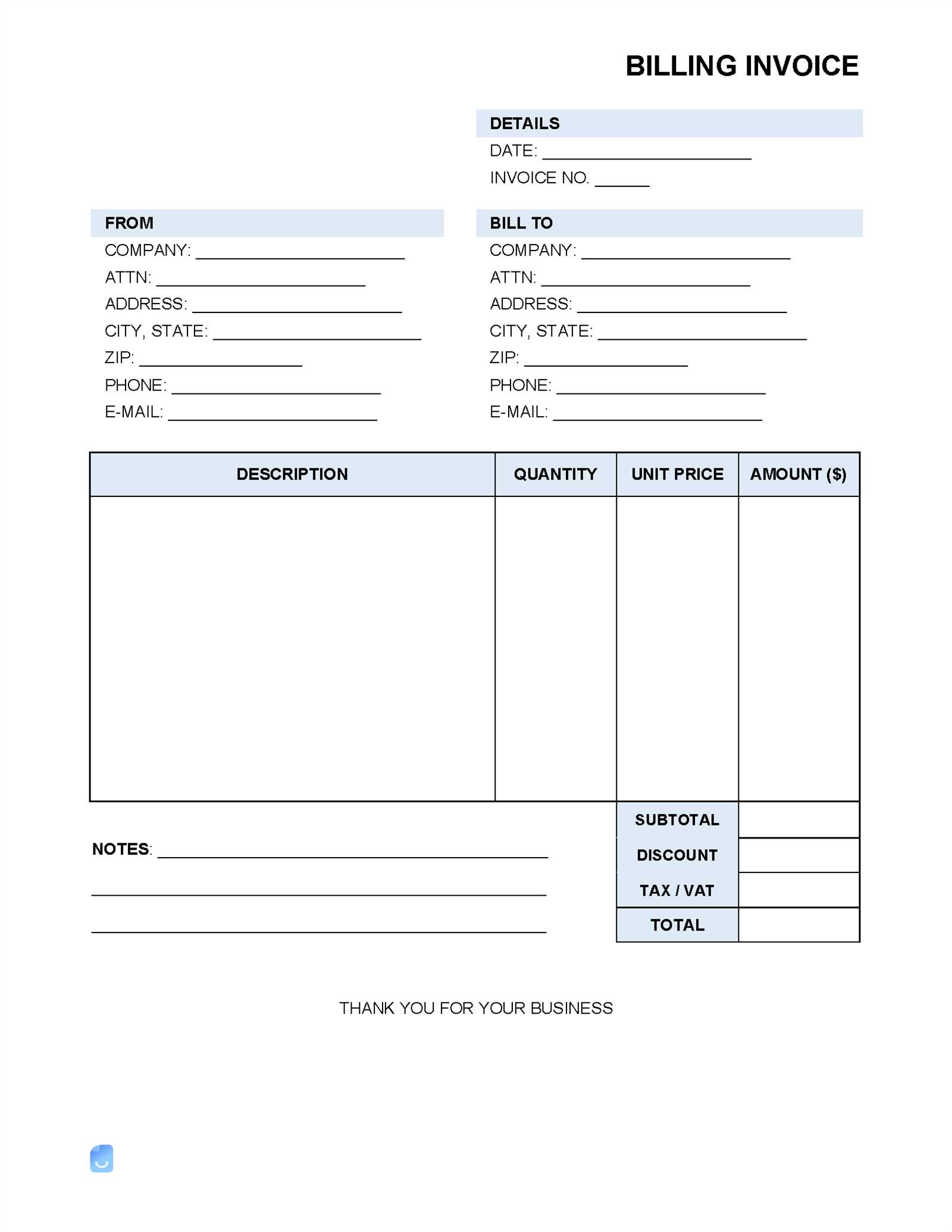

How to Create a Legal Invoice

Creating an accurate and professional document for client payments involves a clear structure and attention to detail. Whether you’re charging for consultations, document preparation, or any other services, it’s essential to include all the relevant information to ensure both clarity and compliance. A well-constructed payment record makes the transaction smooth for both parties and helps avoid misunderstandings.

Here are the key steps to follow when creating a payment record for professional services:

- Include Contact Information: Begin by listing your name or company name, address, phone number, and email. Then, provide the client’s contact information for reference.

- Detail the Services Rendered: Clearly list all the tasks or services provided, including dates and hours worked. Be specific about what each charge relates to.

- State Your Rates: For each service, include the applicable rate (e.g., hourly, flat fee, or retainer). If applicable, note any discounts or special terms.

- Calculate Total Amount Due: After listing the charges, sum them up to determine the total amount owed. Double-check the calculations to ensure accuracy.

- Specify Payment Terms: Include your payment terms, such as due dates, late fees, or acceptable payment methods (e.g., bank transfer, check, credit card).

- Provide Payment Instructions: Include clear instructions on how the client can make a payment, and any additional details such as account numbers or online portals.

By following these steps and ensuring all relevant information is included, you can create a professional payment document that keeps your financial records organized and fosters trust with your clients.

Key Elements of a Law Firm Invoice

When preparing a payment statement for services rendered, it is important to ensure that all critical details are included. A well-organized document not only ensures that both parties understand the charges but also helps to avoid disputes and delays. A clear, concise, and complete payment statement fosters professionalism and builds trust with clients.

Below are the key components that should be present in any professional service payment record:

- Contact Information: Include both your details and the client’s, such as names, addresses, and phone numbers. This ensures that both parties can easily reach one another if necessary.

- Invoice Number: Assign a unique identifier to each statement for easy tracking and future reference.

- Service Description: Clearly list the tasks completed, with details such as the date and nature of the work. This section should be as detailed as necessary to ensure clarity.

- Hourly Rates and Fees: If applicable, specify the hourly rate, flat fees, or any other charges. This helps clients understand how the final amount is calculated.

- Total Amount Due: Clearly state the total charge, ensuring it reflects the sum of all services rendered, applicable taxes, and other fees.

- Payment Terms: Include any terms related to payment, such as deadlines, penalties for late payments, or discounts for early payments.

- Payment Instructions: Provide clear instructions on how the client can pay, including acceptable methods (e.g., credit card, bank transfer, checks) and payment details if necessary.

Including these essential elements helps maintain transparency, ensures smooth transactions, and makes it easier for both parties to stay organized and on track.

Customizing Your Billing Template

Tailoring your payment documentation to meet the specific needs of your practice or services is crucial for maintaining efficiency and professionalism. By customizing your format, you ensure that the document reflects your unique approach and provides clients with a clear, consistent way to understand charges. A personalized structure can also help streamline processes and enhance communication.

Adding Specific Service Categories

One of the most important customization steps is creating categories that match the services you provide. Whether you’re offering consultations, document preparation, or any other specialized task, having well-defined sections for each service can make your records easier to understand. Each category should have a description, rate, and time spent, helping clients see exactly what they’re being charged for.

Branding and Professional Appearance

Customizing the look and feel of your payment statement is another way to make it stand out. Adding your logo, using professional fonts, and choosing an appropriate color scheme can enhance the document’s appearance and align it with your branding. A polished design contributes to your credibility and ensures your payment records reflect the high standard of service you provide.

With these adjustments, you create a document that not only meets legal or professional standards but also suits your specific needs and style. A personalized format adds value by improving client experience and ensuring that every detail is covered.

Benefits of Using a Template

Utilizing a pre-designed structure for documenting client charges offers a range of advantages that can improve both the accuracy and efficiency of the process. Whether you’re handling one-time projects or ongoing client relationships, having a consistent format simplifies the creation of detailed records. It ensures that no important information is overlooked and reduces the chances of errors.

Time Efficiency and Consistency

One of the primary benefits of using a ready-made format is the time saved. Instead of starting from scratch with each new client or project, a structured layout allows for quick adjustments and updates. This means less time spent on formatting and more focus on the actual services provided. Additionally, using the same structure consistently ensures uniformity across all client records, which can be particularly useful when handling multiple accounts.

Minimized Risk of Errors

With a standardized structure, the chances of missing key details or making mistakes are significantly reduced. Every field is already labeled and organized, so you won’t forget to include critical information such as service descriptions, rates, or payment terms. This leads to clearer communication with clients and reduces the likelihood of misunderstandings or disputes.

Overall, having a pre-designed system for managing payments streamlines workflows, enhances professionalism, and ensures that all necessary details are included every time, making the entire process smoother for both you and your clients.

Common Mistakes in Legal Invoices

While creating a clear and accurate payment statement is essential, many professionals overlook key details, leading to mistakes that can cause confusion or delays. Common errors in payment documentation can lead to disputes, dissatisfaction, or even delayed payments. By understanding and avoiding these mistakes, you can improve the quality of your financial records and enhance client relationships.

Missing or Inaccurate Contact Information

One of the most common mistakes is omitting or incorrectly listing client or service provider contact details. This may seem trivial, but without proper contact information, it becomes difficult for clients to reach out with questions or concerns. Always double-check names, addresses, phone numbers, and email addresses before sending out the record.

Unclear Descriptions or Unitemized Charges

Another frequent issue is providing vague descriptions or failing to break down charges into individual items. Clients should be able to see exactly what they are paying for, whether it’s for time spent on consultations, document drafting, or other specific services. Failing to provide enough detail can lead to confusion and cause clients to question the charges. Be specific and transparent about what each line item represents.

By addressing these common errors, you can ensure that your payment documentation is professional, clear, and free from misunderstandings, ultimately improving client satisfaction and timely payments.

Understanding Invoice Terms for Lawyers

In the professional services industry, clear financial documentation is essential to maintaining transparent and smooth relationships with clients. For those offering specialized services, such as legal consultation or representation, it’s crucial to understand the terms and conditions associated with payment statements. Properly defining and outlining these terms not only helps in ensuring timely payments but also minimizes confusion or disputes regarding charges.

Here are some important terms that should be included and understood when preparing a payment document:

- Payment Due Date: Specify when the payment is expected. This is critical for ensuring that clients are aware of the deadline and understand any consequences for late payments.

- Hourly Rate: Clearly outline the rate charged per hour of work. This is especially important for services rendered on an hourly basis, as it gives clients insight into how their charges are calculated.

- Flat Fees: For services that are charged at a fixed rate (such as for specific tasks or packages), ensure that this is clearly stated. This helps clients understand exactly what they are paying for, without the need to calculate time spent.

- Retainer Fees: If a client has paid an advance retainer, outline the amount used and the remaining balance. This helps both parties track the usage of funds and avoid confusion.

- Late Fees: Include any penalties that may apply if the payment is not received by the specified due date. Being clear about these terms can help avoid delays and enforce timely payment.

- Payment Methods: Specify acceptable methods of payment, whether it’s via bank transfer, check, or credit card. This ensures that the client knows how they can settle the balance.

By understanding and clearly communicating these key terms, you ensure that clients have a complete understanding of the charges and expectations, leading to a smoother financial transaction process and fewer misunderstandings.

Best Practices for Legal Billing

Managing client payments efficiently is vital for any professional providing specialized services. A transparent and structured approach ensures smooth financial transactions and helps avoid misunderstandings. Adopting best practices for creating and managing payment statements can improve your workflow, enhance client trust, and reduce administrative issues.

Clear and Detailed Documentation

One of the most effective ways to avoid confusion and disputes is to provide clear, detailed descriptions of services rendered. For each service or task, include specifics such as the time spent, the nature of the work, and the corresponding charge. Clients should never have to guess what they are being billed for. By being transparent about the charges, you not only prevent misunderstandings but also demonstrate professionalism.

Timely and Consistent Communication

Consistency in how and when you send out financial records is essential for maintaining a smooth billing cycle. Ensure that invoices are sent out promptly after services are rendered and that clients are kept informed about the status of their accounts. Additionally, make sure to communicate your payment terms clearly, including deadlines, late fees, and available payment methods.

By following these best practices–clarifying charges and maintaining timely communication–you can streamline your payment process and maintain positive client relationships. Well-managed financial documentation reduces administrative stress and fosters trust, ensuring that your practice runs smoothly and efficiently.

Integrating Time Tracking with Invoices

Accurate time tracking is essential for any professional service provider who charges clients based on the amount of time spent on a project. By integrating time tracking directly into your payment documentation process, you can ensure that your charges are based on real data, reducing errors and increasing transparency. This integration helps create a seamless workflow that can streamline your financial management and improve client satisfaction.

Benefits of Time Tracking Integration

Integrating time tracking with your payment statements offers several key benefits:

- Increased Accuracy: Automatically capturing the time spent on each task ensures that no hours are missed, reducing the risk of overcharging or undercharging clients.

- Efficiency: With automated tracking, there’s no need to manually calculate time entries or transfer data into a separate document. This saves time and effort in preparing payment records.

- Transparency: Clients can see exactly how their time is being billed, which increases trust and minimizes the chance of disputes over charges.

- Consistency: Time tracking tools ensure that each entry follows a consistent format, which can make your records more professional and easier to understand.

How to Integrate Time Tracking with Payment Statements

To effectively integrate time tracking with your payment statements, consider the following steps:

- Choose a Time Tracking Tool: Select a software tool that allows you to track time easily and accurately. Many tools allow you to log hours directly into an invoice template, streamlining the process.

- Define Your Billing Intervals: Determine how you will track and bill time–whether in increments of 15, 30, or 60 minutes. Set these intervals in your tracking software to match your payment structure.

- Link Time Entries to Specific Tasks: Ensure that each time entry is linked to a specific task or service. This makes it easier to generate clear descriptions in your payment records.

- Review and Adjust Before Sending: Double-check the logged hours for accuracy and adjust if necessary before finalizing the payment statement. Ensure that everything aligns with your agreed-upon rates.

By seamlessly integrating time tracking into your payment process, you ensure greater accuracy, efficiency, and professionalism, leading to better client relationships and smoother financial management.

Automating Law Firm Invoices

Automating the process of creating and sending payment statements can significantly enhance efficiency, accuracy, and consistency. By using specialized software to handle financial documentation, professionals can save time and reduce the likelihood of errors. Automation ensures that all required fields are populated correctly, minimizes manual work, and speeds up the entire process, allowing more time to focus on client work and other important tasks.

Benefits of Automation

There are several advantages to automating the payment documentation process:

- Time Savings: Automation eliminates the need for repetitive tasks such as manual entry of charges, client details, and service descriptions. The system can quickly generate statements based on pre-set criteria.

- Consistency and Accuracy: Automated systems ensure that every record follows a consistent format, reducing the risk of missing information or errors in calculations.

- Improved Cash Flow: With automated reminders and payment scheduling, clients are more likely to pay on time, improving your cash flow and reducing overdue accounts.

- Customization: Most automated systems allow customization, so you can tailor payment records to reflect your specific rates, terms, and branding, ensuring each document meets your professional standards.

How to Implement Automation

To effectively automate your financial documentation process, follow these steps:

- Choose the Right Software: Look for software that integrates time tracking, service descriptions, and payment management into one platform. Ensure it aligns with your workflow and billing requirements.

- Set Up Templates and Preferences: Customize the software to match your specific needs, such as setting hourly rates, payment terms, and automated reminders for overdue payments.

- Link to Time Tracking Systems: If you use a time-tracking tool, integrate it with your payment system to automatically populate time entries, ensuring consistency and reducing manual entry.

- Review and Finalize: While automation streamlines the process, always review each payment document for accuracy before sending it to clients. Automated systems should still allow for a final review step to ensure everything is correct.

By automating the creation and management of payment records, you not only improve your operational efficiency but also provide a smoother and more professional experience for your clients, resulting in fewer administrative tasks and faster, more reliable payments.

Handling Client Disputes Over Billing

Disagreements over payment statements are an unfortunate but common aspect of professional services. Whether it’s a misunderstanding regarding the charges, a dispute over the time spent, or confusion about services provided, how you handle these situations can make all the difference. Resolving billing issues effectively is crucial for maintaining strong client relationships and protecting your reputation.

Stay Calm and Professional

When a client disputes a payment record, it’s important to remain calm and professional. Avoid becoming defensive or dismissive of their concerns. Instead, listen carefully and ask clarifying questions to understand the root of the problem. An open, respectful dialogue is key to resolving the issue smoothly.

Review the Documentation

Before responding to the client, review the payment record carefully. Double-check all details, such as the services listed, hours worked, rates applied, and payment terms. Ensure that everything aligns with what was agreed upon and that no errors were made in your documentation. If you find an issue, promptly correct it and communicate the changes to the client.

Provide Clear Explanations

Once you’ve reviewed the details, explain the charges to the client in a clear, concise manner. Break down the payment record by service or task, providing context for each charge. If time was logged or specific work was completed, clarify how those details are reflected in the payment. Transparency helps build trust and can ease the client’s concerns.

Offer Solutions

If the dispute stems from a legitimate issue or misunderstanding, consider offering a solution that benefits both parties. This could include adjusting the amount due, offering a payment plan, or providing a partial refund if applicable. In cases where no error is found on your part, it may be helpful to reiterate the terms of the agreement or contract, emphasizing the fairness of the charges.

Document All Communications

Throughout the resolution process, make sure to document all communications with the client. This includes emails, phone calls, and any other correspondence related to the dispute. Having a record of your interactions can help clarify the situation if further issues arise and ensures that you have a clear trail of how the matter was resolved.

By handling payment disputes with professionalism, clarity, and a willingness to find a fair solution, you can turn a potentially negative situation into an opportunity to strengthen the relationship with your clients. Effective communication is key to preventing misunderstandings and maintaining a positive reputation.

Ensuring Compliance in Legal Billing

Maintaining compliance in payment documentation is essential for service providers to avoid legal issues, disputes, and penalties. Proper adherence to industry standards and client agreements ensures transparency, fairness, and accountability in all financial transactions. Understanding and implementing the necessary guidelines helps protect both the service provider and the client, fostering trust and minimizing the risk of compliance-related problems.

Understanding Legal and Ethical Guidelines

There are several legal and ethical standards that professionals must follow when creating payment records. These can vary by jurisdiction, but they generally include ensuring that all charges are reasonable, accurately described, and in line with the terms outlined in any client agreements or contracts. Being aware of and adhering to these regulations not only helps avoid penalties but also builds a reputation for ethical conduct.

Key Compliance Areas to Consider

- Transparency: Ensure that all charges are clearly itemized and explained, avoiding hidden fees or unclear descriptions. Clients should always know what they are paying for and why.

- Accuracy: Double-check all information for errors, including hours worked, service descriptions, rates, and payment terms. Misleading or incorrect information can lead to legal complications.

- Agreed-Upon Rates: Stick to the rates specified in your contract or agreement with the client. If changes are necessary, make sure they are properly communicated and agreed upon in writing.

- Timely Submission: Submit your payment statements within the agreed-upon time frame. Delayed billing can affect the timeliness of payments and may violate certain professional standards.

By staying informed and following established guidelines, professionals can ensure that their payment practices remain compliant, reducing the risk of disputes and enhancing the overall service experience for clients.

Managing Hourly vs Flat Rate Invoices

When it comes to charging clients for services, professionals often choose between two main pricing models: hourly rates and flat fees. Both methods have their advantages and challenges, and deciding which one to use can depend on the type of service being provided, the client’s needs, and the nature of the work. Understanding how to effectively manage both approaches can help ensure clear, accurate, and fair payment statements.

Hourly Charges

Hourly billing is often used for services that require variable amounts of time or that are difficult to predict in advance. This model provides flexibility, but it also requires careful tracking of time to ensure accuracy. Here are some key considerations when managing hourly charges:

- Clear Time Tracking: It’s essential to track the exact amount of time spent on each task. Use reliable software or tools to log hours to prevent errors.

- Breakdown of Tasks: Clearly itemize the time spent on each activity, making it easier for clients to understand what they are paying for.

- Rate Transparency: Ensure that the agreed-upon hourly rate is communicated upfront and is clearly stated in the payment document.

- Billing Intervals: Determine the billing intervals (e.g., in 15-minute increments) to provide consistency and fairness in how time is charged.

Flat Fees

Flat rate billing is typically used when the scope of the service is clearly defined, and both parties agree on a fixed price for the entire project or task. This approach offers predictability and simplicity but requires careful planning to ensure the price accurately reflects the amount of work involved. Consider the following when managing flat fee charges:

- Clearly Defined Scope: Clearly define what is included in the flat fee and ensure both you and the client understand the scope of work to avoid disagreements later.

- Upfront Agreement: Agree on the flat rate in advance and make sure it’s reflected in the client’s contract or agreement.

- No Surprises: Ensure that there are no additional charges unless they are clearly specified in the contract or agreed to in writing during the course of the project.

Managing Both Models Simultaneously

Many professionals use a combination of hourly and flat-rate charges depending on the nature of the wo

Setting Payment Terms in Legal Invoices

Establishing clear and fair payment terms is crucial for maintaining a professional and transparent relationship with clients. Well-defined payment terms help set expectations, ensure timely compensation, and minimize the risk of misunderstandings or disputes. Whether your payment terms are based on a fixed schedule, milestones, or time worked, having a structured approach is key to smooth financial transactions.

Key Considerations When Setting Payment Terms

To ensure both parties understand and agree to the payment expectations, consider the following factors when establishing payment terms:

- Due Dates: Specify when payment is expected. Common terms include “due upon receipt,” “net 30,” or “net 60,” which indicate the number of days after the client receives the statement when payment should be made.

- Late Payment Penalties: Include provisions for late payments, such as interest charges or flat fees, to encourage timely settlement and protect your cash flow.

- Accepted Payment Methods: Clearly outline the methods of payment you accept (e.g., bank transfer, credit card, online payment platforms) to make it easy for clients to pay promptly.

- Deposit Requirements: For larger projects or ongoing services, you may require an upfront deposit before beginning work. This can help ensure commitment from the client and reduce the risk of non-payment.

Flexible Payment Plans

In some cases, clients may require more flexibility in how they pay. Offering installment or payment plan options can make your services more accessible and can also help clients manage their cash flow. When offering flexible payment terms, keep the following in mind:

- Clear Milestones: Define the payment schedule by milestones or deliverables. For example, you can request partial payments at the completion of certain phases of the project or after specific tasks are completed.

- Set Deadlines for Each Installment: Establish clear due dates for each installment to avoid confusion and ensure a steady flow of payments throughout the project.

- Be Transparent About Terms: Make sure all payment terms are clearly outlined in your agreement with the client, including any potential consequences for missed payments.

By setting clear, transparent payment terms, you can help avoid payment delays, maintain a positive relationship with your clients, and ensure the financial health of your practice or business. Always ensure that your terms are agreed upon in writing to a

Design Tips for Professional Invoices

Creating a well-designed payment statement not only ensures clarity but also reflects professionalism and attention to detail. A clean, organized, and visually appealing document can help your clients understand the charges and make the payment process smoother. Here are some essential design tips to consider when crafting a professional document for your services.

Keep It Clear and Organized

The primary goal of a professional payment record is to convey information clearly and concisely. To achieve this, follow these guidelines:

- Simple Layout: Use a straightforward structure with clearly defined sections. Avoid clutter by leaving enough white space around text and headings.

- Consistent Font Usage: Choose professional and easy-to-read fonts. Use a consistent font style throughout the document to maintain a uniform look.

- Section Headings: Include bold headings for each section (e.g., Client Details, Services Rendered, Payment Terms) to make the document easy to navigate.

Use Clear Visual Hierarchy

Proper use of visual elements can help highlight key details and improve the readability of the document. Consider these strategies:

- Bold Important Information: Highlight key details such as due dates, total amounts, or payment instructions using bold text.

- Color and Contrast: Use subtle colors to differentiate sections or to draw attention to important elements like payment due dates. However, stick to a professional color palette.

- Consistent Alignment: Align text and numbers properly, especially when presenting amounts or dates. This ensures that information is easy to read and comprehend.

Ensure Accuracy and Detail

In addition to design, ensure that all relevant details are present and accurate. A professional statement should:

- Include Clear Descriptions: Break down the services rendered and the time or costs associated with each task to avoid confusion.

- Show Total Amounts Clearly: Make sure the total amount due stands out by positioning it at the bottom or top of the document and using larger text or bold styling.

- List Payment Methods: Specify accepted payment methods clearly to make the transaction process as easy as possible for the client.

By following these design tips, you can create a visually appealing and professional document that not only reflects your work but also improves the client’s experience and ensures prompt payment.

Invoice Software vs Manual Billing

When managing financial documentation, professionals often face the choice between using dedicated software or manually creating payment statements. Both methods come with their own set of advantages and drawbacks. Understanding the differences can help you make an informed decision on which approach is best suited to your needs. In this section, we’ll explore the benefits and challenges of both options.

Advantages of Using Invoice Software

Dedicated software for generating payment records can streamline the entire process. With its automated features, it can save time and reduce the risk of human error. Here are some key benefits of using such tools:

- Automation: Software can automatically calculate totals, apply taxes, and generate recurring invoices based on predefined settings, making the process much faster.

- Professional Design: Many invoicing software programs come with pre-designed, customizable templates, allowing you to create professional-looking statements quickly.

- Efficiency and Speed: With templates, client data, and transaction details stored digitally, you can generate and send payment statements within minutes.

- Record Keeping: Invoice software often stores records for easy access and reference, making it simple to track past payments and generate reports.

Challenges of Invoice Software

While invoice software offers many advantages, there are some challenges to consider:

- Cost: Some invoicing software comes with monthly or annual subscription fees. The cost can be a consideration for smaller businesses or freelancers.

- Learning Curve: While many invoicing tools are user-friendly, some may require a learning curve for those who are not familiar with the software.

- Data Security: Storing payment information and client details on cloud-based platforms may raise concerns about data privacy and security.

Benefits of Manual Billing

On the other hand, manually creating payment statements gives you complete control over the process. This approach is often favored by smaller businesses or professionals who prefer a more personalized touch. Here are some of the benefits:

- Customization: You can tailor every aspect of the payment record to the client’s preferences, from layout to payment terms.

- No Subscription Costs: Manual billing doesn’t require any subscriptions or software purchases, making it cost-effective.

- Control and Flexibility: You have full control over t

How to Send Invoices to Clients

Sending accurate and clear payment statements to clients is a key part of maintaining professional relationships and ensuring timely compensation. The method by which you deliver these statements can impact how quickly they are reviewed and paid. Understanding the best practices for sending these documents helps streamline the process and minimizes the risk of confusion or delays.

Methods for Sending Payment Statements

There are several ways to send financial records to clients, each with its own advantages and considerations. Choosing the most appropriate method depends on your client’s preferences and the level of formality required. Below are some common options:

Method Advantages Considerations Email Quick, cost-effective, easy to track Must ensure proper formatting and secure attachment Postal Mail Provides a formal touch, useful for clients without email Slower, incurs postage fees, less efficient for follow-up Online Payment Platforms Convenient, often allows for instant payment May require the client to create an account or use a third-party service Client Portals Secure and centralized location for document access Requires clients to register and log in Steps to Ensure Smooth Delivery

To ensure that your payment statements are delivered efficiently and professionally, follow these best practices:

- Use Clear File Formats: When sending statements electronically, always use universally accepted file formats such as PDF. This ensures the document will appear exactly as intended on any device.

- Double-Check for Accuracy: Before sending, verify that the payment details, amounts, and client information are correct to avoid confusion or disputes later.

- Include Clear Payment Instructions: Be sure to specify how and where the payment should be made. This can include bank account details, payment platform links, or other relevant instructions.

- Send a Confirmation: Once the statement has been sent, send a brief follow-up message confirming that the document has been delivered. This can help address any immediate questions from the client.

By selecting the most a