Laundry Invoice Template Free and Easy to Customize

When running a service-based business, presenting clear and professional billing documents is essential for maintaining a good relationship with clients and ensuring timely payments. A well-structured bill not only helps you get paid promptly but also reflects your business’s professionalism and attention to detail.

For businesses offering regular services, such as washing and pressing clothes, using a well-designed billing form can streamline the process, save time, and reduce the chance of errors. With the right format, you can easily track services provided, costs, and payments received, ensuring everything is transparent and organized.

In this guide, we’ll explore how to create a customized billing document that suits your specific needs. Whether you prefer paper copies or digital formats, understanding the components of an effective billing document is crucial for smooth transactions and clear communication with your customers.

What is a Billing Document Format

A billing document format is a structured tool used to outline the details of a service provided to a customer. It serves as a formal request for payment, listing services rendered, costs, and terms. This document not only helps businesses maintain accurate records but also ensures clarity in communication with clients about charges and due amounts.

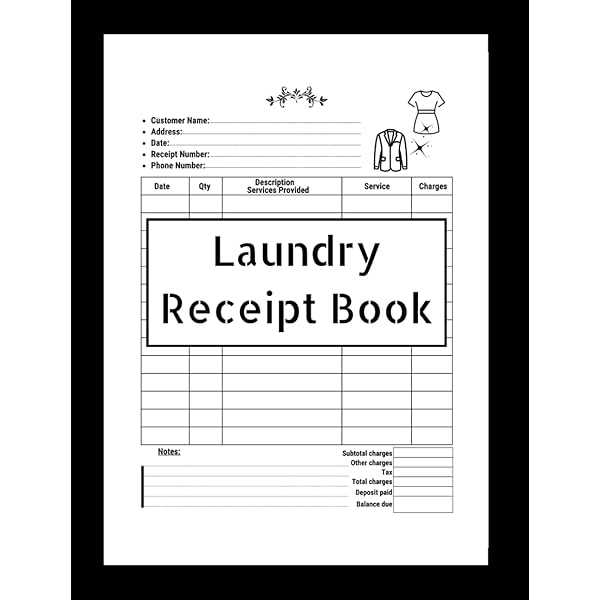

Key Components of a Billing Document

A well-designed billing form includes several essential components that ensure all necessary information is clearly presented. These components typically include:

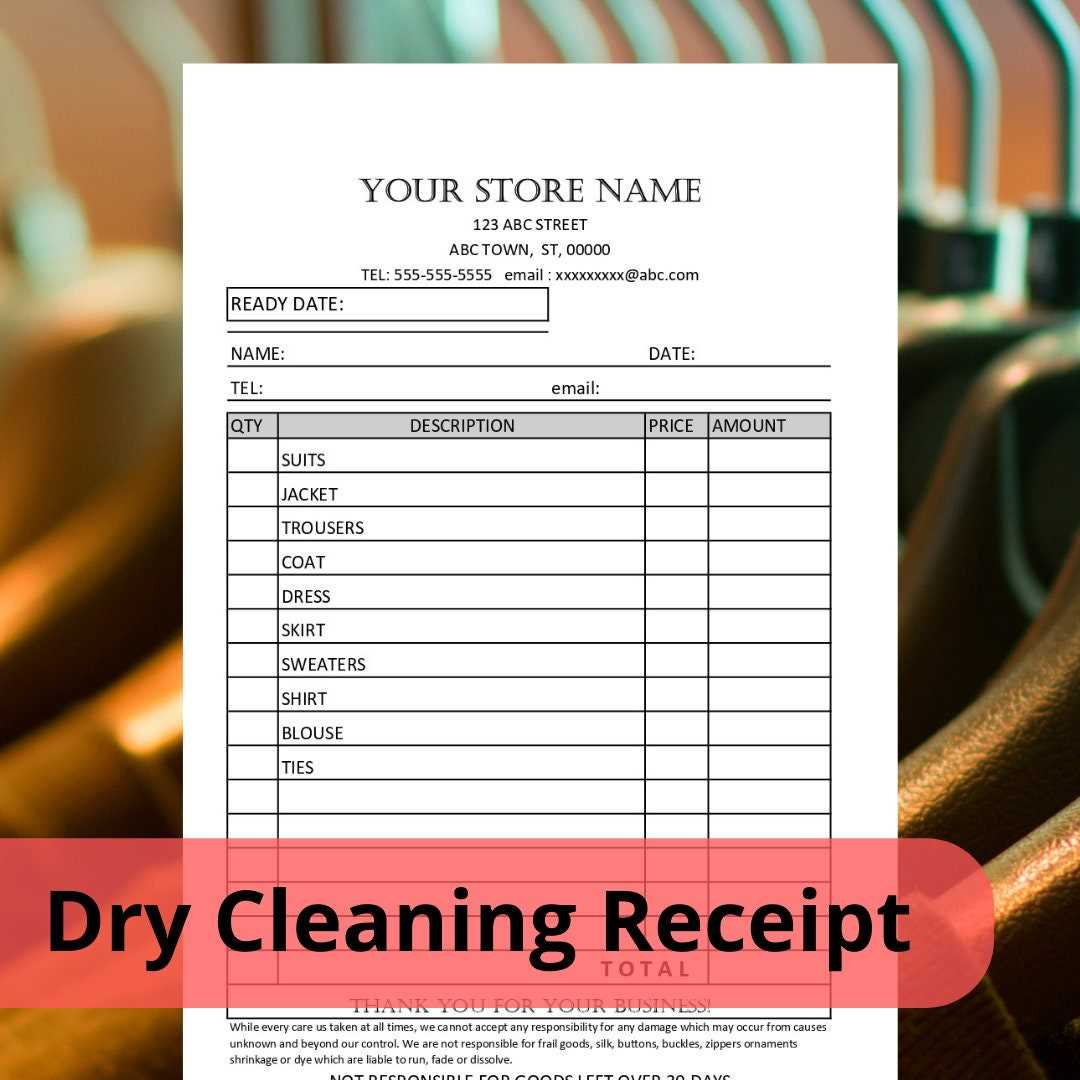

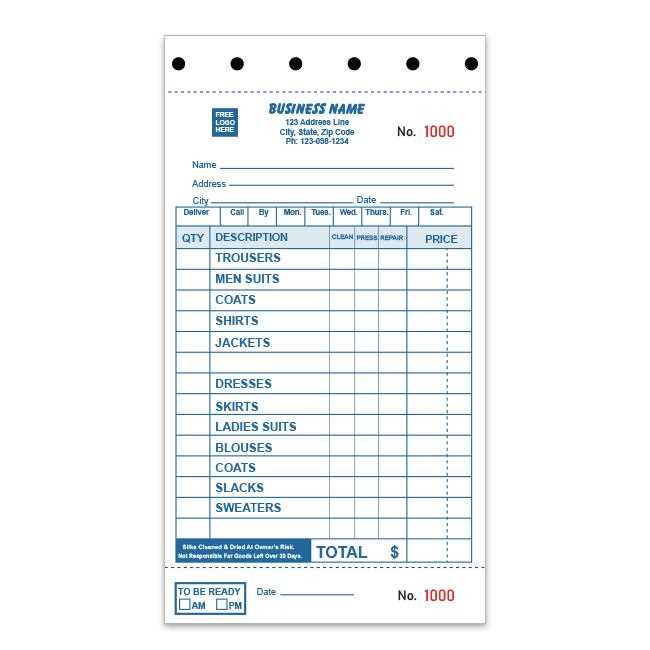

- Business Information: Name, address, and contact details of the service provider.

- Client Information: Name, address, and contact information of the customer.

- Service Details: A description of the services provided, including dates and quantities.

- Charges: The cost for each service or item, as well as the total amount due.

- Payment Terms: Information about payment deadlines, methods, and any applicable late fees.

- Additional Notes: Any extra information, such as discounts or special instructions.

Why Use a Billing Document Format

Using a consistent billing document format provides numerous benefits for both the business and its customers:

- It ensures transparency by providing clear information about services and costs.

- It helps streamline the payment process and reduce disputes.

- It assists in maintaining organized financial records for accounting purposes.

By adopting a standardized billing format, businesses can improve efficiency, boost professionalism, and create a seamless experience for their clients.

Importance of Professional Billing in Service-Based Businesses

In any service-oriented industry, presenting a polished and clear billing document plays a vital role in establishing trust and professionalism. Customers expect transparency, and a detailed, accurate statement of services and charges can greatly influence their satisfaction and willingness to pay on time. For businesses providing regular services like cleaning and garment care, having a professional system in place for managing payments is essential.

Benefits of Professional Billing

Using a professionally designed billing document offers several advantages that help businesses maintain smooth operations and positive client relationships:

- Builds Credibility: A well-structured bill conveys that your business is serious and trustworthy.

- Reduces Misunderstandings: Clear itemization of services helps avoid confusion and potential disputes over charges.

- Promotes Timely Payments: A detailed and well-organized bill makes it easier for customers to understand the total amount due, encouraging faster payments.

- Facilitates Record-Keeping: Professional bills are useful for accounting purposes, making it easier to track transactions and monitor cash flow.

Key Elements of a Professional Billing Document

A comprehensive and professional billing document should include the following elements to ensure clarity and accuracy:

| Component | Description |

|---|---|

| Business Information | Details of the service provider including name, address, and contact details. |

| Customer Information | Name, address, and contact details of the client being billed. |

| Service Breakdown | Detailed list of services provided, with prices for each item or service. |

| Total Charges | Sum of all charges, including any applicable taxes or discounts. |

| Payment Terms | Information about when and how the payment is due, along with any late fees if applicable. |

By including these key elements, businesses ensure that clients have a clear understanding of what they are being charged for, fostering positive business relationships and reducing the chances of payment delays or misunderstandings.

How to Create a Billing Document

Creating a clear and accurate billing document is essential for any business that provides services. Whether you are offering cleaning, repairs, or other services, a well-structured bill ensures that both you and your client are on the same page regarding the work completed and the amount due. The process of creating a professional document involves several key steps that help maintain transparency and avoid confusion.

To create an effective billing document, you need to include specific details, ensure that the charges are clear, and make the layout easy to understand. The goal is to provide your client with all necessary information in a concise, organized manner that reflects your professionalism.

Steps to Create a Billing Document

Follow these steps to build a complete and accurate billing statement:

- Include Your Business Information: Start by adding your business name, address, phone number, and email. This ensures that your client knows exactly who is issuing the bill.

- Client’s Information: Next, include the name and contact details of the client receiving the bill. This helps to personalize the document and avoid any confusion about who the bill is for.

- List of Services Provided: Clearly describe the services or items provided, including the date of service and quantity (if applicable). Be specific to avoid any misunderstandings.

- Pricing Breakdown: For each service, list the individual charges. This might include unit prices, labor costs, or any other applicable fees. Total these amounts for the overall charge.

- Payment Terms: Specify when the payment is due and any terms for late payments or discounts for early payment. Include accepted methods of payment.

- Review and Send: Double-check all the details for accuracy, ensuring that the total is correct. Once confirmed, send the document to your client promptly, whether by email or physical delivery.

By following these steps, you can create a billing statement that is professional, clear, and easy for your clients to understand. This approach not only ensures timely payments but also strengthens your business’s reputation for professionalism and reliability.

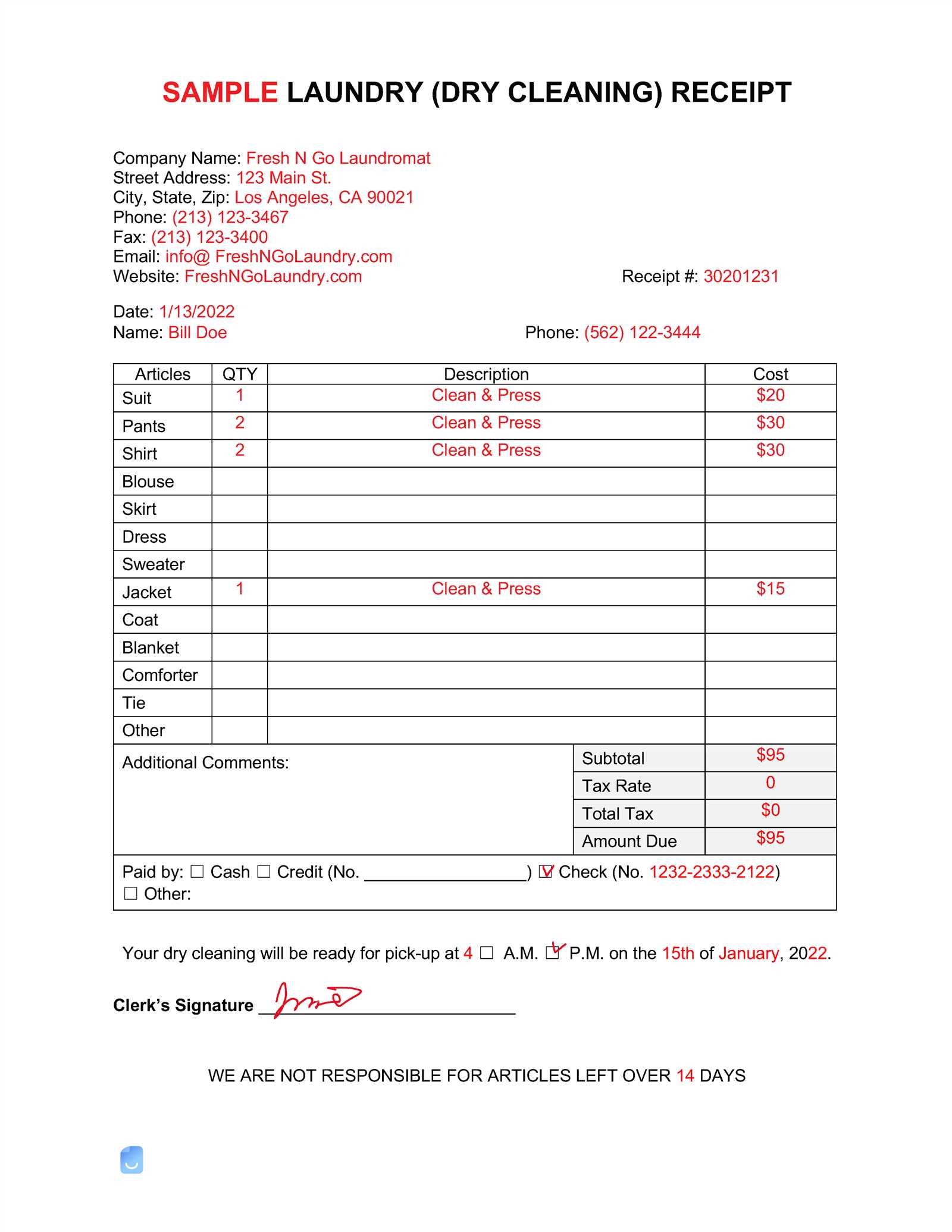

Essential Elements of a Billing Document

Creating a professional and accurate billing document requires careful attention to detail. For any service-oriented business, it’s crucial to include specific components that clearly outline the transaction. These elements ensure both parties understand the services provided, the costs involved, and the terms of payment.

Each billing statement should include key sections that provide a comprehensive overview of the service provided, the charges, and the payment details. These elements help establish transparency and reduce the risk of confusion or disputes between the service provider and the customer.

Key Components to Include

- Business Information: Include your company name, address, phone number, and email address. This ensures the client knows how to reach you if there are any questions.

- Client Details: Include the name, address, and contact information of the client receiving the document. This personalizes the transaction and avoids any confusion about the recipient.

- Service Description: Clearly describe the services provided, including the quantity and unit price (if applicable). This section should also specify any additional services, special requests, or items involved.

- Charge Breakdown: List the individual prices for each service, along with any applicable taxes, fees, or discounts. Summing up all charges will provide the total amount due.

- Payment Terms: Indicate the due date for payment, the payment methods accepted, and any late fees that may apply. Be clear about any discounts for early payments, if applicable.

- Additional Notes: This section can include any relevant details, such as terms for future services, warranty information, or special instructions for the customer.

By including these essential components, you ensure that your billing document is professional, clear, and complete. This level of detail helps build trust with clients and makes the payment process straightforward.

Benefits of Using a Structured Document Format

Using a pre-designed and structured document format offers numerous advantages for businesses that need to generate billing statements regularly. Instead of creating a new document from scratch each time, having a consistent layout simplifies the process, reduces errors, and improves efficiency. A well-organized document format ensures that all essential information is included and presented clearly, leading to a more professional image and smoother transactions with clients.

By relying on a standardized layout, businesses can save time, maintain consistency, and focus on other aspects of their operations. Here are some key benefits of using a structured format for your billing documents:

Key Advantages

- Time Efficiency: With a ready-made format, you can quickly fill in client details and service charges without worrying about layout or design.

- Consistency: A standardized document ensures that each statement follows the same structure, making it easier for clients to understand and for businesses to manage.

- Professional Appearance: A polished, well-organized format reflects professionalism and attention to detail, which can enhance your reputation with clients.

- Reduced Errors: Predefined sections and fields minimize the risk of forgetting important information or making calculation mistakes, ensuring accuracy.

- Customization Options: Many formats allow for easy customization, meaning you can tailor them to reflect your business’s branding, include special terms, or accommodate specific service details.

- Legal Protection: Consistent use of a formal format helps ensure that all necessary information is included for legal and accounting purposes, protecting your business and clients.

Overall, using a structured document format streamlines the billing process, saves time, and helps maintain clear, professional communication with clients, leading to fewer mistakes and faster payments.

Customizing Your Billing Document Format

Personalizing a standardized billing document can enhance its clarity and ensure it meets the specific needs of your business. Customization allows you to add unique details, modify the layout, and incorporate your branding, which can improve your professional appearance and make your documents more relevant to your clients. Tailoring the format to reflect your business style helps maintain consistency and makes your documentation more efficient and effective.

Customizing the document format involves adjusting elements such as your company logo, payment terms, and service descriptions to match your brand and business practices. Below are key aspects to consider when making these adjustments:

Key Customization Options

| Customization Area | Explanation |

|---|---|

| Business Branding | Include your business logo, color scheme, and any other branding elements that represent your company and its identity. |

| Service Descriptions | Tailor the list of services to better match your offerings, ensuring clients understand exactly what is being billed for. |

| Payment Terms | Adjust payment terms to reflect your business practices, such as deadlines for payments, late fees, or discounts for early payment. |

| Additional Notes | Add any relevant information, such as terms for repeat customers, special promotions, or specific instructions related to the service provided. |

By making these changes, you can create a document that not only looks professional but also aligns with your business goals and client expectations. Customizing the document format ensures that each statement is clear, accurate, and representative of your brand.

Common Mistakes in Billing Documents

Even with a clear and structured format, mistakes can still happen when preparing billing documents. These errors, if left uncorrected, can lead to misunderstandings, delayed payments, and even disputes with clients. It’s essential to be aware of the most common issues that can occur when creating service bills so that they can be avoided. A small mistake in your document can have a big impact on your business operations and client relationships.

Below are some of the most frequent mistakes that occur when preparing billing documents:

Frequent Errors to Avoid

- Missing Client Information: Failing to include the correct contact details or name of the client can lead to confusion and delay in payment.

- Incorrect Service Descriptions: Vague or incorrect descriptions of services can make it unclear what the client is being charged for, leading to disputes.

- Calculation Mistakes: Simple math errors, such as incorrect totals or forgotten fees, can cause discrepancies in the final amount due, resulting in client dissatisfaction.

- Omitting Payment Terms: Leaving out payment due dates, methods, or late fees can confuse clients and delay payment. Always include clear payment instructions.

- Inconsistent Formatting: Poor document layout or inconsistent formatting can make the bill harder to read and follow, diminishing its professional appearance.

- Not Including Taxes or Discounts: Forgetting to apply the correct tax rate or to include agreed-upon discounts can lead to overcharging or undercharging.

- Failure to Proofread: A document filled with spelling errors or unclear language can reduce your credibility and the professionalism of your business.

By paying attention to these common mistakes and carefully reviewing each billing document before sending it out, you can ensure that your clients receive accurate, professional, and easy-to-understand statements. This reduces the likelihood of errors and helps maintain good client relationships.

How to Avoid Billing Errors

Errors in billing documents can create confusion, delay payments, and harm client relationships. Ensuring accuracy when preparing a statement is crucial to maintaining professionalism and trust. By following a systematic approach and checking key details, you can minimize the risk of mistakes that could disrupt your workflow or lead to disputes.

To avoid errors, it’s important to take a careful and organized approach at every stage of creating a billing document. From gathering accurate client information to double-checking calculations, being thorough in the process is key to preventing common issues. Below are some practical steps to help you avoid mistakes:

Practical Tips to Prevent Mistakes

- Use a Consistent Format: Always use the same structure and layout for your billing statements. A consistent format reduces the likelihood of missing important information and helps ensure that nothing is overlooked.

- Double-Check Calculations: Always verify the math before finalizing a bill. Use reliable tools like spreadsheets or automated software to ensure accuracy in totals, taxes, and discounts.

- Proofread for Clarity: Carefully review the wording, especially for service descriptions and terms. Any unclear or ambiguous language can lead to confusion for your clients.

- Keep Client Information Updated: Ensure that client contact details are correct and up-to-date to avoid sending bills to the wrong address or contact.

- Specify Payment Terms: Clearly state payment deadlines, acceptable methods, and any late fees to avoid misunderstandings about payment expectations.

- Automate Where Possible: Use software or tools that automatically generate billing documents based on pre-set information, reducing the chances of manual errors.

Regular Reviews and Updates

It’s also important to regularly review and update your processes. If your pricing structure or services change, ensure that the billing document reflects those updates. Keeping your system current helps maintain accuracy and reduces the risk of outdated information being used.

By following these steps, you can reduce the likelihood of errors, streamline your billing process, and maintain a smooth, professional interaction with your clients.

Best Tools for Designing Billing Documents

Creating professional and well-structured billing statements can be simplified with the right tools. Whether you’re looking for basic document editors or specialized software, there are various solutions available to help streamline the design and creation process. Using the right tool ensures that your documents are clear, accurate, and visually appealing, while saving time and reducing manual effort.

Here are some of the best tools to help you design and generate billing statements efficiently:

Top Tools for Designing Billing Documents

- Microsoft Word: A versatile tool that allows you to create customizable billing documents using pre-made templates or from scratch. You can add logos, tables, and service descriptions easily, and format the layout to suit your business style.

- Google Docs: A free and cloud-based alternative to Word. Google Docs offers simple formatting tools and access from any device. You can also collaborate in real-time if you need input from other team members.

- Canva: A graphic design platform that makes it easy to create visually appealing billing statements. With drag-and-drop functionality, you can add your branding elements, icons, and customize the design with pre-made templates.

- QuickBooks: A powerful accounting software that includes features for generating and managing billing documents. It automatically calculates taxes, applies discounts, and tracks payments, making it a good choice for businesses that need invoicing as part of their overall accounting workflow.

- Zoho Invoice: A comprehensive online invoicing tool with customization options. It allows businesses to create professional bills, automate recurring invoices, and integrate with other software for accounting and payment tracking.

- FreshBooks: A cloud-based solution designed for small businesses. FreshBooks provides easy-to-use templates, automatic payment reminders, and detailed reporting features to keep track of client transactions.

- Invoicely: A simple yet effective platform for creating custom billing documents. Invoicely offers both free and paid versions, with the option to add your logo and choose from different document designs.

Each of these tools offers different features that cater to specific business needs. Whether you require basic document creation, advanced payment tracking, or customizable design options, these tools provide a range of functionalities to enhance your billing process.

Digital vs Paper Billing Documents

When it comes to generating and managing service-related billing documents, businesses have the option of using either digital or paper formats. Each method has its own set of advantages and disadvantages, and the choice largely depends on the size of the business, client preferences, and operational needs. Understanding the differences between digital and paper billing methods can help businesses make an informed decision about which option best suits their workflow.

In the past, paper billing was the standard method, but digital formats have become increasingly popular due to their efficiency, environmental benefits, and ease of use. However, some businesses still rely on paper documents due to customer preferences or technical limitations. Below is a comparison of digital and paper billing documents to help businesses determine which option is most suitable for their needs:

Comparison of Digital and Paper Billing

| Aspect | Digital Documents | Paper Documents |

|---|---|---|

| Speed | Instant delivery via email or online platforms, reducing the time spent on physical distribution. | Requires physical mailing or delivery, leading to longer processing times. |

| Cost | No printing or postage costs, making it a more cost-effective option for most businesses. | Printing, paper, and postage costs can add up, especially for businesses with a high volume of clients. |

| Environmental Impact | Eco-friendly as it eliminates the need for paper and physical delivery. | Uses paper and ink, contributing to waste and requiring resources for mailing. |

| Accessibility | Easily accessible on any device, including mobile phones, tablets, and computers, providing greater convenience. | Only accessible in physical form, which can be cumbersome and requires storage space. |

| Security | Can be encrypted and stored securely, but requires proper handling to avoid online fraud or data loss. | More susceptible to being lost or damaged, but offers a physical paper trail for clients who prefer tangible records. |

| Customization | Highly customizable with easy updates and modifications, allowing businesses to create branded and tailored documents. | Limited in customization, often requiring manual adjustments for each document. |

While digital documents are clearly more efficient and cost-effective in many ways, paper documents may still be preferred in certain situations, particularly with clients who are more comfortable with physical records. Ultimately, the choice between digital and paper formats will depend on your business needs, customer preferences, and operat

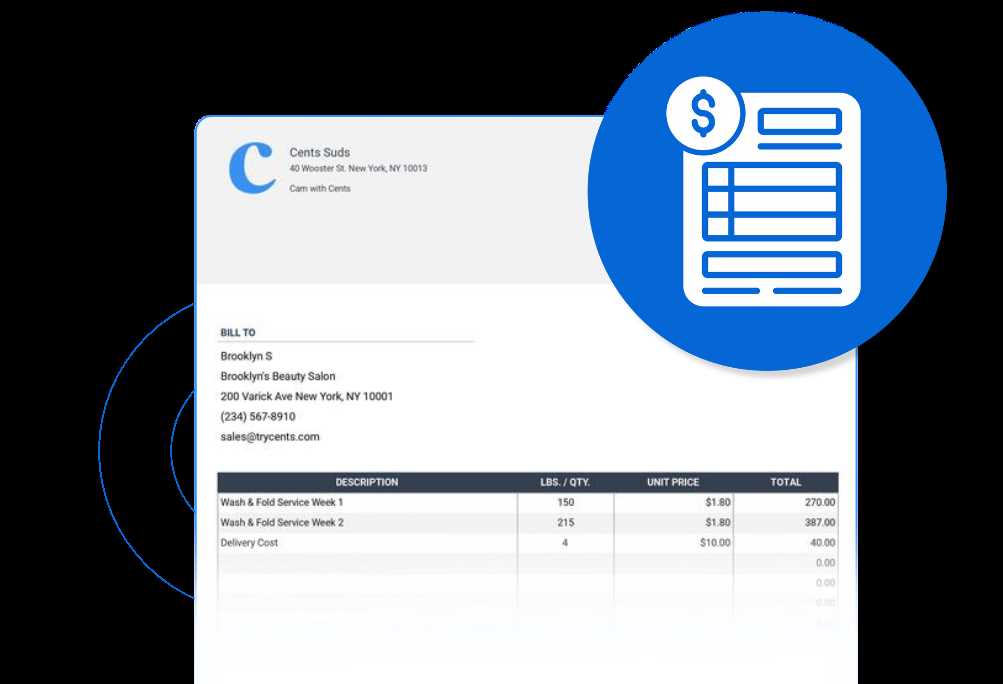

How to Calculate Charges for Cleaning Services

Accurately calculating the charges for cleaning services is essential to ensure that both the service provider and the customer are satisfied with the transaction. Properly determining the cost requires considering multiple factors, such as the type of service provided, the amount of work involved, and any additional fees that may apply. Understanding how to break down these costs helps maintain transparency and fairness, ensuring that the client is aware of what they are paying for and the service provider is compensated appropriately.

Here are the key elements to consider when calculating the charges for cleaning services:

Factors to Consider When Calculating Charges

- Type of Service: Different services may have varying costs. For instance, washing and folding clothes might cost differently compared to dry cleaning or stain removal.

- Quantity of Items: The number of items to be cleaned plays a crucial role in determining the overall charge. For example, pricing may vary based on weight or the number of individual items like shirts, pants, or blankets.

- Complexity of the Task: Special requests or more time-consuming tasks, such as delicate fabric handling or heavy-duty cleaning, should be priced higher than standard services.

- Material or Fabric Type: Certain fabrics require more care or special treatment, which may justify higher charges. For example, silk, wool, and leather require specialized cleaning processes that can increase the price.

- Turnaround Time: Expedited services or same-day deliveries may incur higher charges, as they require priority handling and faster turnaround times.

- Additional Fees: Don’t forget to include any applicable taxes, delivery fees, or additional charges for specialized treatments, such as stain removal or pressing services.

Once you have accounted for these factors, you can create a detailed cost breakdown that ensures both you and your clients are clear about the pricing structure. A simple formula to calculate charges might look like this:

- Calculate the base rate for the service type.

- Multiply the base rate by the quantity of items or weight.

- Add any additional charges for special treatments, delivery, or expedited services.

- Include taxes or fees as required by local regulations.

By carefully considering all the variables and communicating the pricing clearly to your clients, you can ensure a fair and transparent pricing structure that works for both parties.

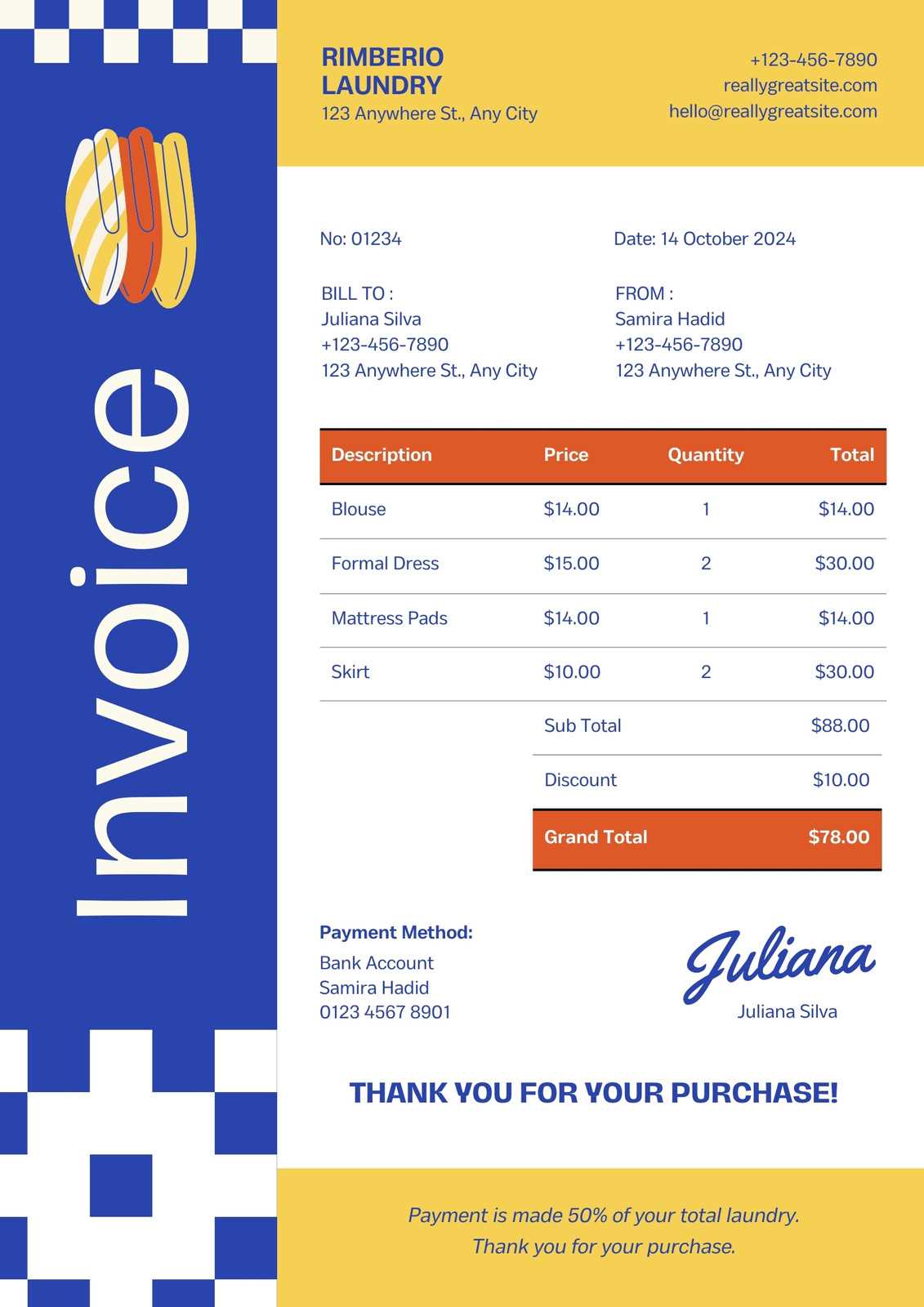

How to Include Discounts on Billing Statements

Including discounts on billing statements is a great way to incentivize customers, offer special promotions, or reward loyal clients. Discounts can help build strong customer relationships, encourage repeat business, and create a positive brand image. However, it’s important to clearly outline the discount on the document to avoid confusion and ensure both the business and the customer are on the same page about the final charge.

When adding discounts, it’s essential to be clear about the terms of the discount, the amount, and how it affects the final price. Below are some key steps to ensure discounts are properly included in your billing documents:

Steps to Include Discounts on Billing Statements

- Define the Discount Type: Specify whether the discount is a percentage off the total or a fixed amount. Make sure the customer understands how the discount is calculated.

- Apply the Discount Clearly: Deduct the discount amount from the total sum and show the adjusted amount on the statement. Include a clear label such as “Discount Applied” or “Promo Code Discount” next to the discount value.

- Include Discount Terms: If applicable, include any terms related to the discount, such as “valid for first-time customers only” or “limited-time offer.” This ensures the client understands the conditions of the offer.

- Show Pre-Discount and Post-Discount Totals: Display both the original amount and the final amount after the discount is applied, making it transparent for the customer. This provides clarity and demonstrates the value of the discount.

Example of How to Present Discounts

Here’s an example of how you might structure a billing statement with a discount:

- Original Total: $100.00

- Discount (10%): -$10.00

- Final Amount Due: $90.00

Including this level of detail ensures transparency and avoids confusion, which can help maintain trust with your clients.

How to Send Billing Documents

Sending billing statements to clients in a timely and professional manner is crucial for maintaining smooth business operations and ensuring prompt payments. The method used for sending these documents can vary depending on the client’s preferences and the size of your business. Whether you choose to send them electronically or via traditional mail, clear communication and proper delivery are essential for maintaining good relationships with your clients.

In this section, we’ll explore the best practices for sending billing documents, including various delivery methods and tips for making the process efficient and reliable.

Methods for Sending Billing Statements

- Email: Sending documents electronically via email is the fastest and most efficient method. You can attach the document as a PDF or include it within the email body itself. Ensure that the subject line is clear, such as “Your Billing Statement for [Month]” to avoid confusion.

- Online Platforms: If you use a billing software or platform, many of these tools offer built-in options to send documents directly through the platform. This can also allow clients to view and pay online, simplifying the process.

- Postal Mail: For clients who prefer traditional methods or in cases where electronic communication is not possible, sending physical documents through postal mail is still an option. Make sure to use a reliable mailing service and ensure that the document is securely packed and clearly addressed.

Tips for Sending Billing Documents Effectively

- Ensure Accuracy: Double-check the details of the billing document before sending it, including the client’s information, service description, and amounts due.

- Include Clear Payment Instructions: Whether you’re sending digitally or by mail, make sure to include clear instructions on how the client can make payment. Include payment methods, due dates, and any applicable late fees.

- Follow Up: After sending the statement, follow up with your client to confirm receipt and remind them of any payment deadlines. This can help encourage prompt payment.

By choosing the right method and ensuring clarity in your communication, you can streamline the process of sending billing documents and enhance your clients’ experience with your business.

Payment Terms to Include in Billing Statements

Clearly outlining payment terms in your billing documents is essential for ensuring both parties understand the expectations for payment. These terms help establish guidelines for when payment is due, what methods are acceptable, and any potential penalties for late payments. Having well-defined payment terms can minimize misunderstandings and help maintain a smooth financial process for your business.

When setting up payment terms, it’s important to include all relevant information that will help the client make timely payments and avoid confusion. Below are the key payment terms to consider including in your billing statements:

Key Payment Terms to Include

- Payment Due Date: Clearly specify when the payment is due, whether it’s within a set number of days after the service is completed (e.g., “Net 30” for payment within 30 days) or on a specific date.

- Accepted Payment Methods: List the payment methods you accept, such as credit cards, bank transfers, checks, or online payment platforms. This ensures the client knows their options for paying the bill.

- Late Payment Fees: Indicate any penalties for late payments, such as a percentage charge after the due date. This encourages timely payment and helps cover any additional administrative costs associated with delayed payments.

- Early Payment Discounts: Offer a discount for early payments, such as a percentage off if paid within a certain time frame. This can be an effective incentive for clients to pay ahead of schedule.

- Billing Frequency: If you offer recurring services, make sure to include how often the client will be billed (e.g., weekly, monthly) and whether payments should be made per cycle or as a lump sum.

- Currency and Taxes: Specify the currency of the amount due, as well as any applicable taxes or fees that are added to the total. This ensures transparency and helps avoid misunderstandings about the total charge.

Examples of Payment Terms

- “Payment is due within 30 days from the date of the service. A 2% late fee will be applied for payments received after the due date.”

- “A 5% discount will be applied for payments made within 7 days of receiving this statement.”

- “We accept payments via credit card, bank transfer, or PayPal. Please make payments in USD.”

By providing clear and comprehensive payment terms, you ensure that both your business and your clients are aligned on expectations, red

Tracking Payments and Outstanding Billing Documents

Efficiently tracking payments and managing unpaid accounts is essential for maintaining healthy cash flow in any business. Having a clear system in place to monitor which payments have been made and which ones are still pending helps you stay organized and avoid confusion. It also enables you to take timely action if a client has missed a payment or is falling behind.

Tracking payments and outstanding balances can be done manually or through automated tools, depending on the size of your business and the number of transactions you handle. Below are some key strategies to effectively track payments and manage outstanding balances:

Methods for Tracking Payments and Outstanding Balances

- Use a Dedicated Software: Accounting and invoicing software tools often have built-in features that allow you to track which payments have been made and which remain outstanding. These tools can automatically update your records, saving time and reducing human error.

- Create a Payment Log: If you prefer to keep things simple, maintaining a manual payment log or spreadsheet can be effective. List the details of each transaction, including the client name, the amount due, the date issued, and the payment date. This method is especially useful for smaller businesses or those just starting out.

- Set Payment Reminders: For outstanding balances, set up automated reminders to notify clients of overdue payments. This can be done through email or text messages, and will help prompt clients to make payments before they accumulate additional late fees or penalties.

- Regularly Review Accounts: Make it a habit to review your accounts on a regular basis–whether weekly or monthly–to identify any overdue payments. This helps prevent payments from slipping through the cracks and ensures you’re always aware of your current financial status.

Handling Outstanding Payments

- Send Polite Payment Reminders: If a client hasn’t paid by the due date, sending a polite reminder is an essential first step. Be courteous but clear in your communication, stating the amount due and the original due date.

- Apply Late Fees: For payments that remain overdue beyond a certain period, consider applying a late fee as specified in your payment terms. This not only incentivizes clients to pay on time, but it also helps cover any administrative costs associated with the delay.

- Offer Payment Plans: If a client is struggling to pay the full amount, offering a payment plan can be a good solution. This allows the client to pay in installments, which can improve cash flow and maintain a positive relationship.

By implementing an organized system for tracking payments and outstanding balances, you can ensure that your business remains financially healthy and that your clients are aware of their obligations, reducing the risk of missed or delayed payments.

Legal Considerations for Billing Documents

When creating and issuing billing statements, it’s important to ensure that all legal requirements are met to avoid potential disputes or legal issues. Legal considerations help protect both the service provider and the client, ensuring that the terms of the transaction are clear, fair, and compliant with local regulations. From tax requirements to contract enforcement, understanding the legal framework surrounding billing documents is crucial for any business.

There are several key legal aspects to consider when preparing and sending out billing statements. Below are some of the most important points to keep in mind:

Important Legal Aspects to Include

- Clear Payment Terms: It’s essential to define the terms under which payment is expected, including the due date, late fees, and accepted payment methods. Ensure these terms are outlined clearly to avoid confusion and ensure enforceability in case of a dispute.

- Tax Compliance: Many regions require businesses to charge and collect sales tax on certain services or products. Ensure that the appropriate tax rate is applied to the total amount due and that the tax is clearly listed on the statement.

- Refund and Cancellation Policies: If applicable, include the terms under which clients can request a refund or cancel services. Being transparent about your policies helps avoid misunderstandings and protects both parties in case of a dispute.

- Client Information Privacy: If the statement includes personal or sensitive information, ensure compliance with data protection laws (such as GDPR or CCPA). Protecting client privacy is a legal requirement in many jurisdictions.

- Dispute Resolution: Include a clause that specifies how disputes will be resolved, whether through arbitration, mediation, or litigation. This helps avoid costly and time-consuming legal battles.

Sample Legal Clauses to Include in Billing Statements

| Clause | Description |

|---|---|

| Payment Terms | “Payment is due within 30 days from the date of issue. Late payments will incur a 5% penalty per month.” |

| Sales Tax | “A sales tax of 8% will be applied to the total amount as required by local laws.” |

| Refund Policy | “Refund requests must be made within 14 days of service completion. A full refund will be issued for unsatisfactory services.” |

| Privacy Protection | “We adhere to the GDPR and will not share your personal information with third parties without your consent.” |

By including these legal considerations in your billing statements, you can ensure that your business practices remain compliant with applicable laws and regulations, which can help prevent disputes and foster trust with your clients.