How to Create a Professional Latex Invoice Template

Efficiently managing financial transactions requires well-structured documents that convey essential information clearly and professionally. A well-designed billing system can simplify the process for both businesses and clients. Crafting a custom solution offers flexibility, allowing you to tailor it to your specific needs, while ensuring consistency and clarity in every transaction.

By using a customizable approach, you can incorporate branding, precise details about goods or services, and payment terms, making each document both functional and visually appealing. Whether you’re a freelancer, small business owner, or part of a larger organization, having the ability to quickly generate customized financial documents can save time and enhance professionalism.

Understanding the components involved in creating these documents is key to building a system that meets your requirements. From itemizing charges to ensuring proper formatting, each element plays a role in conveying the right message and fostering smooth communication with clients.

Why Use Latex for Invoices

Choosing the right tool for creating professional billing documents can significantly impact the ease and efficiency of your workflow. The flexibility and precision offered by certain typesetting systems allow for complete control over design and content, making them ideal for businesses looking to maintain a polished, custom look across all their financial paperwork. By leveraging these powerful tools, you can ensure that your documents are not only accurate but also consistent and visually appealing.

Benefits of Using a Typesetting System

There are several reasons why many professionals prefer this method for generating billing documents:

- Precision and Flexibility: The system provides complete control over document formatting, allowing you to adjust margins, font styles, and spacing to create perfectly aligned content.

- Customizability: You can easily adapt the layout, add logos, and include various elements that reflect your business’s unique branding.

- Automation: Automating repetitive tasks, such as generating document numbers or including current dates, can save valuable time.

- Consistency: The format ensures that all documents maintain the same professional appearance, regardless of how many are created.

- Open-source and Cost-effective: This method is often free to use, with a large community offering additional resources and support.

Streamlined Workflow for Professionals

For freelancers and small businesses, utilizing this system can drastically reduce the time spent on document creation. Once you set up a basic structure, generating multiple documents becomes a quick and efficient task. The ability to easily update templates ensures that changes, whether for taxes or payment terms, are consistently applied across all future documents.

Benefits of Customizing Your Template

Personalizing your billing documents provides a significant advantage by allowing you to adapt the layout and content to your specific needs. This flexibility ensures that your financial records are not only functional but also reflect your business’s identity. Whether you are a freelancer, small business owner, or part of a larger organization, customization helps improve efficiency, accuracy, and the overall client experience.

Professional Appearance

When your documents are tailored to reflect your unique style, they convey a professional image that can strengthen your brand. A personalized format with your logo, business colors, and consistent design creates a cohesive look that enhances the credibility of your business.

Improved Efficiency and Accuracy

By customizing your layout, you can ensure that all necessary details are clearly presented in a logical order, minimizing the risk of errors. A customized structure also allows you to automate recurring elements, such as payment terms or tax rates, which streamlines the process of generating new records.

| Custom Element | Benefit |

|---|---|

| Branding | Ensures your documents reflect your company’s identity and professionalism. |

| Layout Adjustments | Improves readability and ensures that the most important details are highlighted. |

| Automated Fields | Reduces time spent on repetitive tasks and minimizes human error. |

| Flexible Formatting | Allows you to easily adapt to different business requirements or client preferences. |

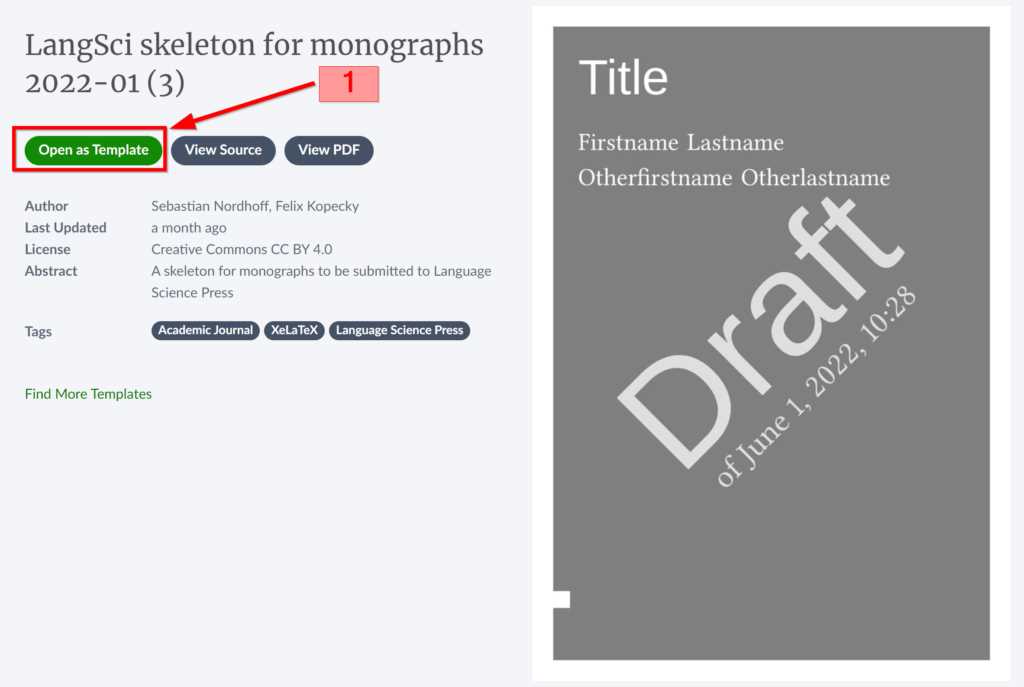

Getting Started with Code for Document Creation

Beginning with a typesetting system might seem daunting at first, but once you understand the basics of the code, you’ll find that creating customized financial records is both efficient and highly adaptable. This approach involves using simple commands to define the structure of your document, allowing you to create professional-looking results with minimal effort. Getting familiar with the syntax and key elements is the first step towards mastering the process.

The core idea is to use a text-based system where you define various components, such as headers, tables, and text alignment, using simple commands. With practice, you can quickly build documents that meet your specific needs, whether it’s adjusting formatting, adding logos, or automating certain sections for repetitive tasks. This system offers complete flexibility in how you present your business details, from the layout to the information structure.

To get started, it’s helpful to break down the process into small, manageable steps. You’ll first learn how to define sections, add essential data, and experiment with different layouts before progressing to more advanced techniques. Understanding the basic syntax and structure is essential for building a customized solution that works for your business.

Key Elements of an Invoice Template

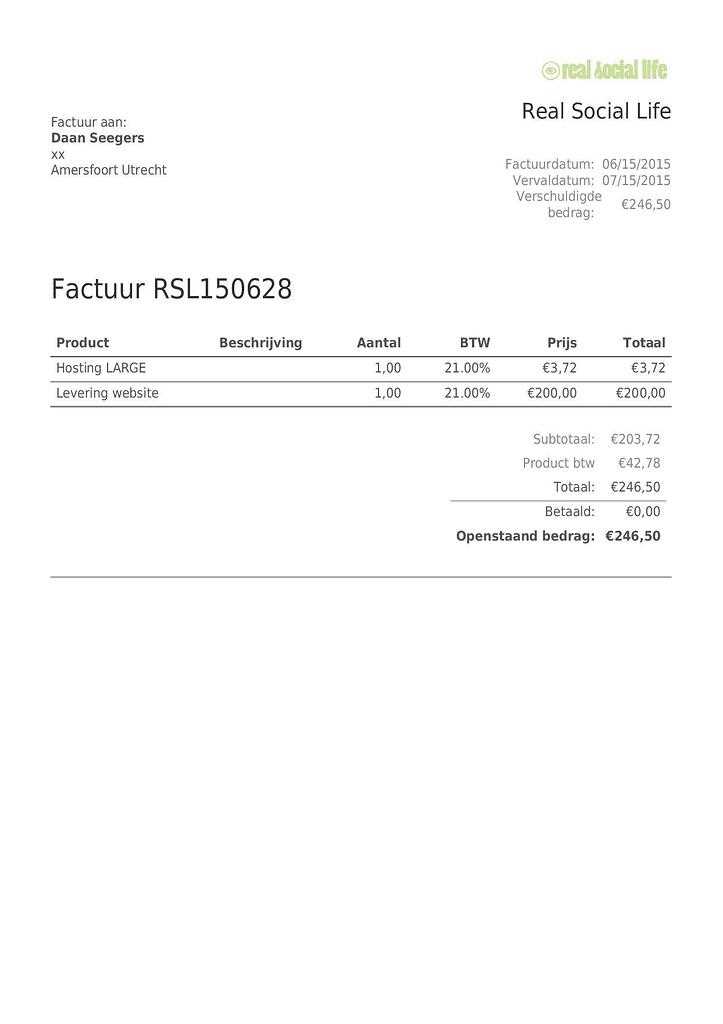

To create effective and professional billing documents, it’s crucial to include several key components that provide clarity and ensure that all necessary details are captured. These elements not only help organize the information in a logical way but also ensure that both parties–business and client–are on the same page regarding the transaction. A well-structured document should be clear, accurate, and easy to read, which is essential for smooth communication and timely payments.

Essential Components to Include

Each document should contain the following elements to ensure that it is both comprehensive and professional:

- Business Information: This includes your company name, address, contact details, and logo to establish the identity of the sender.

- Client Information: Clearly state the name, address, and contact information of the client or company receiving the billing document.

- Document Number: A unique reference number helps track and organize records for future reference.

- Transaction Date: The date when the document was created or the transaction took place, which is critical for record-keeping.

- Itemized List: A detailed list of products or services provided, along with descriptions, quantities, unit prices, and total amounts.

- Total Amount Due: The overall sum of all items or services, including taxes and any applicable discounts.

- Payment Terms: Clearly state the payment due date, accepted methods of payment, and any late fees if applicable.

Formatting for Clarity

In addition to including these elements, formatting plays a significant role in ensuring that the document is both functional and visually appealing:

- Use of Headings: Clearly distinguish between sections with headings to make it easier for the reader to find specific information.

- Tables: Utilize tables to organize product/service descriptions, quantities, and prices for easy readability.

- Consistent Font and Spacing: Maintain uniform font sizes and proper spacing to ensure the document is easy to scan and understand.

- Bold and Italics: Use bold for important headings and italics for additional notes or instructions to enhance clarity.

How to Create a Basic Billing Document

Creating a simple yet effective billing document is the first step toward professional financial communication. The process involves gathering necessary information, organizing it logically, and formatting it in a way that is easy to read and understand. By following a few simple steps, you can quickly put together a document that looks polished and serves its purpose without unnecessary complexity.

Step-by-Step Process

To create a basic billing document, follow these simple steps:

- Set Up Document Structure: Start by defining the overall layout. Begin with a header that includes your business name and contact information.

- Add Client Details: Include the recipient’s name, address, and contact information so that both parties are clearly identified.

- Insert a Unique Reference Number: This number is important for keeping track of transactions and helps avoid confusion.

- Provide a Date: Clearly mark the date when the document was created or the transaction took place.

- List Products or Services: Create a clear list with descriptions, quantities, and prices for each item or service provided. This should be organized in a table format for clarity.

- Calculate Total Amount: Ensure the total due is clearly visible at the bottom of the document, including any applicable taxes or discounts.

- State Payment Terms: Specify how the client can pay and when the payment is due. Be clear about late fees or other conditions if applicable.

Formatting Tips for Clarity

Once all the essential information is added, it’s important to focus on the document’s presentation:

- Use Tables: Tables help organize product or service details, ensuring that all pricing and descriptions are easy to read.

- Consistent Fonts: Use a clean, easy-to-read font for the entire document to maintain a professional appearance.

- Bold Key Information: Highlight important sections, such as the total amount due, payment terms, and dates, using bold text.

- Maintain White Space: Avoid clutter by leaving sufficient space between sections for better readability.

Customizing Your Billing Document Layout

Tailoring the layout of your billing documents allows you to create a more personalized and professional appearance that reflects your business’s style. Adjusting the arrangement of elements such as headers, tables, and totals ensures that the document is not only functional but also easy to navigate. By modifying these design elements, you can create a visually appealing record that aligns with your branding while making key information stand out.

The flexibility of customizing the layout gives you full control over how the document is structured. You can change the positioning of logos, headers, and client details to better fit your preferences or business needs. This allows for a clean, organized design that improves readability and enhances the overall user experience.

When customizing the layout, it’s important to maintain a balance between aesthetics and clarity. A well-organized design will guide the reader’s eye to the most important information without overwhelming them with clutter. Here are some key aspects to focus on when adjusting your layout:

- Header Placement: Position your business name and logo at the top of the document to establish brand identity. Make sure these elements are prominent but not overpowering.

- Client Information: Place the recipient’s name, address, and contact details in a section that is easy to find, ideally near the top or left-hand side.

- Item List Organization: Use a table format to display services or products, ensuring each row contains clear descriptions, quantities, and prices for better legibility.

- Total Calculation: Ensure the total amount due is clearly visible and stands out by positioning it at the bottom or in a separate, highlighted section.

- White Space: Maintain adequate spacing between sections to prevent the document from feeling cramped. This makes the content easier to scan.

By adjusting the layout to your preferences, you can create a document that not only serves its purpose but also leaves a positive impression on your clients, reinforcing your professionalism and attention to detail.

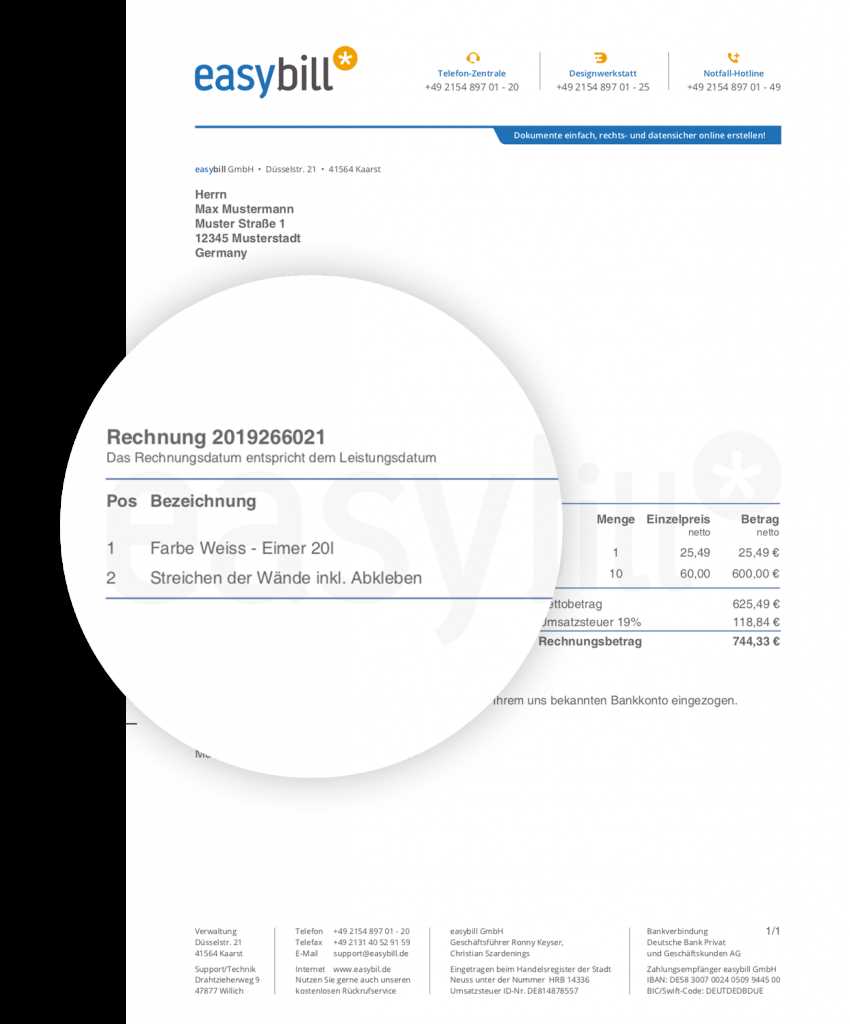

Adding Company Branding to Your Document

Incorporating your company’s branding into your billing documents is essential for creating a cohesive and professional image. By aligning your document’s design with your brand identity, you make sure that every communication, including financial records, reflects the values and personality of your business. Customizing elements like logos, color schemes, and fonts can reinforce your brand and make your documents stand out.

Key Branding Elements to Include

When adding your company’s branding, consider integrating the following components to ensure consistency and professionalism:

- Logo: Place your company logo prominently at the top of the document to ensure immediate recognition. The logo should be clear and high quality to reflect your brand’s professionalism.

- Color Scheme: Use your brand’s color palette to create a unified look. For instance, you can apply your primary brand colors to headings, borders, or background elements.

- Fonts: Use the fonts that represent your business style, ensuring they are legible and match the tone of your brand. Stick to one or two complementary fonts to maintain visual harmony.

- Tagline or Slogan: If appropriate, include your brand’s tagline or slogan to reinforce your message and brand identity.

Where to Position Branding Elements

Strategically placing branding elements throughout the document can enhance its appearance without overwhelming the content. Consider these placement options:

- Header: Position your logo and business name at the top, making them the focal point of the document.

- Footer: Include your contact details or a reminder of your brand’s values in the footer, keeping the document balanced and clean.

- Section Highlights: Use brand colors to accent key sections, such as the total amount or payment terms, drawing attention to the most important information.

By thoughtfully adding these elements, you create a document that not only serves its functional purpose but also strengthens your brand’s presence in every business interaction.

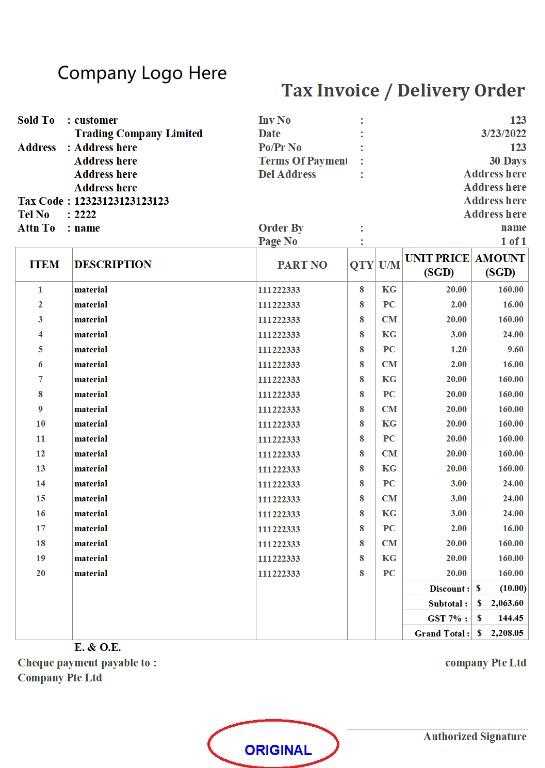

Incorporating Taxes and Discounts

Including taxes and discounts in your financial documents is essential for providing transparency and ensuring accurate pricing. By clearly showing how these adjustments affect the total amount due, you help clients understand the final cost breakdown. Whether it’s applying a standard tax rate or offering promotional discounts, these elements need to be clearly stated to avoid confusion and maintain trust with your clients.

How to Incorporate Taxes

Taxes can vary depending on location, product type, or service provided. It’s important to calculate and present them correctly to ensure compliance and clarity. Here’s how to handle taxes:

- Specify the Tax Rate: Clearly state the tax rate being applied, whether it’s a percentage or a fixed amount. This helps the client understand the exact cost increase.

- Itemized Tax Breakdown: If applicable, list the tax amount for each product or service. This way, the client can see exactly how the tax is calculated for each item.

- Apply Correctly: Ensure that the tax is applied to the right items or total amount, depending on the applicable laws and your business model.

How to Apply Discounts

Discounts are often used as a promotional tool or to reward loyal clients. To maintain transparency, discounts should be clearly marked on the document. Here’s how to handle them:

- State Discount Percentage or Amount: Clearly mention the discount either as a percentage or a fixed amount off the total cost. This ensures the client understands how the final price was reduced.

- Itemized Discounts: If discounts are applied to specific products or services, list them individually with the discounted amount clearly stated.

- Conditional Discounts: If the discount is based on specific conditions (e.g., early payment), make sure these conditions are clearly mentioned.

By clearly incorporating taxes and discounts into your documents, you ensure a straightforward and professional communication of the final amount due, making it easier for both you and your clients to track financial transactions accurately.

Formatting Date and Invoice Numbers

Properly formatting the date and unique reference number in your billing documents is crucial for organizing and tracking transactions. These elements are essential for both you and your clients, as they provide clear records and simplify future reference. A consistent approach to formatting these details ensures that every document is easily identifiable and follows a systematic, professional structure.

Formatting the Date

The date serves as an important marker for the transaction, indicating when the document was created or when the service was rendered. It is essential to present the date in a format that is easily understood by both you and your clients. Here are a few considerations for formatting the date:

- Standard Format: Use a consistent date format, such as DD/MM/YYYY or MM/DD/YYYY, depending on your location and the client’s preferences.

- Transaction Date: Clearly indicate the date when the service was provided or when the document was issued. If necessary, include both the issue date and the due date.

- Clarity: Avoid using abbreviations like “Jan” for January. Instead, spell out the month for better clarity, such as “1st January 2024” or “January 1, 2024.”

Formatting the Reference Number

A unique reference number is vital for tracking and referencing financial records. It ensures that each document can be identified separately and helps avoid confusion. When formatting the reference number, consider the following:

- Unique Identifier: Each document should have a distinct reference number. Use a sequential numbering system or include codes that reflect the year, client number, or project identifier.

- Clear Structure: A common format could be “INV-00123” or “2024-00123” to ensure clarity. This helps you easily identify the document and the sequence of transactions.

- Consistency: Maintain a consistent numbering system across all documents. This ensures easy tracking and avoids errors in your records.

By carefully formatting the date and reference number, you improve the organization and professionalism of your financial documents, making them easier to process, track, and reference.

Using Tables for Itemized Lists

Organizing the details of the products or services you provide is essential for clear communication and transparency. One of the best ways to present an itemized list of charges is by using tables. This format not only enhances readability but also ensures that each item is properly aligned with its respective price, quantity, and description, making the document professional and easy to understand.

Why Use Tables?

Tables offer several advantages when listing products or services:

- Clarity: Tables help organize complex information, such as quantities, prices, and descriptions, into a clear, structured format.

- Readability: The separation of information into rows and columns makes it easy to scan through the details quickly without confusion.

- Professionalism: A well-organized table reflects professionalism, providing a polished appearance that enhances your business’s image.

Key Components of Itemized Tables

When creating a table for your itemized list, there are a few key elements to include:

- Description: Include a brief, clear description of each product or service to ensure the client understands what is being billed.

- Quantity: Specify the number of units or amount of each service being charged.

- Unit Price: List the price per unit, whether it’s the cost of a single item, hourly rate, or service fee.

- Total Price: Calculate the total amount for each item or service by multiplying the quantity by the unit price. This helps the client see how the final amount is derived.

By using tables for itemized lists, you ensure that your billing document is both organized and visually appealing, which improves the client’s experience and reduces the chance of misunderstandings.

How to Add Payment Terms

Clearly stating the payment terms in your financial documents is crucial for ensuring that both parties understand the expectations regarding payment. These terms define when the payment is due, what methods are acceptable, and any penalties for late payment. By including payment terms, you set clear boundaries for financial transactions, which helps prevent misunderstandings and delays.

When adding payment terms, it’s important to be as specific and transparent as possible. This includes outlining the due date, accepted payment methods, and any potential late fees or early payment discounts. Well-defined terms create trust and demonstrate professionalism while ensuring that payments are made on time.

Key Elements to Include in Payment Terms

There are several key details you should include to make the payment terms clear:

- Due Date: Clearly specify the exact date when the payment is due. For example, “Payment due within 30 days from the issue date” or “Due by March 15, 2024.”

- Accepted Payment Methods: List the methods you accept, such as bank transfer, credit card, PayPal, or checks. Make it easy for the client to pay using their preferred method.

- Late Payment Fees: Specify any fees that will be charged if the payment is not received by the due date. This encourages timely payments and sets clear consequences for delays.

- Early Payment Discounts: If applicable, offer incentives for early payment, such as a percentage discount for paying within a certain period.

- Currency: Indicate the currency in which payment should be made (e.g., USD, EUR) to avoid confusion, especially if you work internationally.

By including clear and concise payment terms in your document, you not only ensure that both you and your client are aligned on financial expectations but also establish a framework that encourages timely and efficient payments.

Generating Invoices with Automation

Automating the creation of financial documents is a great way to streamline your billing process and save time. By using automation tools, you can generate professional, consistent records with minimal effort. This approach is especially useful when you have recurring transactions, multiple clients, or need to produce large volumes of documents quickly. Automating the process ensures accuracy, reduces human error, and provides you with a more efficient workflow.

With automation, you can set up predefined fields and formats, allowing you to input new data for each transaction without having to recreate the document from scratch each time. The system will automatically populate the necessary fields, such as client details, itemized lists, and totals, saving you the hassle of manual entry. This not only speeds up the process but also ensures consistency across all your documents.

Steps for Automating the Document Creation

To generate financial records automatically, follow these steps:

- Define Document Structure: Create a standard structure for your documents, including sections for client information, descriptions, prices, and totals. This structure will serve as the foundation for all generated records.

- Use Automation Tools: Use scripting or programming tools that allow you to define placeholders for dynamic content, such as client names, transaction details, and date of issue. Popular automation frameworks allow you to link these placeholders with a database or spreadsheet to pull relevant information.

- Set Up Variables: Define variables for fields such as product descriptions, quantities, prices, and payment terms. These will be automatically filled in when generating each document.

- Include Calculations: Ensure the system can automatically calculate totals, taxes, and discounts based on the provided information, minimizing errors in financial reporting.

- Review and Customize: Before finalizing the automation, review the generated document for accuracy and make any necessary customizations to ensure it aligns with your business needs and branding.

By automating the generation of your financial records, you eliminate repetitive tasks, reduce errors, and save valuable time, allowing you to focus more on the core aspects of your business.

Testing Your Document for Accuracy

Ensuring the accuracy of your billing documents is essential to maintain professionalism and avoid errors in financial transactions. Before using your document format for client communications, it’s important to thoroughly test it to ensure all data is correctly populated and formatted. Testing allows you to identify any inconsistencies, calculation errors, or formatting issues that could potentially confuse clients or result in miscommunication.

By conducting a detailed review and running a few test cases, you can verify that all information is being displayed as intended and that calculations such as totals, taxes, and discounts are correct. Additionally, testing helps confirm that the document structure and layout are aligned with your business needs and are easy for the recipient to navigate.

Steps for Testing Your Document

Here are some steps to effectively test your billing document:

- Verify Data Population: Test with different sets of data, including client information, product descriptions, prices, and quantities, to ensure that all fields are correctly populated.

- Check Calculations: Ensure that calculations, such as item totals, tax amounts, and overall total, are accurate. Check if the document automatically updates totals when information changes.

- Test Formatting: Review the document for alignment, consistency in fonts, and correct use of space. Ensure that all sections, such as itemized lists and totals, are clearly visible and well-organized.

- Check for Edge Cases: Test scenarios like long descriptions, multiple line items, or large numbers to make sure the layout remains readable and that no important information is cut off or misaligned.

- Simulate Real Transactions: Create test documents using real or mock client data to simulate actual transactions. This will help you understand how the document appears from a client’s perspective and whether anything is missing or unclear.

Tools for Testing and Debugging

There are several tools available to help test and debug your documents:

- Preview Function: Use the preview function of your document editor to visualize how the fina

Common Errors in Billing Document Templates

While creating professional financial documents, it is important to avoid common mistakes that can affect the accuracy and clarity of the information presented. Errors can range from calculation mistakes to formatting issues, and they can lead to confusion or even financial discrepancies. Understanding these common pitfalls allows you to prevent them and ensure that your documents are both professional and error-free.

In this section, we will explore some of the most frequent issues people face when setting up billing documents and how to fix them. By addressing these errors, you can improve the quality and reliability of your financial records.

Calculation Mistakes

One of the most critical aspects of any billing document is accurate calculations. Here are some common errors related to calculations:

- Incorrect Total Calculation: Sometimes, the total sum of items or services is not properly calculated, either by missing an item or applying the wrong formula. Always double-check your calculations.

- Omitted Taxes or Discounts: Forgetting to include taxes or discounts can lead to incorrect amounts being billed. Be sure to check if the calculations for tax and discounts are applied correctly based on the provided rates.

- Currency Formatting Issues: Incorrect currency formatting can confuse clients, especially when dealing with international transactions. Ensure that your currency symbols and decimal places are correct and consistent throughout the document.

Formatting Issues

Proper formatting is crucial for ensuring that your documents are visually appealing and easy to understand. Some common formatting errors include:

- Misaligned Text or Columns: If text or data columns are not aligned properly, it can make the document look unprofessional and difficult to read. Double-check that all rows and columns in tables are aligned correctly.

- Inconsistent Font or Style: Using different fonts or inconsistent font sizes within the document can make it look cluttered and less professional. Stick to a uniform style throughout.

- Overcrowded Information: Packing too much information into a small space can overwhelm the reader. Ensure there’s enough white space to make the document easy to read and visually balanced.

Being aware of these common errors and taking the time to address them will help ensure that your billing documents are professional, clear, and accurate every time.

Exporting and Sharing Your Billing Document

Once your financial document is ready, the next step is to export and share it with your clients or partners. The process of exporting ensures that your document is in a format that can be easily accessed and understood by others, while sharing refers to the method you use to send it. Whether it’s by email, cloud storage, or physical delivery, choosing the right export format and sharing method is crucial for ensuring smooth communication and prompt payments.

When exporting your document, it’s essential to select a widely accepted format, such as PDF, to preserve the layout and ensure it looks the same across different devices and platforms. Once exported, you can share the document securely and efficiently through the most suitable medium for both you and your recipient.

Common Export Formats

Here are some of the most common formats you can use to export your financial records:

- PDF: This is the most commonly used format for sharing billing documents. It preserves the formatting, layout, and style, ensuring that the document appears the same to every recipient, regardless of the software or device they use.

- Excel/CSV: If your client needs to edit or process the data, exporting in Excel or CSV format can be useful. These formats allow the recipient to manipulate the data in spreadsheets but may not preserve the document’s layout.

- HTML: Exporting to HTML format allows your document to be displayed in a web browser. This is helpful for clients who prefer to access documents online rather than download a file.

Sharing Methods

Once you’ve exported the document, you can share it in a variety of ways:

- Email: This is the most direct and widely used method. Simply attach the exported file to an email and send it to your client or recipient.

- Cloud Storage: Services like Google Drive, Dropbox, or OneDrive allow you to upload the document and share a link with your client. This method is especially useful for larger files or documents that need to be accessed multiple times.

- Printed Copy: In some cases, a physical copy may be required. Printing and mailing the document ensures that your client receives a hard copy, though this method may take longer than electronic sharing.

Choosing the right format and sharing method depends on the recipient’s preferences and your specific needs. Ensuring that your document is accessible and easy to open will facilitate smoother transactions and better communication.

Tips for Streamlining Your Billing Process

Managing financial documents efficiently is essential for maintaining a smooth cash flow and reducing administrative workload. By streamlining your billing process, you can save valuable time, ensure accuracy, and improve client satisfaction. Automation, organization, and consistency are key factors in making your billing system more efficient and less prone to errors.

Implementing the right strategies can significantly simplify your workflow, reduce delays, and help you focus on other important aspects of your business. Below are some tips to help you improve your billing practices and keep everything running smoothly.

Automation is Key

One of the best ways to speed up your billing process is by automating as much of the work as possible:

- Automate Document Creation: Use software or scripts to automatically generate your financial documents based on preset data. This eliminates the need to manually enter information for every transaction.

- Set Up Recurring Billing: For clients with regular payments, set up recurring billing to ensure invoices are automatically generated at specified intervals.

- Use Payment Reminders: Automatically send reminders to clients about upcoming or overdue payments, helping to reduce the time spent on follow-ups.

Improve Organization

Keeping your financial documents organized will save you time and reduce the chances of errors:

- Maintain a Consistent Filing System: Organize all documents in a clear and consistent manner, either digitally or physically, so they can be easily accessed when needed.

- Track Payments: Use a simple system or software to track paid and unpaid documents, so you can follow up on outstanding amounts quickly and efficiently.

- Use Clear Naming Conventions: Ensure that your files are named in a way that makes it easy to identify the client and the relevant transaction date, helping to avoid confusion later.

Standardize Your Format

Consistency is crucial in any business operation, and your billing system is no exception. Standardizing your documents can make them easier to manage and ensure professionalism:

- Create a Standard Layout: Develop a consistent layout for your financial documents, ensuring that key elements like client details, items, and totals are always in the same places.

- Set Standard Payment Terms: Establish clear and consistent payment terms that you can use for all transactions, helping to avoid confusion with clients.

- Use Templates: Once you’ve established a format, create r