Free Laptop Invoice Template for Easy and Professional Billing

When running a business, maintaining a clear and professional approach to billing is crucial for ensuring smooth financial transactions. Having a structured method to document sales, services, or products is essential for both the seller and the buyer. A well-organized payment record helps build trust and reduces the risk of errors or disputes.

In today’s digital world, creating professional documents has never been easier. With the right tools, you can produce detailed and customized payment forms that meet your specific needs. These documents not only serve as a record of the transaction but also act as a clear statement of terms, payment schedules, and itemized costs.

Customizing your billing documents to reflect your brand and the nature of your transactions can further enhance the professionalism of your business. Whether you’re a small entrepreneur or part of a larger company, adapting your paperwork to suit your work is essential for streamlined operations and maintaining good client relationships.

Using a reliable format for these documents can save you time and help avoid mistakes. This article will explore the tools available to create clear, customizable documents to suit your business needs, offering tips on both design and content to ensure your forms are effective and professional.

Why You Need a Laptop Invoice Template

For any business that involves selling products or providing services, having a reliable method to document transactions is essential. Clear and accurate records not only ensure smooth financial management but also help maintain trust between parties. Without a standardized approach, it’s easy to overlook critical details, leading to confusion or potential disputes.

Using a structured document helps prevent these issues by organizing important transaction details in one place. It provides both the seller and the buyer with a reference for terms, prices, payment dates, and other relevant information. This can simplify communication, making it easier to clarify any questions that may arise during or after the sale.

Automating the process of generating these records through a customizable format further increases efficiency. Rather than starting from scratch each time, having a pre-designed structure allows for quick adjustments and ensures consistency across all transactions. Whether you’re managing a few sales or dealing with high-volume orders, this systematized approach saves valuable time and reduces human error.

Moreover, having a standardized document demonstrates professionalism, which can enhance your business’s credibility. Clients are more likely to trust a company that provides clear, organized documentation, especially when it comes to payment and transaction terms. This level of professionalism can set you apart in a competitive market.

How to Create a Laptop Invoice

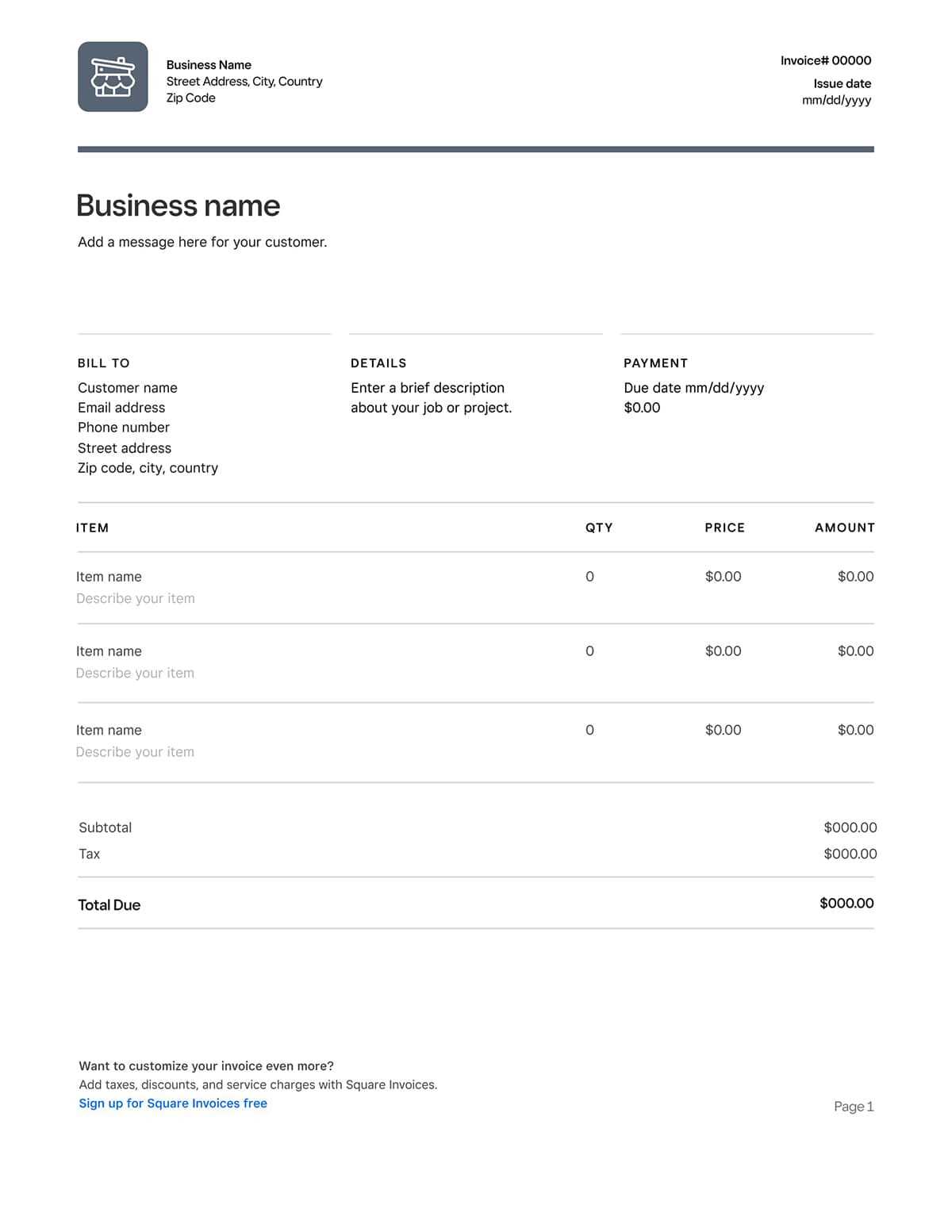

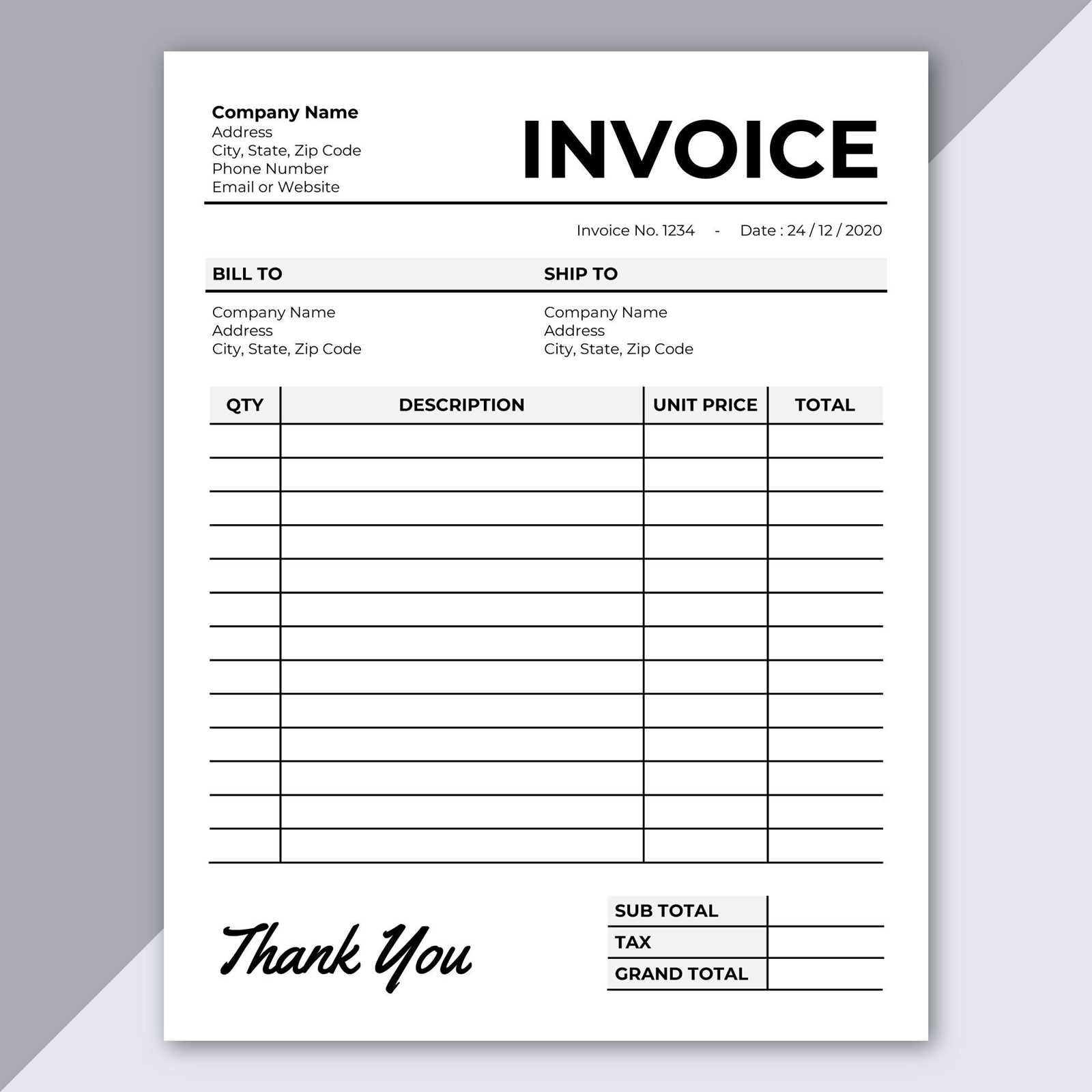

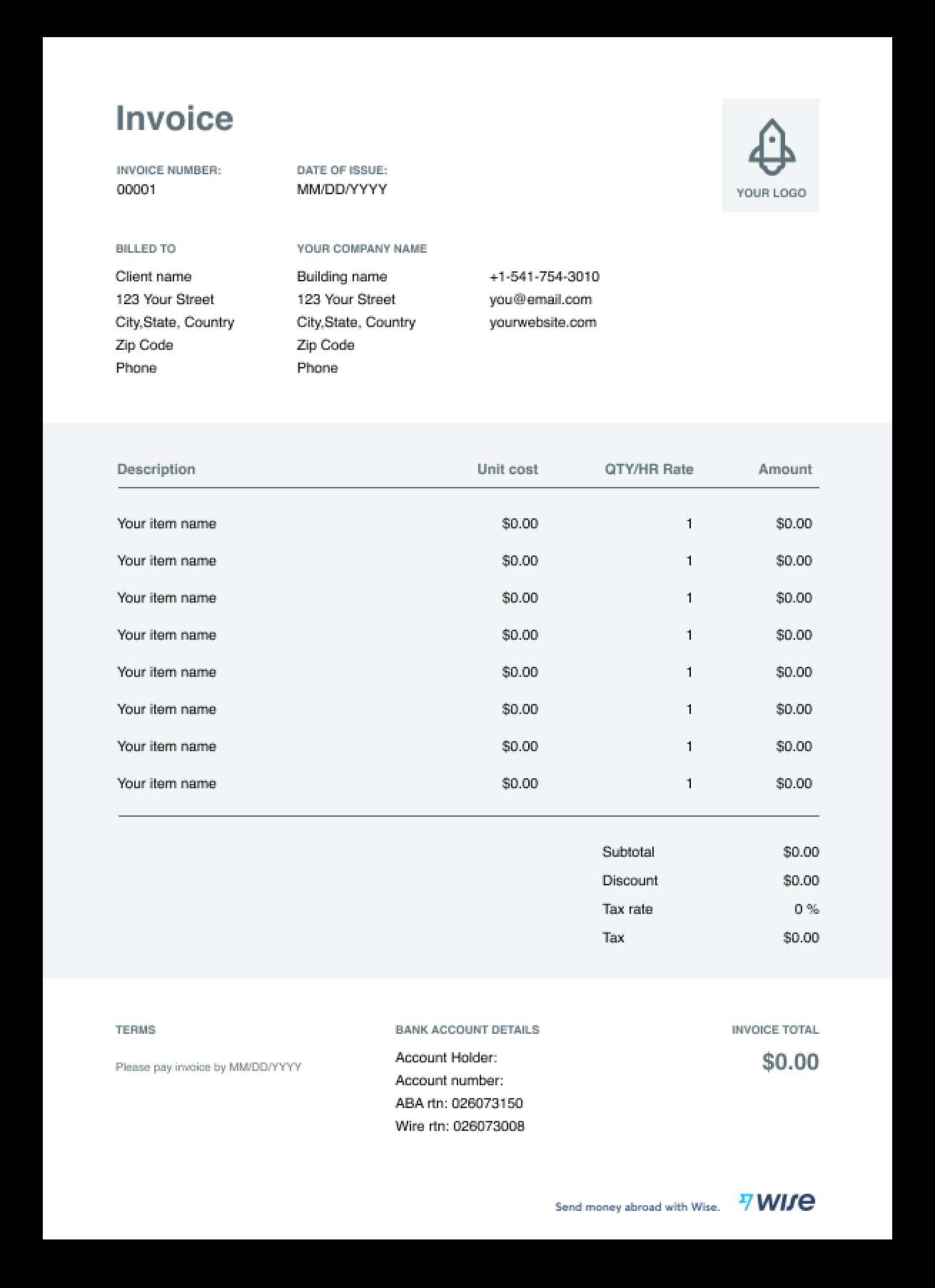

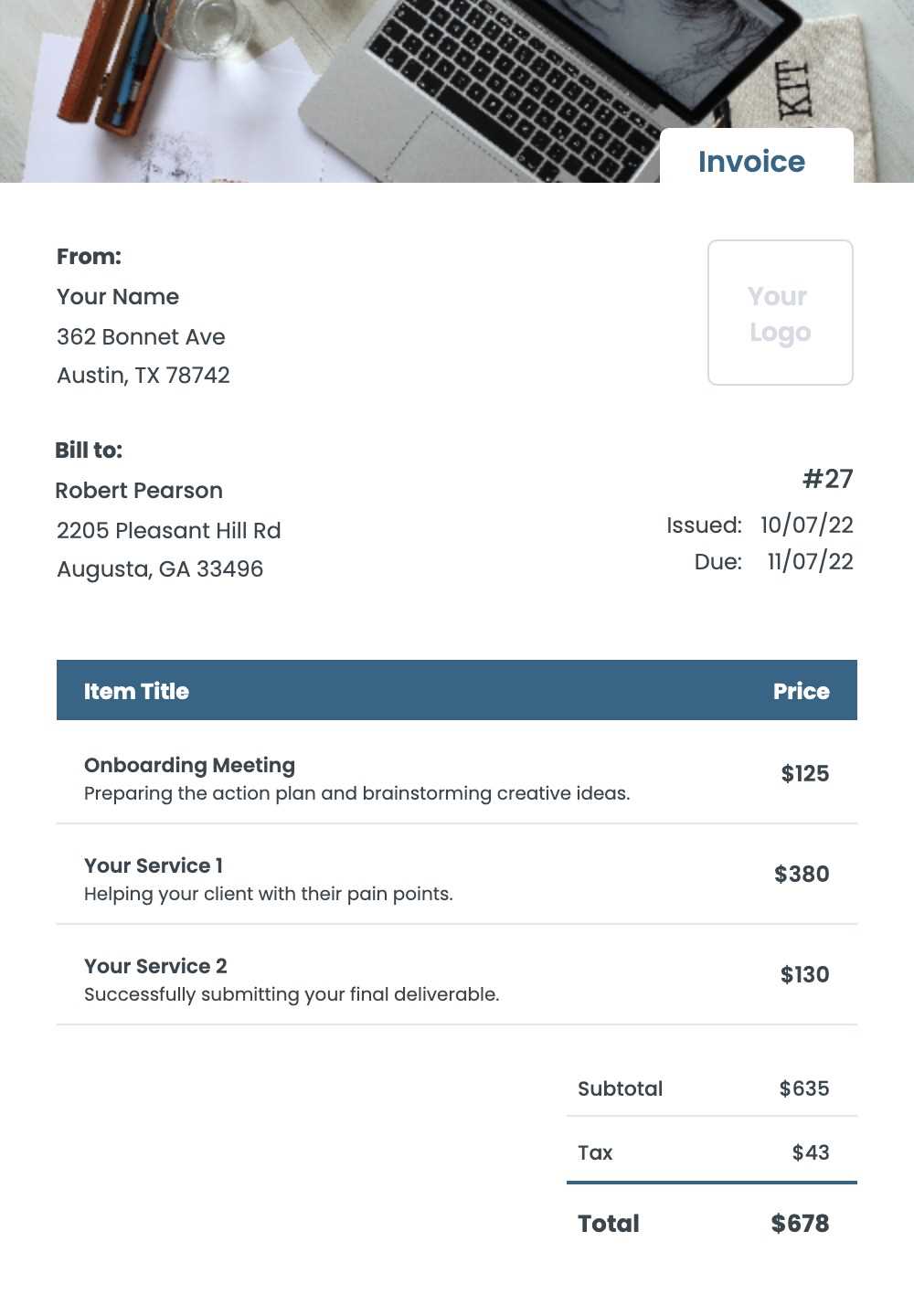

Creating a clear and professional document to record the details of a transaction is essential for any business. This document should outline the services provided, the agreed prices, and the payment terms. By following a structured approach, you can ensure that every necessary detail is included and presented in a way that is easy to understand for both parties involved.

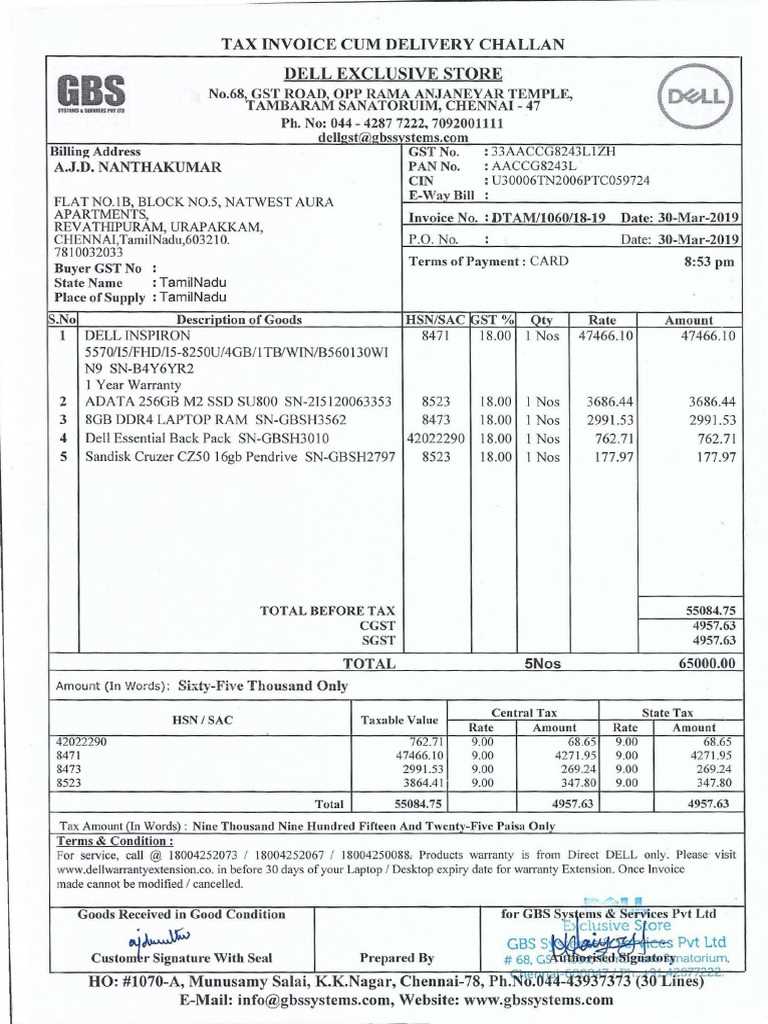

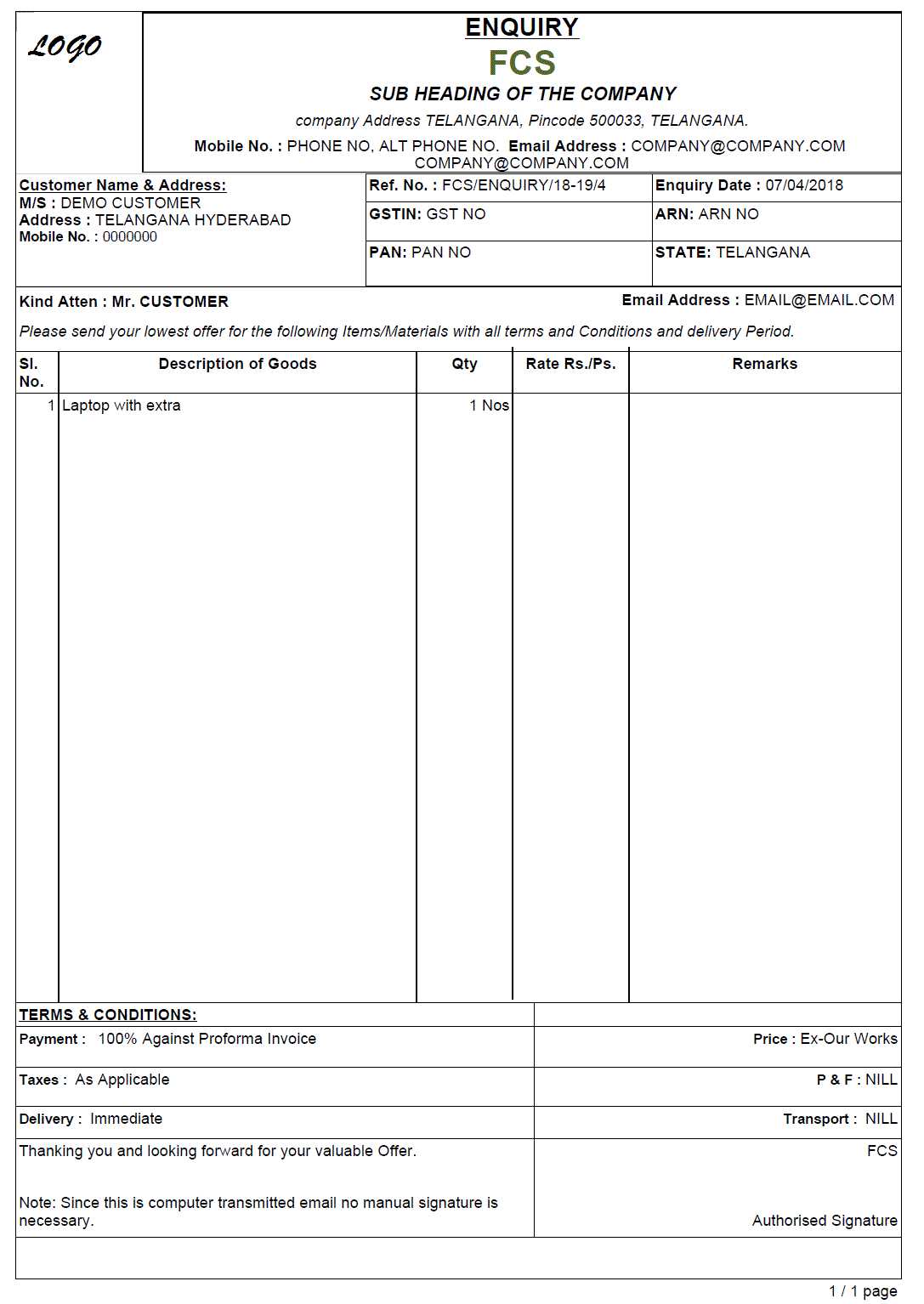

Step 1: Include Essential Information

The first step in creating a professional document is to make sure all the key information is included. At a minimum, this should cover the name and contact details of both the seller and the buyer, a description of the products or services provided, the agreed price, and the total amount due. Don’t forget to also include the date of the transaction and a unique identifier to help keep track of your records.

Step 2: Add Payment Terms and Methods

Next, clearly state the payment terms. This includes the due date for payment, any late fees, and the acceptable methods of payment. If the payment is being split into installments or is subject to taxes, make sure these details are outlined to avoid confusion later. Providing clear and concise payment instructions ensures both parties are on the same page regarding expectations.

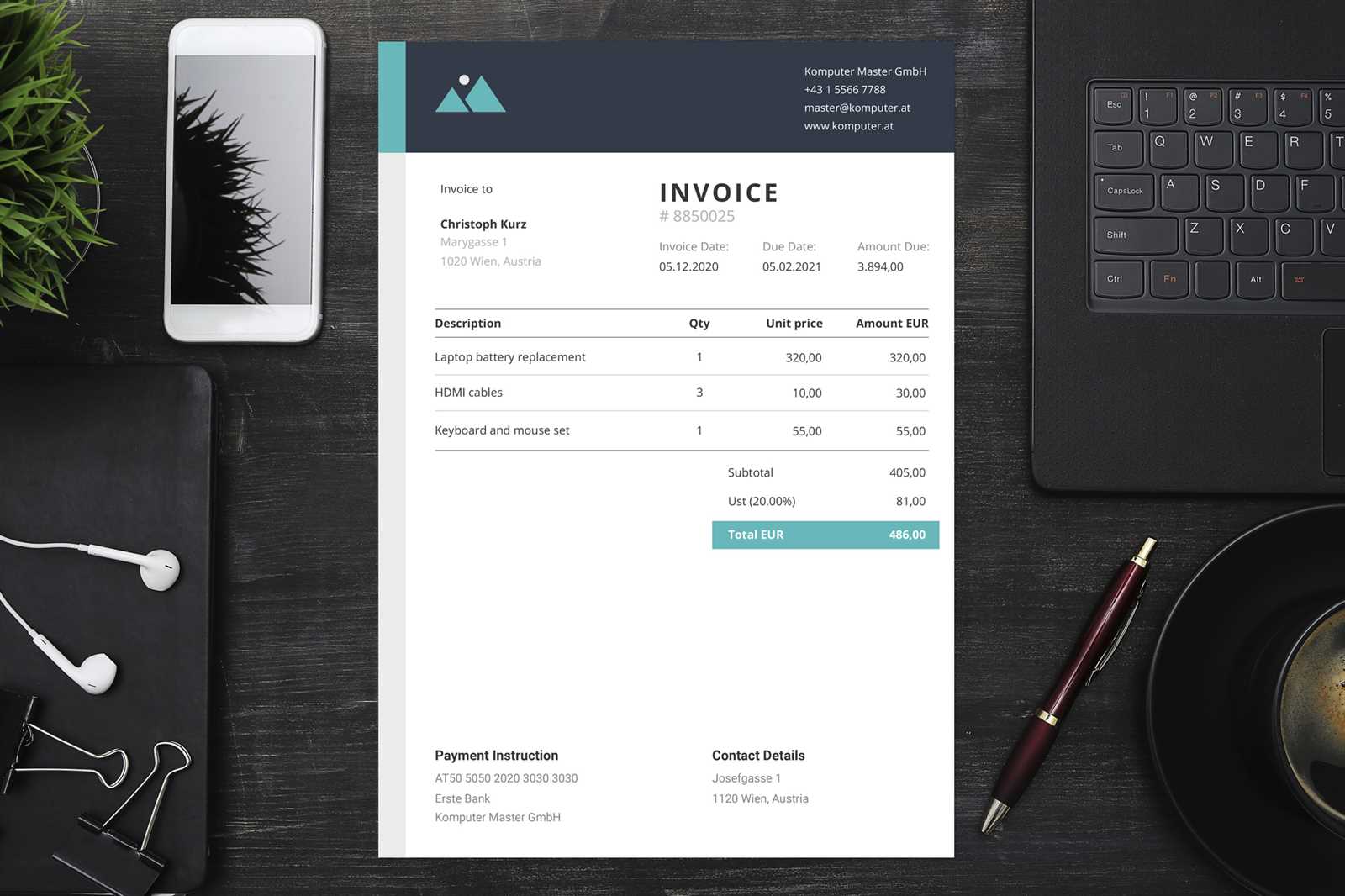

Customizing the document with your business branding, such as logos or color schemes, adds a personal touch and enhances professionalism. This can help foster a stronger relationship with clients and make your documentation easily recognizable. Additionally, using a well-organized layout with itemized sections can make the information more digestible and accessible.

Once your document is complete, review all details carefully before sending it out. A well-crafted document not only ensures that you’re paid correctly but also helps avoid any misunderstandings or disputes down the road.

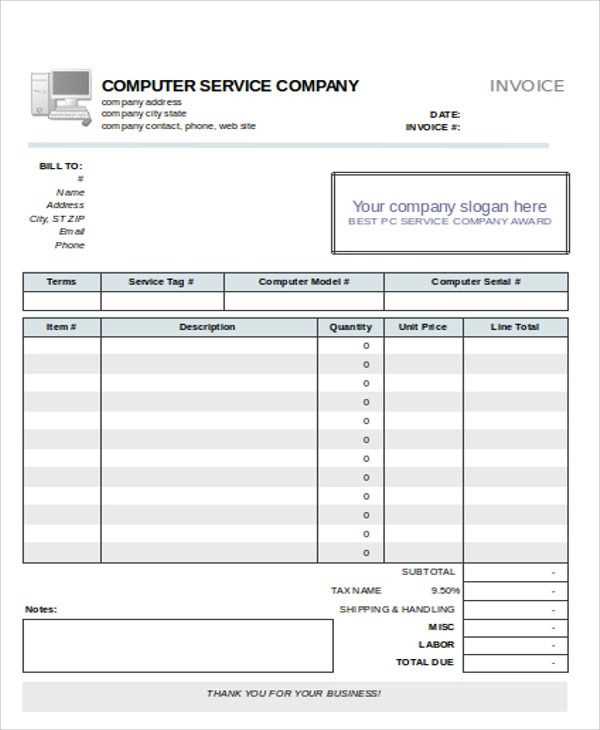

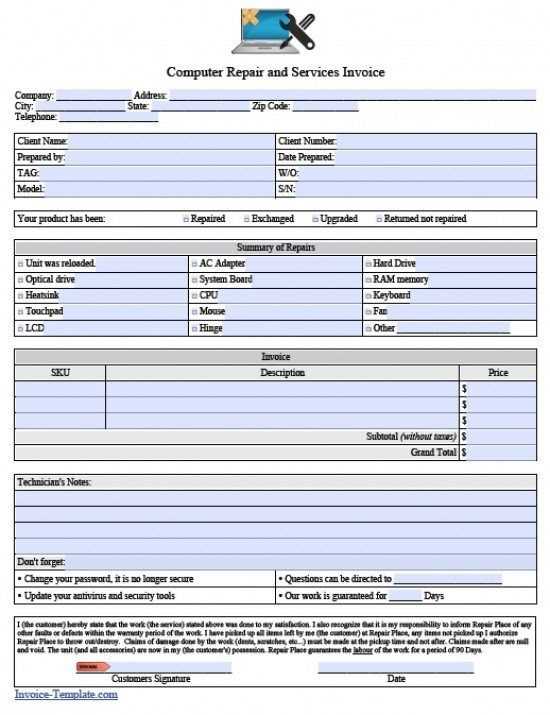

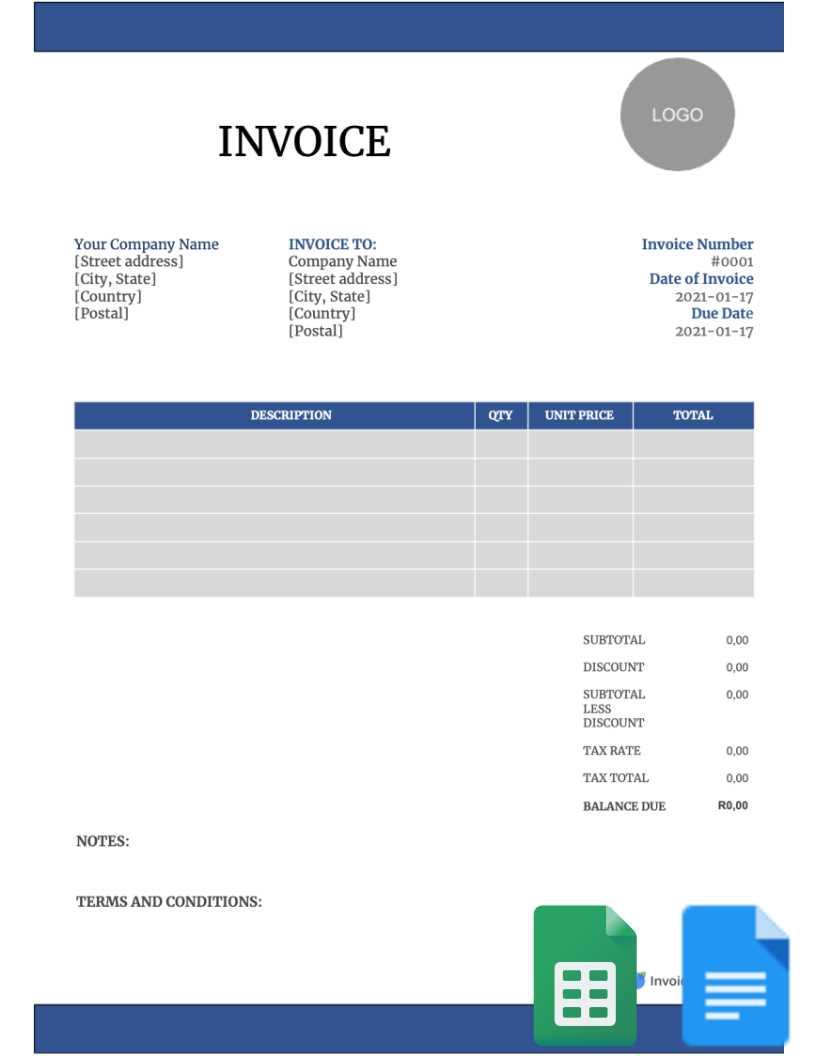

Top Features of an Effective Invoice

An effective billing document is more than just a request for payment. It serves as a clear record of the transaction, providing both the buyer and the seller with all necessary details in a structured and easy-to-understand format. The design and content of the document play a crucial role in avoiding confusion and ensuring smooth financial transactions.

Here are some key features that make a billing document effective:

- Clear Contact Information: Include full contact details for both the seller and the buyer. This ensures that both parties can easily reach each other if necessary.

- Unique Identifier: Every transaction should have a unique reference number. This helps both parties track payments and keeps records organized.

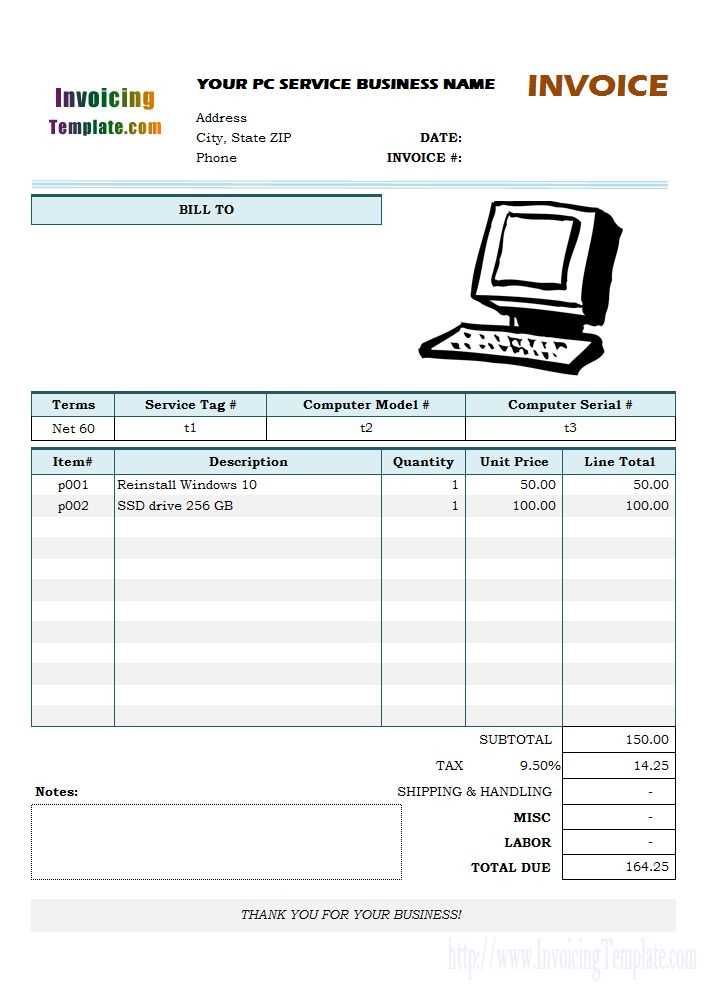

- Detailed Description of Products or Services: Provide an itemized list of what is being sold or provided, including quantities, descriptions, and unit prices. This transparency avoids any misunderstandings.

- Payment Terms: Clearly outline the payment due date, accepted methods of payment, and any applicable late fees. This helps set expectations and prevent delays in payment.

- Tax Information: If applicable, include the necessary tax rates and amounts to ensure the total cost is transparent. This is especially important for legal compliance and clear communication.

- Total Amount Due: Highlight the total amount payable, ensuring that it is clearly visible and easy to read. Include any discounts or adjustments, if applicable.

- Professional Layout and Branding: A clean, well-organized design adds credibility to the document. Incorporating your company logo and using consistent fonts and colors can help reinforce your brand identity.

By ensuring your billing documents include these essential features, you can improve both the professionalism and efficiency of your business transactions.

Best Software for Laptop Invoice Creation

Creating detailed and professional billing documents can be time-consuming if done manually. Fortunately, there are various software solutions that can streamline the process, allowing businesses to generate polished and accurate records in just a few clicks. These tools offer customizable options, automation features, and templates that save time while maintaining a high level of professionalism.

1. QuickBooks

QuickBooks is one of the most popular accounting software programs used by businesses of all sizes. It offers an easy-to-use platform for creating, managing, and tracking financial documents. With customizable templates and automatic tax calculations, QuickBooks ensures that your documents are accurate and professional. Additionally, it allows for seamless integration with bank accounts and payment systems, helping you keep track of payments and expenses.

2. FreshBooks

FreshBooks is another excellent option for businesses looking to simplify their billing process. Known for its user-friendly interface, FreshBooks allows you to create and send professional documents with ease. The software offers customizable features, such as branding options and payment reminders, ensuring that your records reflect your company’s identity. It also offers cloud-based storage, which allows for easy access and management from anywhere.

Both of these tools provide businesses with the ability to create clear, accurate, and visually appealing documents, saving valuable time and reducing the risk of errors in financial transactions. Whether you’re a freelancer or running a larger operation, the right software can help you maintain organized and professional records effortlessly.

Customizing Your Laptop Invoice Template

Personalizing your billing documents helps create a professional image for your business and ensures that the transaction details are presented clearly. Customization allows you to reflect your brand identity, adjust the layout to your specific needs, and make sure that every necessary element is included for clarity and accuracy. By tailoring the design and content, you can create documents that are both functional and visually appealing.

Here are several aspects to consider when customizing your billing documents:

- Branding: Incorporate your company logo, brand colors, and fonts to make the document uniquely yours. This adds professionalism and makes your communications easily recognizable to clients.

- Layout and Structure: Choose a layout that suits the complexity of your transactions. If you are offering multiple products or services, consider a table format that breaks down the details clearly. Keep sections well-organized to enhance readability.

- Payment Terms and Instructions: Customize the section that outlines payment terms, including due dates, accepted payment methods, and any late fees. Make sure this information is prominently displayed for easy reference.

- Itemization: Adjust the level of detail based on your business. For example, if you provide customized services or have complex pricing, include a more detailed breakdown of costs to ensure transparency and avoid confusion.

- Additional Information: Include any necessary legal or tax details, such as VAT numbers, business registration information, or specific terms related to warranties or returns. Customizing this section ensures you meet legal and regulatory requirements.

By carefully adjusting these elements, you can ensure that your documents are both practical and aligned with your brand’s image. Customizing your records not only enhances your professionalism but also improves communication with your clients, leading to smoother transactions and stronger relationships.

Common Mistakes When Writing Invoices

When creating billing documents, even small errors can lead to confusion, delayed payments, or disputes. It’s essential to ensure that every detail is accurate and clearly presented to avoid misunderstandings with clients. Many businesses make common mistakes that can negatively affect the transaction process, and identifying these issues can help improve your financial management practices.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate contact details for both the buyer and the seller. Whether it’s an incorrect email address, phone number, or company name, missing or outdated contact information can cause delays in communication and payments. Make sure that both parties’ details are current and easy to find on the document.

2. Incomplete or Ambiguous Descriptions

Vague descriptions of products or services can create confusion and lead to disputes. It’s crucial to provide clear, detailed information about what is being sold or provided. Always include specifics such as quantities, model numbers, and service descriptions. An unclear or incomplete description can result in the client questioning what they are paying for.

Accurate descriptions help clarify the terms of the transaction, ensuring that both the seller and the buyer are on the same page. Taking the time to list all relevant details upfront can prevent unnecessary back-and-forth later.

3. Forgetting Payment Terms

Another common mistake is neglecting to include payment terms or making them unclear. It’s important to specify the due date, accepted payment methods, and any additional fees for late payments. Without this information, clients may be uncertain about when and how to make payments, leading to delays or confusion.

By avoiding these common errors, you can ensure smoother transactions and maintain professionalism in your financial dealings. Clear, accurate documents not only help build trust with clients but also protect your business interests.

How to Add Taxes to Your Invoice

Including taxes in your billing records is essential for ensuring that the total amount reflects the correct charges. Properly calculating and displaying taxes not only helps you comply with legal requirements but also prevents misunderstandings with your clients. It’s important to clearly show the tax breakdown so both parties understand the total amount due and how it’s been calculated.

1. Determine the Tax Rate

The first step in adding taxes is to determine the applicable tax rate. Depending on your location and the nature of your business, tax rates may vary. For example, sales tax rates differ by state or country, and some products or services may be exempt from tax. Research the correct tax rate for your location and product type to ensure accurate calculations.

2. Calculate and Display Taxes

Once you have the tax rate, apply it to the price of the goods or services. Here’s a simple way to show the tax breakdown:

| Description | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Product A | $500 | 10% | $50 |

| Service B | $200 | 10% | $20 |

| Total | $700 | $70 |

In this example, the tax amount is calculated based on the listed rates. Make sure to list the individual tax amounts and the total tax at the end of the document so that clients can clearly see how the total price is broken down.

Important Tip: If you are working with international clients, make sure to include any relevant VAT or other sales taxes that may apply based on their location. Always check the tax laws that apply to your business to ensure you are compliant and transparent.

Understanding Invoice Numbering Systems

A well-organized numbering system is essential for keeping track of your financial records. Each transaction should have a unique identifier to ensure proper record-keeping, avoid confusion, and make it easier to locate specific documents when needed. By implementing a structured numbering system, you can improve your workflow and stay compliant with accounting or tax regulations.

Numbering systems can vary depending on the business needs and preferences. Some companies use sequential numbers, while others prefer to incorporate dates, client codes, or other identifiers. It’s important to create a system that works for your business and helps streamline your billing process.

Basic Numbering Format

A common approach is to use a sequential numbering format that starts from a specific number (e.g., 001) and increases with each new transaction. This ensures each document has a unique reference, making it easier to track payments and organize your records. Here’s an example of how a simple numbering system might look:

| Transaction Number | Date | Total Amount |

|---|---|---|

| #001 | 01/01/2024 | $500 |

| #002 | 01/05/2024 | $200 |

| #003 | 01/10/2024 | $750 |

Customizing Your Numbering System

You can also customize your numbering system based on your business needs. For example, you may want to include the year or month in the number to make it easier to identify when a transaction occurred. This can be especially helpful if you handle a high volume of transactions. Here’s an example of a customized numbering system:

| Transaction Number | Date | Total Amount |

|---|---|---|

| 2024-001 | 01/01/2024 | $500 |

| 2024-002 | 01

When to Send a Laptop Invoice

Timing is crucial when it comes to sending billing documents. Sending them too early can cause confusion, while sending them too late can delay payments and create misunderstandings. Knowing the right moment to send these records helps maintain a smooth cash flow and fosters trust with your clients. It ensures that both parties are on the same page and that payments are processed in a timely manner. Best Times to Send Billing Documents

Factors to Consider When Determining Timing

|