Free Landscaping Invoice Template PDF for Easy Billing

In any service-based business, efficient billing is crucial for maintaining smooth operations and ensuring timely payments. Having a professional, well-organized document for client transactions can save time and reduce the risk of errors. Using pre-designed forms tailored to your needs allows you to focus on providing excellent service, while your financial records stay neat and accurate.

These forms provide a clear structure for listing services rendered, payment terms, and other important details, making them an essential tool for any professional. Whether you’re managing multiple projects or handling individual tasks, simplifying your payment collection process can improve both client satisfaction and cash flow.

Adopting a digital solution for your financial documents makes it easy to store, share, and update your records. With customizable options available, these solutions ensure that your billing remains consistent and error-free, regardless of the scale of your business. The flexibility and accessibility of digital formats mean you can quickly adjust to client needs or legal requirements with minimal effort.

Landscaping Invoice Template PDF Overview

When managing client transactions, having a clear and professional document to outline charges and payment terms is essential for any business. These organized forms help businesses ensure accuracy, avoid confusion, and maintain a high level of professionalism. By utilizing digital solutions, professionals can streamline the billing process, making it easier to track payments, create new records, and share documents efficiently.

Key Benefits of Using Pre-Formatted Documents

Using pre-designed forms offers several advantages, including:

- Consistency: A standardized format ensures all records follow the same structure, reducing the risk of missing details.

- Time-saving: Ready-to-use documents allow quick generation, reducing the time spent on manual entry and design.

- Accuracy: Built-in fields minimize human error and guarantee important information is included in every record.

- Professional appearance: A clean, polished design presents a trustworthy image to clients and helps build credibility.

How These Forms Simplify Business Operations

By integrating digital documents into everyday practices, businesses can significantly reduce administrative overhead. This efficiency is particularly useful for managing large volumes of projects or clients. Other advantages include:

- Easy customization to reflect your business’s branding or specific services.

- Immediate access and sharing, whether you’re in the office or on-site.

- Better organization of financial records, simplifying future audits or tax filing processes.

Ultimately, using these digital tools helps businesses stay organized, save time, and maintain a professional image throughout client interactions.

Why Use an Invoice Template

Efficient billing is crucial for maintaining smooth business operations and ensuring prompt payment for services rendered. Using a standardized document not only helps in organizing financial details but also enhances the professional image of your business. With a pre-designed structure, these documents simplify the process, allowing you to quickly input necessary information and send them to clients without delays.

Consistency is one of the primary reasons to use these forms. A uniform format ensures that every transaction follows the same layout, which reduces the chances of important details being overlooked or omitted. It helps in keeping your records clean and makes it easier to manage your business finances over time.

Another important benefit is the time-saving aspect. Instead of starting from scratch each time you need to issue a statement, you can simply customize an existing form to suit your needs. This streamlined approach allows you to focus more on delivering quality services to your clients rather than spending excessive time on administrative tasks.

Moreover, using a ready-made document enhances professionalism. Clients appreciate receiving well-organized and easy-to-read statements, which contributes to a more positive working relationship. A polished document reflects attention to detail, which builds trust and strengthens your reputation in the industry.

Benefits of PDF Invoice Formats

When it comes to managing business transactions, using digital formats offers a range of advantages. Choosing a universally recognized, fixed-layout format for your financial documents can streamline operations, enhance security, and simplify the sharing and storage of important records. This digital solution ensures that your documents remain professional, easy to access, and compatible across different platforms and devices.

Enhanced Security and Integrity

One of the major benefits of using this digital format is its ability to maintain the integrity of your documents. Unlike editable formats, a fixed layout ensures that the content cannot be accidentally altered, ensuring that the details remain unchanged. Additionally, documents can be password-protected or encrypted, offering an extra layer of security to prevent unauthorized access to sensitive information.

Easy Sharing and Accessibility

Another key advantage is the ease with which these files can be shared. Digital documents can be sent instantly via email or uploaded to cloud storage, making them accessible to both you and your clients from anywhere. This eliminates the need for physical copies and helps avoid delays in delivery, which can be particularly useful when working with clients in different locations.

In addition, because the format is widely supported across various devices and operating systems, you don’t have to worry about compatibility issues. Whether your client is using a computer, tablet, or smartphone, the document will appear the same, preserving its layout and content.

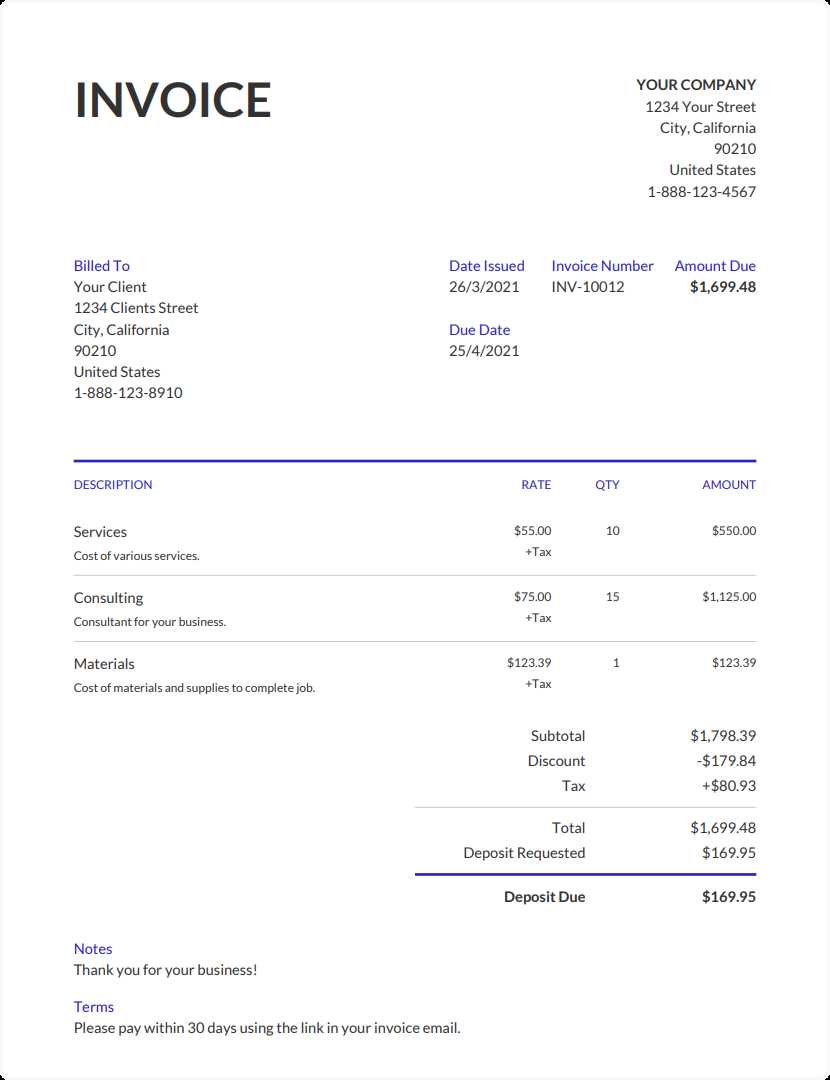

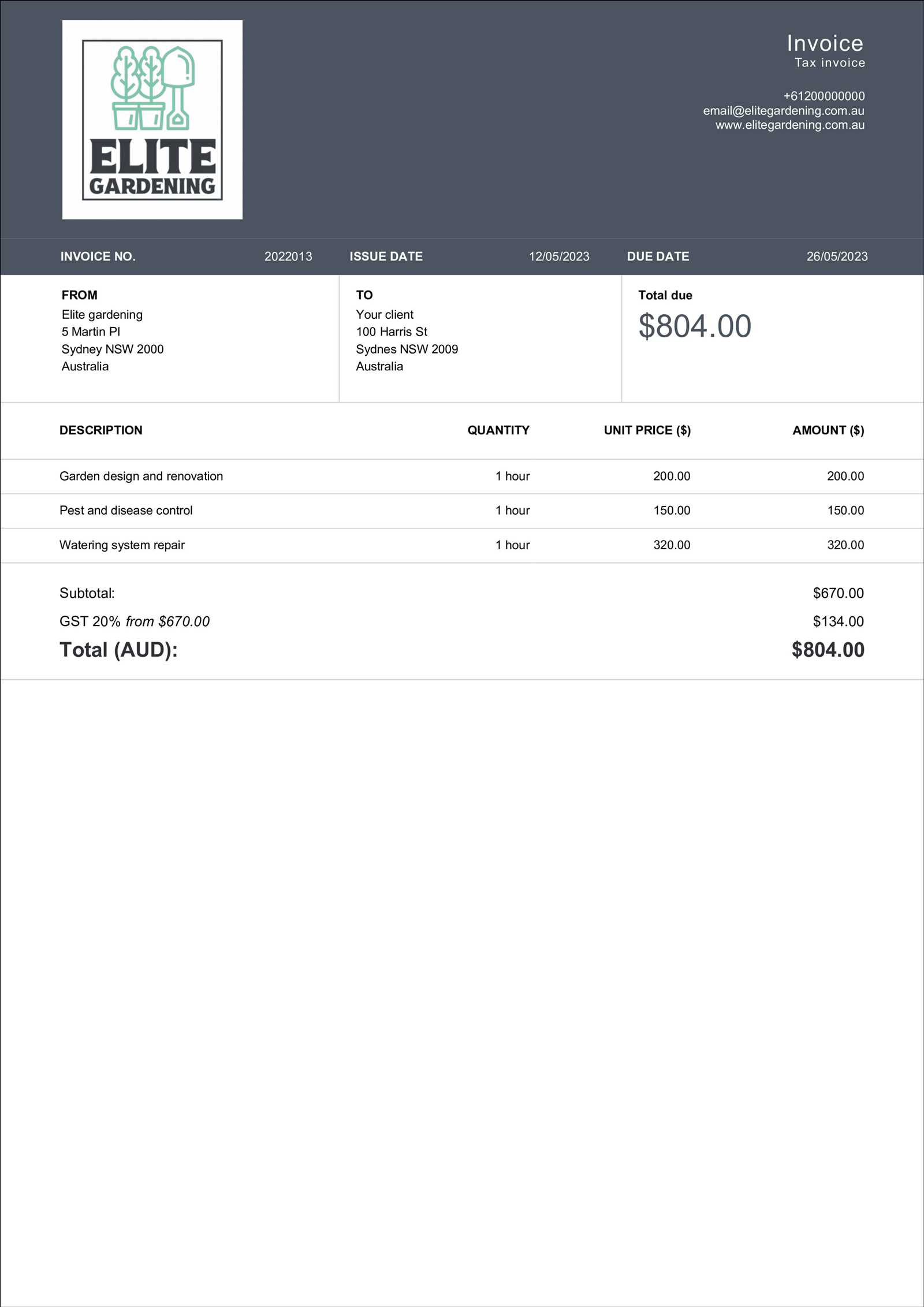

Essential Elements of a Landscaping Invoice

When creating a document to detail services provided and the amount due, it’s crucial to include all the necessary components that ensure clarity and prevent any misunderstandings. A well-structured statement not only provides essential information but also contributes to maintaining professionalism and trust with clients. Below are the key elements that should be included in any professional financial document.

Key Components of a Service Billing Statement

To ensure the document is both complete and easy to understand, consider including the following details:

- Business Information: Include your company name, address, contact details, and logo (if applicable) to establish your business identity.

- Client Information: Ensure the client’s name, address, and contact details are correct to avoid delivery issues or confusion.

- Unique Document Number: Assign a unique reference number to each record for easy tracking and future reference.

- Service Description: List all tasks performed, including any materials used, so the client understands exactly what they are being charged for.

- Payment Terms: Clearly state the payment due date, acceptable payment methods, and any late fees or discounts for early payment.

- Total Amount Due: Include the total amount to be paid, along with a breakdown of the cost for each service or item provided.

Additional Details to Include

In addition to the basics, these additional elements can make the statement more comprehensive and professional:

- Tax Information: If applicable, include the tax rate and amount charged, as well as any other relevant legal information.

- Work Dates: Clearly list the dates the work was completed, especially for projects that span multiple days or weeks.

- Notes or Special Instructions: Add any additional information, such as special terms, future service agreements, or customer feedback.

Incorporating these elements into your financial records will ensure both you and your clients have a clear understanding of the charges, terms, and expectations, fostering better communication and smoother transactions.

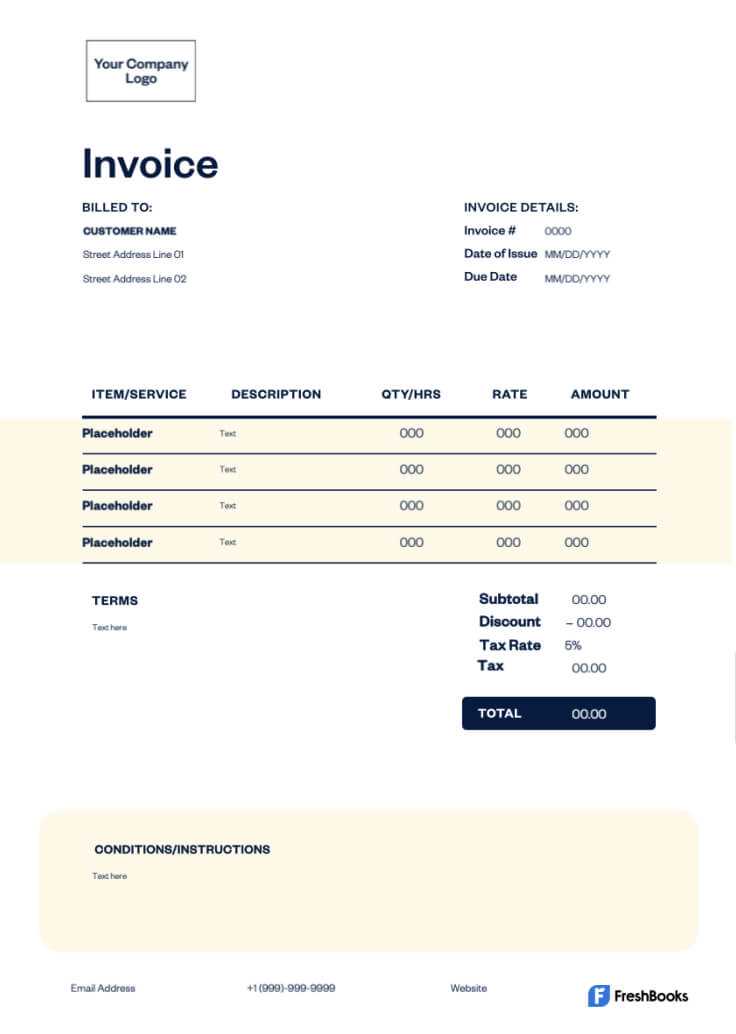

Customizing Your Landscaping Invoice Template

Personalizing your financial documents can help reflect your brand identity and meet specific business needs. Customization ensures that every detail, from the design to the content, aligns with your style and the nature of your services. By tailoring the document to your preferences, you create a professional appearance while also making the document more functional and easier to manage.

Adjusting Layout and Design

One of the first steps in customizing your billing document is selecting a layout that suits your business. You can modify elements such as:

- Logo and Branding: Include your company’s logo and color scheme to make the document instantly recognizable to clients.

- Font and Typography: Choose fonts that align with your brand’s tone–whether professional, modern, or creative.

- Sections and Headings: Customize the headings to match the terminology that best fits your industry, making it easier for clients to understand.

Adding Custom Fields and Information

To make your document more relevant to your specific business, consider including or modifying the following fields:

- Payment Terms: Adjust the terms to match your payment policy, such as due dates, late fees, or deposit requirements.

- Service Descriptions: Add or modify descriptions to fit the services you provide, ensuring clarity for your clients.

- Discounts and Promotions: Include custom fields to apply any discounts or promotional offers, helping clients see the value in your services.

These customizations will not only enhance your document’s functionality but also make it a stronger reflection of your business, helping to create a lasting impression with your clients.

How to Download Landscaping Invoice Templates

Getting the right financial document for your business is easy once you know where to look and what options are available. Many websites offer ready-to-use documents that can be downloaded and customized to fit your specific needs. In this section, we will walk you through the process of finding and downloading the most suitable format for your business operations.

Steps to Download the Right Document

Follow these simple steps to download a customizable document that suits your business:

- Search for Reliable Sources: Look for reputable websites that specialize in business tools, such as accounting or administrative resources.

- Select the Correct Format: Choose a format that works best with your system–whether it’s a Word document, Excel sheet, or fixed-layout file.

- Download the File: Most websites offer a simple download button or link. Ensure that you are downloading the document from a trustworthy source to avoid any security risks.

- Customize as Needed: After downloading, open the document and personalize it with your business details, including your logo, contact information, and services offered.

Where to Find Quality Documents

There are several platforms where you can find a range of downloadable documents. Here’s a quick comparison of popular sources:

| Platform | Features | Cost |

|---|---|---|

| Template Websites | Wide variety of options, easy-to-use interfaces | Free or Paid |

| Business Tool Websites | Specialized for business users, customizable templates | Free |

| Online Marketplaces | Variety of professional designs, premium options | Paid |

By selecting the right platform, you can quickly access the document that fits your business needs and start managing your transactions with ease.

Top Features of a Professional Invoice

When creating a document to request payment for services rendered, certain features are essential to ensure clarity, professionalism, and efficiency. A well-designed billing document not only outlines the transaction details but also enhances trust between the business and the client. The following features are key to making your financial documents effective and professional.

Clear Contact Information: Ensure both your business and client’s contact details are prominently displayed. This includes your company name, address, phone number, and email, as well as the client’s name and address. Having this information easily accessible helps avoid any confusion and provides a direct way to resolve potential issues.

Unique Reference Number: Assigning a unique number to each document helps with record-keeping and ensures that both parties can easily track and reference specific transactions. This is particularly useful for accounting and future inquiries.

Itemized List of Services: Break down the services or products provided in clear, easy-to-understand terms. This itemization ensures the client knows exactly what they are being charged for, preventing any misunderstandings.

Clear Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or discounts. Having transparent terms helps clients understand when and how to pay, avoiding unnecessary delays or confusion.

Total Amount Due: Clearly display the total amount owed, along with any applicable taxes or additional charges. A concise summary of the amount due helps the client process the payment quickly.

Professional Layout and Design: A well-organized and aesthetically pleasing design contributes to a professional image. The document should be easy to read, with a consistent structure that guides the client through each section logically. This includes appropriate use of headers, tables, and bolded text to highlight important details.

Design Tips for Creating Clear Invoices

Designing a well-organized and easy-to-read document for requesting payment is crucial for ensuring timely and accurate transactions. A clean, simple layout not only makes it easier for your clients to understand the charges, but it also helps reinforce your business’s professionalism. Below are some essential design tips for creating documents that effectively communicate all the necessary information.

Keep It Simple and Organized: Avoid cluttering the document with unnecessary elements. Use ample white space to separate sections and make the content easy to follow. Divide the document into clear sections–such as client information, services rendered, and payment terms–to guide the reader’s eye smoothly through the content.

Use Clear and Legible Fonts: Choose fonts that are easy to read, both on screen and in print. Stick to standard, professional fonts like Arial, Times New Roman, or Helvetica, and avoid using too many different font styles. Ensure the text size is large enough for comfortable reading, especially for important details like the total amount due.

Highlight Key Information: Make important details stand out by using bold text or larger font sizes. This could include the client’s name, service descriptions, and the total payment due. By drawing attention to these elements, you make it easier for your client to quickly identify crucial information without having to search for it.

Use Tables for Clarity: When listing services, quantities, and prices, a table can provide a clear and structured layout. Tables organize the information neatly and allow for easy comparisons, especially when you’re providing a breakdown of multiple items or services. Make sure to label each column clearly, and leave enough space for the client to review each item individually.

Consistency in Design: Consistent use of color, fonts, and layout elements helps reinforce your brand identity. Stick to a color scheme that reflects your company’s branding, and maintain a uniform structure across all documents. This consistency adds to the overall professionalism of the document and makes your business look more organized.

Managing Payments with Invoice Templates

Effectively managing client payments is essential for maintaining cash flow and ensuring business continuity. A well-structured document can streamline the payment process, making it easier for clients to understand the amount owed and the due date. By including clear payment terms and convenient payment options, businesses can reduce delays and improve the efficiency of their financial operations.

Setting Clear Payment Terms

One of the most important aspects of managing payments is establishing clear and concise payment terms. This includes specifying:

- Due Date: Clearly state when the payment is due, whether it’s within a set number of days or on a specific date.

- Late Fees: Mention any penalties for overdue payments to encourage timely settlements.

- Accepted Payment Methods: Indicate the different ways clients can pay, such as bank transfers, checks, or online payment systems.

Tracking and Following Up on Payments

Once you’ve sent a payment request, it’s important to keep track of the status of each transaction. This can be done using a payment tracking system or by simply noting when payments are received. In cases of delayed payments, timely follow-up is essential:

- Send Reminders: A polite reminder can prompt clients to pay if they haven’t done so by the due date.

- Document Payment History: Keep accurate records of payments made and any outstanding amounts, which will help with accounting and future communication.

- Provide Payment Receipts: After receiving payment, issue a receipt to confirm the transaction and maintain transparency.

By organizing and managing payments effectively, businesses can ensure smoother transactions, reduce confusion, and foster better client relationships.

How to Calculate Charges for Landscaping Services

Accurately calculating charges for services ensures fair pricing and helps maintain profitable business operations. To determine the right amount to charge, it’s important to consider various factors such as the scope of the work, materials needed, labor involved, and any additional costs. By breaking down these elements systematically, you can arrive at a price that reflects the true value of your services while remaining competitive.

Factors to Consider When Calculating Charges

Several key elements should be taken into account when determining the cost for a project:

- Labor Costs: Factor in the time it will take to complete the job and the hourly or daily rate for workers. Be sure to include any specialized labor, such as equipment operators or skilled laborers.

- Materials and Supplies: The cost of plants, soil, mulch, tools, or other necessary materials should be included in the total charge. Always estimate the quantity of materials needed to avoid undercharging or running out of stock.

- Overhead and Equipment Rental: Consider costs for equipment maintenance, fuel, or rental charges for machinery required to complete the work.

- Travel Expenses: If the job site is far from your business location, account for transportation costs, including fuel, vehicle maintenance, and travel time.

Calculating a Fair Price

Once you have all the necessary components, you can calculate a fair and competitive price by following these steps:

- Estimate Total Hours: Multiply the total estimated work hours by the labor rate to get the labor cost.

- Add Material Costs: Add the cost of all required materials and supplies.

- Factor in Additional Costs: Include equipment rental, travel expenses, and overhead costs.

- Set a Profit Margin: Finally, add a reasonable profit margin to cover your business’s operational costs and make a profit.

By carefully considering all of these factors, you can ensure that your pricing is fair to both you and your clients while covering the costs of running your business effectively.

Common Mistakes to Avoid in Invoices

Creating a billing document might seem straightforward, but there are several common pitfalls that can lead to confusion, delays in payment, or even disputes with clients. Avoiding these mistakes ensures that your documents are clear, professional, and serve their purpose effectively. Below are some of the most frequent errors and how to prevent them.

1. Inaccurate or Missing Information

One of the most common mistakes is failing to include accurate or complete information. This can include missing details like:

- Client Information: Always double-check the client’s name, address, and contact details.

- Your Business Details: Ensure that your contact information is up-to-date, including your address, phone number, and email.

- Service Descriptions: Be specific about what was provided, including the quantities, dates, and any special instructions.

Missing or incorrect information can delay payment or cause misunderstandings, so it’s essential to verify every detail before sending the document.

2. Lack of Clear Payment Terms

Not clearly stating the terms of payment can create confusion and lead to late payments. Ensure your document includes:

- Due Date: Clearly state when payment is expected.

- Late Fees: Specify any penalties for late payment to encourage timely settlement.

- Accepted Payment Methods: Indicate the various methods clients can use to pay (e.g., bank transfer, check, online payment platforms).

Without clear payment terms, clients might delay payments or misunderstand your expectations.

3. Overcomplicating the Layout

A cluttered or overly complex document can confuse clients and make it harder to understand the details. To avoid this:

- Keep It Simple: Use a clean, straightforward layout with sections clearly divided.

- Highlight Key Information: Use bold text or larger fonts for important details, like the total amount due and the due date.

A well-organized, easy-to-read format ensures that clients can quickly find the information they need and process payments without issues.

By avoiding these com

How to Send Invoices to Clients

Sending financial documents to clients is a crucial step in ensuring timely payment and maintaining clear communication. It’s important to choose the right method for sending these documents, ensuring they reach the client securely and efficiently. In this section, we’ll explore the best practices for sending your billing requests and ensuring clients have all the information they need to make a prompt payment.

Choosing the Best Delivery Method

There are several ways to send your documents to clients, and each has its benefits:

- Email: Sending the document via email is one of the quickest and most convenient methods. It allows for instant delivery and can be easily tracked. Simply attach the document as a file or include a link to a cloud-based version.

- Postal Mail: For clients who prefer physical documents, mailing a printed version might be necessary. This method can sometimes take longer, but it may be preferred for formal or high-value transactions.

- Online Payment Platforms: Many online payment systems allow businesses to send requests directly through their platforms, offering an integrated solution for both delivery and payment processing.

Ensuring Proper Documentation and Follow-Up

When sending financial documents, it’s essential to ensure everything is accurate and clear:

- Double-Check Details: Before sending, verify that all client details, service descriptions, and amounts are correct.

- Send a Confirmation: After sending, follow up with a brief email or phone call to confirm the client has received the document and to answer any questions they may have.

- Set Up Reminders: If payment is not received by the due date, send a polite reminder to ensure the client is aware of the outstanding balance.

By choosing the right method and following up professionally, you ensure that your billing process runs smoothly and efficiently, helping you maintain good relationships with clients and secure timely payments.

Tracking Invoices and Payment Status

Efficiently tracking your payment requests and monitoring their status is essential for maintaining smooth financial operations. By keeping an organized system for tracking payments, you can ensure timely settlements, avoid confusion, and quickly follow up with clients on overdue amounts. This process helps prevent missed payments and ensures your cash flow remains steady.

Methods for Tracking Payments

There are several approaches you can take to effectively track payment status:

- Manual Tracking: Using a spreadsheet or a ledger to manually record and track each request sent, along with its due date and payment status. This method works well for smaller businesses but can become cumbersome as the volume of transactions grows.

- Accounting Software: Many businesses use specialized accounting or invoicing software to automatically track sent documents, payment status, and send reminders for overdue amounts. These tools can also generate reports to give you a better overview of your finances.

- Cloud-Based Solutions: Cloud-based platforms often allow both the business and client to access and track payment status in real-time. These platforms can send automatic reminders and notifications for both parties, making it easier to manage payments.

Steps for Monitoring and Following Up

Once you’ve set up a system for tracking, it’s important to stay on top of payment deadlines and follow up when necessary:

- Track Sent Documents: Keep a record of all documents sent, along with the dates they were sent and when they were due. This allows you to quickly reference past transactions if there are any issues.

- Monitor Payment Progress: Regularly check if payments have been received on time and mark them as paid in your tracking system. If payment is delayed, send a gentle reminder or reach out to the client for clarification.

- Send Reminders: If payment is overdue, send a polite follow-up email or message with the details of the outstanding balance and a reminder of the due date.

By consistently tracking payments and maintaining clear communication, you can reduce payment delays, improve cash flow, and foster better relationships with your clients.

Legal Considerations for Landscaping Invoices

When creating and sending billing documents, it’s important to understand the legal implications to ensure that your requests for payment are valid and enforceable. Proper documentation can protect both your business and your clients in case of disputes. There are key legal considerations that every business should keep in mind when preparing financial documents to avoid potential issues down the road.

1. Clear Terms and Conditions

Establishing clear payment terms in your financial documents is essential for avoiding misunderstandings. These terms should include:

- Payment Due Date: Specify the exact date or time frame in which payment should be made, such as “within 30 days of receipt” or a set date.

- Late Payment Penalties: Include details on any fees or interest charged if the payment is delayed. This acts as a deterrent to late payments and can be legally enforced if properly stated.

- Scope of Services: Clearly outline the work provided, including any agreed-upon conditions, such as deliverables and timelines. This ensures that both parties are aligned on expectations.

2. Tax Requirements and Compliance

In many jurisdictions, businesses are required to collect and remit taxes on services provided. It is important to ensure that your billing documents comply with local tax laws. This includes:

- Sales Tax: If applicable, include the correct sales tax rate for services or goods sold. Some services may be tax-exempt, while others may be subject to a specific rate.

- Tax Identification Number: Include your business’s tax identification number (TIN) or employer identification number (EIN) if required by law. This information may be necessary for tax reporting purposes.

- Proper Documentation: Ensure that all amounts, including taxes, are clearly itemized in the document. This helps with transparency and makes the financial records easier to audit if necessary.

3. Retaining Proof of Transactions

It is essential to retain copies of all financial documents for legal and tax purposes. Keeping detailed records of sent documents, payment receipts, and any communications related to payment is crucial for:

- Tax Filing: You may need to provide documentation of income for tax reporting, and clear records help make this process smoother.

- Dispute Resolution: In the event of a legal dispute, having a clear record of the work completed and payments requested can help protect your business and provide evidence of agreed terms.

- Legal Enforceability: In case of non-payment, proper

How Invoice Templates Save Time

Creating financial documents from scratch can be a time-consuming and repetitive process. However, by using pre-designed structures, businesses can save significant time while ensuring consistency and accuracy. A standardized approach allows for faster preparation, less room for error, and more efficient management of client communications. This section will explain how pre-made formats can streamline your workflow and free up valuable time for other tasks.

1. Faster Document Creation

One of the main advantages of using pre-structured formats is the time saved in the document creation process. Instead of designing a new layout every time a request for payment is issued, businesses can:

- Pre-fill Common Information: Use existing fields for frequently repeated details like business name, client contact information, or standard service descriptions.

- Quickly Adjust Amounts: Simply input the variable figures (e.g., hourly rates, quantities, or totals) without having to worry about formatting or layout.

- Minimize Errors: Reduce the risk of mistakes by sticking to a set format that already includes all necessary fields and information.

2. Consistency and Professionalism

Using a consistent format across all documents not only speeds up the creation process but also ensures a professional appearance. Consistency in design and layout enhances brand identity, making your business appear more organized and trustworthy. Additionally:

- Streamlined Branding: Customize the format with your logo, color scheme, and business details to maintain a cohesive look across all documents.

- Standardized Communication: Clients will recognize the structure, making it easier for them to understand your billing and payment terms every time.

3. Reduced Administrative Burden

Time spent on administrative tasks can be minimized by utilizing pre-designed formats. With templates, you can:

- Automate Repetitive Entries: Once your template is set up, you can automate aspects like payment terms, due dates, or service descriptions.

- Save Time on Adjustments: Instead of reformatting or creating new documents from scratch, simply adjust the necessary numbers and text for each client.

- Track Outstanding Amounts Easily: Keep records of sent documents, follow up on overdue payments, and manage accounts more efficiently without dealing with each document manually.

Incorporating pre-made designs into your business operations can drastically cut down on the time spent generating and managing financial documents, allowing you to focus on providing quality service and expanding your business.

Integrating Invoices with Accounting Software

Integrating your billing documents with accounting systems can simplify the management of your finances and streamline your workflow. By syncing these documents directly with your financial software, you reduce manual data entry, improve accuracy, and gain real-time insight into your cash flow. This section will explore how such integration can enhance business operations and help you maintain better control over your financial records.

1. Automated Data Transfer

One of the primary benefits of integrating billing systems with accounting software is the automation of data transfer. This integration allows:

- Real-Time Updates: As soon as a billing document is issued, the relevant details (e.g., amount, client name, due date) are automatically updated in your accounting system, ensuring your records are always current.

- Reduced Data Entry Errors: Eliminating manual input reduces the risk of mistakes, such as entering incorrect payment amounts or forgetting to update financial records.

- Time Savings: Automation saves significant time by eliminating the need to manually enter each transaction into your accounting software.

2. Improved Financial Tracking and Reporting

When integrated, your billing documents become a part of your overall financial ecosystem. This improves tracking and reporting by allowing you to:

- Generate Accurate Reports: Accounting software can automatically generate financial reports based on up-to-date billing data, making it easier to monitor profit margins, track outstanding payments, and analyze cash flow.

- Monitor Payment Status: Track which payments are pending, partially paid, or overdue directly within your accounting software, streamlining follow-ups and financial management.

- Stay Organized: Having all financial data in one place helps you maintain a comprehensive record of transactions, making it easier to file taxes and meet compliance requirements.

3. Streamlined Workflow and Better Client Management

Integrating financial documents with accounting tools also improves your overall workflow and client management. The benefits include:

- Centralized Communication: With all billing and payment data in one system, communication with clients becomes more efficient. You can quickly reference previous transactions or payment history during client interactions.

- Faster Payment Processing: When payments are automatically tracked in your accounting software, you

Free vs Premium Invoice Templates

When choosing a structure for your billing documents, businesses often face the decision between free and premium options. Both have their advantages and limitations, and understanding these can help you decide which best suits your needs. Free formats offer a budget-friendly option, while premium choices typically provide more advanced features and customization. This section explores the key differences between these two types of solutions and the value they offer.

1. Cost and Accessibility

The most obvious distinction between free and premium options is the cost. Free formats are easily accessible and can be downloaded or used immediately without any financial commitment. However, premium designs often come with a cost, offering enhanced features in return for a fee. Consider the following:

- Free Options: These are typically available at no cost and can be a good solution for small businesses or startups with limited budgets. Many free options are easily downloadable from various platforms, often with basic designs and functionality.

- Premium Options: These formats require payment, either on a one-time basis or via a subscription model. Premium options often offer more sophisticated designs, better support, and additional features that are not available in free formats.

2. Features and Customization

While free formats might meet basic needs, premium designs typically offer far more flexibility and advanced features that can make the billing process more efficient and professional. Here’s what to consider:

- Free Options: Free designs may come with limited customization options, and you may have to stick with predefined layouts or basic functionality. This can work for businesses with simpler needs but may be limiting as your business grows.

- Premium Options: Premium formats often allow for more customization, including editable sections, integration with accounting software, and advanced design elements such as logos, color schemes, and more professional layouts. These templates help create a more polished and personalized appearance for your business.

3. Support and Updates

Support and updates are often key factors when choosing a solution. With premium formats, you typically receive better customer support and regular updates to ensure the documents meet changing legal or industry standards. Consider the following:

- Free Options: Free solutions may not include customer support or regular updates, and you might have to troubleshoot issues on your own. In some cases, they may not stay up to date with new regulations or trends in billing.

- Premium Options: Premium formats often come with dedicated customer service and regular updates. This ensures your documents remain compliant, professional, and functional over time.

In conclusion, while free designs may be a good starting point for businesses on a tight budget, premium formats offer enhanced customization, features, and support that can ultimately save time and improve the professionalism of your business’s billing process. The choice between free and premium formats will depend on your specific needs, budget, and growth ambitions.

How to Secure Your PDF Invoices

Protecting sensitive financial documents is crucial for both businesses and clients. Digital files, particularly those containing payment information and personal details, need to be secured to prevent unauthorized access or tampering. This section will explore effective methods to ensure your financial documents remain safe and private when sharing or storing them.

1. Password Protection

One of the most effective ways to secure your digital documents is by adding password protection. This adds an extra layer of security and ensures that only authorized individuals can access the file. Here’s how to use password protection:

- Set a Strong Password: Choose a complex password that combines letters, numbers, and special characters to make it difficult to guess.

- Use Encryption: Many PDF readers allow for encryption when applying a password. This ensures that the content of the file is unreadable without the correct password.

- Share Passwords Securely: Avoid sharing passwords through email or unsecured messaging apps. Consider using a secure password manager or encrypted communication methods.

2. Redacting Sensitive Information

Sometimes, documents need to be shared with clients or third parties, but certain details must remain confidential. Redaction tools can permanently remove sensitive data from your digital files, such as credit card numbers, personal addresses, or payment details. Consider these steps:

- Use Redaction Software: Many PDF editing tools have redaction features that allow you to permanently remove sensitive text or images from the document.

- Check for Hidden Data: Ensure that no hidden or invisible text remains in the file. Simply deleting the information isn’t always enough, as it can sometimes be retrieved with specialized software.

3. Digital Signatures

Adding a digital signature not only verifies the authenticity of your document but also ensures its integrity. This can prevent unauthorized modifications to the file after it has been signed. Here’s how digital signatures help:

- Verify Identity: A digital signature authenticates the sender, making it clear that the document was indeed issued by your business.

- Ensure Document Integrity: Once a file is signed, any changes made to the document will be detected, alerting the recipient to potential tampering.

- Use Secure Digital Signature Tools: Many PDF software programs, such as Adobe Acrobat, offer secure methods to add a digital signature.

4. Limiting Access to Documents

Another way to secur