Free Landscape Invoice Templates for Easy Professional Billing

Managing business finances efficiently is crucial for any professional service provider. One of the most important tasks is creating accurate and well-structured documents to request payments. With the right design, these documents not only look polished but also ensure all essential details are clearly communicated. Whether you are an independent contractor or a small business owner, having the right tool for this process can save you significant time and effort.

By using ready-made document formats, you can easily generate professional-looking payment requests without the need for complex software or design skills. These formats allow you to input necessary information quickly and customize the appearance to suit your brand. The best part is that you don’t have to spend a fortune on design services or costly software subscriptions.

In this section, we explore how these resources can simplify your billing process and help you maintain a smooth cash flow. With just a few clicks, you can access and adapt these ready-made formats to fit your needs, ensuring accuracy and professionalism with every transaction.

Free Landscape Invoice Templates You Can Use

Creating clear and professional documents for payment requests is essential for any business. Fortunately, you don’t need to hire a designer or invest in expensive software to produce them. There are various options available online that allow you to download and use ready-to-go formats for your needs. These documents can be easily customized with your own details, ensuring that each one fits your business requirements perfectly.

Here are some of the best resources where you can find such useful tools:

Where to Find Useful Resources

- Online Template Websites: Many platforms offer a wide range of formats for different business types. These are often available for immediate download and can be personalized with just a few simple edits.

- Office Software Platforms: Popular office suites often provide built-in formats that you can use without any additional cost. Simply open your preferred program, choose the appropriate style, and start customizing.

- Business Resource Blogs: Various blogs focused on entrepreneurship and small business management often share free downloadable documents. These resources are perfect for those looking to save time and avoid additional expenses.

Benefits of Using Pre-Designed Documents

- Time-Saving: These resources save you hours of work by eliminating the need for designing your own document from scratch.

- Customization: While the format is pre-made, you can easily add your business information, modify the layout, and adjust text to match your brand identity.

- Professional Appearance: Pre-designed formats ensure your payment requests look polished and credible, which can help foster trust with clients.

Why Use Landscape Invoice Templates?

When it comes to requesting payments from clients, the way you present your details can make a significant difference. Using a well-organized and visually appealing document not only helps ensure that all necessary information is included but also gives your business a professional appearance. By opting for pre-designed formats, you can save time while ensuring consistency across all your billing communications.

Here are a few key reasons why utilizing such formats can be beneficial for your business:

Efficiency and Time-Saving

One of the main advantages of using ready-made formats is the amount of time they save. Instead of starting from scratch, you can simply customize an existing design with your own details. This streamlined process allows you to focus on your work rather than spend unnecessary hours designing documents.

Consistency and Professionalism

Using a consistent format for all payment requests helps build credibility with clients. A professional-looking document reflects well on your business and can even enhance your reputation. Whether you’re a freelancer or a small business owner, maintaining a uniform style in your communication can lead to better client relationships.

- Clear Layout: Pre-designed formats usually have an intuitive layout, making it easier for clients to understand payment terms and amounts.

- Customizable Design: Even though the format is pre-made, you can tailor it to reflect your brand’s colors and logo for added personal touch.

- Accuracy: These formats are structured to include all the necessary fields, reducing the likelihood of missing important details.

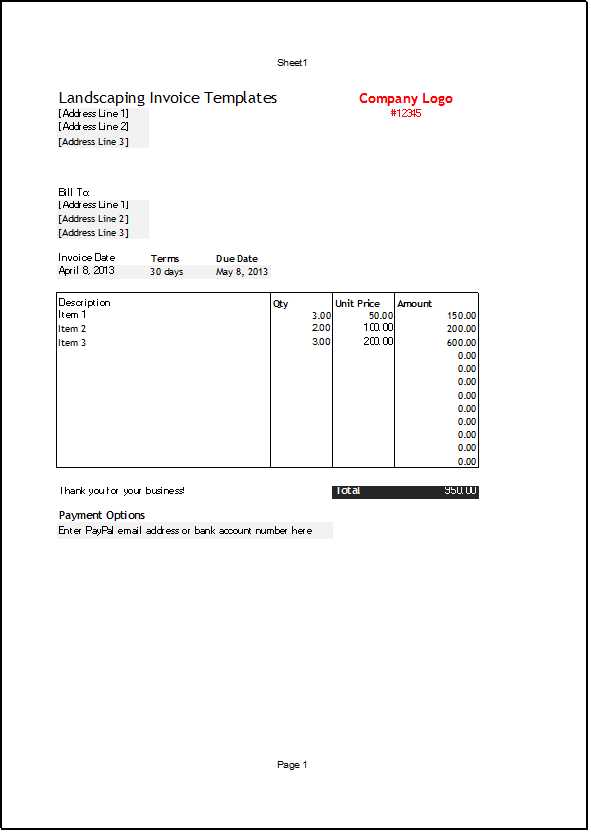

How to Customize Landscape Invoices

Personalizing your billing documents allows you to present your business in a more professional light. Customization ensures that all the essential details are clearly communicated while also reflecting your brand’s identity. With just a few simple steps, you can modify any pre-made format to suit your specific needs, making each document unique to your business.

Basic Customization Steps

Customizing your payment request documents is straightforward. Here are the basic steps you can follow:

- Insert Business Information: Include your company name, contact details, and logo to give the document a professional look.

- Modify Fields: Adjust sections like the date, payment terms, and amounts to reflect the specifics of each transaction.

- Add Personal Notes: If needed, include any special instructions, such as payment methods or late fees, to keep things clear for your client.

Advanced Customization Tips

For a more polished appearance, consider adjusting the design elements, such as fonts and colors. Most programs that offer editable formats allow you to tweak these aspects to align with your brand’s visual identity. You can also reorder sections or add extra fields if necessary, ensuring that the document meets your exact specifications.

Top Benefits of Free Invoice Templates

Using pre-designed documents for payment requests offers a range of advantages that can help streamline your billing process and save you time. These ready-made resources provide an easy way to generate professional-looking records without the need for specialized software or design skills. Whether you’re a freelancer or a small business owner, the benefits of utilizing these tools are clear.

Time and Cost Savings

- Quick Setup: You can easily download and customize a pre-made format, reducing the time spent creating documents from scratch.

- No Need for Paid Software: Instead of investing in expensive design tools or software subscriptions, you can use these resources at no cost.

- Access Anytime: These resources are available online and can be downloaded at your convenience, making them ideal for fast turnaround times.

Increased Professionalism

- Consistent Appearance: By using a uniform format, you can ensure all your payment requests look professional, building trust with clients.

- Clear Structure: Pre-designed documents often feature easy-to-follow layouts, making it simpler for clients to understand payment terms and avoid confusion.

- Customizable for Branding: You can adjust the colors, fonts, and logo placement to align with your brand, giving your business a more personalized touch.

Where to Find Free Templates Online

There are numerous platforms where you can easily find pre-made documents for payment requests. These websites offer a wide variety of designs, from simple and minimalistic to more detailed and intricate formats. The best part is that these resources are available at no cost, allowing you to download and use them immediately. Below is a list of some of the most reliable sources for obtaining these documents:

| Website | Description |

|---|---|

| Template.net | Offers a large collection of customizable payment request designs in various formats, suitable for different industries. |

| Microsoft Office | Provides easy-to-use formats for business documents, including payment requests, directly within Office software like Word or Excel. |

| Canva | A design platform offering stylish, editable document layouts. Great for those who want to personalize their request forms with graphics. |

| Google Docs | Offers simple, straightforward designs that can be customized using Google Docs or Sheets, perfect for quick access and collaboration. |

| Zoho Invoice | Provides free tools to create and manage billing documents, with a variety of designs tailored to different business types. |

These platforms offer easy access to various designs that can be tailored to suit your specific needs. With just a few clicks, you can download and begin using a document that meets your business requirements. Whether you need something basic or more sophisticated, these resources are a great starting point for all your billing needs.

Creating Professional Invoices Without Cost

Generating polished payment requests doesn’t have to come with a high price tag. With the help of easily accessible resources, you can create well-designed and accurate documents without purchasing expensive software. Using online tools and pre-made formats, you can quickly produce professional-looking records that meet the needs of your business, all while saving time and money.

Steps to Create Professional Payment Requests

- Select a Reliable Tool: Choose a platform or software that offers customizable options, such as Google Docs, Microsoft Word, or online design tools like Canva.

- Choose the Right Format: Look for a design that suits your business style. Keep it simple but clear, ensuring all important details are easy to read.

- Add Your Details: Include necessary information, such as your business name, payment terms, client contact details, and itemized charges.

- Customize Design Elements: Adjust fonts, colors, and logos to align with your branding. A personalized look makes the document feel more professional.

Additional Tips for Effective Payment Requests

- Ensure Clarity: Avoid clutter and make sure key details–such as total amount due, payment due date, and methods of payment–are prominently displayed.

- Proofread for Accuracy: Double-check the document for any errors, as mistakes can undermine your professionalism and cause confusion.

- Track Payments: Once the payment request is sent, keep a record of all transactions and follow up if necessary. Simple tracking ensures you stay organized and maintain cash flow.

By following these simple steps and utilizing free online tools, you can easily create professional, branded documents without the need for costly programs or subscriptions.

How Landscape Invoice Templates Save Time

Creating billing documents from scratch can be a time-consuming task, especially when you’re focused on running a business. However, by using pre-designed formats, you can significantly reduce the time spent preparing these records. These ready-made options offer a structured layout, allowing you to simply input the required details and have a professional document ready in minutes.

Efficient Document Creation

- Pre-Designed Layouts: With predefined sections and fields, you don’t have to worry about arranging the layout or ensuring you haven’t missed any crucial elements.

- Instant Customization: Instead of designing from the ground up, simply add your business information, payment terms, and itemized charges to generate a document quickly.

- Consistency Across Documents: Using the same format for every request ensures uniformity, eliminating the need to recreate the layout for each new transaction.

Time-Saving Features

- Quick Updates: Any changes to your business information or pricing can be easily updated in the format, saving you the time of manually adjusting every document.

- Automatic Calculations: Many online tools allow for automatic calculations of totals, taxes, and discounts, reducing the time spent on manual math.

- Ready for Printing or Sending: After customization, these documents are often ready for immediate download or direct email sending, eliminating the need for additional formatting or preparation.

By streamlining the document creation process, these pre-made resources allow you to focus more on running your business and less on administrative tasks. The simplicity and efficiency they offer are key to saving valuable time and improving your workflow.

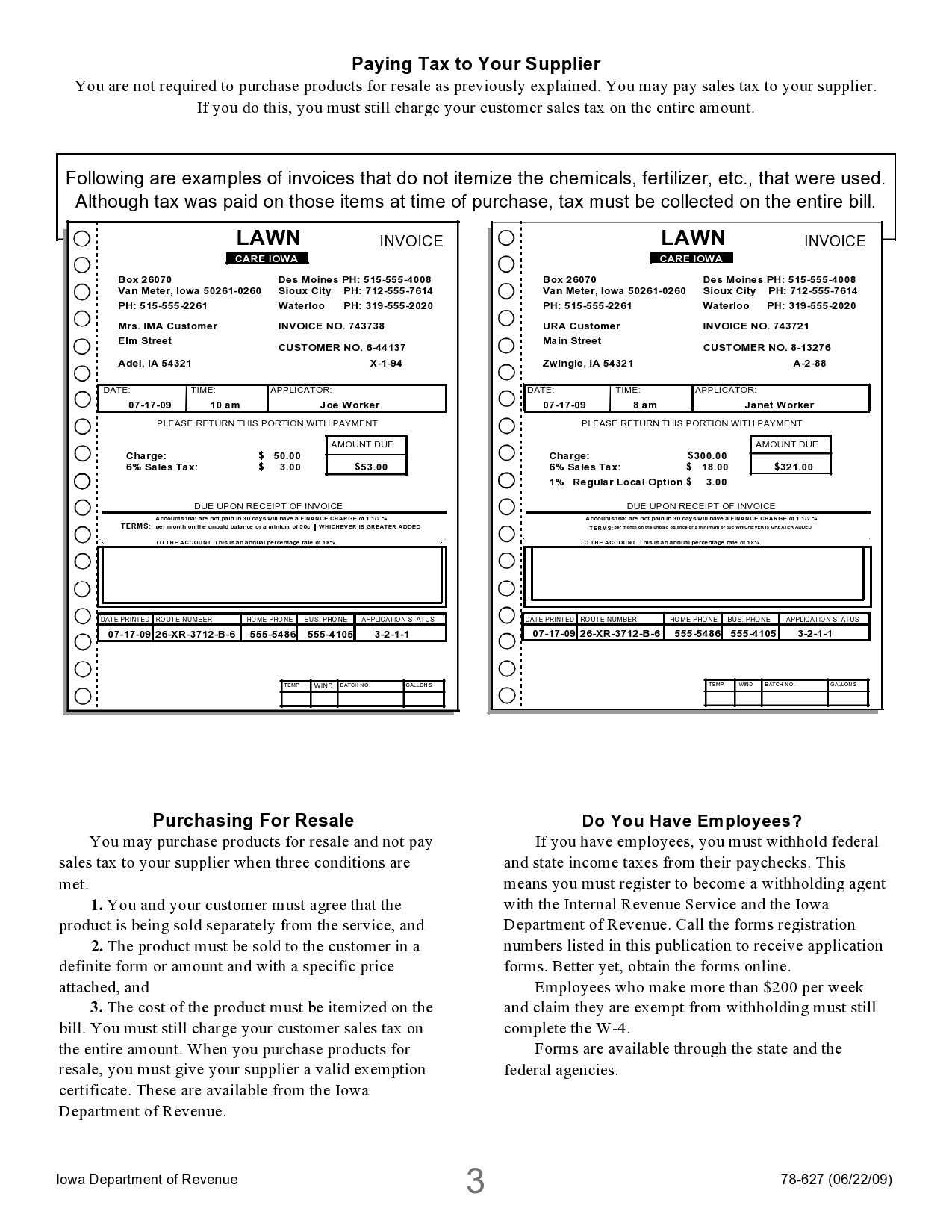

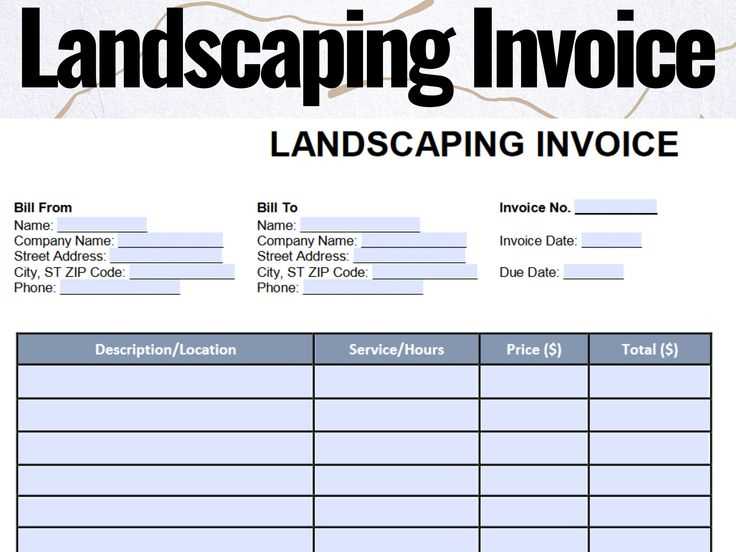

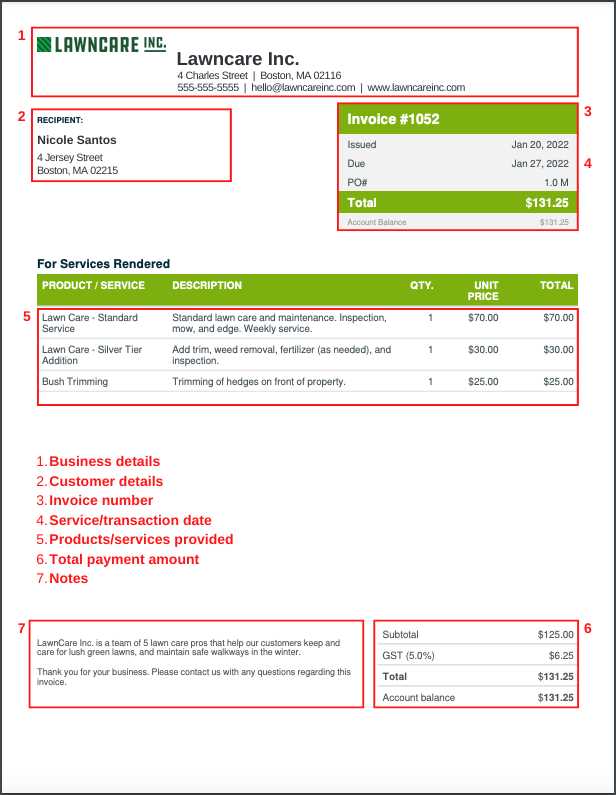

Essential Information to Include in Invoices

When creating payment request documents, it’s important to ensure that all necessary information is included. A well-structured document helps avoid confusion and ensures that clients have all the details they need to process payments promptly. Whether you’re dealing with a simple transaction or a more complex service, certain key elements should always be present.

Key Details Every Payment Request Should Have

| Information | Purpose |

|---|---|

| Your Business Information | Clearly state your business name, address, and contact details to ensure the client knows who the request is from. |

| Client’s Information | Include the name and address of the client, so there is no ambiguity about who is being billed. |

| Invoice Number | Assigning a unique reference number helps you and your client track the document and makes record-keeping easier. |

| Date of Issue | Indicate the date the document is created. This helps establish the timeline for payment and any applicable due dates. |

| Due Date | Clearly state when payment is due to avoid confusion and to ensure timely settlement. |

| Itemized List of Services or Products | Break down what you are charging for, with descriptions, quantities, rates, and totals for each item, so the client knows exactly what they are paying for. |

| Total Amount Due | Summarize the total charge for all services or products, including taxes, to make payment clear. |

| Payment Terms | State how the payment should be made (e.g., bank transfer, check) and any late fees or penalties for overdue payments. |

Additional Information to Consider

- Discounts: If applicable, include any discounts or promotional offers and specify how they affect the total price.

- Notes or Terms: You may want to add specific instructions or clarifications about the work completed, warranties, or future contracts.

- Tax Information: If relevant, include your tax identification number and the applicable tax rates for the goods or services provided.

By ensuring that these essential elements are included in your payment request documents, you can reduce misunderstandings, enhance your professionalism, and make it easier for clients to pay on time.

Simple Steps to Download Free Templates

Finding and downloading ready-made billing documents is easier than you might think. With numerous online resources available, you can quickly access customizable options to suit your business needs. These straightforward steps will guide you through the process, ensuring you can get started in no time.

How to Download Ready-Made Documents

| Step | Action |

|---|---|

| Step 1 | Visit a trusted website that offers downloadable payment request formats. Popular sites include template providers or online business resource platforms. |

| Step 2 | Browse through the available designs. Choose one that suits your style and business needs, whether simple or more detailed. |

| Step 3 | Click the “Download” or “Get Started” button to access the document. Some sites may ask you to provide an email for access, while others allow direct downloads. |

| Step 4 | Open the downloaded document in your preferred software, such as Word, Excel, or a design platform, to begin customization. |

| Step 5 | Edit the document by adding your company details, client information, pricing, and any other necessary data to complete the request. |

Following these simple steps, you can quickly download and personalize a payment request document that meets your specific needs. Whether you’re sending out a single document or creating multiple requests, these resources streamline the process and save you valuable time.

Best Practices for Invoice Design

Creating clear, professional, and well-structured billing documents is essential for ensuring that clients can easily understand payment terms and quickly process their transactions. A well-designed document not only reflects the professionalism of your business but also makes it easier for both parties to track and verify payment details. Below are some best practices to follow when designing payment request documents to ensure clarity and efficiency.

Key Design Elements to Consider

- Keep It Simple and Organized: Use a clean layout that separates key sections clearly, such as the client’s information, payment terms, and itemized list of services or products.

- Use Consistent Fonts: Choose easy-to-read fonts for all text and keep the font sizes consistent. Highlight headings with bold or larger text, but avoid overuse of multiple font styles.

- Incorporate Your Branding: Include your logo, brand colors, and other design elements that reflect your business’s visual identity. This adds a professional touch and reinforces your brand.

- Ensure Clear Legibility: Use ample white space between sections and avoid clutter. Ensure there’s enough contrast between text and background for easy reading.

- Highlight Important Information: Make the total amount due, payment due date, and payment methods stand out by using bold text or a larger font size to draw attention to these crucial details.

Additional Tips for a Professional Touch

- Include Terms and Conditions: If applicable, clearly outline your payment terms, late fees, and any discounts offered to avoid confusion.

- Ensure Accuracy: Double-check all the details to ensure there are no errors in the document. Accuracy is key to building trust with clients.

- Provide Payment Methods: Clearly list accepted payment methods, such as bank transfer, PayPal, or credit card, to make it easy for clients to settle their accounts.

- Be Mobile-Friendly: With many clients using mobile devices to review documents, ensure your design looks good and is easy to navigate on smaller screens.

By following these best practices, you can ensure that your payment requests are not only visually appealing but also functional and easy to understand. A well-designed document helps maintain a positive business relationship and speeds up the payment process.

How to Keep Your Invoices Organized

Maintaining an organized system for your billing documents is crucial for both efficiency and financial tracking. Whether you’re handling a few requests or managing a large volume, having a clear and structured process ensures you can easily access, track, and manage payments. Proper organization also helps prevent errors and delays, making it easier to follow up on outstanding amounts and maintain a smooth workflow.

To keep everything in order, it’s important to develop consistent habits and leverage the right tools. You can use digital systems, such as accounting software, or implement manual filing systems that work best for your business. Regardless of the method, here are a few strategies to help you stay organized:

- Number Your Documents Sequentially: Always assign a unique number to each document to keep them easily traceable. This allows for quick referencing and avoids duplication.

- Create Folders or Categories: Whether digital or physical, organize your payment requests into folders by client, date, or status (e.g., paid, pending). This helps you locate any document with minimal effort.

- Use Accounting Software: Accounting tools like QuickBooks or Xero can automatically store and categorize documents, making it easier to track payments, send reminders, and generate reports.

- Set Up Reminders: If you rely on manual tracking, create reminders or due date alerts for each payment request. This ensures you don’t forget to follow up on overdue payments.

- Regularly Backup Your Files: Whether using cloud storage or external hard drives, regularly backup your documents to avoid data loss and ensure you have access to historical records.

By adopting these practices, you’ll ensure that all your payment records are easily accessible and well-organized, allowing you to stay on top of your business finances with minimal stress.

Invoice Formatting Tips for Clarity

Clear and professional document design is crucial for ensuring that clients easily understand the details of their payments. Proper formatting not only helps clients quickly identify key information but also reflects positively on your business. A well-organized document can prevent misunderstandings, reduce the chances of payment delays, and improve your overall professionalism.

Key Formatting Elements to Focus On

- Use a Logical Layout: Organize your document in a way that follows a natural flow, starting with your contact information, followed by the client’s details, then the list of charges, and finishing with payment terms and totals.

- Clearly Highlight Important Information: Use bold text or larger font sizes for key details such as the total amount due, payment due date, and your contact information. This makes them stand out and reduces the risk of these details being overlooked.

- Separate Sections Clearly: Ensure there is enough space between each section of the document, such as the itemized list of services and the payment terms. This will make it easier for the reader to navigate and understand the content quickly.

- Use Consistent and Readable Fonts: Choose fonts that are simple and easy to read, such as Arial or Times New Roman. Stick to one or two fonts for the entire document to maintain consistency and avoid visual clutter.

Additional Tips for Enhanced Readability

- Include a Clear Header: Make sure your document includes a clear title at the top, such as “Payment Request” or “Billing Statement,” so the purpose of the document is immediately apparent.

- Be Consistent with Dates: Always use the same date format throughout the document, and clearly indicate the date the request was issued and the due date for payment.

- Incorporate Simple Visuals: If relevant, add small visual elements like borders or lines to help break up the text and guide the reader’s eye. However, keep these subtle and professional to avoid distraction.

By following these formatting tips, you ensure that your payment requests are easy to understand and visually appealing, helping to create a positive experience for your clients and encouraging timely payment.

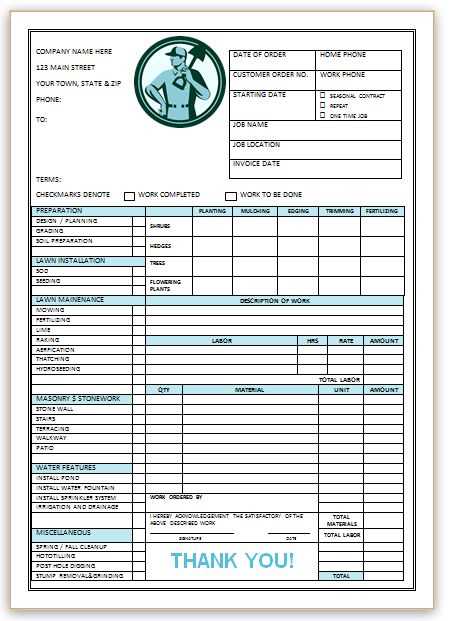

Why Choose a Landscape Layout for Invoices

When it comes to creating professional payment request documents, the layout you choose can have a significant impact on readability and organization. A horizontal format offers distinct advantages, especially when dealing with complex information or larger amounts of data. By using a wider layout, you can provide a clearer, more structured view of the document’s contents, making it easier for both you and your clients to follow the details of the transaction.

Benefits of Using a Horizontal Format

| Advantage | Explanation |

|---|---|

| More Space for Detailed Information | The wider layout provides more room to neatly arrange detailed descriptions, itemized lists, and calculations, reducing the need for cluttered text or small font sizes. |

| Better for Business Reports | A horizontal design is ideal for displaying summary tables and charts, allowing for better presentation of figures and easy-to-read columns, especially when multiple items or services are involved. |

| Enhanced Professional Appearance | The balanced, wide design often feels more formal and professional, making it suitable for high-end clients or industries that require a more polished presentation. |

| Improved Visual Flow | A horizontal format can guide the reader’s eye more naturally from left to right, helping them easily follow through the document from the date of issue to the payment due date and totals. |

When to Use a Horizontal Layout

- Multiple Items or Services: When listing several products or services with detailed descriptions, a horizontal layout gives you ample space to organize the information clearly.

- Incorporating Visual Elements: If you plan to include charts, graphs, or detailed tables, a wider design accommodates these visuals without making the document feel cramped.

- Complex Payment Terms: If your payment terms involve complex breakdowns, such as installments or payment schedules, the landscape format provides more room to present this information logically and clearly.

By choosing a horizontal layout, you can enhance the clarity, professionalism, and organization of your payment documents, making them more effective in communicating the necessary details to your clients.

What to Do After Sending an Invoice

After you’ve sent out your billing document, it’s important to stay proactive in ensuring that payment is received promptly. The process doesn’t end with sending the document; there are several key actions you can take to track the status, maintain professional communication, and resolve any potential issues that may arise. Staying organized and attentive can help you avoid delays and ensure smooth transactions.

Steps to Take After Sending a Billing Document

- Confirm Receipt: Follow up with your client to confirm that they’ve received the document. Sometimes emails get lost or overlooked, so it’s a good idea to check that it has been received and is under review.

- Set a Reminder for Payment: Set a reminder for yourself to follow up on the due date. This helps you stay on top of your cash flow and ensures you don’t miss any overdue payments.

- Monitor for Payment: Track payments as they come in. You can use accounting software or spreadsheets to keep a record of which transactions have been paid and which are still outstanding.

- Send a Payment Reminder: If the due date has passed and you haven’t received payment, send a polite reminder. A simple, professional email can serve as a gentle nudge for your client to make the payment.

What to Do If Payment Is Delayed

- Communicate Clearly: If payment is delayed, reach out to your client to inquire about the status. It’s important to keep the communication professional and polite, avoiding any confrontation.

- Offer Payment Flexibility: If your client is having trouble paying, consider offering flexible payment terms, such as extended deadlines or installment plans, to make it easier for them to settle the amount.

- Consider Late Fees: If your payment terms include late fees, ensure that they are clearly communicated and applied in accordance with the terms agreed upon.

- Use a Collection Service: If payments remain unresolved for an extended period, consider engaging a collection service or legal support to recover the funds, though this should be a last resort.

By staying organized and proactive after sending a payment request, you can minimize delays, ensure that you’re paid on time, and maintain positive relationships with your clients.

Common Mistakes to Avoid in Invoices

When creating payment requests, accuracy and clarity are essential to avoid confusion or delays in payments. Common mistakes can create misunderstandings, disrupt your cash flow, and potentially damage your professional reputation. Being aware of these mistakes and taking proactive steps to avoid them can ensure that your billing process is smooth, efficient, and error-free.

Common Mistakes and How to Avoid Them

| Error | Explanation | How to Avoid It |

|---|---|---|

| Missing or Incorrect Client Information | Incorrect client details can lead to confusion and delayed payments, especially if the client has trouble verifying their information. | Always double-check the recipient’s name, address, and contact details before sending the document. |

| Omitting Important Dates | Without clear start and due dates, clients may not know when payment is expected, leading to delayed payments. | Include both the date the document is issued and the payment due date to ensure clarity. |

| Unclear Payment Terms | If the payment terms are not clearly defined, it can cause confusion and disputes over when and how much should be paid. | Be explicit about payment deadlines, accepted payment methods, and any late fees in the document. |

| Incorrect Calculations | Simple errors in pricing or totals can undermine your professionalism and cause clients to question your attention to detail. | Double-check all calculations, including item prices, tax, and totals, before sending the document. |

| Failure to Include Reference Numbers | Without unique identifiers, such as invoice numbers, it can be difficult to track payments and handle queries efficiently. | Assign a unique reference number to each document for easy tracking and identification. |

Other Potential Mistakes to Watch For

- Unprofessional Appearance: A poorly formatted or cluttered document may create a negative impression. Keep your layout clean and organized.

- Lack of Itemization: Not breaking down individual charges can confuse clients and delay payment.

How to Track Payments with Templates

Keeping track of payments is crucial for maintaining healthy cash flow and ensuring that no outstanding amounts slip through the cracks. By using well-structured documents, you can efficiently monitor the status of each transaction. When payments are organized properly, it’s much easier to follow up on overdue balances and stay on top of your financial records.

Key Features to Include for Payment Tracking

Feature Description Payment Status Column A clear column indicating whether the payment is “Paid,” “Pending,” or “Overdue” helps you track the status of each transaction at a glance. Due Date Tracking Clearly marking due dates and having a column for the payment received date makes it easier to see if there are any overdue payments. Unique Reference Number Using a unique number for each transaction makes it easy to reference specific payments and track them in your financial system. Amount Paid vs. Total Amount Including both the total amount due and the amount received helps you quickly identify partial payments and remaining balances. How to Stay Organized While Tracking Payments

- Set Up a Payment Log: Create a separate document or spreadsheet that tracks all transactions. This will allow you to quickly look up the status of any payment by reference number, client name, or due date.

- Use Color-Coding: Color-coding payment statuses (such as green for paid, yellow for pending, and red for overdue) can provide a quick visual cue and make it easier to spot unpaid balances.

- Send Timely Reminders: As payments become overdue, send polite follow-up reminders to clients. You can automate this process using reminders based on due dates to ensure you never miss a follow-up.

By incorporating these tracking features into your documents, you will simplify the process of managing your financial transactions, avoid delays in payment, and maintain clearer records for accounting purposes.