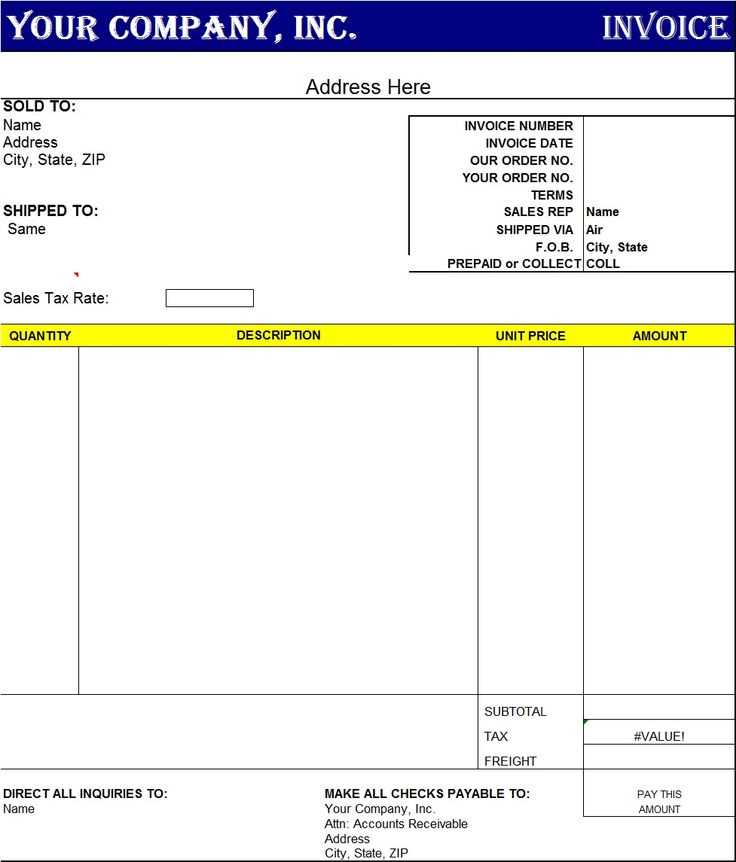

Download Free Labor Invoice Template for Word

When it comes to managing service-related payments, having an organized and clear document is essential for both businesses and freelancers. A well-structured record not only ensures that clients are billed accurately but also helps maintain transparency in financial transactions. Whether you provide one-time services or ongoing support, using an efficient format can simplify the billing process and improve cash flow management.

Creating a detailed statement that outlines the work performed, the time spent, and the corresponding charges is crucial for setting expectations and ensuring timely payments. By using digital tools, you can easily customize your documents to suit your needs, adding professionalism and clarity to each transaction. With the right format, you can avoid errors, misunderstandings, and delays in receiving compensation.

In this guide, we’ll explore how to design and customize an editable document for service charges, offering flexibility for different types of work. Whether you’re working as a contractor, consultant, or offering skilled services, you’ll learn how to create accurate and clear statements that streamline the payment process.

Labor Invoice Template Word Overview

When providing services, it’s essential to have a clear and structured method for requesting payment from clients. A standardized document that outlines the details of the work performed, hours spent, and agreed-upon charges can simplify this process, ensuring both parties are on the same page. Having a well-designed, editable format allows for quick adjustments and customization, making it suitable for various projects and clients.

Using a flexible format for billing enables service providers to maintain professionalism while clearly presenting the information needed for the client to review and pay the amount due. With the right layout, it’s easier to track payments and manage multiple transactions. Additionally, it helps avoid mistakes that could lead to confusion or delays in payment.

Key Features of an Effective Billing Document

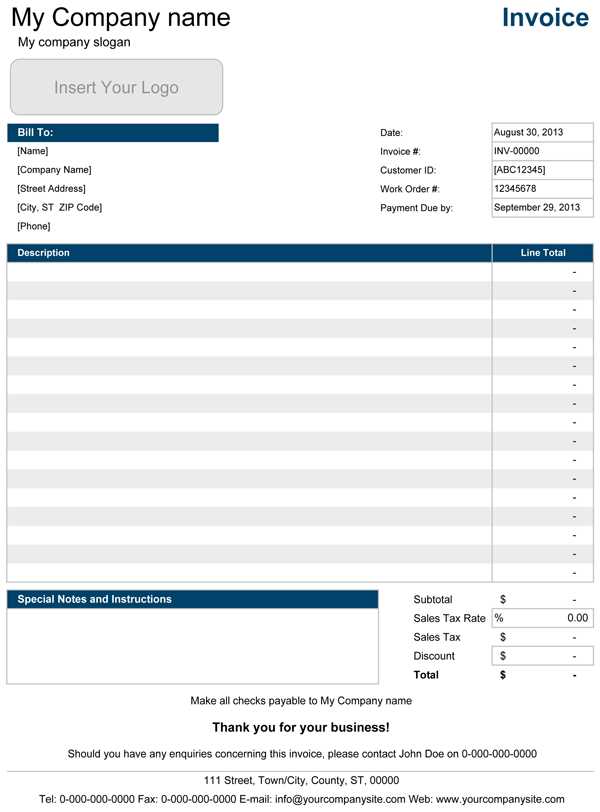

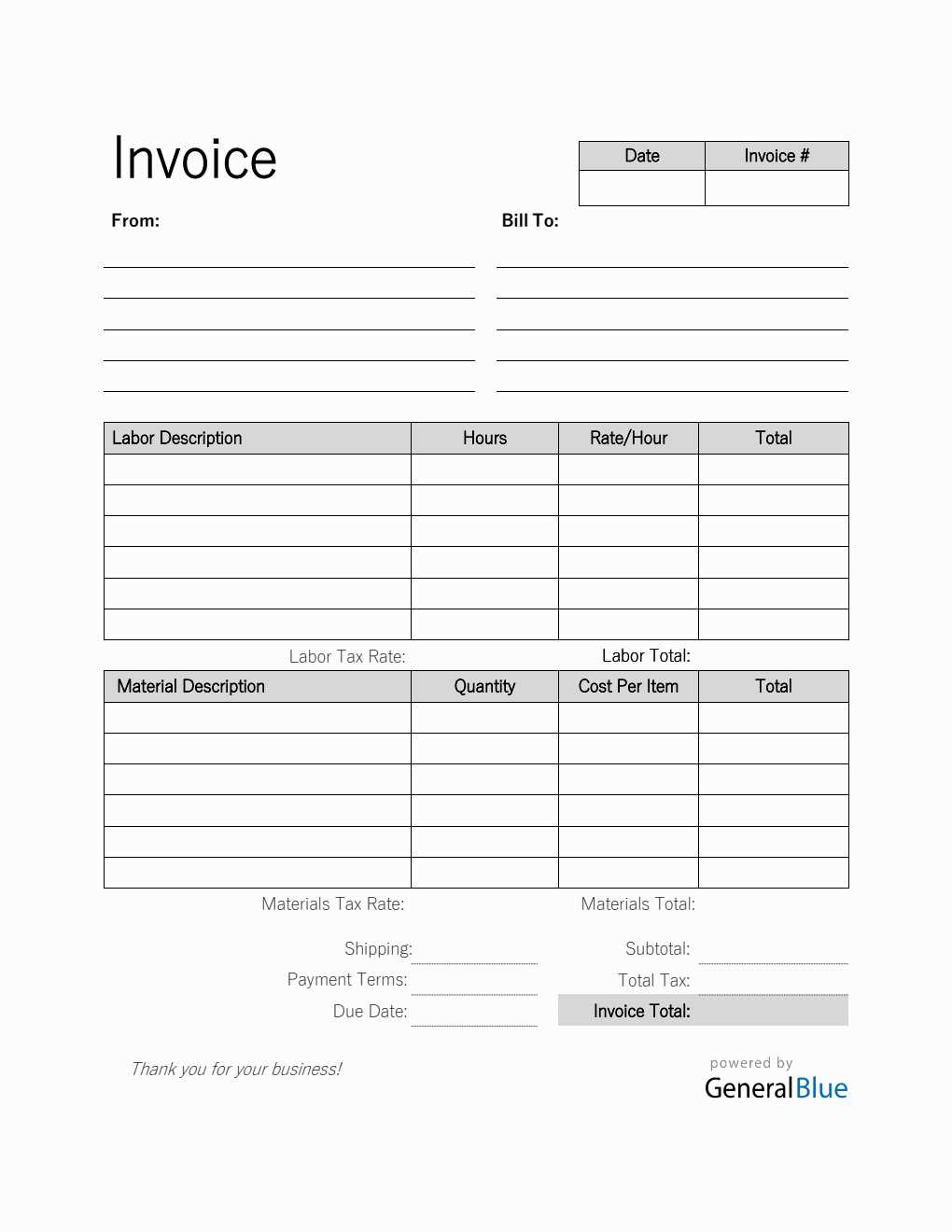

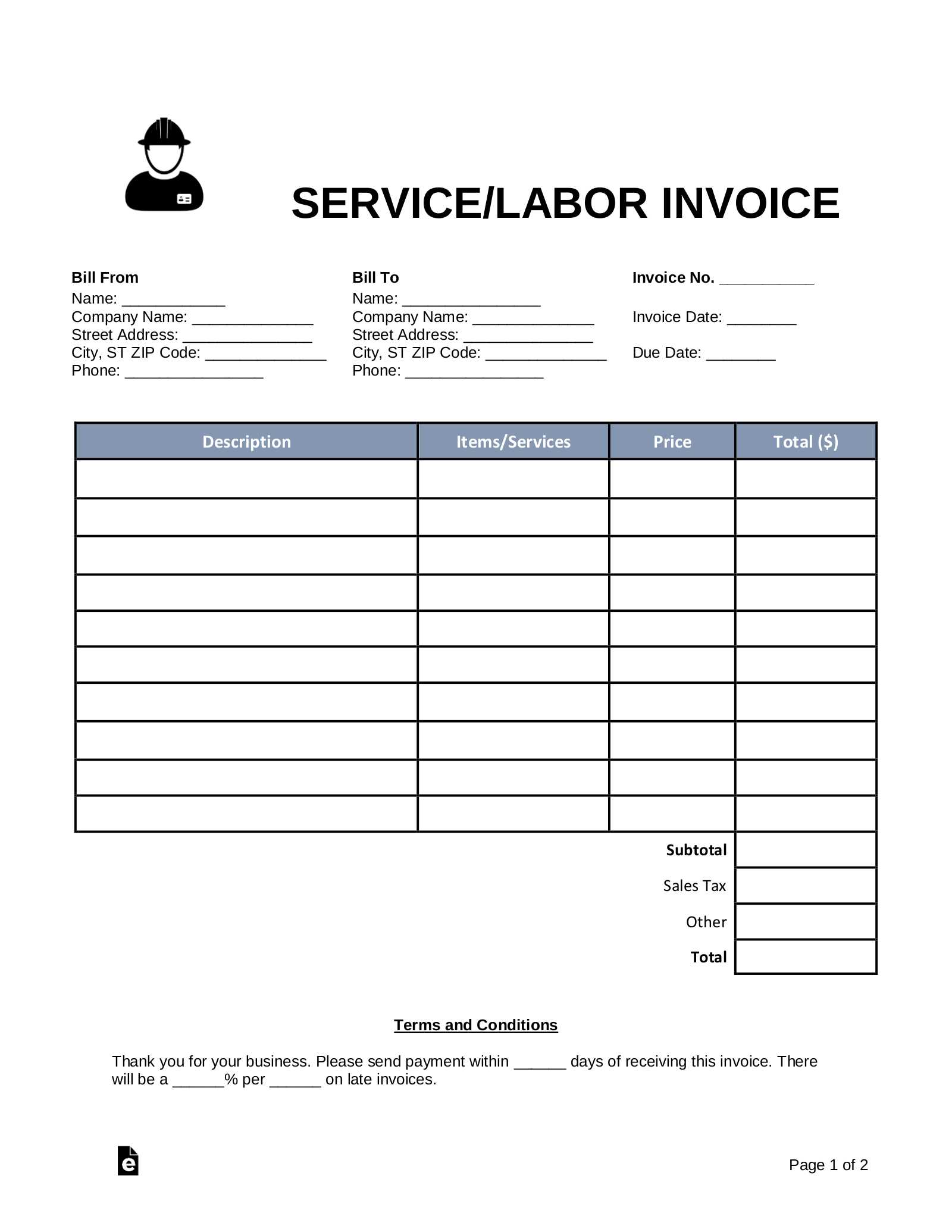

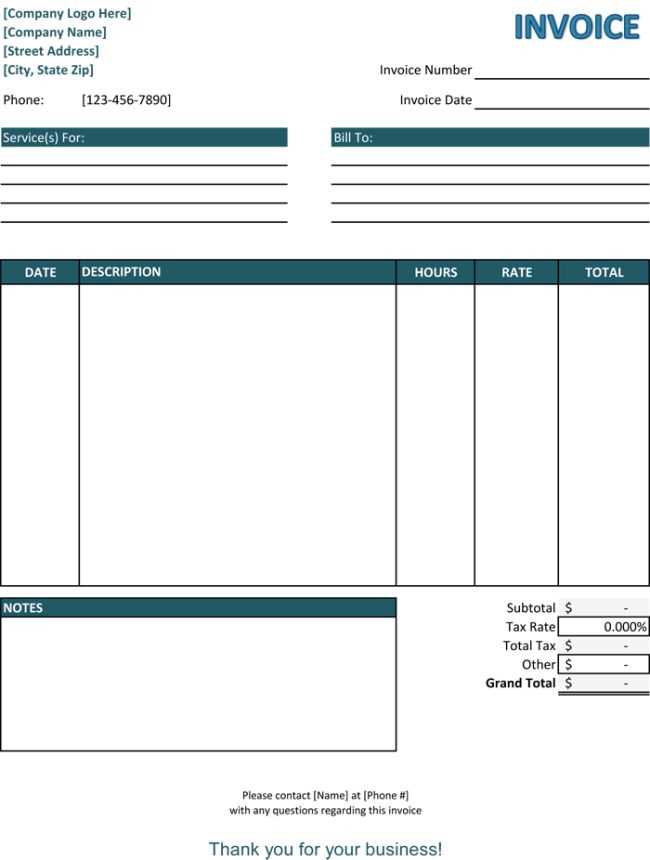

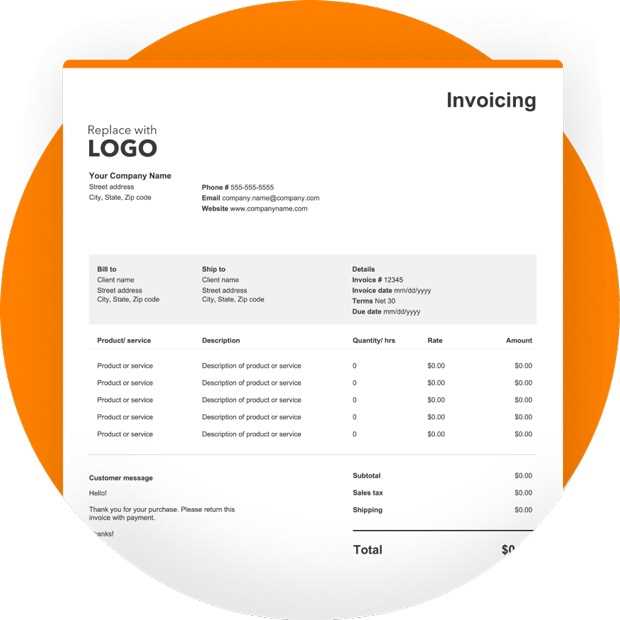

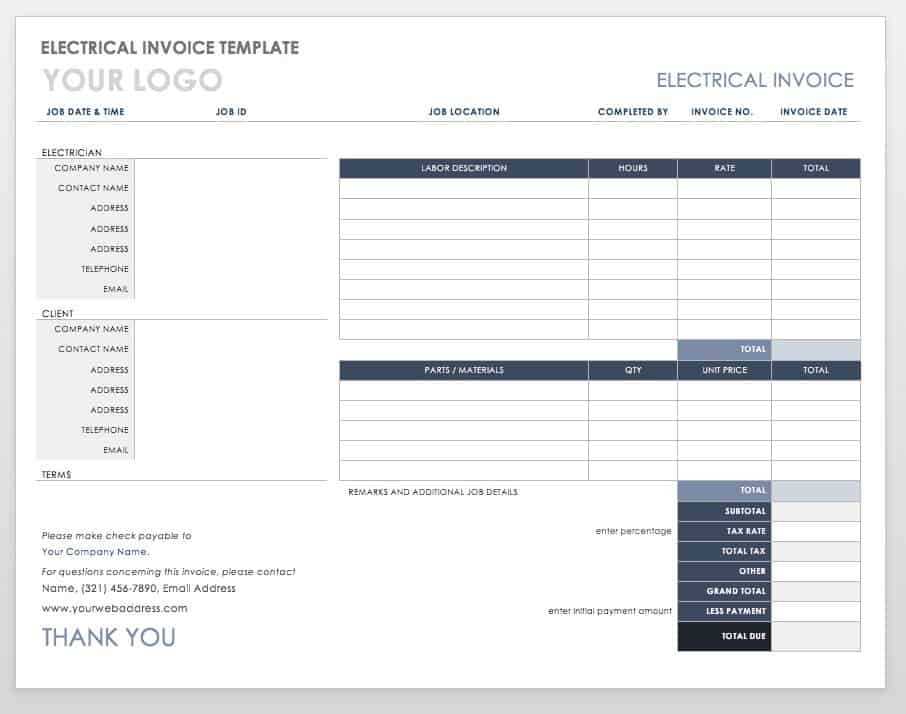

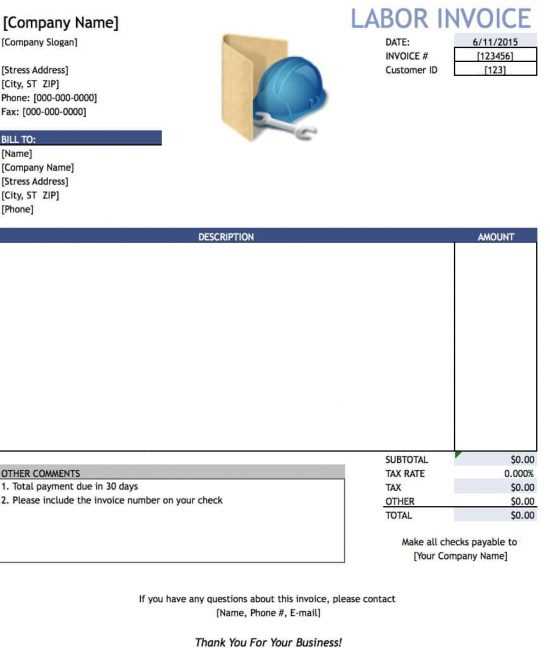

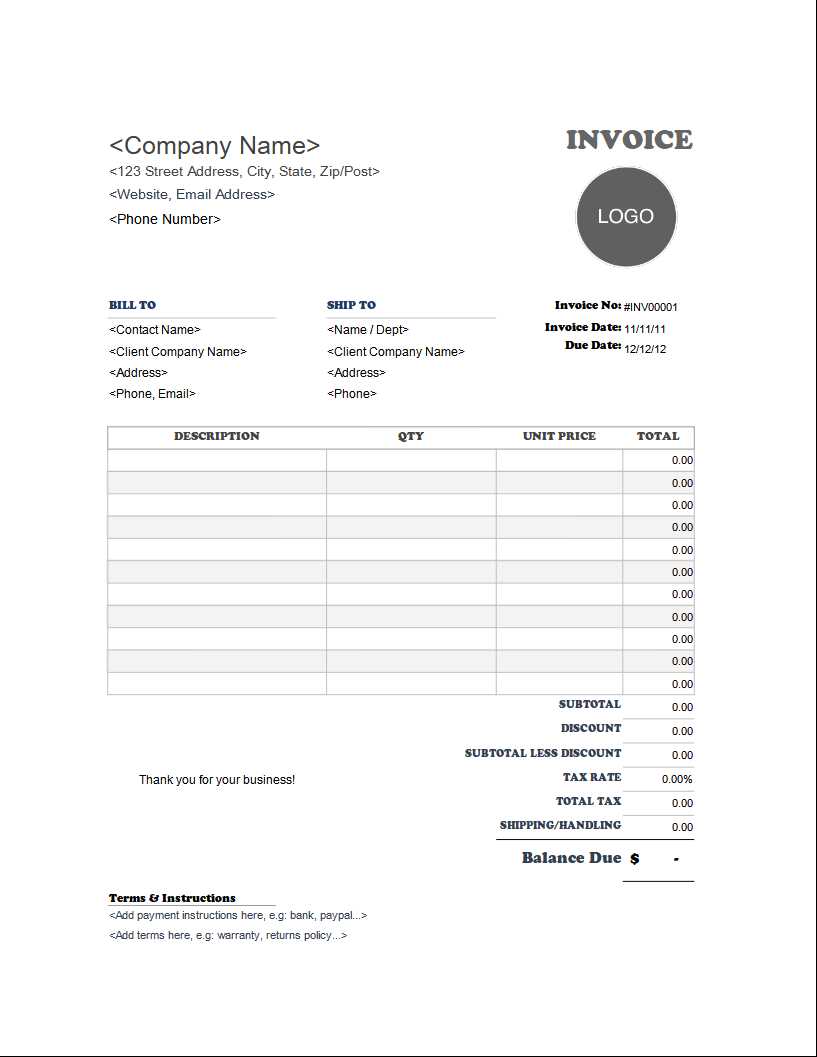

A well-designed billing document typically includes fields for the client’s contact details, a description of services provided, the time or quantity of work completed, and a breakdown of the total cost. It also includes important payment terms such as due dates and accepted payment methods. With a consistent layout, each new billing statement can be created quickly and accurately, minimizing the risk of missing essential details.

Why Choose an Editable Format

Editable formats allow for flexibility and easy updates as your business grows or as client needs change. For example, you can adjust rates, add or remove services, or update your branding with just a few clicks. This flexibility is crucial for maintaining efficiency in the invoicing process while ensuring consistency across all documents. Whether you’re a freelancer or a small business owner, using an editable format ensures you always have a professional-looking document ready when needed.

Why Use a Labor Invoice Template?

Having a pre-designed document for billing purposes streamlines the process of charging clients for services rendered. It eliminates the need to start from scratch with each new payment request, saving valuable time and reducing the chances of missing critical details. A well-structured form helps ensure consistency in every transaction, making it easier to track payments, manage client relationships, and maintain professionalism.

Using a consistent structure for each payment request not only simplifies the administrative process but also provides clarity for both the service provider and the client. This clarity fosters trust and minimizes the risk of confusion or disputes over payment terms, scope of work, or total charges. Whether for one-time projects or ongoing work, an established layout helps create a smooth transaction experience for all parties involved.

Time Efficiency and Accuracy

With a ready-to-use structure, you don’t have to repeatedly input the same details for every client. Fields such as your business information, payment terms, or service descriptions are already formatted, allowing for quick customization and completion. This reduces the risk of errors and ensures that the same professional standards are met every time you generate a payment request.

Professional Appearance

Using a standardized format helps present a polished, professional image to clients. A clear and organized document reflects well on your business and assures clients that you are serious about your work and payments. This can enhance credibility and foster stronger long-term client relationships, ultimately supporting your business growth.

Benefits of Word Format for Invoices

Using a document format that is easily editable and accessible provides several advantages when managing billing tasks. The flexibility to quickly adjust the content, layout, and style of a payment request makes it ideal for businesses of all sizes. Whether you’re a freelancer, contractor, or small business owner, the convenience of a simple, editable document format allows you to customize each bill to suit the specific needs of each client or project.

One of the key benefits of this format is its compatibility with a wide range of software. Unlike more specialized tools, it can be opened, edited, and saved on almost any computer or device. This makes it an excellent choice for individuals and businesses that need a reliable, straightforward way to manage payment requests without requiring specialized software or knowledge.

Another advantage is the ability to quickly create and modify documents. With a familiar interface, you can easily add or remove information, adjust item descriptions, or update rates. This ensures that each payment request can be tailored to meet the particular needs of your business, offering both accuracy and efficiency.

How to Create a Labor Invoice

Creating a payment request document requires careful attention to detail to ensure that all necessary information is included and presented clearly. The goal is to outline the services provided, specify the time spent or materials used, and list the agreed-upon charges in a way that is easy for the client to understand. A professional format not only simplifies communication but also ensures timely and accurate payment.

To begin, start by including your business information at the top of the document. This should include your company name, address, phone number, and email address. Next, add the client’s details, such as their name, address, and contact information. This ensures that both parties are clearly identified and helps avoid any confusion when processing the payment.

Next, provide a detailed description of the services rendered. Be specific about what was done, including the date and duration of each task, if applicable. It’s important to ensure that the description is clear enough that the client understands exactly what they are being charged for. If you are billing for materials, include a breakdown of those costs as well.

Finally, add the payment terms, including the total amount due, payment methods, and the due date. Clearly state any late fees or interest that may apply if payment is not received on time. With everything in place, review the document for accuracy before sending it to the client. Ensuring every detail is correct helps build trust and avoids unnecessary delays.

Customizing a Labor Invoice in Word

When creating a payment request document, customization allows you to tailor it to your specific business needs, client preferences, or industry standards. Personalizing the layout, design, and content of the document helps ensure that it aligns with your brand image and enhances professionalism. With an editable format, making these adjustments is simple and allows for consistency across all your billing records.

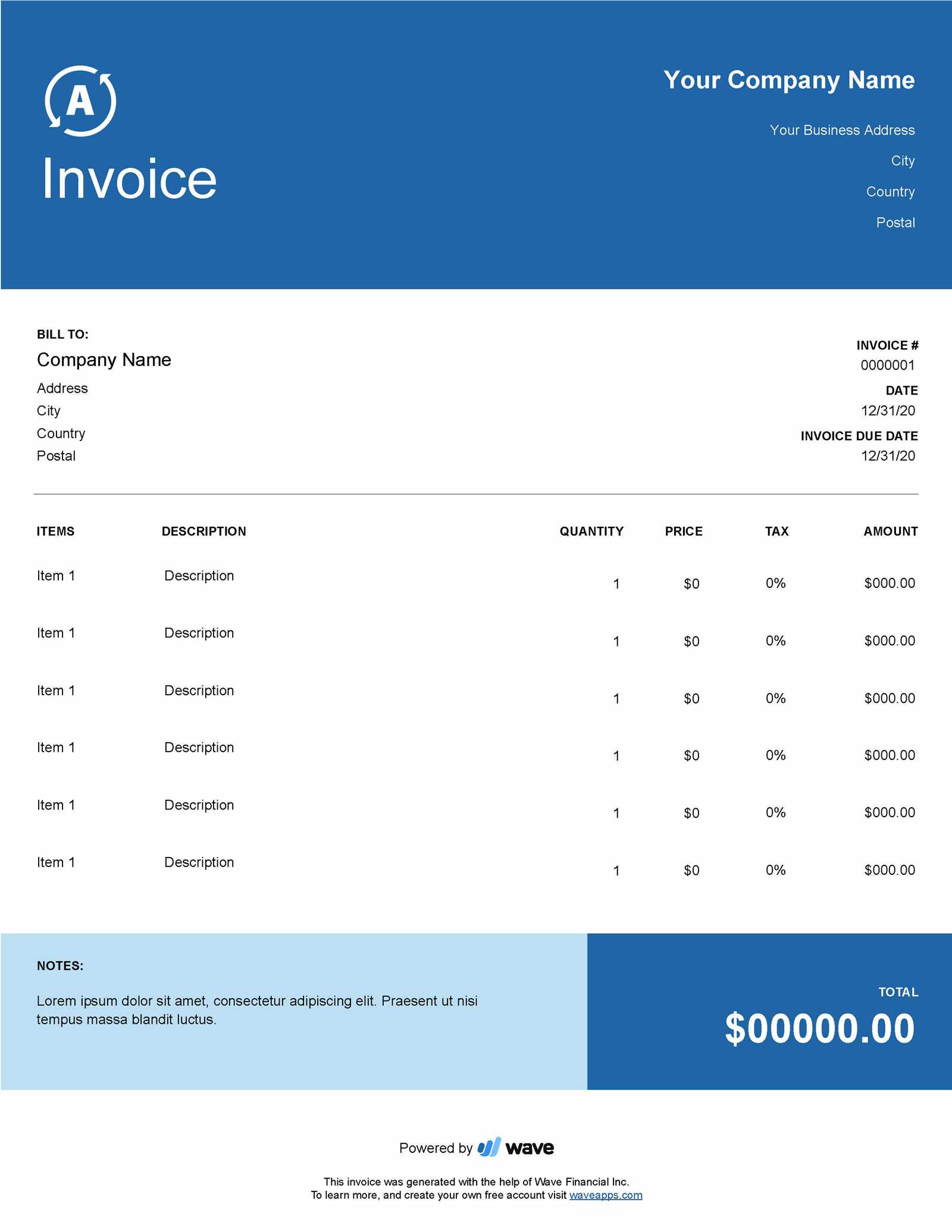

To begin customizing, consider adjusting the header to include your logo or business branding. This adds a professional touch and makes the document easily recognizable. You can also modify the font, color scheme, and overall design to reflect your business’s aesthetic, creating a cohesive look across all client-facing materials.

Modifying Sections for Specific Services

Each service or product you offer may require different details in the billing document. Customize the sections where you describe services to be more specific to the project or client. For example, you might need to adjust the rate, add a project description, or include additional costs for materials or special tasks. Tailoring these details ensures clarity and avoids confusion during the payment process.

Adjusting Payment Terms and Layout

Another key customization area is the payment terms. You can easily update the due date, late fees, or accepted payment methods to suit each individual agreement. Customizing the layout to fit the specifics of your business, such as adding payment reminders or discount offers, can also help improve cash flow. These adjustments ensure that the document serves as a clear and accurate record for both you and your client.

Common Elements in a Labor Invoice

To ensure that your payment request is clear and comprehensive, there are several essential components that should always be included. Each section serves a specific purpose, helping both you and your client understand the details of the transaction. A well-structured document minimizes confusion and enhances the likelihood of timely payment.

The following are some of the most common elements found in a standard payment request:

- Business Information – Your company name, address, phone number, and email should be clearly displayed at the top of the document. This helps clients easily identify the source of the billing document.

- Client Information – Including the client’s name, address, and contact details ensures that the payment request is addressed to the correct party.

- Invoice Number – A unique identifier for the document that helps both you and the client track the transaction.

- Date of Issue – This marks when the payment request was created and helps establish the timeline for payment.

- Description of Services – A detailed breakdown of the work performed, including dates, hours, or units of service. Clear descriptions help the client understand what they are being charged for.

- Costs and Rates – A detailed list of charges, including hourly rates, fixed costs, or material expenses, so the client can easily verify the total amount due.

- Payment Terms – Specifies the due date, acceptable payment methods, and any late fees or interest that will apply if the payment is not made on time.

- Notes or Additional Information – This section can include any additional instructions, terms, or special offers related to the payment request.

By including these elements in your payment request, you create a transparent and organized document that helps avoid misunderstandings and supports prompt payment. Properly structured billing is an essential part of maintaining a professional relationship with clients and ensuring smooth financial operations.

Setting Up Payment Terms on Invoices

Establishing clear payment terms is a crucial part of the billing process, as it sets expectations between you and your clients. By outlining specific guidelines for when and how payments should be made, you help avoid confusion, missed payments, or delays. Well-defined terms ensure that both parties are aware of their responsibilities, promoting smoother financial transactions.

When setting up payment terms, it’s important to consider factors like due dates, late fees, and acceptable payment methods. These terms should be clear and easily understood, ensuring that clients know exactly when and how to settle their balance. Below are key elements to include when defining payment terms:

- Due Date – Clearly state the exact date by which payment is expected. This helps clients plan their payment and avoids unnecessary follow-ups.

- Late Fees – Specify if there will be any penalties or interest charges for late payments. This can encourage clients to pay on time and prevent overdue balances from accumulating.

- Payment Methods – List the methods of payment you accept (e.g., bank transfer, credit card, checks). The more flexible the payment options, the easier it is for clients to settle their accounts.

- Discounts for Early Payments – Offering a discount for early payment can motivate clients to pay ahead of schedule. This can be a great way to improve cash flow.

- Installment Options – If the amount is large, consider offering a payment plan. Be sure to specify the installment amounts, dates, and any interest associated with the payments.

Clarifying Payment Expectations

Clearly outlined terms not only protect your business but also create transparency in the client relationship. It’s important to communicate these terms before beginning the work, preferably in your contract or agreement, to avoid disputes later. In your payment request document, reiterate these terms to ensure the client has a clear understanding of when and how to pay.

Customizing Terms for Each Client

Some clients may have different payment needs or preferences. Customizing payment terms for each individual agreement can be a useful strategy. For example, you might offer longer payment periods for loyal clients or allow for specific payment methods based on the client’s location. Tailoring these terms ensures flexibility while maintaining clear expectations for both parties.

Tips for Clear Labor Billing

To ensure smooth financial transactions and avoid confusion, it’s important to present billing information in a straightforward and transparent way. Clear and concise billing not only helps clients understand what they are paying for, but also reduces the chances of disputes or delayed payments. Here are some practical tips for creating easy-to-understand payment requests.

- Be Specific with Descriptions – Always provide a detailed description of the work completed. Include dates, hours worked, and any special tasks or materials used. The more specific the details, the easier it is for clients to verify the charges.

- Break Down Costs – If your services include different components (e.g., hourly rates, material costs), break down each cost separately. This helps clients understand exactly what they are being charged for and reduces ambiguity.

- Use Simple Language – Avoid jargon or complex terms in your billing document. Use clear, everyday language to ensure that the client can easily interpret the charges without confusion.

- Provide a Clear Total – Summarize the charges at the bottom of the document with a clear total amount due. This allows the client to quickly assess how much they need to pay without searching through the document.

- State Payment Terms Clearly – Include a section that outlines payment due dates, accepted payment methods, and any penalties for late payments. This ensures both parties are on the same page regarding expectations.

Maintain Consistency Across Documents

Maintaining a consistent format across all your billing documents helps avoid confusion and builds trust with your clients. Use the same structure for each payment request, keeping sections like descriptions, rates, and totals in the same order. This consistency makes it easier for clients to compare different invoices and ensure that no charges are missed or misunderstood.

Proofread Before Sending

Before sending any billing document, always double-check for errors. Simple mistakes such as incorrect pricing or missing details can create delays in payments or lead to misunderstandings. A quick review can save time and help maintain a professional image with your clients.

How to Track Payments Using Invoices

Properly tracking payments is essential for maintaining healthy cash flow and ensuring that all outstanding balances are cleared. By using a well-structured document, you can easily monitor which payments have been received and which are still due. Consistent record-keeping not only helps keep your finances organized but also reduces the risk of missed payments or discrepancies with clients.

To effectively track payments, it’s important to include specific information on each document that helps identify the status of the payment. For example, assigning a unique identifier for each billing statement and clearly marking whether it has been paid or is still pending allows for quick reference. Additionally, maintaining a log of all sent documents and payments will make it easier to follow up on overdue accounts and avoid confusion later.

Key Information to Include for Tracking

For accurate tracking, be sure to include the following details on each document:

- Invoice Number – A unique identifier for each document that helps easily reference and track payments.

- Payment Due Date – This helps you know when the payment should be made and gives you a clear timeline for follow-up actions if the payment is not received on time.

- Amount Due – Clearly display the total amount owed to avoid confusion about the balance.

- Payment Status – Mark each document as “Paid” or “Pending” to easily track which payments have been made and which are still outstanding.

- Transaction Reference – If payment is made electronically, include any reference number or details related to the transaction for future reference.

Using Software for Payment Tracking

If managing multiple clients or large volumes of transactions, consider using accounting software or spreadsheets to log all payments. This can help automate the tracking process and provide an overview of your financial status. With these tools, you can quickly see which accounts are overdue, which payments have been received, and how much revenue is still pending.

Incorporating Taxes into Labor Invoices

When creating a payment request document, it is essential to factor in taxes to ensure you comply with local regulations and accurately reflect the amount owed by the client. Including taxes in your billing process not only helps with legal compliance but also ensures that your business is properly accounting for any applicable tax obligations. Here’s how you can effectively incorporate taxes into your payment documents.

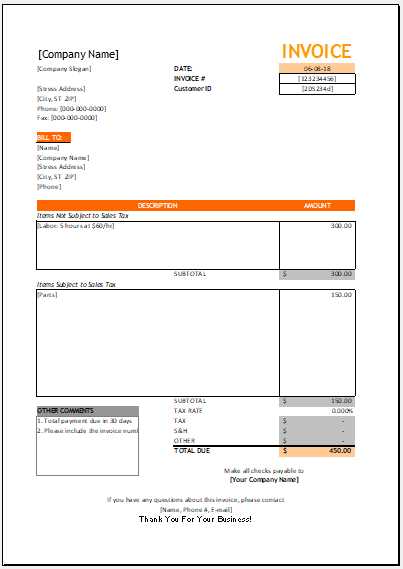

Taxes can vary based on the location, type of service, and applicable tax rates. It’s important to calculate the correct tax amount and display it separately on the document to avoid confusion. Including a detailed tax breakdown also ensures transparency and helps the client understand how the total amount is being calculated.

Steps to Incorporate Taxes

- Determine Applicable Tax Rates – Research the appropriate tax rate for your region or industry. This can vary by location and may differ based on the type of service you are providing.

- Calculate the Tax Amount – Multiply the taxable amount (e.g., the cost of services or goods) by the appropriate tax rate. This will give you the tax amount that needs to be added to the total.

- Display the Tax Separately – On your payment request, clearly list the tax as a separate line item. This ensures that the client understands exactly how much is being charged for taxes.

- Include the Total Amount – After adding the tax amount, calculate the total amount due, including both the services provided and the taxes. Ensure that this final total is prominently displayed.

Types of Taxes to Consider

- Sales Tax – A common tax applied to most goods and services, usually based on the sale price or service fee.

- Value-Added Tax (VAT) – A tax levied on the value added to goods or services at each stage of production or distribution.

- Service Tax – A tax specifically for services rendered, typically applied by governments in some regions.

By incorporating taxes correctly into your payment requests, you can avoid potential tax-related issues and maintain a transparent relationship with your clients. Always ensure that the tax details are accurate, up to date, and clearly presented to avoid confusion and maintain professionalism.

Labor Invoice Template for Freelancers

For freelancers, creating a clear and professional payment request is crucial to getting paid on time. A well-structured document helps establish credibility with clients and ensures there is no confusion regarding services rendered, rates, and due dates. Having a standardized format makes it easy to manage multiple projects and streamline the billing process.

Freelancers often work on varying contracts with different rates, timelines, and payment terms. Using a customized payment document that can be adjusted for each project is essential. This document should clearly outline the agreed-upon services, itemized rates, and the final amount due, as well as include important details like due dates and accepted payment methods.

Essential Components for Freelance Billing

When preparing a billing document for a freelance project, it’s important to include the following details:

- Freelancer Information – Your name, business name (if applicable), contact details, and tax identification number if required.

- Client Information – Include the client’s name, business name (if applicable), and contact details.

- Description of Services – Clearly describe the services you provided, including the time spent or units delivered, if applicable.

- Hourly Rate or Project Fee – Specify your rate, whether hourly, daily, or for a fixed project amount. If billing hourly, indicate the number of hours worked.

- Payment Terms – Specify the due date for payment, accepted payment methods, and any late fees or interest charges for overdue balances.

- Total Amount Due – Sum up the costs and taxes to provide a clear, concise total that the client needs to pay.

Customizing for Different Projects

Freelance work often involves a wide range of projects, each with different requirements. Customizing the payment request for each job is important to ensure all necessary information is captured. For example, if you’re working on a project with milestone payments, break down the total amount due into multiple installments. Include payment due dates for each stage and any specific terms related to the progress of the work.

By ensuring that your payment requests are clear and professional, you improve your chances of getting paid on time and maintaining strong relationships with clients. Keep your billing documents organized and update them as needed to fit the specifics of each project.

Free vs Premium Invoice Templates

When it comes to creating professional billing documents, business owners and freelancers often face a choice between free and premium options. Both have their advantages, but the right choice depends on your needs, the volume of your work, and the level of customization you require. Understanding the differences between these options can help you make an informed decision.

Free billing documents are often sufficient for simple tasks and one-time projects, offering basic features at no cost. On the other hand, premium versions come with enhanced features, more customization options, and greater flexibility, but they often come with a price tag. Below are the key differences between free and paid options to help you decide which best suits your business.

Advantages of Free Templates

- Cost-Effective – As the name suggests, free templates come at no cost, making them ideal for individuals or small businesses with limited budgets.

- Quick and Easy to Use – Many free options are straightforward and can be easily downloaded or customized with minimal effort. This is ideal if you need a simple solution without a lot of features.

- Basic Design – Free templates typically feature a simple layout and basic structure, which may be suitable for less formal or one-off projects.

Advantages of Premium Templates

- Customization Options – Paid templates usually offer more flexibility when it comes to customizing fields, layout, and branding elements like logos or colors. This is beneficial for businesses that want to maintain a consistent brand image.

- Advanced Features – Premium templates often come with added functionality, such as automatic calculations, integrated tax options, and the ability to track multiple payments or clients in a single document.

- Professional Design – Paid templates often feature modern, sophisticated designs that convey professionalism and make your billing documents stand out, helping you leave a better impression on clients.

- Customer Support – Premium options usually come with dedicated customer support, allowing you to resolve any issues or get assistance with customization quickly.

Choosing between free and premium billing solutions depends on your specific business needs. If you have a low volume of transactions or are just starting, free options may be all you need. However, if you require more advanced features, a customized design, or the ability to manage numerous clients efficiently, investing in a premium version might be worthwhile.

How to Save and Send Word Invoices

Once your payment request document is created, it’s important to know how to save it properly and send it securely to your clients. Whether you are sending it via email or uploading it to a client portal, following the right steps ensures that your document remains intact and professional. The process of saving and sending your documents is an important aspect of maintaining clear communication with your clients and ensuring timely payments.

Here are some simple steps to follow for saving and sending your billing documents:

Saving Your Document

- Choose the Right Format – When saving your document, consider saving it in a universally accessible format like PDF. This ensures that the layout, fonts, and overall appearance remain consistent, no matter what device your client uses.

- Give It a Descriptive Name – Name the file clearly to include key details, such as the client’s name and the project date. For example, “ClientName_ProjectName_MonthYear.pdf”. This makes it easier to locate and reference the document later.

- Use a Consistent File Naming System – Develop a standardized naming system for your saved documents to maintain organization. This will make it easier to track different projects and clients over time.

Sending Your Document

- Email – The most common method for sending billing documents is via email. Attach your saved document (preferably in PDF format) to the email and include a polite message with any necessary context (e.g., due date, amount owed). Be sure to double-check the recipient’s email address before sending.

- Client Portals – If your client has a secure portal for document submission, upload your file there according to their specified guidelines. Make sure the file is properly named and categorized, if needed.

- Follow Up – After sending your document, it’s good practice to follow up with the client after a few days to confirm receipt and address any questions. If payment is not received by the due date, a gentle reminder is often appreciated.

By properly saving and sending your payment request documents, you ensure that your billing process is streamlined and professional. Clear communication about payment details helps foster good relationships with clients and minimizes the chances of missed or delayed payments.

Best Practices for Invoice Design

A well-designed billing document not only ensures that you present yourself professionally but also helps clients easily understand the charges and payment terms. The design of your payment request plays a crucial role in communication, as it conveys clarity and transparency. Following some best practices can make your document more effective and easier for your clients to process and pay on time.

From layout to fonts and colors, every element in your payment request should be carefully considered to make it both functional and visually appealing. Here are some key design practices to ensure your billing documents stand out and provide all necessary details without overwhelming the reader.

Clear and Simple Layout

A clean and organized layout is essential for readability. The design should guide the reader’s eye naturally from one section to the next, with enough white space to avoid a cluttered appearance. Key elements, like the total amount due, due date, and service details, should be easy to locate at a glance.

- Organize Information – Use a logical structure to separate each section (e.g., service description, cost, taxes, total amount). Group related information together to help your client quickly find what they need.

- Use Headings and Subheadings – Clear headings and subheadings improve readability and ensure your client can quickly identify the most important sections.

- Avoid Overcrowding – Leave sufficient margins and space between different sections. This ensures that the document is visually easy to scan, reducing the risk of errors.

Brand Consistency

Incorporating your brand’s logo, color scheme, and fonts into the design of your billing document not only maintains professionalism but also helps build trust with your clients. Using your branding on every communication reinforces your identity and creates a more consistent experience for the client.

- Use Your Logo – Place your logo at the top of the document, preferably in the header, to ensure it’s easily identifiable.

- Stick to Brand Colors – Choose one or two primary colors from your brand’s color palette to highlight important information, like the total amount due or the due date.

- Choose Readable Fonts – Select fonts that are clear and easy to read. Avoid using too many different fonts and focus on one or two styles for headings and body text.

Be Transparent and Clear

Your payment request should leave no room for confusion. Clearly break down the services provided, including rates, hours, or quantities, so the client understands exactly what they are paying for. The total amount due should be prominently displayed, and taxes or additional fees should be itemized where appropriate.

How to Avoid Invoice Mistakes

Billing documents are critical to getting paid accurately and on time. Small mistakes can lead to confusion, delays in payment, or even lost income. To avoid these issues, it’s essential to double-check every aspect of your payment request before sending it to clients. By being thorough and organized, you can minimize the risk of errors and ensure smooth transactions.

Here are some practical tips to help you avoid common mistakes when creating and sending your payment requests:

Common Mistakes to Avoid

- Incorrect or Missing Information – Always include your name, address, and contact details, along with the client’s information. Missing or incorrect details, like the wrong client name or address, can cause confusion and delays in payment.

- Unclear Payment Terms – Specify payment terms clearly, including the due date, late fees, and accepted methods. Avoid vague wording, as it can lead to misunderstandings or delayed payments.

- Missing or Incorrect Itemization – Ensure that all services or products are accurately listed, with the correct amounts, rates, or quantities. Incomplete or inaccurate itemization can make it difficult for your client to understand the charges.

- Failure to Include Taxes – If applicable, include taxes in the breakdown. Failing to include tax information can lead to discrepancies when your client reviews the bill and may cause delays in payment.

- Not Double-Checking for Typos – Typos, especially in amounts or numbers, can cause confusion and may result in the wrong payment being made. Always review the document for errors before sending it.

Best Practices for Avoiding Mistakes

- Use Templates or Software – Using a well-designed, consistent format helps ensure that all necessary details are included and reduces the risk of overlooking important elements.

- Double-Check Figures and Calculations – Always double-check calculations to ensure that amounts, taxes, discounts, and totals are accurate. Use automated tools if possible to avoid human errors.

- Review Client Information – Before sending, verify the client’s contact details and project description to ensure everything matches the agreed terms.

- Keep a System for Tracking Payments – Establish a clear system for tracking sent documents, payments, and follow-up reminders. This helps avoid confusion and ensures that all invoices are sent and followed up on properly.

By paying attention to these details and avoiding common mistakes, you can improve the accuracy and

Legal Requirements for Labor Invoices

When creating billing documents, it’s important to be aware of the legal requirements that govern the information included in them. Different regions and countries may have specific rules that businesses must follow to ensure that the documents are legally compliant and serve as valid records for tax purposes. Failure to meet these requirements could result in penalties or complications in the event of an audit.

In general, billing documents must contain certain essential elements to ensure their legitimacy. These elements can vary depending on local laws, but there are some standard components that most regions will require for legal purposes. Below are the key legal requirements commonly found across many jurisdictions.

Key Elements for Compliance

| Requirement | Description |

|---|---|

| Business Information | Your full business name, address, and contact details, including your VAT or tax identification number if applicable. |

| Client Information | The name and address of the client or customer receiving the goods or services. |

| Unique Reference Number | A unique identifier for each billing document to help track it in case of disputes or for accounting purposes. |

| Itemized Breakdown | A clear description of the products or services provided, including quantities, unit prices, and total amounts for each item. |

| Total Amount Due | The total amount payable, including applicable taxes, fees, and discounts, clearly highlighted. |

| Tax Details | Applicable taxes (e.g., VAT, sales tax) should be specified separately, including the tax rate applied. |

| Payment Terms | Terms of payment, including due date, acceptable methods of payment, and any late payment penalties if applicable. |

Regional Variations

It’s important to recognize that each jurisdiction may have its own specific rules. For example, in some countries, invoices must include specific tax information or an explanation of the tax calculation. Similarly, some regions require that certain payment terms be stated explicitly, including how late fees are applied.

For example, in the European Union, businesses must comply with VAT regulations, which means they need to include a VAT number on their billing documents. Similarly, in the United States, sales tax and the tax rate must be indicated depending on the state’s requirements. Always consult local tax laws or a legal professional to ensure full compliance with the relevant regulations.

By adhering to these legal requirements, you can avoid potential legal issues and ensure that your billing documents are accepted as

Where to Find Free Templates Online

If you’re looking for pre-designed documents to streamline your billing process, there are many free resources available online. Whether you’re a freelancer, a small business owner, or a contractor, using ready-made documents can save time and ensure consistency. Many websites offer free, customizable files that you can easily download and use, and some even allow you to make adjustments directly in the browser.

These free resources can help you create professional-looking payment requests without needing to hire a designer or spend time formatting from scratch. Below are some reliable sources where you can find high-quality templates at no cost.

Top Sources for Free Documents

- Google Docs – Google’s suite of tools offers free templates for all kinds of business documents, including billing requests. The templates are customizable and can be accessed and edited online, making them a convenient choice for users who need quick access to editable files.

- Microsoft Office Templates – If you have access to Microsoft Office, you can explore their library of free document templates. They offer a variety of styles and formats for creating clear, professional-looking payment requests.

- Template.net – Template.net offers a wide range of free and paid templates, including those for business transactions. The free templates are easily downloadable and customizable for your needs.

- Canva – Known for its design tools, Canva also provides free templates for a range of business needs, including billing. These templates are fully editable in the platform’s design editor, making customization easy for users with no design experience.

Benefits of Using Free Resources

- Time Savings – Ready-made documents allow you to skip the lengthy process of creating a new format each time you need to bill a client.

- Ease of Customization – Many free resources are fully customizable, allowing you to tailor the design and content to fit your specific needs and branding.

- No Cost – These platforms provide high-quality documents at no cost, which is ideal for small businesses or independent workers on a tight budget.

By using these free resources, you can access professional-grade documents without spending money or time on design, helping you streamline your billing process and maintain a professional image with minimal effort.