Free Job Invoice Template for Easy and Professional Billing

Managing payments and maintaining clear financial records is a crucial aspect of running a successful business. A well-organized document can simplify the entire process, ensuring that all services rendered are accurately accounted for and that both parties are on the same page. By using a structured approach, you can avoid confusion, delays, and potential disputes over transactions.

Whether you’re a freelancer, contractor, or small business owner, having a reliable structure for requesting payments is essential. With the right format, you can include all necessary details, from the services provided to the due date and payment methods, ensuring that the process is smooth and professional. This method not only helps in maintaining proper financial documentation but also boosts your credibility with clients.

Customizing such documents allows for flexibility, meaning you can tailor them to fit the specific needs of your business and clients. The time spent creating an effective document upfront will save time in the long run, making transactions more efficient and reducing the likelihood of errors or missed payments.

In this guide, we’ll explore how to create and use these documents to their full potential, offering you the tools to handle all financial requests with ease and professionalism.

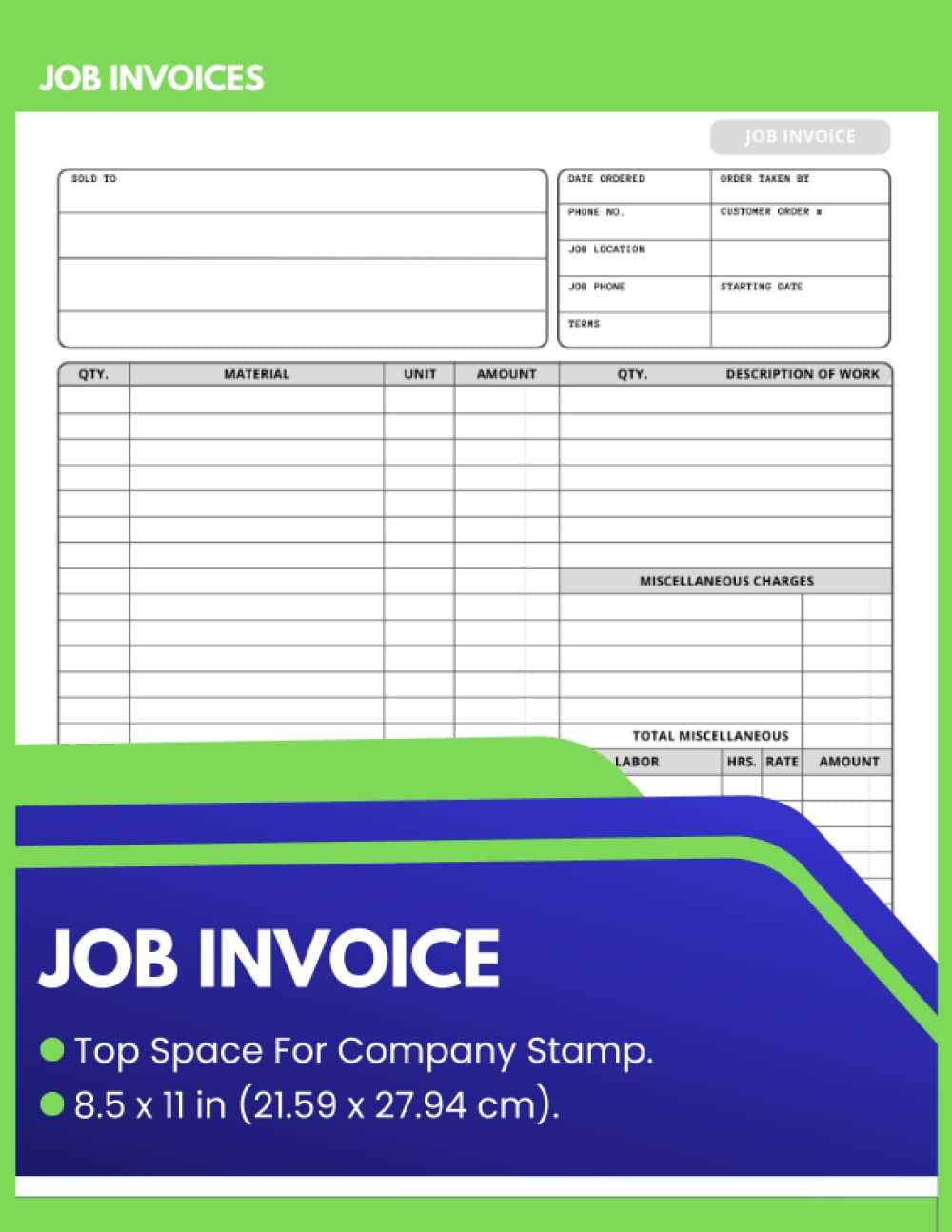

Job Invoice Template Overview

Having a clear and consistent method for requesting payment is essential for any business or individual providing services. A well-structured document not only helps in outlining the terms of the agreement but also ensures that all necessary details are captured in a professional manner. It serves as both a record for you and your client, reducing the risk of misunderstandings and promoting timely payment.

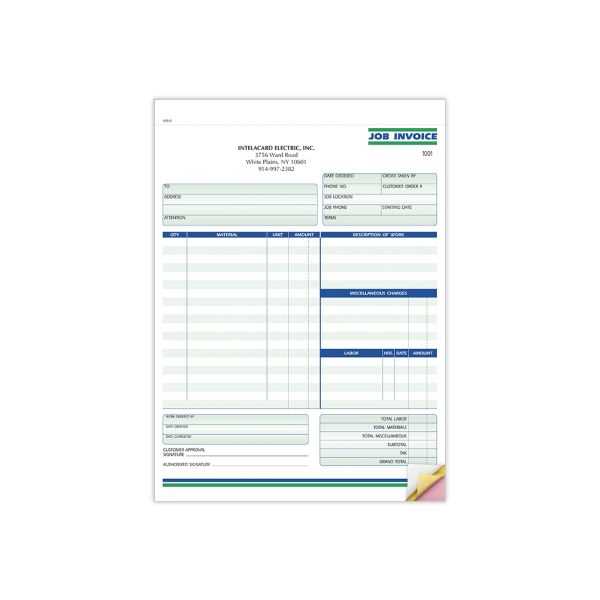

These documents typically include key information such as the services rendered, the agreed-upon rates, deadlines, and payment terms. By including all relevant details in a single, organized format, it becomes much easier to manage transactions and maintain accurate financial records. This approach can be adapted to fit various types of work, from consulting to repairs, allowing for a streamlined process regardless of the business type.

Using a pre-designed structure allows for quick customization, enabling you to create consistent and professional requests each time. It also minimizes the risk of omitting important details or making errors, ensuring that both parties are clear on what is expected and when the payment should be made.

Why Use a Job Invoice Template

Using a structured document for billing and payment requests offers several advantages for businesses of all sizes. By providing a standardized format, it ensures that all necessary information is included, reducing the chance of errors and simplifying the process for both the service provider and the client. This consistency can lead to quicker payments and fewer misunderstandings about terms.

One of the primary reasons to adopt a well-organized billing document is efficiency. With a ready-made format, you can quickly adapt it to your needs without having to reinvent the wheel each time you need to request payment. This not only saves you time but also gives you a professional appearance, which can help build trust with your clients.

The following table highlights some of the key benefits of using a structured format for payment requests:

| Benefit | Description |

|---|---|

| Time-saving | Pre-designed documents allow for quick customization, reducing the effort required to create each request. |

| Consistency | A uniform approach ensures that every request follows the same format, minimizing errors or omissions. |

| Professionalism | Using a well-designed format demonstrates professionalism, which can help improve client relationships. |

| Clarity | Clearly outlining all necessary details ensures that both parties are on the same page regarding terms and payment expectations. |

| Legal Protection | A well-documented request serves as a legal record, offering protection in case of payment disputes. |

Overall, incorporating a standardized document into your workflow not only helps streamline your billing process but also enhances communication and reduces the likelihood of misunderstandings between you and your clients. This leads to smoother transactions and a more professional image in the eyes of your customers.

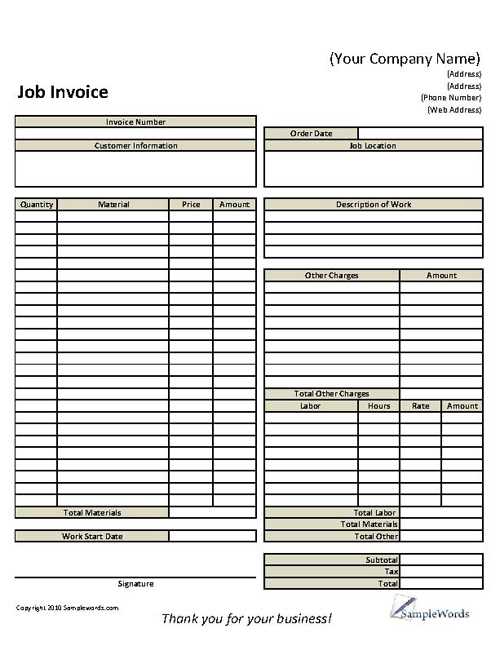

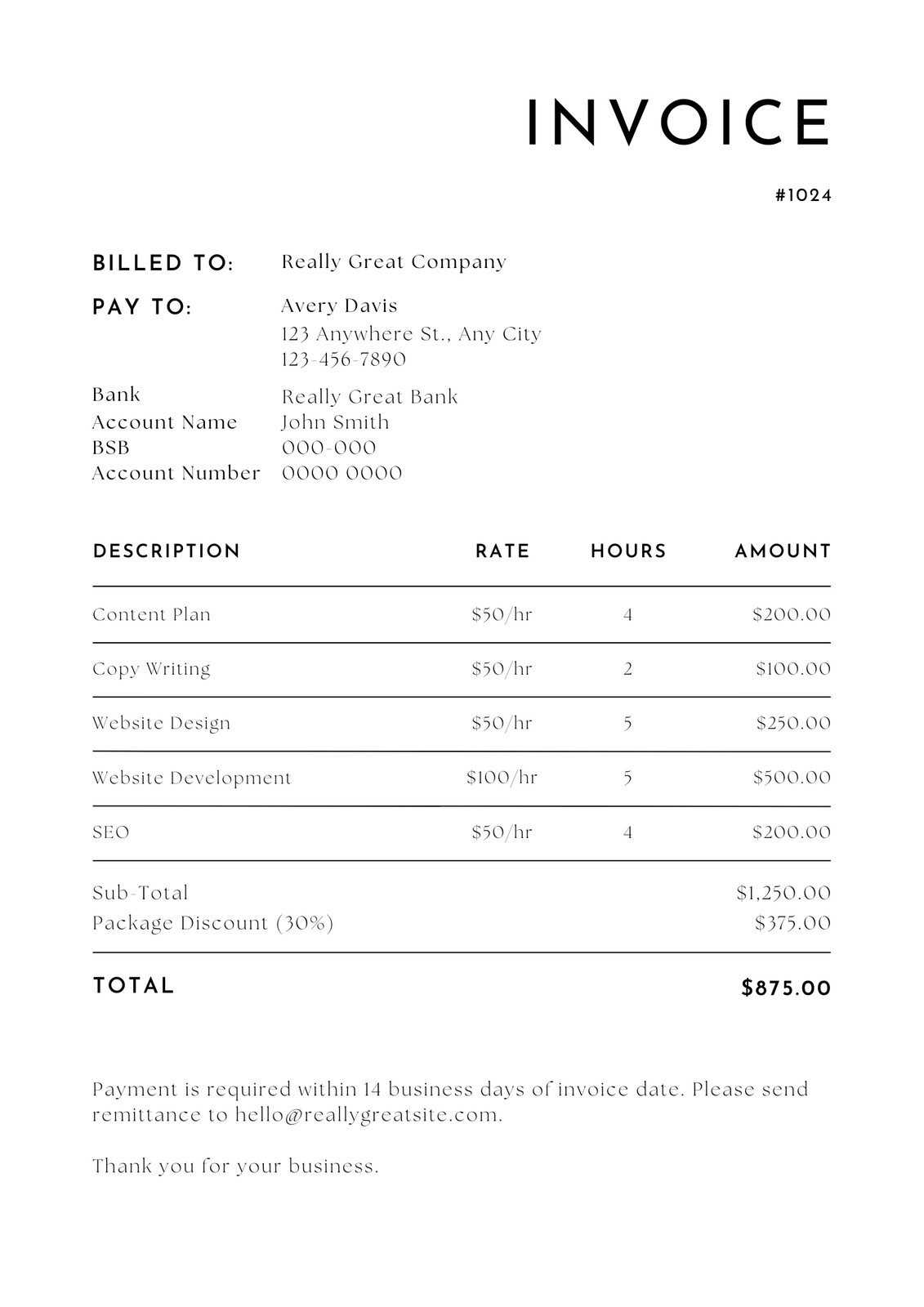

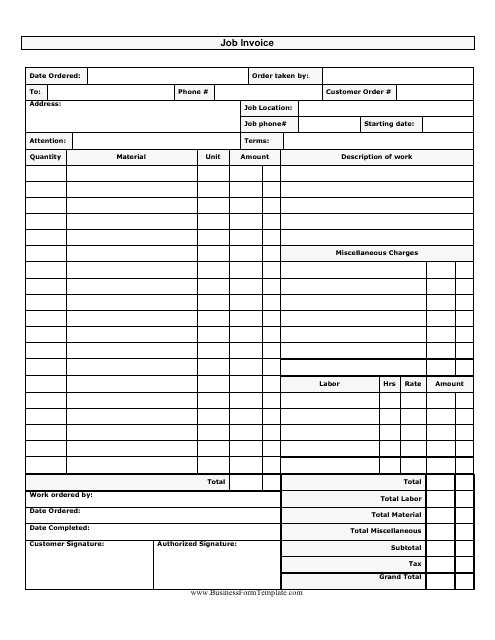

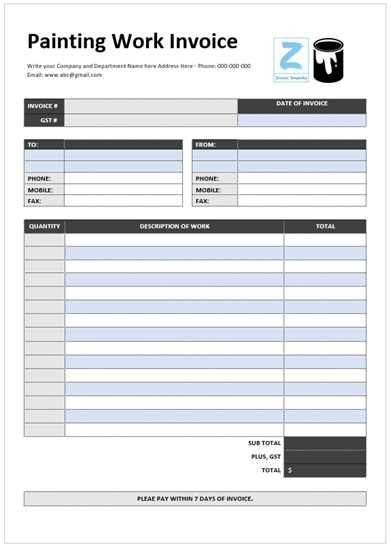

Key Components of a Job Invoice

To ensure that payment requests are clear, accurate, and professional, it is essential to include several key elements. These components provide both the service provider and the client with all the necessary details to understand the terms of the agreement and the payment expectations. Each section plays a vital role in ensuring that there are no misunderstandings and that the transaction can proceed smoothly.

The following elements should always be included in any payment request document:

- Contact Information: Include both your details and the client’s contact information, such as names, addresses, phone numbers, and email addresses. This ensures that both parties can easily communicate regarding the transaction.

- Unique Identification Number: A unique reference number helps track the document for record-keeping purposes and makes it easier to manage multiple transactions.

- Description of Services: Clearly outline the work performed, including the date and details of each service. This allows both parties to see exactly what is being billed.

- Rates and Fees: Specify the pricing structure, whether hourly or fixed, along with the total amount due. It’s important to break down the cost for transparency.

- Payment Terms: Clearly state the due date and accepted payment methods. This section may also include late fees or discounts for early payment.

- Taxes: If applicable, include the relevant tax amounts and specify whether the total is before or after tax to avoid confusion.

- Notes or Additional Terms: Use this space for any additional details or special terms that may apply to the transaction. It’s an opportunity to clarify specific conditions or agreements made between the parties.

Including these key components ensures that the document is comprehensive and leaves no room for ambiguity, making the payment process more efficient and reducing the risk of disputes. By maintaining a clear and professional structure, both service providers and clients benefit from smoother transactions and improved business relationships.

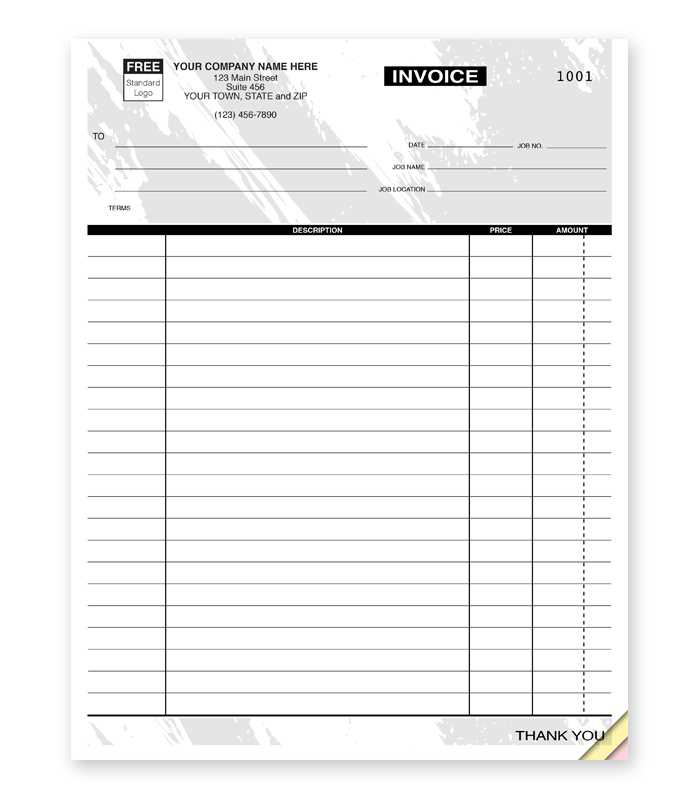

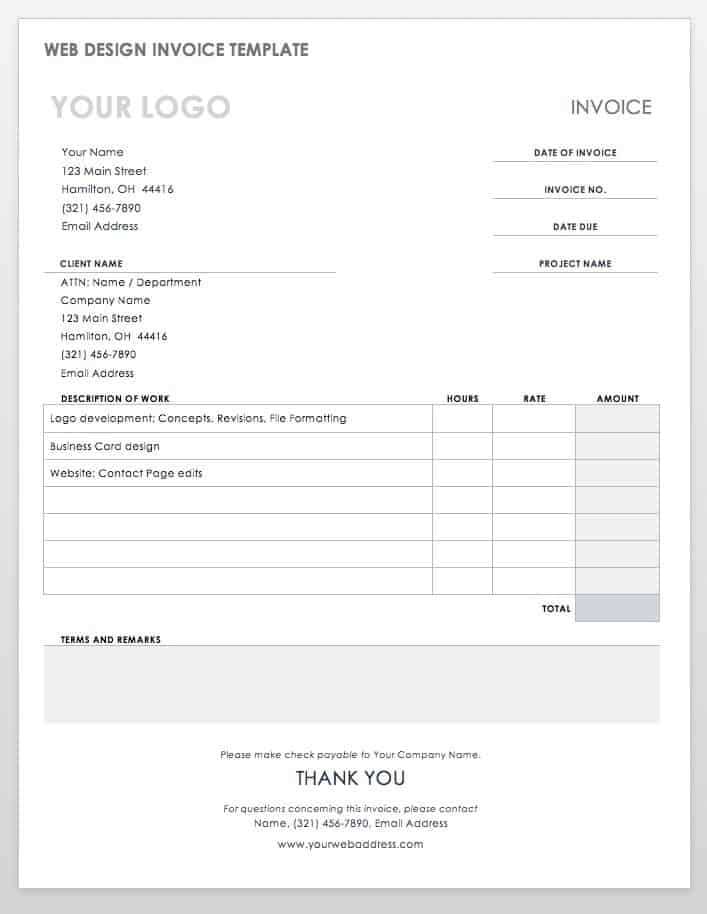

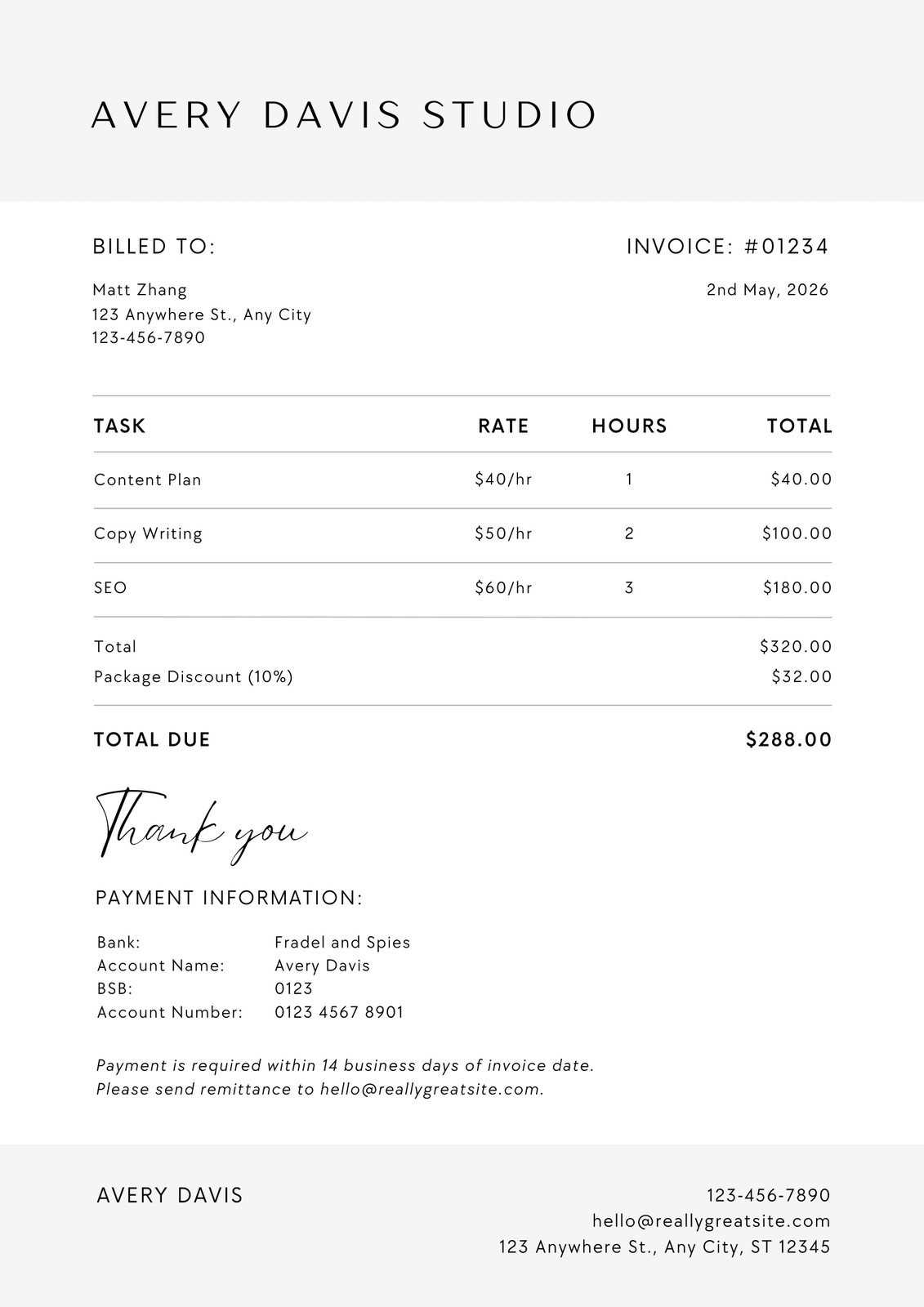

How to Customize Your Invoice

Personalizing your billing document allows you to align it with your business needs, ensuring that every detail is relevant and professional. Customization not only makes the document reflect your brand but also ensures that all necessary information is included in a clear and structured format. By making small adjustments, you can tailor the layout and content to best suit your services and clients.

Adjusting the Layout

Start by modifying the overall layout to match your business’s identity. This includes selecting appropriate fonts, adding your logo, and choosing colors that align with your branding. Many systems and tools allow you to easily drag and drop elements, so you can place the most important sections at the top, such as payment terms or the total amount due. This will give your document a polished and professional look that reflects your business’s image.

Including Custom Details

Beyond visual adjustments, you should customize the content based on your specific needs. Add or remove sections that are relevant to your services. For example, if you offer multiple service packages, you may want to include a section for itemized pricing. Also, include any specific terms that apply to your business, such as discounts for early payment or detailed tax calculations. Personalized notes can also be included to remind clients about deadlines, payment methods, or to express gratitude for their business.

Customizing the document in these ways ensures it is not only tailored to your specific needs but also looks professional and organized. This helps in building stronger relationships with clients and enhances the overall customer experience.

Benefits of Professional Invoices

Creating well-structured and visually appealing billing documents brings numerous advantages, enhancing business image and ensuring clear communication with clients. Using a professional format establishes trust and promotes a smooth payment process, as clients easily understand the details provided.

Enhanced Credibility and Trust

Presenting a polished, organized document to clients builds credibility and reflects a commitment to quality. This type of professional presentation shows attention to detail, which can reinforce clients’ confidence in the services received. When clients feel assured of accuracy, they are more likely to continue working with the business, fostering long-term relationships.

Efficient and Transparent Communication

Professional documents improve clarity by listing essential information in an organized way. Clearly laid-out amounts, services provided, and due dates ensure that all parties understand the transaction fully, reducing the chance of misunderstandings or disputes. This transparency also saves time by minimizing follow-up inquiries, allowi

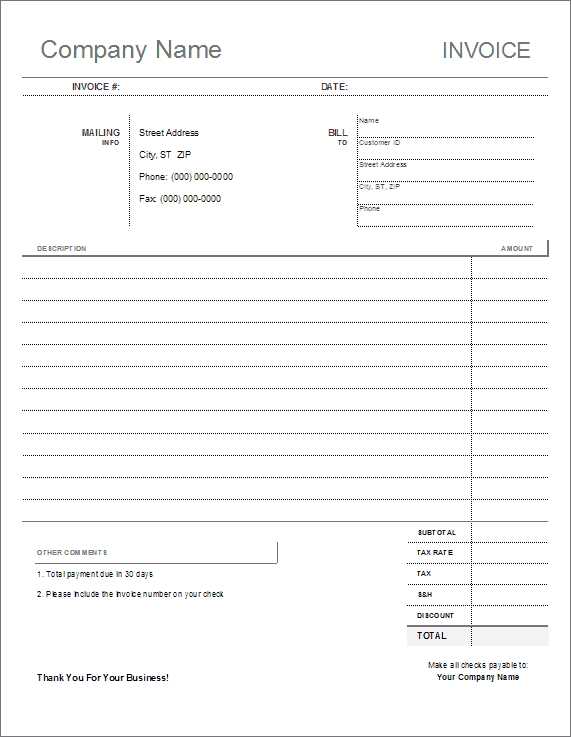

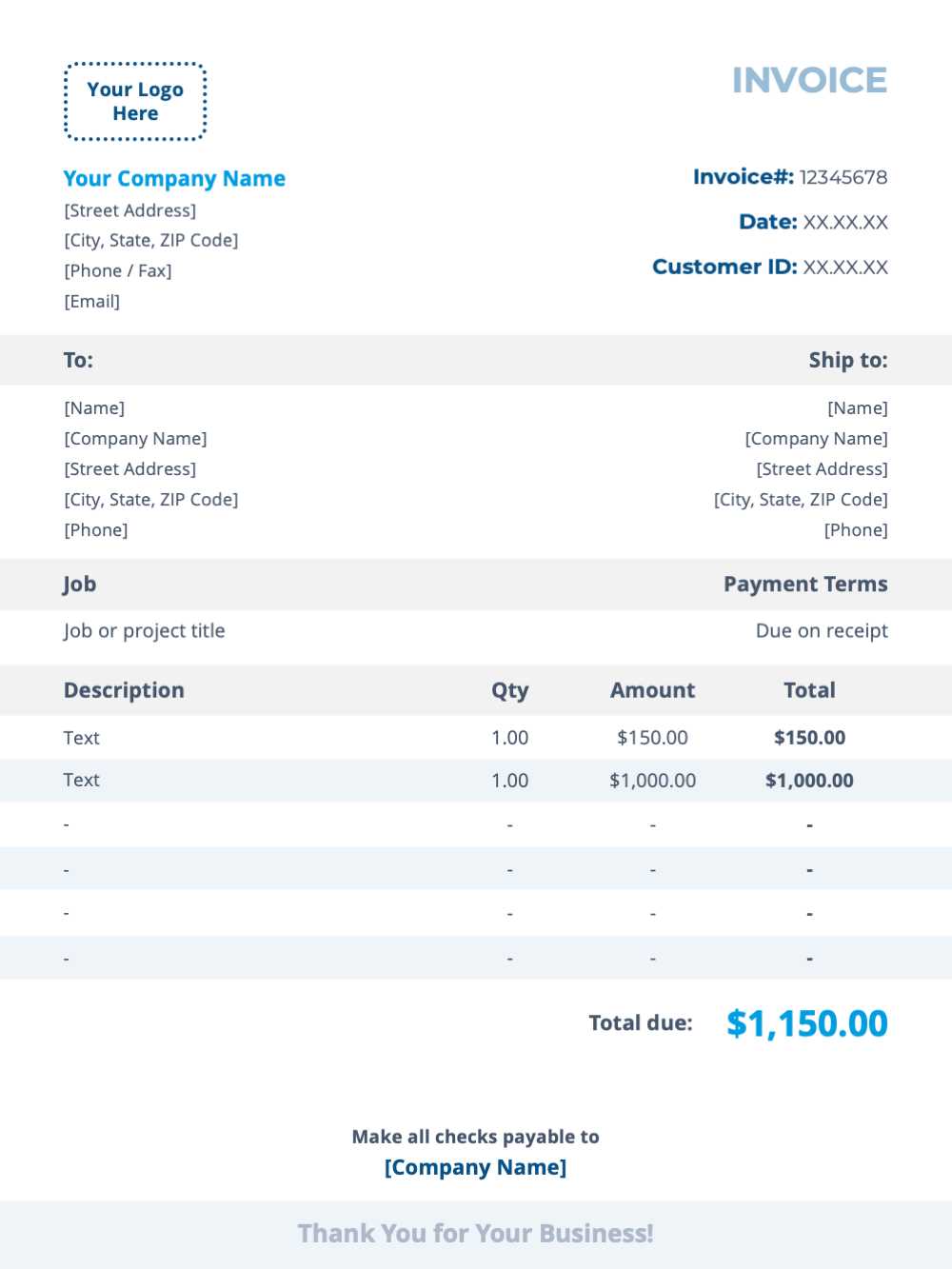

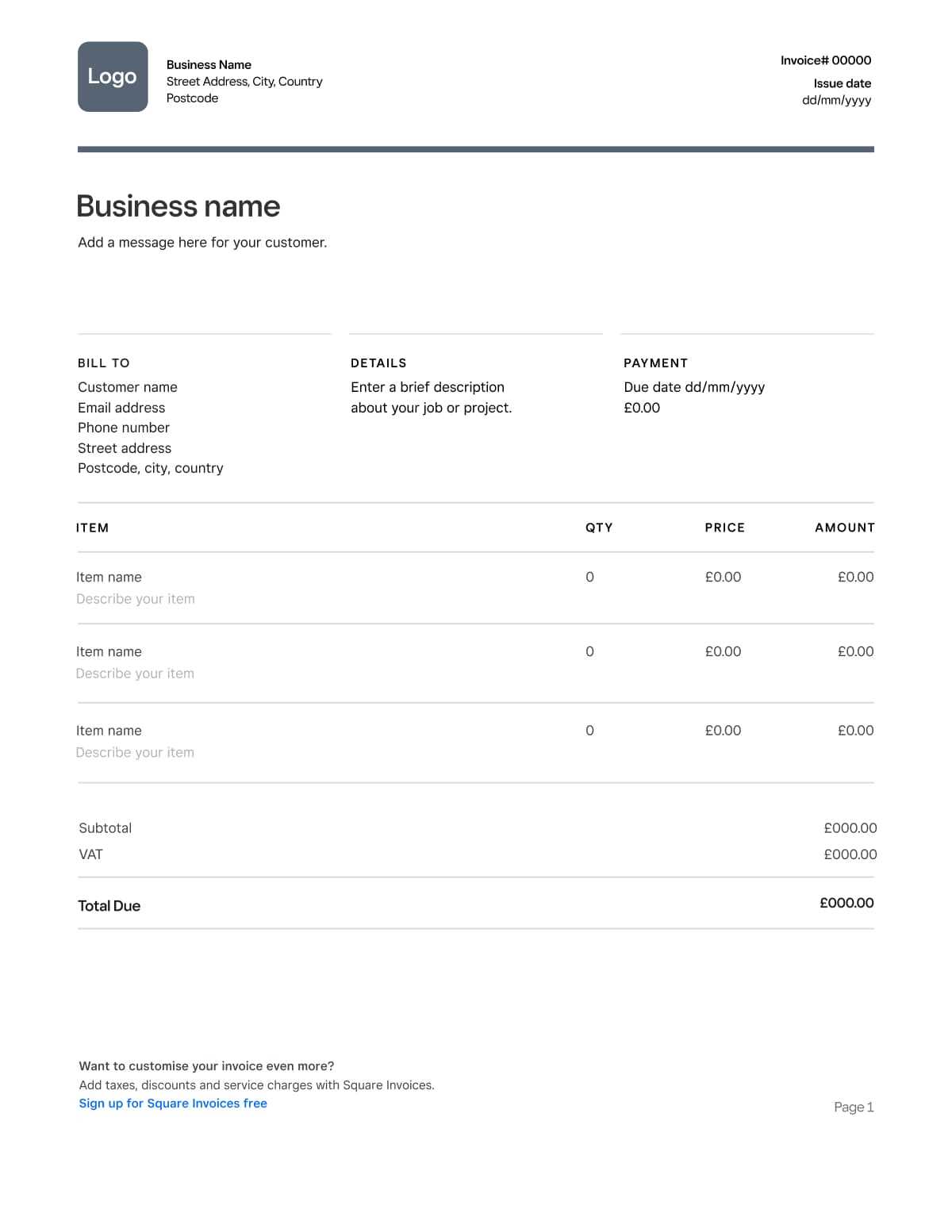

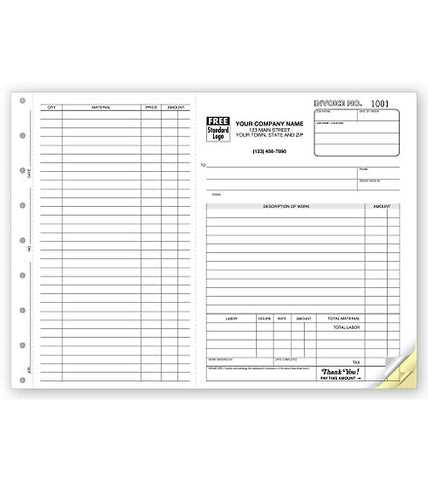

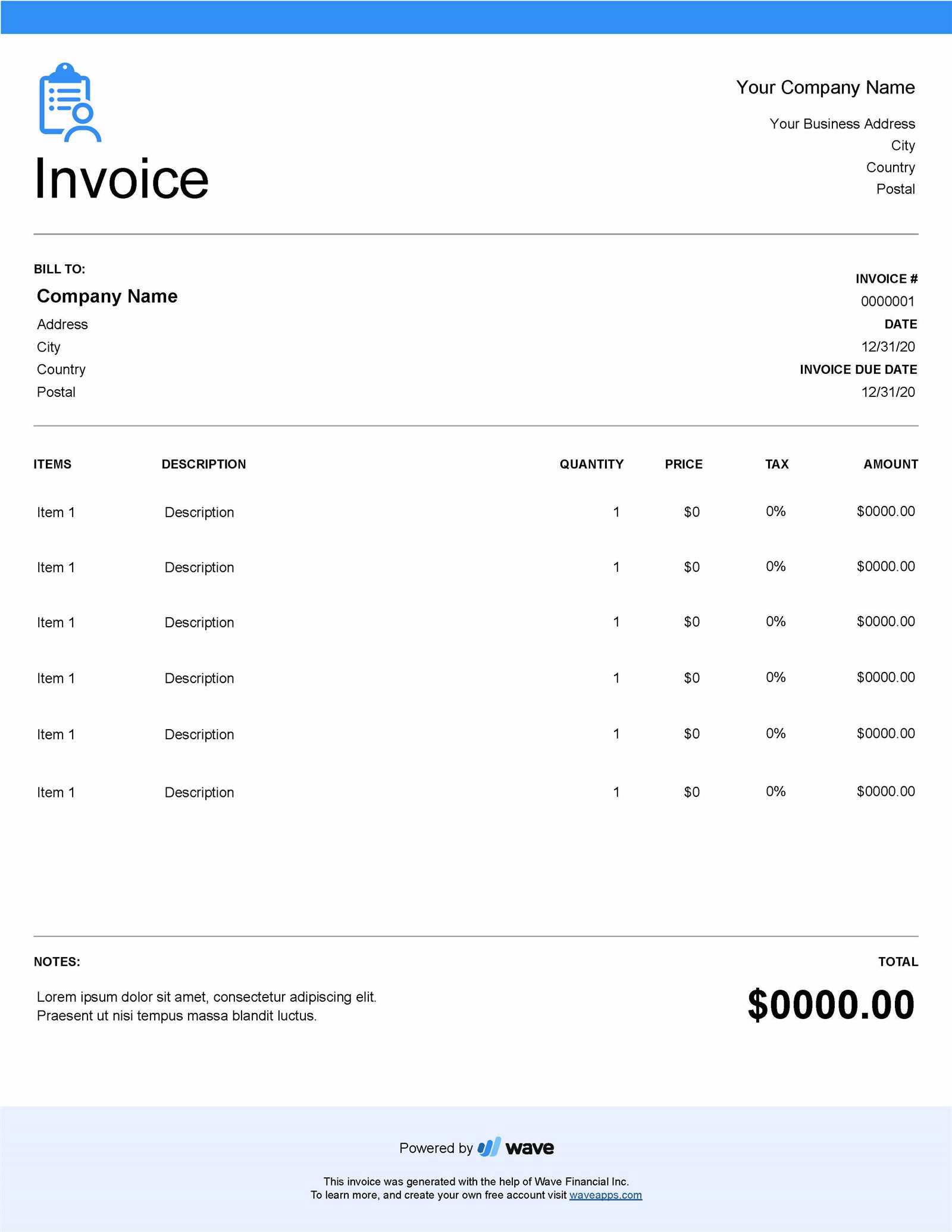

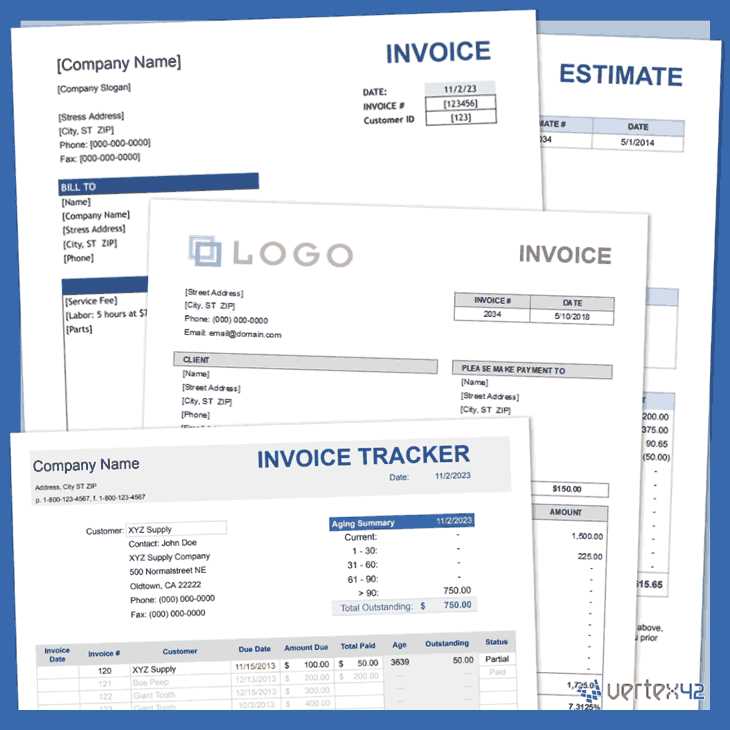

Free Job Invoice Templates Online

Finding pre-designed billing formats online provides a convenient way to streamline payment requests while maintaining a professional appearance. These resources offer a range of customizable options to suit different business needs, saving time and ensuring consistency across documents.

Accessibility and Convenience are key benefits of online billing formats. Many platforms offer free, ready-made layouts that users can easily modify, allowing even small businesses to create polished documents quickly. This approach minimizes the need for designing from scratch, making the process more accessible for those with limited resources or design experience.

Using customizable online resources also allows businesses to adapt layouts as their requirements evolve. These platforms often provide options for branding, itemized lists, and payment instructions, enabling users to tailor each document to meet specific preferences. This adaptability supports a smooth payment workflow, enhancing both user and client satisfaction.

How to Create an Invoice from Scratch

Developing a billing document from the ground up allows for complete customization to meet specific business needs. This approach provides flexibility in organizing essential details, ensuring the format aligns perfectly with the brand’s style and communication standards.

Essential Information to Include

A professional billing document typically contains critical details that clarify the transaction. Including the following sections ensures that clients can quickly understand the charges and terms:

| Section | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Information | Details such as name, address, and contact information. This identifies the service provider and establishes professionalism. | ||||||||||||||||||

| Client Details | Information about the client, including their name and address, to ensure accurate record-keeping. | ||||||||||||||||||

| Client Name | Service Provided | Amount Due | Due Date | Payment Status |

|---|---|---|---|---|

| Client A | Consulting | $500 | March 10, 2024 | Paid |

| Client B | Design Services | $1200 | March 15, 2024 | Pending |

| Client C | Development | $750 | March 20, 2024 | Overdue |

Tips for Timely Payment Follow-ups

To improve payment turnaround, consider sending automated reminders a few days before and after the due date. This reduces the likelihood of delays and shows clients you are committed to timely processing. Consistent follow-up practices help maintain positive business relationships and encourage regular, on-time payments.

Legal Considerations in Job Invoices

When creating billing documents, it is essential to ensure that they comply with relevant laws and regulations. These legal considerations protect both the business and the client, ensuring transparency, fairness, and clarity in all transactions.

Compliance with Tax Laws is one of the most important aspects to keep in mind. Depending on your location and the nature of your business, certain taxes must be applied to the amount due. This includes sales tax, VAT, or other local levies. Properly itemizing these taxes ensures legal compliance and prevents potential fines.

Payment Terms and Conditions should also be clearly stated. It is important to outline the due date for payment, as well as any penalties for late payments. These terms should be in accordance with local commercial laws to avoid disputes and legal challenges later on. Be sure to include the method of payment accepted and any applicable fees for processing.

Contractual Obligations must be reflected in the document. If there is a signed agreement in place, make sure that the terms of that contract are incorporated into the billing document. This includes the scope of services provided, agreed-upon rates, and any other special terms that were negotiated.

By paying attention to these legal factors, you ensure that your billing documents are not only professional but also legally binding and enforceable.

How to Handle Late Payments on Invoices

Delayed payments can disrupt your cash flow and cause financial strain for your business. To maintain a healthy business operation, it is essential to have a clear plan for managing overdue balances. Establishing proactive strategies can help resolve payment delays while preserving good relationships with clients.

Send Friendly Reminders shortly after the due date. Often, late payments are simply overlooked or forgotten. A polite reminder email or message can prompt the client to settle their balance. You can set up automated reminders to ensure timely follow-ups.

Offer Flexible Payment Options to encourage quicker payments. Some clients may struggle with paying the full amount at once. Providing installment plans or different payment methods could make it easier for clients to clear their balance.

Implement Late Fees as a deterrent for future delays. Clearly outline any late payment fees in your initial terms and conditions. If a payment is overdue, apply these fees consistently to maintain the integrity of your policies. Ensure that the client is aware of the penalty before the agreement is signed.

Escalate the Matter If Needed when other methods fail. If repeated reminders and payment plans do not work, consider taking more serious actions. Sending a formal demand letter or engaging a collection agency may be necessary to recover the owed amount.

Integrating Billing Documents with Accounting Software

Linking your billing documents with accounting software can streamline your financial processes and enhance overall efficiency. This integration automates many tasks, reduces errors, and provides a real-time overview of your financial health.

Improved Accuracy is one of the key benefits of integration. Manual data entry is prone to mistakes, but when your billing records sync with accounting software, the system automatically updates your accounts, reducing the risk of errors in calculations and record-keeping.

Time-Saving Automation also plays a crucial role. By integrating your billing system with accounting software, you eliminate the need to input transaction details manually. This can save significant time, allowing you to focus on other critical aspects of your business.

Real-Time Financial Tracking enables better decision-making. With up-to-date financial information, you can easily track outstanding balances, identify trends, and make informed decisions regarding cash flow management and budgeting.

Seamless Reporting is another advantage. Most accounting software offers built-in reporting tools that allow you to generate detailed financial reports without manually compiling data from multiple sources. These reports are invaluable for understanding the financial health of your business.