Free Job Invoice Template for Easy Billing

Managing payment requests efficiently is essential for professionals and businesses alike. Creating a clear and structured document to request payments not only ensures accuracy but also improves the overall workflow. With the right tools, this task can be simplified significantly, saving time and minimizing errors.

Whether you are a freelancer, contractor, or small business owner, having a pre-designed format can make a significant difference. These documents can be tailored to fit different services, ensuring they meet the specific needs of your work while maintaining a professional appearance.

Customization is key when preparing these documents, allowing you to include important details such as payment terms, due dates, and itemized costs. This level of organization is beneficial for both you and your clients, making transactions smoother and more transparent.

With a variety of options available online, you can find the perfect solution that fits your requirements without the need for costly software or excessive time investment. The right tools can help you stay organized and focused on what truly matters–delivering quality work and managing your business effectively.

Free Job Invoice Templates for Professionals

For any professional, managing payment requests can be a time-consuming task. However, with the right tools, the process becomes simpler and more efficient. Ready-made documents designed for requesting payments are a great solution for anyone looking to streamline their business operations. These structured forms help you maintain professionalism while saving time on manual creation.

Whether you’re a freelancer, contractor, or consultant, having access to high-quality, customizable forms can make a world of difference. Instead of spending valuable time formatting and organizing payment details, you can focus on what matters most: delivering excellent service to your clients.

Why Professionals Rely on Ready-to-Use Documents

Professionals often juggle multiple projects at once, which is why efficiency is crucial. Using pre-designed documents ensures that payment requests are consistent and easy to understand. These ready-made solutions allow you to insert specific details, such as payment terms and service descriptions, while maintaining a polished, professional appearance.

Where to Find the Best Solutions

There are various platforms offering these documents at no cost, enabling professionals to quickly download and customize them. Many of these resources provide multiple formats, ensuring compatibility with different software tools and personal preferences. From simple designs to more advanced options, these tools help professionals ensure accuracy and consistency in every transaction.

Why Use a Job Invoice Template

Creating a structured payment request is an essential part of any business transaction. Having a pre-designed document can greatly enhance efficiency, ensuring that all the necessary details are included and presented in a professional manner. This eliminates the need for manually crafting each request from scratch, saving time and reducing the likelihood of errors.

Professionals and businesses of all sizes benefit from using these ready-made solutions, as they streamline the process of billing clients and customers. With clear, easy-to-fill-in fields, these documents ensure that no important information is overlooked. Whether it’s a fixed rate or hourly work, these documents provide a consistent way to outline services, costs, and payment terms.

Consistency and Professionalism

One of the biggest advantages of using a structured document is consistency. Every request follows the same format, which not only looks professional but also makes it easier for clients to understand. This consistency builds trust, as clients know exactly what to expect with each payment request, whether it’s a one-time service or part of an ongoing project.

Time and Error Reduction

By eliminating the need to manually organize each detail, professionals save valuable time. The simple, intuitive design of these documents ensures that no fields are left empty or incorrectly filled out. This significantly reduces the risk of mistakes that could delay payments or lead to misunderstandings with clients.

Benefits of Using Free Invoice Templates

Utilizing pre-designed billing documents offers a range of advantages for both individuals and businesses. These structured forms provide a simple yet effective way to request payment for services rendered. By using ready-made formats, professionals can save time and ensure all necessary details are included without the hassle of designing each document from scratch.

Whether you are a freelancer, small business owner, or contractor, having access to these documents allows you to maintain a consistent, professional appearance in your transactions. They provide clarity for clients and streamline the process, making it easier for both parties to understand the terms and due dates.

Time and Cost Efficiency

One of the primary benefits of using pre-made solutions is the significant time savings. Rather than spending time creating new payment requests for each project, you can simply fill in the required information on an existing form. This efficiency also extends to cost savings, as there’s no need to invest in expensive accounting software or hire a professional designer to create custom forms.

Consistency and Accuracy

Pre-designed documents ensure that every payment request follows the same format, which fosters a professional image and helps avoid mistakes. With clear fields for all necessary details, there’s less chance of missing important information, such as service descriptions or payment terms. This consistency builds trust and ensures clients know exactly what they’re being charged for each time.

How to Customize a Job Invoice

Tailoring a payment request document to suit your specific needs is crucial for maintaining professionalism and clarity. Customizing a standard form ensures that all relevant information is included, while also allowing you to adjust the design to match your brand or business style. By making these adjustments, you can provide a more personalized experience for your clients.

There are several key areas to focus on when customizing a billing document:

Essential Information to Include

- Client details: Name, address, and contact information.

- Service description: A clear breakdown of the services provided or work completed.

- Payment terms: Specify due dates, late fees, and acceptable payment methods.

- Itemized charges: List individual costs for each service or product, if applicable.

Design and Layout Adjustments

- Logo and branding: Incorporate your business logo or brand colors to make the document feel more official.

- Font choices: Use professional and easy-to-read fonts for a clean appearance.

- Organization: Ensure the layout is intuitive, with clearly defined sections for each piece of information.

By customizing your documents in these ways, you can create a more organized, visually appealing, and effective tool for managing payments with your clients. This attention to detail not only improves efficiency but also fosters trust and transparency in your business dealings.

Key Elements of an Effective Job Invoice

To create an efficient payment request document, it is important to include all necessary details in a clear and organized manner. An effective billing form not only outlines the charges but also sets expectations for both the service provider and the client. A well-structured document ensures that no important information is overlooked and provides clarity for the payment process.

The following table highlights the key components that should be included in every professional payment request document:

| Element | Description |

|---|---|

| Contact Information | Include the names, addresses, and contact details of both the client and the service provider. |

| Unique Reference Number | Assign a unique identifier for each payment request to ensure easy tracking and reference. |

| Detailed Description of Services | Clearly list the services provided, along with dates or project milestones where applicable. |

| Payment Terms | Outline payment conditions, such as due dates, late fees, and accepted payment methods. |

| Itemized Charges | Provide a breakdown of costs for each service, product, or hour worked, allowing the client to understand the charges. |

| Total Amount Due | State the final amount the client is required to pay, ensuring it matches the itemized charges. |

Incorporating these key elements will make your payment requests clear, professional, and easy to understand. This helps build trust with your clients and ensures that both parties are on the same page regarding expectations and payment terms.

Where to Find Free Job Invoice Templates

Finding high-quality, ready-made billing documents online can significantly simplify the process of requesting payments. These resources offer a range of pre-designed forms that can be easily customized to suit your specific needs, saving you the time and effort of creating one from scratch. Whether you need a simple layout or a more detailed structure, there are many platforms where you can access these tools at no cost.

Popular Websites Offering Downloadable Forms

Several websites specialize in providing ready-to-use billing forms. These platforms often allow you to choose from a variety of styles and formats, ensuring you find one that fits your business needs. Some popular websites include:

- Microsoft Office Templates – Offers a wide selection of professional forms that are compatible with Word and Excel.

- Google Docs – Provides easy-to-edit documents that can be accessed and customized directly in your browser.

- Template.net – Features a variety of options for different industries, all available for instant download.

Online Tools for Customizing Payment Documents

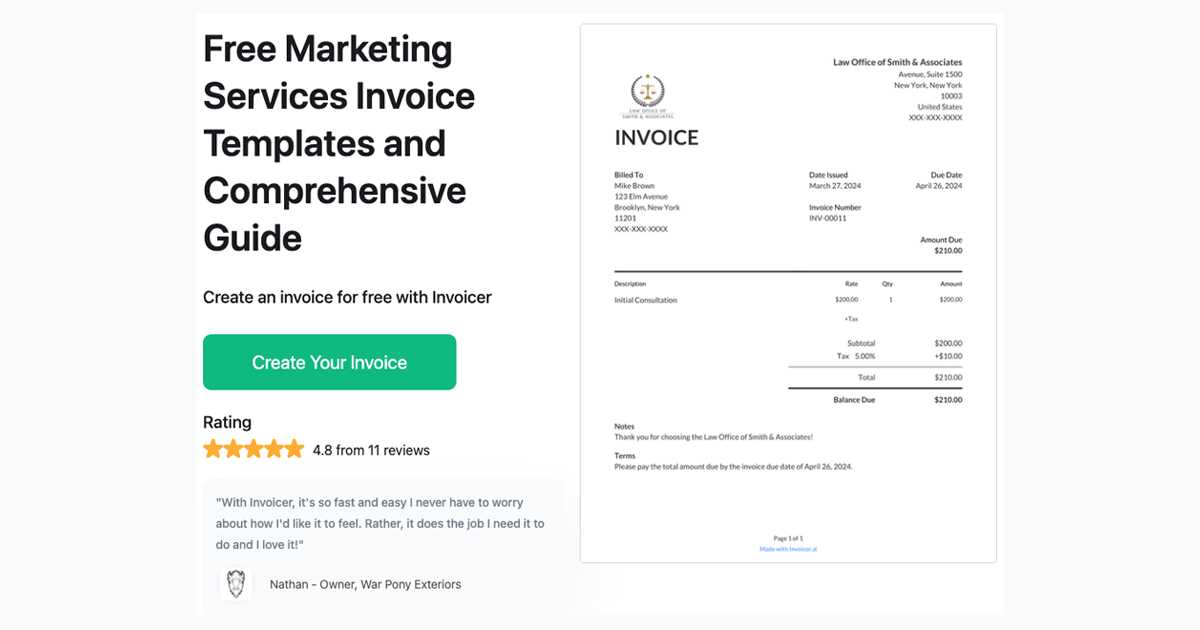

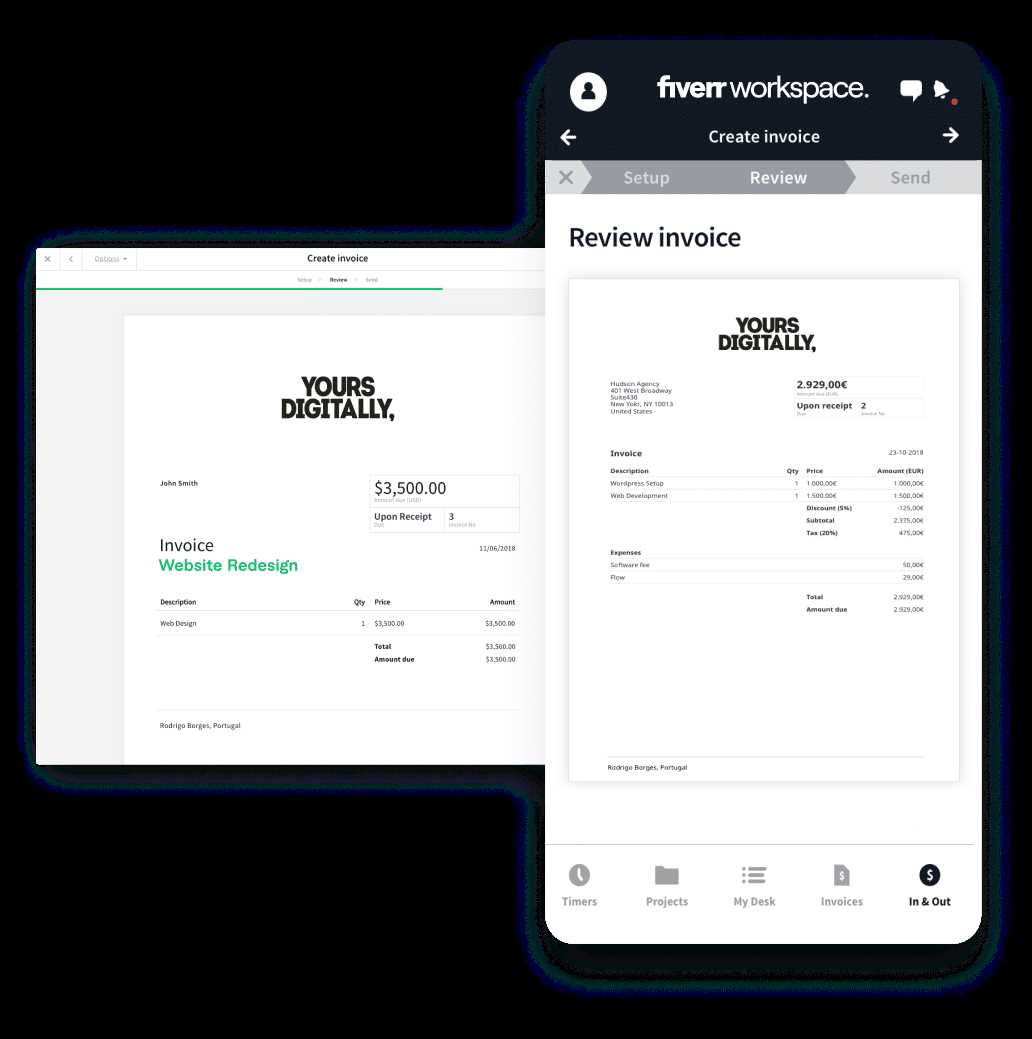

There are also online tools that allow you to customize and generate payment forms directly on their websites. These platforms usually provide a user-friendly interface and offer more flexibility in terms of design and layout. Some of these services may require creating an account, but they offer a range of customization options without any costs involved. Examples include:

- Zoho Invoice – An online invoicing platform with customizable options for billing details.

- Invoice Generator – A simple tool that lets you create and download a customized document within minutes.

By using these resources, you can find the perfect billing document and tailor it to your business, ensuring a professional and efficient way to manage your payment requests.

How Job Invoices Help Freelancers

For freelancers, managing payments is an essential part of running a successful business. A clear and organized payment request not only ensures prompt payment but also helps maintain professionalism. With the right tools, freelancers can easily track their earnings, avoid misunderstandings, and build stronger client relationships.

Using a well-structured document provides several benefits to freelancers:

- Clarity for Clients: A detailed document clearly outlines the services provided, payment terms, and any additional charges. This transparency helps avoid confusion and disputes.

- Timely Payments: A professional payment request with set due dates encourages clients to pay on time, helping freelancers maintain a steady cash flow.

- Record Keeping: These documents serve as a formal record of completed work and agreed-upon payments, making it easier to manage finances and track outstanding amounts.

- Tax Documentation: Detailed payment records simplify tax filing by providing a clear summary of income and expenses for the year.

With easy-to-use tools available online, freelancers can quickly create and customize these documents for each project, ensuring that every payment request is clear, professional, and legally sound. This not only improves the efficiency of financial management but also strengthens their credibility with clients.

Common Mistakes to Avoid in Job Invoices

When creating payment requests, it’s easy to overlook key details or make simple errors that can lead to confusion, delayed payments, or misunderstandings with clients. Ensuring accuracy and clarity in these documents is crucial for maintaining professionalism and fostering trust. By being aware of common mistakes, you can avoid issues that may arise during the billing process.

Here are some frequent errors to watch out for when preparing your payment requests:

- Missing or Incorrect Contact Information: Always double-check that your contact details and those of your client are accurate. This ensures smooth communication and helps prevent any delivery issues.

- Unclear Service Descriptions: Avoid vague descriptions of the work completed. Be specific about the tasks performed and any deadlines met, so clients fully understand what they are being charged for.

- Omitting Payment Terms: Clearly outline when payment is due and the accepted methods. Failing to include this information can lead to delays or missed payments.

- Incorrect Calculation of Costs: Double-check all figures to ensure that itemized charges, taxes, and totals are accurate. Mistakes in calculations can create confusion and delay the payment process.

- Not Using a Unique Reference Number: A unique reference number for each payment request helps you track payments more easily and ensures your records are organized.

By avoiding these common mistakes, you can create more accurate, professional, and efficient billing documents that ensure smooth transactions with your clients. Clear communication and attention to detail are key to a successful payment process.

How to Add Payment Terms to Invoices

Including clear payment terms in your billing documents is essential to ensure both you and your client are on the same page regarding expectations. These terms help prevent confusion or disputes by clearly outlining the conditions for payment, including deadlines, penalties for late payments, and accepted methods of payment. By specifying these details upfront, you create a transparent and professional agreement that sets the stage for timely payments.

Key Elements to Include in Payment Terms

- Due Date: Clearly state the exact date by which payment is expected. For example, “Payment due within 30 days from the issue date.”

- Late Payment Fees: If applicable, include any penalties for late payments. For instance, “A late fee of 5% will be applied to overdue balances after 30 days.”

- Accepted Payment Methods: Specify how you prefer to receive payment, whether it’s via bank transfer, credit card, or another method.

- Discounts for Early Payment: Offering a discount for early payment can incentivize clients to pay faster. For example, “A 2% discount will be applied if payment is made within 10 days.”

How to Communicate Payment Terms Effectively

When adding payment terms, make sure they are easy to understand and placed in a prominent location on the document, such as near the total amount due. Additionally, make these terms consistent across all your billing documents to avoid confusion and ensure that clients are always aware of the same expectations. Clear and concise terms contribute to a smoother and more professional billing process.

Job Invoice Templates for Different Industries

Each industry has its own set of requirements and standards when it comes to billing clients. Whether you’re in construction, consulting, or creative services, customizing your payment request documents to match the specific needs of your sector can make the process more efficient and professional. Tailored forms can help ensure that all relevant information is captured, making it easier for both you and your client to track and process payments.

Here’s a look at how different industries can benefit from customized billing forms:

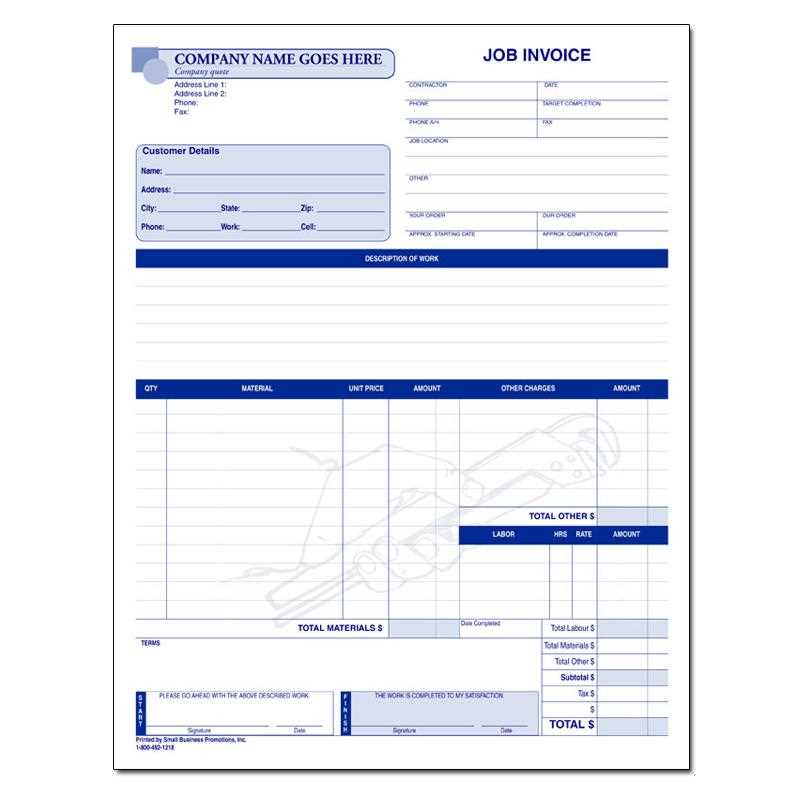

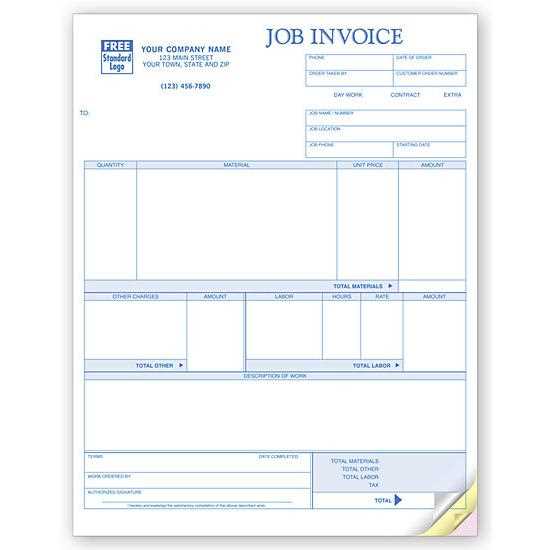

1. Construction and Contracting

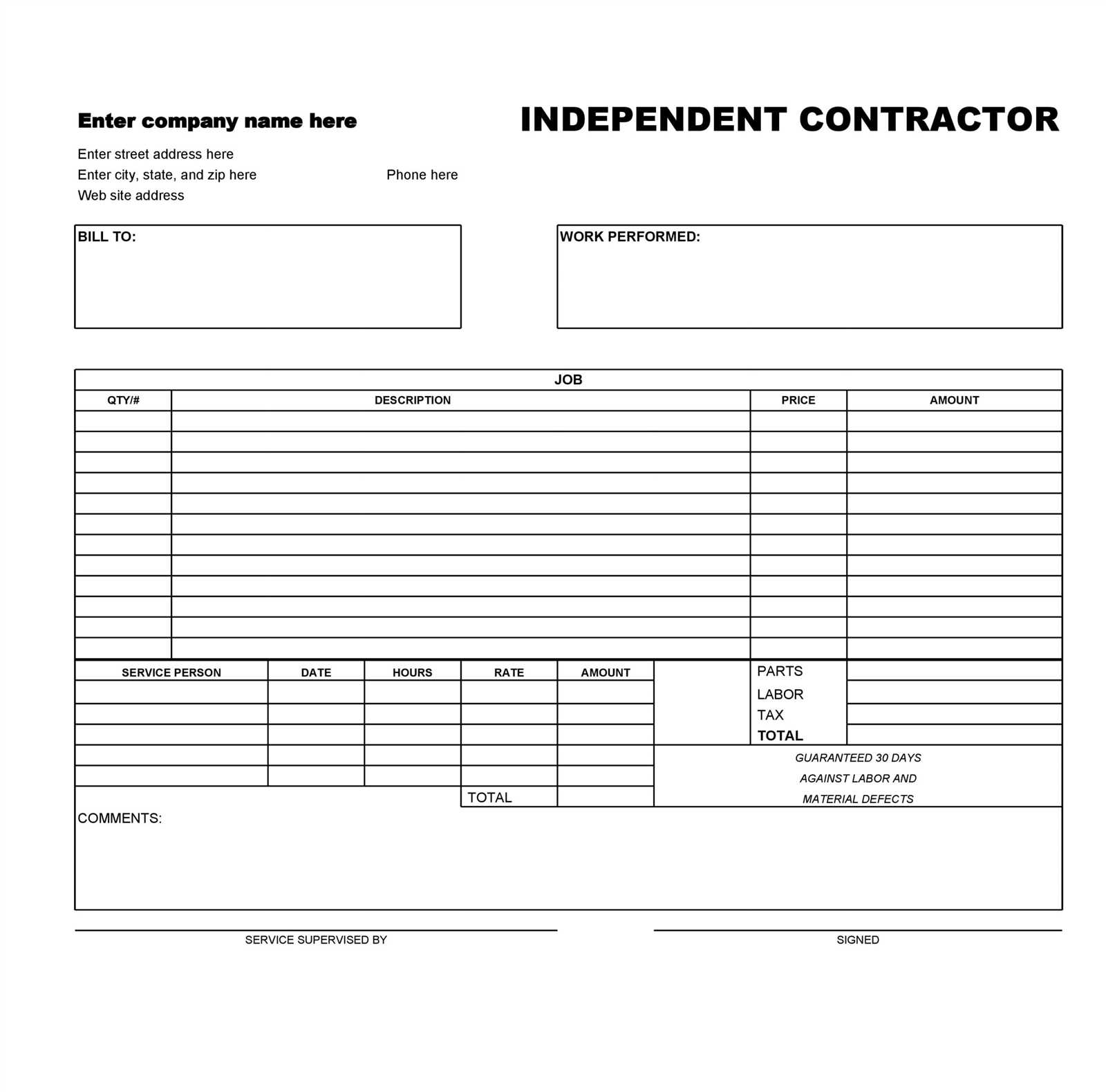

In the construction and contracting industry, payment requests often need to include detailed breakdowns of labor, materials, and additional expenses. Custom documents for this sector typically include sections for:

- Labor costs: A detailed list of hours worked and rates.

- Materials and supplies: A breakdown of all materials used, including quantities and prices.

- Project milestones: Clearly defined stages of the project, with corresponding payment due dates.

2. Creative Services (Design, Writing, Photography)

For professionals in creative fields, invoices are often simpler but still require clear descriptions of the work done. These documents usually highlight:

- Hourly or project rates: A clear outline of rates for specific tasks or completed work.

- Copyright or usage rights: Any rights associated with the work being delivered.

- Revisions or additional services: Any extra services offered or revisions made, with associated costs.

3. Consulting and Coaching

Consultants and coaches often charge for time or for specific deliverables. Payment requests in these industries might include:

- Hourly charges: Clear tracking of hours worked and specific consulting tasks completed.

- Packages or retainer fees: A list of pre-agreed package prices or ongoing fees for long-term clients.

- Travel or additional expenses: A section for reimbursement of any travel or out-of-pocket expenses.

By using industry-specific forms, professionals can ensure that they’re billing clients accurately and clearly, which helps maintain a strong, professional relationship while ensuring smooth and timely payments.

Creating Professional Invoices with Free Templates

Having a well-structured and professional billing document is key to maintaining a positive relationship with clients and ensuring timely payments. By using pre-designed forms, businesses can easily generate documents that not only look professional but also include all the necessary information for clear and transparent transactions. These ready-made solutions help save time, eliminate errors, and ensure that clients know exactly what to expect when it comes to costs and payment terms.

Step-by-Step Guide to Customizing Your Document

Creating a polished payment request is straightforward when using customizable forms. Here’s how you can make the most of these tools:

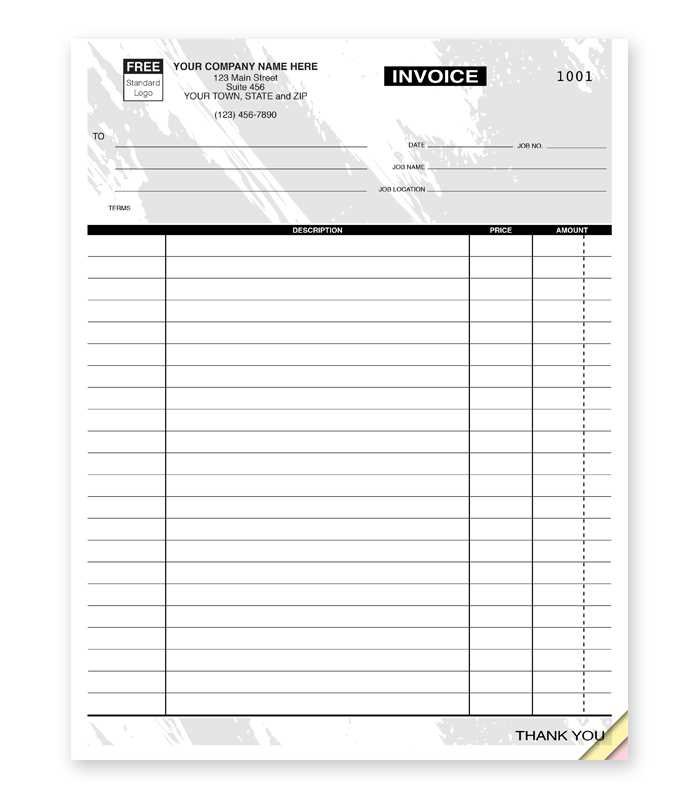

- Select the right style: Choose a format that suits your business needs and reflects your brand’s professional image.

- Fill in necessary details: Ensure all client information, services rendered, and payment terms are accurate and clearly listed.

- Review for accuracy: Double-check that all calculations are correct and the final amount matches the services provided.

Benefits of Using Customizable Billing Documents

Using these documents ensures consistency across all your billing processes. Not only do they look professional, but they also help avoid confusion by including clear sections for all required details such as payment terms, service descriptions, and payment due dates. This consistency builds trust with clients and helps your business maintain a reliable, organized reputation.

How to Track Payments with Job Invoices

Keeping track of payments is a vital part of managing any business, especially when you are working with multiple clients or on various projects. By using properly structured payment requests, you can easily monitor the status of outstanding amounts and ensure that payments are made on time. These documents serve not only as a request for payment but also as a valuable tool for tracking and organizing financial transactions.

Here are a few steps to help you effectively track payments with billing documents:

- Assign unique reference numbers: Each document should have a distinct identifier. This helps you track individual transactions easily and reference specific payments in your records.

- Include clear payment terms: Clearly state the due date and any late fees, so both you and your client are aware of the payment expectations. This ensures that you can follow up in a timely manner if the payment is not received.

- Record payment status: After receiving a payment, update the status of the document to indicate whether the amount has been fully paid or partially settled. This makes it easy to keep track of what has been cleared and what is still due.

- Maintain organized records: Store all documents in an organized system, either digitally or physically, so that you can easily reference them when needed, whether for tax purposes, audits, or client follow-ups.

By keeping a detailed record of payments received and due, you can reduce the chances of missed payments, ensure a steady cash flow, and stay organized with your financial reporting. These practices also provide you with the necessary documentation for resolving any potential disputes over payments in the future.

Job Invoice Templates vs Custom Invoices

When it comes to billing clients, businesses often face the choice between using pre-designed forms or creating custom documents. Both options have their advantages, but the right choice depends on your specific needs, business type, and the level of personalization you require. Pre-designed forms offer convenience and consistency, while custom documents provide flexibility and a more tailored approach.

The following table compares the two approaches to help you understand the key differences:

| Aspect | Pre-designed Forms | Custom Documents |

|---|---|---|

| Ease of Use | Quick to use, as they come with pre-filled sections and a standardized layout. | Requires more time to design and format, but offers greater flexibility. |

| Customization | Limited customization; mostly fixed templates with some editable fields. | Completely customizable to suit your brand’s specific needs and preferences. |

| Consistency | Provides uniformity across all documents, ensuring professional presentation. | May vary depending on design, which could affect consistency if not properly formatted. |

| Time Efficiency | Very quick to generate and send out; no need for design work. | Time-consuming as it requires creating the document from scratch or adapting an existing one. |

| Cost | Often free or low-cost, especially for basic versions. | Could be more expensive if outsourced or if using advanced design software. |

For businesses that prioritize speed and efficiency, using pre-designed forms may be the best option. These documents are ideal for those who need to quickly send out clear and professional payment requests with minimal effort. However, if you want to reflect your brand identity and require specific fields or design elements, custom documents will give you the flexibility to tailor every detail according to your needs.

Integrating Job Invoice Templates with Accounting Software

Integrating billing documents with accounting software can streamline your financial processes, making it easier to manage payments, track expenses, and maintain accurate records. By syncing your payment request documents with your accounting system, you eliminate the need for manual data entry, reduce the chances of errors, and ensure your financial information is always up to date. This integration allows for a more efficient workflow and provides a comprehensive overview of your business finances.

Benefits of Integration

There are several advantages to linking your billing system with accounting software:

- Automatic Data Transfer: When you create a payment request, relevant details like amounts, dates, and client information are automatically transferred to your accounting software, saving you time and effort.

- Real-Time Tracking: Integrated systems allow you to track payments and outstanding amounts in real time, providing you with an accurate financial picture at any given moment.

- Minimized Errors: By reducing the need for manual input, you minimize the risk of human error, ensuring that your financial records are precise and reliable.

- Faster Payment Processing: Integration speeds up the process of sending out payment requests and receiving payments, helping to improve cash flow and reduce delays.

- Streamlined Tax Reporting: All your financial data, including transactions, are automatically compiled in the software, making it easier to generate reports for tax filing.

How to Integrate Your Billing System with Accounting Software

Integrating your documents with accounting software can be done in a few simple steps:

- Choose the right accounting software: Select a system that supports integration with your payment request documents, such as QuickBooks, Xero, or FreshBooks.

- Link your systems: Many software solutions offer integration features or plugins that allow you to connect your billing system to the accounting software.

- Customize your settings: Tailor the integration to automatically import relevant information, such as client names, services rendered, and amounts due, into the accounting system.

Free vs Paid Job Invoice Templates: Which to Choose

When it comes to creating payment request documents, businesses often face the choice between using no-cost options or investing in premium versions. Both types of solutions come with their own set of advantages and limitations. Choosing the right one depends on your specific needs, the complexity of your billing process, and your business’s budget. While free options offer basic functionality, paid versions often provide more customization, advanced features, and better overall support.

Advantages of Free Templates

For businesses on a tight budget or those just starting out, free options can be a great way to generate simple and functional documents without any upfront cost. Here are some key benefits:

- Cost-effective: No payment required, making them ideal for startups or small businesses with limited funds.

- Quick Setup: Pre-designed and easy to use, free forms can be generated almost immediately with minimal customization needed.

- Basic Features: Most free forms come with the essential features you need to create professional-looking documents, including spaces for services, dates, and amounts.

Benefits of Paid Solutions

On the other hand, opting for a paid version can offer significant benefits in terms of functionality, customization, and long-term value. Here’s why a premium option might be worth the investment:

- Advanced Features: Paid versions often include features like automatic calculations, payment tracking, tax inclusion, and integration with other business tools like accounting software.

- Customization Options: Paid forms offer more flexibility in terms of design, allowing you to tailor them to better align with your brand and specific billing needs.

- Better Support: Paid options usually come with customer support to help resolve any issues or assist with customization, providing greater peace of mind.

- Time-Saving: Premium templates may have features that automate parts of the billing process, helping you save time on administrative tasks and improving efficiency.

Ultimately, the decision between free and paid solutions comes down to the scale and complexity of your business’s needs. If your requirements are basic, free templates can suffice. However, if you are looking for advanced features, a professional design, and enhanced support, a paid option may be a better choice to help streamline your operations and maintain a professional image.

How Job Invoice Templates Save Time

Time management is crucial in any business, especially when handling administrative tasks like preparing billing documents. Using pre-designed forms helps streamline the billing process by reducing the time spent on formatting, calculations, and layout design. These ready-made solutions allow businesses to quickly create professional documents without the need for starting from scratch each time.

Here are some ways these tools can save time:

- Quick Setup: Pre-designed forms come with most of the necessary sections already included, such as client information, itemized lists, and payment terms. This means you only need to fill in the specific details, saving time on repetitive formatting tasks.

- Consistency Across Documents: When using pre-built forms, you ensure that all your payment requests have a uniform look. This eliminates the need to reformat or recheck each document for consistency, saving time and reducing errors.

- Automatic Calculations: Many advanced forms include built-in formulas that automatically calculate totals, taxes, and discounts. This feature eliminates the need to manually compute amounts, ensuring accuracy and reducing the time spent on math.

- Reduced Errors: By using a standard format, you minimize the chances of missing important information, which can often lead to delays. Fewer mistakes mean less time spent on revisions and follow-ups with clients.

- Easy Customization: With these forms, you can quickly adjust details like services rendered, payment terms, or client information, without having to redesign the entire document. This adaptability saves time when dealing with different clients or projects.

By utilizing pre-designed solutions, you free up valuable time to focus on other critical tasks in your business, from client work to strategic planning. The efficiency gained from using these tools allows you to streamline operations and maintain a professional workflow, ultimately saving both time and resources.

Tips for Designing a Clear Job Invoice

A well-designed billing document not only makes your request for payment look professional but also ensures that all the necessary information is clearly communicated to your client. An effective document should be easy to read, with a clean layout that helps clients quickly understand the details of the payment. Whether you are creating a document from scratch or modifying a pre-designed version, there are key principles to follow for clarity and effectiveness.

1. Keep the Layout Simple and Organized

Cluttered and confusing designs can make it difficult for your client to find important information. A clean, well-organized layout is crucial for ensuring that every detail is easy to locate. Use clear headings and consistent spacing to separate sections like client details, services, and payment terms. Here are some tips for an organized design:

- Use grids or sections: Break the document into distinct sections for each piece of information. For example, one section for client information, another for the list of services, and another for the payment terms.

- Align text properly: Ensure that all text is aligned neatly to avoid a chaotic look. This will make the document easier to read.

- Use bullet points: For lists of services or items, bullet points or numbered lists can enhance readability.

2. Focus on Key Information

When designing your document, make sure that the most important details are easy to find. Your client should be able to immediately see the total amount due, the due date, and the services provided. Some key elements to focus on include:

- Client and business details: Include your business name, contact information, and the client’s information at the top of the document.

- Clear breakdown of charges: List each service or item with an associated price, and make sure the total is easy to find.

- Payment instructions: Clearly state how payments can be made and when they are due. Include bank account details or other payment methods if necessary.

By following these tips, you can ensure that your billing document is not only professional but also easy for your client to understand. A well-designed request for payment helps to avoid confusion and sets the stage for smooth transactions.