Easy to Use Itemized Invoice Template in Excel

Efficiently managing financial transactions with clients is essential for maintaining a professional image and ensuring timely payments. One of the best ways to stay organized and clear in your dealings is by using structured documents that outline all charges, services, and associated costs. These documents can help prevent confusion and provide clarity to both you and your clients, making the payment process much smoother.

By utilizing a well-designed system, you can easily track every aspect of your business’s financial dealings. Whether you’re a freelancer, small business owner, or contractor, having a customizable solution that allows you to input specific details and adjust amounts as needed can save time and reduce errors. A properly formatted billing sheet not only ensures accuracy but also improves communication with your clients.

Creating such documents doesn’t have to be complicated. There are various tools available that simplify the process, allowing you to focus on delivering your services while maintaining control over financial records. With the right setup, generating and updating these records becomes a quick and efficient task.

Why Use a Detailed Billing Document

Having a well-structured billing record is crucial for any business or freelancer aiming to maintain clarity and professionalism. A clear and organized financial statement helps both you and your clients stay on the same page, ensuring there are no misunderstandings about the services provided or the costs involved. A detailed document breaks down every item or task, leaving no room for confusion and promoting transparency.

By using a structured format, you can easily list each service, its corresponding cost, and any other relevant details, such as taxes or discounts. This not only enhances your credibility but also makes it easier for clients to verify charges and understand the value of what they’re paying for. Furthermore, a detailed bill allows for quicker resolution in case of any disputes, as both parties can refer to the clearly presented breakdown.

Additionally, a well-organized record saves time when you need to track or update your financial information. Whether you’re managing multiple clients or handling recurring payments, having a consistent and reliable system can streamline the entire process, reducing the risk of errors and omissions.

Benefits of Excel for Billing Records

Using a spreadsheet program for creating financial documents offers a range of advantages, especially when it comes to managing detailed billing records. This powerful tool makes it easy to organize, track, and calculate various charges in an efficient manner, allowing you to streamline the entire process and reduce the chances of errors.

One of the key benefits is the ability to automate calculations. Instead of manually adding up totals or applying taxes, formulas can handle these tasks for you, saving time and ensuring accuracy. Additionally, spreadsheets allow for quick adjustments, whether you’re updating prices or adding new items to a record.

Other notable benefits include:

- Customization: You can create documents tailored to your business needs, adjusting layouts and formats to best suit your operations.

- Organization: Information is easily categorized and sorted, making it simple to find specific records whenever necessary.

- Reusability: Once a structure is set up, it can be reused across multiple clients or transactions with minimal changes.

- Tracking: Data can be tracked over time, giving you insight into your financial history and helping with reporting.

- Sharing: Digital formats are easy to share via email or cloud services, making distribution hassle-free.

With these features, a spreadsheet program provides the flexibility, speed, and precision needed to manage your financial documents more effectively and professionally.

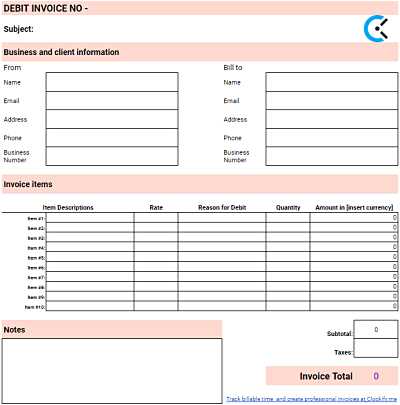

How to Create a Detailed Billing Record

Creating a clear and accurate billing document is a key part of maintaining professionalism in any business. A well-organized statement helps your clients easily understand the services rendered and the corresponding costs, ensuring transparency and reducing the likelihood of disputes. The process can be simple if you break it down into clear steps, which can be customized to fit your specific needs.

Follow these steps to create a comprehensive record:

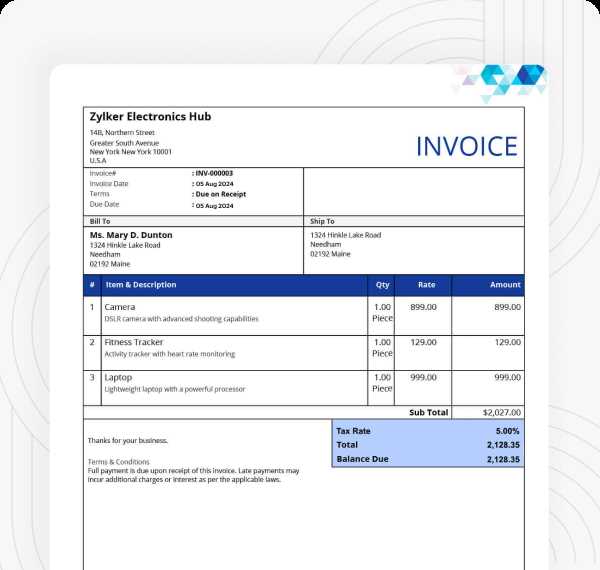

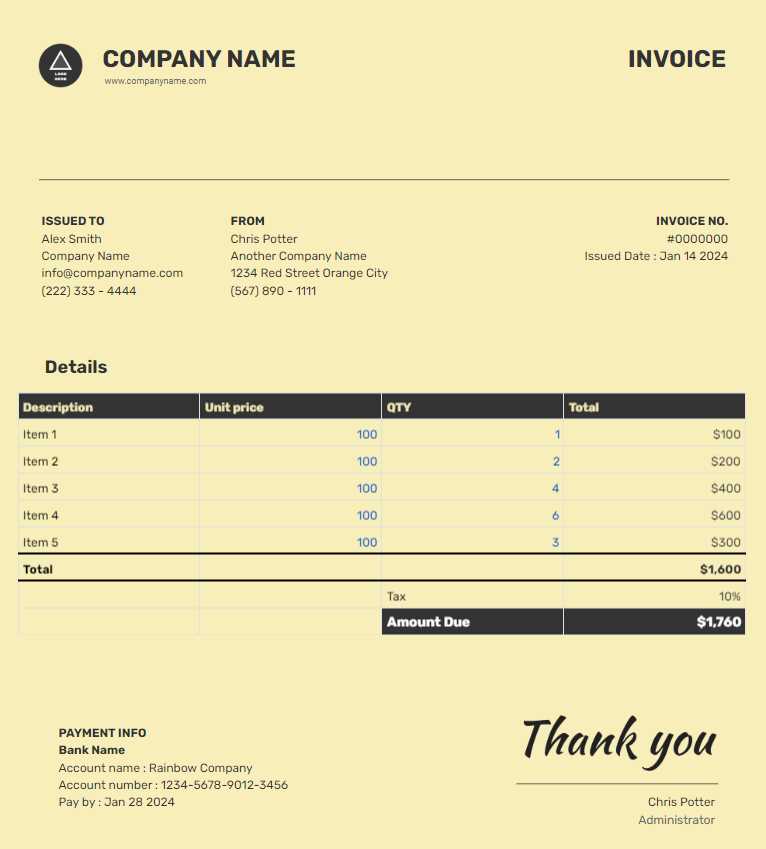

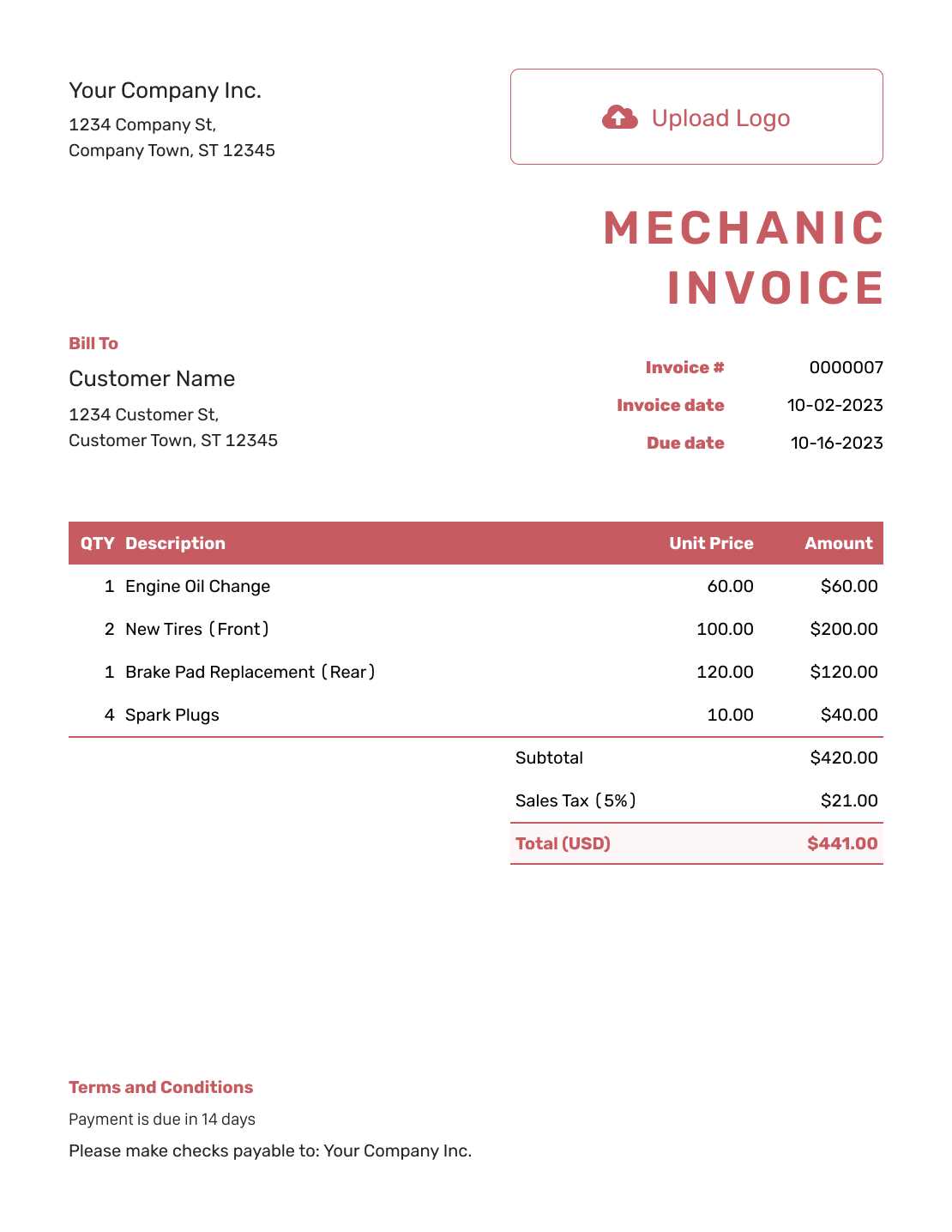

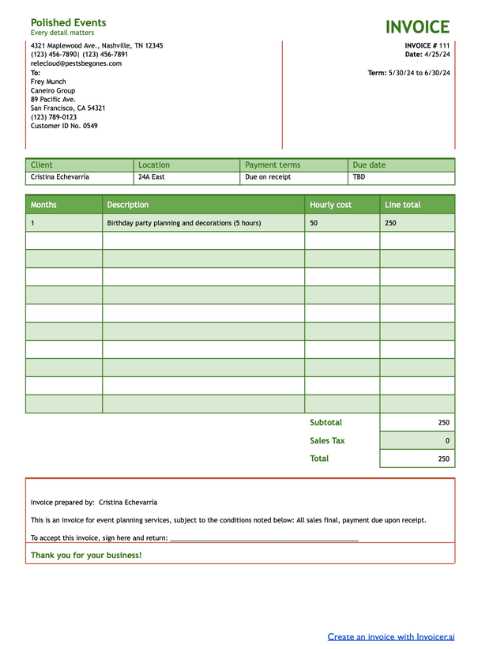

- Set Up Basic Information: Start by including your business details at the top, such as your name, address, contact information, and logo (if applicable). Below this, list your client’s details including their name, address, and contact info.

- Assign a Unique Identifier: Each document should have a unique reference number for easy tracking. This helps both you and your client easily reference the specific record in the future.

- Break Down Services or Products: List each service or product separately with a brief description. Include the quantity, unit price, and the total for each item. This will provide a clear breakdown of what the client is paying for.

- Apply Taxes and Discounts: If applicable, include any taxes or discounts. Make sure to list these separately to avoid confusion and show how they affect the overall total.

- Include Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. This ensures both parties are clear on the terms of the transaction.

- Provide a Total Amount Due: At the bottom, sum up all the amounts to provide a final total. This should include the subtotal, taxes, discounts, and any additional fees, clearly separated for easy reading.

Once these elements are in place, double-check for any errors and ensure all details are accurate. A well-organized and precise document will not only keep your finances in order but also reflect professionalism to your clients.

Customizing Your Billing Record Layout

Personalizing your financial documents allows you to create a more professional and visually appealing record while ensuring it aligns with your brand identity. Customizing the layout and design not only makes the document more user-friendly but also gives you flexibility to include specific details that reflect your business needs. Whether you’re adjusting the color scheme or adding your logo, customization can enhance the clarity and presentation of the information provided.

Steps to Personalize Your Document

Here are a few key areas you can modify to make your billing documents stand out:

- Adjust the Layout: Organize the sections of your document in a way that flows logically, ensuring clients can easily navigate through the information. This might include rearranging sections or adjusting the size of certain columns.

- Include Branding: Add your business logo, change the font style, or use your brand colors to make the document consistent with your overall business identity.

- Customize Fields: Depending on your business type, you may need to add specific fields like project codes, order numbers, or payment terms. Tailor the layout to reflect your unique requirements.

- Modify Calculations: Update formulas to ensure accurate and up-to-date calculations. You can also add new formulas for custom discounts or taxes, depending on your business practices.

Using Pre-built Styles for Quick Customization

If you’re looking for a quicker approach, many spreadsheet programs offer pre-built style options that allow for instant formatting. This can include automatic table styles, predefined color schemes, and font selections. Using these built-in features, you can create a polished document with minimal effort.

By making these adjustments, you can tailor your financial records to match your business goals, enhance readability, and foster a professional image with every transaction.

Key Features of a Detailed Billing Record

A well-crafted financial document includes several essential elements that ensure clarity and transparency for both the business and its clients. These features help break down the costs in an organized manner, making it easier to track payments, verify charges, and maintain accurate records. A detailed billing record typically includes specific sections for services provided, totals, and payment terms, which together create a complete picture of the transaction.

Some of the most important components of such a document include:

| Feature | Description |

|---|---|

| Client and Business Information | Includes names, contact details, and addresses for both the service provider and the client. This ensures that the document is properly identified and can be referenced when needed. |

| Service Breakdown | Lists each individual service or product provided, along with a brief description, unit price, and quantity. This section ensures transparency and helps clients understand exactly what they are paying for. |

| Subtotal and Total | Shows the total for each service or product, then calculates the overall amount due. This section often includes a summary of any taxes, fees, or discounts applied. |

| Payment Terms | Specifies due dates, accepted payment methods, and any late fees or penalties for overdue payments. It provides clear instructions on how and when the payment should be made. |

| Unique Reference Number | A unique identifier for each document, which helps track and manage multiple transactions. This makes it easier for both parties to reference the record in the future. |

Including these elements ensures that your financial documents are thorough, easy to read, and professional, which in turn helps strengthen relationships with clients and ensures that payments are handled efficiently and accurately.

How to Add Taxes in Billing Records

Including taxes in financial documents is essential for ensuring compliance with local tax regulations and providing a complete breakdown of the costs to clients. Adding tax calculations automatically not only simplifies the process but also guarantees accuracy. With the right setup, you can quickly apply the appropriate tax rates to your charges and present them clearly to your clients.

Follow these steps to effectively include taxes in your billing records:

- Identify the Tax Rate: Determine the applicable tax rate for the products or services you provide. This could vary depending on location, type of service, or specific business regulations. Make sure to check local tax laws to apply the correct rate.

- Calculate Taxable Amounts: In your document, identify the subtotal or individual service prices that are subject to tax. If certain items are tax-exempt, exclude them from the calculation.

- Use Formulas for Automatic Calculation: In a spreadsheet, you can use simple formulas to calculate tax amounts. For example, if your subtotal is in cell B10 and the tax rate is 5%, you can enter the formula =B10*0.05 in the next cell to calculate the tax amount.

- Display the Tax Clearly: Make sure the tax amount is shown separately from the subtotal, with a clear label such as “Sales Tax” or “VAT.” This will make the final total easier to understand for your client.

- Include a Total with Tax: After calculating the tax, ensure that the total amount due is updated to reflect both the subtotal and the tax. You can use another formula to add the tax to the subtotal, such as =B10+B11, where B11 is the calculated tax amount.

By incorporating these steps into your documents, you ensure that tax calculations are both accurate and transparent, leading to smoother transactions and satisfied clients.

Automating Calculations in Spreadsheet Documents

Automating calculations in financial records can save valuable time and reduce the likelihood of errors. By using built-in formulas and functions, you can ensure that totals, taxes, and other calculations are always up-to-date without the need for manual input. This not only streamlines your workflow but also enhances the accuracy of your documents, allowing you to focus on delivering your services rather than crunching numbers.

Here’s how you can automate key calculations in your billing documents:

- Using Sum Functions: The SUM function is one of the most common ways to quickly add up a range of values. For example, if you have a column of individual amounts in cells B2 to B10, you can use the formula =SUM(B2:B10) to calculate the total of all these values.

- Calculating Tax Automatically: To automate tax calculation, simply multiply the total amount by the appropriate tax rate. For example, if the total is in cell B12 and the tax rate is 5%, use the formula =B12*0.05 to calculate the tax amount. This will automatically adjust if the subtotal changes.

- Creating Dynamic Totals: To ensure the final total is always updated, add the tax amount to the subtotal automatically. Use a formula like =B12+B14, where B12 is the subtotal and B14 is the calculated tax amount.

- Incorporating Discounts: If you apply discounts to the total, you can automate that calculation as well. For instance, to apply a 10% discount, use the formula =B12-(B12*0.10), where B12 is the subtotal.

- Auto-Updating for Additional Items: When adding new items or services, use formulas that automatically adjust the totals. By referencing the entire column or row (instead of specific cells), you can ensure that new entries are included in the calculations without needing to manually update each formula.

With these automated calculations in place, your documents will always be accurate and reflect the most current data, allowing for smoother transactions and less administrative effort on your part.

Saving Time with Pre-made Billing Documents

Using pre-designed financial records can significantly reduce the amount of time spent creating and managing your documents. By starting with a ready-to-use structure, you eliminate the need to set up the layout and formulas from scratch, allowing you to focus on the content instead. These ready-made formats are designed to handle common billing scenarios and include fields for all the necessary details, saving you both time and effort on each transaction.

Key Benefits of Using Pre-made Documents

Pre-made financial documents offer several advantages that can streamline your workflow:

- Quick Setup: Instead of starting from a blank page, you can simply input the relevant information, such as client details and service descriptions, and the rest is already set up for you.

- Consistency: Using the same format for each record ensures consistency in your business documentation. This makes it easier to track past transactions and present a professional image to clients.

- Accuracy: Many pre-made records come with built-in formulas to automatically calculate totals, taxes, and other amounts, reducing the risk of manual errors.

- Ease of Use: These documents are designed to be user-friendly, requiring minimal customization. This makes them suitable for both small business owners and freelancers who need to handle financial records efficiently.

How Pre-made Documents Save Time

By using pre-made formats, you reduce the time spent on repetitive tasks. You can quickly generate and send records for multiple clients without needing to manually format each document or enter calculations. Additionally, many of these documents can be easily modified to suit specific needs, offering both flexibility and speed. This efficiency frees up time for you to focus on growing your business or serving your clients, instead of getting bogged down by paperwork.

Tracking Payments with Billing Documents

Tracking payments efficiently is an essential part of managing your finances and ensuring timely cash flow. By organizing payment records systematically, you can easily keep track of which clients have paid and which are still outstanding. Using a digital document for this purpose allows for quick updates and ensures that you always have an accurate view of your financial status.

Here’s how you can track payments in your financial records:

- Create a Payment Status Column: Add a column that indicates the payment status for each client, such as “Paid,” “Pending,” or “Overdue.” This will give you a clear overview of what needs follow-up and what is settled.

- Set Payment Due Dates: Include a due date for each transaction. This will help you set reminders and stay on top of overdue payments.

- Record Payment Dates: When a client makes a payment, log the date in your document. This helps you track the timeline and ensures that payments are not missed or forgotten.

- Track Partial Payments: For clients who pay in installments, create a column for the amount received and another for the outstanding balance. This way, you can monitor progress and adjust accordingly.

- Use Conditional Formatting: Use color coding to highlight overdue payments or payments that are nearing their due date. This visual cue can help you prioritize which clients to follow up with first.

By incorporating these elements into your documents, you can stay organized and reduce the chances of missing or overlooking payments. Having a clear and updated record helps maintain a smooth financial workflow and strengthens client relationships.

Managing Multiple Clients with Billing Records

When dealing with multiple clients, keeping track of each individual transaction and maintaining organized records can quickly become overwhelming. Efficiently managing these documents ensures that no client is overlooked, payments are tracked correctly, and all transactions are documented in a clear and accessible way. By setting up an organized system for managing numerous clients, you can streamline your workflow and reduce the risk of errors.

Organizing Client Records

Here are several strategies to help you effectively manage billing documents for multiple clients:

- Create Separate Sheets for Each Client: For large numbers of clients, consider creating a separate sheet within a single file for each client. This allows you to keep each client’s billing history organized without cluttering a single page.

- Use a Master Summary Sheet: Keep an overview sheet that lists all clients along with the status of their payments, due dates, and total amounts. This allows you to quickly check the status of any client’s account without needing to open individual files.

- Standardize Record Layouts: Using a consistent format for each client’s records will make it easier to track and update. Include standard sections for services rendered, amounts due, and payment terms.

- Track Payment Status: Add a column to monitor payment statuses such as “Paid,” “Pending,” or “Overdue.” This provides a quick reference to identify which clients still need follow-up.

Automating and Simplifying Client Management

By automating certain elements, you can save time and reduce errors:

- Use Formulas to Track Totals: Set up formulas that automatically calculate totals for each client, including taxes and discounts. This minimizes the chance of mistakes when updating records.

- Apply Conditional Formatting: Highlight overdue payments with color coding to quickly identify which clients need immediate attention.

- Set Reminders: Use built-in calendar or alert functions to set reminders for follow-up emails or calls for outstanding payments.

By implementing these strategies, you can effectively manage multiple client accounts without becoming overwhelmed, ensuring timely payments and smooth operations for your business.

Excel vs Word for Billing Document Creation

When it comes to creating financial records, two of the most commonly used software programs are spreadsheet tools and word processors. Both offer distinct advantages depending on the type of document you’re creating and the level of complexity involved. Understanding the key differences between these programs can help you choose the best option for your business needs.

Advantages of Using Spreadsheet Tools

Spreadsheet applications are often the preferred choice for creating detailed records due to their flexibility and ability to handle calculations automatically:

- Automatic Calculations: Spreadsheet programs allow for the use of built-in formulas to automatically calculate totals, taxes, and discounts. This feature eliminates the need for manual calculations, reducing the risk of errors.

- Organization and Tracking: With the ability to organize data in rows and columns, it’s easy to break down charges and monitor payment statuses. You can also use filters and conditional formatting to highlight overdue payments or missing data.

- Customization: You can easily modify the layout and add or remove fields, adjusting the structure as needed to suit different billing scenarios.

- Data Analysis: Spreadsheet programs offer advanced tools for analyzing financial data, making it easier to generate reports and track overall business performance.

Advantages of Using Word Processors

Word processing software, on the other hand, is better suited for simpler, more straightforward documents that don’t require complex calculations:

- Ease of Use: Word processors are user-friendly and offer a wide variety of templates that allow for quick setup. Creating and formatting documents is more intuitive for users who are focused on appearance rather than data.

- Professional Layouts: Word processors provide greater flexibility in terms of font styling, images, and custom branding. This can result in more polished and visually appealing records, ideal for those who want to emphasize the design aspect of their documents.

- Simplicity: If your documents don’t require calculations or complex tracking, word processors are a great option. They allow you to focus on the content without worrying about complex functions.

Ultimately, the choice between a spreadsheet tool and a word processor depends on the complexity of the document you’re creating and the features you require. For businesses with a high volume of transactions, spreadsheet applications provide efficiency and automation. However, for those needing simple, aesthetic documents, word processors may be the better fit.

Common Mistakes to Avoid in Billing Records

Creating accurate financial documents is essential for maintaining a professional image and ensuring timely payments. However, several common mistakes can lead to confusion, delayed payments, or even lost business. By understanding these pitfalls and taking steps to avoid them, you can ensure your records are clear, accurate, and effective in getting paid on time.

Frequent Errors in Billing Documents

Here are some of the most common mistakes to avoid when preparing your billing records:

- Missing or Incorrect Contact Information: Always double-check that the names, addresses, and contact details of both the client and your business are accurate. Incorrect information can delay communication and cause confusion when payments are made.

- Unclear Descriptions of Services or Products: Be specific about the services rendered or products provided. Vague descriptions can lead to misunderstandings, disputes, or questions from your clients about what they are being charged for.

- Incorrect Calculation of Totals: Always double-check the math. Simple mistakes, such as miscalculating subtotals or tax amounts, can result in inaccurate billing. Using automatic calculations or formulas can help prevent this issue.

- Not Including Payment Terms: Clearly specify your payment terms, including due dates, accepted payment methods, and late fees, if applicable. Failure to include these details can create confusion or delays in receiving payments.

- Forgetting to Add Taxes: If applicable, ensure that taxes are properly calculated and displayed separately. Overlooking this step can cause discrepancies and create complications for both you and your client.

- Not Using a Unique Reference Number: Always assign a unique identifier to each document. This makes it easier to track transactions and allows your clients to reference specific billing records when communicating with you.

How to Avoid These Mistakes

By taking a few proactive steps, you can avoid these common errors and ensure smooth transactions:

- Review Before Sending: Always double-check your document before sending it to the client. A quick review can catch mistakes that may have been overlooked.

- Use Digital Tools: Consider using pre-made or automated systems that can handle calculations, ensure consistent formatting, and reduce human error.

- Clarify Details: When in doubt, provide extra details or ask the client if they need any clarification. It’s better to over-explain than leave important information out.

By avoiding these mistakes, you can create more professional and accurate records that not only facilitate prompt payment but also help build trust with your clients.

How to Share Your Billing Document with Clients

Once your financial record is created and ready, the next step is ensuring that it reaches your client in a timely and efficient manner. There are several ways to share your document, and the method you choose can depend on factors such as convenience, professionalism, and the client’s preferences. By selecting the right sharing method, you can facilitate smooth transactions and maintain a clear communication line with your clients.

Methods for Sharing Financial Documents

Here are some common methods for sending your billing document to clients:

- Email: Sending your document via email is one of the most popular and convenient methods. You can either attach the file directly or include a download link if it’s hosted online. Always ensure that the subject line is clear (e.g., “Billing Record for [Service Name]”) and the message is concise and polite.

- Cloud Storage Links: If the file is too large to send via email or if you prefer to keep documents accessible for both parties, using cloud storage services like Google Drive, Dropbox, or OneDrive is a great option. Just upload the document and send the client a secure sharing link.

- Postal Mail: For clients who prefer physical documents or for legal reasons, mailing the document may be necessary. You can send the hard copy via regular mail or use courier services for faster delivery and added tracking options.

- Client Portals: If you’re working with larger organizations or businesses, they may have client portals where you can upload billing records directly. This is a secure and professional way to share important financial documents and track when they’ve been received.

- In-Person Delivery: If you have a local client or are meeting in person, you can hand-deliver the document. This personal touch can help build stronger client relationships, especially for long-term collaborations.

Best Practices When Sharing Billing Documents

To ensure smooth communication and professionalism, consider these best practices when sending your billing records:

- Ensure Proper Formatting: Before sharing, make sure your document is easy to read and professional in appearance. Use clear headings, proper organization, and any necessary branding or logos.

- Include Clear Instructions: If you are sharing the document via email or a cloud link, include simple instructions on how to view or pay the bill. This can avoid confusion and improve client experience.

- Confirm Receipt: After sending, follow up to ensure your client has received the document. This helps confirm that there are no issues with the delivery method and that the client has all the information they n

Tips for Organizing Your Billing Files

Staying organized is essential when managing multiple financial records. Proper organization helps you quickly access the necessary documents, track payments, and avoid confusion. By creating a streamlined system for storing and sorting your records, you can ensure your workflow remains efficient and that your clients’ transactions are easily traceable.

Effective Organization Strategies

Here are some helpful tips for organizing your billing files:

- Use Clear File Naming Conventions: Always use descriptive and consistent names for your files. A good format could include the client’s name, the service or product provided, and the date of the transaction. For example, “John_Doe_Consulting_Fee_Jan2024” helps you instantly identify the contents without needing to open the file.

- Create Separate Folders for Clients: Organize your documents by client, especially if you have recurring transactions. Each client should have their own folder where all related documents are stored, making it easier to track history and payments.

- Sort by Date: Within each client’s folder, consider sorting your records by date. This way, you can quickly see the most recent transactions and avoid confusion over older documents.

- Use Digital Tools for Organization: If you’re working with many records, consider using document management software or cloud storage solutions. These tools allow you to search for specific files, tag documents for easy reference, and even automate organization tasks.

- Keep Backup Copies: Regularly back up your files to an external drive or cloud storage service. Having backups ensures that your important records are safe from accidental loss or hardware failure.

- Set Up a Filing System for Pending Transactions: For payments or documents that have not yet been completed or processed, create a separate folder to track them. This will allow you to easily follow up on outstanding transactions.

Additional Tips for Streamlining Your Workflow

In addition to basic organization, these strategies can further streamline your processes:

- Use a Version Control System: If you make frequent updates to documents, such as payment status or amounts, track changes by saving new versions with incremental names (e.g., “Document_v1,” “Document_v2”). This keeps everything well-documented and avoids confusion.

- Label Paid and Unpaid Documents: Make sure to clearly label which documents have been paid and which are pending. Using color coding or specific tags can help differentiate between completed and open transactions at a glance.

- Review Regularly: Set aside time weekly or monthly to review your files, ensu

How to Protect Your Billing Document Templates

When creating and using financial records, it’s important to protect your files to prevent unauthorized access, accidental changes, or data loss. Taking the necessary steps to secure your documents can help maintain the integrity of your work and safeguard sensitive business information. Fortunately, there are several methods available to protect your files while still keeping them accessible for legitimate use.

Methods for Securing Your Documents

Here are several ways you can secure your billing document files:

- Password Protection: One of the most effective ways to secure your financial files is by setting a password. This ensures that only authorized individuals can open or modify the document. Most spreadsheet programs offer an option to add a password to your file when saving it, providing an extra layer of security.

- File Encryption: For sensitive information, consider encrypting your files. Encryption turns the document into a code that is unreadable without the correct decryption key. This adds an additional level of protection beyond password security.

- Limit Permissions: If you’re sharing the document with colleagues or clients, limit their access by restricting editing permissions. You can allow users to view the file without being able to make changes, preventing accidental alterations.

- Backup Your Files: Always keep backup copies of your important documents in a separate location, such as a cloud service or an external hard drive. This ensures that you can recover your data in case of accidental deletion or file corruption.

- Use Read-Only Mode: If you need to distribute your records but want to prevent any edits, save the document as “read-only” or export it as a PDF. This way, your clients or team members can view the document but will not be able to modify it.

Best Practices for File Management

In addition to securing your files, it’s essential to follow best practices for managing them effectively:

- Best Practices for Professional Billing Records

When creating billing documents for your clients, presenting them in a professional and organized manner is key to maintaining strong business relationships and ensuring timely payments. A well-crafted document reflects your attention to detail and helps build trust. Implementing a few best practices will ensure that your financial records are not only clear and precise but also align with your company’s professionalism and standards.

Key Elements of a Professional Billing Record

Follow these essential tips to make sure your financial documents are polished and well-received:

- Clear Contact Information: Always include accurate contact details for both your business and the client. This should include full names, addresses, phone numbers, and email addresses. Ensuring this information is correct will make communication easier and reduce the risk of confusion.

- Unique Reference Numbers: Assign a unique reference number to each record. This helps both you and your client track the document easily, making it simpler to follow up or refer to the transaction in the future.

- Detailed Descriptions: Include a clear description of the services provided or products sold. Being specific about each item or service helps your client understand exactly what they’re being charged for and reduces the chances of disputes.

- Transparent Payment Terms: Always specify the payment due date, accepted payment methods, and any late fees or discounts. Clear payment terms help manage client expectations and ensure that you’re paid on time.

- Consistent Layout and Design: A clean, professional design makes your document easy to read and follow. Use consistent fonts, headers, and section spacing. Avoid clutter, and ensure the layout is simple yet well-organized.

- Itemized Costs and Calculations: When listing services or products, break down each item separately. This allows clients to see the breakdown of costs and avoid confusion. Additionally, always double-check your calculations to ensure accuracy.

Additional Tips for Enhancing Professionalism

Here are some extra practices that can enhance the professional look and feel of your financial documents:

- Include Your Branding: Incorporating your company logo, colors, and other branding elements can add a professional touch to your documents. It creates a cohesive identity and makes your billing records immediately recognizable to your clients.

- Use a Polite Tone: Even if the document is a simple transaction request, maintain a polite and respectful tone. Phrases like “Thank you for your business” or “We appreciate your prompt payment” create a posit