Complete Guide to Using an Italian Invoice Template for Your Business

Managing financial transactions smoothly is essential for any business, especially when it comes to creating professional and accurate documents for clients. Whether you are a freelancer, a small business owner, or running a larger enterprise, having a reliable way to document services rendered or goods sold is crucial. Customizable billing formats can help ensure that all necessary information is included and formatted correctly, saving both time and effort.

These documents not only serve as proof of a transaction but also play a key role in ensuring compliance with local tax laws. A well-structured billing document can help avoid errors, reduce confusion, and streamline your administrative tasks. By using a standardized format, you can focus on providing high-quality products or services without worrying about paperwork details.

Efficiency and accuracy are the cornerstones of good financial practices, and having the right structure for your billing needs can make all the difference. With the right solution, creating a professional, clear, and legally compliant record of every sale becomes an easy and straightforward process.

Understanding the Italian Invoice Template

When it comes to documenting transactions, having a consistent and organized format is essential for both businesses and clients. A proper format ensures that all the necessary details are included, reducing the risk of errors or confusion. In many countries, including Italy, specific guidelines must be followed to ensure compliance with tax regulations, making it even more important to use the correct structure for these documents.

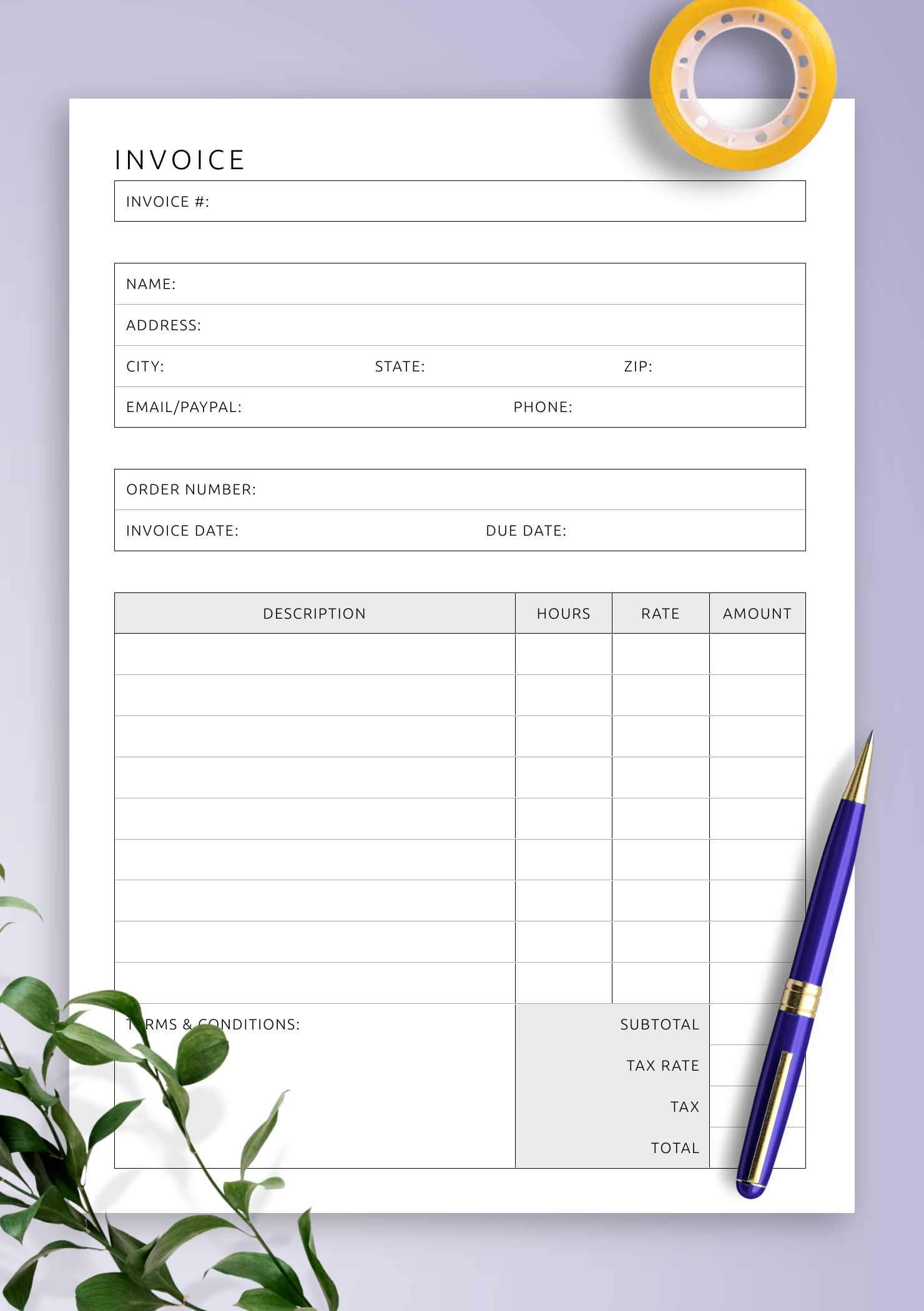

Key Components of a Standardized Billing Document

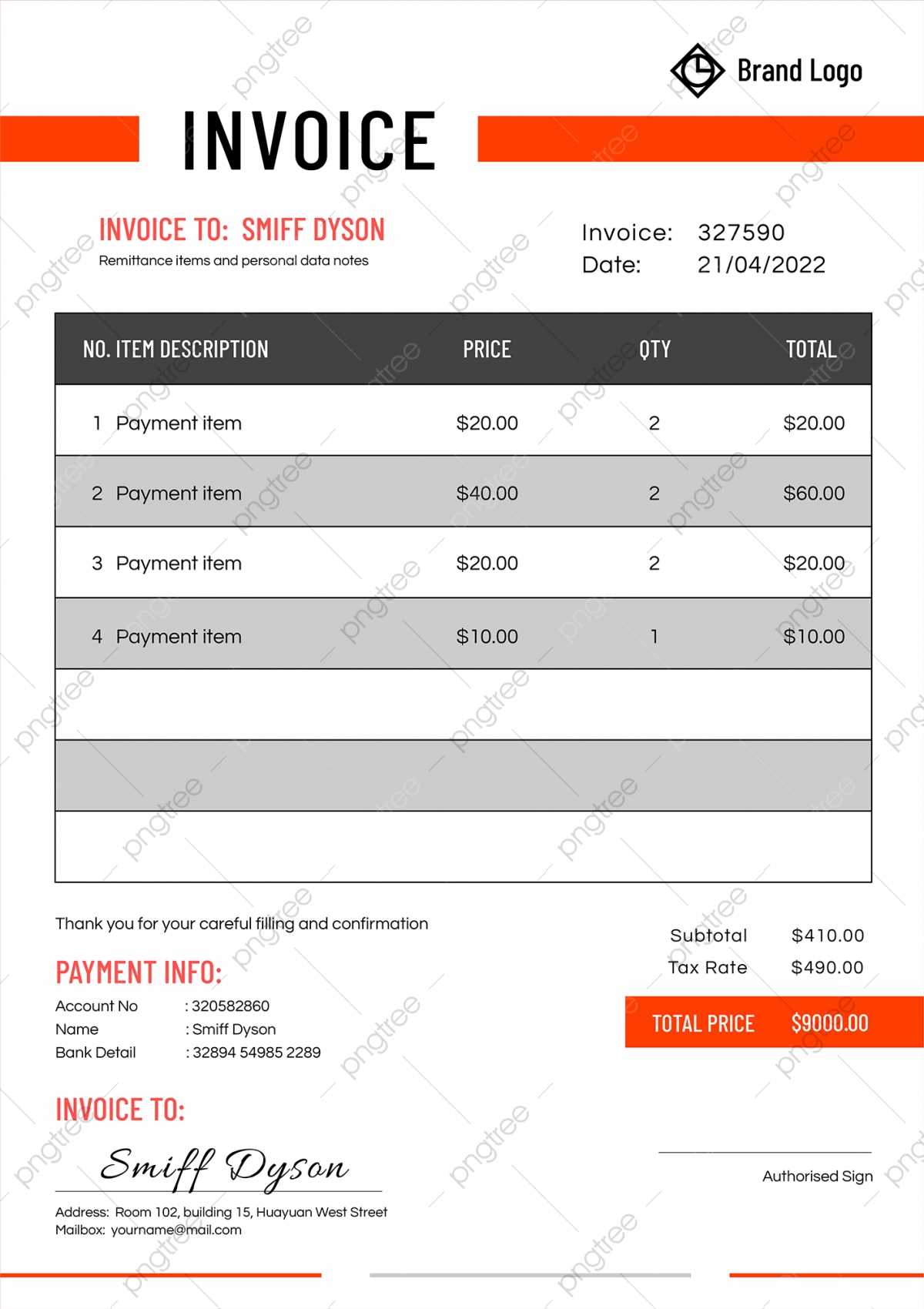

A well-organized financial record should include certain essential elements that not only help in documenting the sale but also serve legal and administrative purposes. These components typically include the following:

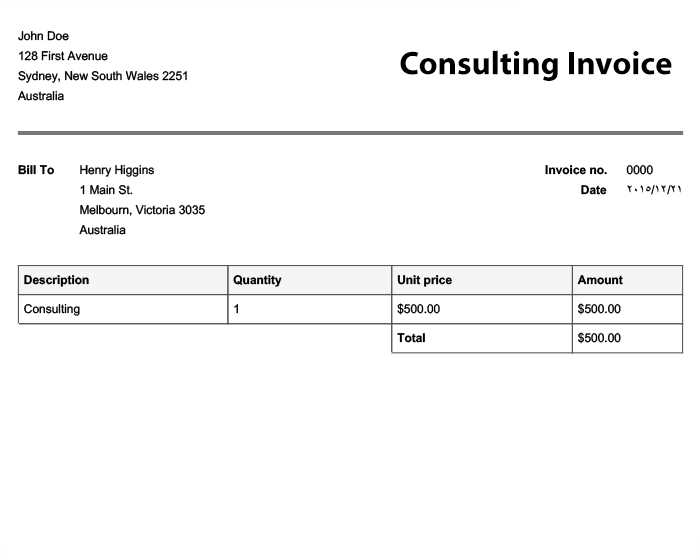

- Seller and buyer details: Names, addresses, and contact information.

- Transaction date: The date when the sale or service was completed.

- Description of goods or services: A detailed list of what was provided or sold.

- Pricing information: The cost of individual items, quantities, and the total amount due.

- Tax breakdown: Clear indication of applicable taxes and their percentages.

- Payment terms: The due date and payment methods accepted.

- Unique document number: An identifier for record-keeping and tracking purposes.

Why Structure Matters

Having a clear and structured document provides numerous benefits, including:

- Compliance: Ensures that all required information is included, helping to meet legal obligations.

- Professionalism: Demonstrates that your business is organized and trustworthy in the eyes of your clients.

- Efficiency: A standardized format reduces the time spent creating these documents, freeing up resources for other tasks.

By following a well-established format, you not only maintain professionalism but also make it easier to handle future financial and tax-related processes. Proper documentation is key to managing cash flow, auditing, and tracking business performance.

Why You Need an Italian Invoice Template

Having a standardized format for documenting financial transactions is crucial for any business. Whether you are an entrepreneur or a large company, using a reliable and consistent method for creating these records helps ensure clarity and compliance. Without a proper structure, important details might be overlooked, leading to potential confusion, delays in payments, or even legal complications.

In many countries, including Italy, specific rules must be followed when preparing financial records for transactions. A pre-designed structure makes it easier to comply with local tax regulations and ensures all required information is included. This is particularly important for businesses that need to maintain accurate records for tax reporting, audits, and other financial activities.

Efficiency is another key advantage of using a predefined document format. Instead of starting from scratch with each transaction, you can quickly fill in the necessary details, saving valuable time and effort. This is especially beneficial for businesses that handle a high volume of transactions, as it helps streamline administrative tasks and improves overall productivity.

Moreover, having a professional and consistent document format enhances credibility and trust with your clients. When customers see that your business uses a well-organized and accurate method for recording sales or services, it reinforces the impression that you are a reliable partner. In turn, this can help build long-term relationships and contribute to your company’s reputation in the marketplace.

How to Customize an Italian Invoice

Tailoring your financial documents to match your business’s needs is an essential step in maintaining both professionalism and efficiency. Customizing these records ensures that they not only reflect your company’s brand but also comply with local regulations and meet specific client requirements. By adjusting the structure and design, you can create a document that works best for your business model while adhering to necessary legal standards.

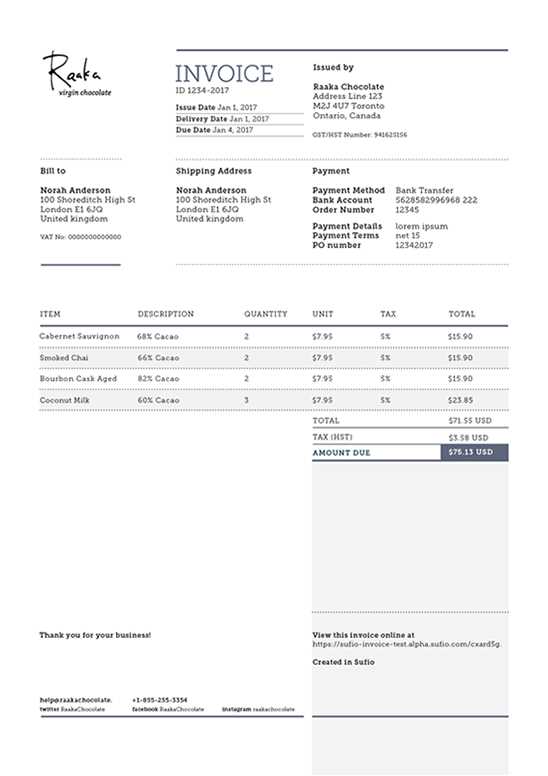

One of the first steps in personalization is adjusting the layout and format. Many pre-designed solutions offer flexibility, allowing you to add or remove fields depending on the type of transaction. Common elements to consider include:

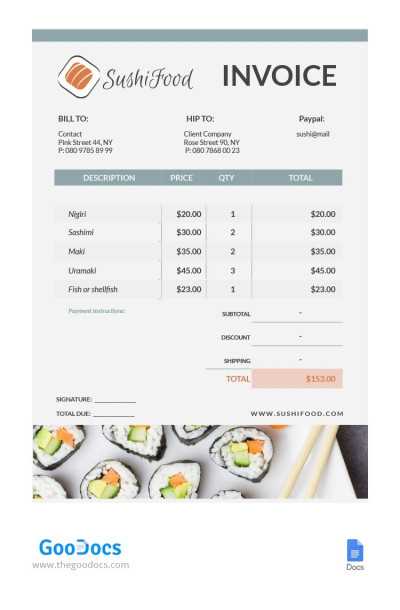

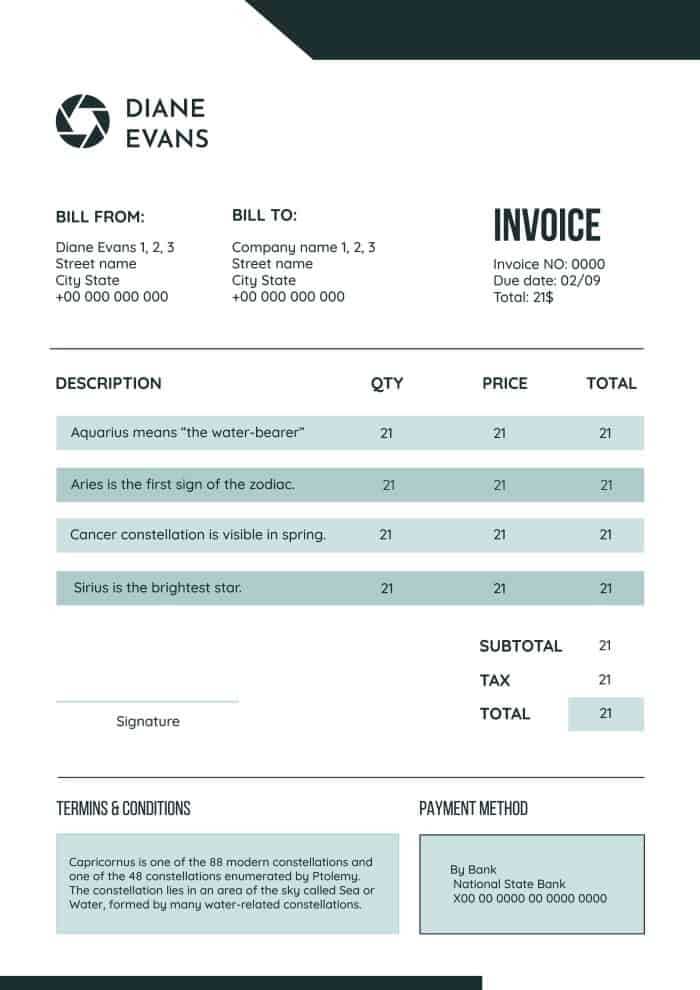

- Company logo and branding: Incorporating your logo and brand colors helps establish a professional and consistent identity.

- Contact information: Including your business address, phone number, and email makes it easy for clients to get in touch with any inquiries.

- Payment details: Clearly outlining accepted payment methods and due dates prevents confusion and streamlines payment processing.

- Custom fields: Depending on the nature of your business, you might need specific fields, such as project codes or customer references, to further personalize the document.

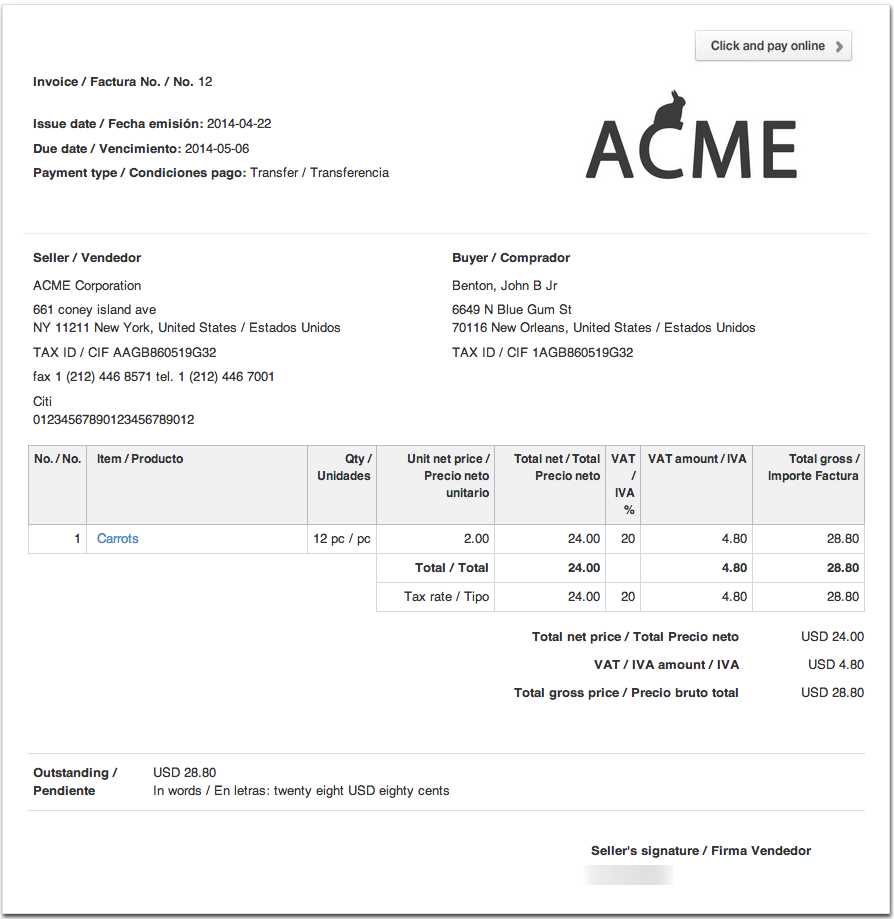

Another important customization is ensuring that the document includes all required tax and regulatory information. This can include VAT rates, applicable taxes, and unique transaction identifiers that ensure your records are compliant with local tax laws. Whether you are working with local clients or international customers, these details are crucial for legal accuracy and business transparency.

Finally, make sure that the document’s overall structure is user-friendly and visually appealing. Clear headings, logical order, and readable fonts not only make the document more professional but also easier for your clients to understand. A well-organized and polished financial document can strengthen relationships and improve your company’s reputation.

Essential Information in an Italian Invoice

To ensure that your financial records are both accurate and legally compliant, it’s crucial to include all the necessary details in your billing documents. Missing or incorrect information can lead to confusion, delays in payments, or potential legal issues. A well-structured document should clearly outline both the transaction specifics and any relevant legal requirements.

The following are key pieces of information that should be included:

- Business details: Both the seller’s and buyer’s name, address, and contact information must be clearly stated to ensure the parties involved are easily identifiable.

- Unique document number: Each record should have a distinct number for easy tracking and reference. This helps in maintaining order, especially when dealing with multiple transactions.

- Transaction date: The exact date when goods were delivered or services were provided is essential for accurate record-keeping and to avoid disputes regarding payment timelines.

- Description of goods or services: A detailed list of the products or services provided should be included, specifying quantities, unit prices, and a clear description to avoid any misunderstandings.

- Amount due: The total cost, including any applicable taxes, should be clearly stated. This ensures transparency and provides clarity for both parties involved.

- Tax information: If applicable, the tax rate and amount must be listed, as well as any other relevant fiscal information, to comply with local tax regulations.

- Payment terms: The due date for payment, accepted methods, and any applicable penalties for late payments should be clearly outlined.

By including these crucial elements, you not only ensure compliance with legal standards but also promote transparency, reduce confusion, and enhance professionalism in your transactions. Properly formatted documents are vital for maintaining trust with your clients and smooth financial operations for your business.

Top Features of an Italian Invoice Template

A well-designed financial document can save time, ensure accuracy, and help maintain professionalism in your business transactions. The right format offers essential features that make it easier to manage billing, track payments, and comply with legal requirements. Below are the key features that a well-structured document should include to streamline your billing process and ensure that it meets the needs of both your business and your clients.

1. Clear and Organized Layout

An intuitive layout is crucial for ensuring that all details are easy to find and understand. A good structure typically includes:

- Simple design: A clean and professional appearance that minimizes clutter and highlights the most important information.

- Logical flow: The document should present details in a clear order, such as seller information, buyer details, item descriptions, and pricing.

- Well-defined sections: Sections such as taxes, payment terms, and total amounts should be clearly separated for easy readability.

2. Customizable Fields

One of the best features of a good financial document is its ability to adapt to various business needs. Customizable fields allow you to tailor the document to your specific products, services, and business requirements. These can include:

- Additional reference numbers: Unique order or project numbers that help you track specific transactions.

- Custom notes: The option to include personalized messages, terms, or conditions for each client.

- Flexible tax fields: Depending on the type of transaction, you may need to adjust tax rates or include exemptions.

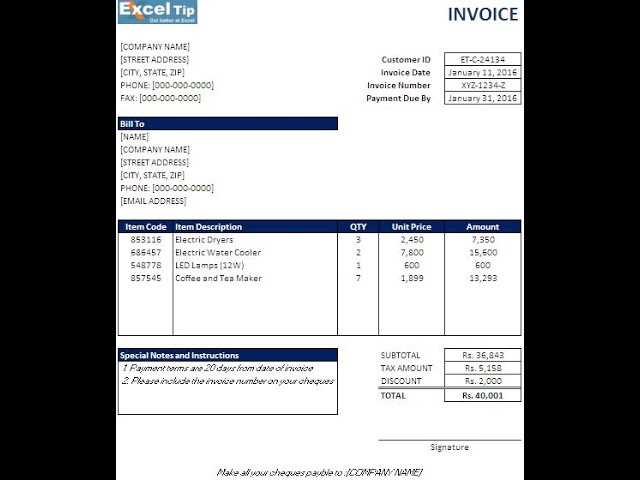

3. Automatic Calculations

A great financial document can help you automate complex calculations, reducing the risk of errors and saving time. Key features include:

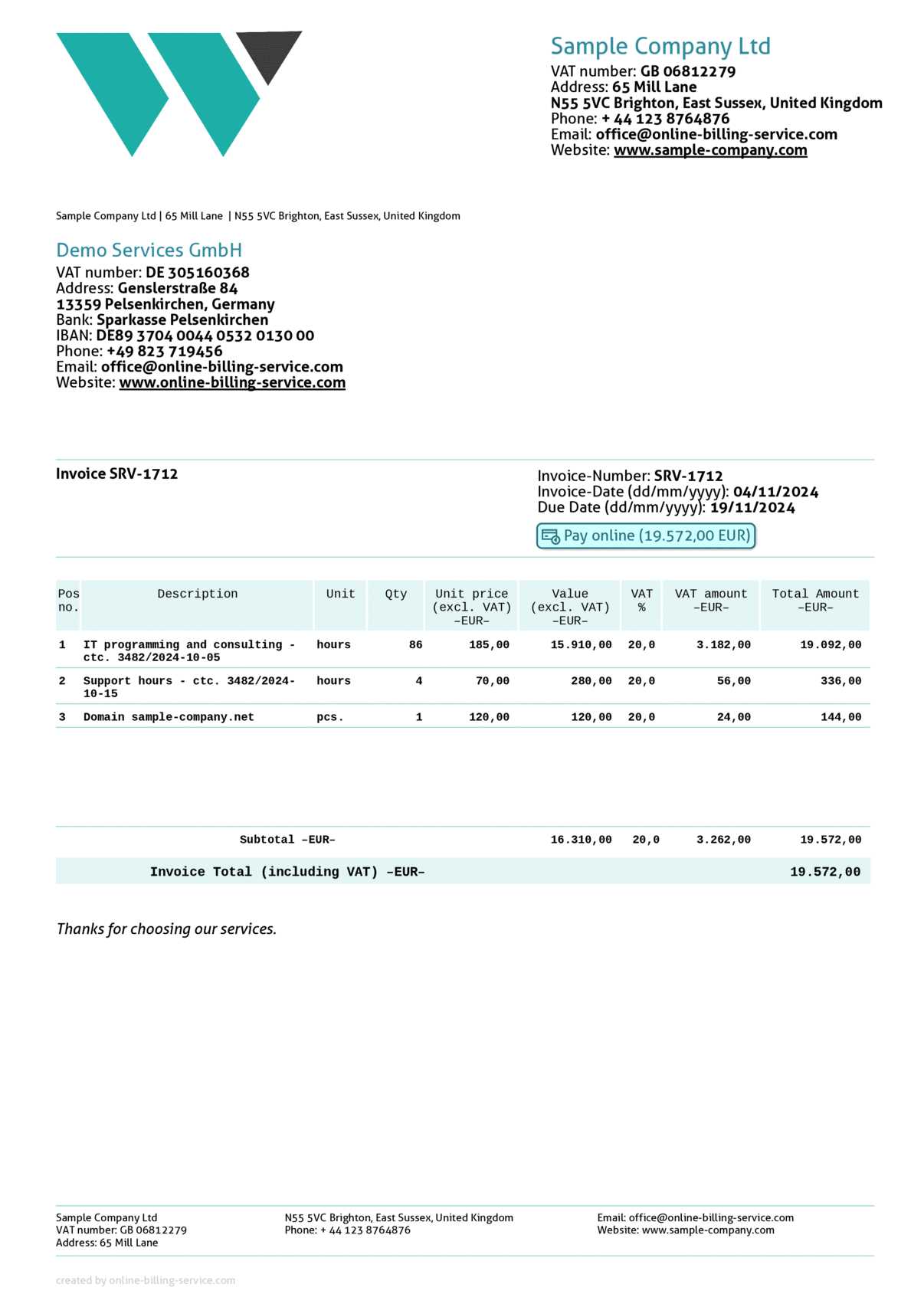

- Subtotal and total calculations: Automatic addition of item prices, taxes, and discounts to calculate the final amount due.

- Currency conversion: If you deal with international clients, having automatic currency conversion tools integrated can be very helpful.

- Tax breakdown: Clear calculations for applicable taxes, including VAT or sales tax, ensuring compliance with local regulations.

4. Legal Compliance

Ensuring that your document meets legal standards is crucial, especially when dealing with tax regulations and invoicing requirements. A well-crafted solution will automatically include:

- Tax numbers and registration details: For proper legal documentation, including VAT or business registration numbers as required by law.

- Correct date format: Depending on the region, the document should follow local conventions for displayin

Free vs Paid Italian Invoice Templates

When choosing a format for your business transactions, you have the option to use either free or paid solutions. Each comes with its own set of advantages and limitations, so it’s important to carefully consider which option best suits your needs. Whether you are just starting your business or have an established enterprise, understanding the differences can help you make an informed decision that aligns with your operational goals.

Advantages of Free Solutions

Free formats are a popular choice, particularly for small businesses or freelancers looking to save on expenses. These options offer several benefits:

- No upfront costs: Free options can be downloaded or accessed without any financial commitment, making them ideal for those with limited budgets.

- Basic functionality: Most free solutions offer enough features to handle standard transactions, including essential fields like item descriptions, pricing, and basic tax calculations.

- Quick and easy to use: Many free formats are simple to download and start using immediately, which can be a huge time-saver when you need to get documents out fast.

However, free solutions may come with limitations in customization and features, which can be restrictive as your business grows.

Advantages of Paid Solutions

Paid options provide more comprehensive tools and features, designed to accommodate growing businesses with more complex needs. Some key benefits include:

- Advanced customization: Paid formats often allow more flexibility in design and layout, letting you tailor the document to your company’s branding and unique requirements.

- More sophisticated features: These solutions often include automatic tax calculations, multi-currency support, and integration with accounting software, saving you time and reducing errors.

- Customer support: With paid services, you typically gain access to dedicated support teams who can assist you with troubleshooting or help with any customization issues.

- Legal and tax compliance: Many paid solutions are regularly updated to comply with the latest legal and regulatory requirements, ensuring that your documents remain compliant with local laws.

While these options come with a cost, they provide a higher level of functionality, reliability, and long-term value, especially for businesses that require consistent and professional-looking documents.

Which is Right for You?

The decision between free and paid options depends largely on your business needs, volume of transactions, and budget. For small businesses or those just starting out, a free option may be sufficient. However, as your business grows and requires more advanced features, investing in a paid solution can offer greater efficiency, support, and customization.

Italian Invoice Format and Structure

When creating a billing document, it is essential to follow a structured format to ensure that all necessary information is included and easily understood. A well-organized document not only reflects professionalism but also helps with compliance and smooth payment processing. The format and structure should cover key details like transaction specifics, buyer and seller information, and legal obligations, while maintaining clarity and consistency.

Core Elements of the Document

The structure of your financial document typically includes several important sections, each serving a specific purpose:

- Seller and Buyer Information: This includes the full name, business address, and contact details of both parties involved in the transaction.

- Document Identification Number: A unique reference number for each document is essential for record-keeping and tracking purposes.

- Transaction Date: The date when the product or service was provided is crucial for both payment and tax purposes.

- Description of Goods or Services: This section should provide a clear and detailed list of what was sold or rendered, including quantities, unit prices, and any relevant specifications.

- Payment Terms: Information regarding the total amount due, payment methods, due dates, and any discounts or late fees should be clearly outlined.

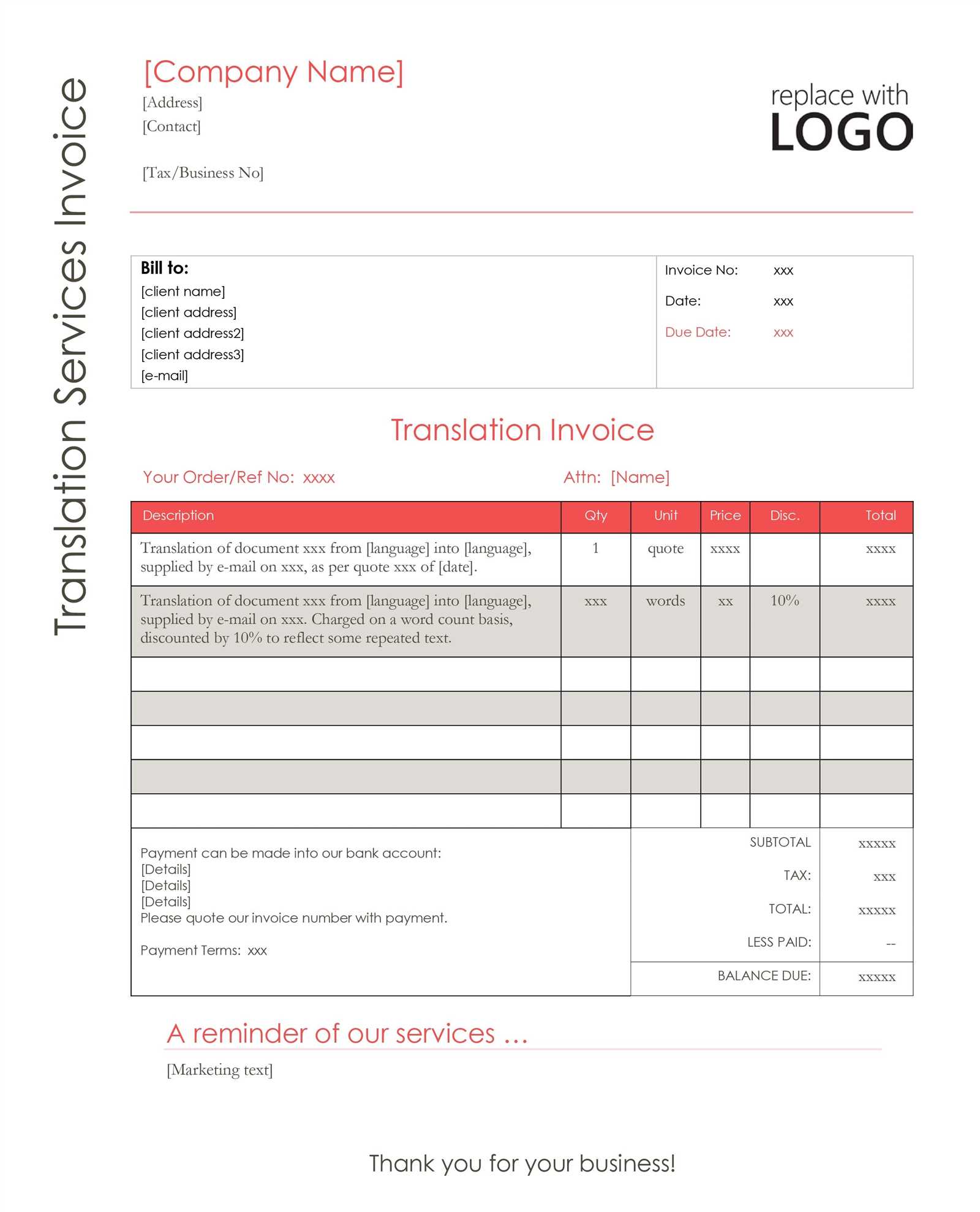

Tax and Legal Compliance Information

In many countries, certain details must be included to ensure that the document meets legal and tax requirements. These may include:

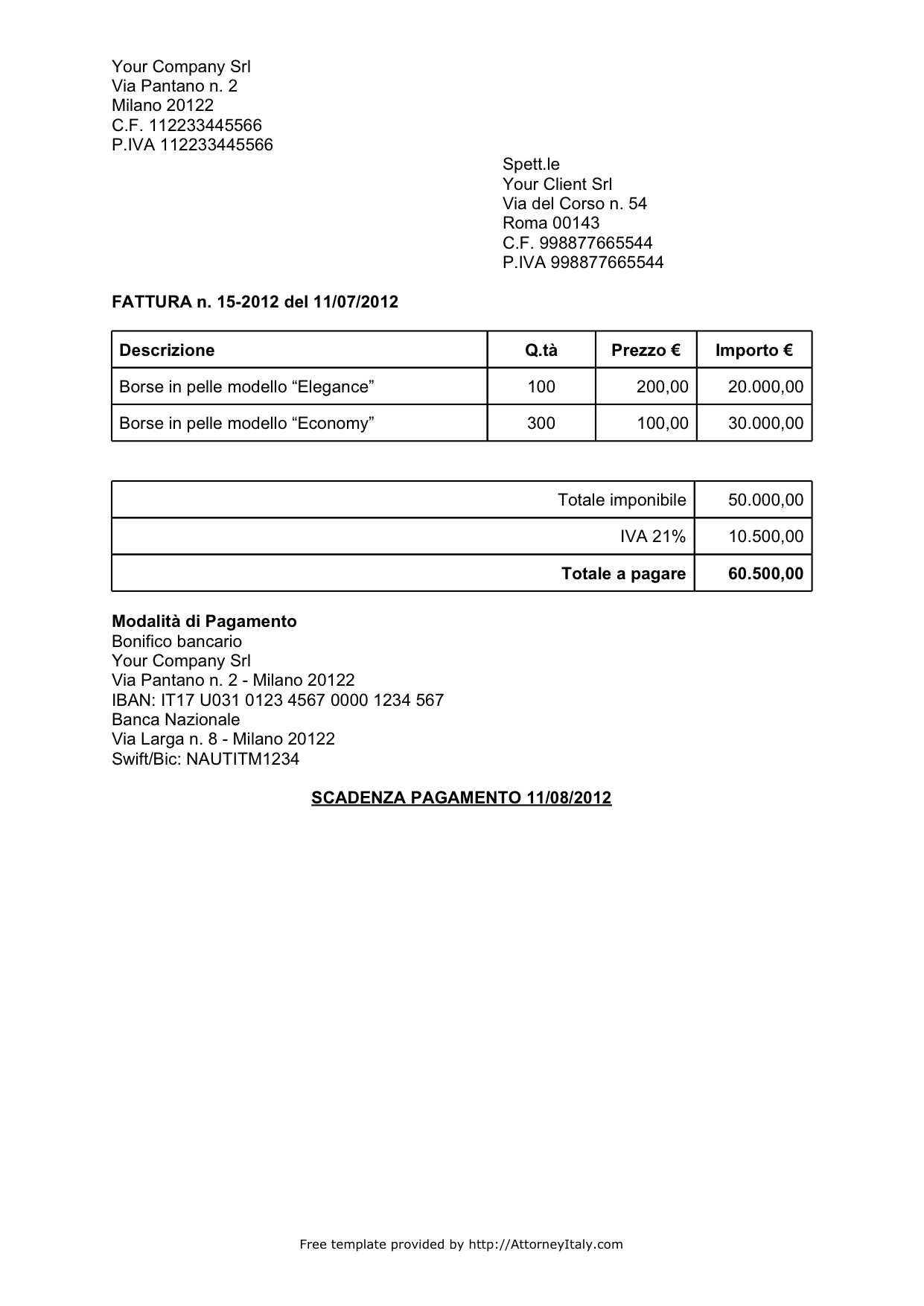

- Tax Breakdown: A detailed calculation of any taxes applied, such as VAT, along with the tax rate, is essential for compliance with local regulations.

- Business Registration Numbers: Both the seller and buyer may need to include their respective tax IDs or business registration numbers as part of the legal requirements.

- Signature or Declaration: In some cases, it may be necessary to include a signature or legal declaration confirming the accuracy of the document.

By following a clear and standardized format, you ensure that all required information is included and easy to find, reducing the chance of errors or delays. A consistent structure also makes it easier to track and reference past transactions for accounting or auditing purposes.

Common Mistakes to Avoid in Italian Invoices

Even small errors in your billing documents can lead to confusion, delays in payments, or even legal issues. It’s important to ensure that all the necessary information is accurately included and formatted. By avoiding common mistakes, you can maintain a professional image, ensure compliance, and improve your overall business efficiency.

Here are some common errors to watch out for:

- Missing or Incorrect Contact Information: One of the most frequent mistakes is not including complete contact details for both the seller and the buyer. Make sure that both addresses, phone numbers, and email addresses are correctly listed.

- Incorrect Tax Calculations: Failing to properly calculate or apply the correct tax rates, such as VAT, can cause compliance issues. Always double-check that the right tax percentages are applied and that the tax breakdown is clear and accurate.

- Omitting a Unique Document Number: Every transaction should have a unique reference number. Not including this number or using a non-sequential numbering system can create confusion and hinder record-keeping.

- Incorrect Payment Terms: Clear payment instructions, including the due date and accepted methods, should be outlined. Failing to include this information or miscommunicating payment expectations can lead to delayed payments.

- Not Specifying Payment Due Date: Many businesses forget to indicate when the payment is expected, which can lead to misunderstandings. Always ensure that the due date is clearly stated to avoid delays.

- Inconsistent Formatting: An unorganized or hard-to-read layout can confuse both the recipient and your accounting team. Stick to a clean, consistent structure with easily readable fonts and well-defined sections.

- Failure to Include Legal Information: Not including mandatory information, such as business registration numbers or relevant tax IDs, can cause problems with audits or legal compliance. Make sure all required details are included according to local regulations.

By taking the time to review and double-check each element, you can avoid these common mistakes and ensure that your documents are both professional and legally compliant. Properly formatted and error-free records not only promote trust with your clients but also streamline your business operations and financial management.

Legal Requirements for Italian Invoices

When creating a billing document, it is crucial to follow local legal guidelines to ensure that your records meet regulatory standards and are recognized by tax authorities. These documents are not only essential for maintaining clear financial records but also for complying with tax laws. Failing to meet legal requirements can lead to penalties or complications in audits. Below are the key legal aspects to consider when preparing such records for transactions in Italy.

Requirement Description Unique Document Number Each document must have a unique number, which helps with proper tracking and prevents duplication. Seller and Buyer Information The document must include the full name, address, and tax identification numbers of both the seller and the buyer. Transaction Date The date when the goods or services were provided must be clearly stated for proper record-keeping. Description of Goods or Services Details such as quantities, item descriptions, and unit prices must be clearly outlined to ensure transparency and compliance. Tax Breakdown The applicable tax rates (e.g., VAT) and the total tax amount must be included to comply with tax regulations. Payment Terms It is necessary to include payment terms, such as the payment due date and accepted methods, to ensure clarity in financial transactions. Tax Identification Numbers Both parties must include their tax IDs (e.g., VAT number) to validate the transaction in the context of tax reporting. Ensuring these legal elements are included in your billing records not only keeps your business compliant but also builds trust with clients and helps facilitate smoother transactions. Always check for updates to local tax laws to remain in compliance and avoid penalties for failing to meet regulatory standards.

How to Add Tax Information to Your Invoice

Accurately including tax information in your billing document is crucial for compliance with local tax laws and ensures smooth financial transactions. Proper tax details help your clients understand the full cost of the transaction and allow both parties to stay within legal requirements. Adding tax information correctly can also streamline your accounting and reporting processes, making tax filings much easier.

Here are the key steps to ensure that tax details are properly included in your financial documents:

Step Description 1. Include Applicable Tax Rates Clearly list the tax rates that apply to the transaction. This is especially important for VAT or sales tax, which should be displayed as a percentage. Make sure the rate matches the local legal requirement. 2. Provide Tax Breakdown For transparency, include the tax amount calculated separately from the total amount due. This allows your client to clearly see how much they are being charged in taxes. 3. Show Total Amount with Tax After listing the taxable items, ensure that the final amount includes the calculated tax. The total should be displayed clearly, including both the base price and the tax amount, so that clients can easily verify the final payment amount. 4. Include Tax Identification Numbers Both the seller’s and the buyer’s tax identification numbers (e.g., VAT number) should be included. This is especially important for businesses involved in cross-border transactions or those who need to comply with VAT regulations. 5. Mention Tax Exemptions or Reductions If any tax exemptions or reductions apply, ensure they are clearly stated. This can include special rates or exemptions for certain types of goods or services, such as medical supplies or educational materials. Adding tax information correctly helps maintain transparency with clients and ensures compliance with local tax regulations. Always double-check tax rates, identify applicable exemptions, and ensure all required tax identification numbers are included to avoid potential issues during audits or disputes.

Tips for Using an Italian Invoice Template

Using a structured billing format can greatly simplify your financial record-keeping and streamline the payment process. To get the most out of your document design, it’s important to know how to efficiently customize and utilize the structure to ensure accuracy, compliance, and professionalism. Below are several helpful tips to optimize the way you create and manage your billing records.

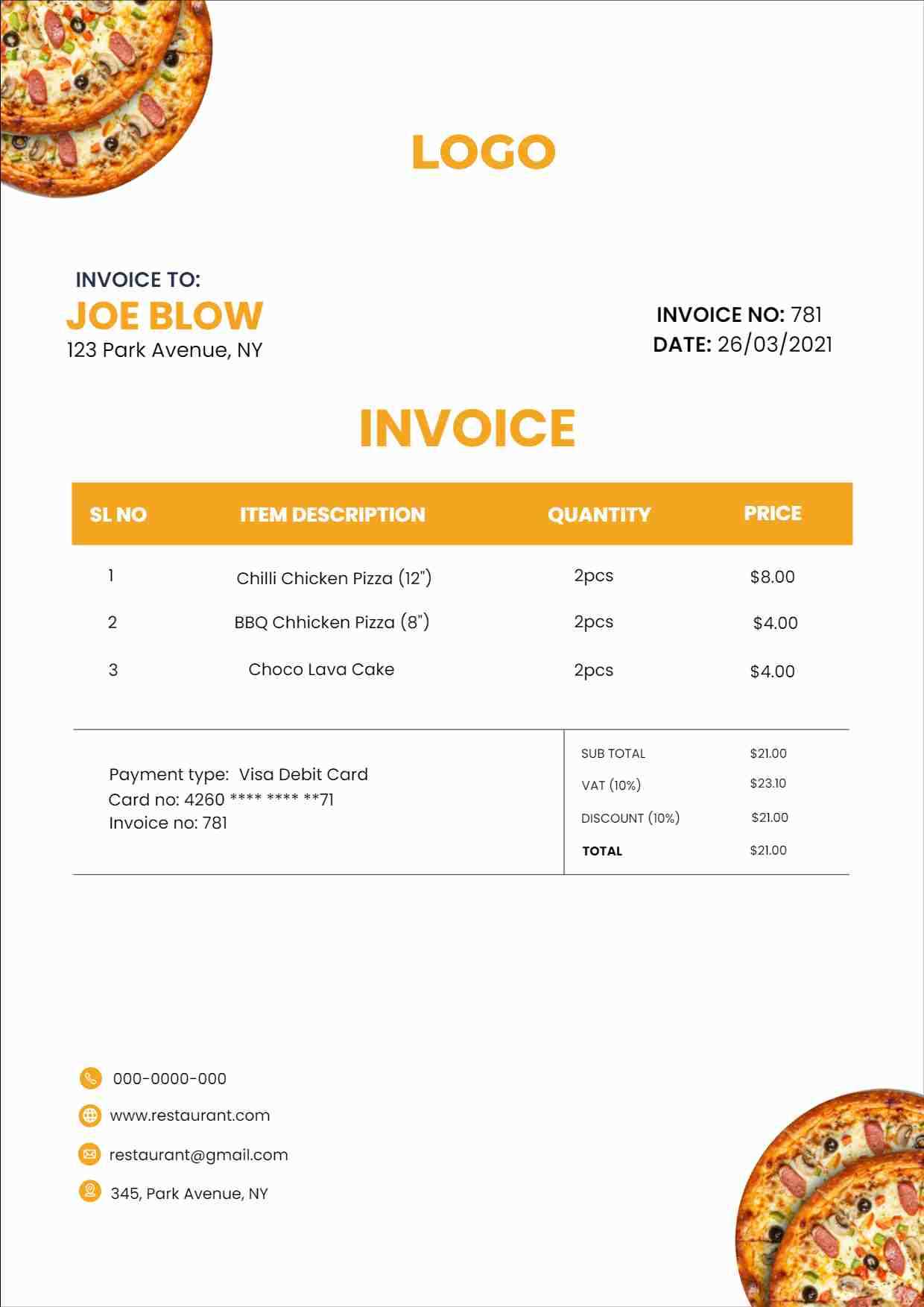

- Keep It Simple and Professional: A clear and well-organized layout ensures that clients can easily read and understand the document. Avoid unnecessary clutter and focus on presenting the most important details in a clean, easy-to-follow format.

- Customize Your Document for Your Business: Tailor the format to reflect your brand’s identity. Adding your logo, adjusting fonts, and choosing your business colors helps maintain a professional look and makes your documents instantly recognizable to clients.

- Double-Check Legal Information: Always ensure that all mandatory information, such as your tax identification number, client details, and applicable tax rates, are included. Missing or incorrect legal information could result in compliance issues or delays in payments.

- Use Automatic Calculations: Many document tools offer built-in formulas for automatic tax calculation and summing totals. This helps reduce errors and ensures that your calculations are accurate every time.

- Include Clear Payment Terms: Be explicit about payment due dates, acceptable payment methods, and any penalties for late payments. This reduces misunderstandings and encourages prompt payment.

- Save Templates for Future Use: Once you’ve created a billing document that works well for your business, save it as a template. This way, you can reuse it, saving you time and ensuring consistency for future transactions.

- Keep Records Organized: Make sure to keep copies of all documents for record-keeping purposes. This helps with tax filings, audits, and resolving any disputes that may arise.

By following these tips, you’ll ensure that your billing documents are not only professional but also accurate and compliant. Streamlining this process can help save time, avoid errors, and improve client satisfaction.

How to Save Time with Invoice Templates

Creating billing documents from scratch can be a time-consuming process, especially when you need to ensure accuracy and compliance with every transaction. Using pre-designed formats allows you to streamline the entire process, saving time and reducing the chances of errors. With the right structure in place, you can automate much of the work, leaving you more time to focus on your business operations.

Benefits of Using Pre-Designed Formats

One of the main advantages of using a ready-made document structure is that it reduces the need to start from scratch each time. Here’s how:

- Consistency: A saved structure ensures that every document you create follows the same format, making your financial records more organized and easier to manage.

- Speed: You don’t have to input basic information like company name, contact details, or legal identifiers every time. With pre-set fields, you can quickly fill in specific details such as transaction amounts and dates.

- Automatic Calculations: Many pre-designed structures include built-in formulas for tax calculations, discounts, and totals. This feature reduces the risk of human error and speeds up the process.

How to Maximize Efficiency with Templates

To fully benefit from pre-made structures, here are a few ways to enhance your efficiency:

- Customize for Reuse: Tailor the layout to fit your business’s specific needs, saving you time on repetitive tasks while maintaining a professional look.

- Save Multiple Versions: If your business deals with multiple types of transactions, consider saving different structures for different scenarios, such as service-based versus product-based sales.

- Use Digital Tools: Many accounting software platforms offer integrated templates that automatically save your data and update your records, providing even greater time savings.

By adopting pre-designed formats, you can significantly cut down the time spent creating each document while ensuring that your business remains organized and professional. Efficiently handling billing tasks helps free up resources for other aspects of your business that require attention.

Best Software for Creating Italian Invoices

Choosing the right software for generating billing documents can drastically improve your efficiency and accuracy. With the right tools, you can automate calculations, reduce human error, and create professional documents that comply with legal requirements. Below is a list of some of the best software options available for businesses looking to streamline their document creation process.

Software Key Features Best For FreshBooks Cloud-based, customizable templates, automatic tax calculations, multi-currency support Small to medium businesses, freelancers, and contractors QuickBooks Invoice generation, expense tracking, VAT support, integration with accounting features Businesses that need both invoicing and full accounting management Zoho Invoice Customizable templates, recurring billing, payment reminders, integration with Zoho CRM Startups and small businesses, especially those using other Zoho software Wave Free invoicing, easy-to-use interface, automatic tax calculations, expense tracking Freelancers and small businesses with simple invoicing needs Bill.com Payment automation, invoice tracking, tax compliance, online payment integration Businesses that handle frequent bill payments and require integration with banking systems Each of these tools offers

How to Manage Invoices for Italian Business

Efficiently managing billing documents is crucial for any business, especially for those operating in regions with complex tax and financial regulations. For businesses in Italy, staying organized and adhering to local laws can be a challenge, but with the right approach, it can be streamlined. Properly managing these records ensures timely payments, tax compliance, and overall financial clarity.

Here are a few key strategies to effectively handle your billing documents:

- Organize and Categorize: Maintain a well-structured system for storing your documents, whether in digital or physical format. Group documents by month, quarter, or year for easier access and organization. Digital software can help automate this process and make it more efficient.

- Track Payments and Due Dates: Keep a close eye on payment due dates to ensure timely collection. Using a system that automatically sends reminders to clients can help reduce late payments and improve cash flow. Additionally, keeping track of paid and outstanding invoices will give you a clearer picture of your financial status.

- Ensure Compliance with Local Tax Laws: Italian businesses must follow strict tax regulations, including VAT requirements. Ensure that your billing documents reflect the appropriate tax rates and include all necessary tax identification numbers for both the seller and the buyer. This can help avoid complications during audits and ensure proper reporting.

- Use Digital Tools: Employing software that integrates invoice generation, payment tracking, and tax calculation can save time and reduce the risk of human error. Many tools also offer customizable templates, so you can create professional, legally-compliant documents with ease.

- Regularly Review and Update Processes: Periodically assess your invoicing process to identify areas for improvement. This could include implementing new technology, training staff on best practices, or adjusting payment terms to optimize cash flow.

By following these steps, you can ensure that your billing practices remain efficient, compliant, and professional. Properly managing these financial documents helps prevent errors, delays, and potential legal issues, ultimately contributing to the smooth operation and growth of your business.

Italian VAT and Invoice Compliance

When doing business in Italy, understanding and adhering to local tax regulations is crucial to ensure legal compliance. One of the key aspects is the proper handling of VAT (Value Added Tax), which must be accurately reflected in all financial records. Failing to include the correct tax information can lead to penalties, tax audits, and disputes with customers. To avoid these issues, businesses must ensure that their financial documents meet the required standards set by the local tax authority.

In Italy, VAT is a significant part of the business landscape, and it applies to most goods and services. It’s important for businesses to be familiar with the various VAT rates that apply to different products and services, as well as the proper documentation required to avoid legal complications.

Here are the main compliance considerations for VAT and billing documents:

- Accurate Tax Rates: Ensure that the appropriate VAT rate is applied based on the type of goods or services provided. Standard rates may vary depending on the product, and certain items may be exempt or eligible for reduced rates.

- VAT Identification Numbers: Both the buyer and the seller are required to include their VAT registration numbers in the billing document. This is essential for proper reporting and verification of the transaction by the tax authorities.

- Detailed Breakdown of Tax: It’s important to clearly separate the taxable amount from the VAT. The amount of tax charged must be specified, along with the total amount due, to ensure transparency and correct calculation.

- Inclusion of Other Required Details: Businesses must ensure that their billing documents include all necessary details, such as the transaction date, a unique document number, and accurate descriptions of the goods or services provided. These are key for audit purposes and compliance with local regulations.

- Record-Keeping: VAT-compliant businesses must retain accurate records of all transactions, including detailed copies of all documents, for a set period of time, typically 10 years. These records should be readily accessible for review by the tax authorities if needed.

By following these guidelines, businesses can ensure that their financial documentation remains compliant with local VAT laws, minimizing the risk of legal issues and ensuring smooth operations. It’s essential to stay up to date with any changes in tax laws and billing requirements to avoid unnecessary complications.

Understanding Invoice Numbers in Italy

In any business transaction, having a unique reference number for each document is essential for both organization and legal compliance. In Italy, this numbering system plays a crucial role in maintaining an orderly record of transactions and ensuring that financial documents are easily traceable for both the seller and the tax authorities. The correct use of document numbers helps streamline accounting practices, avoid duplication, and simplify audits.

Each document created by a business, such as a sales receipt or a billing statement, must include a unique serial number that follows a consistent and sequential pattern. This numbering system is not just a matter of organization; it is a legal requirement that ensures transparency and accountability in the business’s operations.

Here are the key points to understand about document numbering in Italy:

- Sequential Numbering: Invoice numbers must follow a consecutive order without any gaps or repetition. This means that each document issued should have a unique number, and businesses should ensure that no numbers are skipped.

- Format of Numbers: The numbering system can be customized to suit the business’s needs but must always be clear and sequential. Typically, businesses may include the year or month as part of the number, such as “2024-001” or “2024-05-001”. This helps keep track of documents issued within a specific time period.

- Chronological Order: The sequence should reflect the order in which documents are issued, which helps in tracking and organizing transactions efficiently. This also assists in avoiding errors and inconsistencies in financial records.

- Legal Requirement: The Italian tax authority requires businesses to maintain proper records of all transactions, including the use of consecutive and unique document numbers. Non-compliance with this requirement could lead to penalties or complications during audits.

- Use of Electronic Systems: Many businesses today use digital tools or accounting software that automatically generate document numbers. These systems help prevent human error and ensure that the numbering is consistent and in line with the regulations.

By following these guidelines and maintaining a systematic approach to numbering documents, businesses can ensure compliance and facilitate smooth financial operations. A properly implemented numbering system is essential for both tracking transactions and fulfilling legal obligations.

Benefits of Digital vs Paper Invoices in Italy

When it comes to managing business transactions, choosing between digital and paper-based billing systems is a critical decision. Both methods offer advantages, but the shift toward digital records is becoming more common due to the numerous benefits it offers, particularly in terms of efficiency, accuracy, and compliance. In Italy, businesses are encouraged to adopt electronic billing systems to streamline operations and ensure regulatory compliance.

Advantages of Digital Billing

Digital billing has rapidly gained popularity because of its ease of use, accessibility, and the ability to automate many tasks. Here are some key advantages:

- Speed: Digital billing speeds up the entire process. You can create, send, and receive documents almost instantaneously, improving cash flow and reducing delays.

- Automation: Many digital tools allow for automatic tax calculations, due date reminders, and even payment processing, reducing human error and saving time.

- Compliance: In Italy, digital systems can help ensure that all necessary legal and tax requirements are met, reducing the risk of audits and penalties.

- Cost-Effective: By eliminating paper, ink, and postage costs, digital billing is often more affordable in the long run.

- Storage and Access: Electronic records are easier to store, back up, and retrieve, making them more secure and accessible than physical documents.

Benefits of Paper Billing

Although digital systems are growing in popularity, paper-based billing still has some distinct advantages, particularly for businesses that deal with clients less familiar with electronic formats or those that require physical documentation. Below are some benefits of using paper-based documents:

- Traditional Use: Some businesses or customers prefer physical copies due to familiarity with the process or for official documentation needs.

- No Technical Issues: With paper billing, businesses are not reliant on internet access or digital tools, which can be beneficial in areas with unreliable technology or for those who prefer face-to-face transactions.

- Legally Accepted: Paper documents are still widely accepted, and businesses can maintain a tangible record for clients or legal purposes when required.

Criteria Digital Paper Speed Instant transmission and receipt Time-consuming, requires mailing Cost Lower long-term costs Printing, postage, and storage costs