IT Consulting Invoice Template for Streamlined Billing

Managing payments for technology-related services can be challenging without the right tools. For businesses in the IT sector, creating clear, professional documents that outline charges, payment terms, and work performed is essential for smooth transactions with clients. A well-organized billing document not only ensures timely payments but also helps maintain a transparent relationship between service providers and their clients.

Having a structured format for detailing service costs, hours worked, and additional fees can greatly simplify this process. Instead of starting from scratch each time, using a ready-made format tailored to the industry can save time and reduce errors. It provides a standardized approach, making it easier to track finances and keep clients informed about what they owe.

In this article, we will explore the best practices for creating and using such documents in the IT field. From essential components to tips on customization, you’ll learn how to ensure your billing process is both efficient and professional, while also meeting the specific needs of your clients.

IT Service Billing Document Overview

When working in the technology industry, accurately detailing the work performed and corresponding fees is essential for maintaining clear communication with clients. A structured document for charging clients allows service providers to track their services, manage payments, and ensure that both parties understand the terms. This section will focus on the importance of using a standard format for billing and how it helps IT professionals streamline their administrative tasks.

Key Benefits of a Structured Billing Document

Using a consistent format for billing offers several advantages:

- Clarity: A professional layout ensures that all services and charges are easy to read and understand.

- Efficiency: Pre-designed formats save time and effort by removing the need to create a new document from scratch each time.

- Accuracy: Reduces the risk of errors in calculations, ensuring that all information is correct before submission.

- Consistency: Helps maintain a uniform appearance across all documents, reinforcing your professionalism and brand identity.

What to Expect from a Standard Format

A typical billing document for IT services usually includes the following sections:

- Service Description: A detailed list of the work provided, including the time spent and tasks completed.

- Rates and Fees: An outline of the charges for each service or task, along with the total amount due.

- Payment Terms: Clear instructions on how and when payment is expected, including any late fees or discounts for early payment.

- Contact Information: Details for both the service provider and the client, making it easier to resolve any billing issues.

By following this format, IT professionals can ensure that all relevant information is presented in a clear and organized manner, making the billing process more straightforward for both parties involved.

Why Use a Standard Billing Format

Managing payments efficiently is crucial for businesses, especially in fields that require precise tracking of services and hours worked. Having a pre-designed structure for creating payment requests can simplify the entire process, reducing the risk of errors and improving communication with clients. This section explores why adopting a standardized method for billing is beneficial for IT professionals.

Time-Saving Benefits

Using a pre-built structure for payment documents significantly speeds up the process. Instead of starting from scratch each time, a ready-to-use format allows you to:

- Quickly fill in details such as services rendered, rates, and dates.

- Eliminate repetitive tasks like reformatting and organizing data.

- Maintain consistency in your communications with clients, saving time in the long run.

Professional Presentation

A uniform format adds credibility and professionalism to your financial communications. A well-structured document demonstrates that you value your client’s time and ensures that your business is presented in the best possible light. With a polished appearance, clients are more likely to:

- Trust your business and feel more confident in your services.

- Follow payment instructions promptly, reducing delays in receiving payments.

- Recognize your professionalism in every transaction, reinforcing positive business relationships.

By adopting a standard format, you can ensure your billing process is both efficient and professional, benefiting both you and your clients.

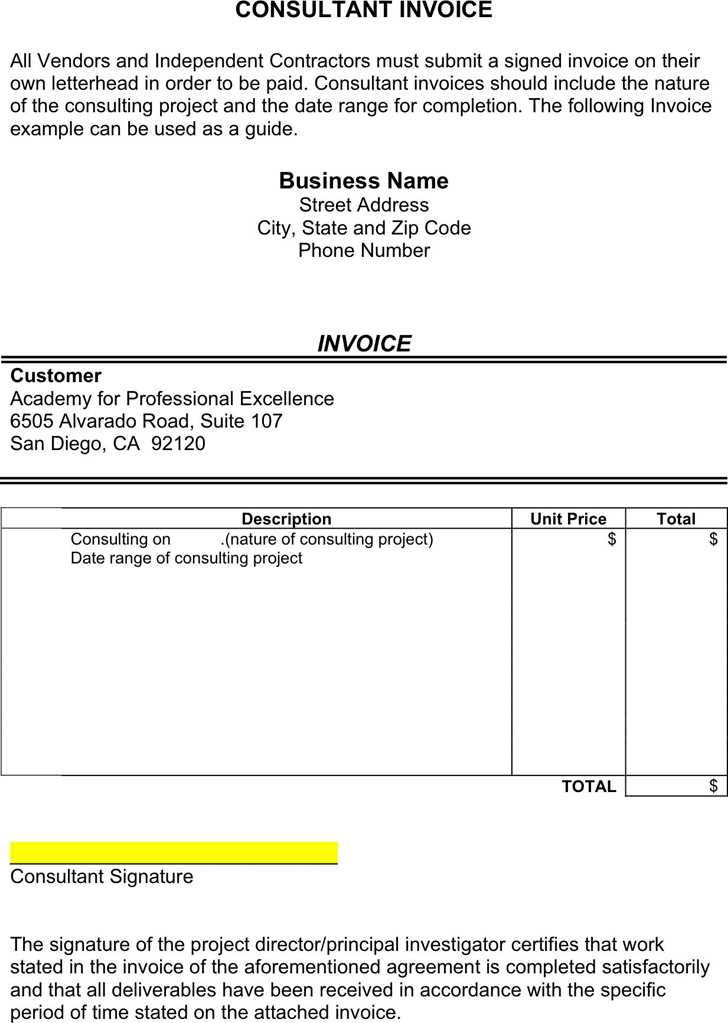

Key Features of IT Billing Documents

When creating a billing document for IT services, certain key elements must be included to ensure clarity, accuracy, and professionalism. These documents serve as an official record of the services provided, the charges for those services, and the terms of payment. In this section, we will explore the essential features that should be included in any billing document for IT-related work.

Essential Components

A well-structured document should contain the following key sections to ensure it effectively communicates all necessary details:

- Contact Information: The names, addresses, and contact details of both the service provider and the client are crucial for clear communication.

- Service Description: A clear and detailed breakdown of the tasks performed, including the scope of work, time spent, and any relevant project milestones.

- Rates and Charges: A list of the hourly or fixed rates for each service provided, along with any additional fees or expenses incurred during the work.

- Payment Terms: Details about the due date, any late payment penalties, and accepted payment methods should be clearly outlined to avoid misunderstandings.

- Payment Total: A clear calculation of the total amount due, including all applicable taxes, discounts, and adjustments.

Additional Features for Clarity

In addition to the core sections, other elements can enhance the clarity and functionality of your billing document:

- Project Reference or ID: Including a unique reference number for the project or contract can help both parties trac

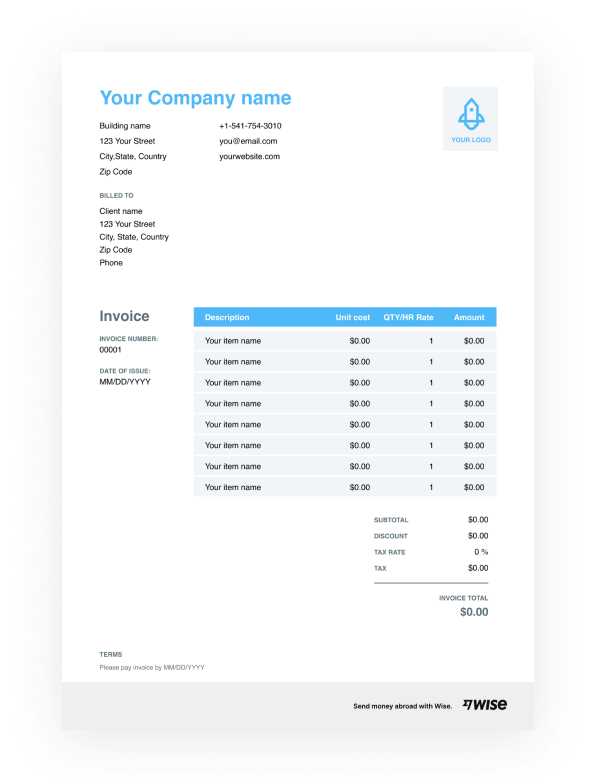

How to Customize Your Billing Document

Customizing a billing document for your IT services allows you to tailor it to your specific business needs and make it more personal and professional. By adjusting various elements, you can ensure that the document reflects your branding, provides clarity to clients, and includes all relevant details. In this section, we will guide you through the key steps to customize your billing document effectively.

Step 1: Adjust Your Business Information

First, ensure that your contact details, including your business name, address, phone number, and email, are up to date. This makes it easier for clients to reach you if they have any questions about the charges. Here’s a sample layout:

Field Example Business Name Tech Solutions Ltd. Address 1234 Tech Avenue, Suite 100, City, Country Phone +123 456 789 Email [email protected] Step 2: Customize Service Details

Next, update the sections that describe the specific services you provide. Clearly state the tasks completed, the time spent on each, and the rate charged for each task or service. This section should be detailed enough to avoid any confusion on the client’s end. Here’s an example format:

Service Description Hours Worked Rate Total Website Development 10 hours $100/hour $1,000 Technical Support 5 hours $80/hour $400 By ensuring the descriptions are clear and the rates are accurate, you help your clients understand exactly what they are being charged for.

Step 3: Include Payment Information

Customize the payment terms to suit your preferences. Be sure to include details like the payment due date, acceptable payment methods (e.g., bank transfer, credit card), and any late fees for overdue payments. This will help avoid misunderstandings and ensure smooth transactions.

By following these steps, you can create a professional, tailored document that will streamline your billing process and make it eas

Common Mistakes in IT Billing

Inaccurate billing is a common issue in the IT industry and can lead to misunderstandings, delayed payments, and strained client relationships. Many service providers make avoidable mistakes that could be easily corrected with careful attention to detail. In this section, we’ll highlight some of the most frequent errors and offer tips on how to avoid them.

1. Lack of Detailed Descriptions

A frequent mistake is providing vague or incomplete descriptions of the work performed. This can lead to confusion or disputes over what was actually delivered. Clients may challenge charges if they don’t clearly understand the value of the services rendered. To avoid this:

- Be specific: List the tasks completed, hours worked, and any deliverables provided.

- Use clear terminology: Avoid jargon that the client may not understand.

- Include project milestones: Break down large projects into smaller, well-defined tasks to make charges more transparent.

2. Incorrect Calculations

Errors in calculating hours worked, hourly rates, or total amounts due are another common issue. Such mistakes can cause discrepancies that delay payments or damage your professional reputation. To prevent calculation errors:

- Double-check figures: Always review the numbers before sending the billing document.

- Use automated tools: Consider using software or spreadsheets that can automatically calculate totals and apply discounts or taxes.

- Break down charges: Include a clear breakdown of each service charge to make it easier to verify totals.

3. Missing or Unclear Payment Terms

One of the biggest sources of confusion is failing to clearly communicate the payment terms. Without specifying due dates, accepted payment methods, or late fees, clients may delay payments or misunderstand when and how to pay. To avoid this:

- Clearly state due dates: Be explicit about when payment is expected, and include penalties for late payments.

- List payment methods: Indicate the ways clients can pay (bank transfer, check, credit card, etc.).

- Set clear conditions: If there are discounts for early payment or additional fees for delayed payments, ensure these are clearly mentioned.

By avoiding these common mistakes, you can ensure that your billing process is smooth, accurate, and professional, helping you maintain positive client relationships and timely payments.

Choosing the Right Format for Billing Documents

Selecting the right structure for your billing documents is crucial to ensuring clarity, efficiency, and professionalism in your transactions. Whether you prefer a digital or printed format, the layout should be simple, easy to understand, and tailored to the services you provide. This section will help you choose the most effective format for your business needs.

1. Digital vs. Paper Formats

One of the first decisions to make when choosing a structure is whether to use a digital or printed document. Each option has its advantages:

- Digital formats: Are often more convenient and faster to deliver. They can be emailed instantly, and many software tools allow you to create and store documents efficiently.

- Printed formats: Can be used for clients who prefer hard copies or require them for record-keeping purposes. Printed documents may be more formal, but they can also be slower to deliver and harder to manage over time.

2. Pre-Designed Layouts vs. Custom Formats

Another choice is between using pre-designed layouts or creating a custom structure from scratch. Here’s a comparison:

- Pre-designed layouts: Offer quick, consistent results with little effort. They are ideal for businesses that need to send invoices regularly and want a simple, standardized format.

- Custom formats: Allow for more personalization and flexibility. If your services are unique or if you want to brand your documents with your logo and style, creating a custom format may be a better option.

3. Consider Client Preferences

When deciding on a format, always consider your client’s preferences. Some clients may prefer digital documents, while others may require paper copies. Asking clients upfront about their preferred method of delivery can help you avoid unnecessary confusion and improve your professional image.

Ultimately, the right choice will depend on your business model, the scale of your operations, and the expectations of your clients. By selecting an appropriate structure, you can streamline your billing process and make it easier for both you and your clients to manage payments.

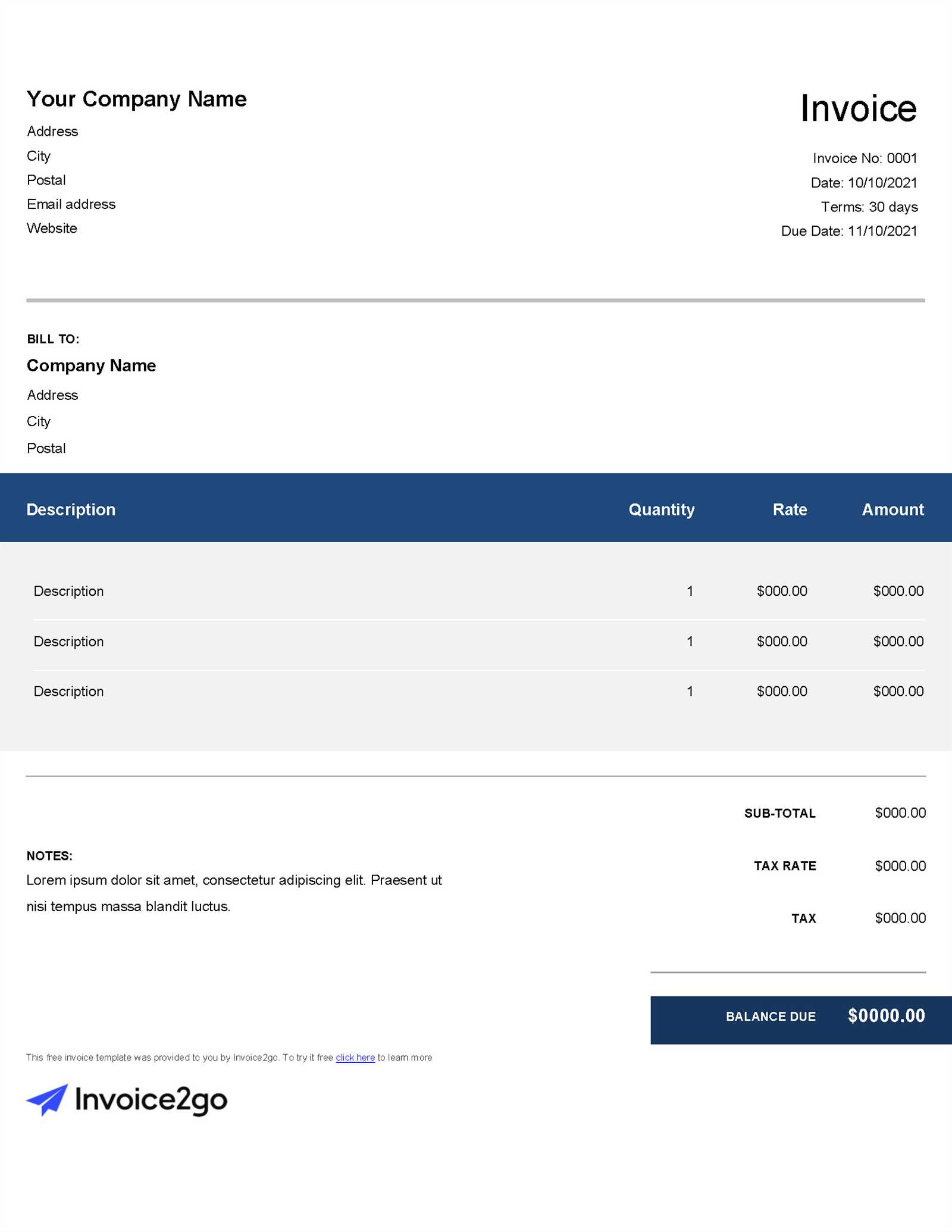

Essential Elements of an IT Billing Document

When creating a billing document for IT services, it’s important to include certain key components that will provide clarity and ensure the document is both professional and comprehensive. These elements help avoid confusion and make it easier for clients to understand what they are being charged for and why. Below, we’ll outline the critical components that should be included in any billing document for technology-related services.

Key Components of a Billing Document

A properly structured billing document should contain the following essential elements to ensure both clarity and professionalism:

Component Explanation Contact Information Include the names, addresses, and phone numbers of both the service provider and the client to facilitate easy communication. Service Description Provide a detailed description of the tasks completed, including the time spent, the nature of the services, and any relevant milestones. Rates and Charges Clearly state the hourly rates, flat fees, or any other applicable charges, ensuring transparency in pricing. Payment Terms Specify the due date for payment, any discounts for early payment, and late fees for overdue payments. Total Amount Due Summarize the total amount that is owed, including taxes, additional charges, and discounts applied. Additional Details for Clarity

In addition to these key components, including the following details can further enhance the clarity and professionalism of your billing document:

- Project Reference or ID: Including a unique reference number or project code helps both you and the client track the work more easily.

- Payment Instructions: Clarify how the client should make the payment (e.g., bank transfer, credit card) and provide the necessary account details if needed.

- Terms and Conditions: Include any relevant contractual terms, such as warranties, refunds, or dispute resolution processes, to avoid potential misunderstandings.

By ensuring that these essential elements are included in your billing documents, you help promote transparency and professionalism, ensuring smooth transactions and positive client relationships.

Benefits of Using Digital Billing Documents

Switching from paper-based billing to digital documents offers a wide range of advantages for IT professionals. The speed, convenience, and efficiency of digital formats can significantly improve the overall billing process, benefiting both service providers and clients. In this section, we will explore the key benefits of adopting digital billing practices.

1. Faster Delivery and Processing

One of the biggest advantages of digital documents is the ability to send them instantly. Instead of waiting for physical mail delivery or having to print and prepare documents manually, you can email or share the document online within minutes. This leads to quicker processing times and faster payment cycles, ensuring that your clients receive their bills on time and reducing delays in payment.

2. Easy Storage and Access

Digital documents are much easier to store and retrieve than paper-based ones. With electronic billing, you can store all your records in cloud storage or a local file system, making it simple to access any past transactions when needed. Digital records also help keep your workspace organized, reducing the clutter of paper and filing systems. Additionally, searching for specific documents is faster and more efficient with digital files.

3. Reduced Costs

Using digital formats helps eliminate the costs associated with printing, paper, and postage. These savings can add up over time, especially for businesses that handle large volumes of transactions. By reducing these overheads, you can allocate resources to other areas of your business, increasing overall profitability.

4. Enhanced Professionalism

Digital documents can be easily customized with your branding, making them appear more polished and professional. Adding your company logo, consistent fonts, and a clean layout can enhance your image and help clients see your business as modern and reliable. Furthermore, the ease with which you can share and modify digital documents helps to avoid errors and ensures that all relevant information is always up-to-date.

5. Environmentally Friendly

By switching to digital documents, you contribute to sustainability efforts. Reducing paper usage and avoiding the environmental impact of physical mail not only lowers your carbon footprint but also aligns your business with eco-friendly practices that many clients appreciate.

Overall, adopting digital billing documents offers significant advantages in terms of speed, cost, organization, and professionalism. These benefits can help streamline your business processes and provide better service to your clients.

How to Calculate IT Service Fees

Determining the appropriate fees for IT services is essential for maintaining profitability and ensuring fair compensation for your work. The way you calculate your charges will depend on various factors, such as the nature of the services, the time required, and any additional costs involved. In this section, we will guide you through the process of calculating service fees accurately and fairly.

1. Hourly Rate Calculation

Many IT professionals charge based on the time spent providing services. To calculate your hourly rate, consider the following:

- Base Rate: Determine the standard hourly rate for your expertise and the services you provide. Research industry standards and adjust according to your experience and location.

- Overhead Costs: Factor in your business expenses such as software subscriptions, equipment, and office supplies that contribute to the service delivery.

- Profit Margin: Add a reasonable profit margin to your base rate to ensure your business remains sustainable and profitable.

For example, if your base rate is $75 per hour, and you want to add a 20% profit margin, your final hourly rate would be $90 per hour.

2. Fixed Price for Project-Based Work

For larger projects that have a clearly defined scope, you might prefer to offer a flat rate. To calculate a fixed price for a project, follow these steps:

- Estimate the Time: Calculate the number of hours required to complete the entire project.

- Estimate Additional Costs: Include any additional expenses that may be necessary, such as third-party software, tools, or subcontractor fees.

- Apply a Margin: Add a reasonable profit margin to cover unforeseen costs and ensure a fair return on investment.

For example, if you estimate a project will take 40 hours, and the hourly rate is $90, the base charge would be $3,600. If there are additional costs of $500, you might add a 15% margin, bringing the total to $4,195.

3. Value-Based Pricing

Another approach is value-based pricing, where fees are determined based on the value of the service to the client rather than the time spent. This method is often used when delivering high-impact solutions. To calculate value-based pricing:

- Understand Client Needs: Assess how your service will impact the client’s business and how much value it will provide.

- Determine Value Delivered: Quantify the results, such as improved efficiency or increased revenue, and translate this into a fair price.

Value-based pricing can sometimes be more lucrative, but it requires a deep understanding of the clien

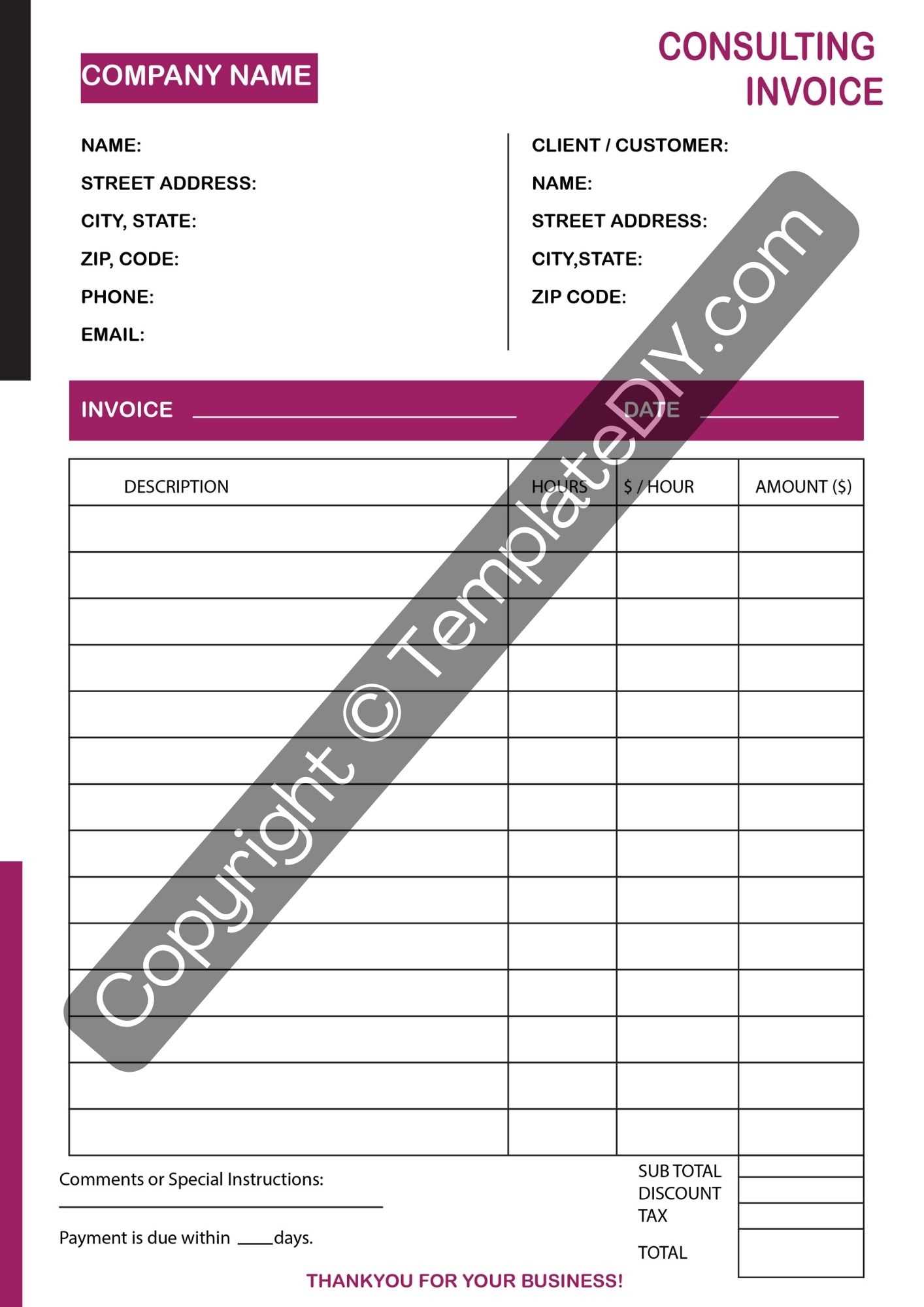

Best Practices for IT Billing Document Design

Designing a clear, professional, and easy-to-read billing document is essential for ensuring smooth transactions and avoiding any confusion for your clients. A well-structured layout not only reflects your professionalism but also helps clients understand the details of the charges without difficulty. In this section, we’ll discuss best practices for creating a billing document that is both visually appealing and functional.

1. Keep the Layout Simple and Organized

A cluttered or overly complicated document can confuse clients and delay the payment process. To ensure clarity, organize the content in a logical flow:

- Use clear headings: Separate sections like business details, services rendered, and payment terms with bold headings for easy navigation.

- White space: Ensure there is enough space between sections and lines of text to avoid a crowded appearance.

- Consistent formatting: Maintain a uniform font style, size, and alignment to create a professional, cohesive look.

2. Highlight Key Information

Clients should easily be able to spot the most important details, such as the total amount due, the payment due date, and your contact information. Use the following strategies to emphasize critical information:

- Bold key figures: Highlight important amounts such as the total due or taxes in bold or with a larger font size.

- Use color sparingly: If your document allows for color, use it sparingly to draw attention to key sections, such as “Due Date” or “Amount Due.”

- Section separations: Visually separate sections like itemized charges, payment instructions, and contact information using borders or spacing.

3. Include Necessary Details for Transparency

To avoid disputes or confusion, always ensure that the document includes all relevant information, including:

- Accurate descriptions: Clearly describe the services provided and the time spent, with precise dates or hours worked.

- Payment terms: Be clear about the payment method, due date, and any penalties for late payments.

- Contact information: Include your company name, address, phone number, and email to make it easy for clients to reach out if they have questions.

By following these best practices for design, you can create billing documents that enhance your professional image, reduce misunderstandings, and promote quicker payments.

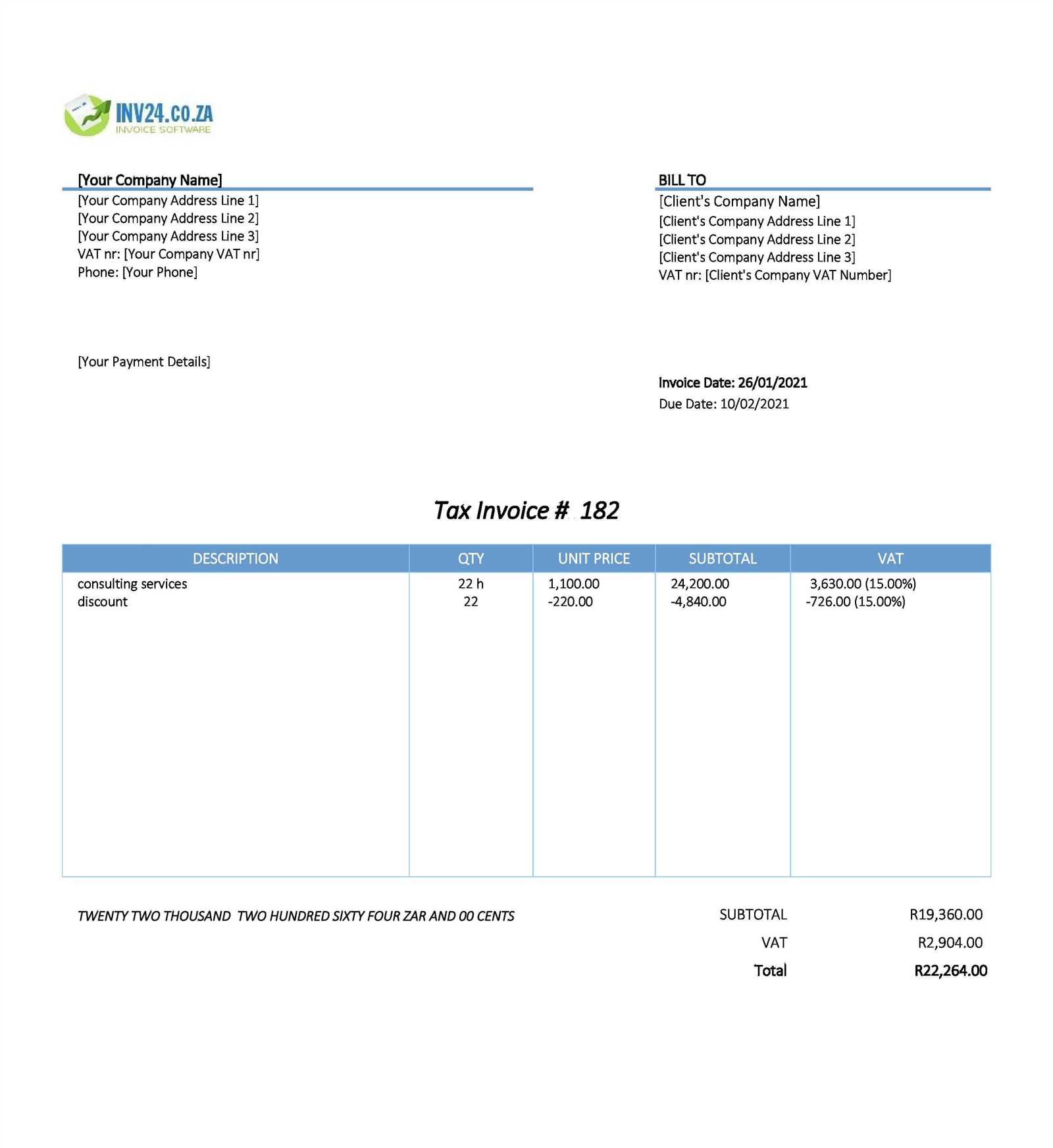

How to Add Taxes and Discounts

When preparing a billing document for your IT services, it’s essential to account for taxes and discounts. Properly calculating and displaying these adjustments ensures transparency and compliance with tax regulations. This section will guide you through the process of adding taxes and applying discounts accurately, helping you create a clear and professional document for your clients.

1. Adding Taxes to the Total Amount

Taxes are an integral part of most service transactions. To correctly add taxes to your billing document, follow these steps:

- Determine the Tax Rate: Research the applicable sales tax rate for your location or the client’s jurisdiction. This could vary by region or country.

- Calculate the Tax Amount: Multiply the subtotal of your services by the tax rate. For example, if your subtotal is $1,000 and the tax rate is 8%, the tax amount would be $80.

- Display the Tax Clearly: Include a separate line or section on the document to show the tax amount being added to the subtotal.

2. Applying Discounts

Offering discounts can be a great way to incentivize clients, especially for long-term projects or early payments. Here’s how you can apply them effectively:

- Specify the Discount Type: Whether it’s a percentage or fixed amount, ensure the type of discount is clearly stated.

- Calculate the Discount: For a percentage-based discount, multiply the subtotal by the discount percentage. For a fixed discount, simply subtract the given amount from the subtotal.

- Apply the Discount to the Subtotal: After calculating the discount, subtract it from the subtotal to determine the new total.

- Show Discount Clearly: Just like taxes, list the discount as a separate line item to ensure clarity.

3. Example of Taxes and Discounts Calculation

The following table illustrates how taxes and discounts can be calculated and displayed on a billing document:

Description Amount Service Subtotal $1,000.00 Discount (10%) -$100.00 Tax (8%) $72.00 Total Due $972.00 In this example, the subtotal is $1,000. A 10% discount is appli

Legal Considerations for IT Billing Documents

When creating billing documents for IT services, it is essential to ensure that they comply with legal requirements and protect both the service provider and the client. Legal considerations help prevent disputes, clarify the terms of payment, and ensure that the transaction is legally binding. This section will cover the key legal aspects to consider when drafting billing statements for your IT business.

1. Clear Terms and Conditions

Every billing document should include a clear and concise statement of the terms and conditions of the transaction. This may include payment due dates, late fees, and any other stipulations that apply to the service agreement. Be sure to:

- Specify payment terms: Indicate the expected payment due date, whether it’s immediate, net 30, or another arrangement.

- Late fees and penalties: If applicable, state the interest or penalties that will apply if payments are overdue.

- Refund and cancellation policies: Outline any refund policies or terms for canceling services to avoid future misunderstandings.

2. Accurate Representation of Services

It is critical that the services listed in the billing document accurately reflect the work completed. Misrepresentation of services can lead to disputes or legal action. Make sure that:

- Describe the services clearly: Include specific details of what was provided, the time spent, and any milestones or deliverables.

- Provide proof of work: Attach supporting documents or evidence that demonstrate the work completed if needed for verification.

3. Tax Compliance

Ensure that you comply with the relevant tax laws when preparing your billing documents. Different regions may have specific requirements regarding the collection of taxes on services. To stay compliant:

- Include tax details: Clearly state any applicable sales tax or value-added tax (VAT) on the document, based on the location of your business and client.

- Register for tax purposes: Ensure that your business is registered for tax collection and remittance if required by local tax authorities.

- Accurate tax calculation: Always calculate taxes accurately and be aware of different rates that may apply based on location or type of service.

4. Retaining Proof of Payment

It is important for both the service provider and the client to keep records of all payments made. You sho

Automating Billing Document Generation for Efficiency

Manually creating billing documents can be time-consuming and prone to errors, especially for businesses that handle a large number of transactions. Automating the process of generating these documents not only saves time but also reduces the risk of mistakes and ensures consistency. In this section, we will explore how automating the creation of billing records can enhance operational efficiency, streamline workflows, and improve overall business performance.

1. Benefits of Automation

Automation can significantly improve the billing process for IT service providers. Some of the key advantages include:

- Time-saving: Automatically generate documents based on predefined templates, reducing the need for manual entry.

- Accuracy: Automation minimizes human errors by automatically calculating totals, taxes, and discounts.

- Consistency: Using automated systems ensures that all documents follow the same format and structure, maintaining a professional appearance.

- Faster Processing: Automation speeds up the generation and sending of billing documents, which can lead to quicker payment cycles.

2. Tools for Automating Billing Documents

There are various tools available that can help you automate the creation and management of billing documents. Some options include:

- Accounting Software: Platforms like QuickBooks, Xero, and FreshBooks can generate billing records with a few clicks based on your service data.

- Custom Billing Systems: Businesses can integrate automated systems into their existing software to generate documents directly from time-tracking and service logs.

- Cloud-Based Solutions: Cloud platforms allow you to access automated billing systems from anywhere, with real-time data synchronization and document generation.

- API Integrations: For more advanced automation, APIs can connect your time-tracking, project management, and accounting tools to streamline the billing process.

3. Setting Up an Automated Billing Workflow

To take full advantage of automation, you’ll need to establish an efficient workflow. Here’s how to get started:

- Define Billing Parameters: Set up rules for how charges, taxes, discounts, and payment terms should be calculated based on your services.

- Integrate Data Sources: Ensure that your project management or time-tracking systems are connected to your billing tool so data flows seamlessly.

- Choose Template Options: Select a format and structure for your documents that can be used consistently across all transactions.

- Automate Delivery: Set up automatic email notifications or integrations with your client portal to send documents directly after they are generated.

4. Key Considerations for Automation

While automation offers numerous benefits, there are a few key factors to keep in mind to ensure a smooth implementation:

- Customization: Make sure that the automated system can accommodate any specific needs or unique terms for your services.

- Data Accuracy: Ensure that all data inputs, such as hours worked and service rates, are accurate to avoid discrepancies in the final document.

- Security: Automating billing means handling sensitive financial information, so make sure the software you use is secure and complies with data protection regulations.

- Regular Updates: Automate updates for tax rates and service charges to ensure that your documents reflect the most current rates.

By adopting an automated approach to generating billing documents, you can eliminate the burden of manual calculations and create an efficient, error-free process that saves ti

What to Include in Payment Terms

Establishing clear and precise payment terms is essential to ensure that both the service provider and the client are on the same page regarding expectations and timelines. Well-defined terms help avoid confusion and disputes, ensuring smooth financial transactions. In this section, we will explore the key elements to include in your payment terms to foster transparency and streamline the payment process.

1. Payment Due Date

Clearly specifying when the payment is expected is crucial for setting proper expectations. The due date provides both parties with a clear timeframe for completing the transaction. Here’s how to define it:

- Specific Date: Indicate the exact date when payment is due (e.g., “Payment due by March 1st”).

- Payment Period: For longer timelines, define the payment period, such as “Net 30” (meaning payment is due within 30 days of the billing date).

- Early Payment Discounts: Offer incentives for early payments, like a 2% discount for payments made within 10 days.

2. Accepted Payment Methods

Specify the methods of payment that are accepted. This provides clarity on how clients can settle their bills, reducing delays caused by uncertainty or technical issues. Common options include:

- Bank Transfers: Provide bank details for wire transfers or ACH payments.

- Credit Cards: Include details on accepting payments via credit card and whether there are any associated processing fees.

- Online Payment Platforms: Platforms like PayPal, Stripe, or other digital payment systems can be included as alternatives.

- Checks: For traditional payments, indicate whether checks are accepted and where they should be mailed.

3. Late Payment Penalties

Late payments can affect your business’s cash flow. To encourage timely payments, it’s important to include penalties for overdue amounts. Some options are:

- Interest Charges: Apply an interest rate (e.g., 1.5% per month) on overdue balances to encourage clients to pay on time.

- Late Fees: Charge a flat fee for overdue payments (e.g., $25 after 30 days).

- Suspension of Services: State that services will be suspended or halted if payment is not received within a certain period (e.g., after 60 days).

4. Currency and Taxes

Clarify the currency in which the payment is expected and any taxes that may apply. This ensures that clients understand the full financial scope of the transaction. Points to cover include:

- Currency: Specify whether payments should be made in US dollars, euros,

How to Handle Late Payments

Dealing with late payments can be a common challenge for businesses, but it is essential to have a strategy in place to manage these situations effectively. Delays in payment can disrupt your cash flow and affect your ability to run operations smoothly. Having clear procedures for addressing overdue accounts helps maintain a positive relationship with clients while ensuring your business is compensated fairly and promptly.

1. Set Clear Payment Terms

Preventing late payments starts with setting clear, transparent payment terms upfront. Be specific about due dates, acceptable payment methods, and consequences for late payments. Key points include:

- Due Dates: Clearly specify the date by which payment is expected, whether it is immediately, in 30 days, or on a particular date each month.

- Late Fees: Include terms for interest or penalties on overdue payments to encourage timely payments.

- Payment Methods: List acceptable methods of payment (e.g., bank transfer, credit card, online platforms), making it easier for clients to pay promptly.

2. Send Friendly Payment Reminders

If a payment is missed, start with a friendly reminder. This could be a polite email or phone call to notify the client of the overdue balance. Consider the following strategies:

- First Reminder: Send a gentle reminder shortly after the due date, offering assistance if there is any issue with the payment process.

- Follow-Up Communication: If the first reminder doesn’t result in payment, follow up again with more urgency, detailing the overdue amount and any late fees that apply.

- Be Professional: Always maintain a professional tone, even if the payment delay is frustrating. This will help preserve your client relationship.

3. Offer Payment Plans

For clients experiencing financial difficulties, offering a payment plan can be a good solution. This approach allows you to maintain cash flow while being understanding of the client’s situation. To implement a payment plan:

- Assess the Situation: Understand the reason for the late payment. If it’s a temporary issue, offering a flexible payment schedule may be appropriate.

- Define Terms: Set clear terms for the installment plan, such as the amount of each payment and the due dates for each installment.

- Document the Agreement: Make sure the revised terms are documented and agreed upon by both parties to avoid future confusion.

4. Charge Interest or Late Fees

If reminders and payment plans do not resolve the issue, you may need to enforce your late fee policy. Charging interest or a late fee is a common method to incentivize prompt payment. Consider the following:

- Interest Charges: Apply an interest rate (e.g., 1.5% per month) on overdue amounts to encourage timely payment.

- Flat Late Fees: Charge a flat fee for overdue payments, such as a $25 fee after a certain number of days.

- Reinforce Consequences: Be clear about the consequences of continued late payments, including suspension of services or legal action if applicable.

5. Suspend Services or Contracts

If late payments continue to be an issue, you may need to suspend services or halt work until payment is received. This step is often effective in getting the client’s attention. Steps include:

- Notification: Notify the client in advance that services will be suspended if payment is not received within a specific period.

- Clear Terms: Ensure that your service agreement cle

Tracking Payments Using Invoice Templates

Efficiently managing and tracking payments is crucial for maintaining smooth financial operations. By incorporating well-structured documents for billing, businesses can ensure they stay organized, meet deadlines, and avoid missing payments. Using a standardized document for tracking payments allows you to easily monitor the status of each transaction, making it easier to follow up on overdue amounts and reconcile accounts.

1. Key Elements for Payment Tracking

To effectively track payments, certain fields must be included in your documents to capture essential transaction details. These fields ensure that you have all the necessary information to monitor the status of each payment:

- Payment Status: Indicate whether the payment has been received, is pending, or is overdue.

- Due Date: Clearly state when the payment is expected to be made, helping you easily identify overdue transactions.

- Amount Due: List the total amount the client owes, which helps you track any remaining balance after partial payments.

- Amount Paid: Keep track of the exact payment amounts received, making it easy to calculate the remaining balance.

- Transaction ID: For online payments, include the transaction number to easily match the payment with your records.

2. Organizing Payment Records

Keeping a systematic record of all transactions is essential for reconciling accounts and ensuring timely follow-ups. Here are a few best practices for organizing your payment records:

- Use Digital Tools: Leverage accounting or billing software to record and update payment statuses automatically. These tools can also generate reports and send reminders for overdue payments.

- Maintain a Payment Log: Create a log that lists all payments received, including the date, amount, and method of payment. This will provide a comprehensive overview of your financials.

- Regularly Update Records: Make it a habit to update payment statuses as soon as payments are made. This ensures you have real-time insights into your financial situation.

3. Automating Payment Reminders

Automation can help reduce the manual effort of tracking payments and sending reminders. Many accounting platforms offer automated features that can save time and ensure timely follow-ups. Here’s how to incorporate automation:

- Set Up Automated Reminders: Use tools that send automatic reminders to clients about upcoming or overdue payments, reducing the risk of missing payments.

- Customize Notification Triggers: Configure reminders based on your preferred timeline, such as sending a reminder a week before the due date and another when the payment is overdue.

- Track Multiple Clients: If you manage multiple clients, automate the process of tracking payments across different accounts. This helps avoid confusion and ensures you don’t overlook any outstanding payments.

4. Reporting and Reconciliation

Generating reports on payments and reconciling accounts are crucial tasks for financial accuracy. By using a consistent format to track payments, you can generate detailed