Is There an Invoice Template Available in Excel

Managing finances efficiently is a crucial task for businesses and freelancers alike. One of the most essential aspects of this process is creating accurate and professional documents for transactions. Many people seek tools that can simplify this task while ensuring a clean, organized layout. A commonly used software for this purpose is a spreadsheet program, known for its versatility and user-friendly features.

For those looking for a quick and customizable way to generate financial documents, spreadsheets can be an excellent solution. Whether you’re a small business owner or an independent contractor, using a simple, adaptable file can save both time and effort. The key lies in finding the right structure that suits your specific needs while maintaining clarity and precision.

In this article, we will explore how spreadsheet tools can assist in streamlining your billing workflow. We will also highlight ways to customize your document, ensuring it aligns with your professional standards and requirements. From basic setup to advanced features, the flexibility of spreadsheet programs offers a wide range of options to suit every billing need.

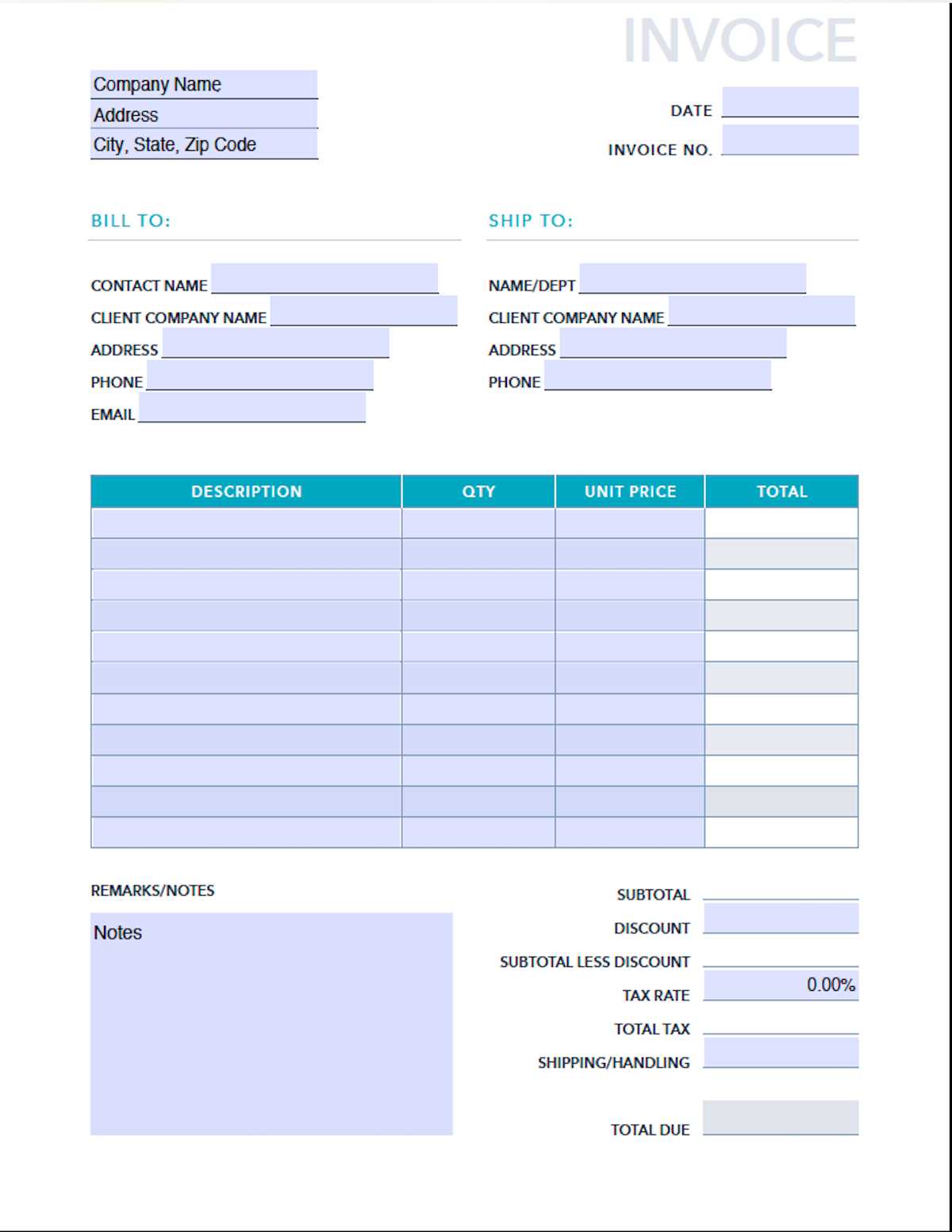

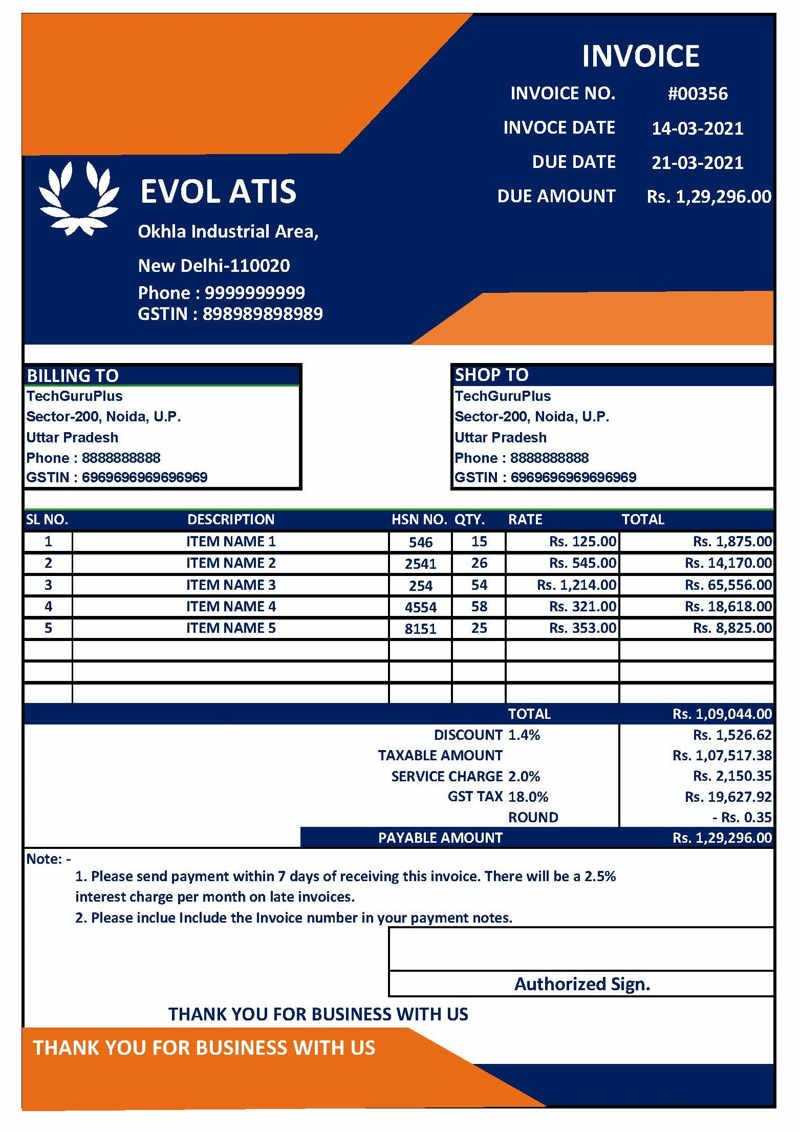

Is an Invoice Design Available in a Spreadsheet Program

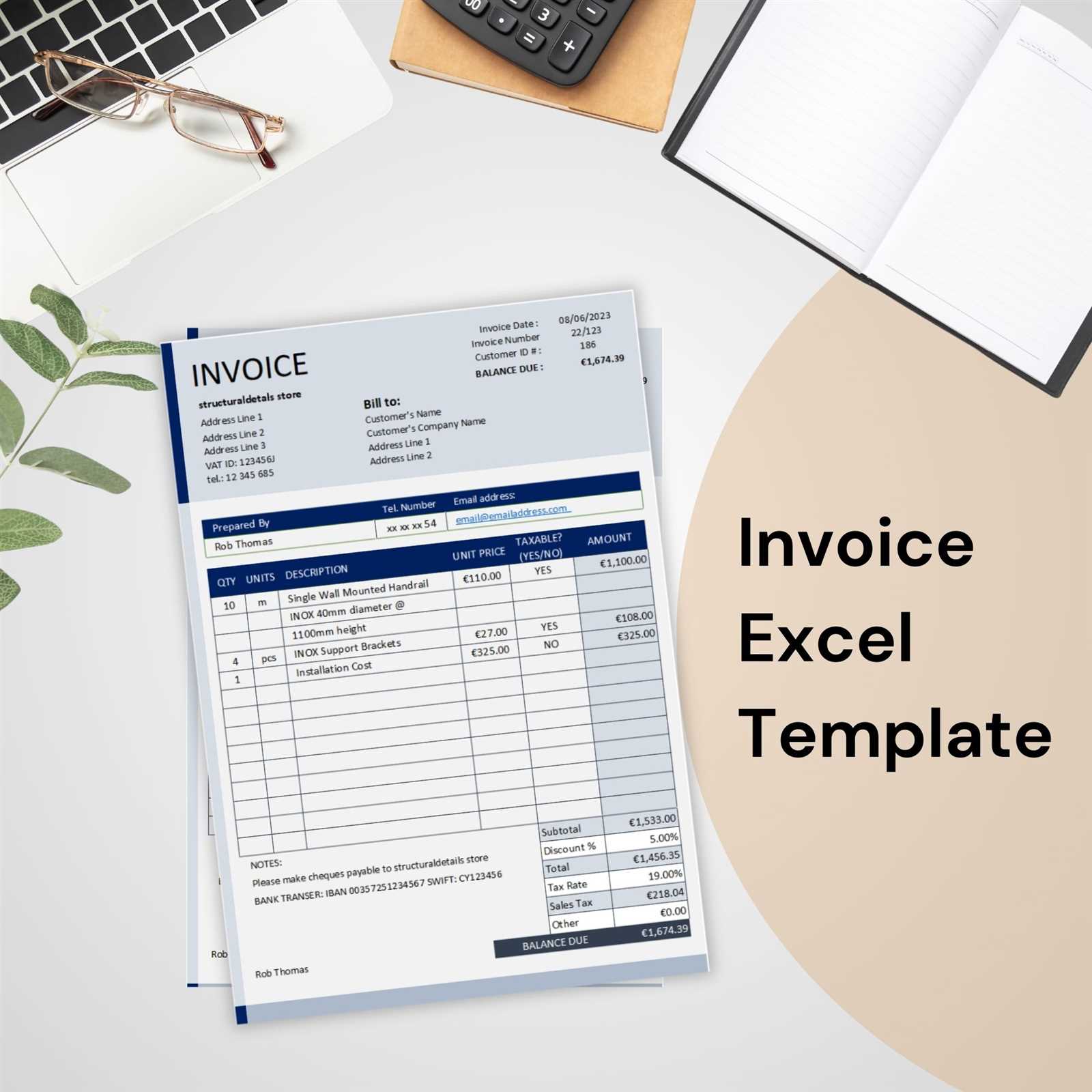

For those looking to simplify the process of creating billing documents, it’s important to know what options are available in commonly used software. Many users prefer programs that allow them to create professional-looking financial records quickly. In this case, a well-known spreadsheet tool offers multiple pre-built solutions that can easily be customized for business needs.

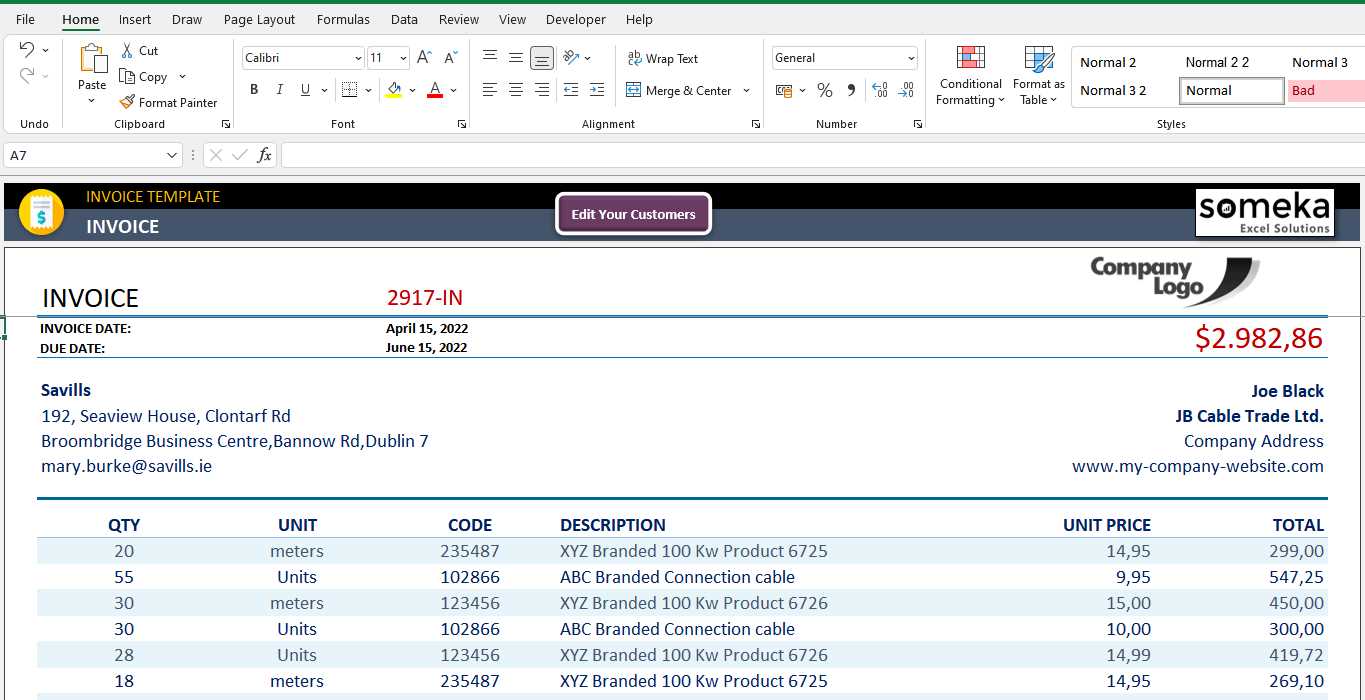

To answer the question, yes, such a solution exists in the form of pre-configured designs. These allow users to generate a detailed record of transactions without needing to start from scratch. You can customize the layout to include the necessary details, such as client information, amounts, and due dates. This can be done with minimal effort and provides an efficient method for managing payments.

Where to Find These Pre-Configured Designs

- Within the program itself: Most spreadsheet tools have built-in options for creating documents based on common formats.

- Online sources: Numerous websites offer free or paid downloads of pre-made documents that can be opened in your software.

- Third-party services: Some companies provide additional features for creating and managing billing documents that integrate with spreadsheet programs.

Benefits of Using a Pre-Made Solution

- Time-saving: No need to design a document from scratch; simply adjust it to your needs.

- Ease of customization: You can change the content, style, and structure as required.

- Accuracy: Pre-configured options ensure all essential fields are included for accurate tracking and documentation.

Understanding Spreadsheet Designs for Billing Documents

When it comes to creating professional financial records, the use of ready-made designs can significantly streamline the process. Many individuals and businesses rely on tools that offer pre-structured files, making it easy to fill in the necessary details without worrying about layout or organization. These designs provide an efficient way to track payments, manage transactions, and maintain accurate financial documentation.

The concept behind these ready-made files is simple: they offer a clean, organized structure that only requires minimal customization. Users can quickly input specific information, such as amounts, dates, and client details, ensuring their records are both accurate and visually appealing. By utilizing such a design, you avoid the time-consuming task of creating a new document from scratch, while still achieving a polished, professional result.

How These Designs Work

- Pre-structured fields: The layout is already set, so you only need to replace placeholder text with your own details.

- Formulas and calculations: Many designs include automatic calculations for totals and taxes, reducing the chance of human error.

- Adjustable elements: You can modify colors, fonts, and other visual aspects to match your company’s branding.

Key Features of These Designs

- Clarity and organization: They are structured to ensure that all necessary details are presented clearly, reducing the likelihood of misunderstandings.

- Time efficiency: Once set up, these files can be reused for multiple transactions, saving you time in the long run.

- Compatibility: Files created in spreadsheet programs are easy to share and can be opened by most users, whether they have the same software or not.

Why Use a Spreadsheet Program for Billing

Many people and businesses opt for spreadsheet programs when creating financial documents due to their versatility, ease of use, and powerful features. These tools offer the flexibility to design and manage detailed records quickly, ensuring that all the necessary information is included without much effort. Whether you are a freelancer or a small business owner, using such a program can help you stay organized and efficient in handling payment tracking.

One of the primary reasons to choose this method is its ability to automate calculations. Spreadsheets can be set up to perform math functions automatically, ensuring accuracy and saving time. Additionally, the simple interface makes it easy to input details while maintaining a professional, clean layout.

| Feature | Benefit |

|---|---|

| Customization | Adjust the layout to suit your needs, from fonts to colors and data fields. |

| Automatic Calculations | Reduce the risk of errors by using built-in formulas for totals, taxes, and discounts. |

| Ease of Sharing | Documents can be easily shared with others via email or cloud storage, compatible across platforms. |

| Affordability | Spreadsheets are often part of software suites that are either free or come at a low cost. |

Types of Billing Document Designs in Spreadsheet Programs

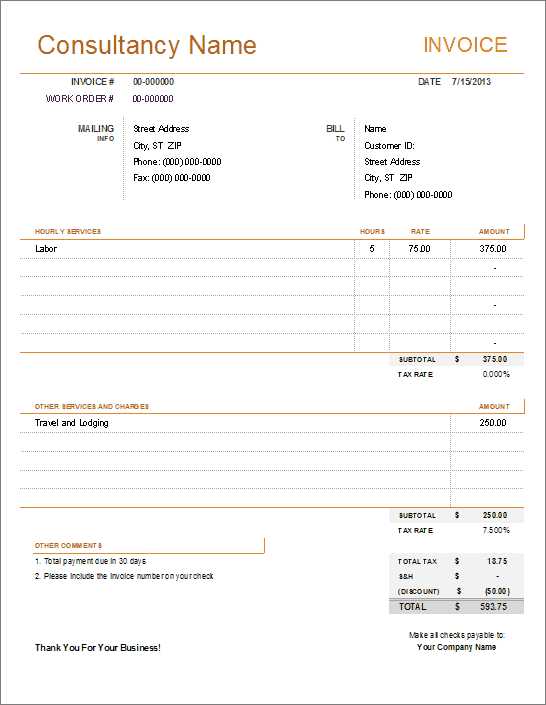

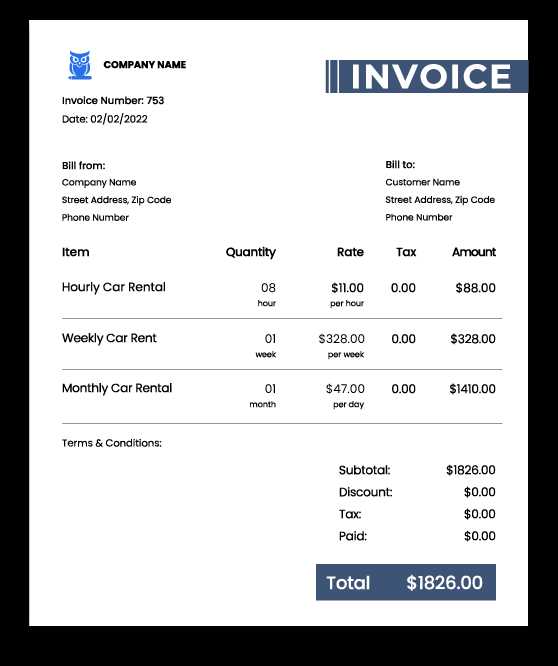

When it comes to creating professional records for transactions, different designs serve various business needs. Whether you are managing a small business or working as a freelancer, using a pre-configured document format can significantly simplify the process. These structured files offer a variety of options that cater to different styles of work, from simple one-time charges to recurring billing arrangements.

Each design serves a specific purpose, and selecting the right one can enhance your workflow and improve the overall appearance of your financial records. Below are the common categories of designs that you can choose from depending on your business needs.

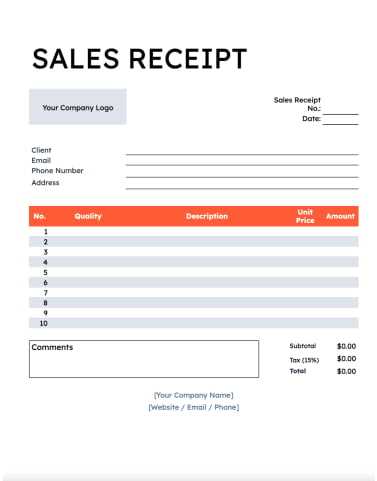

Common Types of Designs Available

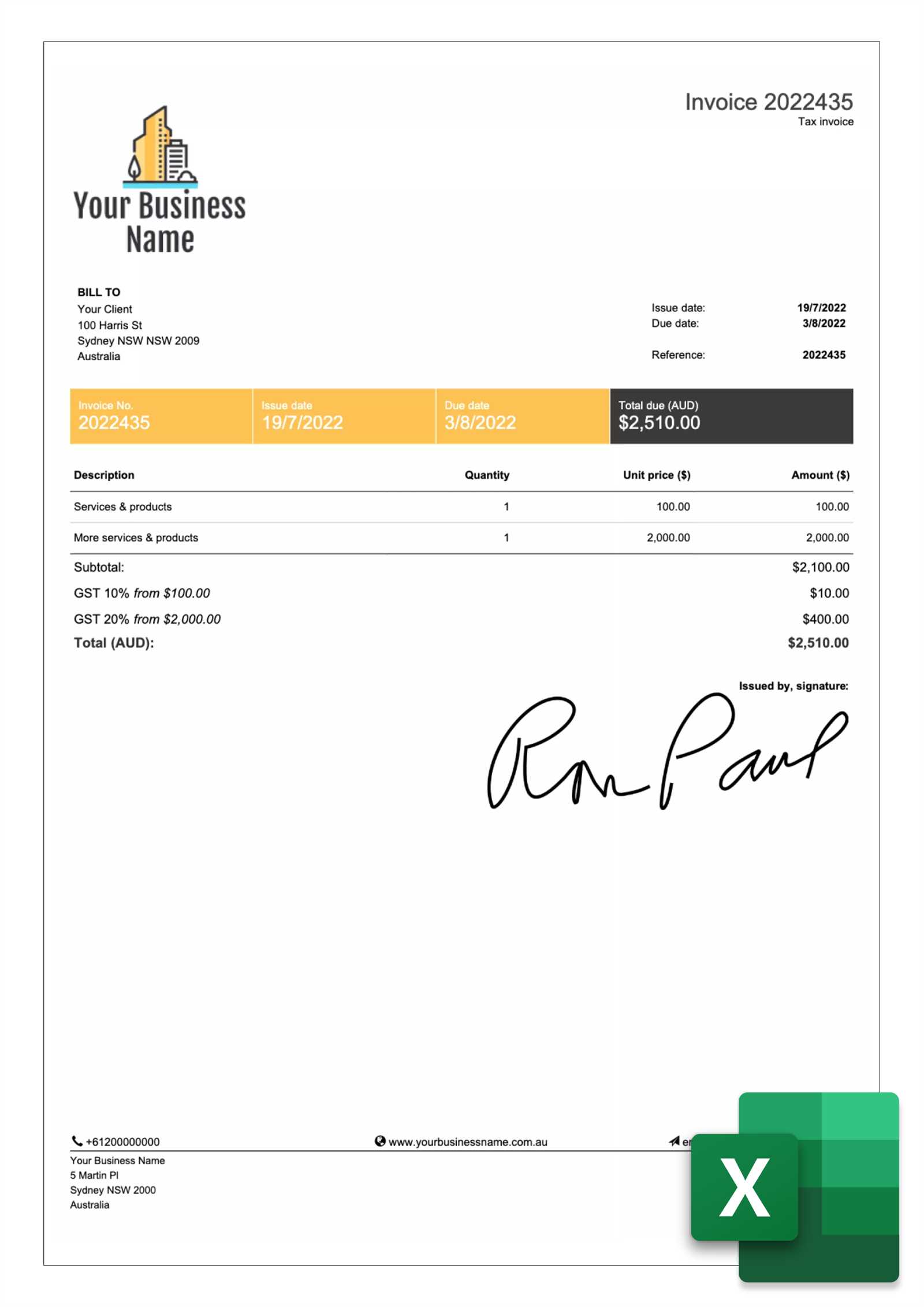

- Basic Billing Documents: Ideal for straightforward transactions, these designs contain only essential fields such as item description, quantity, price, and total amount.

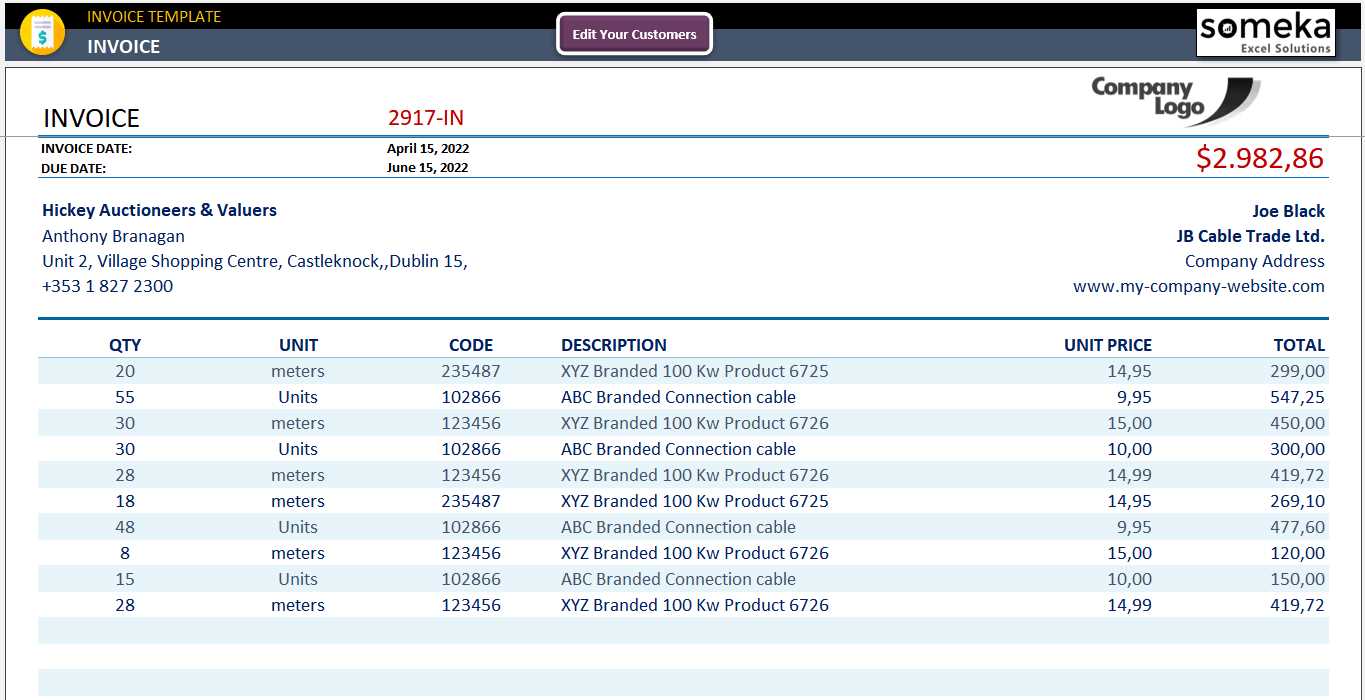

- Itemized Billing: Perfect for businesses that need to break down their charges into detailed components. This design includes a list of all items or services provided, with individual pricing for each one.

- Recurring Payments: Suitable for subscriptions or ongoing services, these designs allow users to set up regular payment intervals and include sections for payment frequency and due dates.

- Professional Custom Designs: These are more advanced, offering customizable sections and branding options. They can include logos, customized color schemes, and additional fields for tracking terms and conditions.

Choosing the Right Design for Your Business

- Consider your transaction type: If you deal with single, one-time payments, a basic document might be sufficient. For clients with recurring services, consider a design that allows for easy updates and tracking.

- Branding needs: Some designs offer more flexibility in terms of appearance, allowing you to match the document to your company’s branding.

- Complexity of your services: If you provide a range of services or products, itemized designs may be more appropriate to give clients a clear breakdown of charges.

How to Find Free Billing Document Designs

For those looking to simplify their financial record-keeping, finding a free pre-structured layout can be a valuable time-saver. Many platforms offer ready-to-use designs that can be easily downloaded and customized according to your needs. These resources are ideal for individuals or small businesses that need a professional document without the cost of expensive software or templates.

Finding these free resources is relatively simple, as many websites and even software tools provide a variety of options that can be accessed with minimal effort. Whether you need a basic design or a more complex structure, there are multiple places where you can download and start using these layouts immediately.

Where to Look for Free Designs

- Official Software Websites: Many programs offer free downloadable files as part of their service. Check the resources or templates section on the official website of your spreadsheet tool.

- Online Template Directories: Websites dedicated to hosting free document designs often offer a wide range of formats. Popular examples include platforms like Template.net or Vertex42.

- Community Forums and Blogs: Various online forums, blogs, or business websites provide free downloads of useful files, often shared by other users.

- Cloud Storage Services: Some cloud storage platforms, like Google Drive or OneDrive, feature free layouts in their template galleries, allowing users to easily find and adapt them to their needs.

How to Choose the Best Design for Your Needs

- Consider your business type: Different businesses have different requirements. Choose a format that suits your specific services or products.

- Look for ease of use: A good design should be easy to customize and update without requiring advanced knowledge of the software.

- Check compatibility: Make sure the format is compatible with the spreadsheet software you are using to avoid any technical issues when opening or editing the file.

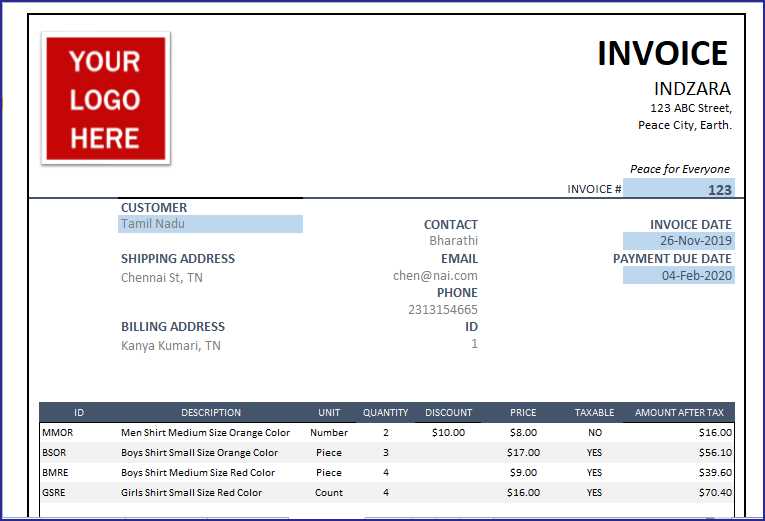

Customizing Your Billing Document Design

Once you’ve chosen a pre-made layout for your financial records, the next step is to personalize it according to your needs. Customizing the design allows you to make it more suited to your business, adding your unique branding elements and adjusting the structure to fit the types of transactions you handle. Whether you’re adjusting colors, adding your company logo, or modifying field names, personalizing the layout ensures that your document reflects your professionalism.

Customization not only makes the document visually appealing but also ensures that all necessary information is included in a way that aligns with your specific workflow. The process is simple, and even those with minimal experience in the software can make meaningful changes quickly.

How to Personalize Your Layout

- Add Your Branding: Include your logo, business name, and contact details at the top of the document to ensure that clients recognize your brand immediately.

- Modify Field Names: Change standard labels like “Amount” or “Due Date” to reflect the specific language you use in your business, making the document more tailored to your operations.

- Change the Colors: Customize the color scheme to match your brand’s colors, giving your records a cohesive, professional look.

- Adjust the Layout: If needed, modify the arrangement of the fields so that the most important information stands out or fits the way you prefer to present data.

Adding Advanced Features

- Automate Calculations: Use formulas to automatically calculate totals, taxes, or discounts, reducing manual work and the risk of errors.

- Include Payment Terms: Customize the document to include your payment policies, such as late fees or payment methods accepted, to avoid confusion later on.

- Set up Automatic Numbering: Configure the file to automatically generate unique document numbers for each transaction, ensuring organized tracking.

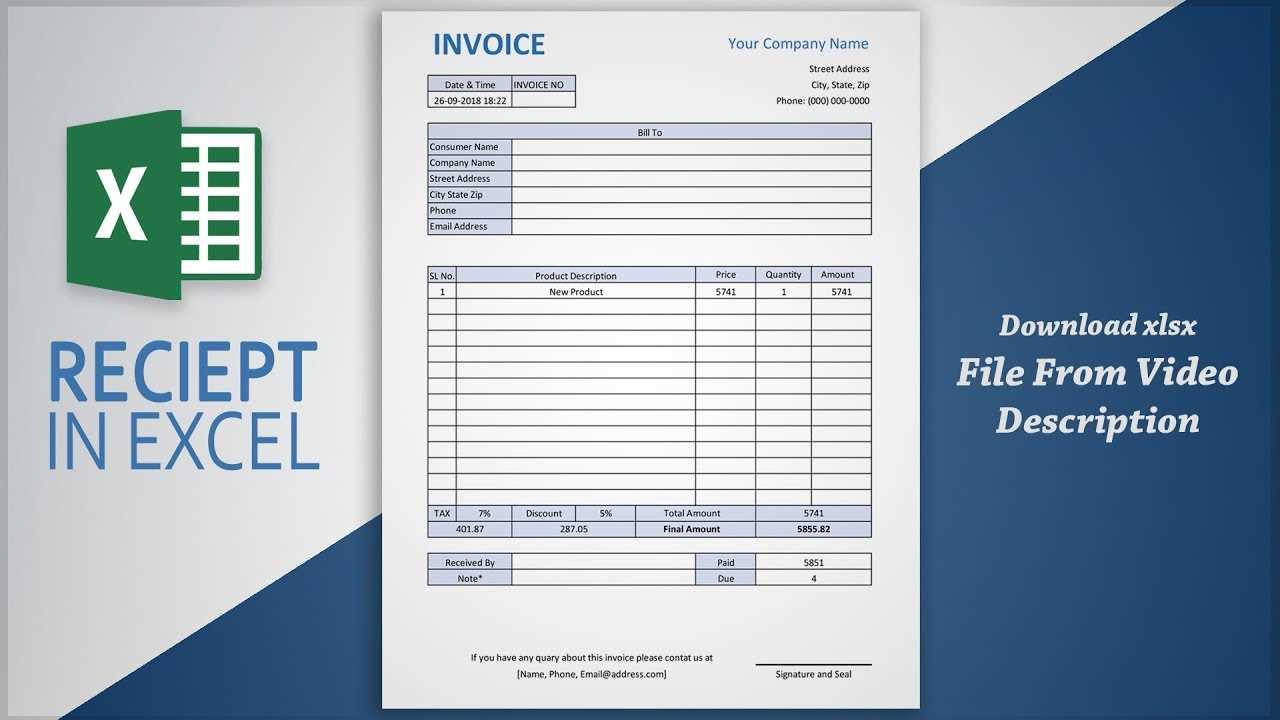

Steps to Create a Billing Document from Scratch

Creating a professional billing record from the ground up can seem like a daunting task, but with the right approach, it becomes a straightforward process. Starting with a blank document allows you to fully customize the layout and fields to suit your business needs. By following a few simple steps, you can create an efficient and professional document that meets your specific requirements.

The key is to focus on essential elements such as client information, transaction details, and payment terms. These are the building blocks of any financial record. Once the foundation is laid, you can adjust the design and structure to better reflect your business style and preferences.

Essential Components of a Billing Document

- Business Details: Include your company name, address, phone number, and email address at the top of the document.

- Client Information: Add the recipient’s name, address, and contact details. This helps ensure accurate communication and delivery.

- Date and Reference Number: Always include the date of the transaction and a unique reference number for easy tracking.

- Itemized List: List all products or services provided, including quantity, description, unit price, and total cost for each item.

- Total Amount: Include a section at the bottom with the total due, and clearly state any taxes or discounts applied.

Steps to Build the Document

- Step 1: Open a new blank document and set up the layout. Create a table or use individual text boxes for each section.

- Step 2: Input your business information at the top. Add any necessary headings or subheadings to organize the document.

- Step 3: Enter the client’s details, ensuring correct spelling and format.

- Step 4: List each product or service provided with its respective pricing and descriptions. Use formulas for automatic calculation of totals.

- Step 5: Add payment terms, due date, and any relevant notes, such as accepted payment methods or late fees.

- Step 6: Review the document for accuracy and consistency, ensuring all calculations are correct before sending it to your client.

Benefits of Using a Spreadsheet Program for Billing

Utilizing a spreadsheet tool for creating financial records offers numerous advantages, especially for small businesses and freelancers who need efficiency and accuracy. From organizing payment details to automating calculations, this software allows users to manage transactions seamlessly. Whether you’re sending a one-time record or handling recurring payments, spreadsheets can significantly enhance your workflow.

One of the primary benefits of using this tool is the flexibility it provides. Users can easily adjust the document to fit their specific needs, allowing for customization without the need for specialized software. Additionally, the built-in features of most spreadsheet tools, such as formulas and templates, ensure that even those with minimal technical expertise can create professional documents quickly.

Key Advantages of Using a Spreadsheet for Billing

- Automation: Spreadsheets allow you to set up automatic calculations for totals, taxes, and discounts, reducing manual work and the chance for errors.

- Customization: You can tailor the document’s design to fit your business style, from adding logos to adjusting the layout and content.

- Time Efficiency: Once set up, templates can be reused for multiple transactions, saving time on future records.

- Cost-Effective: Many spreadsheet tools are included in software packages that are either free or come at a low cost, making them an affordable option for businesses of any size.

- Easy Sharing: Files created in spreadsheet programs can be easily shared via email or cloud storage, ensuring that you can communicate with clients and collaborators without hassle.

Additional Features to Enhance Your Billing Process

- Organized Data Tracking: By using this tool, you can track payments, due dates, and transaction history all in one place, making it easier to follow up on overdue payments.

- Professional Appearance: Spreadsheets offer clean and clear formatting options, ensuring your records look polished and organized every time.

- Compatibility: Files can be opened on multiple platforms, so whether your client uses the same software or not, the document is accessible and editable.

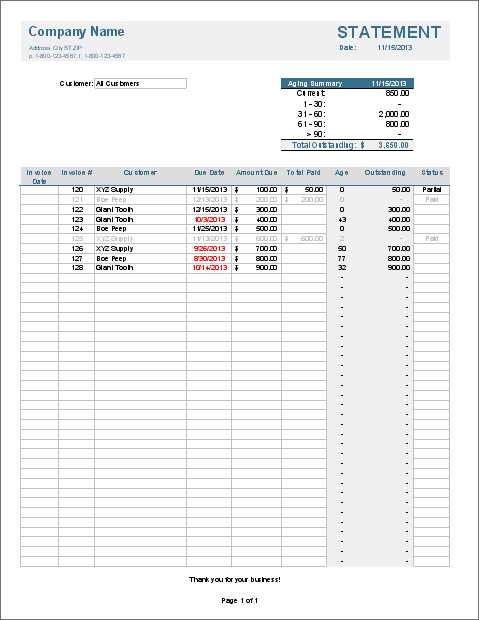

How to Use a Spreadsheet Program for Tracking Payments

Keeping track of financial records is crucial for businesses and freelancers alike. Using a spreadsheet program for managing payment details offers an organized way to monitor transactions, outstanding balances, and due dates. With the right setup, it becomes easy to track which payments have been received and which are still pending, ensuring you never miss a payment.

By using built-in functions and customizable fields, this tool can help you stay on top of all your financial activities. Whether you’re managing a few transactions or hundreds, you can set up a tracking system that works best for your needs. From automatic updates to clear visual indicators, a well-structured spreadsheet ensures you’re always informed about the status of your financial records.

Setting Up Your Payment Tracking System

- Create a Data Table: Start by creating columns for key information such as the transaction date, client name, due amount, paid amount, balance, and payment status.

- Use Conditional Formatting: Highlight overdue payments or completed transactions with different colors for easy identification at a glance.

- Automate Calculations: Set up formulas to automatically calculate outstanding balances, ensuring that totals are always up to date as payments are made.

- Track Due Dates: Include a column for due dates and use reminders to notify you when a payment is due or overdue.

How to Monitor Payment Status

- Mark Paid Transactions: Once a payment is received, update the status column to reflect that the transaction is completed.

- Use Filters: Apply filters to view only unpaid or overdue transactions, making it easier to follow up with clients when necessary.

- Generate Reports: Create summary reports to quickly assess your payment history, outstanding amounts, or client payment patterns.

Popular Spreadsheet Billing Document Features

When creating financial records using a pre-configured design, there are several key features that can make the document both functional and professional. These features are designed to streamline the billing process, reduce errors, and provide a polished, cohesive appearance. Whether you are managing simple transactions or complex business arrangements, these features can help ensure your records meet your specific needs.

From automatic calculations to customizable fields, these built-in capabilities save you time and effort, allowing you to focus on the more important aspects of running your business. Below are some of the most common and useful features found in popular billing document designs.

Essential Features for Professional Billing Records

- Automatic Calculations: Many designs include built-in formulas to calculate totals, taxes, and discounts, reducing the chance of errors and saving time.

- Customizable Fields: Easily modify sections to suit your business needs, such as adding custom payment terms, project descriptions, or client-specific details.

- Clear Payment Due Date: A prominent due date section ensures that both you and your clients know when payments are expected.

- Payment Status Tracking: Many designs include fields to track whether the payment has been received, is pending, or overdue, making it easier to follow up when necessary.

- Branding Options: Add your logo, company name, and branding colors to maintain a consistent and professional appearance that reflects your business identity.

Additional Features for Enhanced Functionality

- Itemized Breakdown: These designs often allow you to list individual items or services, with detailed descriptions, quantities, and prices, giving clients a clear understanding of charges.

- Custom Payment Methods: Some designs let you specify accepted payment methods such as credit cards, bank transfers, or checks, ensuring clarity for your clients.

- Recurring Billing Options: For businesses with subscription models or ongoing services, certain layouts include sections to easily manage recurring charges and payment cycles.

- Tax Calculation: Many designs automatically calculate sales tax or VAT, ensuring compliance with local tax regulations.

How to Add Payment Terms in a Spreadsheet

Clearly stating the payment terms in a financial record is essential to avoid confusion and ensure both parties are on the same page regarding deadlines and conditions. Adding these terms in a spreadsheet not only enhances clarity but also sets professional expectations for your clients. Payment terms can include important details like due dates, accepted payment methods, discounts, and penalties for late payments. Knowing how to properly integrate these terms into your documents can save you time and improve cash flow management.

In this section, we’ll walk you through how to add and customize payment terms in your document, ensuring all necessary information is easy to find and understand. By following these simple steps, you’ll be able to create a document that clearly outlines payment expectations for your clients.

Steps to Add Payment Terms

- Step 1: Identify the location in the document where payment terms should appear. Typically, this section is placed at the bottom or near the total amount to ensure it’s visible.

- Step 2: Create a section labeled “Payment Terms” or “Terms & Conditions.” This can be a text box or just a cell in the spreadsheet.

- Step 3: Input the specific payment conditions. This may include the due date, accepted methods (e.g., bank transfer, credit card), and any early payment discounts or late fees.

- Step 4: If applicable, add a note about penalties or interest charges for overdue payments. This ensures clarity in case of delayed payments.

- Step 5: Adjust the formatting to make the payment terms stand out. Consider bolding the heading and using bullet points for easier readability.

Customizing Payment Terms for Different Clients

- Flexible Deadlines: For clients with long-term contracts or projects, you may want to offer extended payment deadlines. Include the specific dates and the duration of any grace periods.

- Payment Method Preferences: Customize this section based on the client’s preferred payment method. If some clients pay by check while others use online payment systems, make sure to note these preferences.

- Discounts and Late Fees: If you offer discounts for early payments or impose fees for overdue payments, make these terms clear by specifying the percentage or flat amount, along with the timing.

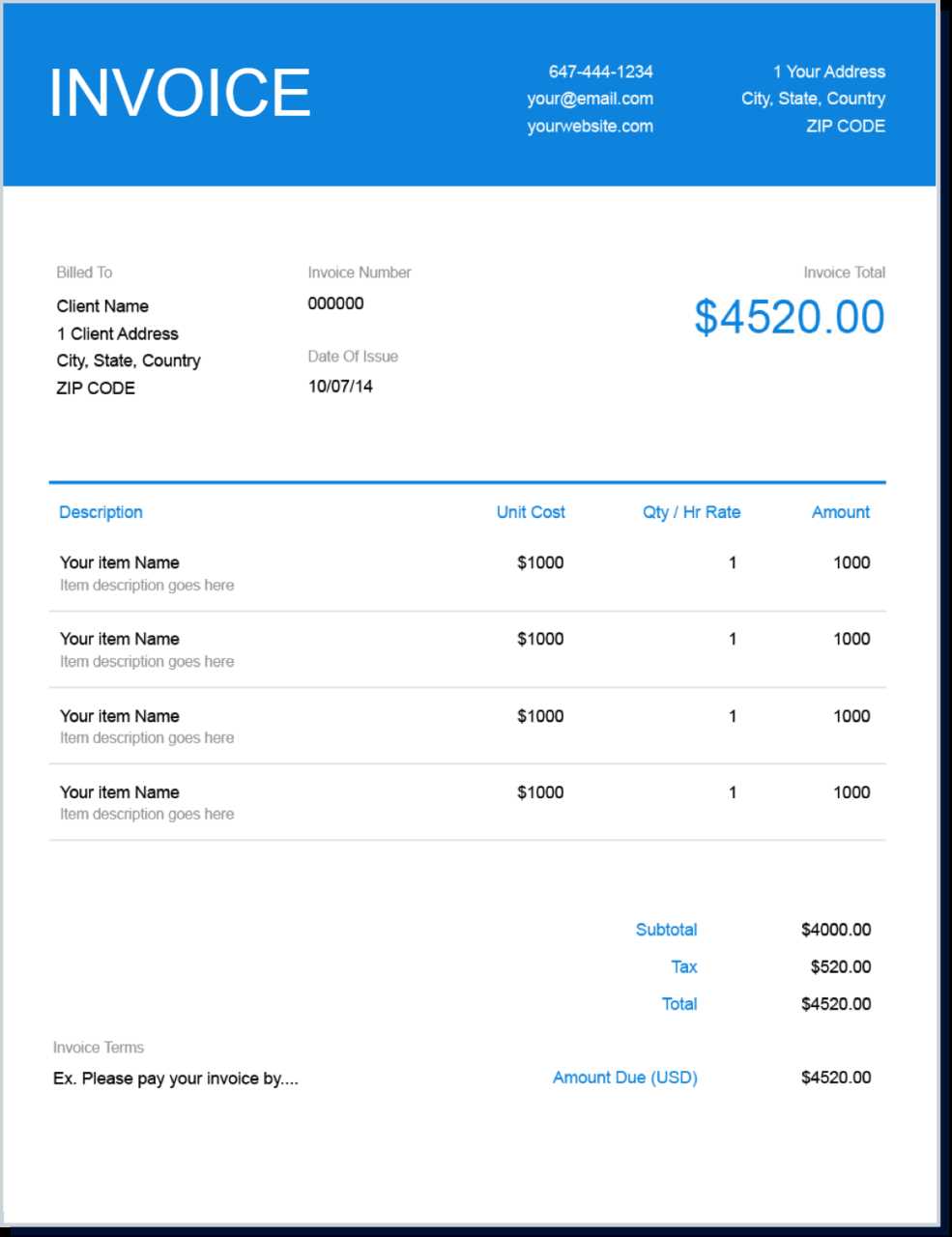

Document Formatting Tips for Billing in a Spreadsheet

Properly formatting a financial record is crucial for ensuring clarity, professionalism, and ease of use. A well-organized layout helps clients understand the details of their payment, making the document look clean and polished. Good formatting not only improves readability but also ensures that the necessary information stands out, such as due dates, totals, and payment instructions. With the right adjustments, you can create a document that’s both functional and visually appealing.

In this section, we will provide you with several key formatting tips to enhance the appearance and effectiveness of your financial records. These simple changes can make your document easier to read and more attractive, whether it’s being printed or sent digitally.

- Keep it Clean and Simple: Avoid clutter by using enough white space around sections and limiting the use of unnecessary colors or fonts. A minimalist design helps ensure that the most important information is highlighted and easy to spot.

- Use Bold for Key Information: Bold the most important details such as due dates, total amounts, and payment terms. This draws attention to the areas that matter most to your client.

- Align Your Data Properly: Ensure that text, numbers, and headings are aligned correctly. For example, right-align monetary values and quantities to improve readability and ensure consistency across rows and columns.

- Highlight Totals and Due Dates: Make sure the total amount and due date are prominently displayed in a larger font size or a shaded box, making them easy for clients to locate quickly.

- Use Borders Wisely: Adding light borders around sections or tables can help differentiate between various parts of the document, like the list of items, the payment section, and the contact details. However, don’t overuse them, as too many lines can make the document appear crowded.

- Choose Readable Fonts: Stick to clean, professional fonts like Arial, Calibri, or Times New Roman. Ensure the font size is readable (10-12 pt), with headings slightly larger to provide structure and hierarchy.

By applying these formatting tips, you will ensure that your document is not only easy to read but also looks professional and well-organized, providing a seamless experience for both you and your clients.

How to Automate Billing Calculations

Automating the calculation of totals, taxes, discounts, and balances can significantly streamline the process of creating financial documents. By utilizing formulas and functions, you can reduce human error, save time, and ensure that all amounts are accurate and up-to-date. With automation in place, all you need to do is input the necessary data, and the document will handle the rest, from summing up charges to applying the correct tax rate.

In this section, we’ll explore how to set up automated calculations that will simplify the process and increase the efficiency of your financial record-keeping. With a few simple steps, you can create a more effective and error-free system for managing your transactions.

Essential Calculations to Automate

- Total Price Calculation: Use a multiplication formula to calculate the total cost for each item by multiplying the quantity by the unit price. Then, sum all the totals for an overall amount.

- Tax Calculation: Automatically apply the appropriate tax rate to the subtotal by using a percentage formula. This ensures tax is correctly calculated every time.

- Discounts: Set up a formula that calculates a discount based on the percentage you offer, and subtract it from the subtotal or total price.

- Balance Due: Deduct any payments received or deposits made from the total amount, leaving only the balance due. This can be automated by referencing specific payment cells.

How to Set Up Automated Calculations

- Step 1: Enter the data for each item, such as quantity, price per unit, and any discount percentages or payment amounts.

- Step 2: Create a formula for each calculation–multiply quantity by price for the total per item, apply tax percentages, and subtract discounts where needed.

- Step 3: Use the SUM function to add up all item totals, taxes, and discounts to get a final sum or balance due.

- Step 4: Test the formulas by changing some input values to ensure that the document adjusts automatically and calculates correctly.

- Step 5: Once you’re satisfied, save your document and reuse it for future transactions, knowing that calculations will be performed automatically every time.

By automating these calculations, you ensure your billing records are always accurate and reduce the time spent on manual updates, allowing you to focus more on other aspects of your business.

Setting Up Document Numbers in a Spreadsheet

Organizing and tracking financial records often requires assigning unique identifiers to each entry for better management and reference. A sequential numbering system can help streamline this process, ensuring that each document is distinct and easy to locate. By setting up automatic number generation, you can save time and avoid the confusion that may arise from manually inputting numbers. This method also helps maintain a consistent format, which is crucial for keeping accurate records over time.

In this section, we’ll discuss how to set up a system that automatically generates document numbers, making it easier to manage your records and stay organized. With a few simple steps, you can create a well-structured numbering system that will work for any of your financial documents.

How to Set Up Sequential Document Numbers

- Step 1: Select the cell where the number will appear. Typically, this will be in a dedicated field at the top of the document or in the header row.

- Step 2: Input the first number in the sequence (for example, “001” or “0001”). This will serve as the starting point for the numbering system.

- Step 3: Use the fill handle to drag the number down or across to the next rows or columns. The spreadsheet will automatically increment the numbers in sequence (e.g., 001, 002, 003).

- Step 4: If you prefer a specific format (such as including letters or dates), adjust the first number accordingly, and the program will continue the sequence with that format.

- Step 5: Alternatively, use a formula to create a custom sequence. For example, you can combine the current year and a sequential number (e.g., “2024-001”) by using the CONCATENATE function.

Advanced Tips for Customizing Numbering Systems

- Automatic Numbering with Date Integration: Include the current date in the number for better tracking, such as “2024-001,” “2024-002,” and so on. This can be set up using a combination of date and sequential number functions.

- Resetting Numbering Periodically: If you want to restart the numbering each month or year, simply adjust the formula or manually reset the starting number at the beginning of each new period.

- Preventing Number Duplicates: Use formulas to check if a number already exists in the list. This ensures each document number is unique, avoiding any accidental duplication.

By automating the numbering system, you can ensure consistency and efficiency in your records while reducing the risk of errors in your financial documentation process.

Billing Document Solutions for Small Businesses

For small business owners, managing financial records efficiently is essential for staying organized and ensuring timely payments. Using a pre-designed structure for creating billing documents can simplify this task, saving valuable time and reducing errors. These structures can be customized to fit various needs, from simple one-time transactions to recurring payments, and are perfect for small operations looking to streamline their accounting process.

By utilizing a structured layout, small businesses can quickly generate professional-looking records that include all necessary details, such as client information, payment terms, and totals. This not only improves the accuracy of financial documentation but also enhances the professionalism of interactions with clients.

Using a structured design for billing documents allows small business owners to focus more on growing their business rather than spending time on complicated record-keeping tasks. This solution helps create consistency across all transactions and offers a clear, easy-to-read summary of financial activities.

Limitations of Spreadsheet Billing Solutions

While using a pre-designed structure for creating financial records offers many benefits, there are certain limitations that users should be aware of. These solutions may not always be suitable for businesses with complex billing needs or those that require advanced features such as automatic reminders, payment tracking, or integration with other accounting software. In some cases, relying on manual input and basic functions can lead to inefficiencies or errors, especially as the volume of transactions grows.

Additionally, spreadsheets may lack the flexibility and scalability that dedicated accounting software offers, making them less ideal for companies that need more advanced functionality, such as inventory management or detailed reporting. As a result, users should carefully consider their business’s needs and the limitations of these solutions before deciding if they are the right fit.

Here are some common limitations that small businesses may face when using a spreadsheet-based billing structure:

- Limited Automation: While basic calculations can be automated, more advanced tasks like payment reminders, automatic updates, or recurring billing require manual input or additional tools.

- Potential for Errors: Spreadsheets are prone to human error, especially when working with large volumes of data or complex formulas. Incorrect inputs or formula mistakes can lead to inaccurate records.

- Scalability Issues: As businesses grow, the number of transactions may increase to a point where managing all the documents in a spreadsheet becomes cumbersome and inefficient.

- Lack of Integration: Unlike specialized accounting software, spreadsheets don’t integrate easily with other business systems such as inventory management, customer relationship management (CRM), or payment gateways.

- Limited Reporting Features: Spreadsheets can generate basic summaries, but they lack the sophisticated reporting and analytics features found in dedicated financial management tools.

For businesses that require more advanced functionality, it may be worth exploring specialized software that offers greater automation, integration, and scalability. However, for small businesses with simple needs, a well-organized spreadsheet-based solution can still be a practical choice.

How to Save and Share Your Billing Document

Once your financial record is complete, the next step is to save and share it with the client in a professional manner. Ensuring that the document is properly saved in a widely accessible format makes it easier to distribute, whether through email, cloud storage, or physical print. There are several formats and methods available for saving and sharing, depending on the preferences of the business and the client.

In this section, we will walk you through how to save your document in formats that are both reliable and easy for clients to access. Additionally, we will discuss different sharing options to ensure your records are delivered efficiently and securely.

Saving Your Document in the Right Format

- PDF Format: The most common and preferred format for sharing financial records. PDFs preserve the layout and formatting of the document, ensuring that it appears the same on any device. This format is universally accessible and prevents accidental editing.

- Spreadsheet Format: If you prefer to keep the ability to edit the document later, you can save it in the original spreadsheet format. This is useful if you need to update the record for any reason but should be shared with caution as it allows the recipient to make changes.

- Cloud Storage: Saving the document in cloud storage such as Google Drive, Dropbox, or OneDrive allows for easy access from anywhere and simplifies sharing by providing a link to the file instead of attaching it to an email.

Sharing Your Document

- Email: The most common method of sharing a document is via email. Attach the saved file and include a brief message outlining the details, such as the amount due and payment terms. If you are using a cloud storage service, simply share the link to the document in the email.

- Client Portals: Some businesses use online portals where clients can securely log in and access their financial records. Uploading the document to such a portal provides easy access for your clients, along with a secure method for sharing.

- Printed Copies: For clients who prefer physical copies, you can print the document and send it by post. Ensure that the printed copy is clear and legible to avoid any confusion.

By saving and sharing your billing documents efficiently, you ensure that the process remains professional and seamless, helping to maintain strong relationships with your clients.

Alternatives to Excel for Billing Management

While spreadsheets are a popular tool for creating and managing financial records, there are several alternatives that may better suit the needs of businesses, especially as they grow or require more advanced features. These alternatives often offer increased automation, better security, and more specialized tools designed specifically for billing and accounting tasks. Depending on the complexity of your needs, exploring these options can help streamline the billing process and reduce time spent on manual tasks.

In this section, we will explore a variety of options available to businesses looking for an alternative to using spreadsheets for financial documentation, each offering unique features that can enhance efficiency and professionalism.

Cloud-Based Billing Software

- FreshBooks: A user-friendly platform designed for small businesses, offering features like automatic time tracking, payment reminders, and integration with various payment systems.

- QuickBooks Online: A robust cloud-based accounting software that includes billing features, automated tax calculations, and financial reporting tools suitable for small to medium-sized businesses.

- Zoho Books: A comprehensive accounting tool that allows you to manage your finances, send professional billing records, and automate reminders for overdue payments.

Online Billing Services

- PayPal Invoicing: A simple solution for creating and sending financial documents directly through PayPal, with the ability to track payments and send reminders automatically.

- Wave: A free cloud-based platform offering easy-to-use tools for creating and managing financial documents, with features for expense tracking and payment processing.

- Invoice Ninja: A web-based platform that offers a wide range of customizable options for creating and sending professional billing documents. It also integrates with various payment gateways for easy transactions.

These solutions can significantly reduce the time spent on administrative tasks, automate processes, and offer advanced reporting features that spreadsheets often lack. They are ideal for businesses seeking a more streamlined and scalable way to handle financial documentation.