iPad Pages Invoice Template for Quick and Professional Invoicing

Managing financial transactions and keeping track of payments can be a time-consuming task for any business. Whether you’re a freelancer or a small company owner, having a streamlined system to create and send professional documents is essential for smooth operations. With the right tools, you can simplify the process of requesting payments and maintain a polished image for your clients.

One of the most practical approaches to creating business documents is using digital platforms that offer easy customization and flexibility. These tools allow you to generate customized records quickly, ensuring that each detail, from amounts to payment terms, is accurately represented. By leveraging these resources, you can save valuable time and focus more on growing your business.

In this guide, we’ll explore how to design and use ready-made document layouts that allow you to maintain a professional standard while managing your financial affairs. These solutions can help you create a consistent billing experience that aligns with your brand, supports transparent transactions, and reduces the risk of errors.

iPad Pages Invoice Template Overview

Creating professional and organized financial documents is crucial for maintaining a clear and efficient workflow in any business. With the right digital tools, generating accurate and customizable records can be quick and straightforward. These platforms offer pre-designed layouts that enable users to easily input their details, saving time and reducing errors. They also ensure that the final result reflects a polished, business-ready appearance.

Key Features of Professional Document Layouts

These ready-made formats come equipped with various features to enhance both functionality and design. Users can personalize each section, from the company name and contact information to the amounts and payment instructions. The layouts are fully editable, ensuring that businesses can adapt them to their unique needs, including adding logos, adjusting colors, and incorporating specific terms.

Advantages of Using Pre-Designed Layouts

Utilizing these digital resources offers numerous benefits. The most notable is the speed and ease with which you can generate and send documents. Moreover, the consistent use of a standardized format helps establish a professional image, fostering trust and credibility with clients. Customization options allow businesses to align the documents with their branding, creating a seamless experience for clients.

Why Use an Invoice Template

Streamlining the process of creating professional business documents is essential for efficiency and consistency. Using pre-designed formats eliminates the need for starting from scratch each time, ensuring that all required information is included and properly formatted. This approach not only saves time but also reduces the likelihood of errors and inconsistencies, which can lead to confusion or delays in payments.

By leveraging customizable layouts, businesses can ensure a uniform presentation across all financial records. This consistency enhances credibility and makes it easier for clients to understand the details of the document. Pre-built designs also allow for quick adjustments, such as updating payment terms, adding specific charges, or incorporating branding elements like logos and colors, without requiring extensive technical knowledge.

Additionally, using a ready-made structure allows for better organization of key details, such as the amount owed, due date, and payment methods. This clarity helps to establish trust with clients and ensures that there is no ambiguity in financial transactions. With the right tools, businesses can create and send documents with confidence, knowing they reflect professionalism and attention to detail.

Benefits of Using iPad for Invoices

Using a tablet for managing business documents offers significant advantages, especially when it comes to handling financial records. The portability and versatility of modern tablets make it easy to generate, edit, and send documents from virtually anywhere, ensuring that tasks can be completed on the go. This flexibility helps small business owners and freelancers save time and improve workflow efficiency.

Convenience and Accessibility

The convenience of using a mobile device for creating business records cannot be overstated. With a tablet, users can access their files, update details, and generate new documents while away from the office. This makes it possible to send billing statements to clients immediately after services are rendered, eliminating delays and improving cash flow. Cloud integration further enhances this by allowing access to documents from multiple devices, ensuring that critical information is always available when needed.

Streamlined Workflow and User Experience

Tablets designed for business tasks often come with intuitive interfaces that make document creation and management straightforward. These devices support touch controls, enabling users to quickly edit text, adjust layouts, and move elements with ease. Additionally, many apps offer pre-configured styles, making document formatting and customization even faster. This streamlined workflow reduces the effort required to maintain a professional appearance, allowing business owners to focus on what matters most–serving clients and growing their operations.

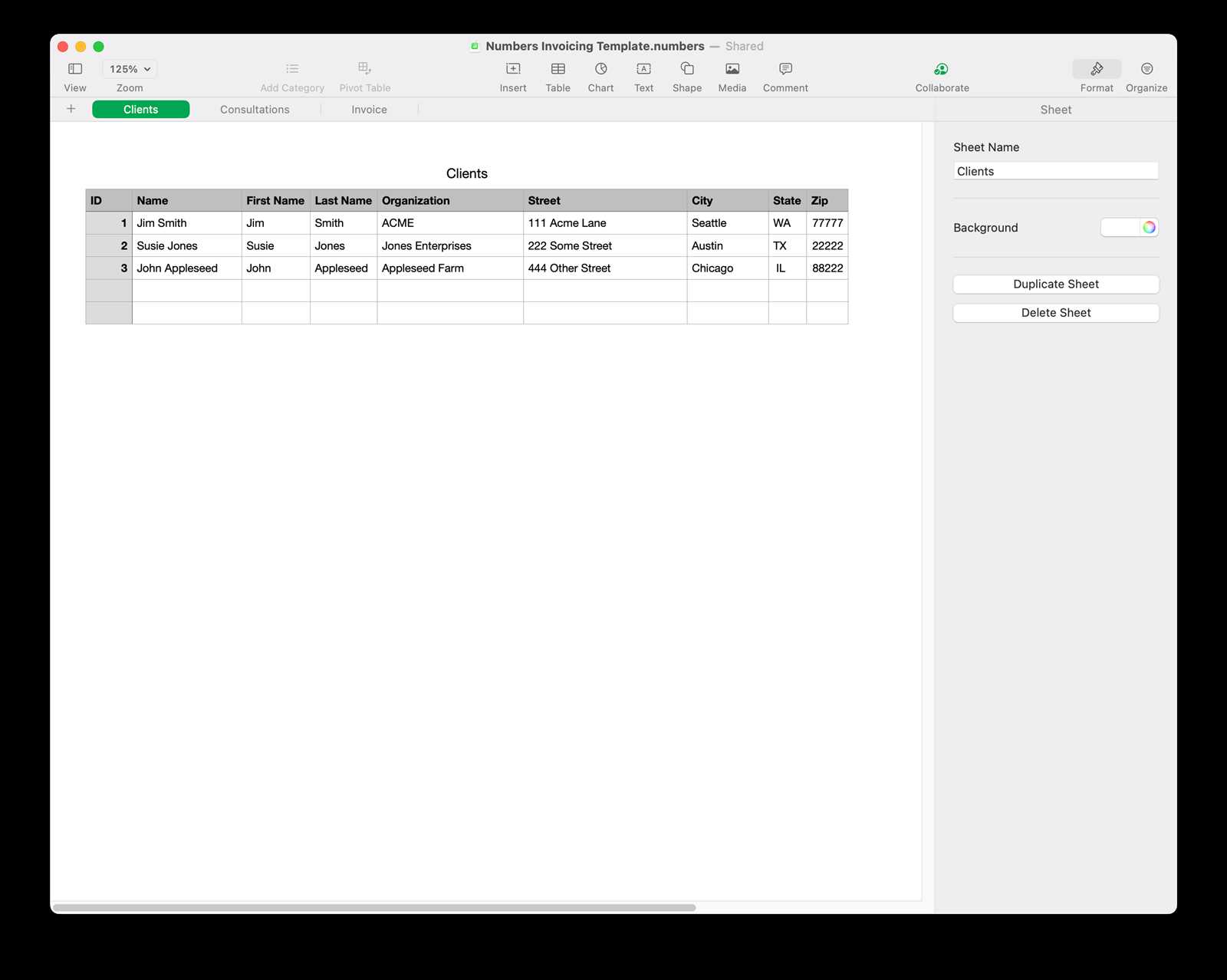

How to Create an Invoice in Pages

Creating a well-structured billing statement from scratch can seem like a daunting task, but with the right tools, it can be quick and easy. By using a digital platform with pre-built layouts, you can generate professional documents that include all necessary information. The key steps include selecting a design, entering your business details, and ensuring the document is fully customizable for your specific needs.

Step-by-Step Guide to Create a Billing Statement

Follow these simple steps to craft a complete and polished document for your business:

- Choose a layout that suits your needs from the available designs.

- Customize the header by adding your company name, logo, and contact details.

- Input your client’s name and contact information in the relevant sections.

- Enter the list of services or products provided, including quantities and prices.

- Include payment terms, due dates, and any additional notes for your client.

Adding Detailed Items and Costs

After you have set up the basic framework of your document, it’s time to add specific items and costs. To ensure clarity, you can create a table that organizes your products or services, making it easy for both you and your client to reference each line item.

| Item | Description | Quantity | Price | Total |

|---|---|---|---|---|

| Web Design | Custom website creation | 1 | $500 | $500 |

| Hosting | Annual web hosting | 1 | $100 | $100 |

Ensure the total amount is calculated correctly and displayed at the bottom of the table, along with the payment instructions. Once the document is complete, review it for any errors and save it in your preferred format for easy sharing with your clients.

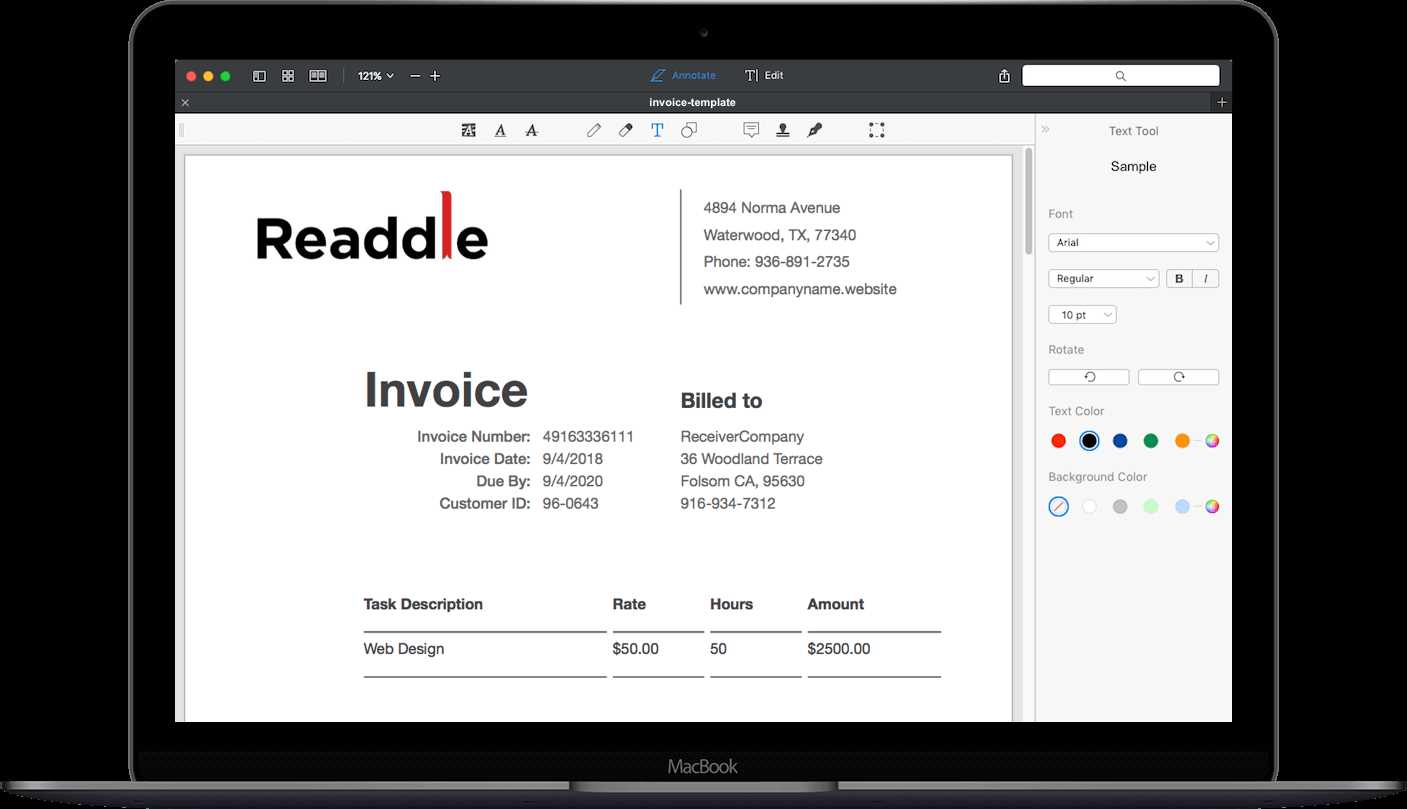

Customizing Your Invoice Template

Personalizing your financial documents is essential for maintaining a professional image and aligning your records with your brand identity. By customizing pre-designed layouts, you can ensure that your business details, aesthetic preferences, and specific terms are clearly represented. Tailoring each document allows you to stand out and present a cohesive, polished look to your clients.

Key Elements to Customize

There are several key components of the document that you can modify to make it your own. Each section can be adjusted to reflect your brand’s unique style and ensure all necessary information is clearly presented. Here are the main areas to focus on:

- Business Information: Add your company name, logo, address, and contact details. This creates a clear and professional introduction for your clients.

- Client Information: Include the name, address, and contact details of the client you’re billing, ensuring that all relevant contact points are covered.

- Payment Terms: Customize the payment instructions, including methods, due dates, and late fees, based on your preferences and business practices.

- Design & Layout: Adjust colors, fonts, and styles to match your company branding. You can also organize sections in a way that best suits your workflow.

Tips for Effective Customization

When personalizing your business documents, it’s important to strike a balance between functionality and design. Here are some tips for making your document both practical and visually appealing:

- Keep it Simple: Avoid clutter. A clean, straightforward design helps ensure your document is easy to read and understand.

- Use Clear Headers: Organize sections with clear, bold headers so clients can easily navigate through the details.

- Incorporate Branding: Use colors and fonts that match your logo and business theme to create a consistent brand experience.

- Highlight Important Information: Ensure that key details such as total amount due and payment terms are prominently displayed.

By customizing your financial documents, you not only create a more professional and polished appearance but also streamline your billing process to fit your specific needs.

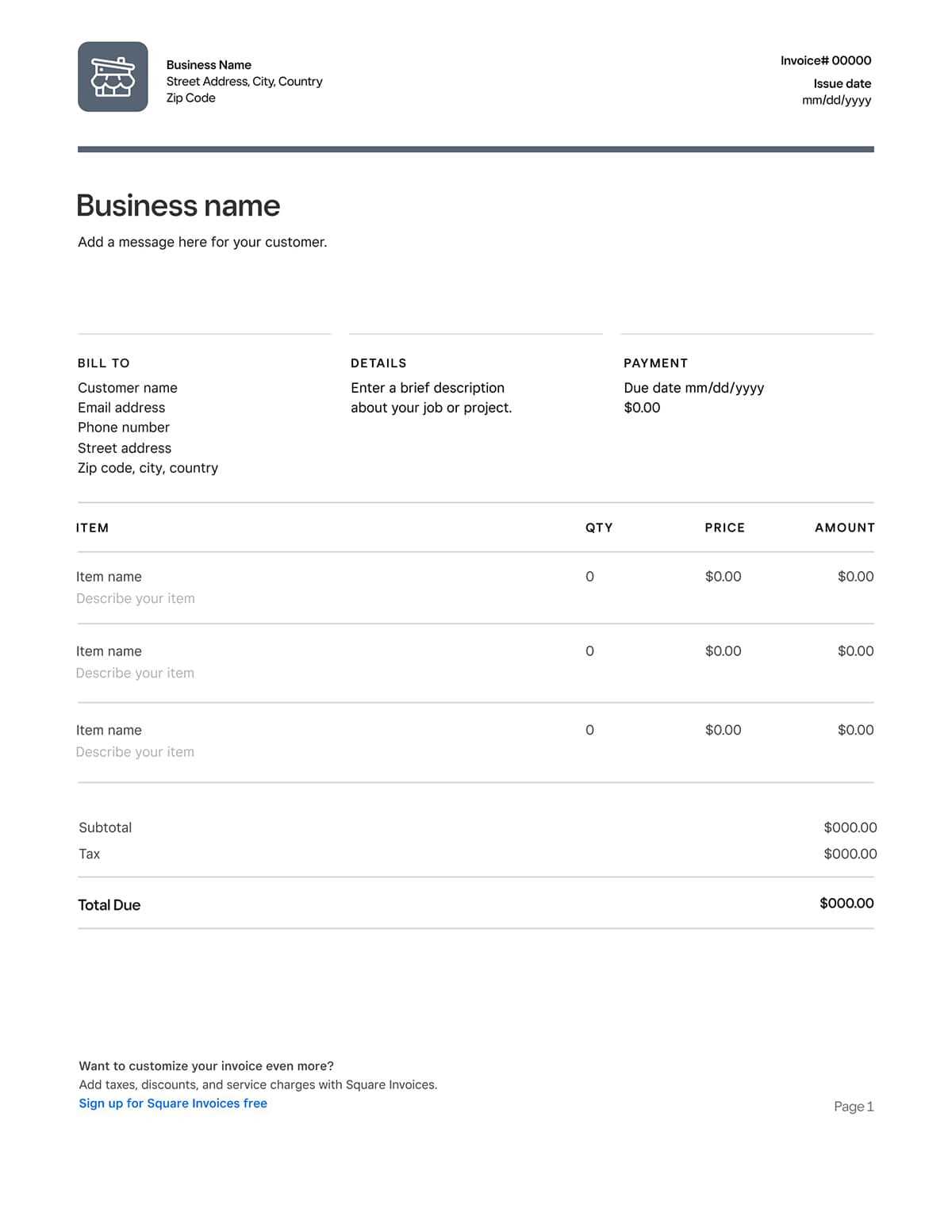

Essential Features in Invoice Templates

When creating professional billing documents, certain elements are essential for clarity, accuracy, and efficiency. A well-structured document not only conveys the necessary information but also ensures that both parties are on the same page regarding payment details. The key features to include are those that facilitate smooth transactions and foster trust with clients.

The most critical components of any document include clear identification of the parties involved, a breakdown of services or products provided, and the total amount due. These features not only make the document easy to understand but also help prevent any potential misunderstandings. Accurate payment terms and contact details are also essential to ensure a seamless transaction process.

Key Features to Include

- Client and Business Information: Both the sender and recipient’s names, addresses, and contact details should be clearly displayed.

- Itemized List: A detailed description of the products or services provided, including quantities, individual costs, and total amounts.

- Payment Terms: Clearly outline the due date, accepted payment methods, and any late fees for overdue payments.

- Unique Invoice Number: Helps keep track of financial records and ensures easy reference for future correspondence.

- Tax and Discounts: Accurately reflect any applicable taxes or discounts, ensuring transparency and clarity.

Design Considerations

The layout of your document is just as important as its content. A clean, organized structure enhances readability and ensures that clients can quickly locate the necessary information. Bold headings and ample white space around sections make the document easy to follow, while keeping the design professional and polished.

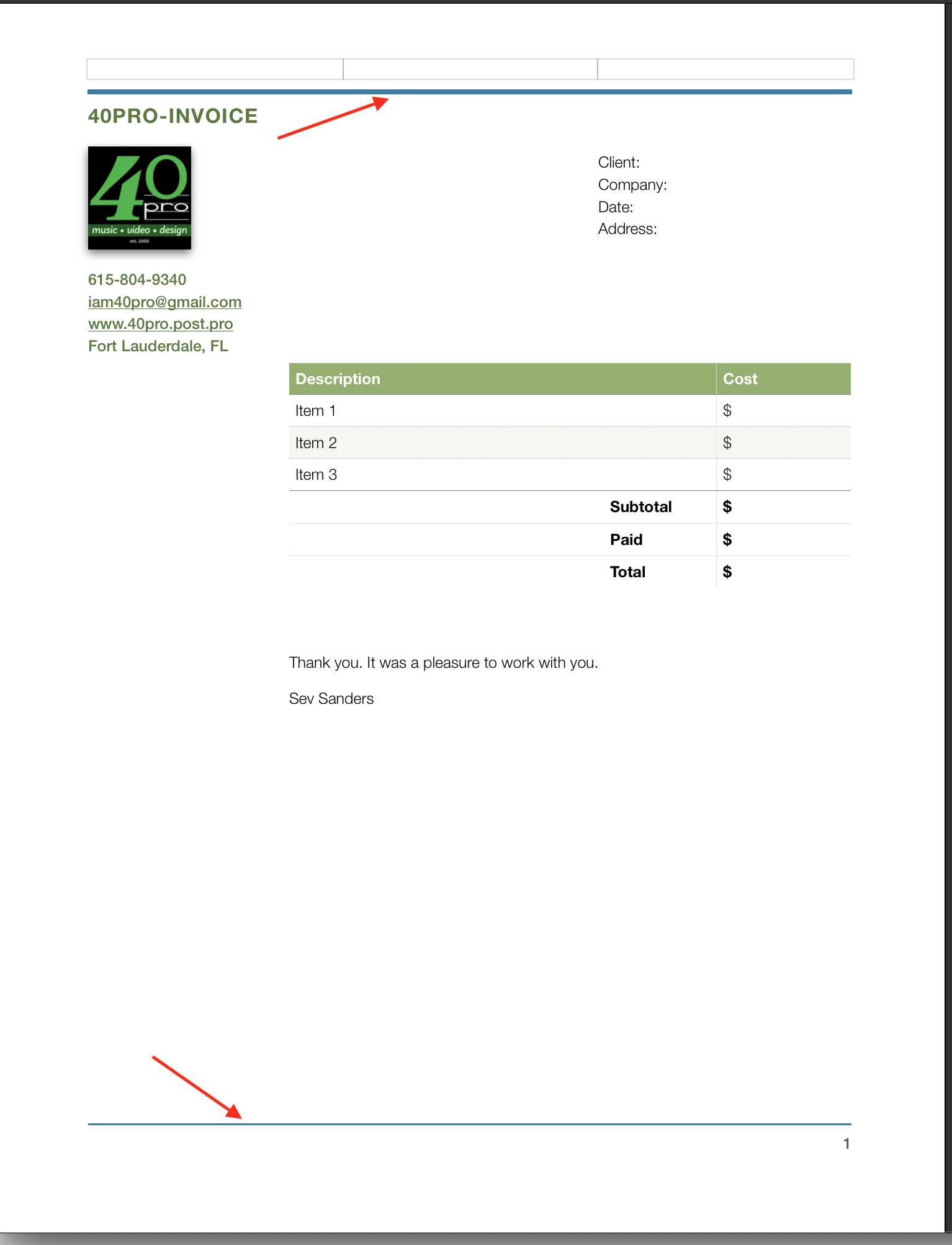

Design Tips for Professional Invoices

The design of your financial documents plays a crucial role in how your business is perceived by clients. A well-designed record not only conveys professionalism but also makes it easier for the recipient to understand and process the information. Simple, clear, and organized designs can improve the client’s experience and help streamline your billing process.

Keep It Clean and Organized

Cluttered documents are difficult to read and may lead to confusion. To create a professional look, focus on a clean layout with well-defined sections. Group similar information together and use clear headers to separate key sections such as services, totals, and payment terms. Ample white space is important for legibility, ensuring that each piece of information stands out without overwhelming the reader.

Use Consistent Branding

Consistency in design reinforces your brand identity. Incorporate your company logo, color scheme, and fonts throughout the document to maintain a cohesive appearance. Subtle use of brand colors can make the document visually appealing without distracting from the content. A professional layout should reflect the tone of your business while keeping the focus on clarity and functionality.

Additionally, ensuring that the font size is appropriate for readability and using bullet points or numbered lists to organize items can further enhance the overall user experience. A polished and well-structured document not only impresses clients but also helps build trust and credibility.

How to Add Company Logo to Template

Incorporating your company logo into financial documents helps reinforce your brand identity and adds a professional touch. A well-placed logo not only makes the document visually appealing but also ensures that your business is easily recognizable to clients. The process of adding a logo is simple and can be done in just a few steps.

Steps to Add Your Logo

Follow these easy steps to add your logo to the document:

- Prepare Your Logo: Ensure your logo file is in an appropriate format, such as PNG or JPEG. The logo should be high resolution to ensure it appears crisp and clear when printed or viewed on a screen.

- Open the Document: Access the document layout where you wish to place your logo.

- Insert the Logo: Use the insert or image function to add your logo file. Most platforms allow you to simply drag and drop the logo into the header or designated area of the document.

- Adjust the Size: Once inserted, resize the logo to fit within the header or area without overpowering the content. The logo should be large enough to be noticeable but not so large that it distracts from the main details of the document.

- Position the Logo: Position the logo in a corner or the center of the page, depending on your design preference. Make sure it aligns with the rest of the content for a balanced and professional appearance.

Additional Tips

- Consistency: Ensure that the logo placement remains consistent across all your business documents for uniformity.

- Contrast: Choose a logo color that contrasts with the background for better visibility. Avoid using logos that blend in with the document colors.

- File Quality: Always use high-quality files for your logo to avoid pixelation or blurriness, which can reduce the professional look of the document.

Adding your logo to business records not only enhances the document’s appearance but also makes it more recognizable and authoritative in the eyes of your clients.

Setting Up Payment Terms in Pages

Clear and well-defined payment terms are crucial for ensuring smooth financial transactions with clients. Including this information in your documents helps avoid confusion and sets expectations for both parties. Customizing the payment terms section allows you to outline important details such as due dates, payment methods, and penalties for late payments.

Steps to Set Up Payment Terms

Follow these steps to effectively set up payment terms in your business documents:

- Specify the Due Date: Clearly indicate when the payment is expected. This can be a specific date or a number of days after the document is issued (e.g., “Due in 30 days”).

- Outline Accepted Payment Methods: List all payment options you accept, such as bank transfers, credit cards, or online payment systems. This makes it easy for clients to understand how they can pay.

- Late Payment Fees: If applicable, specify any penalties for late payments, such as a percentage of the total amount due after a certain number of days. For example, “A late fee of 1.5% will be applied for payments received after 30 days.”

- Early Payment Discounts: If you offer a discount for early payment, include it in the terms. For instance, “A 5% discount will be applied if paid within 10 days of receipt.”

Best Practices for Payment Terms

- Keep It Simple: Ensure the payment terms are easy to read and understand. Avoid complex legal jargon that could confuse clients.

- Highlight Important Details: Use bold or italics to draw attention to key information, such as due dates and late fees, making it easier for clients to spot.

- Consistency: Use the same payment terms across all documents to maintain clarity and professionalism.

- Be Clear About Disputes: If you have a process for handling payment disputes, outline it in this section to avoid future misunderstandings.

By clearly specifying the terms and conditions under which payment is expected, you ensure that both parties are aligned and reduce the risk of payment delays or misunderstandings.

How to Include Taxes in Invoices

When generating business records, including taxes in your billing statements is essential for transparency and legal compliance. Properly calculating and displaying taxes ensures that both you and your clients are clear on the amounts due. Including tax information also prevents confusion and ensures that your business stays in line with local tax regulations.

Steps to Include Taxes in Your Document

To accurately incorporate taxes, follow these basic steps:

- Identify Applicable Taxes: Determine which taxes apply to your products or services. This could include sales tax, VAT, or any other local taxes based on your location or the location of your client.

- Calculate the Tax Amount: Multiply the taxable amount by the tax rate to determine how much tax is due. For example, if the tax rate is 8% and the total before tax is $100, the tax would be $8.

- Break Down the Tax: Display the tax amount as a separate line item in your document, clearly labeling it as a “Tax” or “Sales Tax.” This allows the client to see how much tax they are being charged.

- Include Total Taxable Amount: After calculating and adding the tax, show the total amount due, including both the original amount and the tax amount.

Best Practices for Displaying Taxes

- Transparency: Always make it clear what the tax rate is and how it was calculated. Consider adding a note explaining the applicable tax laws if needed.

- Show the Breakdown: Include a detailed breakdown of the taxes applied, especially if multiple tax rates or categories apply (e.g., state tax and local tax).

- Highlight the Total Amount: Ensure the final amount, including tax, is clearly visible to avoid confusion.

- Stay Updated: Keep track of tax changes in your area to ensure your calculations remain accurate and compliant with new regulations.

Including taxes clearly and accurately helps to maintain professionalism and ensures that both you and your clients are aligned on the financial aspects of the transaction.

Adding Discounts and Adjustments

Incorporating discounts and adjustments into your billing statements is a great way to offer flexibility to clients and maintain positive business relationships. These modifications can help incentivize prompt payment or account for special pricing arrangements, ensuring both parties are satisfied. Whether you’re offering a seasonal discount or applying a correction to a previous charge, it’s important to show these changes clearly in your documents.

Steps to Add Discounts and Adjustments

To apply discounts and adjustments effectively, follow these key steps:

- Identify the Type of Discount: Determine whether the discount is a percentage off the total amount or a fixed amount. You can also apply a special adjustment for any errors or changes in pricing.

- Calculate the Discount Amount: If you’re offering a percentage discount, calculate the amount by multiplying the total before discount by the discount rate. For example, a 10% discount on a $500 charge would be $50.

- Apply the Discount: Deduct the discount amount from the total or adjust the pricing as needed. Clearly label this section on your document to avoid confusion.

- Update the Total: After applying the discount or adjustment, ensure the final amount is updated to reflect the change, and show it clearly on the document.

Displaying Discounts and Adjustments Clearly

It’s essential to present discounts and adjustments in a way that’s easy to understand. Here’s how you can show these changes effectively:

| Item | Description | Original Price | Discount/Adjustment | Final Price |

|---|---|---|---|---|

| Product A | Custom Design | $200 | – $20 (10% Discount) | $180 |

| Product B | Hosting Services | $300 | – $30 (Early Payment Adjustment) | $270 |

By listing the discounts and adjustments in a clear format like the example above, you ensure that your clients can easily understand the changes. This transparency not only helps maintain trust but also makes it easier to track financial records and prevent any disputes.

Using iCloud for Invoice Storage

Storing business documents in a secure and accessible location is essential for maintaining an organized financial system. Cloud storage solutions, like iCloud, offer an effective way to keep your records safe and easily accessible from any device. With iCloud, you can store your business documents online, ensuring that they are protected from loss and available whenever you need them.

Benefits of Using Cloud Storage for Documents

Cloud storage provides several advantages for managing your business records. Here are some key benefits of using iCloud:

- Accessibility: Access your documents from any device, anywhere, as long as you have an internet connection. This is especially useful for remote work or traveling.

- Automatic Backup: iCloud automatically backs up your documents, ensuring that you don’t lose important files due to hardware failure.

- Collaboration: Share documents easily with colleagues or clients. Multiple users can access and edit documents simultaneously, improving workflow.

- Security: iCloud provides secure encryption for stored files, making it a reliable option for keeping your business documents safe from unauthorized access.

Organizing Your Files in iCloud

Proper organization is key to managing your business documents efficiently. Here are some tips for organizing your files in iCloud:

| Folder Name | Purpose |

|---|---|

| Financial Records | Store all documents related to transactions, payments, and receipts. |

| Client Documents | Keep contracts, agreements, and communication with clients in this folder. |

| Tax Documents | Store tax returns, invoices, and other relevant paperwork for tax purposes. |

| Reports | Maintain any reports or summaries related to sales, expenses, and financial performance. |

By organizing your documents into clearly labeled folders, you can quickly find what you need, improving efficiency and reducing time spent searching for files. Cloud storage, combined with good organization, can significantly streamline your document management process.

How to Export Invoices from Pages

Exporting your business records into a widely accepted format ensures they can be easily shared with clients, colleagues, or stored for future reference. Most commonly, these documents are converted into formats such as PDF or Word, which are both easily accessible and maintain the integrity of the original layout. Exporting allows you to save the document in a secure, portable format for easy distribution and record-keeping.

Steps to Export Your Document

Follow these steps to export your business documents from your preferred application:

- Open the Document: First, open the document that you wish to export. Make sure all necessary edits and updates are completed before proceeding.

- Select Export Option: Go to the file menu and choose the “Export” option. This will typically provide several formats to choose from.

- Choose the File Format: For most business documents, PDF is the best option due to its universal compatibility and secure, uneditable nature. Select “PDF” from the list of available formats.

- Adjust Settings (Optional): Depending on the application, you may be able to adjust settings such as file quality, password protection, or specific page selections. Review and configure these options if necessary.

- Save the File: Once the format and settings are chosen, click the “Export” or “Save” button. Select the location on your device or cloud storage where the file will be saved.

Best Practices for Exporting Documents

- Use PDF Format: PDF is the most common format for business documents due to its professional appearance and easy sharing capabilities.

- Double-Check the Content: Before exporting, ensure all details are accurate, including totals, dates, and client information.

- File Naming: Give your exported file a clear and identifiable name, such as “Client_Name_Document_Date,” to make it easy to find later.

- Secure Storage: Consider storing exported documents in a cloud service or encrypted folder for added security and backup.

By exporting your records to a widely accepted format, you ensure that your documents are ready for sharing, storage, or further editing while maintaining their integrity and accessibility.

Sharing Your Invoice with Clients

Once your business document is finalized, sharing it with clients is the next crucial step in the transaction process. Ensuring that the file reaches them in a timely and accessible format helps maintain professionalism and streamline payment procedures. There are various methods to share your files, each offering different advantages depending on your client’s preferences and the type of transaction.

Methods for Sharing Your Document

Here are some common methods for sending your completed business document to clients:

- Email: The most popular method for sharing business documents is through email. Simply attach the file in a secure format (such as PDF) and send it to the client’s email address. Ensure the subject line and message are clear and professional.

- Cloud Storage Links: If the file is too large to attach to an email, or if you need to share multiple documents, consider using cloud storage platforms like Google Drive, Dropbox, or iCloud. Share the document by sending the client a link to access or download it.

- Secure File Sharing Services: For added security, especially for sensitive financial information, consider using services designed for secure file sharing. These platforms often provide encryption and password protection to ensure only authorized individuals can access the document.

- Physical Mail: For clients who prefer physical copies or when legal requirements demand hard copies, printing and mailing the document is still a viable option. However, this method is slower and less efficient than digital sharing.

Best Practices for Sharing Documents

To ensure smooth communication and prevent any issues during the sharing process, follow these best practices:

- Confirm Contact Information: Double-check the client’s email address or physical address before sending the document. Sending it to the wrong recipient can cause delays or confusion.

- Use Clear and Professional Communication: Always include a brief message explaining the contents of the document. Mention any important details such as due dates or instructions for payment.

- Set Permissions When Sharing Links: If you’re using a cloud storage link, ensure you set the proper permissions, such as “view only” or “edit,” depending on whether the client needs to make changes or simply view the document.

- Follow Up: After sharing the document, follow up with the client to ensure they received it and to address any questions or concerns they may have. This reinforces good communication and shows your commitment to customer service.

By selecting the right method for sharing and following best practices, you can ensure your documents are delivered efficiently and securely, maintaining a professional relationship with your clients.

Keeping Track of Payments with Pages

Effectively managing payments is crucial for maintaining a smooth cash flow in any business. Tracking which payments have been received, which are still pending, and when they are due helps you stay organized and avoid financial confusion. Using a document creation tool to keep track of payments can streamline the process and ensure that your financial records are up-to-date and accurate.

Setting Up a Payment Tracking System

To effectively monitor payments, it’s important to create a structured system within your documents. Here’s how you can set up a tracking system:

- Payment Due Date: Include a column or section where you list the due dates for each payment. This will help you keep track of deadlines and avoid late payments.

- Payment Status: Add a section to mark the status of each payment, such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly identify which payments have been completed and which are still outstanding.

- Amount Paid: For each transaction, make sure to include a column for the amount paid. This helps you track partial payments or identify discrepancies between the expected and received amounts.

- Outstanding Balance: Include a column showing the remaining balance for each payment. This is particularly useful if payments are being made in installments.

Organizing Payment Information

Once you’ve created your payment tracking system, keeping it organized is key to maintaining accuracy. Here’s how to stay on top of it:

- Regular Updates: Regularly update your payment records as payments come in or statuses change. This will keep the information current and help you avoid overlooking any transactions.

- Color Coding or Highlighting: To easily identify overdue payments or important updates, consider using color coding or highlighting certain cells in your document.

- Record of Communication: Keep notes on any relevant communication with clients regarding their payments. This could include payment plans, extensions, or disputes.

By implementing a simple and organized system to track payments, you can ensure that no payment slips through the cracks and that your financial records remain accurate. This will not only save you time but also reduce the risk of errors in your bookkeeping process.

How to Edit and Update Invoices

Occasionally, business documents need to be updated to reflect changes in pricing, client details, or terms. Whether it’s due to a mistake, a change in services, or an adjustment in payment terms, being able to quickly and accurately update your records is important. Editing and updating these documents is a straightforward process that ensures you maintain professional and accurate financial records.

Steps to Edit Your Document

Follow these steps to edit and update your business documents effectively:

- Open the Document: First, locate the file you wish to update. Open it in the relevant application or software where it was initially created.

- Make Necessary Edits: Change any details that need to be updated, such as client names, dates, amounts, or service descriptions. You can also adjust any formatting if needed to improve the document’s readability.

- Check for Accuracy: Once changes have been made, review the document thoroughly. Ensure that all updates are correct, including totals and any terms or conditions that have been modified.

- Save Changes: After completing your edits, save the updated version of the document. Consider saving it under a new file name to keep track of revisions or keep the original intact for record-keeping.

Best Practices for Updating Documents

Here are some best practices to keep in mind when making updates to your documents:

- Track Changes: Keep a record of all changes made, especially if you are adjusting amounts or terms. This helps avoid confusion or disputes with clients over what was agreed upon.

- Update All Versions: If you have sent multiple versions of the document to the client or colleagues, ensure that all copies are updated to reflect the most recent changes. This ensures consistency across all copies.

- Communicate Updates: After making changes, inform the client or recipient about the updated document. A brief message explaining the changes can help avoid confusion and ensure everyone is on the same page.

- Retain Old Versions: It’s often helpful to keep previous vers

Best Practices for Invoice Management

Efficiently managing business documents related to payments and transactions is crucial for maintaining a smooth workflow and ensuring timely payments. Proper organization, consistent communication, and careful tracking help prevent errors and delays, enabling businesses to maintain a positive cash flow. By following best practices for managing your financial documents, you can stay on top of outstanding balances and streamline your entire payment process.

Organizing Your Records

Keeping your documents well-organized is essential for quick access and easy tracking. Here are some tips for maintaining organized records:

- Use a Standardized Naming Convention: Develop a consistent naming system for your documents, such as including the client name, date, and document type in the file name. This makes it easy to search for and retrieve specific documents later.

- Store Documents Securely: Whether you store your files digitally or in physical form, make sure they are secure. Use encrypted cloud storage or a password-protected system for digital files, and keep physical documents in a safe place to avoid loss or theft.

- Keep Records for the Required Time: Different jurisdictions may have specific requirements for how long financial documents should be kept. Make sure you store all relevant documents for the necessary period to ensure compliance with tax or legal requirements.

Tracking Payments and Due Dates

To avoid missed payments and late fees, it’s important to keep a close eye on payment statuses and due dates. Here are some strategies for effective tracking:

- Use a Payment Tracker: Implement a simple tracker, such as a spreadsheet or specialized software, to monitor outstanding payments. Include important details like payment amounts, due dates, and statuses (paid, pending, overdue).

- Set Payment Reminders: To ensure you follow up on overdue payments, set reminders for both yourself and your clients. Automated reminders can be sent via email or through accounting software to notify clients of upcoming or overdue payments.

- Confirm Receipt of Payments: Always confirm when a client has made a payment and update your records accordingly. Sending a confirmation receipt or thank-you note reinforces professionalism and ensures both parties are aligned on payment statuses.

Communication and Follow-Up

Clear communication is key when it comes to managing business payments. Whether you’re sending reminders, confirming payments, or addressing discrepancies, being proactive and transparent fosters trust with your clients. Here are some tips for effective communication:

- Be Clear and Professional: Ensure your documents are easy to understand and free of errors. Clearly state the amount due, payment terms, and due dates to avoid confusion.

- Follow Up Promptly: If payments are delayed, follow up with clients in a courteous but firm manner. Send reminders before

Common Mistakes to Avoid in Invoicing

When managing financial documents related to client transactions, it’s easy to overlook details that can lead to confusion or delays in payment. Simple mistakes in these documents can have significant repercussions, such as late payments, disputes, or loss of credibility. By being aware of common errors and taking proactive steps to avoid them, you can ensure smoother financial operations and maintain strong relationships with clients.

1. Incorrect Client Information

One of the most common mistakes is failing to accurately include client details. Whether it’s the client’s name, address, or contact information, any discrepancies can cause confusion or delays in payment processing. Always double-check the information provided to ensure accuracy.

- Verify Names and Addresses: Ensure the client’s name and address are spelled correctly and match the information in your records.

- Update Contact Details: If there have been any changes in your client’s contact information, make sure these are reflected in the document.

2. Missing or Incorrect Payment Terms

Payment terms set the expectations for when payment is due and how it should be made. Failure to clearly specify these terms can lead to misunderstandings and delayed payments. Common issues include omitting due dates, using vague language, or failing to mention late fees.

- Specify Due Dates: Always include a clear due date for payment to avoid confusion.

- Clarify Payment Methods: Indicate the preferred payment methods, whether it’s via bank transfer, credit card, or another method.

- Include Late Fees: If applicable, mention any fees for overdue payments to encourage timely settlements.

3. Overlooking Taxes and Additional Charges

Failing to account for taxes, shipping costs, or other additional charges can create problems when clients question the final amount due. It’s crucial to clearly list all charges, including tax percentages, so that the client knows exactly what they’re paying for.

- Itemize All Charges: Clearly list all items or services provided and their respective costs to avoid confusion.

- Include Taxes: Be sure to calculate and display the correct tax amount, especially if you’re required to collect taxes in your jurisdiction.

4. Inconsistent or Incorrect Formatting

Disorganized or unclear documents can cause confusion and lead to delays in payment. It’s important to present the information in a professional, easy-to-read format. Poorly formatted documents may also appear unprofessional to clients.

- Use Clear Headings and Sections: Organize the document logically, using headings to separate sections like “Serv