Top Invoicing Templates for Excel to Simplify Your Billing

Managing payments and keeping track of financial transactions is an essential part of any business. Having the right documents for billing can save time, reduce errors, and ensure that clients receive clear and professional invoices. With the right tools, creating these documents becomes an effortless task, allowing you to focus more on what matters–your work.

Customizable solutions that can be easily tailored to meet specific business needs make this process even more efficient. Whether you’re running a small startup or a large corporation, an effective system for generating invoices is crucial. These tools not only ensure accuracy but also help maintain a consistent, organized record of all financial interactions.

In this article, we will explore practical solutions for generating billing documents quickly and accurately. From basic formats to more advanced features, you’ll discover how to choose the right method for your business and simplify the way you manage payments.

Best Billing Solutions for 2024

As businesses continue to grow, the need for efficient billing solutions becomes more crucial. In 2024, it’s not just about having a basic document to track payments–it’s about finding a streamlined, easy-to-use system that can be customized to meet your specific needs. A well-designed billing document can save valuable time and reduce errors, which is essential for maintaining smooth financial operations.

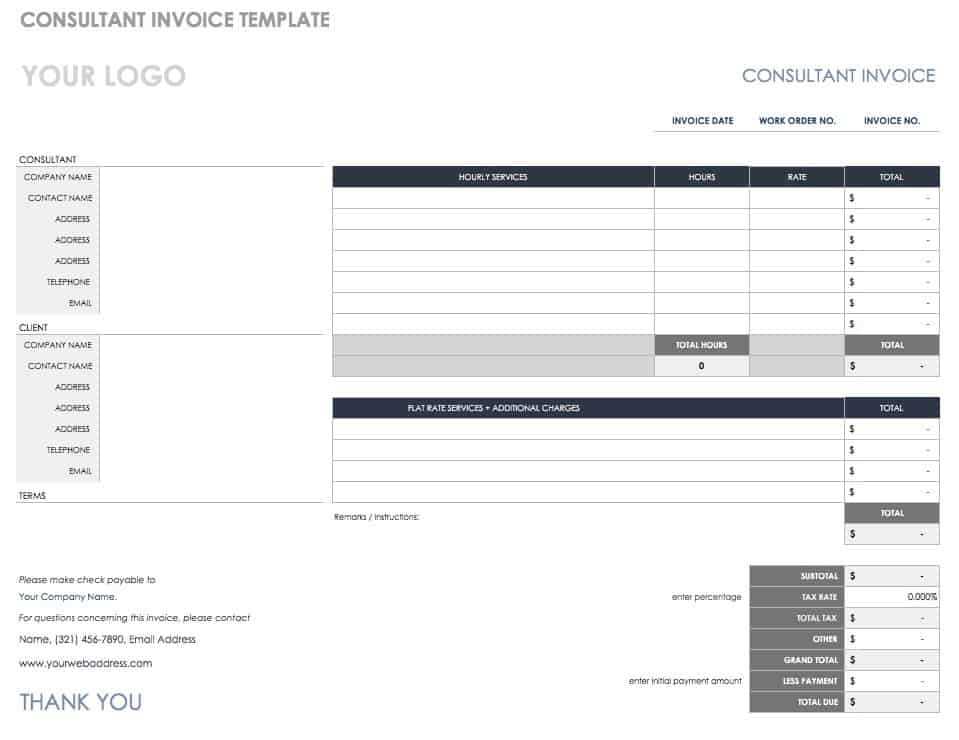

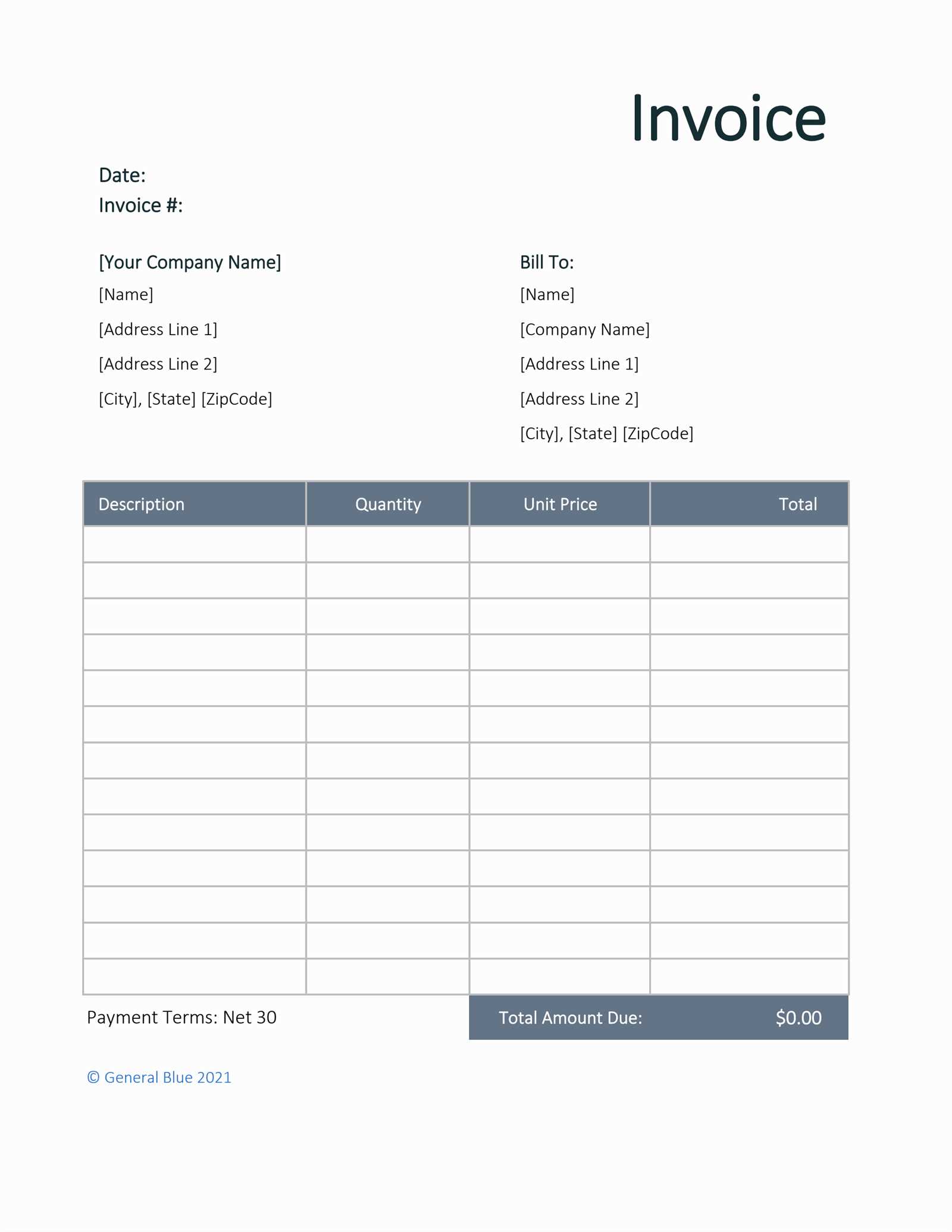

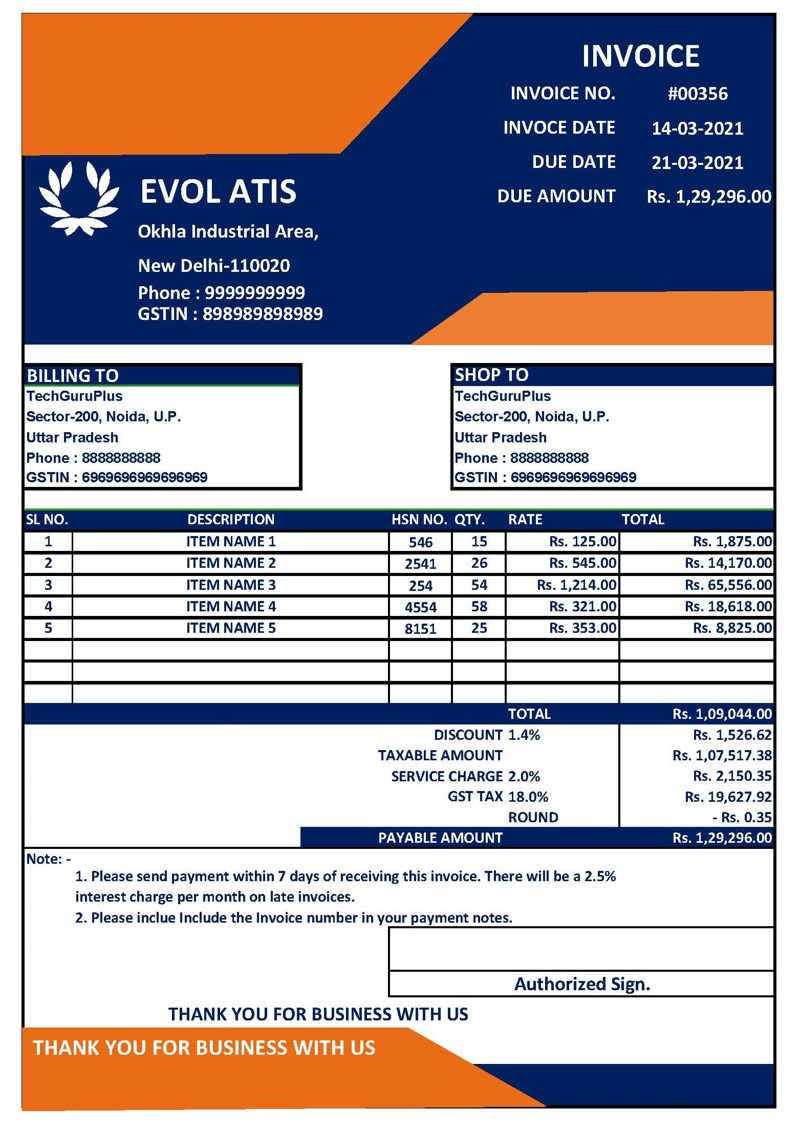

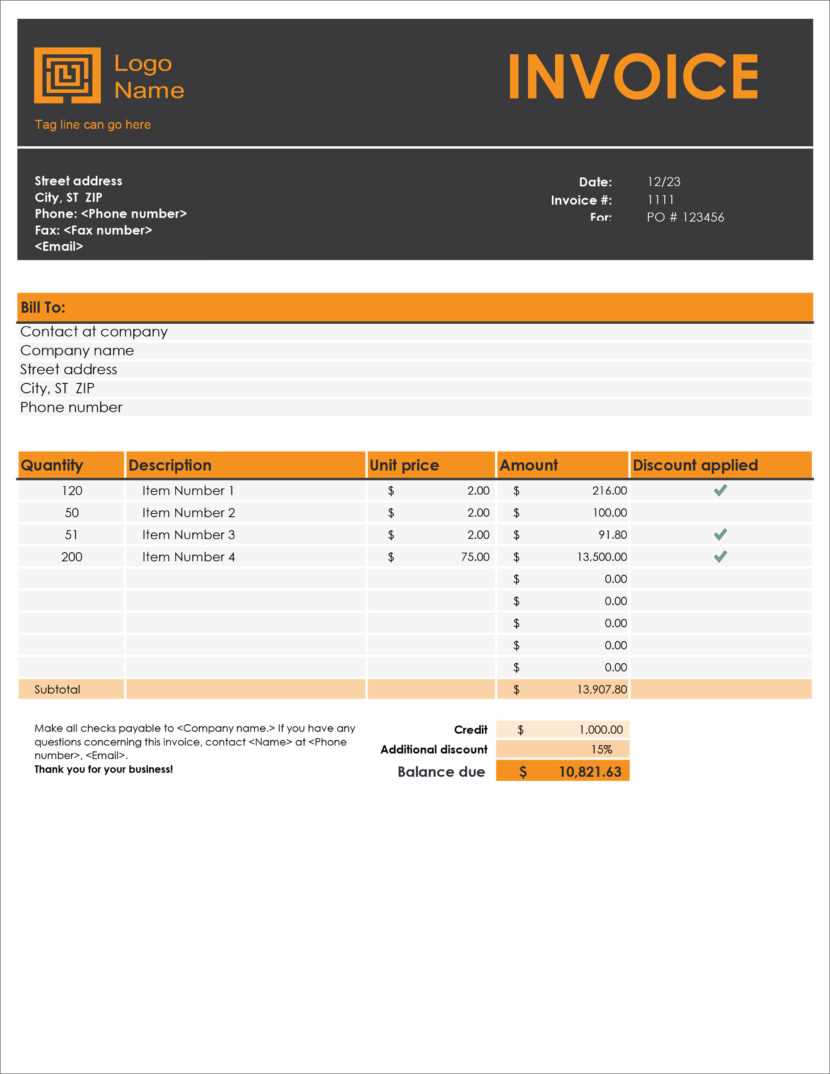

Some of the best options available this year include pre-built systems that allow for quick customization. These options feature clean, professional layouts and can handle everything from simple transactions to more complex calculations. Whether you need to create invoices for individual clients or manage multiple accounts, these tools offer flexibility without the steep learning curve.

Key features of the best solutions in 2024 include automated calculations, easy formatting adjustments, and a variety of styles to suit different industries. From freelancers to established companies, these tools are designed to improve productivity and ensure that your financial documents are accurate and professional. With the right solution, you can easily track payments, apply discounts, and generate detailed reports with just a few clicks.

How to Customize Billing Documents in Excel

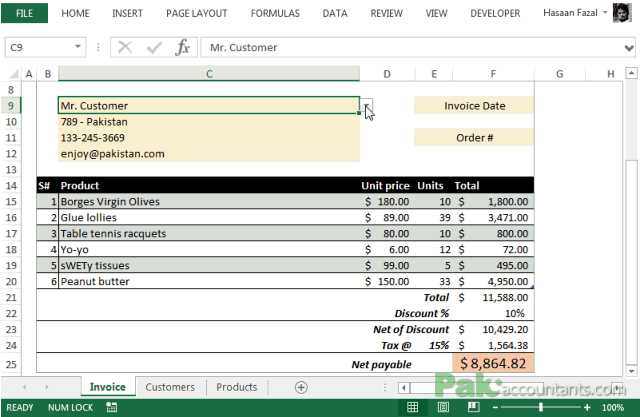

Customizing a billing document allows you to tailor it to your specific business needs, creating a more professional and consistent appearance for your clients. With the right tools, you can adjust every aspect, from the layout to the data fields, ensuring that your document reflects your brand and makes payment processing smoother. Here’s a step-by-step guide to modifying your billing document in a spreadsheet program:

- Start with a Basic Structure – Begin with a simple template that includes the essential fields such as client details, item descriptions, and payment terms.

- Adjust Columns and Rows – Modify the number of rows and columns based on your needs. You might want to add space for additional services, taxes, or discounts.

- Customize Font and Colors – Personalize the document’s font style, size, and color to match your company’s branding. This ensures that the document looks cohesive with other materials you send to clients.

- Include Your Branding – Insert your company logo, contact details, and any other relevant information in the header or footer sections to make your document easily recognizable.

- Automate Calculations – Use built-in formulas to automatically calculate totals, taxes, and discounts. This reduces the chances of errors and makes the billing process more efficient.

- Add Payment Instructions – Customize the payment terms and instructions section to clearly communicate your preferred payment methods and deadlines.

By following these steps, you can create a tailored document that fits your business perfectly, making the billing process more professional and hassle-free for both you and your clients.

Top Features of Excel Billing Documents

When creating or selecting a system for managing client payments, certain features can make all the difference in terms of efficiency and accuracy. A good billing document should not only present a professional look but also streamline the entire process, from data entry to final payment tracking. Below are some of the top features that can enhance the functionality and ease of use of your billing system:

- Automated Calculations – The ability to automatically calculate totals, taxes, and discounts eliminates manual errors and speeds up the process.

- Customizable Layout – You can adjust the structure, add or remove fields, and format the document to align with your brand identity and business needs.

- Multiple Currency Support – For businesses with international clients, having the ability to manage and convert different currencies can be incredibly useful.

- Professional Design – Pre-designed templates often include sleek, modern layouts that make your billing documents look polished and trustworthy.

- Recurring Billing Setup – Many systems allow you to set up automatic recurring charges, making it easier to manage subscription-based services.

- Payment Status Tracking – You can track whether a payment has been received, is pending, or is overdue, helping you stay on top of finances.

- Clear Terms and Conditions – Space to include payment terms, delivery information, or any other specific details ensures that both parties are on the same page.

These features not only save time but also help maintain a more organized and accurate billing process, which is essential for smooth financial management.

Why Use Excel for Billing

Choosing the right tool for managing client payments is crucial for efficiency and accuracy. One of the most popular and versatile options for creating billing documents is a spreadsheet program. It offers flexibility, customization, and a range of features that make it a top choice for businesses of all sizes. Here are some key reasons why using a spreadsheet application can be highly beneficial for managing billing processes.

Flexibility and Customization

A spreadsheet provides complete freedom to customize the document according to your specific needs. You can easily adjust columns, rows, and data fields, as well as incorporate your branding, making the document truly yours. Whether you need to add additional charges, taxes, or special payment terms, everything can be tailored effortlessly.

Ease of Use and Accessibility

Spreadsheets are user-friendly, making them accessible even to individuals with minimal technical knowledge. Many people are already familiar with how spreadsheet programs work, so there’s little to no learning curve involved. Furthermore, since these documents can be saved and accessed on almost any device, it’s easy to stay on top of your payments anytime, anywhere.

| Feature | Benefit |

|---|---|

| Customization | Adaptable to your brand, business model, and client needs |

| Built-in Calculations | Automates totals, taxes, and discounts to reduce errors |

| Accessibility | Accessible from any device, allowing easy updates and record keeping |

| Cost-effective | Free or low-cost compared to specialized software |

| Data Management | Simple tracking of payments and financial records |

By using a spreadsheet, you gain a simple yet powerful tool that can handle a variety of billing tasks without requiring additional, costly software. Its flexibility, ease of use, and cost-effectiveness make it an excellent choice for businesses looking to simplify their payment processes.

Free Billing Solutions for Small Businesses

For small businesses, managing finances and keeping track of payments can be a challenging task. One of the easiest and most cost-effective ways to handle this is by using a free, customizable document that allows you to create professional invoices. These simple tools can save time and improve organization without the need for expensive software or complicated systems.

Why Choose Free Billing Documents?

There are several reasons why free billing systems are a great option for small businesses:

- Cost-effective – Free options eliminate the need for expensive accounting software, which is especially helpful for businesses with tight budgets.

- Easy to use – These systems are designed to be user-friendly, requiring little to no experience with financial management tools.

- Customization – You can adjust every aspect of the document, from the layout to the content, making it tailored to your specific business needs.

- Quick to implement – With ready-to-use solutions, you can start generating billing documents in minutes.

Where to Find Free Billing Documents

There are numerous sources where you can download or access free, pre-made billing documents. Some of the best places include:

- Microsoft Office Templates – Offers a variety of free billing documents that can be customized to suit your business.

- Online platforms – Websites like Google Sheets or other online platforms offer free billing solutions with cloud-based access.

- Business blogs and forums – Many small business-focused websites offer free downloadable files or links to free tools.

By taking advantage of these free resources, small businesses can maintain a professional appearance and keep their financial records organized without any additional costs. With the right system in place, businesses can streamline their billing processes and focus on growing their operations.

Step-by-Step Guide to Creating Billing Documents

Creating professional billing documents is a crucial task for managing payments and keeping financial records organized. Fortunately, you don’t need advanced software to create these documents–using a basic spreadsheet program allows you to generate detailed and accurate bills. This step-by-step guide will help you create a well-structured payment request, customized to fit your business needs.

Step 1: Set Up the Layout

The first step is to structure your document. You’ll need a few key sections: your business details, client information, a list of products or services, and payment terms. Here’s how to start:

- Header – Include your business name, logo, and contact details at the top of the document. Make sure to also add the invoice number and date for easy reference.

- Client Information – Below the header, include the client’s name, company (if applicable), and contact details. This helps keep the document personalized and professional.

Step 2: Add Product or Service Details

Next, list the products or services provided. This section should include the following columns:

- Description – A brief description of the product or service.

- Quantity – The amount of each item or service.

- Price – The price per unit or service.

- Total – The total cost for each item (multiply the quantity by the price).

For each item, make sure the totals automatically calculate using basic formulas to save time and reduce errors.

Step 3: Calculate and Apply Taxes and Discounts

Once the main items are listed, add any applicable taxes or discounts. Here’s how to handle them:

- Tax – If applicable, calculate the sales tax and apply it to the total amount.

- Discount – If offering a discount, apply it to the final amount before taxes.

- Auto Calculations – Use built-in formulas to automatically compute totals, taxes, and discounts. This reduces the chance of human error and ensures consistency across all documents.

- Dynamic Date Tracking – Automatically populate dates, such as the invoice date or due date, based on predefined formulas or system settings. This ensures that your documents are always up to date.

- Payment Status Tracking – Set up automatic alerts or color codes to track whether an invoice has been paid, is pending, or is overdue, helping you stay on top of accounts receivable.

- Use Formulas for Calculations – Start by using simple formulas to calculate the cost of each item or service, the tax amount, and the final total. This eliminates the need for manual calculations.

- Set Date Functions – Use date functions to auto-fill invoice and payment due dates based on a specified start date, reducing the time spent manually entering dates.

- Apply Conditional Formatting – Set rules for conditional formatting to highlight overdue invoices, or automatically change the color of cells depending on payment status.

- Auto Calculations – No more manually adding totals or tax rates. Spreadsheets automatically compute costs, reducing time spent on each document.

- Batch Processing – You can create multiple payment requests in a fraction of the time it would take to generate them individually, especially when using predefined formulas or formatting.

- Predefined Layouts – Save hours on formatting by using ready-made structures that require minimal adjustments.

- No Software Fees – Unlike specialized billing software, spreadsheets come at no additional cost, making them an affordable option for businesses on a tight budget.

- Reduced Errors – By automating calculations and using preset formulas, the likelihood of errors in pricing or data entry is minimized, saving businesses from having to correct mistakes later.

- Incorrect Formulas – Not setting up automatic calculations correctly can result in manual entry errors and inconsistent totals.

- Missing Tax Calculations – Failing to apply sales tax or using an outdated rate can lead to inaccurate invoices and potential legal issues.

- Manual Errors – Relying too much on manual data entry without validation checks can increase the likelihood of mistakes.

- Inconsistent Design – Using multiple font styles or mismatched column sizes can make the document harder to read.

- Lack of Clear Structure – A poorly organized document can make it difficult for clients to find the necessary information, such as the payment due date or the total amount owed.

- Unlabeled Fields – Not clearly labeling each section, such as item descriptions or taxes, can lead to confusion.

- Missing Contact Information – Forgetting to include the client’s phone number, email, or address can slow down the payment process.

- Wrong Client Details – Entering the wrong information or outdated contact details can lead to delayed responses or confusion when sending payment reminders.

- Improved Accuracy – Data is transferred directly from one system to another, reducing the chance of human error when entering information into both systems.

- Time Savings – Automation eliminates the need for double data entry, which saves time and ensures consistency across documents and financial records.

- Better Financial Tracking – Integration allows for real-time updates to financial records, helping you stay on top of payments, expenses, and profits.

- Automated Reporting – With all financial data in one place, generating financial reports, such as profit and loss statements, becomes much simpler.

- Choose Compatible Software – Make sure the accounting software you use supports importing or syncing data from spreadsheets. Many popular accounting programs offer this feature.

- Set Up Data Fields – Ensure that the fields in your spreadsheet match those in your accounting system (e.g., item descriptions, amounts, taxes). This ensures the correct transfer of information.

- Import Data – Most accounting programs allow you to upload CSV or Excel files directly. Some may even support more automated sync options, linking the two systems in real time.

- Automate Updates – Set up your system to automatically update payment statuses and financial records when new documents are created or payments are received.

- Business Information – Ensure that your business name, logo, and contact details are clearly visible at the top. This creates a professional first impression and makes it easy for clients to contact you.

- Client Details – Include the client’s name, address, and other relevant contact information. This ensures that your document is personalized and accurate.

- Invoice Number and Date – Assign a unique invoice number to each document and include the issue date. This helps with tracking and organizing your billing records.

- Payment Terms – Clearly specify the payment due date, late fees (if applicable), and accepted payment methods.

- Payment Status – Add a column for payment status where you can mark whether the payment is “Paid,” “Pending,” or “Overdue.” This helps you quickly identify which documents need follow-up.

- Amount Paid – Include a field to record partial or full payments. This allows you to track progress toward settling the total balance.

- Due Date – Clearly highlight the due date for each payment. This ensures that you know when to expect payments and helps you stay on top of overdue amounts.

- Highlight Overdue Payments – Use conditional formatting to automatically change the color of cells for overdue payments. For example, you can set the system to highlight “Pending” payments in red once the due date has passed.

- Track Partial Payments – If the payment is only partially made, you can use a different color to show that a balance is still due, helping you keep track of amounts outstanding.

- Mark Paid Invoices – You can set a rule to change the cell color for fully paid invoices to green, helping you quickly identify completed transactions.

- SUM – Use this formula to quickly add up totals for multiple line items. For example, =SUM(B2:B10) will calculate the sum of values in cells B2 to B10.

- IF – The IF function is useful for setting conditions. For example, you can use it to apply different tax rates based on the type of service or product. Example: =IF(A2=”Service”, 0.10, 0.15) would apply a 10% tax for services and 15% for products.

- VLOOKUP – VLOOKUP helps you pull information from a table based on specific criteria. This is helpful when dealing with large inventories or repeating products/services across multiple bills.

- ROUND – The ROUND function ensures that your numbers are rounded to the desired decimal places, which is particularly useful for currency values. Example: =ROUND(C2, 2) rounds the value in cell C2 to two decimal places.

- Data Validation – Set up rules to restrict the type of data that can be entered into specific cells. For example, you can restrict an “Amount Paid” field to only accept numbers or only allow specific dates in the “Due Date” field.

- Drop-Down Lists – Use drop-down lists to make data entry more consistent. For instance, create a drop-down list for the “Payment Method” field that includes options like “Credit Card,” “Bank Transfer,” and “Cash.” This ensures uniformity and reduces the chance of typographical errors.

- Clear Section Breaks – Ensure that sections like “Business Information,” “Client Details,” “Charges,” and “Total Due” are clearly separated. This allows for easier reading and understanding, especially when the document is printed.

- Optimized for Standard Paper Sizes – Design your document to fit common paper sizes, such as A4 or letter size, ensuring that it prints neatly without cutting off any important details.

- Simple Fonts and Readable Sizes – Use legible fonts and keep the text size consistent to ensure the document is easy to read once printed. Avoid overly complex designs or fonts that may not render well on paper.

- Pre-set Print Area – Define the print area within your document so that it automatically formats correctly when you click “Print.” This ensures that only the relevant sections of the document are included.

- Print Preview – Always use the print preview feature to ensure everything looks correct before sending the document to the printer. This prevents errors such as misalignment or missing content.

- Save as PDF – In addition to printing directly, consider saving the document as a PDF. This provides a professional, easily shareable format for sending electronically or storing a record of the payment request.

- Business Size – If you’re running a small business, a simple, straightforward layout with basic functions may be sufficient. Larger businesses might require more complex documents that include multiple fields for various payment types, taxes, discounts, and detailed client information.

- Transaction Frequency – If you send invoices frequently, you might benefit from an automated structure that can easily be duplicated and modified. For occasional billing, a more static, simple format could suffice.

- Customization – Consider how much customization you need. Some spreadsheets come with pre-built fields for specific industries (e.g., service, product sales, etc.), while others allow for complete flexibility to fit your unique workflow.

- Simple Calculation Functions – Look for spreadsheets that include built-in formulas for automatic calculations of totals, taxes, and discounts. This saves time and reduces the chance of errors in manual calculations.

- Clear Layout – A well-organized, easy-to-read layout is essential. Your spreadsheet should allow for a clean presentation of client information, charges, and payment terms.

- Customizable Fields – Flexibility to adjust fields, such as adding your company logo or adjusting the pricing structure, will help tailor the document to your brand and business needs.

- Data Tracking – Spreadsheets that allow you to track payment status (paid, pending, overdue) help you stay on top of your accounts receivable and ensure timely follow-ups.

Automating Billing with Spreadsheet Documents

For businesses looking to save time and reduce errors, automating the billing process is an essential step. By using a system that automatically calculates totals, applies discounts, and tracks payments, you can streamline the process and ensure greater accuracy. Automating key elements of your payment requests allows you to focus more on growing your business while ensuring that each document is generated with minimal manual effort.

Key Automation Features

There are several automation features that can significantly improve the efficiency of your billing process:

How to Set Up Automation

Setting up automation in your billing document is easier than you might think. Follow these steps:

By incorporating these features, you can significantly reduce the time spent on each billing cycle, improve accuracy, and ensure a smoother workflow for both your business and your clients.

How Excel Invoices Save Time and Money

Managing financial records and sending payment requests can be time-consuming and costly, especially for small businesses. Traditional methods often require manual calculations, repetitive data entry, and tracking across multiple systems. Using a spreadsheet to generate these documents streamlines the entire process, reducing both the time spent on administrative tasks and the likelihood of costly errors.

Time Savings with Automation

One of the biggest advantages of using a spreadsheet for billing is automation. Built-in formulas can quickly calculate totals, apply taxes, and adjust for discounts without the need for manual intervention. This not only speeds up the process but also ensures that the numbers are accurate every time.

Cost Reduction

Spreadsheets also reduce costs by eliminating the need for expensive billing software and minimizing errors that could lead to costly mistakes or lost revenue. By using a free, customizable system, businesses can allocate their resources more effectively.

By adopting a spreadsheet-based system for managing payment requests, businesses can save valuable time on administrative tasks and reduce unnecessary costs, all while maintaining accuracy and professionalism in their financial communications.

Common Mistakes in Excel Billing

While using a spreadsheet to manage payment requests can be a highly efficient solution, it’s easy to make mistakes that can lead to confusion or financial discrepancies. These errors often arise from overlooked details or incorrect formulas. Understanding and avoiding these common mistakes can help ensure that your billing process is accurate and professional.

1. Calculation Errors

One of the most frequent mistakes is failing to properly set up calculations for totals, taxes, and discounts. Incorrect formulas or missing data can lead to incorrect billing amounts.

2. Inconsistent Formatting

Inconsistencies in formatting can make your documents look unprofessional and create confusion for clients. This includes misalignment of text, inconsistent fonts, or failure to use clear headings.

3. Missing or Incorrect Client Information

Another common mistake is failing to include all necessary client details or entering them incorrectly. This can cause delays in payments or lead to miscommunication.

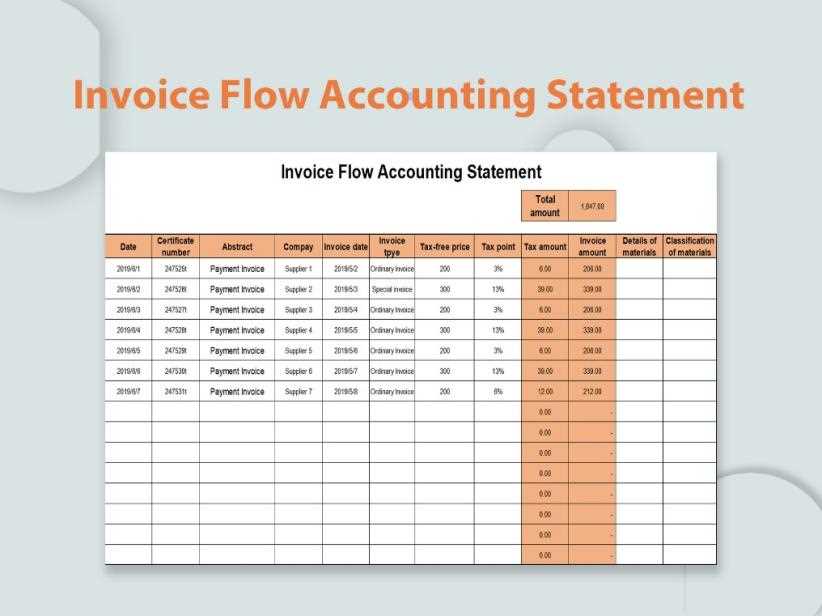

For businesses looking to streamline their financial workflows, integrating billing documents with accounting software can be a game changer. Combining the simplicity of spreadsheet-based payment requests with the power of accounting systems allows for seamless data transfer, improved accuracy, and more efficient financial management. This integration enables businesses to automatically update their financial records, track payments, and generate reports with minimal manual effort.

Benefits of Integration

When you link your billing system with accounting software, several advantages become immediately apparent:

How to Integrate Your System

Integrating your billing documents with accounting software involves a few steps, depending on the specific tools you are using. Here’s a general approach:

By integrating your billing documents with accounting software, you can reduce administrative work, improve financi

Designing Professional Billing Documents in Excel

Creating a professional-looking payment request is crucial for any business. A well-designed document not only improves your business’s image but also ensures that clients can easily understand and process the details. Using a simple spreadsheet to design these documents allows you to customize the layout, include necessary details, and maintain a polished appearance that aligns with your brand. Here are some key design elements to consider when creating professional billing documents.

Key Elements of a Professional Design

When designing a professional payment request, focus on clarity, organization, and branding. Here are the essential elements to include:

Creating a Structured Layout

A well-organized layout ensures that all the essential information is easy to find. Here is a simple example of how to structure the data in your billing document:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation Fee | 1 | $100.00 | $100.00 |

| Service Charge | 3 | $50.00 | $150.00 |

| Subtotal | $250.00 | ||

| Sales Tax (10%) | $25.00 | ||

| Total Amount Due | $275.00 | ||

By using a table like the one above, you can clearly display the products or services provided, their prices, and the total amount due. This format ensures that clients can easily review the charges and understand the breakdown of costs.

Branding and Customization

To further enhance the professional look, consider adding your brand colors and fonts. Customize the document’s appearance by using consistent formatting and ensuring that it matches the style of your business’s other materials. A cohesive brand identity can make your payment requests look more polished and trustworthy.

In conclusion, a well-designed payment document not only improves clarity and professionalism but also help

Tracking Payments with Spreadsheet Billing Documents

Keeping track of payments is an essential part of any business’s financial management. Using a structured document to record payments allows you to monitor the status of each payment, track overdue amounts, and maintain accurate financial records. By integrating payment tracking features into your billing system, you can ensure that you stay organized and can quickly identify outstanding balances, improving cash flow management.

Setting Up Payment Tracking

To effectively track payments, your billing document should include dedicated fields for payment status, due dates, and amounts paid. Here’s how you can set up these fields:

Using Conditional Formatting to Track Overdue Payments

Conditional formatting can be a powerful tool to visually track overdue payments and ensure nothing slips through the cracks. Here’s how you can set it up:

By setting up these features and using conditional formatting, you can make it easy to track payments at a glance, improving your workflow and ensuring timely follow-ups on outstanding balances.

Advanced Excel Billing Features You Should Know

While basic spreadsheet functions are useful for creating and sending payment requests, there are several advanced features that can take your billing process to the next level. These tools help automate calculations, improve efficiency, and provide deeper insights into your financial data. By mastering these features, you can save time, reduce errors, and make your billing process much more effective.

1. Automating Calculations with Formulas

Advanced formulas can make your billing process much more efficient. By automating complex calculations, you can ensure accuracy and save time. Here are some essential formulas to integrate into your document:

2. Using Data Validation and Drop-Down Lists

Data validation and drop-down lists are excellent tools for maintaining consistency across your documents and avoiding data entry mistakes. Here’s how you can use them:

By implementing these advanced functions, you can significantly enhance the capabilities of your billing documents, making them more efficient, accurate, and easier to use.

Printable Billing Documents for Quick Billing

For businesses that require fast and efficient billing, having printable payment requests ready to go can save time and streamline the process. With the right setup, you can quickly generate documents that are ready for printing or sharing with clients. The ability to create and print payment requests directly from a spreadsheet ensures that you maintain a professional look while keeping everything organized. Here’s how to design documents that are easy to print and distribute.

Designing a Printable Layout

A clean, well-structured document makes it easier for both you and your clients. Here are key elements to consider when designing a printable layout:

Setting Up for Quick Printing

To make the printing process as seamless as possible, it’s important to set up the document for easy access and quick printing:

By following th

Choosing the Right Spreadsheet for Your Business

Selecting the right spreadsheet for creating payment requests is essential for managing your billing process efficiently. The right setup ensures that your financial documents are organized, easy to read, and tailored to your specific business needs. Whether you are a small business owner or running a larger enterprise, choosing the right structure can help you save time, reduce errors, and maintain professional standards. Here’s how to make an informed choice when picking the best spreadsheet for your billing needs.

Consider Your Business Needs

Before selecting a spreadsheet, take a moment to consider the unique needs of your business. The following factors will help guide your decision:

Features to Look for in a Spreadsheet

When choosing the right spreadsheet, make sure it offers the following key features:

By carefully considering these factors and evaluating the available options, you can choose the right spreadsheet for your business. With the right tool, you can streamline your billing process, maintain organization, and improve overall efficiency.