Invoicing Template Word for Professional and Easy Invoice Creation

For businesses and freelancers, having a reliable system to generate accurate and professional payment requests is essential. A well-structured document not only helps maintain clarity with clients but also ensures smooth financial operations. Creating these documents efficiently and with minimal effort is possible using ready-to-edit files designed for various needs.

Using customizable formats allows individuals and companies to create invoices that are tailored to their specific requirements. These documents can include important details such as payment terms, client information, itemized lists of services, and more, while maintaining a professional appearance that aligns with your brand’s image.

Whether you are a small business owner, a contractor, or a freelancer, having access to easy-to-use tools that simplify the billing process is key. The right document format can save you time, reduce errors, and present your business in a polished manner to clients and customers.

Invoicing Template Word Benefits for Businesses

Effective billing solutions are crucial for businesses to maintain financial order and ensure timely payments. Having access to well-designed documents that can be quickly customized for each transaction helps streamline the entire process. This approach reduces the complexity of creating payment requests from scratch while ensuring accuracy and professionalism in every detail.

Time and Cost Efficiency

One of the key advantages of using editable billing files is the significant amount of time and money businesses save. Instead of designing new documents for each client or project, companies can simply modify pre-existing files. This not only reduces administrative costs but also speeds up the invoicing process, allowing business owners to focus more on their core operations.

Consistency and Professionalism

Consistency is vital in presenting your business to clients. By using structured billing documents, companies can ensure that all necessary information is included in a uniform manner. This enhances professionalism and builds trust with clients, making them more likely to engage in repeat business. A polished and standardized document shows that your business is organized and reliable.

| Benefit | Explanation |

|---|---|

| Efficiency | Ready-to-use files save time by eliminating the need to create each document from scratch. |

| Cost Reduction | Pre-designed documents reduce administrative costs and minimize errors. |

| Accuracy | Standardized formats ensure all necessary fields are correctly filled out every time. |

| Professional Appearance | Templates create polished, business-like documents that reflect your brand image. |

How to Create Professional Invoices

Creating polished and well-structured billing documents is essential for maintaining smooth financial transactions and fostering trust with clients. A professional payment request not only ensures you get paid on time but also reflects the quality of your business. Whether you’re a freelancer, small business owner, or contractor, the key to a successful document is in the details and consistency.

Follow these simple steps to create clear and professional billing documents:

- Start with Clear Contact Information: Include your name or company name, address, phone number, and email. Don’t forget your client’s contact details as well.

- Provide a Unique Invoice Number: Each document should have a unique identifier for tracking purposes. This helps both you and your clients manage records easily.

- Set the Date: Clearly state the date when the bill is being issued and, if applicable, include the due date for payment.

- List Services or Products: Itemize all the services or products provided, including quantities, rates, and any other relevant details. Be thorough to avoid confusion.

- Include Payment Terms: Specify the payment methods you accept, the due date, and any late fees or discounts for early payment.

- Tax Details: If necessary, include tax percentages and the amount due, making sure your clients are aware of the total cost breakdown.

- Final Total: Clearly indicate the total amount due, including taxes, discounts, and any other applicable charges.

Once all sections are filled out, make sure to double-check for accuracy. A small mistake can lead to payment delays or confusion. It’s also a good idea to keep your design simple and easy to read, ensuring that all information is clearly presented.

Finally, always save your documents in a format that is easy to share and print, ensuring your client can access and review it without any issues.

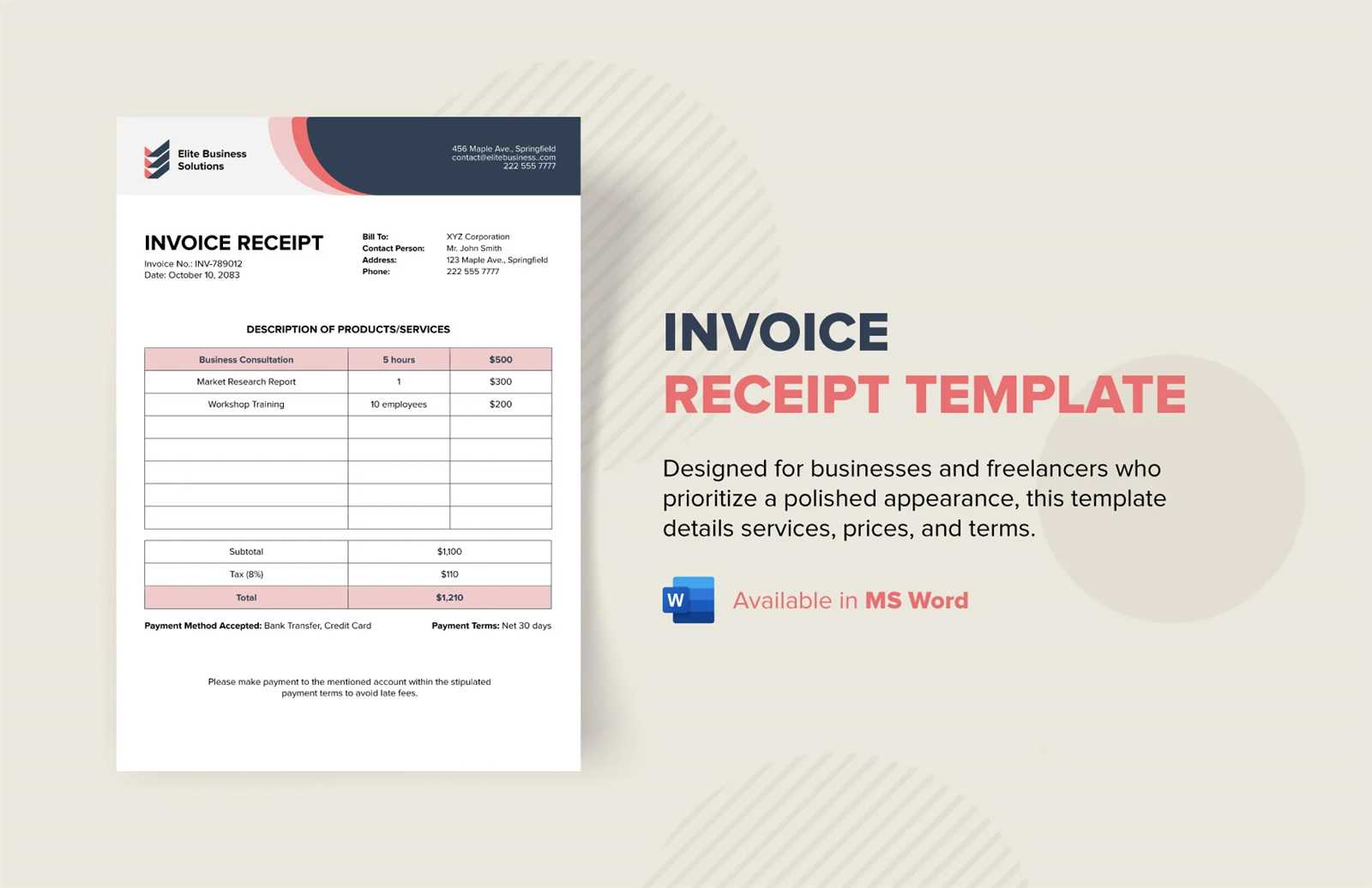

Customizable Features of Word Templates

Having flexible and adaptable billing documents is key for businesses to maintain efficiency and professionalism. Customizable formats allow you to adjust the structure and design to fit your unique needs. Whether it’s altering the layout, adding your company branding, or modifying fields to match your service offerings, the ability to tailor these documents makes managing payments much easier and more aligned with your brand identity.

Flexible Design Options

One of the biggest advantages of editable files is the ability to modify design elements. You can adjust the font styles, colors, and layouts to match your company’s branding. For example, you can incorporate your company logo, choose specific fonts, and use brand colors to create a consistent look across all your business materials. This simple customization enhances the professional appeal of your billing documents.

Editable Fields for Specific Details

Customizable files also allow you to easily add or remove fields based on your business’s needs. You can personalize each document by including specific information such as payment terms, service descriptions, or tax rates. This flexibility ensures that your billing statements are comprehensive and tailored to each transaction.

| Feature | Benefit |

|---|---|

| Branding Customization | Adjust design elements like colors, fonts, and logos to reflect your brand identity. |

| Editable Fields | Easily add, remove, or modify fields such as taxes, payment terms, and service descriptions. |

| Layout Flexibility | Change the layout and structure of the document to fit different types of services or products. |

| Automatic Calculations | Incorporate formulas for automatic total calculations, saving time and reducing errors. |

Why Use Word for Invoices

When it comes to creating professional billing documents, flexibility and ease of use are key. For many businesses, choosing the right software to create these documents can make a significant difference in how efficiently tasks are completed. A widely accessible and familiar program offers a straightforward solution for creating, customizing, and managing payment requests with minimal effort.

Familiarity and Accessibility

One of the main reasons businesses opt for this software is its familiarity. Most people are already comfortable using the program for everyday tasks like document creation or editing. This means less time spent learning how to use new tools and more focus on creating accurate and professional documents. Additionally, this software is available on almost all devices, making it easy to access and work from anywhere.

Customization and Professional Presentation

The software also provides a high degree of flexibility in customizing the layout and design of your billing documents. You can easily adjust fonts, colors, and even add images or logos to create a professional and personalized appearance. The ability to quickly make these changes ensures your documents not only look great but also align with your brand’s identity.

In addition, it supports several file formats, making it easy to share with clients in various ways. You can send your documents as email attachments, print them out, or store them for future reference. This versatility ensures your business can maintain a smooth workflow, no matter how your clients prefer to receive their payment requests.

Free Invoicing Templates Download Options

For small businesses and freelancers, finding affordable solutions to create professional billing documents is crucial. Fortunately, there are many free resources available online that allow you to download ready-to-use payment request files. These resources offer a variety of layouts and styles, making it easier to select one that fits your business needs without the cost of purchasing expensive software.

Many websites provide access to basic billing document designs, which can be customized to suit specific requirements. These downloadable files are typically in popular formats, ensuring compatibility with most systems. Whether you need simple designs for one-time projects or more detailed templates for ongoing client work, these free downloads provide a quick and cost-effective way to manage your financial documents.

In addition to free downloads, some platforms also offer advanced features like customizable fields and built-in calculation tools, which can further streamline your billing process. With the right options, businesses can improve efficiency and ensure their documents look polished and professional every time.

Design Tips for Effective Invoices

Creating a clear, professional, and easy-to-read billing document is essential for any business. A well-designed payment request not only improves client communication but also helps avoid confusion or delays in payment. The design of your document plays a crucial role in ensuring that the recipient can quickly understand the details and take the appropriate action. Here are some design tips to enhance the effectiveness of your billing documents:

- Keep the Layout Simple: Avoid clutter by using a clean, straightforward layout. Make sure all important details, like payment terms and amounts, are easy to find at a glance.

- Use Clear Headings and Sections: Organize the document into clearly labeled sections (e.g., contact details, services provided, total amount). This will make it easier for the recipient to navigate the information.

- Highlight Key Information: Use bold or larger fonts to emphasize the most important details, such as the total amount due and the payment due date.

- Incorporate Your Brand: Include your logo, company colors, and fonts to ensure that the document reflects your business’s identity and professionalism.

- Ensure Consistent Alignment: Proper alignment of text, columns, and rows creates a neat and organized appearance, which makes the document easier to read.

- Include Clear Payment Instructions: Provide explicit details on how the client should make the payment, including accepted payment methods and account information if applicable.

By following these design tips, you can create effective and visually appealing billing documents that will help maintain professional relationships and ensure timely payments.

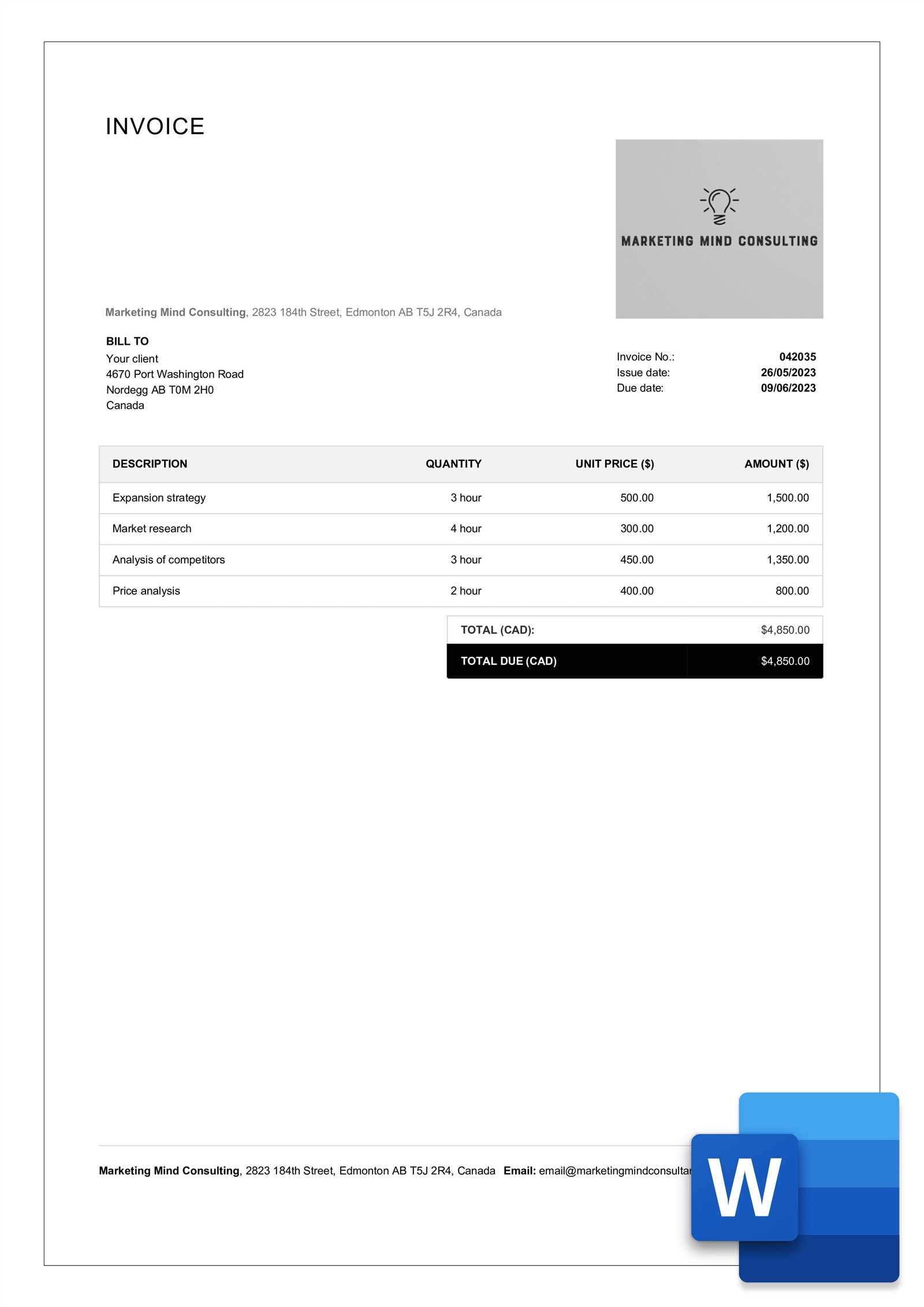

Setting Up Your Invoice Layout

Designing a well-structured and organized payment request is essential for clear communication and smooth financial transactions. A properly set-up layout ensures that both you and your clients can quickly locate key information, such as amounts due, payment terms, and contact details. The layout should be intuitive and easy to navigate, making the billing process more efficient for everyone involved.

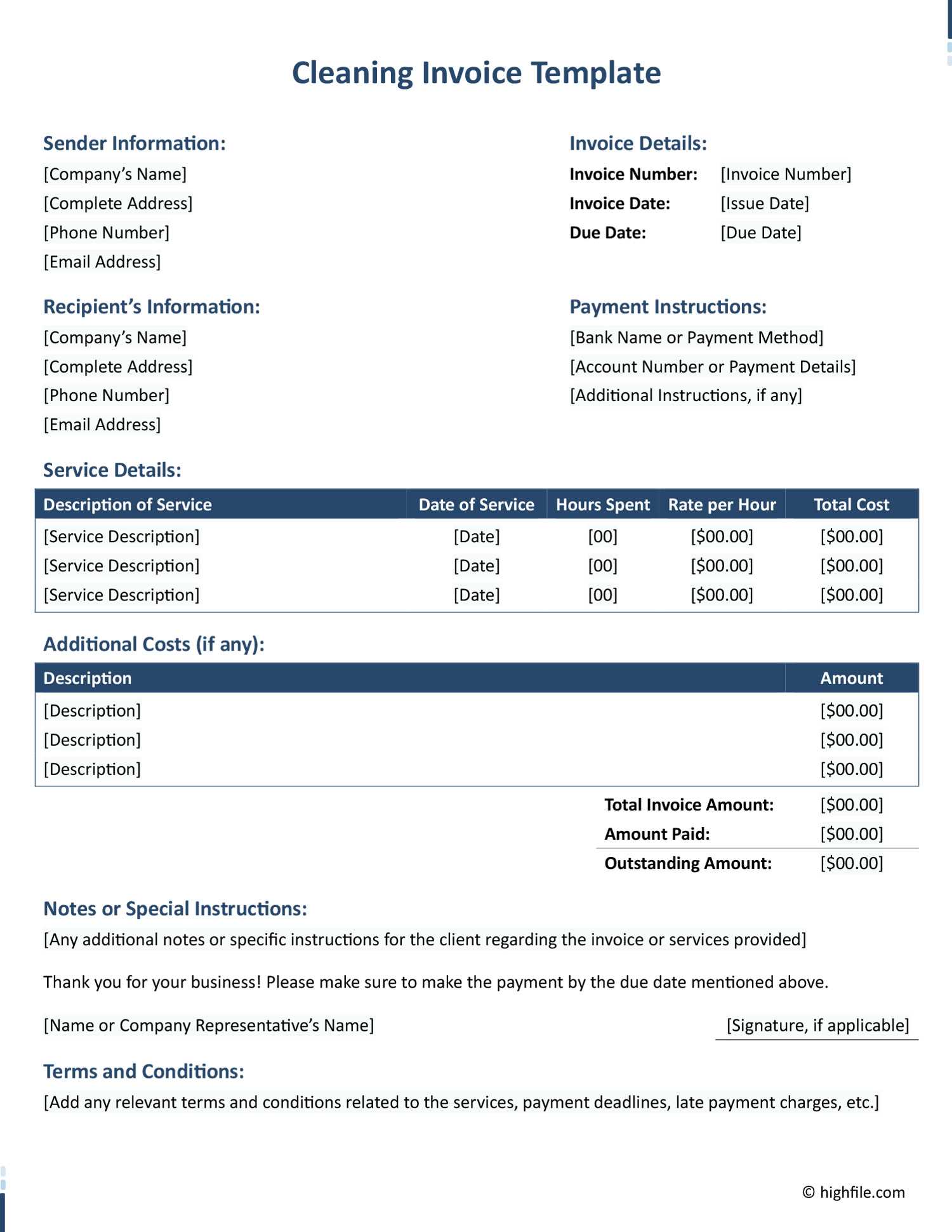

Start by defining the most important sections of your document. You should have distinct areas for your company’s contact information, the client’s details, a list of services or products, and a breakdown of costs. The structure should prioritize clarity while maintaining a professional appearance.

Key elements to include in your layout:

- Header Section: Include your business name, logo, and contact details at the top for easy identification.

- Client Information: Clearly present the recipient’s name, address, and other contact details right below your information.

- Invoice Details: Add a unique identifier for the document, the issue date, and the payment due date.

- Services or Products: List each item with a description, quantity, rate, and cost breakdown. This helps the client understand exactly what they’re being billed for.

- Total and Payment Instructions: Clearly highlight the total amount due and provide simple, detailed instructions for payment.

Use sufficient white space between sections to avoid a crowded appearance. Align text and numbers consistently to maintain readability. The overall goal is to create a document that looks clean and professional, ensuring that every piece of information is easily accessible.

Common Mistakes to Avoid in Invoices

Even a small error in a payment document can cause confusion or delay in payment. It’s essential to ensure that every detail is accurate and clearly presented. Avoiding common mistakes can help maintain professionalism, reduce the chances of disputes, and ensure that payments are received on time.

Incomplete or Missing Information

One of the most common mistakes is failing to include all the necessary details. Missing or incomplete information can confuse your client and lead to delays. Always ensure that your document contains:

- Accurate contact details for both parties

- A unique reference number

- The full description of services or products provided

- The correct total amount due, including any applicable taxes

- Clear payment terms and instructions

Incorrect Calculations or Overlooked Discounts

Another frequent mistake is incorrect billing calculations. Double-check the math to ensure that quantities, rates, taxes, and discounts are properly calculated. Any miscalculation can lead to confusion and the potential loss of trust with your client. If offering discounts, make sure they are clearly stated, and the final total reflects the deduction.

Additionally, ensure that any adjustments (such as early payment discounts or late fees) are clearly explained in the document to avoid misunderstandings.

How to Add Tax and Discount Information

Incorporating tax and discount details correctly into your payment request is essential for clarity and transparency. Both tax charges and discounts can significantly impact the total amount due, and it’s crucial to ensure they are clearly stated to avoid confusion. By clearly outlining these elements, you help clients understand how the final price is calculated and what they are expected to pay.

Here are the key steps for including tax and discount information in your billing documents:

- Specify the Tax Rate: Clearly indicate the applicable tax rate for your products or services. If you operate in different regions, make sure to include the correct tax percentage for each location if necessary.

- Break Down the Tax Amount: Show the exact amount of tax that has been added to the base price. This provides transparency and makes it easier for clients to verify the total.

- List Discounts Clearly: If you are offering any discounts (e.g., early payment discounts or promotional offers), include the discount amount or percentage, and subtract it from the original price. Make sure the discount terms are clear, such as the deadline for availing the discount.

- Show the Final Amount: After applying taxes and discounts, clearly display the final amount due. This helps prevent confusion and makes it easier for clients to see the total payment required.

Including tax and discount details correctly not only promotes transparency but also demonstrates professionalism in your billing process. Always double-check the calculations to ensure the amounts are accurate before sending the document to clients.

Simple Invoice Tracking in Word

Keeping track of your billing documents is essential for staying organized and ensuring timely payments. By using a structured approach to record and monitor issued requests, businesses can avoid missed payments and maintain proper financial records. With basic tools and strategies, you can efficiently track the status of your documents and stay on top of your finances.

A simple way to track your documents is by creating a table within your payment records. This table can include key details such as invoice numbers, client names, issue dates, due dates, and payment statuses. Having this information in one place makes it easy to spot outstanding balances and follow up on overdue accounts.

| Invoice Number | Client Name | Issue Date | Due Date | Status |

|---|---|---|---|---|

| INV-001 | John Doe | 01/10/2024 | 15/10/2024 | Paid |

| INV-002 | Jane Smith | 05/10/2024 | 20/10/2024 | Unpaid |

| INV-003 | Acme Corp. | 10/10/2024 | 24/10/2024 | Pending |

By maintaining such a table, you can easily track which documents have been paid, which are overdue, and which are still pending. This simple method of tracking can save time and reduce errors, ensuring that you always have an up-to-date overview of your financial situation.

Using Word Templates for Small Business

For small business owners, creating professional and consistent documents is crucial for establishing credibility and maintaining smooth operations. Whether it’s a payment request, a service contract, or any other business correspondence, using ready-made formats can significantly reduce the time spent on document creation while ensuring accuracy. By leveraging customizable documents, small businesses can maintain a polished image without the need for expensive software or complex systems.

Streamlining Daily Operations

One of the primary advantages of using ready-made formats is the efficiency it brings to daily tasks. Instead of starting from scratch each time, you can quickly fill in the necessary details and have a professional-looking document ready in minutes. This can save valuable time, especially for businesses with high volumes of transactions or frequent client interactions.

Professional Appearance and Consistency

Consistent formatting across all your business documents helps build trust with clients and suppliers. Customizable designs allow you to adjust elements like fonts, logos, and colors, ensuring that each document matches your brand’s identity. Having a cohesive look not only reflects professionalism but also makes your business stand out in a competitive market.

By using ready-to-edit formats, small businesses can:

- Save time on document creation and focus on core business activities.

- Ensure consistency in branding and communication.

- Maintain a professional image without the need for graphic design or complex software.

- Quickly adapt documents for specific needs, from simple bills to more complex contracts.

In summary, utilizing pre-designed formats allows small businesses to create effective and professional documents quickly, ensuring they can focus on growing their business without getting bogged down in administrative tasks.

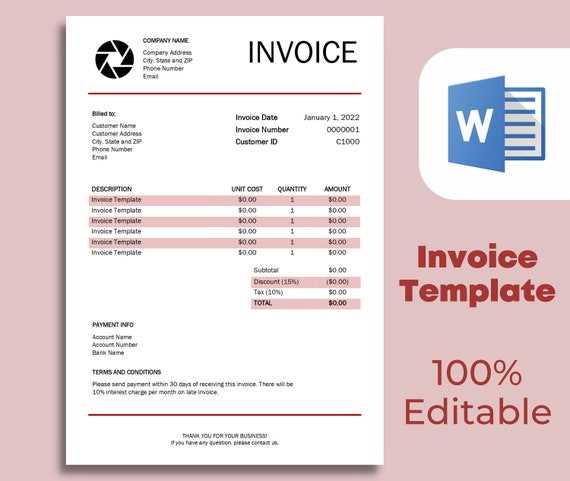

Top Word Invoicing Templates to Try

When it comes to creating billing documents quickly and efficiently, choosing the right layout is essential. Many ready-to-use formats offer a professional look and can be easily customized to suit your specific needs. These ready-made designs not only save time but also ensure consistency and clarity in all of your financial communications. Below are some of the best options to consider for your business.

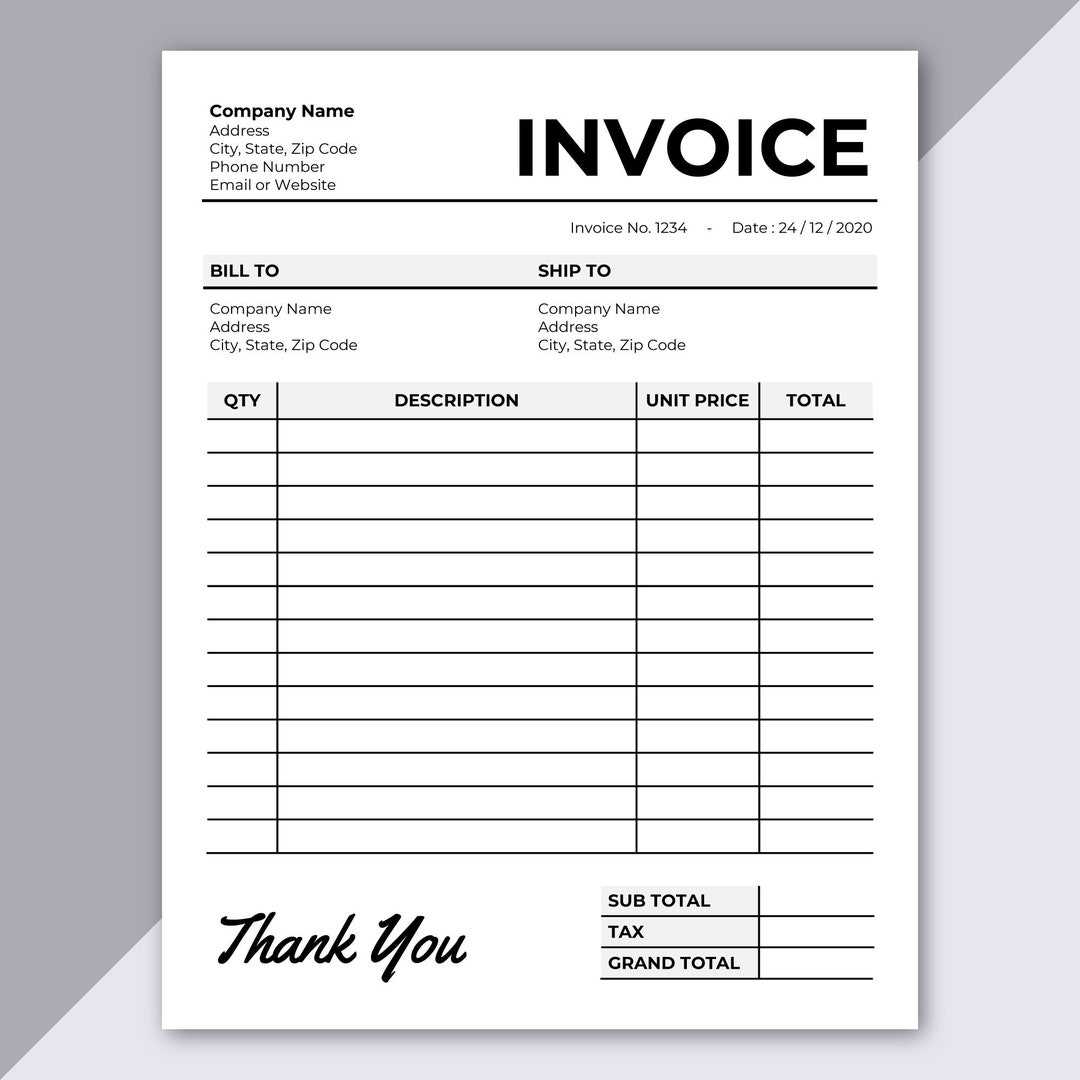

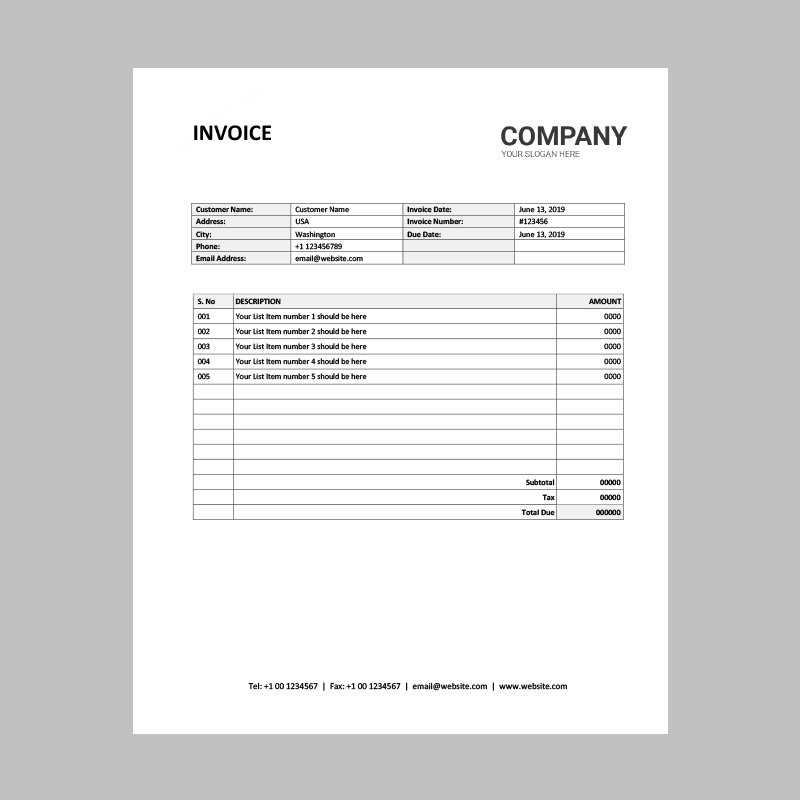

Simple and Clean Designs

If you’re looking for a straightforward, no-frills design, simple billing formats are an excellent choice. These styles are easy to read and ideal for businesses that prefer minimalism. They often feature clear sections for client details, services provided, and the total amount due, with enough space for any additional notes.

- Basic Invoice Format: Clean design with all essential fields, perfect for freelancers or small service-based businesses.

- Classic Style: Features a professional layout with neatly aligned columns for better organization of itemized services and totals.

- Minimalist Billing: Uses ample white space, ensuring clarity and a modern, fresh look that suits any industry.

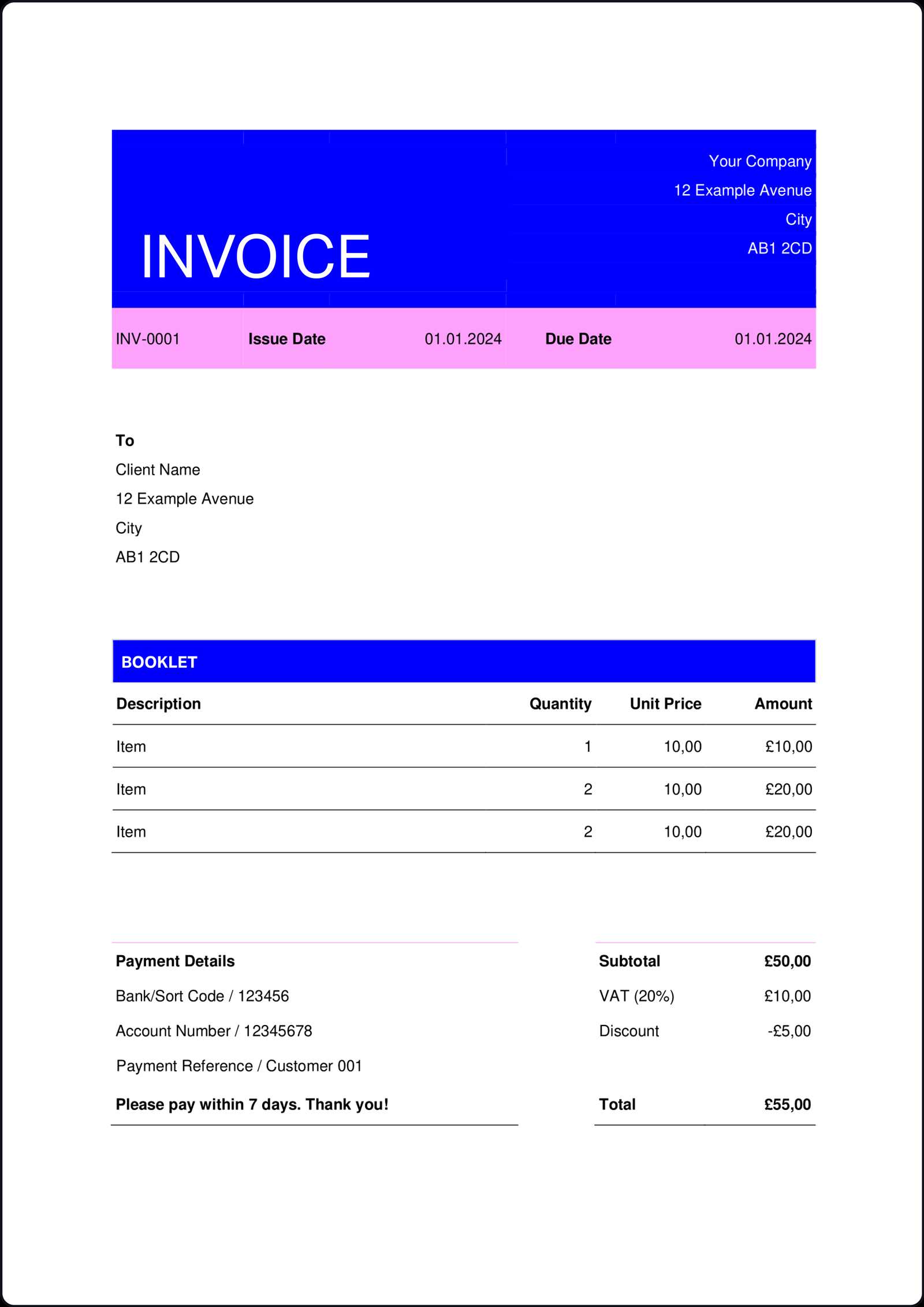

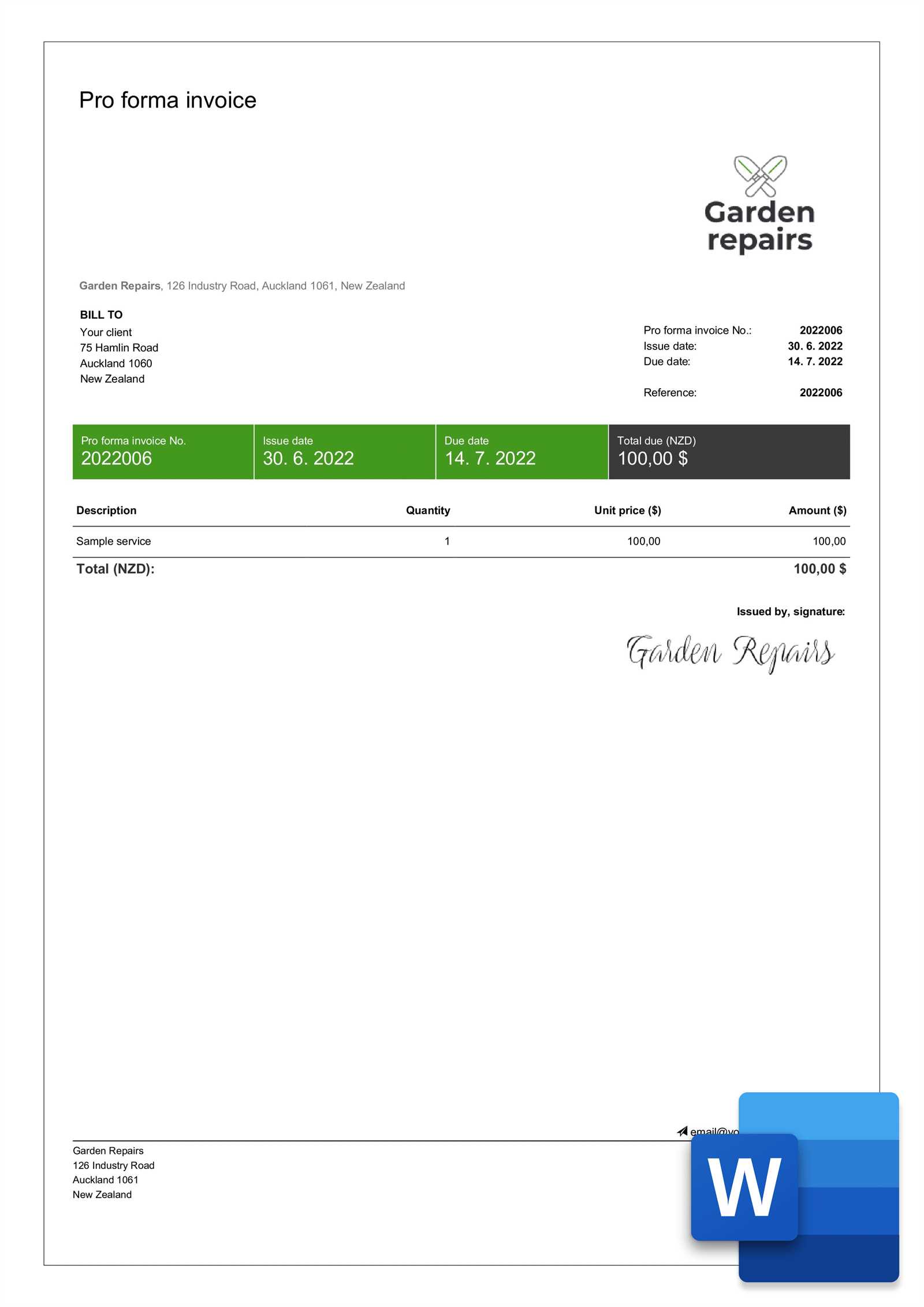

Stylish and Creative Options

If you want your billing documents to stand out and reflect your brand’s creativity, opt for more visually appealing designs. These formats allow for the inclusion of logos, custom color schemes, and even graphical elements to personalize the invoice while keeping it professional.

- Elegant Invoice with Logo: A more refined design, perfect for companies wanting to incorporate their logo and maintain a polished look.

- Modern Design with Sidebar: Features a creative sidebar to display your brand information while leaving the main section for the billing details.

- Invoice with Watermark: Adds a subtle watermark for a stylish touch, making the document look sophisticated yet professional.

Choosing the right design depends on your business needs and the image you want to project. Whether you prefer simple, minimalist layouts or something more creative, these customizable formats can be adjusted to suit any type of service or product offering.

How to Personalize Your Invoice Template

Customizing your payment request documents is a great way to make them reflect your business identity and establish a professional tone with your clients. Personalization goes beyond just adding your business name – it’s about making the document unique to your brand, ensuring consistency across all your communications. Here are some ways to make your billing documents stand out and better represent your business.

Incorporate Your Brand Elements

One of the easiest ways to personalize your document is by adding your brand’s logo and colors. This gives the document a more professional and cohesive look. Consider the following:

- Business Logo: Include your company’s logo in the header or footer to reinforce your brand’s identity.

- Brand Colors: Use your company’s color palette for headings, borders, and accents to create a branded, polished appearance.

- Custom Fonts: If your brand uses specific fonts, apply them to headings and key information to maintain consistency.

Customize Fields and Information

Tailoring the content of your documents to suit the specifics of your business and your clients can help improve clarity and relevance. Consider these modifications:

- Payment Terms: Include personalized payment terms, such as discounts for early payment or penalties for late payments.

- Additional Notes: Add a section for personalized notes, where you can provide extra details or thank clients for their business.

- Custom Service Descriptions: Instead of generic descriptions, tailor the service list to your specific offerings, including more detailed information when needed.

Make Use of Interactive Fields

To streamline your billing process, consider adding editable fields. This allows you to quickly fill out the document each time and customize it based on the client’s order. You can include:

- Client Details: Pre-set fields for client name, address, and contact information.

- Itemized List: Editable fields for each service or product, so you can quickly input quantities, prices, and descriptions.

- Total and Taxes: Fields for automatic calculations of taxes and the final amount due.

By incorporating these personal touches, you create a more professional, branded, and customer-friendly document that not only looks good but also

Setting Payment Terms in Your Invoice

Clearly defining payment terms is essential to ensure smooth transactions and prevent misunderstandings with clients. By outlining when payment is due, what methods are accepted, and any penalties or discounts, you provide transparency that can lead to faster payments and better client relationships. Setting these terms upfront helps set expectations and protects your business from late payments or disputes.

Here are some key elements to consider when setting payment terms:

- Due Date: Specify the exact date by which the payment should be made. This helps avoid confusion and sets clear expectations for both parties.

- Late Fees: Indicate any penalties that will be applied if the payment is not received by the due date. A clear late fee structure can encourage clients to pay on time.

- Early Payment Discounts: Offering a discount for early payment can be an effective way to incentivize clients to settle their balance sooner.

- Accepted Payment Methods: List the payment methods you accept (e.g., bank transfer, credit card, online payment systems) to make the process easier for your clients.

- Currency and Tax Details: Specify the currency in which payment should be made, and include any relevant tax information if applicable, so there are no surprises for the client.

Tips for Effective Payment Terms:

- Be Clear and Concise: Ensure your payment terms are easy to understand and not overly complicated. Keep the language simple and direct.

- Consistency: Apply the same terms across all of your payment requests to maintain fairness and avoid confusion.

- Consider Client Relationships: While it’s important to set strict payment expectations, being flexible with long-term or repeat clients can help strengthen business relationships.

By setting clear and reasonable payment terms, you not only protect your cash flow but also ensure that your clients are well-informed and can comply with your billing procedures. This helps build a professional reputation and minimizes delays in payment processing.

Invoice Formatting Best Practices

Proper formatting is crucial for creating clear, professional, and effective billing documents. Well-organized invoices not only enhance your business’s image but also make it easier for clients to understand the charges and process payments quickly. Whether you’re sending a single request or managing a large volume of them, adopting a consistent and clean layout is essential for both clarity and efficiency.

Here are some best practices for formatting your payment requests:

- Keep It Simple: Avoid clutter. A clean, straightforward layout ensures all the necessary information is easy to read and access. Use adequate spacing between sections to make the document less dense.

- Highlight Key Information: Make important details, such as the total amount due, due date, and client information, stand out by using bold text or larger fonts.

- Use Consistent Fonts: Choose legible fonts and sizes for body text and headings. Avoid using too many different fonts or styles, which can create confusion.

- Itemize Charges Clearly: List all services or products with clear descriptions, quantities, and prices. This transparency helps clients understand what they are being charged for.

- Include All Essential Details: Ensure your payment request contains the following details:

- Invoice number

- Client’s name and contact information

- Issue and due dates

- A detailed list of goods/services provided

- Amount due and tax (if applicable)

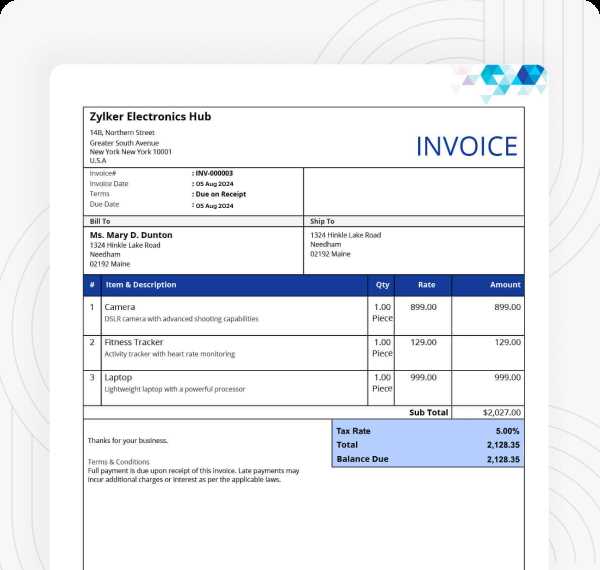

Invoice Sample Format

Below is a simple example of how to structure your document effectively:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Service 1 | Consultation for Project X | 5 hours | $50/hour | $250 |

| Service 2 | Design Work for Website |