Free Invoice Templates for Effortless Billing

For any business, keeping track of payments and managing financial transactions is essential. Having a professional approach to issuing documents that request payments can make a significant difference in how clients perceive your business. Using well-organized, pre-made formats ensures that you present clear and concise information every time.

With the right tools, you can quickly create and send professional billing documents without having to start from scratch. These resources are designed to be easily customizable, saving you valuable time while maintaining a polished appearance. Whether you’re a freelancer or a small business owner, you can simplify the invoicing process and ensure accuracy every time.

Choosing the right format helps to avoid common errors, track payment statuses, and foster a stronger relationship with your clients. No matter the size of your business, having an efficient method for requesting payments is crucial to smooth operations and financial clarity. Explore how these helpful documents can improve your workflow and ensure you get paid on time.

Free Invoice Templates for Small Businesses

Running a small business often means managing multiple tasks with limited resources. One of the key responsibilities is ensuring accurate and timely billing for products or services provided. Instead of spending excessive time creating documents from scratch, having access to pre-designed structures can simplify this process, allowing you to focus on growing your business.

For small business owners, using well-organized documents that request payments can save both time and effort. Whether you’re a freelancer, consultant, or retail owner, having ready-to-use formats tailored to your needs can help streamline your operations. These ready-made solutions are easy to customize and will ensure that every client receives a professional and consistent document each time.

Why Pre-Made Billing Documents Matter

- Time-saving: Customizing a pre-made structure is much faster than starting from scratch each time.

- Professional appearance: A polished, uniform look builds trust and credibility with clients.

- Consistency: Ensures each billing document adheres to your business standards and includes all necessary details.

- Efficiency: Quickly send out accurate and organized documents without worrying about formatting issues.

Where to Find Ready-Made Solutions for Small Businesses

There are many reliable sources online offering these ready-made formats. Some platforms even provide customizable options for specific industries, ensuring that the document fits the unique needs of your business. Popular places to find such resources include:

- Online document creation platforms

- Business resource websites

- Accounting software that includes built-in billing solutions

Utilizing these resources will not only save you time but also improve your client experience by maintaining clarity and professionalism in your financial interactions.

Why Use Free Invoice Templates?

Efficient billing practices are essential for any business. Having an organized approach to requesting payment ensures you maintain a professional image while minimizing the risk of errors. Using pre-designed documents offers a simple solution that saves time and effort, allowing you to focus on other critical aspects of your business.

By adopting ready-made structures, businesses can eliminate the need to design new payment requests every time, ensuring consistency and accuracy. Whether you’re just starting out or looking to optimize your process, this approach provides a convenient way to meet your financial documentation needs without unnecessary complexity.

| Benefit | Description |

|---|---|

| Time Efficiency | Quickly create professional documents without needing to format them from scratch. |

| Professionalism | Consistent, clear communication that builds trust with clients. |

| Accuracy | Pre-designed structures minimize the chances of omitting important details. |

| Customization | Easily adjust fields to fit your business needs and preferences. |

| Cost-effective | Eliminates the need for hiring professionals or purchasing expensive software. |

Whether you’re a freelancer, consultant, or a small business owner, leveraging pre-structured formats can streamline your operations and help ensure you stay on top of your financial records with minimal hassle.

How to Customize Your Invoice Template

Customizing your billing document is a crucial step in ensuring it fits your business’s unique needs. With a well-tailored structure, you can present all necessary details in a clear and professional manner, improving both your workflow and client relations. Personalization allows you to highlight important information, create a consistent branding experience, and meet legal requirements specific to your business type.

Key Elements to Customize

- Business Information: Include your business name, address, contact details, and logo for a professional touch.

- Client Details: Add your client’s name, address, and contact information to ensure accuracy and easy communication.

- Payment Terms: Clearly define payment due dates, methods, and any late fees or discounts to avoid confusion.

- Itemized List: Break down the services or products provided with descriptions, quantities, and pricing for full transparency.

- Tax Information: Include applicable taxes and rates, ensuring compliance with local regulations.

Steps to Personalize Your Document

- Select a document structure that suits your business needs, such as a simple or detailed format.

- Input your company and client details, double-checking for accuracy.

- Adjust the layout to fit your branding, including font styles and colors.

- Include relevant sections, such as itemized charges or terms and conditions, based on your service or product type.

- Save your personalized document as a template for future use, making adjustments only when necessary.

By following these steps, you ensure your payment requests reflect your brand’s professionalism and meet both your and your client’s needs efficiently.

Top Benefits of Using Invoice Templates

Utilizing pre-designed structures for requesting payments can significantly enhance your business operations. These ready-made documents offer a streamlined approach to managing transactions and ensuring accuracy in financial communication. By adopting a standardized format, you can reduce errors, save time, and maintain a professional image, all while improving the efficiency of your payment processes.

Here are some of the key advantages of incorporating these ready-to-use billing documents into your workflow:

- Time-saving: No need to start from scratch for each new client or transaction. Simply customize and send, cutting down on preparation time.

- Professionalism: A consistent, polished appearance helps build trust with clients and gives your business a more credible image.

- Accuracy: Pre-designed formats ensure that all required fields are included, minimizing the chances of missing crucial information.

- Ease of use: With simple customization options, these structures can be easily adapted to meet your business needs without requiring advanced skills.

- Legal compliance: Certain billing documents may include standard terms and tax information, helping you stay compliant with local laws.

By taking advantage of these ready-made options, businesses can focus more on their core operations while ensuring smooth and timely financial transactions with clients.

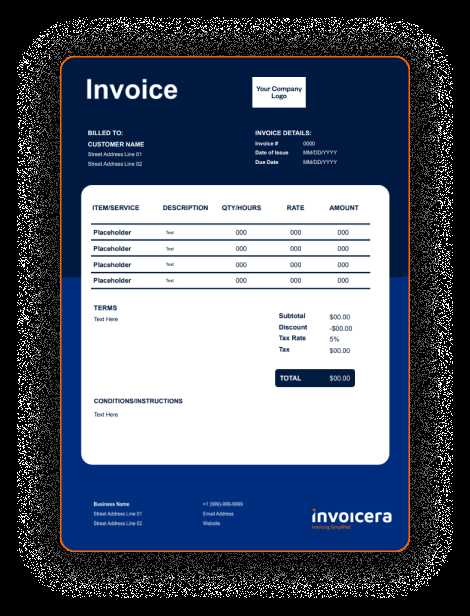

Different Types of Invoice Templates Available

When it comes to managing financial transactions, the need for structured documents is essential. Various formats exist, each tailored for specific requirements, ensuring clarity and precision in documenting exchanges. These documents can range from simple receipts to more comprehensive statements, and choosing the right format depends largely on the nature of the transaction and the preferences of the involved parties.

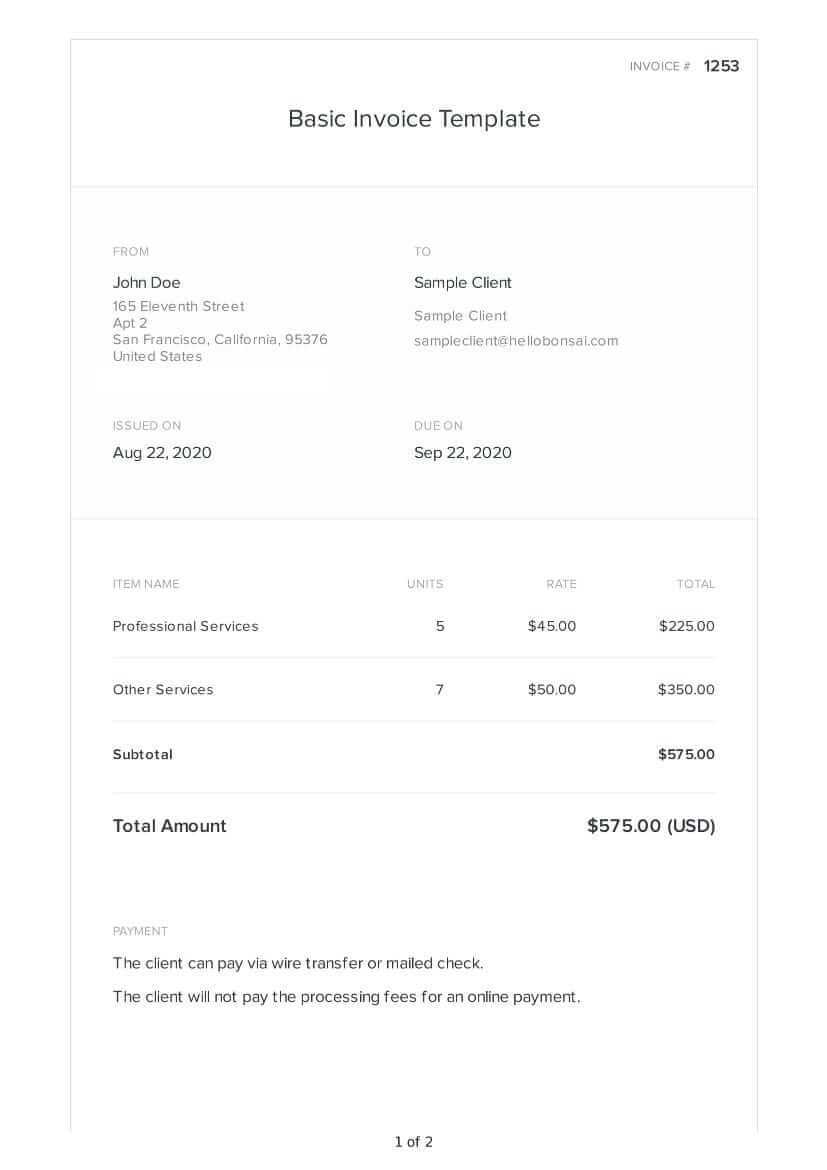

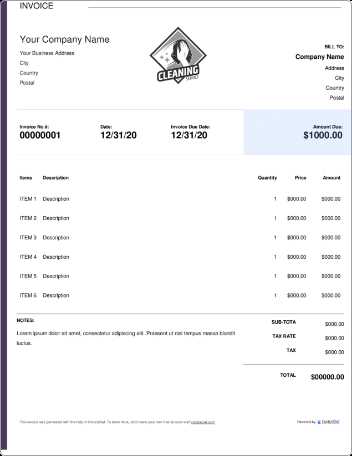

Standard Billing Statements

These are the most commonly used for everyday business dealings. They typically include basic information such as the names and contact details of the buyer and seller, along with a breakdown of the purchased items or services. This type of document is ideal for straightforward exchanges and can be customized according to the business’s needs.

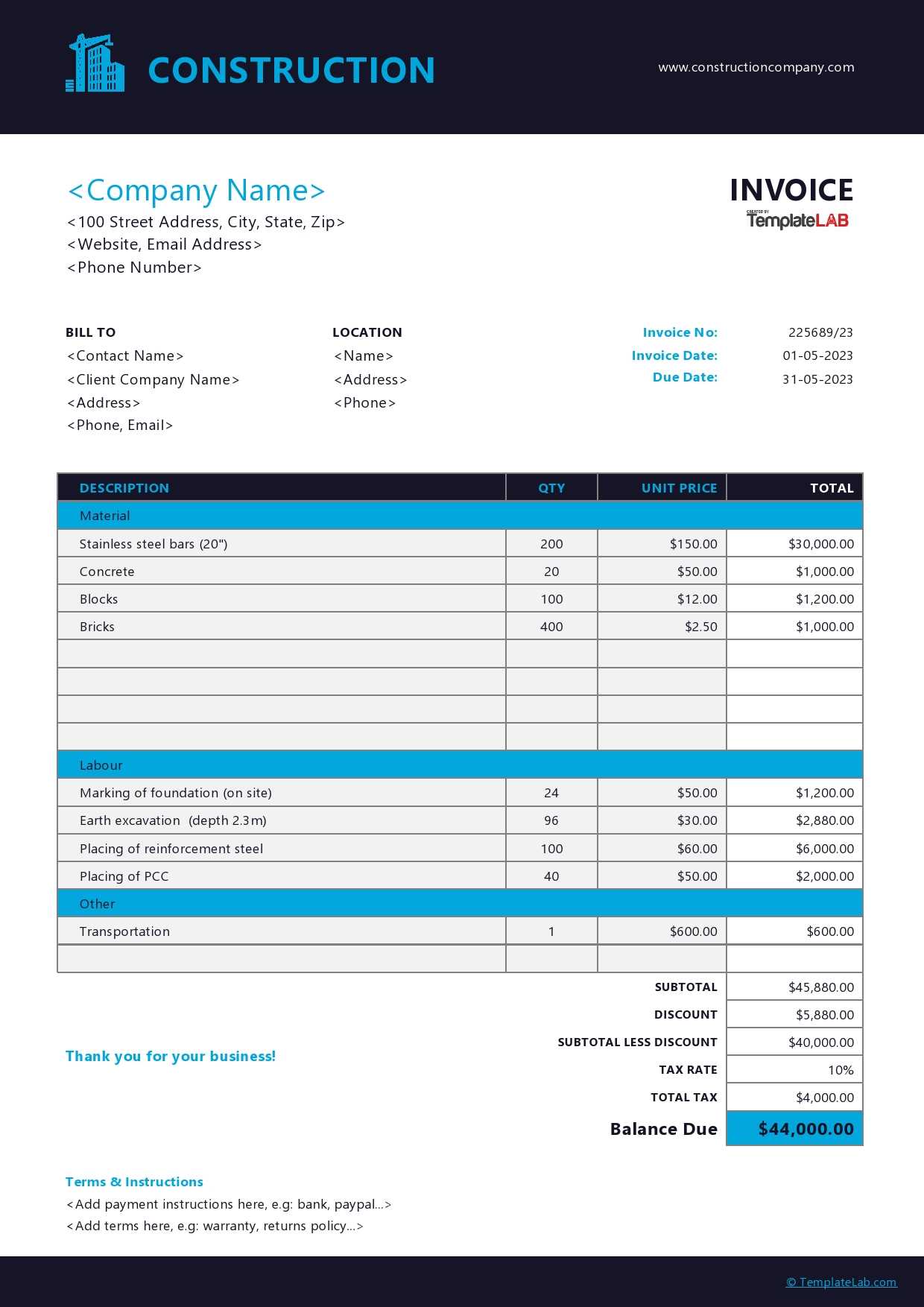

Detailed Financial Records

For more complex transactions, these documents provide an in-depth record, offering more granular information. They might feature multiple sections, such as tax breakdowns, payment schedules, and additional charges, to ensure both parties have a clear understanding of the financial details involved.

| Type | Description | Best For |

|---|---|---|

| Standard Billing | Basic breakdown of transaction details. | Small to medium-sized businesses |

| Comprehensive Financial | Detailed records with tax, payment terms, and additional charges. | Larger transactions or ongoing services |

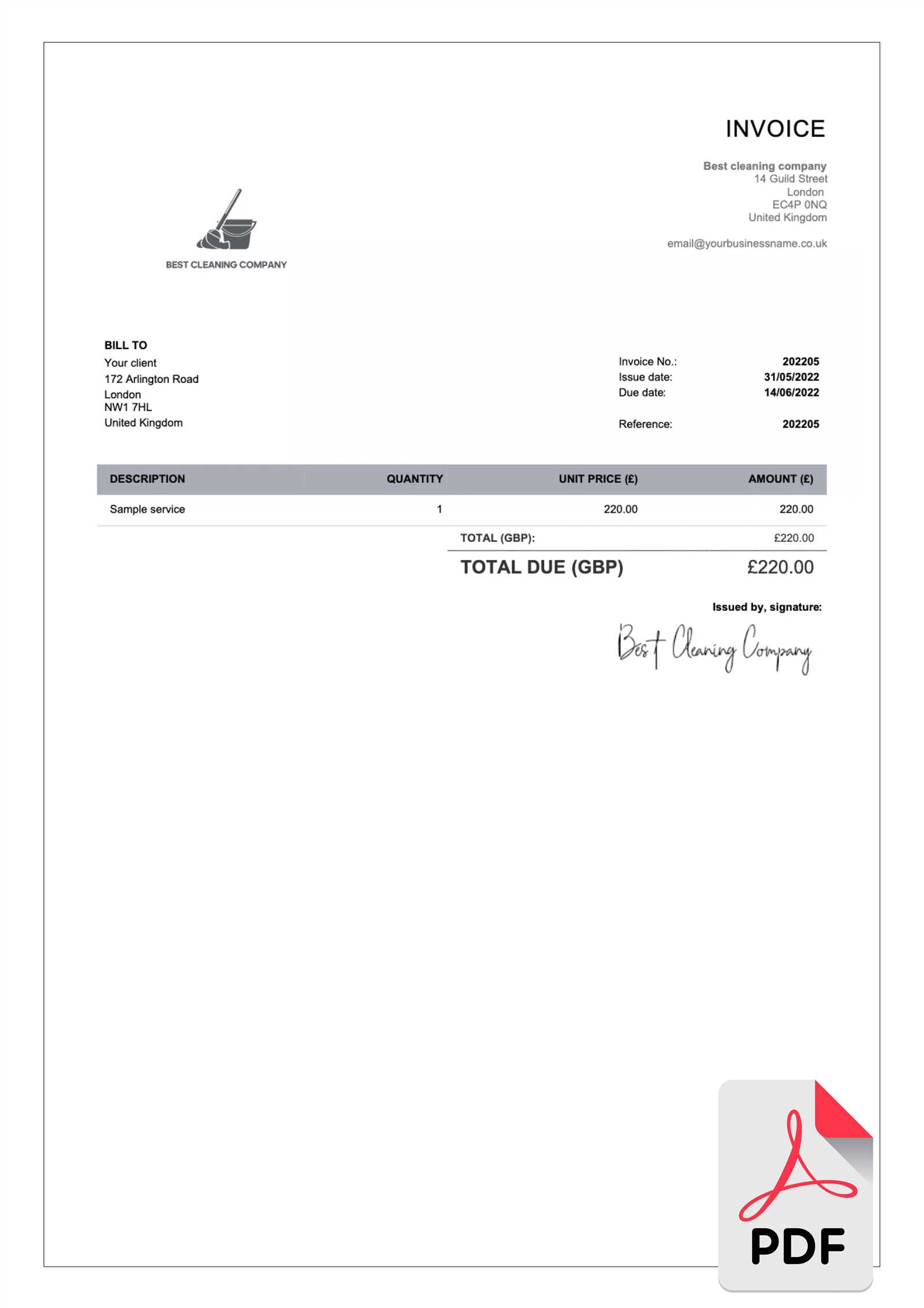

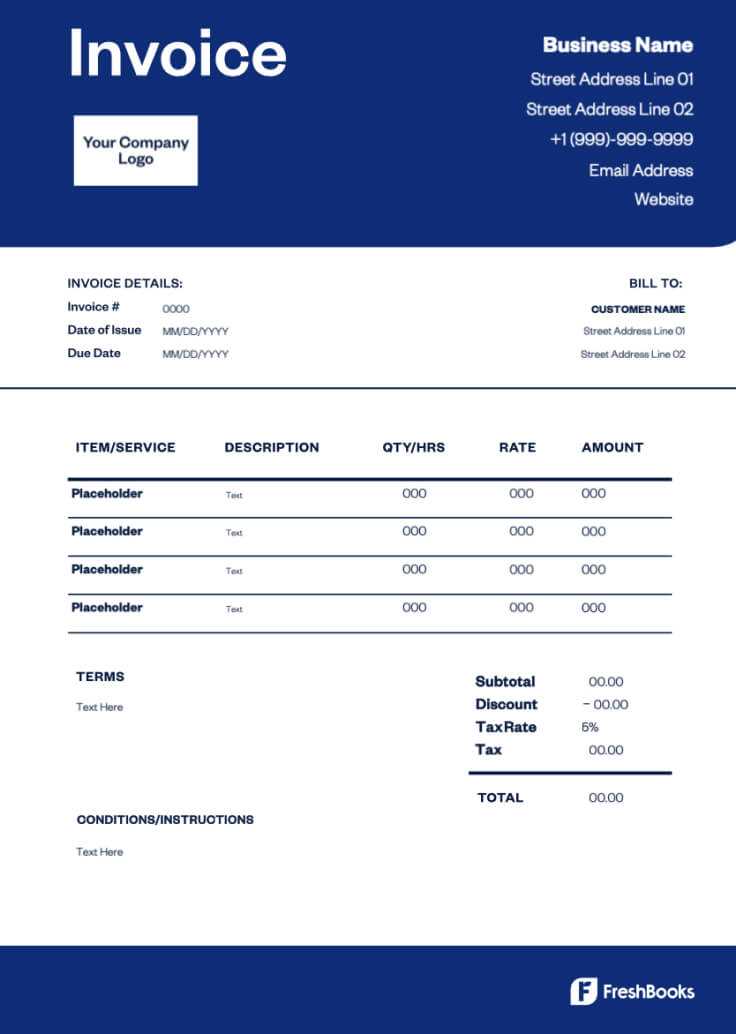

How to Create a Professional Invoice

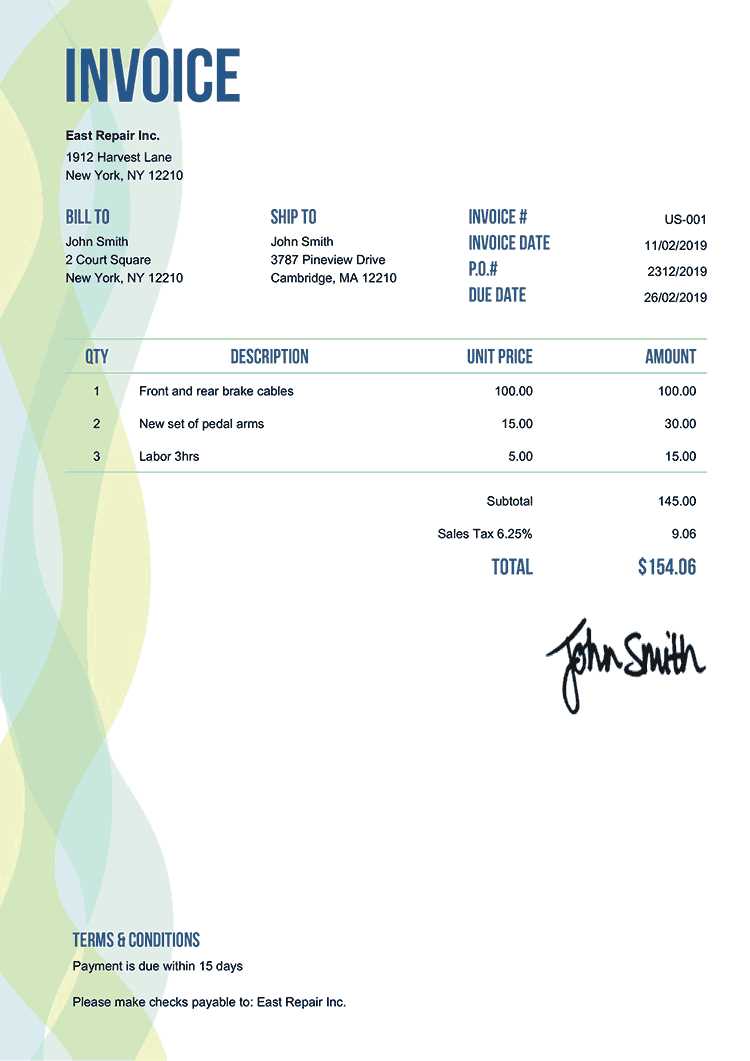

Creating a well-organized and clear document is key to ensuring smooth financial transactions. A professionally crafted document not only conveys the necessary details but also reflects the credibility and attention to detail of your business. Structuring such a document involves more than just listing services or products; it requires a thoughtful approach to layout, information flow, and accuracy.

Essential Information to Include

To start, make sure to include all relevant details that will help both parties easily identify and process the exchange. This includes the names and addresses of both the sender and receiver, a unique reference number, as well as the date of the transaction. Providing an itemized list with clear descriptions, quantities, and prices ensures transparency and avoids any misunderstandings.

Organizing the Layout

The structure should be straightforward yet visually appealing. A simple, uncluttered format helps in delivering the message clearly. Highlight key elements such as the total amount due, payment methods, and due dates. Bold headings and clear sections will guide the reader’s eye and make the document easier to follow.

Best Practices for Filling Out Invoices

Properly completing financial documents is crucial for maintaining accurate records and ensuring smooth transactions. Clear, concise, and error-free paperwork helps build trust and minimizes confusion between parties. Following a few key practices can streamline the process and ensure all essential details are included, reducing the risk of misunderstandings or delayed payments.

Double-Check Information

Before finalizing any document, it’s important to verify that all information is correct. This includes ensuring the names, addresses, and contact details of both parties are accurate. Additionally, review the list of products or services to confirm pricing, quantities, and descriptions match what was agreed upon. Accuracy is vital to avoid disputes or payment delays.

Be Clear with Payment Terms

Clearly stating payment terms helps set expectations for both parties. Include details such as the due date, any late fees, and acceptable methods of payment. If applicable, providing instructions on how to pay, such as bank account details or online payment options, can make the process smoother. Clarity in these areas helps avoid confusion and ensures timely payments.

Where to Find Free Invoice Templates Online

Many websites offer ready-made documents that can be easily downloaded and customized for your business needs. These resources provide a convenient and quick solution for those looking to streamline their billing process without spending time creating documents from scratch. Here are a few places to explore if you need a professional and efficient option.

Top Websites for Downloading Documents

- Template.net – A wide variety of customizable designs for all types of transactions.

- Microsoft Office Templates – Offers simple and professional options within Word and Excel formats.

- Google Docs – Provides basic designs that are easy to use and share online.

Additional Resources

- Canva – Offers visually appealing options, ideal for businesses looking for a modern look.

- Zoho – Provides both basic and more advanced options, great for growing businesses.

- Invoicely – A platform that includes both simple and detailed document designs for various industries.

How to Avoid Common Invoice Mistakes

Accurate and professional documentation is key to ensuring smooth business operations and maintaining strong relationships with clients. Even minor errors can cause confusion, delay payments, and create a negative impression. Avoiding common pitfalls is essential to ensure that all details are correct and the process runs efficiently.

Check for Accuracy in Client Information

One of the most common mistakes is failing to verify the client’s contact information. Double-check the name, address, and any other relevant details to ensure they are correct. Incorrect details can result in your documents being sent to the wrong place or delayed payments.

Be Clear with Payment Terms and Deadlines

Ambiguity in payment terms can lead to misunderstandings and late payments. Always specify clear due dates, payment methods, and any late fees that may apply. Clear payment expectations will help both parties stay on track and avoid any confusion down the road.

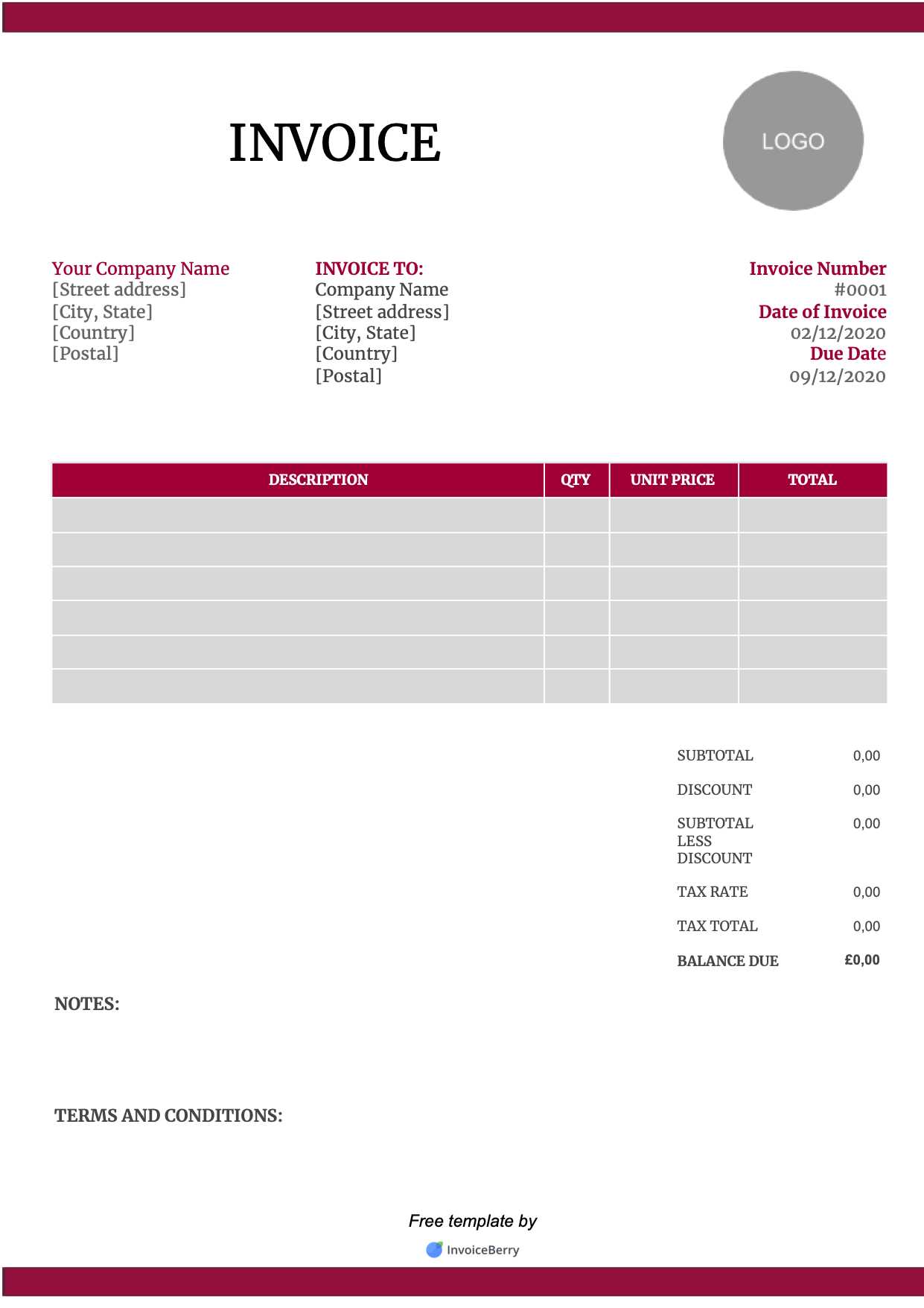

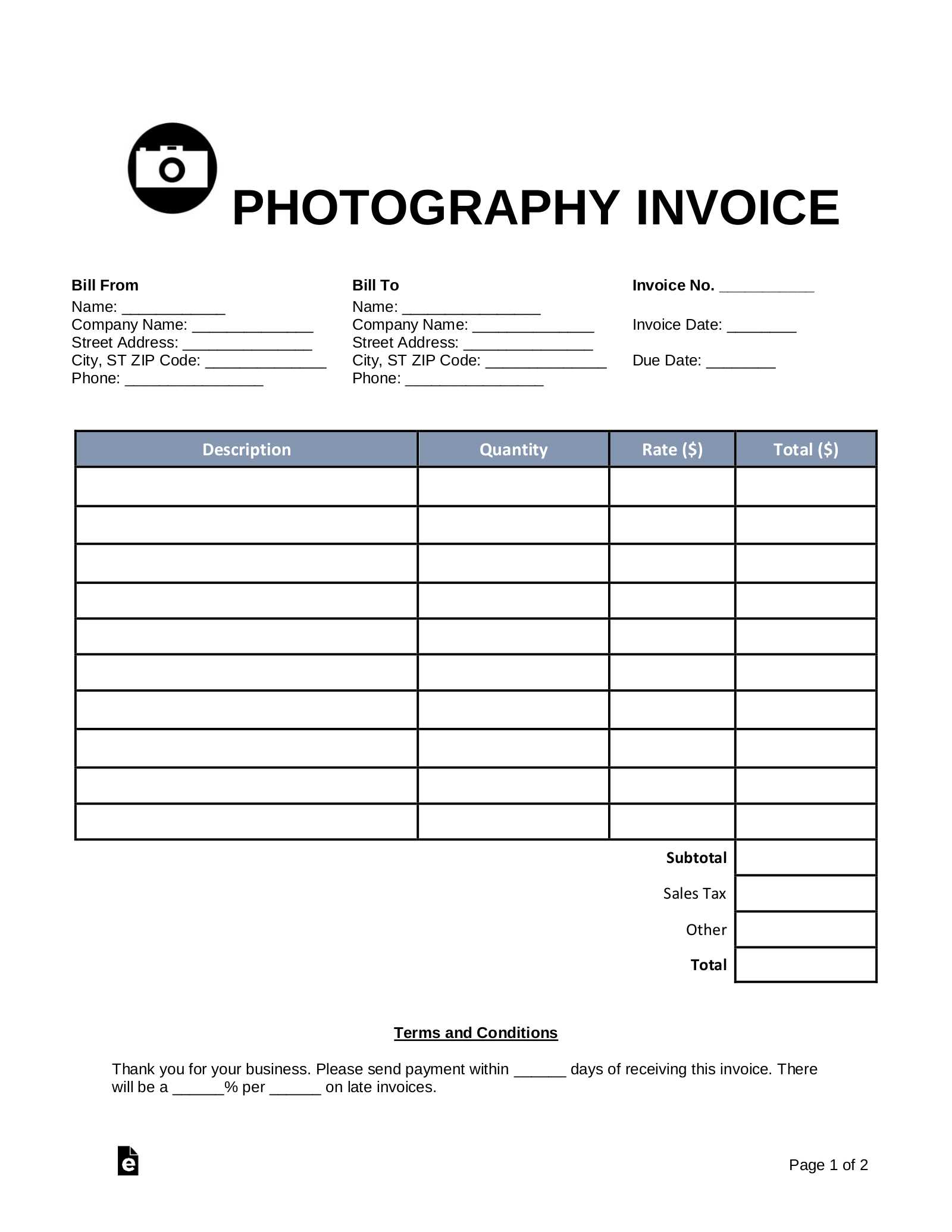

Invoice Templates for Freelancers and Contractors

For freelancers and contractors, having a well-organized document for billing clients is essential for maintaining professionalism and ensuring timely payments. These documents should clearly outline the work completed, the agreed-upon rate, and the total amount due. A good structure also helps prevent misunderstandings and keeps both parties informed.

Customizable Designs for Freelancers

Freelancers often need a simple yet effective way to present their services and charges. Templates tailored for freelancers typically include sections for work descriptions, hourly or project rates, and specific payment instructions. These formats are easy to adjust, allowing freelancers to include relevant project details without complexity. Customization is key for showcasing individual work and unique services.

Contractor-Specific Billing Options

Contractors may require more detailed documents due to the nature of their work, which often involves larger projects and multiple payment milestones. Documents designed for contractors should allow for clear breakdowns of labor, materials, and costs, as well as milestones or progress payments. Detailed billing ensures both the contractor and client are aligned on expectations throughout the project.

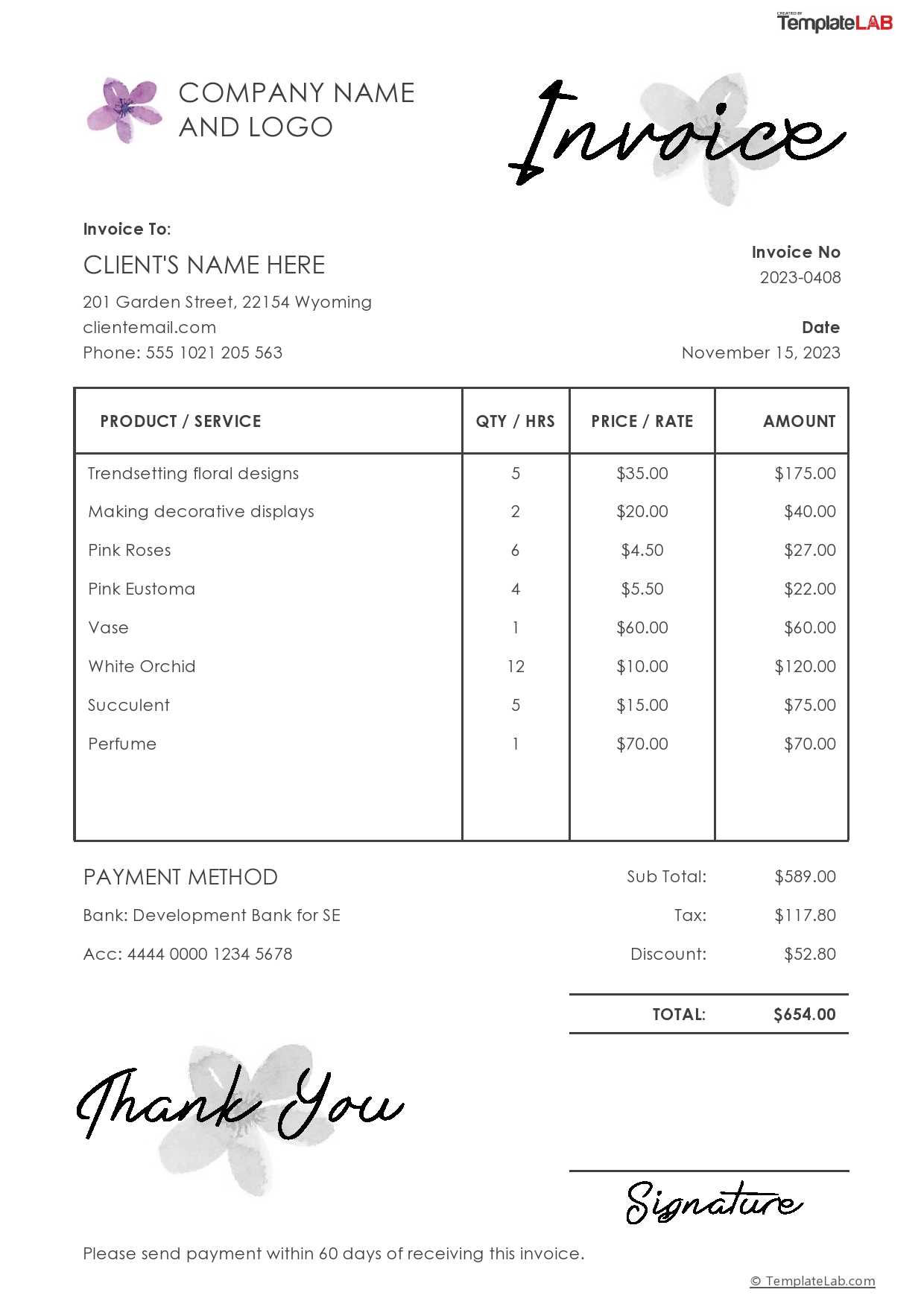

How to Make Your Invoice Stand Out

When it comes to getting paid promptly and maintaining a professional image, a well-designed and clear document can make all the difference. Making your billing statement visually appealing and easy to read not only improves communication but also leaves a positive impression on your clients. A standout document reflects the quality of your work and the attention to detail you put into every aspect of your business.

Incorporating a Professional Design

One way to ensure your document catches attention is by using a clean and polished design. Incorporating your brand colors, logo, and a consistent layout will create a cohesive and professional look. Adding a touch of design helps distinguish your statement from others, making it memorable. Simple fonts, organized sections, and adequate white space ensure that the important information stands out.

Clear Breakdown of Charges

A well-organized and detailed breakdown of charges makes it easier for clients to understand the cost structure. Be sure to include descriptions of services or products, quantities, unit prices, and any applicable taxes or discounts. A clear summary helps clients feel more confident in their payment and minimizes any potential questions.

| Element | Benefit |

|---|---|

| Branding | Establishes professionalism and consistency with your business identity. |

| Clear Pricing | Improves transparency and trust by outlining detailed costs. |

| Visual Appeal | Helps your document stand out and be memorable to the client. |

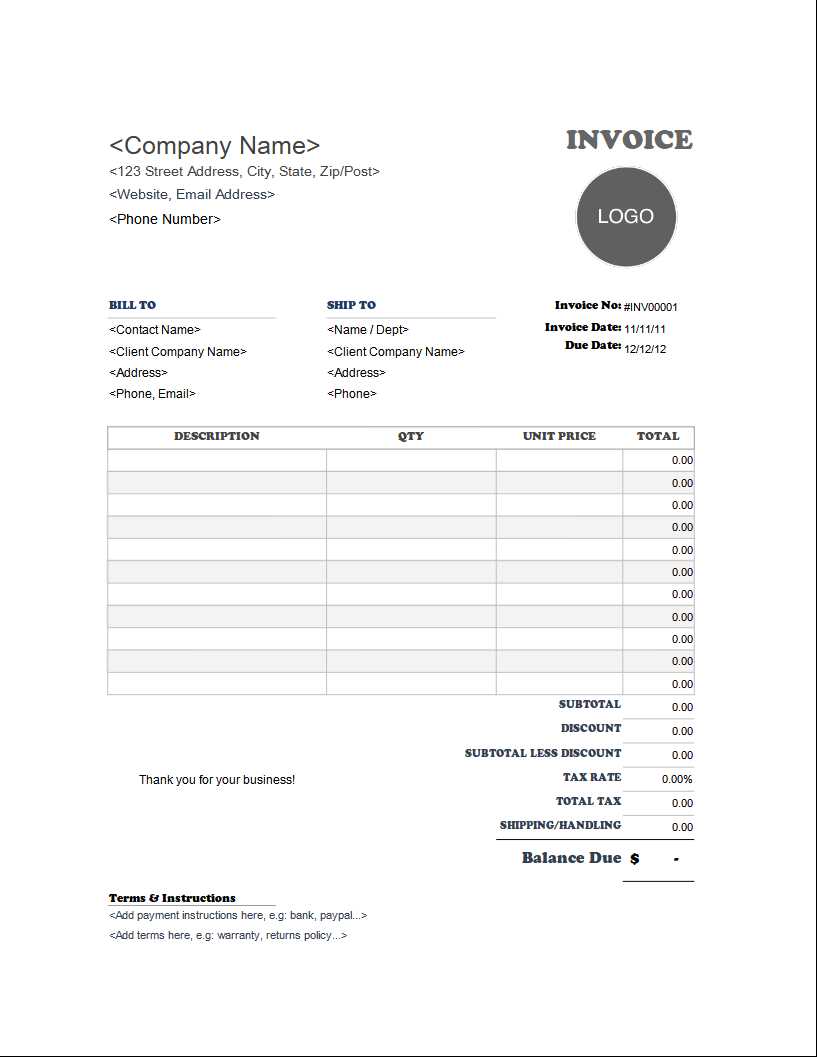

Using Excel or Word for Invoice Templates

Excel and Word are popular tools for creating documents that require organization and structure. Both programs offer flexible options to design a clean and professional billing statement. While Excel excels in calculations and data organization, Word provides a more straightforward approach for simple, text-based documents. Choosing the right tool depends on your needs, whether you need detailed itemization or a more basic format.

| Tool | Advantages |

|---|---|

| Excel | Ideal for complex calculations, automatic totals, and itemized billing. Great for managing large quantities of data. |

| Word | Simple to use for creating text-based documents. Offers customization for layout and design, ideal for straightforward statements. |

Simple Invoice Templates for Quick Billing

For businesses that need to generate billing statements quickly, using a straightforward and easy-to-understand format is key. Simple designs ensure that all necessary information is included without overwhelming the client. These documents streamline the process and allow for efficient billing, saving time while maintaining professionalism.

Key Elements for Fast Billing

- Client contact information

- A clear breakdown of products or services provided

- Payment terms and due date

- Company details, including logo and address

Advantages of Using Simple Formats

- Quick to create and modify for each new transaction

- Easy for clients to read and understand

- Helps maintain a consistent and professional appearance with minimal effort

Legal Considerations for Invoice Creation

When creating billing documents, it’s crucial to understand the legal requirements that ensure compliance and protect both the business and the client. These documents must meet certain standards to be valid and enforceable. By including essential legal information, such as tax identification numbers, payment terms, and the applicable law, you help avoid potential disputes and maintain clear, transparent communication with clients.

Essential Legal Information

| Element | Legal Importance |

|---|---|

| Tax Identification Number | Ensures tax compliance and verifies your business identity. |

| Payment Terms | Helps establish clear expectations regarding due dates and penalties for late payments. |

| Service Descriptions | Reduces the risk of disputes by providing a detailed account of goods or services rendered. |

Other Legal Considerations

In addition to the basics, it’s important to consider regional laws that may impact billing practices. For example, certain jurisdictions may require specific formatting, such as including both the buyer’s and seller’s legal names, or issuing sequential document numbers. Understanding these requirements ensures your documents are legally sound and enforceable.

How to Track Paid and Unpaid Invoices

Keeping track of outstanding balances is essential for maintaining cash flow and ensuring that payments are received on time. Organizing and monitoring which documents have been settled and which are still pending can help avoid missed payments and ensure that clients are billed appropriately. This process involves creating a simple system to mark payments and follow up on overdue accounts.

Methods for Tracking Payments

- Spreadsheet Management: Use a basic spreadsheet to track issued documents, payment status, and due dates. Add columns to indicate whether the payment has been received or is still outstanding.

- Accounting Software: Use specialized software to automate tracking, send reminders, and generate reports for easier financial management.

- Manual Record Keeping: Maintain a physical logbook with detailed records of all issued documents and their payment statuses. This method is ideal for smaller businesses with fewer transactions.

Helpful Tips for Managing Unpaid Balances

- Set clear payment terms and deadlines when issuing each document.

- Send timely reminders to clients with pending payments, providing a friendly but firm notice of overdue balances.

- Track payment dates and review account status regularly to stay on top of outstanding amounts.

Updating Your Invoice Templates for 2024

As we move into a new year, it’s important to review and update your billing documents to ensure they align with current business practices and legal requirements. Updating your document format can improve efficiency, reduce errors, and make sure your clients receive the most accurate and professional statements. The start of a new year is the perfect opportunity to make necessary adjustments and add any new features that can enhance the billing process.

Consider the following areas when updating your documents for 2024:

- Legal Compliance: Ensure your document includes any new tax rates, legal requirements, or regional regulations that may have changed in the past year.

- Payment Methods: Update payment options to reflect new digital payment methods or changes in your business’s banking information.

- Design Improvements: Enhance the layout and visual appeal with a cleaner, modern design that aligns with your brand.

Staying current and organized with your billing process can help maintain a smooth workflow and keep your clients happy throughout the year.