Invoice Writing Template for Easy and Professional Billing

Generating clear and well-structured billing documents is essential for maintaining smooth financial transactions. Whether you’re running a small business or working as a freelancer, having a reliable way to outline the terms of a payment can make a significant difference. A well-crafted statement not only ensures prompt payment but also reinforces your professionalism.

By utilizing a customizable form, you can streamline your billing process, saving time and reducing errors. These tools offer flexibility, allowing you to adjust the document to fit different payment scenarios and client requirements. Whether you need to include detailed descriptions, apply taxes, or specify payment terms, an effective structure provides clarity for both parties involved.

Efficiency and accuracy are key when it comes to financial transactions, and a properly formatted document can help achieve both. With the right approach, you’ll avoid common mistakes that can lead to misunderstandings, ensuring a smoother experience for both you and your clients.

Comprehensive Guide to Billing Documents

Creating a structured and professional billing document is crucial for ensuring smooth financial transactions. Having a well-organized document allows businesses and individuals to clearly communicate payment expectations, deadlines, and terms. Whether you are managing a small business or freelancing, an effective document can make all the difference in getting paid on time.

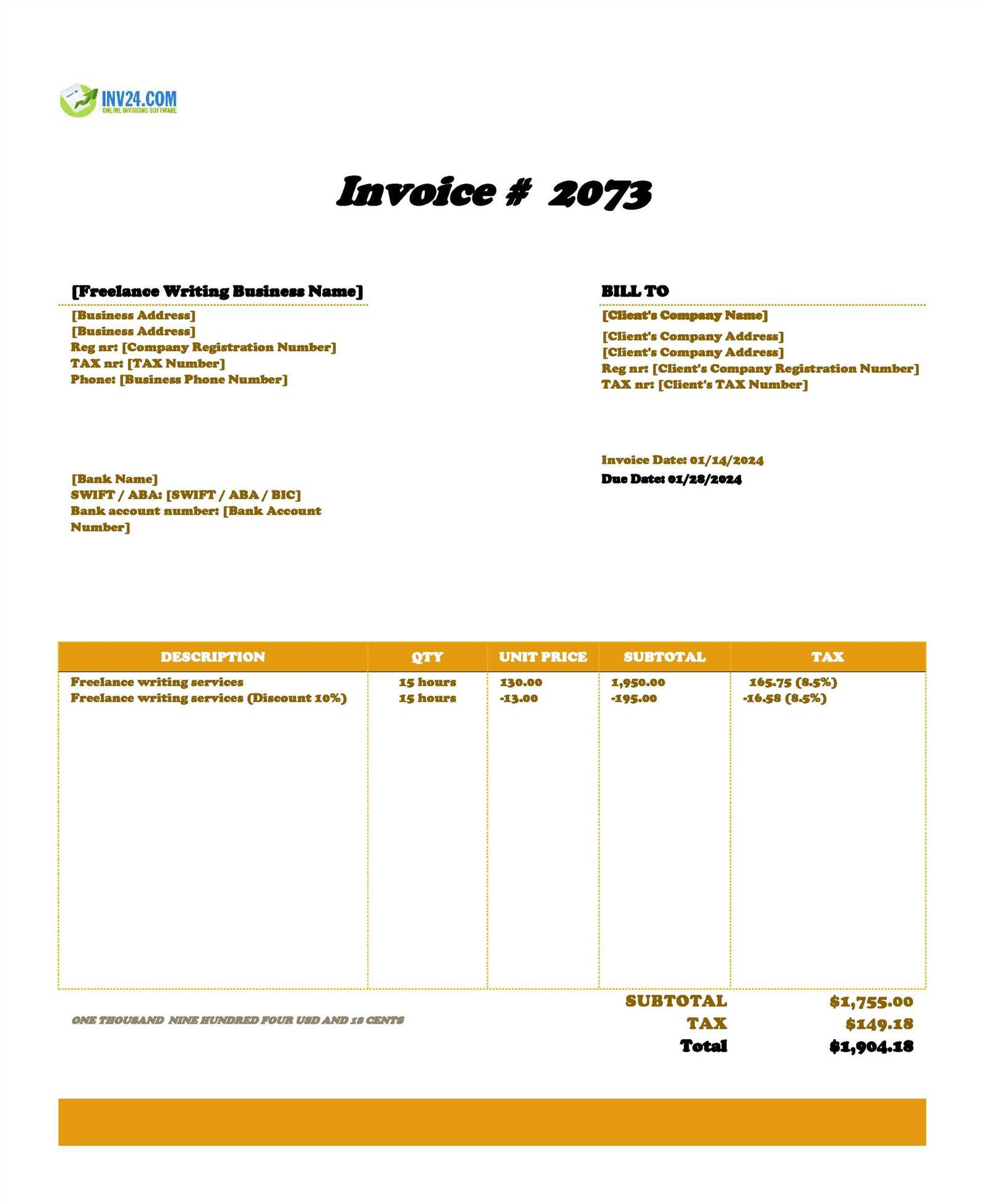

There are several key elements that should be included in a well-crafted form. These include a clear breakdown of services or products, payment terms, and the overall format. With a versatile design, you can easily adapt the content to suit different client needs, ensuring flexibility while maintaining a professional appearance.

Efficiency in billing is essential for maintaining positive relationships with clients, and a clear structure helps to avoid misunderstandings. By carefully organizing the document, you ensure that every necessary detail is included, reducing the risk of confusion and ensuring both parties are on the same page.

Customizability is another key benefit, as it allows for quick adjustments based on specific requirements. Whether it’s adding discounts, taxes, or specific payment instructions, a flexible layout will help you tailor each document to the situation at hand.

Why Use a Billing Document Format

Using a structured format for creating billing documents offers several advantages for both businesses and freelancers. A standardized approach helps ensure that all necessary information is included consistently, reducing the chances of errors and misunderstandings. It also saves time by eliminating the need to recreate the layout for each new transaction.

Here are some key reasons why adopting a set format can be beneficial:

- Consistency: A consistent format makes it easier to manage and track payments, ensuring that all details are presented uniformly.

- Professionalism: A well-designed document enhances the credibility of your business and helps build trust with clients.

- Efficiency: Streamlining the process of creating these documents reduces the time spent on administrative tasks, allowing you to focus on your core work.

- Flexibility: A customizable design ensures that you can adjust the content to fit various client needs, whether it’s applying taxes or offering discounts.

- Accuracy: A pre-defined structure minimizes the risk of leaving out important details, ensuring clarity in the billing process.

Incorporating a reliable format into your workflow will not only save time but also improve the overall experience for both you and your clients. It allows you to focus on your business while ensuring that payment details are communicated clearly and professionally every time.

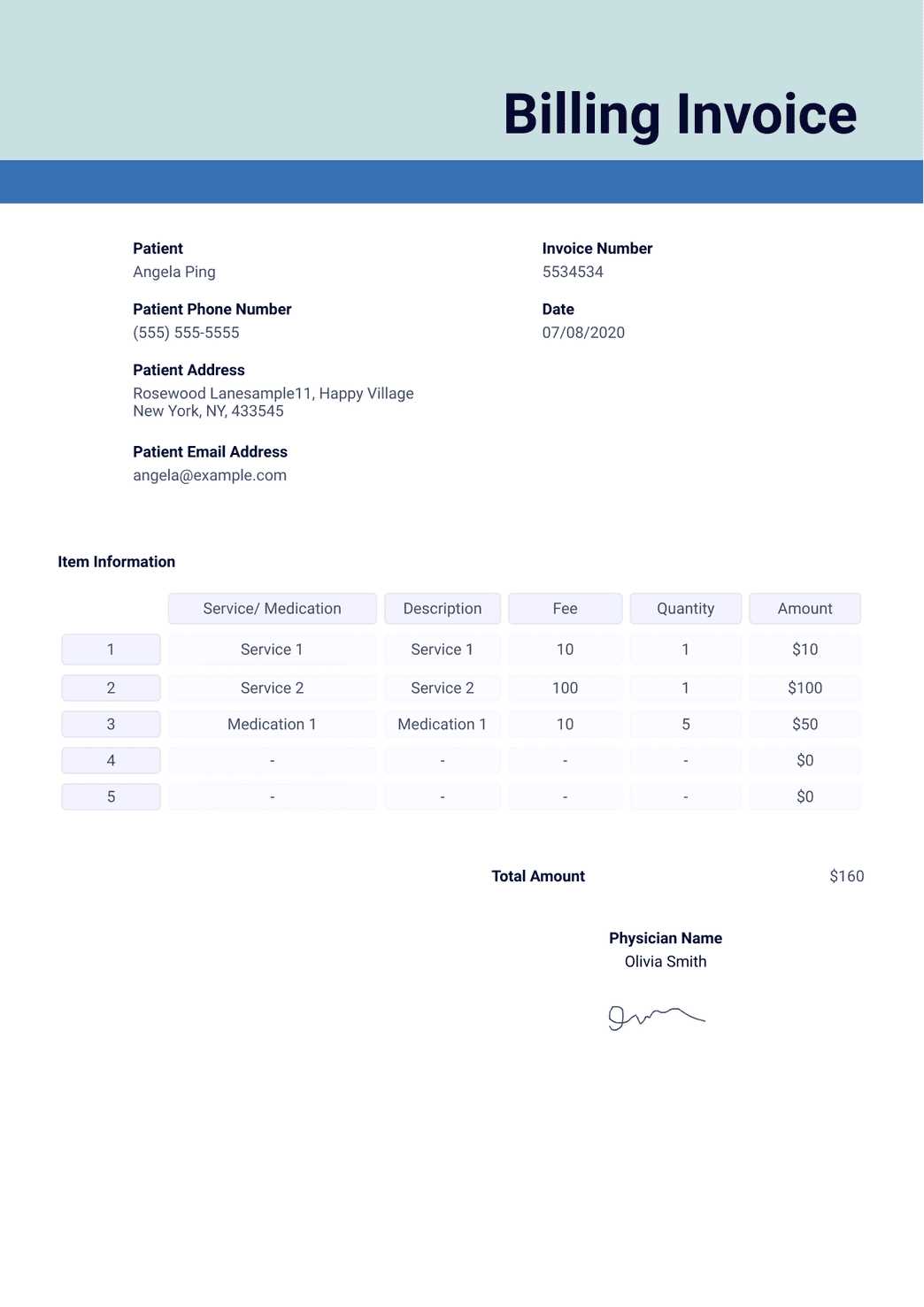

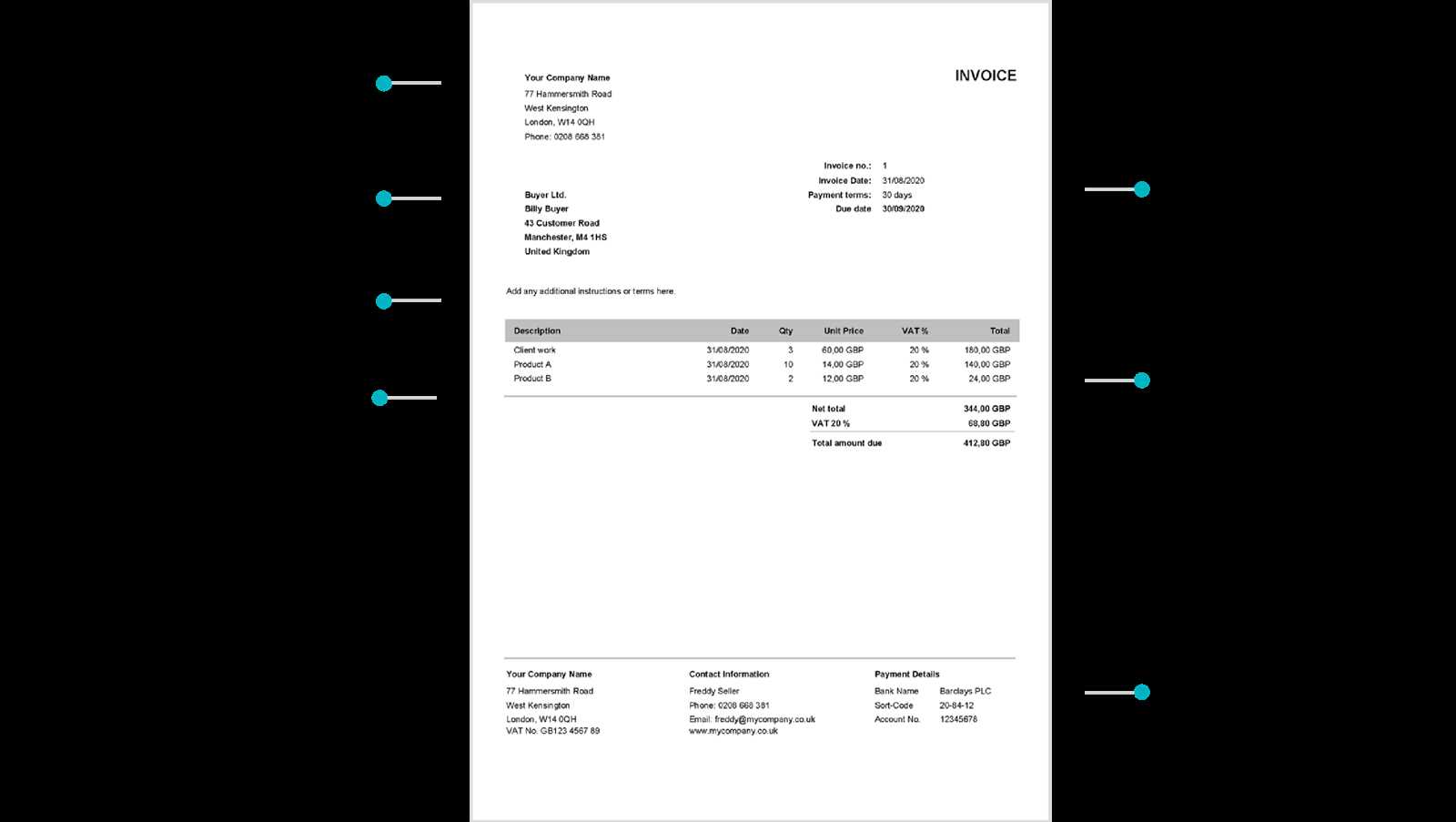

Key Components of a Billing Document

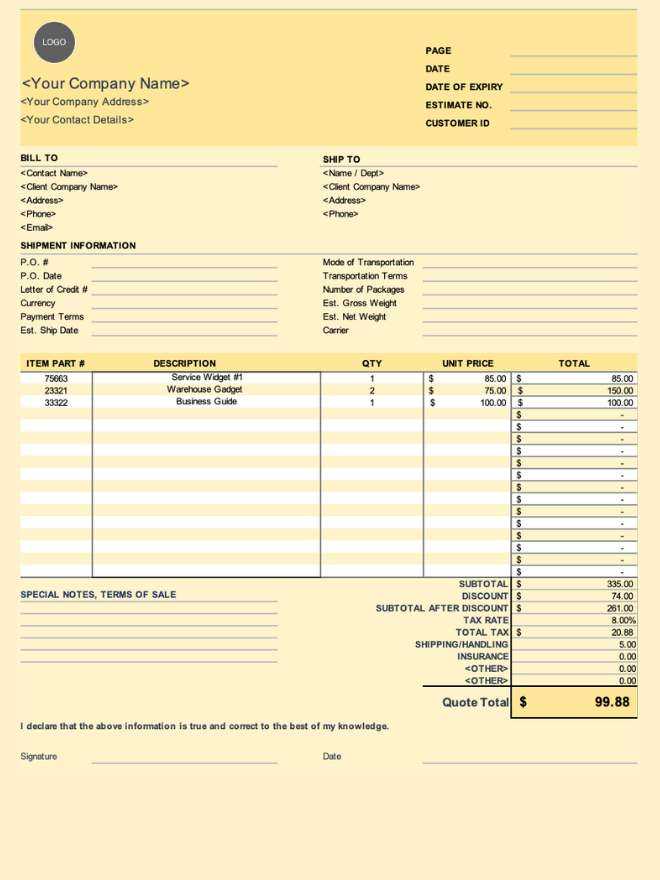

To ensure clear communication and smooth transactions, it’s important to include all necessary elements in a billing statement. A well-structured document provides all the required details, helping to avoid confusion and ensuring that both parties are fully informed about the payment expectations. Here are the essential components that should be present in every billing document:

- Contact Information: Include your business name, address, phone number, and email, along with the client’s details for easy reference.

- Unique Identifier: Assign a unique reference number to each document for easy tracking and to avoid any duplication.

- Issue Date: The date when the document is created, which helps establish the start of the payment term.

- Due Date: Clearly specify when payment is expected to be made, avoiding delays in the transaction process.

- Description of Goods or Services: Provide a detailed list of what is being charged for, including quantities and prices where applicable.

- Payment Terms: Specify how payments should be made, including methods (e.g., bank transfer, credit card) and any relevant instructions.

- Amount Due: Clearly state the total amount payable, including taxes or discounts, and provide a breakdown if necessary.

- Tax Information: If applicable, include the tax rate and the amount of tax charged to ensure compliance with local regulations.

By incorporating these elements, you ensure that your document is complete, easy to understand, and ready for processing. Each section contributes to a smoother payment process and helps to prevent any potential disputes regarding the details of the transaction.

How to Customize Your Billing Document

Personalizing your billing statement allows you to tailor it to your specific needs and client expectations. By adjusting the structure and content, you can ensure that each document reflects the nature of your business and the terms of the transaction. Customization provides flexibility, enabling you to include necessary details such as special instructions, discounts, or additional fees that may apply to a particular situation.

Here are some ways you can modify the format to suit your requirements:

- Branding: Include your company logo, colors, and fonts to make the document match your business identity. This adds a professional touch and helps clients recognize your brand.

- Payment Options: Adjust payment methods based on client preferences. Whether it’s through online platforms, bank transfers, or credit cards, make sure to clearly indicate the available options.

- Terms and Conditions: Customize the payment terms, such as specifying the time frame for payment, late fees, or discounts for early payment.

- Itemization

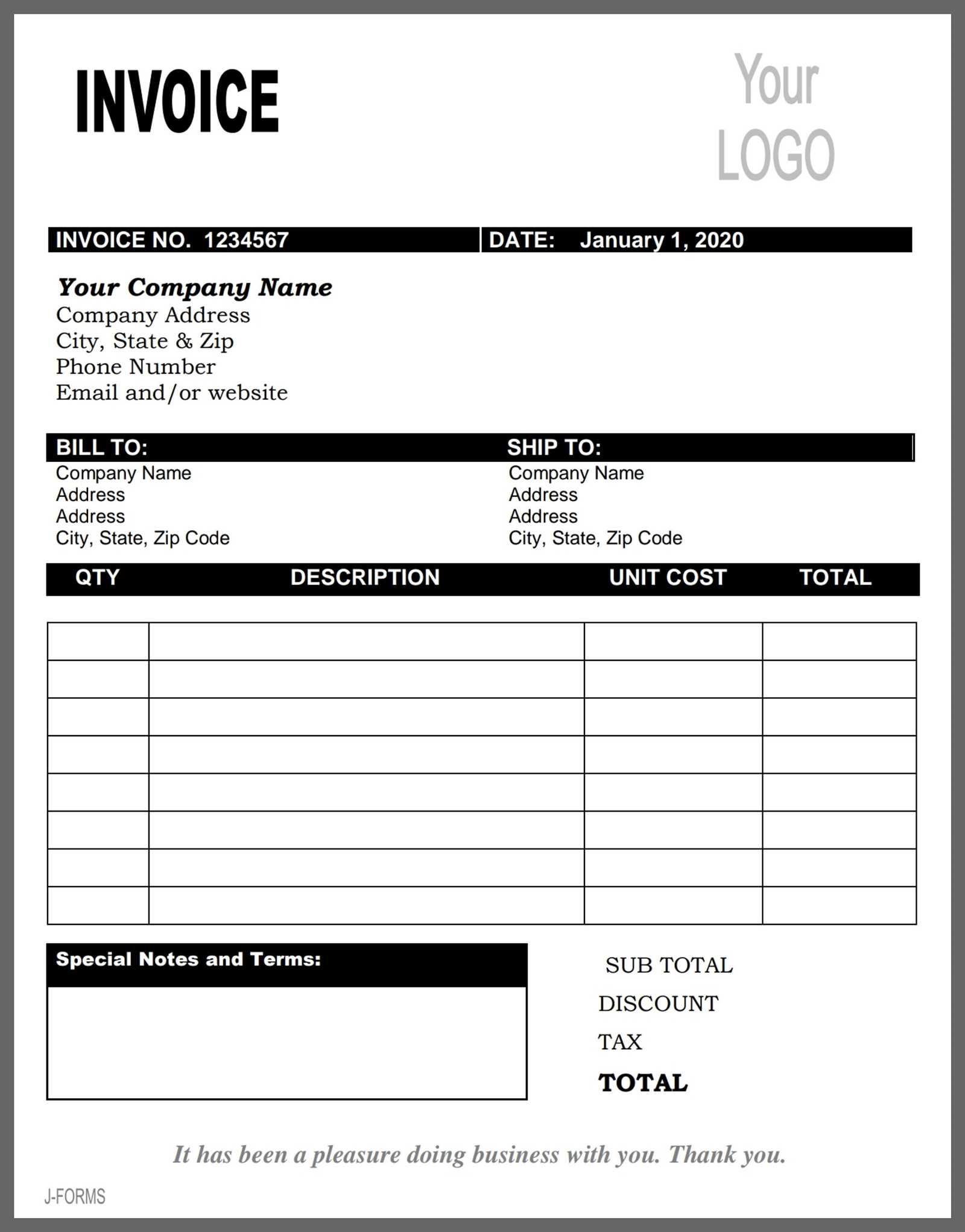

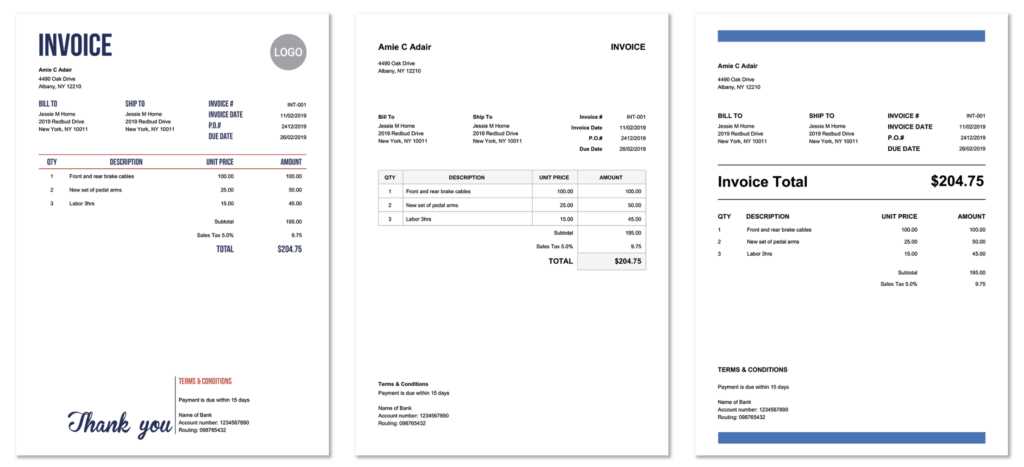

Choosing the Right Billing Format

Selecting the appropriate structure for your billing documents is crucial to ensure clarity and efficiency in communication. The right format not only provides the necessary details but also presents them in a way that is easy for both parties to understand. Whether you’re handling a few transactions or managing a high volume of clients, the chosen layout should align with your business needs and provide flexibility for customization.

Here are some factors to consider when choosing a format for your billing documents:

- Simplicity: A clean and straightforward design helps reduce confusion and makes it easy for clients to find important details quickly.

- Customizability: Ensure the format allows for modifications to suit various business needs, such as adding or removing fields, including specific payment terms, or applying discounts.

- Professionalism: A well-organized layout with proper branding and clear sections reflects a professional image and helps build trust with clients.

- Legal Requirements: Choose a format that accommodates all the necessary legal information, such as tax identification numbers or compliance statements, depending on your location and industry.

- Client Preferences: Consider whether your clients prefer a more detailed or simple document and whether they have any specific format requirements, such as PDF, Word, or online forms.

By evaluating these factors, you can select the ideal structure for your billing documents, ensuring they meet both your and your clients’ needs while maintaining efficiency in the process.

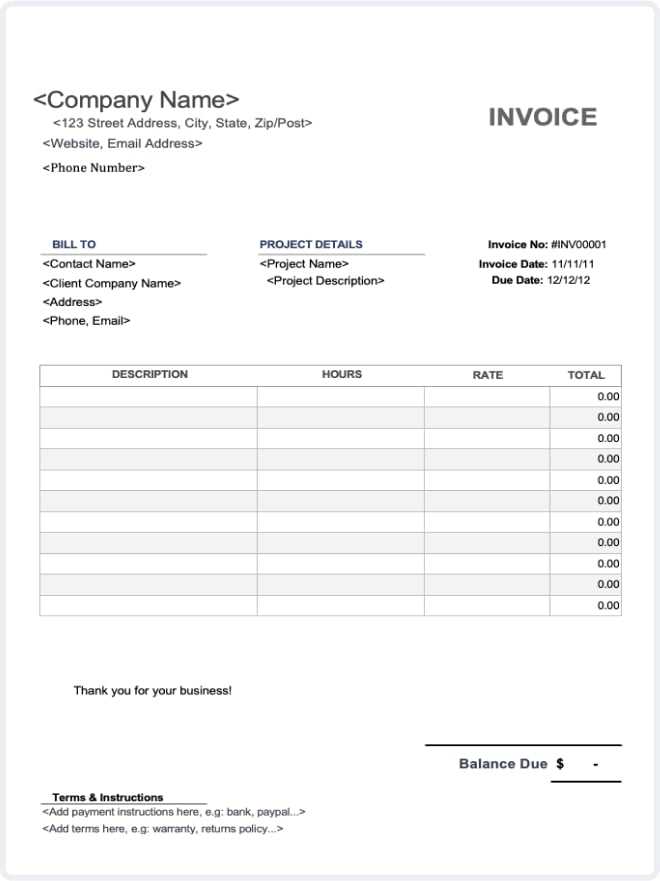

Step-by-Step Billing Document Creation Process

Creating a well-organized billing document requires following a clear and structured process to ensure all necessary details are included and presented correctly. By adhering to a step-by-step approach, you can streamline the creation of these documents, minimize errors, and maintain consistency across all transactions.

Here’s a simple guide to help you through the process:

- Start with Client Information: Begin by entering the client’s name, address, and contact details. This ensures the document is properly personalized for the recipient.

- Add Your Business Details: Include your business name, address, phone number, and email. This provides your client with the necessary contact information for future correspondence.

- Assign a Unique Reference Number: Create a unique reference number for each document. This will help both you and your client track the transaction more easily.

- Specify the Date: Include the issue date and the due date for payment. Clearly state when the payment should be made to avoid delays.

- List Goods or Services Provided: Detail the items or services being billed, including quantities and prices for each. Provide a clear description to avoid confusion.

- Include Payment Terms: Define how payment should be made, whether it’s via bank transfer, credit card, or other methods. Specify any relevant terms, such as discounts for early payment or late fees for overdue payments.

- Calculate the Total Amount: Add up the individual amounts and apply taxes, discounts, or additional charges. Ensure the total is clearly visible at the bottom of the document.

- Review and Finalize: Before sending the document, double-check all information for accuracy. Ensure there are no missing details, and the format is clear and professional.

By following these steps, you can ensure that each document is complete, accurate, and easy to understand, facilitating smoother transactions and stronger client relationships.

Benefits of Using Digital Billing Documents

Adopting digital methods for managing billing statements offers numerous advantages that streamline processes, save time, and reduce human error. Transitioning from paper-based methods to digital formats can significantly improve efficiency in how businesses handle transactions, invoicing, and client communication.

Increased Efficiency and Speed

One of the main benefits of using digital formats is the speed at which these documents can be created, sent, and processed. Digital billing systems allow you to generate and send statements in minutes, eliminating the need for printing, mailing, and waiting for physical delivery. This leads to faster payment cycles and improved cash flow management.

Cost Savings and Sustainability

By switching to digital, businesses save money on paper, ink, and postage. Additionally, using electronic records reduces the environmental impact, as fewer resources are consumed, and less waste is produced. This eco-friendly approach also appeals to clients who prioritize sustainability in their business dealings.

Overall, digital methods provide a more streamlined, cost-effective, and environmentally conscious way to manage billing and payments, ultimately benefiting both businesses and their clients.

Common Mistakes in Billing Document Creation

Creating accurate billing statements is crucial to maintaining professional relationships and ensuring timely payments. However, there are several common mistakes that businesses often make when drafting these documents. These errors can lead to confusion, delays in payment, or even disputes with clients.

Here are some of the most frequent mistakes to avoid when preparing your billing documents:

- Missing Client Information: Failing to include the correct details of the client, such as their name, address, or contact information, can lead to delays and miscommunication.

- Incorrect Dates: Entering incorrect issue or due dates can cause confusion about when the payment is expected, resulting in late or missed payments.

- Unclear Descriptions: A lack of detailed descriptions for the products or services being billed can lead to misunderstandings. Ensure that every item is listed clearly and with enough detail to avoid questions later on.

- Errors in Calculations: Mistakes in calculating totals, taxes, or discounts can create discrepancies in the payment amount, causing unnecessary back-and-forth with clients.

- Inconsistent Format: Using a non-standardized format or inconsistent structure can make the document difficult to read and unprofessional, impacting your business’s image.

- Missing Payment Instructions: Failing to include clear payment instructions, such as bank details or online payment methods, can cause delays or confusion for clients trying to make payments.

By being mindful of these common mistakes and addressing them during the document creation process, you can ensure a smoother, more professional billing experience for both you and your clients.

Tips for Clear and Concise Billing

Ensuring that your billing statements are clear and easy to understand is key to maintaining good client relationships and avoiding any confusion or disputes. A well-structured document provides all the necessary information in a straightforward way, making it easy for your clients to process and pay promptly.

Use Simple Language and Layout

Keep the language simple and avoid using jargon or complex terms. Use a clear, logical structure with labeled sections that highlight the most important details, such as the payment amount, due date, and payment terms. This ensures that your client can easily find the information they need.

Break Down Complex Information

If the billing document contains multiple items or services, break them down into separate lines or categories. This helps the client understand exactly what they are being charged for and prevents misunderstandings about what is included in the total amount. Provide clear descriptions and, if necessary, itemize the quantities, rates, and discounts.

By following these tips, you can create concise, professional billing statements that are easy for clients to read and process, reducing the likelihood of delays or errors in payment.

How to Include Payment Terms

Clearly outlining payment expectations in your billing statements is essential for preventing misunderstandings and ensuring timely payments. Including precise terms helps both you and your client understand the agreed-upon payment schedule and any conditions attached to the transaction.

Here are some key points to consider when adding payment terms to your documents:

- Specify the Due Date: Clearly state when the payment is expected. This removes ambiguity and sets clear expectations for both parties.

- Define Payment Methods: Indicate the available methods for making payment, such as bank transfer, credit card, or online payment platforms. This gives your client options and ensures they know how to proceed.

- Late Payment Penalties: If you have a policy for late payments, outline the penalties or interest that will apply. This encourages prompt payment and helps avoid delays.

- Early Payment Discounts: If applicable, mention any discounts for early settlement. This can incentivize clients to pay before the due date.

- Payment Plans: If the payment is to be made in installments, detail the amount due for each installment and the specific due dates for each payment.

By including clear and detailed payment terms, you reduce the likelihood of confusion and ensure that both you and your clients are aligned on expectations, leading to smoother transactions.

Incorporating Tax Information in Billing Documents

When preparing billing statements, it’s essential to include accurate tax details to comply with local regulations and ensure transparency for both you and your clients. Tax information not only helps in avoiding legal complications but also ensures that the final amount due is clearly understood by the recipient.

Here are some key aspects to consider when adding tax details to your documents:

- Specify the Tax Rate: Clearly mention the applicable tax rate for the goods or services being charged. This helps clients understand how the tax is calculated and ensures compliance with local tax laws.

- Include the Tax Amount: Break down the tax amount separately, showing how it contributes to the total. This adds clarity and helps avoid any confusion about the final payment amount.

- State Your Tax Registration Number: If required by law, include your business’s tax identification number. This provides legitimacy and transparency to the transaction.

- Itemize Taxable and Non-Taxable Items: Clearly distinguish between taxable and non-taxable goods or services, especially if you offer both. This ensures that the right tax is applied only to the relevant items.

- Compliance with Local Tax Laws: Ensure that the tax information complies with local tax regulations. Different regions may have different rules regarding tax rates, exemptions, or mandatory disclosures.

By including all relevant tax information, you help clients easily understand the charges and demonstrate your professionalism and adherence to tax laws.

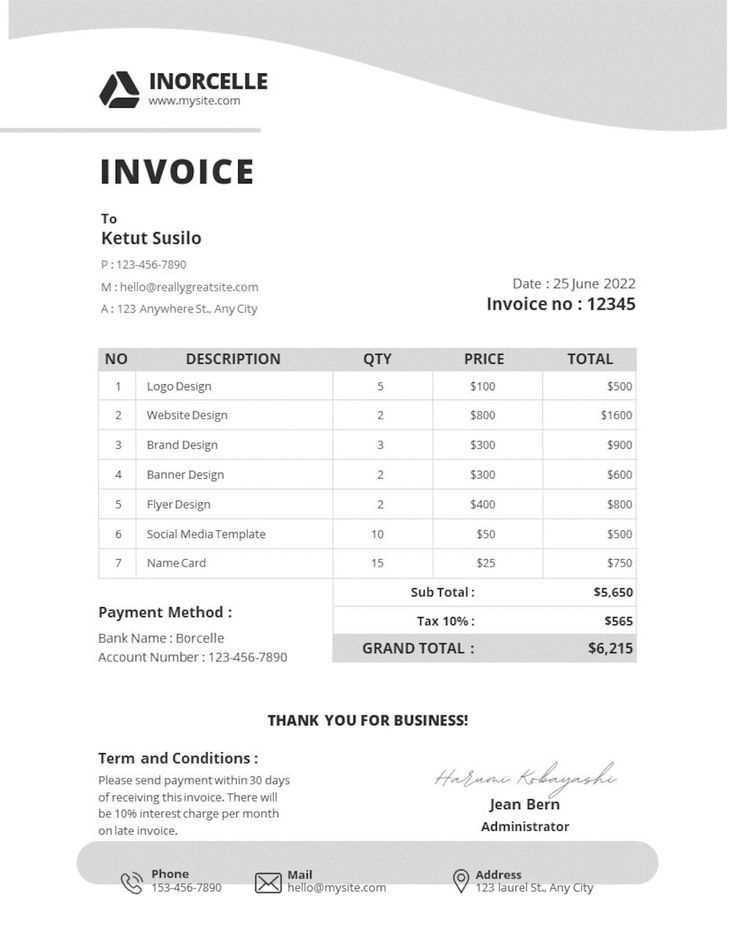

Best Practices for Billing Document Design

Designing a billing document with a clean, professional layout enhances readability and ensures that all necessary information is easily accessible. A well-structured design not only reflects your business professionalism but also helps in ensuring that your client can quickly process and respond to the charges.

Here are some best practices for creating an effective and visually appealing billing document:

- Use Clear Fonts: Choose simple, legible fonts that make the document easy to read. Avoid overly decorative fonts that may make the text difficult to decipher, especially for key details like amounts and payment instructions.

- Include a Clear Header: The header should contain essential business information such as your company name, contact details, and logo. It should be easy to identify and should set a professional tone.

- Keep Information Organized: Divide the document into distinct sections such as billing details, service descriptions, and payment terms. Use headings or borders to separate these sections for clarity.

- Maintain Consistent Formatting: Use consistent font sizes, colors, and alignment throughout the document. This uniformity makes the document easier to navigate and looks more professional.

- Provide Adequate White Space: Avoid clutter. Adequate spacing between sections and text blocks makes the document more readable and visually pleasing.

- Highlight Key Details: Important information such as payment due dates and total amounts should stand out. Use bold or larger fonts for emphasis without overwhelming the overall design.

- Use Tables for Itemization: When listing multiple items or services, use a table format to make the information clear and organized. Include columns for descriptions, quantities, rates, and totals.

By following these design best practices, you create a more professional, user-friendly billing document that ensures clear communication and timely payments.

Tracking and Organizing Billing Statements

Efficiently managing and tracking your billing documents is crucial for maintaining organized financial records and ensuring timely payments. Proper organization helps in quickly locating specific transactions and monitoring the status of each document, whether it is paid, pending, or overdue.

Here are some strategies for effectively tracking and organizing your documents:

- Maintain a Centralized Record System: Keep all your billing statements in one place, either digitally or in physical form. This centralized system allows you to quickly access and review any document when needed.

- Use Clear Identification Numbers: Assign a unique reference number to each billing document. This number will help you track and retrieve specific records easily, reducing the risk of confusion.

- Track Payment Status: Clearly mark the status of each transaction (e.g., paid, pending, overdue) to easily monitor outstanding amounts and ensure follow-up actions are taken promptly.

- Utilize Digital Tools: Use accounting software or online tools to automate and organize your billing process. Many platforms offer features like auto-reminders, payment tracking, and data storage, which can save you time and effort.

- Regularly Update Your Records: Review and update your records frequently to ensure everything is accurate and up-to-date. This prevents backlog and helps keep financials in order.

For better organization, consider using the following table structure to track and organize your billing statements:

Reference Number Client Name Date Issued Amount Due Status INV12345 Client A 2024-10-01 $500.00 Paid INV12346 Client B 2024-10-05 $300.00 Pending INV12347 Client C 2024-10-10 $750.00 Overdue By following these practices, you can streamline the process of managing and tracking your billing documents, ensuring that everythi

Legal Requirements for Billing Documents

When preparing billing documents, it’s essential to adhere to specific legal guidelines to ensure compliance with tax regulations and business laws. These requirements may vary depending on your country, industry, or business type, but understanding the core elements can help you avoid legal issues and maintain transparency with your clients.

Here are some of the key legal requirements to include in your billing documents:

- Accurate Business Information: Always include your company’s legal name, business address, and contact details. This ensures that the document can be traced back to your business, which is crucial for tax and legal purposes.

- Client Information: It’s important to include the name and contact details of the client receiving the goods or services. This will help prevent any confusion regarding who is responsible for the payment.

- Unique Document Number: Every billing document should have a unique identification number, which helps both you and your clients track the transaction and prevents errors in record-keeping.

- Detailed Description of Goods or Services: A clear breakdown of the products or services provided, including quantities, prices, and any additional charges, ensures transparency and helps prevent disputes.

- Payment Terms: Clearly state the payment due date and the accepted payment methods. Include any late payment penalties if applicable to encourage timely payments.

- Tax Information: Depending on your location, you may need to include applicable tax rates, the amount of tax charged, and your tax identification number. This is necessary for compliance with local tax laws.

- Issue and Due Dates: Both the date the billing document is issued and the due date for payment should be clearly stated to avoid confusion about payment expectations.

By ensuring that your billing documents meet all legal requirements, you not only protect your business but also maintain trust with your clients and avoid unnecessary legal complications.

Invoice Templates for Small Businesses

For small businesses, creating clear and professional billing documents is essential for smooth transactions and maintaining healthy cash flow. Using well-organized and customizable documents not only helps streamline the billing process but also builds trust with clients. By choosing the right format, small business owners can ensure they meet client expectations while keeping things efficient and consistent.

Why Small Businesses Need Customized Billing Formats

For small businesses, it’s crucial to use a format that suits their specific needs. Here’s why tailored billing documents are beneficial:

- Brand Consistency: Customizing your documents allows you to incorporate your branding elements, such as logos and color schemes, making your documents look more professional and in line with your brand.

- Clarity and Transparency: A well-structured document ensures all necessary information is included, such as service descriptions, payment terms, and deadlines, reducing the chance of misunderstandings with clients.

- Efficiency: Using templates saves time, making it quicker to create documents for each new transaction while maintaining consistency.

- Legal Compliance: A customizable structure ensures that you can easily add any required legal information, such as tax details, that may be unique to your business’s location or industry.

Choosing the Best Format for Your Business

Selecting the best format for your small business billing documents depends on several factors, such as the type of services or products you provide and the nature of your client relationships. Consider the following:

- Simplicity: For many small businesses, a clean, straightforward document without excessive details can be effective. It should include essential elements like the client’s name, itemized costs, and total amount due.

- Customizable Sections: Look for formats that allow easy modification. For example, you might want to add discounts, custom services, or payment terms that vary with each client.

- Digital Accessibility: As small businesses often operate digitally, using formats that are easily shareable via email or online platforms is key. Formats like PDF, Word, or even Excel are common for this purpose.

By choosing the right format, small businesses can ensure they maintain professionalism, reduce errors, and improve their overall client relations.

Using Invoices for International Transactions

When conducting business across borders, it’s essential to ensure that your billing documents meet the specific needs of international transactions. These documents not only serve as a formal request for payment but also play a crucial role in ensuring legal compliance and smooth cross-border financial operations. A well-structured billing statement can help prevent misunderstandings and facilitate a quicker payment process between parties from different countries.

Key Considerations for Cross-Border Billing

In international transactions, there are several factors to keep in mind when preparing billing documents:

- Currency Selection: Always specify the currency in which the payment is expected. This helps avoid confusion, especially when dealing with clients in different parts of the world.

- Tax Regulations: International tax laws can differ greatly from one country to another. Ensure that your billing documents comply with both your local tax rules and the tax requirements of the client’s country.

- Payment Methods: International payments often involve different methods such as wire transfers, PayPal, or credit cards. Clearly state the available payment options and associated details to avoid delays.

- Legal Requirements: Different countries may have specific legal requirements regarding billing documents, such as the inclusion of tax numbers, company registration numbers, or other local identifiers. Make sure your documents are compliant with international regulations.

How to Adapt Your Billing Process for Global Transactions

Adapting your billing documents to cater to international clients requires careful planning. Here are some steps to ensure smooth international transactions:

- Language Translation: If you are working with clients from non-English speaking countries, consider providing translations of your billing documents in their native language to minimize confusion and ensure clarity.

- Detailed Descriptions: Provide clear and comprehensive descriptions of the products or services offered. This is especially important when dealing with clients from different countries who may not be familiar with your local business practices or terminology.

- Time Zone Awareness: Be mindful of time zone differences when setting deadlines for payments. Clearly communicate the payment due date, taking into account the time zone of both parties involved.

By incorporating these considerations into your cross-border billing process, you can facilitate smooth international transactions, improve client satisfaction, and ensure compliance with global business standards.

How to Send Invoices Effectively

Successfully sending billing documents requires more than just generating them. It’s about ensuring that the recipient receives all the necessary information in a timely and professional manner. An effective process for delivering these documents can significantly reduce delays in payments and improve the overall relationship with your clients. Knowing the best practices for sending these documents can help streamline your billing process and reduce misunderstandings.

Key Steps for Sending Billing Documents

To ensure your billing documents are received and processed without issues, consider the following key steps:

- Choose the Right Delivery Method: The method of delivery should align with your client’s preferences and your business needs. Common options include email, postal mail, or through invoicing software platforms. Ensure you use a secure and reliable method to avoid the risk of your document being lost or delayed.

- Include All Necessary Details: Double-check that all required information is included before sending. This includes the recipient’s name, address, payment instructions, the amount due, and the payment due date. Missing details can lead to confusion and delays.

- Set Clear Payment Terms: Be explicit about payment terms to avoid misunderstandings. This includes the total amount due, the deadline for payment, and any penalties for late payment.

- Send a Reminder: If the due date is approaching and payment has not yet been made, consider sending a gentle reminder to your client. A polite follow-up ensures that they don’t forget to settle the payment on time.

Best Practices for Sending Billing Statements

To further enhance the efficiency of sending your billing documents, keep the following best practices in mind:

- Use Professional Templates: Whether you create your own or use an online tool, a clean and professional layout helps ensure that the recipient can easily understand the payment request.

- Track Sent Documents: Keep a record of all documents that have been sent, including the date and method of delivery. This will help you monitor the status of each transaction and provide proof if needed.

- Keep a Copy for Your Records: Always retain a copy of the sent documents for your records, whether in digital or physical form. This ensures that you have access to all relevant information in case of future disputes or inquiries.

By following these steps, you will ensure that your billing documents are sent in an effective and organized manner, improving your chances of timely payments and maintaining positive client relationships.