Invoice with Tax Calculation Template for Easy Billing

Efficient billing is crucial for any business, ensuring smooth transactions and proper financial tracking. One of the key components of an effective invoicing system is ensuring the correct financial figures are applied automatically, avoiding human error and saving valuable time. A well-designed document can simplify this process, making it easy to generate accurate records for clients and keep a clear overview of your earnings.

In this guide, we’ll explore how you can easily generate professional documents that automatically adjust figures based on the relevant financial percentages. You’ll learn how to customize these documents for different business needs, as well as the tools and features that make them an essential part of your accounting workflow. Whether you’re a small business owner or managing a large-scale operation, having a streamlined system can greatly improve your productivity and accuracy.

Managing finances doesn’t have to be complicated. With the right system in place, you can ensure that every transaction is properly recorded, and all necessary details are included, from service fees to additional charges. By using a pre-built structure that automates key processes, you can focus more on growing your business and less on manual paperwork.

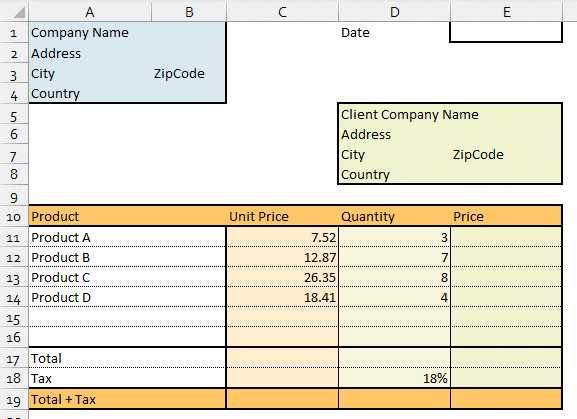

Invoice with Tax Calculation Template

Creating precise financial records is essential for any business, ensuring transparency and ease of tracking payments. A well-structured document can streamline the billing process, automatically applying necessary charges to ensure correctness and compliance. By utilizing a structured format, businesses can save time and avoid errors, simplifying what could otherwise be a complex task.

Key Benefits of Using an Automated Document

- Accuracy: Automation reduces the risk of manual errors when entering numbers or rates.

- Efficiency: The template automatically adjusts figures, saving time during the billing process.

- Consistency: Each transaction follows the same format, ensuring uniformity across all records.

- Legal Compliance: An automated document ensures that all necessary legal requirements are met when processing payments.

How to Set Up an Automated System

Setting up an automated system requires selecting the right platform or software to generate documents tailored to your needs. The following steps can help you get started:

- Choose a tool that allows you to input essential details such as services, products, and rates.

- Ensure the system can automatically compute any additional fees or charges based on the data entered.

- Customize the format to match your company’s branding and the type of financial transactions you handle.

- Review the results to ensure that everything is correct and meets any legal standards.

By implementing such a system, businesses can ensure that all financial transactions are properly documented and compliant, minimizing the chances of disputes or misunderstandings with clients. This approach not only simplifies the process but also improves overall business efficiency.

Why Use a Tax Calculation Template

Managing financial documents can be time-consuming and error-prone, especially when it comes to adjusting amounts based on various charges. Utilizing an automated document ensures that figures are calculated accurately, saving time and reducing the potential for mistakes. This streamlined approach simplifies billing and enhances overall efficiency, providing businesses with more control over their financial processes.

Advantages of Using an Automated Document System

- Reduces Human Error: Automation minimizes the risk of manual mistakes, ensuring all figures are correctly computed based on predefined rates.

- Saves Time: Instead of manually adding calculations, an automated system quickly computes everything for you, allowing you to focus on other tasks.

- Ensures Consistency: Each document generated follows a uniform structure, which helps maintain a professional image and prevents discrepancies.

- Improves Accuracy: Automated systems use precise formulas to apply the correct amounts, ensuring that no vital information is missed or miscalculated.

- Boosts Efficiency: With automatic adjustments and calculations, you can process more transactions in less time, optimizing your workflow.

When is it Useful?

Such tools are especially beneficial in situations where multiple services, products, or different rates are involved. Whether dealing with different regions or varying price structures, having a reliable, automated system makes handling diverse pricing models more manageable.

In addition, businesses that deal with frequent financial transactions, such as freelancers, small companies, or e-commerce platforms, can greatly benefit from such tools. The ability to generate accurate and professional records instantly allows for quicker payments, fewer disputes, and easier bookkeeping.

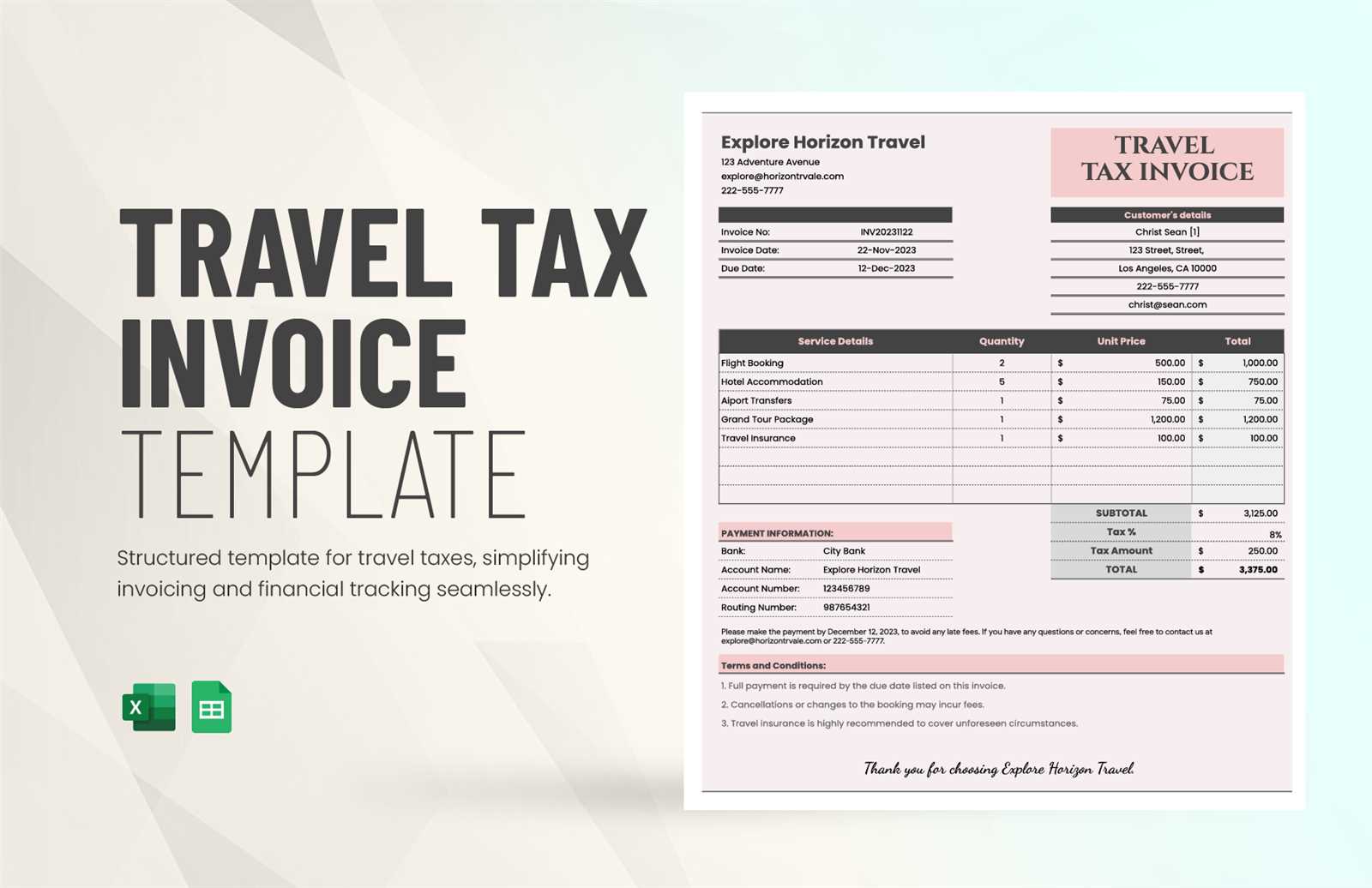

Key Features of a Tax Invoice Template

Having a structured document to manage payments and associated charges can significantly improve business operations. A well-designed system offers clarity, accuracy, and ease of use, ensuring all necessary information is captured while minimizing errors. The right features can simplify the entire billing process and help maintain professional standards across all financial records.

Essential Elements in an Automated Document

Every well-organized document should include certain core elements that make it both practical and legally compliant. These features ensure that each transaction is accurately recorded, and all necessary details are provided for clients and financial records.

| Feature | Description |

|---|---|

| Clear Itemization | Each product or service should be listed separately along with its price, ensuring transparency. |

| Predefined Rates | Automated systems can apply the correct rates based on the type of transaction, saving time and avoiding errors. |

| Automatic Adjustments | Any changes or updates to the prices or rates should be automatically reflected in the document. |

| Client Information | All relevant client details, such as name, address, and contact information, should be included for accurate records. |

| Legal Compliance | The document must meet any local legal requirements, including specific charge details or identifiers. |

Customization for Business Needs

While these features form the core structure of a well-organized document, customization options allow businesses to tailor the format according to their needs. Whether it’s adjusting the layout, adding company branding, or modifying charge categories, flexibility ensures the system fits seamlessly into any business model. Having these key features available in an automated system makes it easier to manage large volumes of transactions while maintaining professionalism and accuracy.

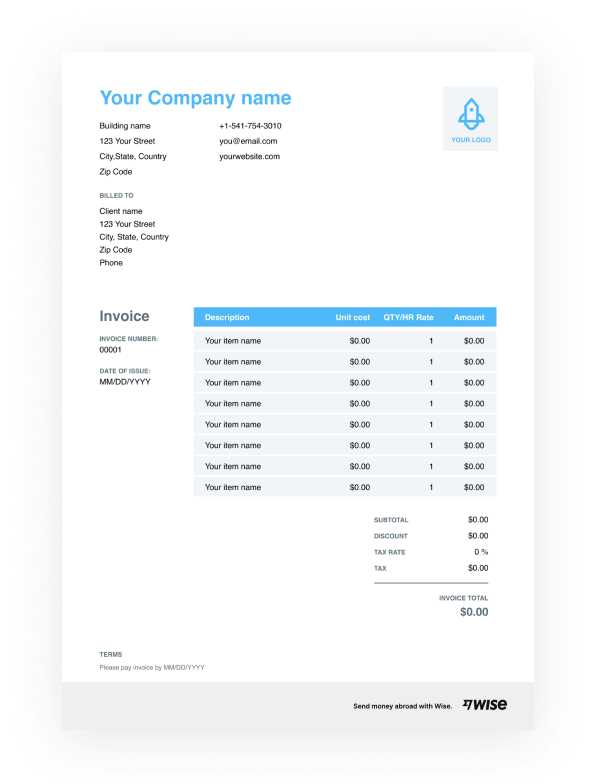

How to Customize Your Invoice Template

Creating a personalized document for financial transactions allows businesses to maintain professionalism while reflecting their unique brand identity. Customization ensures that all essential information is displayed correctly and that the document meets your specific needs. Whether you’re a freelancer or running a larger operation, tailoring your structure can enhance clarity and improve client satisfaction.

Essential Customization Options

Customizing your document involves adjusting several key aspects to make it functional, compliant, and aligned with your business style. Here are some critical areas to focus on:

- Company Branding: Include your company’s logo, brand colors, and font styles to create a cohesive look across all documents.

- Client Details: Ensure fields are available for capturing accurate client information, such as name, address, and contact details.

- Service or Product Descriptions: Clearly describe the services or products being provided, including quantities, prices, and any additional charges.

- Payment Terms: Customize the payment due date, acceptable payment methods, and any late fees or discounts for early payments.

- Additional Charges: Adjust the format to automatically include shipping, handling, or other extra fees based on the specific transaction.

Using Tools to Simplify the Process

Many software platforms allow easy customization through pre-built templates that can be modified as needed. These tools typically offer drag-and-drop options, making it easy to adjust sections like item lists, payment terms, or legal disclaimers. You can also save time by using automated systems that update calculations and apply appropriate charges based on the input data.

By taking advantage of these customization options, you can create documents that are both professional and functional, ensuring that all necessary details are included and presented clearly.

Steps to Add Tax Information in Your Template

Incorporating relevant financial details into your billing documents is essential for maintaining accuracy and legal compliance. Properly adjusting for applicable charges ensures that all parties involved are aware of the costs and avoids any confusion down the line. Following a structured approach to include these adjustments helps streamline the process and minimizes errors.

Key Steps for Adding Charges

Here are the main steps to follow when adding necessary financial adjustments into your system:

- Determine the Applicable Rates: Identify the appropriate rates based on your location, the nature of the product or service, and any regulatory requirements.

- Create a Field for Financial Adjustments: Ensure your document includes a dedicated area for specifying the total percentage of applicable charges.

- Include Pre-Calculated Amounts: Automatically calculate the total amount due, incorporating the charges based on the rate and itemized costs.

- Provide a Breakdown: Clearly list all components, such as service/product costs and any additional charges, for full transparency.

- Set Up Dynamic Fields: Use dynamic fields that can adjust the final amount automatically when the rates or the number of items change.

Finalizing Your Adjustments

Once the rates and fields are added, it’s crucial to test the system to ensure all numbers are calculated correctly. Check for accuracy by running a few sample transactions through the system to ensure the appropriate charges are applied and clearly displayed. This process helps maintain precision and ensures that the documents meet your business’s financial and legal standards.

By following these steps, you can ensure your billing documents are clear, transparent, and fully aligned with relevant financial regulations.

Benefits of Automated Tax Calculations

Automating the process of adjusting financial figures for various charges provides several key advantages that can simplify and enhance the way businesses handle transactions. By removing the need for manual intervention, automated systems ensure that all amounts are calculated accurately, consistently, and quickly, making the entire process more efficient and reducing the risk of errors.

Key Advantages of Automation

- Improved Accuracy: Automation eliminates the human error factor, ensuring that all figures are calculated correctly every time, even in complex transactions.

- Time Savings: Automating adjustments speeds up the process significantly, reducing the time spent on manual calculations and allowing businesses to focus on other tasks.

- Consistency: With automated systems, each transaction is processed in the same way, ensuring consistency across all documents and reducing the chances of discrepancies.

- Instant Updates: Automated systems can quickly adapt to changes, such as new rates or financial regulations, without requiring manual updates to each document.

- Compliance Assurance: Automation ensures that your financial records remain compliant with the latest regulations by applying the correct rules to each transaction.

Why Automation is Essential for Growth

As businesses grow and the volume of transactions increases, it becomes more challenging to manually track and adjust for applicable charges. Automation not only keeps the process smooth and accurate but also frees up resources to focus on scaling the business. Whether it’s managing more clients or handling larger orders, automated adjustments streamline your operations, reduce backlogs, and improve overall workflow.

Incorporating automated adjustments into your system is a smart move for any business looking to maintain accuracy, save time, and reduce the risk of costly errors.

Common Mistakes in Tax Invoices

When preparing financial records for clients, certain errors can occur that affect the accuracy and professionalism of the document. These mistakes can lead to confusion, delays in payment, or even legal complications. Understanding the common pitfalls in the process can help you avoid them and ensure that all records are accurate and compliant.

Common Errors to Avoid

- Incorrect Financial Percentages: One of the most common mistakes is applying the wrong rate or missing out on adjustments. Double-checking rates can prevent miscalculations that could lead to legal or financial issues.

- Omitting Necessary Information: Forgetting to include essential details such as the service or product description, client information, or due date can create confusion and result in delays.

- Failure to Update Rates: Not adjusting rates to reflect changes in regulations or pricing can lead to inaccuracies, affecting both your business and client relationships.

- Manual Calculation Errors: Relying on manual input increases the risk of mistakes. Human errors can occur when entering amounts or applying charges, leading to discrepancies between what’s owed and what’s invoiced.

- Confusing Layout: A cluttered or unclear document can make it difficult for clients to understand the breakdown of charges. A well-organized layout is key to ensuring transparency.

How to Prevent Mistakes

By using an automated system or predefined structure, many of these errors can be easily avoided. Automation ensures that all calculations are accurate, and templates with clear fields reduce the chances of missing or incorrect information. Additionally, regularly reviewing rates and keeping financial records up to date can further minimize the risk of mistakes.

Staying on top of these details will help you maintain professionalism and accuracy, making the process smoother for both your business and your clients.

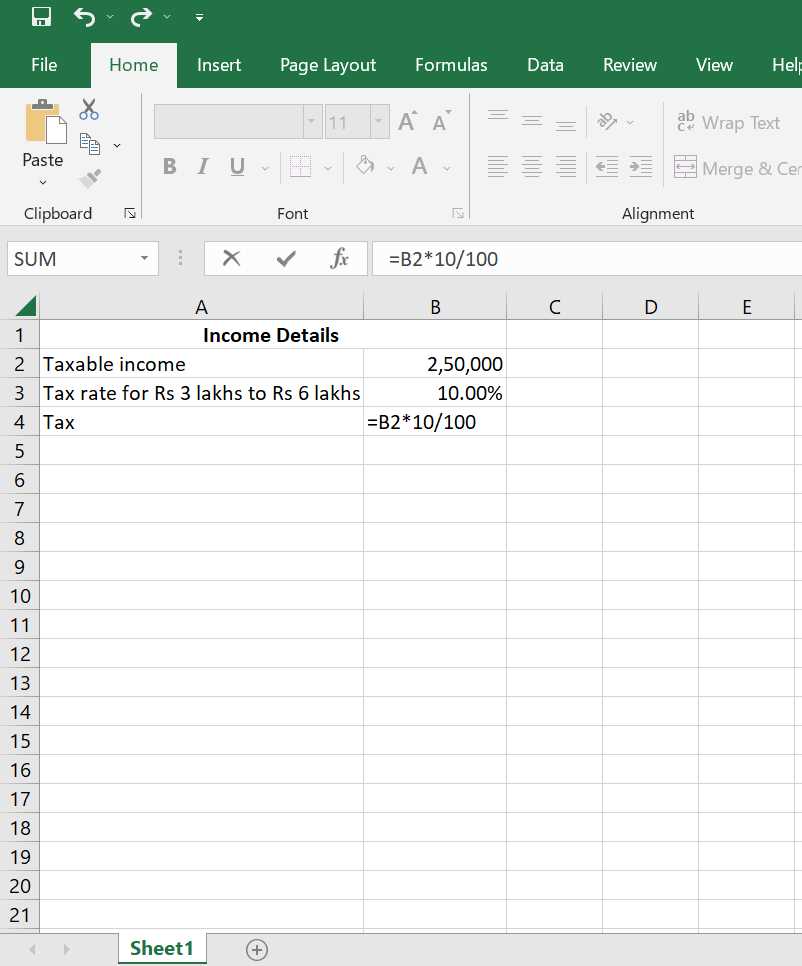

How to Calculate Sales Tax Accurately

Correctly adjusting for applicable charges is essential for maintaining accurate financial records and ensuring compliance with local regulations. When you are calculating additional amounts for products or services, it’s crucial to apply the right rates and perform the necessary computations to avoid errors that could affect your bottom line or create confusion for your clients.

Steps to Calculate Proper Charges

Here are the essential steps for accurately determining the additional charges to be applied to your products or services:

- Identify the Rate: Determine the correct rate based on the location, the type of product or service, and any other relevant criteria. Rates can vary depending on the jurisdiction and the type of item sold.

- Apply the Rate to the Total: Once you have the rate, multiply it by the total cost of the product or service. If there are multiple items, apply the rate to the sum of all items before calculating the charge.

- Check for Exemptions: Some products or services may be exempt from additional charges, so it’s important to verify whether certain items fall under any exemptions based on local laws or special categories.

- Calculate the Final Amount: After applying the necessary rate, add the additional amount to the base cost of the product or service. This will give you the total amount due, including any applicable charges.

Tools to Simplify the Process

Using automated systems or predefined structures can make these calculations faster and more accurate. Many modern tools allow you to input the basic cost of items and the relevant rate, then calculate the full amount in seconds. These tools also help ensure that rates are consistently updated, which is crucial when regulations change or new items are added to your inventory.

By following these steps and utilizing the right tools, you can ensure that the calculations are performed accurately every time, improving efficiency and helping you avoid errors in your records.

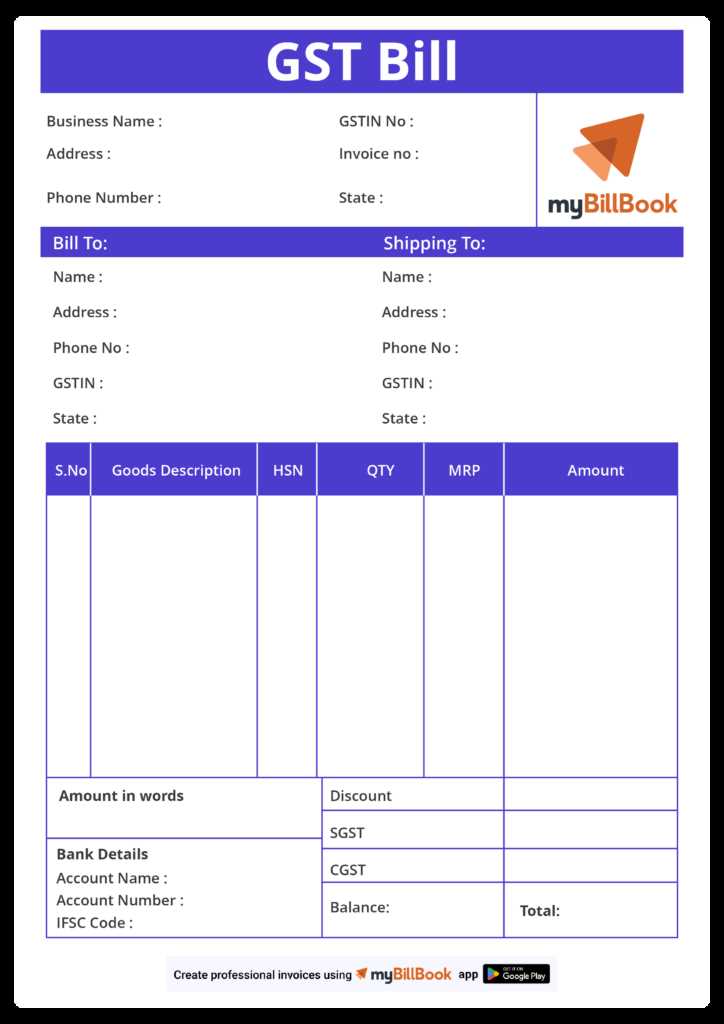

Types of Taxes to Include in Invoices

When creating billing documents, it’s important to correctly apply various additional charges required by law. Different types of fees may apply depending on the nature of your business, location, and the products or services provided. Understanding which types of charges to include helps ensure legal compliance and avoids confusion or disputes with clients.

Common Types of Additional Charges

- Sales Charges: These are the most common and are applied to most products or services. The rate can vary based on location or product category and is usually a percentage of the total amount.

- Value-Added Charges (VAT): VAT is a consumption-based fee added at each stage of production and sale. The rate may differ by country or region and is often included in cross-border transactions.

- Service Fees: Some businesses apply a fee for specific services rendered, such as handling or administrative costs. This fee is typically added on top of the base price.

- Import/Export Duties: When goods are shipped across borders, specific duties or fees may be applied. These charges depend on the type of product and the international agreements in place.

- Environmental Levies: In some regions, businesses must apply a fee to products that contribute to environmental impact, such as certain electronics or packaging materials.

How to Include These Charges Correctly

To avoid confusion, it’s crucial to clearly itemize each type of charge in your documents. List the base cost, followed by each additional fee or charge separately. For transparency, ensure that the rates and the calculation methods are clearly explained. This approach not only maintains professionalism but also keeps your financial transactions accurate and compliant with local laws.

By understanding and correctly applying these different charges, you ensure that your business remains in compliance and avoids any legal or financial issues related to incorrect billing practices.

Choosing the Right Template for Your Business

Selecting the appropriate structure for managing financial transactions is crucial to maintaining efficiency and professionalism. The right system ensures all necessary information is included, helps reduce errors, and aligns with your business needs. Whether you’re a small business owner or managing a larger operation, the format you choose should complement your workflow and legal requirements.

Factors to Consider When Choosing a Structure

When deciding on the most suitable document format, several factors should guide your choice:

- Business Type: The size and nature of your business can influence the level of complexity required. Small businesses might prefer simple, straightforward formats, while larger businesses may need more detailed structures to account for multiple services or product categories.

- Client Needs: Consider what your clients expect in terms of detail and clarity. If your customers prefer detailed breakdowns of services and products, your chosen structure should be flexible enough to accommodate that.

- Compliance Requirements: Ensure the structure you choose meets local regulations or industry standards. This may include specific fields, such as business registration numbers or regulatory identifiers, which vary from region to region.

- Automation Features: Automation can significantly improve efficiency by reducing human error and speeding up the process. Look for formats that allow automatic calculations and updates based on input data.

Customizing to Fit Your Workflow

One of the advantages of modern document systems is the ability to customize the layout and features to suit your specific needs. You can modify sections, adjust the level of detail, and even automate repetitive tasks. Whether you need to generate large volumes of records quickly or prefer more personalized documents for each client, a customizable format can make managing transactions easier and more efficient.

Choosing the right format is an investment in both efficiency and professionalism, ensuring your business maintains accurate, clear, and compliant financial records.

Free vs Paid Tax Invoice Templates

When it comes to creating documents for financial transactions, businesses often face the choice between using free or paid formats. While both options have their advantages, the decision ultimately depends on your specific needs, budget, and the level of customization you require. Understanding the differences between free and paid solutions can help you make an informed decision that best suits your business.

Advantages of Free Options

Free solutions can be an excellent choice for small businesses or individuals who need basic functionality without any additional costs. These formats usually offer simplicity and ease of use but may come with certain limitations:

- Cost-Effective: Free formats can help businesses save money, especially for startups or small enterprises that don’t have the budget for paid services.

- Quick Setup: Free options are generally easy to use and require little to no learning curve. Many online platforms provide downloadable or customizable versions that can be ready to use in minutes.

- Basic Features: For businesses with straightforward needs, free versions often provide all the essential fields and functions, such as product descriptions, prices, and basic adjustments.

Advantages of Paid Options

On the other hand, paid solutions typically offer more advanced features, greater flexibility, and support. These options are ideal for businesses that require specific functions or professional design. Here’s what paid services can offer:

- Customization: Paid formats allow for a higher degree of personalization, including branding options like custom logos, colors, and fonts.

- Advanced Features: Many paid versions include automated calculations, real-time updates, and integration with accounting or payment systems, making them more efficient for businesses with complex needs.

- Support and Updates: Paid services often include customer support and regular updates, ensuring the document system stays current with new features or compliance requirements.

- Professional Design: Paid formats often come with polished, professional designs that help create a more trustworthy and credible impression with clients.

Making the Right Choice

Choosing between free and paid formats comes down to your business’s size, complexity, and budget. If you’re just starting out or don’t need advanced features, a free solution might be enough. However, as your business grows or if you require more functionality, investing in a paid option could save you time and help you maintain a professional image.

Ultimately, whether you go for a free or paid option, the most important factor is ensuring that your system meets your specific business needs and compliance requirements.

Ensuring Legal Compliance with Tax Invoices

For businesses, maintaining compliance with legal and financial regulations is crucial. This includes ensuring that all necessary details are correctly documented in financial records and that applicable laws are followed when charging customers. Adhering to these guidelines not only helps avoid potential legal issues but also fosters transparency and trust with clients.

Key Legal Considerations

To stay compliant, businesses must ensure that specific requirements are met when issuing financial documents:

- Accurate Information: Include all required details such as company registration numbers, client information, and clear itemized lists of products or services. Missing or incorrect data can lead to penalties or disputes.

- Appropriate Rates: Make sure the correct rates are applied according to the laws of the jurisdiction. Rates may vary by location and product category, so it’s essential to stay updated with any changes in the law.

- Proper Documentation: In some regions, businesses are required to submit specific reports or keep detailed records for tax purposes. Ensure your documents are ready for audit and align with any regulatory reporting requirements.

- Transparency: Clearly outline any adjustments or additional charges to avoid misunderstandings. Providing a transparent breakdown helps both businesses and clients stay informed about the charges applied.

Staying Updated with Changing Laws

Legal requirements for financial documents can change over time, so it’s important to regularly review any updates to local, state, or international laws that may affect your business. For example, changes in product categorization, new tax rates, or other industry-specific regulations could impact how you create your documents.

By staying informed and ensuring all necessary information is included and accurate, businesses can confidently meet legal standards and maintain smooth operations without the risk of non-compliance.

Integrating Tax Calculation into Accounting Software

Efficient financial management requires accurate and timely calculations for various business transactions. Integrating tax-related computations directly into accounting systems simplifies this process, saving time, reducing errors, and ensuring consistency across records. By automating these calculations, businesses can streamline operations and focus more on growth while maintaining compliance.

Benefits of Integration

Integrating automated calculations into accounting software offers several advantages:

- Efficiency: Automating complex financial computations eliminates the need for manual adjustments, reducing time spent on each transaction and speeding up the overall process.

- Accuracy: By syncing your records with the software, the system ensures that calculations are performed correctly every time, minimizing human error and improving the quality of financial data.

- Consistency: Integration ensures that calculations are consistent across all documents and reports. This reduces the risk of discrepancies between various records, improving the reliability of your financial data.

- Real-Time Updates: As rates and regulations change, integrated systems can be updated in real time, ensuring that you are always compliant with the latest laws without needing to manually adjust rates or settings.

How to Implement Integration

Successfully integrating automated computations into your accounting software involves several key steps:

- Choose the Right Software: Select an accounting system that supports the necessary features for tax adjustments. Many modern platforms offer built-in functionalities for tax management and can handle multiple jurisdictions.

- Configure Settings: Ensure that the software is set up to handle specific rates, exemptions, and other financial parameters relevant to your business. This customization will ensure that the system processes information correctly.

- Sync Data: Connect your sales records and client details to the accounting software. This integration will enable automatic updates to your financial data, including the necessary charges and adjustments.

- Test and Monitor: After the system is set up, test it by generating sample records to ensure that calculations are working correctly. Regularly monitor the software to ensure it continues to perform as expected and stays up to date with any regulatory changes.

By incorporating automated calculations into your accounting software, you can significantly reduce manual workload, improve accuracy, and ensure that your financial processes remain smooth and compliant.

Best Practices for Sending Tax Invoices

Sending accurate and timely financial documents is an essential part of maintaining good business relationships and ensuring that your records are properly maintained. By following best practices, businesses can reduce errors, ensure clarity, and streamline their billing process. Properly handling the delivery of these documents not only helps with compliance but also enhances customer trust and satisfaction.

Key Guidelines for Efficiently Sending Documents

To ensure that your financial communications are effective, follow these key best practices:

- Ensure Accuracy: Double-check all details before sending out any documents. This includes verifying client information, item descriptions, prices, and any additional charges. Errors can lead to confusion and delays in payment.

- Use Clear Descriptions: Provide detailed descriptions of goods and services. Clear itemization helps clients understand exactly what they are being charged for and can prevent misunderstandings.

- Send Promptly: Aim to send documents as soon as the transaction is complete. Delayed submissions can lead to payment delays and may cause customers to question the professionalism of your business.

- Choose the Right Delivery Method: Whether it’s through email or traditional mail, make sure that your delivery method suits the client’s preferences. Digital delivery is faster and more efficient, but some clients may prefer paper copies for record-keeping.

Formatting and Presentation Tips

How your documents look can also play a role in how quickly and smoothly they are processed. Consider these formatting tips:

- Professional Design: Use a clean, professional layout that is easy to read. A cluttered document can confuse the recipient and make it harder to find important information.

- Include Payment Terms: Be sure to clearly state payment terms, due dates, and acceptable payment methods. This helps avoid any misunderstandings and encourages timely payments.

- Provide Contact Information: Always include a phone number or email address where clients can reach you if they have questions or concerns. Being easily accessible will help resolve issues quickly and keep relationships positive.

By following these best practices, businesses can create a more efficient and transparent billing process, leading to faster payments, better client satisfaction, and fewer disputes.

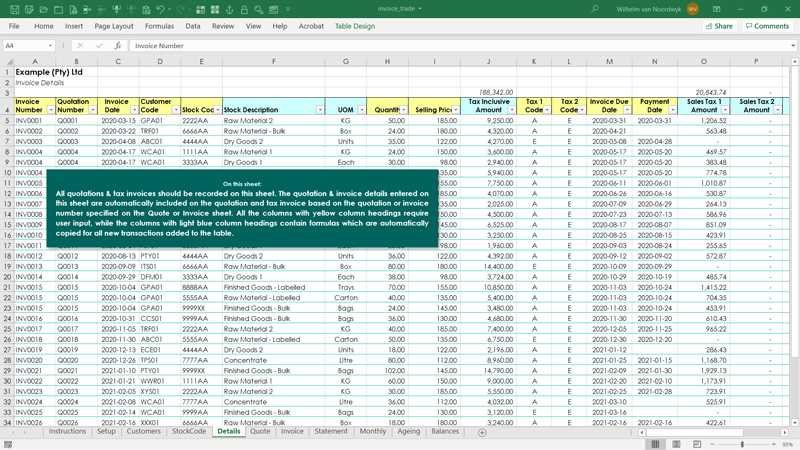

How to Track Tax Payments in Your Template

Effective tracking of financial transactions is essential for maintaining transparency and ensuring compliance with regulations. Properly recording payments, including any necessary adjustments or contributions, allows businesses to stay organized and keep accurate records. By implementing a reliable system for monitoring these payments, you can streamline your accounting and avoid potential issues during audits.

Steps for Tracking Payments

To keep track of contributions in your document system, follow these steps to ensure accurate and up-to-date records:

- Record Payment Dates: Always include the date when payments are made or received. This will help you track the timeline of each transaction and ensure timely processing.

- Include Payment Amounts: Clearly record the exact amount paid for each transaction. This ensures that the amount aligns with the agreed-upon terms and helps avoid discrepancies in your records.

- Use Payment Categories: Assign specific categories or line items to each type of contribution. This will help differentiate between payments for products, services, and other charges.

- Monitor Outstanding Payments: Track any pending or overdue contributions to avoid delays in cash flow. Including a section for outstanding balances will help you stay on top of any unfulfilled obligations.

Organizing Your Data

Maintaining organized records is key to efficient tracking and auditing. Consider these organizational tips:

- Group by Client or Transaction: Organize your documents by customer or project so that you can easily identify which payments correspond to which accounts.

- Use Software for Automation: Many modern accounting systems offer automatic payment tracking and categorization, reducing manual entry and the potential for human error.

- Generate Reports Regularly: Set up automatic reporting features to keep you informed about the status of payments. Regular reports can provide an overview of all transactions, helping you quickly identify any issues.

By following these steps and staying organized, businesses can easily monitor contributions, ensuring compliance and minimizing the risk of errors or misunderstandings.

Customizing Templates for Different Tax Rates

When dealing with financial records, businesses often need to account for varying rates depending on the region, product type, or customer category. Customizing your document system to automatically apply the correct rates based on these variables helps maintain accuracy and ensures compliance with local laws. This customization process is essential for businesses that operate across different jurisdictions or offer multiple product categories.

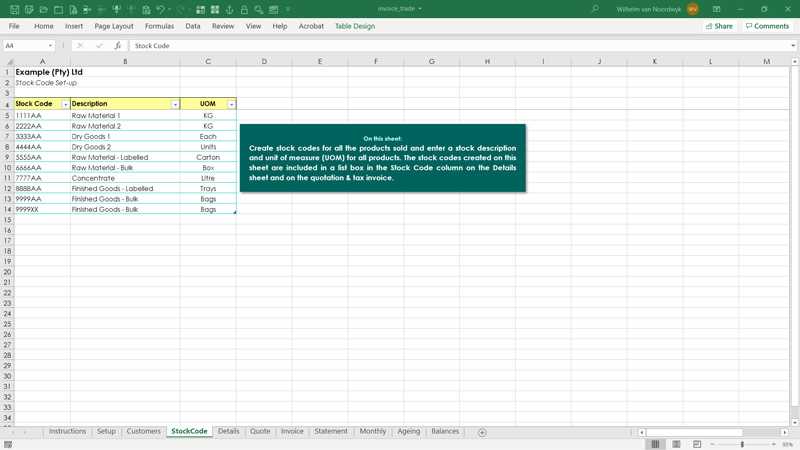

Steps for Customizing Your Document System

To ensure your system is flexible enough to handle different rates, follow these essential steps:

- Identify the Applicable Rates: Research and identify the specific rates that apply to your products, services, and the locations in which you operate. This could include different rates for goods versus services, or varying rates based on geographic location.

- Set Up Automatic Adjustments: Customize your document system to automatically adjust the rate applied to each item. This can be done by adding conditional logic based on location, product type, or customer type.

- Multiple Rate Fields: If your business operates in regions with different rates, set up multiple fields where different rates can be applied to different categories or geographical locations. This allows for flexibility without needing to manually adjust the rates each time.

- Include a Summary of Calculations: Clearly display how the rate has been applied to each item and provide a breakdown of the total charges. This transparency helps avoid confusion and ensures your clients understand the breakdown of their charges.

Maintaining Consistency Across Documents

To prevent errors and ensure consistency in applying rates, consider these best practices:

- Regularly Update Your Rate Information: Keep your system up to date with any changes in local or national rates. Automated systems can be programmed to alert you when rate changes are required.

- Test Customization Regularly: Before finalizing your setup, test the system to ensure the correct rates are being applied under all conditions. This will help avoid mistakes that could lead to discrepancies in your records.

- Integrate Software Tools: Use accounting or invoicing software that allows for dynamic rate customization based on predefined rules. This can save you time and reduce manual entry while ensuring accuracy.

By customizing your document system to handle multiple rates and ensuring it’s always up to date, you can improve efficiency, reduce errors, and ensure that you’re in full compliance with local regulations.

Frequently Asked Questions About Tax Invoices

Businesses often have numerous questions regarding how to handle financial documents correctly. Understanding the essential aspects of these records is crucial for smooth operations and compliance. In this section, we will address some of the most common queries related to managing these records, including how to issue, customize, and track them effectively.

1. What information should be included in a financial record?

A complete financial document should include the following details:

- Seller’s and buyer’s contact information

- Date of transaction

- List of goods or services sold

- Amount owed and any relevant fees or adjustments

- Payment terms and due date

- Any applicable rates or charges

Ensuring all required information is present helps prevent confusion and supports smooth transactions.

2. How can I automate the process of issuing documents?

Automating your financial record creation is simple with the right software. Many modern tools allow you to pre-set details like customer information, rates, and itemized lists, reducing manual entry. Once the relevant details are inputted, the system can generate the document automatically, saving time and ensuring accuracy.

3. Can I customize my documents for different customers?

Yes, customization is essential for addressing varying business needs. You can tailor the format, information, and appearance based on customer preferences or regional regulations. Many software solutions provide options to create multiple templates or adjust fields based on specific client categories or tax rules.

4. How do I ensure accuracy in my financial records?

To guarantee the precision of your records, you should:

- Double-check all entries before sending

- Use automated tools for calculations

- Regularly update your rate information to reflect any changes

Following these steps helps prevent errors and maintains the integrity of your financial reporting.

5. Are electronic documents as valid as physical ones?

Yes, electronic records are legally valid in many jurisdictions, provided they meet the requirements for authenticity, integrity, and accessibility. However, it’s important to verify local laws and regulations, as requirements may vary based on location and industry.

By addressing these common questions, businesses can navigate the complexities of managing financial documentation with more confidence and ensure that they remain compliant with regulatory standards.