How to Create an Invoice with PO Number Template

For any business, maintaining clear and organized financial records is essential. One of the key components of smooth transactions lies in using structured documents that ensure both accuracy and accountability. Properly formatted paperwork helps to prevent errors, improve efficiency, and make tracking easier for both parties involved.

When dealing with multiple clients or orders, incorporating an identifying reference on each transaction form becomes crucial. This unique identifier streamlines the billing process, making it easier to cross-check purchases and payments. By using a systematic approach, companies can also avoid delays and confusion, ensuring faster processing times.

Creating customized forms that fit specific business needs can significantly enhance workflow. These personalized documents help businesses manage accounts and payments, improving both customer relations and internal procedures. A tailored design also contributes to a professional image and demonstrates attention to detail.

Adopting the right structure allows businesses to stay organized, reduce errors, and ensure every transaction is accounted for. It simplifies financial tracking and provides both companies and clients with clear, transparent records for future reference.

Why Use an Invoice with PO Number

In any business transaction, clarity and precision are key to maintaining smooth operations. Using an organized system to track purchases and payments ensures that both parties involved can refer back to a clear record. A well-structured document, linked to a unique reference from the buyer, provides a straightforward way to manage orders, prevent confusion, and enhance communication between companies.

Improved Organization and Tracking

When a specific reference is included on each billing document, it becomes easier to trace the origin of any transaction. This identifier simplifies the process of matching orders to payments, reducing the chances of mix-ups or lost records. It also helps businesses quickly retrieve relevant information when needed, streamlining accounting tasks and audits.

Enhanced Accuracy and Communication

Incorporating a reference system fosters better communication between the seller and buyer. By linking each payment to a particular order or contract, both sides can cross-check the details and avoid misunderstandings. This method ensures that each item, service, or agreement is properly documented and processed, reducing the risk of errors and promoting transparency throughout the entire process.

Benefits of PO Number on Invoices

Using a unique reference code on financial documents can significantly improve both accuracy and efficiency in business transactions. By linking each transaction to a specific identifier provided by the buyer, companies can ensure that all details are correctly recorded and easily accessible. This simple addition can make a world of difference in managing purchases and payments, leading to smoother operations.

Streamlined Process – Including a reference helps create a more organized workflow by allowing both parties to track and verify orders quickly. This ensures that there is no ambiguity regarding the specifics of a transaction and reduces the time spent reconciling accounts or searching for relevant details.

Reduced Errors – The inclusion of an identifying code minimizes the likelihood of mistakes in matching products, services, or amounts to the correct transaction. By linking each financial document to a particular order, both the supplier and the buyer can ensure greater consistency and less chance of confusion when handling multiple transactions.

Better Communication – A clear reference system allows both sides to communicate effectively. If a discrepancy arises, both parties can immediately refer to the same identifier, which makes it easier to resolve issues and clarify any misunderstandings related to the transaction.

How PO Numbers Streamline Billing

Incorporating a unique reference identifier into financial transactions significantly improves efficiency and reduces errors. By linking each payment to a specific purchase or order, businesses can simplify the entire process, from generating paperwork to managing accounts. This structured approach allows for quick, accurate tracking and ensures smooth coordination between both parties.

Improved Efficiency in Record-Keeping

When a distinct reference is assigned to each transaction, it becomes easier to categorize and organize documents. This approach reduces the time spent searching for specific orders, as each record is clearly marked and easy to locate. Both companies and clients benefit from having a streamlined system that enhances overall operational efficiency.

Minimized Risk of Errors

Accurate matching of products, services, and amounts is made simpler when each financial record is connected to a unique identifier. This minimizes the chances of mismatched details or oversight, leading to fewer discrepancies in billing and payment processes. By reducing the potential for errors, businesses can save time and money while enhancing the accuracy of their transactions.

Faster Dispute Resolution – In case of any discrepancies, a clear reference number makes it easier for both parties to resolve issues quickly. This ensures that both the buyer and the seller can address concerns promptly, without delays caused by unclear or missing information.

Creating Professional Invoices with PO Numbers

Designing clear, well-structured billing documents is an essential step for any business aiming to maintain a professional image and ensure smooth transactions. Incorporating a unique reference assigned by the buyer into these records allows both parties to easily track and verify each order. This not only enhances the professionalism of the documents but also helps streamline accounting and auditing processes.

Customizing Your Document for a Professional Look

Tailoring financial records to reflect your brand’s identity can make a significant difference in how your business is perceived. A clean and organized layout that includes all necessary details, such as the specific reference code, will create a polished image and help clients feel more confident in their dealings with your company. Customized forms also convey attention to detail and a commitment to efficiency.

Ensuring Clarity and Transparency

Clearly displaying all relevant information, such as the buyer’s reference code, purchase details, and payment terms, makes it easier for both parties to verify and understand the terms of the transaction. A professional, easy-to-read document fosters trust and reduces the chances of confusion or disputes. By including all the necessary elements in a structured manner, you ensure that all communications regarding the transaction are transparent and straightforward.

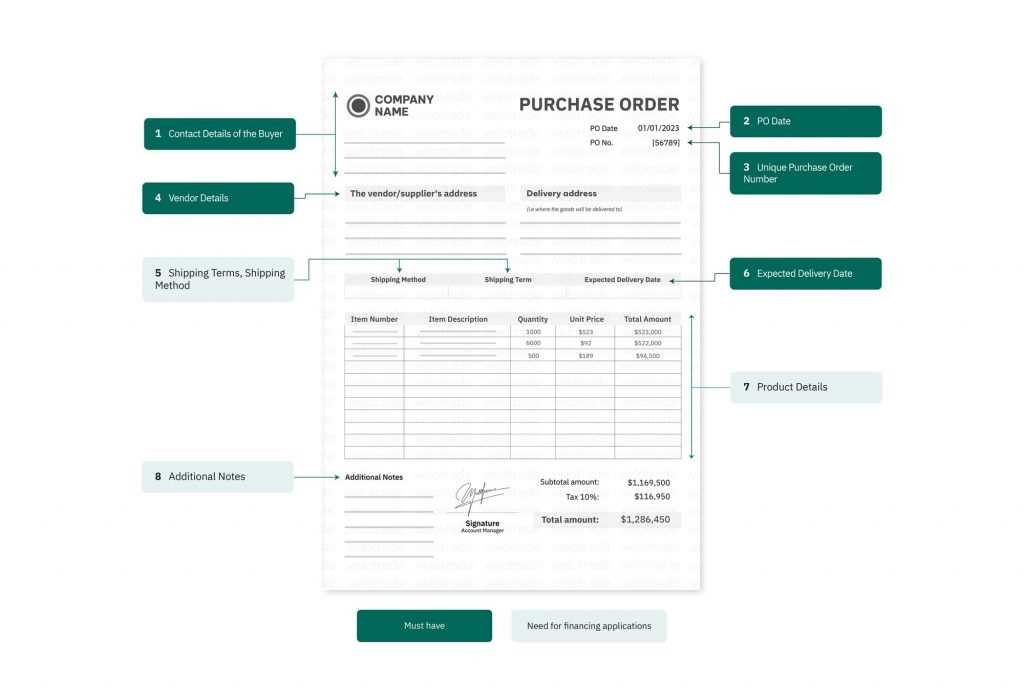

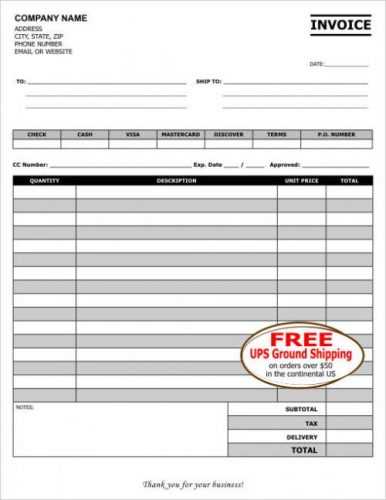

Key Elements of an Invoice Template

Creating a structured and effective document for billing purposes involves including key components that ensure clarity and proper record-keeping. These essential elements help both the seller and buyer track transactions, verify details, and maintain smooth financial operations. A well-organized layout ensures that all necessary information is easy to find and understand.

Essential Information to Include

- Business Details: Include your company’s name, contact information, and logo for a professional touch.

- Client Information: Clearly list the recipient’s name, address, and contact details.

- Transaction Reference: Add a unique order or purchase code to link the document to a specific deal.

- Description of Goods or Services: Provide a detailed list of what was delivered or performed, including quantities and unit prices.

- Total Amount Due: Make sure the final amount is clearly stated, including any taxes or discounts applied.

- Payment Terms: Specify the payment deadline, acceptable methods, and any late fees that may apply.

Formatting Tips for Clarity

- Consistent Layout: Ensure the layout is clean, with sufficient white space and easy-to-read fonts.

- Logical Flow: Arrange information in a sequence that makes sense–start with business and client details, followed by the transaction breakdown.

- Highlight Key Information: Use bold or underlined text to emphasize important details, such as the total due and payment terms.

By following these guidelines and including the necessary elements, you create a document that serves as a clear, professional record for all parties involved.

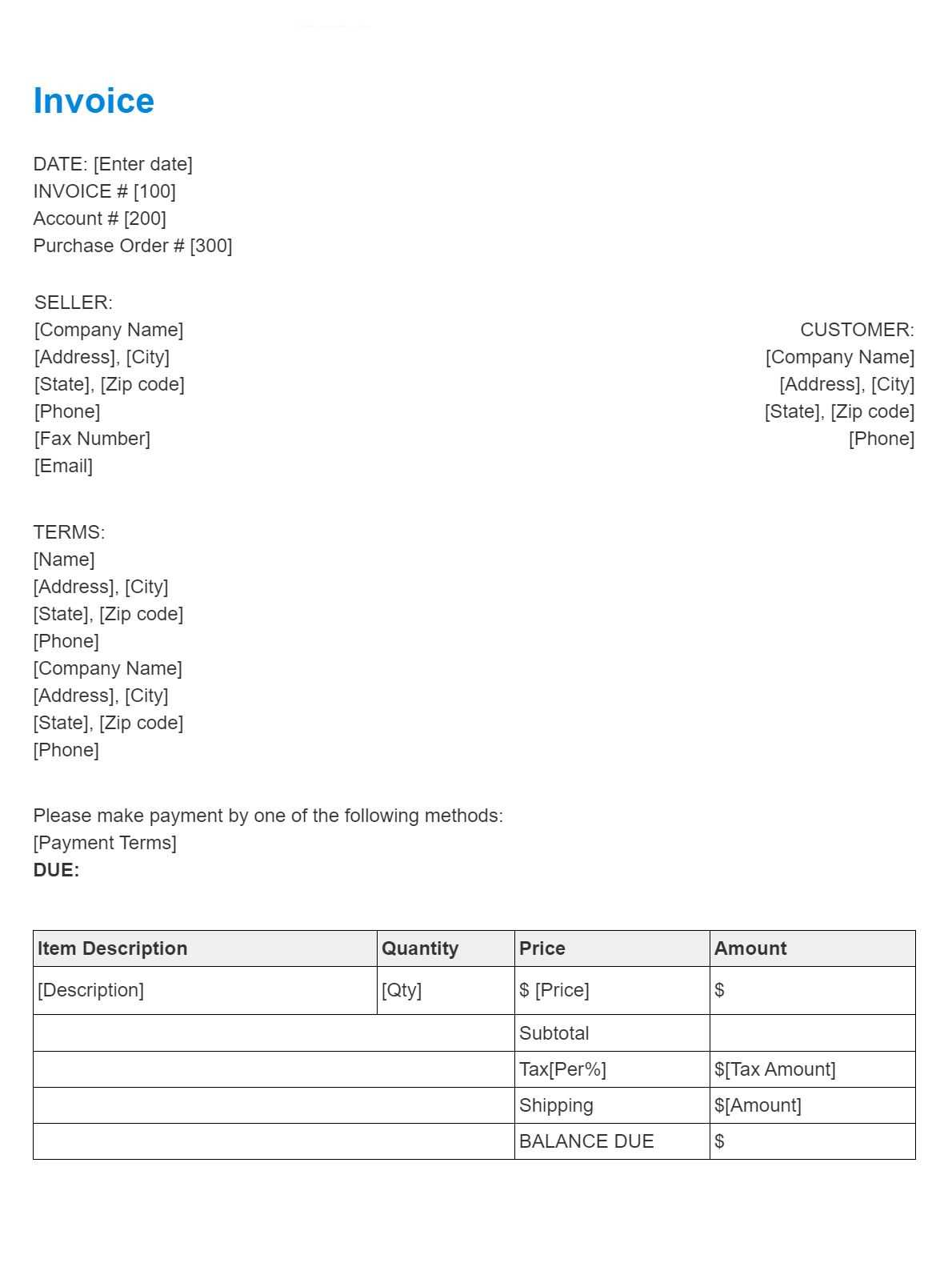

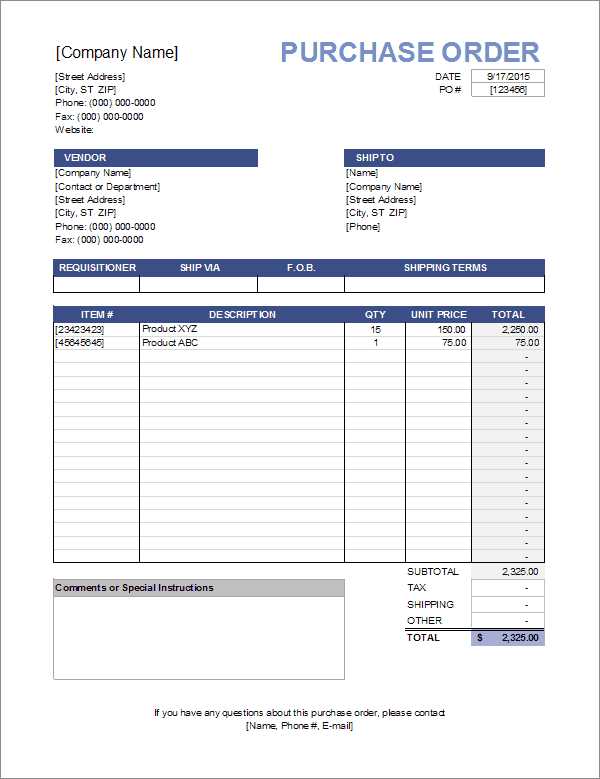

How to Customize Your Invoice Template

Customizing your billing documents allows you to create a unique and professional presentation that aligns with your brand. Tailoring these forms to fit your specific needs can improve communication, streamline the process, and leave a positive impression on clients. A well-designed document makes it easier to manage transactions, track payments, and maintain consistency across your business operations.

Steps to Personalize Your Document

- Branding: Include your company logo, color scheme, and business details at the top to make the document instantly recognizable.

- Layout: Choose a layout that’s clean and easy to read. Organize information logically to ensure clients can find the key details quickly.

- Custom Fields: Add fields that are specific to your business, such as delivery instructions, product codes, or additional references that enhance clarity.

- Payment Details: Clearly state accepted payment methods, due dates, and any early-payment discounts or late fees.

Advanced Customization Options

- Automated Calculations: Use built-in formulas for tax, discounts, and totals to reduce the risk of manual errors.

- Multiple Language Support: If you serve international clients, consider including multiple language options for clarity.

- Custom Terms: Personalize the terms of payment to suit specific agreements, such as offering installment plans or specifying special conditions.

By tailoring your documents, you ensure they meet the specific needs of your business while maintaining a professional and organized appearance. This helps build stronger relationships with clients and improves overall operational efficiency.

Tracking Orders with PO Number Invoices

Efficiently managing and monitoring orders is essential for any business, especially when dealing with multiple transactions at once. A well-organized system that assigns a unique identifier to each purchase allows businesses to quickly locate and cross-check order details. This method of tracking ensures that nothing is overlooked and that both buyers and sellers can stay on the same page throughout the transaction process.

Benefits of Using a Unique Identifier for Orders

Enhanced Tracking – By linking each sale to a specific reference, businesses can easily trace the status of an order, from initial purchase to delivery and payment. This added clarity reduces the risk of missing or misplaced information.

Better Organization – A clear order reference helps organize records in a structured way, allowing for easy access and quick retrieval of any relevant details. Whether managing inventory or resolving customer queries, having everything neatly labeled can save valuable time.

Improving Communication and Accuracy

Efficient Dispute Resolution – If a problem arises, such as a discrepancy in delivery or payment, both parties can quickly reference the same identifier to address the issue. This simplifies communication and reduces delays, ensuring that issues are resolved promptly.

Transparency – Clients and suppliers can easily verify the status of a specific order, as all information is linked to a unique identifier. This transparency fosters trust and ensures that everyone involved is well-informed.

Ensuring Accuracy in Invoice Details

Accurate records are the backbone of effective financial management. When creating transaction documents, it’s essential to ensure that every detail is correct and properly aligned. Small errors in data entry can lead to larger issues down the line, such as delayed payments, customer dissatisfaction, or discrepancies in financial reporting. By prioritizing accuracy, businesses can avoid costly mistakes and maintain smooth operations.

Key Areas to Double-Check

- Client Information: Always verify the correct name, address, and contact details before finalizing the document.

- Product/Service Descriptions: Ensure that the descriptions are clear, detailed, and correspond to the actual products or services provided.

- Pricing: Double-check the unit price, quantity, and any applicable discounts or taxes to avoid calculation errors.

- Payment Terms: Confirm that payment deadlines, methods, and any late fees are correctly listed to avoid confusion later.

Strategies to Minimize Errors

- Automated Calculations: Use automated tools to calculate totals, taxes, and discounts to reduce the risk of human error.

- Cross-Verification: Always cross-check the details before sending out the document to ensure consistency and accuracy.

- Template Usage: By using pre-designed forms that are properly set up, you can ensure that all necessary fields are included and correctly formatted.

Implementing these strategies helps create reliable, error-free records that not only improve business efficiency but also strengthen client trust and ensure smooth financial transactions.

Common Mistakes When Using PO Numbers

Although using a unique reference code can significantly enhance the tracking and accuracy of financial transactions, there are several common pitfalls businesses should be aware of. These errors, often small, can lead to confusion, delays in processing, or even disputes between parties. By understanding and avoiding these mistakes, companies can ensure smoother operations and improve client relationships.

Typical Errors to Avoid

- Incorrect or Missing References: Failing to include the correct reference or leaving it blank can cause confusion and delays in matching orders with payments.

- Using Duplicate References: Using the same reference code for multiple transactions can lead to serious discrepancies and complicate financial tracking.

- Miscommunication on Reference Details: Sometimes, both parties may misunderstand the format or specifics of the reference, leading to mismatched documents.

How to Prevent These Issues

- Verify Each Reference: Always double-check the reference codes provided by clients to ensure they are accurate and up-to-date.

- Establish Clear Guidelines: Ensure that both the buyer and seller are on the same page about the reference format and its usage.

- Use a Centralized System: Implement an organized system for generating, tracking, and managing references to avoid duplication and confusion.

By being vigilant and proactive in preventing these common mistakes, businesses can ensure smoother transactions, improve efficiency, and maintain strong, transparent relationships with clients.

Best Practices for Invoice Numbering

Maintaining a clear, consistent system for tracking financial documents is essential for any business. A well-structured numbering system helps streamline operations, ensures accuracy in record-keeping, and makes it easier to manage multiple transactions. Following best practices in numbering ensures that each document is properly identified and easily accessible for both internal teams and clients.

Effective Numbering Strategies

- Sequential Order: Always use a simple, sequential approach to assigning identifiers, starting from 001 or another logical beginning. This makes it easy to track and ensures that no documents are overlooked or duplicated.

- Use Prefixes for Clarity: Adding a prefix such as “SA” for sales or “PUR” for purchases helps differentiate document types and adds an extra layer of organization.

- Include Date Information: Incorporating the year or month into the code (e.g., 2024-001) provides immediate context for when the transaction took place, making it easier to reference and categorize.

- Avoid Gaps: Never skip numbers, as this can lead to confusion or missed documents. Each identifier should follow a logical and uninterrupted sequence.

Automating Number Assignment

- Use Software Tools: Many accounting systems and invoicing platforms can automatically generate and assign identifiers, ensuring consistency and saving time.

- Prevent Human Error: Automated tools reduce the likelihood of mistakes caused by manual entry, such as skipping numbers or duplicating identifiers.

- Maintain Unique Codes: Ensure that each document has a completely unique identifier, even if you are working with multiple clients or projects. This eliminates confusion and ensures every record is traceable.

Adopting these best practices will help ensure that your business maintains a highly organized and error-free system for managing transactions, improving bo

How to Automate PO Number Invoices

Automating the process of generating billing documents linked to purchase order references can save valuable time and minimize human error. By setting up a system that automatically generates and assigns unique purchase order identifiers, businesses can streamline their transaction processes, ensuring greater consistency and efficiency. Automation also helps in maintaining accurate records and improving overall workflow management.

Steps to Automate the Process

- Choose the Right Software: Select an accounting or invoicing platform that allows for automated document creation and assignment of purchase order references.

- Integrate with Purchase Order System: Connect your invoicing system to the purchase order management software. This integration will allow the system to automatically retrieve PO references and apply them to relevant transactions.

- Set Up Custom Rules: Configure your system to automatically generate unique identifiers based on pre-set rules (e.g., including the date, client name, or project number) to ensure no duplication or errors.

- Automate Notifications: Set up automated reminders and notifications for both you and your clients, informing them of due payments and upcoming deadlines linked to the reference codes.

Benefits of Automation

- Time Savings: Automated systems handle the repetitive task of generating and tracking references, freeing up time for other important tasks.

- Reduced Risk of Errors: Automation eliminates the possibility of human errors such as duplicate codes, missed references, or incorrect details, ensuring consistency across all records.

- Improved Efficiency: With all purchase order references automatically assigned, you can quickly generate accurate documents, speeding up your entire billing cycle.

Implementing an automated system for handling references and related billing documents improves the accuracy and speed of your processes while reducing manual effort, making it an essential tool for growing businesses.

Integrating PO Numbers with Accounting Software

Integrating unique purchase order references into your accounting system allows for smoother financial management and better tracking of transactions. By linking these references directly with your accounting software, businesses can streamline data entry, reduce the risk of errors, and enhance overall efficiency. This integration ensures that all relevant details are automatically synchronized across systems, making it easier to manage payments, track expenses, and generate accurate reports.

Steps to Integrate PO References into Accounting Software

- Select Compatible Software: Choose accounting software that supports integration with other business tools, such as purchase order management systems.

- Set Up Integration: Use APIs or built-in integrations to link your purchase order system to your accounting platform. This enables automatic syncing of

Legal Requirements for PO Number Invoices

When creating transaction documents that include purchase order references, businesses must ensure compliance with legal standards. These requirements vary depending on the jurisdiction and industry but generally focus on accuracy, transparency, and proper documentation. Adhering to legal guidelines is essential to avoid potential fines, disputes, or delays in processing payments. A well-structured document that includes the correct references can help businesses remain compliant and avoid complications.

Essential Legal Elements to Include

- Unique Reference Codes: Many countries require that each document related to a transaction includes a unique reference identifier. This helps ensure traceability and accountability.

- Accurate Tax Information: Ensure that the applicable tax rates and amounts are clearly stated, as they are often subject to legal scrutiny.

- Business Information: Include the full legal name of your company, business registration number, and contact details. This is often required for transparency and traceability.

- Clear Payment Terms: Outline the terms of payment, including due dates, any penalties for late payments, and accepted payment methods. This helps establish a legal framework for the transaction.

Jurisdiction-Specific Compliance

- Local Tax Laws: Different regions may have specific tax regulations that dictate what needs to be included, such as VAT or sales tax identification numbers.

- International Transactions: If working with international clients, ensure that all required documentation complies with the legal standards of both countries involved in the transaction.

- Industry Regulations: Certain industries, like healthcare or construction, may have additional requirements, such as certifications or compliance statements, which should be included alongside references.

Understanding the legal landscape surrounding purchase order references helps businesses stay compliant, avoid costly errors, and maintain a strong reputation with clients and regulatory authorities.

How to Manage PO Number Discrepancies

Discrepancies involving purchase order references can cause significant delays and complications in business transactions. When the reference code on a document does not match the one provided by the buyer or there is missing information, it can create confusion, impact payment processing, and lead to disputes. Effectively managing these discrepancies is crucial for maintaining smooth operations and strong client relationships.

Steps to Resolve Discrepancies

- Identify the Issue: Carefully examine the document and compare the provided reference to the one recorded in your system. Verify if there are typographical errors, mismatches, or missing data.

- Contact the Buyer: Reach out to the client or supplier who issued the purchase order to confirm the correct reference. This is especially important if the discrepancy is due to an internal error or misunderstanding.

- Cross-check Internal Records: Double-check your own records and systems to ensure that the correct reference is assigned and that no mistakes were made during data entry.

- Update Systems: Once the discrepancy is resolved, update your internal records and ensure that all systems reflect the correct information moving forward.

Preventing Future Discrepancies

- Standardize Processes: Establish clear protocols for entering and verifying references. Make sure both your team and clients follow the same procedures for assigning and using these codes.

- Implement Automated Systems: Use software that automatically checks for discrepancies, matches references, and alerts you to potential errors before they become issues.

- Provide Training: Educate your team and clients on the importance of accuracy when dealing with reference codes. Providing clear instructions and guidelines can reduce human error.

Managing discrepancies efficiently helps prevent delays, maintain strong relationships with clients, and ensures smooth financial operations. By taking proactive steps and using technology, you can streamline your processes and minimize future issues.

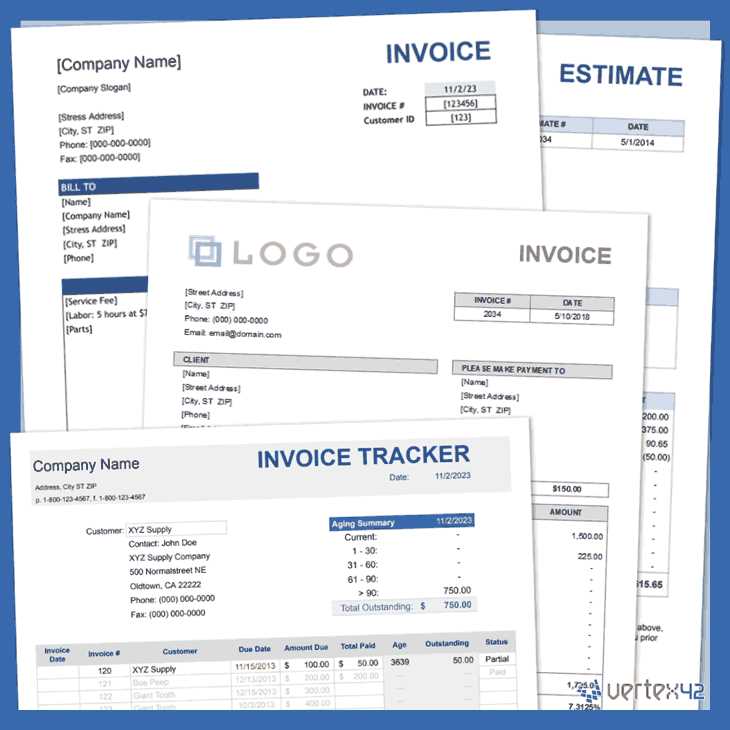

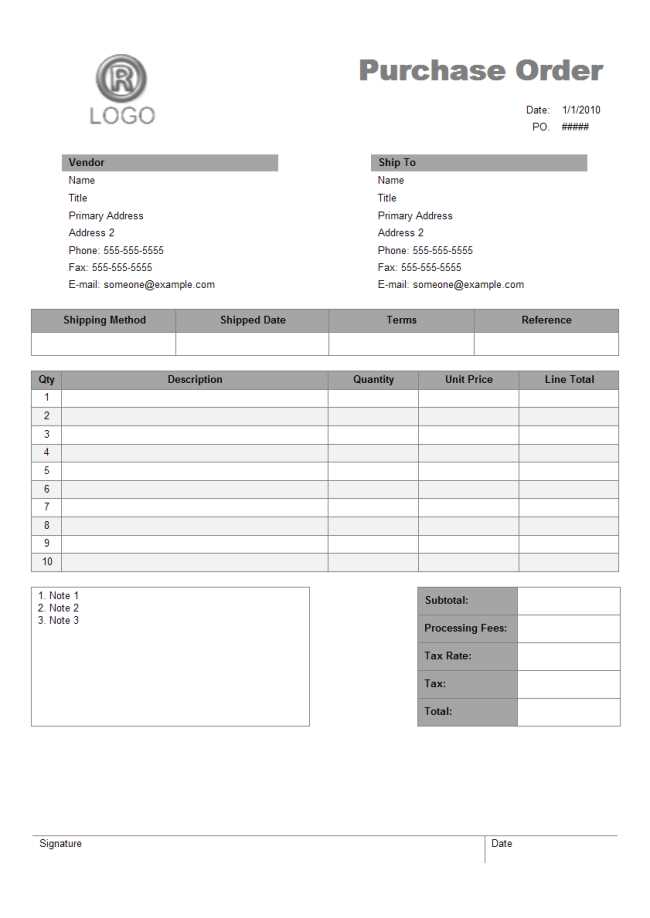

Free PO Number Invoice Templates Available

For businesses looking to streamline their transaction records, a variety of free tools are available online to create documents linked to purchase order references. These resources can be easily customized to fit specific needs and ensure that every transaction is well-documented. Accessing free templates provides an efficient way for businesses, especially small and medium enterprises, to maintain proper financial records without the need for expensive software solutions.

Where to Find Free Templates

- Online Platforms: Websites offering free tools and templates that allow for easy customization to meet specific business requirements.

- Spreadsheet Software: Tools like Google Sheets or Microsoft Excel often provide pre-designed formats that can be modified for your business needs.

- Accounting Software: Many free accounting systems come with built-in features that allow you to generate documents with purchase order references.

Key Features of Free Templates

Feature Description Customization Options These tools allow you to adjust fields, add or remove details, and personalize the layout based on your business preferences. Ease of Use Free templates are designed to be user-friendly, even for those with minimal technical skills, ensuring quick and efficient document creation. Variety of Formats Templates are available in different formats (Excel, PDF, Word, etc.), providing flexibility for your preferred method of usage.