Easy to Use Invoice UK Template for Quick Billing

Managing finances is a critical part of any business, and an organized approach to billing ensures smooth operations. For companies operating in the UK, professional documentation for payments is essential to build credibility and maintain accurate financial records. Using ready-made documents can simplify the process, ensuring that each bill meets local standards and includes all necessary details.

Ready-to-use formats allow businesses to quickly prepare documents that reflect their brand while covering essential transaction details. They save time by providing a structure that’s easy to customize and use, making them an efficient option for both large organizations and smaller enterprises. In addition to keeping things organized, these tools help avoid common billing errors and reduce the administrative burden on staff.

Choosing the right format for financial docume

Comprehensive Guide to UK Invoice Templates

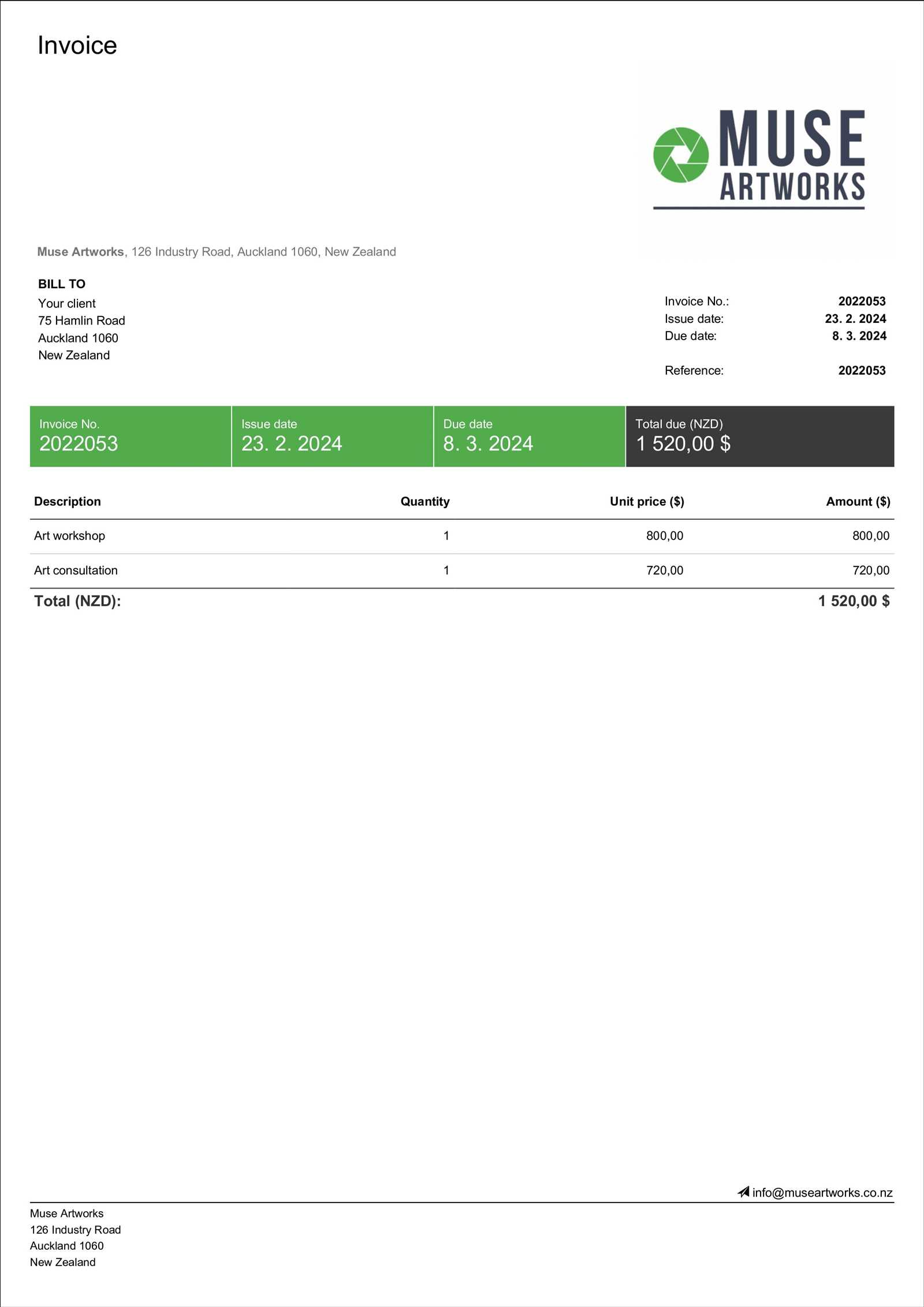

Creating professional and accurate financial documents is essential for maintaining good relationships with clients and ensuring timely payments. In the UK, using well-structured formats for billing can help companies streamline their processes and meet local standards. A standardized approach to these documents supports clarity and consistency, making it easier for both businesses and clients to manage transactions efficiently.

The benefits of using pre-designed formats go beyond simplicity. These layouts include essential sections that cover all necessary details, from payment terms to contact information. Customizable templates allow companies to adapt each document to fit their brand identity while ensuring that all required information is clear and easy to read.

In addition, these tools offer flexibility, whether billing for one-time services or handling recurring charges. By choosing the right design, businesses can enhance

Why Choose a UK Invoice Template

For businesses of all sizes, a streamlined approach to billing can save time and reduce the likelihood of errors. Selecting a format designed specifically for UK standards ensures that each document meets legal requirements and includes essential information, enhancing professionalism and clarity in business transactions. Using a structured billing document also simplifies the process for clients, making payment expectations clear and encouraging prompt settlement.

Key Advantages of Using a UK-Specific Format

Tailored for UK-based businesses, these standardized formats offer numerous benefits. They are designed to capture necessary details specific to local business practices and tax regulations, ensuring accuracy and compliance. Additionally, a ready-made layout provides flexibility to add personalized branding and adjust details for different types of transactions.

| Benefit | Description |

|---|

| Benefit | Description |

|---|---|

| Compliance | Ensures that each document meets UK legal and tax standards, reducing compliance risks. |

| Professionalism | Creates a polished look that enhances trust and demonstrates reliability to clients. |

| Efficiency | Streamlines the billing process by providing a clear format that saves time on document preparation. |

| Flexibility | Allows businesses to customize fields and layout to suit various billing needs and company branding. |

Improving Accuracy and Client Relations

By using a format that is both clear and compliant, businesses can prevent common billing errors and avoid misunderstandings with clients. This approach not only aids in financial management but also strengthens client relationships by promoting transparency and professionalism in every transaction.

How to Customize Your Invoice Template

Creating a personalized and professional billing document can enhance your brand and streamline the payment process for clients. Customization allows you to include essential information tailored to your business, ensuring that every transaction is both clear and efficient. A well-designed layout not only simplifies record-keeping but also leaves a lasting impression on clients, reinforcing your business’s identity.

Adding Your Brand Elements

Incorporating your logo, color scheme, and font choices is a key step in making a document uniquely yours. Branding elements help clients instantly recognize your business, adding a layer of professionalism. Consider using a color

Free Invoice Template vs Paid Versions

When choosing a billing format, businesses have the option between free and paid versions. Each has distinct advantages, depending on the specific needs and budget of the company. Free options can be ideal for startups or freelancers looking to minimize costs, while paid versions often offer additional features that can save time and add a layer of customization that enhances professionalism.

Free formats are often straightforward, offering basic layouts that cover essential fields like client information, itemized services, and payment terms. These options are generally accessible, making them easy to set up without any additional costs. However, while free tools may cover basic needs, they

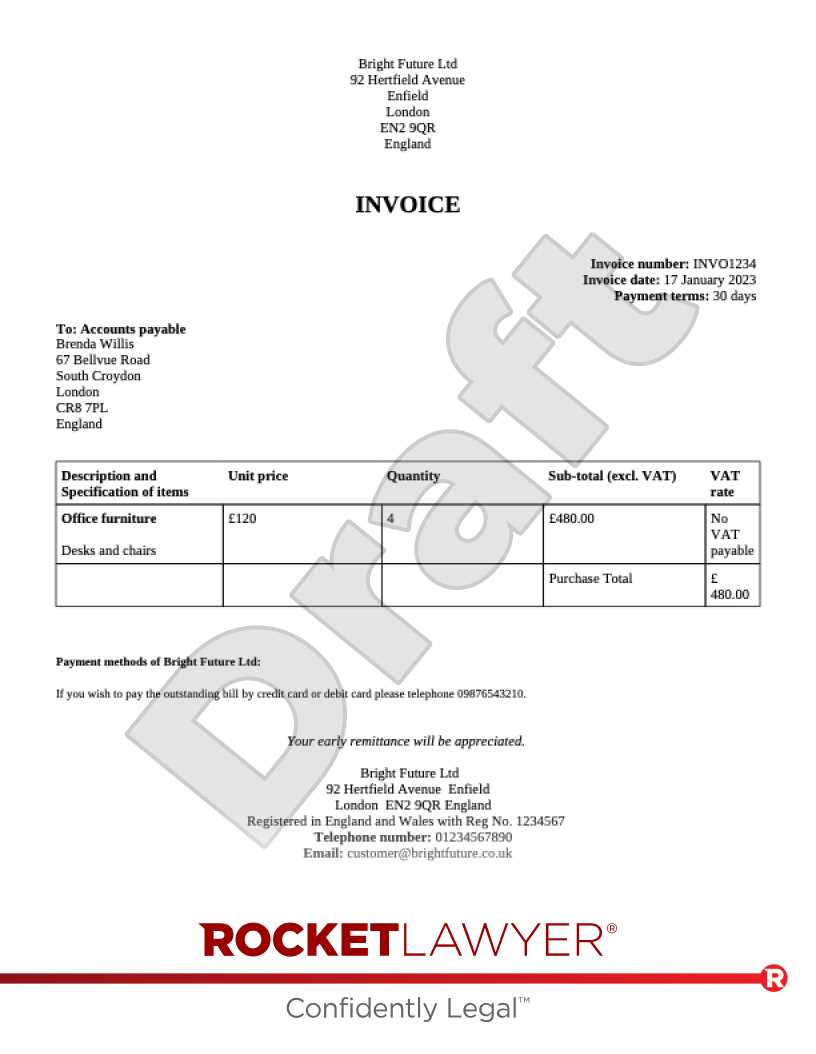

Understanding UK Invoice Requirements

To ensure smooth business transactions in the UK, it’s essential for companies to adhere to certain standards when creating billing documents. Meeting these guidelines not only demonstrates professionalism but also helps to avoid potential legal and tax issues. Understanding what details are required in these documents can simplify the billing process and ensure compliance with UK regulations.

Essential Elements to Include

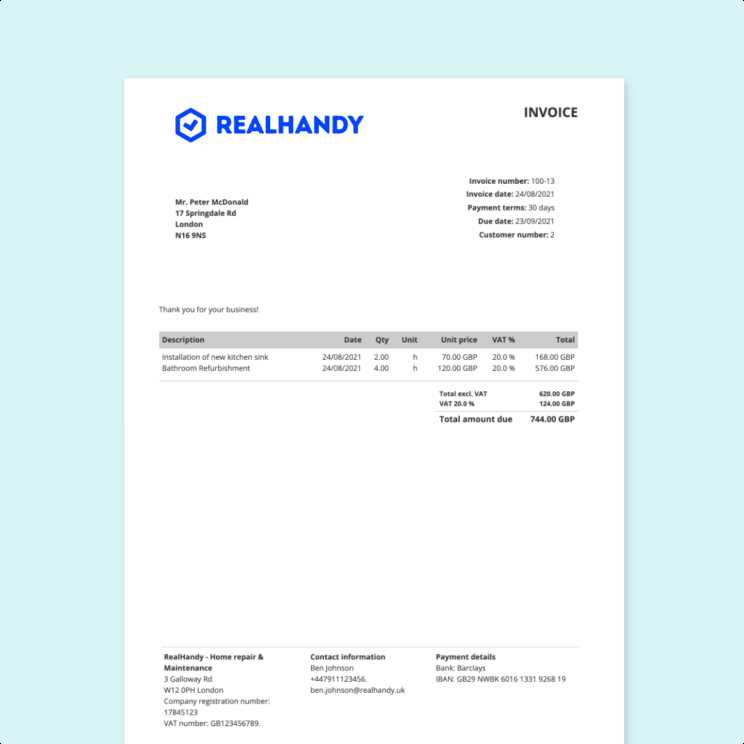

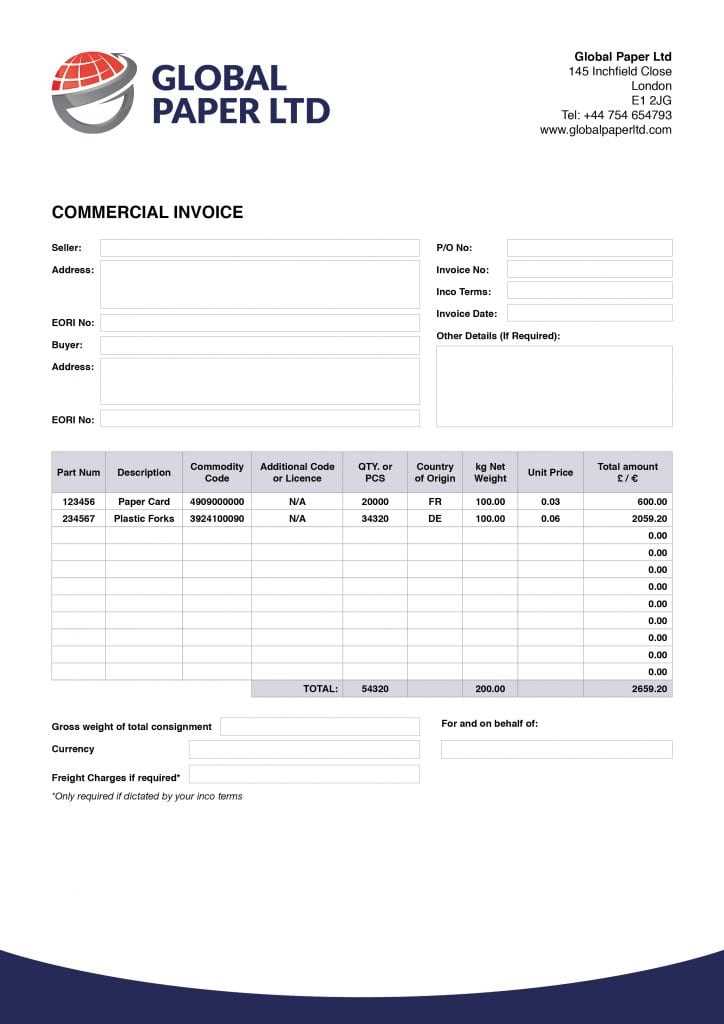

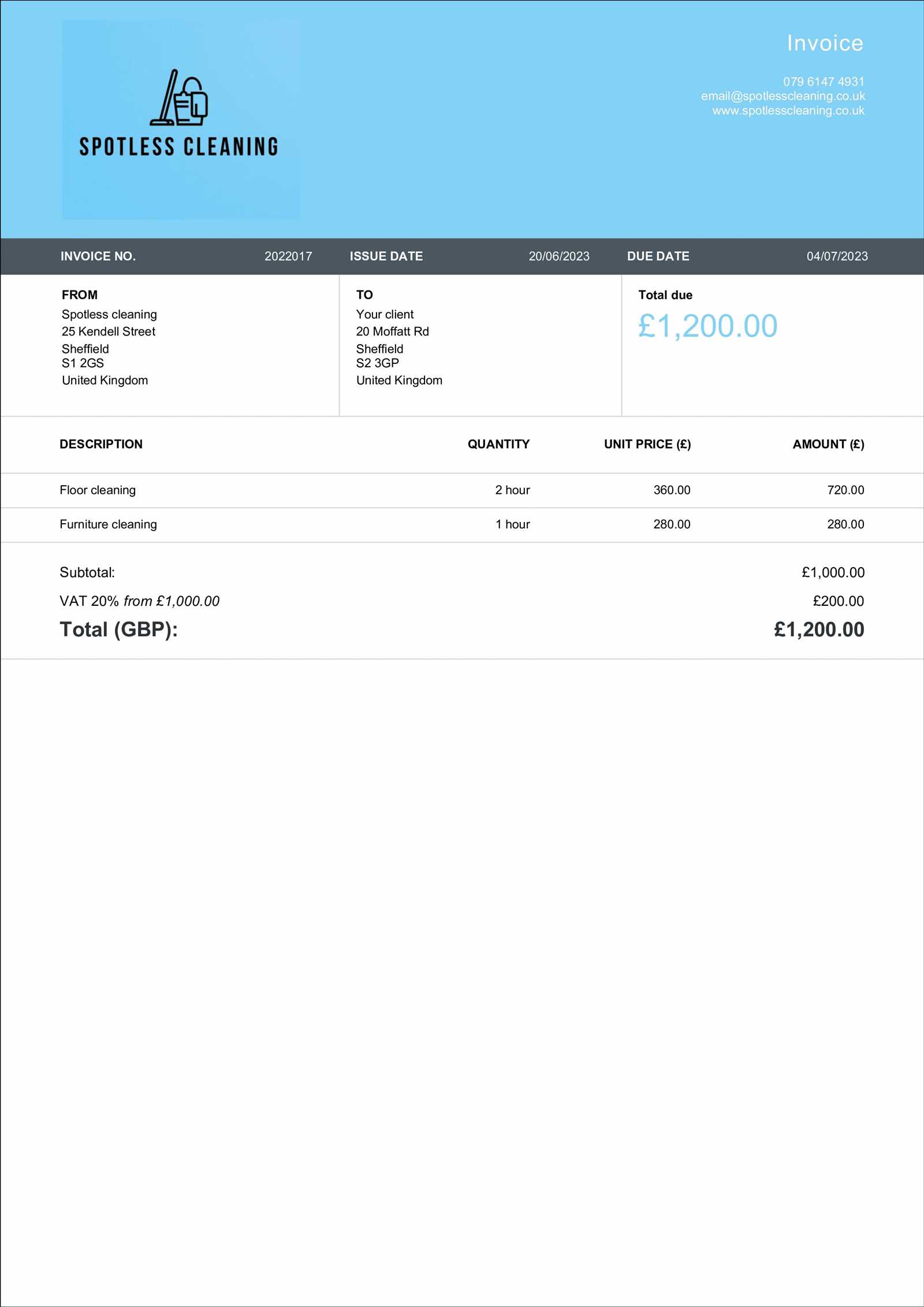

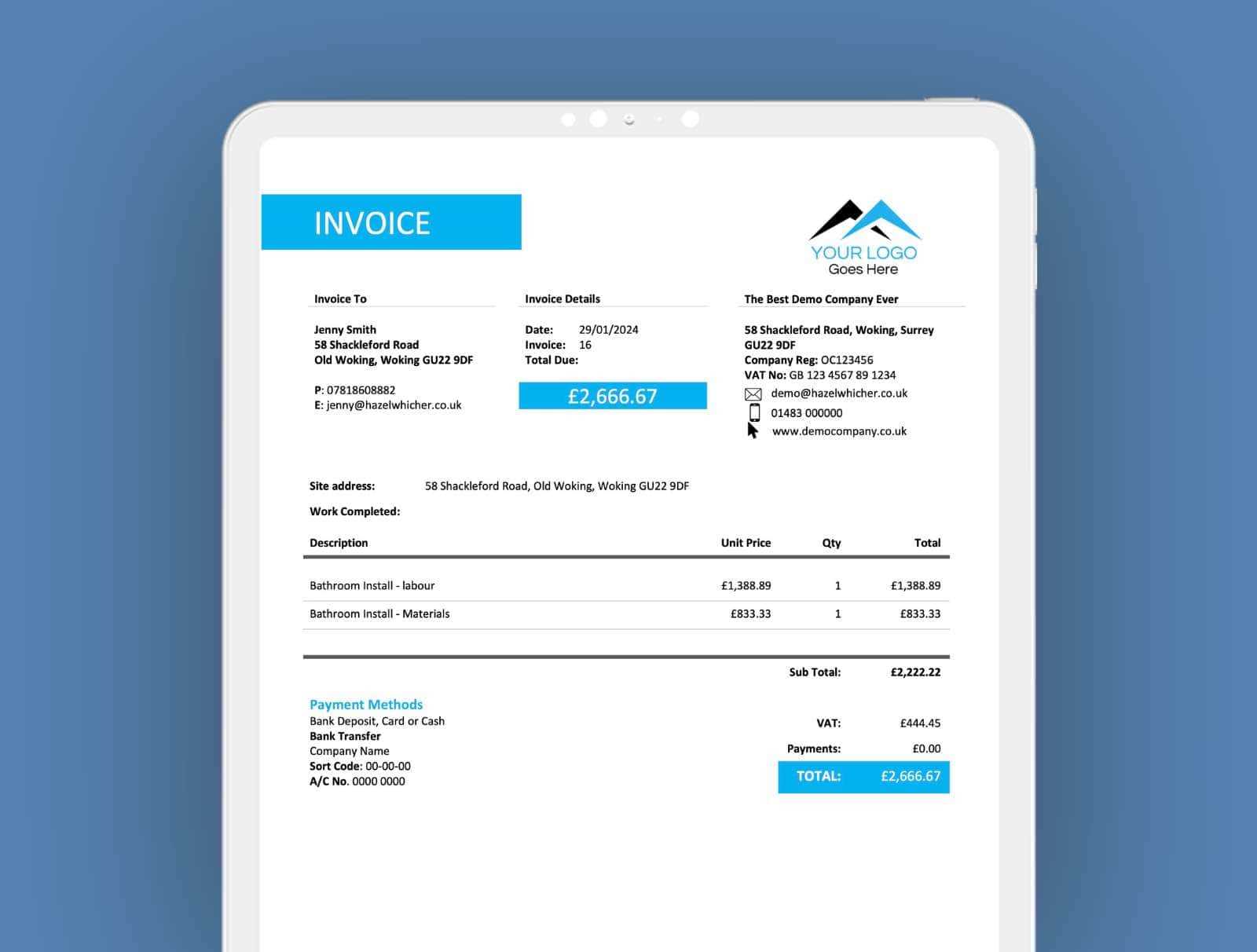

- Company Information: Your business name, address, and registration number (if applicable) should be clearly displayed at the top of the document.

- Company Information: Your business name, address, and registration number (if applicable) should be clearly displayed at the top of the document.

- Client Details: Include the name and address of the individual or company being billed. This ensures clear communication and accurate record-keeping.

- Date of Issue: The date on which the document is created is essential for tracking and timely payments.

- Description of Goods or Services: List each item or service provided, along with quantities and individual prices to ensure transparency.

- Total Amount Due: Clearly display the full amount payable, including any applicable taxes or discounts.

Understanding UK Invoice Requirements

To ensure smooth business transactions in the UK, it’s essential for companies to adhere to certain standards when creating billing documents. Meeting these guidelines not only demonstrates professionalism but also helps to avoid potential legal and tax issues. Understanding what details are required in these documents can simplify the billing process and ensure compliance with UK regulations.

Essential Elements to Include

Tax Compliance and Additional Details

- VAT Information: If your business is VAT-registered, include your VAT registration number and a breakdown of VAT charges. Non-registered businesses should specify that VAT does not apply.

- Payment Terms: State the payment due date, accepted payment methods, and any late fees that might apply. This ensures both parties understand the payment expectations.

- Unique Document Number: Assigning a unique number to each document helps with tracking and organizing financial records.

By incorporating these elements, businesses can create well-structured documents that meet UK standards, making the payment process smoother and minimizing any potential disputes or confusion.

Steps to Create an Invoice from Scratch

Creating a billing document from the ground up allows you to customize it according to your business needs. By following a clear process, you can ensure that all necessary details are included, and the document is professional and easy for your clients to understand. The steps below outline how to create a document that meets all necessary requirements and serves its purpose effectively.

Gather Essential Information

Before you begin designing the document, collect all the necessary information you’ll need to include. This will ensure that the document is complete and avoids any confusion later on. Make sure to have the following ready:

- Your business name, address, and contact details

- Client’s name and contact information

- A list of products or services provided, with quantities and prices

- Applicable taxes or fees

- Payment terms and due date

Design the Layout and Format

Once you have all the necessary information, the next step is to design the layout. The structure should be clear, with easy-to-read sections that include all the required elements. Consider the following:

| Section | Details |

|---|---|

| Header | Include your business name, logo, and contact information at the top. |

| Client Details | List the client’s name and address underneath the header. |

| Services or Products | Describe each item or service provided, with quantities and unit prices. |

| Total Amount | Clearly display the total amount due, including any taxes or discounts. |

| Payment Terms | State the payment due date, accepted methods, and any late payment fees. |

This structure helps ensure that all important details are easily accessible for both you and your client, improving the chances of prompt payment.

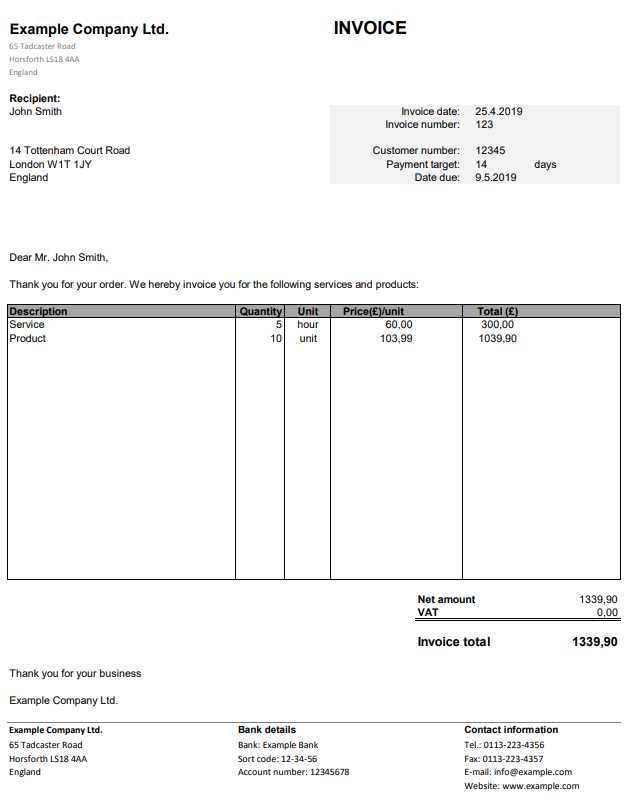

How to Format Your UK Invoice

When creating a billing document, proper formatting ensures that all the necessary information is clearly displayed and easy to understand. This not only helps your client process the payment efficiently but also ensures compliance with UK regulations. A well-structured document gives a professional appearance and can streamline communication between you and your clients.

Start by organizing your document with a clean layout, ensuring that key details such as the date, amount, and services or products are easy to find. Clearly differentiate sections, using bold headings or borders if necessary, so your client can quickly identify relevant information. Additionally, using a consistent font and alignment throughout the document ensures readability.

Here are some formatting tips to follow:

- Header: Include your business name, logo, and contact information at the top of the document.

- Client Details: Make sure the client’s information is positioned clearly, ideally under the header, so it’s easy to reference.

- Services/Products: Use a table to list each service or product provided, with columns for quantity, unit price, and total.

- Total Amount: The total cost should be clearly stated, including any taxes or discounts applied.

- Payment Terms: Indicate the payment due date, methods accepted, and any late fees that may apply.

By following a consistent and organized format, your document will be both professional and effective in conveying the necessary information to your clients.

Managing Multiple Invoices Effectively

Handling several billing documents at once can quickly become overwhelming, especially when managing a large client base. To maintain organization and ensure timely payments, it’s essential to implement a streamlined system. This will allow you to track payments, send reminders, and manage overdue accounts without unnecessary complications.

Start by creating a consistent system for categorizing and organizing all your documents. You can use software or digital tools to track the status of each payment. Additionally, setting up reminders for upcoming due dates will help you stay on top of your obligations and reduce the risk of missing payments.

One effective method of managing multiple documents is to create a table or log to track the details of each one. Here’s an example of how to structure it:

| Client | Amount | Due Date | Status | Payment Received |

|---|---|---|---|---|

| Client A | £500 | 01/12/2024 | Paid | £500 |

| Client B | £350 | 05/12/2024 | Pending | £0 |

| Client C | £700 | 10/12/2024 | Overdue | £0 |

By maintaining a detailed log, you can easily keep track of each document’s status, follow up on overdue payments, and ensure all records are accurate and up to date.

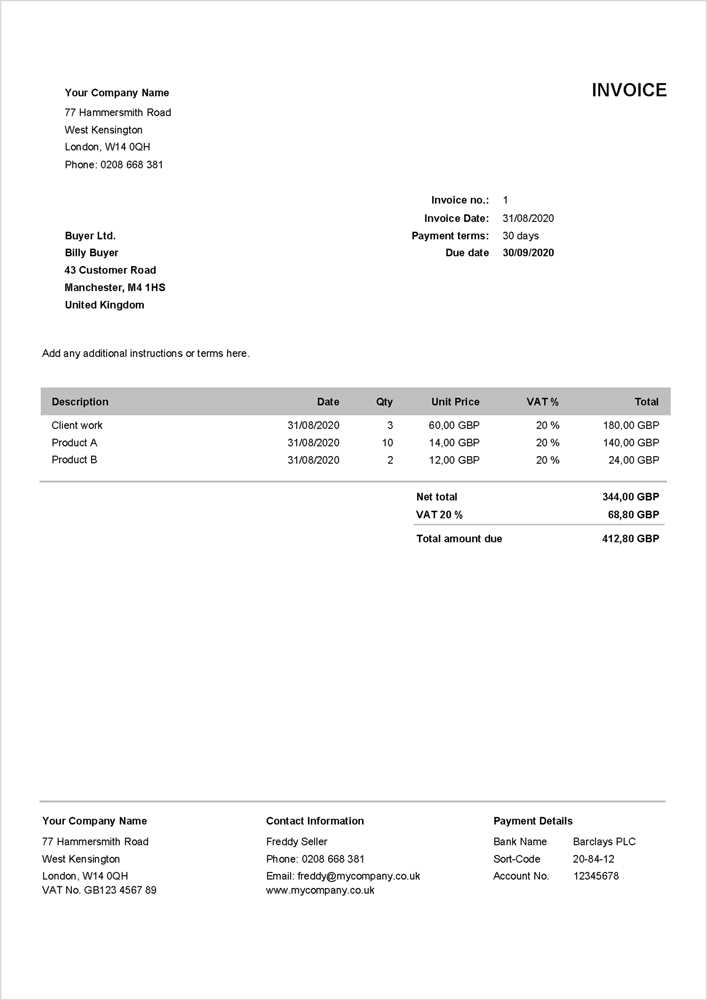

Legal Considerations for UK Invoices

When creating billing documents, it’s essential to be aware of the legal requirements to ensure compliance with UK laws. These requirements help protect both the business and the client, providing clarity and reducing the risk of disputes. Understanding the key elements of a legal document can make a significant difference in maintaining smooth business operations and ensuring timely payments.

Key Information to Include

To comply with UK regulations, certain details must be included in every billing document. These include:

- Business Information: Your company name, address, and contact details must be clearly stated.

- Client Information: Ensure the client’s name and address are included.

- Transaction Details: A clear description of the goods or services provided, along with the respective charges.

- VAT Information: If registered for VAT, your unique VAT number should be displayed on the document.

- Payment Terms: Include due dates, late payment fees, and accepted payment methods.

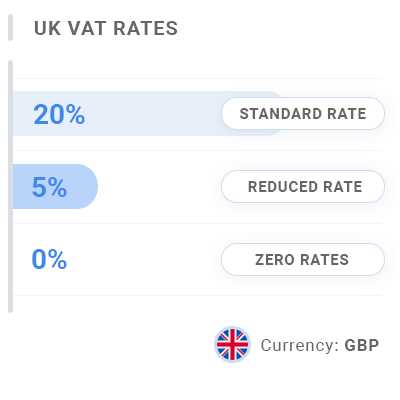

Compliance with Tax Regulations

In the UK, businesses must follow specific tax laws, including VAT rules if applicable. If you are VAT registered, it’s important to ensure your documents meet HMRC standards. This includes displaying the correct VAT rate for the services or goods provided and keeping records for the required number of years.

By following these legal guidelines, businesses can avoid costly mistakes, ensure proper documentation, and protect themselves in case of audits or disputes.

How to Add Tax Information Correctly

Accurately adding tax details to your billing document is crucial for maintaining compliance with local tax regulations. This ensures that both you and your clients are aware of the tax obligations, preventing any misunderstandings or legal issues. Properly documenting tax rates, VAT numbers, and other required tax-related information guarantees smooth transactions and helps keep your business transparent.

Key Elements of Tax Information

When incorporating tax details, there are several key elements to include:

- Tax Identification Number (TIN): If your business is VAT registered, you must display your VAT number clearly.

- Tax Rate: Indicate the percentage of tax applied to the total amount, such as 20% VAT.

- Tax Amount: Specify the amount of tax being charged, separate from the total cost of goods or services.

- Tax Inclusive or Exclusive: State whether the listed price includes tax or if it should be added separately.

Best Practices for Correct Tax Documentation

Follow these guidelines to ensure that tax information is properly documented:

- Always double-check tax rates and ensure they are up to date with current regulations.

- Provide a breakdown of the tax charge for clarity, showing how the final amount is calculated.

- Keep accurate records of transactions that include tax, as this is vital for tax reporting and audits.

By following these steps, you can add tax information clearly and accurately, avoiding potential issues with tax authorities and maintaining transparency with your clients.

Using Templates for Recurring Invoices

For businesses that offer ongoing services or products, using pre-structured documents for regular billing is a time-saving and efficient solution. This method ensures consistency in communication with clients and reduces the chances of errors while maintaining professionalism. The ability to quickly adapt these documents for each billing cycle can significantly streamline administrative tasks.

Advantages of Using Pre-Structured Documents

- Consistency: A standardized format helps to maintain uniformity in every transaction, making it easier for clients to understand and process payments.

- Time Efficiency: Instead of creating a new document each time, you can reuse an existing layout and simply update the necessary details.

- Reduced Errors: Using the same format for each cycle minimizes the chances of missing important details like pricing, dates, or service descriptions.

- Automation: Some systems allow you to automatically populate recurring information, saving even more time and effort.

How to Effectively Use Pre-Structured Documents

- Update Key Details: Each time a document is created, ensure that the dates, amounts, and other dynamic information are updated accordingly.

- Keep Information Relevant: Avoid overloading the document with irrelevant data. Focus only on the key points that are needed for the specific billing period.

- Use Software Tools: Utilize software that can help automate repetitive tasks and store data securely for easy access when creating each new document.

By using structured layouts for recurring transactions, businesses can save time, improve accuracy, and foster better client relationships with less administrative effort.

Invoice Payment Terms and Conditions

Clearly defined payment terms and conditions are crucial for ensuring smooth financial transactions between businesses and their clients. These terms set expectations regarding when and how payments should be made, including the time frame for settlement, acceptable payment methods, and potential penalties for late payments. Having well-structured terms helps avoid misunderstandings and protects both parties legally.

Common Payment Terms to Include

| Term | Description |

|---|---|

| Due Date | The specific date by which payment must be received. It could be expressed in days (e.g., “Due in 30 days”) or a fixed date. |

| Late Fees | Charges applied if payment is not made by the due date. Typically, these are a percentage of the total due or a fixed amount. |

| Payment Methods | Accepted forms of payment, such as bank transfer, credit card, or checks. This helps ensure both parties are clear on how payment should be processed. |

| Discounts for Early Payment | Offering a discount if the payment is made before the due date, encouraging clients to settle their bills sooner. |

| Interest on Overdue Payments | If payments are delayed beyond a certain period, interest may be charged on the outstanding amount, which is typically specified as a percentage per month or year. |

Incorporating clear and concise payment conditions in each billing document ensures that both businesses and clients have a shared understanding of their financial obligations. This can reduce disputes, improve cash flow, and maintain a healthy professional relationship.

Digital vs Paper Invoices: Pros and Cons

When choosing how to send financial requests for payment, businesses often weigh the advantages and drawbacks of digital versus paper methods. Each option offers distinct benefits depending on the needs of the business, the client, and the nature of the transaction. Understanding the pros and cons of each approach can help in making an informed decision that aligns with operational efficiency, environmental concerns, and cost-effectiveness.

Advantages of Digital Invoices

- Speed and Efficiency: Digital requests for payment can be created, sent, and received almost instantaneously, ensuring a faster transaction process.

- Lower Costs: There are no printing, paper, or postage fees associated with digital documents, making this method more affordable over time.

- Environmentally Friendly: Using digital methods reduces paper waste and supports sustainability efforts by lowering resource consumption.

- Easy Storage and Access: Digital records are simple to store, organize, and retrieve, making it easier to manage financial documents and comply with regulations.

Disadvantages of Digital Invoices

- Technical Issues: Digital documents rely on technology, which can pose challenges such as software incompatibility or issues with internet connectivity.

- Security Concerns: There is a risk of digital documents being lost or intercepted if proper encryption or secure systems are not in place.

- Client Preferences: Some clients may prefer physical documents for various reasons, such as lack of technology or internal policies requiring paper records.

Advantages of Paper Invoices

- Universal Accessibility: Paper documents can be received, viewed, and stored by anyone, regardless of their access to digital tools or systems.

- Formal Perception: Some clients may perceive physical documents as more formal or official, which may be important in certain business sectors.

- No Digital Dependency: Paper requests are not dependent on internet access or electronic devices, ensuring they are always available for review.

Disadvantages of Paper Invoices

- Slower Processing Time: The delivery of paper documents takes longer, leading to slower payments and extended cash flow cycles.

- Higher Costs: Printing, paper, and mailing expenses can add up, especially for businesses with a high volume of transactions.

- Storage and Organization Challenges: Physical documents require more space and can be harder to organize and track compared to their digital counterparts.

Ultimately, the choice between digital and paper methods depends on the business’s priorities and the preferences of the clientele. By considering the unique benefits and limitations of each approach, businesses can choose the method that best suits their operational needs and the expectations of their clients.

Best Tools for Invoice Creation

Creating financial documents efficiently and professionally requires the right set of tools. The best options on the market provide customizable features, ease of use, and integration with other systems to help businesses streamline their operations. By choosing the right tool, companies can save time, reduce errors, and ensure compliance with necessary requirements.

Top Features to Look For

- User-Friendly Interface: Choose software that is easy to navigate and doesn’t require advanced technical skills to operate.

- Customizability: Look for tools that allow you to personalize layouts, add your logo, and choose different styles to match your brand identity.

- Automated Features: Tools with automation can save time by generating recurring requests, sending reminders, and managing payments automatically.

- Integration with Accounting Systems: Opt for platforms that integrate seamlessly with your financial tracking and management systems to reduce manual entry and ensure accuracy.

Popular Tools for Financial Document Creation

- QuickBooks: This well-known tool offers comprehensive features for small businesses, including easy generation of payment requests and detailed financial reports.

- FreshBooks: A cloud-based solution that helps create professional documents, manage client records, and track payments with minimal effort.

- Zoho Invoice: Known for its user-friendly interface, Zoho offers a wide range of customization options and integrates well with other Zoho business applications.

- Wave: A free tool that allows small businesses to create and send financial documents easily while also providing bookkeeping features.

By utilizing these tools, businesses can significantly improve the efficiency of their financial document creation process, allowing them to focus on core operations and improve cash flow management.

Why Accurate Invoicing Matters for Your Business

Ensuring that your financial documents are precise and clear is crucial for the smooth running of any business. The accuracy of these documents not only reflects professionalism but also plays a significant role in cash flow management, customer satisfaction, and overall financial health. A well-prepared financial document can prevent misunderstandings, avoid delays, and maintain trust between your business and its clients.

Improved Cash Flow: Properly detailed financial requests help ensure timely payments, reducing the chances of late payments and improving cash flow. When all the necessary information is included, such as due dates and payment methods, clients are more likely to pay promptly.

Building Client Trust: Clients expect transparency and accuracy in financial matters. When you provide clear and error-free documents, it builds confidence in your professionalism and reliability, which can foster long-term business relationships.

Avoiding Legal Issues: Clear and accurate financial records can help protect your business in the event of disputes. If any legal matters arise, having properly documented transactions ensures that you can resolve issues quickly and efficiently, keeping your business secure.

Streamlined Accounting: The accuracy of your financial documentation plays a critical role in simplifying your bookkeeping and accounting processes. Well-organized records make it easier to track revenue, expenses, and taxes, ultimately reducing the time and cost associated with financial management.

In summary, investing time and effort into ensuring the precision of your financial documents is not just about getting paid on time–it also helps to maintain good relationships with clients, avoid potential legal troubles, and streamline your internal processes for better business performance.