Essential Invoice Terms and Conditions Template for Your Business

When running a business, it’s essential to have a set of clear rules that define the relationship between you and your clients. These guidelines not only ensure smooth transactions but also protect both parties from potential misunderstandings. Whether you’re a freelancer or managing a company, having a structured approach to payments is crucial for maintaining financial stability.

Having specific rules about payment deadlines, fees, and procedures can prevent delays and disputes, making your processes more efficient. By outlining expectations upfront, you create a transparent environment where both you and your clients understand what is required for a successful exchange. This approach fosters trust and reduces the chances of conflicts arising from unclear agreements.

In this article, we will explore how to craft comprehensive agreements that cover all necessary aspects of the payment process. From setting deadlines to handling late fees, we’ll guide you through creating documents that safeguard your business interests while ensuring a professional relationship with your customers.

Understanding Invoice Terms and Conditions

Clear agreements between a business and its clients are crucial for ensuring smooth financial interactions. These agreements help set expectations for both parties, outlining how payments should be made, when they are due, and the consequences of non-compliance. By establishing precise guidelines, businesses can prevent misunderstandings and ensure timely compensation for their products or services.

Why Clear Guidelines Are Important

Without well-defined rules, disputes are more likely to arise. Ambiguity in the payment process can lead to delayed settlements or even legal issues. By implementing solid principles regarding deadlines, fees, and responsibilities, you reduce the risk of confusion and provide your clients with a clear roadmap. This not only strengthens the business-client relationship but also ensures that your revenue stream remains consistent.

Key Aspects to Include in Payment Agreements

Some of the most important elements to cover include the agreed-upon payment schedule, interest on overdue amounts, and any refund or cancellation policies. Additionally, including dispute resolution procedures can help both parties navigate any potential conflicts in a professional manner. Clear communication in these areas builds trust and promotes a healthy business environment.

Why Invoice Terms Matter for Businesses

Establishing clear guidelines for payments is vital for any business, as it provides both structure and security for financial transactions. When the rules of engagement are clearly defined, businesses can reduce the risk of late payments, disputes, and cash flow problems. Having a solid framework in place allows for smoother operations and creates a professional image for the business, encouraging client trust and satisfaction.

Impact on Cash Flow

One of the most significant advantages of having well-defined payment rules is the positive effect it can have on cash flow. By clearly specifying deadlines and penalties for late payments, businesses can ensure a steady stream of income. This reduces financial uncertainty and helps companies plan for upcoming expenses.

Building Client Relationships

Transparent financial agreements also contribute to stronger client relationships. Clients appreciate knowing exactly what to expect in terms of payment schedules, fees, and expectations. This leads to fewer misunderstandings and fosters a sense of professionalism and reliability.

| Benefit | Description |

|---|---|

| Improved Cash Flow | Clear payment schedules and penalties ensure steady revenue, allowing for better financial planning. |

| Reduced Disputes | Defining payment procedures minimizes the likelihood of misunderstandings and disagreements. |

| Professional Image | Well-drafted agreements demonstrate that the business is organized and trustworthy, fostering confidence in clients. |

Key Elements of Invoice Terms and Conditions

To ensure smooth transactions and avoid potential misunderstandings, it’s essential to include certain elements in any financial agreement. These components set clear expectations between the business and the client, providing a framework for how payments will be handled, including deadlines, penalties, and other relevant guidelines. Well-structured agreements reduce the risk of disputes and foster positive, professional relationships.

Essential Components to Include

- Payment Deadlines: Clearly specify the due date for payments to avoid delays.

- Late Fees: Include any penalties for overdue payments to encourage timely settlements.

- Accepted Payment Methods: List the methods of payment accepted, such as credit cards, bank transfers, or online platforms.

- Refund Policy: Define the conditions under which refunds will be issued, if applicable.

- Dispute Resolution: Establish how any disputes will be handled, including mediation or legal action if necessary.

Additional Considerations

- Tax Information: Include applicable tax rates or requirements to ensure transparency in the final amount due.

- Service or Product Description: Clearly outline the goods or services provided to avoid confusion over what is being paid for.

- Currency: Indicate the currency in which the payment is to be made, especially for international transactions.

- Termination Clause: Define the conditions under which the agreement can be terminated by either party.

How to Create a Clear Payment Policy

Establishing a transparent and straightforward payment policy is crucial for ensuring smooth financial transactions between a business and its clients. A well-defined policy helps manage expectations, reduce confusion, and prevent disputes over payment schedules, fees, and other important details. By setting clear guidelines from the outset, businesses can foster trust and maintain a professional relationship with their customers.

To create an effective policy, it’s important to address all key aspects of the payment process, including deadlines, acceptable payment methods, and any consequences for late payments. Each component should be easy to understand and accessible to the client. Ambiguity can lead to delays and unnecessary conflicts, so clarity is essential in every part of the policy.

Key steps to follow when crafting your policy:

- Define the payment due date: Clearly state when the payment is expected, whether it’s upon receipt, within 30 days, or after the delivery of services or products.

- Specify late payment penalties: Mention any fees or interest that will be charged if the payment is not made on time.

- List accepted payment methods: Outline the available options, such as bank transfers, credit cards, or online payment systems, to ensure convenience for the client.

- Set up a grace period: If applicable, provide a reasonable window of time before penalties are enforced.

- Provide a refund or cancellation policy: Clearly state under what circumstances refunds or cancellations are allowed, along with any associated terms.

By including these elements in your policy, you can help ensure smooth transactions, avoid misunderstandings, and maintain positive relationships with your clients.

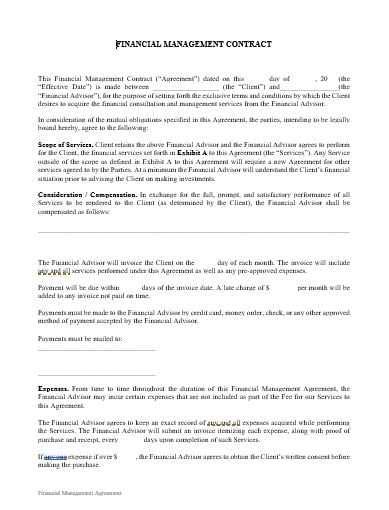

Legal Considerations in Invoice Agreements

When creating payment agreements, it’s essential to be aware of the legal aspects that govern the relationship between a business and its clients. A well-crafted agreement not only sets clear expectations but also protects both parties from potential legal issues. Understanding the relevant laws and regulations ensures that the document is enforceable and that both parties are aware of their rights and obligations.

Key legal considerations include ensuring that the agreement complies with local laws, clearly outlining payment deadlines and penalties, and addressing any potential disputes. Failing to address these elements can lead to confusion or even legal challenges, which can delay payments and damage business relationships.

Some important legal factors to consider:

- Contract Law: Ensure that your agreement is legally binding by including all necessary components, such as an offer, acceptance, and consideration (value exchanged).

- Late Payment Penalties: Check that any penalties for overdue payments align with local regulations. Some jurisdictions may limit the interest or fees that can be charged for late payments.

- Consumer Protection Laws: Make sure the agreement does not violate any consumer protection laws, particularly when dealing with individual customers or non-business clients.

- Data Protection: If personal information is involved, ensure compliance with privacy regulations, such as GDPR, to safeguard customer data.

- Dispute Resolution: Outline how any disputes will be resolved, whether through mediation, arbitration, or litigation, to avoid lengthy legal processes.

Being mindful of these legal considerations ensures that your agreements are clear, fair, and enforceable, protecting both your business and your clients from potential conflicts.

Customizing an Invoice Terms Template

Customizing your payment agreement is essential for aligning it with your specific business needs. A one-size-fits-all approach may not be suitable for every transaction, so tailoring the document ensures that all relevant details are covered. By adapting a standard framework, you can incorporate unique elements that reflect your business practices and industry standards, while also ensuring clarity for your clients.

The customization process involves adjusting various sections to suit the nature of your services, the expected payment schedule, and any specific client requirements. It’s crucial to make sure that the agreement is both flexible and comprehensive, as this will help avoid misunderstandings or disputes down the line.

Steps to Customize Your Payment Agreement

- Adjust Payment Terms: Depending on your industry, you may need to specify whether payments are due upon delivery, in installments, or on a specific date. Tailor the timing based on your typical transaction cycle.

- Include Relevant Fees: If you charge for late payments, make sure the fee structure aligns with your business model. Specify interest rates or flat fees for overdue amounts.

- Specify Payment Methods: List all accepted methods of payment, including online options or specific bank account details, to offer flexibility to your clients.

- Account for Special Circumstances: If you offer refunds, discounts, or cancellation options, ensure those clauses reflect your business’s policies and any conditions that apply.

Example of Customizable Sections

- Payment Schedule: Define whether payments will be due in full upfront, within a set number of days, or in multiple installments.

- Late Payment Penalties: Customize the late fee amounts and the time period after which penalties will be applied (e.g., 10% after 30 days).

- Refunds and Cancellations: Clarify any circumstances under which refunds or cancellations may occur, including deadlines and any non-refundable deposit amounts.

- Jurisdiction and Dispute Resolution: Specify which legal jurisdiction will apply in case of disputes and whether disputes will be handled via mediation or arbitration.

By personalizing these aspects, you ensure that the agreement suits the needs of your business while providing clarity and fairness to your clients. Tailoring these elements not only helps avoid conflicts but also strengthens professional relationships by setting clear expectations from the start.

Common Mistakes to Avoid in Invoice Terms

When drafting financial agreements, it’s easy to overlook certain details that can lead to confusion or disputes later. Even small mistakes can have a big impact on cash flow, client relationships, and legal compliance. By being aware of common pitfalls, businesses can create more effective, clear, and enforceable agreements that protect both parties involved.

Ambiguity in Payment Deadlines

One of the most common mistakes is not specifying a clear due date for payments. Vague statements like “pay within a reasonable time” or “when possible” can leave both parties unsure about expectations. This can lead to delayed payments, unnecessary follow-ups, or, worse, a breakdown in the client-business relationship. Always state a specific payment due date or provide a clear payment period (e.g., “payment due within 30 days of invoice date”).

Neglecting Late Payment Penalties

Another frequent mistake is not including consequences for overdue payments. Without an outlined penalty, clients may delay payments without concern, which can disrupt a business’s cash flow. Clearly stating late fees or interest rates for overdue amounts ensures that clients are aware of the consequences and encourages timely payments. These fees should be reasonable, in line with industry standards, and compliant with local laws.

Other Mistakes to Avoid:

- Overcomplicating Language: Using overly complex or legal jargon can confuse clients. Keep the language simple and direct.

- Not Defining Payment Methods: Failure to specify acceptable payment options can lead to delays. Make sure to list all available methods clearly.

- Ignoring Refund Policies: If applicable, a refund policy should be outlined. Not addressing it can create uncertainty in case of cancellations or returns.

By avoiding these common mistakes, you can ensure that your payment agreements are clear, fair, and more likely to be followed. The more specific and transparent your agreements are, the easier it is to maintain professional relationships and ensure prompt payments.

How to Set Payment Deadlines Effectively

Setting clear and realistic payment deadlines is crucial for maintaining smooth business operations. Having well-defined due dates helps ensure that clients understand their financial obligations and enables your business to plan its cash flow more effectively. However, establishing deadlines requires more than simply choosing a date–it’s important to account for various factors that can influence a client’s ability to meet the agreed-upon schedule.

Effective payment deadlines strike a balance between giving clients enough time to process payments while ensuring that your business receives compensation in a timely manner. Setting overly tight deadlines can lead to frustration or missed payments, while overly lenient ones can create unnecessary delays. To find this balance, it’s essential to consider the nature of the product or service, the client’s typical payment behavior, and industry standards.

Tips for Setting Effective Payment Deadlines

- Consider the Payment Cycle: Tailor deadlines to fit the typical payment cycle of your industry. For example, if you’re in a B2B environment, a 30-day or 60-day deadline is common. For smaller businesses or freelancers, shorter payment periods like 14 or 30 days may be more appropriate.

- Provide Clear Dates: Always specify a clear due date, such as “Payment due within 30 days of the invoice date” rather than using vague language like “as soon as possible.”

- Offer Early Payment Incentives: Consider offering discounts or incentives for clients who pay before the due date. This can encourage quicker payments and improve cash flow.

- Set Realistic Expectations: Avoid setting deadlines that may be difficult for your clients to meet. If you’re working with a new client or larger organization, allow them extra time to process payments if necessary.

- Be Flexible in Certain Cases: Offer some flexibility for clients experiencing difficulties. Establishing a grace period can prevent unnecessary tension, but ensure it’s clearly outlined in the agreement.

Enforcing Payment Deadlines: It’s important to be consistent in enforcing the deadlines you’ve set. If payments are consistently late, remind clients of the consequences outlined in your agreements and consider implementing late fees or interest to encourage timely settlements. Keeping communication professional and consistent helps ensure that the payment process remains smooth.

Late Payment Fees and Penalties Explained

Late payments can disrupt a business’s cash flow, making it difficult to plan for expenses and growth. To encourage timely payments, many businesses implement fees or penalties for overdue balances. These charges serve as a deterrent for clients who may otherwise delay payment, ensuring that both parties understand the consequences of missing the agreed-upon deadline.

Late fees and penalties can vary depending on the industry, the client relationship, and local regulations. While it’s essential to include these provisions in your agreements, it’s equally important to ensure they are fair, transparent, and legally enforceable. Below are some key considerations to help you establish effective late payment policies.

Types of Late Payment Fees

- Flat Fees: A fixed charge applied to any overdue payment, such as $25 for every week the payment is delayed. This is a straightforward approach that is easy to understand.

- Percentage-Based Fees: A percentage of the total outstanding amount, typically ranging from 1% to 5% per month. This fee structure grows with the overdue balance, encouraging faster resolution.

- Interest Rates: Charging interest on overdue amounts is another common approach, usually at an annual percentage rate (APR). For example, a 12% APR means clients are charged 1% of the outstanding balance each month.

Best Practices for Setting Late Payment Penalties

- Clearly Define the Penalty: Be specific about when the penalty will be applied and how it will be calculated. This should be outlined in your agreement from the start.

- Ensure Compliance with Local Laws: Check that your fees comply with local regulations. In some regions, there are legal limits on the amount or percentage that can be charged for late payments.

- Provide Grace Periods: Offering a short grace period (e.g., 5–7 days) before applying penalties can help maintain a positive client relationship while still encouraging timely payments.

- Balance Fairness: Make sure the penalty is reasonable and not punitive. Excessive fees can damage client relationships and potentially lead to disputes.

- Include a Reminder Process: Set up a clear process for reminding clients of overdue payments before penalties are applied. This could include email notifications or phone calls to avoid surprises.

By implementing fair but firm late payment fees, businesses can encourage clients to honor deadlines while maintaining healthy cash flow and professional relationships.

Dispute Resolution Clauses for Invoices

When it comes to financial agreements, it’s inevitable that disagreements may arise at some point. Having a clear process in place for resolving disputes can help prevent conflicts from escalating and ensure a fair and efficient solution for both parties. Including a dispute resolution clause in your agreements sets expectations for how disagreements will be handled, which can save time and resources in the long run.

A well-drafted dispute resolution clause helps clarify the steps that both parties should follow if a disagreement occurs. This can include options for negotiation, mediation, or arbitration, depending on the nature of the issue. It’s important that the process be outlined in a transparent way, so both businesses and clients know what to expect should a conflict arise.

Key Elements of a Dispute Resolution Clause

| Element | Description |

|---|---|

| Negotiation | A process where both parties attempt to resolve the issue through informal discussions before taking further action. |

| Mediation | If negotiation fails, a neutral third party can help facilitate a resolution, though the mediator has no binding authority. |

| Arbitration | A more formal process where a neutral arbitrator makes a binding decision, often faster and cheaper than litigation. |

| Legal Jurisdiction | Indicates which region or country’s laws will govern the resolution process, in case litigation is required. |

| Timeframe | Specifies how long the parties have to resolve the dispute at each stage before escalating to the next step. |

Impact of Clear Terms on Cash Flow

Clear financial agreements are crucial for maintaining healthy cash flow in any business. When payment expectations are explicitly outlined from the start, both parties are better prepared to meet their obligations. This reduces uncertainty, speeds up the payment process, and minimizes the chances of delays or disputes. As a result, businesses can better forecast their income and manage expenses effectively.

Ambiguous or vague payment guidelines can lead to confusion, misunderstandings, and delays in payments. When clients are unsure about payment dates, fees, or methods, they may procrastinate or fail to follow through on their financial commitments. On the other hand, well-structured agreements create a sense of professionalism and transparency, fostering a more reliable cash flow cycle.

How Clear Financial Agreements Affect Cash Flow

- Timely Payments: When clients understand the payment expectations clearly, they are more likely to pay on time, ensuring a steady cash inflow.

- Reduced Administrative Costs: Clear agreements minimize the need for constant reminders or follow-ups, saving both time and resources.

- Improved Budgeting: Predictable payments make it easier to plan for both short-term and long-term financial goals.

- Better Client Relationships: Transparent communication about payment expectations can prevent frustration or disputes, fostering a stronger, more cooperative business relationship.

Consequences of Unclear Financial Guidelines

- Late Payments: Unclear payment expectations often lead to delays, which can severely disrupt cash flow.

- Increased Disputes: Lack of clarity increases the risk of disagreements over payment amounts, deadlines, or services rendered.

- Strain on Operations: Unpredictable cash flow makes it difficult to manage operational costs, impacting business stability.

In conclusion, businesses that prioritize clear financial guidelines not only enhance their cash flow but also build stronger, more trusting relationships with clients. By setting clear expectations upfront, you create a smoother, more reliable financial process that supports long-term growth.

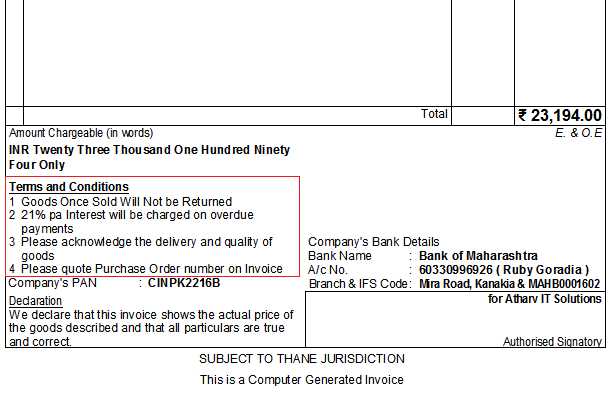

Importance of Clear Tax Information on Invoices

Clear tax details in financial documents are essential for both businesses and clients. They ensure compliance with legal requirements, prevent misunderstandings, and help maintain transparency in financial transactions. When taxes are clearly outlined, it becomes easier to manage accounts, prepare tax filings, and avoid disputes over incorrect charges or calculations.

Incorporating detailed tax information not only helps in fulfilling legal obligations but also fosters trust between the service provider and the client. Without proper tax details, clients may become confused or question the charges, which could potentially harm the business relationship. Additionally, unclear tax information can lead to costly errors during audits or tax filings.

Key Elements of Tax Information

- Tax Rates: Clearly state the applicable tax rates for the goods or services provided. Specify whether it is a flat rate or if different rates apply to different items.

- Tax Identification Numbers: Include the business’s tax ID number, which helps clients verify the legitimacy of the charges and ensures compliance with tax authorities.

- Tax Breakdown: Provide a clear breakdown of the tax amounts, showing how the total tax is calculated based on the subtotal of services or products. This adds transparency to the billing process.

- Exemption Information: If any goods or services are exempt from taxes, clearly indicate these exemptions and provide supporting documentation if necessary.

Benefits of Clear Tax Information

- Legal Compliance: Accurate tax details ensure adherence to local, state, and federal tax laws, reducing the risk of fines or legal issues.

- Avoiding Disputes: Transparent tax information prevents confusion or disputes over the amount being charged and builds trust with clients.

- Streamlined Tax Filing: Properly documented tax information makes it easier to prepare and file taxes, simplifying both the business’s internal processes and any required reporting.

- Professionalism: Including detailed tax information demonstrates professionalism and attention to detail, which can positively impact your business reputation.

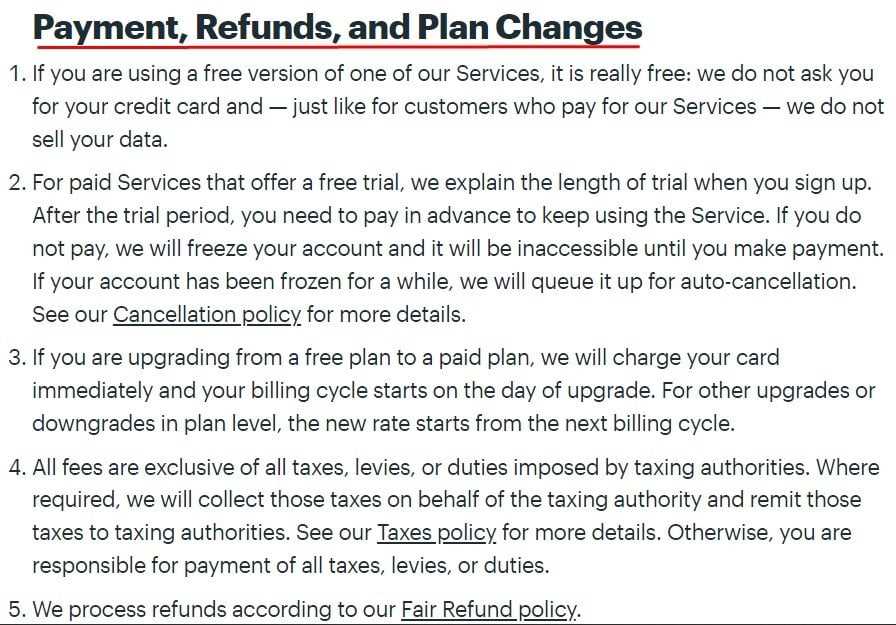

Managing Refunds and Cancellations in Contracts

Refunds and cancellations are a common part of doing business, but without clear guidelines in place, they can become a source of confusion and disputes. Establishing a clear process for handling cancellations and refunds helps protect both the business and the customer, ensuring that expectations are set and adhered to from the outset. By addressing these situations proactively in agreements, businesses can mitigate risks and improve client satisfaction.

Clear policies regarding refunds and cancellations not only set expectations but also help manage potential financial losses. Defining the circumstances under which refunds or cancellations are allowed, along with any associated fees or time frames, ensures that both parties are aligned on how these situations will be handled. It’s essential to include these details in contracts, as they can help prevent misunderstandings and streamline operations when these events occur.

Key Elements to Include in Refund and Cancellation Policies

- Refund Eligibility: Specify the conditions under which a refund will be issued, such as product defects, service dissatisfaction, or failure to meet agreed-upon deadlines.

- Cancellation Period: Outline the acceptable time frame for cancellations. For example, you may specify that cancellations can only occur within a certain number of days after purchase or before a service is delivered.

- Refund Amount: Clearly state how much the client will receive in case of a cancellation or refund request, considering restocking fees, service costs, or other deductions.

- Non-Refundable Fees: Indicate if any portion of the payment is non-refundable, such as deposits or service fees already rendered.

- Notification Process: Describe the steps the client must take to request a refund or cancellation, including any documentation or forms they need to submit.

Best Practices for Managing Refunds and Cancellations

- Be Transparent: Clearly communicate the refund and cancellation policies upfront. The more transparent the process, the less likely there will be misunderstandings.

- Offer a Grace Period: Consider providing a reasonable grace period for cancellations, such as a 7- or 14-day window, to allow customers time to change their minds or address any concerns.

- Outline Communication Channels: Provide customers with clear instructions on how to initiate a cancellation or refund request, whether through email, phone, or an online portal.

- Stay Consistent: Apply the same refund and cancellation policies across all clients to ensure fairness and avoid any potential legal issues.

- Document Everyth

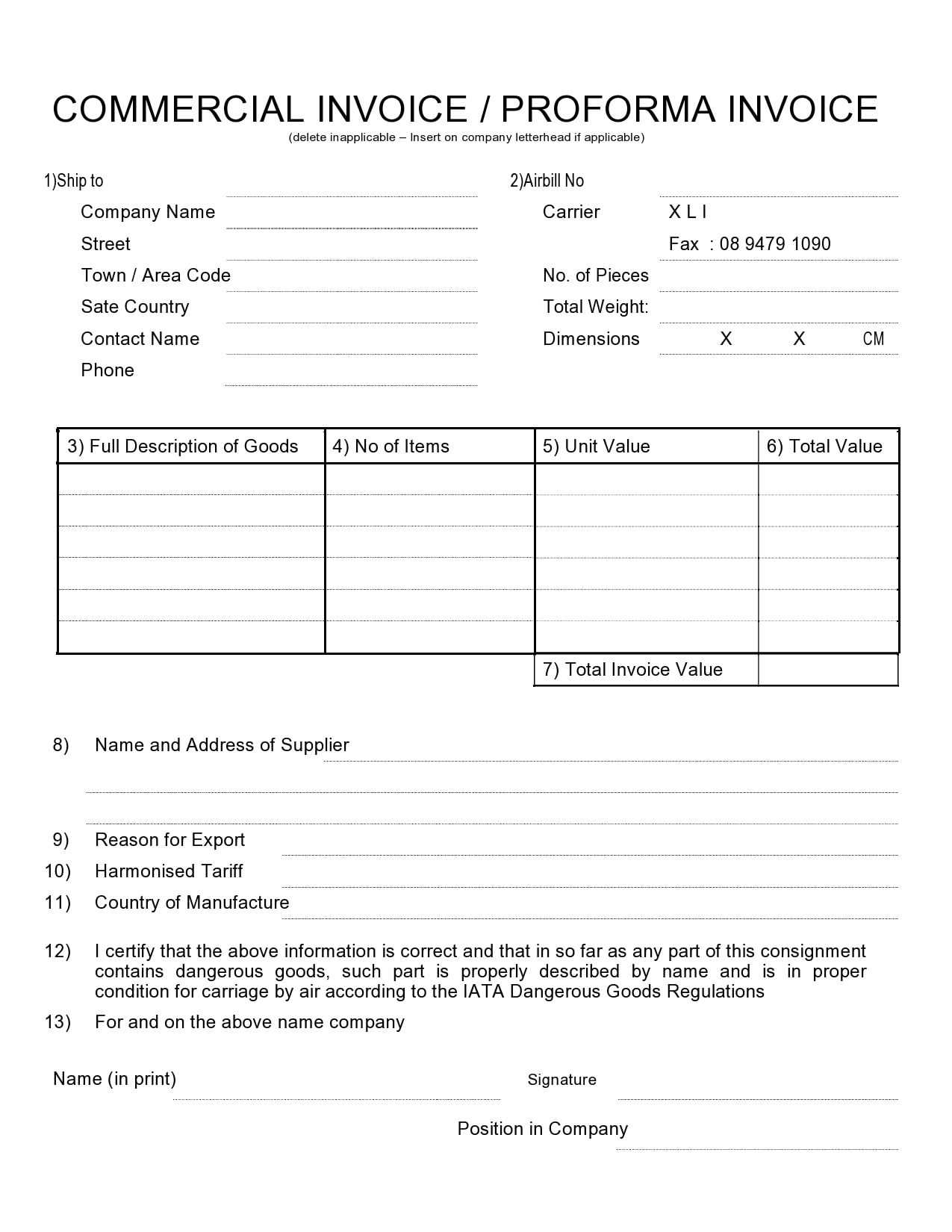

How to Address International Invoice Terms

When conducting business across borders, it’s important to consider the complexities that arise from dealing with different countries. Currency differences, payment methods, legal regulations, and time zones all play a role in how financial agreements are structured. To avoid confusion and ensure smooth transactions, it is essential to clearly outline expectations related to payments, delivery, and disputes, while also taking into account international business practices.

International transactions require special attention to avoid misunderstandings and delays. Addressing key factors such as currency exchange rates, taxes, shipping charges, and legal requirements can help streamline the process. By specifying these elements in your contracts, both parties will have a clear understanding of their obligations, reducing the risk of costly errors and disputes.

Key Elements for International Transactions

Element Description Currency and Payment Methods Specify the currency in which payments will be made and the payment methods that will be accepted. For example, whether payments will be made in USD, EUR, or another currency and whether bank transfers, credit cards, or digital wallets will be used. Taxes and Duties Clarify which party will be responsible for paying any taxes, customs duties, or import/export fees that may arise in the transaction. This ensures there are no surprises down the line. Shipping and Delivery Terms Outline the terms regarding delivery, including shipping charges, delivery times, and who is responsible for the cost of shipping or handling. Legal Jurisdiction Specify which country’s laws will govern the agreement and in which jurisdiction any disputes will be resolved. This is especially important when working with clients in different legal systems. Language and Communication Determine the official language of communication, as well as any specific time zones that apply to deadlines, payments, and customer support hours. Best Practices for International Agreements

- Clearly Define the Currency: Always specify the exact currency to avoid any confusion due to exchange rate fluctuations or cross-border payment issues.

- Include Detailed Shipping Information: Ensure all shipping terms are clear, including delivery dates and responsibilities, to avoid delays and misunderstandings.

- Account for Local Regulations: Research and integrate a

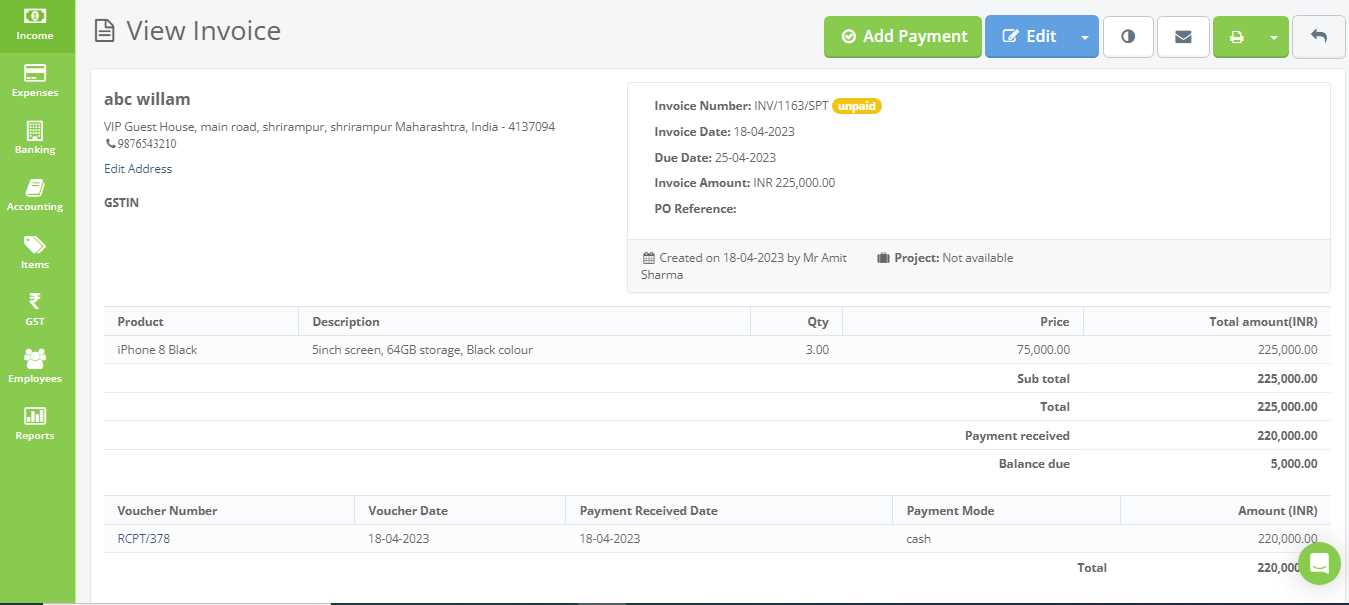

Automating Invoice Terms with Software

Automation tools can significantly streamline the process of managing financial agreements, saving businesses valuable time and reducing human error. By using specialized software, companies can automate various aspects of their agreements, such as payment schedules, late fees, and communication with clients. This ensures that all aspects of the transaction are handled consistently and efficiently, improving cash flow management and enhancing overall business operations.

Integrating software into the billing process allows businesses to standardize payment requirements, reducing the need for manual updates or revisions. This also enables quicker adaptation to changes, such as shifting rates or updated payment policies, without disrupting workflow. Through automation, businesses can focus more on their core operations while ensuring that financial agreements are executed flawlessly every time.

Key Benefits of Automating Financial Agreements

- Consistency: Software ensures that all financial agreements are handled uniformly, eliminating errors or inconsistencies that may arise from manual input.

- Efficiency: Automation reduces the time spent on administrative tasks, such as creating, sending, and following up on agreements, which allows teams to focus on higher-priority tasks.

- Accuracy: Automated systems reduce the risk of human error in calculating payment amounts, late fees, and applicable discounts, ensuring that clients receive correct information every time.

- Better Cash Flow Management: With automated reminders and scheduled billing, businesses can ensure that payments are received on time, improving cash flow predictability.

- Scalability: As businesses grow, automated systems can easily handle an increased volume of financial agreements without needing additional resources or manual oversight.

How to Get Started with Automating Billing Agreements

- Choose the Right Software: Select a solution that integrates with your existing business systems and offers the features that best suit your billing needs.

- Set Clear Payment Guidelines: Before automating, make sure your payment policies are well-defined so the software can implement them accurately.

- Customize Features: Tailor the automation to match your specific business requirements, such as applying discounts, setting payment due dates, and issuing reminders.

- Monitor Performance: Regularly track the performance of your automated system to ensure it’s working effectively and adjust as needed.

In conclusion, automating financial agreements with software helps businesses increase efficiency, improve accuracy, and ensure consistency, ultimately streamlining the entire billing process and fostering stronger financial management.

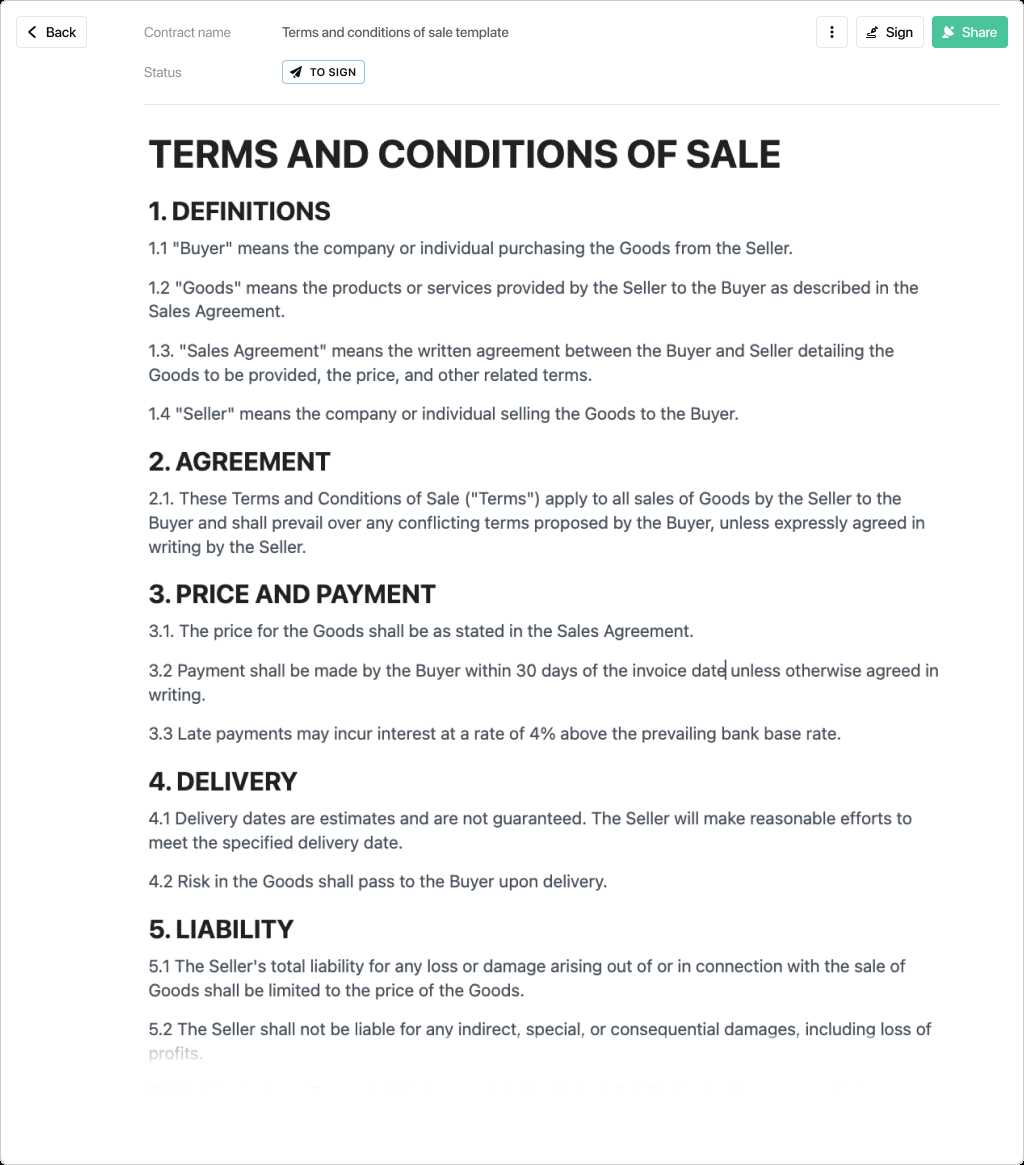

Examples of Well-Written Invoice Terms

Clearly written guidelines in business agreements ensure that both parties understand their responsibilities and expectations. Well-constructed clauses help prevent confusion, disputes, and delays. The key is to be precise, concise, and transparent, outlining specific requirements such as payment deadlines, penalties for late payments, and other financial obligations. Below are examples of effectively written clauses that can be used to create clear, professional agreements.

Examples of Clear Payment Guidelines

- Payment Due Date: “Payments for services rendered are due within 30 calendar days from the date of this agreement. Late payments will incur a 5% fee for every 15 days overdue.”

- Late Payment Fees: “A late fee of 2% per month will be applied to any overdue amounts. Fees will accrue starting from the day after the payment due date.”

- Early Payment Discount: “A 10% discount will be applied to the total amount if payment is made within 7 days of receiving the invoice.”

- Payment Methods: “Payments can be made via bank transfer, credit card, or digital payment platform. Bank details will be provided upon request.”

Examples of Delivery and Service Guidelines

- Delivery Terms: “All services will be provided and completed by the agreed-upon delivery date. Any delays will be communicated promptly, with a revised schedule provided within 48 hours.”

- Service Warranty: “We offer a 30-day warranty on all services performed. If issues arise within this period, they will be corrected at no additional charge.”

- Non-Refundable Fees: “Deposits made for custom work are non-refundable unless the project is cancelled by the provider before the work begins.”

Examples of Dispute Resolution and Legal Clauses

- Dispute Resolution: “In case of any disputes arising from this agreement, both parties agree to attempt mediation before seeking legal recourse. If mediation fails, the dispute will be resolved through arbitration.”

- Governing Law: “This agreement shall be governed by the laws of the state of New York, USA. Any legal actions must be filed in the competent courts of New York County.”

- Jurisdiction: “The jurisdiction for any legal disputes will be limited to the location where the services were rendered unless otherwise agreed upon in writing.”

In conclusion, clear and specific language in agreements is key to fostering smooth business operations. By outlining payment schedules, service expectations, and dispute resolution procedures with clarity, businesses can minimize risks and improve their client relationships.

Ensuring Consistency Across All Invoices

Maintaining uniformity in business agreements is essential for creating clear expectations between parties and preventing misunderstandings. Consistency in the way financial agreements are structured, from payment terms to delivery details, helps both businesses and clients manage expectations. Standardizing important elements across all agreements can also improve efficiency and ensure that no critical details are overlooked.

By implementing a structured approach to documenting obligations and deadlines, businesses can create a smoother process for both their internal teams and clients. This practice minimizes confusion, enhances professionalism, and ultimately leads to stronger working relationships.

Key Areas to Standardize Across All Agreements

- Payment Deadlines: Establish a standard payment schedule that is used consistently across all financial documents. For example, setting a 30-day window for payment following service completion or product delivery.

- Late Payment Penalties: Clearly define penalties for overdue payments. It’s important to communicate these consistently to clients to avoid disputes later on.

- Payment Methods: List the accepted payment methods in every agreement, whether it’s bank transfer, credit card, or digital payment platforms, to ensure clarity for clients each time.

- Service Delivery Details: Outline the service delivery terms consistently, including the process and expected timeline for completion. This ensures both parties are on the same page about when work is expected to be finished.

- Tax Information: Always include clear details on applicable taxes or fees in every agreement. If tax rates change, update all related documents to reflect the latest rates.

How to Implement Consistency

- Create Standardized Documents: Develop a set of pre-approved templates that include all the essential components, such as payment schedules, delivery guidelines, and legal language. This saves time and reduces the likelihood of missing important details.

- Use Automation Tools: Consider using software that allows you to automate the creation of financial agreements. With automation, you can ensure the same structure and content across all documents.

- Regular Reviews: Periodically review your standardized agreements to ensure that all information is up-to-date and relevant. This ensures that changes in laws or business practices are consistently reflected.

- Train Your Team: Make sure your staff understands the importance of consistency in every agreement. Providing training on your standardized processes can help everyone stay aligned and reduce errors.

By maintaining consistency in financial agreements, businesses can improve their operational efficiency, reduce mistakes, and foster stronger, more trustworthy relationships with clients.

Updating Your Invoice Terms Regularly

To ensure smooth business operations, it’s essential to review and revise your financial agreement structure regularly. As your business evolves, so do the legal requirements, industry standards, and customer expectations. Failing to update these agreements can lead to confusion, disputes, or missed opportunities. Regular updates help maintain relevance, protect your interests, and ensure compliance with new regulations.

By staying proactive about revisions, you can address changes in payment practices, incorporate feedback from clients, and improve the clarity of your documents. Below are some key reasons why updating your agreements should be a priority for every business.

Why You Should Update Your Financial Agreements

- Adapt to Legal Changes: Laws and regulations around billing, taxes, and contracts can change over time. Regularly updating your agreements ensures compliance with the latest legal requirements and avoids potential legal issues.

- Respond to Industry Trends: Market conditions and payment expectations can shift. For example, businesses may need to adjust payment options or introduce new fees based on industry practices.

- Enhance Clarity: Over time, some clauses in your agreements may become outdated or unclear. Regular updates provide an opportunity to simplify complex language and make your agreements easier for clients to understand.

- Address Customer Feedback: Clients may provide feedback regarding their experiences with your payment process. Listening to these insights and adjusting your documents accordingly can improve satisfaction and reduce disputes.

- Improve Cash Flow: Updating payment schedules, late fee policies, or discount structures can positively affect cash flow. Revising these regularly can help prevent delays in payment and ensure timely collections.

Best Practices for Updating Your Agreements

- Set a Review Schedule: Establish a regular review cycle, such as quarterly or annually, to go over all agreements and ensure they reflect current business practices and legal guidelines.

- Stay Informed: Keep up-to-date with any changes in tax laws, payment regulations, or industry trends that may impact your financial agreements.

- Solicit Feedback: Regularly ask clients or your internal team for feedback on the clarity and effectiveness of your agreements, and use that input to make meaningful adjustments.

- Make Changes Transparent: Always notify clients of any updates or revisions to your agreements. Transparency is key to maintaining trust and ensuring everyone is on the same page.

- Use Digital Tools: Utilize contract management or billing software to streamline the updating process and ensure that all changes are applied consistently across your documents.

Updating your financial agreements on a regular basis ensures that your business remains compliant, adaptable, and transparent. It reduces the risk of misunderstandings and improves overall client s