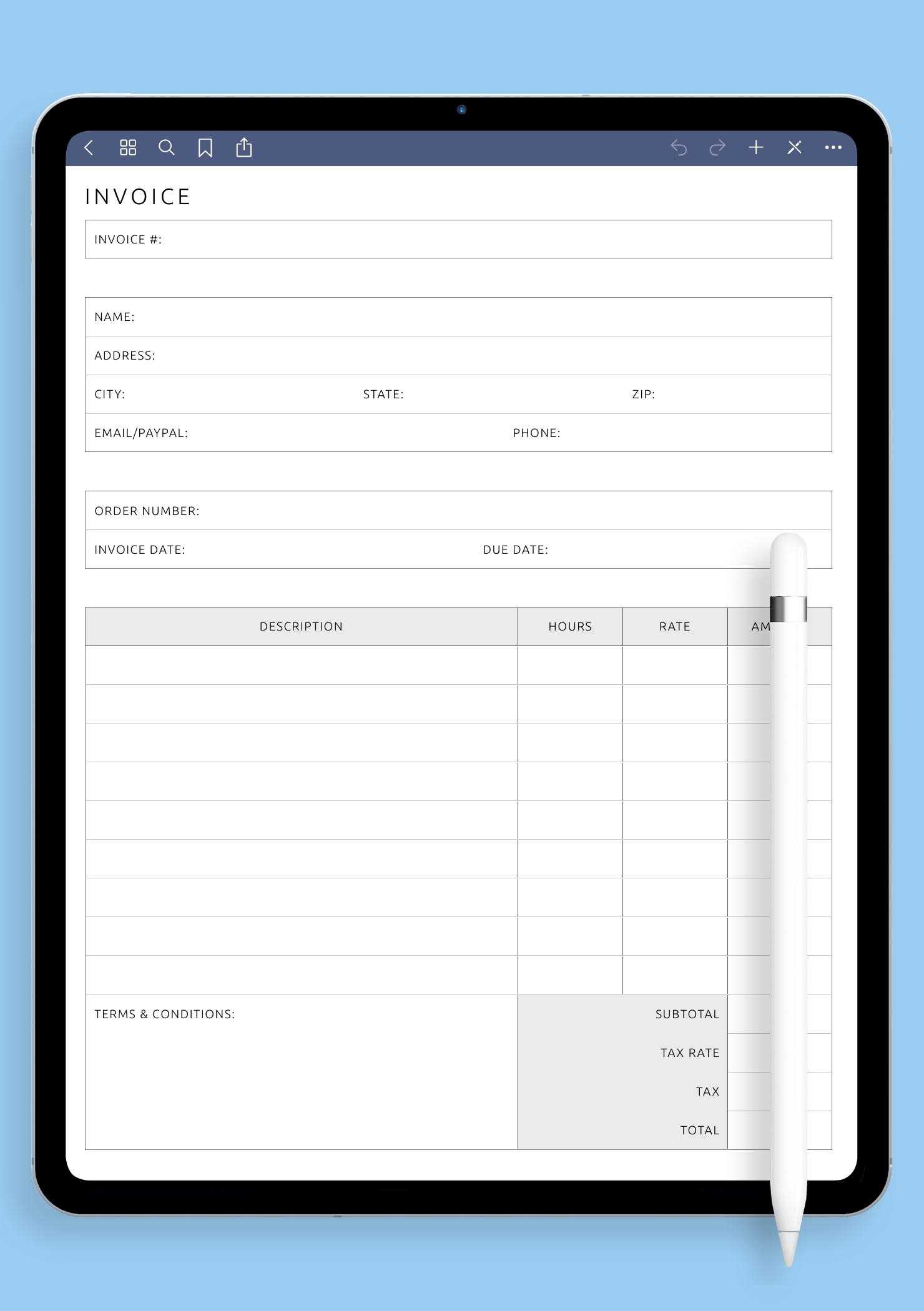

Top Invoice Templates for iPad to Simplify Your Billing

Managing your business finances efficiently requires the right tools. Whether you’re a freelancer, small business owner, or entrepreneur, simplifying the way you handle billing can save you valuable time and reduce errors. With the right solutions, you can create professional-looking documents quickly and easily, ensuring your clients are always satisfied with your professionalism.

Digital solutions offer an intuitive and convenient approach to generating these important documents, allowing you to work seamlessly while on the go. Whether you need to customize your content, track payments, or send your documents instantly, using a mobile device can offer unparalleled flexibility and efficiency.

Finding the right tool is key to making the process smooth. With a variety of options available, you can select the one that best suits your workflow and needs. This section will explore the various options and features that can help you streamline your financial documentation tasks, making it easier to stay organized and on top of your business operations.

Essential Billing Solutions for iPad

When it comes to managing business transactions, having the right tools at your fingertips can make all the difference. With the right mobile applications, you can easily create professional documents that keep your financial processes organized and efficient. Whether you’re a freelancer, a small business owner, or a service provider, these tools can simplify the task of generating accurate documents for your clients.

Here are some key features that every essential solution should offer:

- Customizability: The ability to adjust layouts, fonts, and branding to fit your business style.

- Quick Editing: Making changes on the fly to meet client requirements or correct errors quickly.

- Automatic Calculations: Reducing manual input and ensuring accuracy with built-in formulas.

- Professional Design: Clean, easy-to-read formats that enhance your business’s image.

- Mobile Access: Access your documents anytime, anywhere, making it easy to work remotely.

These solutions help you stay organized and reduce the time spent on manual tasks. By integrating essential features into your workflow, you ensure that each document reflects the professionalism your clients expect. Whether you’re just starting out or expanding your business, having the right digital tools on hand is crucial for success.

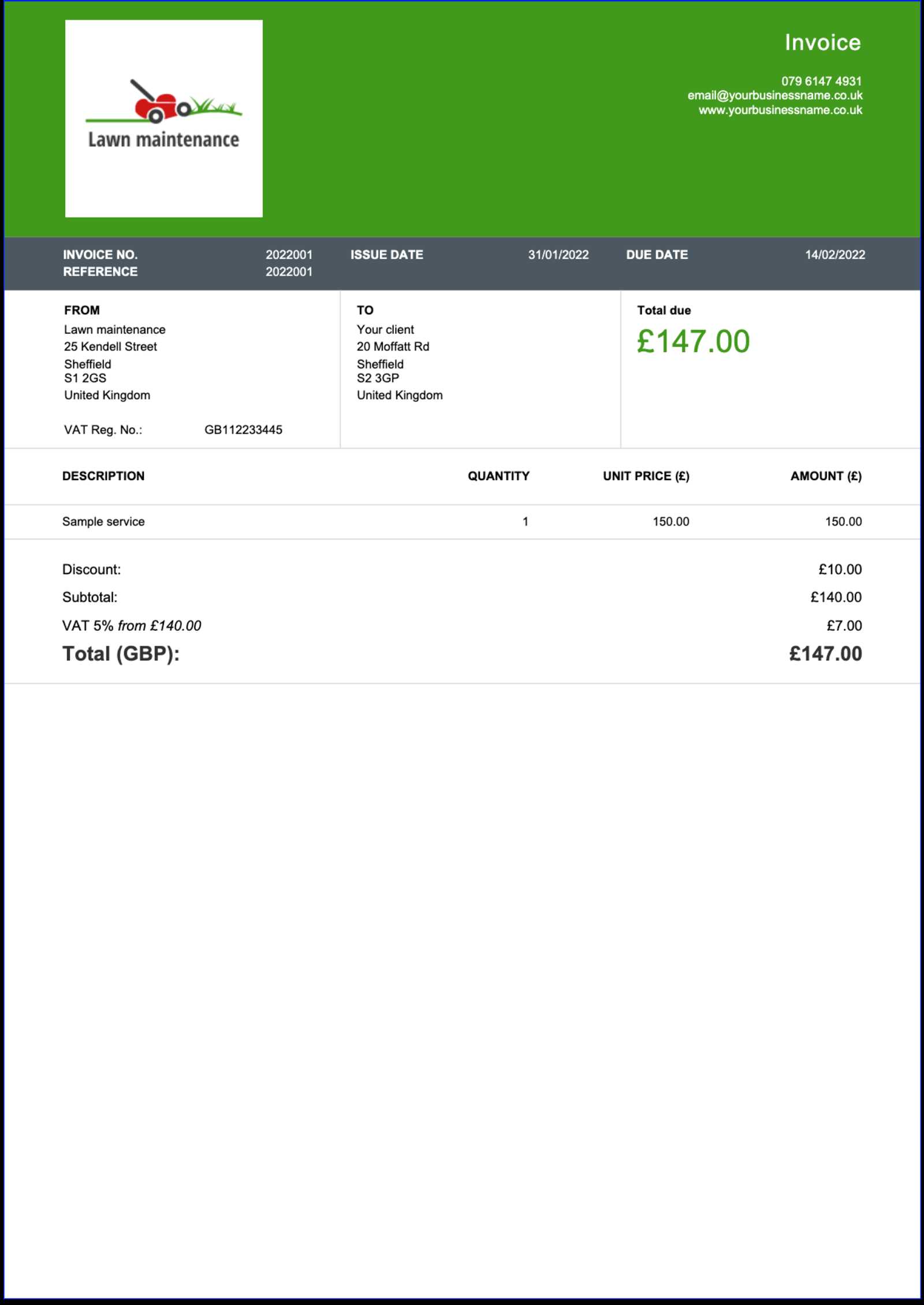

Why Choose iPad for Invoicing

In today’s fast-paced business environment, efficiency is key. The convenience of mobile devices has transformed how professionals manage their operations, and using a portable device to create and manage financial documents offers several advantages. With the right mobile tools, you can streamline your workflow, reduce errors, and ensure seamless communication with clients, all while maintaining flexibility and mobility.

Benefits of Using a Mobile Device

Using a mobile device like the iPad for financial documentation offers several distinct benefits:

| Advantage | Description |

|---|---|

| Portability | Take your work anywhere with ease, whether in the office or on the go. |

| Ease of Use | Touchscreen interface and simple apps make it easy to create and edit documents quickly. |

| Time-Saving | Automate repetitive tasks and streamline processes to save valuable time. |

| Synchronization | Cloud-based solutions allow seamless syncing across devices for better organization. |

Why iPad Stands Out

Compared to other mobile devices, the iPad offers unique advantages. With its larger screen, ease of navigation, and a wide range of compatible applications, it provides a better user experience for managing your business needs. Additionally, iPad’s long battery life ensures that you can stay productive throughout the day without constantly needing to recharge.

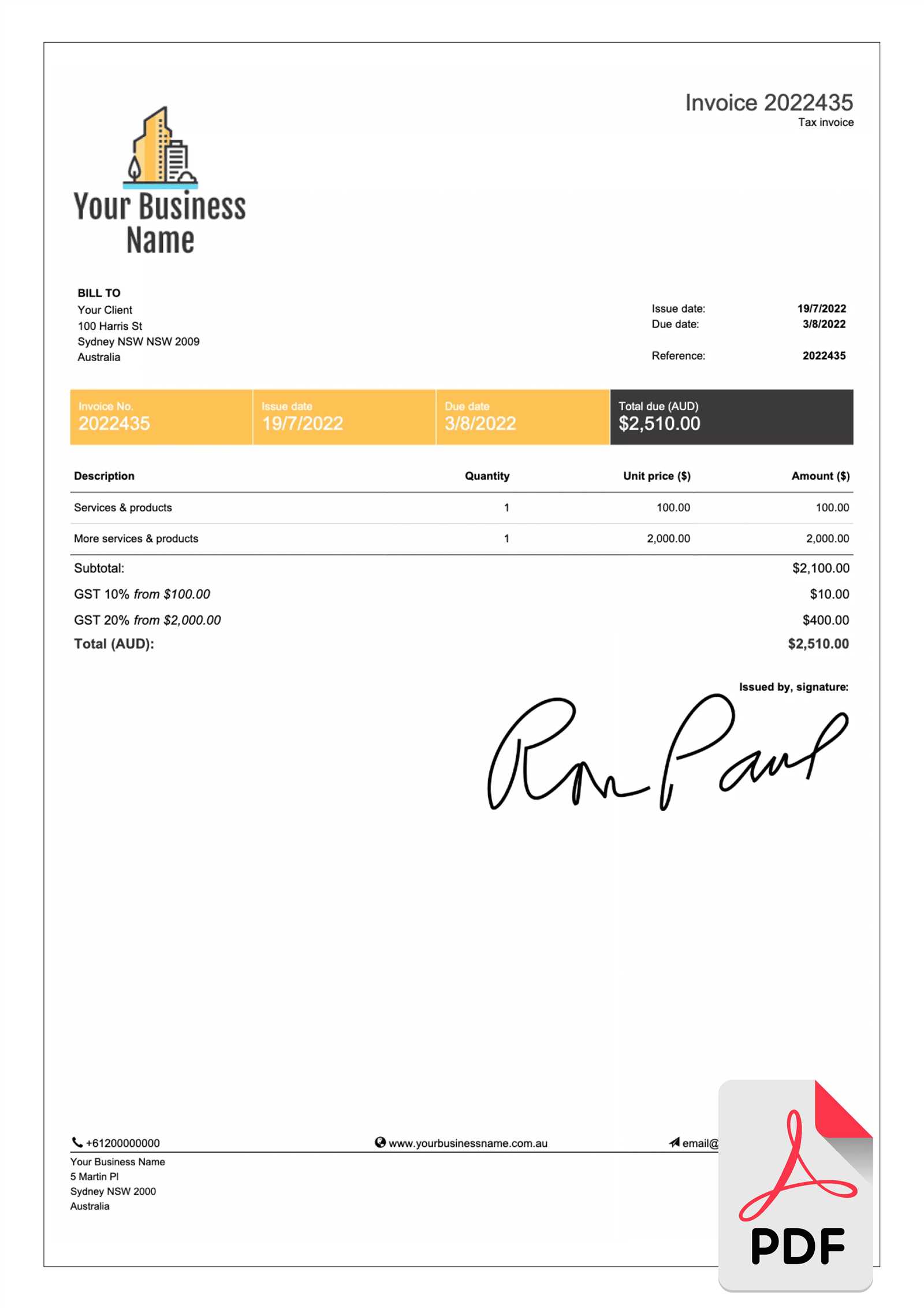

Top Features of Billing Solutions

When managing your business’s financial documentation, having the right features at your disposal can significantly improve your efficiency. Modern tools provide a variety of options that not only save you time but also help ensure accuracy and professionalism. The key to choosing the right solution lies in understanding which features are most important for your needs.

Customization and Flexibility

One of the most important aspects of a well-designed solution is the ability to customize the document to suit your business style. Being able to adjust layout, fonts, and branding elements allows you to maintain a consistent and professional appearance for every document. This flexibility is essential when creating personalized documents that align with your brand’s identity.

Automation and Accuracy

Automation is another powerful feature that simplifies the process. Many solutions automatically calculate totals, taxes, and discounts, reducing the chance of manual errors. This means you can quickly create accurate documents without needing to manually input every figure, saving both time and effort. Additionally, automated reminders and due date tracking help ensure that no payment is ever forgotten.

By utilizing these features, you can improve your workflow, stay organized, and enhance your business’s professional image–all from your mobile device.

How to Find the Right Solution

Choosing the right tool for creating professional documents is crucial for your business. The right choice can streamline your workflow, enhance accuracy, and improve the client experience. However, with so many options available, it can be difficult to pinpoint the best fit for your specific needs. Understanding the key factors to consider will help you make an informed decision.

Evaluate Your Business Needs

Before selecting a solution, it’s important to assess your specific requirements. Consider the following:

- Volume of documents: Are you generating a few documents each month or many on a daily basis?

- Level of customization: Do you need full control over layout, branding, and design?

- Integration: Will the solution need to connect with other tools or systems in your workflow?

Look for Flexibility and Support

Choose a solution that offers flexibility in both design and functionality. It should allow you to make changes quickly and without hassle. Additionally, consider the support options available, whether it’s through online resources, customer service, or tutorials. Having reliable support ensures that you can address any issues that may arise as you integrate the solution into your business.

By carefully evaluating your needs and exploring the available features, you can find the ideal tool to improve your business’s document creation process.

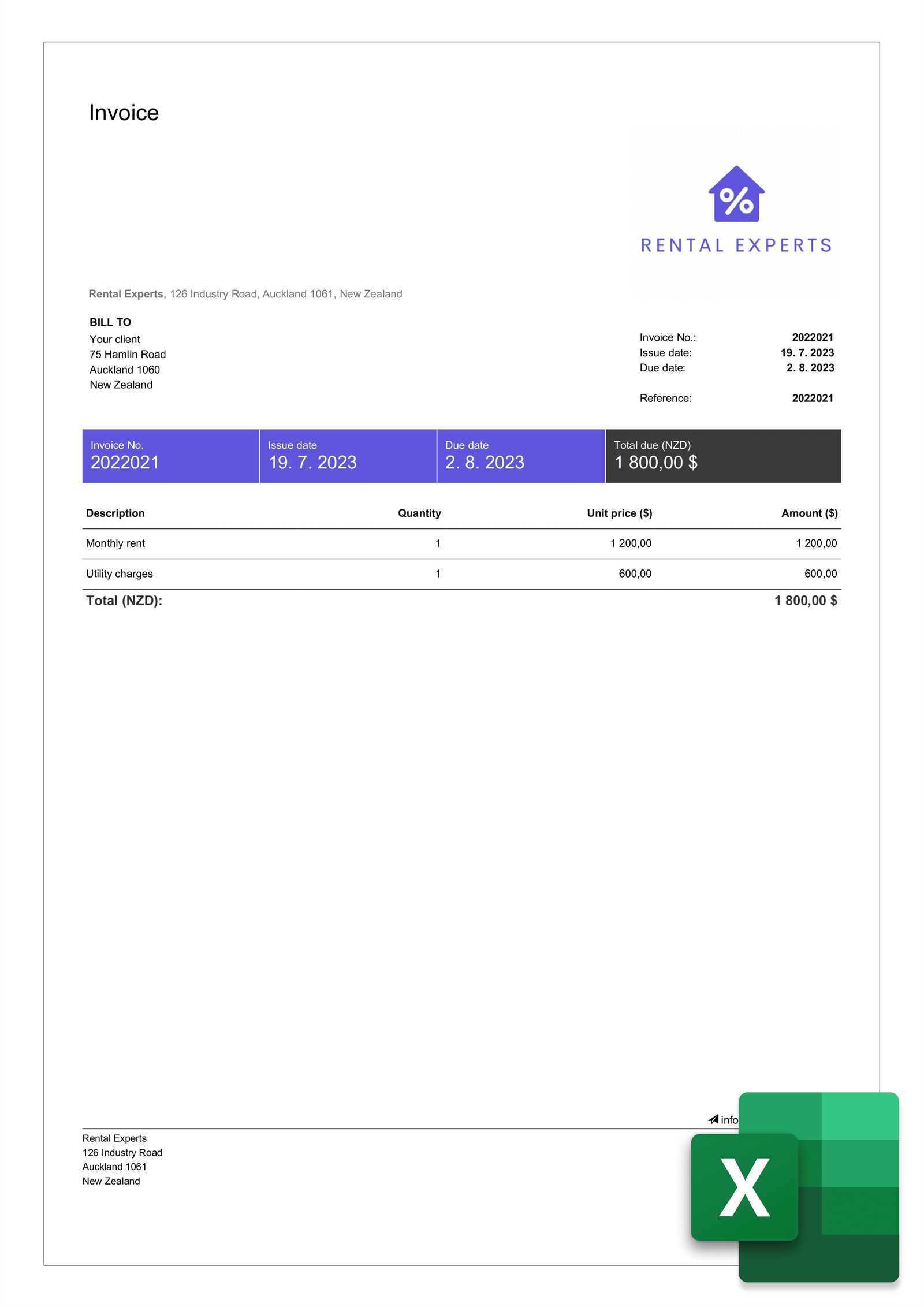

Customizing Your Billing Layout

Personalizing the structure and design of your financial documents is essential for creating a professional and consistent image for your business. By adjusting the layout to reflect your brand, you can ensure that your documents not only look polished but also clearly present important information in an easy-to-read format. Customization helps you maintain control over the visual appeal while improving the functionality of the document.

When customizing your layout, consider the following elements:

| Element | Customization Tips |

|---|---|

| Header | Include your company logo, name, and contact details for easy identification. |

| Fonts | Choose clean, professional fonts that enhance readability and maintain brand consistency. |

| Colors | Use colors that align with your brand identity while ensuring the text remains legible. |

| Sections | Organize information into clear, distinct sections like item descriptions, totals, and payment terms. |

| Footer | Include additional notes, payment instructions, or disclaimers to provide clarity. |

By taking the time to personalize your layout, you not only improve the aesthetic of your documents but also make them more functional and aligned with your brand’s professional image.

Best Free Billing Solutions for iPad

Finding a reliable, no-cost solution to manage your business’s financial documents is essential, especially for small business owners and freelancers looking to keep costs low. Many mobile apps and online tools offer free access to high-quality options that make it easy to create professional documents without the need for paid subscriptions. These free tools can be an excellent starting point for those looking to streamline their business operations without a large upfront investment.

Top Free Tools to Consider

Here are some of the best free options available:

- Wave: An intuitive platform offering a wide range of free features, including customizable layouts and integration with other tools.

- Zoho Invoice: A versatile option with free invoicing features, automation, and the ability to track payments and expenses.

- PayPal: Ideal for businesses that frequently use PayPal, this solution allows you to generate and send documents directly from the app.

- Invoice Simple: A straightforward tool that allows quick document creation, with the option to upgrade for additional features.

What to Look for in Free Tools

When choosing a free solution, consider the following factors to ensure it meets your needs:

- Ease of Use: The tool should be simple to navigate and require minimal time to set up.

- Customizability: Look for features that allow you to adjust layouts, add your logo, and tailor the design to fit your brand.

- Payment Tracking: Ensure that the solution has features that help you monitor and track payments effectively.

By selecting a free solution that fits your needs, you can keep your business organized and maintain a professional image without spending extra money.

Paid Billing Solutions Worth the Investment

While free options can be a great starting point, investing in a premium tool often provides a higher level of functionality, support, and customization. Paid solutions offer advanced features that can streamline your workflow and enhance the professionalism of your business documentation. If you’re looking to scale your operations or require specific capabilities, these paid tools can offer a substantial return on investment by saving time and improving the overall quality of your client interactions.

Features That Justify the Cost

Premium solutions typically come with a range of advanced features that free tools may lack. These can include:

- Advanced Customization: More flexibility in designing and formatting documents to reflect your brand’s identity.

- Automated Workflows: Time-saving tools that automate repetitive tasks such as payment reminders and document delivery.

- Multiple Integrations: Seamless integration with accounting software, payment processors, and CRM systems for improved workflow.

- Priority Customer Support: Access to dedicated support for troubleshooting and expert assistance when needed.

Popular Paid Solutions to Consider

If you’re ready to make the leap to a premium solution, here are a few options worth considering:

- FreshBooks: Known for its user-friendly interface and powerful automation features, FreshBooks helps streamline client management and billing.

- QuickBooks: A comprehensive accounting solution that includes invoicing along with extensive features for managing finances and taxes.

- Invoicely: Offers a wide range of billing options, from simple invoicing to advanced reporting and client management.

By upgrading to a paid solution, you gain access to powerful tools that can significantly improve the efficiency and professionalism of your business’s financial documentation processes.

How to Add Your Business Logo

Incorporating your business’s logo into your financial documents is a simple yet effective way to enhance your brand’s visibility and professionalism. Customizing your paperwork with your logo helps create a cohesive brand image that clients can easily recognize. Whether you’re using an online tool or a mobile application, adding your logo is usually a straightforward process that ensures your documents reflect your business identity.

To add your company’s logo, follow these steps:

- Step 1: Make sure you have a high-quality version of your logo in a widely accepted format such as PNG or JPEG. A transparent background is often preferred to allow for flexible placement.

- Step 2: Open your document editor or billing solution and look for the branding or header section. This is typically where logos are inserted.

- Step 3: Select the option to upload or insert an image, then choose your logo file from your device.

- Step 4: Adjust the size and placement of your logo to ensure it’s prominently displayed but doesn’t overwhelm the rest of the content.

- Step 5: Save the document and check how it looks before sending it to ensure everything is aligned properly.

By adding your logo, you not only reinforce your brand identity but also elevate the overall presentation of your financial documents, making them look more polished and professional.

Using Pre-Designed Solutions to Save Time

Streamlining your document creation process is crucial for efficiency, especially when you need to handle multiple tasks within a short timeframe. By using pre-designed layouts, you can save valuable time and focus on other important aspects of your business. These ready-made structures allow you to bypass the lengthy process of starting from scratch, ensuring you can generate professional-looking documents with minimal effort.

How Pre-Designed Options Help

Here’s how using pre-built solutions can benefit you:

- Consistency: Using a standard layout ensures that all your documents maintain a consistent look, which is important for building brand recognition.

- Speed: You no longer have to worry about designing from the ground up. Simply fill in the necessary details, and your document is ready to go.

- Customization: Many pre-designed options offer customization features, allowing you to adjust the layout or content to suit your specific needs.

Maximizing Efficiency with Pre-Made Structures

By leveraging pre-designed solutions, you significantly cut down on the time spent on formatting and design. This enables you to produce high-quality documents quickly, improving productivity and reducing administrative overhead. Whether you’re running a small business or managing multiple projects, incorporating these tools can be a game changer in terms of efficiency.

Integrating Payment Options in Documents

Including payment methods directly in your financial documents simplifies the transaction process for both you and your clients. When your clients have clear, easy access to payment options within the document, it reduces confusion and ensures quicker payments. By integrating various payment systems into your document layout, you streamline the entire billing experience and make it more convenient for customers to settle their accounts.

Types of Payment Methods to Include

Here are a few common payment methods you can easily integrate into your documents:

- Credit and Debit Cards: Provide a link to a secure payment gateway where clients can make payments with their cards.

- Bank Transfers: Include your bank account details or a payment link for easy transfer options.

- PayPal: A popular online payment system that allows for fast, secure transactions with just a few clicks.

- Mobile Payment Services: Options like Apple Pay or Google Pay are increasingly popular for quick mobile payments.

How to Add Payment Options

To effectively integrate payment options into your documents, follow these steps:

- Step 1: Choose the payment methods that are most convenient for your clients, considering their preferences.

- Step 2: Insert clear instructions or clickable links to your chosen payment systems within your document.

- Step 3: Make sure the payment details are easy to find and prominently displayed, ideally at the top or bottom of the document.

- Step 4: Double-check that your payment links and information are accurate to avoid delays or confusion.

By adding payment options directly within your documents, you not only make it easier for clients to pay on time but also create a more professional and efficient billing experience.

Top Apps for Editing Billing Documents

When it comes to managing and customizing your financial paperwork, using the right application can make all the difference. Several apps are designed specifically to make the process of creating and editing documents faster, more efficient, and easier. Whether you need to add custom branding, adjust formats, or integrate payment options, these tools allow you to streamline your workflow and maintain a professional appearance for all your business communications.

Best Tools for Customization

Here are some top applications that can help you design and edit your financial documents:

- Canva: Known for its user-friendly interface, Canva allows you to create visually appealing documents with ease. It offers customizable templates, drag-and-drop functionality, and a wide range of design elements to choose from.

- Microsoft Word: A classic tool for document creation, Word allows you to create customized billing forms using its robust editing features. You can easily integrate your logo, adjust layouts, and add personalized text.

- Google Docs: A cloud-based solution that lets you access and edit documents from any device. It’s great for collaboration and sharing, and it also provides the flexibility to format your documents as needed.

- Zoho Invoice: This app specializes in streamlining the billing process. Zoho offers customizable options and integrates seamlessly with accounting tools, making it ideal for managing finances in one place.

Features to Look for in Editing Apps

When selecting an app for editing your documents, look for the following features to ensure efficiency and ease of use:

- Customization Options: The ability to adjust layout, fonts, colors, and add your company’s branding is essential for maintaining a professional look.

- Cloud Integration: Ensure the app allows cloud storage or syncing to access documents from anywhere, at any time.

- Payment Integrations: Some apps let you link payment options directly within your documents, which can speed up the transaction process.

- Mobile Compatibility: If you’re frequently on the go, opt for apps that are mobile-friendly or have dedicated apps for smartphones and tablets.

Using the right app to edit your business documents not only saves time but also ensures that your communications are professional and easily manageable. The options listed above provide a mix of powerful features to meet your business’s needs.

Creating Professional Billing Documents on iPad

Generating polished and professional documents on your tablet is an efficient way to handle your business transactions. With the right tools and a bit of customization, you can create professional-looking financial paperwork directly from your device. These documents not only help maintain your brand’s identity but also ensure that your clients receive accurate and clear information about their payments.

Steps to Design Your Documents

Follow these simple steps to create well-structured, professional financial documents on your tablet:

- Choose the Right App: Select an application that allows for easy customization, such as adding your business logo, adjusting the layout, and inserting necessary fields for pricing and services.

- Set Up a Standard Layout: Develop a consistent structure for your documents that includes all essential information, like contact details, itemized lists, and payment instructions.

- Include Personal Branding: Make sure to add your logo, company colors, and fonts to give your documents a personalized, professional touch that aligns with your brand.

- Proofread and Review: Before finalizing, check that all details are correct, including the client’s information, payment amounts, and dates.

Why Use a Tablet for Document Creation?

Using a tablet like the iPad to create your financial documents has several advantages:

- Portability: Create and send documents from anywhere, whether you’re in the office or on the go.

- Ease of Use: Touchscreen controls and intuitive design make editing and formatting much easier compared to traditional desktop tools.

- Efficiency: Quickly access, edit, and send documents directly from your device without needing to transfer them to another computer or device.

By following these steps and using the right apps, you can easily create and send professional documents directly from your tablet, improving both your workflow and your client interactions.

Tracking Payments with Billing Documents

Efficiently monitoring payments is crucial for maintaining a steady cash flow and ensuring timely transactions in any business. With the right tools, you can easily track outstanding balances, due dates, and received payments, helping you stay organized and informed. A well-organized system allows you to follow up on overdue payments and manage your financials more effectively.

To streamline payment tracking, using the appropriate document creation system offers various features such as automatic reminders, status updates, and clear record keeping. These functions can save you time and reduce the risk of errors, making it easier to manage client accounts and stay on top of business finances.

Key Features for Payment Tracking

When selecting the best tools for managing your payments, look for the following features:

- Payment Status Indicators: Easily mark payments as “paid” or “unpaid” to quickly identify which transactions are complete and which still require action.

- Due Date Reminders: Automated reminders can help ensure that your clients know when payments are due, reducing the likelihood of delays.

- Payment History Logs: Keep detailed records of all transactions, including partial payments and adjustments, to ensure transparency and accuracy.

Benefits of Tracking Payments

Accurate payment tracking offers several benefits to both businesses and clients:

- Reduced Errors: By using automated systems, you minimize the chances of manual errors and discrepancies in financial records.

- Improved Cash Flow Management: With clear visibility into your accounts receivable, you can better manage your cash flow and plan for upcoming expenses.

- Professional Client Relations: Tracking payments helps you maintain transparency with clients, ensuring they are aware of their financial obligations and strengthening your business relationship.

Incorporating efficient tracking features into your workflow not only improves the accuracy of your financial records but also enhances your ability to manage outstanding payments and maintain smooth business operations.

Managing Multiple Clients with Billing Documents

Handling multiple clients can be a complex task, especially when it comes to maintaining clear records and ensuring each client’s needs are met on time. A streamlined approach to organizing your financial records helps you stay on top of client transactions and provides a professional way to manage different accounts. By using an efficient system, you can create and track all the necessary documents while keeping everything well-organized.

Key Features for Efficient Client Management

When managing several clients, it’s important to look for tools that allow you to organize and customize each client’s financial details. The following features can help you efficiently manage multiple accounts:

- Customizable Client Profiles: Store specific client information, including billing addresses, preferred payment methods, and payment terms, in one place.

- Multiple Document Formats: Create and save different types of records tailored to each client’s preferences or industry-specific needs.

- Tracking Client History: Keep a record of past transactions for each client, which can help in resolving disputes or revisiting past agreements.

- Payment Reminders: Automatically send reminders for overdue payments to clients, reducing the chances of missed deadlines.

Best Practices for Managing Clients

To stay organized while managing multiple client accounts, consider these best practices:

- Organize by Client: Set up folders or categories for each client to easily access their records and track outstanding payments.

- Set Clear Payment Terms: Clearly define the payment terms for each client to avoid confusion and ensure timely payments.

- Use Automation: Automate repetitive tasks such as reminders, payment logging, and document creation to save time and reduce manual errors.

By utilizing these strategies, you can streamline your workflow and ensure that each client receives the attention and accuracy they deserve, helping you manage multiple accounts efficiently and professionally.

How to Avoid Common Billing Mistakes

When managing financial records, it’s easy to overlook small details that can lead to bigger issues down the line. Many business owners make similar mistakes when creating and sending financial documents, which can result in payment delays, confusion, or strained client relationships. By understanding common pitfalls, you can take proactive steps to avoid them and maintain a smooth workflow.

Top Mistakes to Avoid

Here are some of the most common errors made when handling financial records and how to prevent them:

- Missing or Incorrect Client Information: Always double-check client details, such as addresses, contact information, and payment terms. This ensures the document reaches the right person and reduces the risk of confusion.

- Unclear Payment Terms: Clearly outline your payment terms, including due dates and penalties for late payments. This prevents misunderstandings and helps clients know exactly when and how to pay.

- Inaccurate Calculation of Amounts: Double-check the math before sending out any documents. Errors in total amounts, taxes, or discounts can lead to disputes or delayed payments.

- Failure to Follow Up on Late Payments: Don’t assume clients will automatically pay on time. Establish a system to follow up on overdue payments to maintain a consistent cash flow.

Best Practices for Avoiding Errors

By incorporating a few simple best practices, you can significantly reduce the chance of making costly mistakes:

- Use Automation Tools: Leverage digital tools that automate calculations, reminders, and document generation to minimize human error.

- Establish a Review Process: Before sending out any financial document, have a second pair of eyes review it to ensure everything is accurate.

- Stay Consistent: Maintain a standard format for all your financial documents to make them easier to track and review over time.

By taking care to avoid these common mistakes, you can ensure smooth transactions and foster positive, professional relationships with your clients.

Ensuring Accuracy with Automated Calculations

In any business, accurate financial records are crucial for maintaining smooth operations and preventing errors that could lead to financial discrepancies. Manual calculations can often result in mistakes, especially when dealing with complex figures or multiple entries. By incorporating automated tools, businesses can ensure that all figures are correct and consistent every time, eliminating the possibility of human error.

The Power of Automation

Automated systems can handle complex calculations with precision, saving you time and effort. These tools are designed to quickly and accurately compute totals, apply discounts, calculate taxes, and track payments. As a result, businesses can rely on these systems to ensure the accuracy of their financial documents, reducing the risk of mistakes that could affect cash flow or customer trust.

How Automated Calculations Improve Efficiency

- Eliminates Human Error: Automation removes the chance of simple mistakes like miscalculating totals, misapplying discounts, or forgetting to add taxes.

- Saves Time: Automated tools handle calculations instantly, allowing you to focus on other important aspects of your business.

- Consistency: Using automated systems ensures that all financial records are calculated the same way each time, leading to more reliable results.

- Real-Time Updates: Many tools can update financial data in real-time, reflecting the most current information without manual input.

Incorporating automated calculations into your business process is an effective way to improve accuracy, reduce errors, and streamline your workflow. By relying on technology, you can ensure your financial records are precise and up-to-date every time.

Benefits of Cloud-Based Invoice Templates

Cloud-based solutions have revolutionized the way businesses manage their financial documents, providing flexibility and ease of access that traditional methods can’t match. By utilizing cloud-based systems, businesses can store, access, and share essential documents in real time, from any device with internet connectivity. This approach ensures that vital records are always available when needed, even on the go.

Access from Anywhere

One of the most significant advantages of using cloud-based tools is the ability to access your documents from any location. Whether you’re in the office, at home, or traveling, you can retrieve your files instantly without being tied to a specific computer or device. This flexibility is crucial for businesses that require quick access to financial information while on the move.

Improved Collaboration

Cloud systems facilitate seamless collaboration among team members, allowing multiple users to view, edit, and share documents simultaneously. This eliminates the need for emailing documents back and forth or dealing with outdated versions, ensuring everyone works with the most up-to-date information.

Enhanced Security

With cloud solutions, your financial documents are stored in secure, encrypted servers, minimizing the risk of data loss or theft. Regular backups and advanced security measures ensure that your information remains safe and protected from unauthorized access. Additionally, most cloud providers offer multi-factor authentication, adding an extra layer of protection to sensitive data.

Cost Efficiency

Cloud services are often more affordable than traditional methods. There are no upfront hardware costs, and you only pay for what you need. Many cloud platforms also offer free or low-cost tiers for small businesses, making it an attractive solution for those looking to reduce operational expenses.

Incorporating cloud-based solutions into your business operations offers a wide range of benefits, from increased accessibility and security to enhanced collaboration and cost savings. By adopting this technology, businesses can streamline their processes, ensuring efficiency and accuracy in managing their essential financial documents.

Protecting Your Documents with Security Features

In today’s digital world, ensuring the security of financial documents is essential for protecting sensitive information from unauthorized access. Implementing strong security measures not only keeps your data safe but also ensures the integrity of your records. Whether you’re sharing documents with clients or storing them online, security features are crucial in maintaining privacy and preventing fraud.

Encryption

One of the most effective ways to protect your financial documents is through encryption. Encryption transforms your files into unreadable code, which can only be deciphered with the correct decryption key. This means that even if a malicious actor intercepts your document, they will not be able to access the sensitive information without the proper credentials.

Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring not only a password but also a second piece of information, such as a code sent to your mobile device or an authentication app. This makes it significantly harder for unauthorized users to gain access to your documents, even if they manage to obtain your password.

Access Control

Restricting access to your financial records is another key security measure. By implementing access control settings, you can determine who is authorized to view, edit, or share your documents. This ensures that only trusted individuals have the ability to interact with sensitive data, while others are kept out. Access control is particularly important when multiple team members are involved in managing documents.

Regular Audits and Backups

Regular audits and backups of your files are essential to maintaining security over time. Auditing allows you to track who has accessed your documents and when, making it easier to spot any suspicious activity. Backing up your files ensures that you won’t lose important data in case of a breach or system failure. Automated backups can help ensure that your data is regularly saved without requiring manual intervention.

Secure Sharing and Collaboration

When collaborating or sharing documents, it is essential to use secure platforms that offer built-in protection, such as secure links or password protection. This prevents unauthorized users from accessing your financial documents, even if the links are shared with others. Additionally, always use trusted cloud storage services with strong encryption protocols to store your documents.

By utilizing these security features, you can protect your sensitive documents and ensure that they remain safe from cyber threats, data breaches, and unauthorized access. Implementing these measures will give you peace of mind and help maintain the trust of your clients and partners.