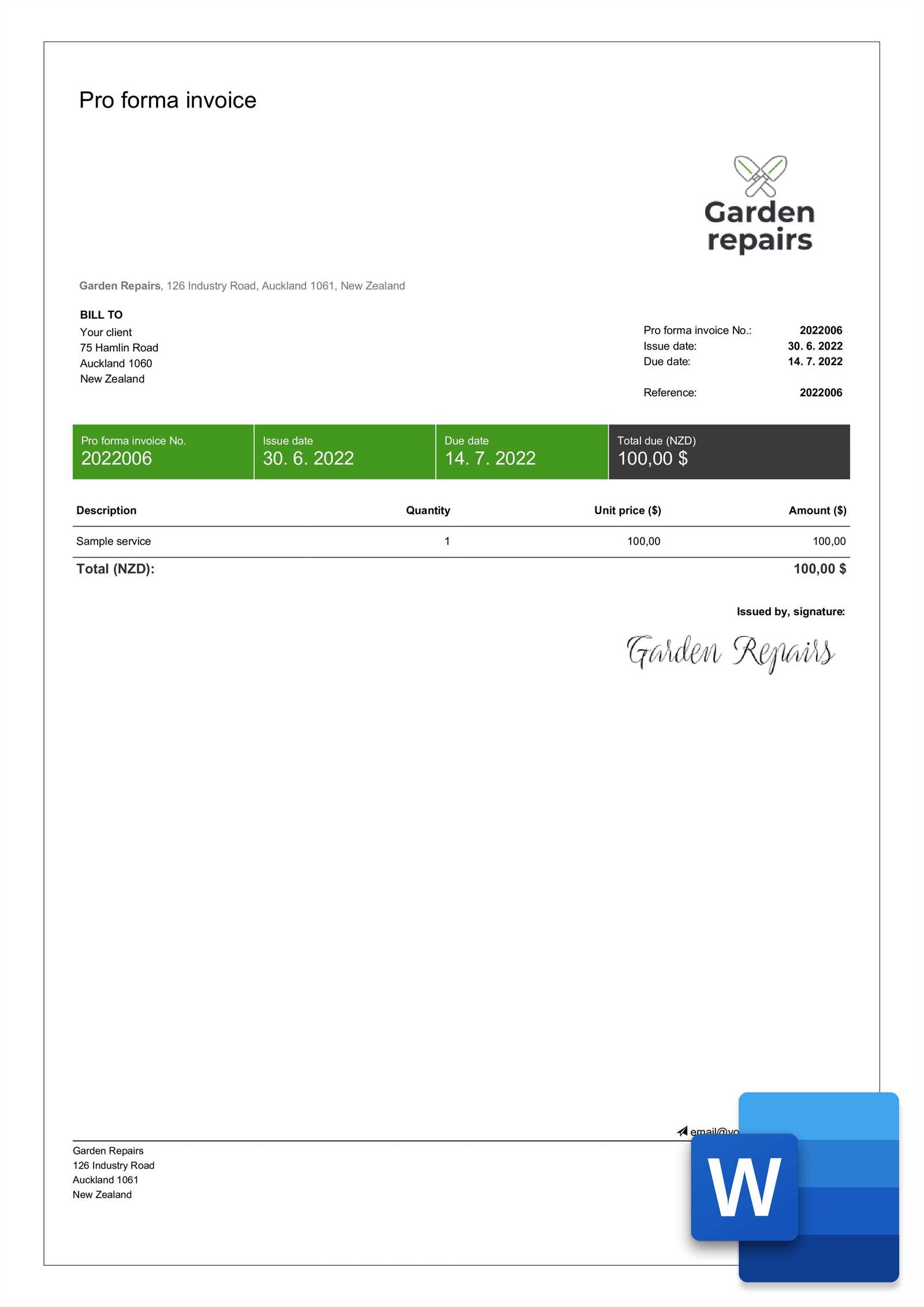

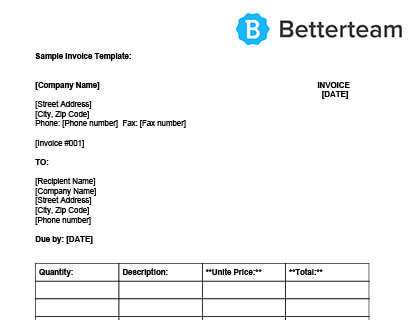

Download Invoice Template in Word Format

For any business, having a reliable and professional way to manage financial transactions is essential. Whether you’re a freelancer, a small business owner, or a large company, having an efficient system to create and manage payment records can save you time and ensure accuracy. With the right tools, creating clear and organized billing documents becomes a straightforward task.

Streamlining your invoicing process with easy-to-edit formats helps maintain consistency in your communications. By utilizing customizable formats, you can tailor each record to your specific needs, ensuring that all necessary details are included while maintaining a professional appearance. This approach not only enhances your workflow but also reinforces your credibility in the eyes of clients and partners.

Whether you need a simple bill or a more detailed statement, using accessible solutions can greatly simplify your daily tasks. These flexible options allow for easy adjustments, making it simple to keep track of payments and due dates. This guide will walk you through the process of utilizing these tools effectively, ensuring that each transaction is documented clearly and accurately.

Benefits of Using Billing Document Formats

Utilizing ready-made formats for creating billing documents offers numerous advantages that streamline your administrative tasks. These pre-designed solutions save valuable time and effort, allowing you to focus on your core business activities. By using such formats, you can ensure a consistent and professional look for every transaction, reinforcing your brand’s credibility with clients and partners.

Efficiency is one of the key benefits. With an easy-to-edit format, you can quickly fill in the necessary details and generate a document that meets all the required standards. This significantly reduces the time spent on formatting and eliminates the risk of overlooking essential information.

Customization is another crucial advantage. These formats can be easily adjusted to suit your specific business needs, whether you’re issuing a single record or managing recurring entries. The flexibility to modify fields, add branding, and adjust styles ensures that each document matches your business’s requirements, enhancing the overall client experience.

How to Access Billing Document Formats

Getting access to ready-to-use formats for creating financial records is simple and quick. There are numerous platforms that provide these pre-designed solutions, allowing you to easily incorporate them into your business practices. Here are the steps to follow when obtaining these formats:

- Choose a Reliable Source: Look for trusted websites offering a variety of professional formats. Many platforms provide both free and paid options.

- Select the Appropriate Format: Ensure the chosen document matches your business style and meets your requirements, whether you need a basic layout or something more advanced.

- Fill in Your Details: Once you’ve selected the format, open it in your preferred software. Customize the document with your company information, client details, and transaction data.

- Save and Use: After personalizing the document, save it on your device for future use. You can easily reuse it for subsequent transactions by making necessary adjustments.

By following these simple steps, you can quickly access and utilize professionally designed solutions for all your financial documentation needs, ensuring consistency and accuracy every time.

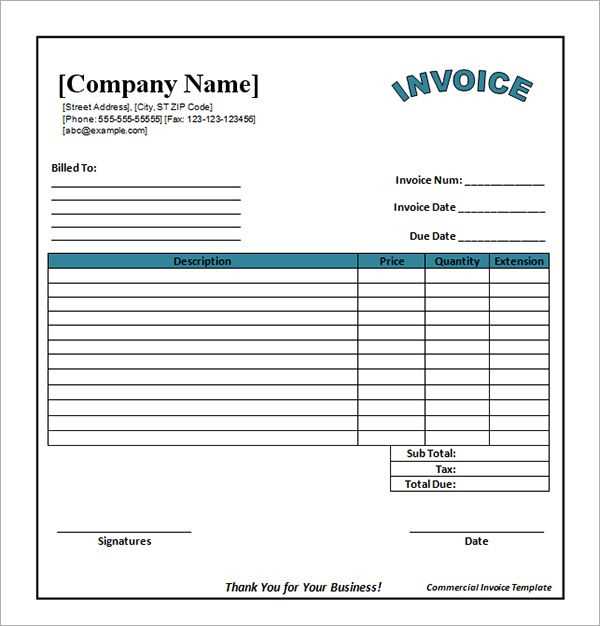

Customizing Billing Document Formats

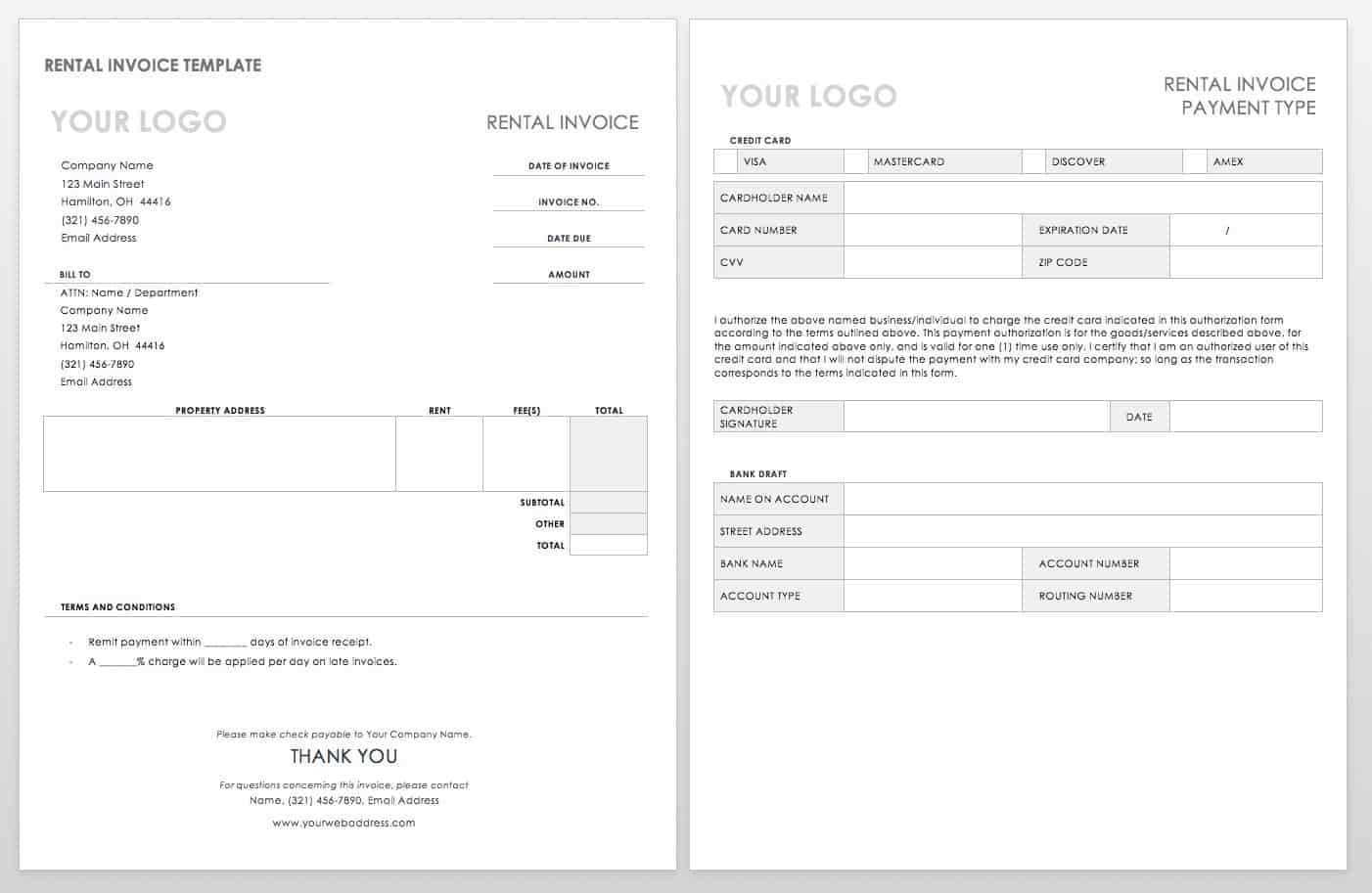

Personalizing your financial documents is an essential step to reflect your brand and meet your specific business needs. Customizing these records allows you to add your company logo, adjust the layout, and ensure that all necessary fields are included for accurate tracking of payments and transactions. By modifying the structure and design, you can create a polished and professional appearance for each document you issue.

Here are a few key areas to focus on when customizing your documents:

| Element | Customization Options |

|---|---|

| Header | Include your company name, logo, and contact details for branding and easy identification. |

| Fields | Modify sections like client name, services provided, payment due date, and amounts, ensuring they align with your business needs. |

| Layout | Adjust the alignment, font styles, and colors to match your brand’s visual identity. |

| Additional Notes | Incorporate sections for terms and conditions, payment methods, or any other relevant information. |

With these simple adjustments, you can ensure that your financial documents are both functional and professional, enhancing your business’s reputation and providing a seamless experience for your clients.

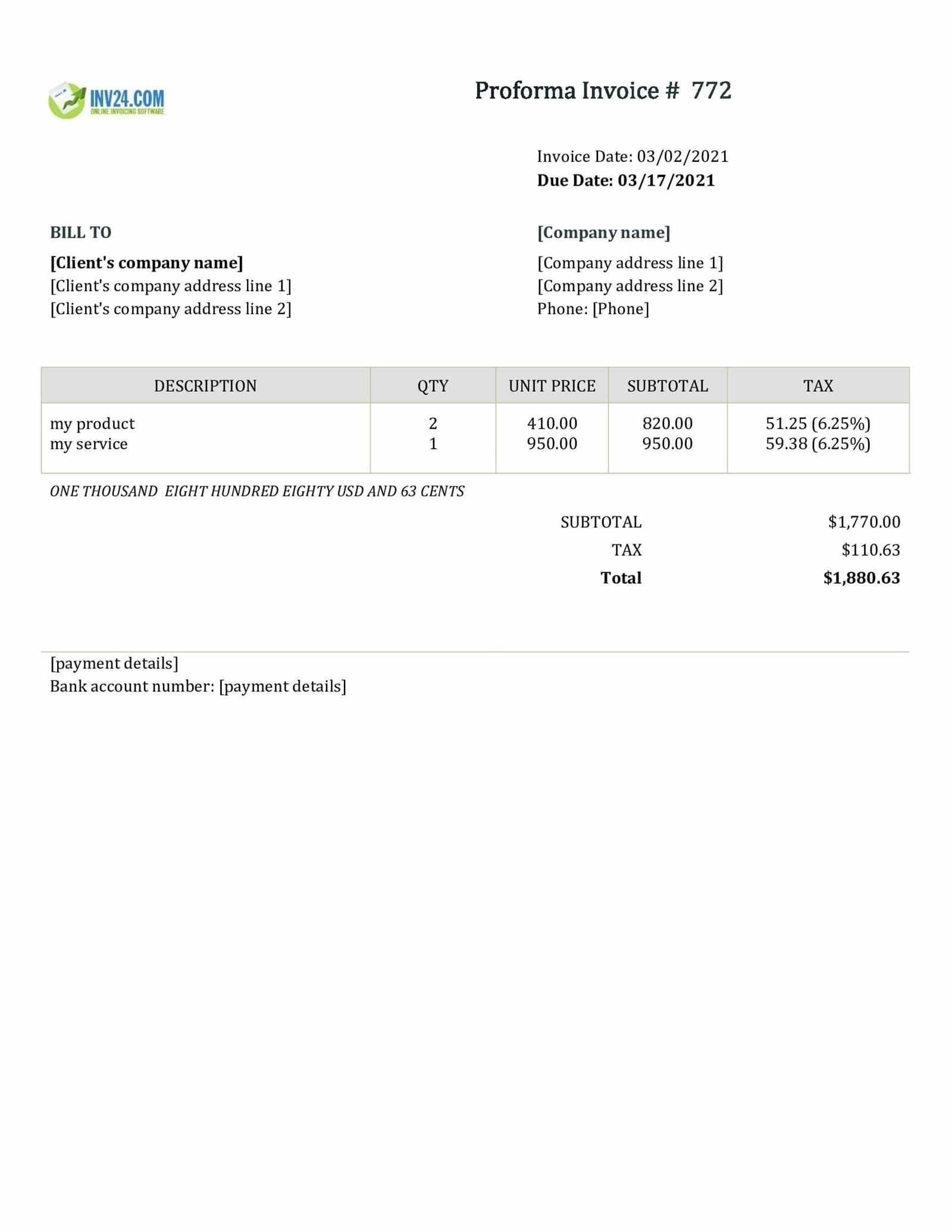

Key Features of Invoice Templates

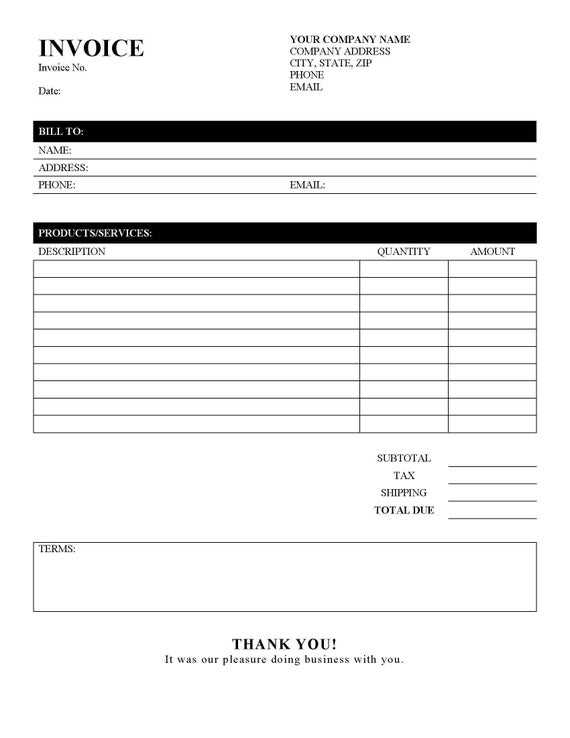

When it comes to managing financial transactions, having a standardized document for billing plays an essential role in ensuring clarity and professionalism. These documents are designed to provide all necessary details about a transaction, offering a clear record for both the payer and the recipient. Understanding their structure and important features can help in selecting the right format for any business or personal need.

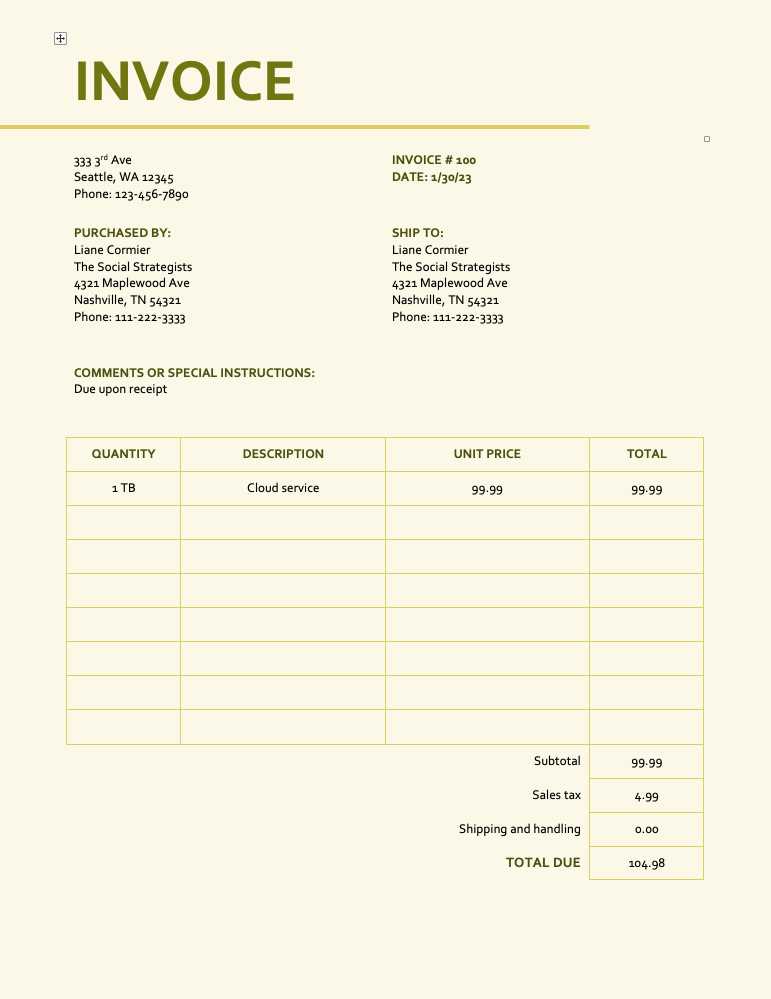

Structure and Layout

The layout of such documents is critical for easy readability and organization. Key sections typically include contact information, transaction dates, and itemized lists of goods or services. A well-organized structure ensures that recipients can quickly grasp the important details, such as amounts due and payment terms. Clear headers and logical groupings of information contribute to a seamless user experience.

Customizability and Versatility

Flexibility is a major advantage, allowing users to adapt the content to their specific requirements. Many formats offer customizable fields where users can enter their company logo, payment terms, and other relevant data. This adaptability ensures that each document can align with various business models and industry standards. Personalized elements like fonts, colors, and branding can further enhance the overall presentation, making the document both functional and visually appealing.

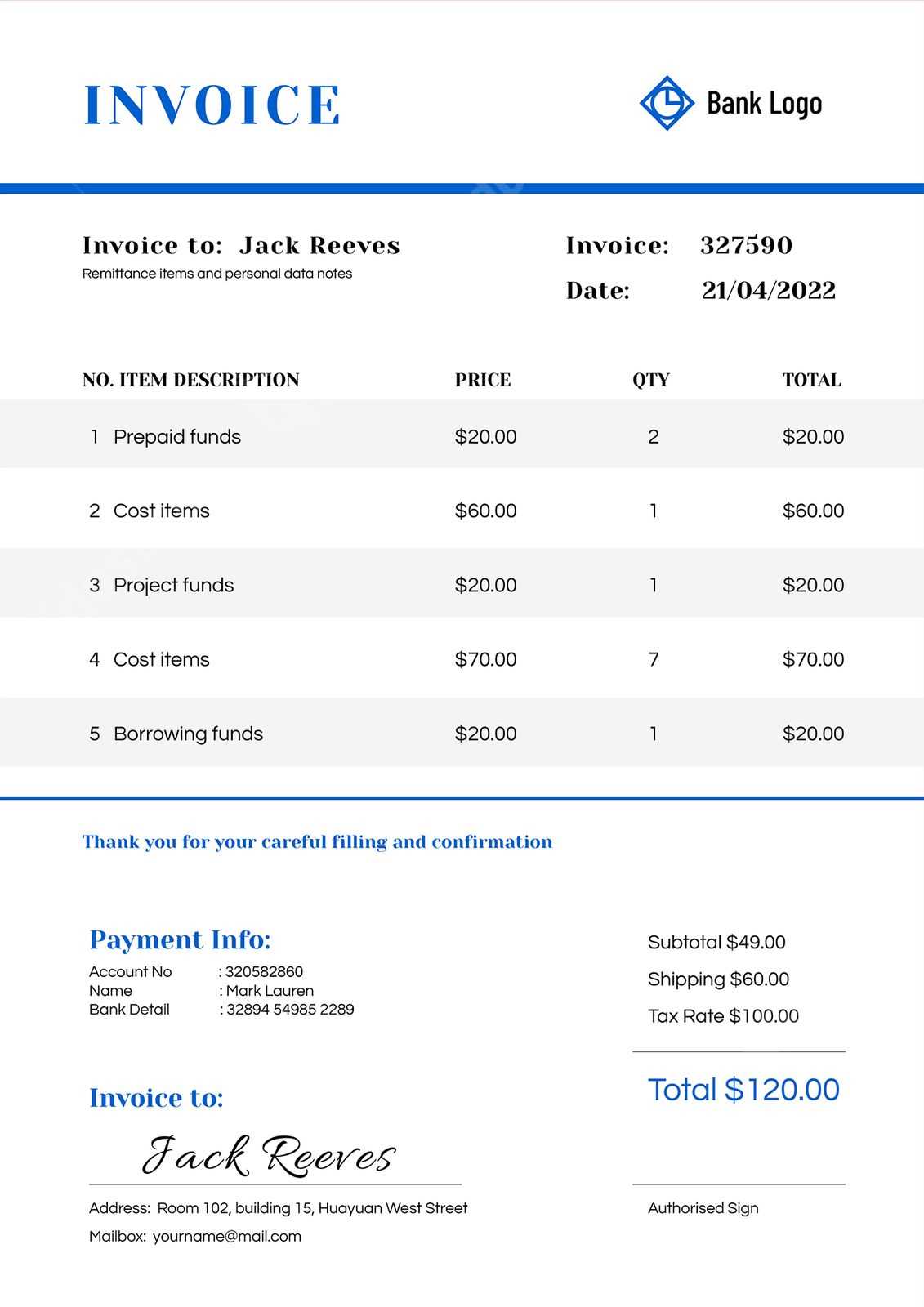

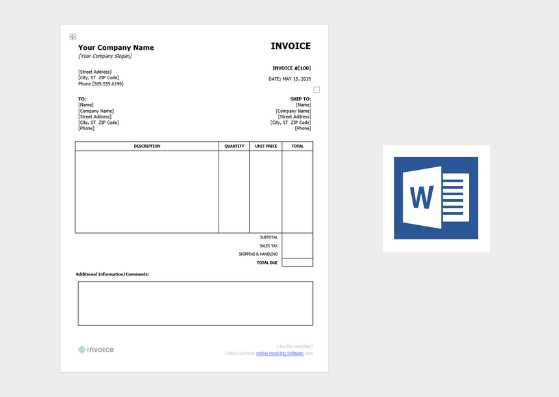

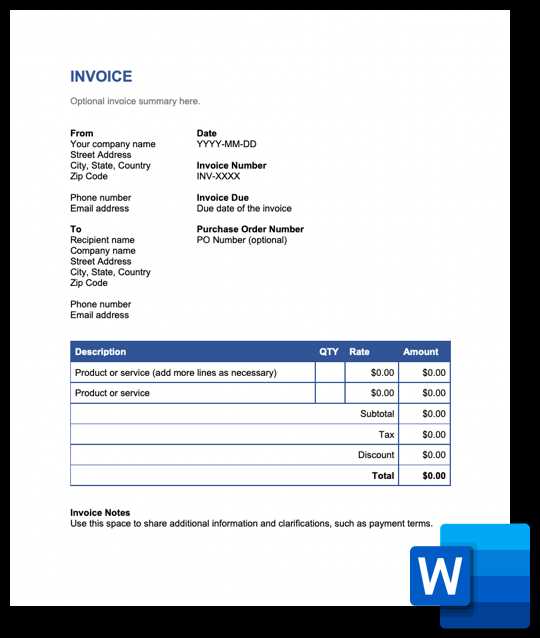

Why Choose Word for Invoices

For those managing financial transactions, choosing the right tool for creating documents is crucial to maintaining professionalism and efficiency. A widely used option offers flexibility, ease of editing, and compatibility with most systems. The ability to make quick adjustments, add personalized details, and ensure clear formatting makes it a preferred choice for many businesses and individuals.

| Feature | Benefit |

|---|---|

| Ease of Use | Intuitive interface, familiar to most users |

| Customizability | Ability to personalize with logos, colors, and fonts |

| Compatibility | Works across multiple platforms and devices |

| Efficient Editing | Quick adjustments and updates to documents |

How to Edit Invoice Information

Adjusting the details in your billing document is essential to ensure accuracy and clarity before sending it out. Whether you need to update contact information, payment terms, or add additional charges, making these changes is a straightforward process. Understanding how to quickly navigate through sections and modify key fields will help you manage your transactions efficiently.

Modifying Text Fields

Most fields in these documents, such as names, addresses, and descriptions of services or products, are easily editable. You can simply click on the text and replace it with the new information. For best results, ensure that the new text fits well within the allocated space without disrupting the overall layout.

Adjusting Dates and Amounts

Changing dates and monetary values is just as simple. Look for the date fields and numerical values, then update them to reflect the correct transaction details. Always double-check the payment terms and the amounts to avoid errors that may cause confusion later on.

Free vs Paid Invoice Templates

When selecting the right document format for your billing needs, it’s important to weigh the differences between no-cost and premium options. Both have their advantages, but understanding which one suits your business requirements can make a significant difference in how effectively you manage your transactions. From basic functionality to advanced customization, each choice offers unique features to consider.

Advantages of Free Formats

Free options are a great starting point for small businesses or individuals just getting started. They offer essential features without any initial cost. Some of the key benefits include:

- No financial commitment

- Simple structure suitable for basic needs

- Quick and easy to access

- Basic customization options

Benefits of Paid Formats

Premium versions offer more advanced features, tailored specifically to businesses that need more control over their documents. These formats often include additional design options, extended functionality, and customer support. The main benefits include:

- More customizable design and layout

- Additional features such as automatic calculations

- Enhanced professional appearance

- Dedicated customer support

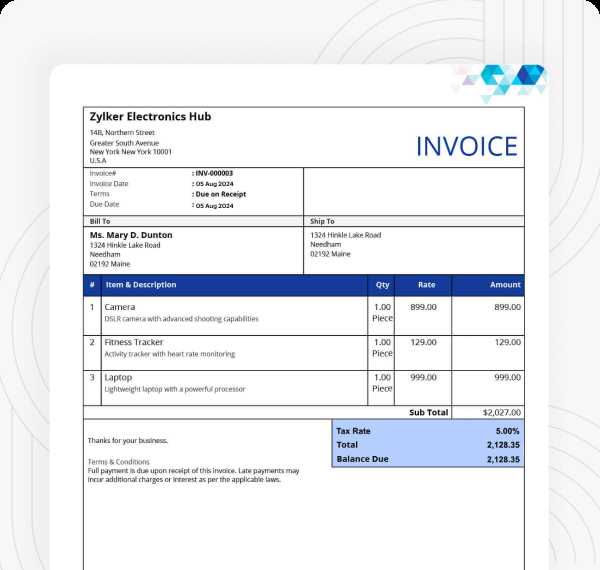

Best Practices for Creating Invoices

Creating professional and clear billing documents is essential for ensuring smooth financial transactions and avoiding misunderstandings. To maintain a high standard, certain guidelines should be followed. These practices help ensure that all the necessary information is included, and the document is easy to read and understand.

Maintain Consistency – Use a consistent format for all your documents to ensure familiarity for both you and your clients. This includes keeping a uniform structure for contact details, payment terms, and item descriptions.

Be Clear and Specific – Ensure that each item, service, or product is clearly described. Include exact quantities, prices, and any applicable taxes or discounts. This transparency builds trust and reduces confusion.

Provide Clear Payment Terms – Always include payment deadlines and methods to avoid delays. Clearly state any late fees or interest charges for overdue amounts to reinforce the importance of timely payments.

Ensuring Invoice Accuracy and Professionalism

Ensuring the precision and professional presentation of your billing documents is critical for maintaining a strong reputation and avoiding errors. A well-crafted document not only reflects your attention to detail but also fosters trust with clients. It’s essential to follow best practices for both accuracy and appearance to create a positive impression and streamline financial processes.

Common Mistakes to Avoid

Even minor errors can lead to confusion and payment delays. Here are some common mistakes to watch out for:

| Error | Consequence |

|---|---|

| Incorrect amounts | Disputes and payment delays |

| Missing payment terms | Misunderstandings regarding due dates |

| Inaccurate contact information | Failed communication and delivery issues |

| Lack of professional formatting | Unprofessional appearance, affecting business reputation |

Tips for Maintaining Accuracy

To ensure your documents are precise, always double-check numerical values, verify contact details, and review the structure. Use automatic calculation tools and proofread for grammatical accuracy. A consistent, clear layout contributes to both accuracy and a polished look.

How to Save and Share Your Invoice

Once you have created your billing document, the next steps involve saving and sharing it with the recipient in a secure and professional manner. Proper handling ensures that the document remains accessible and that it reaches the intended party promptly. There are several methods available for storing and sending the document, each suited to different needs and preferences.

Saving Your Document

Saving your billing document correctly ensures that it remains easy to locate and accessible for future reference. Consider these options:

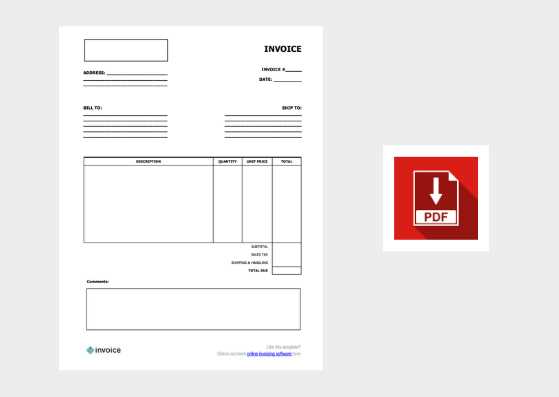

- Choose the right file format – Popular formats include PDF for universal accessibility or a native format for easy future edits.

- Name the file clearly – Use descriptive file names that include client names, dates, or reference numbers for easy organization.

- Store in an organized folder – Keep all related documents in a dedicated folder to make it easy to track your financial records.

Sharing Your Document

Once saved, sharing the document securely and professionally is just as important. Here are some ways to do it:

- Email – Send the file as an attachment through a secure email provider. Ensure that the subject line is clear, and the document is in a readable format.

- Cloud storage – Share a link to a cloud storage location for larger files or to allow clients to access the document at their convenience.

- Physical mail – For clients who prefer hard copies, consider printing the document and sending it via postal services.

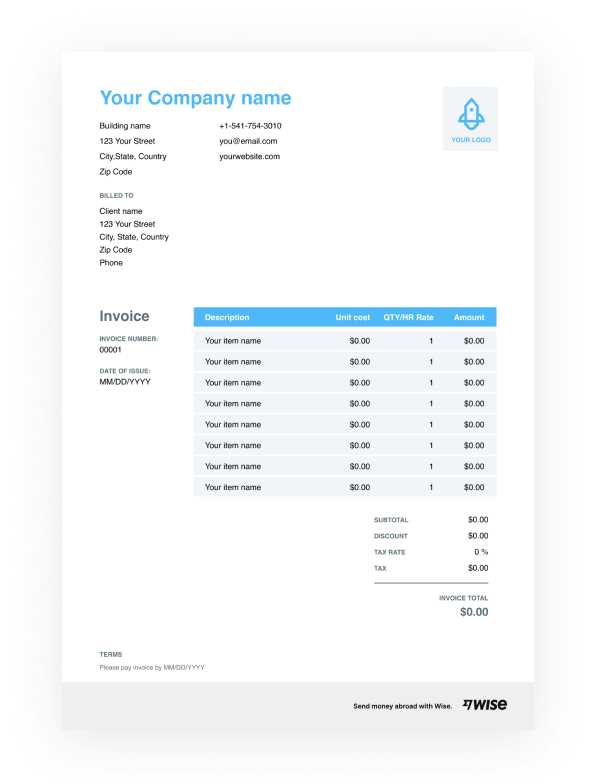

Invoice Templates for Small Businesses

For small businesses, creating professional billing documents is essential for maintaining good relationships with clients and ensuring smooth financial operations. Using the right format can save time and help ensure accuracy. Customizable billing formats are particularly useful as they allow businesses to add their branding, terms, and specific details that suit their unique needs.

| Feature | Benefit |

|---|---|

| Customizability | Tailor details like company name, logo, and payment terms |

| Simple Layout | Easy to fill out and ensures clear presentation |

| Cost-Effective | No need for expensive software or services |

| Professional Appearance | Helps build a trustworthy image with clients |

Using Invoices for Tax Purposes

Accurate billing documents are not only essential for business operations but also play a crucial role in managing taxes. Properly documenting transactions can help ensure compliance with tax laws, simplify reporting, and provide clear evidence of income and expenses. Maintaining accurate records is essential for businesses looking to maximize deductions and avoid legal complications.

| Tax Benefit | Explanation |

|---|---|

| Income Tracking | Helps maintain a detailed record of earnings, making tax filing more straightforward. |

| Expense Deduction | Details of purchases and services can be used to claim business-related expenses. |

| Audit Protection | Well-organized billing records provide evidence in case of audits or disputes with tax authorities. |

| VAT Reporting | For businesses that charge VAT, accurate records ensure proper reporting and tax calculation. |

Creating Recurring Invoice Templates

For businesses with clients who require regular billing, setting up a system for recurring charges can save time and effort. By creating a structured document that can be reused, you ensure that each transaction is recorded correctly and sent on time without having to create new documents from scratch each period. This approach streamlines administrative tasks and ensures consistency in the billing process.

Steps to Create Recurring Billing Documents

To set up a reliable system for recurring payments, follow these essential steps:

- Determine the Billing Frequency – Decide how often the charges will be applied, such as weekly, monthly, or annually.

- Set Clear Payment Terms – Include payment methods, deadlines, and any late fees that may apply.

- Include Consistent Details – Ensure that the service description, pricing, and client details are accurate and uniform in each document.

- Save for Future Use – Store the document in a way that allows easy updates, such as changing dates or amounts.

Automation Tools for Recurring Documents

Consider using software that automates the process of generating these documents. Automation can help with:

- Automatically inserting updated client details and payment information

- Scheduling and sending documents at set intervals

- Tracking unpaid amounts and sending reminders

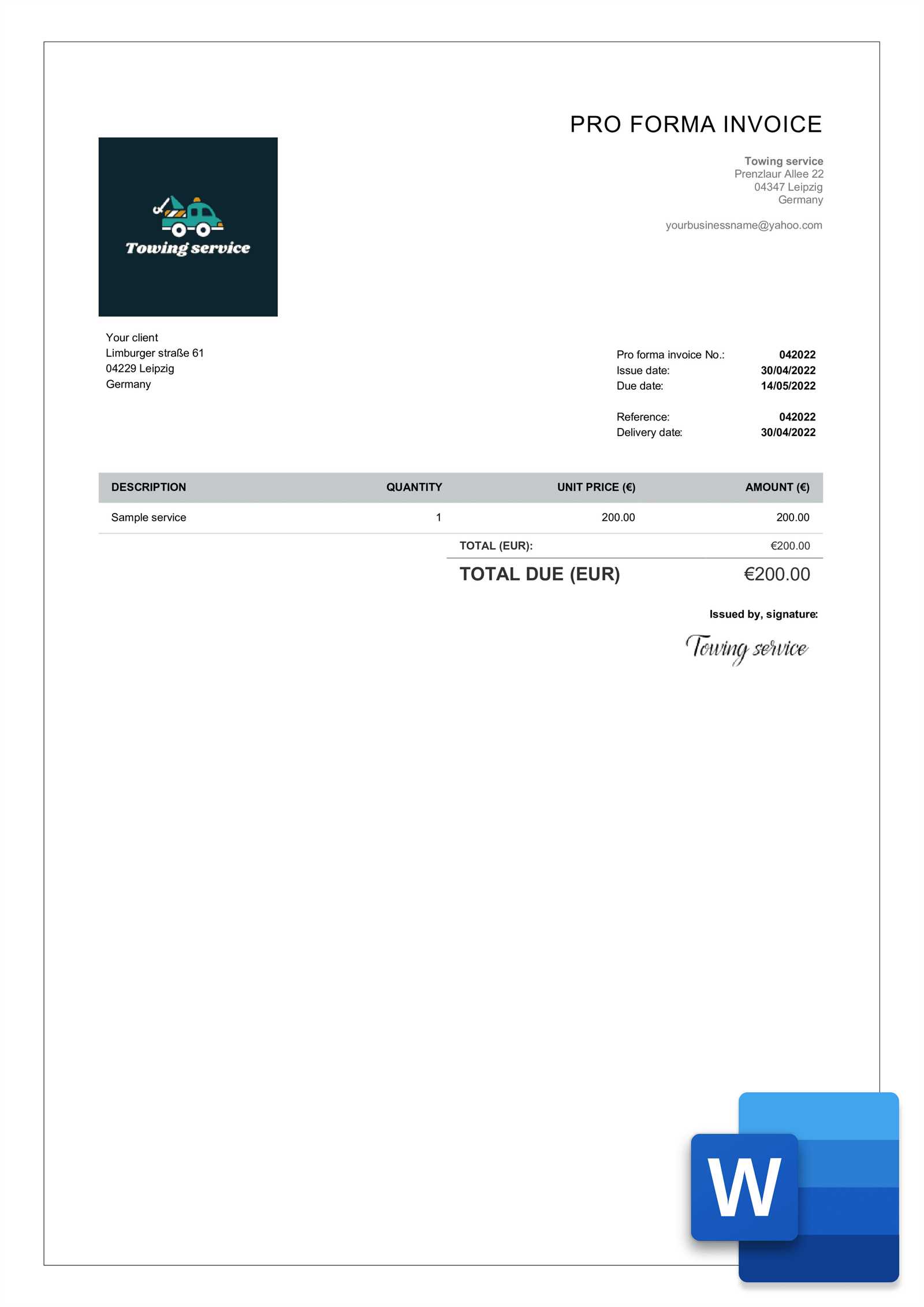

How to Add Branding to Invoices

Customizing your billing documents with your company’s brand elements helps reinforce your professional identity and leaves a lasting impression on clients. By incorporating your logo, color scheme, and consistent typography, you ensure that each document reflects your business’s image, building credibility and recognition.

Include Your Logo – Place your logo prominently at the top of the document to make it instantly recognizable. This helps clients associate the document with your business.

Use Consistent Colors – Apply your brand’s primary colors to headings, borders, or sections to create a cohesive visual identity. This adds a polished touch and strengthens brand recognition.

Maintain Uniform Fonts – Choose fonts that match your brand’s style guide. Consistency in typography makes your documents appear professional and aligned with your overall branding.

Consider Custom Footer Design – The footer is an excellent space to include additional branding, such as your website, contact information, or social media handles. This ensures clients can easily reach out for follow-up or future inquiries.

Security Tips for Sending Invoices

When sharing billing documents, it is crucial to ensure the security of sensitive information, such as client details and payment data. Sending these documents without proper security measures can expose your business and clients to risks like fraud or identity theft. Implementing best practices for securely transmitting financial documents is essential to maintaining trust and safeguarding data.

Methods to Securely Share Documents

Here are some recommended methods to ensure your documents remain secure:

- Email Encryption – Use encryption to protect the contents of your email and ensure that only the recipient can access the information.

- Cloud Storage with Password Protection – Store documents in a secure cloud service with password-protected links to limit access to authorized individuals only.

- Secure File Transfer Services – Use reputable file transfer services that offer secure protocols and end-to-end encryption for sensitive documents.

Precautions to Take Before Sending Documents

Before sending any document, take the following precautions to enhance security:

| Action | Benefit |

|---|---|

| Verify Recipient’s Identity | Ensure the document is sent to the correct person or organization to avoid unauthorized access. |

| Remove Sensitive Information | Consider redacting sensitive details, such as full account numbers, to limit exposure. |

| Use Strong Passwords | Implement strong, unique passwords for documents that require a password for access, reducing the risk of unauthorized viewing. |

| Confirm Delivery | Double-check with the recipient to confirm they received the document securely and without any issues. |