Download Free Invoice Template in Word DOCX Format

Designing a well-organized and effective billing document is crucial for smooth business operations. Whether you’re a freelancer, a small business owner, or a large company, having a reliable tool to generate clear and professional invoices is essential. By using the right format, you can streamline your accounting processes and ensure accurate payments from your clients.

Many businesses rely on editable digital files that can be quickly customized, saved, and shared across multiple platforms. A versatile file format that allows easy modifications while maintaining a professional appearance is often the preferred choice. This approach not only saves time but also ensures consistency across all billing documents.

In this guide, we will explore how to create customized billing documents using a popular, easy-to-use file format. You’ll learn how to adjust the layout, insert relevant details, and ensure that each document aligns with your branding and legal requirements. With just a few simple steps, you can enhance your billing process and make it more efficient.

Understanding the Basics of Invoice Templates

Creating a professional billing document involves much more than just listing services or products and their prices. A well-structured form not only facilitates accurate payments but also enhances your business’s credibility. By utilizing a structured format, businesses can ensure consistency in their financial records and avoid mistakes that may arise from manual entry.

The key to an effective billing document lies in its simplicity and clarity. A clear layout helps both the sender and the receiver to understand the details quickly. Important sections such as client information, payment terms, and a breakdown of costs should be easy to locate and comprehend. Ensuring that the design is intuitive reduces the chances of confusion or disputes.

Moreover, digital files allow for easy customization, making it possible to adapt the document to different needs. By using a reliable structure, you can streamline the process of issuing requests for payment, ensuring that every detail is covered efficiently. This helps maintain professional communication and strengthens your reputation with clients.

Why Use a Word DOCX Invoice Template

Using a standardized document format for billing is an efficient way to manage financial transactions. A digital, editable format provides flexibility and ease of use, allowing users to quickly generate consistent and professional documents. Here are some key reasons why businesses choose this method:

- Customizability – Digital files can be easily adjusted to include specific details, such as client names, service descriptions, and payment terms, ensuring that each document is tailored to the situation.

- Wide Compatibility – The format is universally recognized and can be opened on various devices and platforms, making it easy to share and access across different systems.

- Time Efficiency – Once a basic structure is set up, generating new documents becomes a quick and repetitive task, saving valuable time in daily operations.

- Professional Appearance – Well-designed billing documents help build trust with clients, presenting a polished image that reflects the quality of the services or products offered.

- Easy Editing and Updates – Any necessary modifications, such as changing payment terms or adding extra fees, can be done effortlessly without needing a complete redesign.

By choosing an editable format, businesses can ensure they are always prepared for quick, accurate, and professional communications with their clients.

How to Customize Your Invoice Template

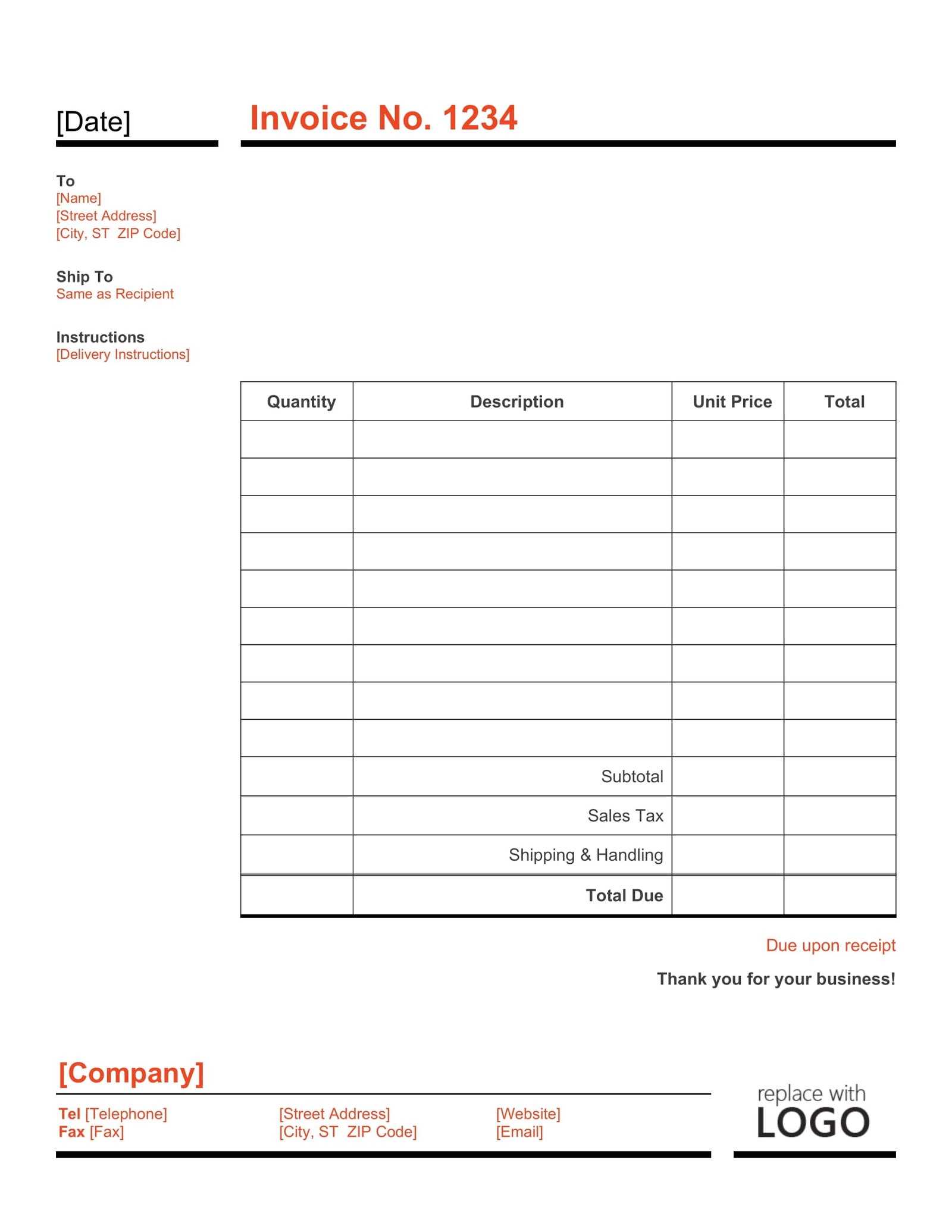

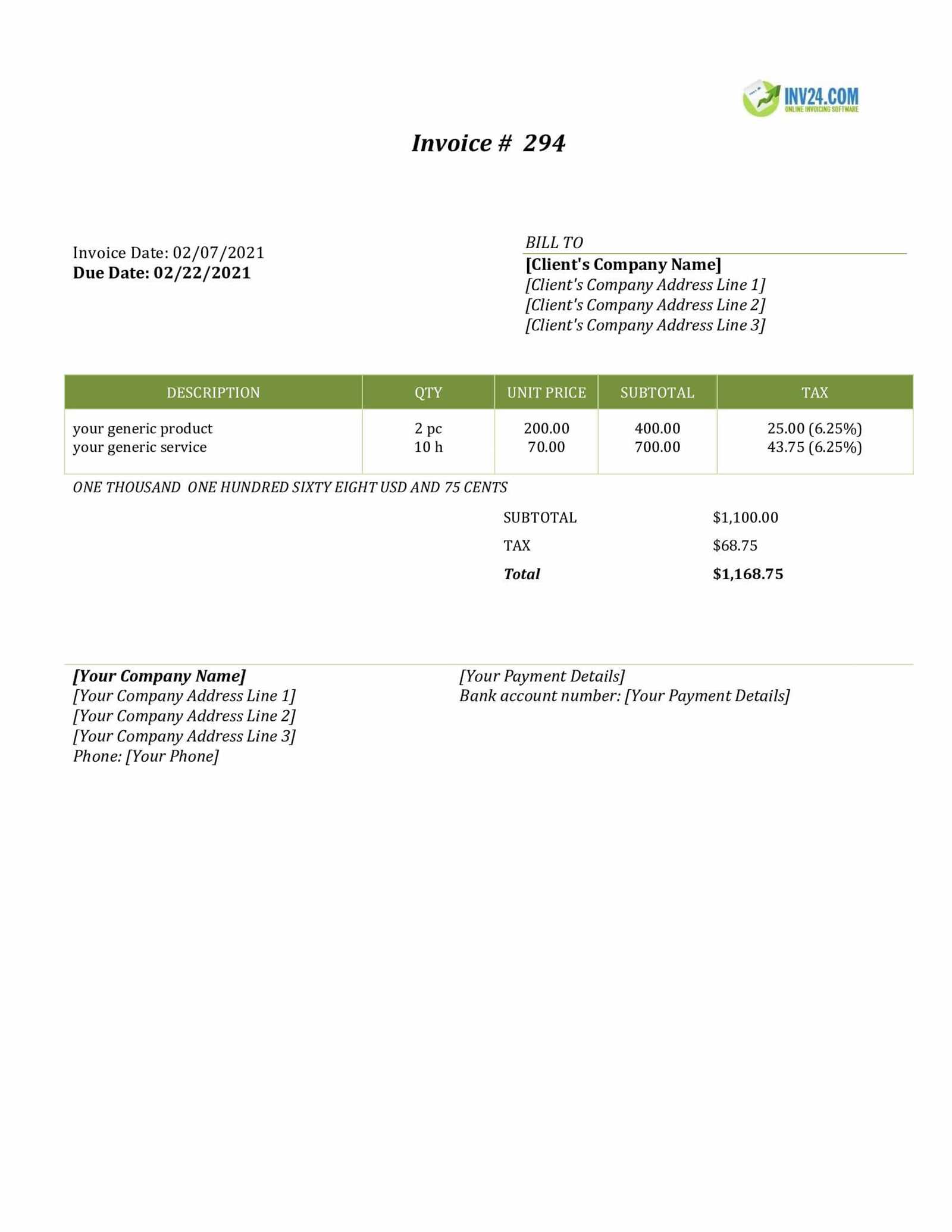

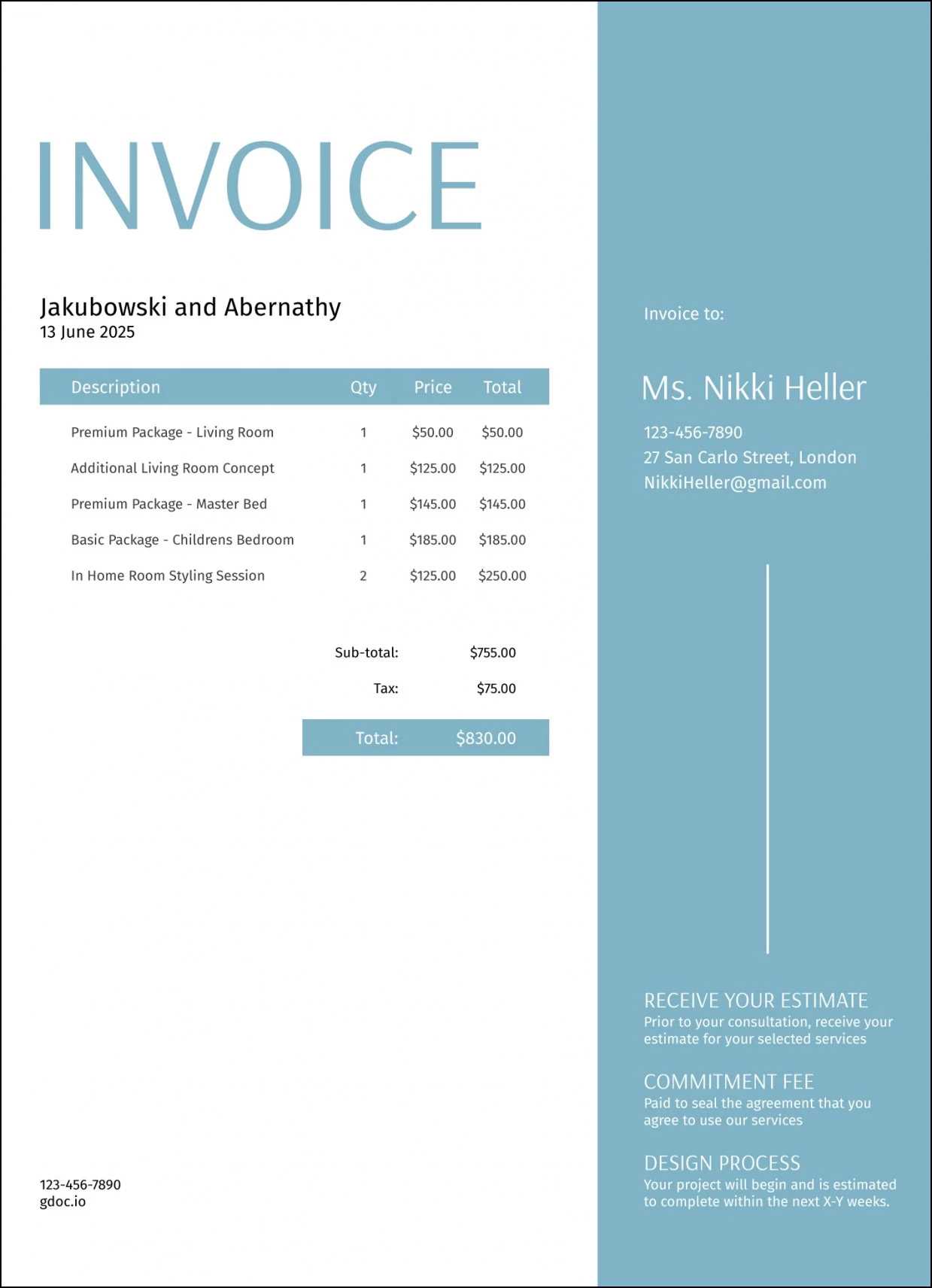

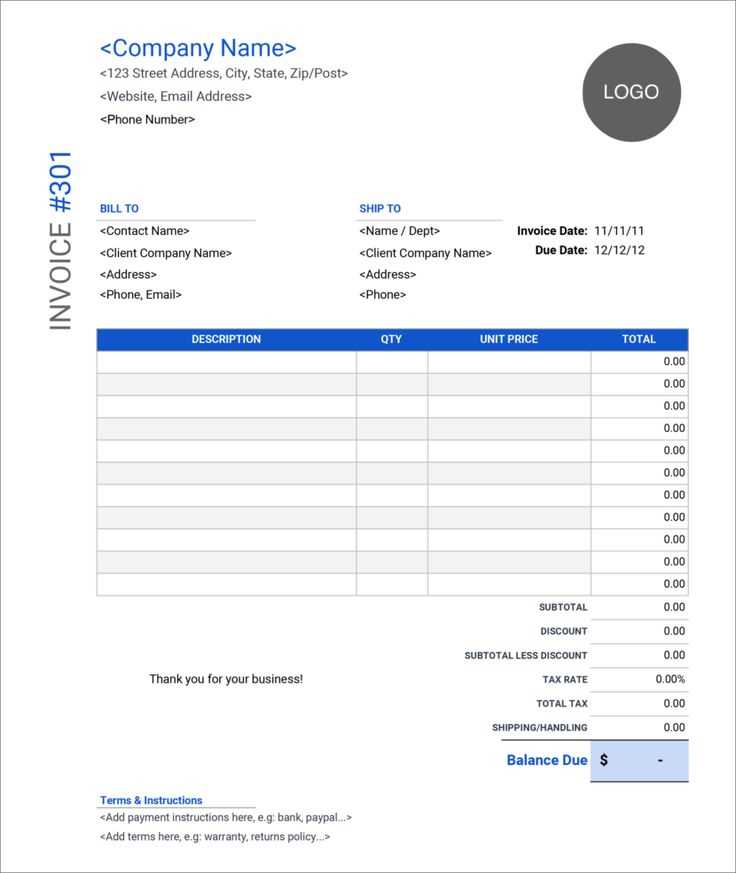

Personalizing your billing document ensures that it meets your business’s specific needs while maintaining a professional appearance. Customization allows you to include important details, adjust the layout, and incorporate your branding elements, such as logos and color schemes. Below is a step-by-step guide on how to easily modify your document:

Start by adjusting the basic structure. Below are key areas you might want to customize:

| Section | Description |

|---|---|

| Header | Include your business name, logo, and contact details at the top of the document to make it easily recognizable. |

| Client Information | Ensure the client’s name, address, and other relevant details are clearly listed for proper identification. |

| Details of Services/Products | List all products or services provided, including quantities, rates, and any applicable taxes or discounts. |

| Payment Terms | Define the due date, accepted payment methods, and any late fees to avoid misunderstandings. |

| Footer | Optional: Add additional information such as your business’s social media links, thank-you note, or legal disclaimers. |

After adjusting these sections, you can further customize the design by changing fonts, colors, and spacing to match your business’s branding. The flexibility of digital documents ensures that you can modify the layout as needed, whether for a more formal or casual look.

Key Features of a Professional Invoice

For any business, issuing a clear and well-organized billing document is essential for effective communication and smooth financial transactions. A professional layout helps ensure that the recipient can quickly understand the charges and makes payment processing easier. Below are the most important elements that should be included to create a professional and reliable document:

Essential Components

- Header Information: Include your business name, logo, and contact details. This ensures that the recipient can easily identify the source of the document and reach out for any queries.

- Client Details: Clearly state the client’s name, address, and any other relevant information. This personalizes the document and ensures it’s directed to the correct party.

- Itemized List: Break down the products or services provided, including quantities, individual rates, and descriptions. This clarity prevents confusion and facilitates the payment process.

- Amount Due: Clearly indicate the total amount owed, including any taxes or additional fees. Transparency about the total reduces the chances of disputes.

- Payment Terms: Specify due dates, accepted payment methods, and any late fees to ensure both parties are on the same page regarding expectations.

Design and Formatting

- Professional Layout: A clean, easy-to-read layout helps present all the important details in an organized manner. Proper use of space and headings enhances readability.

- Consistent Branding: Using your company’s color scheme, logo, and fonts reinforces your brand identity and adds credibility to the document.

- Clear and Simple Language: Avoid jargon or complex terminology. Simple, direct language makes it easy for clients to understand the charges and terms.

By including these features and focusing on clarity and professionalism, you ensure that your billing documents are not only functional but also contribute to your company’s reputation and financial efficiency.

Advantages of Using DOCX Format for Invoices

The use of editable document formats for business communications brings numerous benefits. The flexibility, ease of editing, and compatibility with different platforms make this approach a popular choice for professionals. When dealing with billing and payment records, the ability to create, customize, and share documents efficiently plays a crucial role in streamlining workflows.

One of the main reasons for choosing this format is its user-friendly features, which provide a high level of customization. Unlike other formats, this one allows users to add tables, images, and advanced formatting with ease. The following table outlines key advantages that this format offers:

| Feature | Benefit |

|---|---|

| Ease of Editing | Simple adjustments to text, structure, and content without requiring complex software. |

| Compatibility | Works seamlessly with various software applications and operating systems. |

| Professional Appearance | Allows for clean formatting and design, which enhances the presentation. |

| Security Features | Support for password protection and encryption to safeguard sensitive information. |

| Document Integrity | Preserves content layout and formatting when shared across devices and platforms. |

Furthermore, this format is compatible with most modern software, ensuring that users can access, modify, and distribute their files without worrying about technical issues. The ability to maintain document integrity and the high level of security features also adds significant value when managing sensitive financial records. These advantages make it a highly effective solution for managing business communications and documentation in a professional setting.

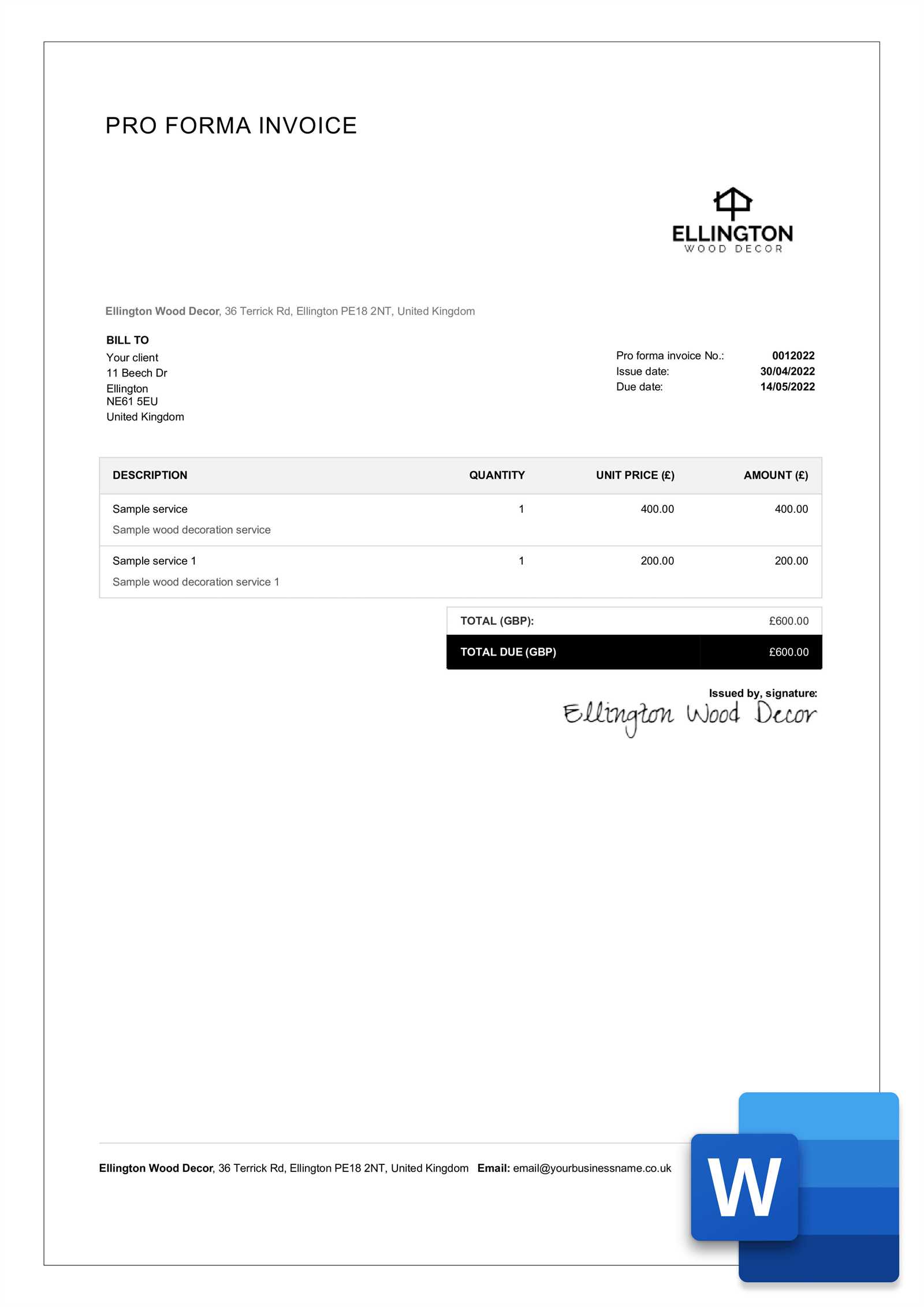

Step-by-Step Guide to Create an Invoice in Word

Creating a professional document for billing purposes is essential for any business or freelancer. This process can be completed quickly and efficiently by using a common document editor, allowing you to customize the content, layout, and details to suit your specific needs. The following steps will guide you through creating a comprehensive and polished document for requesting payments or detailing services provided.

Start by opening the document editor of your choice and selecting a blank document. Once opened, follow these instructions:

- Set Up Your Header

Include your company name, logo (if applicable), and contact details such as your address, phone number, and email. Make sure this information is placed at the top of the document for easy reference. - Include the Recipient’s Information

Below your contact details, provide the recipient’s name, business name, and address. This ensures clear identification of who the payment is being requested from. - Assign a Unique Document Number

For tracking purposes, generate a unique number for the document. This helps both you and the recipient stay organized and allows for easy reference in the future. - List the Services or Products Provided

In the next section, create a table that outlines the services or products you are charging for. Include a description, quantity, rate, and total cost for each item or service. This section ensures that the recipient understands exactly what they are being charged for. - Calculate the Total Amount Due

Below the table, add a line that shows the total amount due. Include any taxes, discounts, or additional fees in this section to provide a clear breakdown of the total amount. - Provide Payment Instructions

Indicate the preferred method of payment, such as bank transfer, check, or online payment portal. Be sure to include any necessary details, such as bank account information or payment links. - Set a Due Date

Specify the deadline for payment. This ensures that both parties are clear on when the payment should be made and can help avoid delays. - Review and Save

Before finalizing the document, carefully review all the information for accuracy. Once confirmed, save the file in an appropriate format and share it with the recipient via email or print it for physical delivery.

By following these steps, you can create a clear, professional, and well-structured document that effectively communicates all the necessary billing details. This method allows for easy customization and ensures that both parties are on the same page regarding expectat

Common Mistakes to Avoid in Invoicing

When creating documents for requesting payments, attention to detail is crucial. Small errors can lead to confusion, delays, and misunderstandings between you and your clients. Avoiding common mistakes ensures a smoother process, timely payments, and clear communication. Here are some frequent missteps that should be carefully considered when preparing such records.

1. Missing or Incorrect Information

Omitting key details or providing incorrect information is a common mistake that can delay payment or lead to disputes. Make sure the following elements are accurate and complete:

- Contact details: Double-check both your and the recipient’s name, address, and phone number.

- Document number: Each payment request should have a unique reference number for easy tracking.

- Description of services: Ensure that each item or service is clearly listed with accurate details to avoid confusion.

2. Errors in Calculating Amounts

Another frequent issue is incorrect calculations, whether it’s the subtotal, tax, or final total. This can lead to clients either overpaying or underpaying. Avoid these issues by following these tips:

- Double-check all numbers: Always verify the calculations before finalizing the document.

- Include taxes and discounts clearly: Ensure that all applicable taxes, discounts, and fees are calculated and displayed separately.

- Use formulas: In many editing programs, you can use built-in calculation features to ensure accuracy.

Paying close attention to these aspects will help eliminate errors and reduce the chances of disputes, ensuring that your client receives an accurate and professional document.

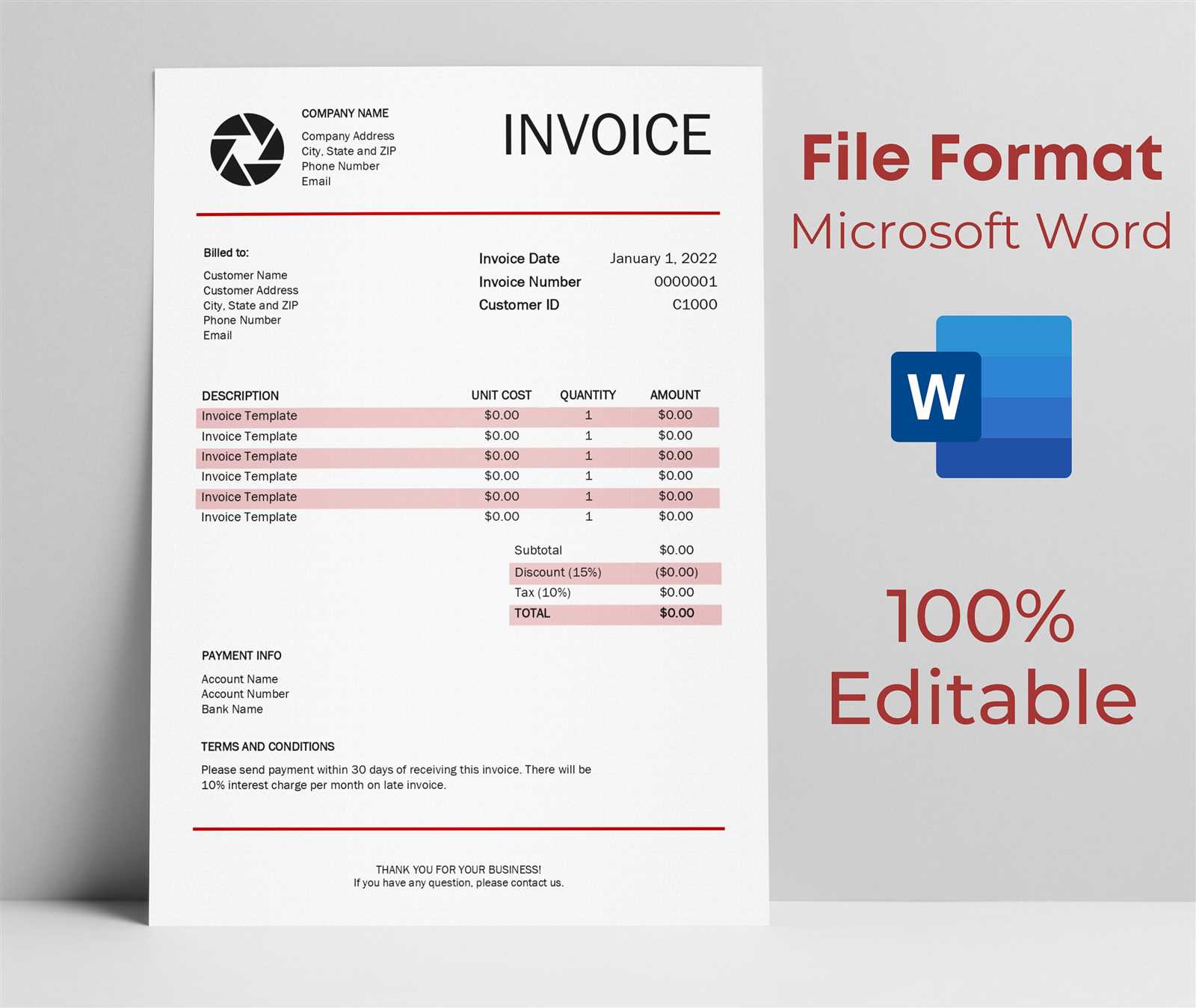

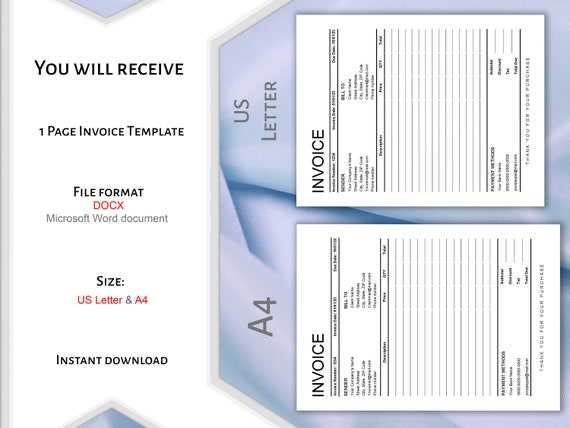

Top Invoice Template Providers for Word

When creating a professional document to request payments, using pre-designed layouts can save time and ensure consistency. Several platforms offer high-quality formats that can be customized according to your needs, making it easier to generate accurate and professional-looking records. Below are some of the top providers known for offering versatile, ready-to-use solutions for creating billing documents.

- Microsoft Office Templates

As the default provider, Microsoft offers a wide variety of free pre-built formats that integrate seamlessly with its software. You can find multiple styles, from simple and clean designs to more complex, branded layouts. These templates are ideal for those who want professional results without spending extra time on design. - Template.net

This platform provides a range of customizable formats for business professionals. Whether you need a basic model or a more intricate design, Template.net offers many choices that can be easily tailored for your specific needs. They also include helpful features such as invoice numbering and payment reminders. - Canva

Canva is known for its user-friendly design tools, and it extends this functionality to customizable documents for billing purposes. With access to both free and paid templates, users can adjust layouts, fonts, and colors to match their branding. Once finalized, these files can be easily exported for use with other applications. - Zoho Invoice

Zoho provides an online service tailored for invoicing, but it also offers downloadable designs that integrate well with document editing software. Their templates are particularly useful for businesses that need to keep their billing process streamlined and automated while maintaining a polished look. - Hloom

Hloom offers a vast selection of customizable layouts, ranging from simple and professional to creative and modern. Their free resources are easy to edit, and they also provide additional tips for optimizing your documents for effective communication and payment collection.

Using these providers, you can quickly create a customized billing document that meets your specific business needs, without sacrificing professionalism or time efficiency.

How to Add Payment Terms to an Invoice

Including clear payment terms in your documents is essential for ensuring that both parties understand the expectations regarding payment deadlines, methods, and any penalties for late payments. By specifying these terms upfront, you can avoid confusion and minimize the risk of delayed payments. Here’s how you can effectively incorporate payment terms into your billing documents.

To begin, locate the appropriate section in your document where you can specify the payment conditions. This is typically placed towards the bottom or near the total amount due, ensuring visibility but not disrupting the main content of the document. Follow these steps to clearly outline the payment terms:

- Define the Payment Due Date: Clearly state the date by which the payment is expected. Use terms like “Due upon receipt” for immediate payments or specify a specific date, such as “Due by [Date].”

- Include Payment Methods: List the available payment methods, such as bank transfer, check, credit card, or online payment platforms. Provide any necessary details, like bank account numbers or payment links, to avoid confusion.

- State Late Fees or Penalties: If you intend to charge a late fee for overdue payments, include the rate or percentage that will be applied. For example, “A late fee of 2% will be charged for payments received after [Due Date].”

- Offer Early Payment Discounts (Optional): Some businesses offer a discount for early payment. For example, “A 5% discount will be applied to payments received within 10 days.” If you provide such incentives, make sure to state the exact terms clearly.

- Specify Currency and Tax Information: If applicable, mention the currency of the transaction and any relevant taxes that may apply. This can help avoid any misunderstandings, particularly in international transactions.

By including these details, you ensure that your client or customer understands the payment expectations clearly, which helps build professionalism and avoid potential disputes. Remember to be concise but thorough, and always review the payment terms to ensure they align with your business practices and legal requirements.

Ensuring Accuracy in Invoice Details

Accurate billing records are essential for maintaining professionalism, preventing disputes, and ensuring timely payments. Small errors, such as incorrect amounts or missing information, can lead to confusion and delays. To avoid such issues, it is crucial to pay close attention to detail when preparing your documents. Here are some key areas to focus on to ensure all the details are accurate and clear.

| Detail to Check | Why It’s Important |

|---|---|

| Client Information | Incorrect contact details can lead to communication issues and delays in payment. |

| Item Descriptions | Clear and accurate descriptions of services or products ensure the client understands what they are being charged for. |

| Quantities and Rates | Double-check quantities and rates to ensure that calculations are correct and avoid overcharging or undercharging. |

| Dates | Accurate dates for both service completion and payment deadlines help clarify timelines for both parties. |

| Total Amount Due | Ensure that the total amount due is correct, including any applicable taxes, discounts, or additional fees. |

It is advisable to review each section of the document multiple times before finalizing it. Using automated tools or software features to verify calculations can also help reduce the chances of human error. A final proofread is always a good practice to catch any overlooked details. Accuracy not only ensures smoother transactions but also fosters trust and professionalism in your business dealings.

How to Save and Share Invoices Easily

Efficiently saving and sharing billing documents is essential for streamlining business operations and ensuring timely payments. By organizing your files properly and utilizing the right tools, you can quickly share your documents with clients and colleagues, reducing delays and improving communication. Below are some simple strategies for saving and sharing your records with ease.

1. Saving Your Documents

Once you have completed your document, it is crucial to save it in a format that ensures compatibility, security, and easy access. Here are some tips:

- Choose the Right File Format: Saving your document in PDF format is often the best option, as it preserves the layout and ensures the file can be opened on any device without altering its appearance.

- Use Descriptive File Names: Name your files in a way that makes them easy to identify, such as “ClientName_Billing_2024.” This helps you quickly locate a specific document when needed.

- Organize Your Files: Create folders on your computer or cloud storage system to categorize documents by client, project, or date. This organization will help you find specific records without wasting time searching.

2. Sharing Your Documents

Once your document is saved, the next step is sharing it with the client or recipient. Here’s how to do it effectively:

- Emailing the Document: Attach the saved file to an email with a clear subject line, such as “Payment Request for [Client Name].” Be sure to include any relevant details in the body of the email, such as due dates or instructions.

- Using Cloud Storage: If the file is large or if you want to keep a record of shared files, upload the document to a cloud storage service like Google Drive, Dropbox, or OneDrive. You can then share a link to the document directly with your client.

- Utilizing Invoice Management Platforms: Many online platforms allow you to create, save, and send billing documents all in one place. These services often provide tracking features so you can monitor when your client opens or views the document.

By following these simple steps, you can save and share your billing documents with ease, making the process more efficient and less time-consuming for both you and your clients.

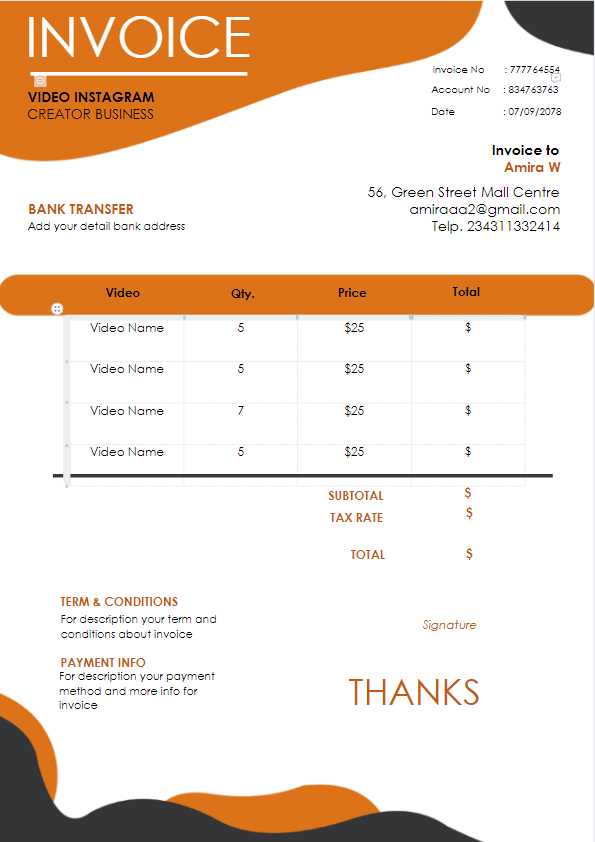

Customizing Invoice Styles for Branding

Customizing the design of your billing documents is an effective way to reinforce your brand identity and make a lasting impression on clients. A well-designed document not only conveys professionalism but also reflects your company’s values and aesthetics. By incorporating elements such as logos, colors, and fonts, you can create a cohesive and memorable experience for your clients. Here’s how to personalize your billing records to align with your brand.

1. Incorporating Your Logo

Including your company logo at the top of the document is one of the easiest ways to make your records instantly recognizable. Place it in a prominent position, such as the header or near your business name, ensuring that it is clear and visible. This small detail helps reinforce your brand’s identity every time a client receives your document.

2. Using Brand Colors

Integrating your brand’s color palette into the design of your billing document adds consistency and aesthetic appeal. Use your brand colors for headings, borders, or highlights. However, avoid overusing colors to ensure the document remains clean and professional. Subtle accents in your brand’s colors can make the document look polished without overwhelming the reader.

3. Selecting Consistent Fonts

Choosing the right fonts is crucial for creating a document that is both readable and aligned with your brand’s image. Use the same fonts you use in other business materials, such as your website or marketing collateral, to create a cohesive visual identity. Ensure that the fonts you select are legible and professional, with clear distinctions between headings, body text, and other key information.

4. Personalizing the Layout

While it’s important to maintain a clean, organized structure for readability, you can personalize the layout by adjusting the placement of various sections. For instance, you can position your business information and the client’s details in a way that fits your design style. Adding a subtle background image or texture can further enhance the document’s visual appeal, but ensure it does not distract from the content.

5. Adding a Custom Footer

Consider including a footer that reflects your brand’s personality. This can be a simple message of thanks, a tagline, or additional contact information. A custom footer helps humanize the document and reinforces your company’s image while providing essential details to the client.

By customizing your billing records with these design elements, you ensure that your documents are not only functional but also reflect your company’s unique brand identity. Consistency in style across all communication materials helps to establish a professional and memorable presence with your clients.

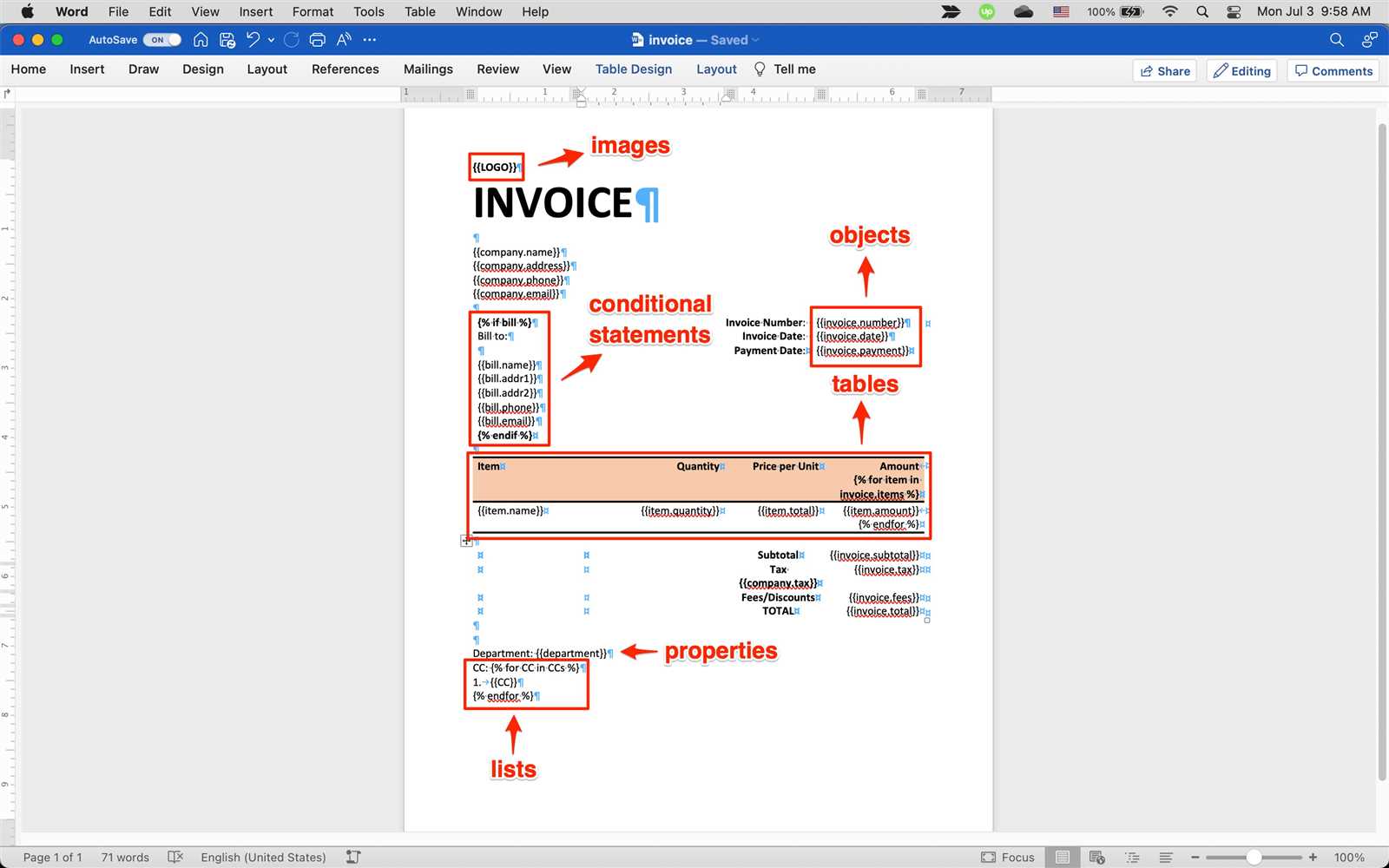

How to Automate Invoice Creation in Word

Automating the process of generating billing documents can significantly save time and reduce the chances of human error. By setting up systems that automatically populate certain fields, you can streamline the process and focus on other important tasks. Below are steps to help automate the creation of payment requests using common tools and features in your document editor.

1. Use Document Fields and Placeholders

Most document editing software allows you to insert fields or placeholders that can be automatically filled. These fields can be linked to other data sources or manually updated with minimal effort. You can set up placeholders for common information, such as:

- Client name

- Billing address

- Payment due date

- Item descriptions

- Total amount due

Once you’ve inserted these fields, you can quickly update the document with client-specific details without needing to manually edit each section every time.

2. Utilize Macros

Macros are a powerful feature that allows you to automate repetitive tasks in documents. You can create a macro to populate certain fields, format the document, or even generate a PDF version automatically. Here’s how to use macros:

- Go to the “View” tab and select “Macros”

- Create a new macro by recording actions, such as filling in client details and adjusting the layout

- Assign a button or keyboard shortcut to the macro so you can run it whenever needed

With macros, you can create a streamlined process for quickly generating documents with consistent formatting and content.

3. Integrate with Data Sources

If you regularly work with a client database or use accounting software, integrating that data with your document editor can speed up the process even further. By linking your document editor to a spreadsheet, CRM, or accounting software, you can automatically import client details, amounts, and other necessary information into your billing documents. Some methods for integration include:

- Linking Excel spreadsheets for automatic population of client data

- Using data from a CRM system to auto-fill client contact details and past purchase information

- Utilizing add-ons or plugins designed for integrating your document editor with third-party software

4. Set Up Custom Styles and Formatting

To further automate the process, set up custom styles and formatting in your document editor. This includes things like consistent font choices, header placements, and table styles. Once set up, you can apply these styles to new documents with just a click, ensuring that all generated documents look professional and on-brand every time.

By implementing these automation techniques, you can significantly reduce the time and effort required to create consistent and professional billing records. This not only helps in improving efficiency but also ensures greater accuracy in your documents.

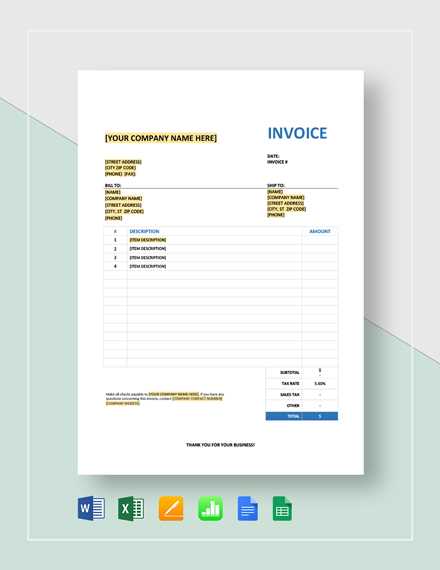

Essential Fields to Include in Your Invoice

When creating a billing document, certain details are crucial for ensuring clarity and smooth transactions. These key components provide both the sender and the recipient with all necessary information, helping avoid misunderstandings and ensuring proper processing of payments. By including these essential elements, you can create a professional and effective bill.

Basic Information

The core of any billing document consists of information that identifies both parties involved. This includes the names, addresses, and contact details of the sender and the recipient. Additionally, a unique identifier, such as a reference number, is essential for tracking purposes.

Transaction Details

To avoid confusion, it’s important to clearly outline the items or services provided, along with their respective quantities and prices. This ensures that the recipient can easily match the charges with their own records.

| Description | Quantity | Price | Total |

|---|---|---|---|

| Service A | 1 | $100 | $100 |

| Product B | 2 | $50 | $100 |

| Total | $200 |

Why Word DOCX is Ideal for Invoicing

For those creating professional payment documents, choosing the right format is essential for ease of use and functionality. A flexible, widely accessible file type makes it easy to customize and ensure that your document looks polished, while also being simple for the recipient to open and review. This format combines versatility with ease of editing, making it an ideal choice for many businesses.

Customization and Flexibility

One of the main advantages of using this format is the ability to fully customize the content. From adding logos to adjusting the layout, it offers a level of flexibility that other formats often lack. This ensures that you can create a document that reflects your brand while keeping all the necessary details clearly organized.

Compatibility and Ease of Use

Another benefit is its compatibility across various devices and software. Most users can easily open and view these files, regardless of their operating system. Furthermore, making adjustments to your document is straightforward, whether it’s adding additional fields or adjusting the design, without needing advanced technical skills.

| Feature | Benefit |

|---|---|

| Customizable Layout | Allows for personalized branding and clear structure |

| Easy Editing | Simple to update and modify content as needed |

| Widely Accessible | Can be opened on most devices and platforms |

Tips for Managing Multiple Invoices

Handling numerous financial documents efficiently is essential to maintain smooth operations and prevent delays in payments. Effective organization and tracking methods ensure that each record is accurately documented and easily accessible when needed. By implementing a few key strategies, you can streamline the process and reduce potential errors.

Organize with Clear Labels and Categories

To avoid confusion, set up a structured system that categorizes each document based on criteria like client, date, or status. Label files clearly to distinguish them, making it simple to locate specific records. Consider organizing by paid, pending, and overdue statuses to keep a clear view of outstanding amounts.

Track Due Dates Regular

How to Track Paid and Unpaid Invoices

Efficient tracking of completed and outstanding payments is essential for maintaining accurate financial records and cash flow. By keeping a close eye on these records, you can ensure timely follow-ups and avoid potential oversights, leading to smoother financial management.

Set Up a Clear Tracking System

To differentiate between settled and pending payments, establish a simple tracking method. This could be as straightforward as creating a checklist or using a digital tool. Mark each entry as “paid” or “unpaid” and include the date of transaction, client name, and amount to ensure everything is easily traceable.

Regularly Review and Update Records

Consistency is key when managing financial entries. Schedule regular check-ins to review your records, updating them as payments are received. By routinely monitoring these entries, you reduce the risk of missed or overdue payments.

Additional Tip: Automate reminders for outstanding balances to ensure you never